TECHNICAL SELLING IN GRAINS

(We apologize for my voice in the audio today as I am under the weather)

Example of why we like to short term hedge with old crop vs new crop

Corn lower despite exports super strong for corn

Charts look due for short term pause

Corn still has a story

The dollar at multi-year lows

The dollar has dropped -10%, that means our products are cheaper globally

If yield gives us any issues, it will lead to substantial rally with the S&D situations

Don’t mind bean sales if you need to move something

Overall still remaining mostly patient for most

Charts running into resistance (charts below)*

Was this a short term top? (charts below)*

Next corn & bean targets (charts below)*

Listen to todays audio below

Want to talk? (605)295-3100

CHARTS

May Corn 🌽

We are perfectly rejecting right at the 61.8% retracement of the sell off and that short term target box we had.

A short term correction here makes sense as we have been talking about since Thursday.

This was our short term target, but what about our next one?

It is subject to change, but right now I am eyeing $5.20

That is 161.8% of this recent rally we just saw.

This is the most common level for a 2nd move to have.

This is only if we put in a short term top here. If we blast higher tomorrow then this changes.

Dec Corn 🌽

Dec corn also perfectly hitting that 61.8% retracement and target box.

Again, a correction here makes sense.

This is the most common retracement level.

This was also the exact lows from Feb 2024 (old support is new resistance often times).

Next bigger target is $4.85

That is 161.8% of this recent rally, just like in May corn.

Again, this is only if we posted a local top here. If we go higher right away, then the target changes.

However, we did post a bearish candle today (scroll for more details on this).

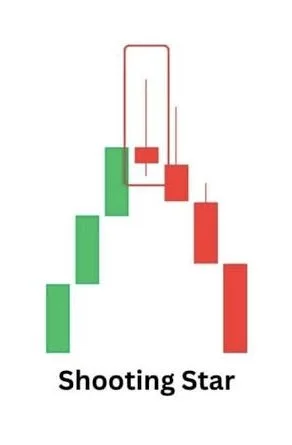

Today we posted a bearish shooting star.

This often happens after a rally and is the sign of a local top.

Doesn’t have to be the local high here, but the signs are definitely there. So something to be cautious of.

(Below is a closer up view of Dec corn & an example of this pattern)

May Beans 🌱

We rejected right at the 200-day MA.

Like we mentioned last week, this is a major hurdle for bulls to climb.

We have not closed above this since 2023.

So on one hand, if we break above this.. it opens the door significantly higher.

On the other hand.. it makes sense to see this rally take a break here.

We rejected off the 200-day MA on the Feb highs as well as the highs from May 2024. A major resistance point.

As for targets, I have 2 I am eyeing.

1) The first is $10.99 which is 161.8% of this rally (just like in corn, this is only if we post a local top here. So subject to change).

This level also lines up with the 50% retracement up to those May 2024 highs.

2) Target 2 is $11.29, which is 200% of this rally and just happens to be the 61.8% retracement to those May 2024 highs.

Here is a simpler view of the 200-day MA.

It also happens to line up perfectly with the 61.8% retracement level up to those Feb highs.

Again, the most common retracement level.

Makes sense we’d take a breather here.

Like in Dec corn, we also posted a bearish shooting star in May beans.

A potential sign for some short term weakness.

Nov Beans 🌱

Just like in May beans, the biggest hurdle for bulls is the 200-day MA.

Once you break above that, that is the green light that we are probably going higher in my opinion.

May Chicago 🌾

Nothing new here.

Trapped in this channel still.

Not looking to do anything until the top.

May KC 🌾

Not much new here either.

Bulls want to hold this +7 month long support box.

Simply stuck in a massive range from the lows to the highs.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

4/11/25

SPECIFIC GRAIN MARKETING DECISIONS

4/10/25

USDA REPORT. HOW THIS IMPACTS CORN

4/9/25

TARIFFS GIVE. TARIFFS TAKE

4/8/25

CORN’S DIVERGING STRENGTH

4/7/25

SOLID PRICE ACTION DESPITE OUTSIDE FEAR

4/4/25

CORN PRICE ACTION SPEAKS VOLUME. ANY HOPE LEFT FOR SOYBEANS?

4/3/25

WHAT IS LEFT FOR CORN BEARS? TRADE WAR: CHARTS HOLDING SUPPORT

4/2/25

SHOULD UNKNOWNS KEEP A FLOOR UNDER GRAIN PRICES?

4/1/25

HOW DO ACRES IMPACT FUTURE OF THE GRAINS?

3/31/25

USDA REPORT: NOW WHAT?

3/28/25

ALL EYES ON USDA

3/27/25

PRE-USDA POSITIONING. DON’T GIVE GRAIN AWAY

3/26/25

HISTORY OF MARCH INTENTIONS. SOYBEANS UNDERVALUED?

3/25/25

6 DAYS UNTIL MAJOR USDA REPORT

3/24/25

HOW TO POSITION YOURSELF BEFORE PLANTING

3/21/25

REASONS TO BE OPTIMISTIC IN GRAINS?

3/20/25

WAS THAT THE BOTTOM IN CORN?

3/19/25

THE PATH HIGHER & THE DOWNSIDE RISKS IN GRAINS

3/18/25

SEASONALS, CATTLE HEDGE, CHARTS & DROUGHT?

3/17/25

WHEAT RALLIES. DON’T GET BACKED INTO A CORNER

3/14/25

MARCH 31ST REPORT THOUGHTS & WHAT’S NEXT FOR GRAINS

3/13/25

EXPLAINING RE-OWNERSHIP VS COURAGE CALLS

3/12/25

TARIFF FEARS. EU, CANADA, & ETHANOL

3/11/25

USDA SNOOZE. RECORD FUND SELLING A CONCERN?

3/10/25

USDA TOMORROW. GETTING COMFORTABLE IN MARKETING

3/7/25

HOW TIGHT IS THE WORLD & US SITUATION?

3/6/25

TARIFFS PUSHED BACK. FUTURE OPPORTUNITIES?

3/5/25

IS GRAINS BIGGEST RISK WEAK CRUDE & DEFLATION?

3/4/25

TRADE WAR BEGINS. 8TH DAY OF PAIN FOR GRAINS

3/3/25

TARIFFS ON TOMORROW. BUY SIGNAL

3/3/25

BUY SIGNAL

2/28/25

WHEN WILL THE BLEEDING STOP?

2/27/25

CORN AT CRITICAL SPOT. USDA ACRE REPORT. WAY TOO EARLY DROUGHT TALK

2/26/25

HISTORY SUGGESTS CORN TOP ISN’T IN? ACRE OUTLOOK TOMORROW

2/25/25

POSITIVE CLOSE. WHAT TO KNOW ABOUT USDA OUTLOOK

2/24/25

USDA OUTLOOK, FIRST NOTICE DAY & BRAZIL

2/21/25

WHAT TO EXPECT MOVING FORWARD IN GRAINS

2/20/25

FIRST NOTICE DAY CONCERNS. MASSIVE CORN ACRES OR NOT?

2/19/25

HOW TIGHT IS THE CORN SITUATION?

2/18/25

MORE DETAILS ON TODAYS SELL SIGNAL

2/18/25

OLD CROP KC WHEAT & CORN SELL SIGNAL

2/14/25

WHEAT BREAKING OUT ON WEATHER RISK. TECHNICALS & FUNDAMENTALS

2/12/25

GLOBAL GRAIN SITUATION, ACRE TALK, CHARTS & MORE

2/11/25

USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

Read More

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25