CATTLE HAMMERED, CALLS VS DP & 2026 SALES?

AUDIO COMMENTARY

Cattle hammered again

Cattle broke major support (chart below)*

Strategies we are using in cattle

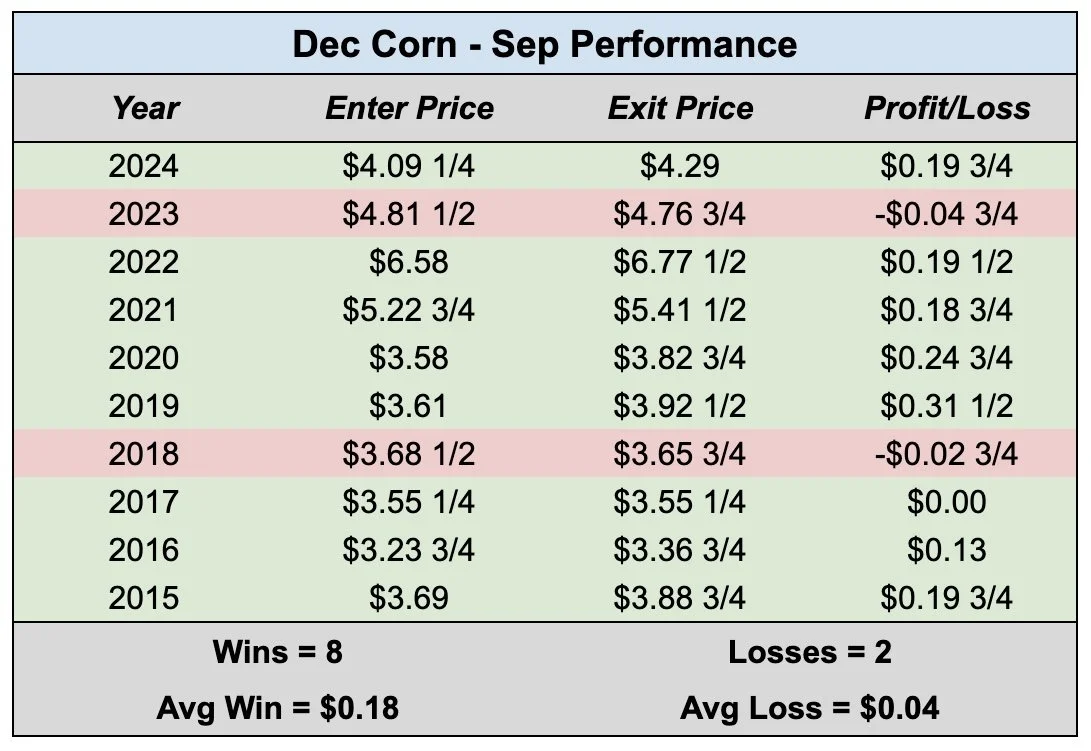

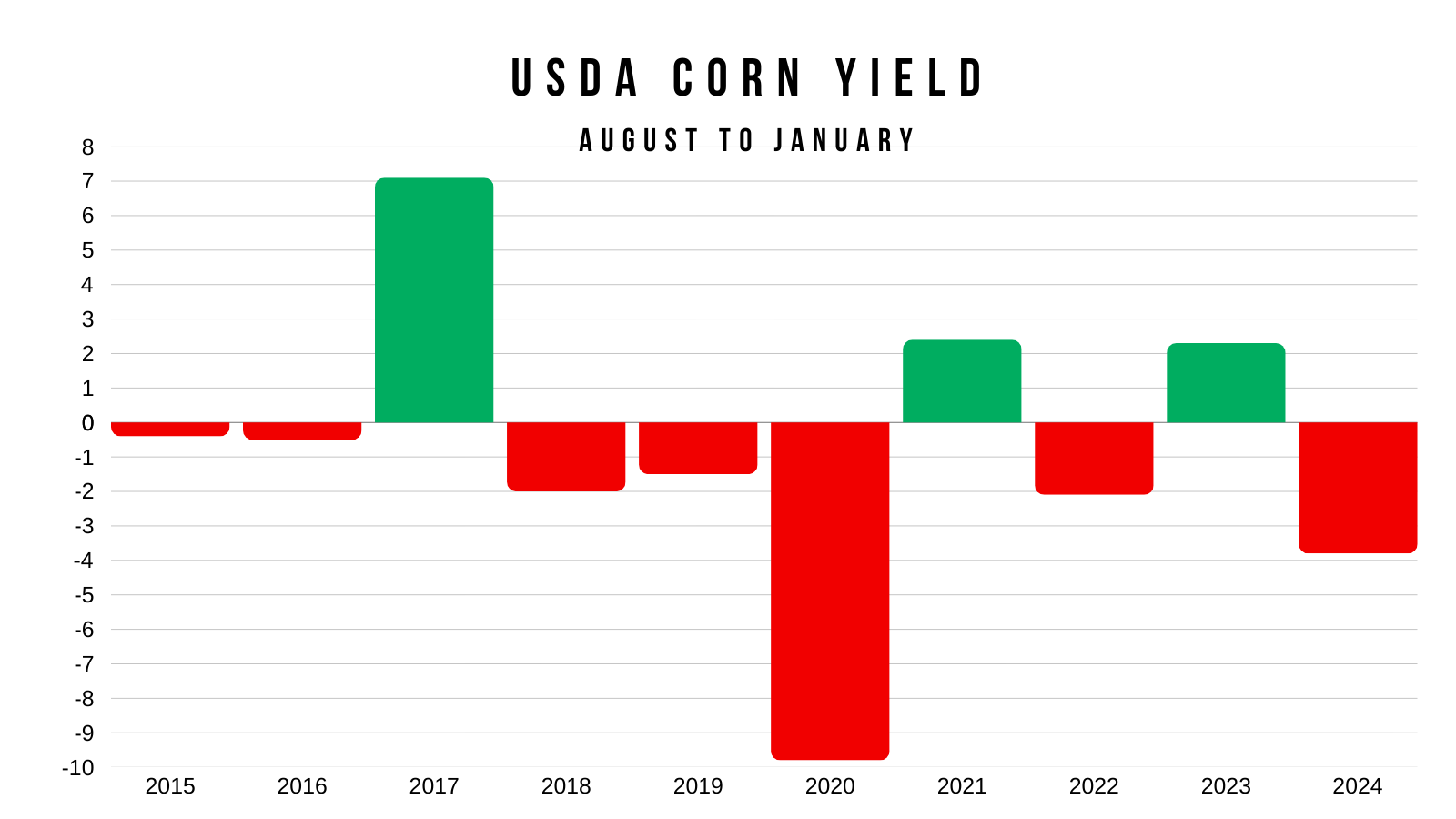

Perhaps a little hedge pressure in corn

Simple re-test in corn? (chart below)*

Crop insurance pricing period is going to be over so you will not have a floor anymore. There is a risk in that

Why is basis firming at harvest?

Canada & US trade war escalation

Questions many of you have had

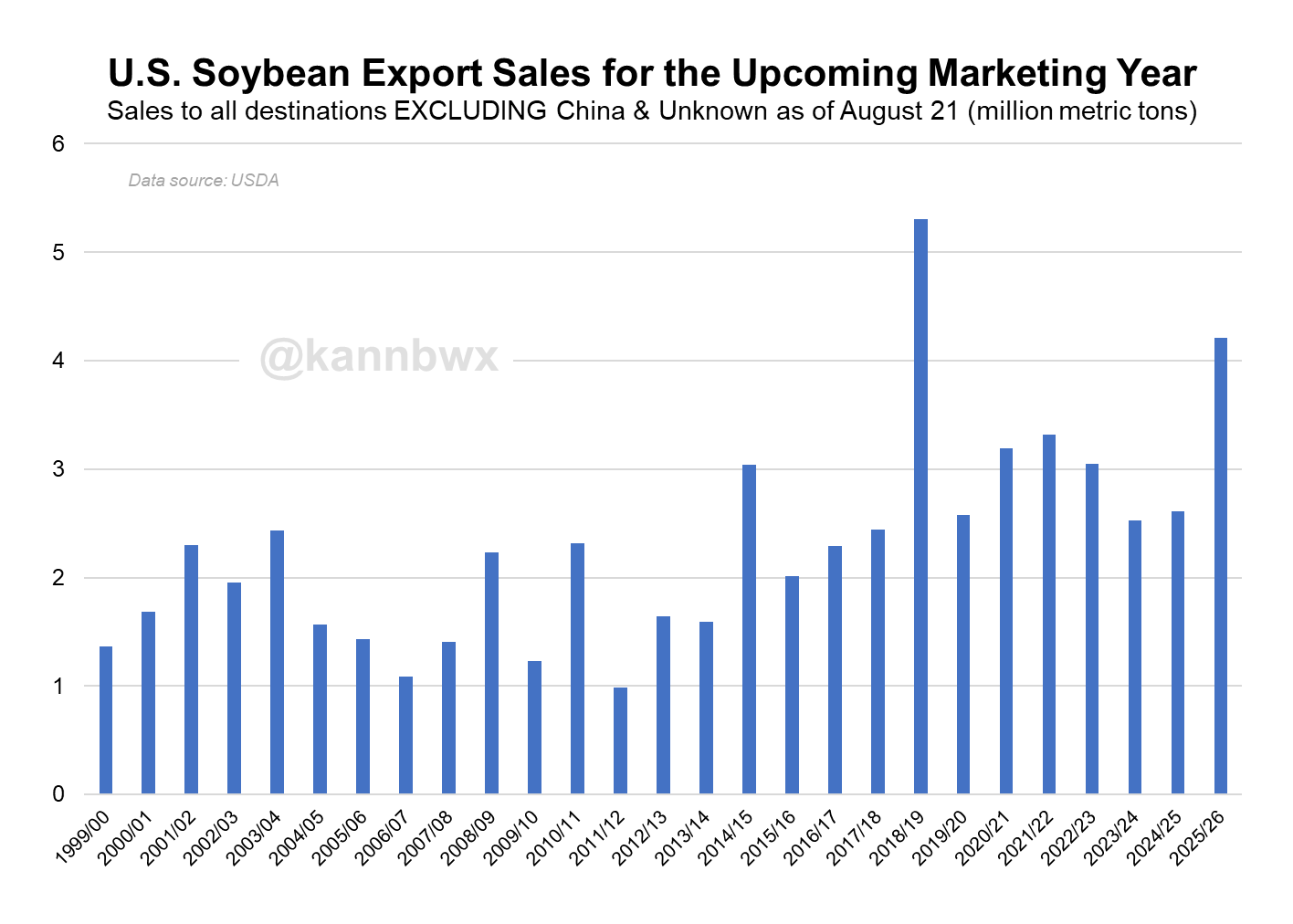

Should you be making any 2026 sales?

Delayed price vs call options

Why options might make more sense than DP

Options are abnormally cheap

Even if prices go lower options could be the better decision than DP because it locks in a floor

How can you capture the carry without locking in the price?

Listen to today’s audio below

Want to talk? (605)295-3100

Your free trial has ended

Don’t miss our updates & future signals

Here is extended access to our harvest sale

CORN & CATTLE CHART

Dec Live Cattle 🐮

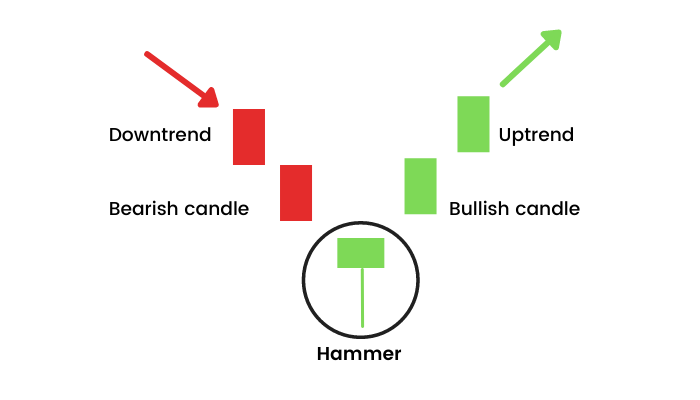

We rejected off that golden fib.

We are now breaking below some pretty critical support.

We broke below the 50-day MA for the first time since April.

This has acted as a complete floor the entire year. The entire run.

It has marked several bottoms.

The only time we broke below was April. We then ultimately came down and tested the 100-day.

This market is still clearly in an uptrend and only at prices seen two weeks ago.

However, breaking below this support is not a good sign as could very well spark additional downside.

I have been talking about the 50-day being our warning sign for months.

Nov Feeder 🐮

We also broke below that critical 50-day MA.

This is pretty much the very first time we’ve broken below in the entire life of this contract.

It could very well spark some more downside.

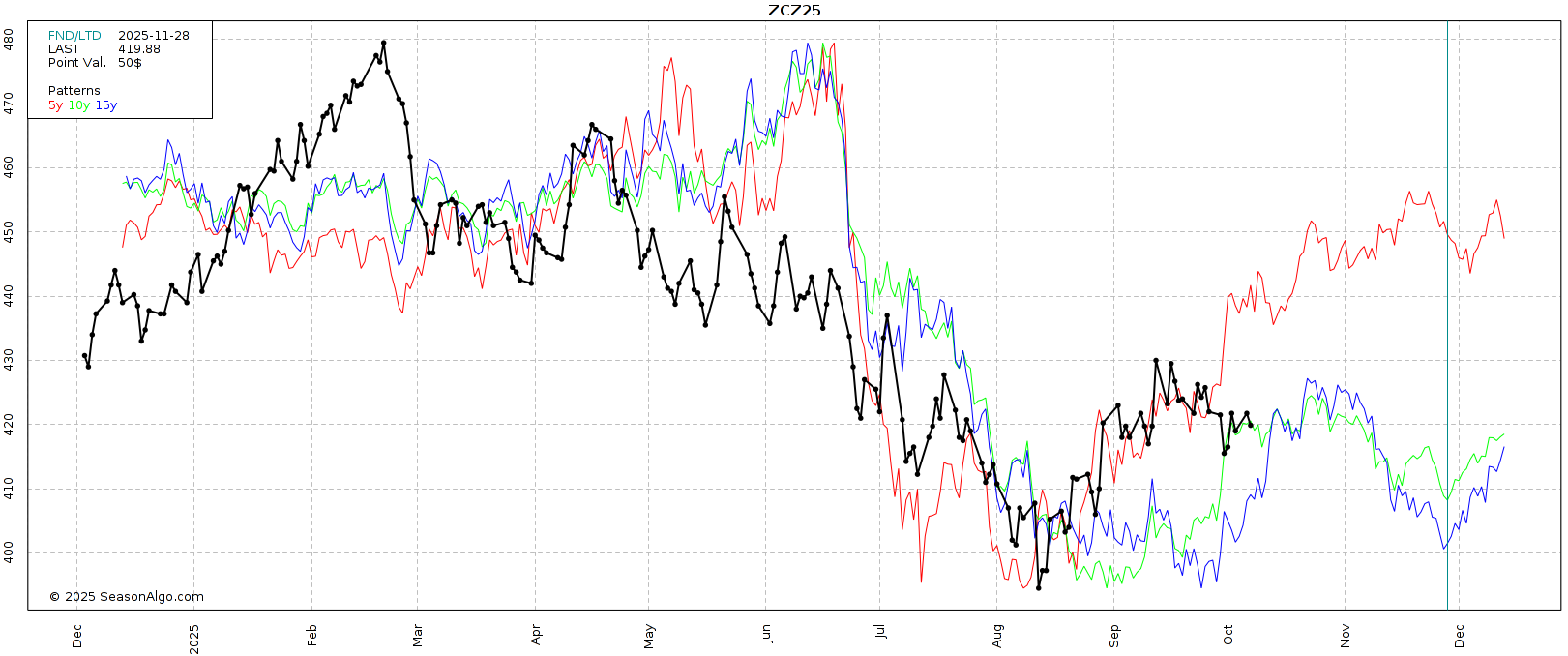

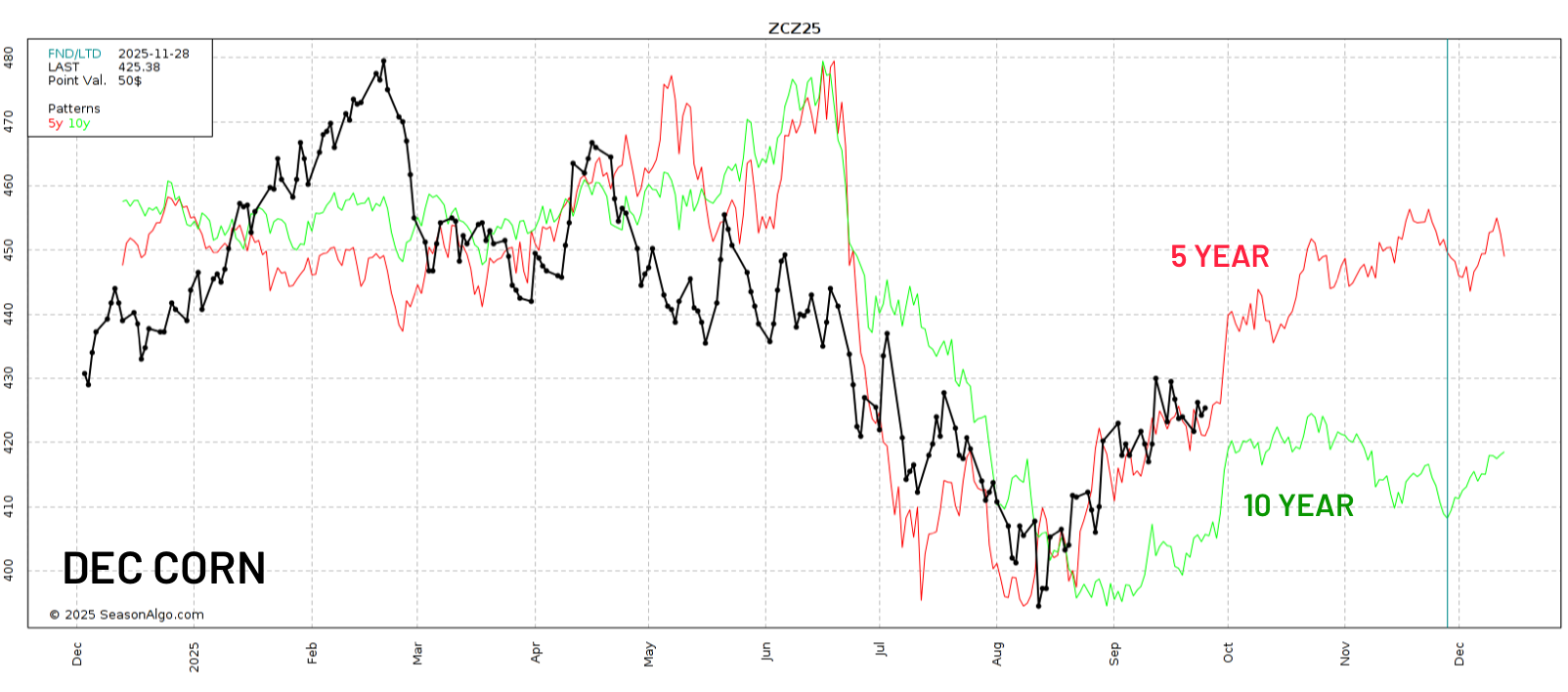

Dec Corn 🌽

I’m not concerned with the price action in corn today.

It was an inside day meaning we did not trade above yesterday’s highs or below yesterday’s lows.

Yesterday we had a clear breakout above the 61.8% retracement up to the Sep highs as well as a break from the downtrend resistance.

Most of the time (not every time) break above the 61.8% and it tells us we are going to see more upside.

I think today’s pressure could simply be a back test of our previous resistance. As old resistance is now viewed as support.

Past Sell or Protection Signals

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

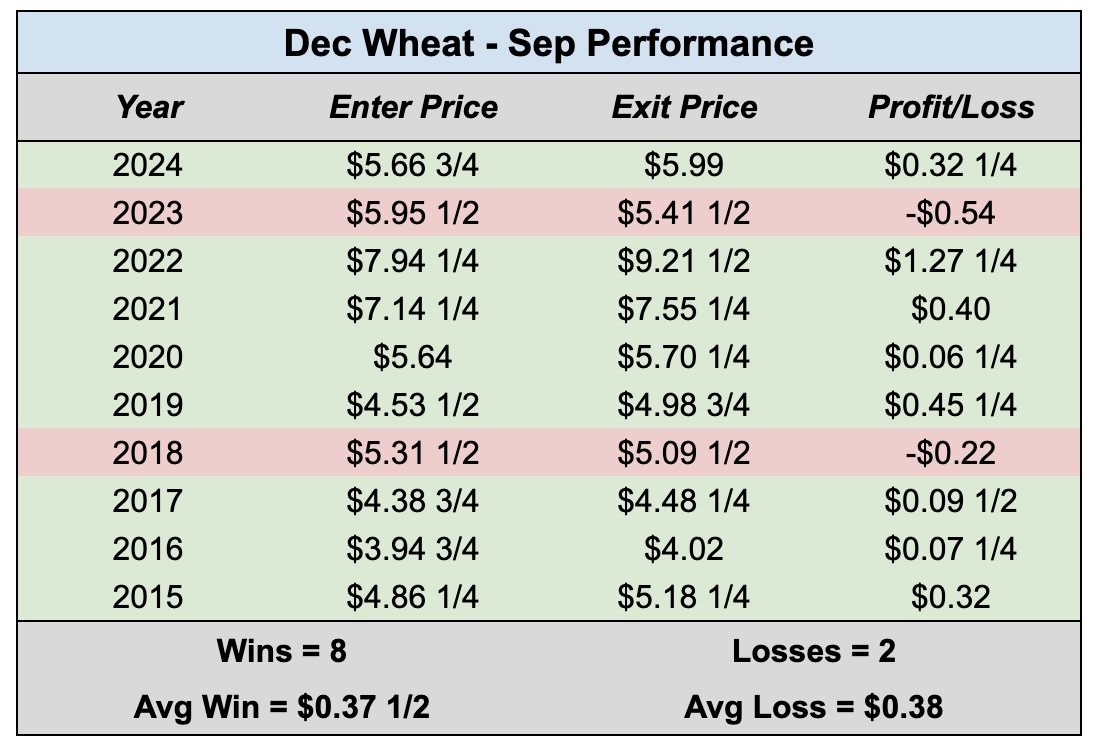

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

GRAINS BREAK OUT

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 3:00min

Options vs DP: 5:00min

Beans: 9:10min

Wheat: 14:10min

Cattle: 15:00min

Want to talk about your situation?

(605)295-3100

Your free trial has ended

You will not get our next signal or future updates

Here is extended access to our harvest sale

Don’t miss the next opportunity

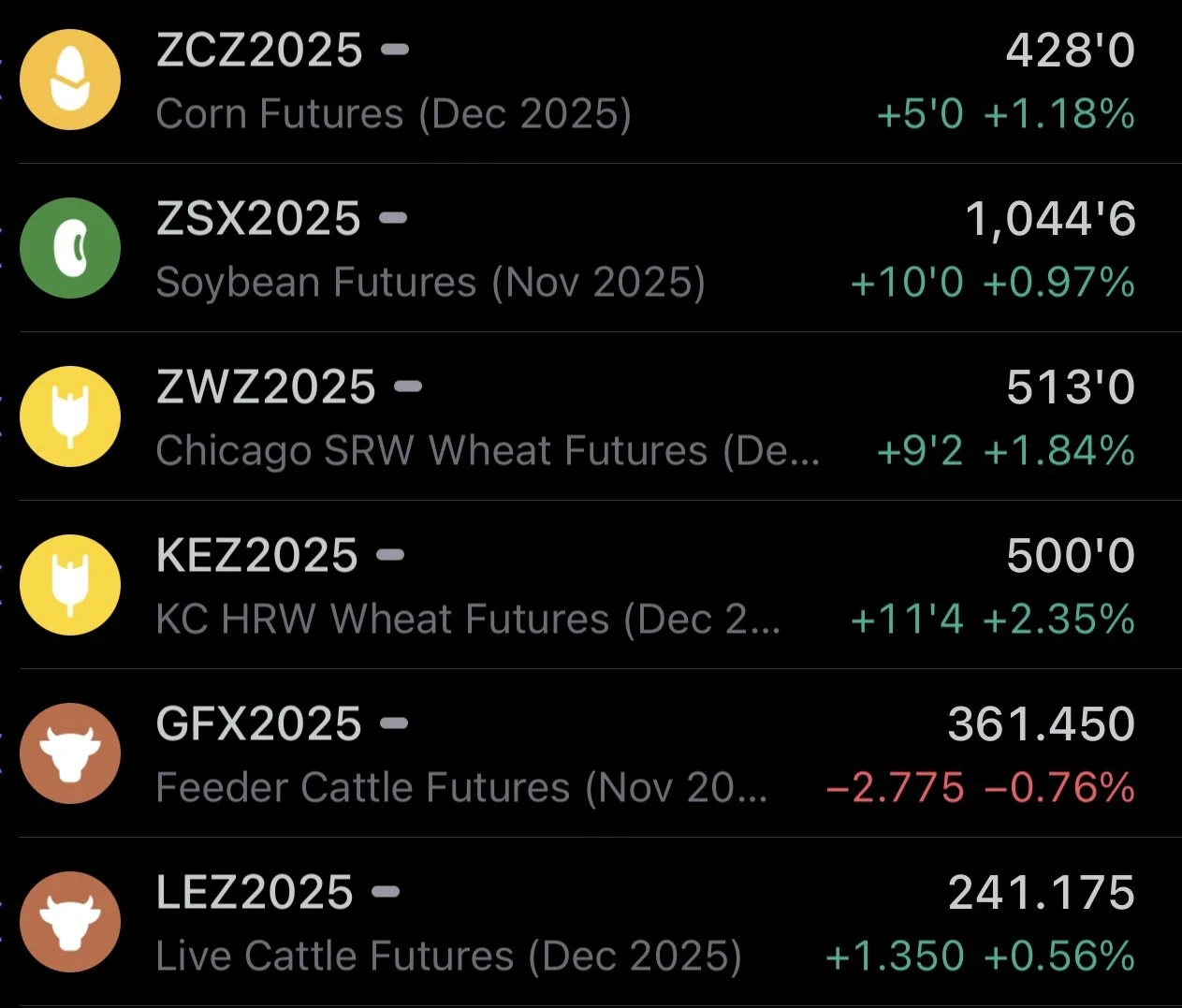

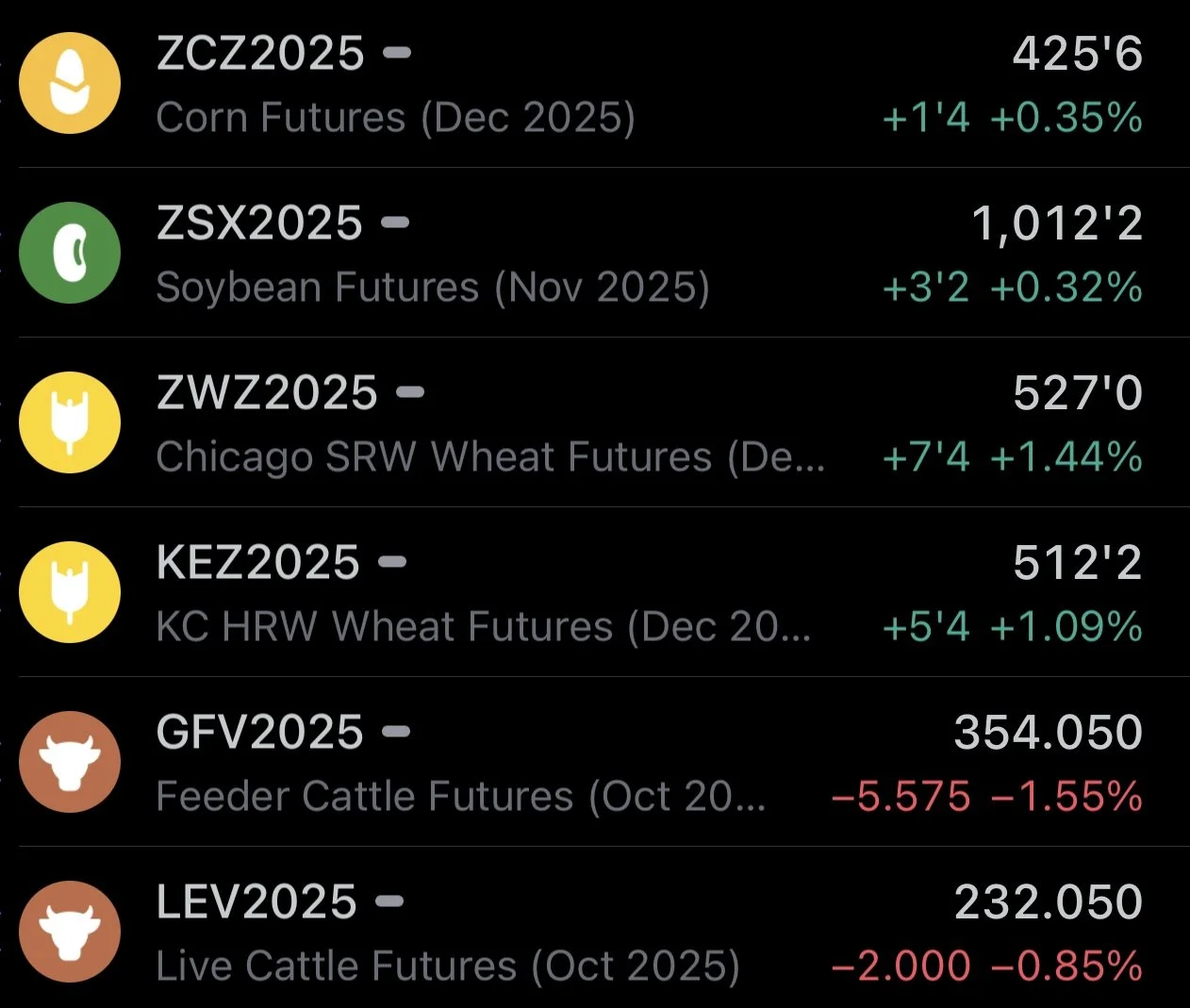

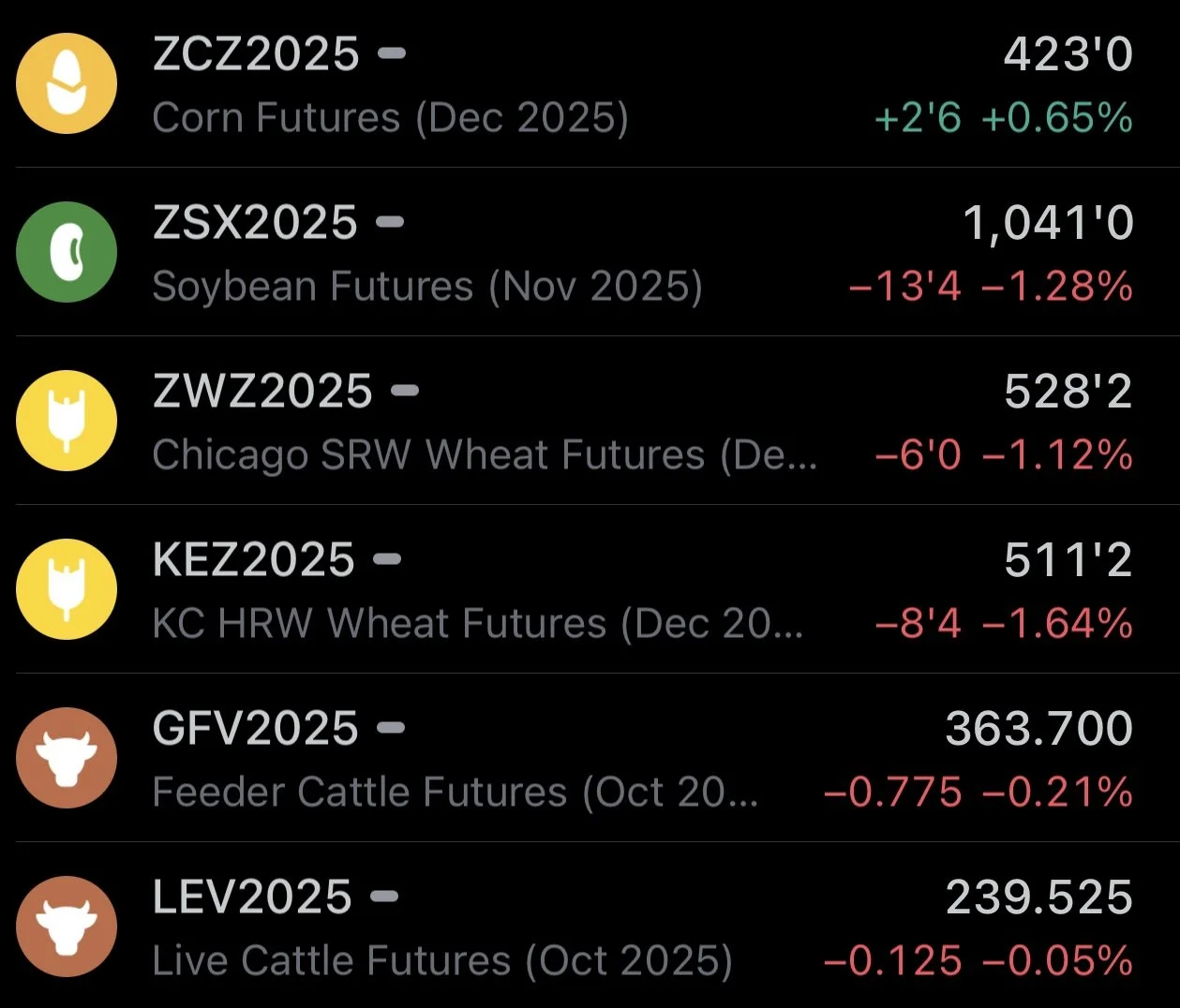

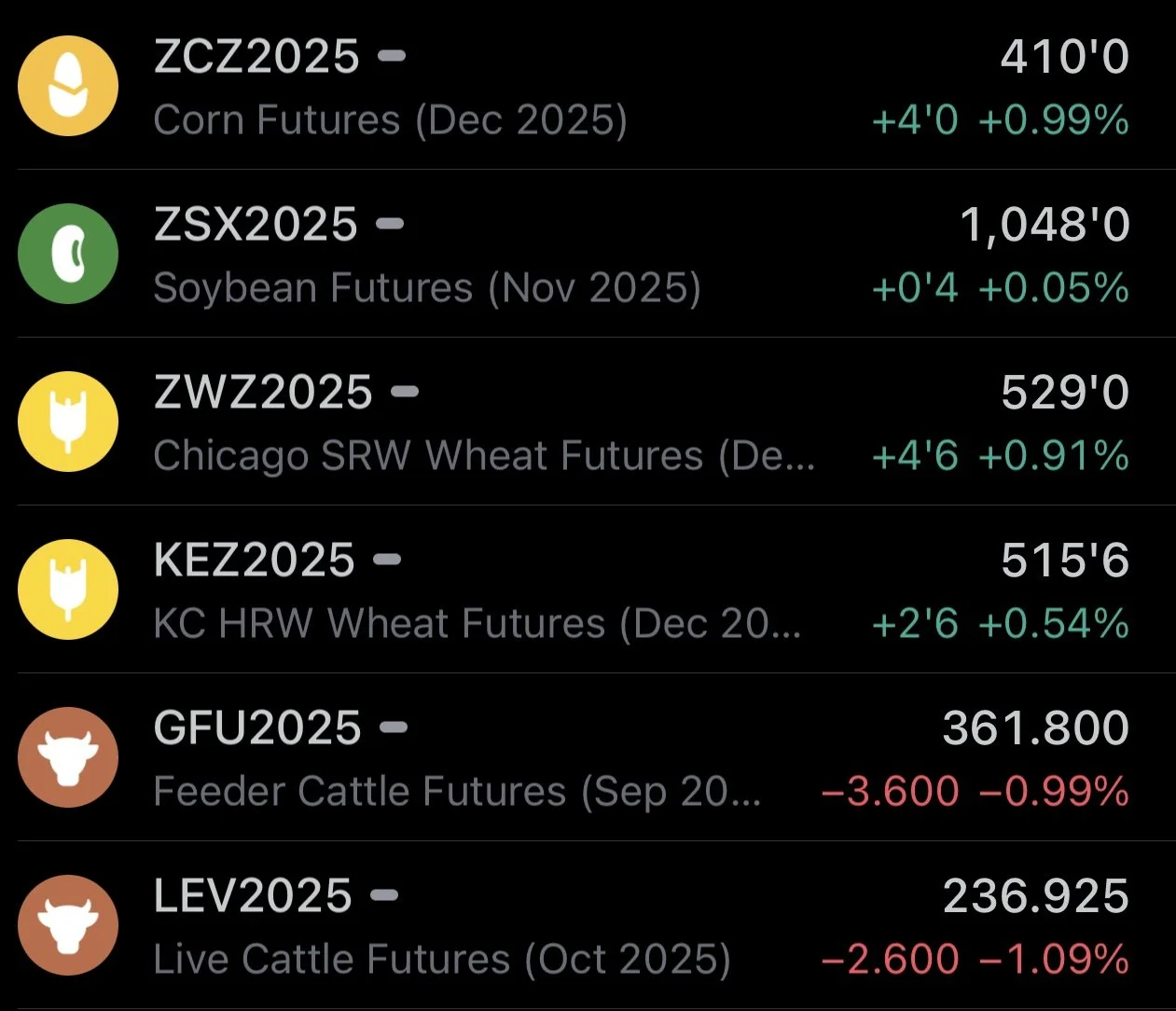

Futures Prices Close

Overview

Great day across the grain markets with the wheat market leading the way higher as soybeans continue to catch a bid from trade deal optimism.

The cattle market was mixed. Feeder cattle led this move higher while live cattle lagged behind. We are now seeing that feeder to fat spread get back in line as live cattle has held up better on this sell off.

Today is a longer update. We go over a ton of charts, targets, the math behind delayed price vs options and what the right move might be in the corn market.

Let's dive right into the news before we jump into the good stuff.

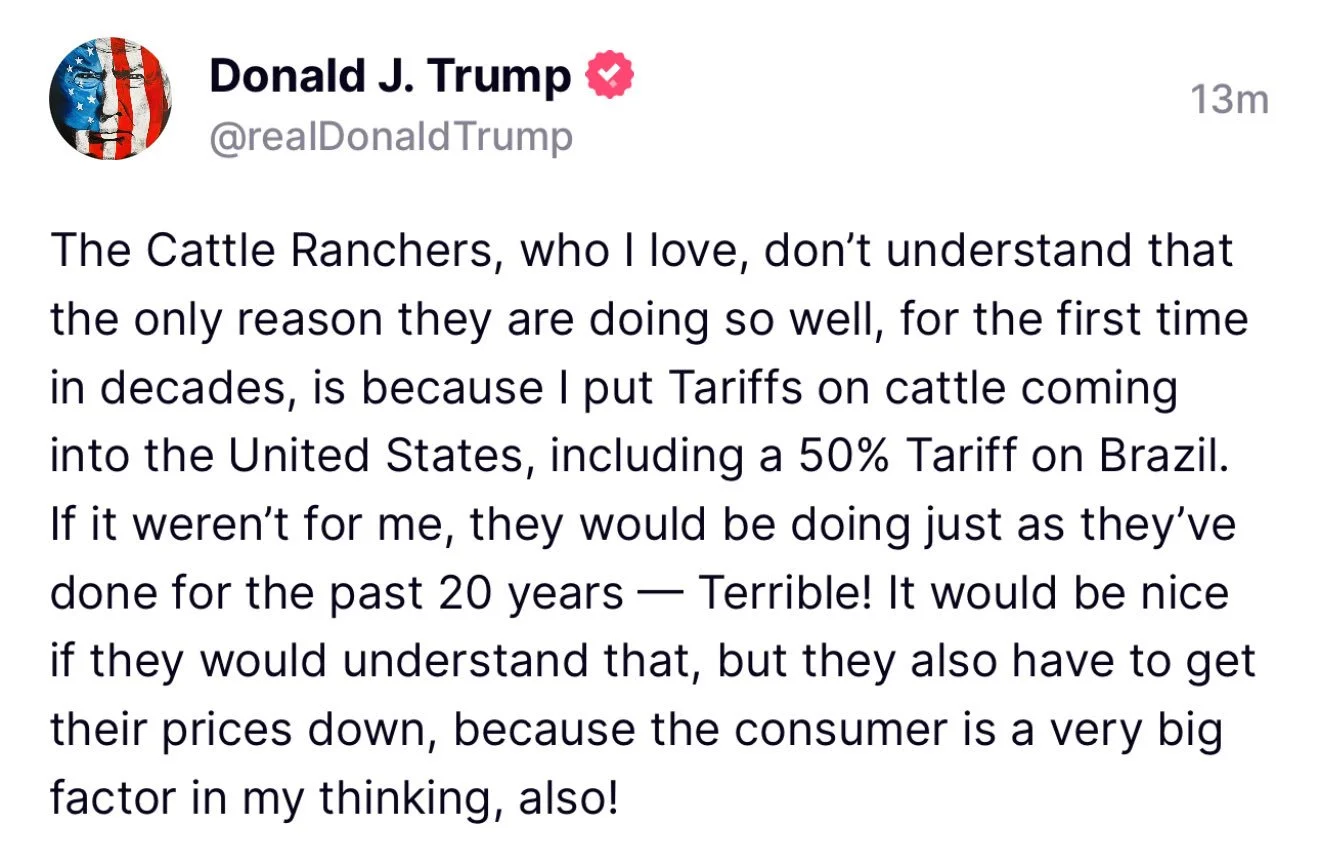

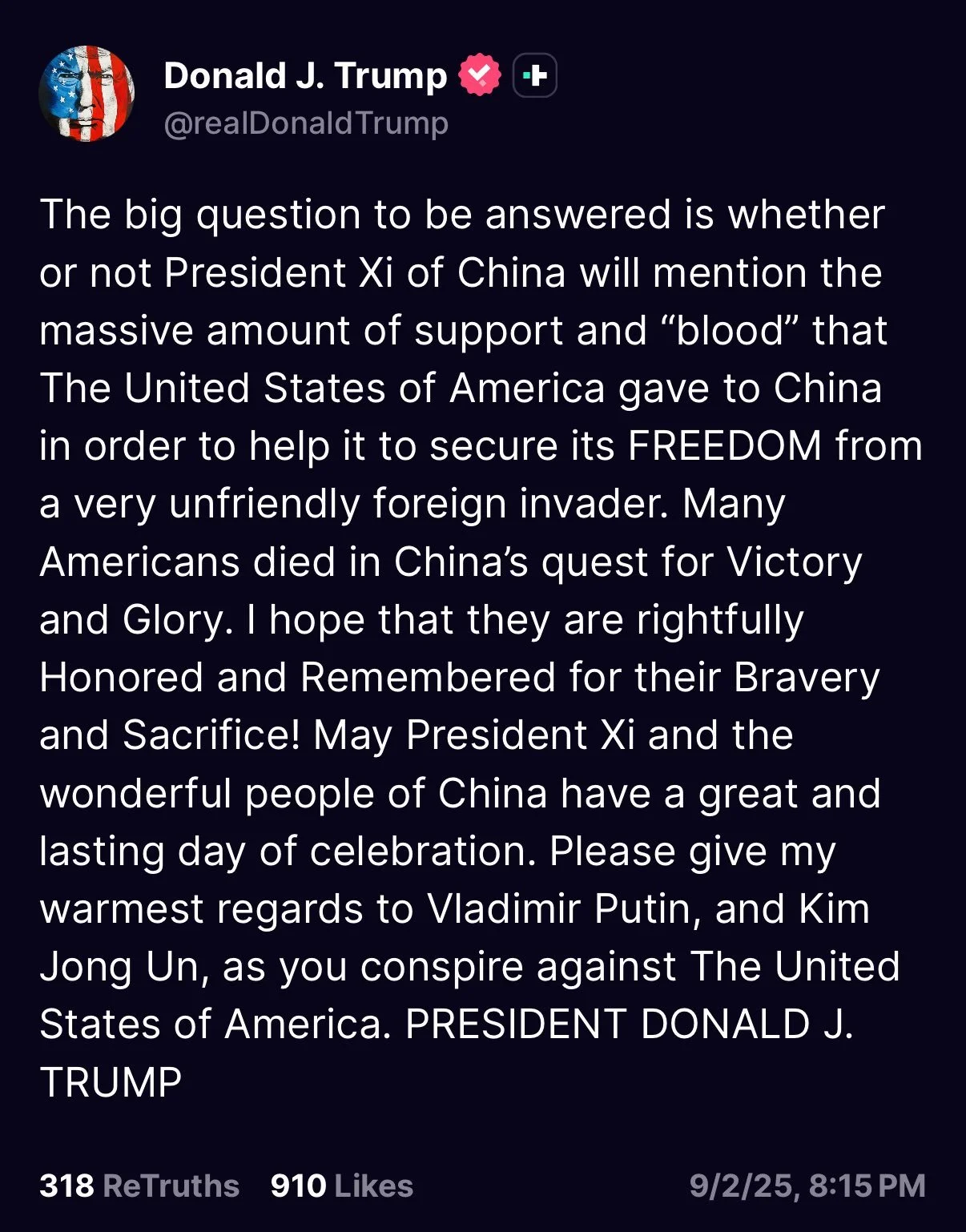

Trump Cattle News

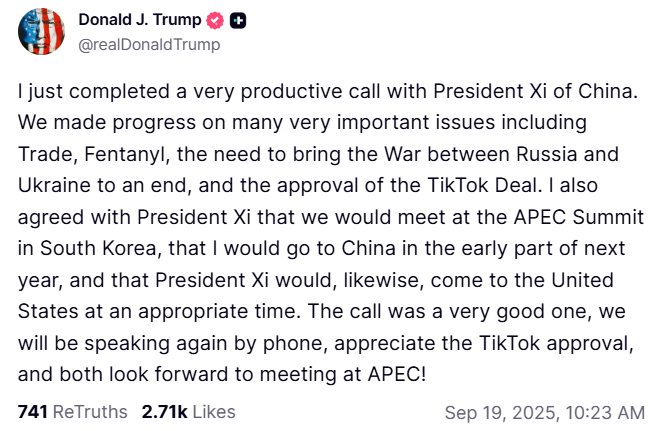

Trump made quiet a few comments yesterday.

The one that stirred the most controversy and upset many was these tweets about the cattle market.

He claimed that he is "the only reason cattle ranchers are doing so well" and that they "have to get their prices down" as the consumer is a big factor.

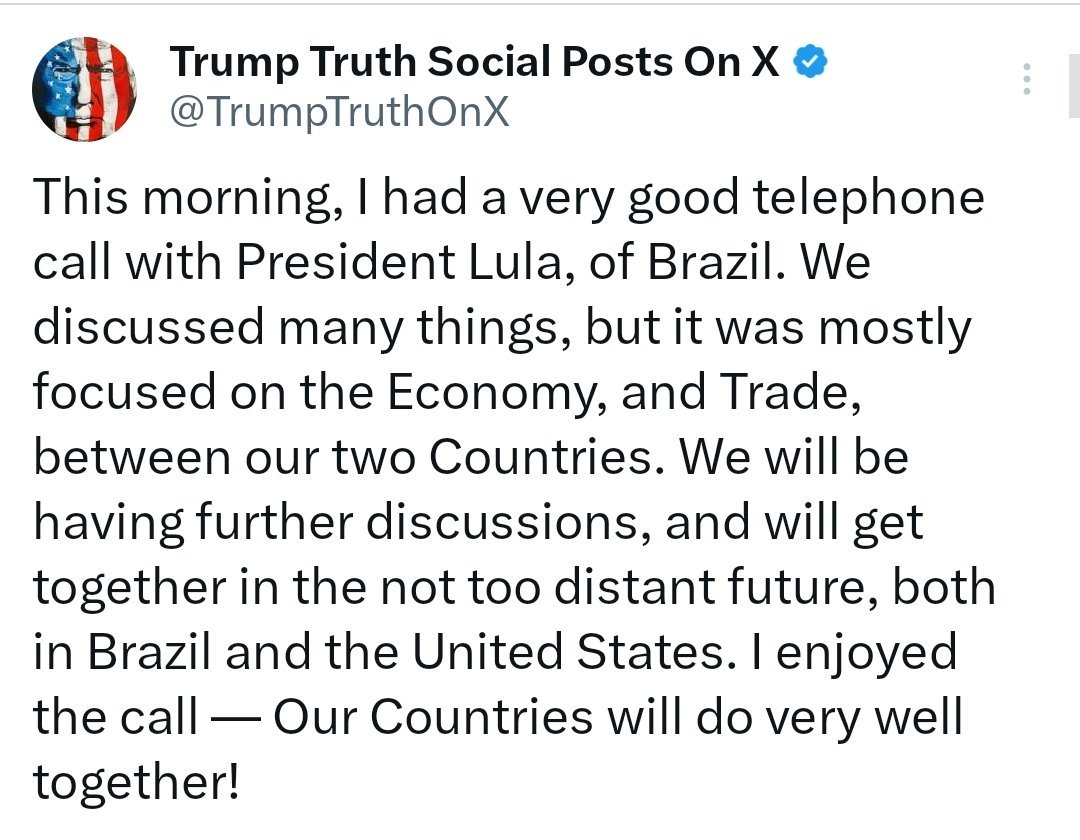

A few days ago, he said they are going to start importing Argentine beef, but that really doesn’t change anything.

Brazil is the one you have to be worried about. If he removes that tariff on Brazil beef that could add some pressure to this market and be a bearish factor. I believe he is scheduled to meet with Brazil next week, so that is going to be something to watch closely.

Regardless of the tariffs, cattle herds are at their lowest levels of all-time. That is the biggest reason why this market is higher. Supply is the tightest it has ever been.

Yes, the government shut down the Mexican border, amongst other things that helped fuel this rally. But tariffs alone aren’t the reason for the high prices.

There are certainly risks in this market which we'll touch on later.

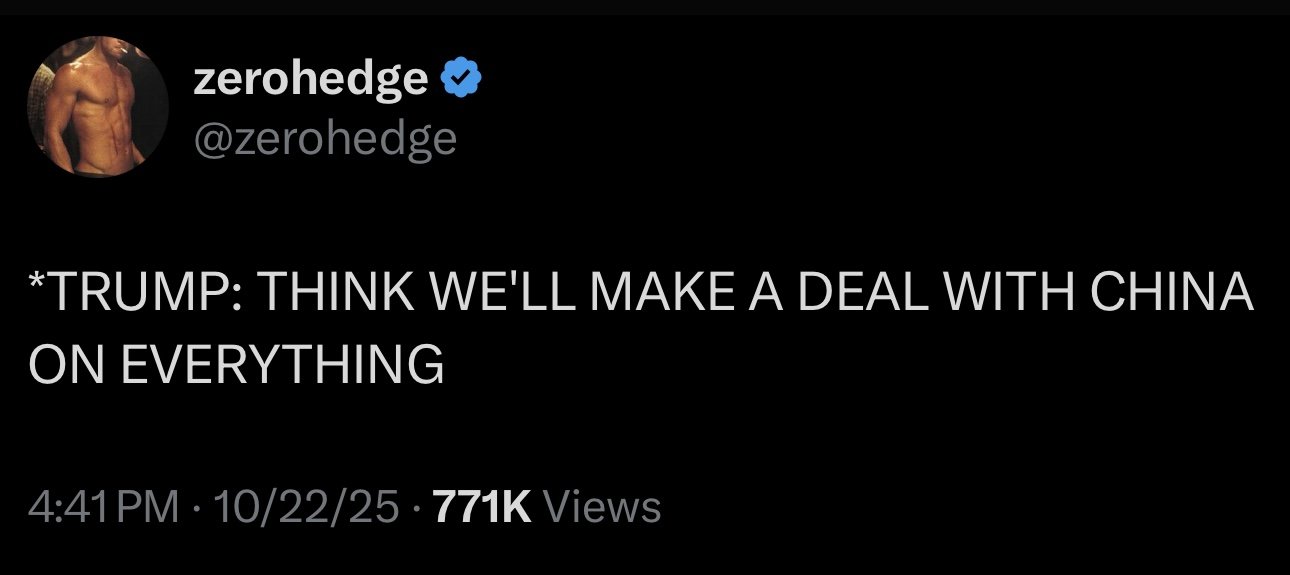

Trump Soybean News

On a more positive note, yesterday Trump said the following:

"We will make a deal on everything."

"I think we are going to make a deal in soybeans."

Optimism of a deal has been the biggest reason for the recent rally in soybeans.

Gov Shut Down Odds

I've been including this in most of my recent updates, but the betting markets date for the government shut down continues to grow longer.

It is now estimated to last 44 days.

Which puts us well into the middle of November (Nov 14th).

As a reminder, the Nov USDA is suppose to be Nov 10th.

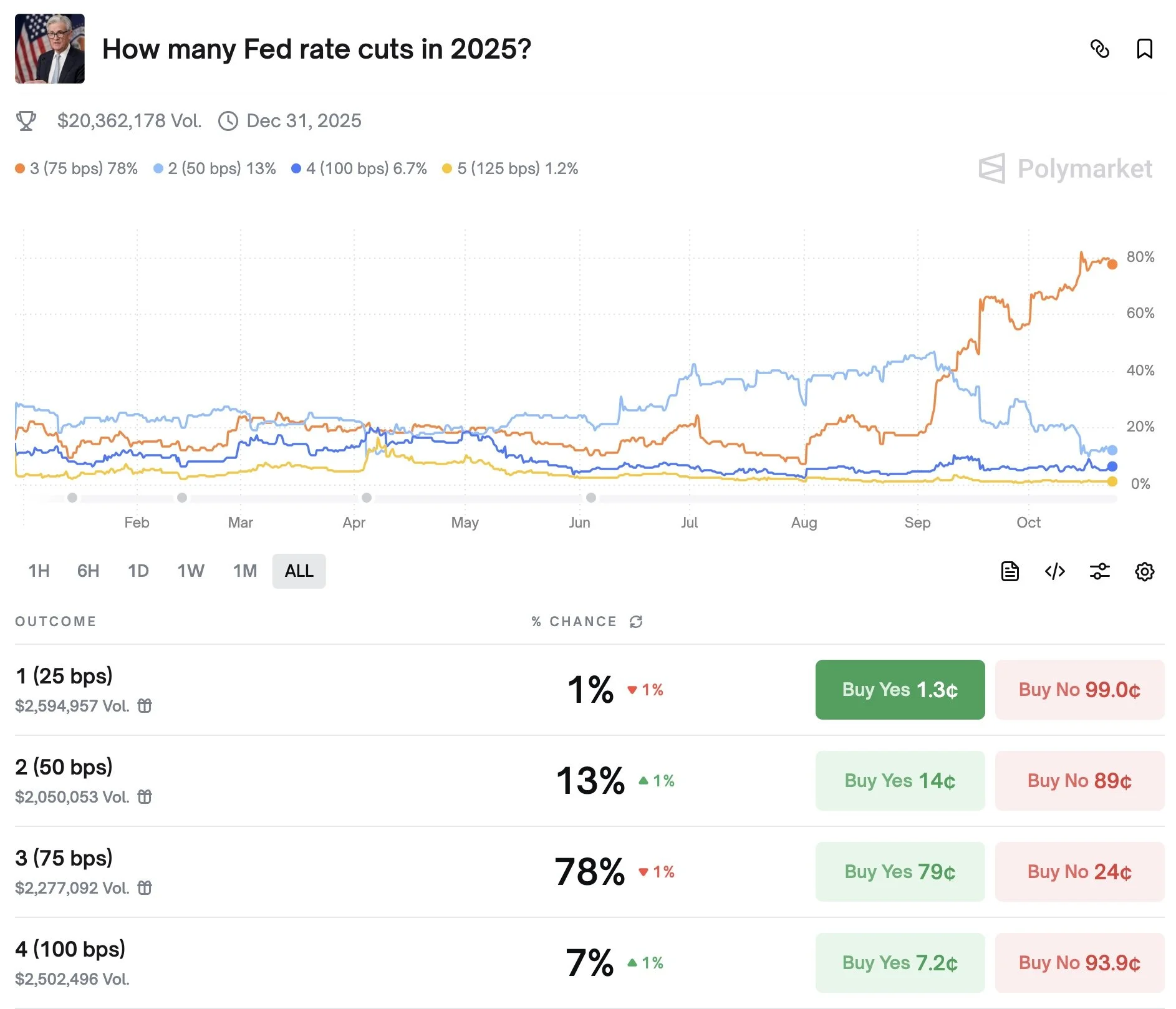

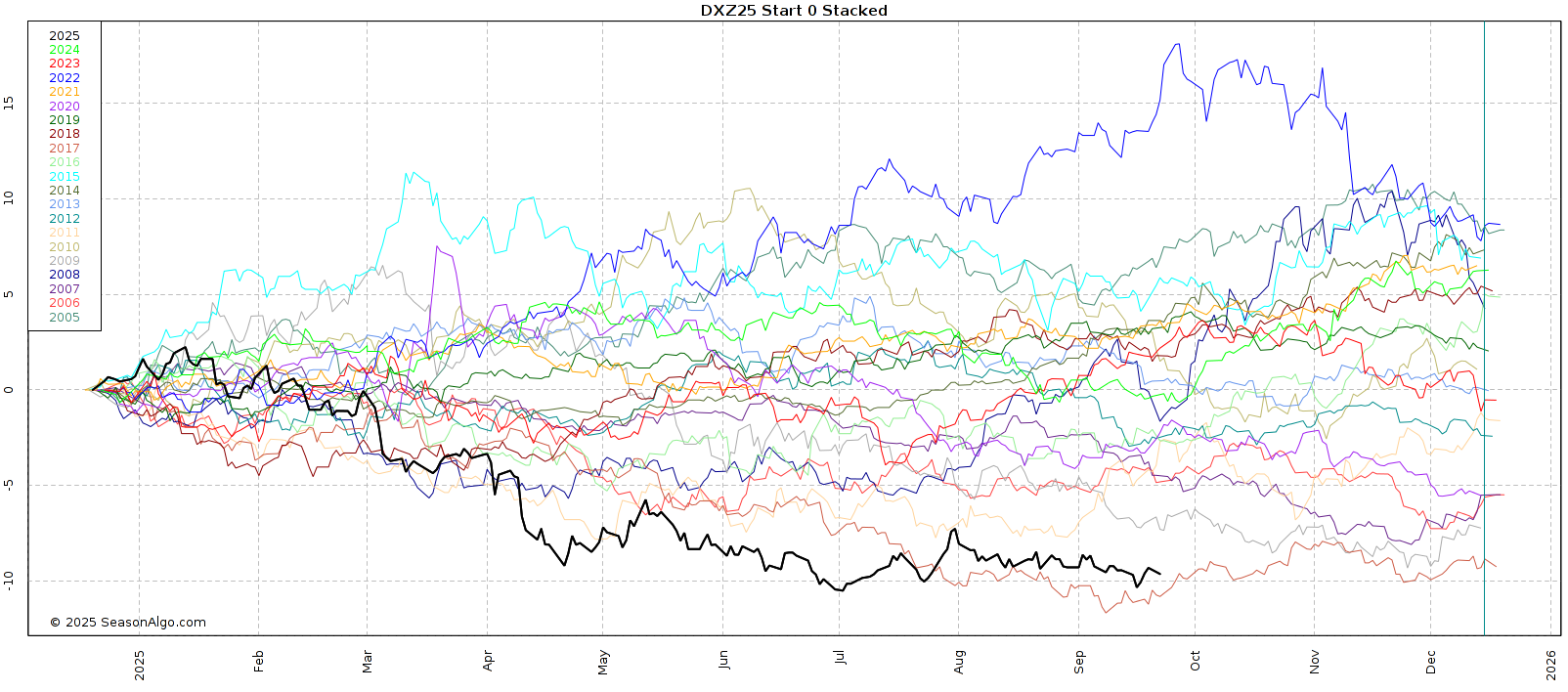

Rate Cuts

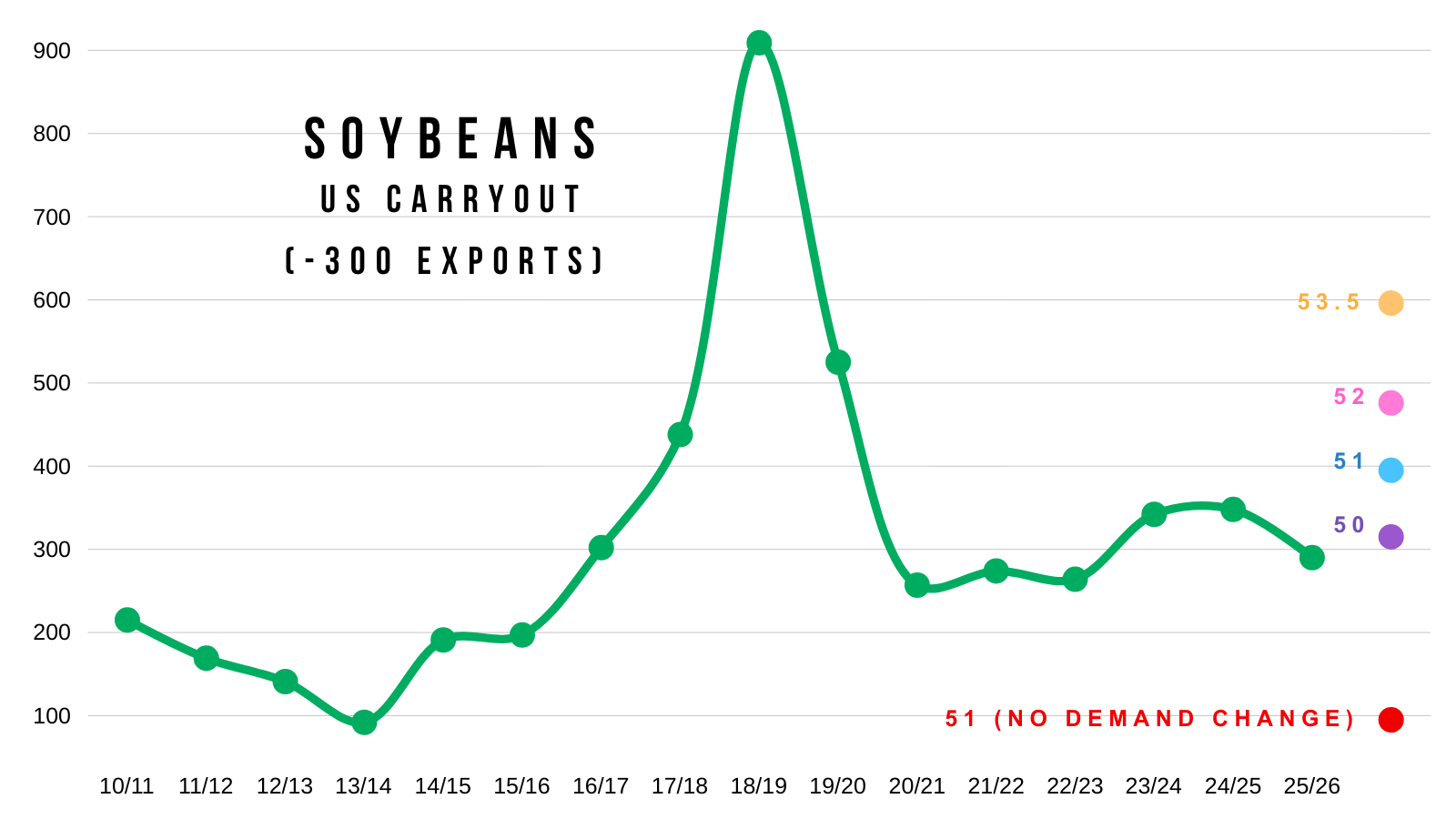

I've been talking about this for months and how this could be a potentially friendly factor for the grains.

There is currently an 80% chance we see 3 rate cuts this year.

Rate cuts lead to higher inflation and often higher-priced commodities.

Rate hikes lead to lower inflation and often cheaper commodities.

I've shown this before, but here is a chart that shows corn and soybean prices along with the feds rate cuts & hikes as well as inflation.

Interestingly enough, corn & soybean prices tend to follow inflation higher or lower.

Our last rate hikes marked the top of the bull market in 2022.

Last fall, our first rate cuts since 2020 coincidentally happened right before corn's most sustained rally of the entire bear market.

It does not mean grains "have" to go higher. Maybe it’s simply a coincidence. But you can’t deny the resemblance.

Today's Main Takeaways

Corn

Fundamentals:

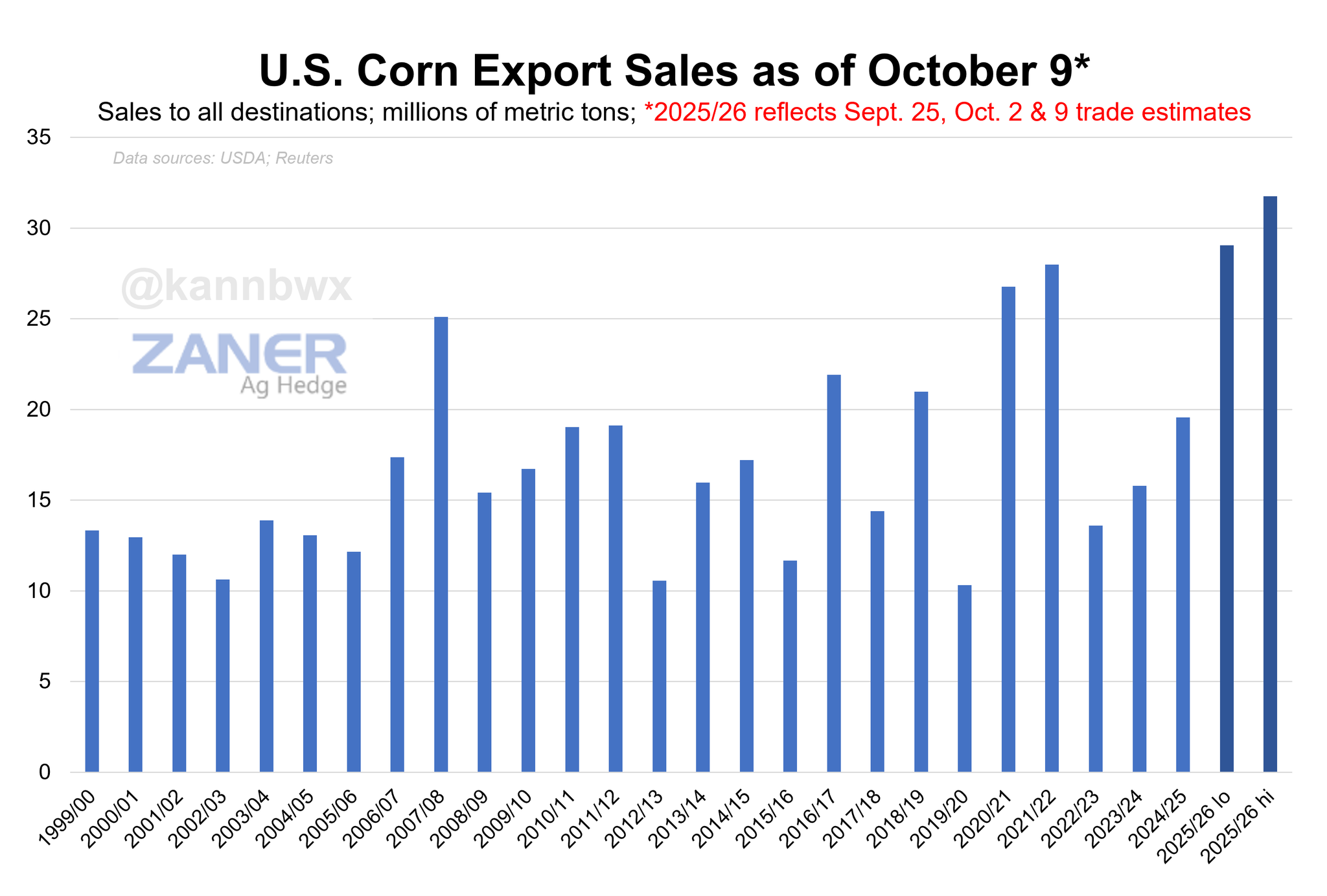

I showed this chart on Tuesday but wanted to include it again.

This is March-25 vs March-26 corn if you align our harvest lows.

So far, the two years have seen very similar price action.

Summer sell off.

August harvest low.

Rally off the harvest lows going into September.

Even the size of the rally off the harvest low was almost the exact same size.

Now seeing a correction and stabilization.

The years are not going to follow each other exactly.

But I could see us following a similar path.

Where we don’t get that real opportunity until late 2025 or early 2026.

China News:

There was a headline that said China is receiving too much moisture and that they may be facing a corn shortage due to this.

China is the world's 2nd largest corn producer.

China has not bought any US corn in a very long time.

Their US corn imports have continued to shrink since the phase 1 trade agreement.

The last bull run in corn was largely due to the demand we saw from China buying US corn.

Even with zero business to China, corn demand is at a record.

Surpassing the demand we saw during the last bull run.

Who knows if China will actually buy US corn. They do have large corn stocks they can tap into, but nobody knows how accurate the data actually is.

However, you can only imagine how friendly it would be for this market if China did come in and buy US corn.

I'm obviously not getting my hopes up and betting the house on this happening.

But what if China has to buy US corn? Or what if we sign a trade deal where they agree to buy some corn? We already have record demand without them.

Chart from Karen Braun

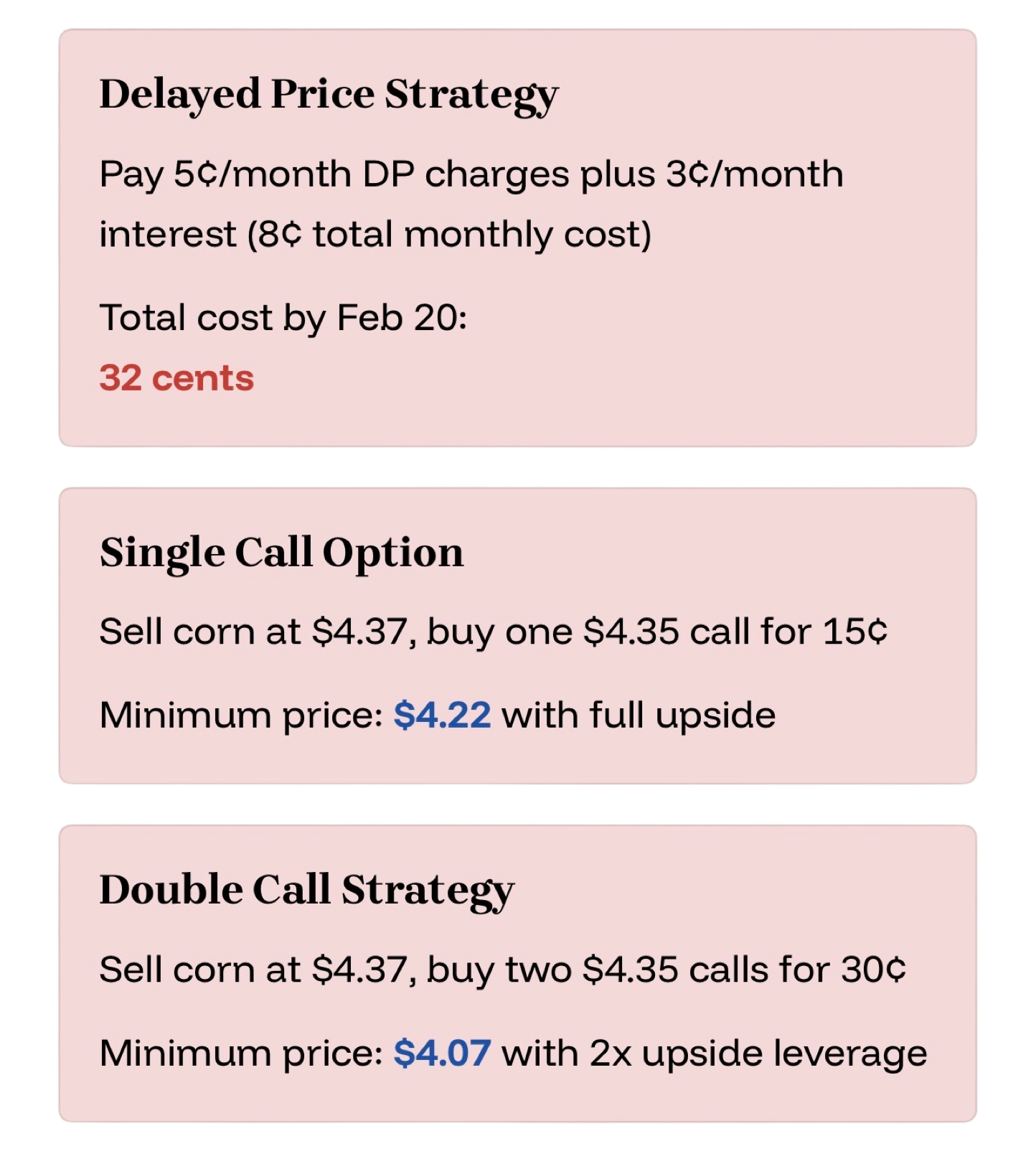

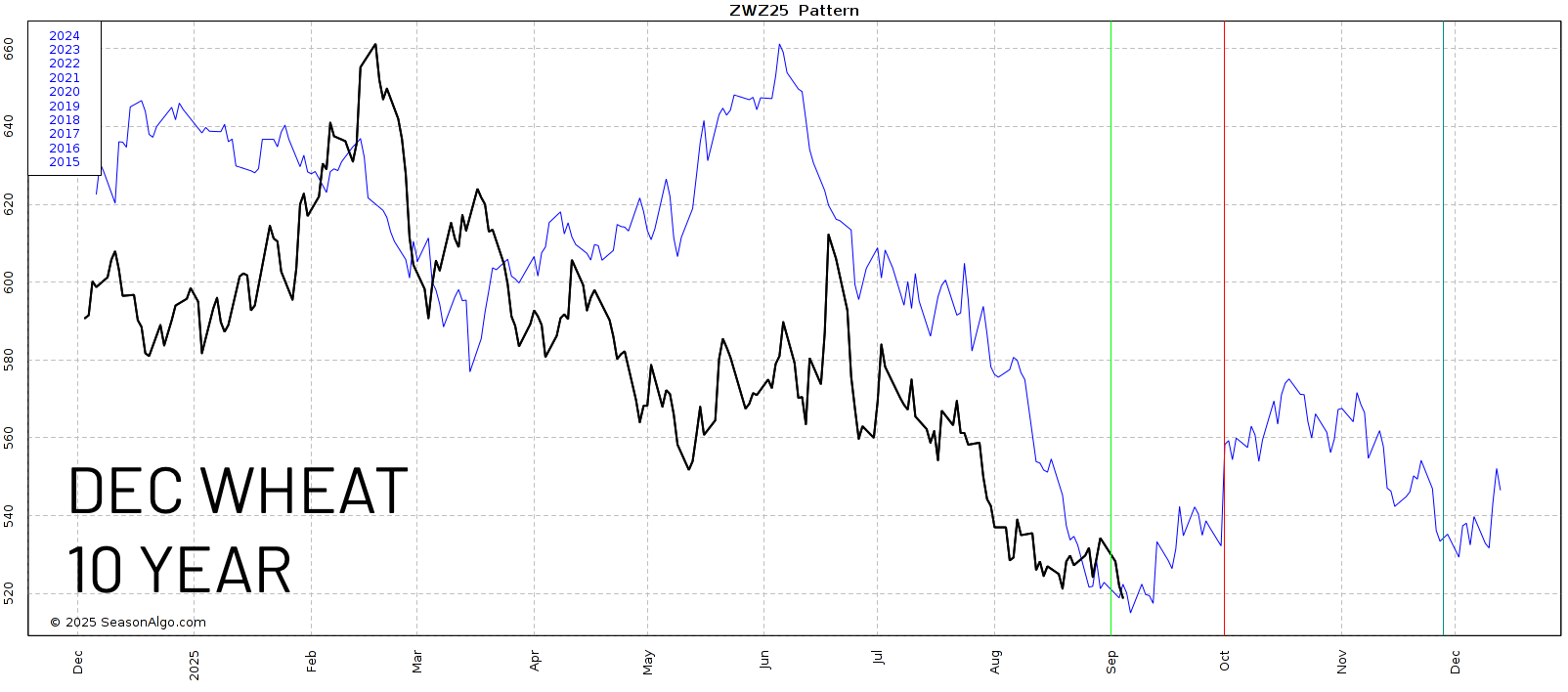

Options vs DP

Many of you have asked about DP charges and what you should do.

Here is a good article that Jeremey and Lauren at Texas Hedge Risk put together:

Many farmers face a critical decision. Should they pay DP charges for stored corn, or explore a different strategy?

The answer is clear for most.

You're likely better off with selling corn and re-owning it will call options.

This approach can save you significant money while keeping your upisde potential.

Here is the math behind it:

Assume you are paying 5 cents per month in DP charges. Plus 8% interest on a line of credit.

At $4.50 corn, interest costs run you 3 cents a month.

For a total of 8 cents every month when you combine the DP and interest.

By February 20th, holding corn on DP would cost you 32 cents in total.

Here is an alternative:

March futures are trading at $4.37

The March $4.35 call options cost only 15 cents.

This presents a compelling opportunity.

You could sell your physical corn, buy one call option to protect your upside, and still come out ahead.

Even better.. you could buy two call options for 30 cents.

This 30 cents for the options would still be less than your total carrying costs.

While leaving you with exposure to the upside if we were to rally.

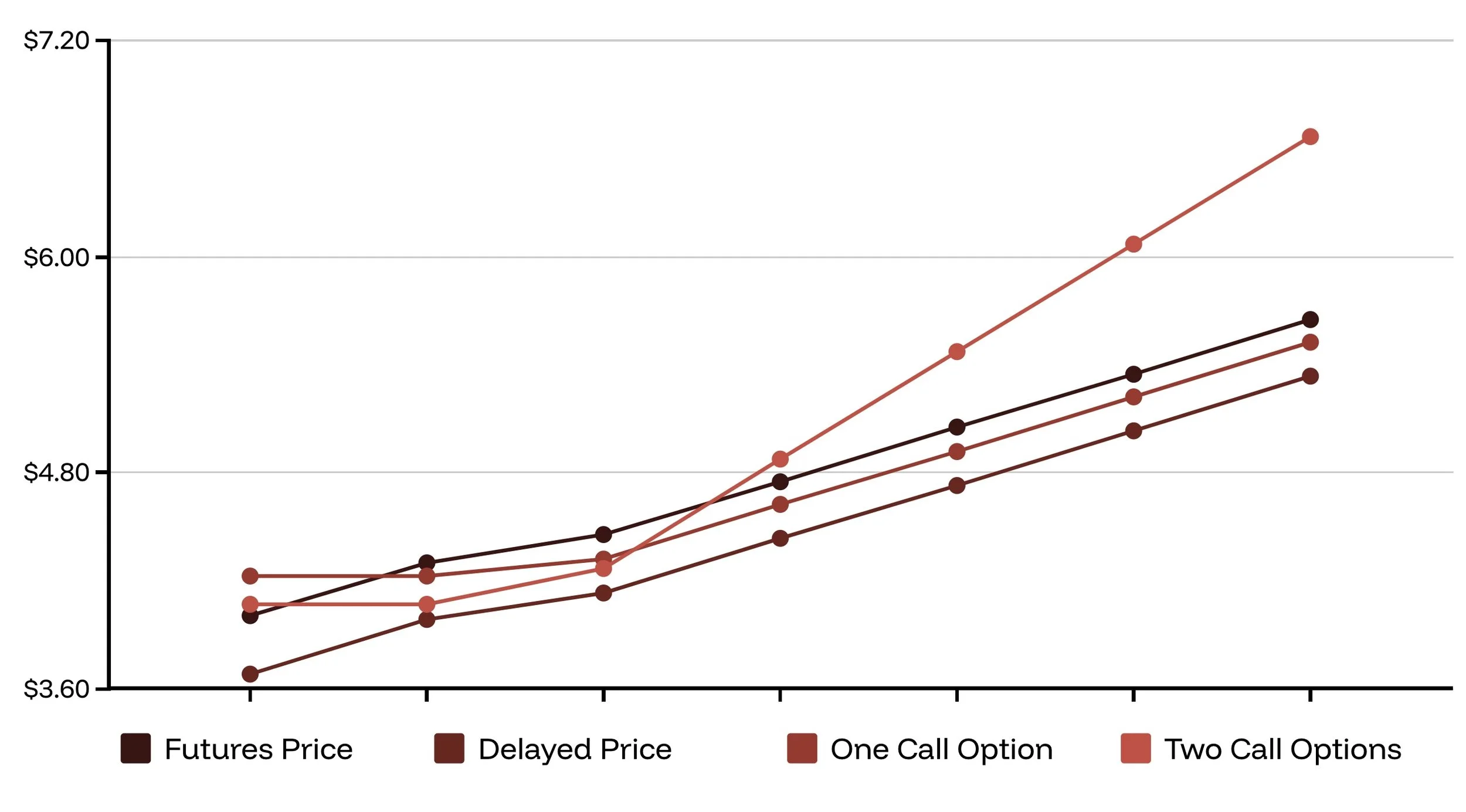

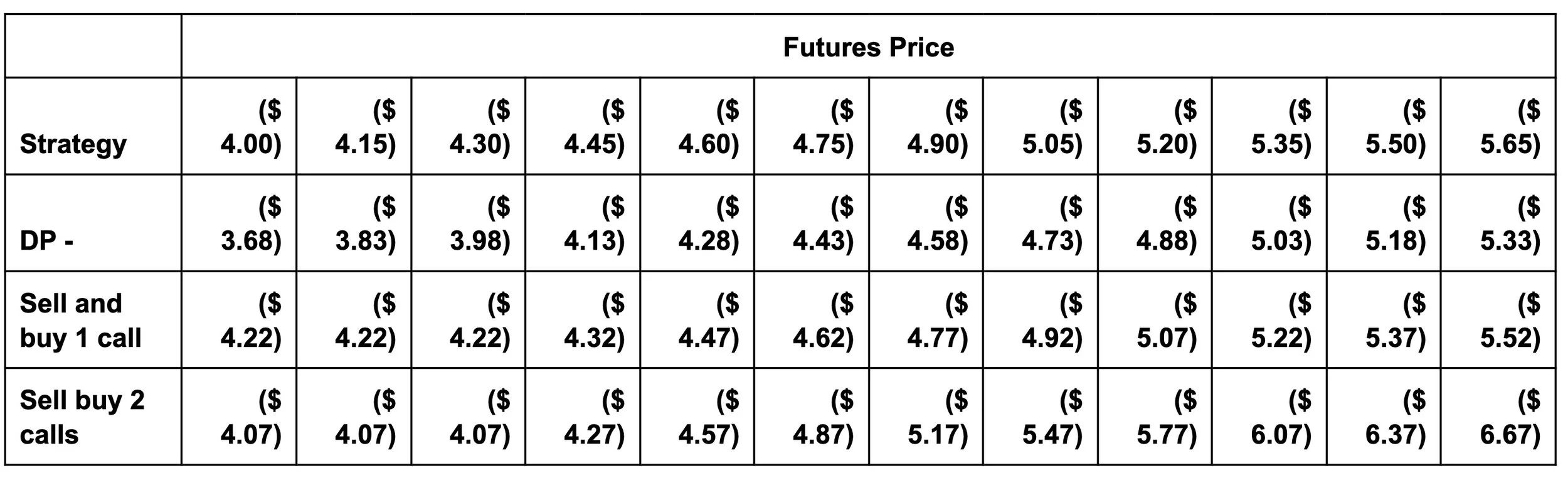

Here is a visual of the strategies and their minimum prices etc.

Now let's compare the outcomes based on various price scenarios.

In this scenario we used $4.00 to $5.65 corn, assuming you must sell by February 20th when the options expire.

This visual comparion reveals a striking difference in outcomes depending on where the market goes.

Here is a table of the outcomes.

The DP strategy simply delivers the futures price minus 32 cents in total carrying costs.

The one call option strategy provides a floor of $4.22 by ($4.37 futures price minus 15 cents for call option). While keeping your upside open.

The double call strategy provides a floor of $4.07 ($4.37 futures price minus 30 cents for both call options). While keeping your upside open by twice as much.

For example, if corn were to rally to $5.05 like we did last year. You would receive $5.47. Which is a full 74 cents above the DP outcome.

So should you pay DP charges?

Probably not in this current environment.

However, this analysis does NOT account for basis appreciation or extreme market moves in either direction.

Remember, you can always make marketing decisions and defer payment until January 1st. The right pricing decision and the right cash flow decision don’t have to align.

The bottom line: If your elevator will improve basis even on DP corn, you might justify paying DP. But right now, options are simply too cheap and DP charges are too expensive to ignore this strategy.

Give us a call or a text if you want to talk through this or have any questions at all.

(605) 295-3100

Technicals:

I really like what I am seeing out of corn.

We finally broke that $4.23 level we had been talking about.

$4.23 clawed back 61.8% of the Sep highs.

That is where most relief bounces fail.

Since we are above that level, it tells us this is no longer seen as just a small bounce. It could very well be the start of something bigger.

More often than not.. it is a sign we are in for some more upside.

Our first target is still $4.35.

That gives back 50% of the Feb highs. It is also old key support from spring, now viewed as resistance.

That is a good spot to start to de-risk.

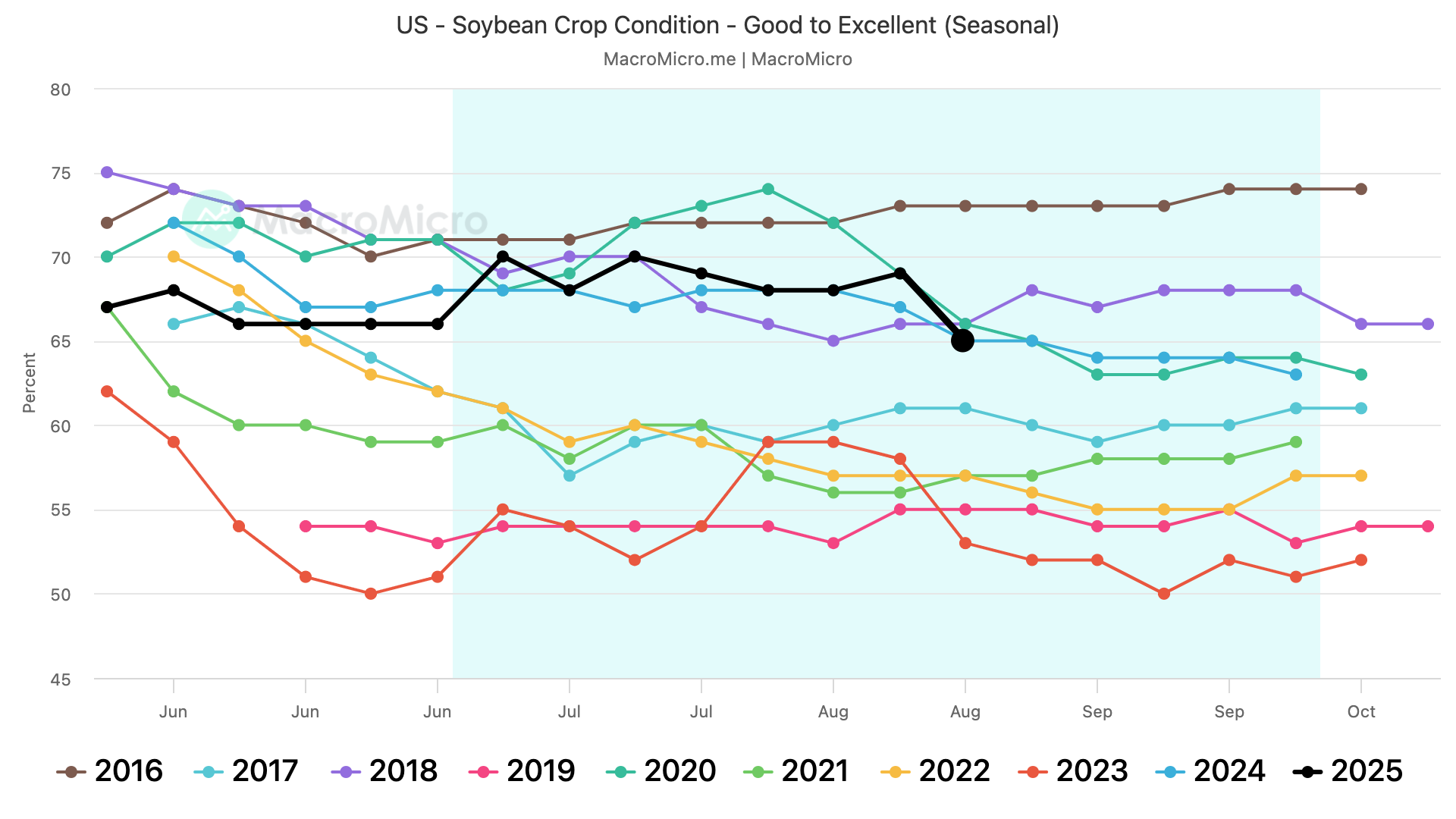

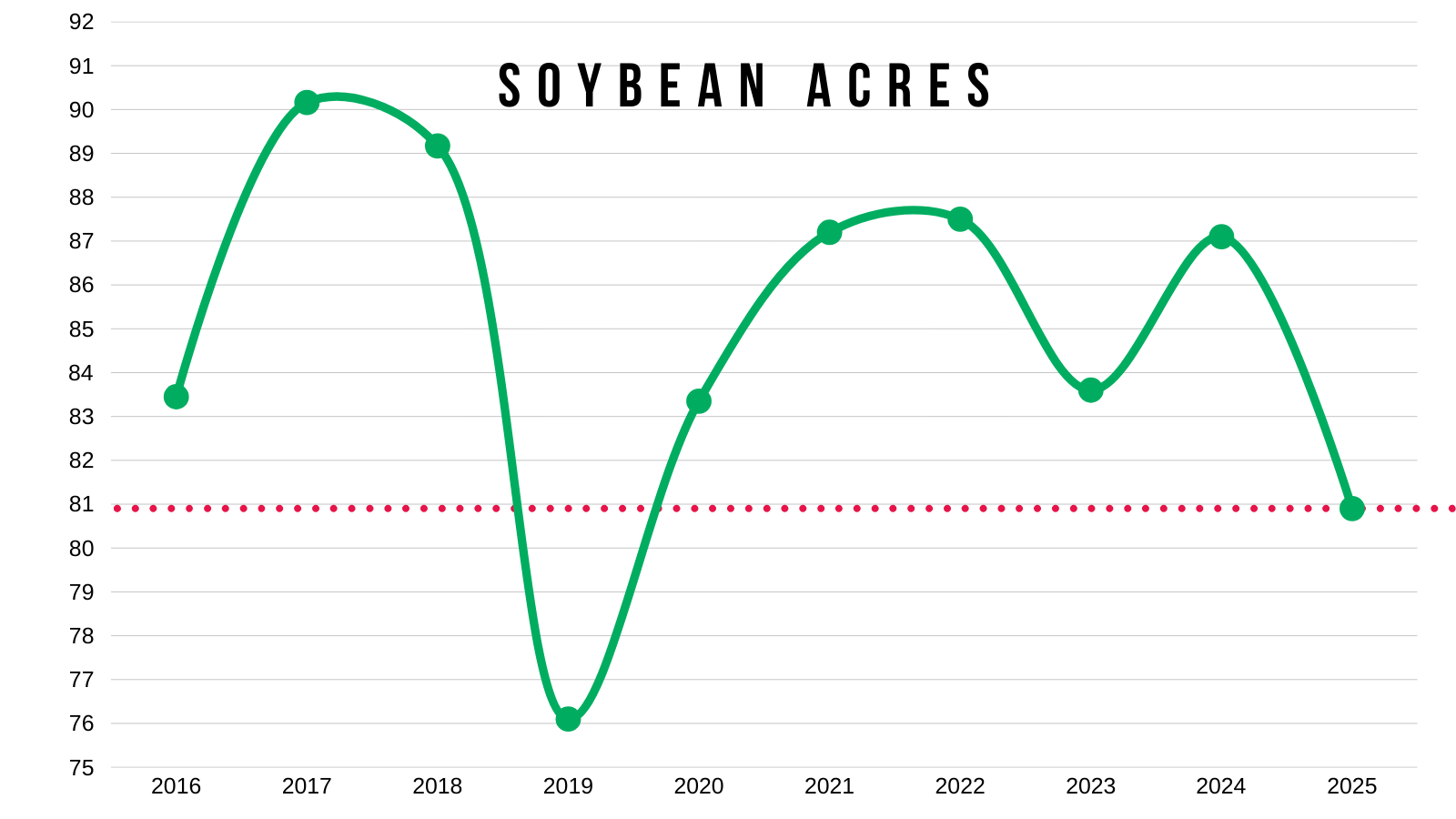

Soybeans

Fundamentals:

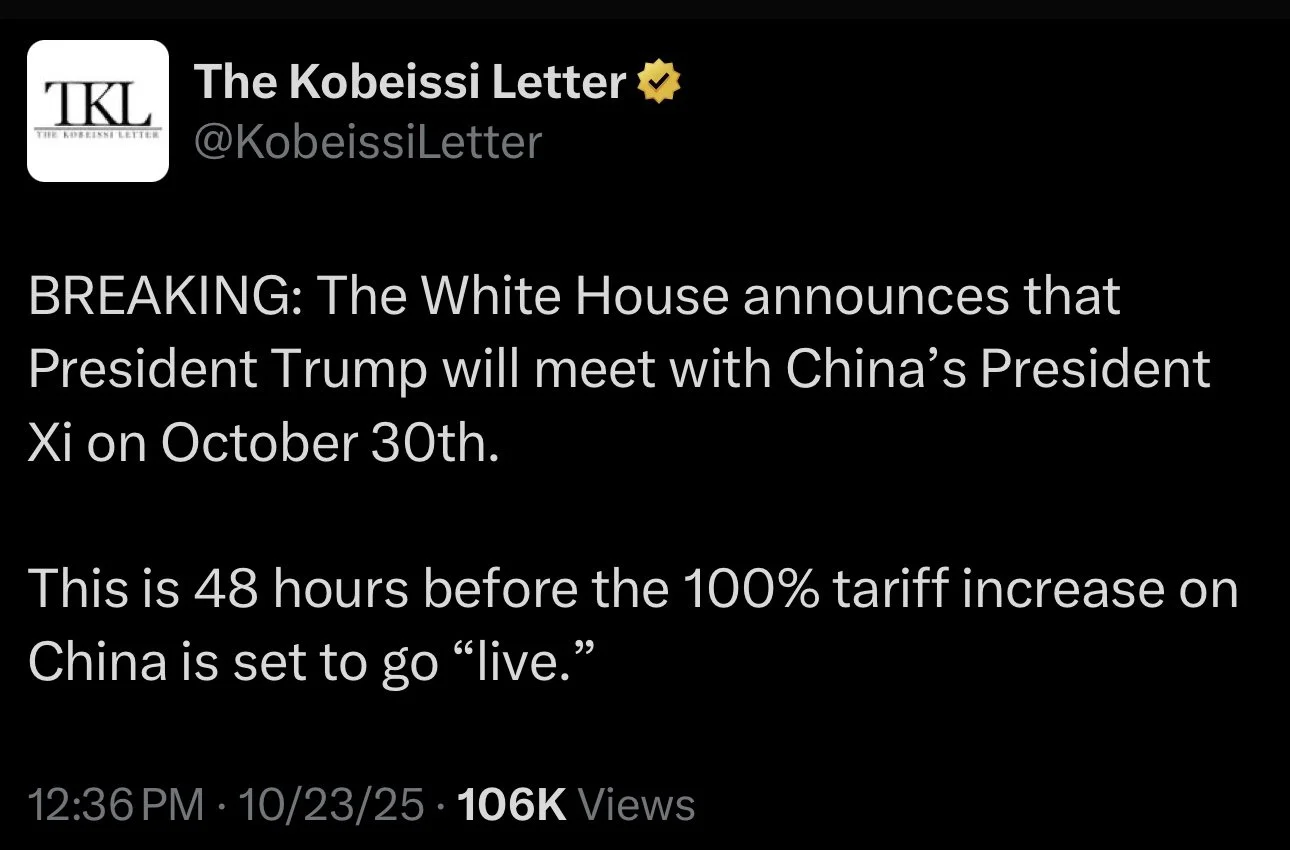

Today it was confirmed that Trump and China are scheduled to meet in exactly a week.

48 hours before those 100% tariffs on China are set to go into effect.

Where this market decides to go will likely stem from what happens between them.

This market continues to trade headlines.

If we strike a deal, there is incredible upside.

If the meeting is a flop, we probably sell off.

One negative headline could very easily kill this rally.

On the other hand, if we do end up making a deal with China and they come in and buy our soybeans.. this market has some insane upside potential.

I have no idea where soybean exports will end at. Rumors are that China is still going to need around 300 million bu of soybeans to meet their needs until Brazil's crop comes online.

Last year China bought 800 million bu from us. So if we secured that 300 million bu worth of demand, we would still be -500 million bu short of last year. But other countries have been stepping up to offset those losses.

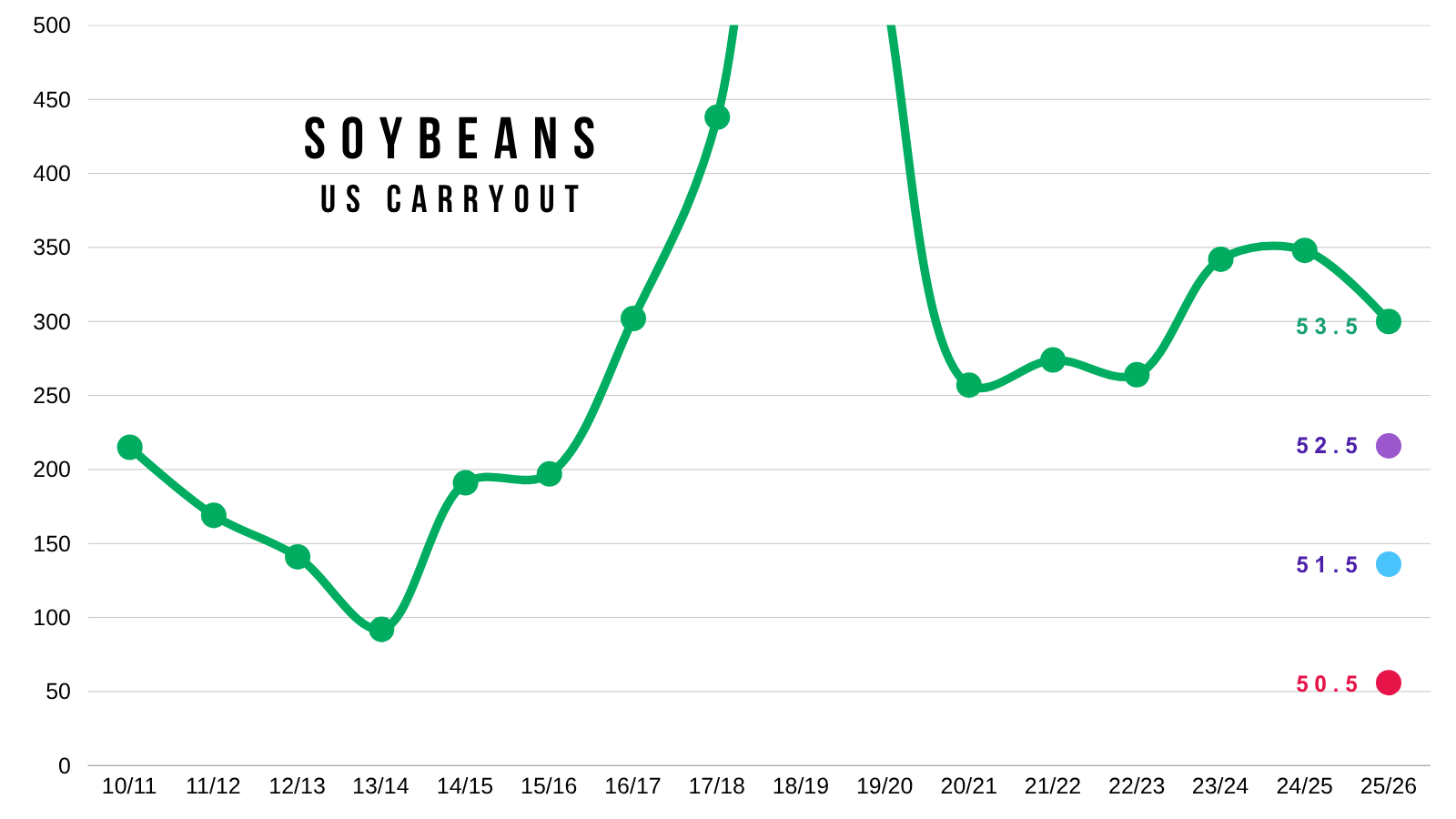

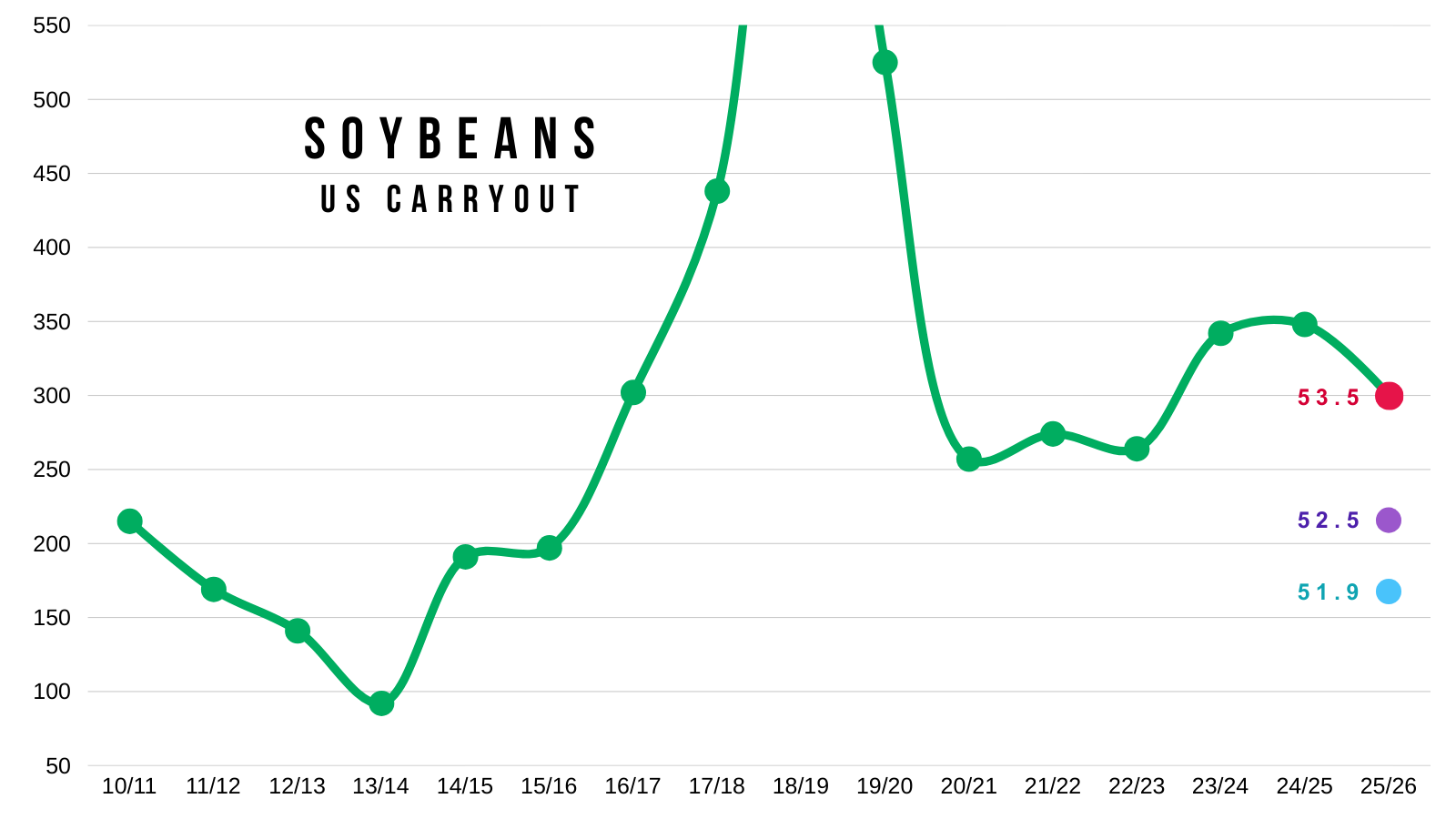

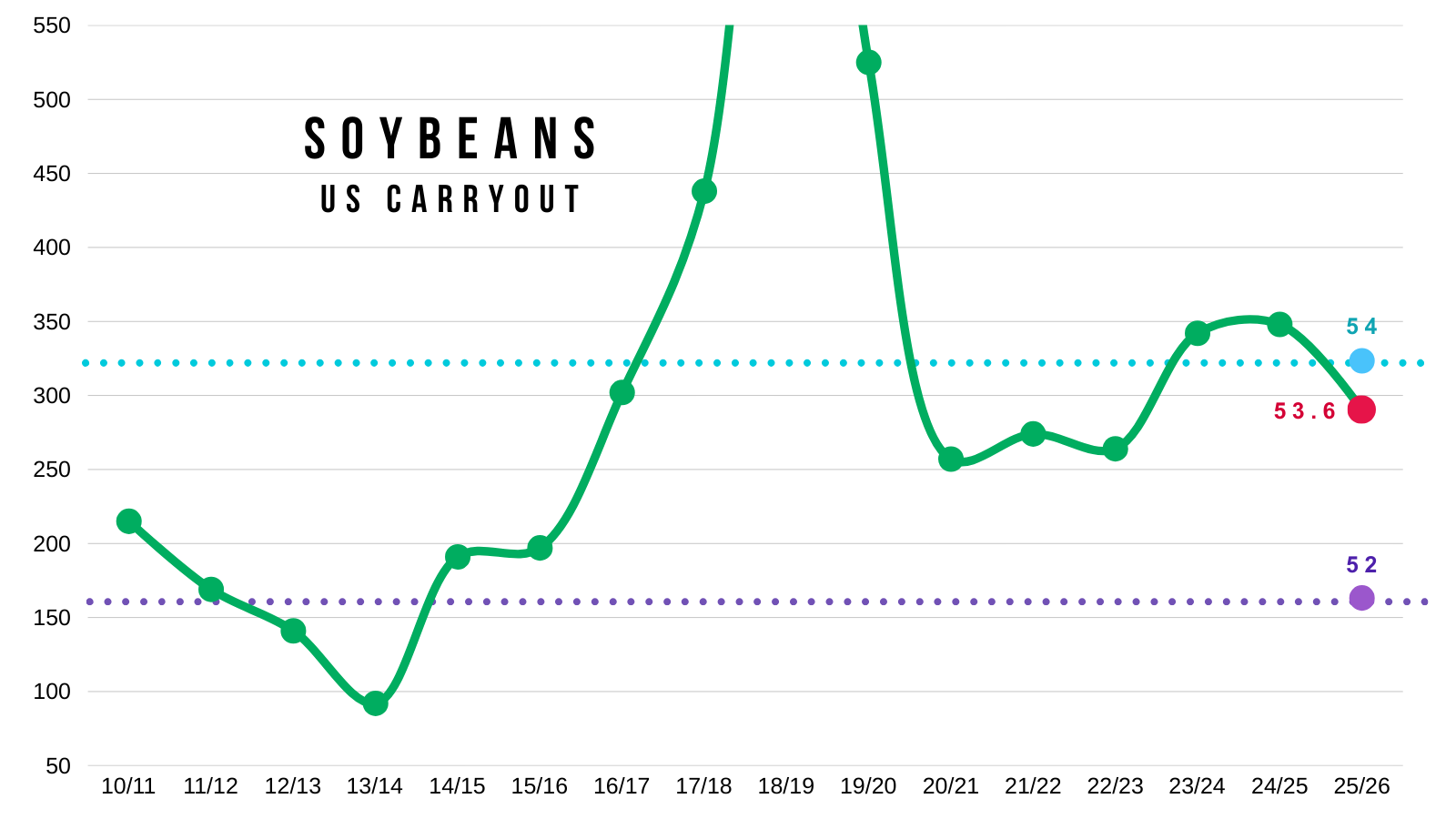

If demand is fine, or if China actually buys soybeans. The supply side of the balance sheet is still razor thin.

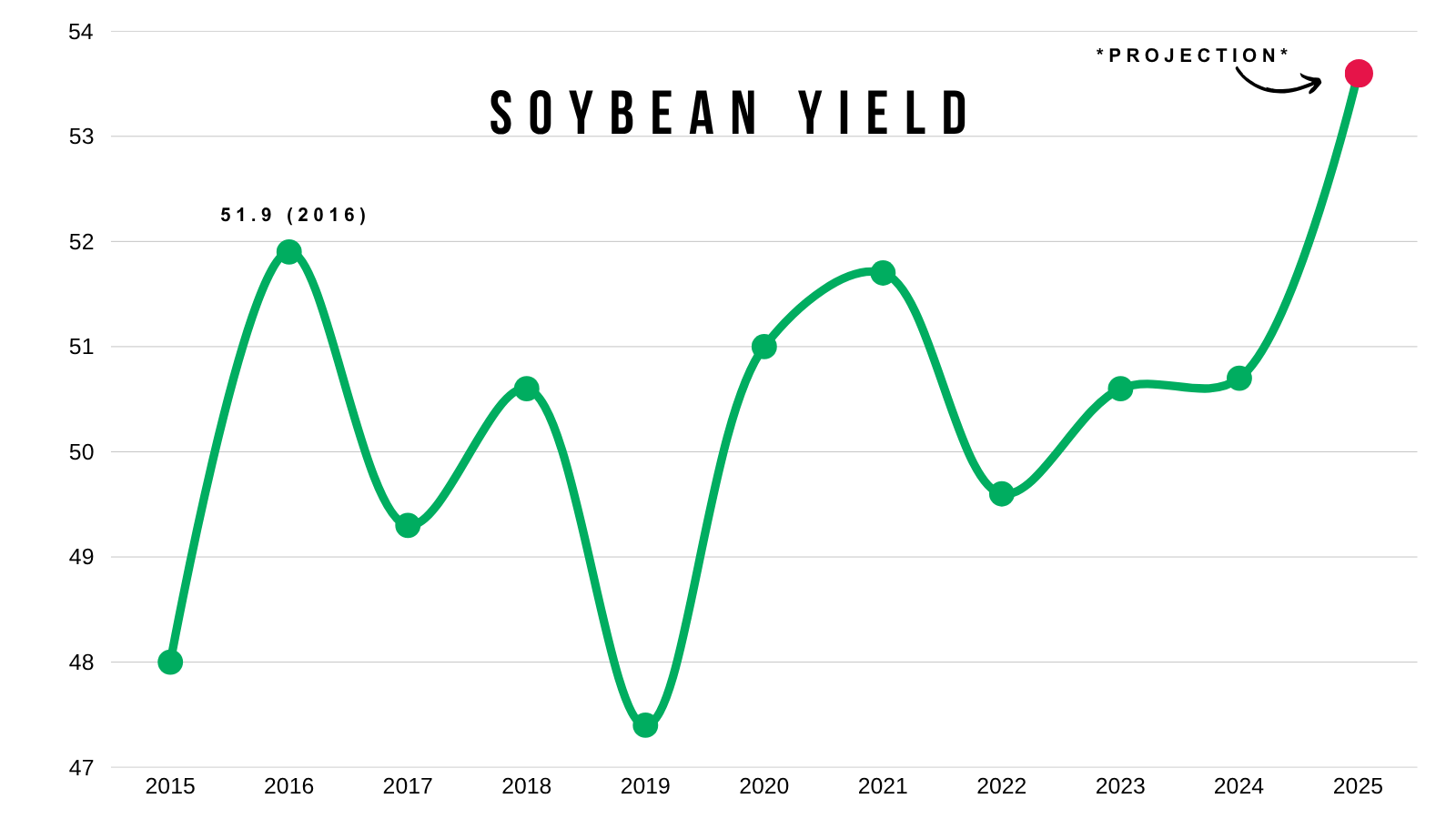

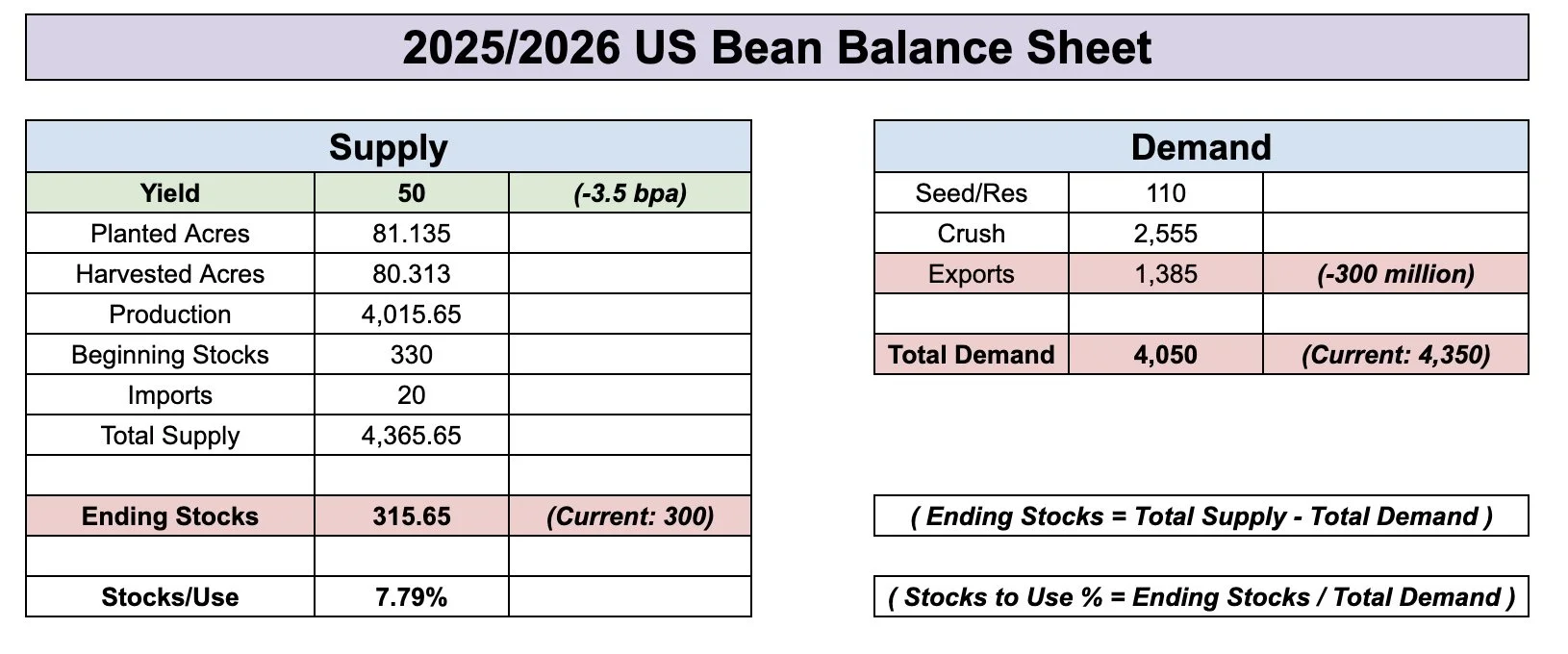

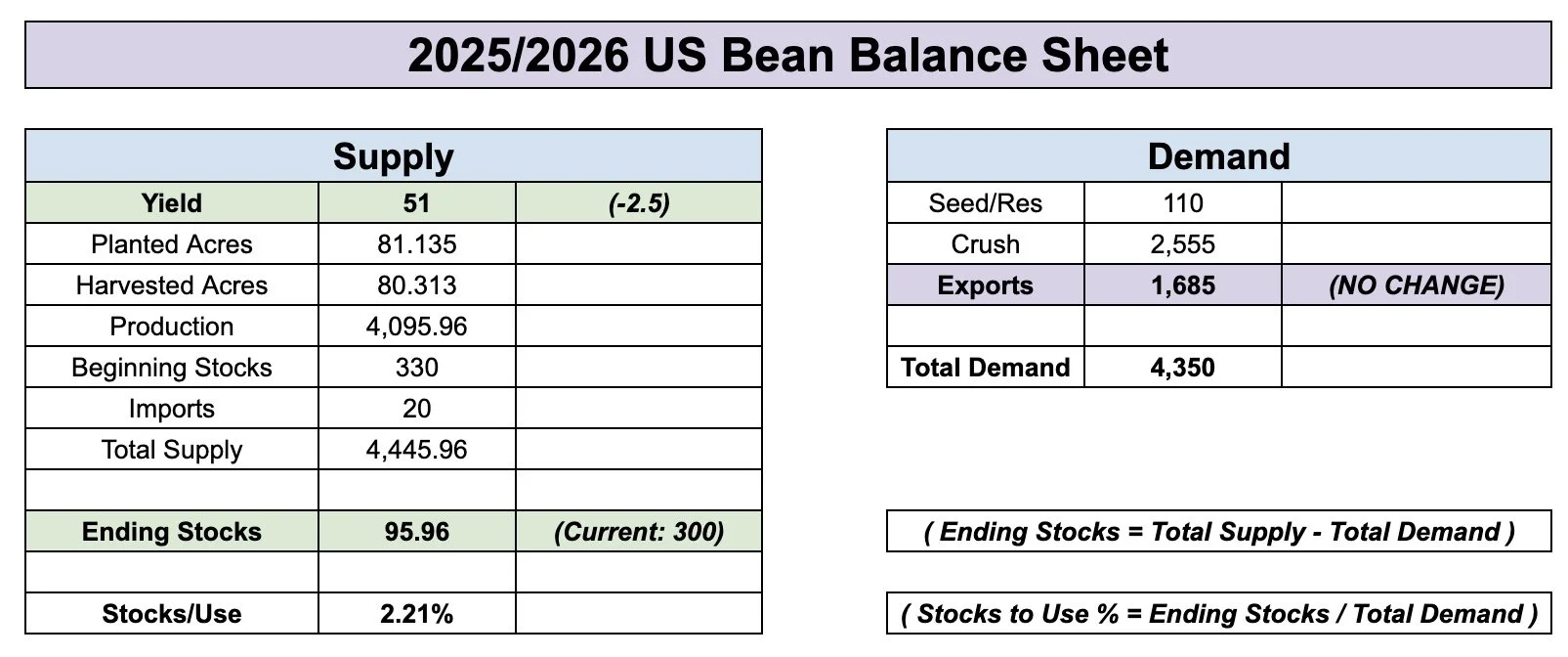

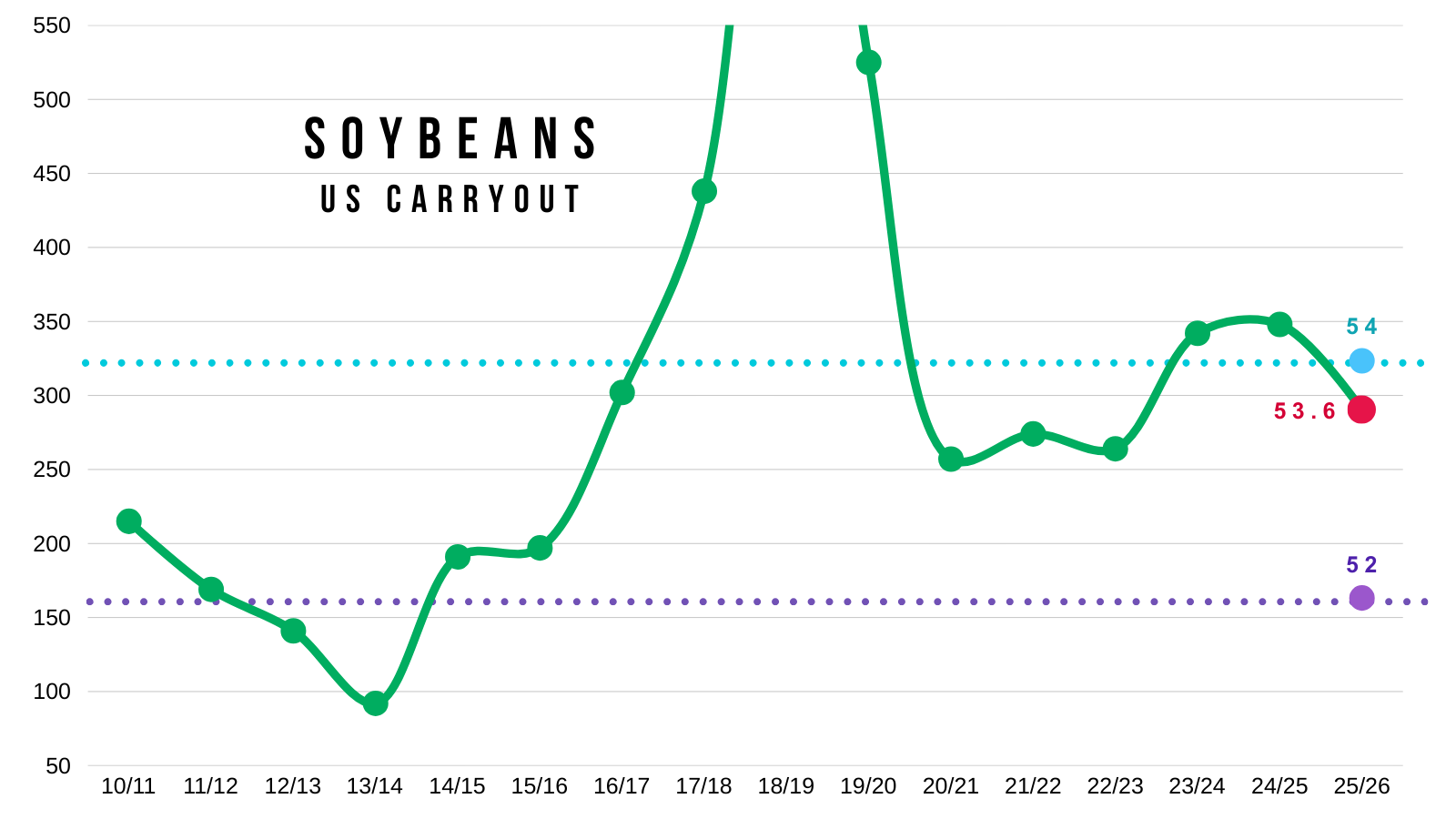

The chart below is where would carryout would come in at based on different yield numbers while using the current demand numbers the USDA has.

As always, if supply drops, the USDA will lower demand and offset some of the supply loss. So the chart isn’t fully accurate. But you get the idea. No room for error on yield.

That is why this market has potential. What if yield isn’t there? What if China buys soybeans?

Currently, China is placing a pretty big bet on Brazil weather.

If Brazil has any production issues at all, China will almost be forced to come to the US.

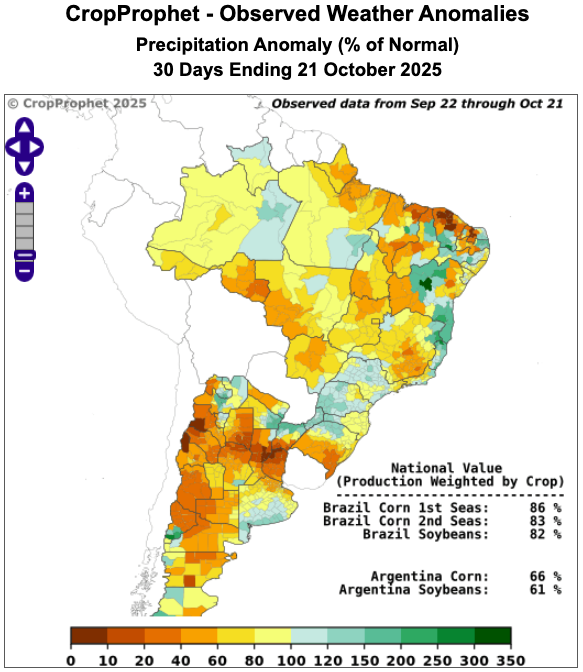

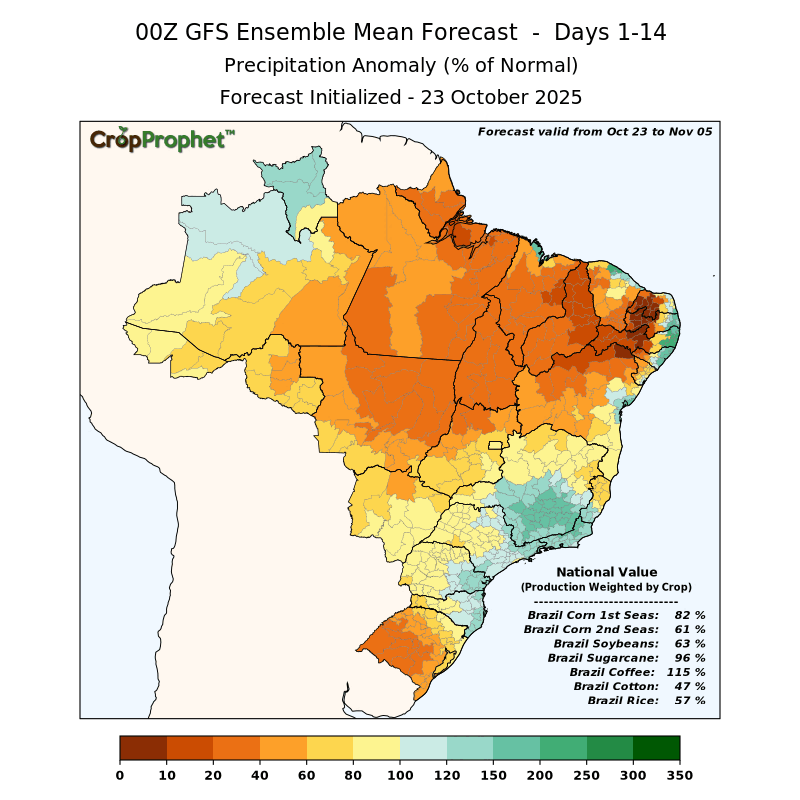

It is still too early to be calling for some drastic drought or production problem in Brazil, but the last 30 days have been pretty dry.

Here are maps from Crop Prophet that show Brazil's rainfall based on the percentage of normal.

Last 30 Days: 82% of normal

Last 14 Days: 63% of normal

Technicals:

Nov Beans

Great price action in soybeans.

We broke above $10.37 which was the 61.8% retracement up to those August highs.

Like in corn, when you break above this level, it oftens tells us that this is no longer a relief bounce and indicates there is more upside from here.

Not everytime.. but most of the time.

We also busted above downtrend resistance that marked the August and September highs.

We are now approaching my first target since our sell signal on August 22nd at $10.60

Next Target: $10.48 to $10.52

Why here?

$10.48 is the 78.6% retracement up to the August highs. It is the next fib level after the 61.8% one.

$10.52 is the golden fib (161.8%) of the first rally we saw off the lows. A common spot for a rally to pause.

In my next chart a give a better visual as to how the golden fib is calculated.

Here is how the golden fib target is calculated.

You simply take that first rally we saw, and $10.52 equals 161.8% of that the size of that first rally.

Which is marked with the gray lines.

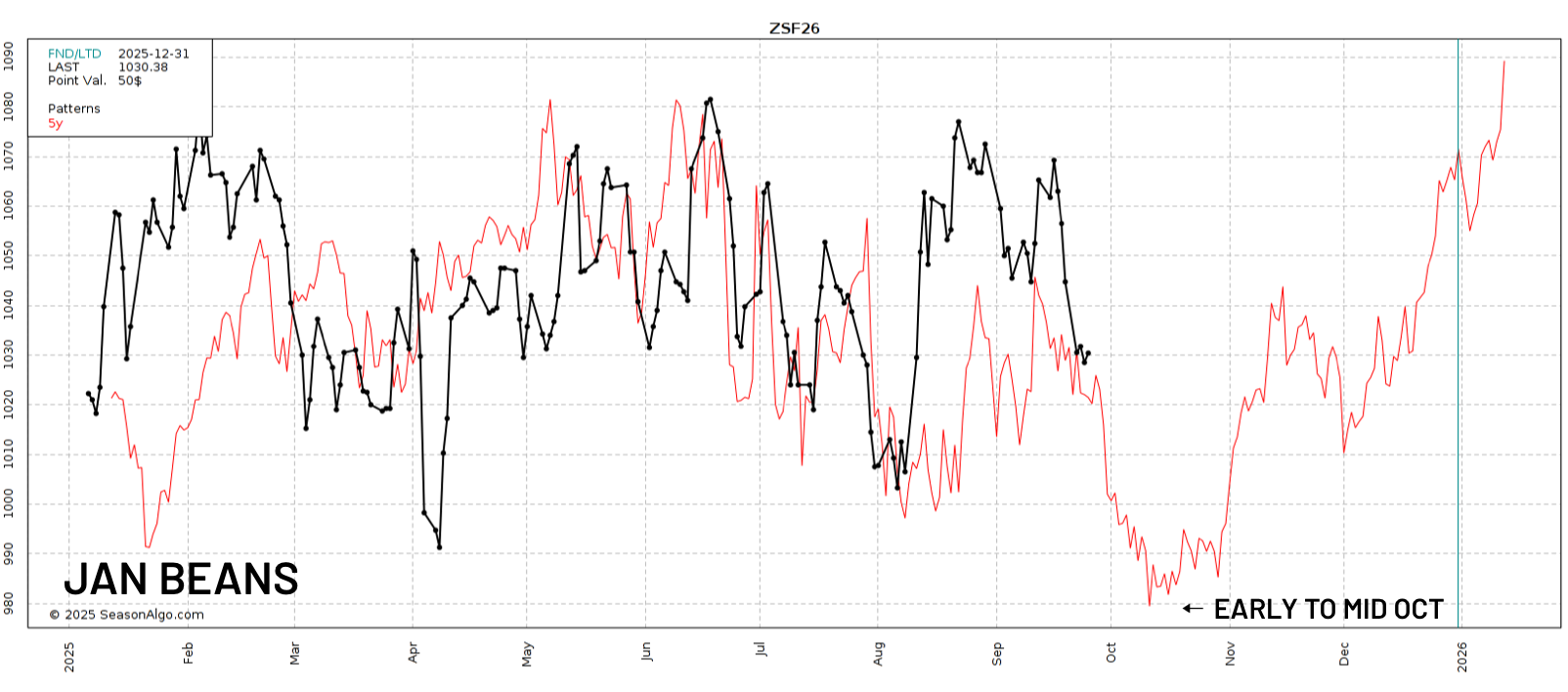

Jan Beans

Jan beans have almost an idential set up to Nov beans.

We shattered that 61.8% level and downtrend resistance.

That first target is $10.66 to $10.67.

Which is the 78.6% level and the golden fib from the first rally.

Continuous Beans

Here is a big picture look on soybeans.

Right now we running up into the same area where we've found resistance for a now year.

However.. if soybeans ever clear that $10.80 there is a ton of upside.

For starters, the very first retracement level from the 2024 lows up to the 2022 highs is the 23.6% level. Which comes in at $11.44

Not only that.. but we have a gap of air to upside. Where this market has previously found support. That also perfectly lines up with that $11.44 level.

Here is an even bigger picture view.

You can see just how critical of level that $10.80 area is.

We've been trapped there a year. It was also key resistance back in 2017-2018.

This market has pretty much never traded between $10.80 and $11.40

Meaning there is a massive gap of air.

Lastly, here is a close up view.

This market has topped in this area 4 separate times over the past year.

It has been an absolute lid.

Which is why we will be looking to take risk off the table here soon.

But again.. if we ever clear $10.80 it opens the door so much higher to that $11.40 range.

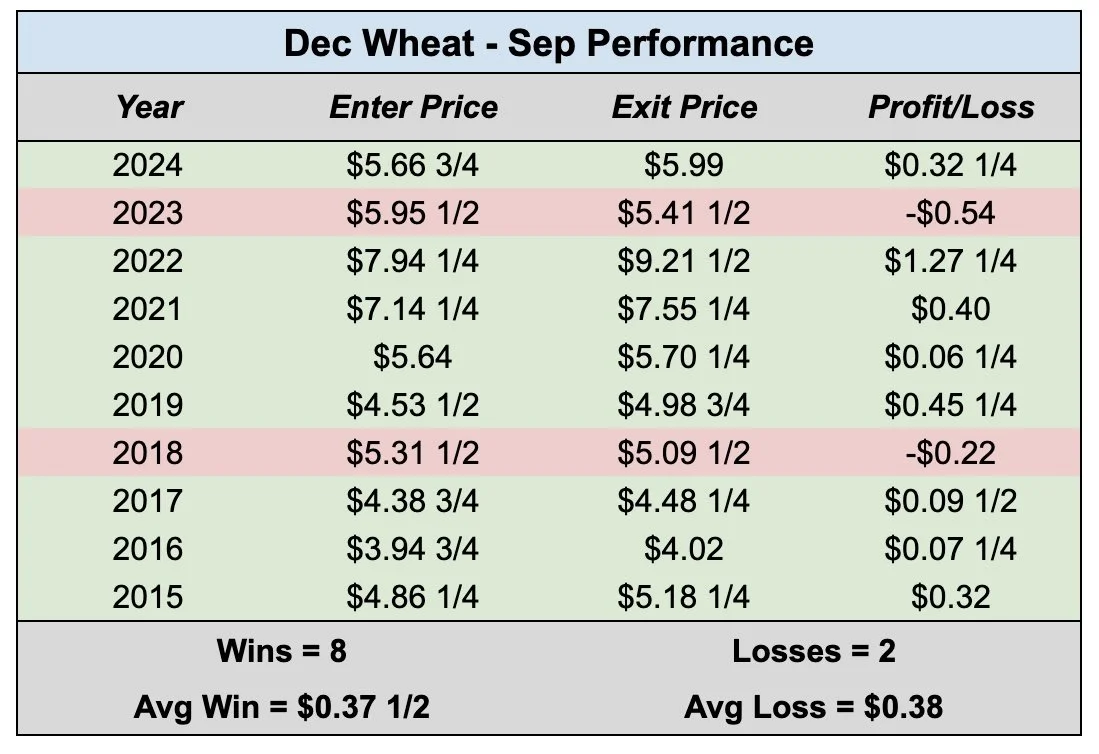

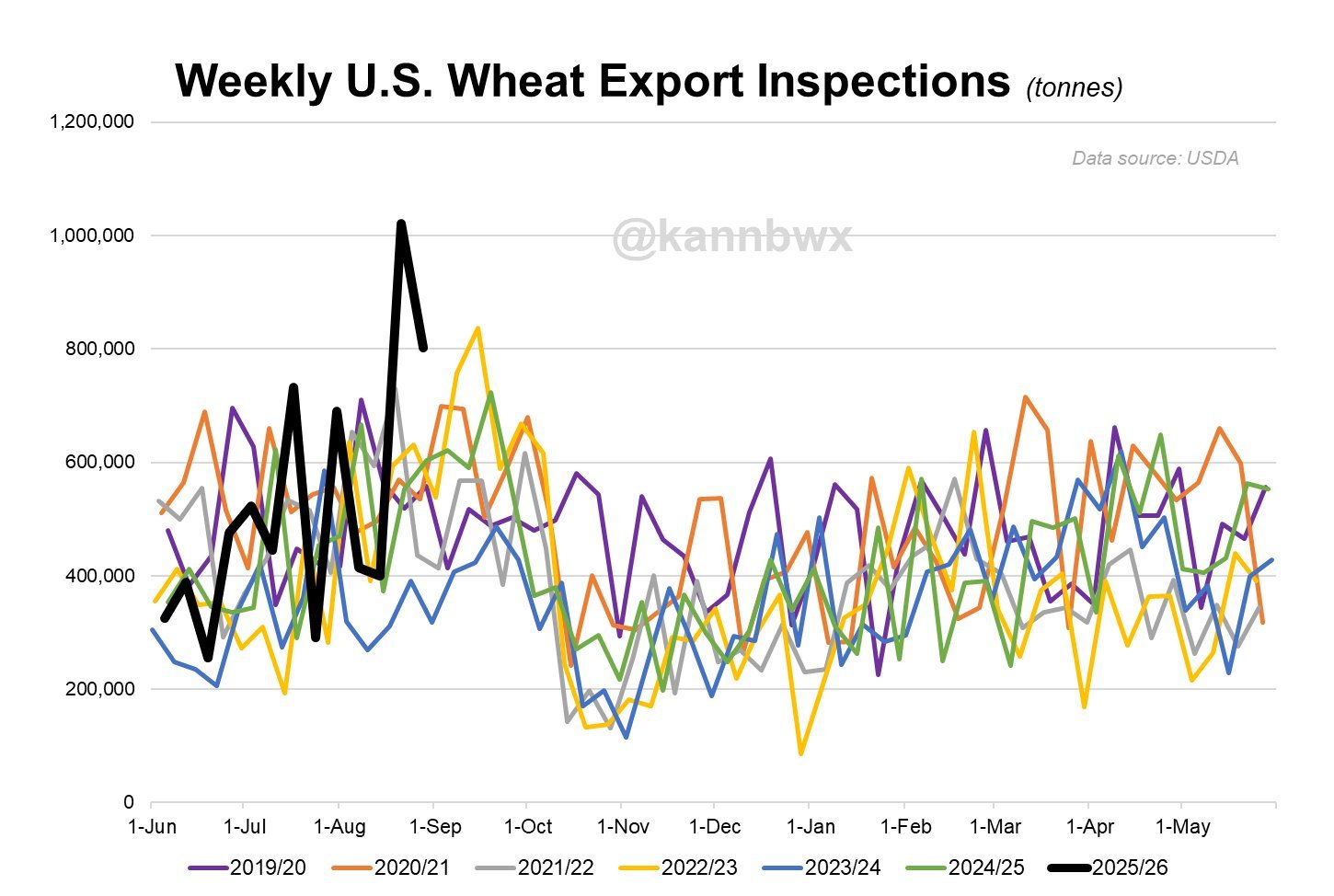

Wheat

Fundamentals:

Like corn, wheat also found some strength due to that China headline about too much moisture.

China also grows a good amount of winter wheat, and their planting is wrapping up here soon. Too much rain are not great for that crop.

Outside of that, the wheat market still lacks a fundamental catalyst.

The charts on the other hand are providing some optimism here.

Dec Wheat Technicals:

Today was the best day for the wheat market in a month.

We now appear to breaking out of this brutal downtrend.

So the chart looks optimistically good here.

If this is truly the start of the turn around, I think we have at least another 25 to 40 cents of upside here.

Dec KC Wheat Technicals:

KC also looks like it is finally seeing a break out.

I see at least 30 cents of upside from here if this is actually the start of the move bulls have been waiting for.

Cattle

We already touched on the Trump news.

We've been very vocal about keeping protection up here at these levels and still like doing so.

Fundamentally nothing has changed in cattle.

But there are several things the government can do to add pressure to this market.

They could remove the Brazil tariffs.

They could re-open the Mexican border.

If your government is flat out telling you that they are trying to lower prices, you need to protect yourself at all-time highs after a historic run.

You do not want to caught with zero protection if this market starts to fade away. If this market tanks and you don’t already have protection, there isn’t much you can do. But you can do something right now.

I am not saying this bull run is over. It just makes sense to protect yourself when your President is telling you lower prices are coming.

Take eggs for example. They wanted lower prices. They got them.

Trump told everyone to buy the stock market on April 9th.

He then paused tariffs, and stocks have exploded higher since he said that.

Whether it is right or wrong, the government can control markets. We can’t control if they are trying to lower beef prices.

The only thing you can control is your risk in this market.

Nov Feeder Chart:

Nov feeders are now in this golden zone box.

Which is 50-61.8% of the recent rally.

This is a pretty big must hold spot.

The 50-day MA also sits right in this box.

Which we are quickly approaching.

If that level gives it, you have to imagine it sparks a leg lower.

The 50-day has acted as a complete floor. If it breaks, I'm sure the algos are going to sell it further.

This is a big spot for bulls to hold.

If we are going to bounce, it needs to be here.

Dec Live Cattle:

Live cattle is holding up better on the sell off.

That is probably because feeders led the rally higher. So they have a larger move to correct.

Like feeders, live cattle is also approaching a must hold spot.

The golden zone and that 50-day MA.

Absolute must hold.

Here is how utterly massive of support the 50-day has been.

It's marked pretty much every bottom.

The one time we broke below was April. It then sparked a sell off down to the 100-day MA.

So if the 50-day fails to hold, one could argue we fall down to the 100-day.

I am not saying cattle is going to fall apart. I am simply stating how crucial of a level we are approaching.

If this market is going to bounce, it has to be soon, or we could very well be in for some larger downside.

Past Sell or Protection Signals

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

TRUMP WANTS LOWER BEEF & CHINA DEAL

AUDIO COMMENTARY

Trump wants to lower beef prices

Why not have puts at all-time highs?

Don’t be completely exposed in cattle

Trump says China tariffs won’t last

Trump will meet with China

Corn needs above $4.23 (chart below)*

Wheat possibly turning around (chart below)*

I still think wheat is a steal down here

Gap lower and limit down in cattle

Sounds like won’t have Nov USDA report

What happens if we don’t have an idea of where yield is at until January?

Demand feels really strong

Options cheap for protection or re-owning

If you have corn on DP

Being careful with certain elevator tools

If you’re upset with locked in basis

If a buyer is trying to get you on a basis contract

Have a plan for basis contracts

Cattle, corn, & wheat charts below*

Listen to today’s audio below

Want to talk? (605)295-3100

Your free trial has ended

Miss our harvest sale?

Here is extended access. Subscribe so you don’t miss out on future updates or our next sell signal.

CHARTS

Dec Corn 🌽

Still not out of the woods just yet.

We have not closed above the 61.8% retracement of this sell off yet, rejecting there back to back days now.

If we close above, most of the time it would suggest we are headed higher.

Big spot to break above.

Nov Feeder 🐮

We hit that target zone.

We now have a gap from today’s gap lower.

A standard correction would take us to that blue box. 50-61.8% of the recent rally.

The 50-day MA and wedge resistance (now possible support) also sit right in that box as well.

We don’t have to go that low, but that will be a point of interest if we get there.

Dec Live 🐮

Tapped the golden fib yesterday.

Unlike feeder, we filled that gap. So we do not have one.

Point of interest is the blue box.

It is the golden zone, the 50-day and previous point of break out (trendline) also sit right there.

Dec Wheat 🌾

Wheat looks pretty good here.

On the verge of a potential breakout, but no confirmation yet. Fingers crossed.

If we break out, I think we have at least roughly 40 cents higher.

Past Sell or Protection Signals

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

TRUMP & CHINA BLOOD BATH

AUDIO COMMENTARY

Blood bath in grains & stocks

Cattle showing strength amidst weakness

Trump says he will cancel China meeting

Grains still flying blind with shutdown

Wheat struggles to find catalyst

Feeder cattle reached target (chart below)*

Like having hedges on cattle up here & rolling up puts

How to capture the cattle rally with puts

How to manage margin risk in cattle

You have to be proactive in soybeans

You have to have a plan if we don’t get trade deal

Spreads & basis been firming

Wheat will take off eventually, it just might not be when you want it to

Soybeans reject exactly off 61.8% (chart below)*

What to do if you know you have to deliver

If you want to capture the carry

Why you want a hedge account vs an elevator when aiming to capture the carry

Biggest weather bet ever on Brazil this year

Listen to today’s audio below

Want to talk? (605)295-3100

Harvest sale ends tomorrow

Your free trial has ended

Take advantage of this offer if you’d like to keep receiving our updates & our next sell signal

CATTLE & SOYBEAN CHART

Nov Beans 🌱

We failed exactly at that critical spot we’ve been talking about for a few weeks.

We reclaimed 61.8% of the sell off before rejecting hard.

This is the most common spot for a relief bounce to end.

Both the summer bounced failed at this same level before heading lower.

Risk is lower until we break above the purple box.

Honestly, I wouldn’t be surprised if we went and posted one final leg lower, but doesn’t have to happen.

This is why one last leg lower would not surprise me. I’ve been showing this chart for a while as well.

The summer sell off featured a 5 wave move.

Up until two days ago, we only had 4 waves.

So we could definitely see that 5 wave make a new low.

Again, this doesn’t “have” to happen. But it’s definitely possible.

Nov Feeder 🐮

We almost touched that target at 377. Right up against it.

This is the golden fib from the bottom of the pennatn up to those late Sep highs.

It is a common spot for a 2nd rally to pause.

Will share target #2 if we break above this one.

Dec Live 🐮

Live finally followed feeders and got a breakout.

The chart looks pretty solid here. We did not post new ATHs but posted a new high close.

Since we got the breakout, we could potentially go and post new highs.

If we do, one target I have is the golden fib at 248.

Past Sell or Protection Signals

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

SPECIFIC SITUATIONS YOU MIGHT BE IN

AUDIO COMMENTARY

Cattle new all-time high (target below audio)*

Live cattle haven’t broke out yet (chart below)*

What to do with cattle

Divergence between feeder & live cattle

Money wants to keep flowing in stocks & cattle

Don’t short cattle, hedge cattle

Flying blind on data in grain markets

Beans at major decision point (chart below)*

Wheat still coiling in wedge (chart below)*

I am waiting for a rally in wheat. Usually, every 3-4 months wheat provides an opportunity

Specific situations you might be in

If you have soybeans that you have to haul because yields are better than expected, just don’t strike out. Spread out that risk. Don’t chase home runs

What to do if you don’t have any storage

What to do if you have excess bushels

Should you be re-owning corn? If so, how?

What to do if you are forced to sell your corn

Why you should spread your risk out

Cattle, beans & wheat charts below audio*

Listen to today’s audio below

Want to talk? (605)295-3100

Harvest sale ends this weekend

Your free trial has ended

Starting next week you will not get future updates or our next signal.

CHART BREAKDOWNS

Nov Beans 🌱

We are RIGHT at the decision point.

This is where we find out if this bounce is simply a relief bounce, or the start of a larger rally.

If we are going to reject, it should be here.

If we close above the purple box, more often than not it would be an indication we are headed higher.

The top of the purple box reclaims 61.8% of the sell off. The most common spot for a relief bounce to reject.

So we should know soon what decision the market makes.

Nov Feeder 🐮

We broke out of this bullish pennant pattern we have been talking about.

Posting fresh all-time highs.

We continue to find life at the 50-day MA. It’s been an absolute floor the entire bull run.

The 50-day MA is going to be your warning sign this market is ready to roll over. Until then, you can’t help but lean higher.

The golden fib is at 377. I think that’s a reasonable target.

The golden fib equals 161.8% of the rally we saw from the bottom of the pennant to that late Sep top. I outlined this with the gray lines.

If we hit there, I think that will be a great opportunity to de-risk.

Dec Live 🐮

Live cattle is different than feeder.

We have not broken out of this recent downtrend yet.

If we break out, it should result in all-time highs like we saw in feeder.

Just like feeder, the warning sign is going to be the 50-day MA. If that ever breaks it could cause the flood gates to open much lower.

Dec Wheat 🌾

We are still coiling in this falling wedge.

Personally my bias still leans towards a break out.

If the break out comes, I think we should have room to run to $5.45

It hasn’t mattered yet, but we’ve been printing bullish divergence since August.

Prices are making new lows.

The RSI is not.

A sign downside momentum is getting weaker.

Past Sell or Protection Signals

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

CORN SITUATION & CATTLE BREAK OUT?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 1:25min

Bean: 5:35min

Wheat: 9:25min

Cattle: 10:40min

Want to talk about your situation?

(605)295-3100

Our harvest offer ends soon

Your free trial has ended.

This is the last week you'll receive our updates.

You will not get our next signal.

Lock in our harvest sale so you’re prepared for the next opportunity.

Futures Prices Close

Overview

Grains mixed with soybeans leading the way higher on optimism of trade aid, while the wheat market leads the way lower.

Meanwhile, the cattle market bounces right at some crucial support off the back of screwworm news and no trade deal between Brazil and the US.

Thursday was supposed to be the October USDA report. That is not happening.

This is now day 7 of the government shutdown.

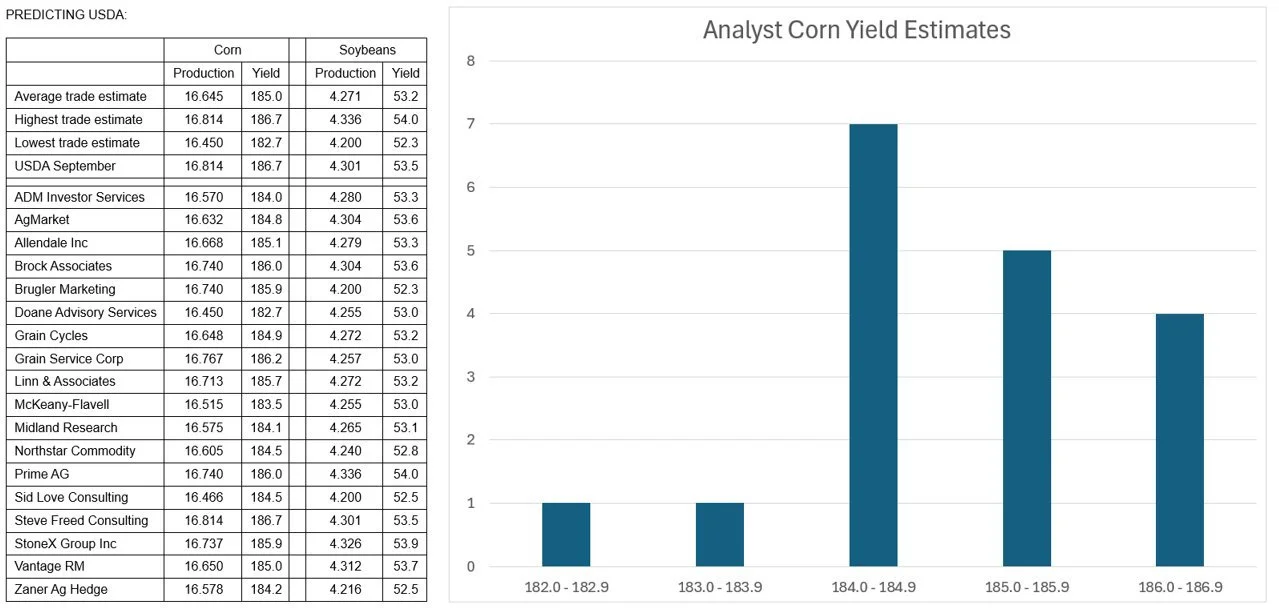

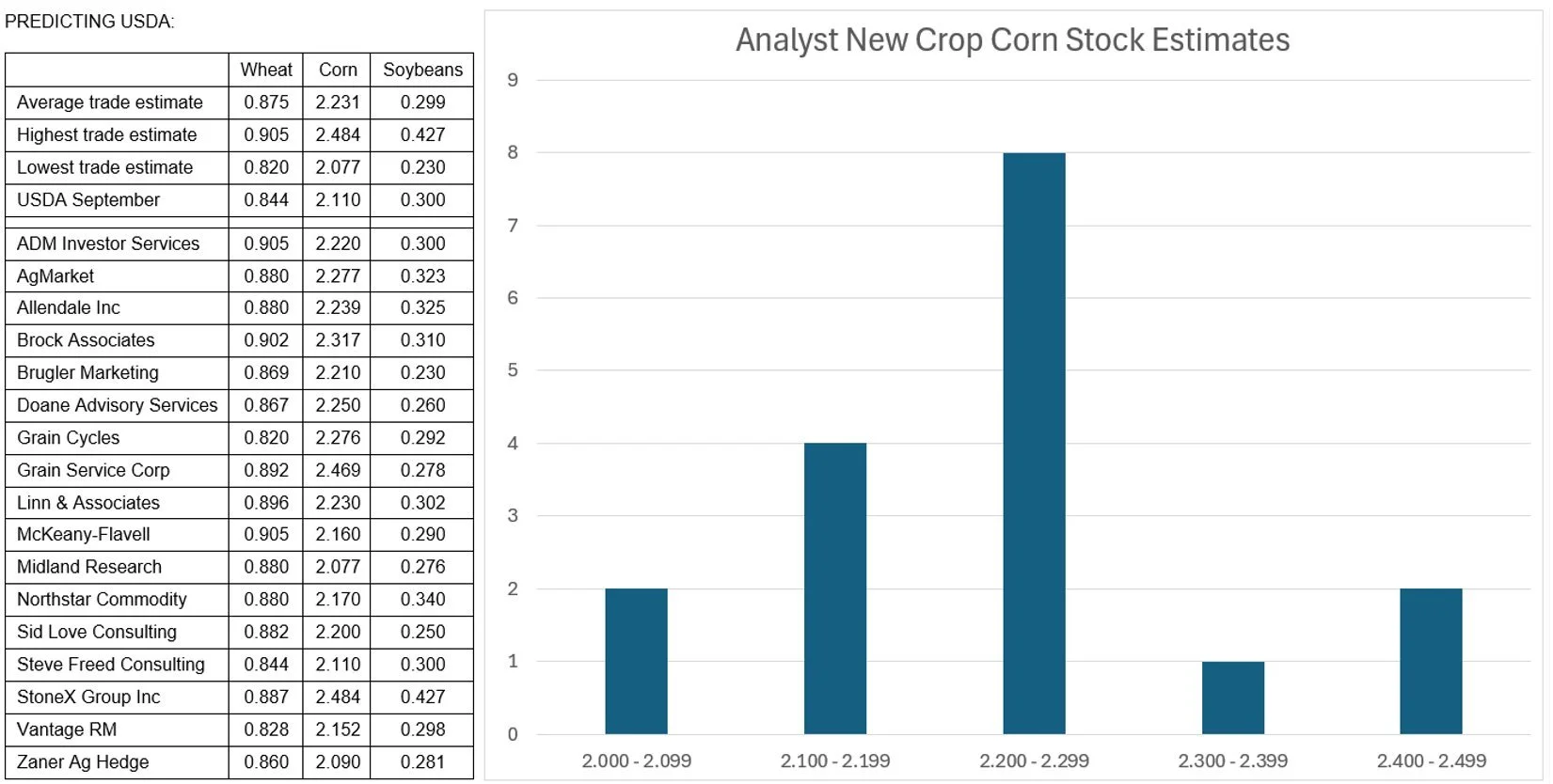

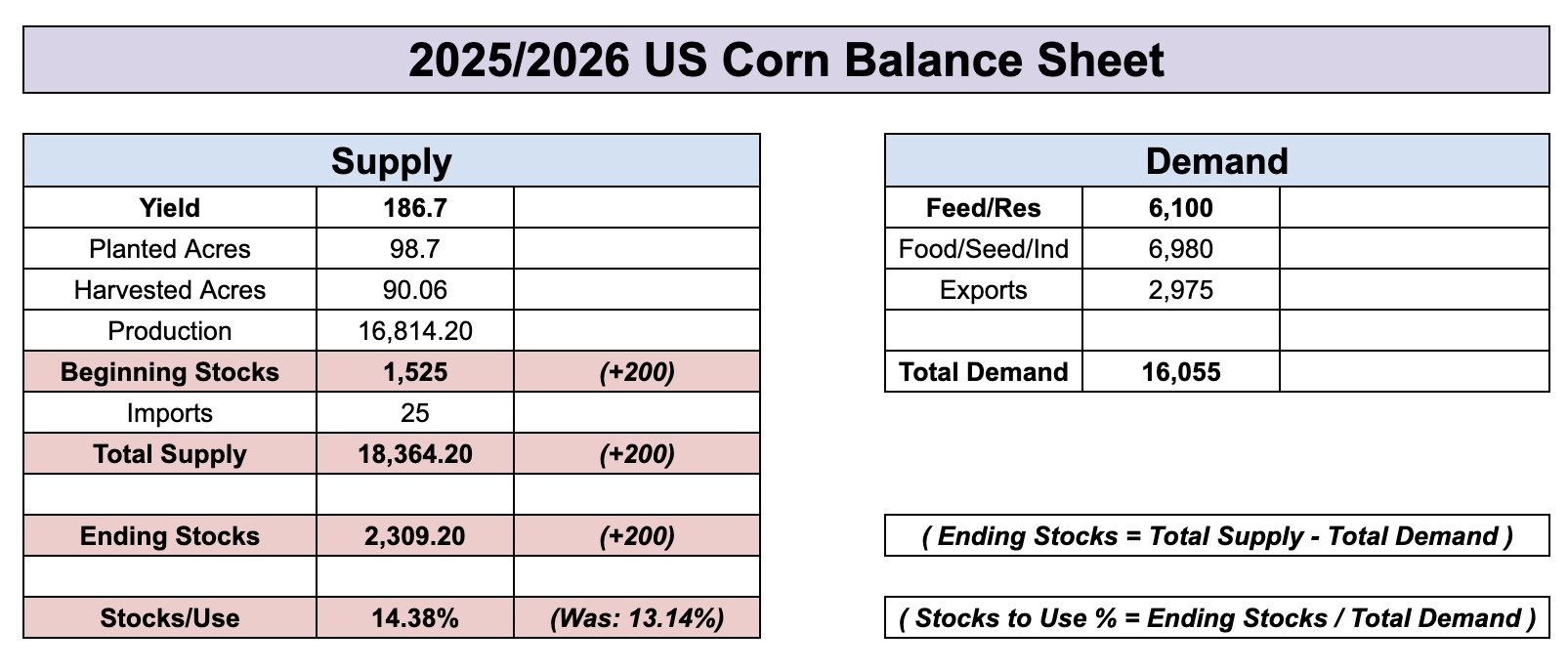

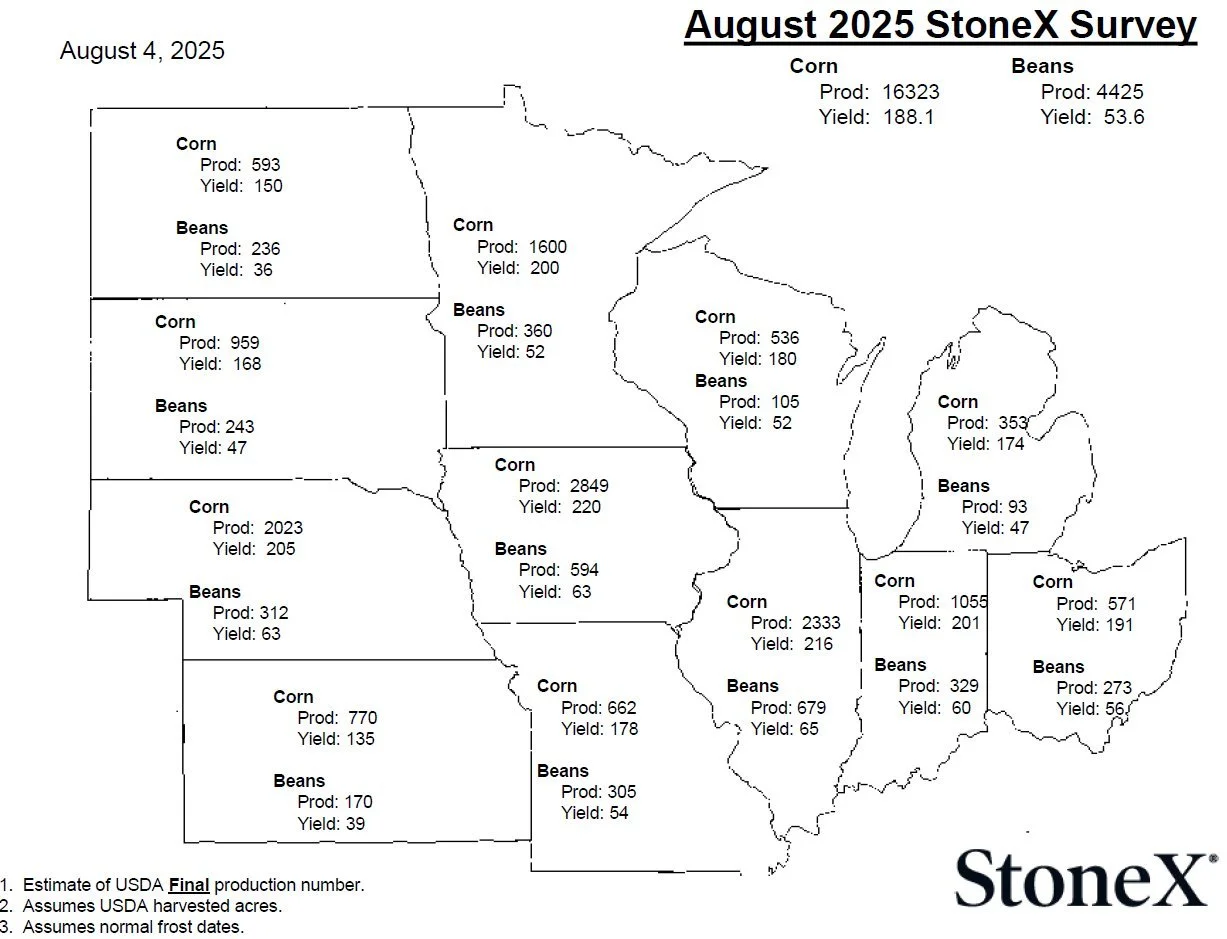

However, despite there not being a report. The analysts still provided their estimates for the report.

Corn Yield: 185 (186.7 in Sep)

Bean Yield: 53.2 (53.5 in Sep)

Chart from Allendale

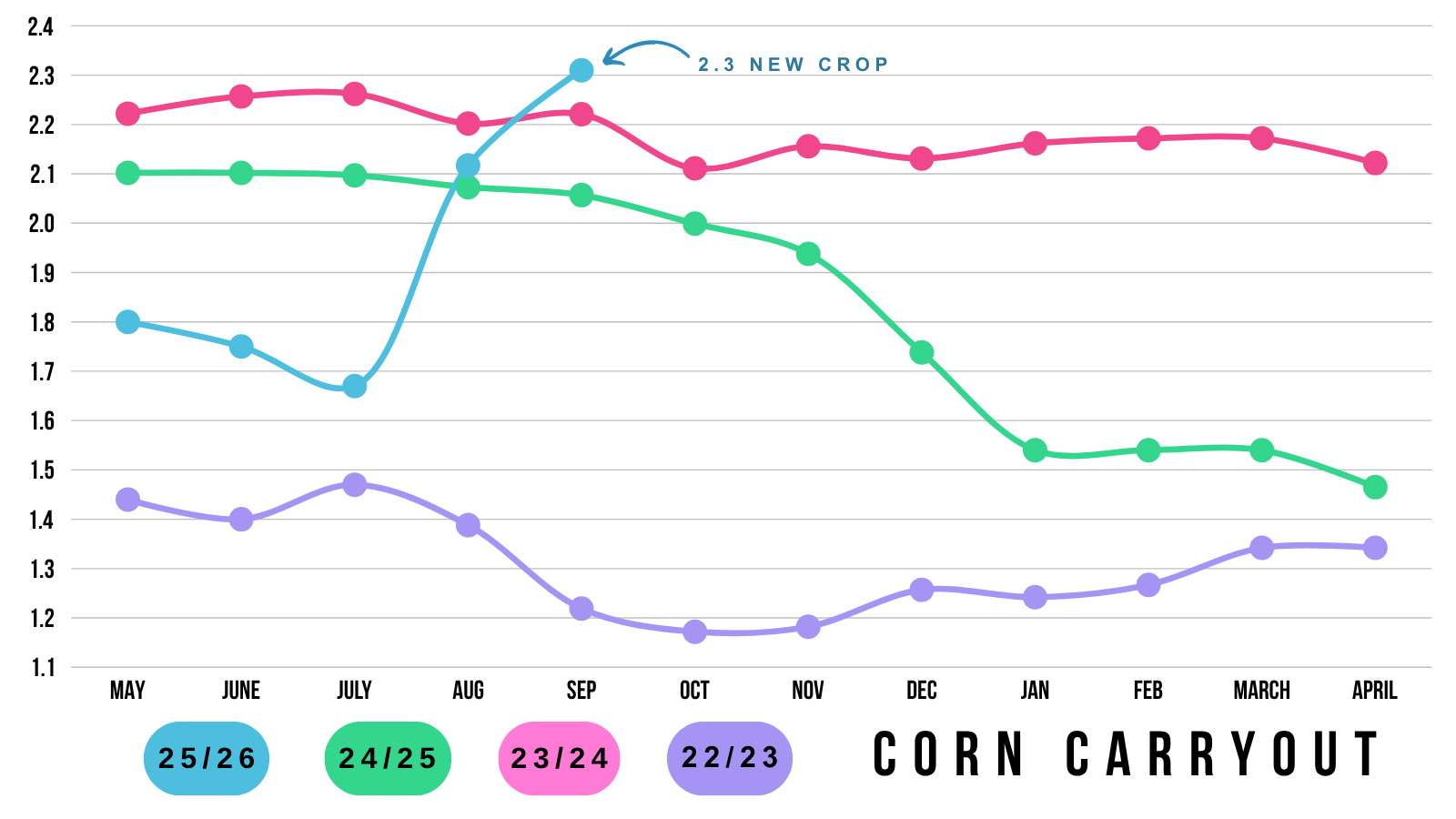

Corn Carryout: 2.231 (2.110 in Sep)

Bean Carryout: 0.299 (0.300 in Sep)

Wheat Carryout: 0.875 (0.844 in Sep)

Corn stocks are projected to be higher due to that quarterly stocks report. Where the USDA was +200 million too high on their old crop feed demand numbers, which automaically got added to the new crop balance sheet in the form of beginning stocks.

Chart from Allendale

Today's Main Takeaways

Corn

Despite harvest ramping up fast, sitting around 30% complete based on the estimates. The corn market isn’t seeing any major harvest pressure.

The market is definitely aware that yield is smaller, some think it could be drastically smaller. Hence why we are hanging in there.

From a pure fundamental standpoint, you could argue corn should be heading lower.

I mean we are looking at a 2.2 to 2.3 billion bu carryout.

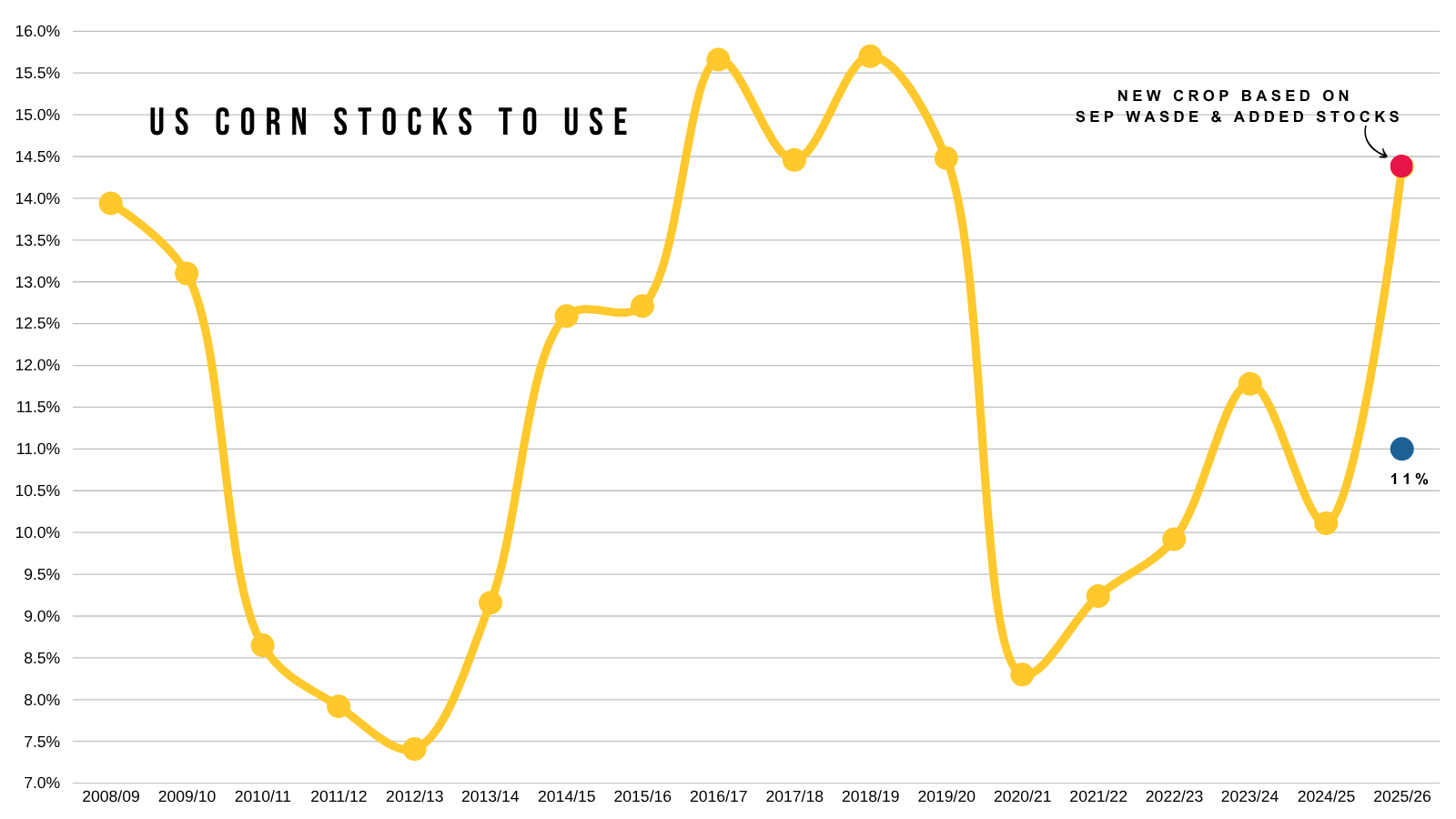

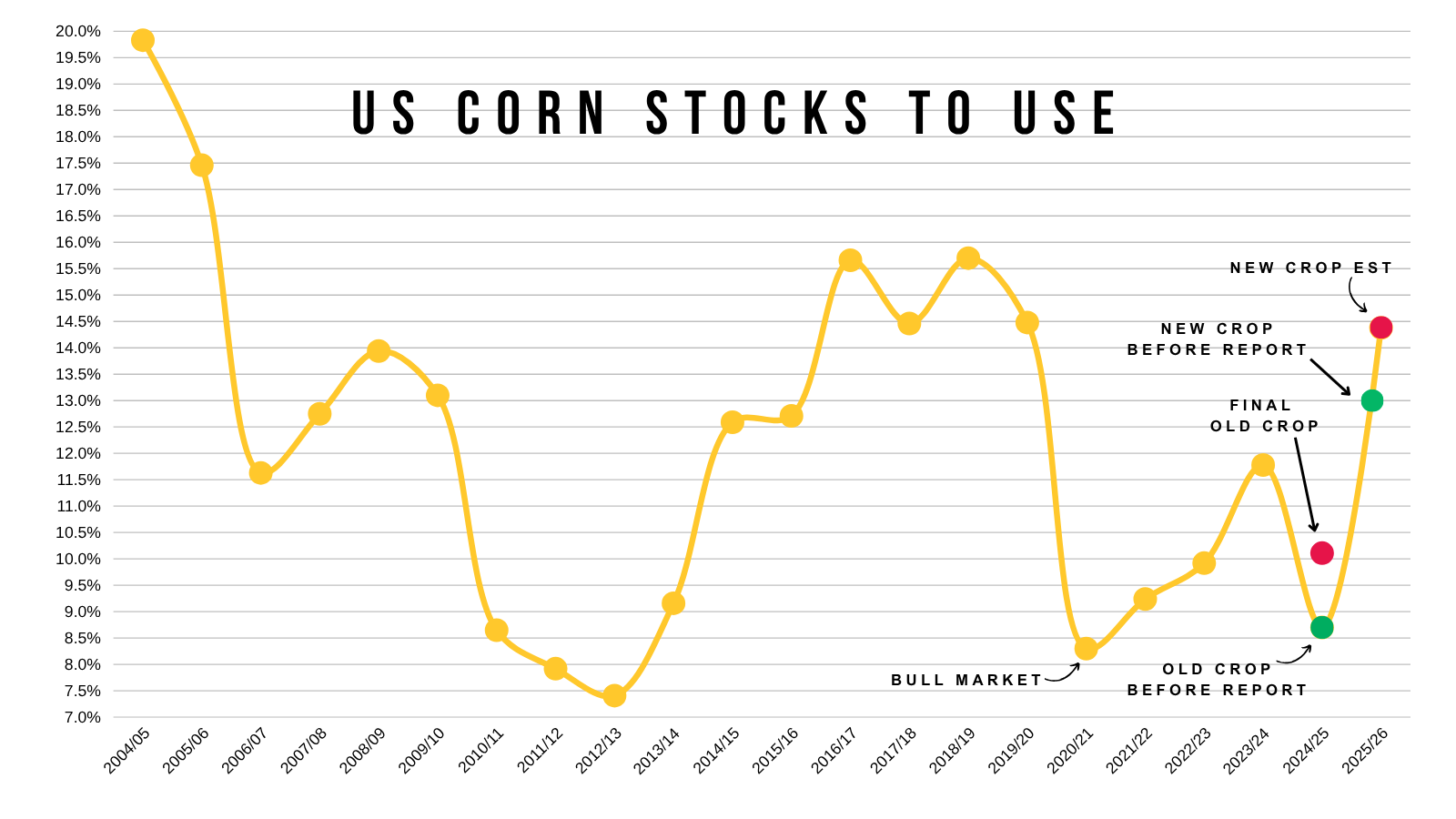

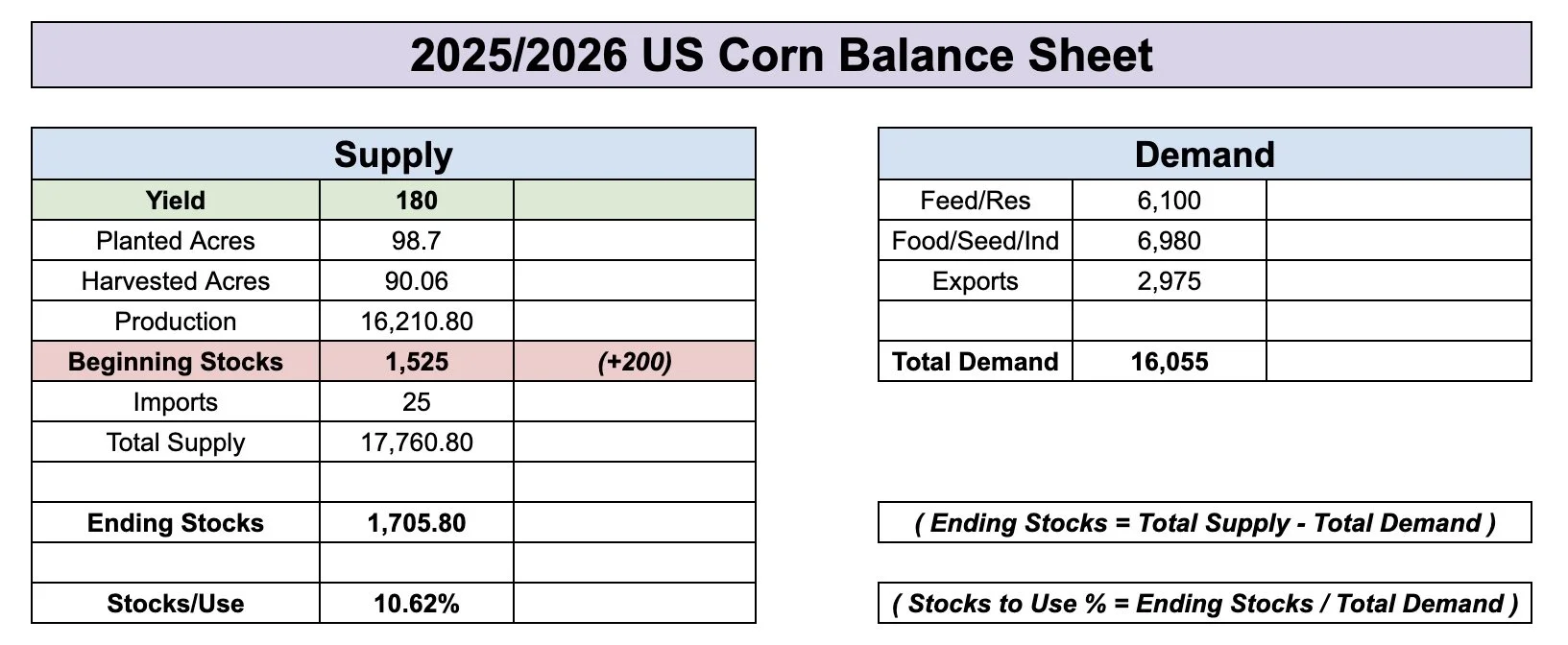

Which would peg out stocks to use ratio at some pretty high levels.

Given the extra acres, even if yield dropped to 180 and you left demand unchanged, it would still only print around an 11% stocks to use which isn’t super bearish, but it's not crazy bullish by any means either.

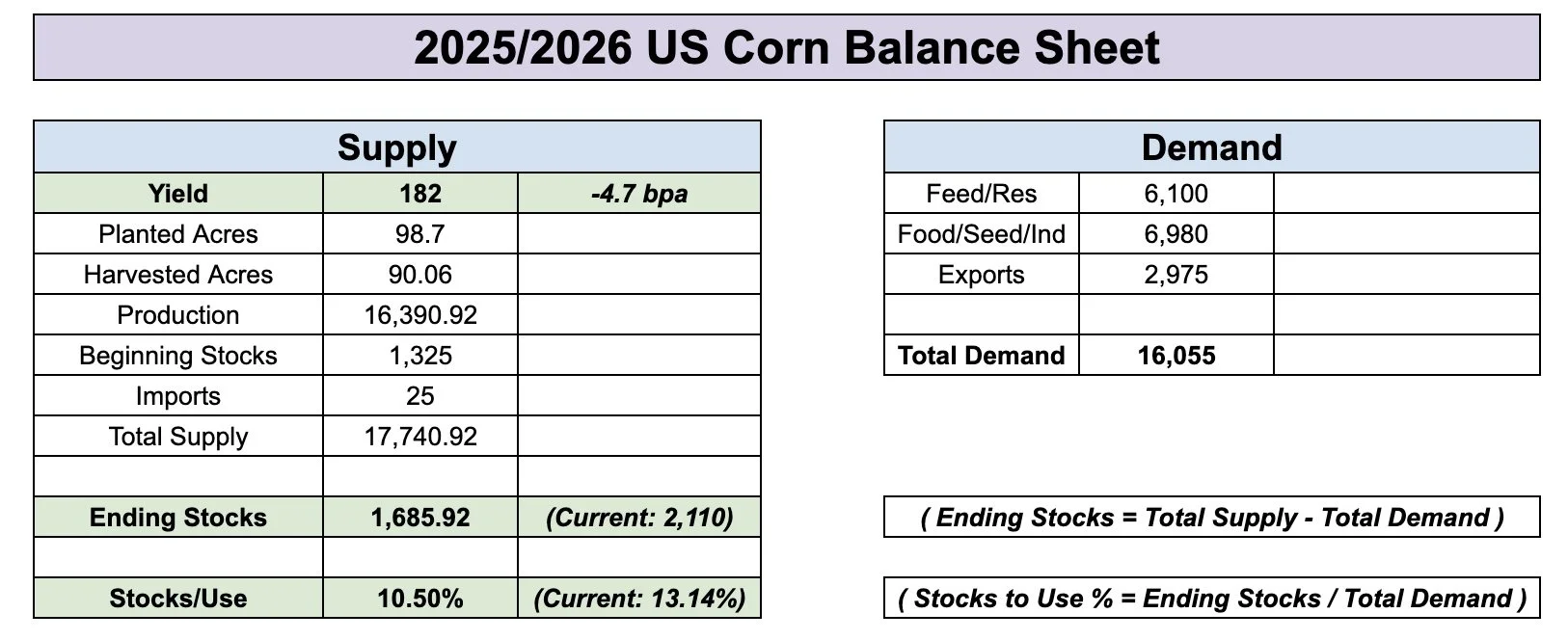

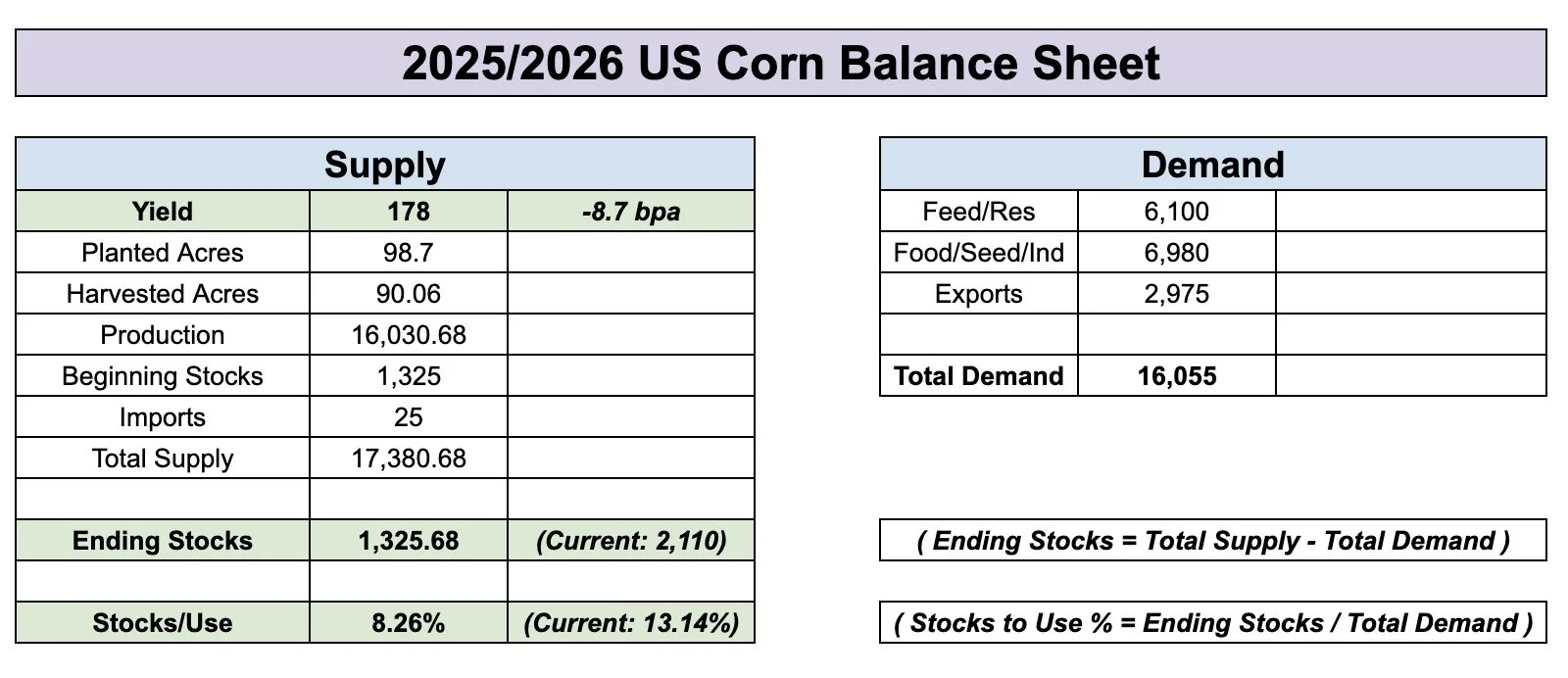

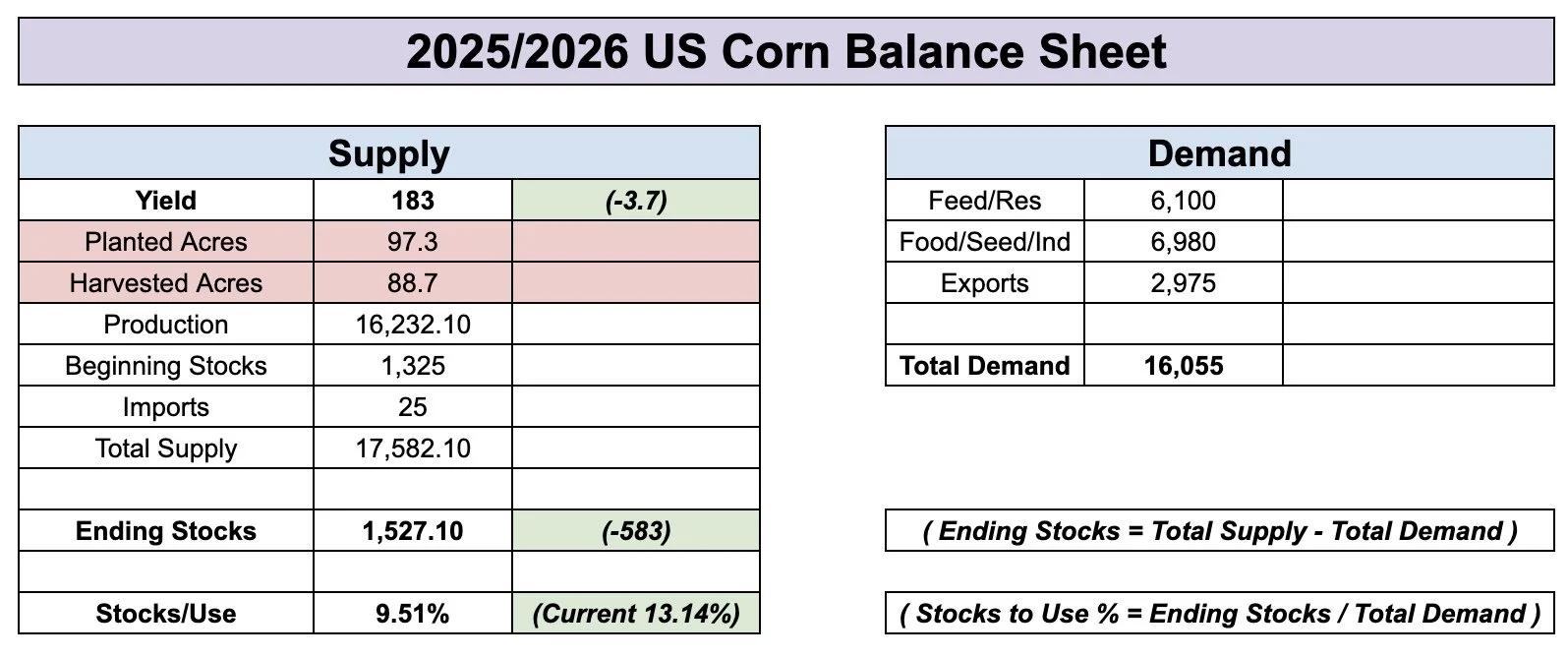

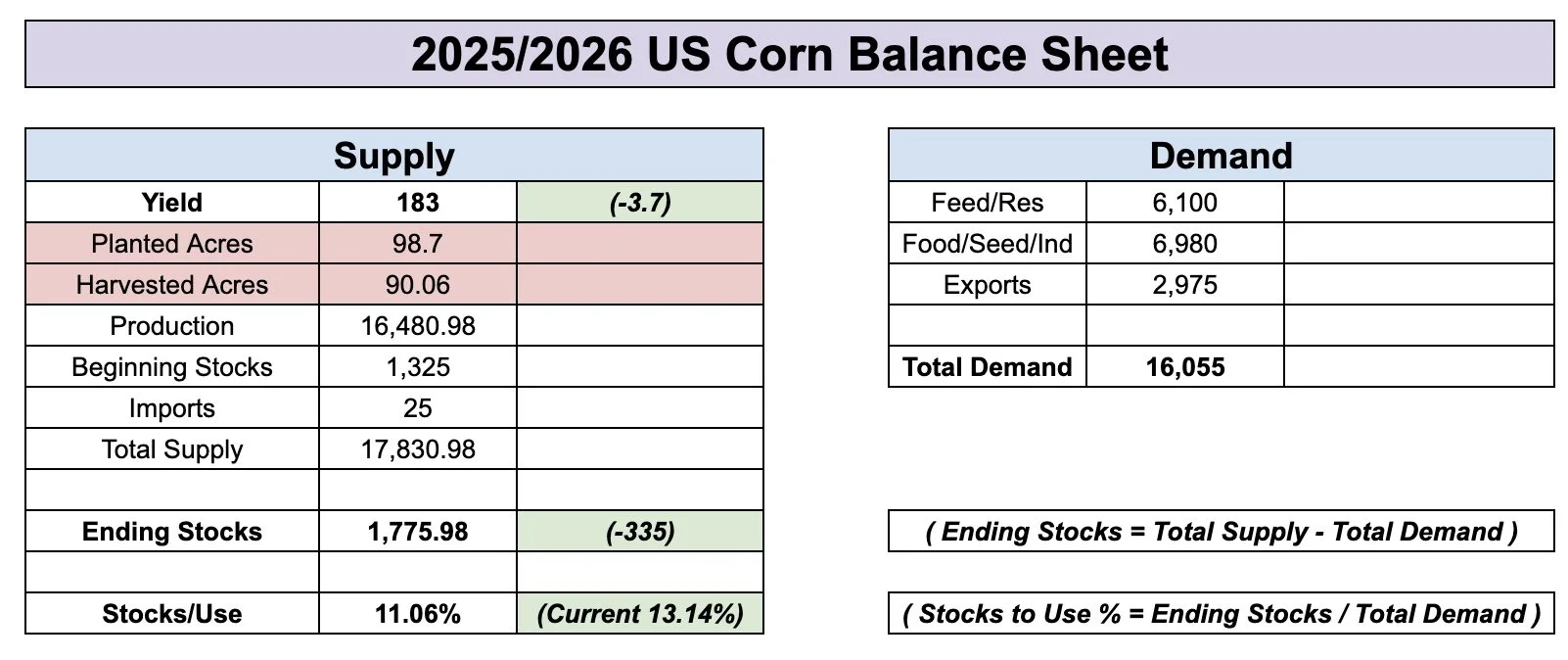

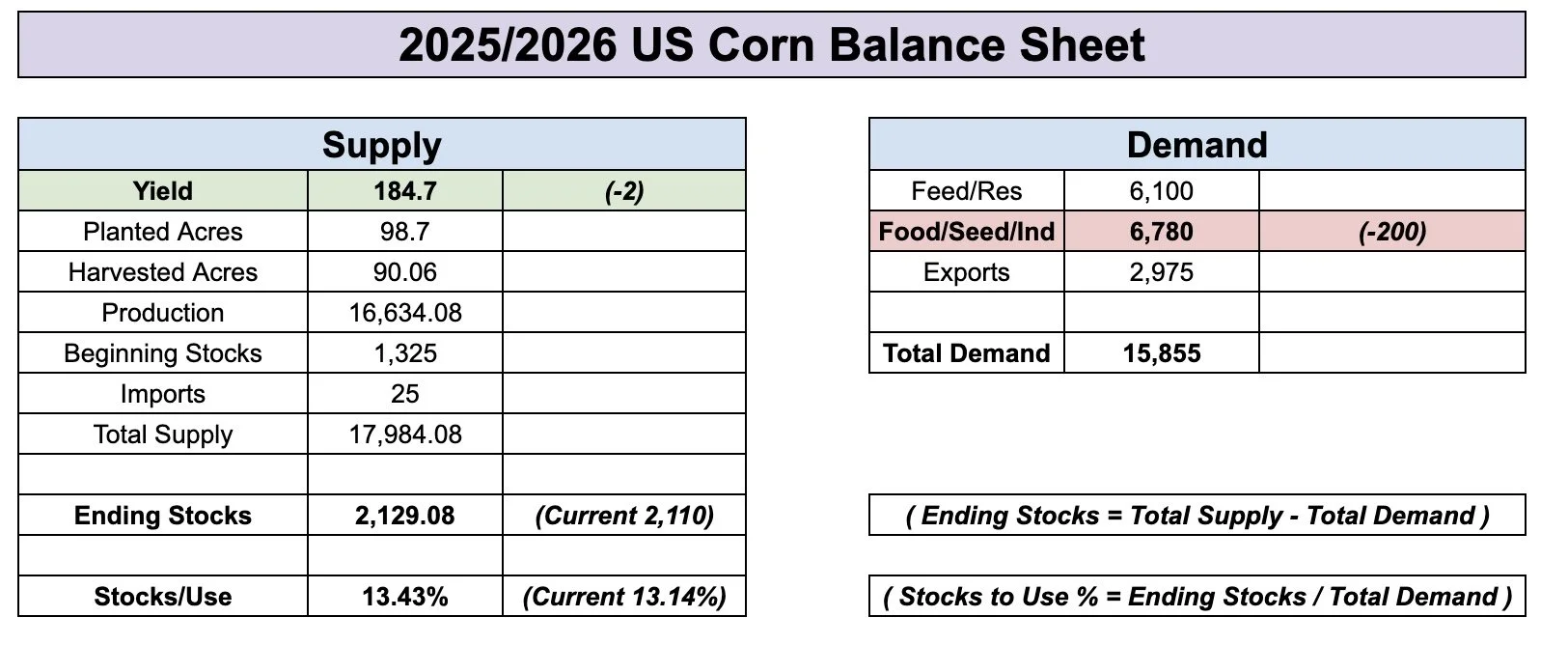

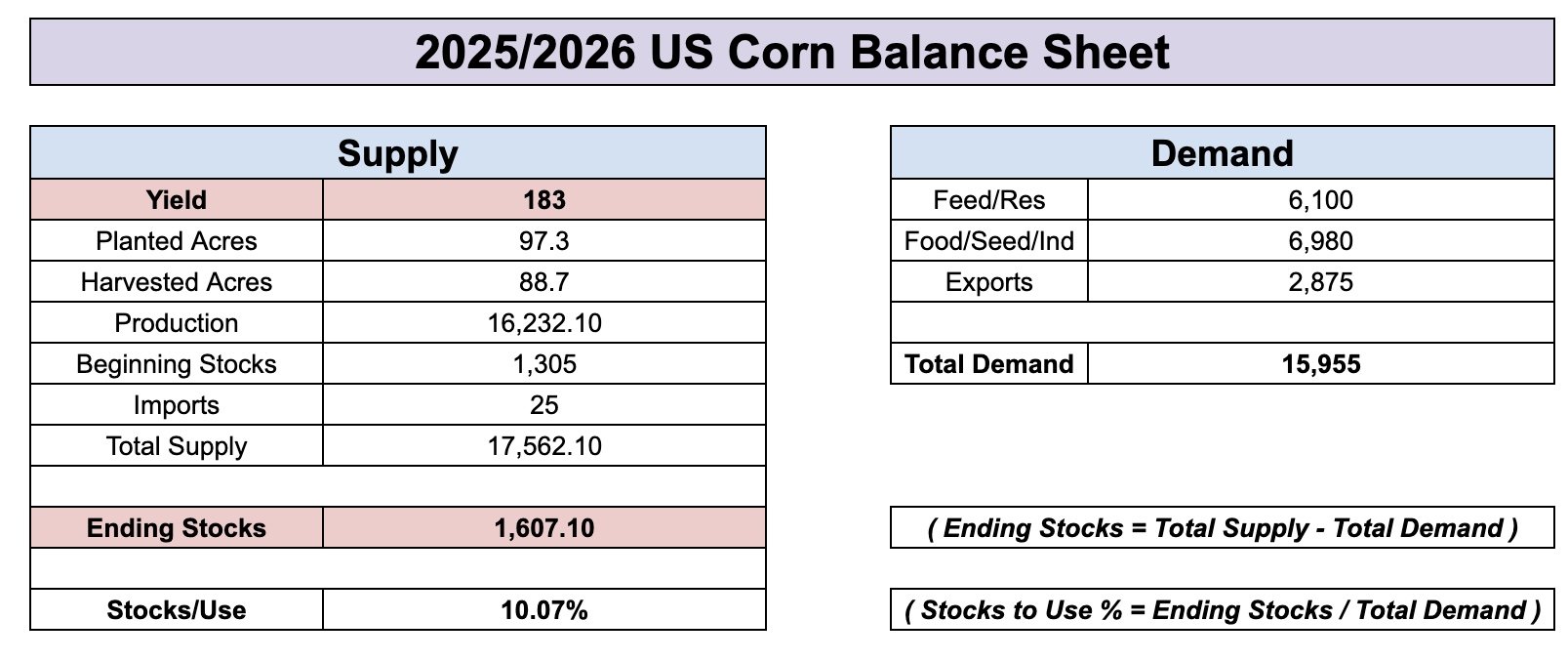

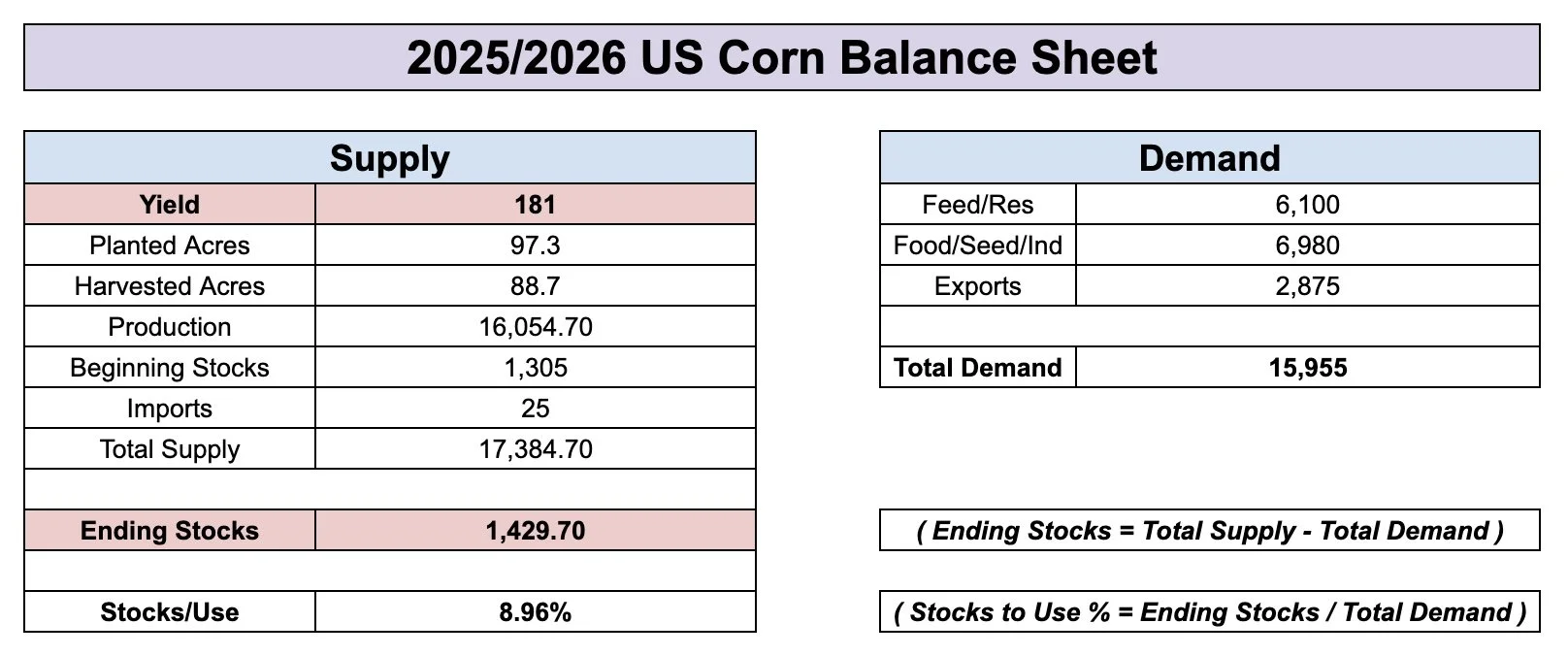

Here is the rough current balance sheet vs with a 180 yield and no demand changes.

Here is what that 11% would look like compared to other years.

Way less burdensome than the current projections, still not out of this world bullish.

We have to keep in mind, that even if yield falls. The USDA will also be taking feed & residual demand back which could offset some of this.

However, on the other hand. The only marketing year that saw over a +2 billion carryout over in recent memory was 2023/2024.

The 2023/2024 marketing year ran from Sep 2023 to August 2024.

If you look at prices during this time frame, we only spent a handful of weeks below $4.00.

Which was last August before we went on that run.

So the point is, does corn really have to venture below $4.00 by a wide margin if at all?

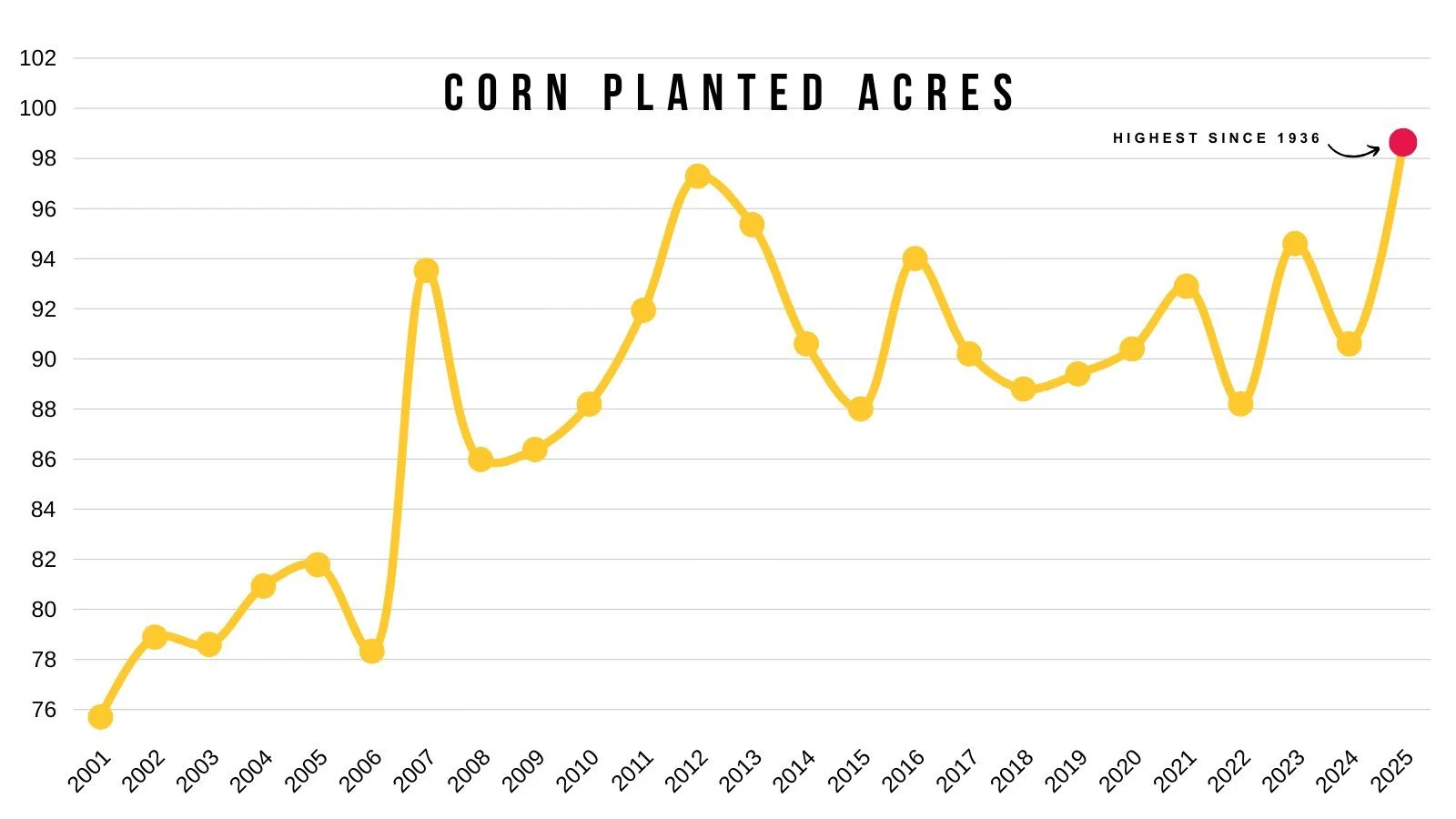

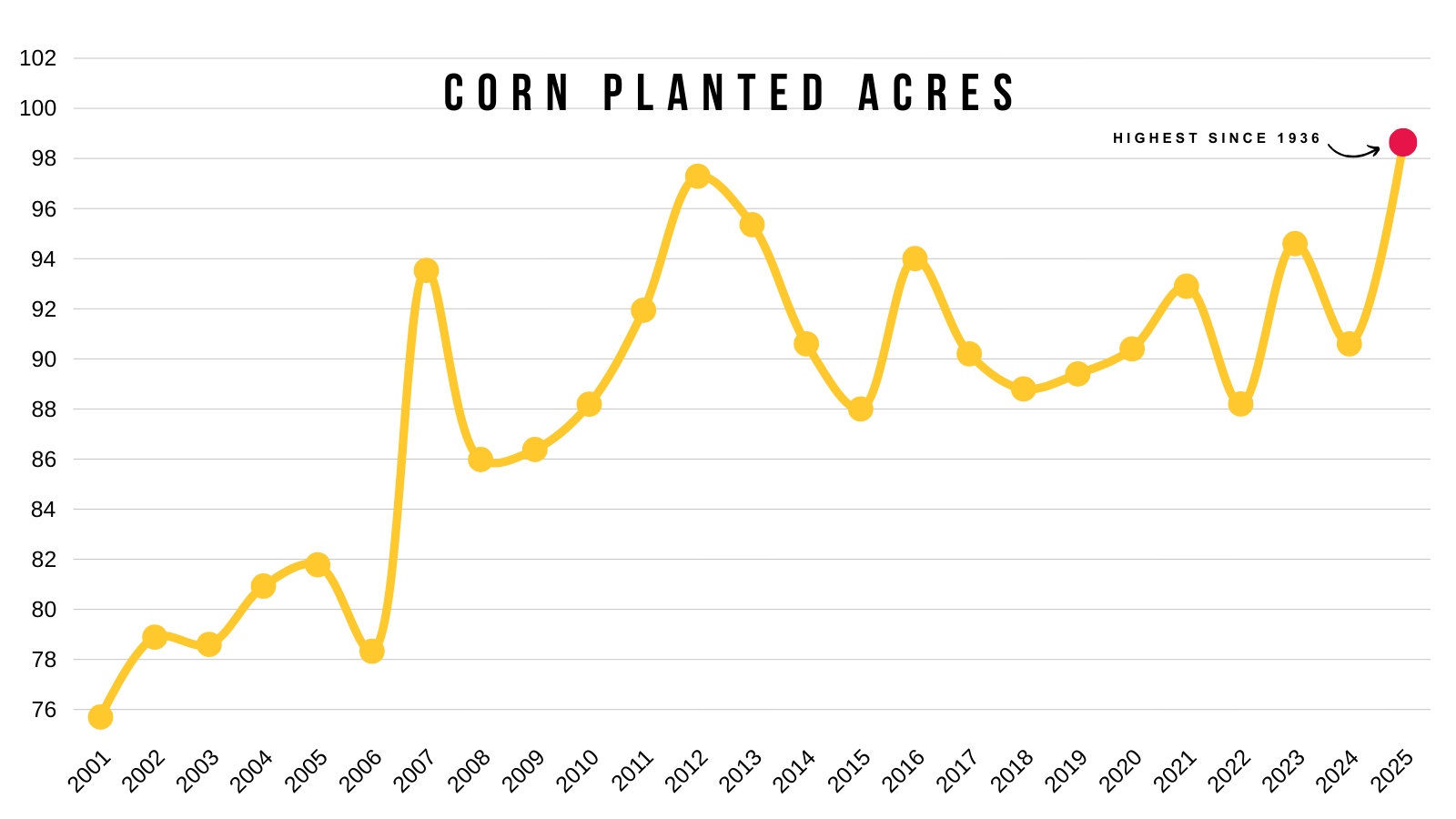

Given the record acres.. we are going to have record corn production no matter where yield comes in at.

Even if yield is 175 we are still going to have a record production number.

However.. we have been creating a demand monster for the last year.

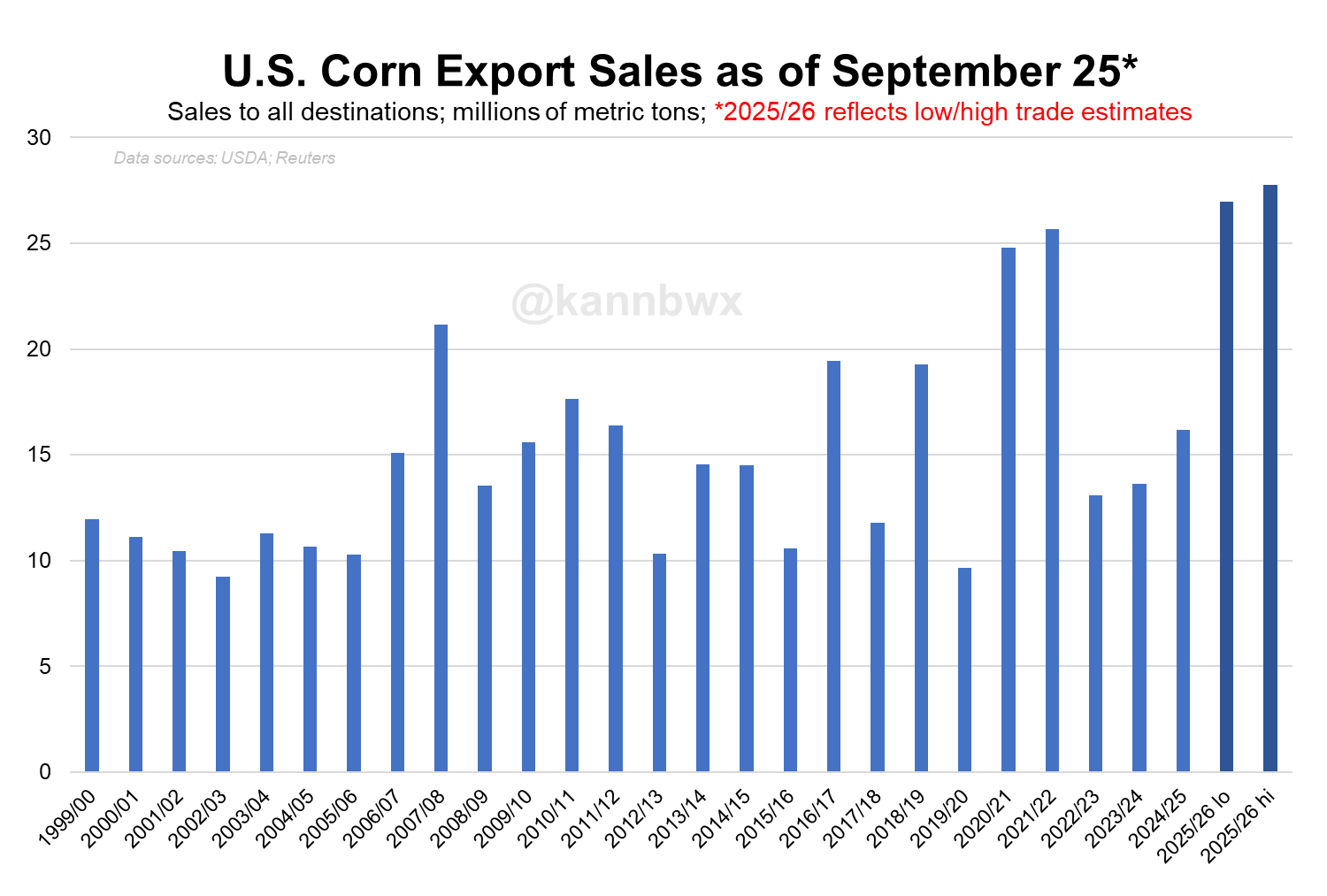

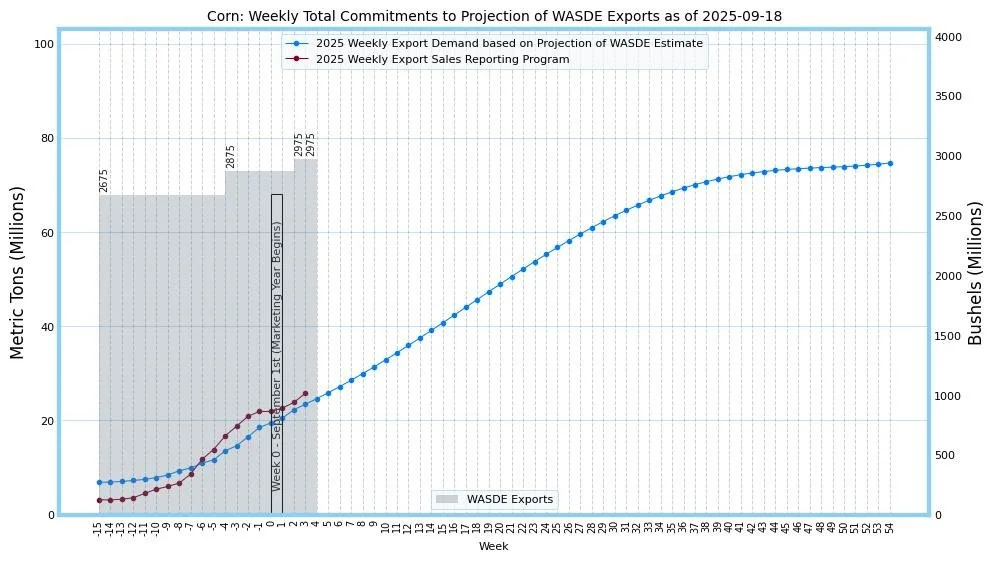

2023 was our record production year.

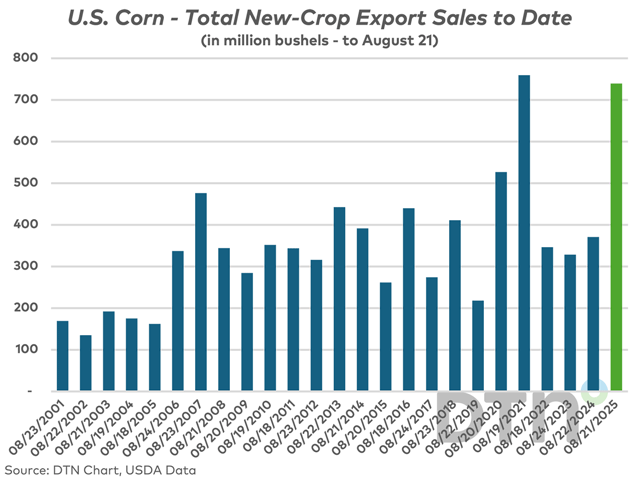

In 2023, exports were 2,150 million bushels.

The current estimate for this year is 2,975 million.

A near 50% increase.

So we have record supply, but we also have record demand offseting that supply.

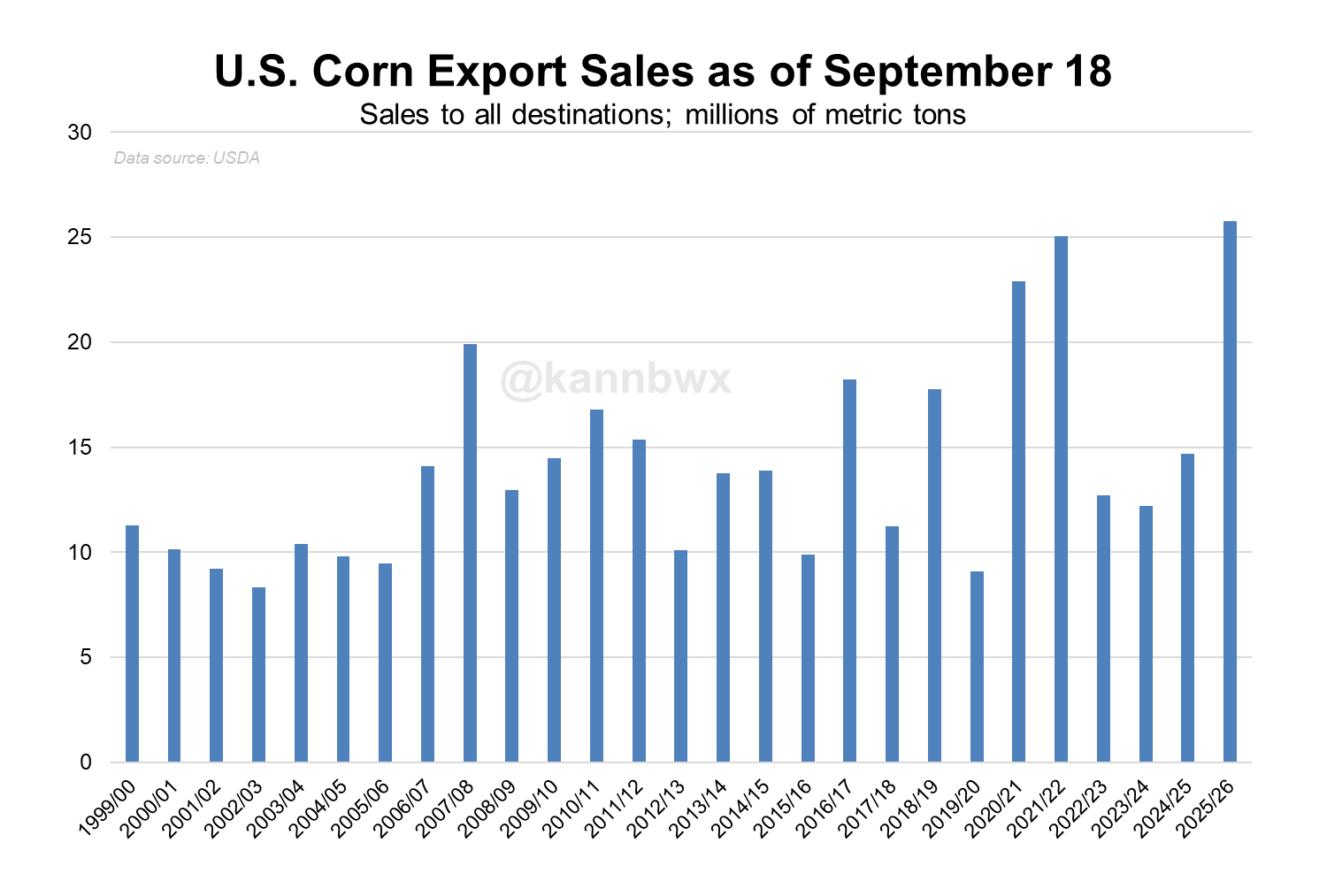

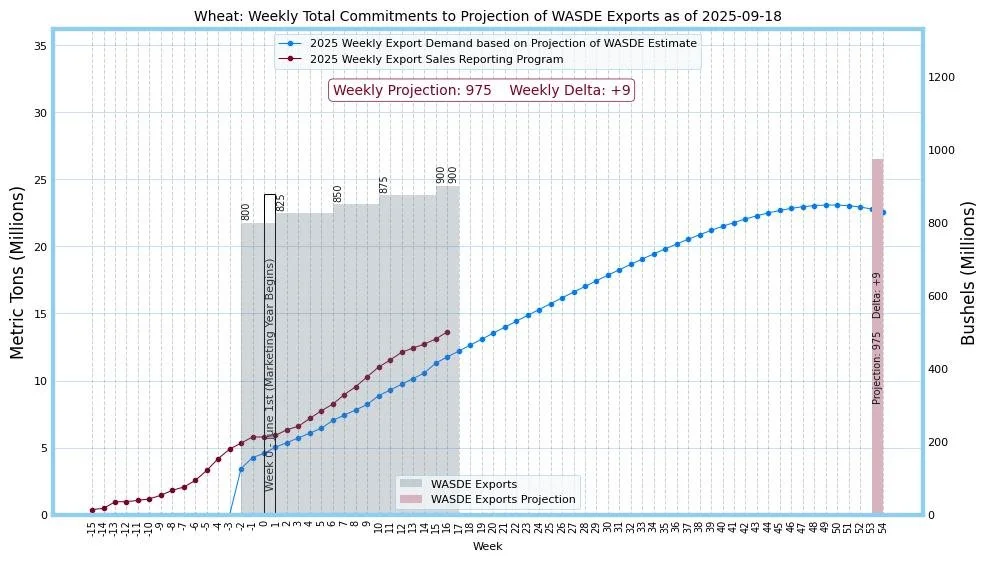

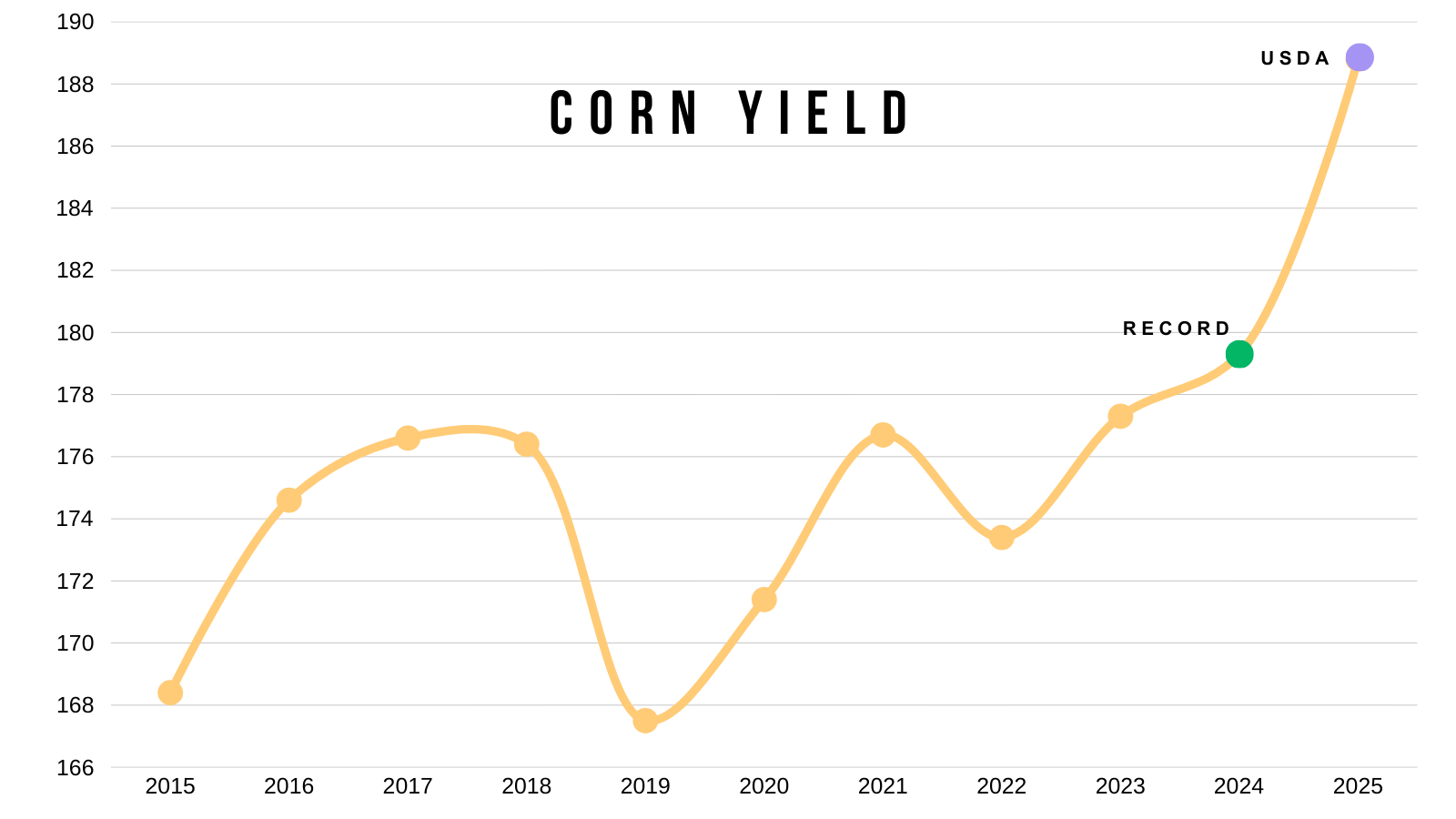

Here is a good chart from Karen Braun I showed last week.

Look at our exports compared to 2023. Up to this point, we are nearly double what we were then.

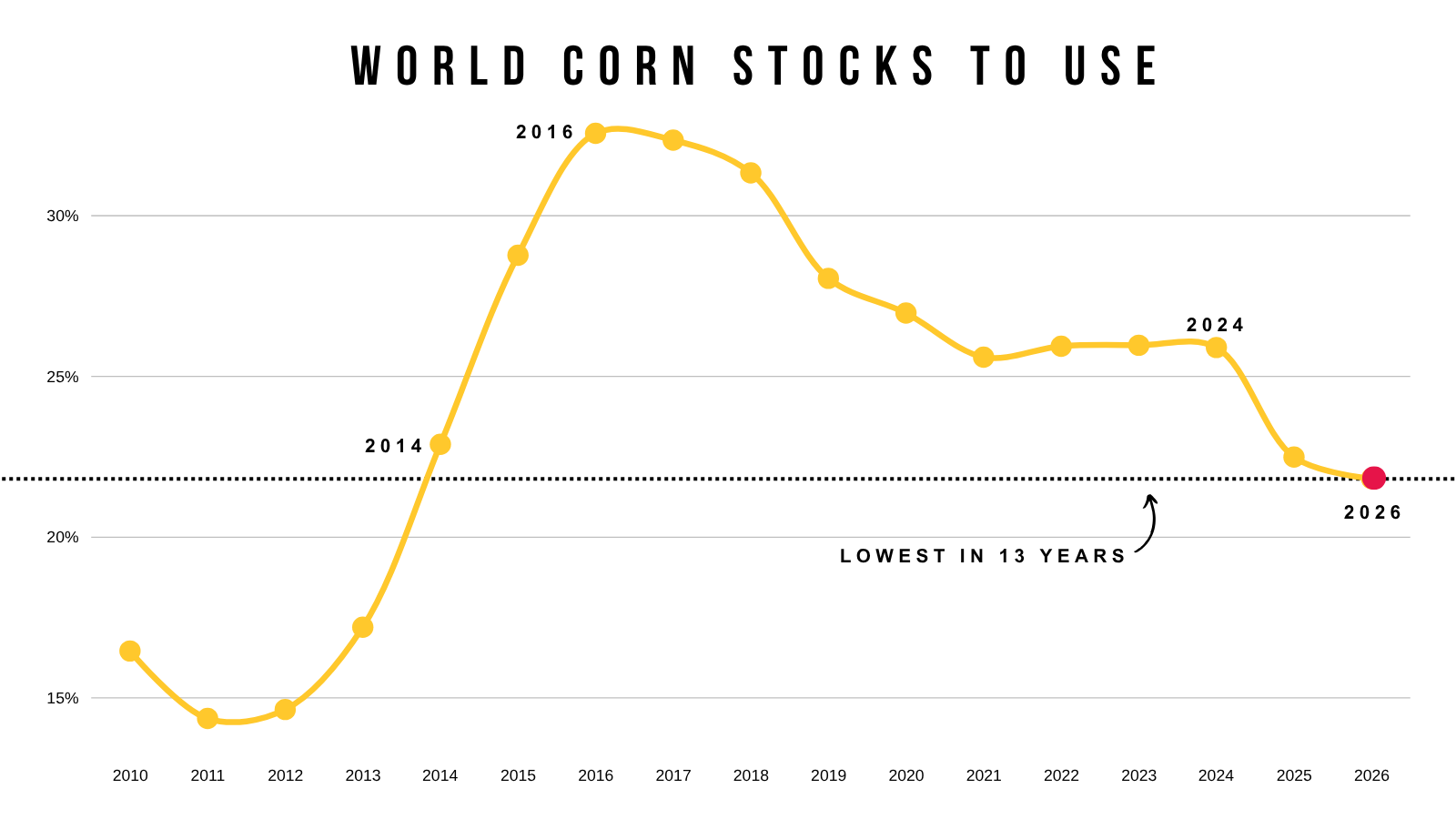

Despite the huge crops out of both the US and Brazil, the world situation is still one of the tightest in years.

The tightest in 13 years.

The world still needs corn.

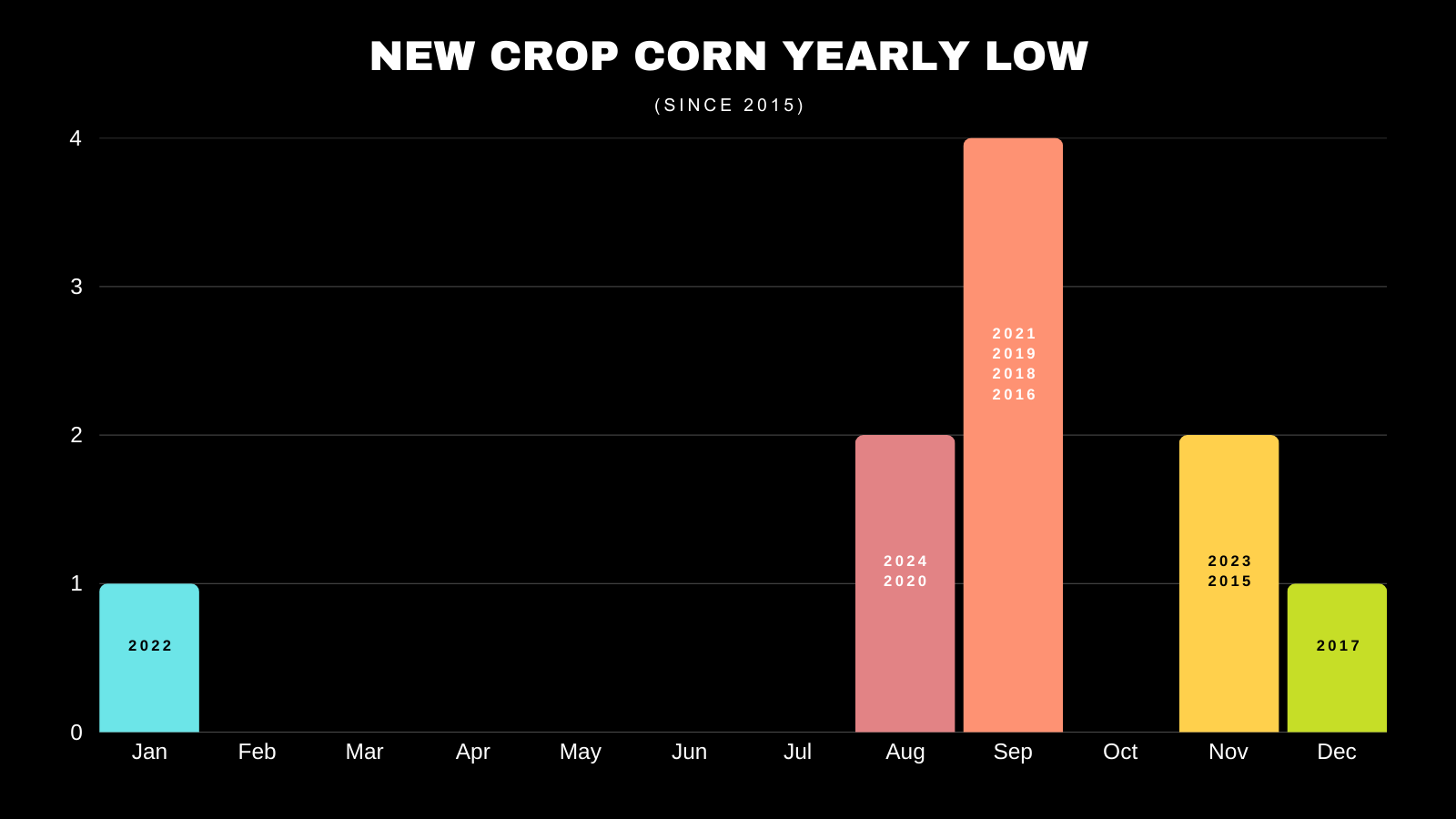

Now the biggest risk in this corn market has to be a post-October insurance sell-off. That would be the worst-case scenario to end the year.

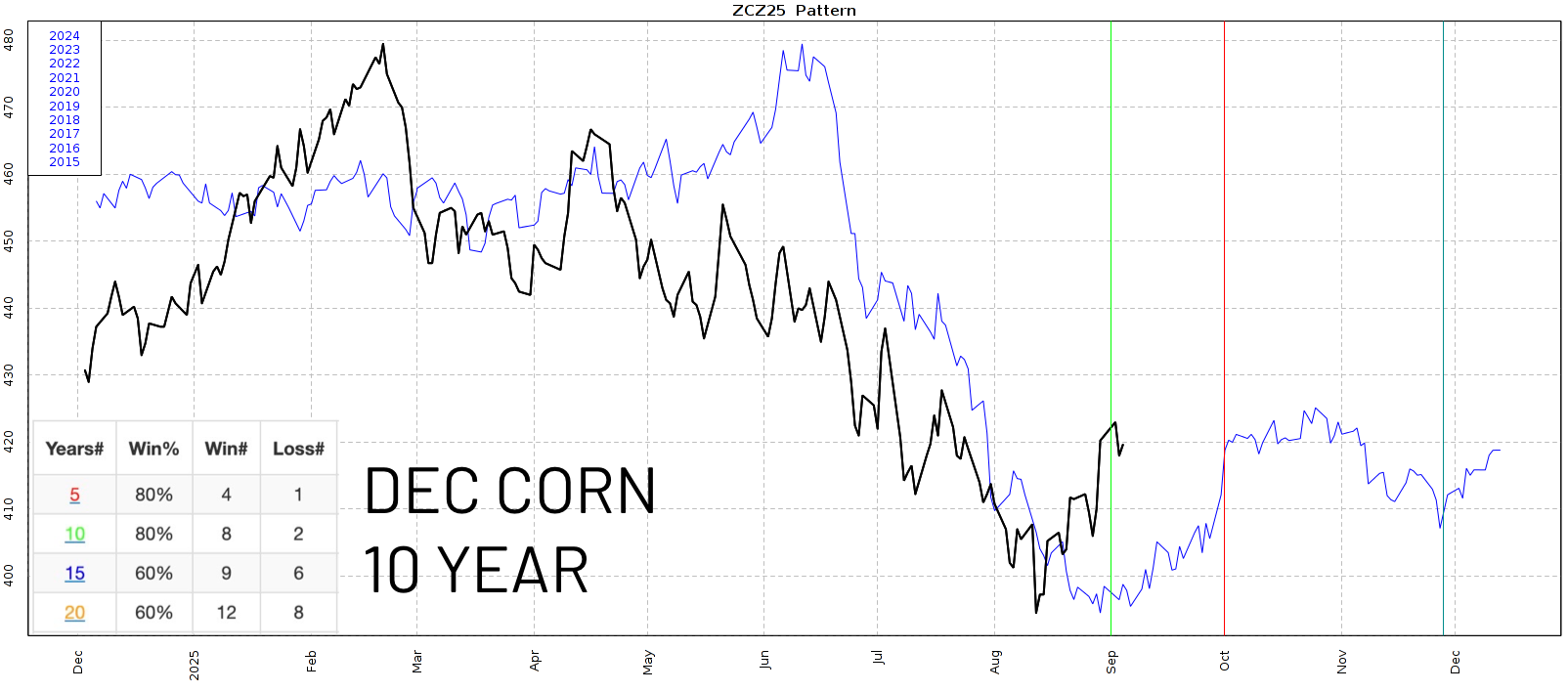

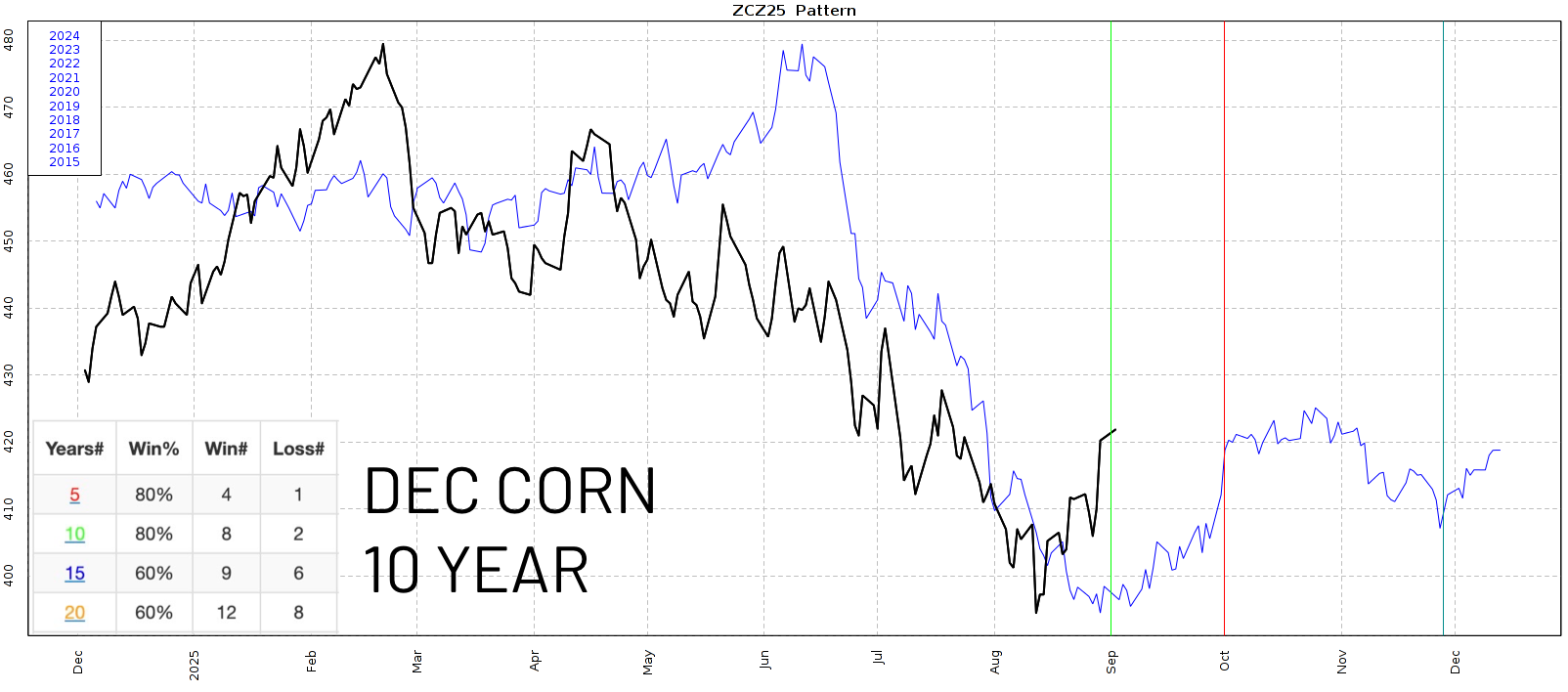

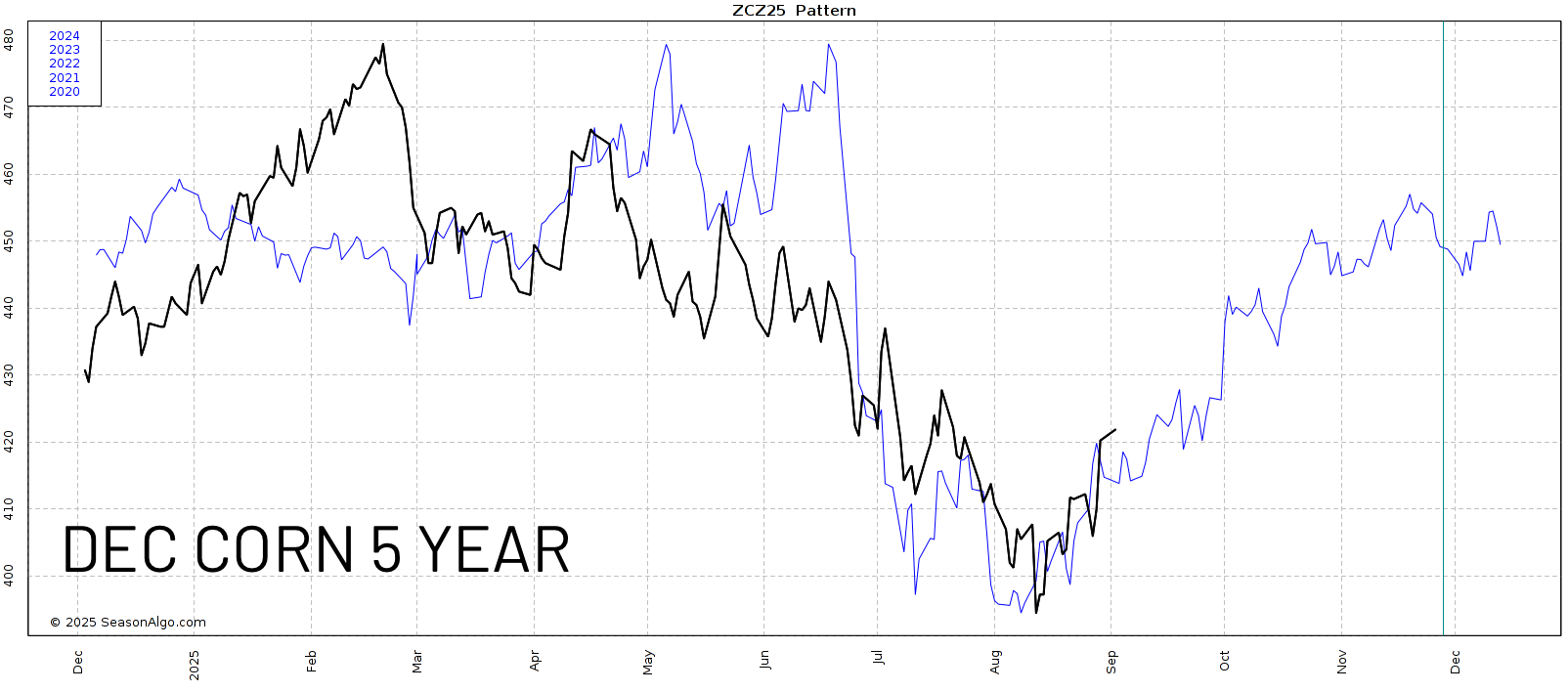

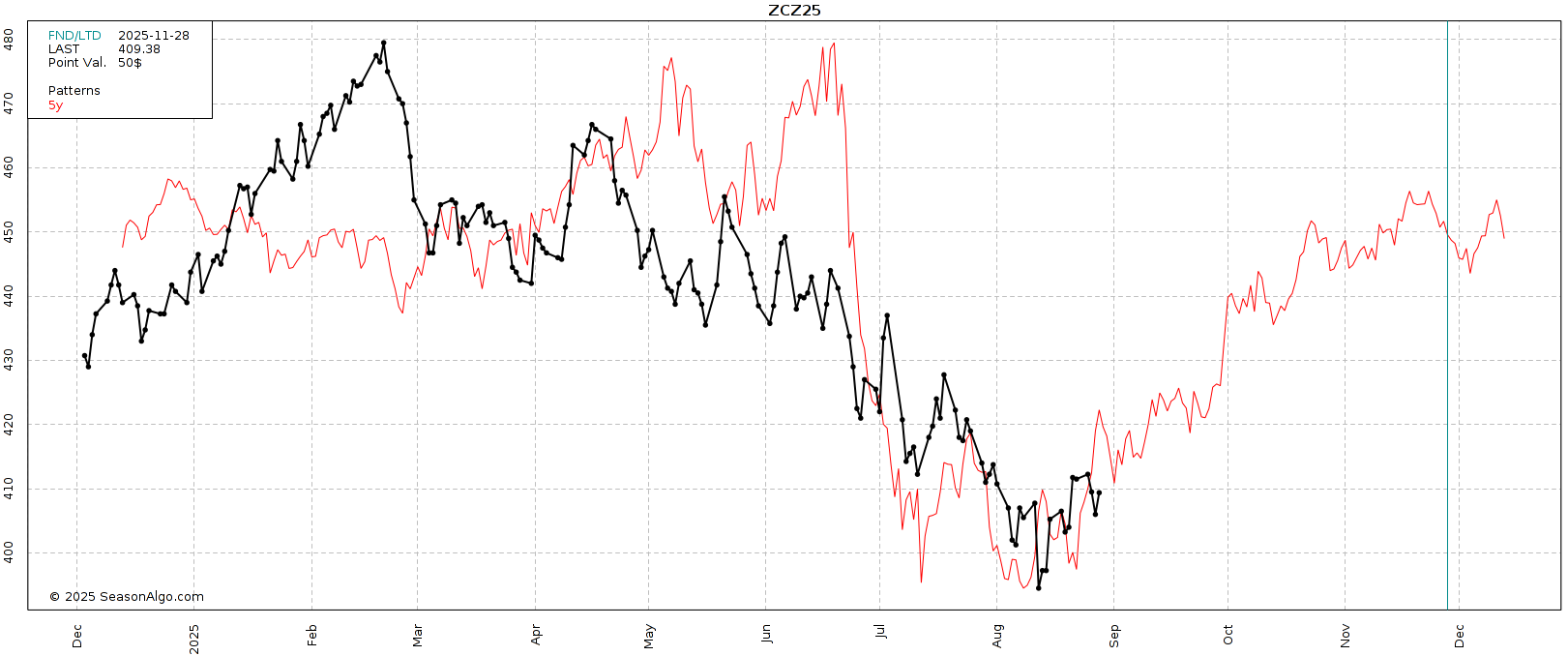

If we look at the seasonal patterns, the 5-year suggests a possible grind the higher the rest of the year. That is what has happened on average over the last 5 years.

However, both the 10 and 15 year patterns suggest a top in October, followed by an end of year sell off.

The most recent example of this was 2023.

That is the one year during that 5-year seasonal window where we did not grind higher the rest of the year.

We sold off in late October and never looked back.

The red line is 2023.

Technicals:

Pretty simple chart in Dec corn.

We had a failed breakout today. Rejecting right off this newly formed downward trend.

If we get the breakout above, it should spark a leg higher.

Target is still $4.35 to de-risk.

We still have an interesting potential inverse head & shoulders pattern.

Which in nature, is considered bullish.

Soybeans

Fundamentals:

Soybeans saw a boost today because the market is anticipating a trade aid package.

There isn’t a ton of news for the market to trade, so any positive news here helps support the market.

Why is this a supportive factor?

Mainly because it could keep some bushels off the market.

Prices aren’t great to begin with. Basis is awful in plenty of areas because we aren’t seeing any business to China. So this aid might help farmers hold on and not dump as much supply into the market.

However, trade aid does make it seem like the government isn’t extremely confident about a trade deal coming to boost prices relatively soon.

It might be quiet here for the next few weeks.

We don’t have the USDA report. China and Trump aren’t scheduled to talk until the end of the month. So the market does not have much to digest and trade on.

Little fundamental changes can lead to quiet markets.

It's mostly a waiting game here in soybeans. We always get a nice boost on these trade deal talks, then sell off after the meeting because it didn’t lead to anything. So you really can’t get overly excited unless this meeting actually materially changes something.

Long term you do have to be somewhat optimistic on how a trade deal could impact things. Short term is the concern given that we've already missed a good chunk of our prime shipping window.

I still find it hard to imagine that yield is going to be +2 bpa higher than anything we've seen before.

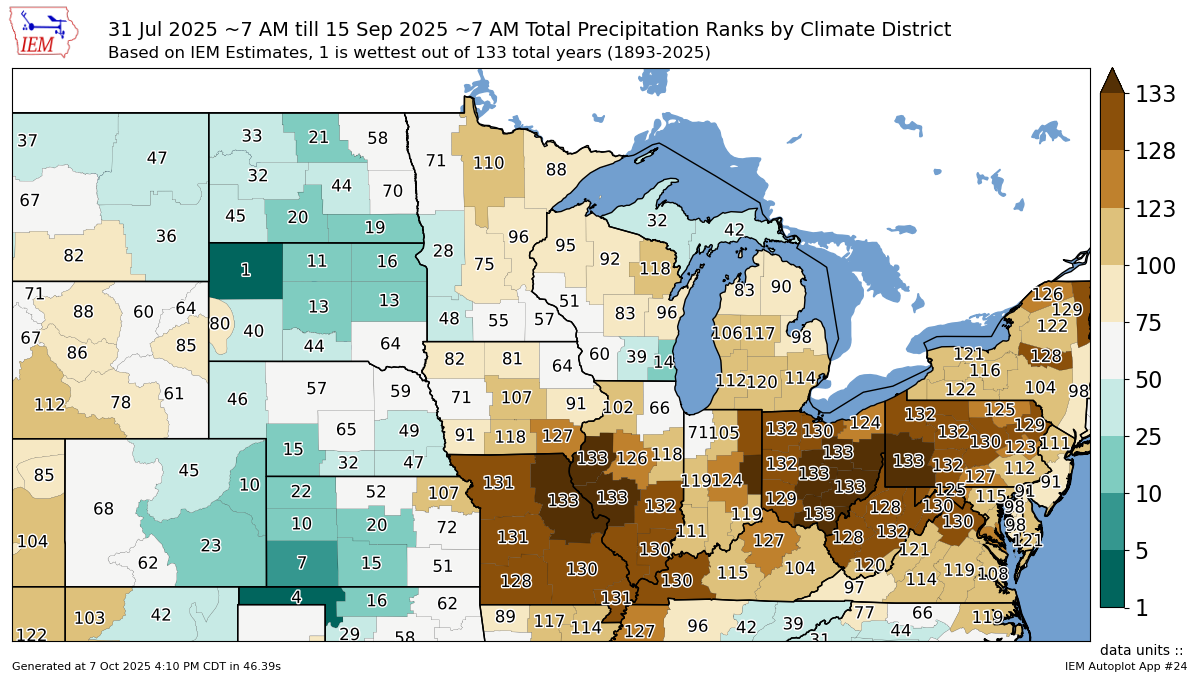

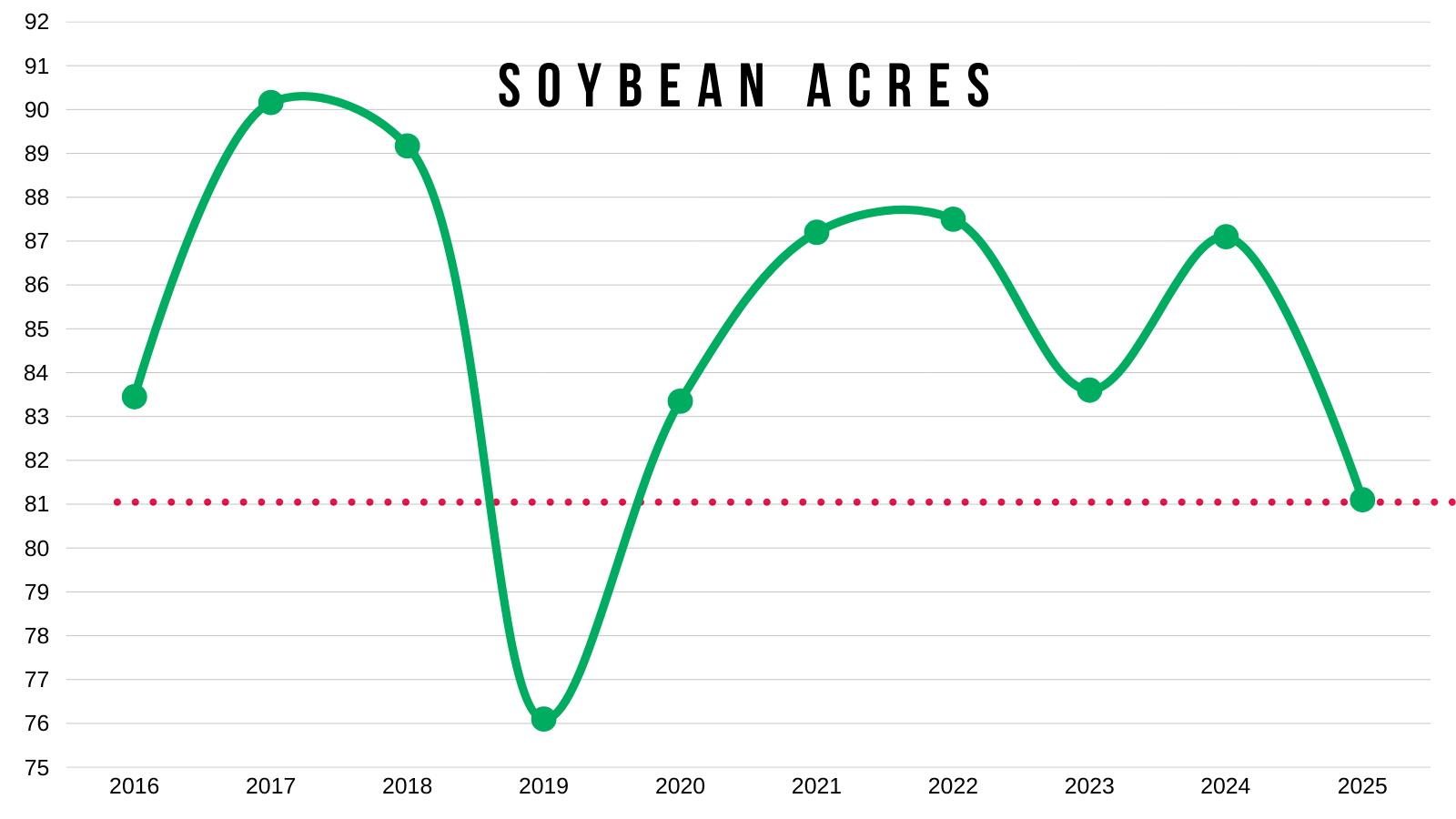

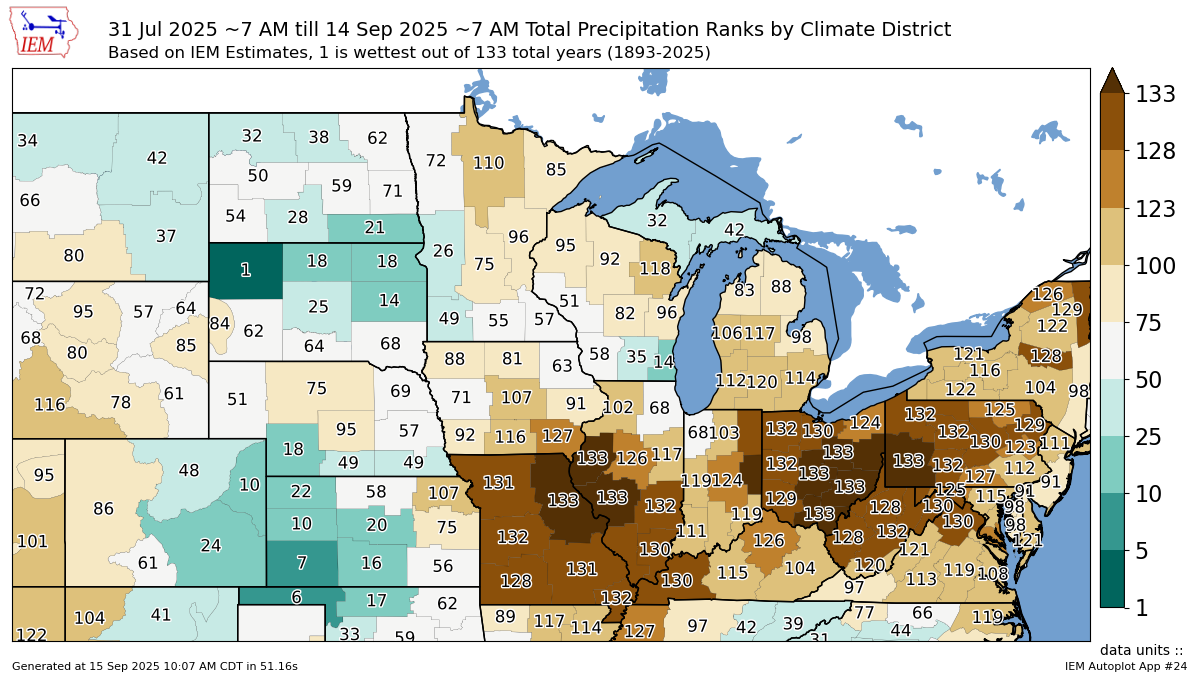

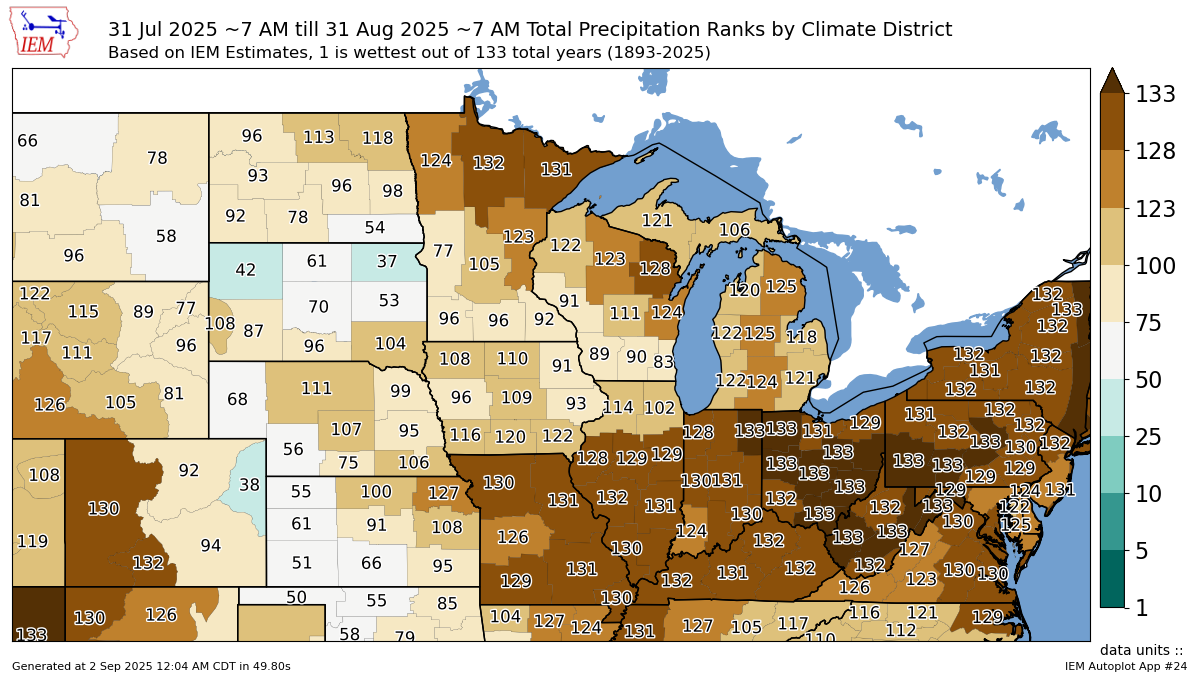

As a reminder, we did just one one of the driest finishes on record.

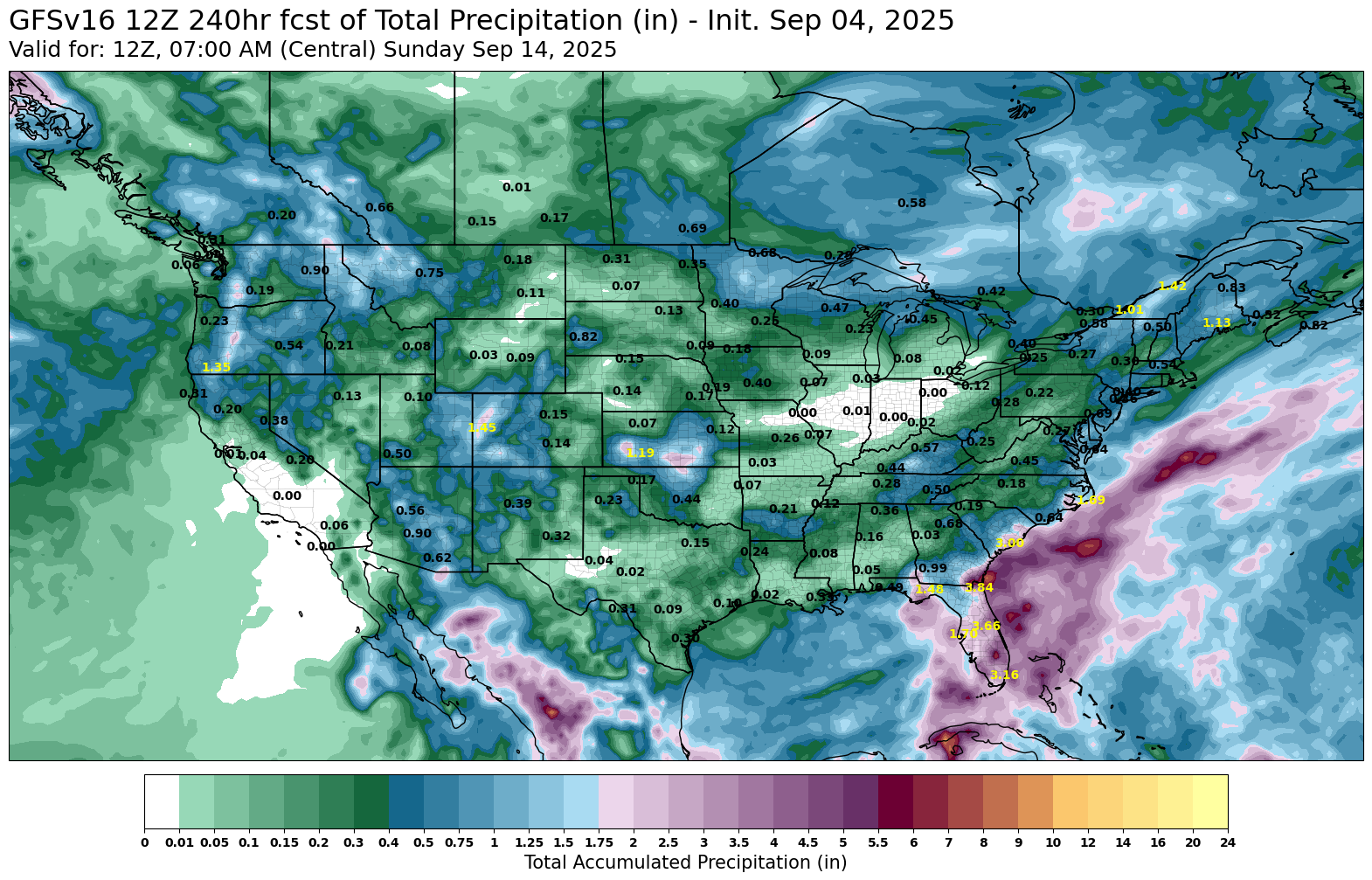

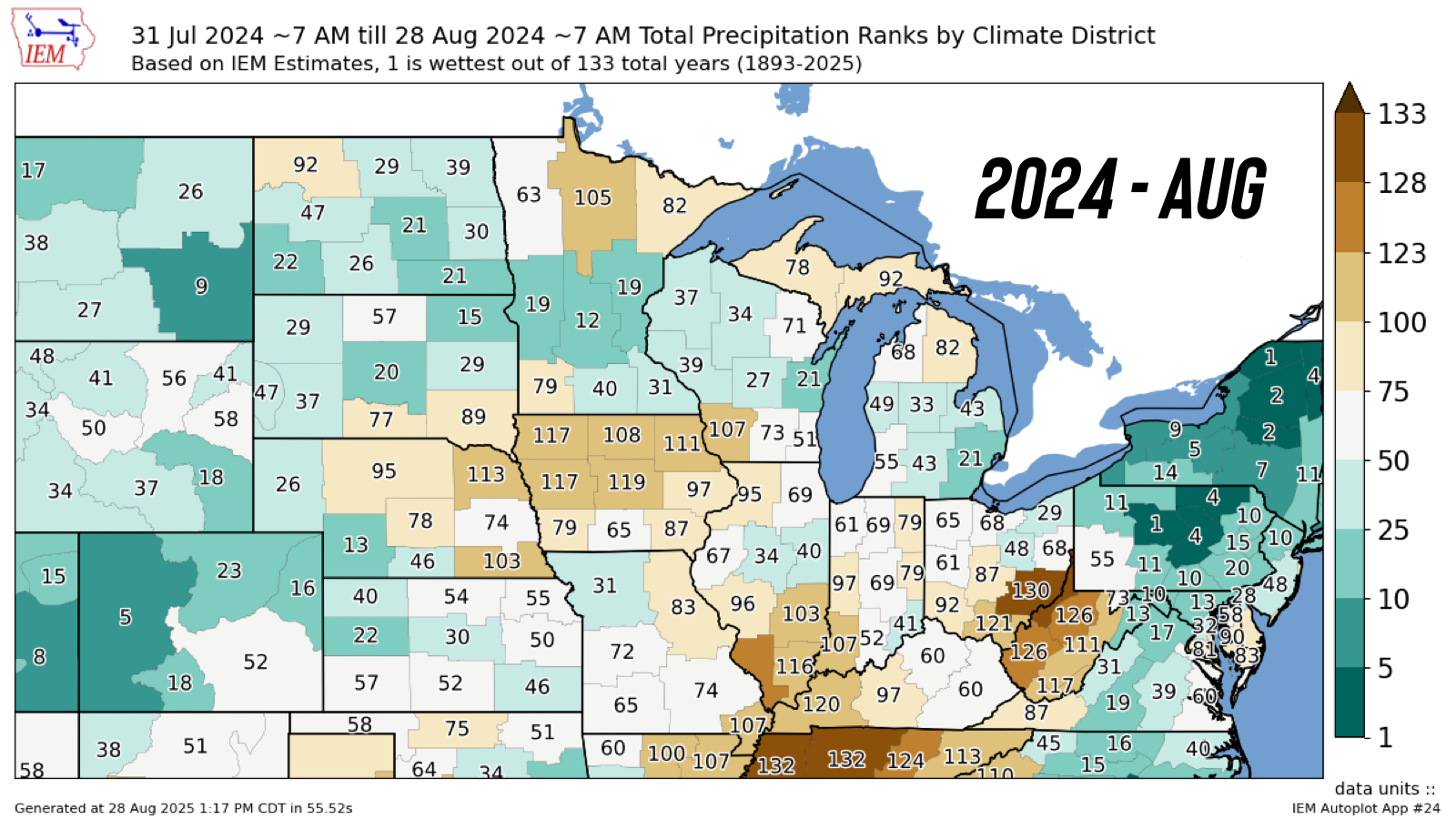

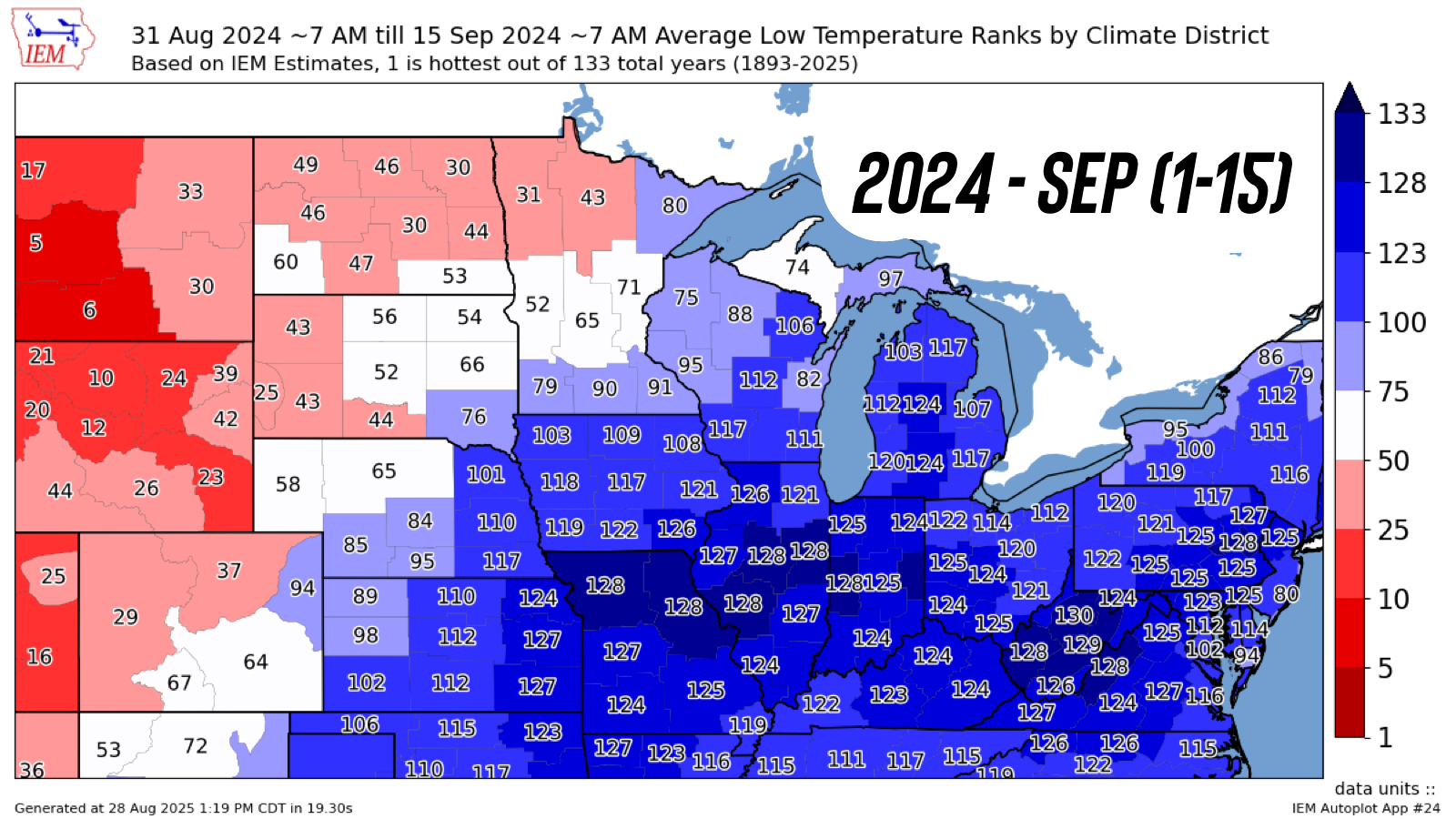

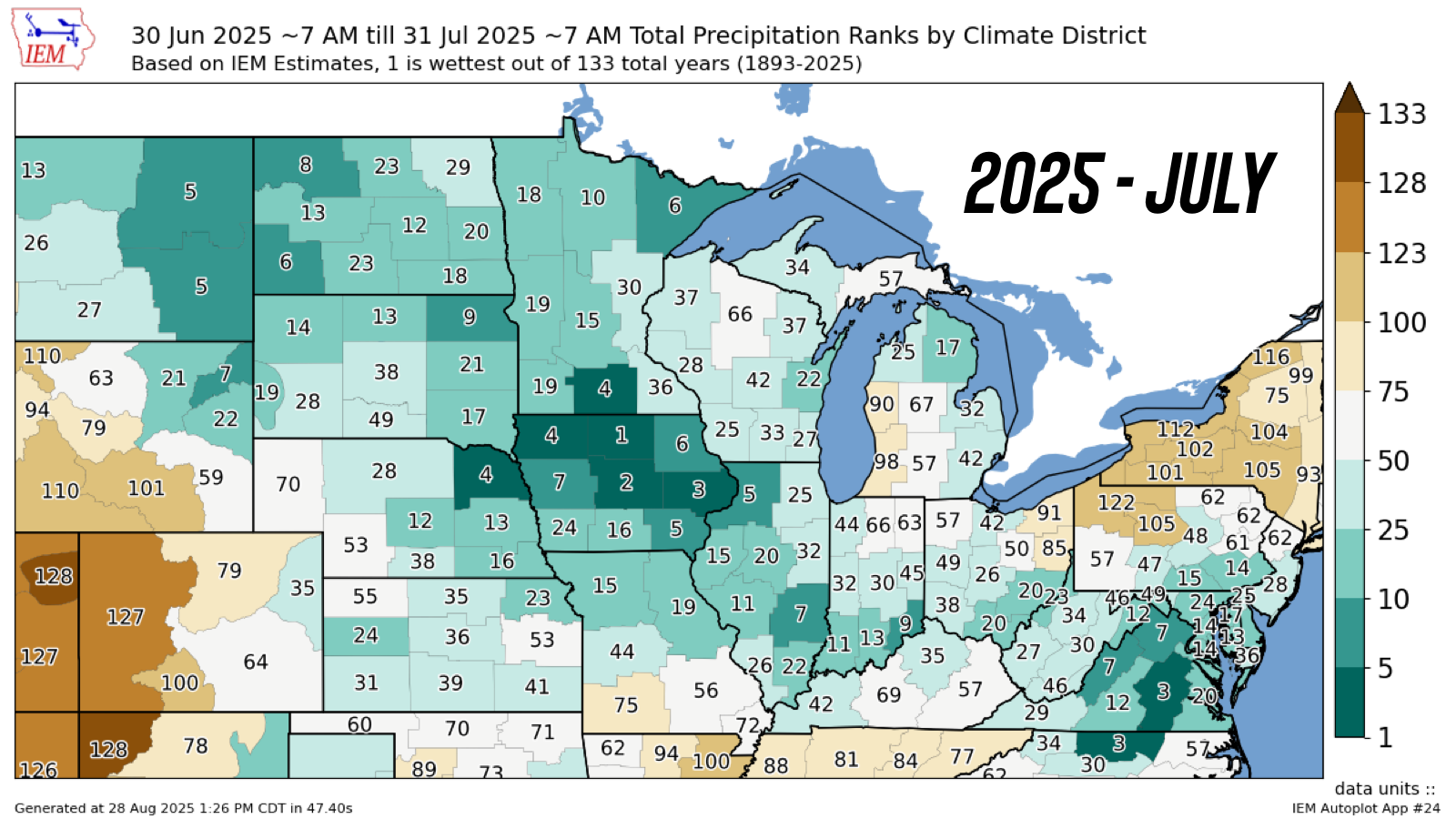

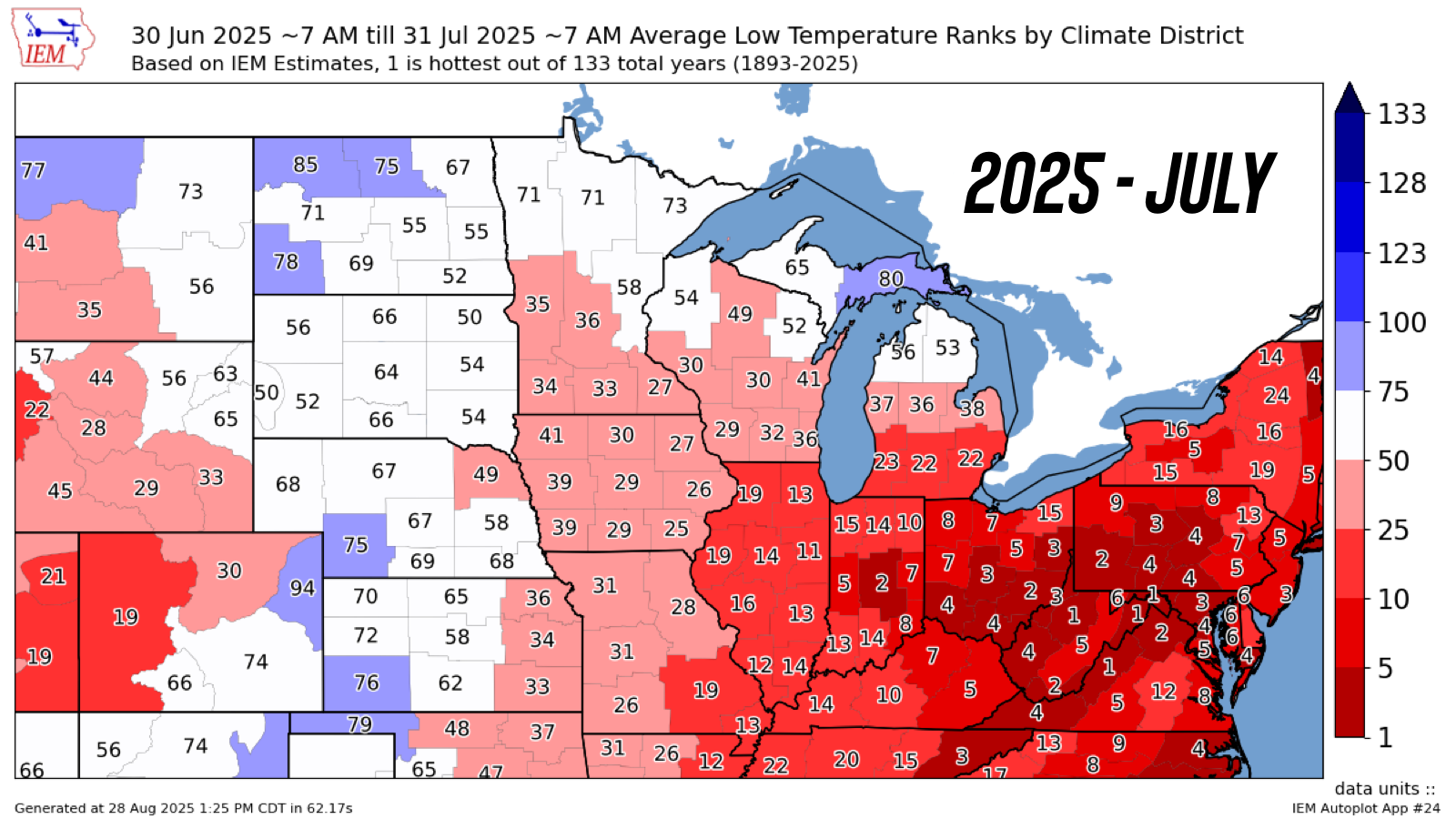

Here is the precip rankings from Aug 1st to Sep 15th.

Technicals:

We rejected right at this golden zone retracement box.

As we reclaimed 61.8% of the recent sell off.

This is a normal size for a correctional bounce. So unless you break above that box, this bounce is seen as nothing more than a usual relief bounce. Meaning the risk is still lower.

If we break above the box, most of the time it would suggest we've put in our lows. As it would no longer be a standard-sized relief bounce in a broader correction.

I'm also cautious here because we could see a similar pattern play out like we did earlier this summer unless we break that box I mentioned above.

Often times, markets move in 5 waves.

The summer sell off saw 5 waves.

So far we only have 4.

Both the 2nd and 4th wave on the summer sell off rejected the 61.8% level. The level we are are currently battling.

This doesn’t have to happen at all. I just can’t be confident in this market until we clear the purple box. It's a big spot.

I've shown this chart recently as well.

Soybeans have traded in one of the smallest & longest ranges we've ever seen.

Trapped between $9.60 and $10.80 for 427 days now. Essentially sideways for over a year.

Finding support at our trade war resistance. While finding resistance where we did in 2016-2018.

Soybeans absolutely hate trading in the $11.00's. Which is marked with the blue box.

We either rally to $12 or break into the $10.00's.

My bias leans towards the belief that $9.60 is our new long term floor. But if you ever broke below that level things could get ugly.

On the other hand, if we ever take out $10.80 the chart is completely open to the upside.

There are so many unknowns in this market. But if we strike a deal with China, this chart has so much room to run long term.

Wheat

Fundamentals:

Very little fresh news in wheat.

Seasonally, this is the time of the year where wheat tries to buy some acres but has struggled to find a catalyst to move higher.

We certainly aren’t buying extra acres here.

We just have an ample amount of supply around the world and no real concerns anywhere.

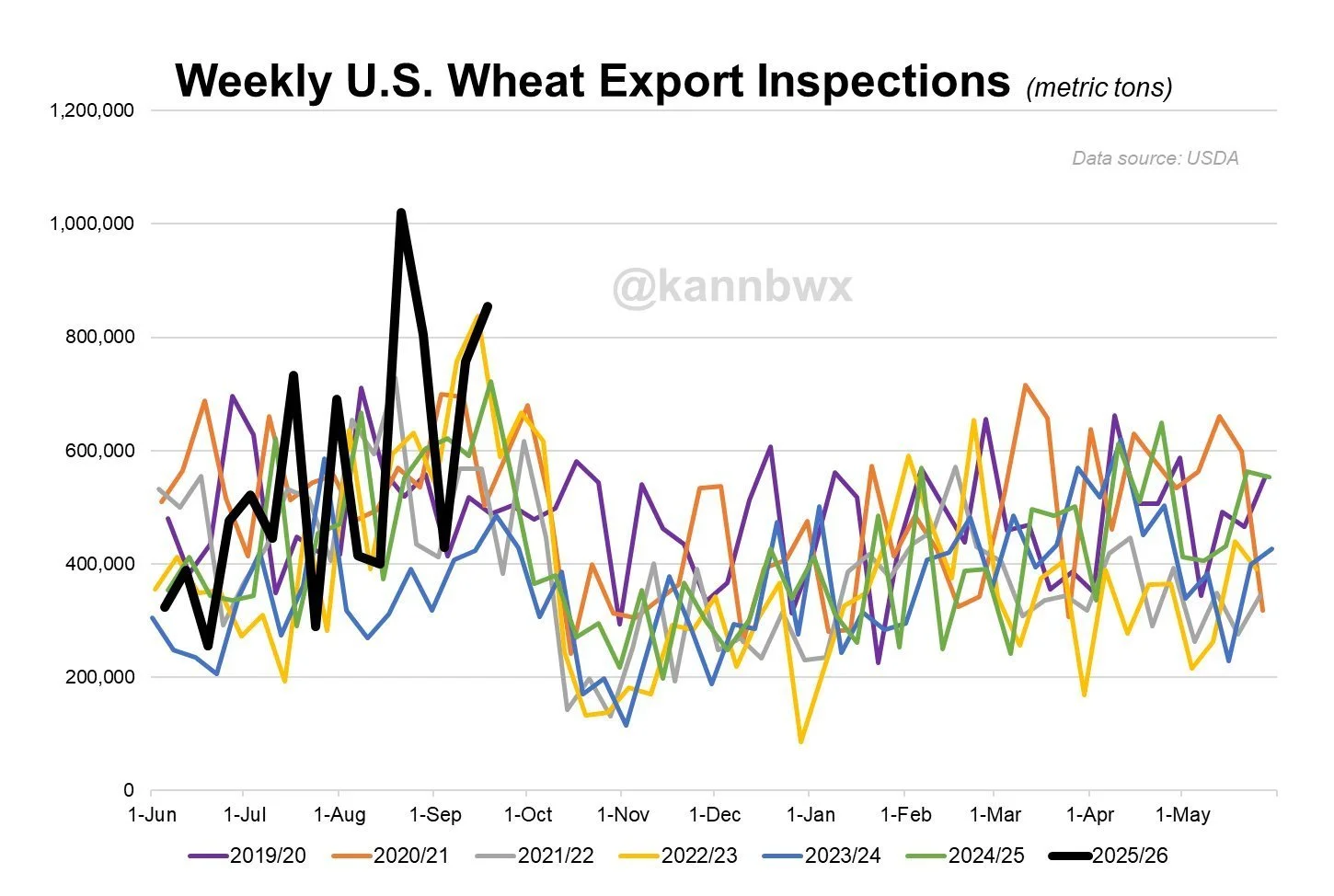

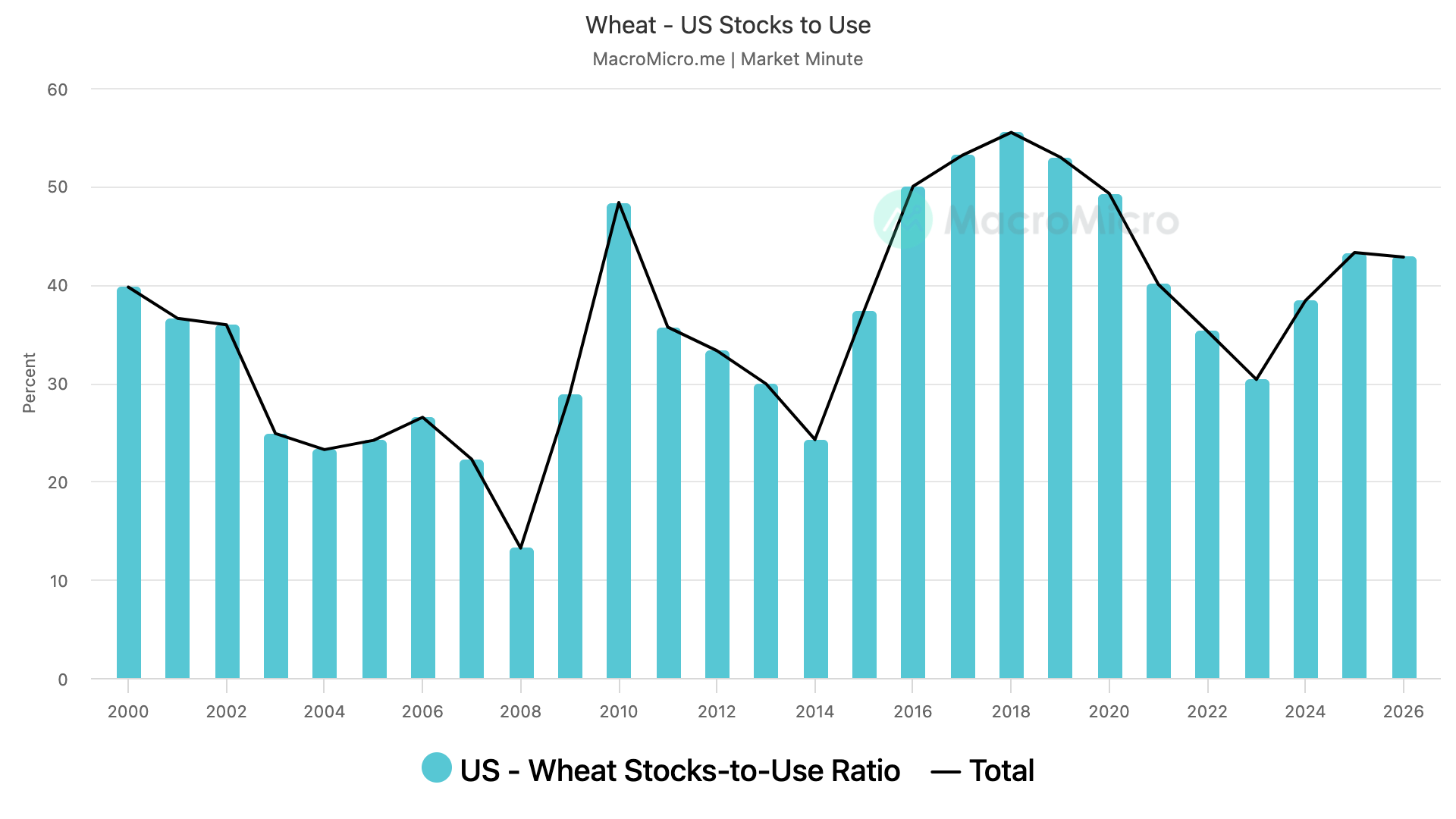

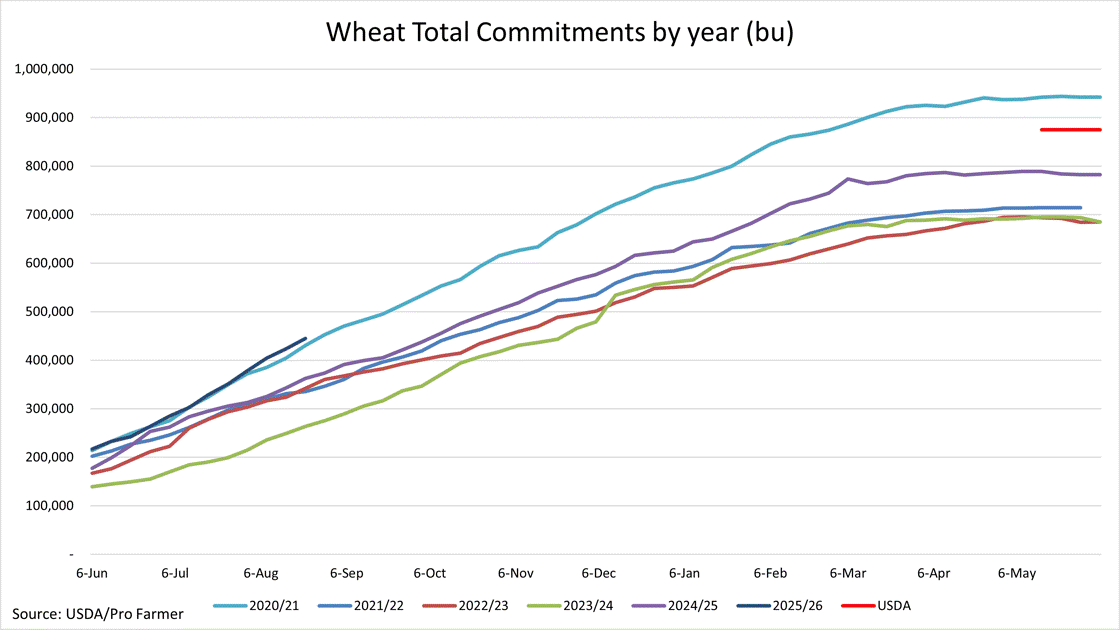

On the bright side, our exports are fantastic. Some of the best demand we've seen in years. Which doesn’t have to lead to higher prices right now, but is one way you can chew into the carryout and paint a friendly situation here in the US.

It's just a waiting game in wheat. Being patient for opportunities. They just might not come as soon as any of us would like.

Dec Wheat Technicals:

We continue to trickle lower. But I personally still think we are coiling for a move higher.

Still trapped in this falling wedge. Waiting for the breakout.

If the breakout comes, I think we could reasonably run to $5.45.

Which gives back 38.2% of the June highs and is old support.

Dec KC Wheat Technicals:

Pretty similar to Chicago.

Coiling in this wedge pattern.

If the breakout comes, a reasonable target would be $5.35 which is old support and 38.2% of the June highs.

Cattle

We had a few pieces of news that's been supporting cattle.

First was that there was another screwworm case in northern Mexico.

It looks like someone knew this info was coming because the market rallied before this came out. But it looks like the border isn’t re-opening soon.

We also had the news that Trump and Brazil did not come to a trade agreement. So the tariffs remain on Brazil beef.

As Trump and Brazil spoke for the first time since he added 50% tariffs on Brazil's beef.

Brazil is the #1 beef exporter in the world. This 50% tariff means that their beef gets priced out of the market.

These pieces of news came at a pretty perfect spot on the charts. Right at critical support.

Oct Feeder Chart:

We were sitting in a wedge pattern and got the breakout today.

That is a pretty friendly sign and suggests we could go print new highs.

If we post new highs, we have a potential target of 377.

That is the golden fib from the bottom of the wedge up the previous end of Sep high (outlined on the chart).

(If you are new, the golden fib means it equals 161.8% of the prior move).

This is a common spot for a 2nd rally to pause.

To the downside, the biggest thing to watch is the 50-day MA. That is a must hold spot and will be our warning sign that this market is truly experiencing a larger correction.

The 50-day has acted as an absolute floor in this market.

If it breaks, it could open the door much lower.

The downside target would be to give back 50-61.8% of the entire rally since June. Which is also where the 100-day MA sits.

They always say the trend is your friend. Until the 50-day gives out, you have to lean higher.

Dec Live Cattle:

Live has not had the breakout that feeders have had.

However, we bounced EXACTLY where we needed to.

Right off that 50-day MA.

This market has bounced there countless times. The only time we broke below it was back in April. We then proceeded to fall to the 100-day.

So the 50-day is still the must hold spot and warning sign. If it gives out, it could open the floor gates lower.

But so far we've continued to hold.

Past Sell or Protection Signals

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

USDA & CORN TRUTH FINALLY EXPLAINED

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

USDA: 0:00min

Corn: 4:15min

Beans: 7:10min

Wheat: 9:00min

Cattle: 10:45min

Want to talk about your situation?

(605)295-3100

USDA Sale Ends Tonight

Your free trial has expired

Subscribe if you would like to keep getting our daily updates. Don’t miss our next sell signal

Futures Prices Close

Overview

Grains lower across the board with today's USDA report.

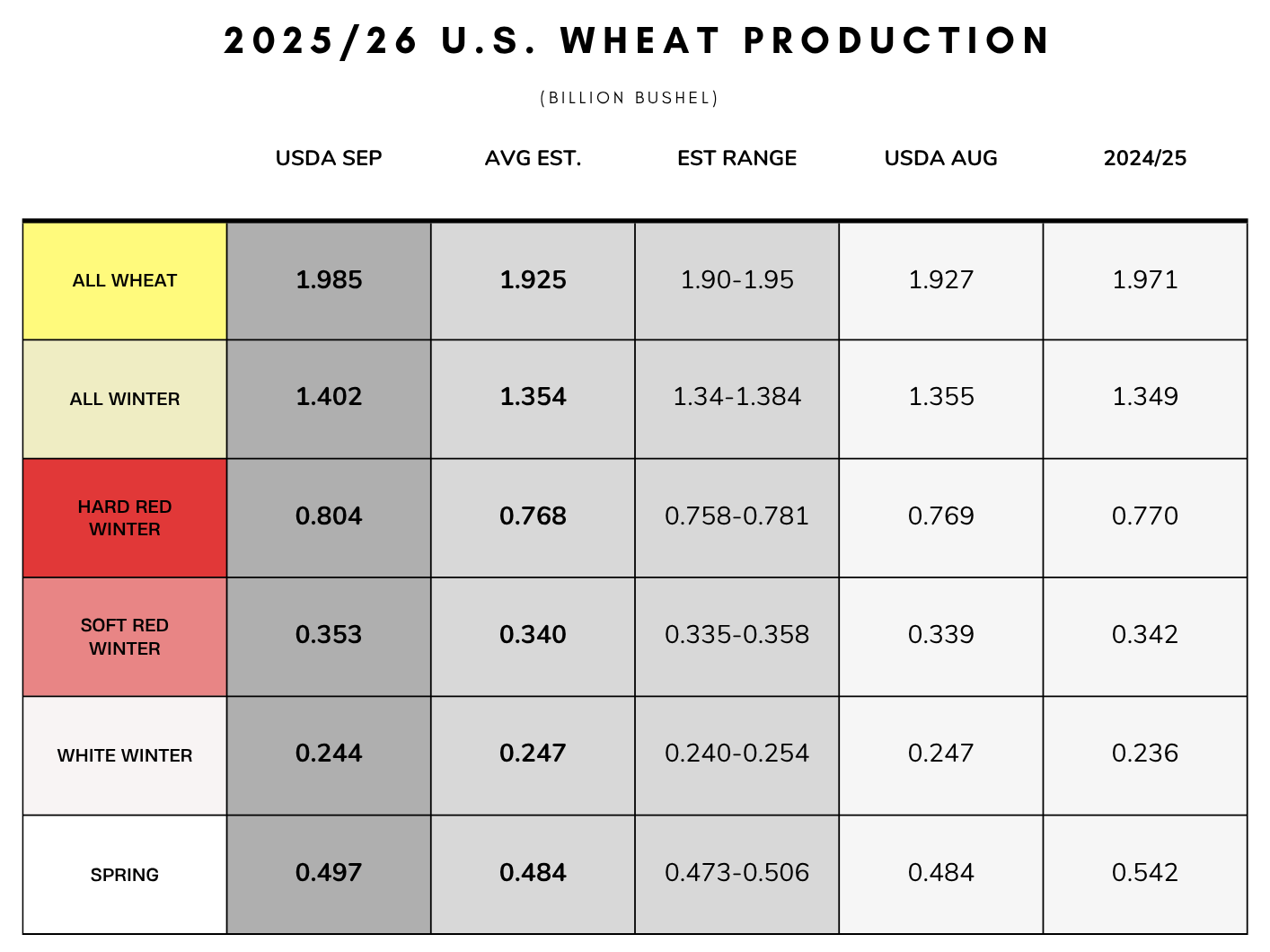

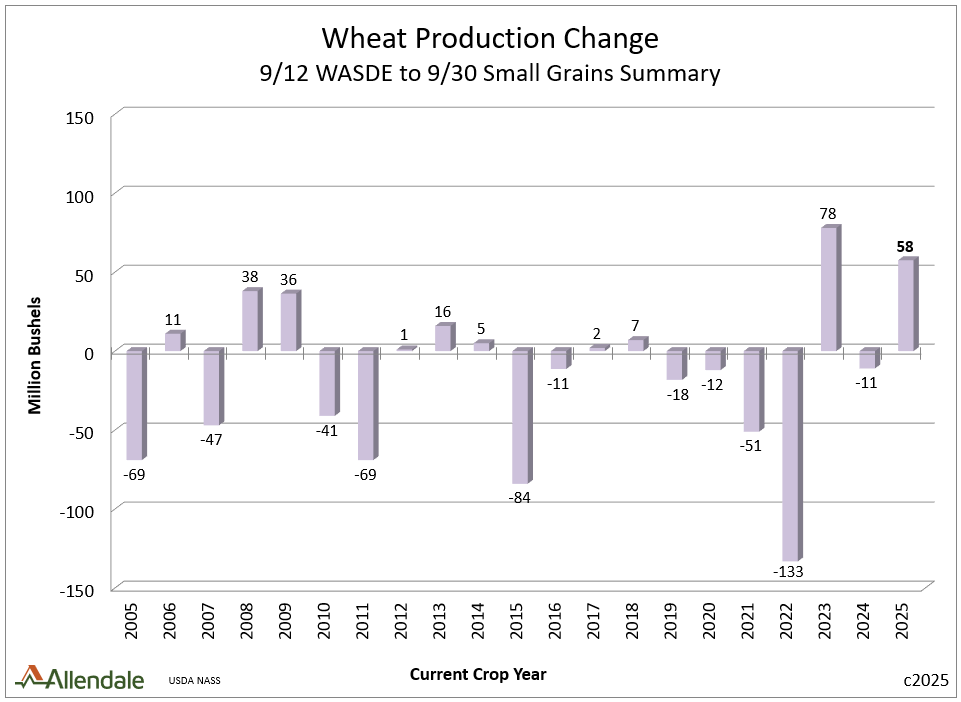

Today we had the quarterly stocks, which is our final old crop balance sheets, along with wheat production.

The report provided a bearish surprise in both corn & wheat.

Old crop corn stocks came in above expectations due to a cut to feed & residul demand.

Old crop wheat stocks also came in above expectations due to finding extra winter wheat acres.

Meanwhile, the report was essentially neutral for soybeans with no major changes made.

Let's dive right into the report and what it means..

Corn Truth Finally Explained

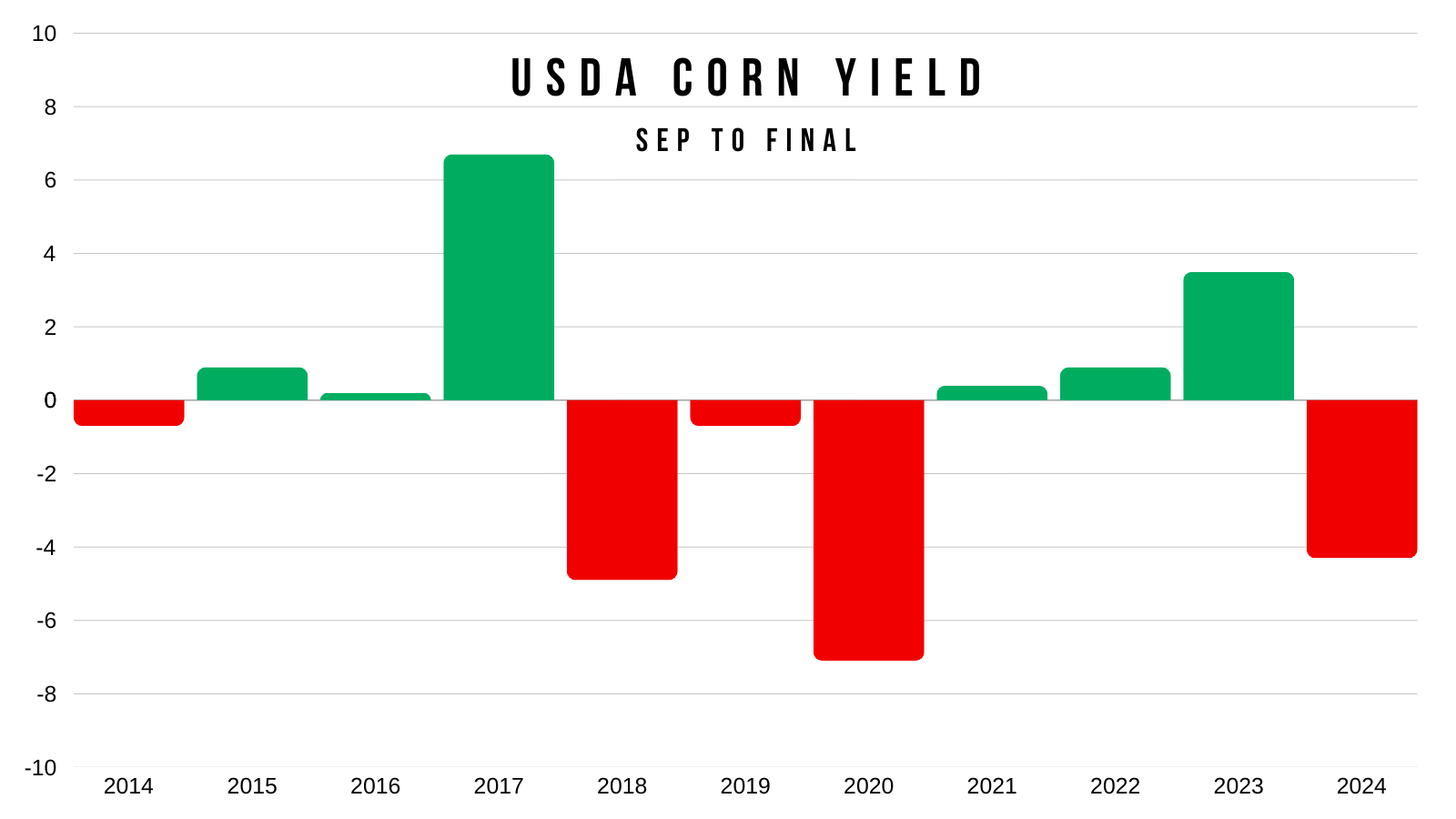

As expected, this was bearish for corn.

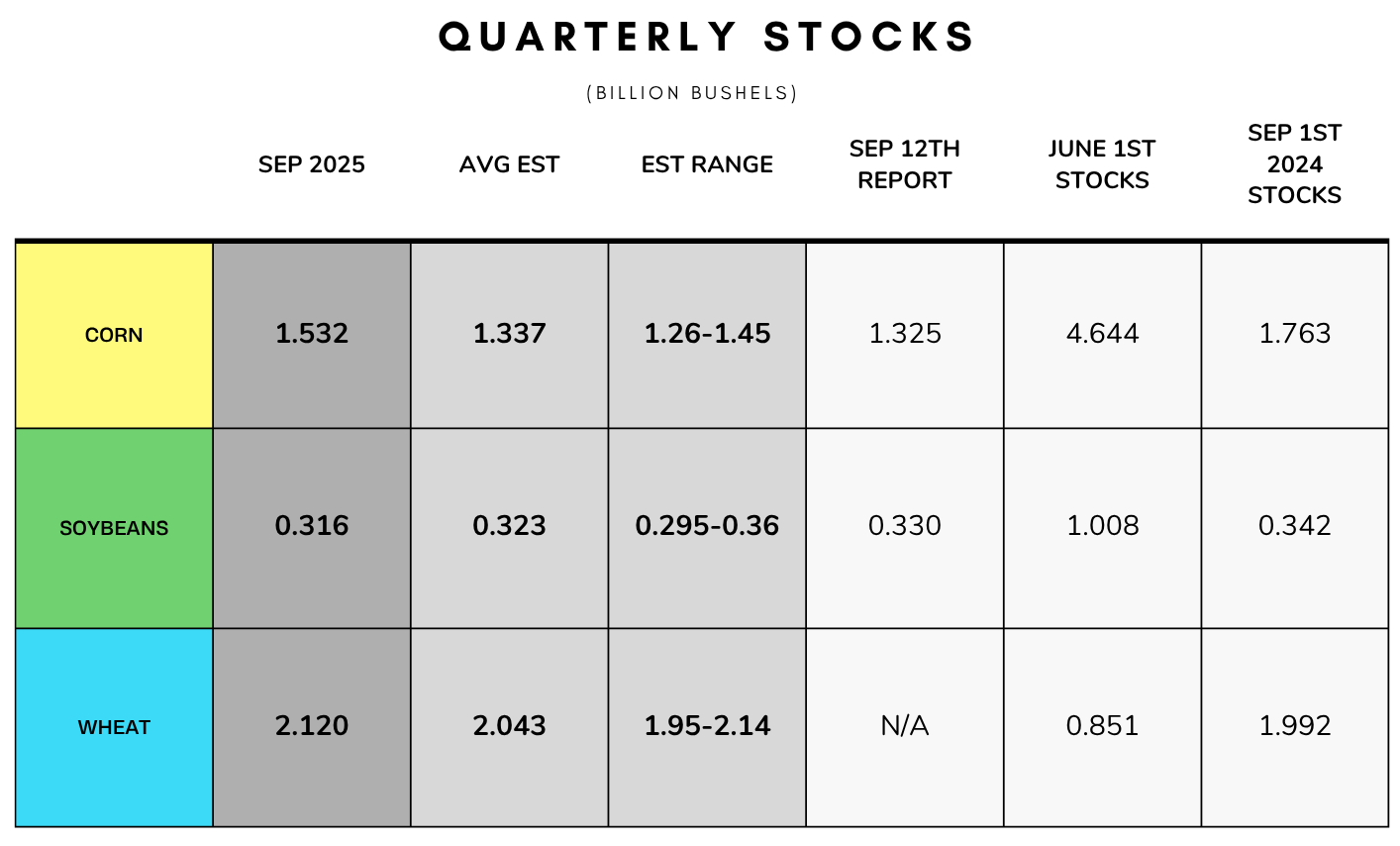

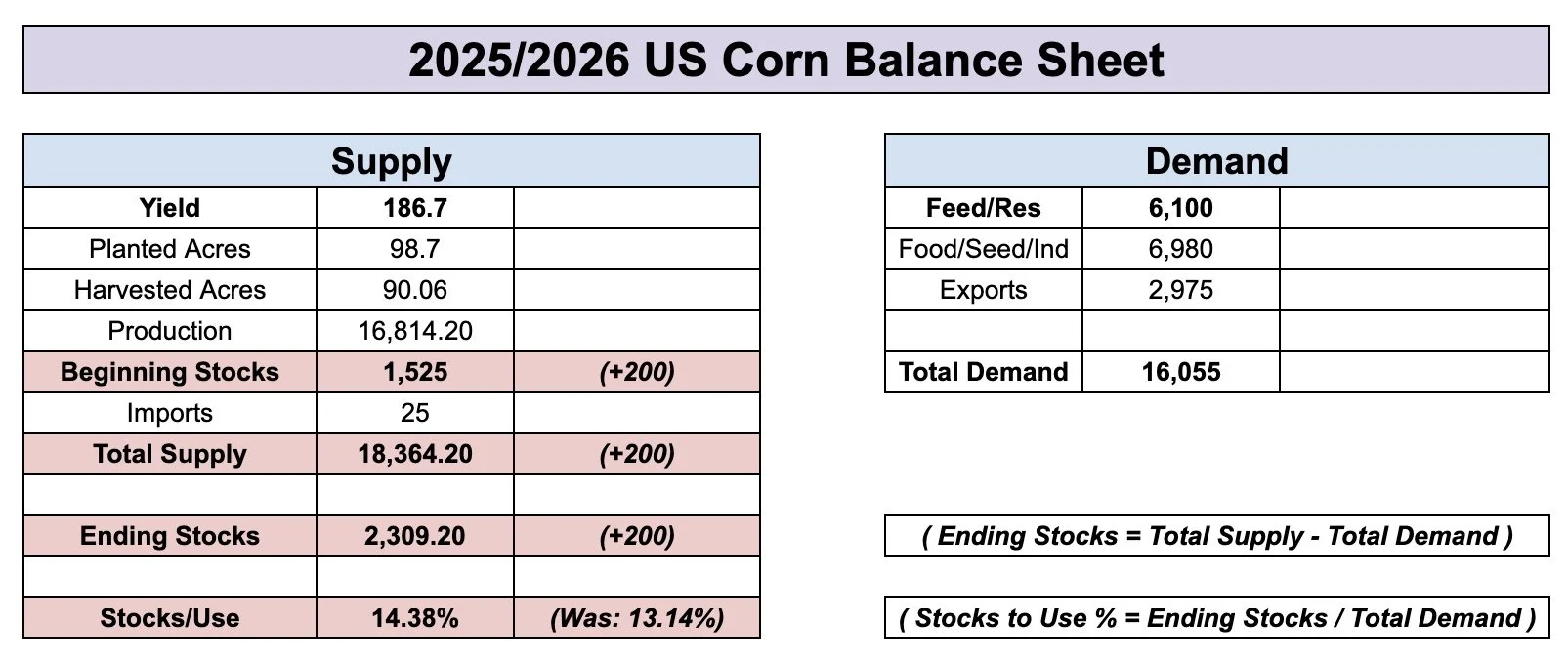

Here is the numbers in case you missed them.

Corn came in +200 million higher than estimates.

Wheat was +80 million higher than estimates.

Beans were just under the estimates.

The USDA found an extra +200 million bushels of old crop corn.

This change in old crop did NOT come from last year's crop being bigger. They left production virutally unchanged.

The USDA dropped old crop feed & residual demand by almost -200 million. Which is where the entirety of this change came from.

We had said all week that this was the biggest risk for this report. Because this market simply never traded like we had a sub 9% stocks to use ratio or a 1.3 billion bushel carryout.

So almost everyone expected that this report would provide an explanation as to why corn performed so poorly the last year despite the supposedly friendly balance sheet. That is exactly what we got.

The market has been hinting at us for months that this crop was never at a 1.3 billion carryout.

Instead, it was actually at 1.5 billion.

Instead of an 8.7% stocks to use ratio. It was actually over 10%.

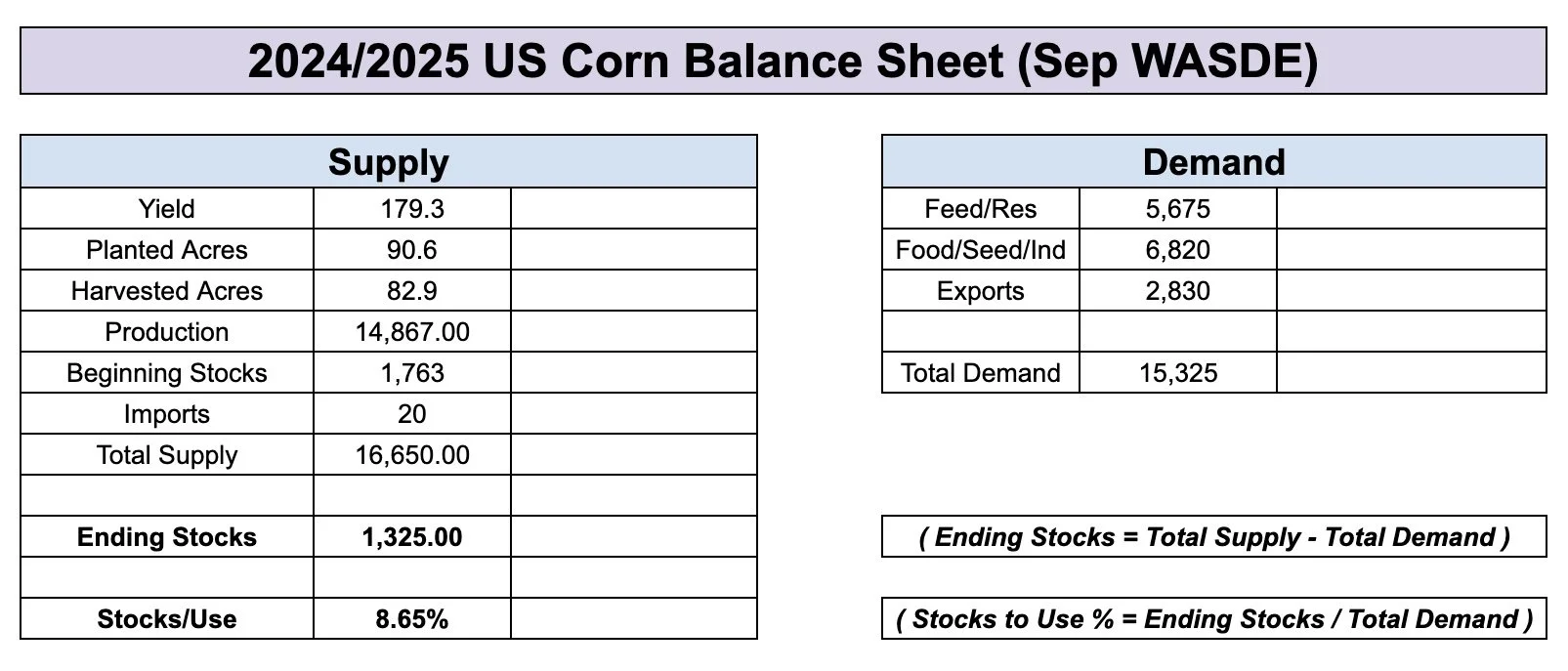

Here is the final old crop balance sheet with the new updated numbers vs what it looked like before this report.

Old Crop Before Report

Final Old Crop Balance Sheet

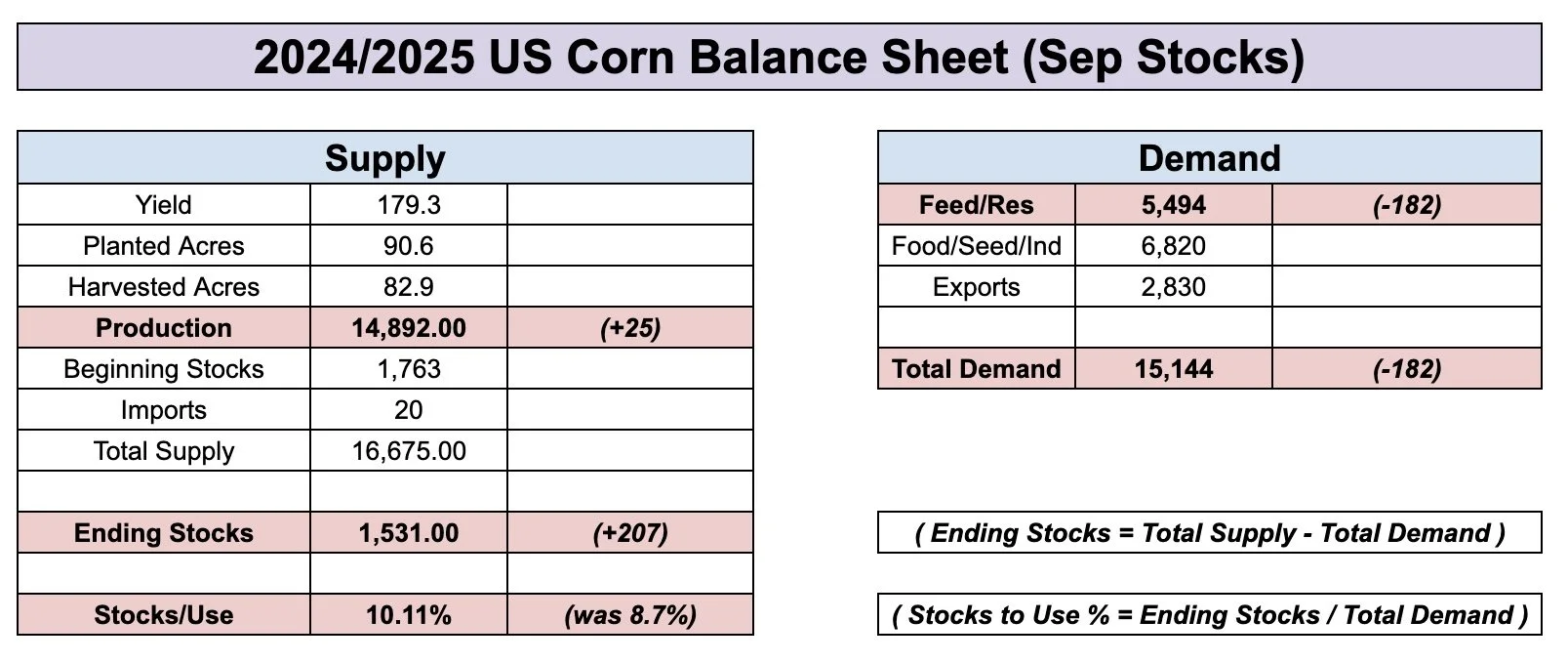

Here is a good visual from Karen Braun that shows how corn stocks changed from the Sep WASDE to the Sep Stocks Report.

This was the 2nd biggest upside change in decades. Only behind 2010.

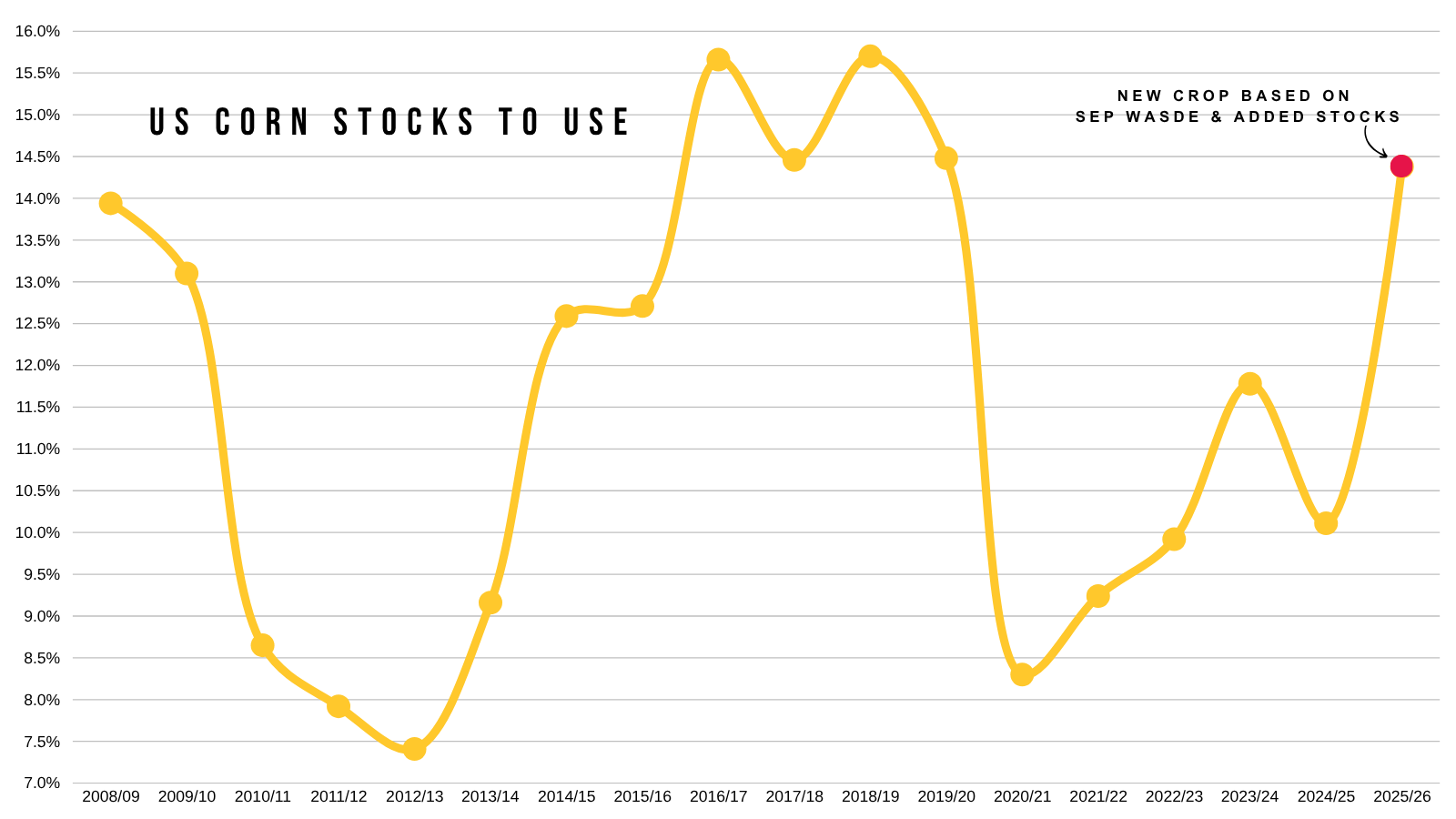

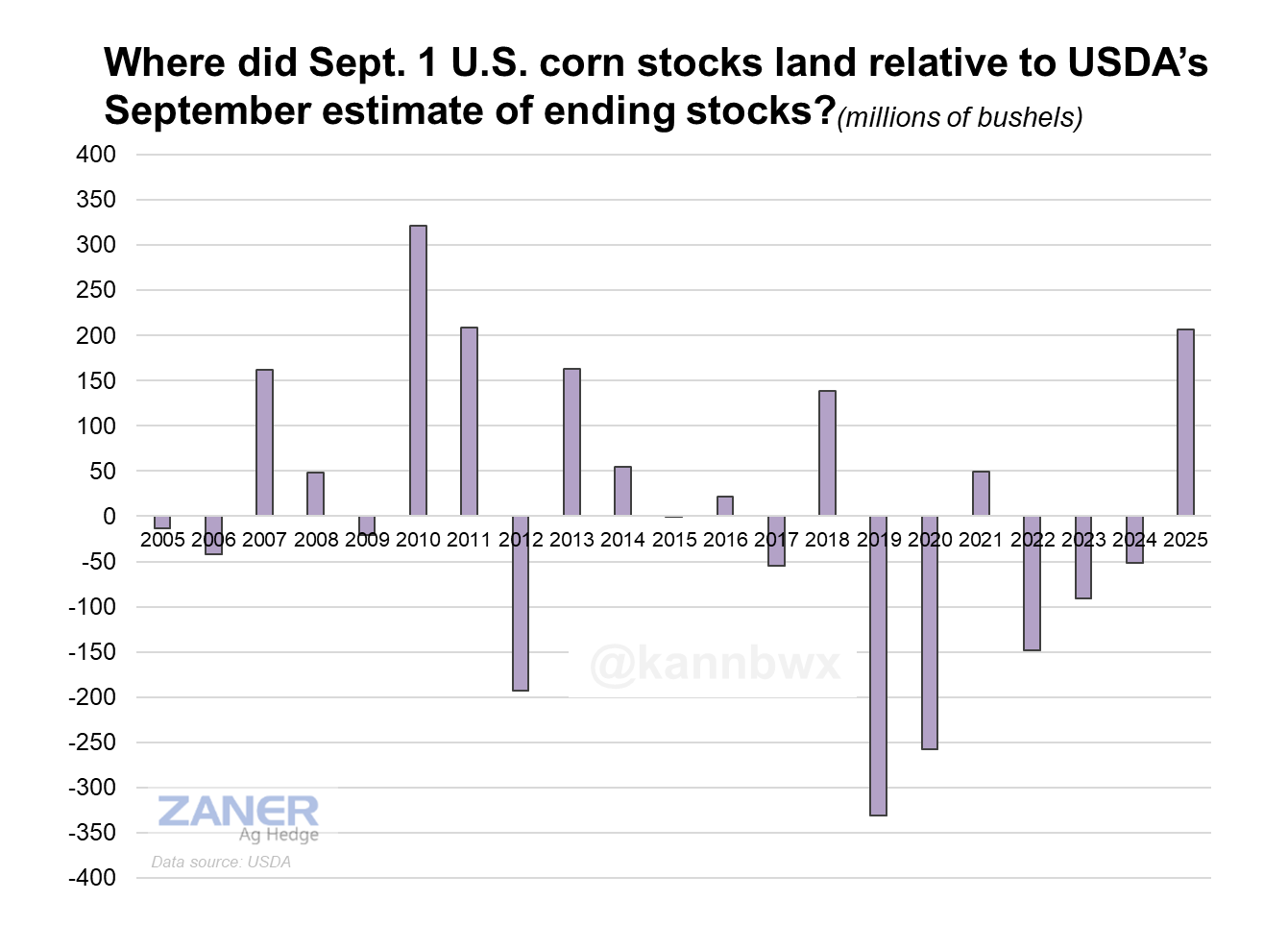

Here is a visual of the stocks to use ratio over the years.

Which includes new crop with the fresh 2.3 billion carryout, along with old crop before & after this report.

There is a big difference between being below 9% and being over 10%.

But at least we partially know why this corn market never traded like it should have.

A sub 9% stocks to use ratio indicates a full blown bull market, but it was never actually true.

What does this mean for new crop corn?

Not only did we find +200 million bushels of old crop corn, but it automatically carries over to new crop and adds another +200 million bushels of supply to the new crop balance sheet.

As this gets added to "beginning stocks".

So instead of a 2.1 billion bushel carryout, this now gives us a whopping 2.3 billion bushel carryout without making any other changes.

(2.1 billion + 200 million = 2.3 billion)

Here is a visual of carryout the last few years.

2.3 is a pretty bearish number.

This 2.3 is not set in stone, as the USDA can make some other changes by the next report.

But purely using their numbers from the Sep WASDE report, while adding this extra supply leaves you with 2.3 billion.

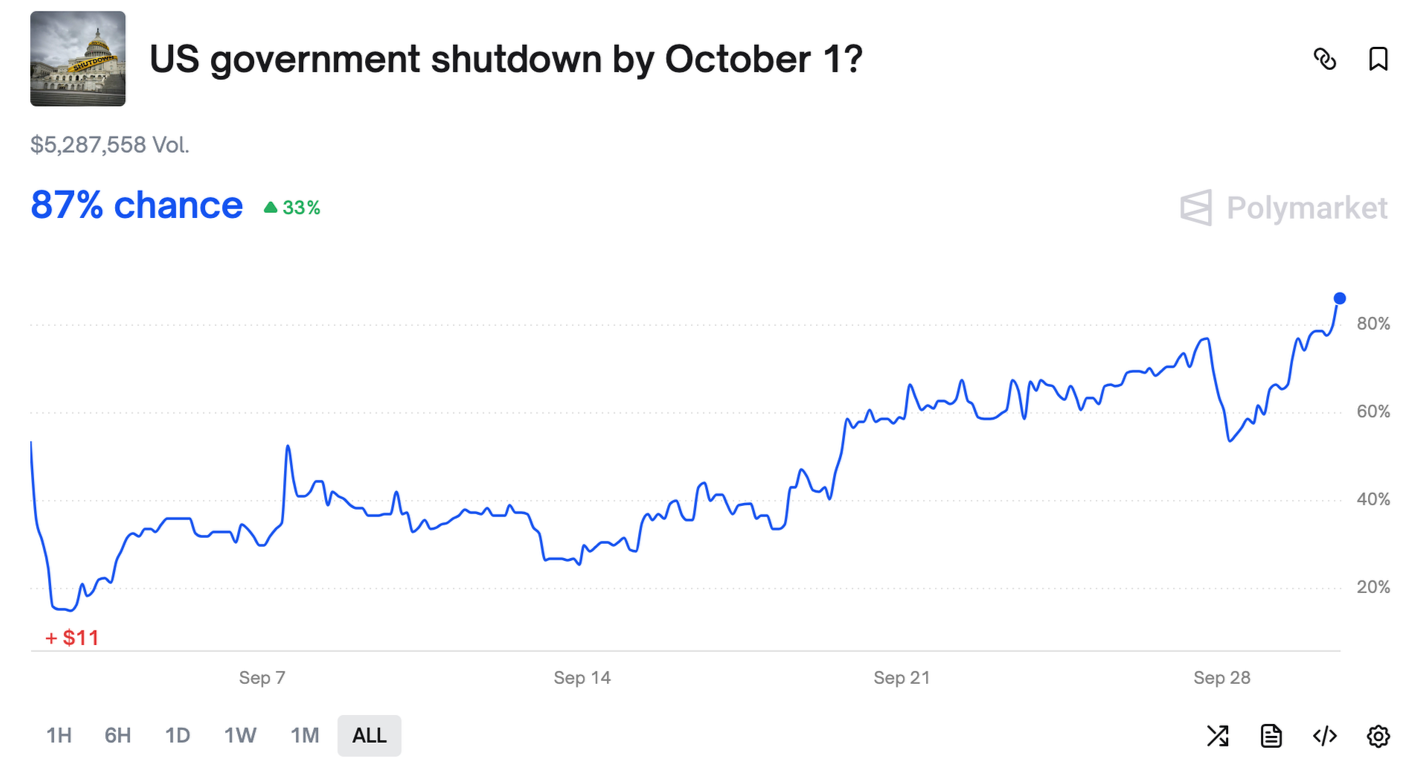

Government Shut Down?

I just wanted to mention this quickly.

There is an 87% chance that the government will shut down today according to the betting markets.

If this happens, we may or may not get the October USDA report. As the USDA is a government agency.

The USDA report is scheduled for October 9th. However, I believe they compile the data during the first week of October.

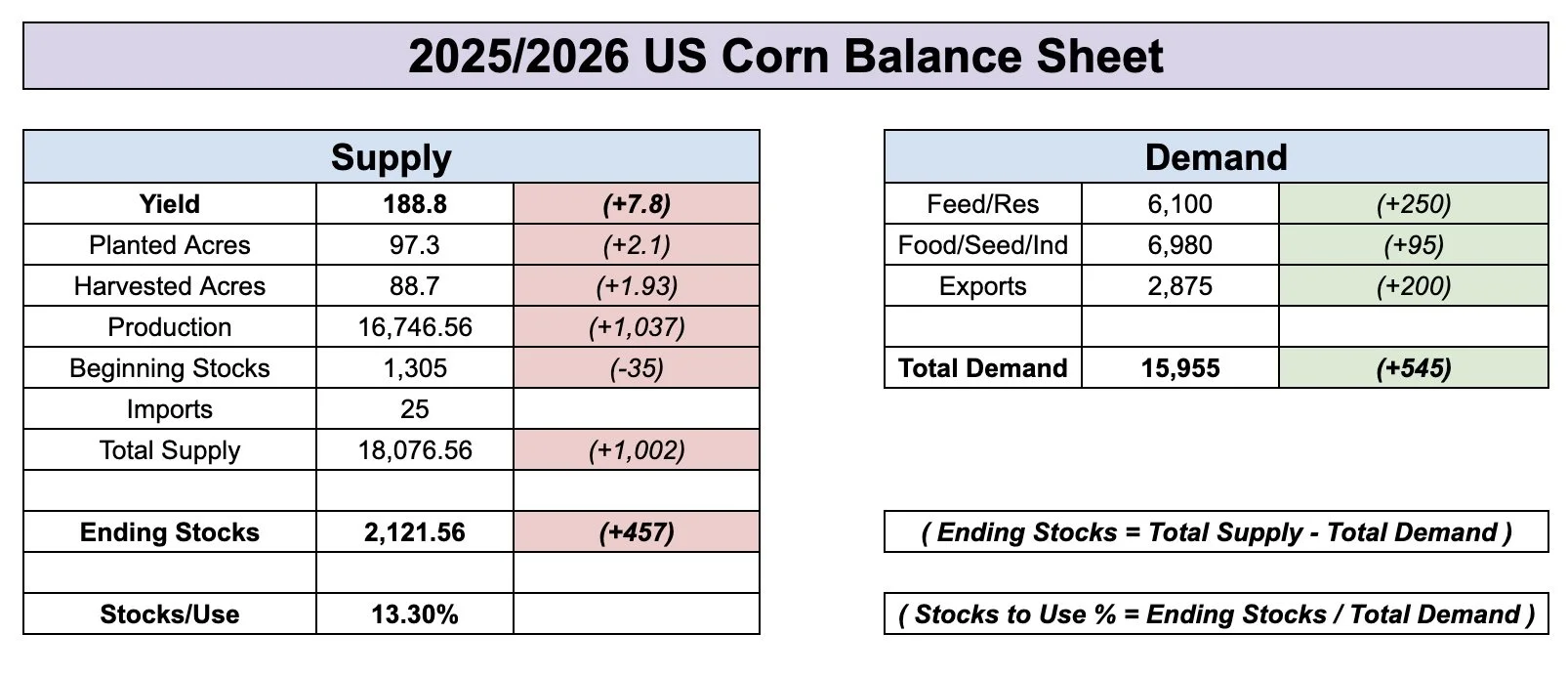

Today's Main Takeaways

Corn

The corn market continues to have bearish surprise after bearish surprise thrown at it.

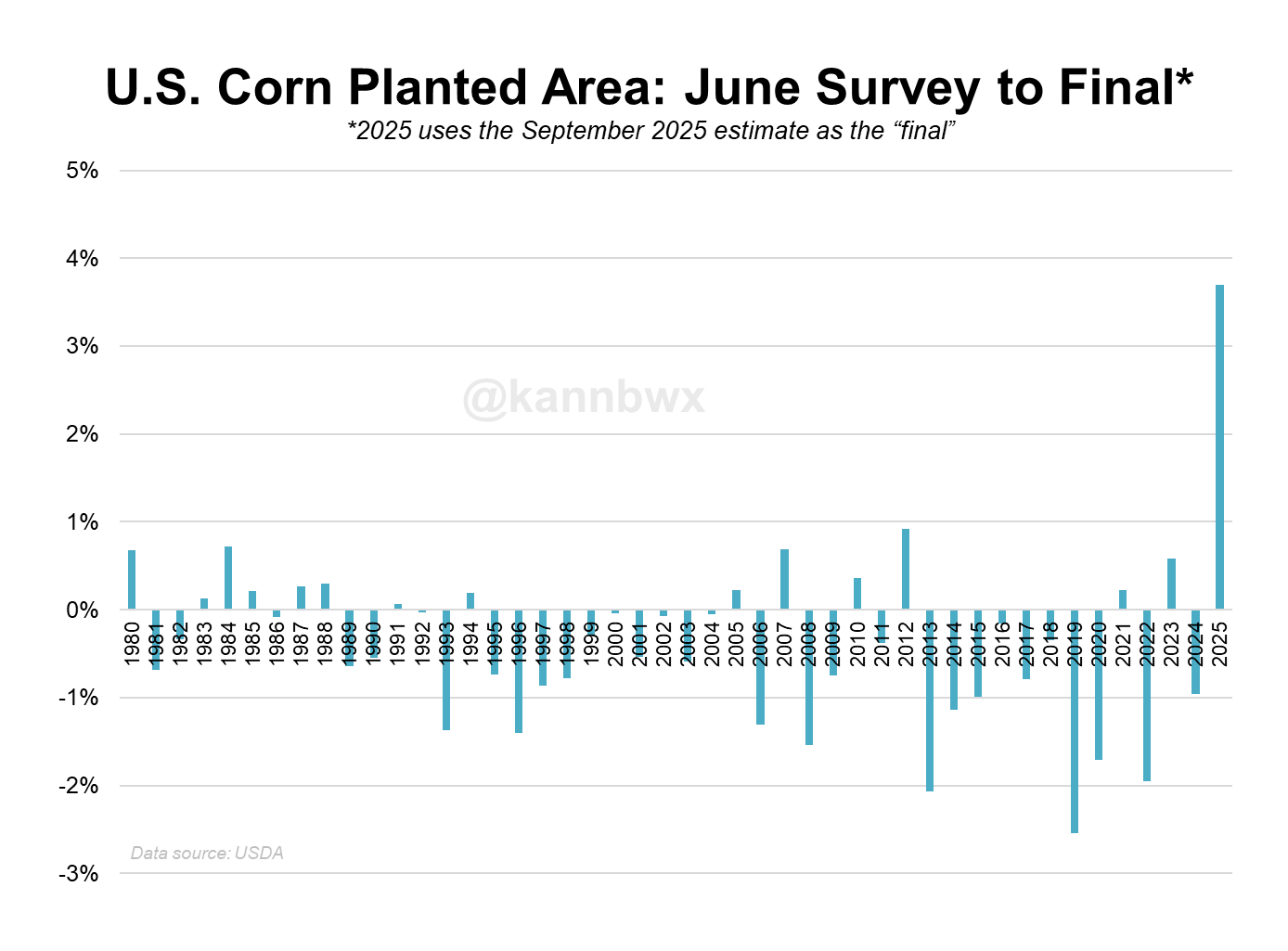

We had more acres TWICE.

A record yield.

Now more stocks.

This report was not friendly for corn at all. It makes it that much harder to paint a friendly situation.

But.. the market was expecting this to a certain extent. This corn market has battled through some incredibly bearish headlines.

Here is what I mean when I say this makes it even that much harder to paint a bullish scenario in corn.

Here is the current balance sheet from the Sep WASDE, with the added beginning stocks once again for reference.

Without changing anything else, we now have a 2.3 billion bushel carryout.

Now here is what the balance sheet would’ve looked like if you hadn’t added that extra +200 million bushels of supply and if yield fell all the way down to 180 bpa.

Cuts to demand would’ve offset some of this, but without changing demand it would’ve resulted in a carryout of 1.5 and a stocks to use ratio below 10%.

180 Yield Before This Report (New Crop)

Now instead.. since we have an extra +200 million.. if yield dropped to 180 it would only result in a carryout of 1.7 with a near 11% stocks to use ratio. Which isn’t super bullish.

This is without changing demand.

If yield gets cut, the USDA is almost certainly going to be cutting some of those lofty demand numbers as well.

180 Yield After This Report (New Crop)

Most believe feed demand is at least +200 million too high.

After all.. they did just cut our old crop feed & residual demand by -200 million as well.

If that is the case, there is a possible scenario where we wind up with a 180 yield and still have a near 2 billion bushel carryout.

In this scenario we dropped yield to 180 and cut feed demand by -200 million. It results in a carryout of 1.9 billion.

This is why this extra supply it makes it even harder to eat into that carryout.

180 Yield With -200 Million Feed & Residual

Am I super bearish corn here? No of course not.

I still think our harvest lows are in and that this market has priced in a lot of bearishness.

We have had 3 very bearish corn reports in a row, and the corn market has held in there.

However, it is incredibly hard to paint some mega bullish scenario in corn unless yield somehow winds up in the realm of 175.

Short term we do also still have to deal with that harvest pressure.

Dec Corn Chart:

Despite the bearish numbers, we didn’t have that awful of price action. Only down -6 cents on the day.

Currently we are right at this cluster of support and bounce nicely off the lows today.

Break below and we could test that red box.

We need to hold that red box to keep an upward bias. That is the golden zone retracement of the entire rally off of contract lows.

Soybeans

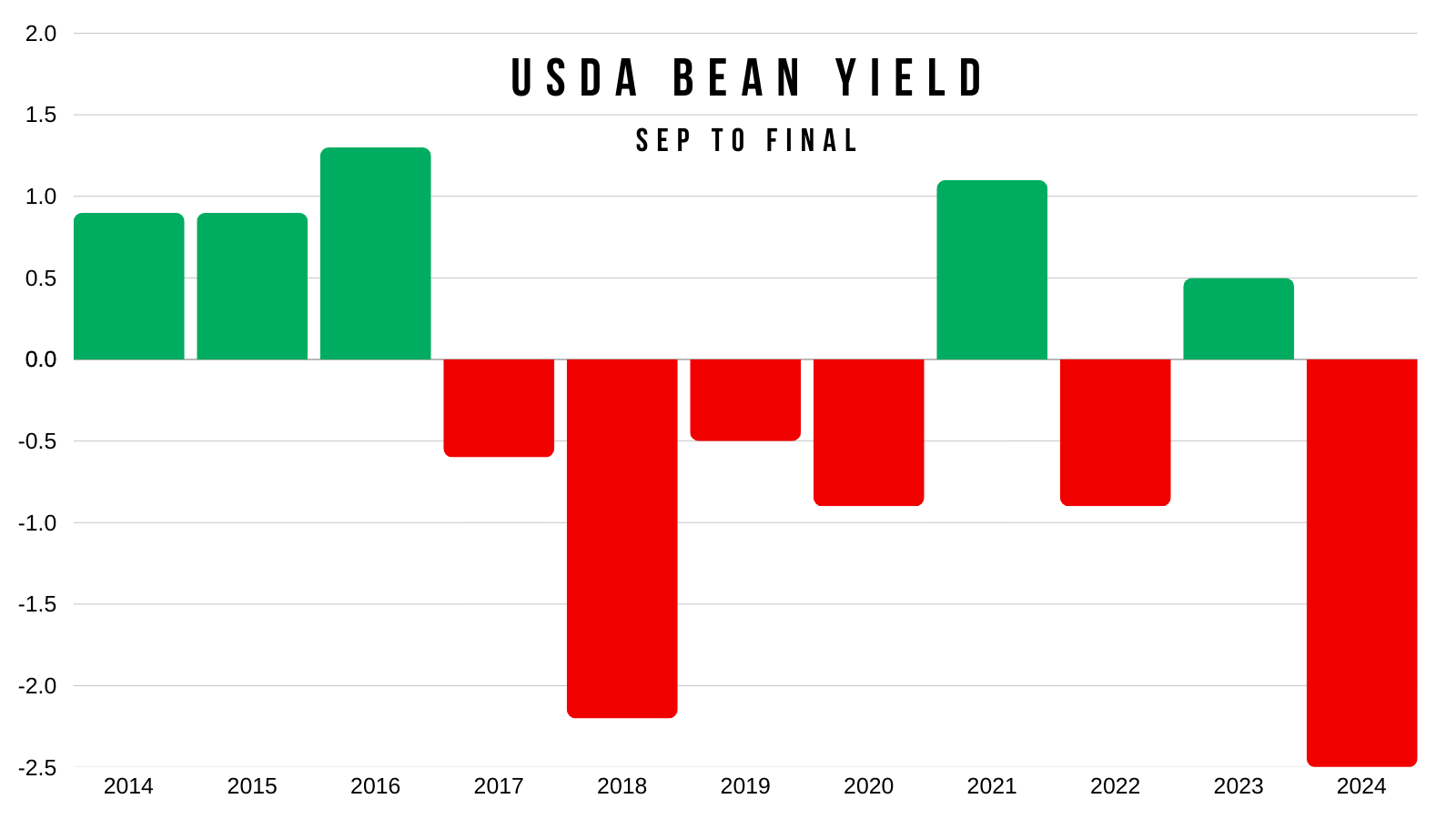

This USDA report virtually made zero changes to the soybean situation.

We still have zero business to China.

The biggest question is.. will our losses in demand offset the possible losses in supply?

If China truly stays away, it would take an immense cut to yield to offset that type of demand loss.

China is the wild card.

Seasonally this is soybeans weakest time of the year as well.

Nov Beans Chart:

We posted new lows for the move today and are now very cleary below that must hold spot. Which was the 61.8% retracement down to the lows.

This tell us that this sell off is probably something bigger.

Where could we post our lows?

I could easily see us falling down to the $9.90 range.

That is about where that trendline comes in that marked the last 3 major bottoms in this market.

That is where I would potentially look at some re-ownership strategies.

What Should You Do With Beans?

There are a few different strategies you can use in soybeans.

We have a massive carry in this market. The market is telling you to simply store soybeans and caputure that carry.

Another possible strategy would to simply sell soybeans off the combine and re-own with a call option, as this is cheaper than storage & interest costs.

Implied volatility for soybeans are at some historically low levels. This means options are cheap because the market isn’t expecting big moves.

However, with the 2nd option you could give up a lot of basis potential.

Give us a call or text if you have questions or want specific advice tailored to you: (605)295-3100

Wheat

The report was bearish for wheat just like corn.

Winter wheat surprised high. Winter wheat production is now up almost +4% vs last year.

We saw spring wheat also surprise high, but spring wheat production is still down over -8% compared to last year.

The interesting thing about this report is that the production increase came almost entirely from more acres. As the USDA left yield unchanged.

They added +450k of harvested acres to Texas with overall winter wheat acres jumping by +773k. Which was an unpredictable surprise.

This report was bearish no doubt.

This was the 2nd largest increase to production we have seen in this report in over 20 years.

However, I still have a hard time getting overly bearish at $5.00 wheat.

Despite selling off today, the charts didn’t create any damange and are still in tact.

Seasonally this is still the time of year where we usually find some life.

I am still being patient waiting for an opportunity.

Dec Chicago Chart:

We are right back down to the bottom of this channel once again.

This is where we have continued to bounce for months, so I would like to think we continue to defend it.

This falling wedge pattern is starting to get pretty tight.

Bulls want to see us bust of out this wedge higher to get some momentum.

Despite posting contract lows once again.. the RSI once again did not post a new low.

We continue to show bullish divergence on the RSI and have been showing this for weeks now.

Dec KC Wheat Chart:

KC wheat also sitting in this falling wedge pattern.

Waiting for a direction and decision to be made.

Bulls watching for a breakout.

Cattle

Continous Feeder Chart:

When front month feeders rolled from Sep to Oct, we left a roll gap at 364.

Oct Feeder Chart:

If we look at Oct feeder, that 364 level would also challenge those recent highs.

If we break above that level it is probably a sign we're going to go post new contract highs.

To the downside, need to hold the red box or we could very easily drop down to the blue one.

Feeder Monthly Chart:

This was our first month where we traded lower for the month since all the way back in October of last year.

Nearly an entire year without a single red month.

We could easily go and post new highs in this market.

But that doesn’t mean I am not going to be managing my risk up here.

I am still very cautious up here.

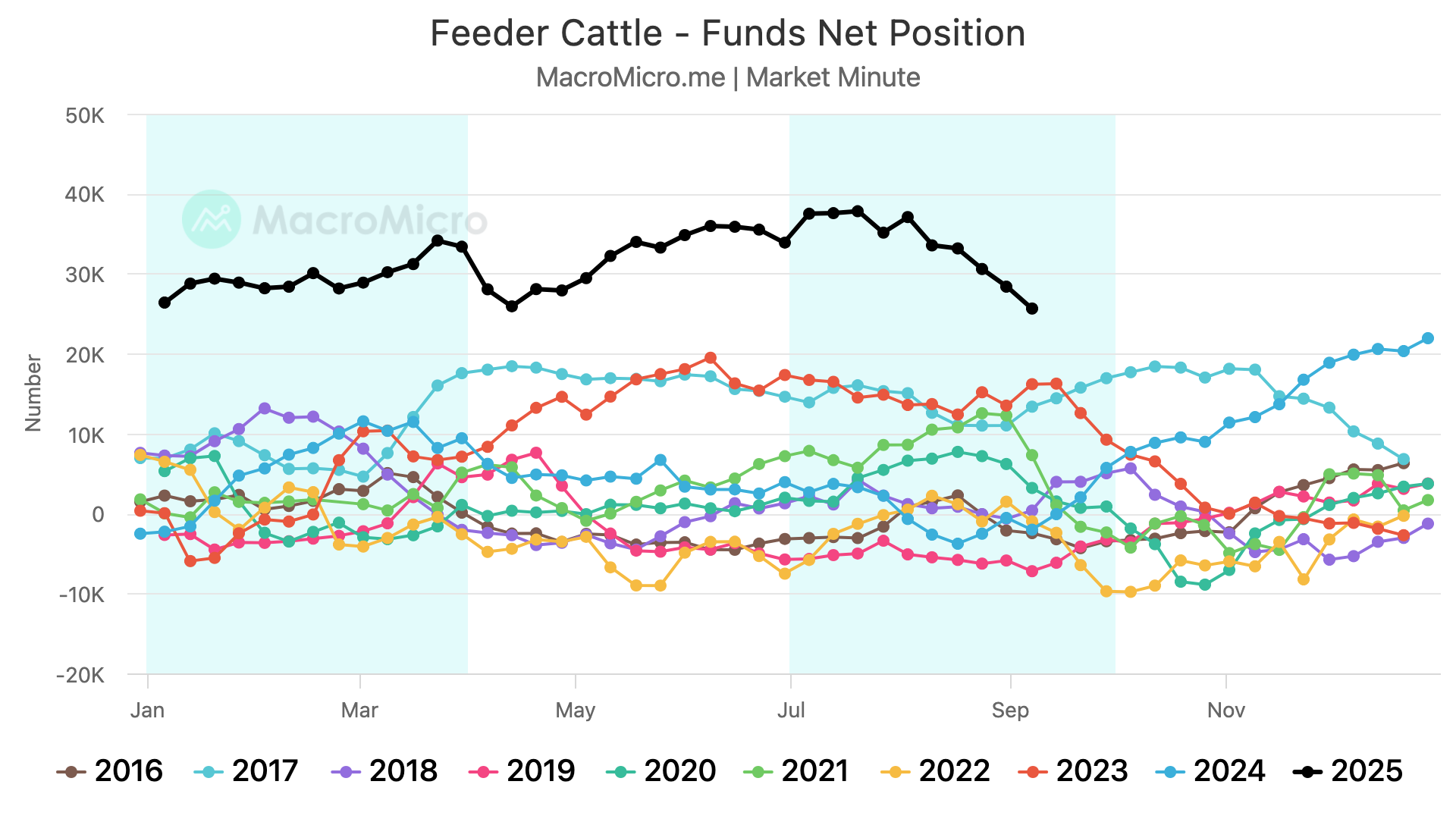

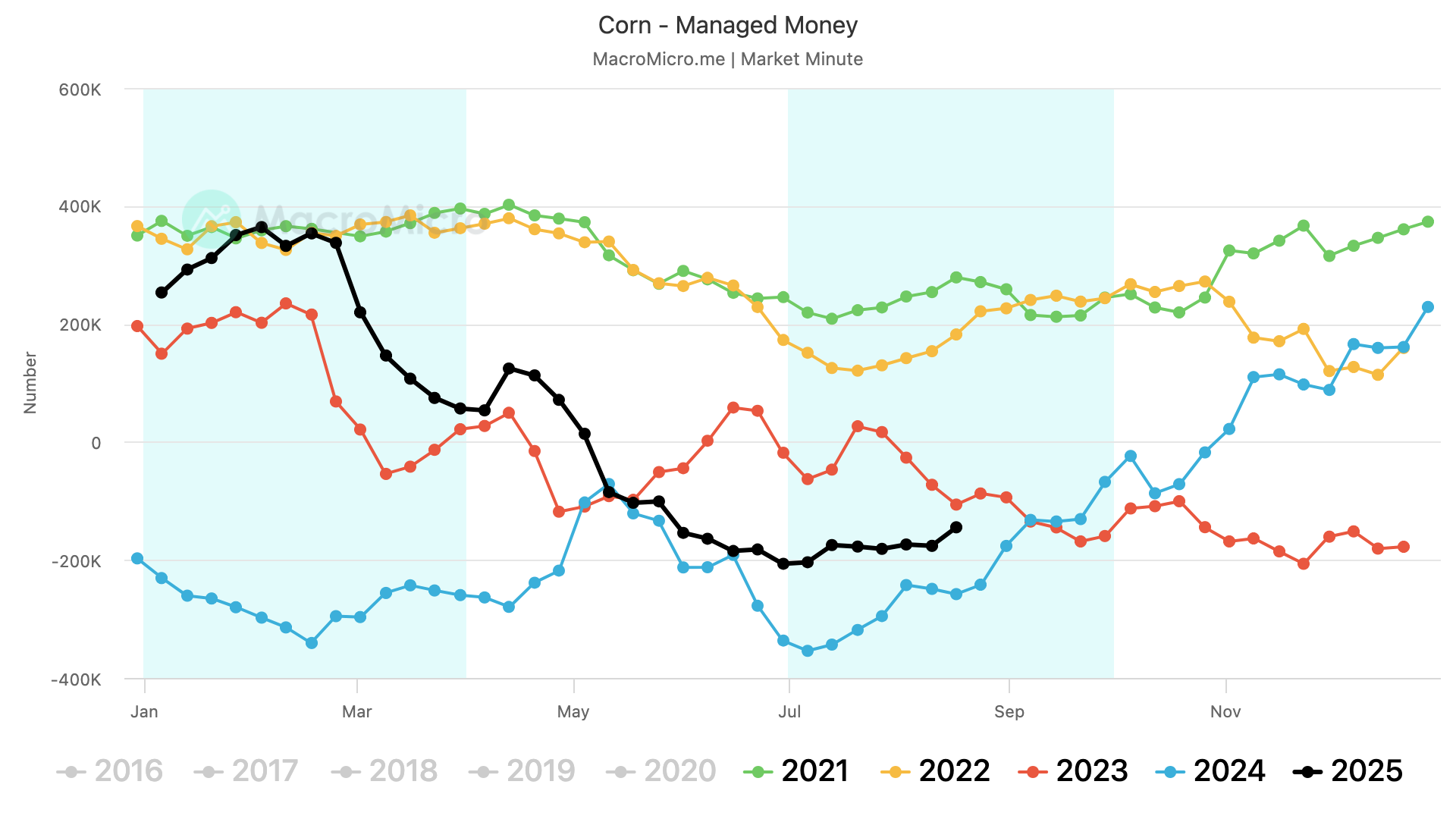

If we look at open interest, it has been droppping by a large amount.

Open interest is the total number of long or short positions in the market. Basically, market participants have been leaving.

If you pair this with cattle posting it's first month lower in a year, it definitely makes me all that more cautious up here.

The funds have also been jumping out of those record-long positions.

They are now holding their smallest long position since last year.

Past Sell or Protection Signals

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

WILL NEXT WEEKS USDA EXPLAIN POOR CORN PRICES?

AUDIO COMMENTARY

Quarterly stocks report on Tuesday

Wheat production on Tuesday

Some years this report is a yawn, sometimes it brings big surprises

Could this USDA report explain the poor prices we saw this year?

Report could tell us if last years crop was bigger

I don’t think it’s realistic that they put the crop smaller, because basis and everything does not indicate that

This report offers more downside risk than upside

We had a 1.3 carryout, no invert, and no basis firm. This market did not trade like a 1.3 billion bu carryout

Some should be buying puts that cover you the next month

How to establish a “free” floor with calls & puts

Longer term I see upside, but short term why do we have to go higher heading into harvest?

Soybeans don’t tend to move as much as corn does on this report

Whenever we get something done with China, we will have a friendly soybean situation

What happens if there is a hiccup in SA’s crop?

Wheat higher from today 15 years in a row

If buyers realize you don’t have a plan, they can use that to their advantage

Listen to today’s audio below

Want to talk ? (605)295-3100

Your free trial has ended

You will not receive our next sell signal or future daily updates

Make sure you take advantage of our harvest sale so you don’t miss the next opportunity

Past Sell or Protection Signals

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

ARGY TAXES REAPPLIED. HOW MUCH SUPPLY TO OFFSET DEMAND?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Argy, China, Trump News: 0:00min

Exports: 2:45min

Seasonals: 4:00min

Corn: 4:45min

Beans: 8:15min

Wheat: 11:40min

Cattle: 13:05min

Want to talk about your situation?

(605)295-3100

Your free trial has ended

You will not receive our next signal or future updates

Lock in our harvest sale before its over

Futures Prices Close

Overview

Decent day for the grains as the wheat market catches a bid while the cattle market takes a hit.

Earlier this morning all the grains were decently higher, but both corn & soybeans faded off the early highs.

This first story is probably the biggest reason for the strength.

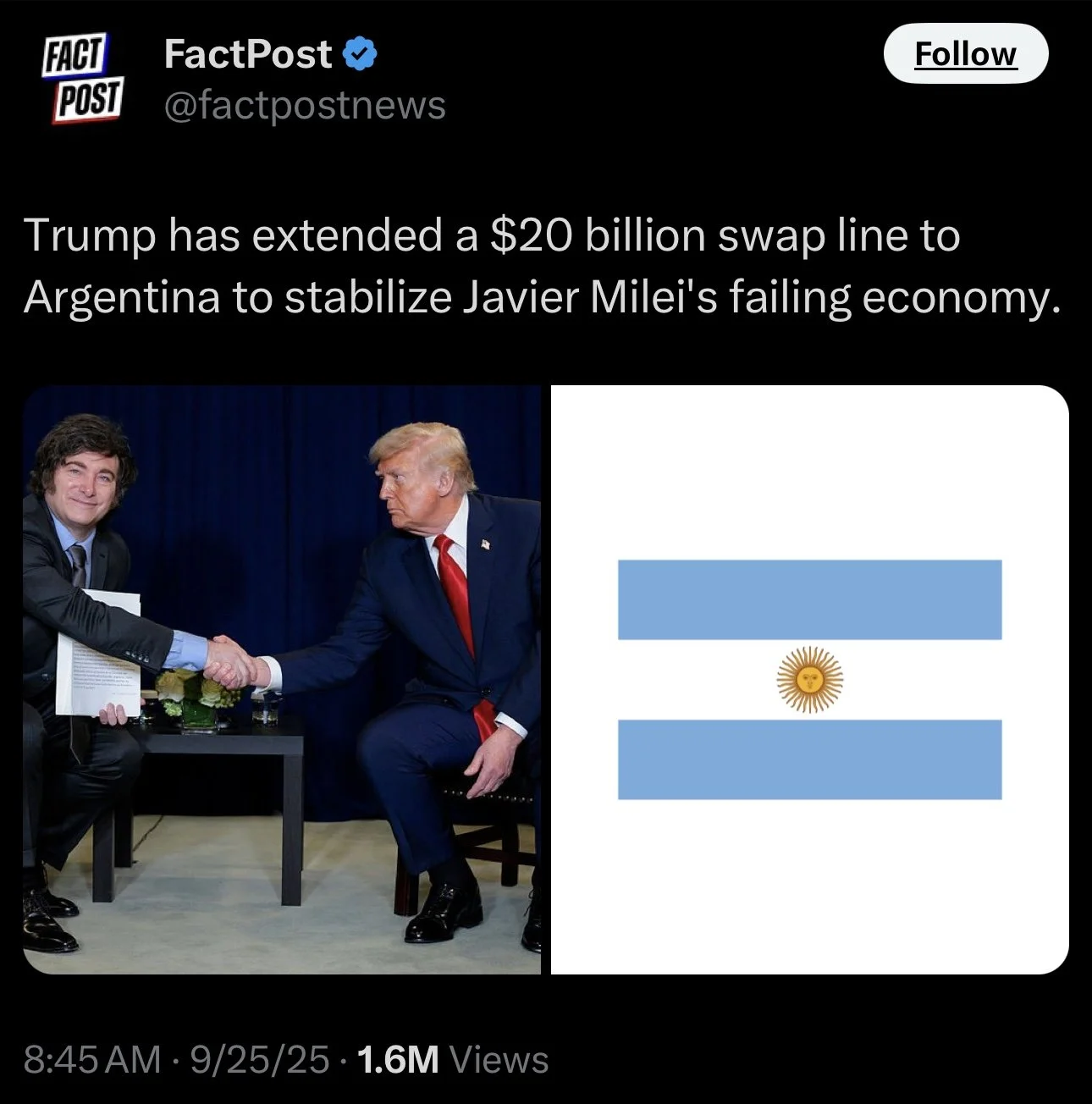

Argy News

This was the biggest news today and had the grains higher this morning.

Argentina's cut to their export tax is already over after just 3 days. As export tax is back on for the grains but still on for beef.

The terms of this cut to export tax on grains were that the cuts remained until October 31st or if grain/oilseed export sales reached the $7 billion cap.

They already met that $7 billion cap so taxes have been re-applied.

Sources say that China bought around 90 million bushels of soybeans from Argentina while taxes were cut.

So we undoubtedly lost some business there.

However, we probably won’t be seeing much more business out of Argentina now.

The reason that Argentina did the tax cuts was to generate some cash and help boost their economy.

As the Argentina Peso has lost -99% of it's value compared to the US Dollar in the past decade, and lost -30% of it's value this year alone. Despite getting a +10% bounce this week due to all of this news.

The US has now announced they are going to extend a $20 billion currency swap line to Argentina, and also buy Argentina's bonds.

Essentially, they are lending $20 billion USD to Argentina. Argentina can then use that money to help stabilize it's economy. Later on, Argentina is then suppose to swap the money back to the US.

By the US doing this, yes we are helping support one of our biggest competitors. But by giving them money, does that now help keep their exports closed for longer now? Potentially helping China come to the table if Argy is closed for business. Who knows, but something to think about.

China News

On Monday, China expressed that they were possibly interested in buying US soybeans.

They signaled that they could buy US soybeans ahead of bigger trade talks "IF" the tariffs were dropped.

On the export market, US soybeans are cheaper than Brazil. But the tariffs are making Brazil beans cheaper than US ones. So China continues to stay away.

Basically, China says they will only buy our beans if we lift the tariffs.

Trump News

Trump announced that US farms will receive some of the proceeds from tariff revenues.

He said:

"Farmers are going to hurt for a little while, until the tariffs kick in to their benefit."

"Ultimately, the farmers are going to be making a fortune."

This does kind of sound like he is not expecting a deal to be struck with China soon, as he makes it sound like the tariffs are here to stay and China essentially said they won’t buy soybeans until the tariffs go away.

Exports

Corn 🌽

We now have RECORD corn exports.

We have offically passed 2021.

The craziest part is that in 2021, China accounted for nearly 50% of all of these exports.

We haven’t sold a penny to China this year.

Chart from Karen Braun

Corn is +5% ahead of the USDA's estimates.

Those estimates already seemed pretty large to begin with, but we are now surpassing them.

Needless to say, corn demand remains phenomenonal.

Many have tried to argue that corn export estimates are too high, but based on this, you can’t really make that argument yet.

The USDA has some lofty expectations, but we are continuing to impress.

I think the bigger question mark for corn demand is going to be the feed and residual. Not exports.

Chart from Robert McClure on X

Soybeans 🌱

Soybeans exports on the other hand remain well below expectations.

Demand everywhere outside of China has been great, but it's hard to make up for the lack of China.

As soybean exports are -19% behind the USDA's expectations.

We are almost certainly going to see the USDA lower their export projections for soybeans.

Chart from Robert McClure on X

Wheat 🌾

Wheat demand remains great along with corn demand.

Well ahead of the USDA's current projections.

Chart from Robert McClure on X

Seasonals Update

Corn 🌽

5 Year:

We've followed this one very close this year. It marked the exact bottom and rally thus far. It has us grinding higher the rest of the year.

10 Year:

This one says we make our highs in October before grinding sideways.

Beans 🌱

5 Year:

Typically we carve out lows in early to mid-October before rallying into November. Which typically coincides with some South America production uncertainty.

Wheat 🌾

The 5, 10, and 15 year seasonal all say we head higher from here.

All of them have us posting our local top in mid-October.

Today's Main Takeaways

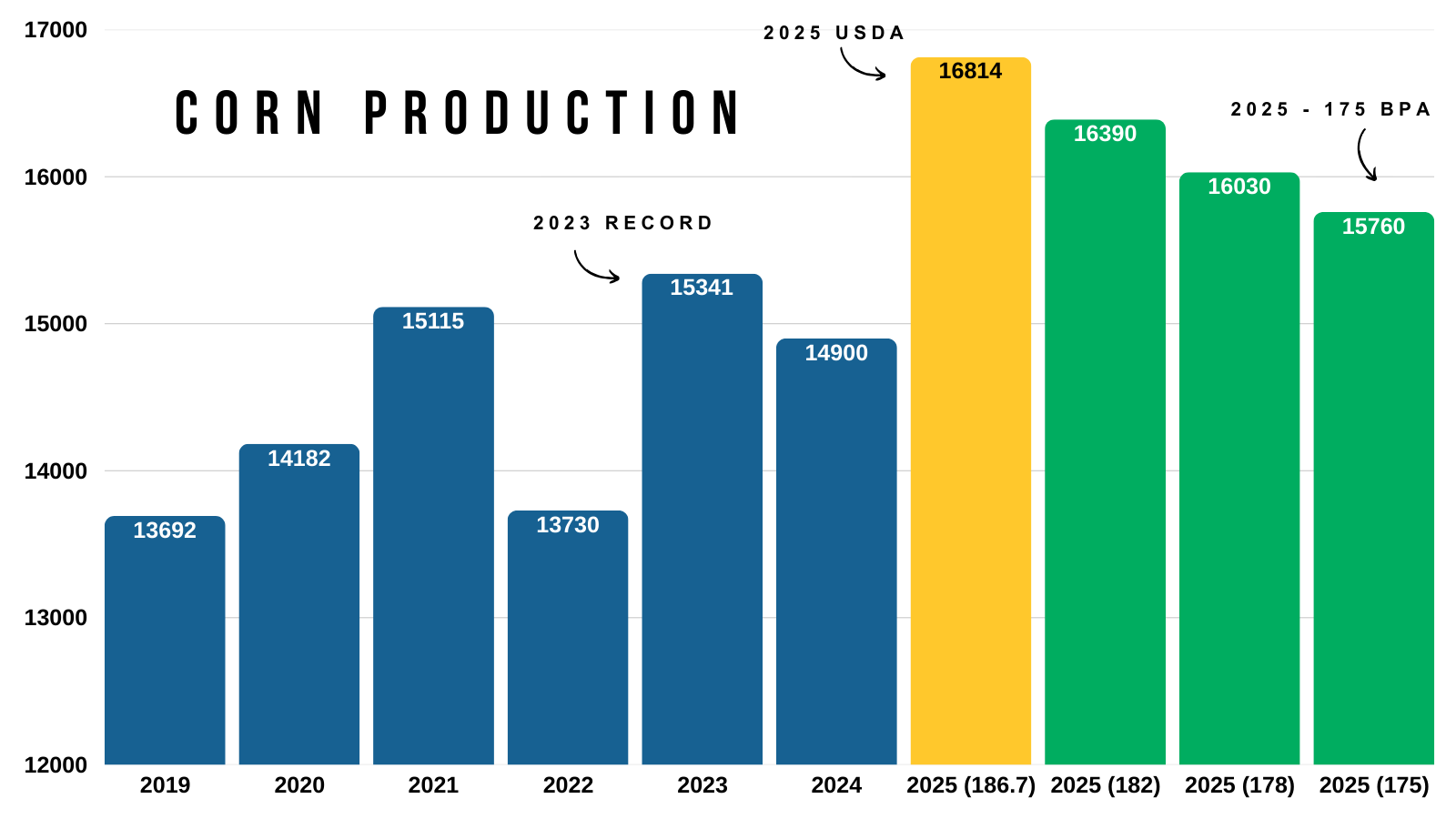

Corn

Demand is amazing.

Yield is getting smaller, some say perhaps drastically smaller.

However, the only reason you can’t get super bullish on this corn market (not yet anyways) is because we are going to have record production even if that yield falls short.

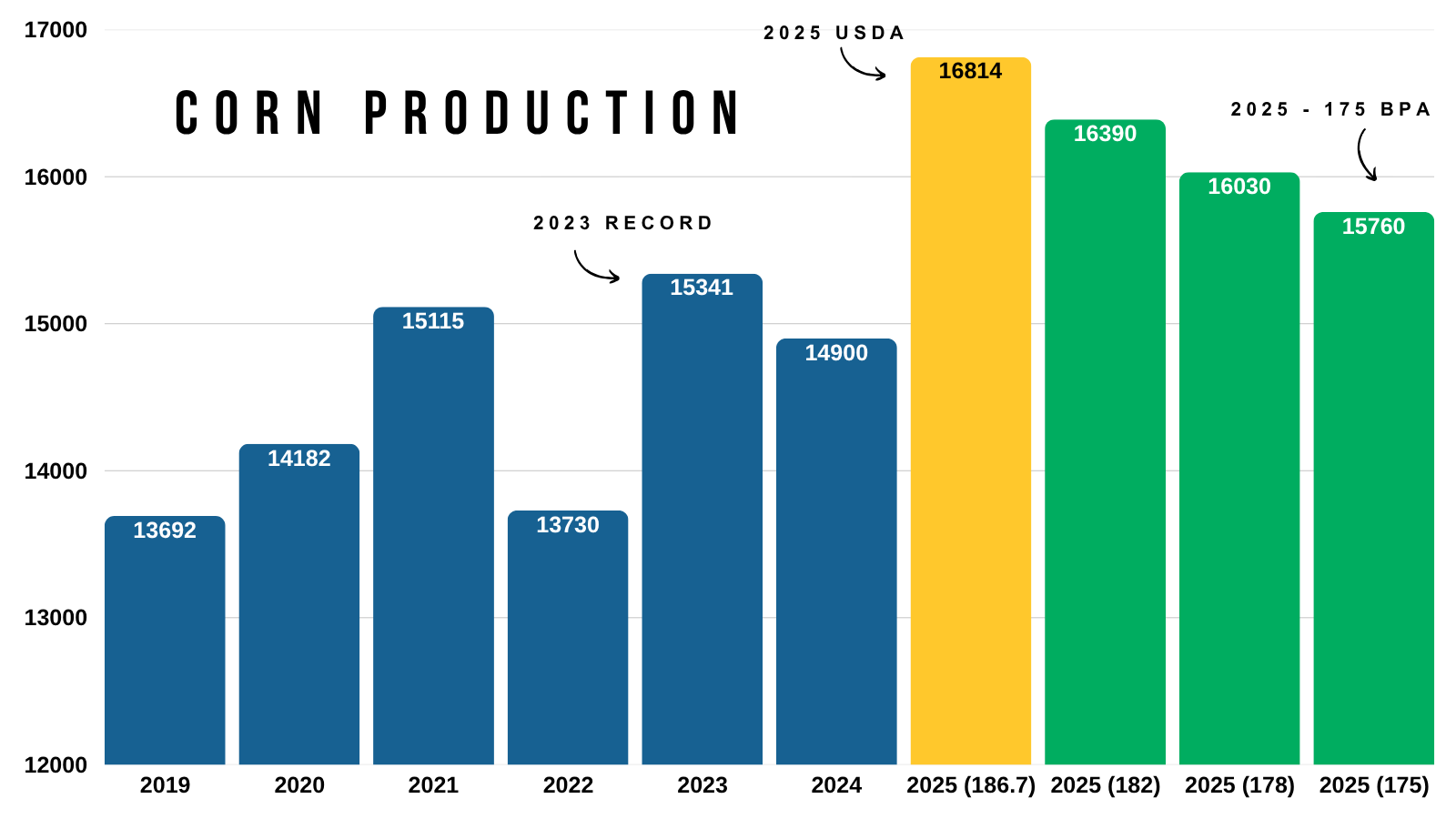

Here is a chart that shows corn production over the years, along with where production would be based on different yield scenarios.

Even if yield fell all the way down to 175, we would still print a record production number given the massive acres.

The current estimates have us being rougly +1.5 billion bushels higher than our previous record in 2023.

That is how big our production is.

However, on the bright side, demand is also the strongest it has ever been. So this helps offset that.

Production is indeed getting smaller.

We've already priced in a massive crop.

So you can’t really get bearish corn here either.

Normally, we are suppose to struggle to rally throughout harvest.

However, once harvest is out of the way and once we get into that January report where I am sure yield is going to be smaller, you do have to wonder where the ceiling is in this corn market.

Here are a few balance sheet scenarios, without changing demand numbers.

Arlan Suderman says this crop is between 178 to 182, and would be surprised if it was bigger but not smaller.

So here is what those potential balance sheets could look like. As always, demand will be cut to offset some of these losses. But it gives you an idea.

Here is the current balance sheet for reference:

182:

It would put our stocks to use ratio around 10.5% to 11% depending on how much they drop demand.

With a 1.7 billion bushel carryout.

That still isn’t exactly bullish, but it's not sub $4 corn bearish.

180:

Here is where things get a little more interesting.

It drops our carryout to 1.5 billion.

Again, this is barring demand changes. If the USDA drops demand by a -100 million then you simply add +100 million to our carry out and get 1.6 billion instead.

It drops our stocks to use ratio below 10%, which is considered bullish.

178:

Now this could potentially paint a bullish situation in the corn market.

This drops carryout down to 1.3 billion.

Dropping our stocks to use ratio to nearly 8%.

In this scenario, even if the USDA dropped feed demand by -200 million our stocks to use would still be below 10% (check 2nd chart for this).

So a 178 could give you a bullish scenario even if demand estimates are too high.

Daily Dec Chart:

Still planning on de-risking at $4.35

That gives back 50% of the Feb highs and is key support from spring.

No damange has been done to this chart. We are simply consolidating above previous resistance. Old resistance is new support.

The price action is pretty similar to what we saw before that last bullish pennant breakout. As before that breakout we consolidated right at old resistance as well.

Short term I'd like to see us hold this newly formed trend and that blue support box. If the box breaks we probably make a leg lower.

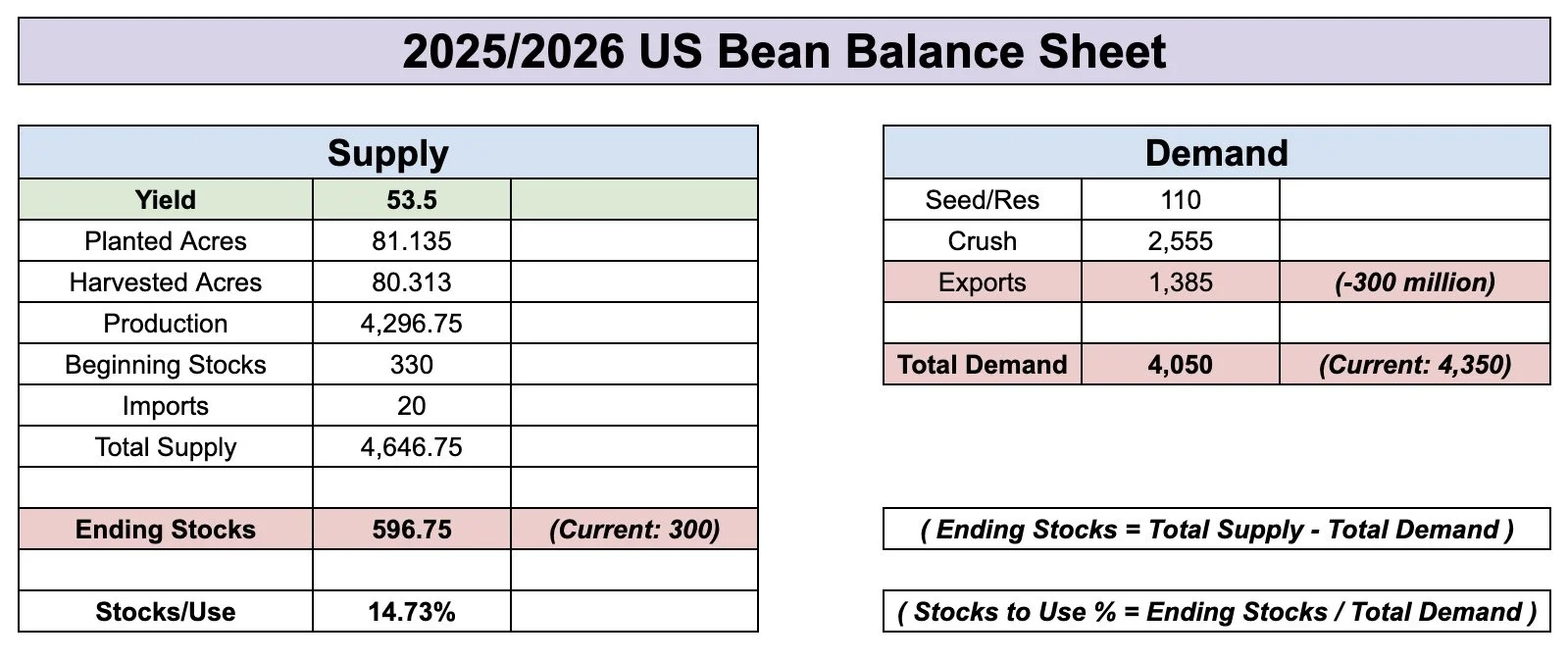

Soybeans

The soybean market is struggling to make a decision.

Does the potential loss in supply make up for the possible loss in demand?

China is the wild card.

Most are saying that exports for soybeans could drop by -300 to -400 million if China refuses to come to the table.

Currently, our exports are behind by -19%. If we continued this pace, exports would end up short by -320 million.

So let's dive into how this impacts the balance sheet and how much supply loss it would take to truly offset these demand losses if we see them.

For this experiment, we are cutting exports by -300 million and only changing yield.

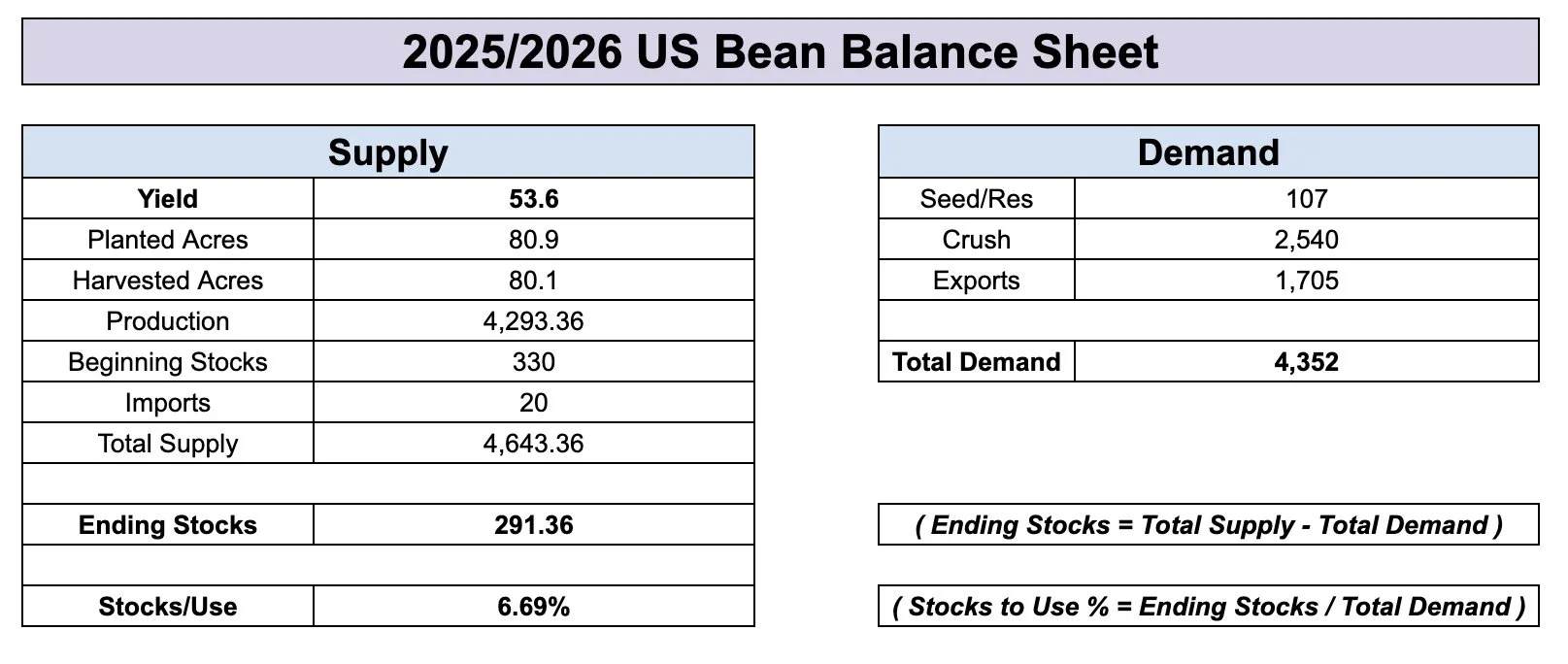

Here is the current balance sheet for reference:

53.5 Yield:

With the loss in exports, this would sky rocket our carryout to 600 million vs the current 300 million.

Our carryout would double.

We had a 300 million carryout. We lost -300 million demand. Which results in a 600 million carryout.

Now that is very bearish.

It would be the highest since the trade war.

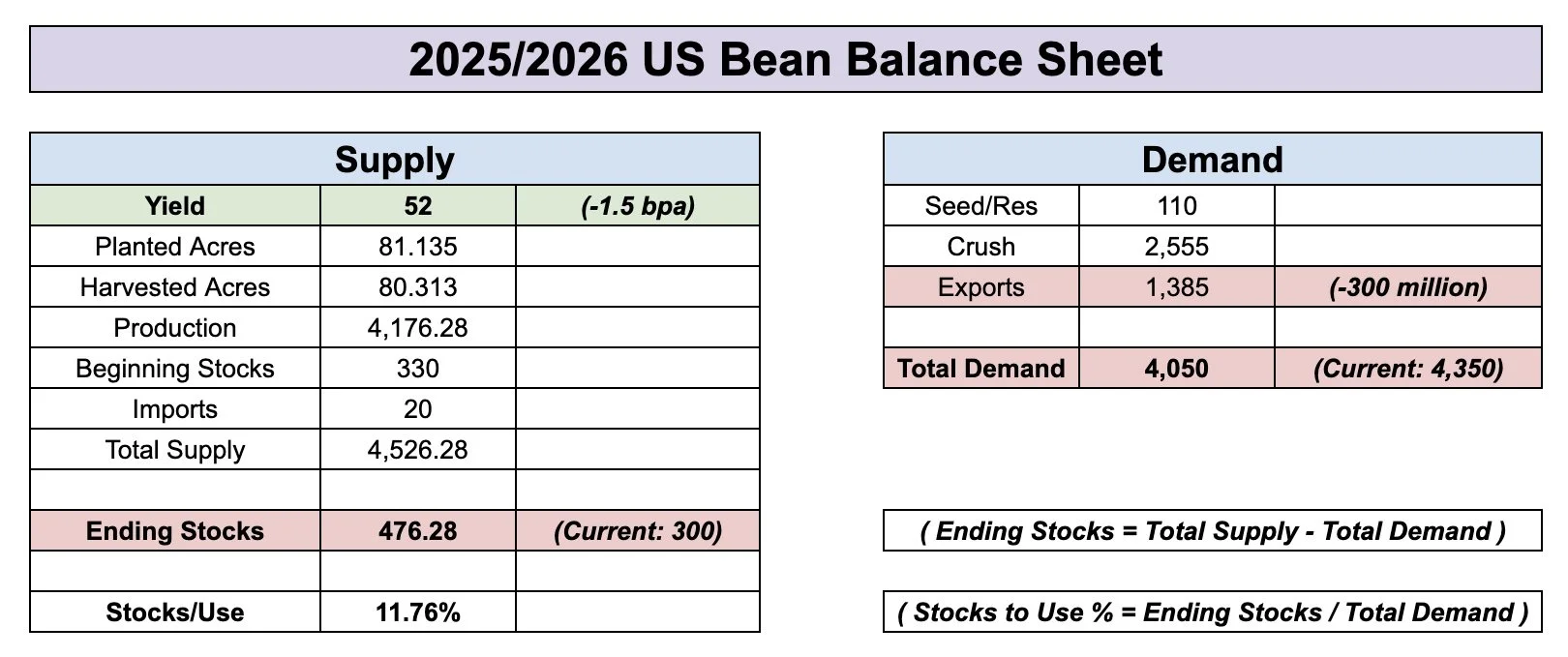

52 Yield:

Carryout would still be almost 500 million.

Still very bearish.

51 Yield:

Carryout is 400 million.

That isn’t crazy trade war bearish, but is still far from being super friendly.

For reference, our final carryout the last two years was around 350 million.

50 Yield:

Carryout would remain roughly the same as it is today with a 53.5 yield.

So if exports are cut by -300 million, it would take a 50 bpa yield to offset those losses in demand.

Leaving our balance sheet about where it is at today.

Which is the tightest in 3 years, but still not considered out of this world bullish.

51 Yield & No Demand Change:

Now here is the balance sheet if demand wasn’t dropped at all and yield came in at 51.

It becomes virtually non-existent. Which would be very bullish.

However, there is no chance the USDA doesn’t lower exports to some extent.

The bigger question is by how much?

Here is what all of those examples look like compared to other years.

This is why there is so much uncertainty in this market, and why you could argue for $9 or $12 soybeans and no one would call you crazy for either argument.

If China actually doesn’t buy any soybeans at all, we could be in trouble.

But if demand isn’t actually in trouble and our yield isn’t as big as advertised, there is a realistic path for this thing to get incredibly tight.

Daily Nov Chart:

Soybeans still hovering right at this 61.8% level at $10.12

This is where the market makes a decision. We either bounce and this is it for the sell off, or we make another leg lower.

If we take out Tuesday's low, I could easily see us testing the $9.90 level. Which is where that trendline that marked the last 3 major bottoms is at.

That is where I would look at some potential re-ownership strategies if we get there.

For now, I am waiting to see what decision the market makes here at this critical spot.

Wheat

Nothing to update fundamentally on the wheat market.

However, I am really liking what I am seeing on the charts.

Daily Chicago:

We are once again bouncing at the bottom of this massive channel like we have done a dozen times.

Now sitting in somewhat of a falling wedge pattern.

Today we did post an outside up day, where we took out yesterday’s lows but closed above yesterday’s highs.

That is seen as a positive sign.

If we zoom in here, I am still watching the $5.35 level.

I think if we break above there, it sparks a leg higher. If we break above, I'd be confident we finally posted our lows.

The chart looks promising but we need to break that level for confirmation.

First point of interest after that is $5.49

On Monday I talked about how we were showing some massive bullish divergence the past few weeks.

We posted new contract lows on Monday, but once again the RSI posted another higher high.

This tells us the downside momentum is getting weaker, not stronger.

Daily KC Wheat:

KC looks pretty good here as well.

Also sitting in a bigger picture wedge pattern.

Need to see us take out those highs from last week to say we found our true bottom.

After that our first point of interest is $5.40

Like Chicago, on Monday we printed some clear bullish divergence.

Cattle

Our partner Lauren of Texas Hedge specializes in the cattle market, and has more fundamental knowledge in this market than I do. Here is what she had to say:

Thoughts from Lauren Urbanczyk of Texas Hedge:

Feeder were limit up on Monday based on the secretary of ag saying that relief was coming to American ranchers to rebuild the beef herd, since cattle supply is historically low.

The market took this and ran with it as rumors of a stimulus package was coming for heffer retention. However, it was then confirmed today by the secretary of ag that there is no stimulus coming for cattle ranchers in the form of heffer rettenion.

So the market gave back all of it's early gains from earlier this week. Beef has struggled as we seasonally get a September pullback. So a lot of this is following the seasonals.