TRUMP SAYS CHINA WILL BUY MORE BEANS

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Trump, China & Beans: 0:00min

Corn: 8:00min

Beans: 11:20min

Wheat: 12:00min

Cattle: 13:50min

Want to talk about your situation?

(605)250-3863

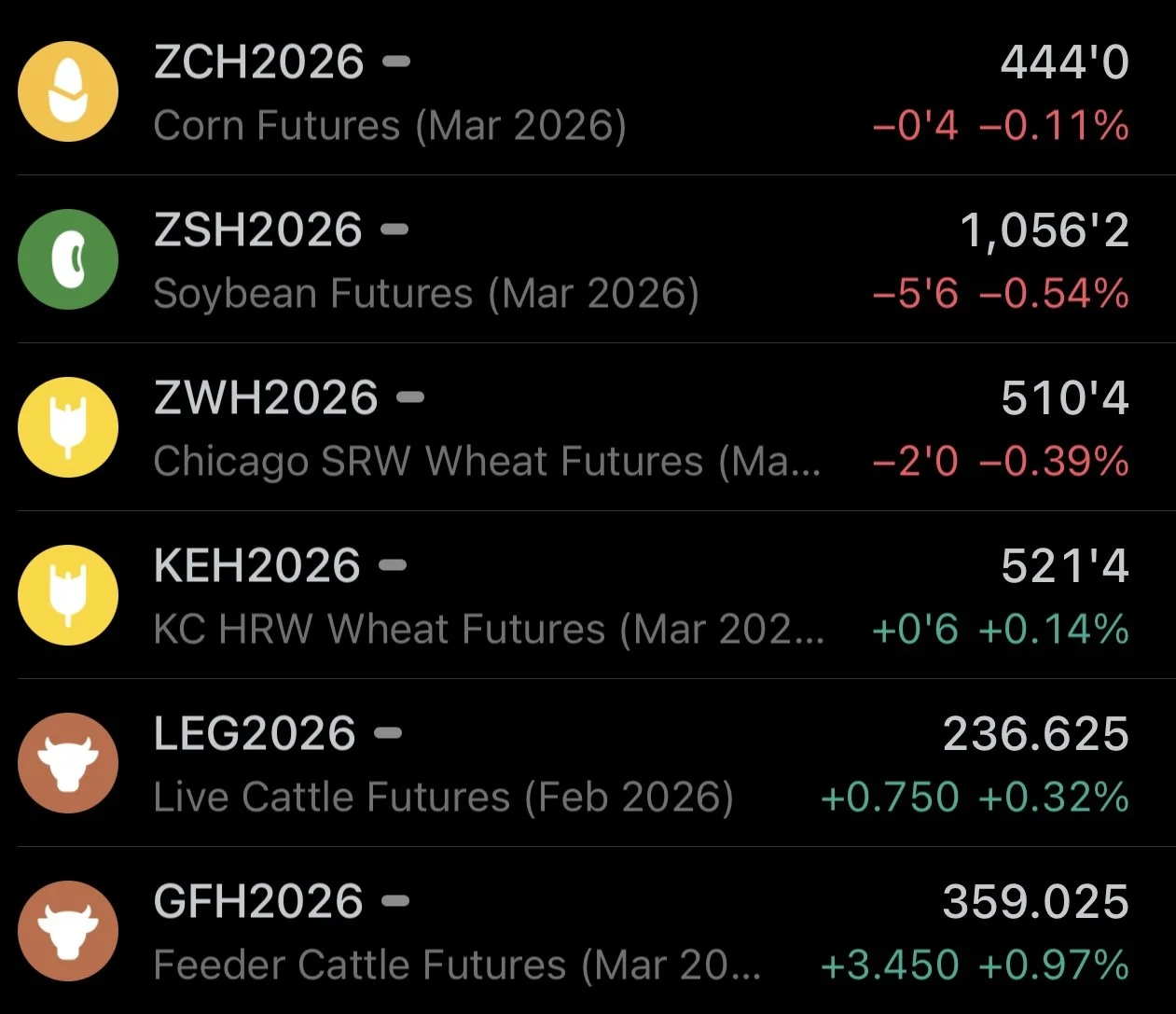

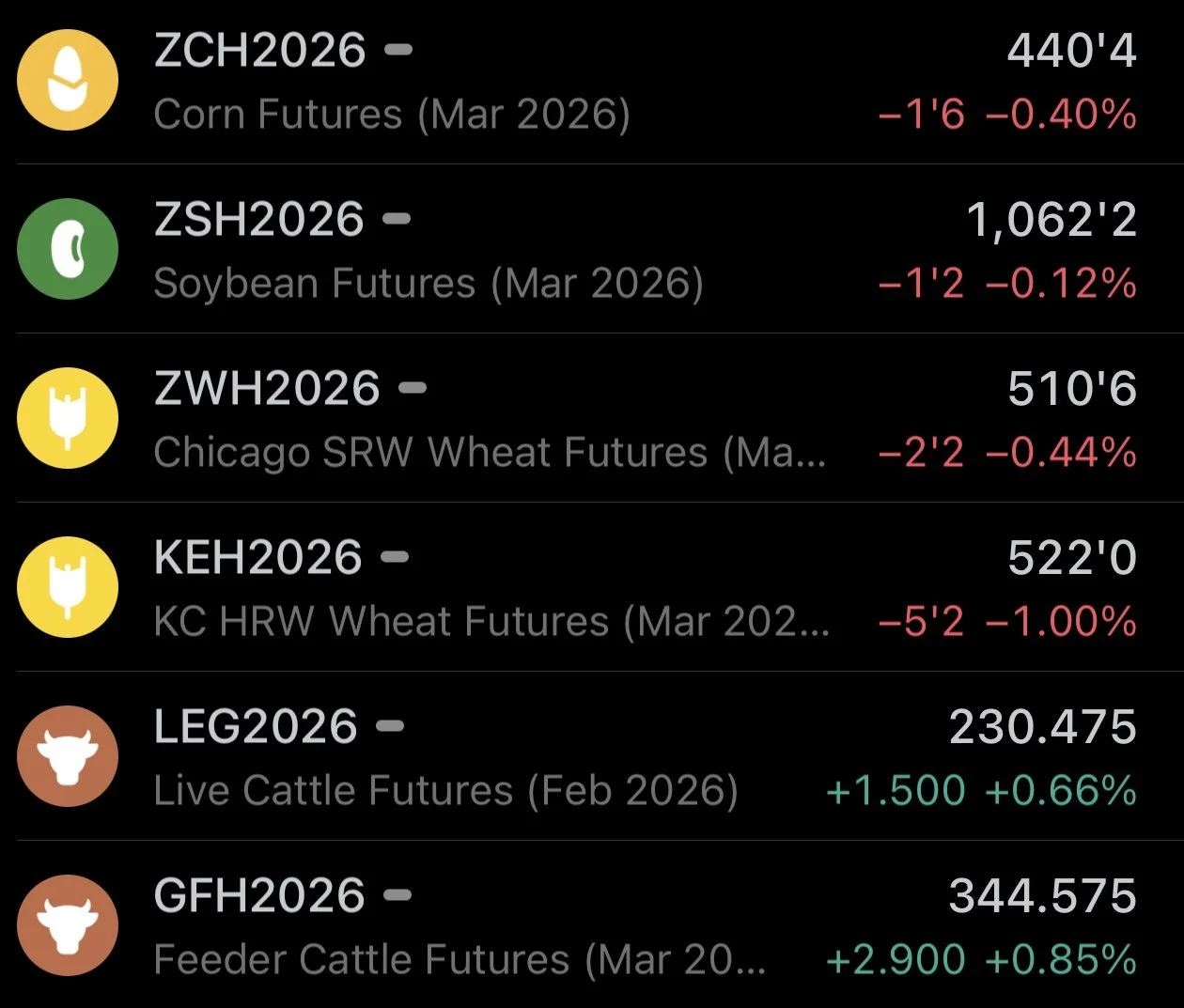

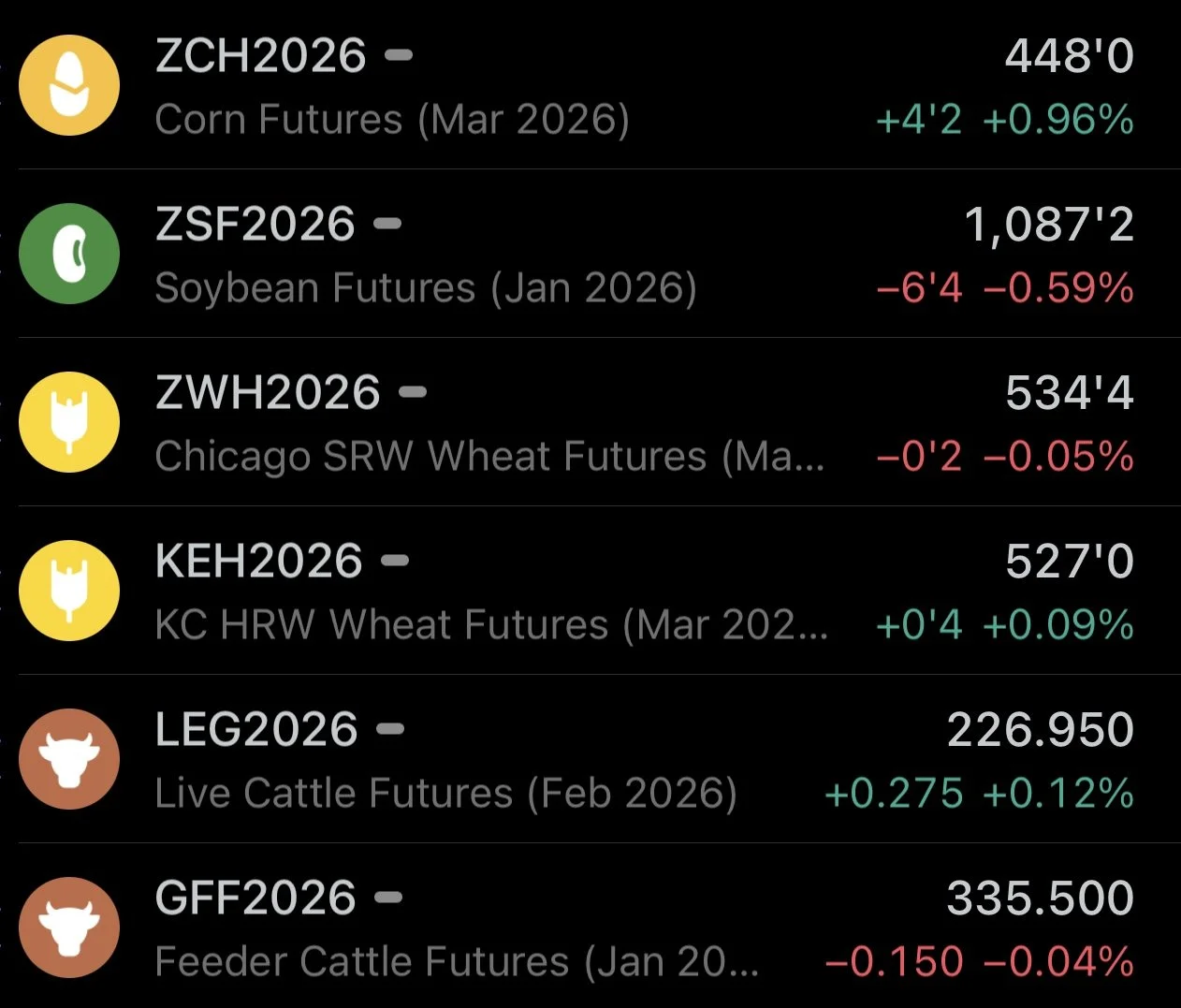

Futures Prices Close

Overview

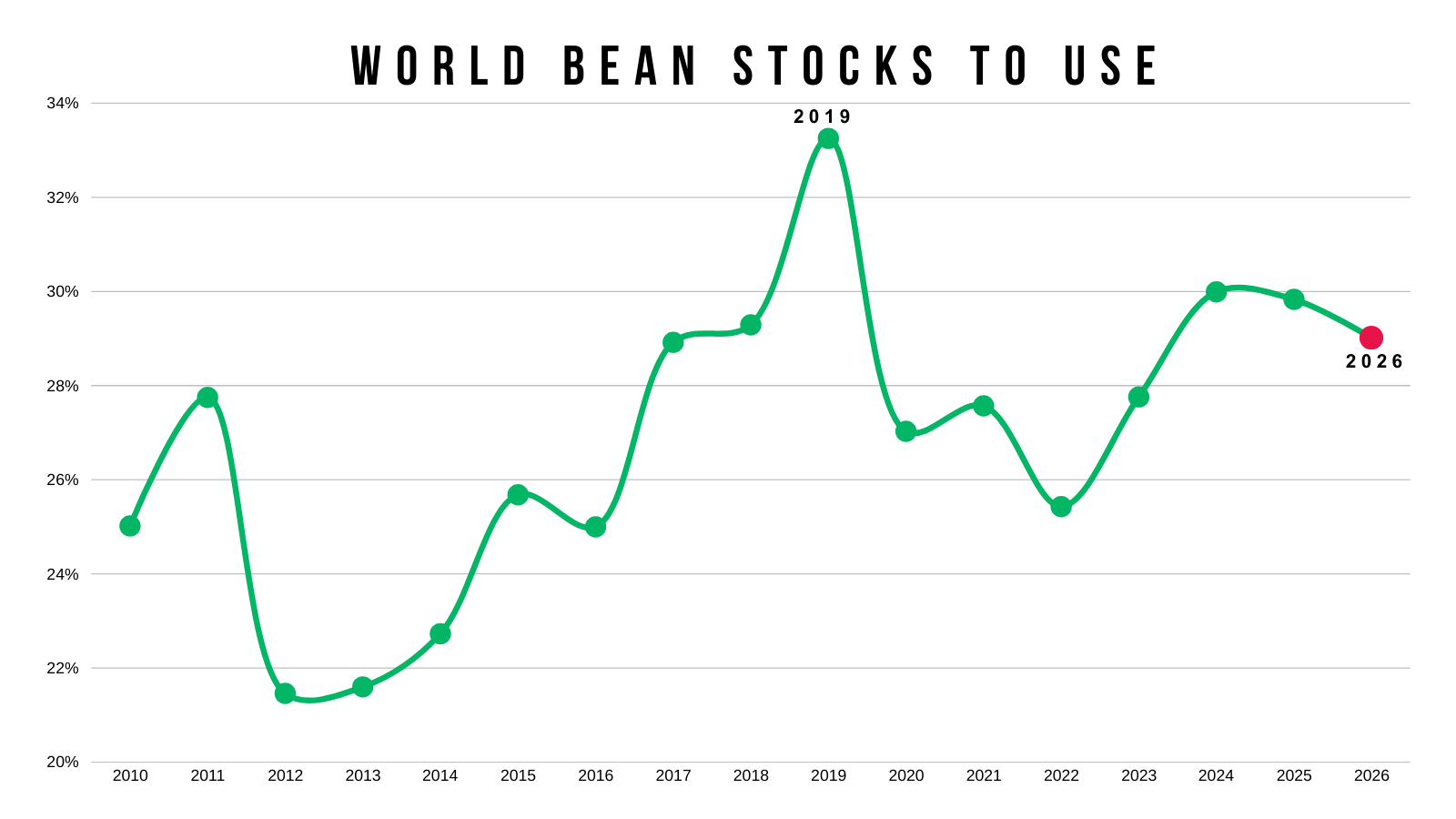

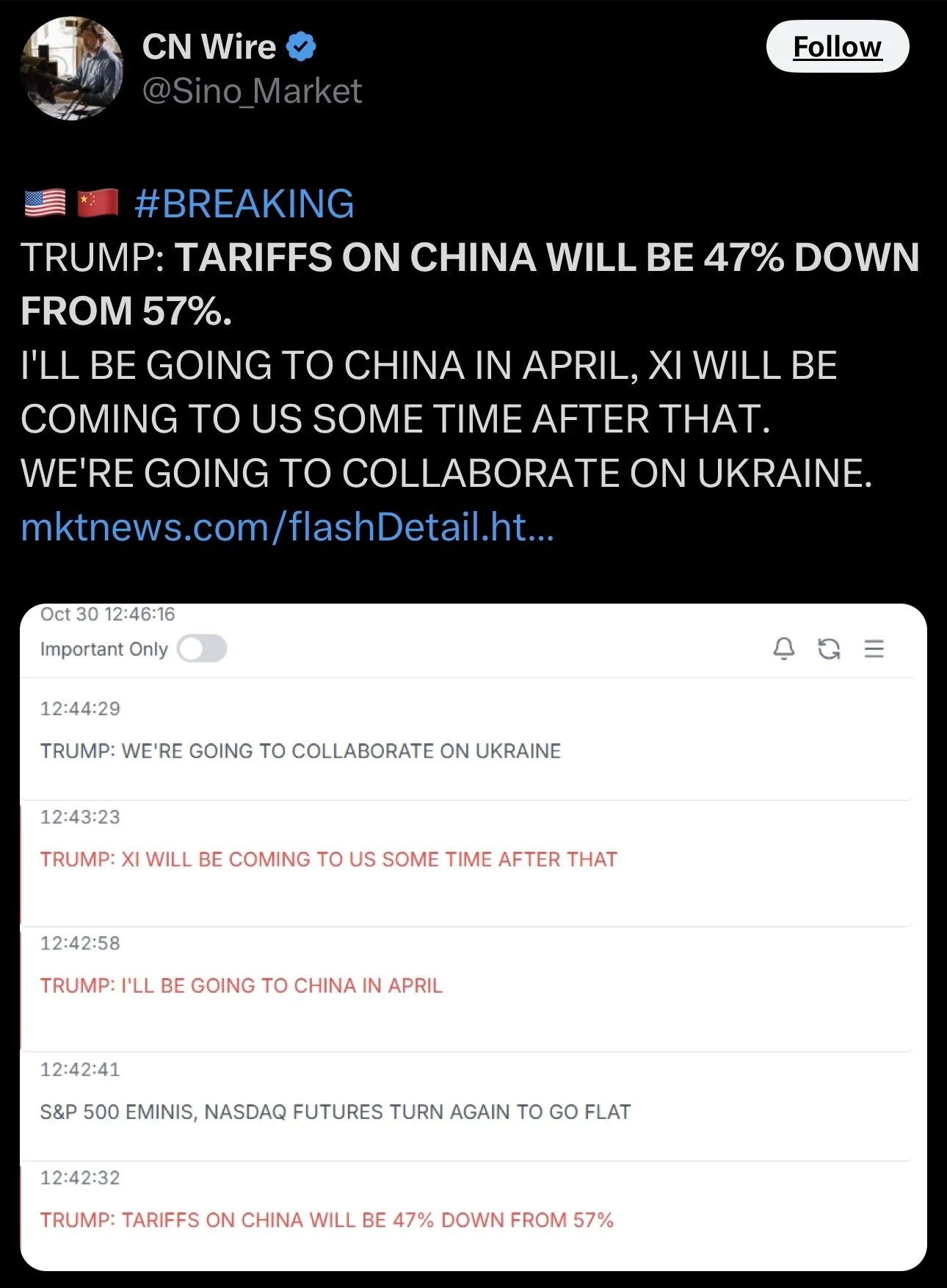

Wild day for the soybean market.

The market was slightly lower, than out of nowhere we rallied a massive +50 cents in just 20 minutes.

Why?

All because of one tweet from Trump.

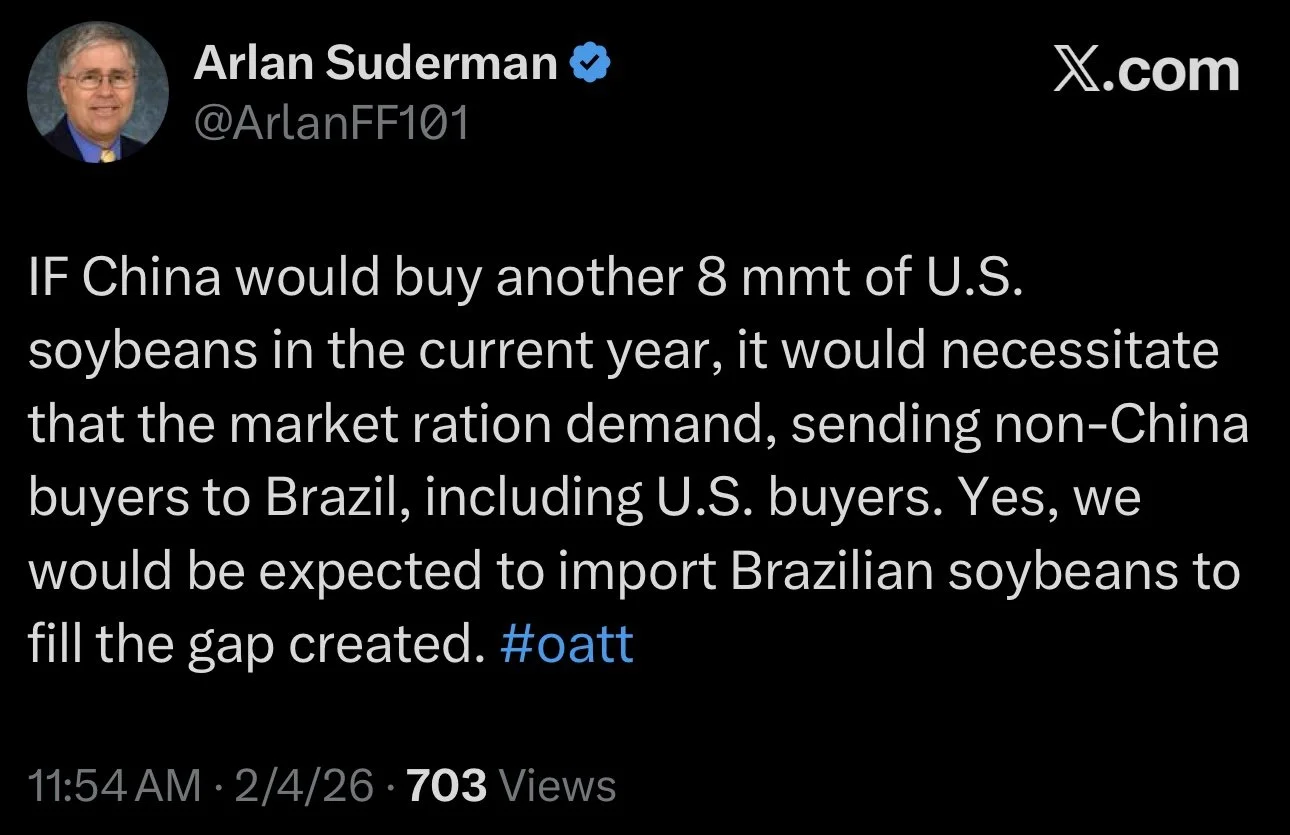

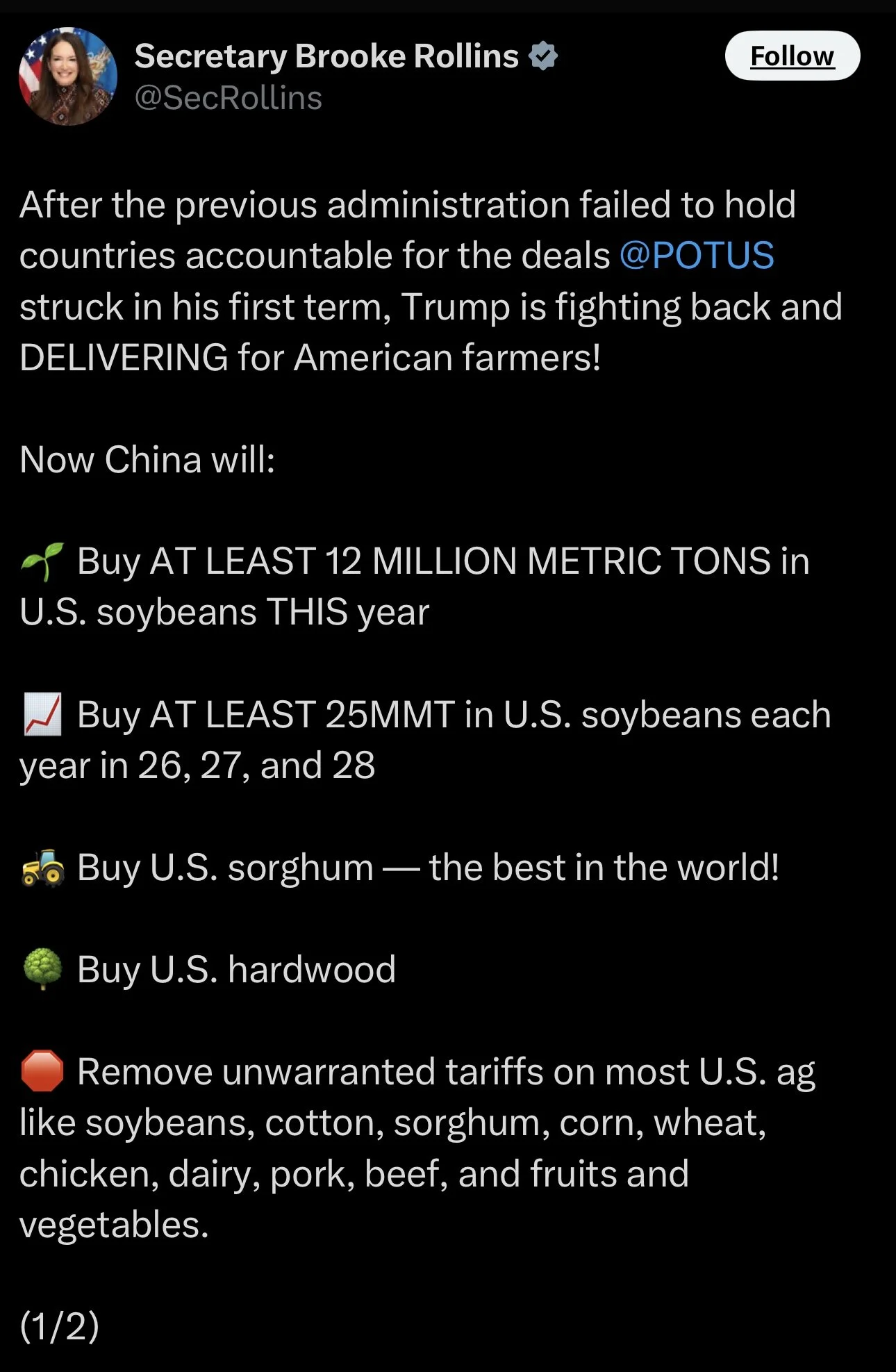

He had a call with China. He essentially said that they discussed China bumping their soybean purchase agreement from 12 million metric tons to 20 million metric tons.

While at the same time reiterating that they are committed to fulfilling that 25 million goal for next season.

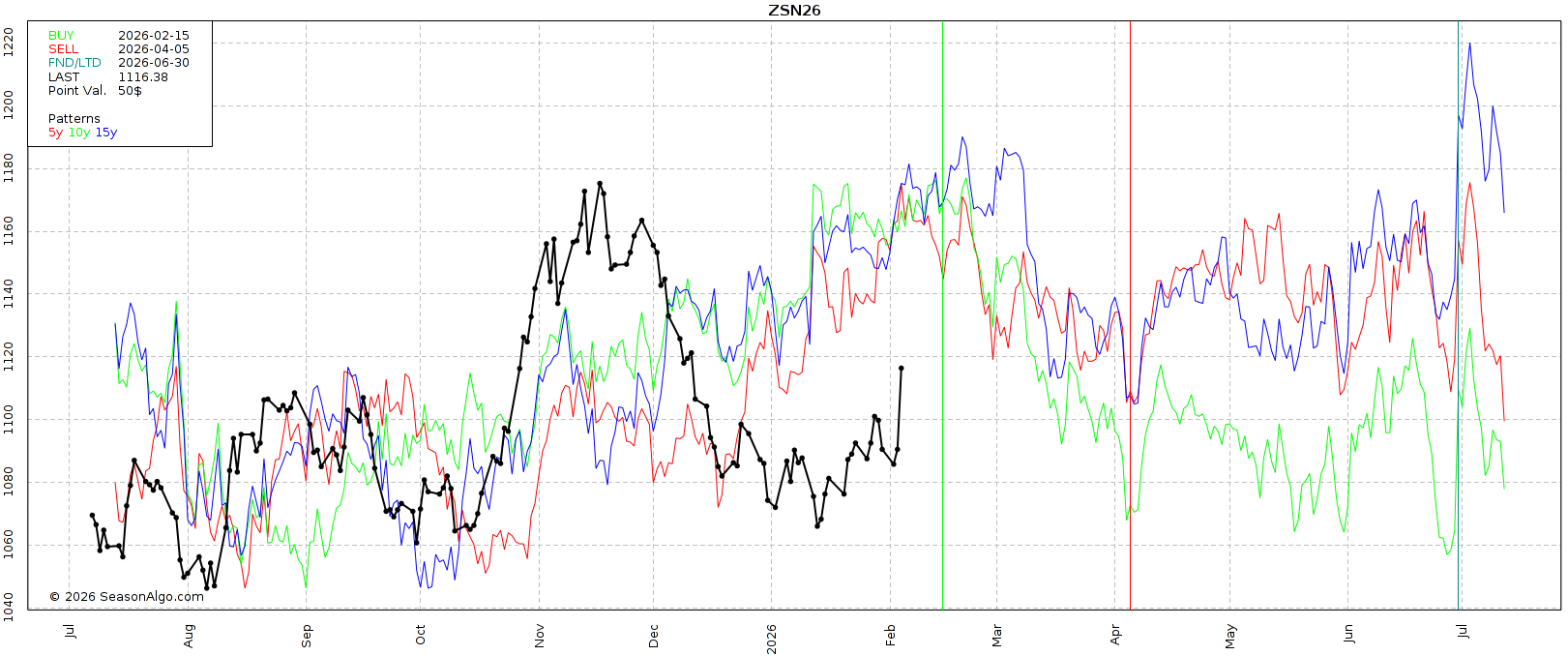

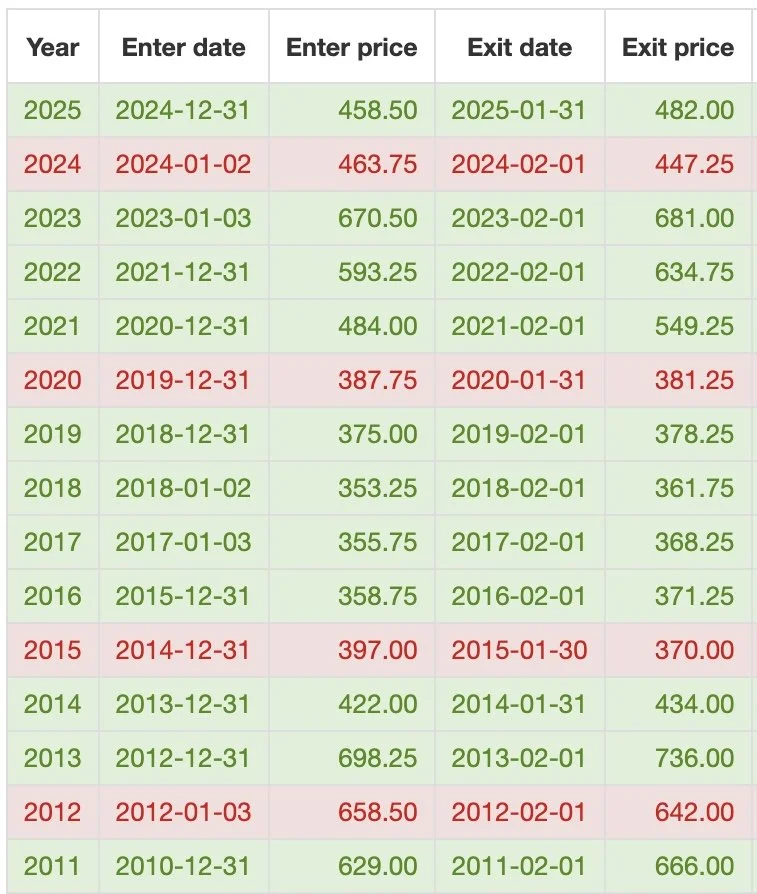

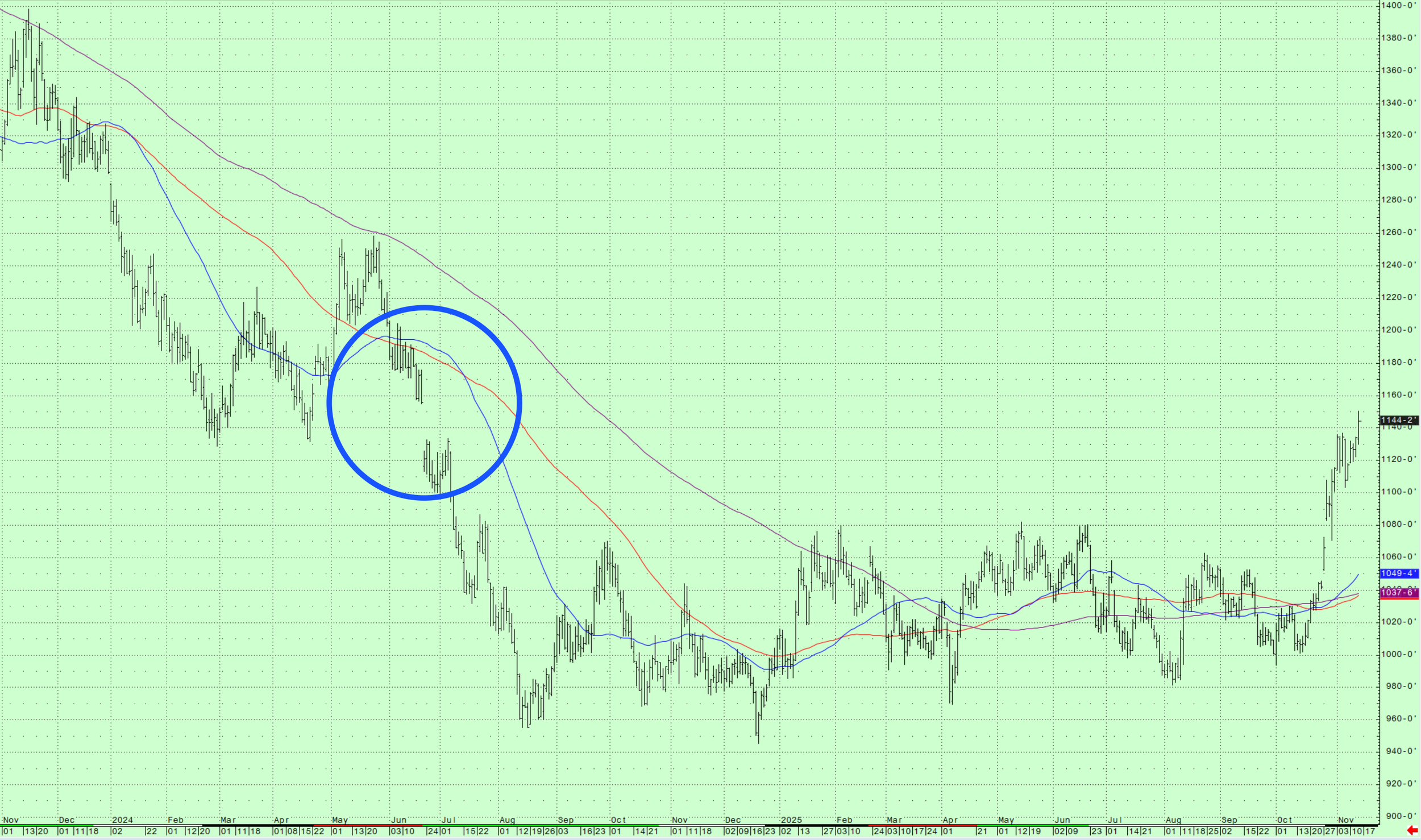

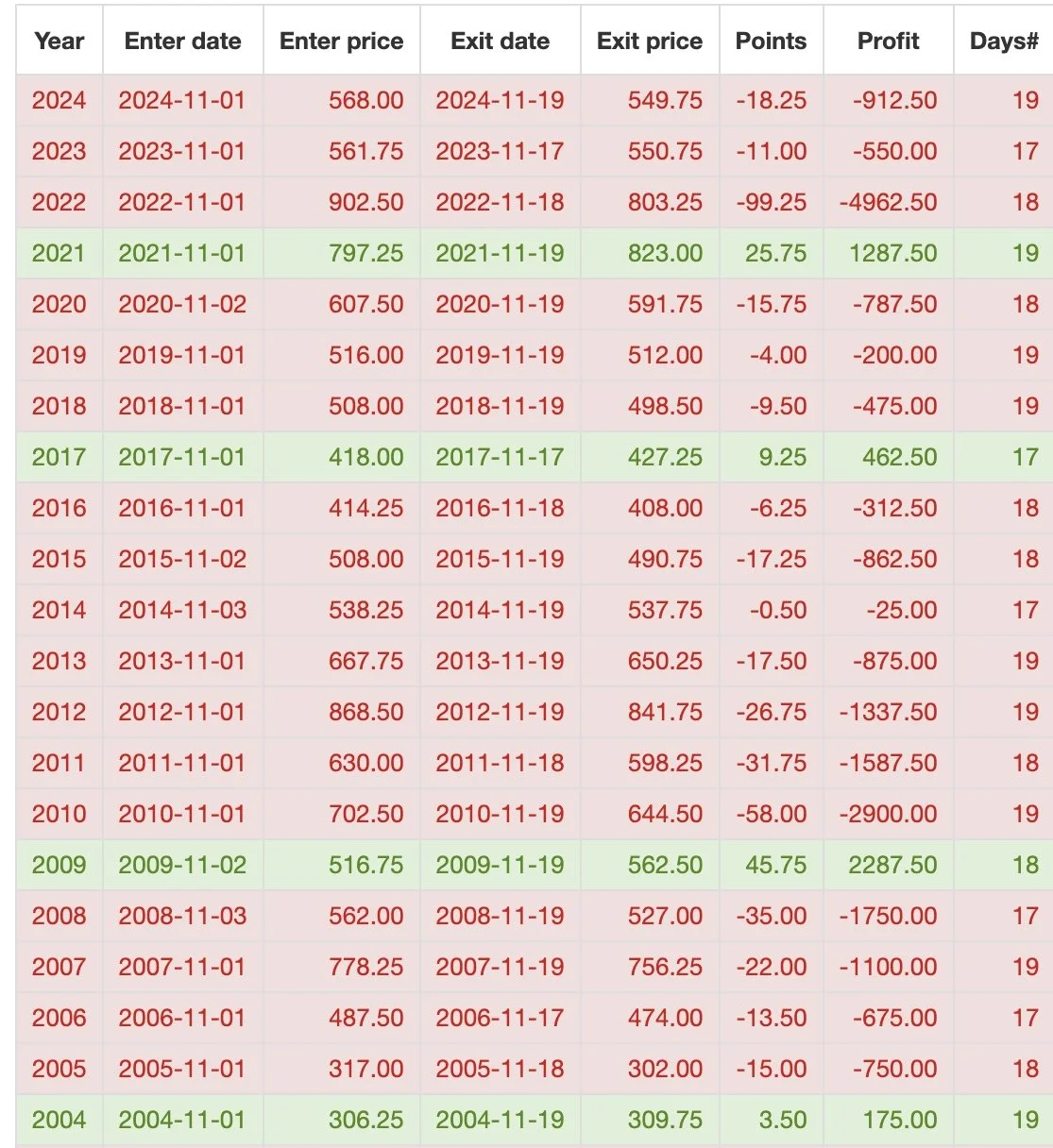

Soybean Sell Signal

This morning, we did issue our first soybean sell signal and hedge alert since November 17th, following the news.

Link to Signal

What was our reasoning behind this signal?

The main reason was simply based on the charts, as 90% of our signals are.

If we look at March soybeans, we alerted the signal because we hit the golden zone.

They ran right into that golden zone before ultimately falling well off their highs.

(The golden zone is when we reclaim 50-61.8% of a sell off. It is the most common spot for a bounce to fail).

What about November soybeans?

They too hit the golden zone retracement and 61.8% level up to those November highs.

Why the Golden Zone?

You hear me talk about this all the time.

Why does this zone tend to be so important?

It is the most common spot for a bounce to fail.

Not all the time.. but it is very common.

There are several instances of this over the years.

Let's go over a few of them.

March-26 Corn: Last November

Here is the most recent example of this zone and where it marked a significant high in a market.

In this case, that same level also happened to be old support. Which we've talked about several times since harvest.

We clawed back 50-61.8% of the highs from February before failing.

July-25 Corn: Last April

We had that brutal sell off after posting those February highs.

We then received a dead cat bounce.

It failed at the golden zone.

July-25 Corn: Last February

From the contract lows, that rally going into February reclaimed 50% of the contract highs.

This level lined up with prior support and resistance.

When the golden zone lines up with old points of support and or resistance, it helps narrow down the target even further.

Sep-23 Corn: Summer of 2023

Remeber that weather scare in 2023 that rallied corn +$1.30 in just a month.

That rally failed after clawing back 61.8% of the contract highs.

Jan-25 Beans: Last November

This was the reason for that sell signal back in November.

We went on that China driven rally before topping out after taking back 61.8% of the contract highs.

This doesn’t mean soybeans definitely topped today.

The point is that it just simply makes sense to take risk off the table in the area where it historically makes the most sense to do so.

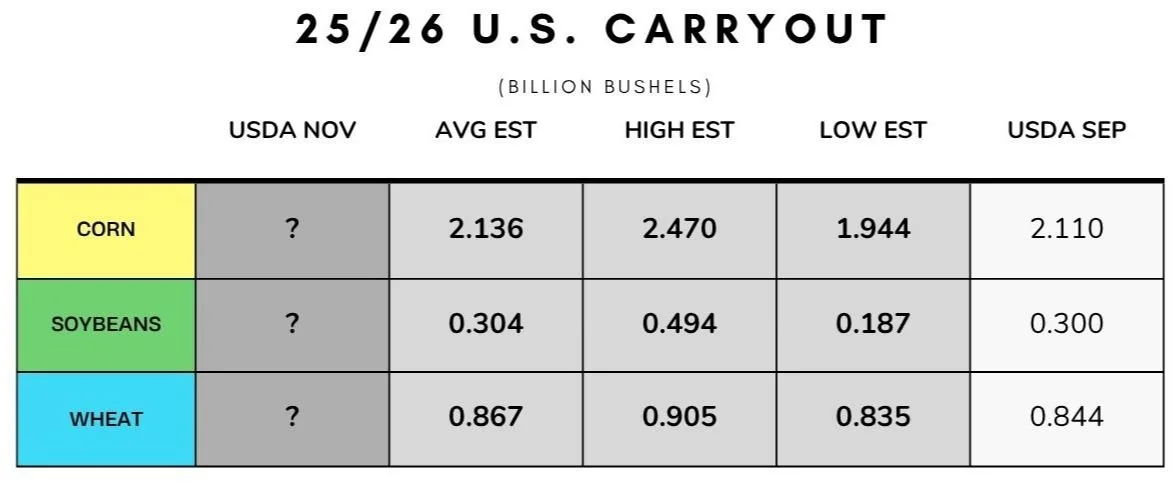

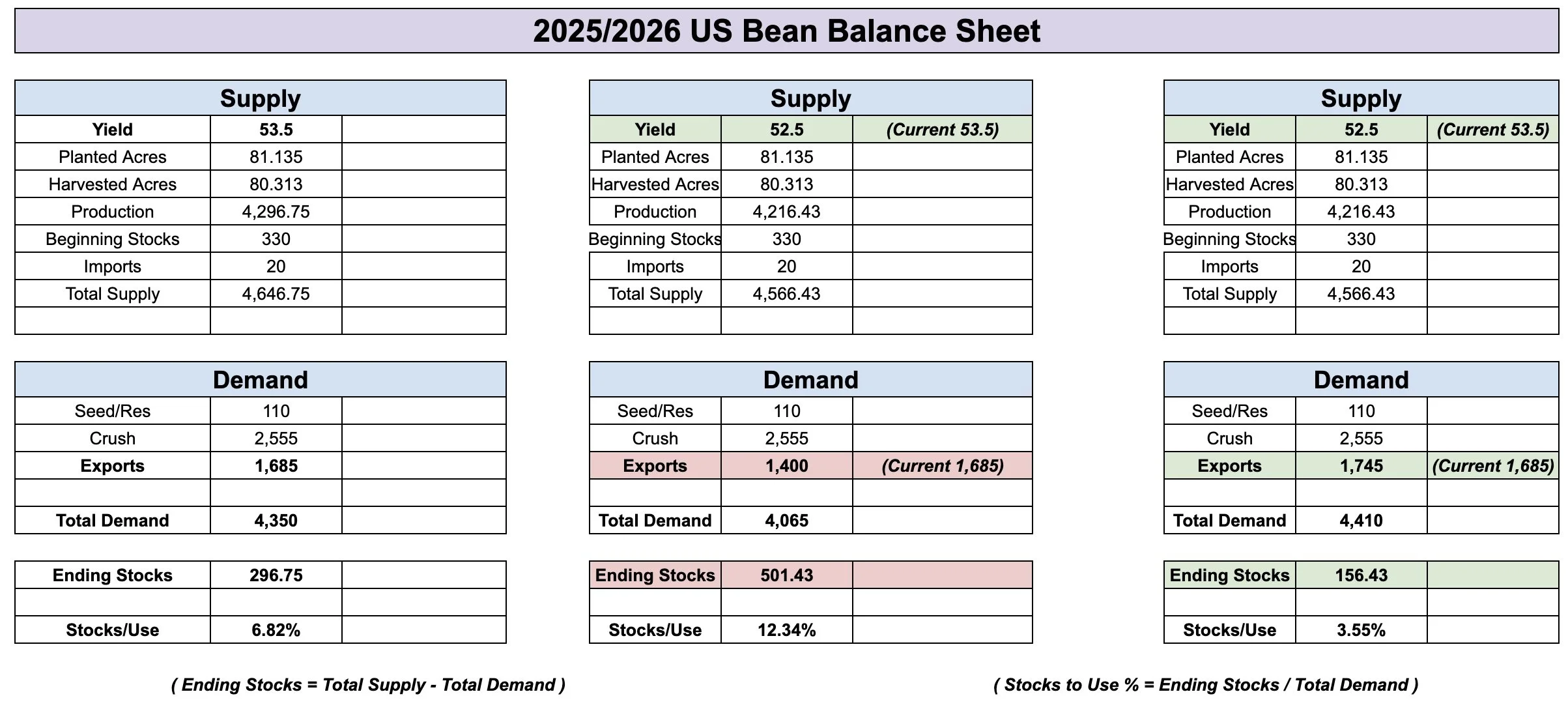

Does Trump & China News Change Anything?

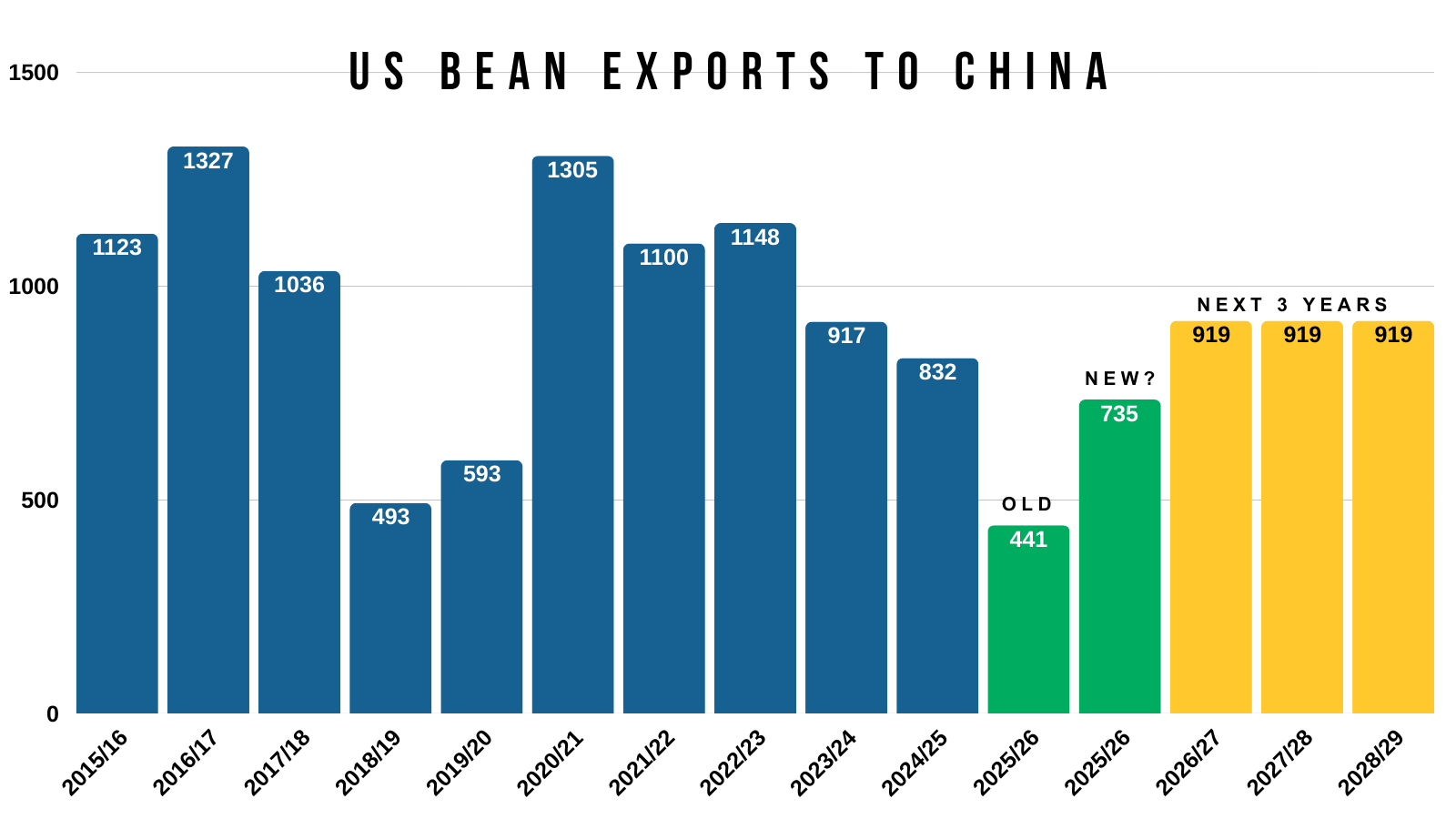

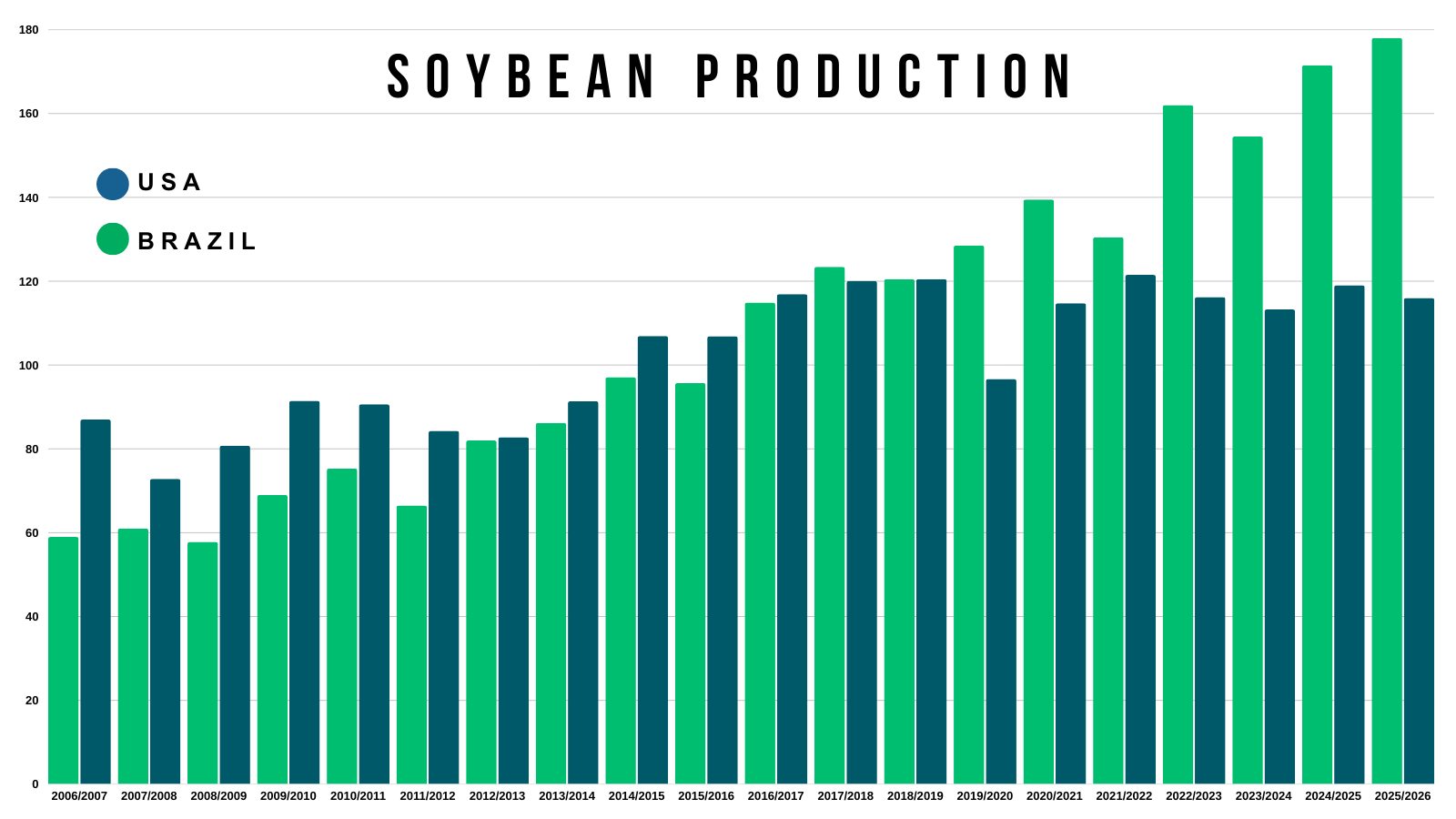

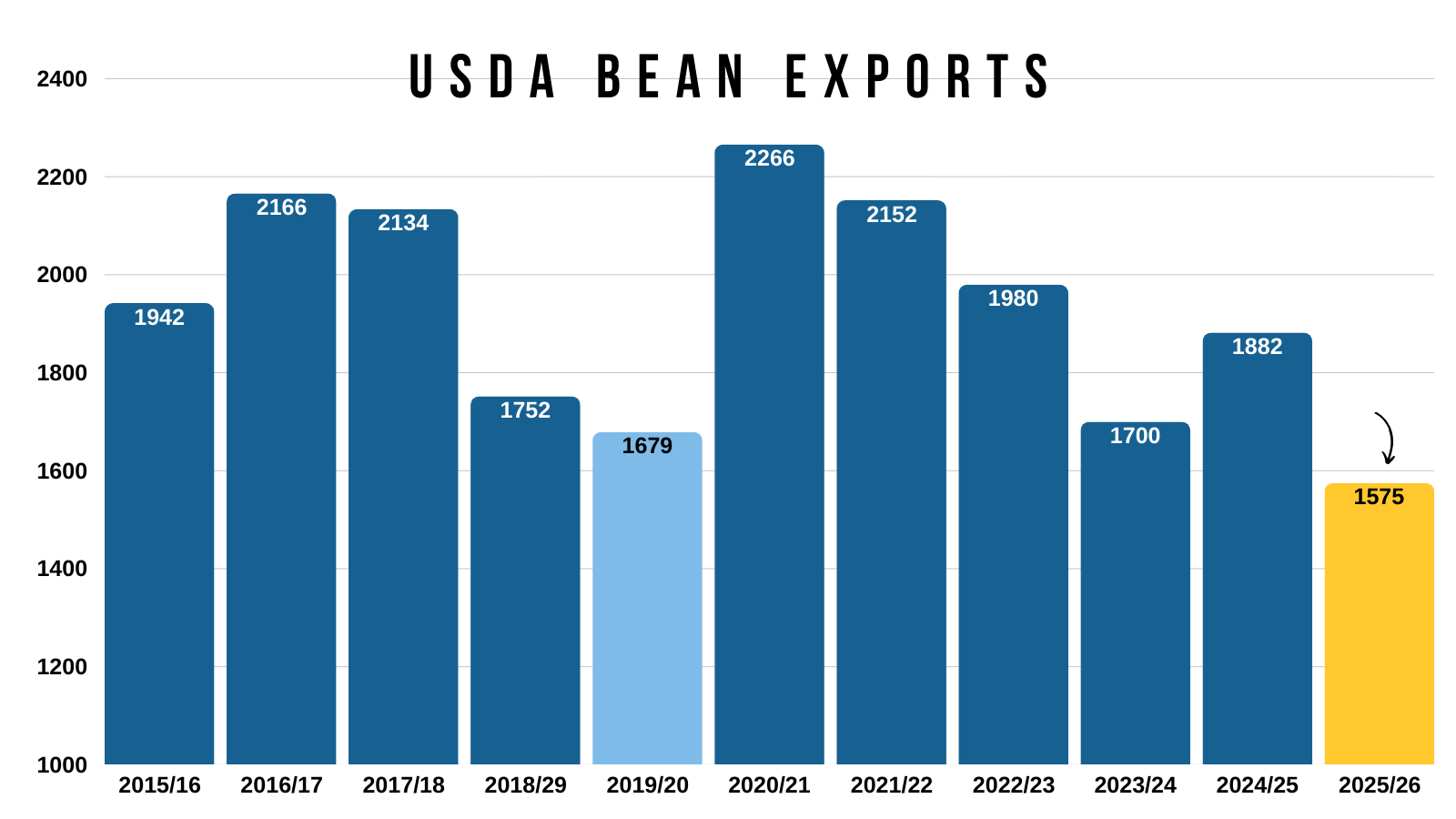

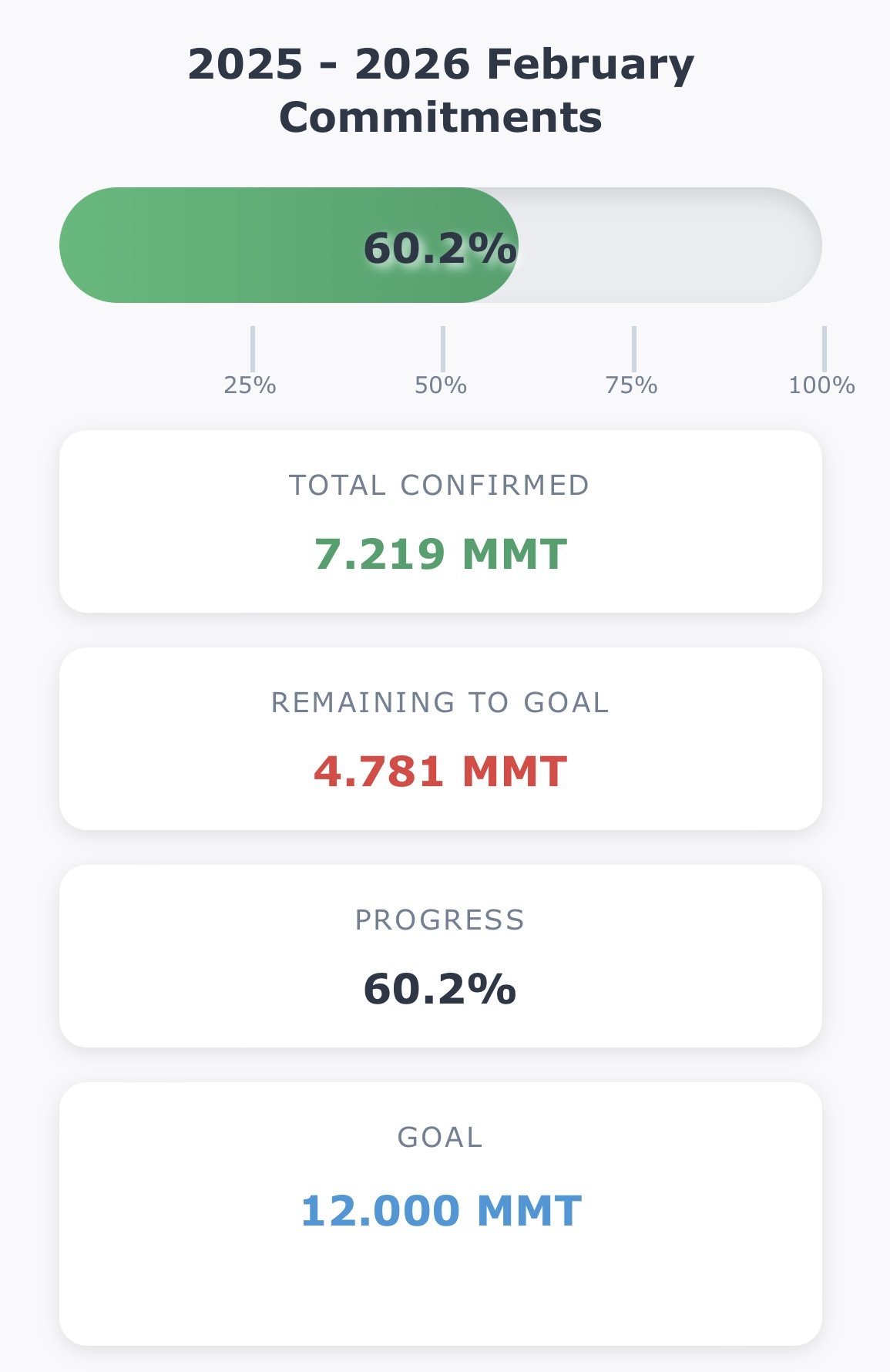

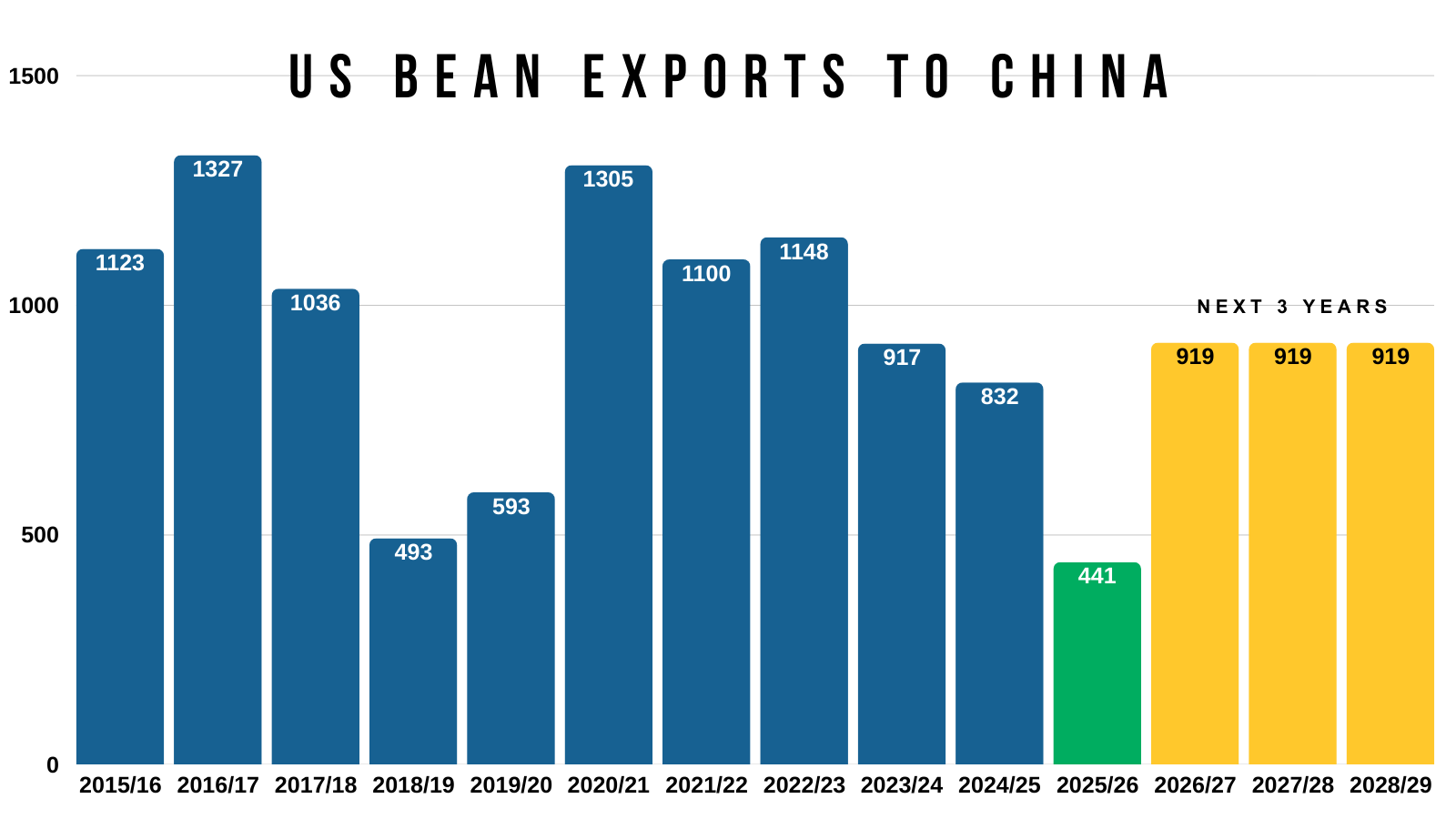

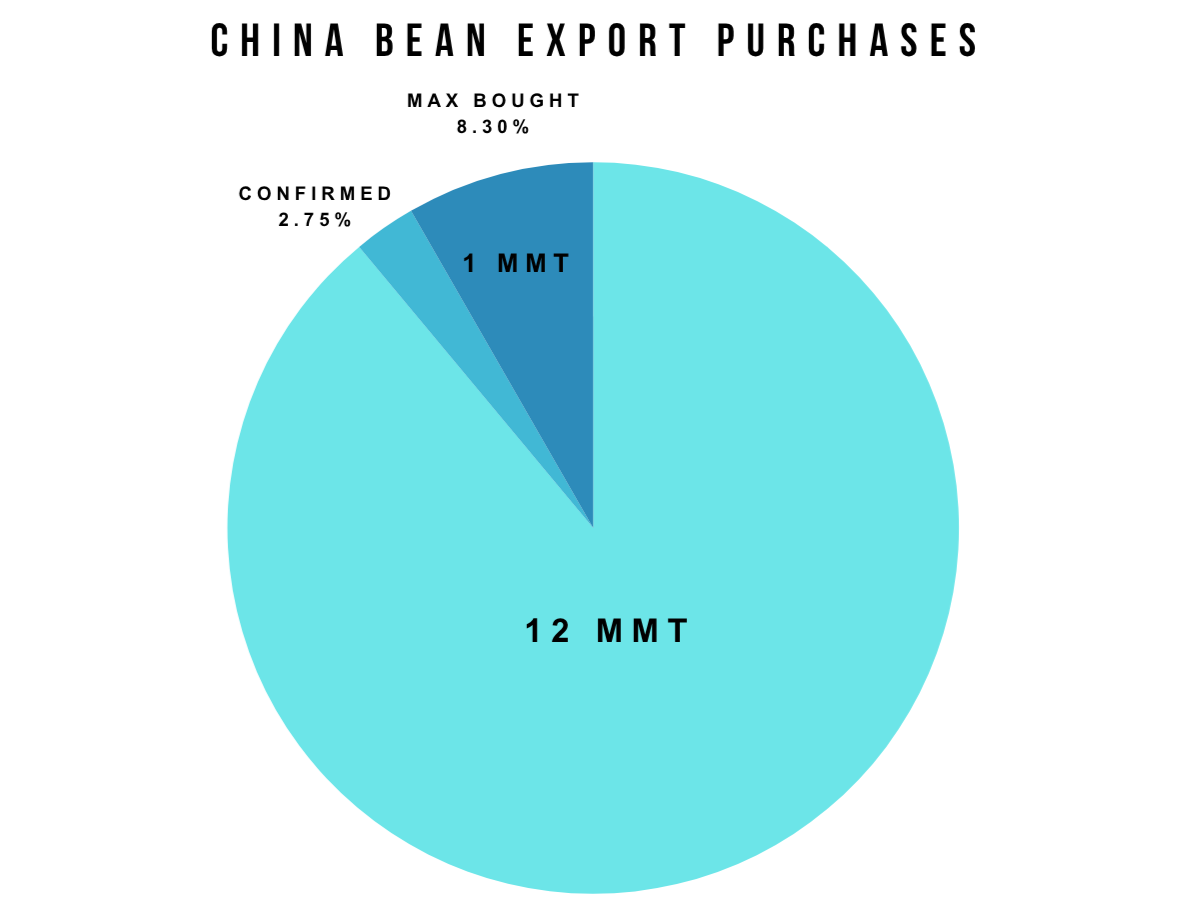

Here is a visual of China's purchases of US soybeans.

This chart includes their past purchases over the years.

It also includes their old agreement, along with the "rumored" new agreement.

12 million metric tons = 441 million bu

20 million metric tons = 735 million bu

Difference = 294 million bu

That is a pretty massive increase.

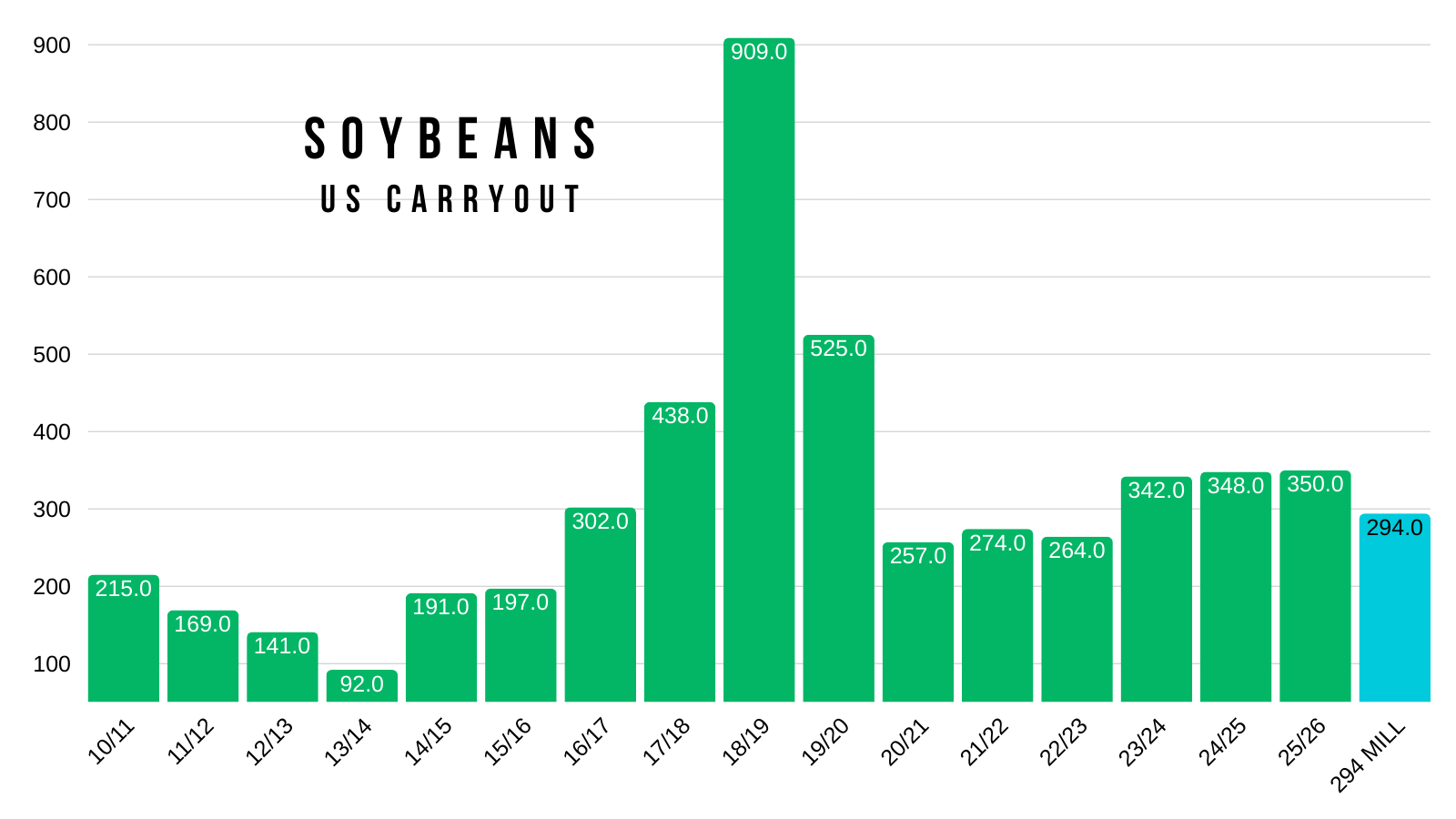

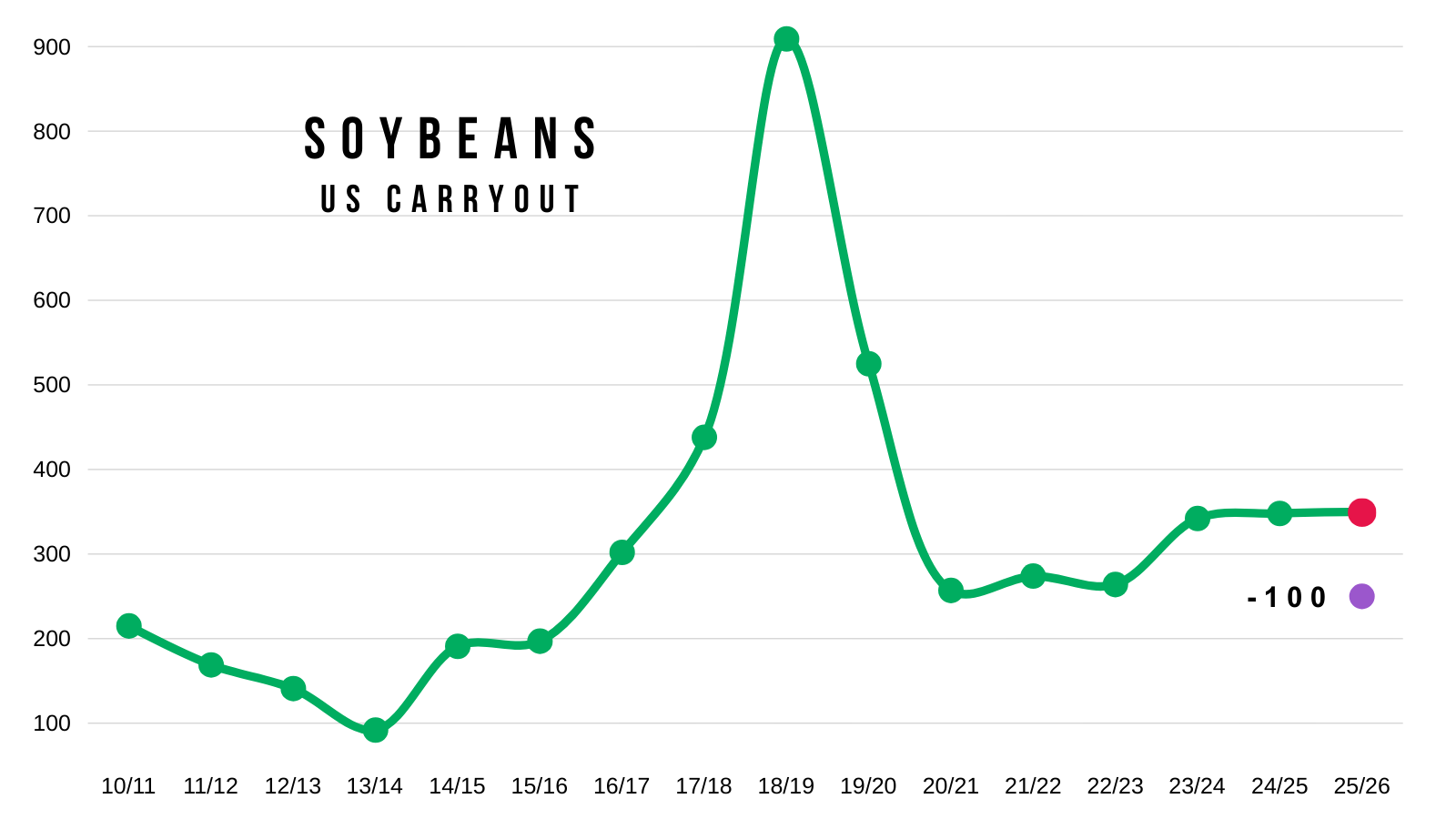

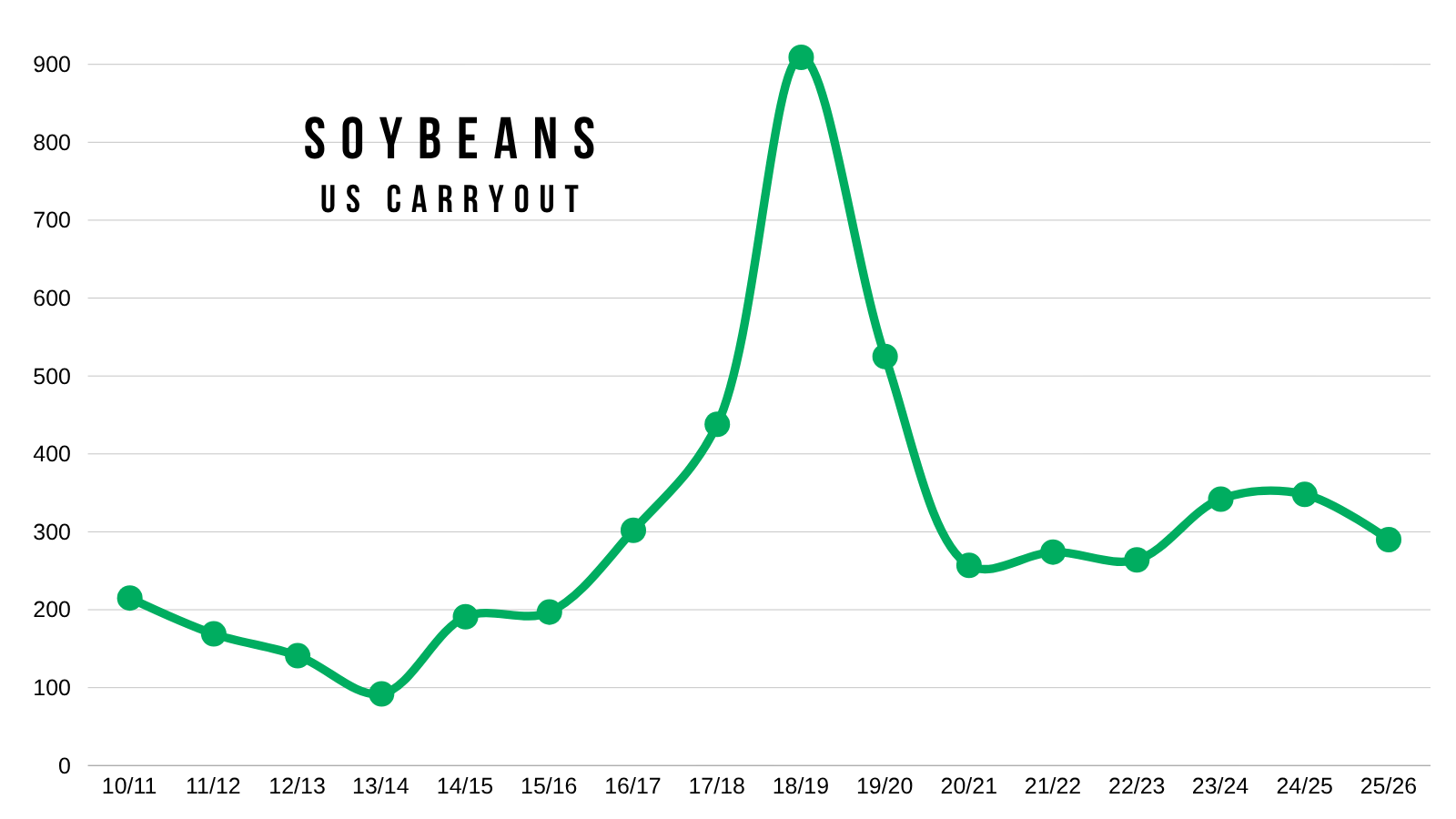

For reference, the entire US soybean carryout is 350 million bushels.

Seems pretty bullish when you think about it that way.

As the US doesn’t have an extra 300 million bushels to export.

We'd literally run out of beans.

But it's not quiet that black and white as there are a lot of moving parts.

However, we still felt that it made sense to reward that size of a move.

As the action could've very well been algo buying on the headline, and we weren’t sure if this market would see any follow through or not.

After all, Trump did only say they are "considering" bumping their purchases.

If that word changes from "considering" to "confirmed" it would be very bullish.

If it is true and China follows through, this is exactly what soybean bulls might’ve needed.

We had been talking about the impact China buying would have for a while. If they continue to buy US soybeans, the market will take notice.

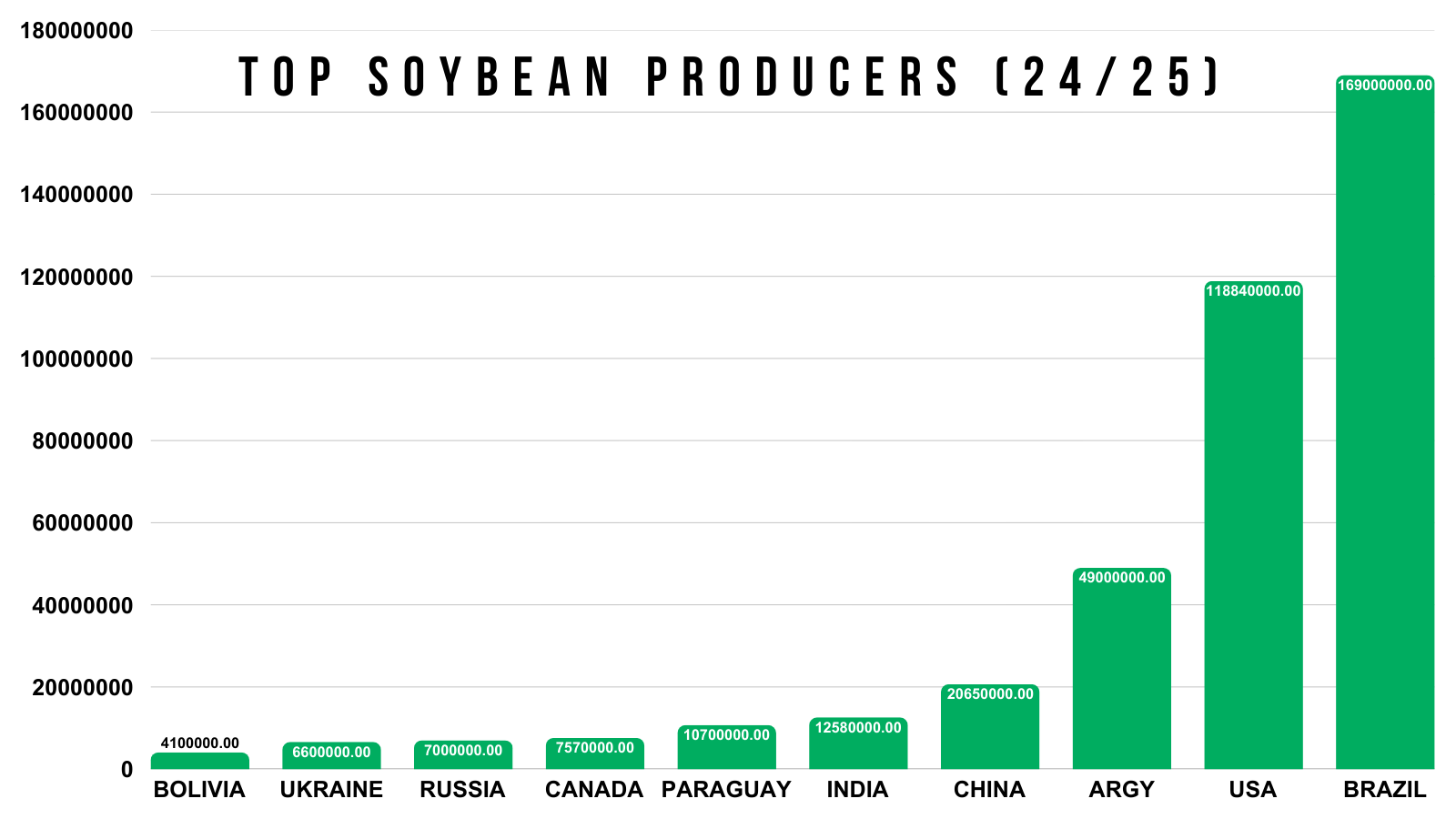

If they back off their purchases like they historically do here, given that Brazil has a monster crop coming around the corner and their soybeans are cheaper than ours, then soybeans will struggle to find a reason to go higher.

Who knows how the political chess match will turn out.

If China wants to continue buying, there is no reason we can’t go higher.

The US balance sheet does NOT have room for an extra 294 million bushels of demand. That is almost the entire carryout.

If China were to buy that amount, prices would probably have to go higher to ration demand.

Because we would need to push away our business from non-China destinations and hand it off to Brazil.

There is even talk that the US could end up having to import Brazil soybeans.

Brazil's beans are more way cheaper than ours.

So China's commercial crushers don’t have an incentive to buy at all. It just doesn’t make any sense for them to buy.

Which means the buying might have to come from their government reserve, not normal commerical demand.

If it is the government buying instead of the commercials, we could see basis and spreads do a lot of the work.

If their government is buying, it could result in the US balance sheet getting tighter, but the world balance sheet remaining the same.

Because those soybeans aren’t going to vanish into thin air. They have to go somewhere.

There is also simply some logistical question marks.

Does China even have room for an extra 300 million bushels of soybeans?

They probably don’t, and that original 12 million already has deliveries scheduled from February to August.

So for China to actually buy this amount of soybeans they might have to do something awkward. Such as buy the soybeans, then auction them into crush to help make room.

There are so many different ways it could go.

It sounds hard, but not impossible.

Like we've talked about before, soybeans could very well just be a small peace offering in the grand scheme of things for the trade war.

Something to keep in mind is that China probably won’t come in and buy these soybeans right now. They are going to be busy with Brazi's crop. We also have the Chinese new year coming up soon.

Regardless, it made sense to defend the rally in some sort of manner at a key spot on the charts.

This market sold off what felt like every day for the last 3 months.

We clawed back nearly 2/3rd's of that sell-off in 20 minutes. Not a move we want to completely ignore.

This could definitely change the tide moving forward this year.

Who knows if today's rally will simply be a one day thing or not, or the start of a bigger rally like in October.

But we still have to keep in mind that Brazil's harvest could start to add some pressure to this market.

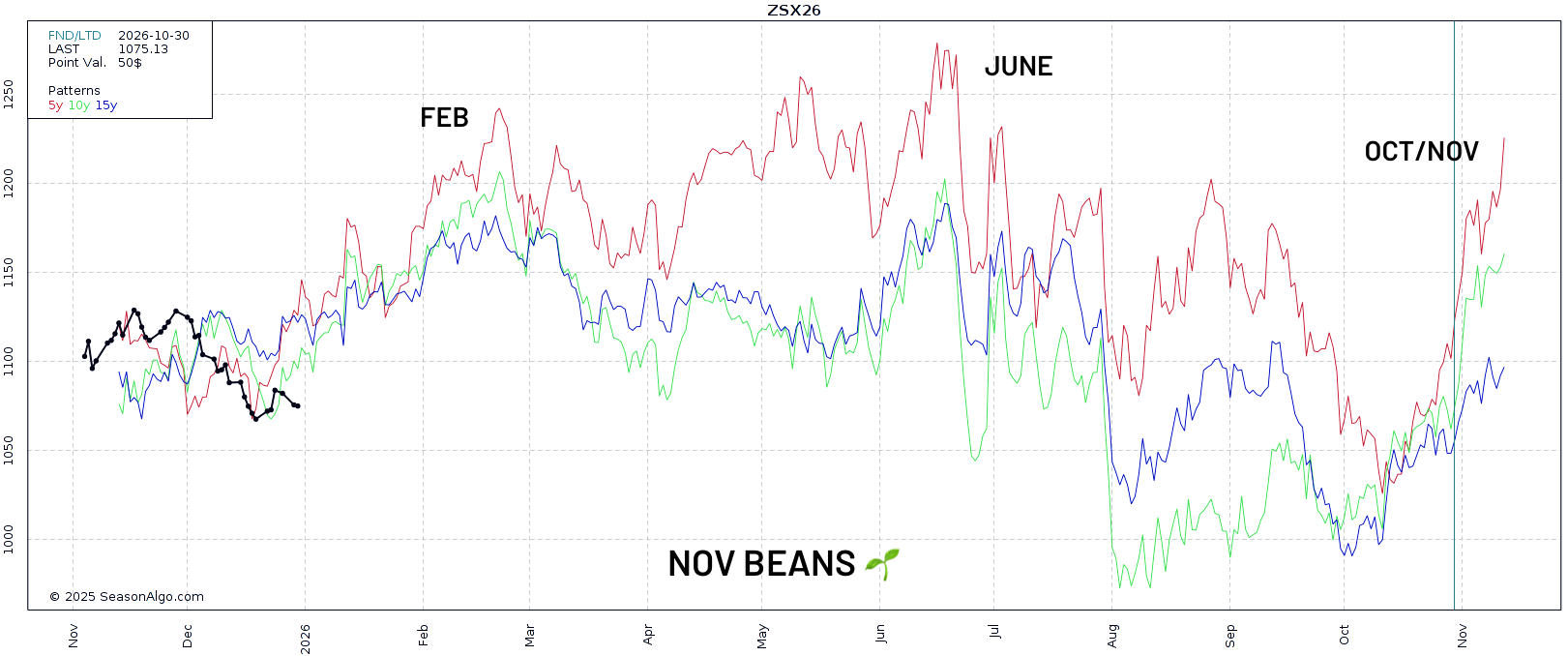

Seasonally, soybeans do tend to struggle from the middle of February until April due to their harvest.

Similar to how the corn market finds life after getting through the harvest pressure here in the US.

Soybeans tend to do the same when it comes to the Brazil crop.

Given that Brazil is by far the dominant player now.

But if China does step up now rather than later, it could very well change things. However, there is some reasons to doubt it happens right away.

Today's Main Takeaways

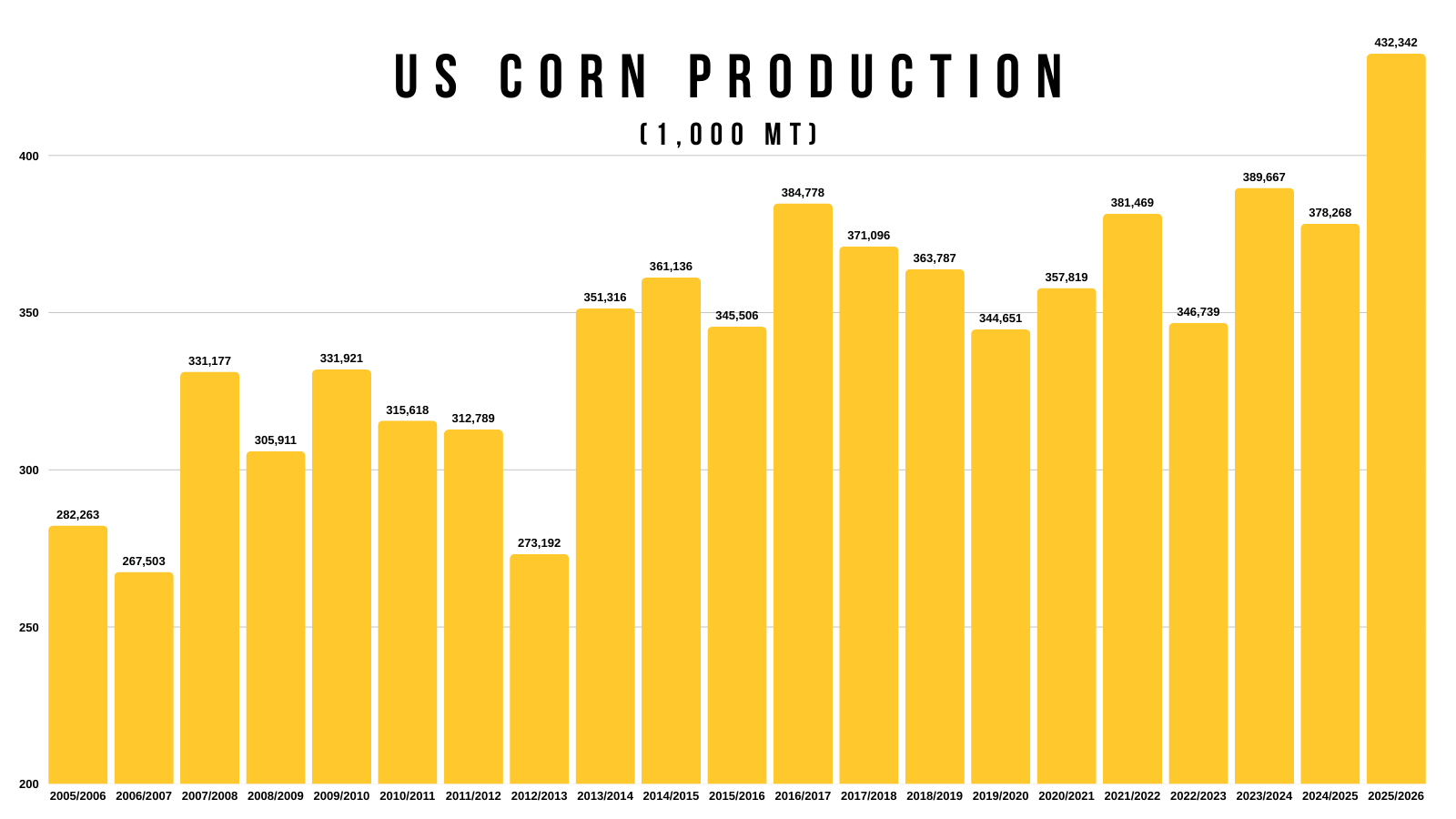

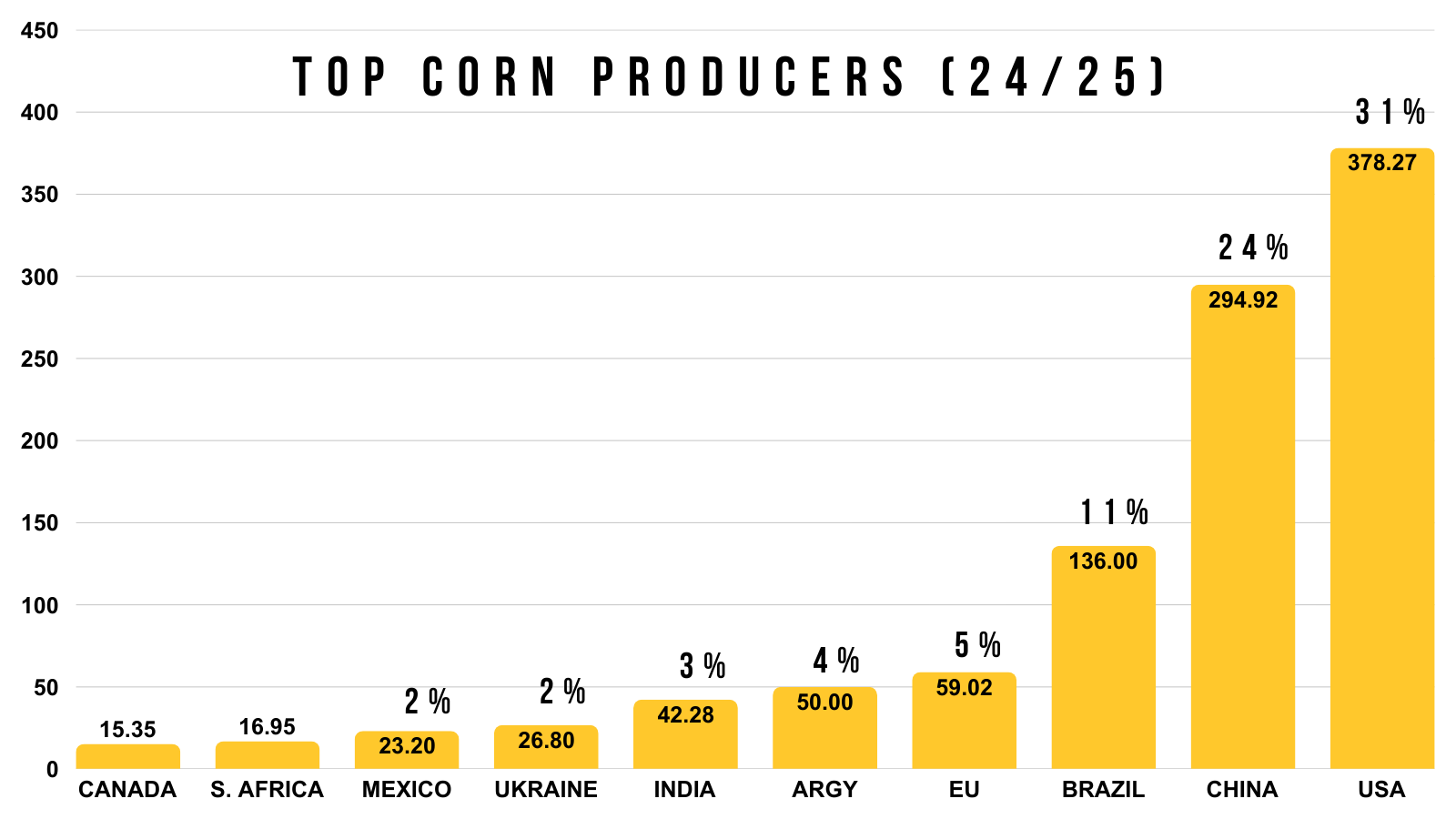

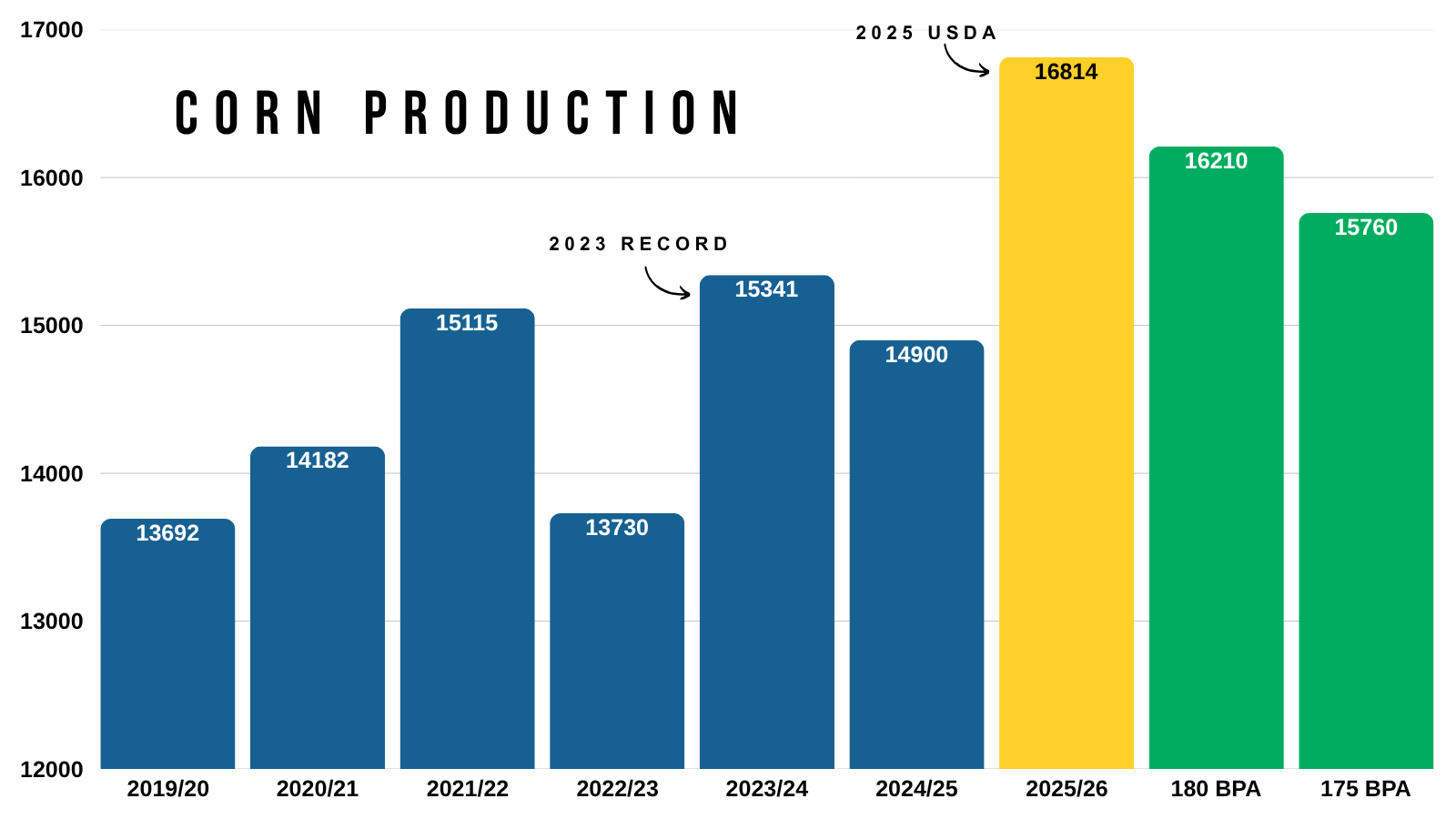

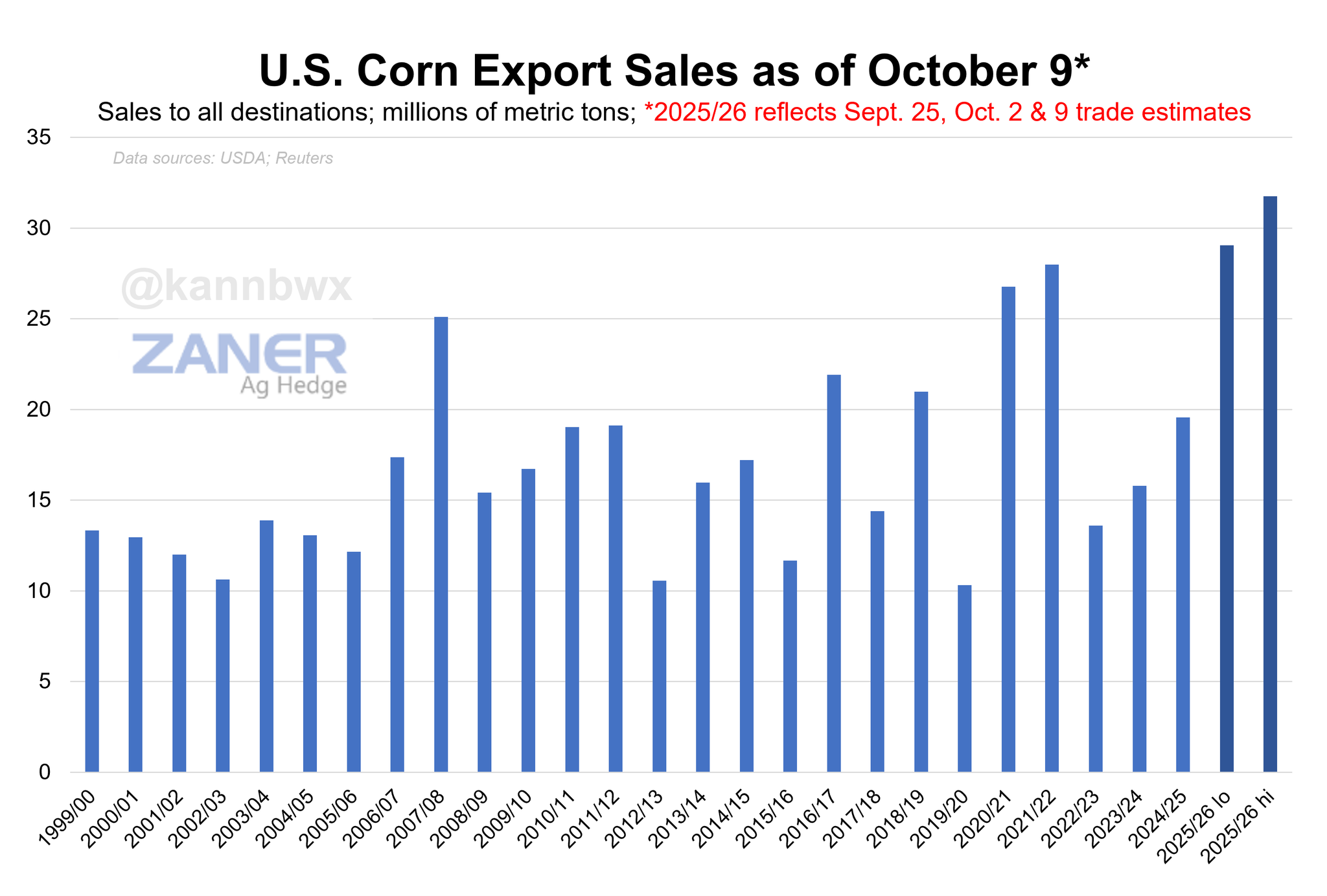

Corn

Fundamentals:

Not much fresh news on corn today.

We are still essentially range bound.

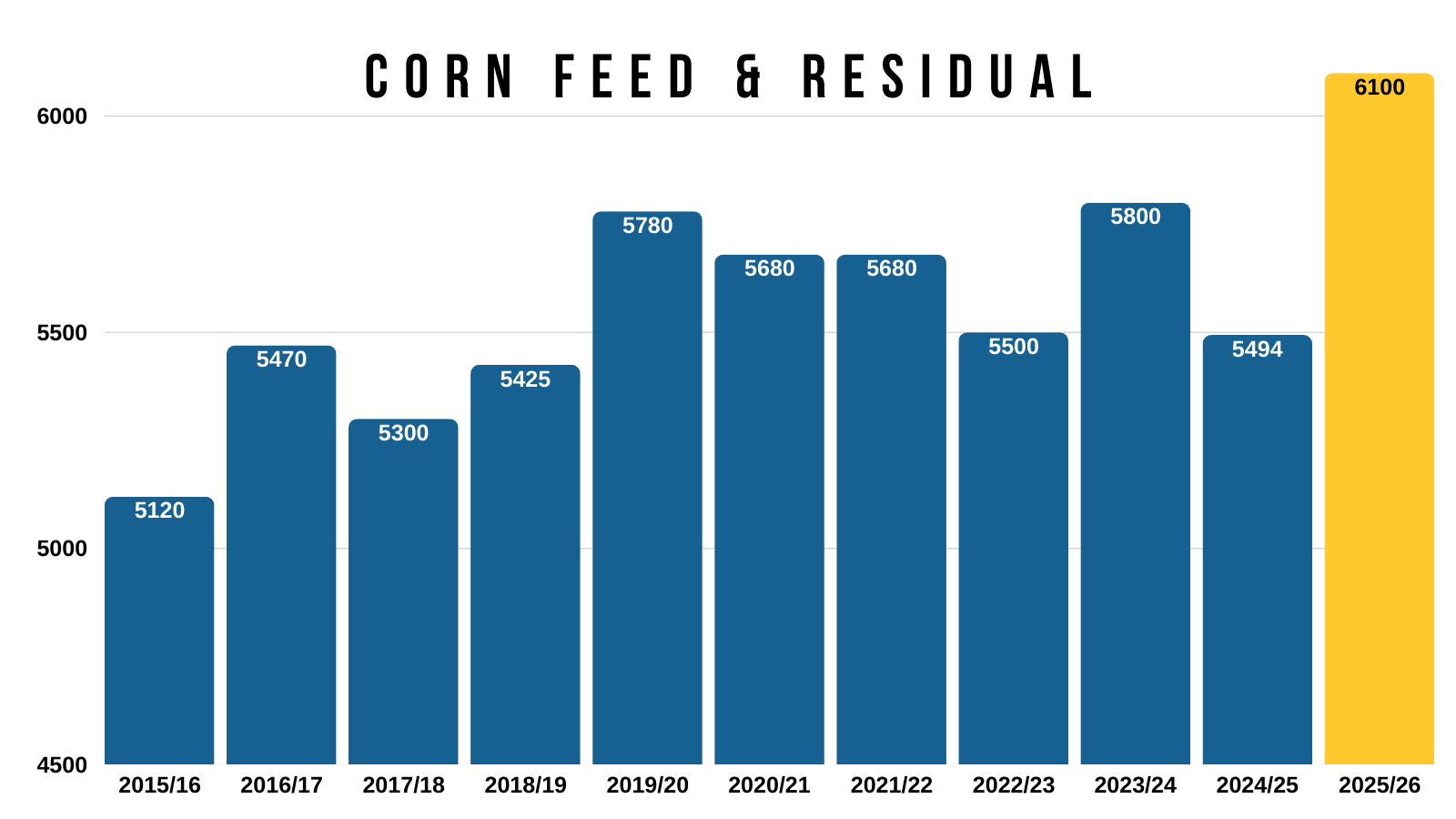

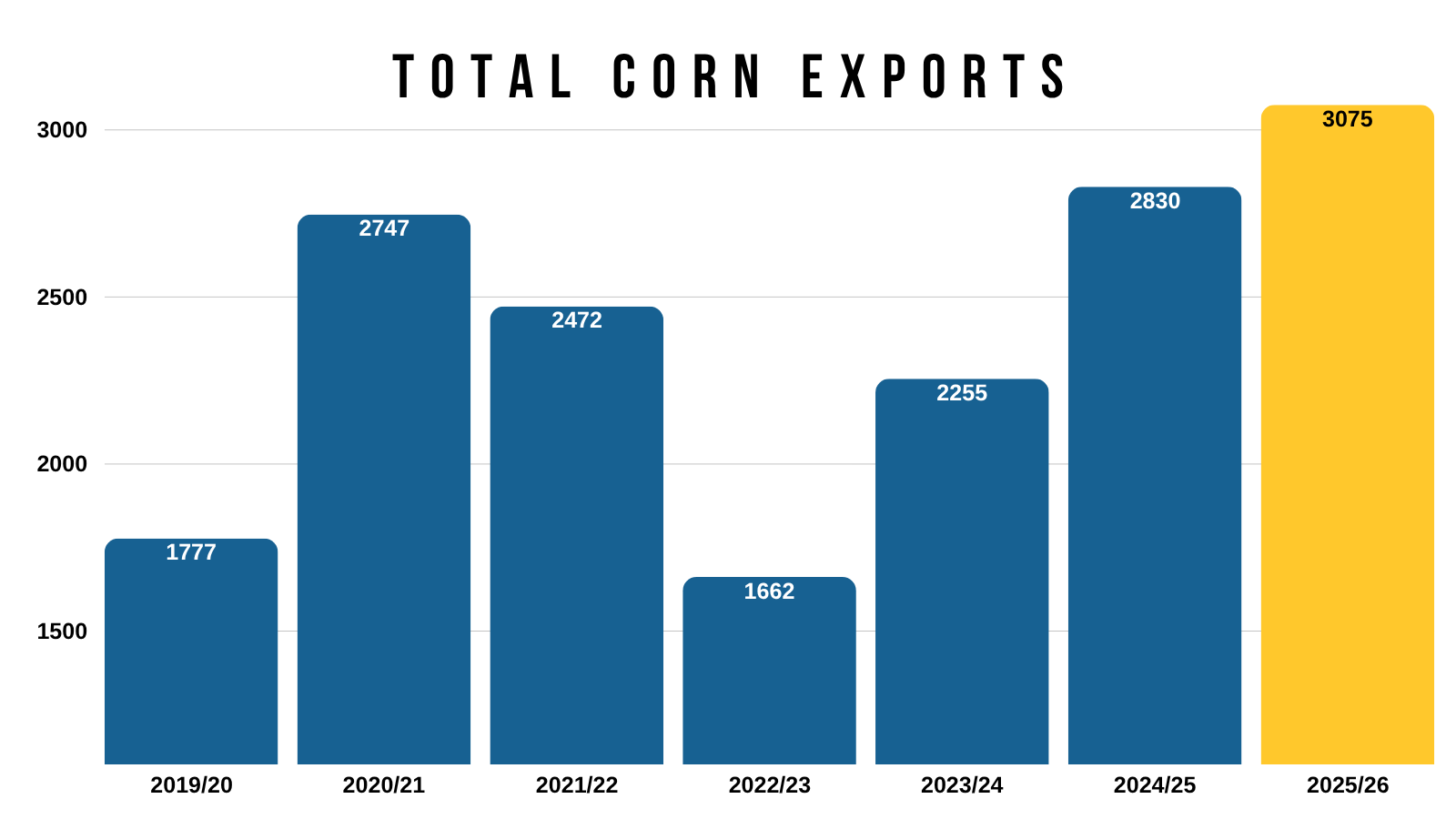

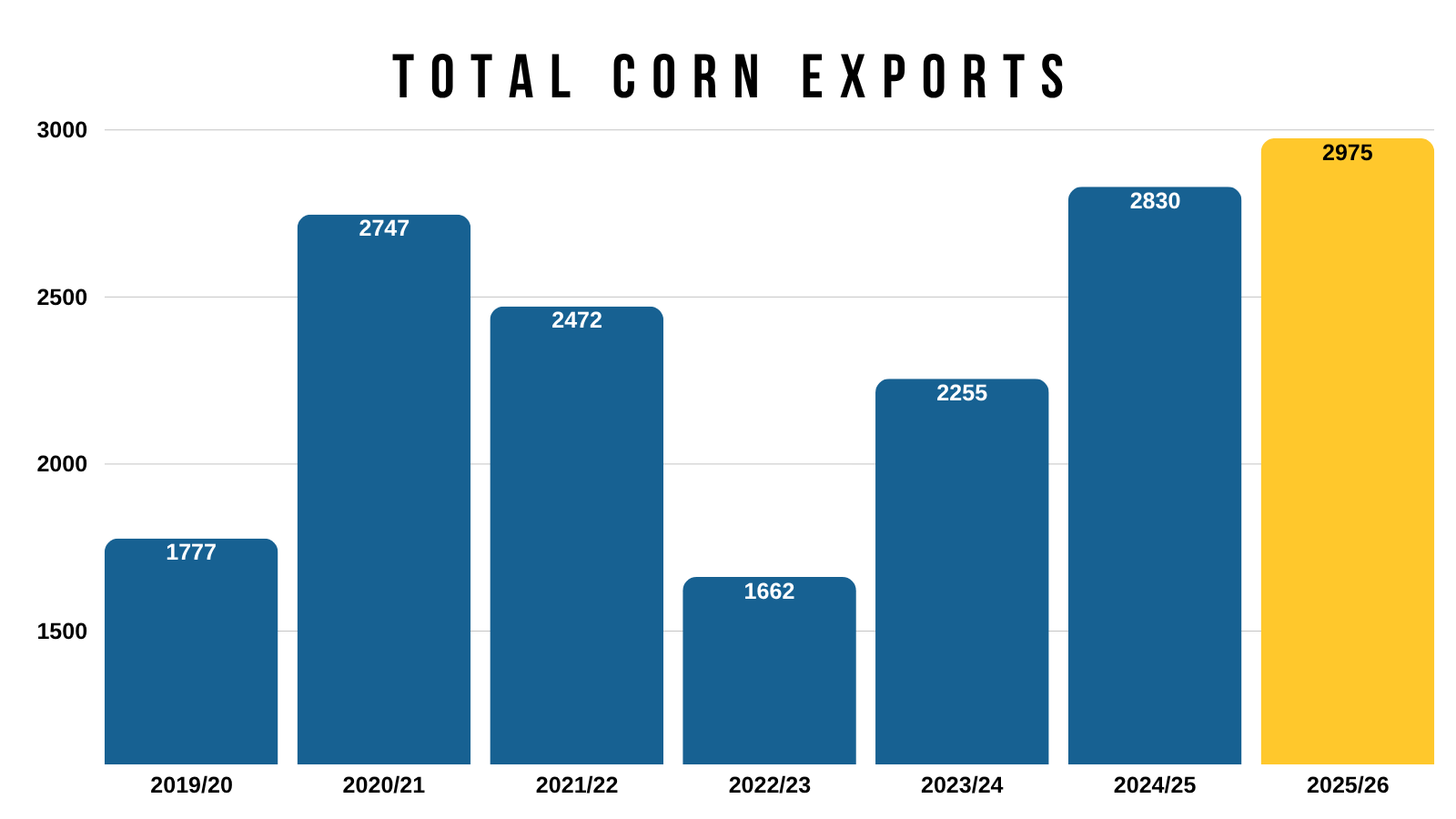

We have record demand keeping a floor under us.

We have record supply keeping a lid on us.

Demand is as great as it's ever been, but we definitely aren’t short on corn here.

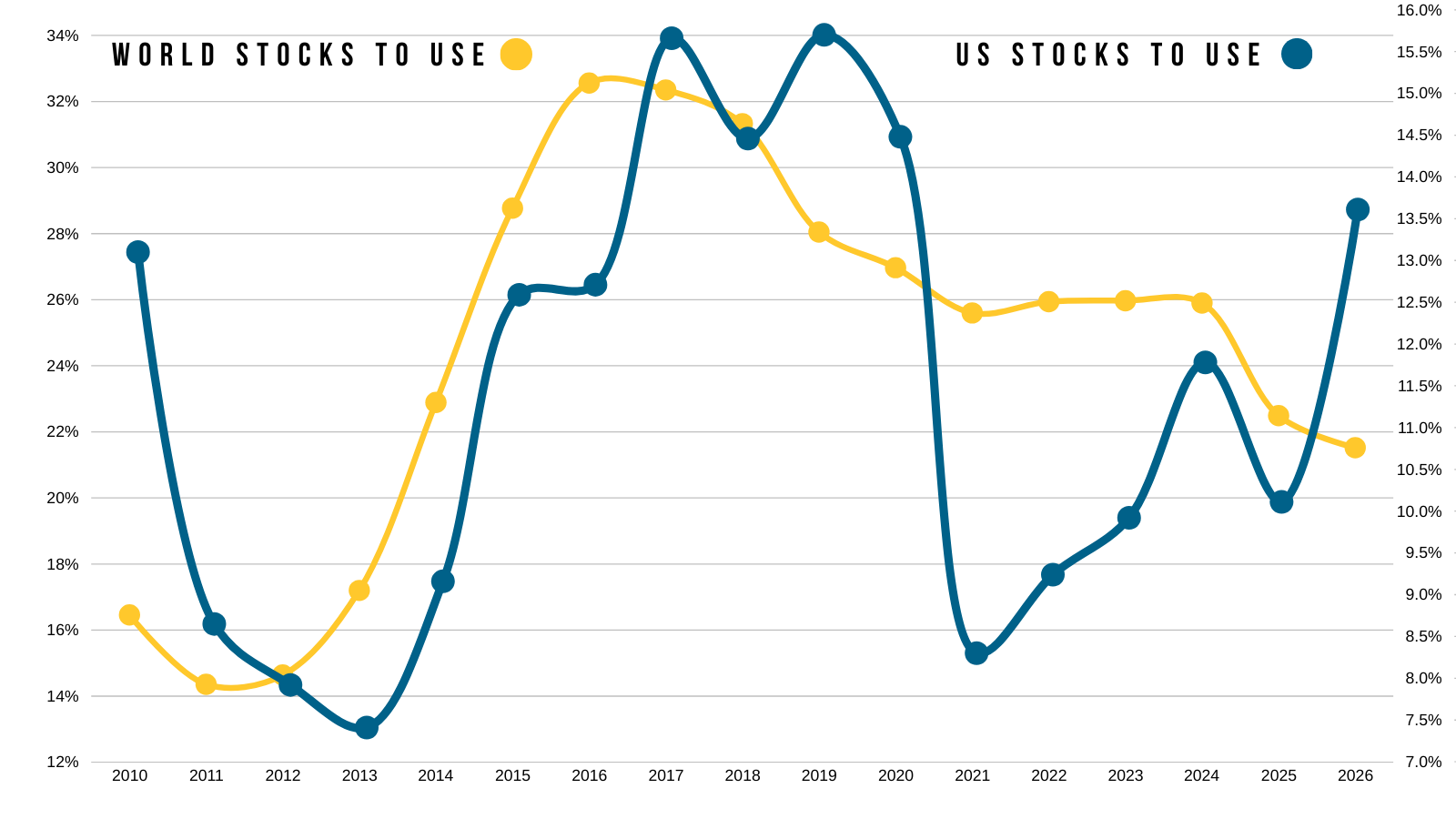

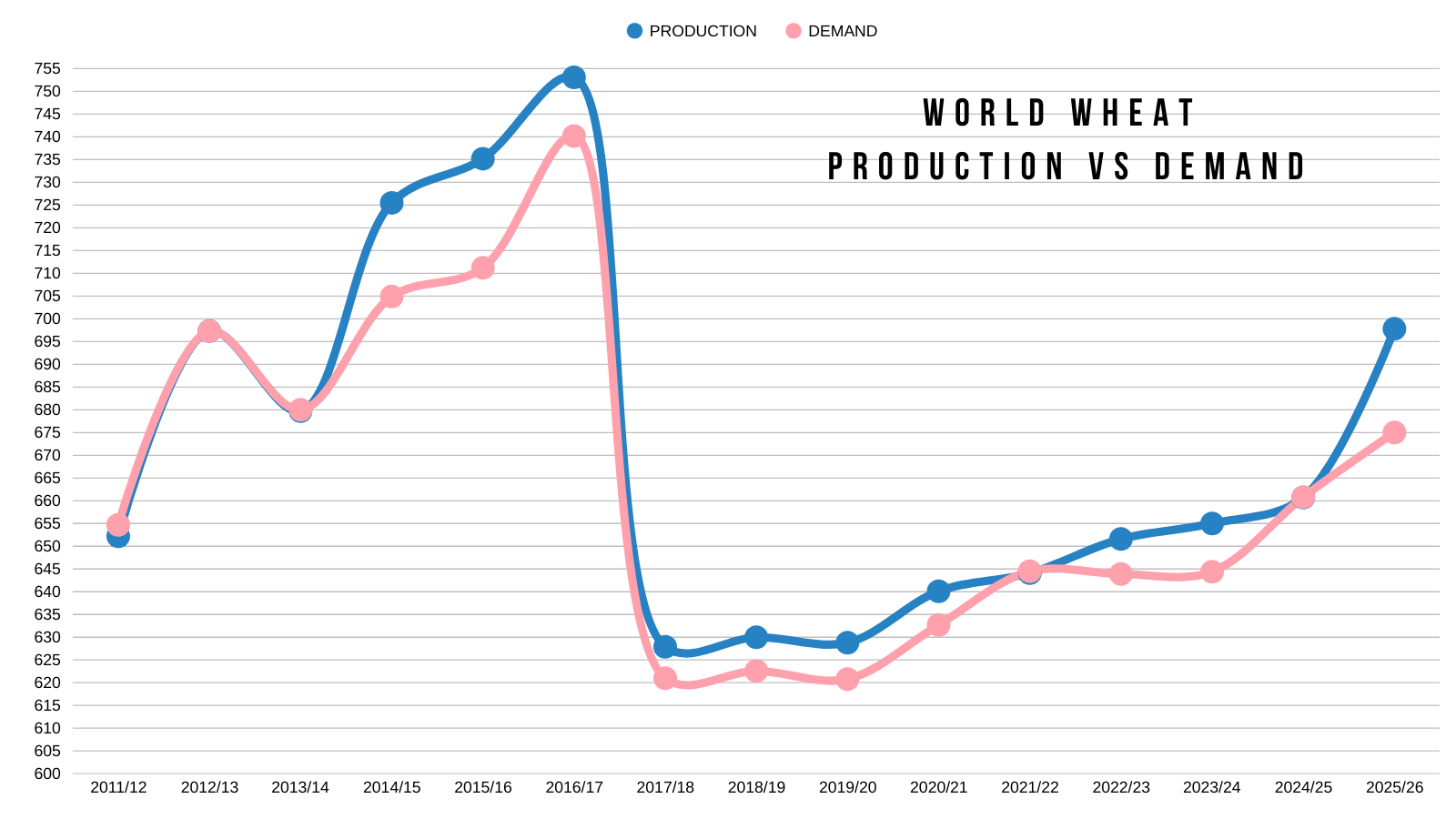

We have two completely different stories when it comes to the US vs the world for.

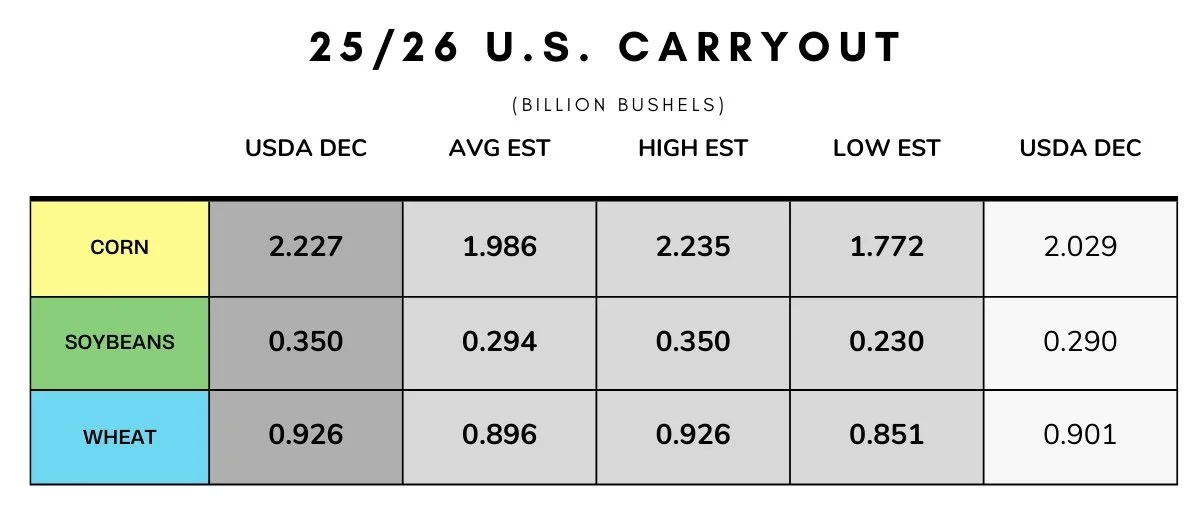

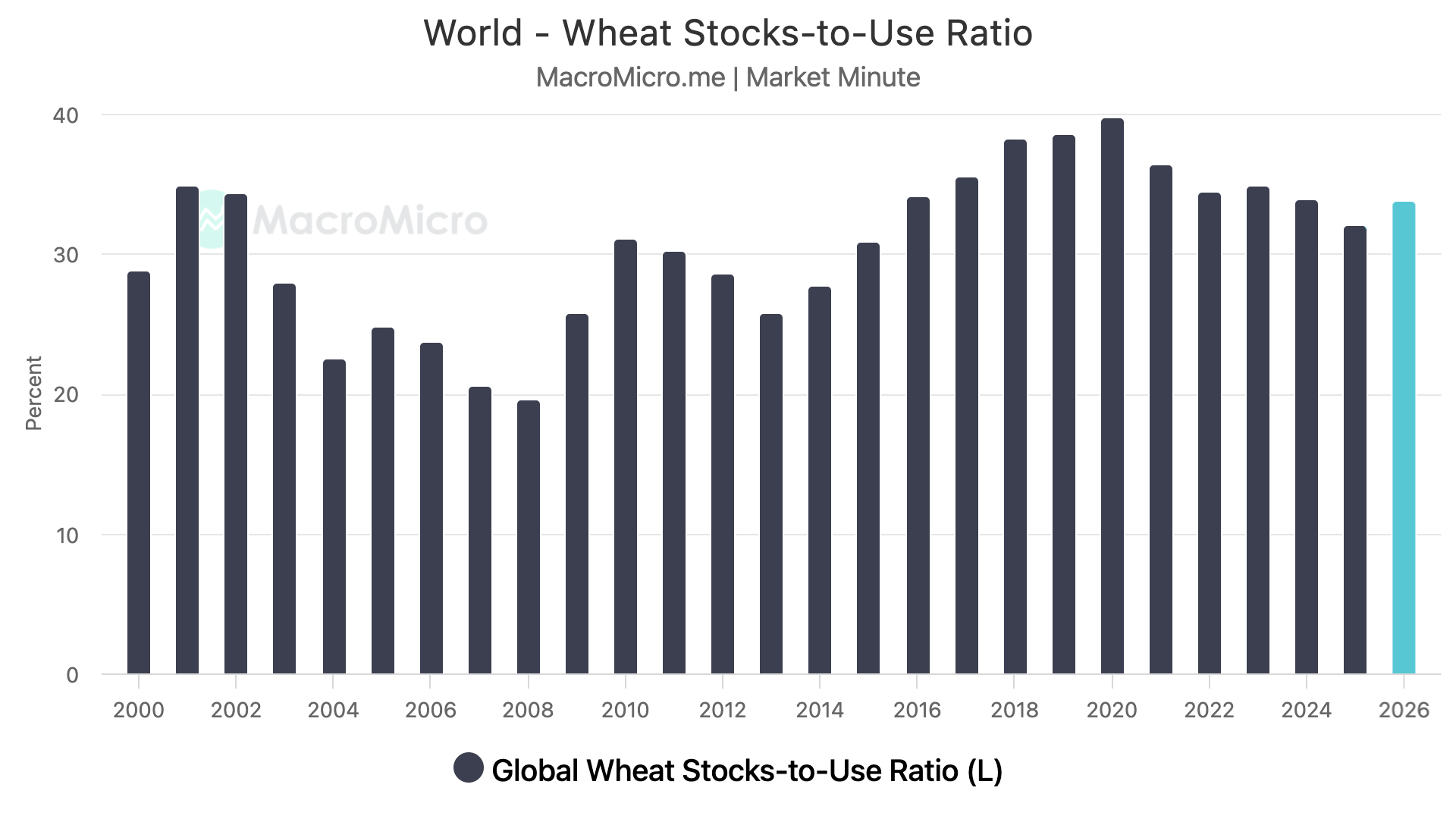

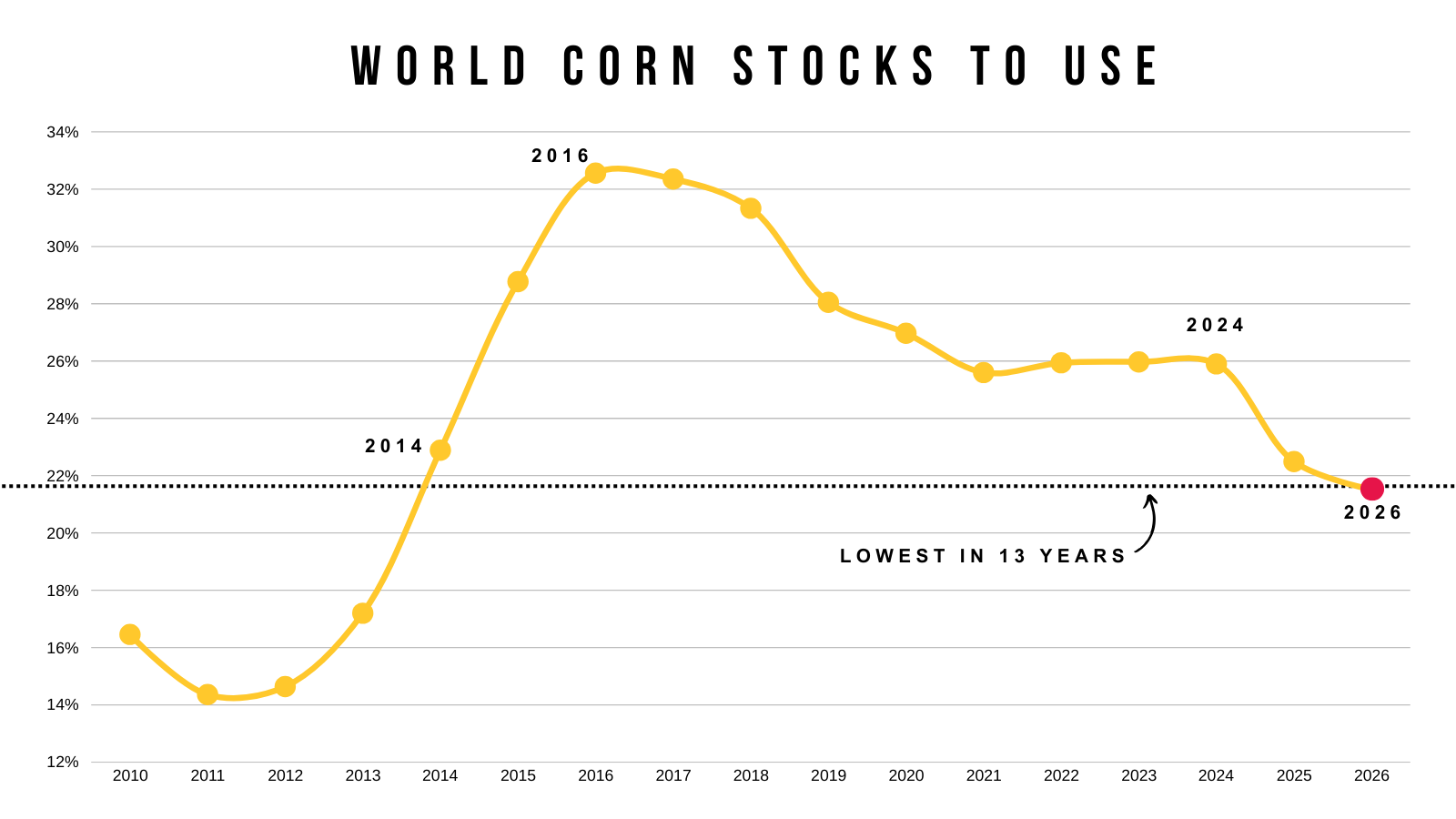

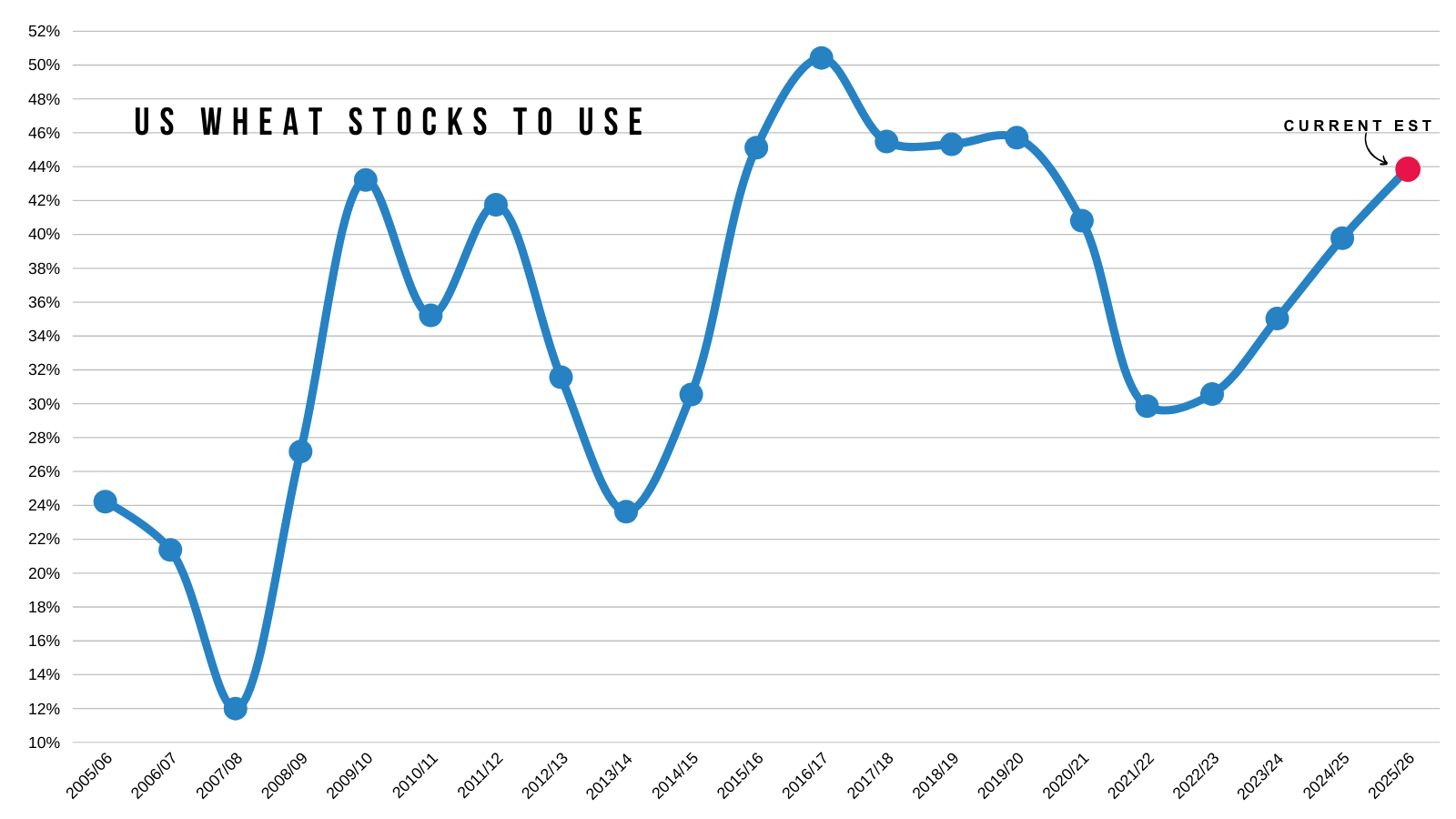

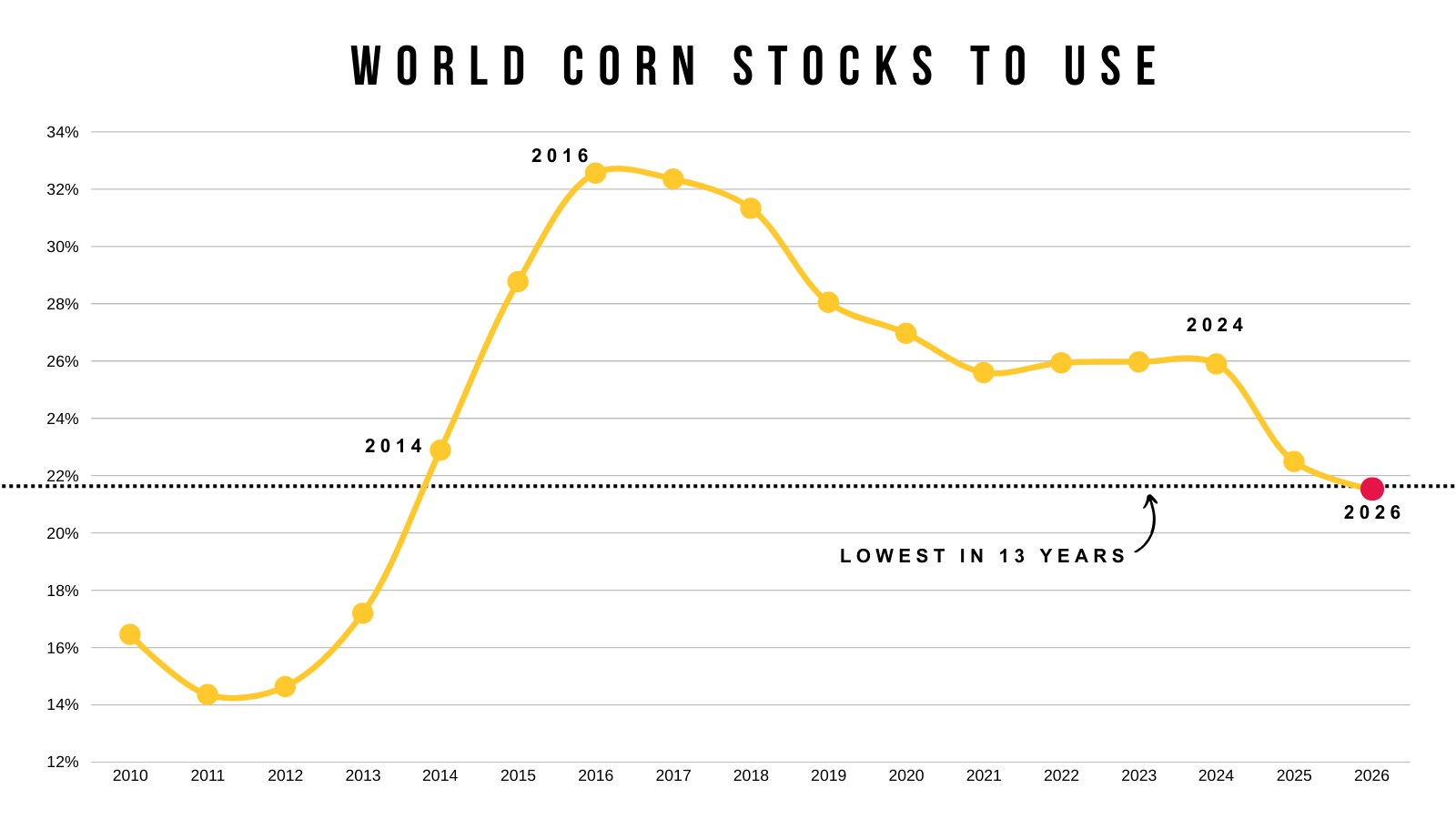

Here is the world stocks to use overlayed on top of the US stocks to use.

The world is the tightest in over a decade.

The US is far from being bullish.

We've talked about this several times before, but essentially, this just means the US has to perform. As the rest of the world couldn’t afford it.

One sub-par US crop would flip the corn story right around in a heart beat.

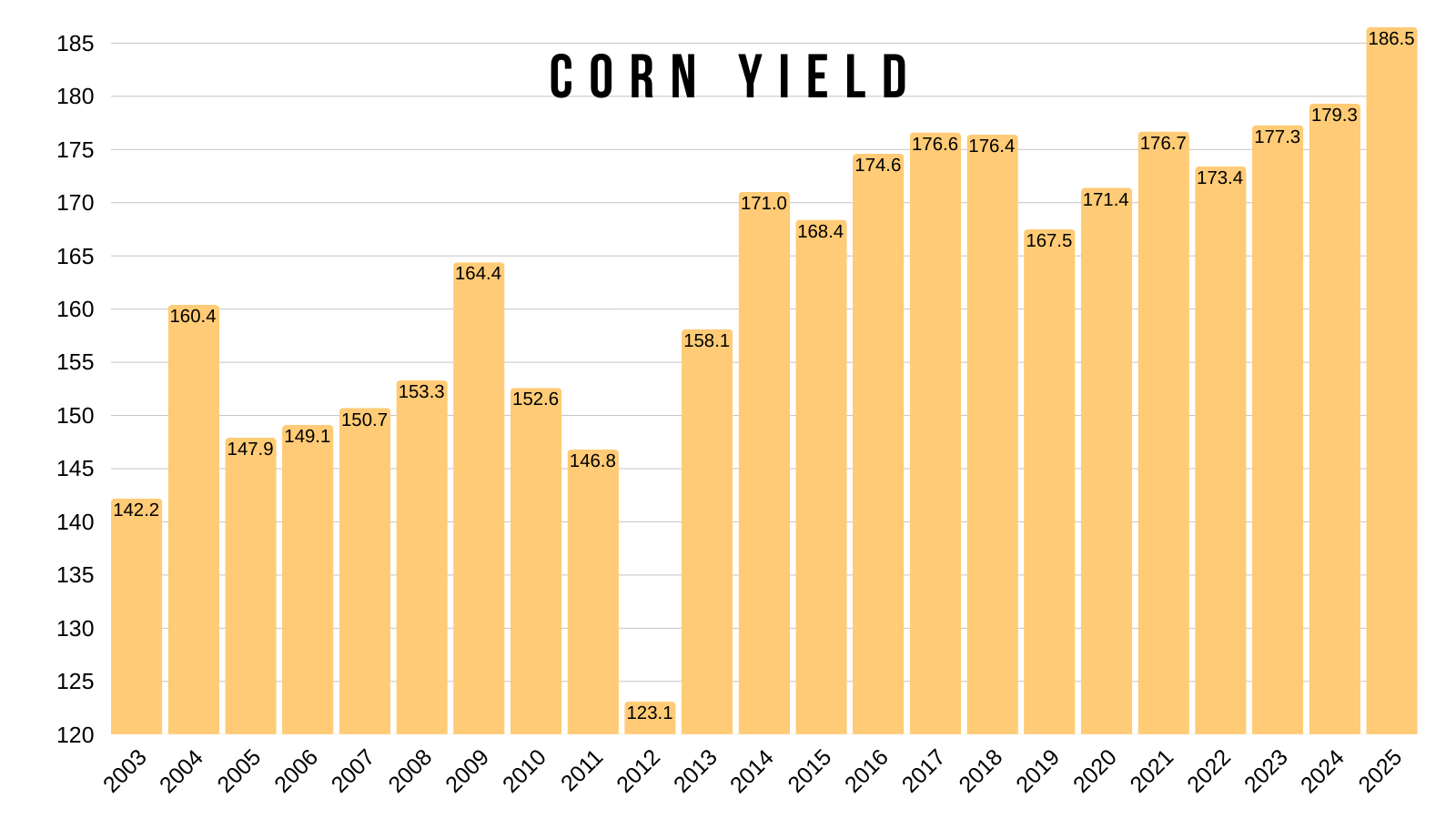

Yield has been a record for 3 straight years.

The first time we've seen a record yield 3 years in a row in around 50 years.

Can we go for 4 in a row or not?

The current situation is not overly friendly corn at all. But I don’t see a reason for us to collapse either.

It very well could take a weather scare to get a major opportunity.

Something we haven’t seen since 2023.

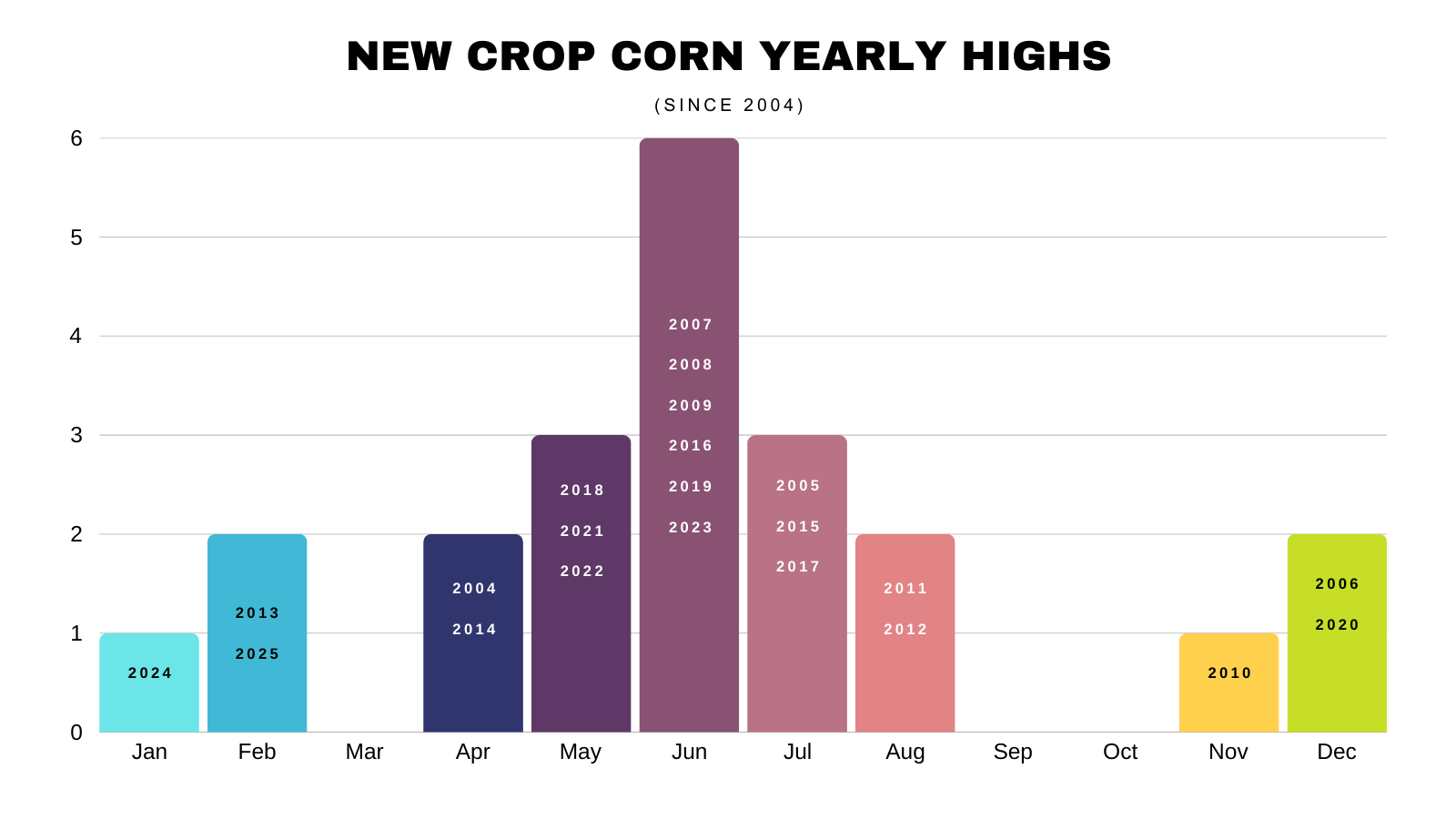

I've shown this chart in my last few updates. This is when corn has posted it's highs for the year since 2004.

We "almost" always get an opportunity in the spring or summer.

Which is typically off the back of a weather scare.

The last 2 years were in a realm of their own.

Sure, it could happen 3 years in a row. But up until 2024 we had only posted our highs for the year before April one single time.

That was in 2013 when we were already on a downfall coming off the record 2012 levels.

So history does favor an opportunity.

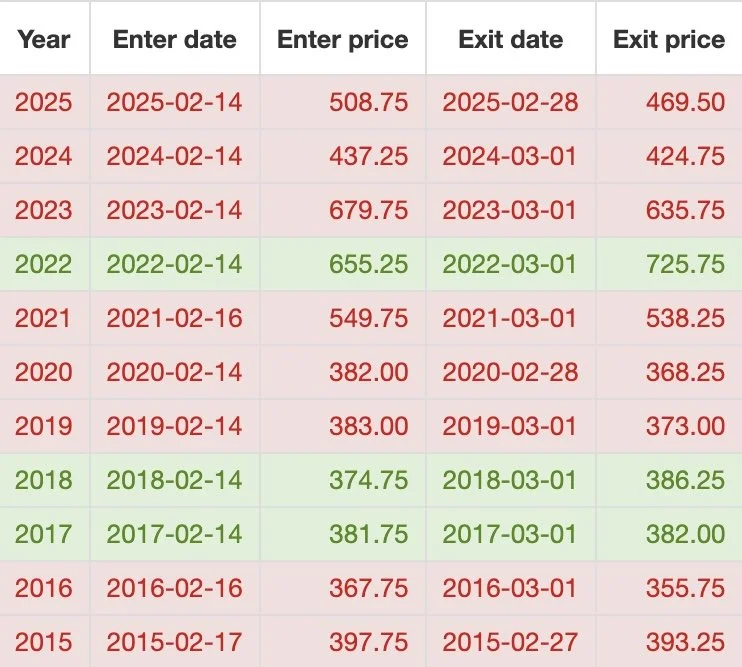

Short term, we still need to be cautious of first notice day.

We've traded lower the last two weeks of February 8 of the last 11 years heading into first notice day.

Overall it's hard to get super bullish on corn here unless we see a weather scare that threatens supply. For now our upside does feel limited.

The market is going to lack fresh data until we get into the acre talk and planting intentions.

We have that USDA report next week, but the only thing the USDA will play with is the demand side.

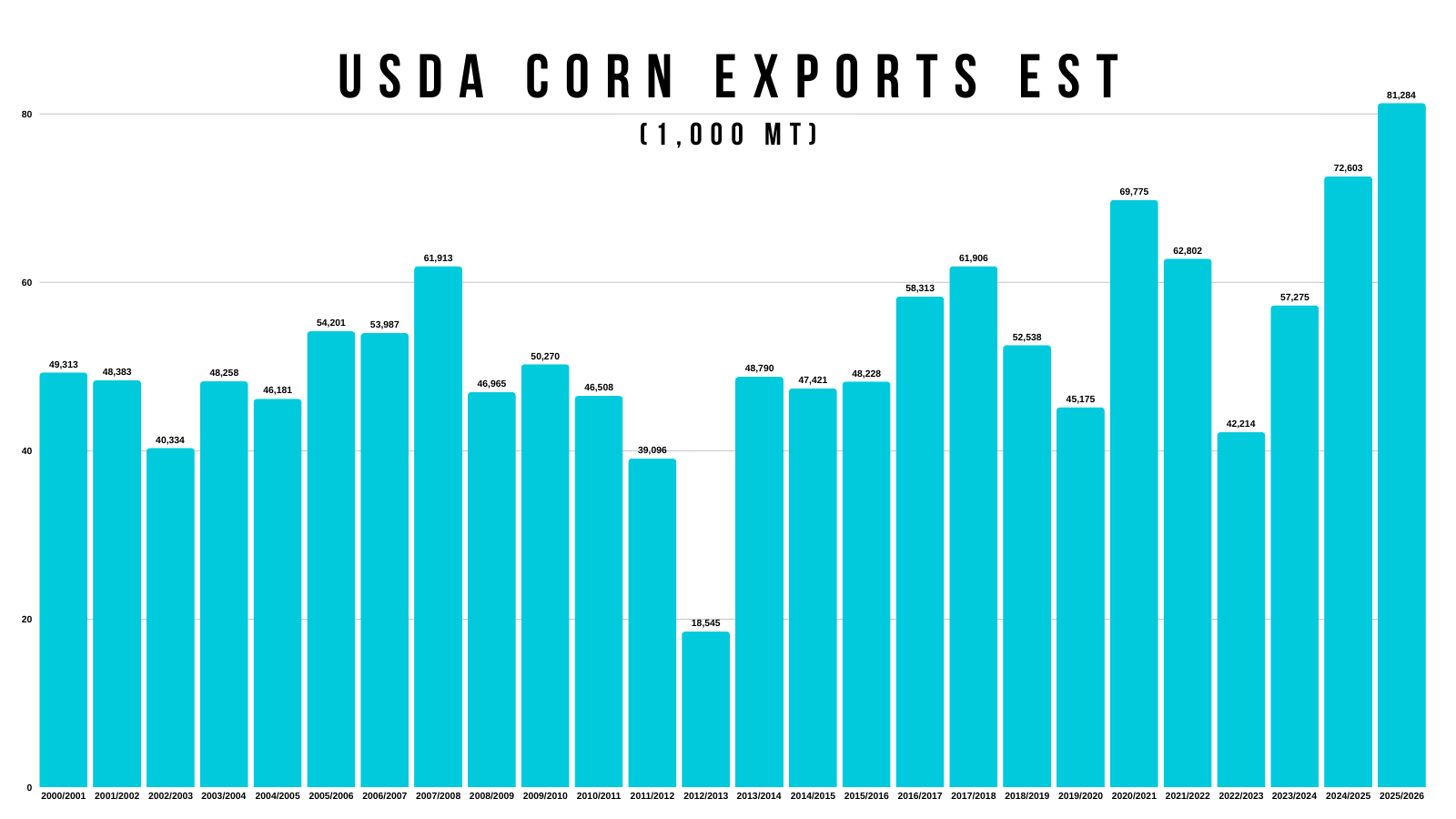

You could very well argue that they are too light on their export projections.

We've created a demand monster in corn.

What happens if the US underperforms?

If the USDA is right, the US will absolutely need another big crop to keep up with demand.

Something to keep in mind this growing season.

Technicals:

March Corn

I still want to reward a move towards $4.36 to $4.37

It's 50% of the November highs and old key support.

The fall rally failed at 50% of the February highs and key support from last spring.

Same set up. Smaller scale.

We are finding life right at the golden zone retracement of this entire bounce.

This is where the market decides if the bounce is over, or if it's time to continue higher.

Holding this level is key to keeping our bias remaining higher.

It's the most common spot for a correction to end, so bouncing here would make perfect sense.

Soybeans

Fundamentals:

We covered soybeans earlier, so let's just take a quick look at the March chart.

Technicals:

March Beans

Monday we bounced right after giving back 61.8% of this entire rally.

The exact level we needed to hold.

Today we then rallied and clawed back into the golden zone retracement of the entire sell off from November.

A very common level for a bounce to fail. Hence why we issued the sell alert this morning.

We closed -22 cents off the highs today. So not the best looking candle here short term.

Tomorrow's price action will be interesting and give us some further confirmation if the rally is over for now or not.

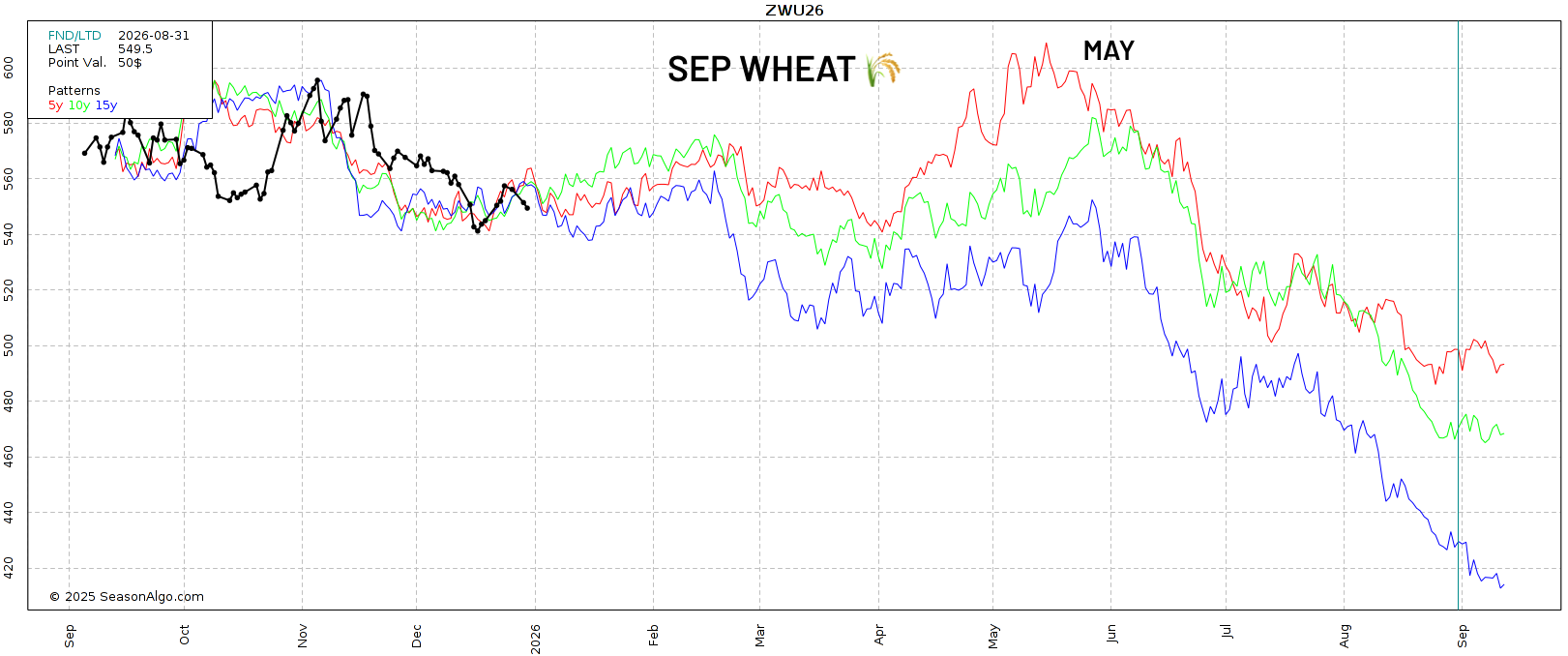

Wheat

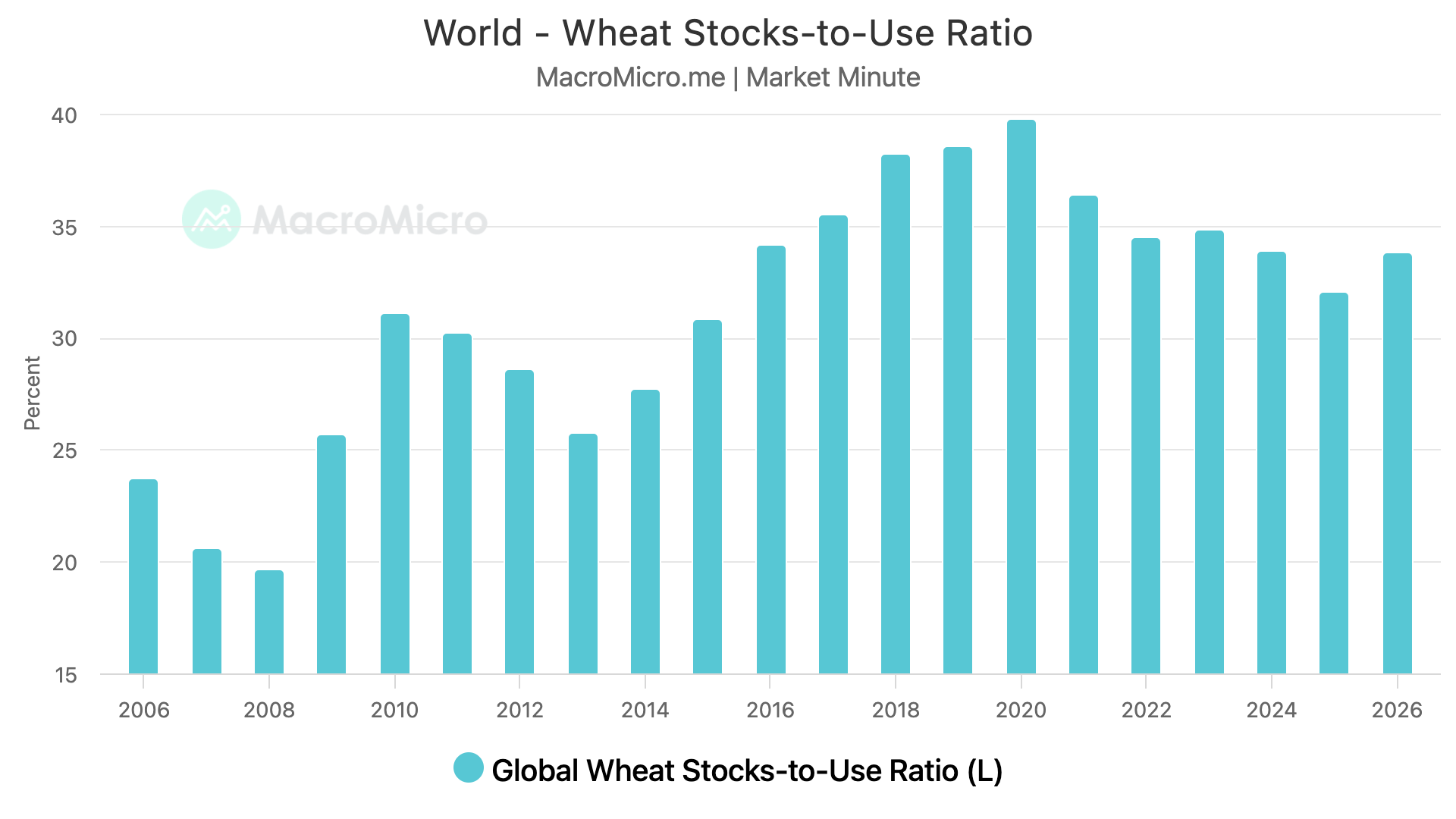

Fundamentals:

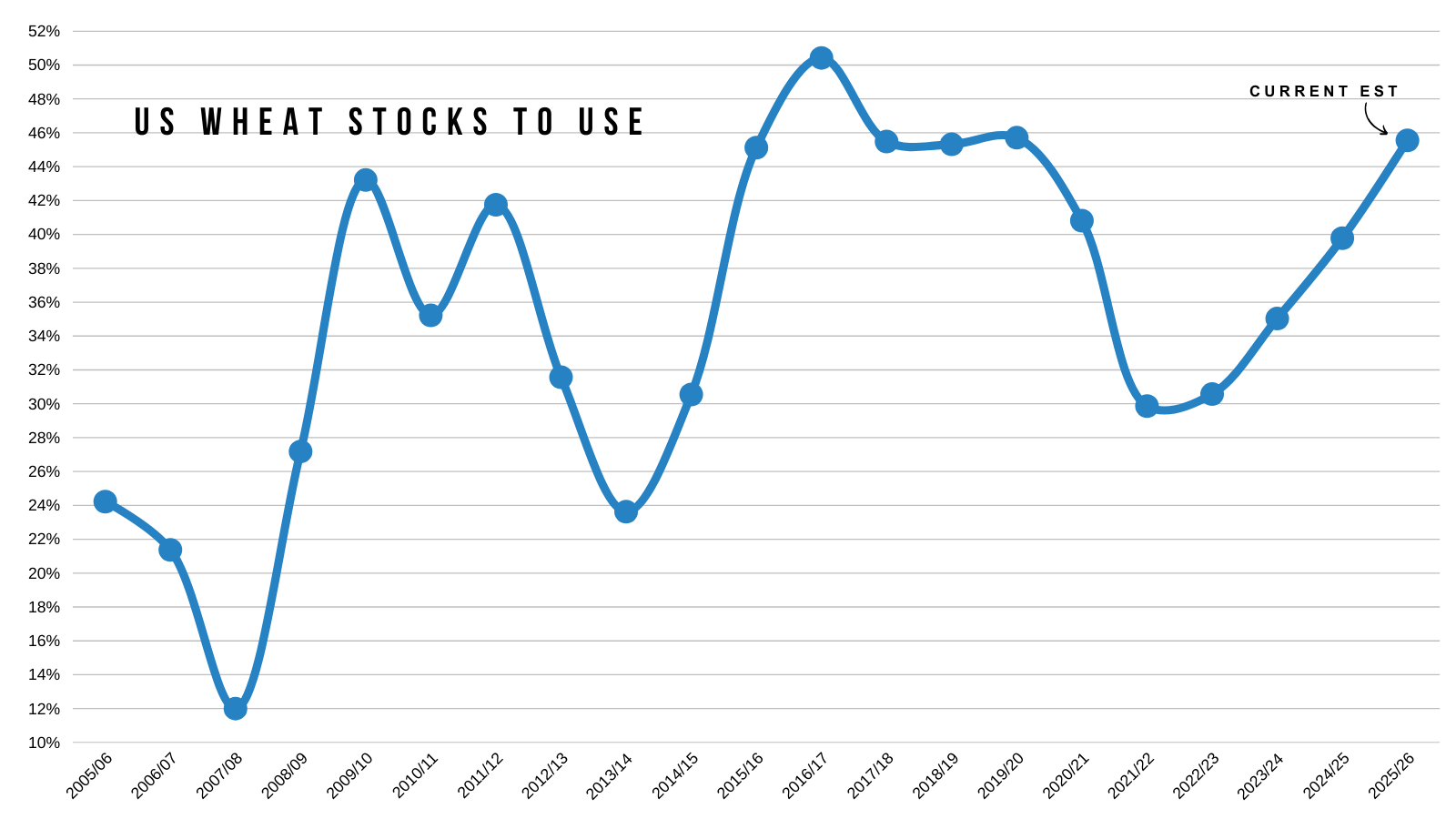

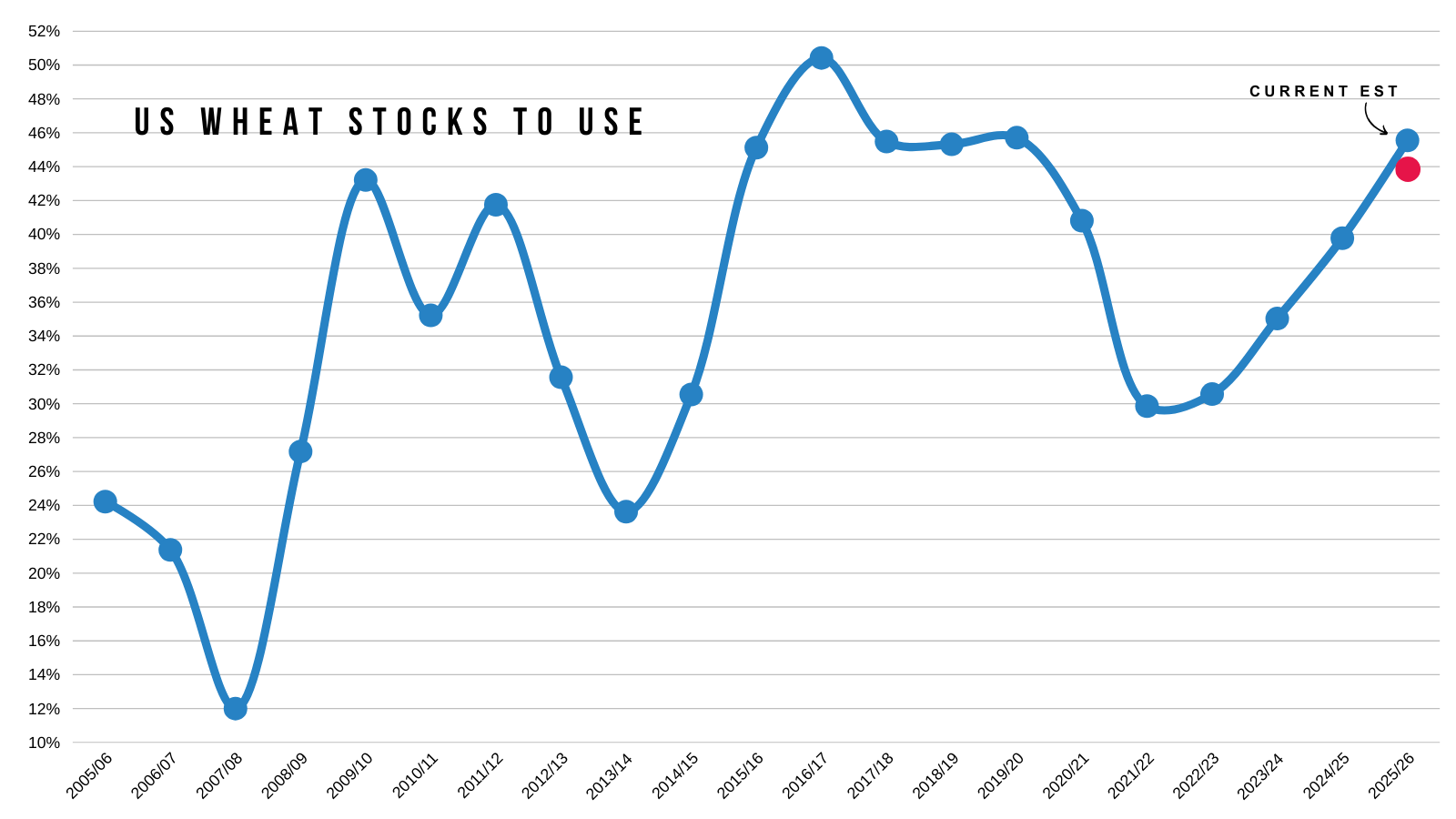

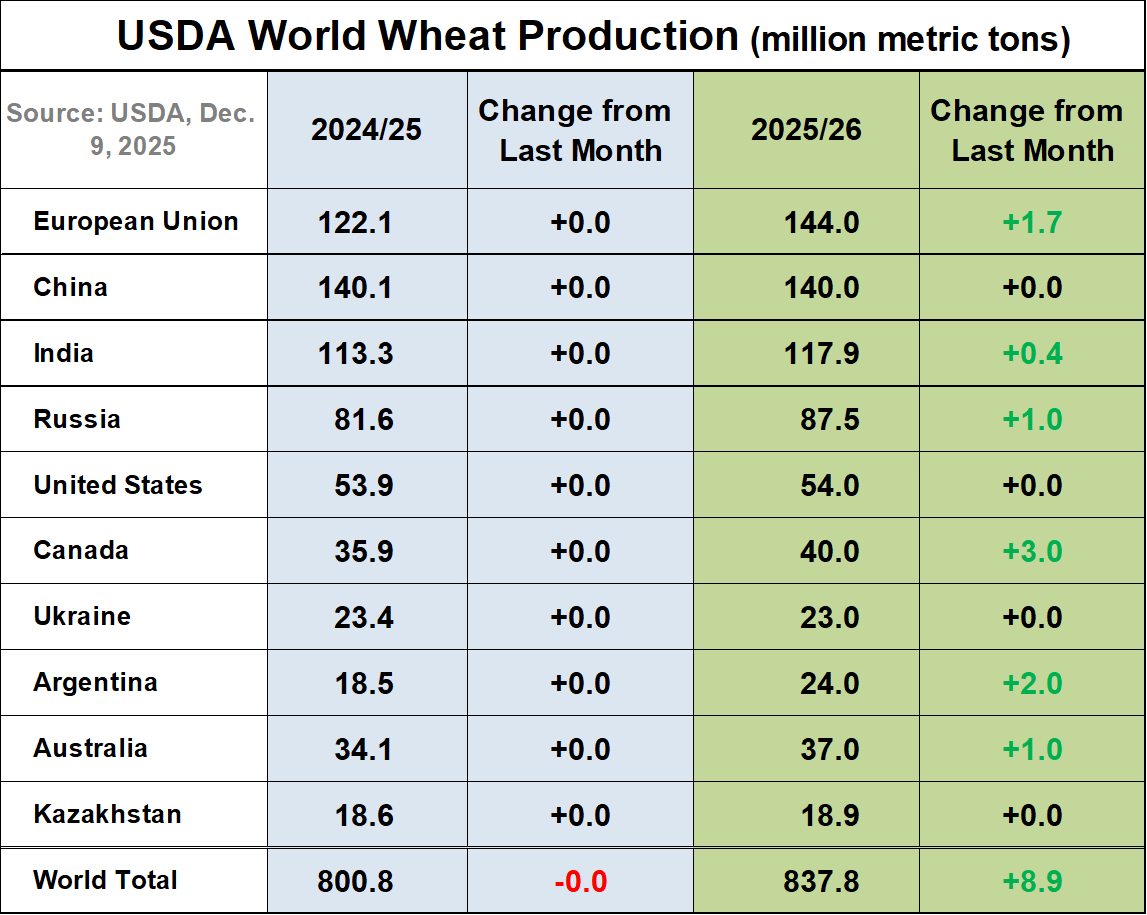

The US wheat situation is far from bullish.

The world situation is on the rise for the first time in a few years as well.

But that does not mean the wheat market cannot provide an opportunity.

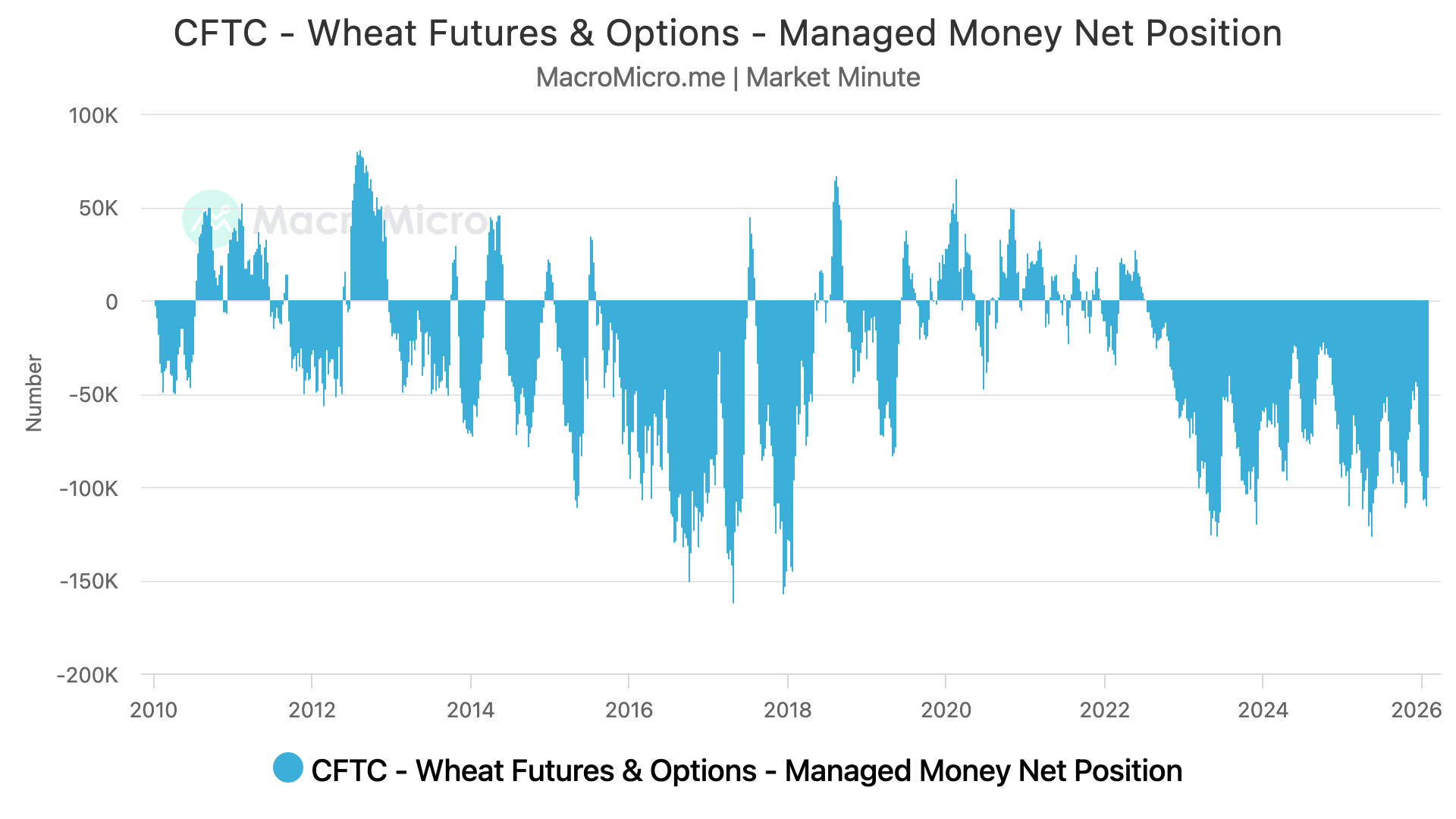

The funds are still incredibly short like usual. They haven’t been long since 2022.

Since the US and world stories are not super friendly, the wheat market will need to see some sort of supply scare somewhere in the world.

Which we have been seeing a little bit of with the US and Ukraine both experiencing brutal cold snaps recently.

We now have Russia getting awfully cold as well.

But it doesn’t appear like we've seen anything material that is going to result in a massive rally just yet.

For the wheat market to continue higher, it will likely take a supply scare.

The thing about supply scare rallies is that they don’t typically last very long. However, they can run far in a short amount of time.

Technicals:

March KC

Sitting right at the 61.8% retracement of the last bounce.

Must hold spot here short term to keep the immeditate bias remaining higher.

If we are going to bounce, it needs to be here.

Otherwise, we likely fall back into the old range.

March Chicago

The recent rally failed at the 61.8% retracement up to the Nov highs.

Break above that level and it should result in further upside.

To the downside, like KC, we are at a critical spot. The golden zone retracement levels.

Need to bounce here to prevent us from going back to the old range.

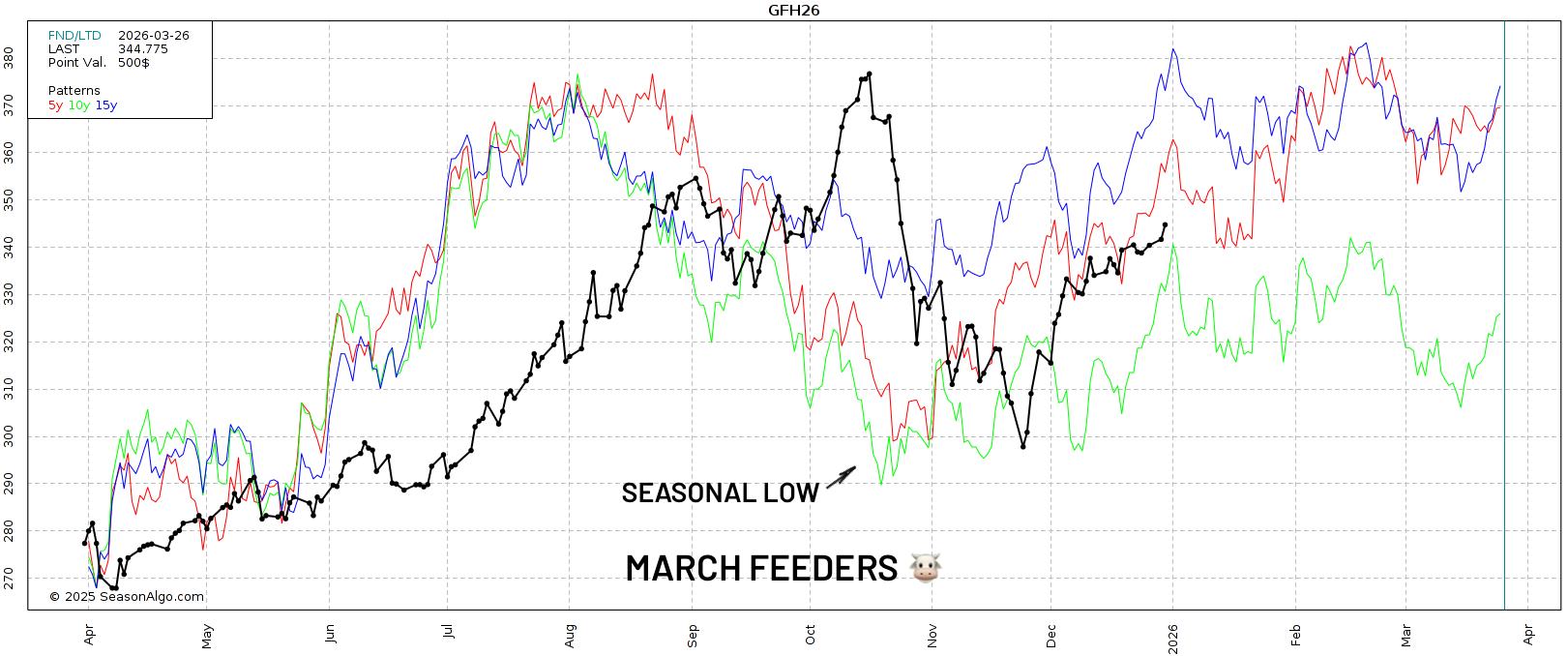

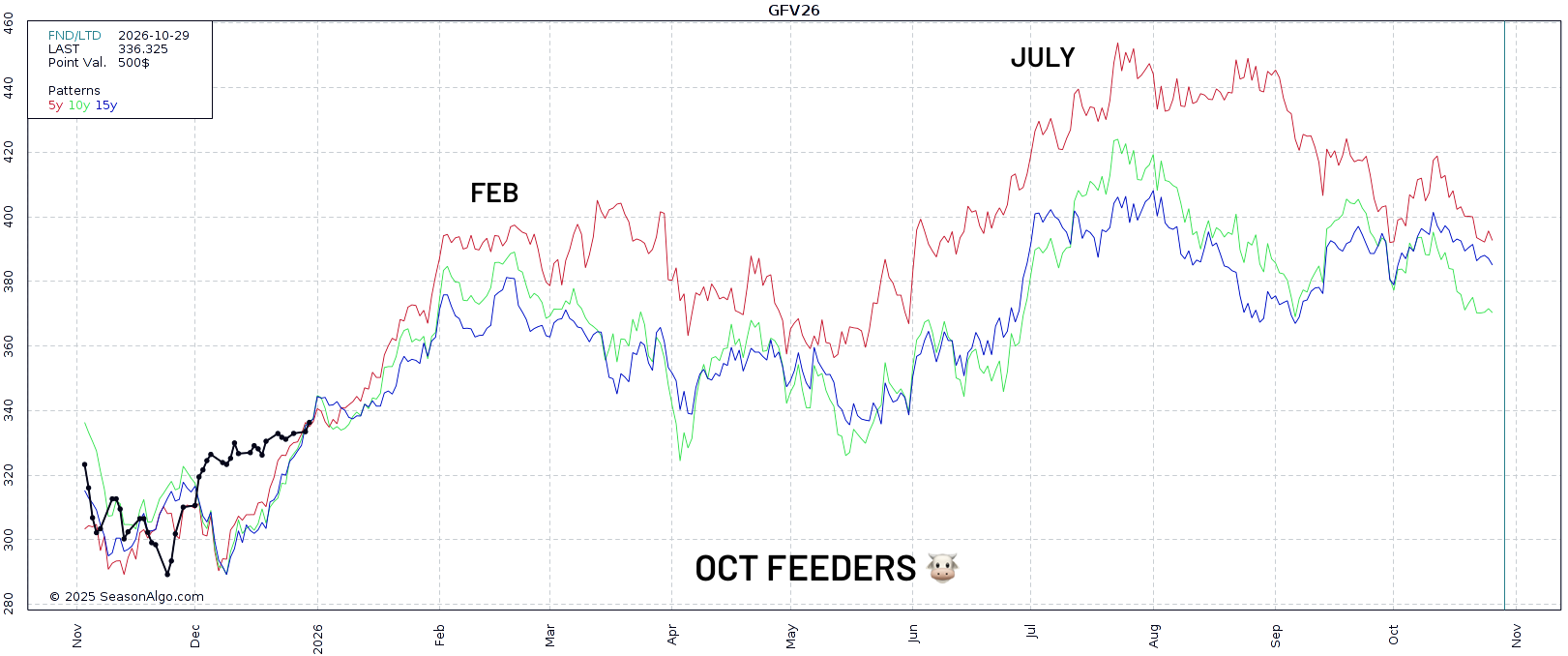

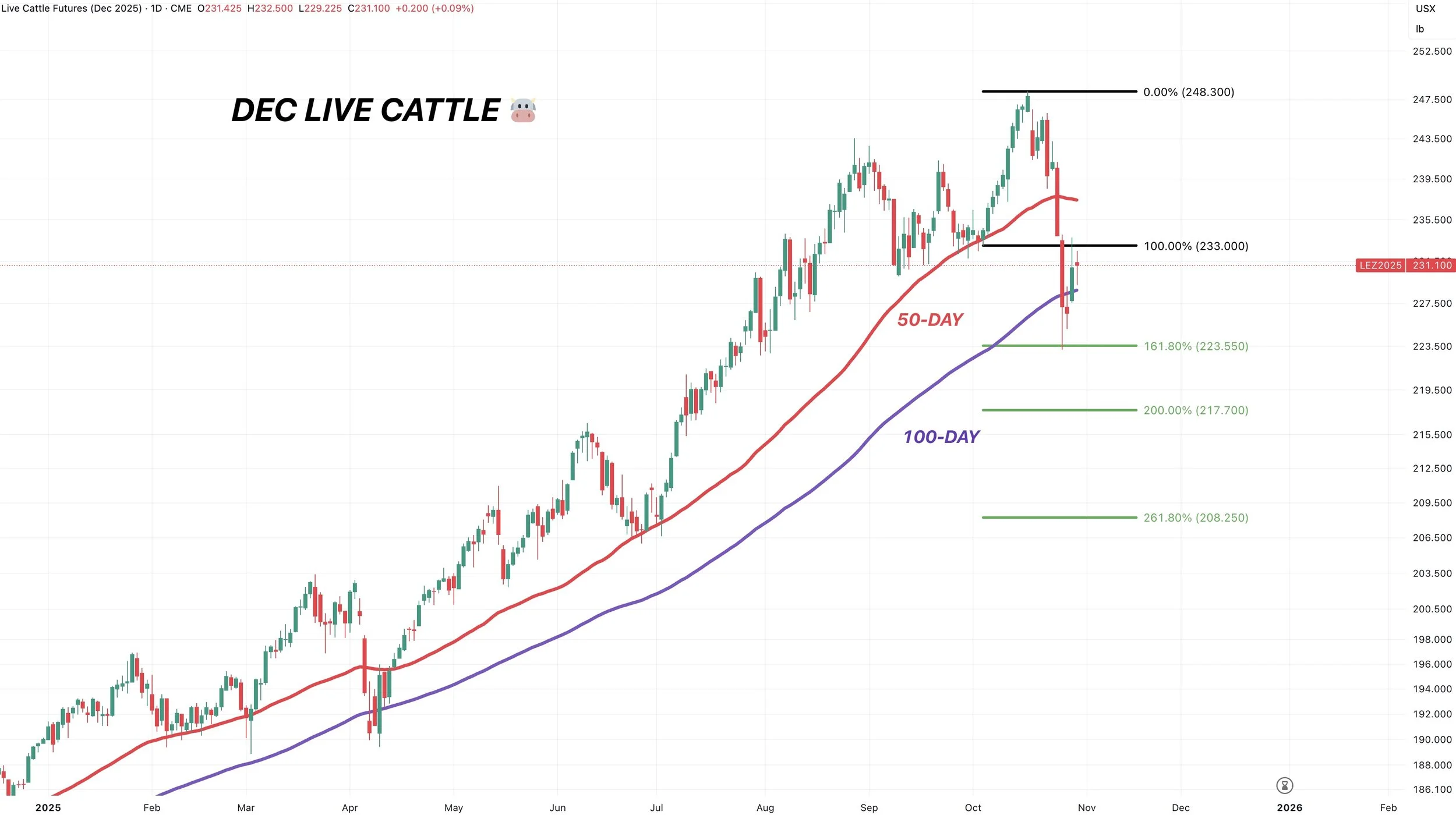

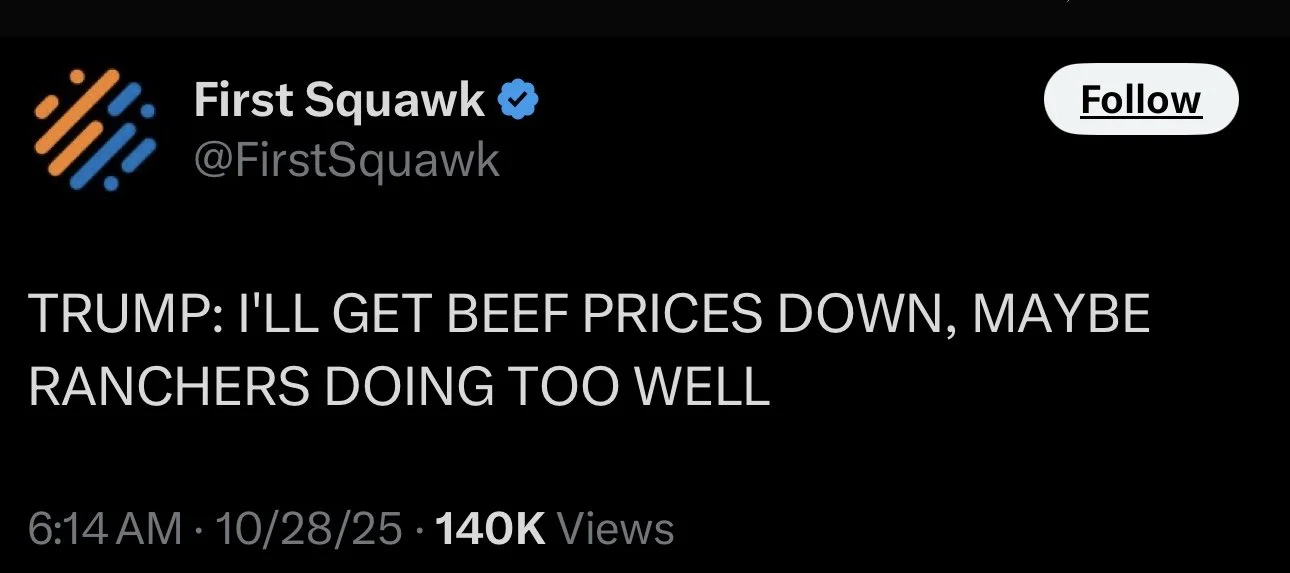

Cattle

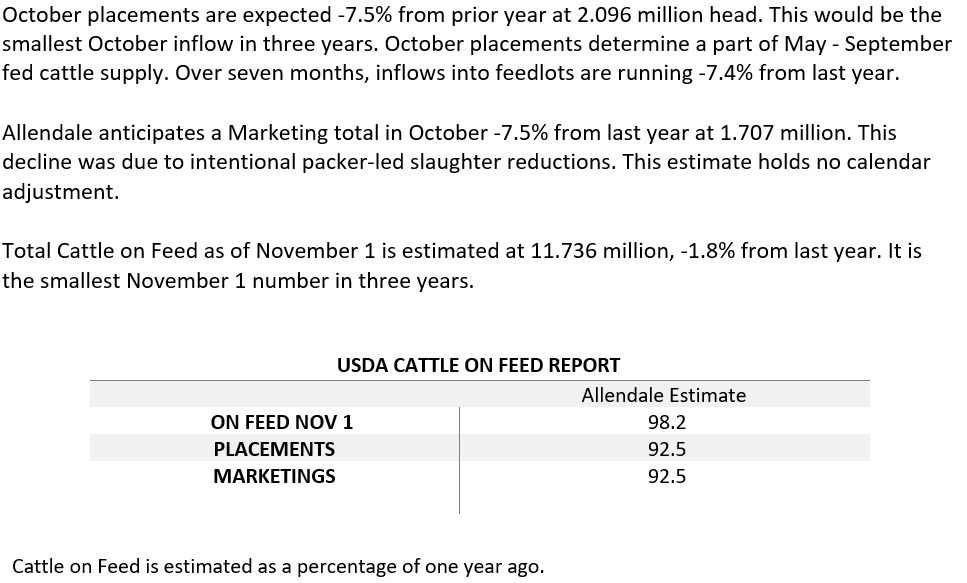

Fundamentals:

Not a lot on cattle today.

The market clearly found Friday's report to be bullish and reaffirmed the fundamental situation is as tight as ever. The tight situation isn’t something that can be fixed overnight.

This market could easily challenge the highs, but it might take some additional news for this market to go and post some crazy new highs.

There is still definitely headline risk in this market, which can happen at any time.

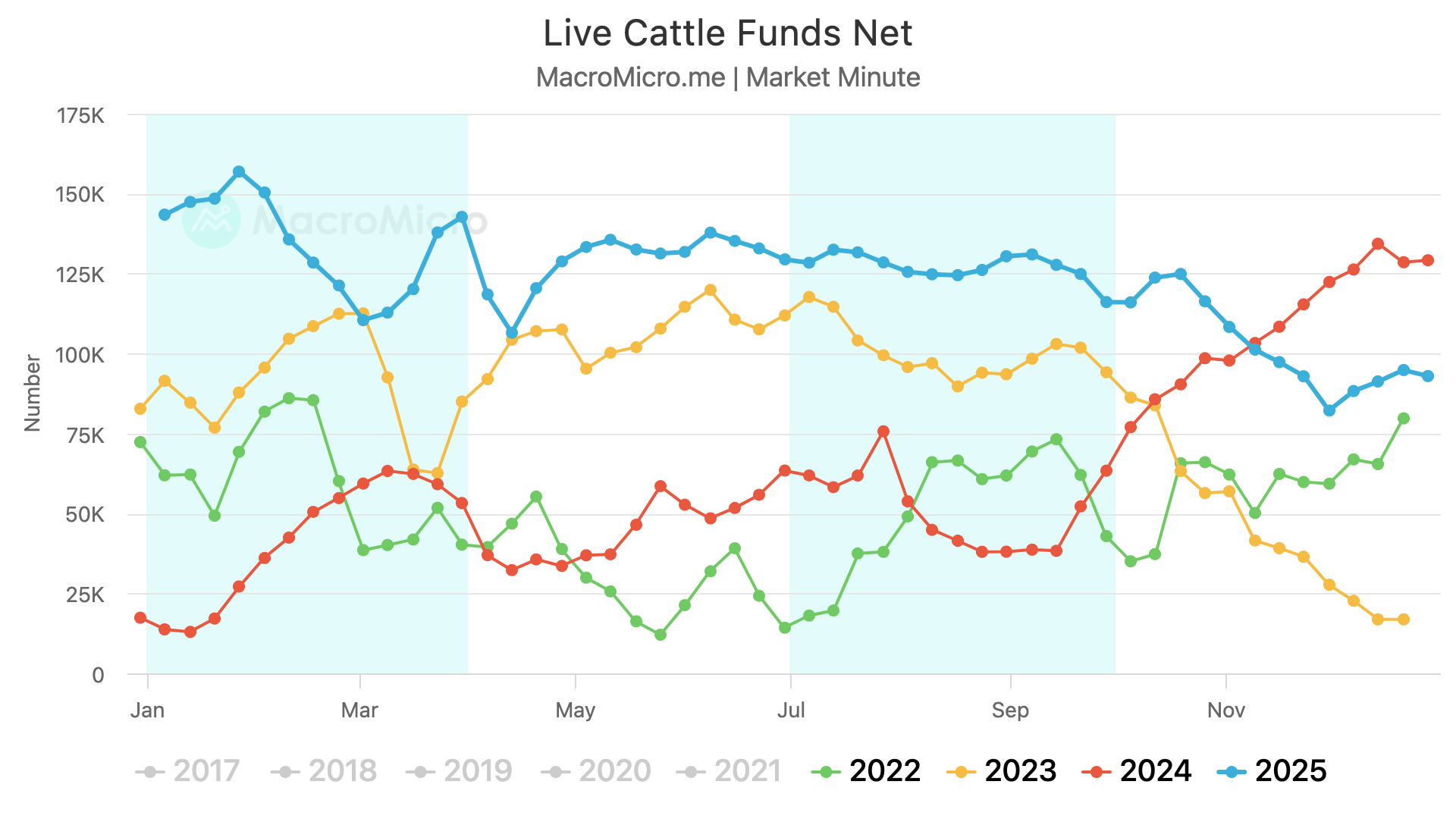

If you're the funds, you took a pretty big hit back in October because of one Trump tweet. What would make you want to again get overly long in this market?

The biggest headline risk has to be screwworm.

If screwworm enters the US, I am sure the algos will take the headline and run.

Despite cattle still having potential given the tight fundamentals, it still just makes sense to defend these levels given all of the headline risk.

Technicals:

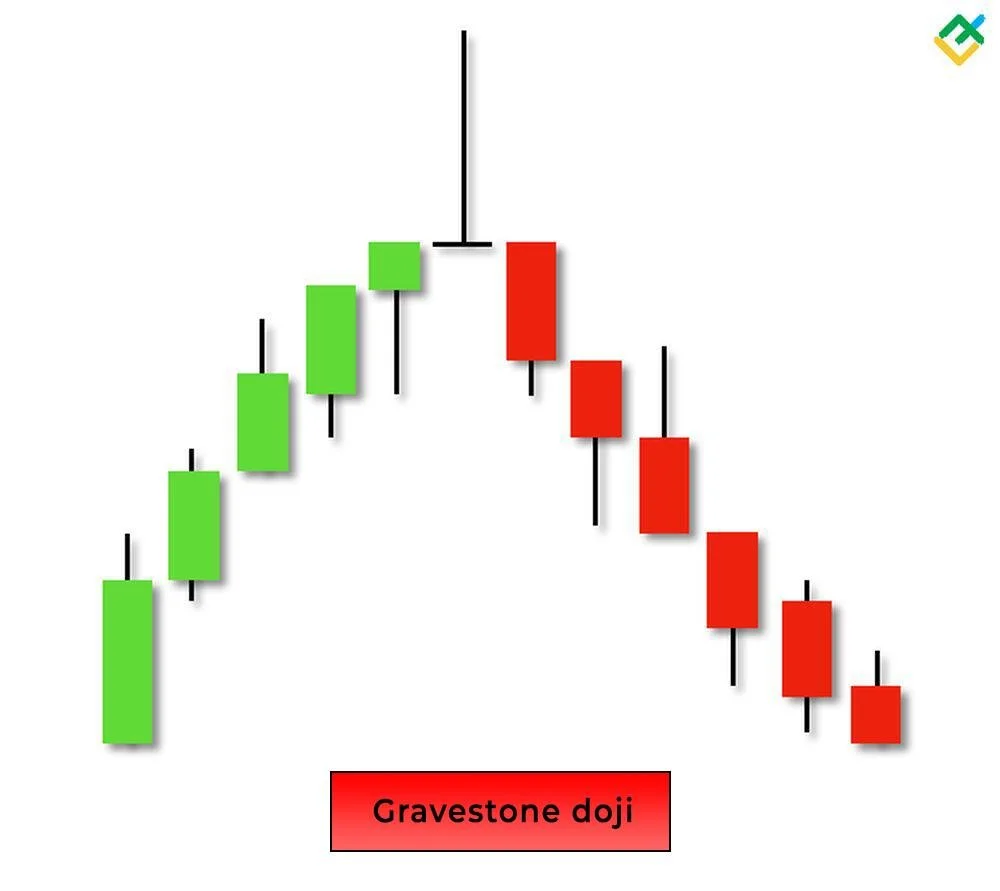

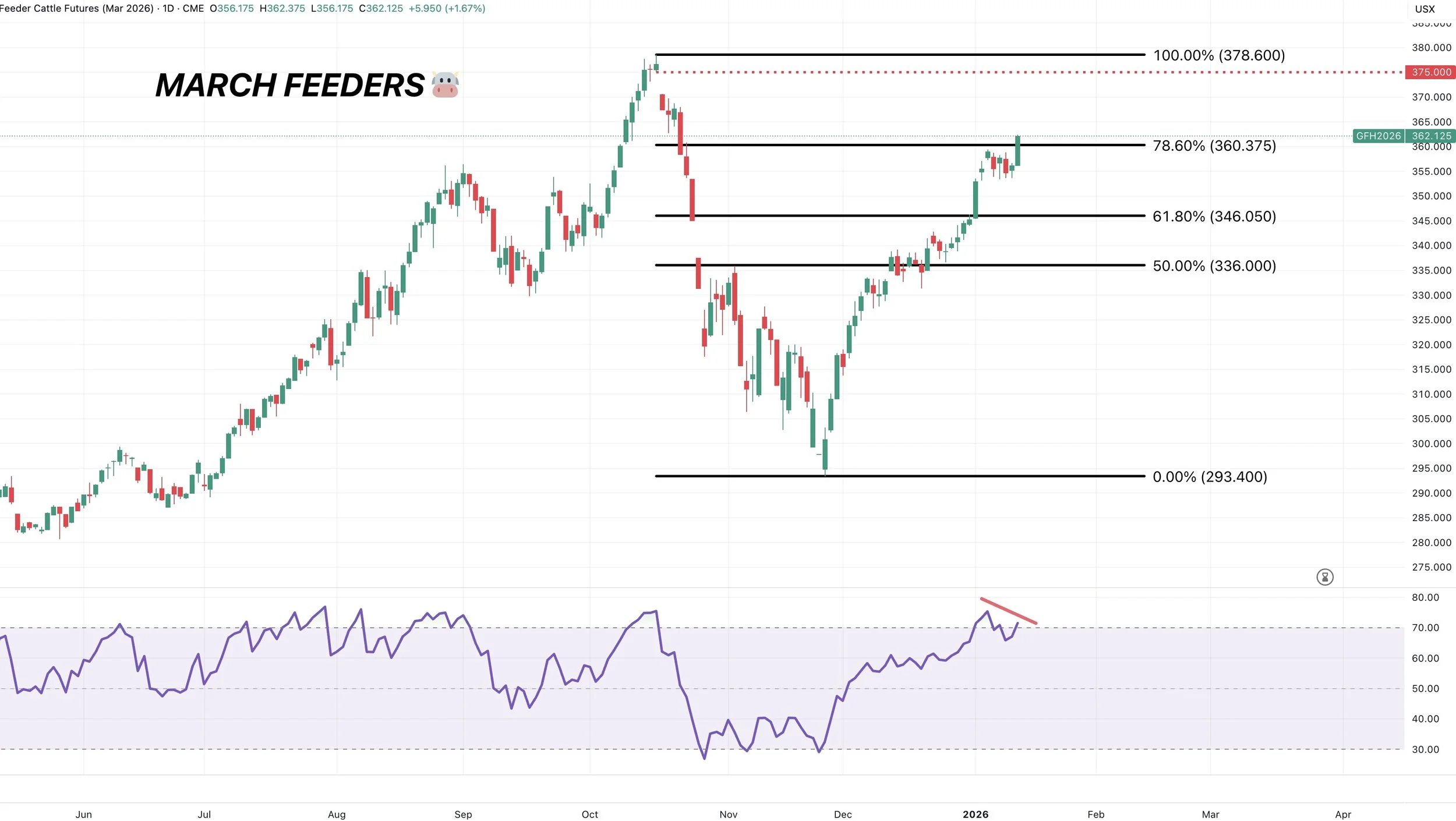

April Live

We left a gravestone doji candle today.

That can often can be considered a potential reversal candle.

Still showing some bearish RSI divergence.

March Feeders

Nearly filled the gap.

Also still showing very clear bearish divergence on the RSI.

Which is typically a sign upside momentum is starting to get weaker.

Past Sell or Protection Signals

Feb 4th: 🌱

Soybean sell signal & hedge alert.

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

NEXT MARKET MOVER FOR GRAINS?

AUDIO COMMENTARY

Trump cancels EU tariffs

Want to protect cattle

Risk of screwworm in U.S.

Biggest supply ever & best demand ever for the corn market

One weather scare away from story in corn

No fundamental story saying corn has to go a lot higher today

If you’re going to have to market corn soon

We won’t see any major data until planting intentions

China bought the amount of soybeans what agreed to buy. Are they done?

Soybean oil rally leading beans

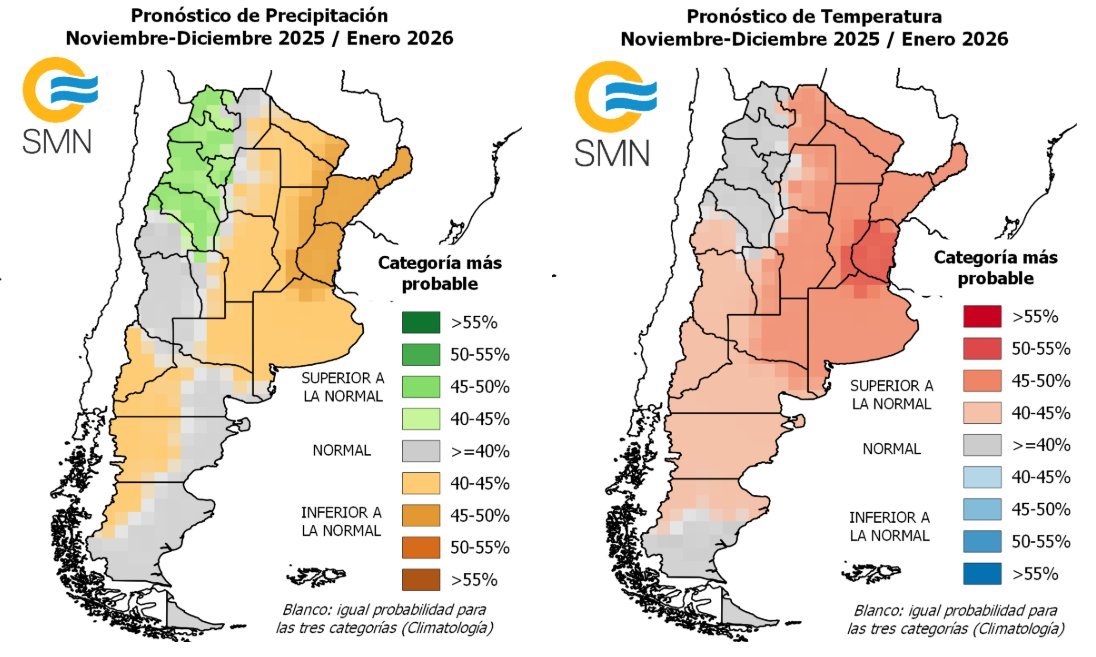

Slight weather story in Argy?

There isn’t much fundamentally screaming that we have to go higher

Don’t supply the market until it pays you

Cold weather story in wheat?

Usually no material damage in winter kill

Often buy rumor sell fact on winter kill

Staying patient for now for most

Stories not as friendly as they could’ve been

Only selling new crop if you lock in profit

Listen to today’s audio below

Want to talk? (605)250-3863

Your free trial has ended.

Want to keep full access to our daily updates & signals?

CORN CHART

March Corn 🌽

Plan is still the same for corn.

Still looking to reward a move towards $4.33 to $4.36 if it comes.

It’s the golden zone retracement of the entire USDA sell off.

It’s also our old support from the last several months.

The rally ended after hitting the golden zone retracement up to the Feb highs. That same level was key support from spring. Hence why it was our first target to take risk off the table this fall.

We’ll go over the rest of the markets tomorrow.

Past Sell or Protection Signals

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

DEEP DIVE INTO USDA: HOW BEARISH FOR CORN?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 0:40min

Beans: 10:00min

Wheat: 13:10min

Cattle: 15:10min

Want to talk about your situation?

(605)250-3863

Futures Prices Close

Overview

Grains lower while cattle continues to run.

Yesterday's report was a memorbale one, and not in a good way.

It was bearish across the board. Production came in higher than estimates everywhere, and wheat plantings even came in higher than expected.

It caught almost everyone off guard.

It was the most bearish report in over a decade for the corn market.

Yesterday corn saw it's largest daily loss since June 2023.

In one single candle, we wiped out the past 150 days of price action.

Let's jump right into the corn section and go through this report and what it means moving forward.

Today's Main Takeaways

Corn

Fundamentals:

Well, I didn’t have yesterday's USDA numbers on my bingo card.

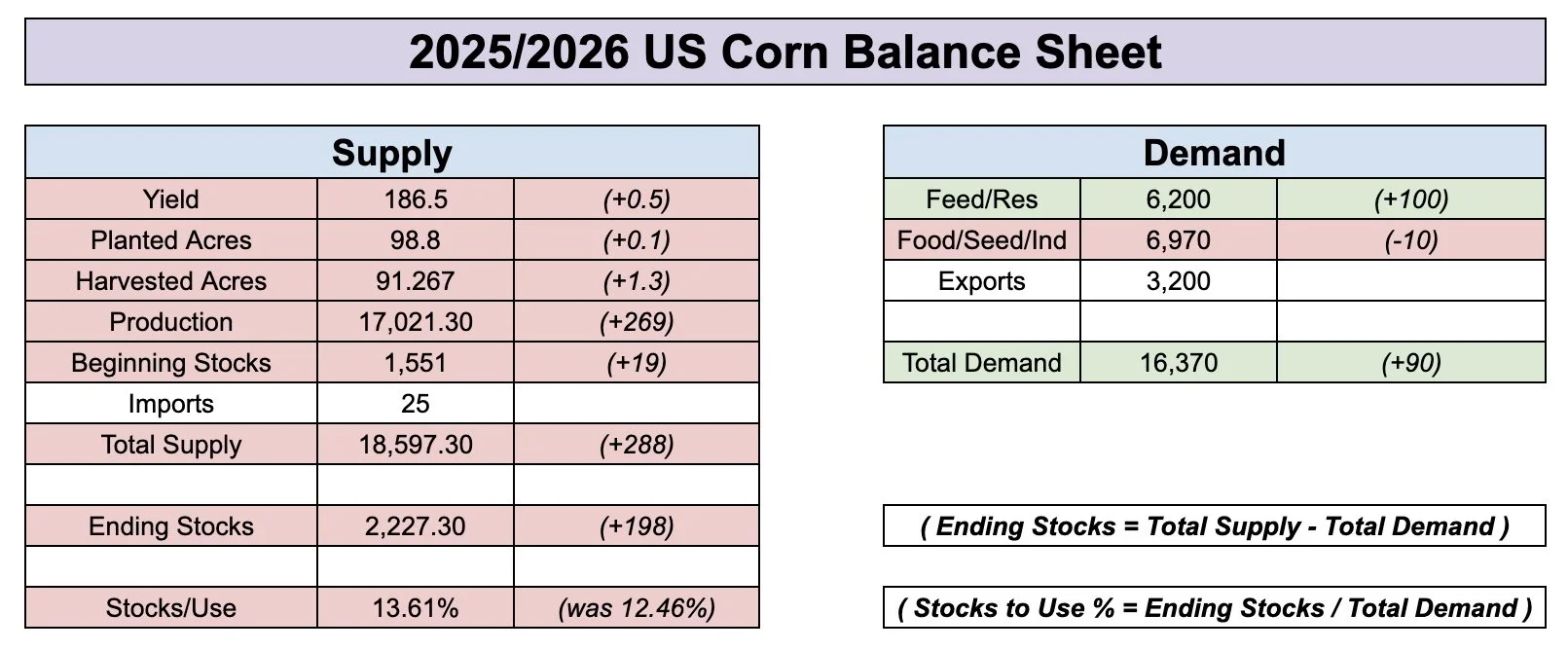

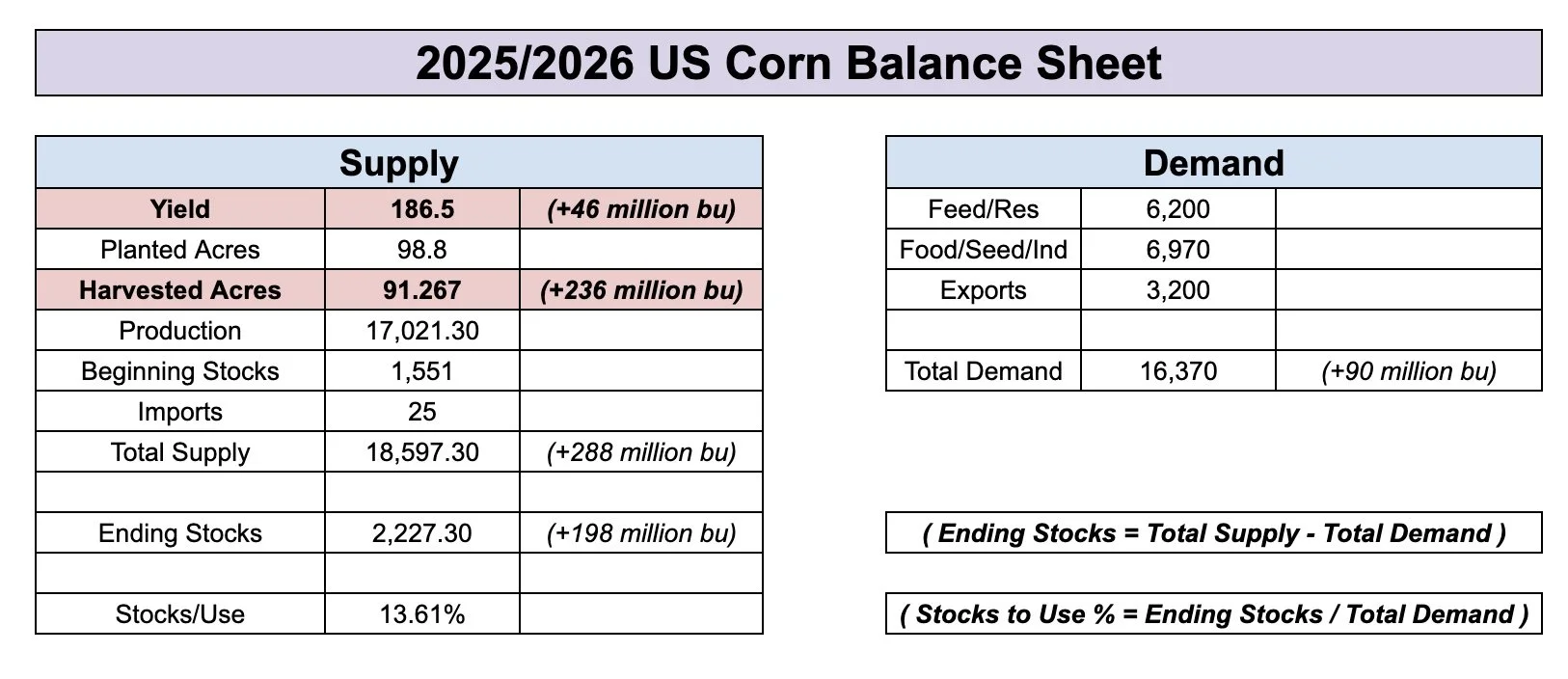

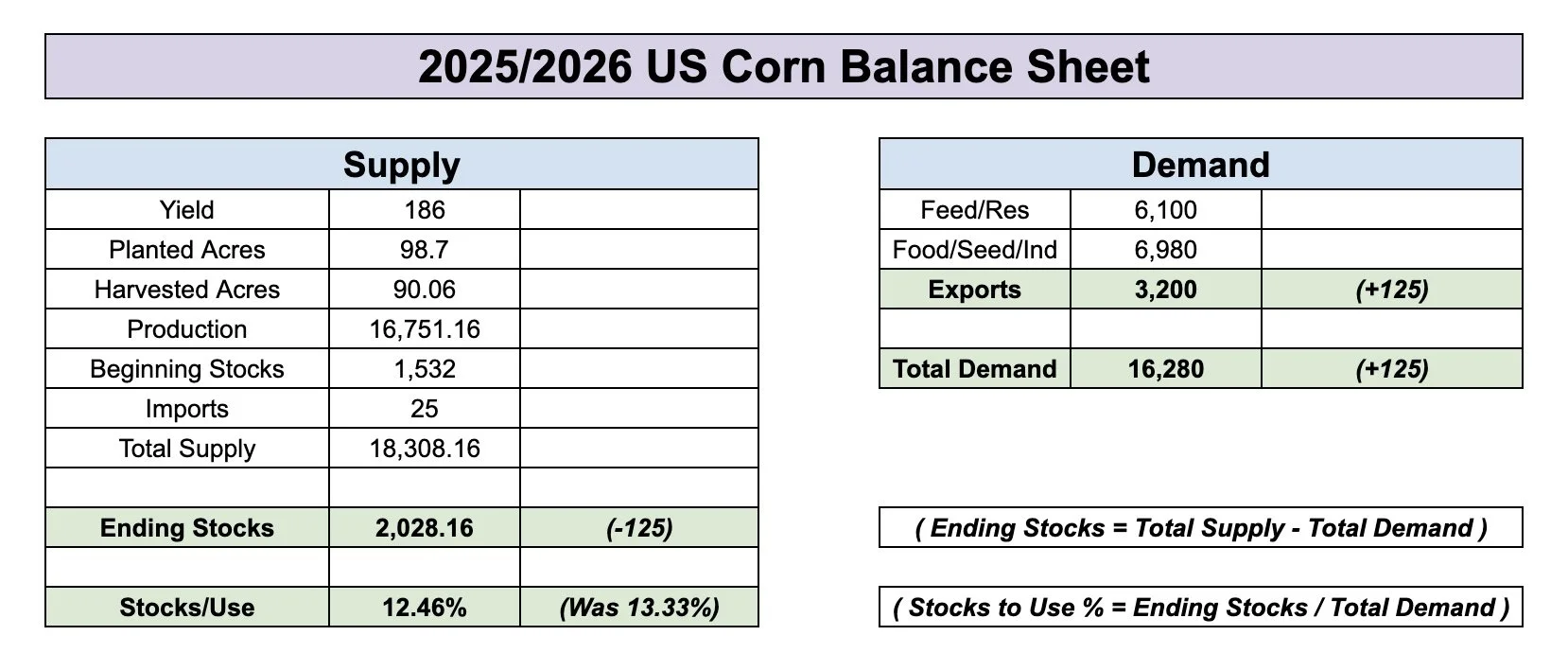

Here are the complete balance sheet changes.

This report was about worst case possible for the corn market.

It was actually the most bearish report in 14 years.

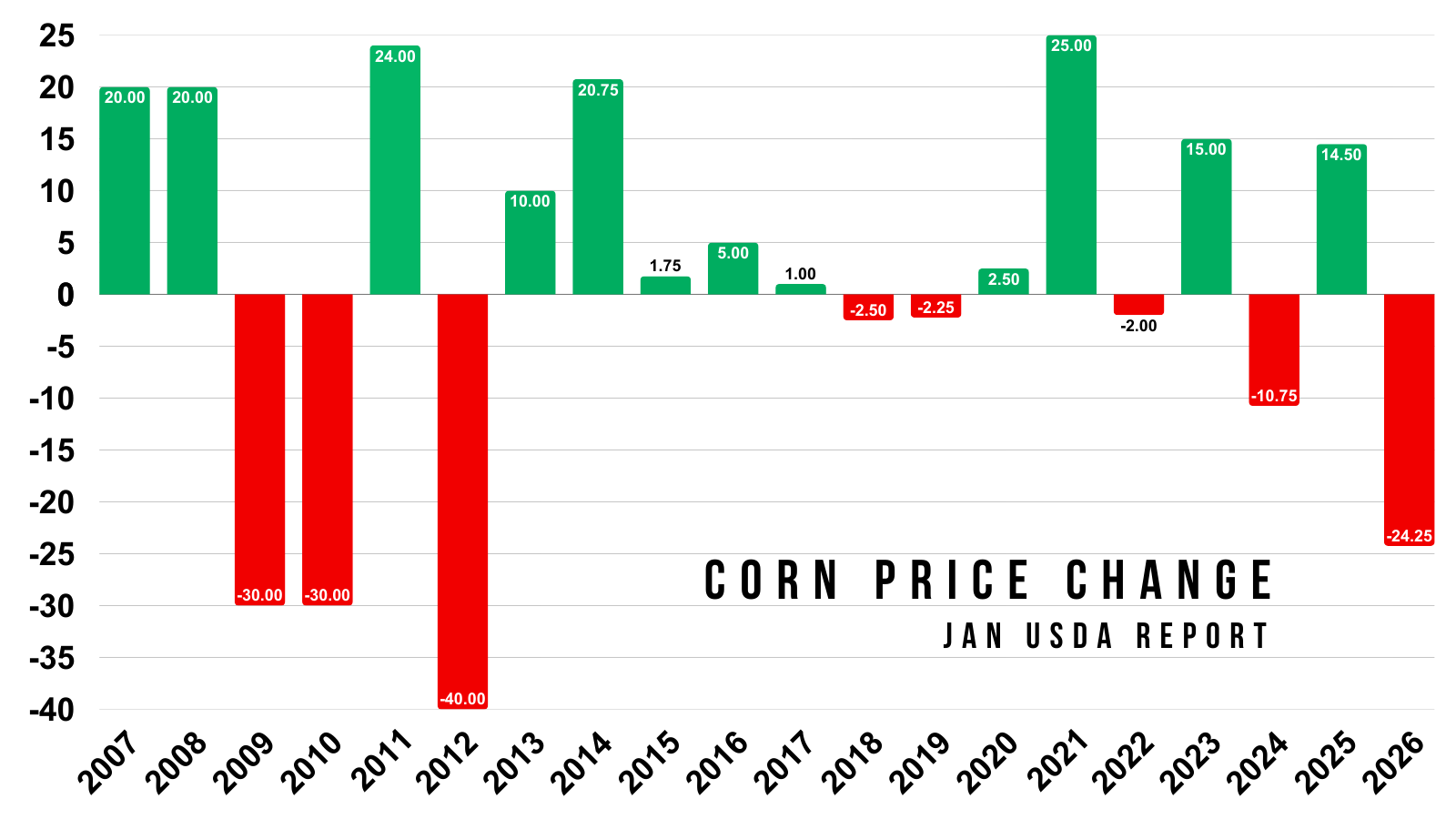

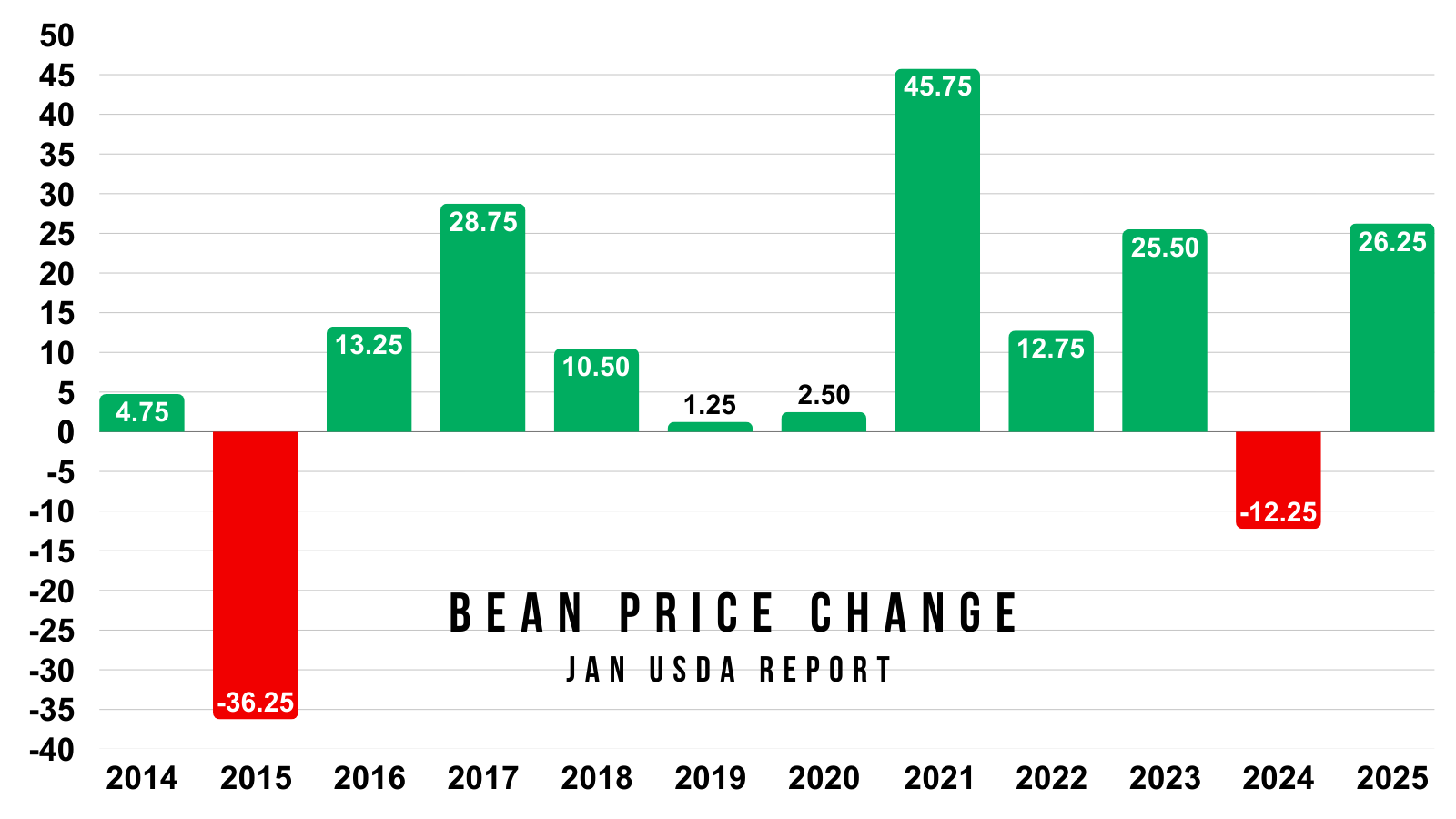

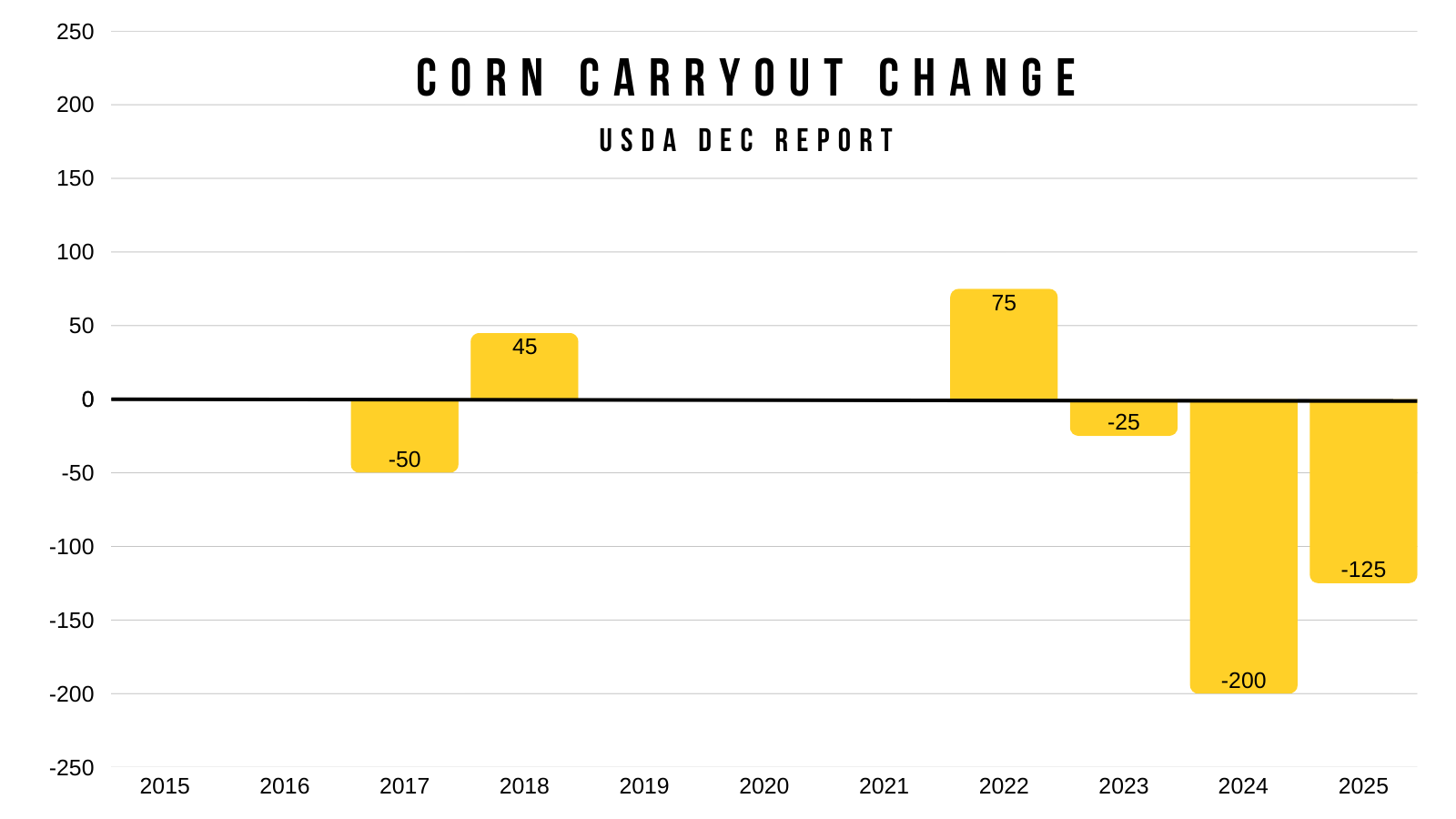

Here is the past price changes.

It resulted in the biggest sell off for the day of this report since 2012.

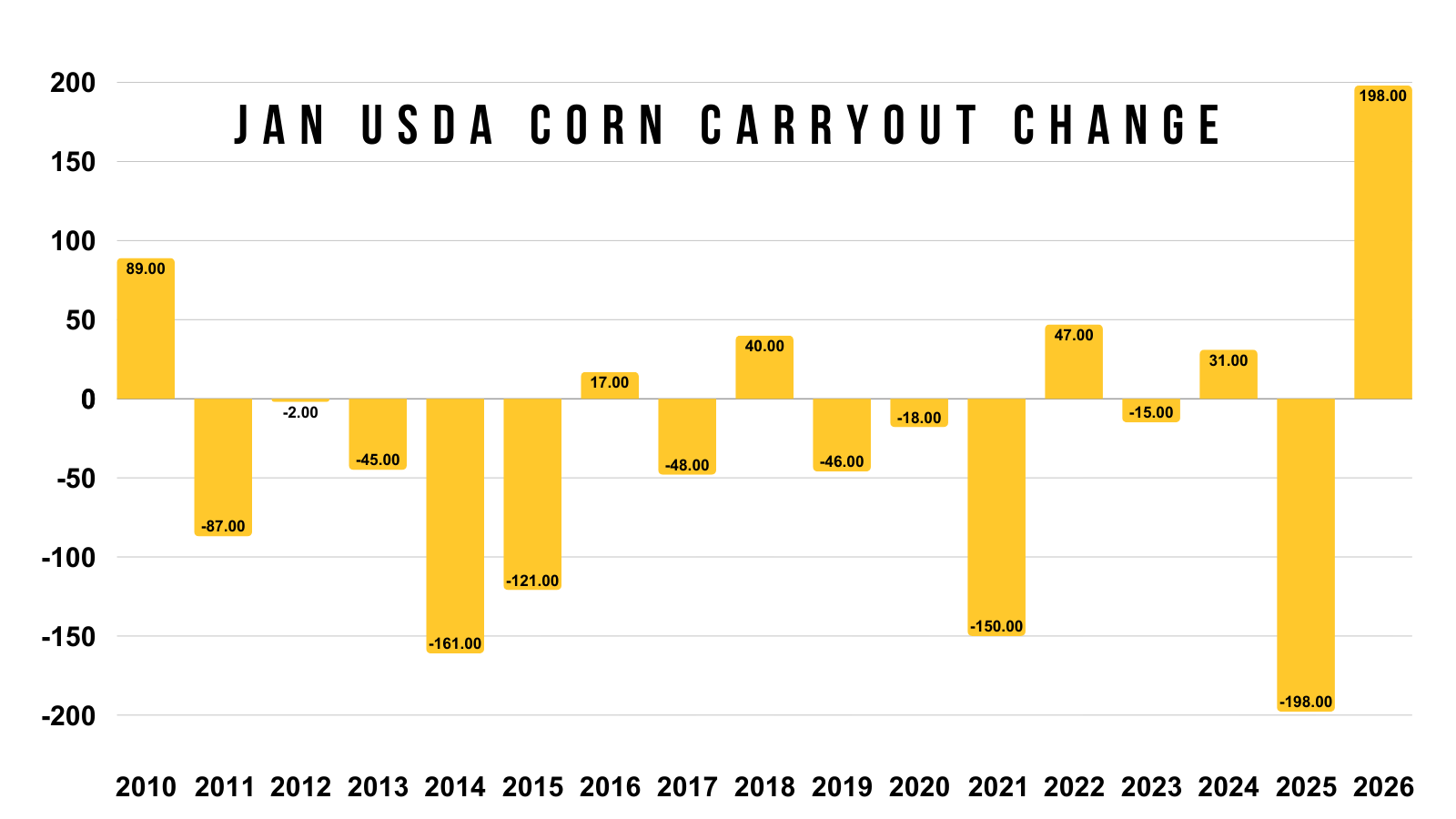

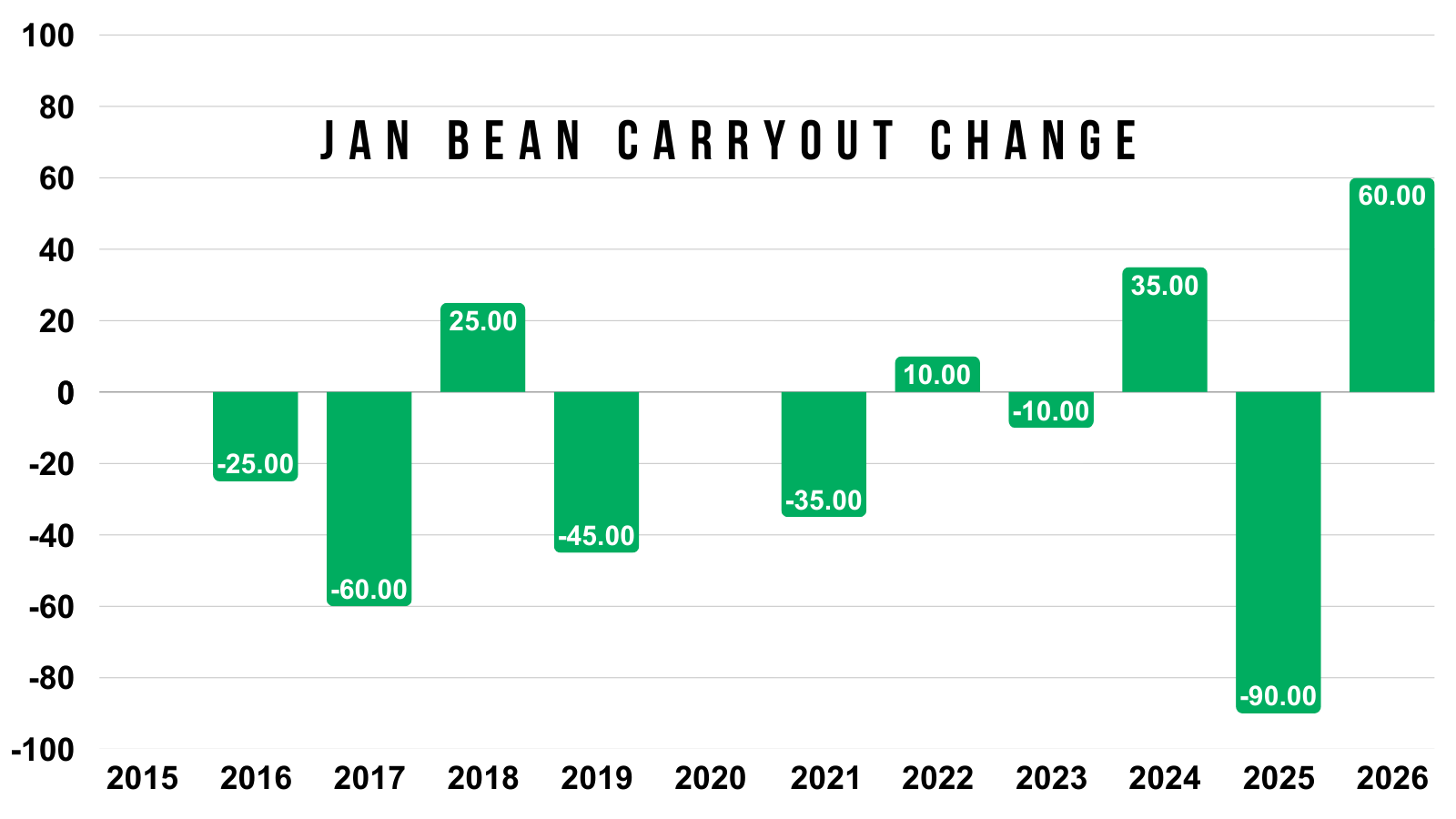

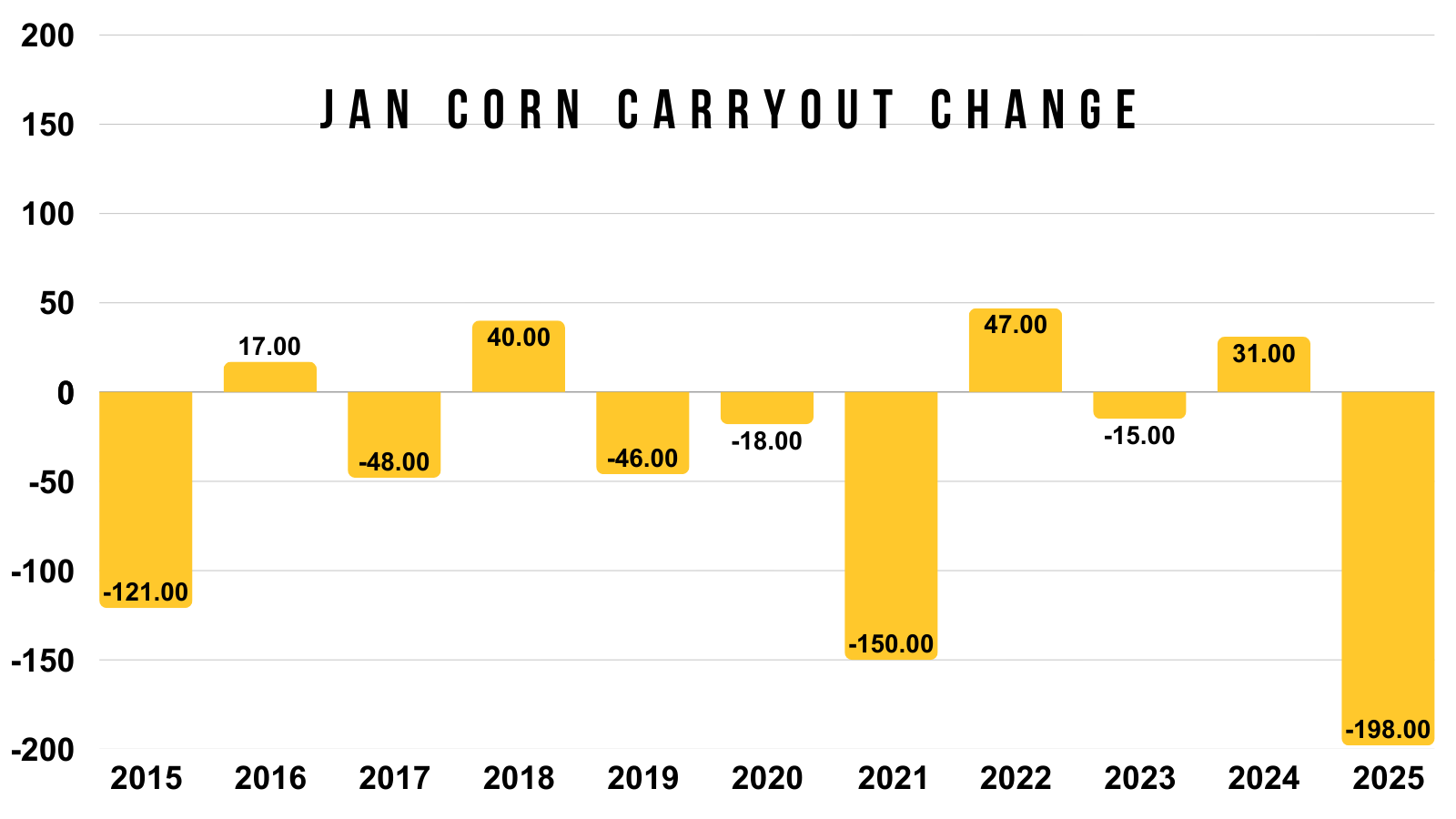

Here is the past carryout changes for this report.

Yesterday was the biggest increase to carryout we've seen in this report in over a decade.

They increased carryout by nearly +200 million bushels.

We've only seen one other year that resulted in over a +50 million bushel increase.

Clearly, this report is in a world of it's own the last decade.

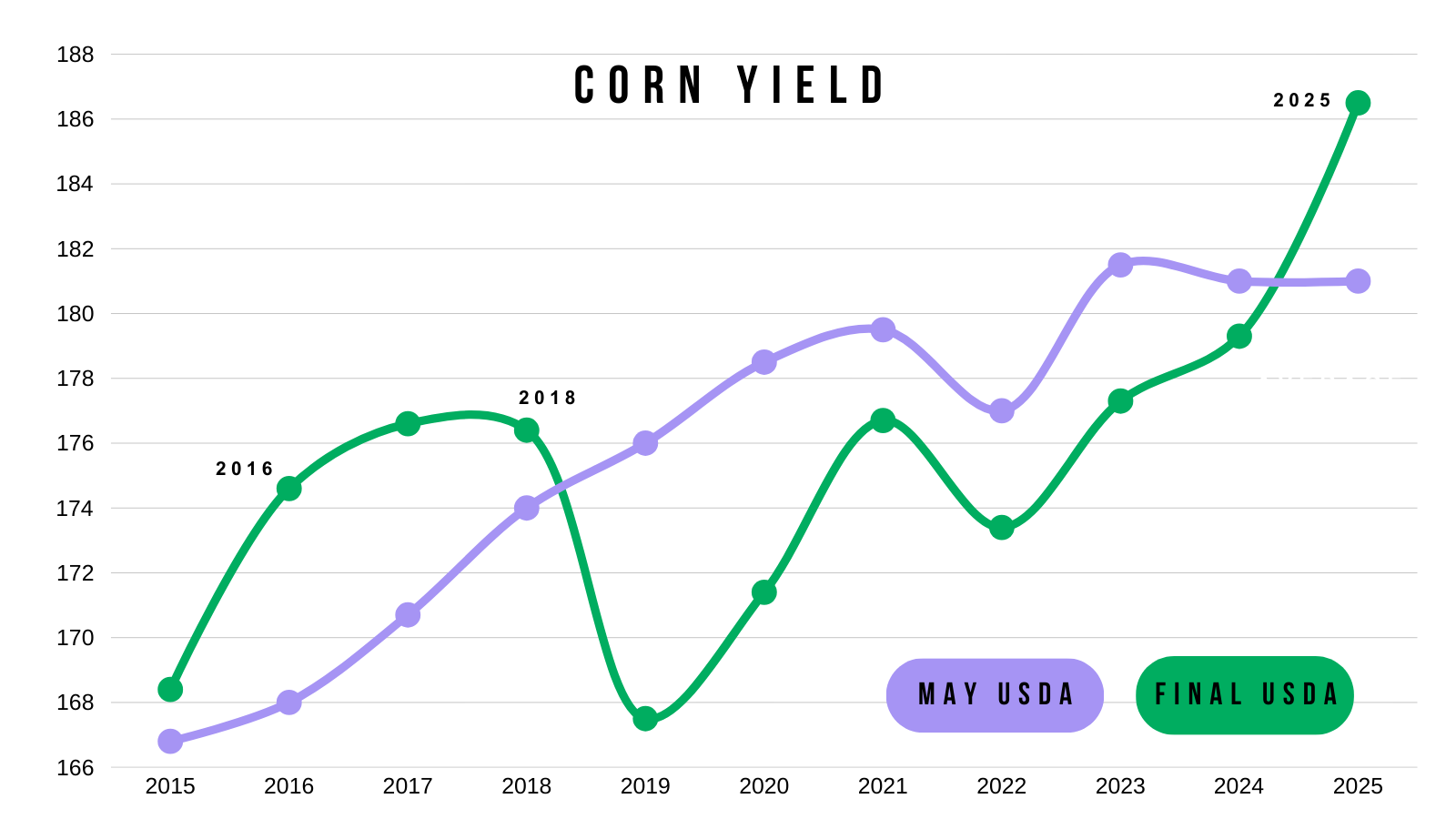

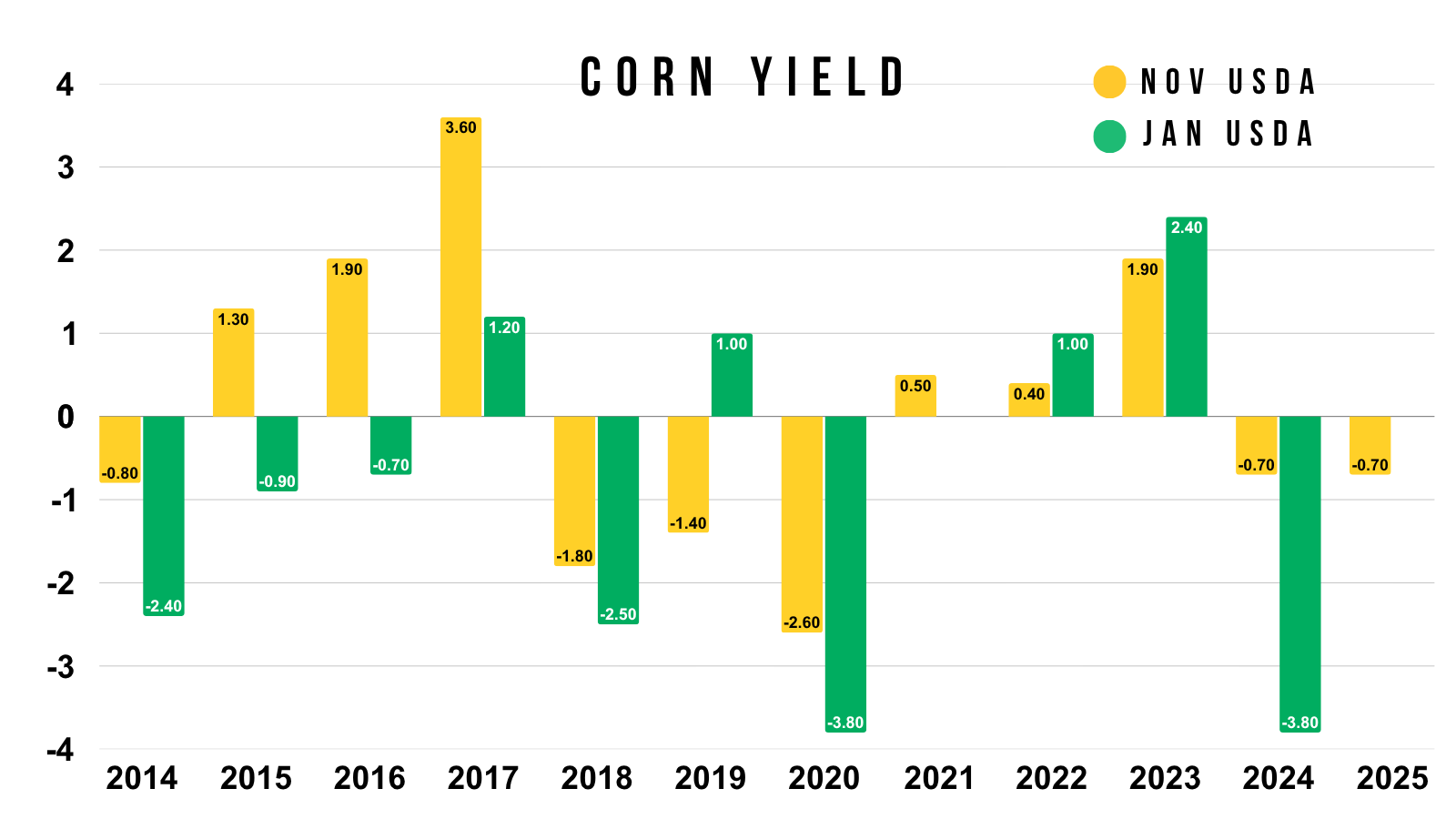

As you all know, the USDA chose to actually raise yield up to 186.5 bpa.

Almost everyone thought yield would be coming down, some thought it could be a rather drastic change.

Even Arlan of StoneX who had this 186 guess back during the summer, recently said he thought yield was 182 and wouldn’t be surprised if it was even lower.

So everyone was surprised.

Here is a chart showing May vs final yield.

For the first time since 2018, our final yield came in higher than the orginal May estimate.

186.5 vs the orginal 181 (+5.5 bpa).

Not only did the USDA raise yield.. they also added acres.

Planted acres only rose 100k, but harvested acres jumped a large 1.3 million...

This was an even larger surprise than the yield.

And it's a more bearish factor than the yield.

Just to put it into perspective:

That 1.3 million acres added an EXTRA 236 million bushels of supply to the balance sheet.

The 0.5 bpa increase to yield only rose supply by 46 million bushels.

Not only did yield increase, but they found more acres which provided an even bigger blow.

The numbers the USDA gives us are the numbers we have to deal with.

Yes it sucks. But none of us can do anything about it whether we agree with their methodology or not.

Regardless, it is getting harder and harder to defend them when they've been incredibly inconsistent with their data the last year or two.

It's no secret that the USDA is understaffed, so you have to wonder if that is starting to show in their work.

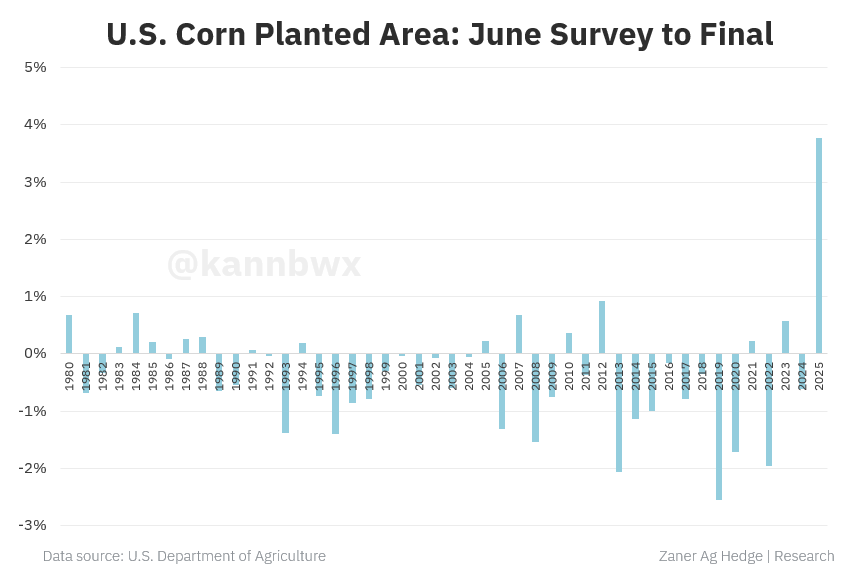

Here is a fantastic chart from Karen Braun of Zaner Hedge.

This shows corn planted area from June to final.

A completely unprecedented miss.

This has still yet to be explained.

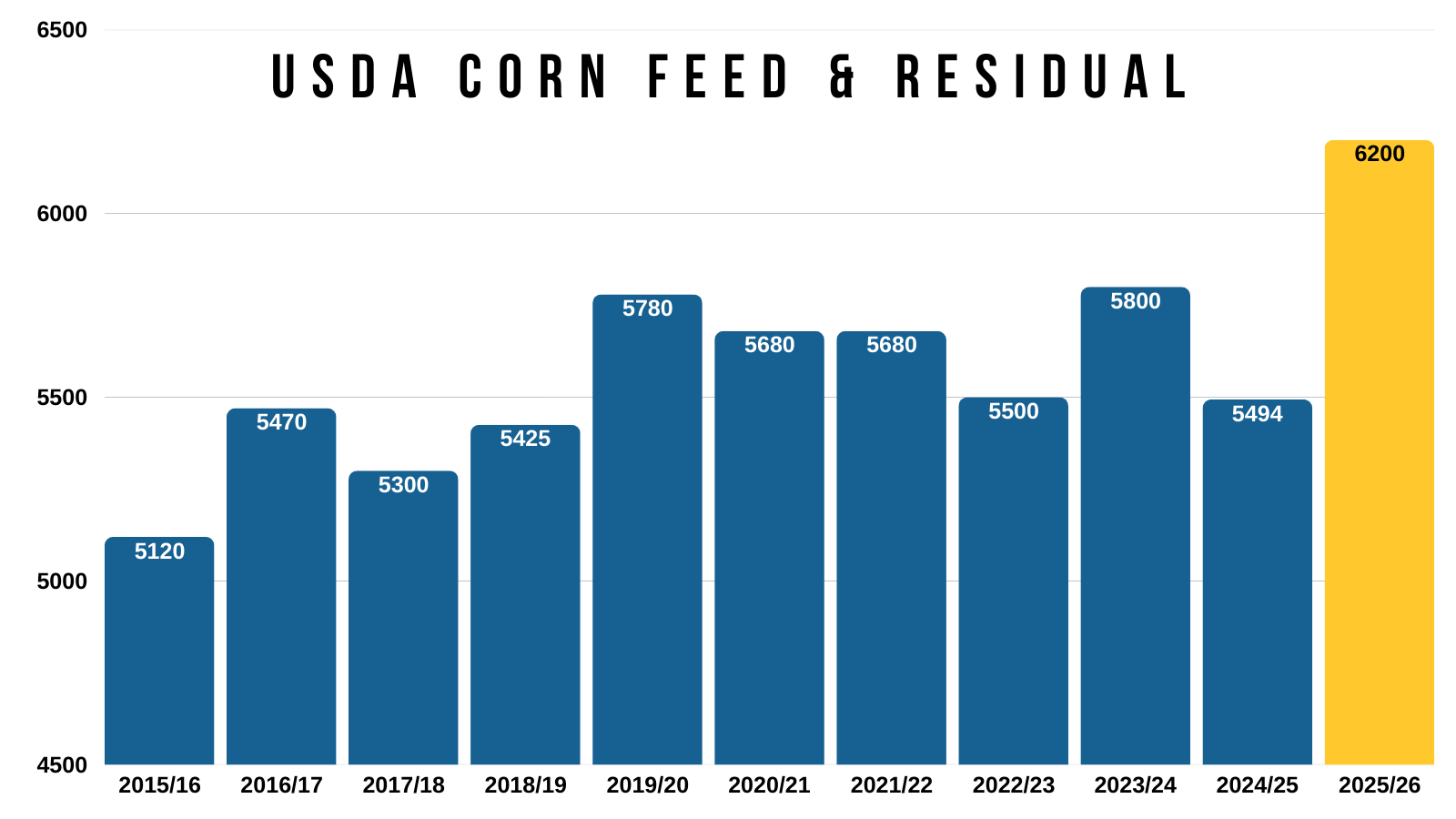

Since the USDA added so much supply, they naturally had to balance the balance sheet to prevent our carryout from getting too large.

What they did was raise feed and residual by another +100 million bushels.

While leaving our export demand completely unchanged.

Almost everyone would agree this just makes no sense.

Most agree feed usage is too high to begin with.

What argument would justify feed demand being +700 million higher than last year when we have fewer animals on feed?

We have never seen this type of increase before.

The USDA is using this as a toy number so they can hide other data in there. Next year we are going to be wondering why they dropped the feed usage number.

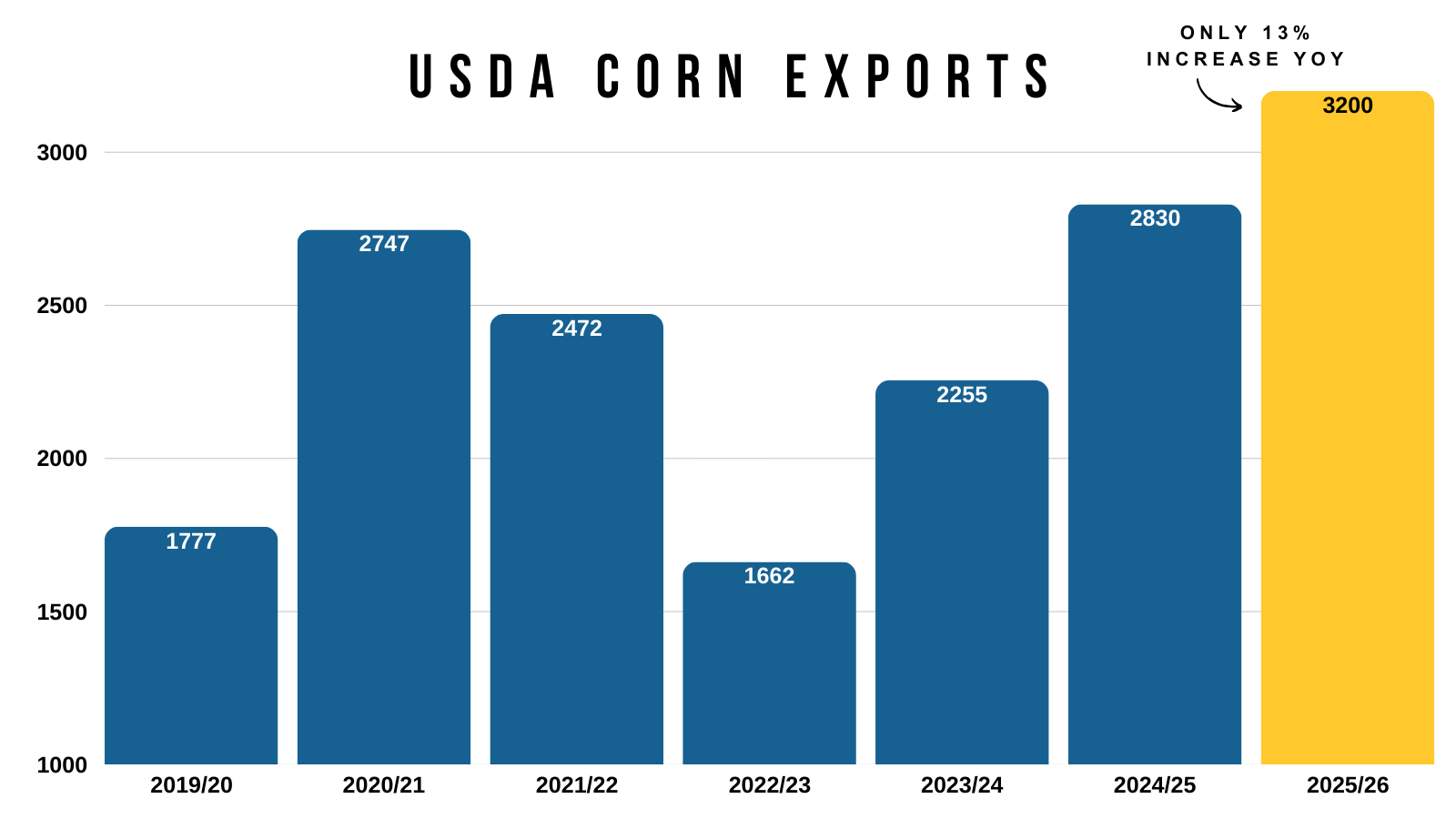

Now on the other hand, they chose to leave exports unchanged..

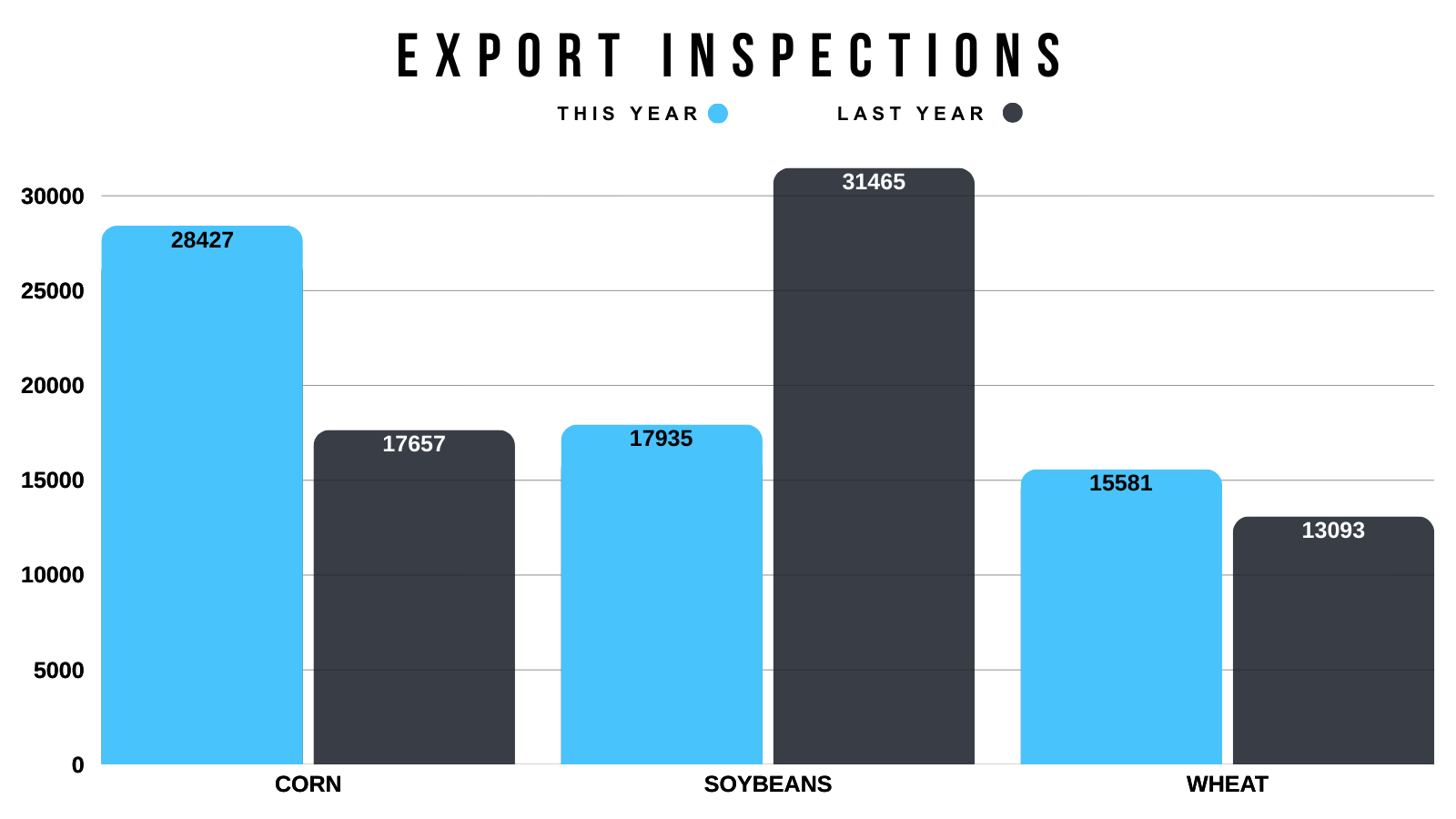

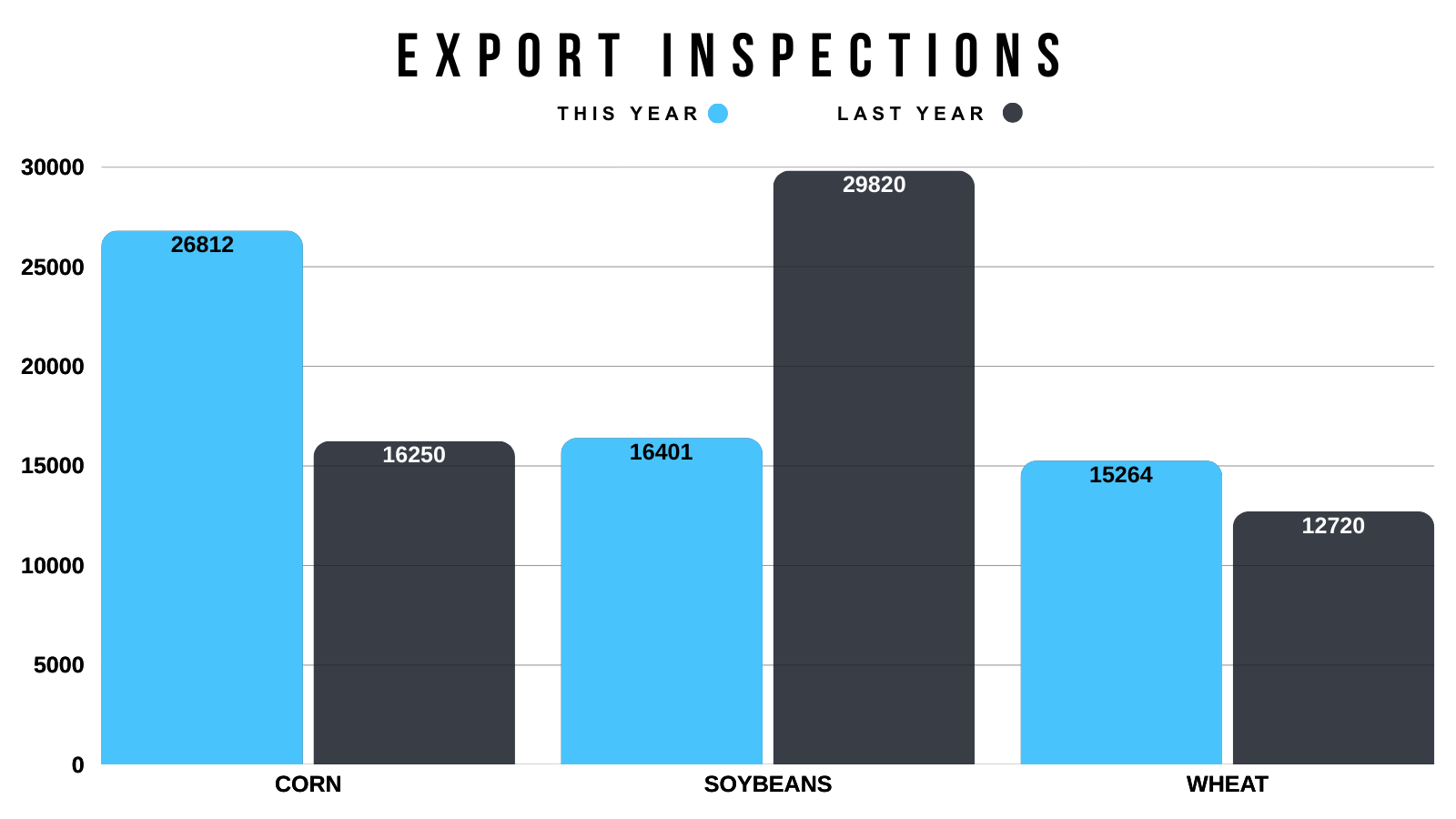

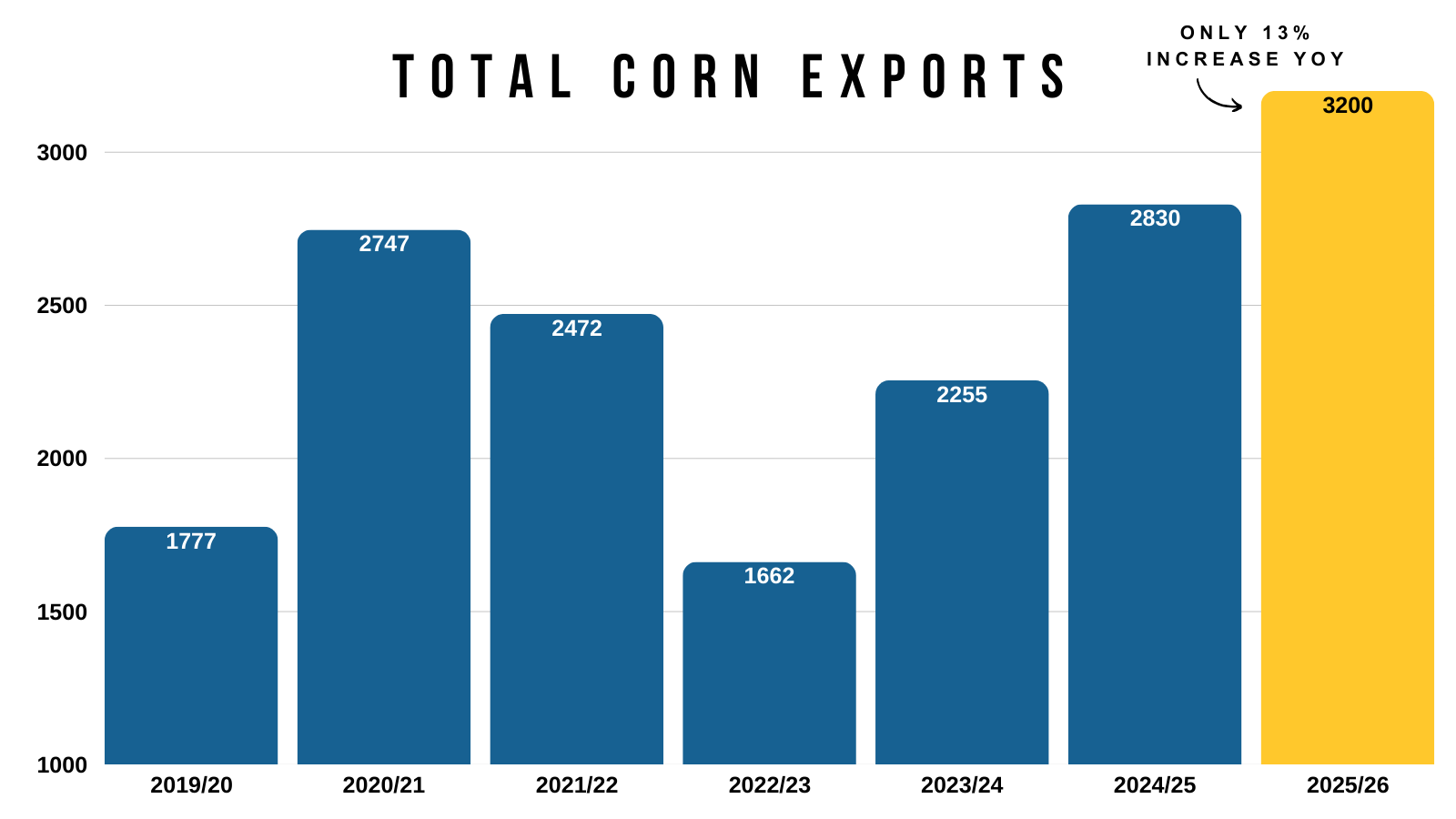

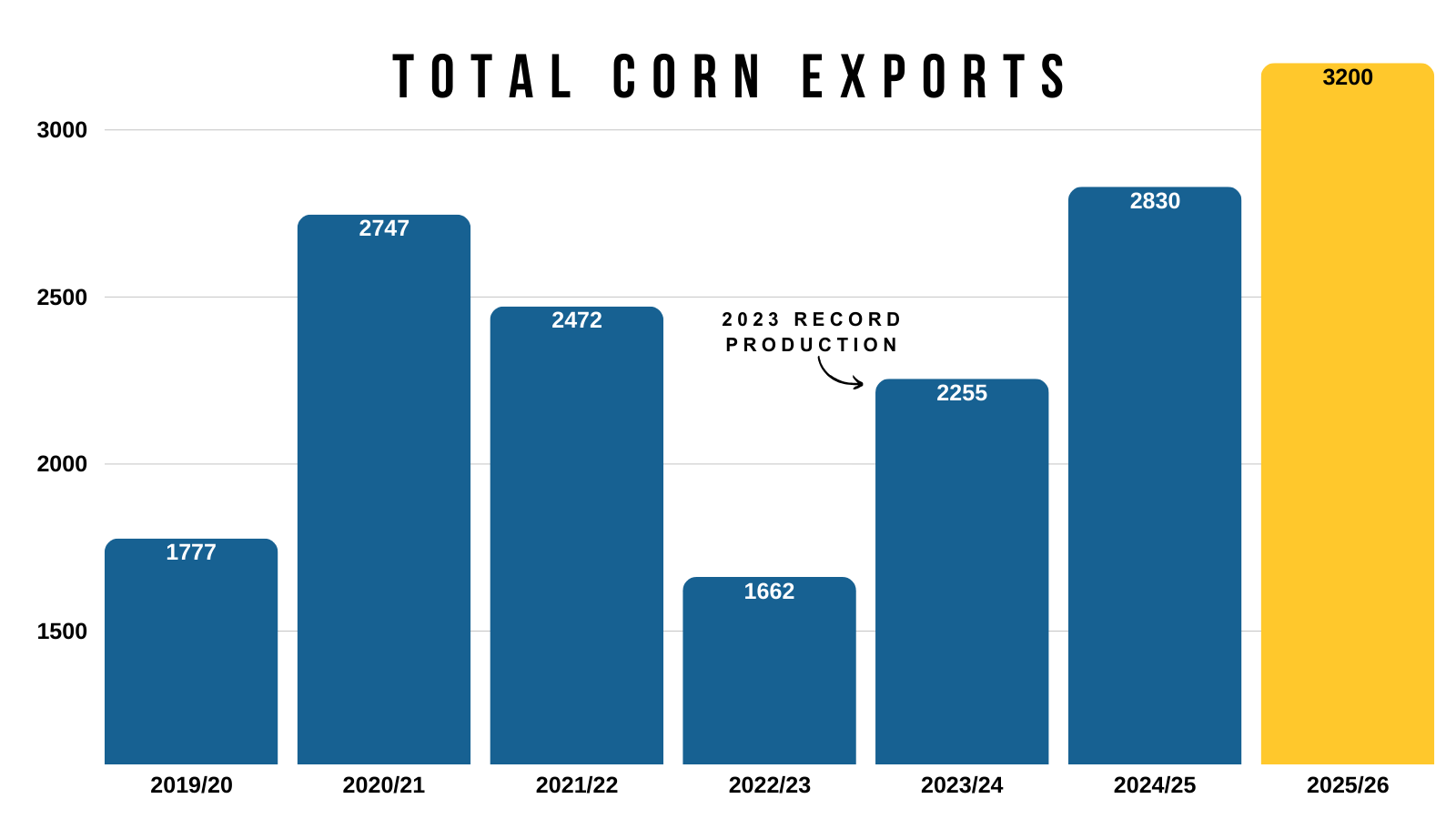

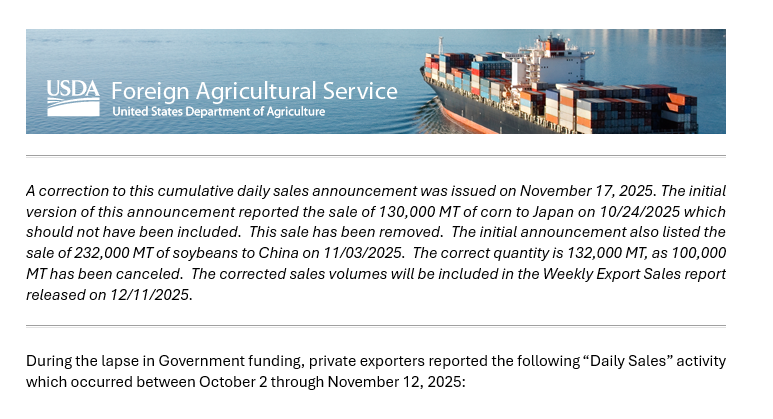

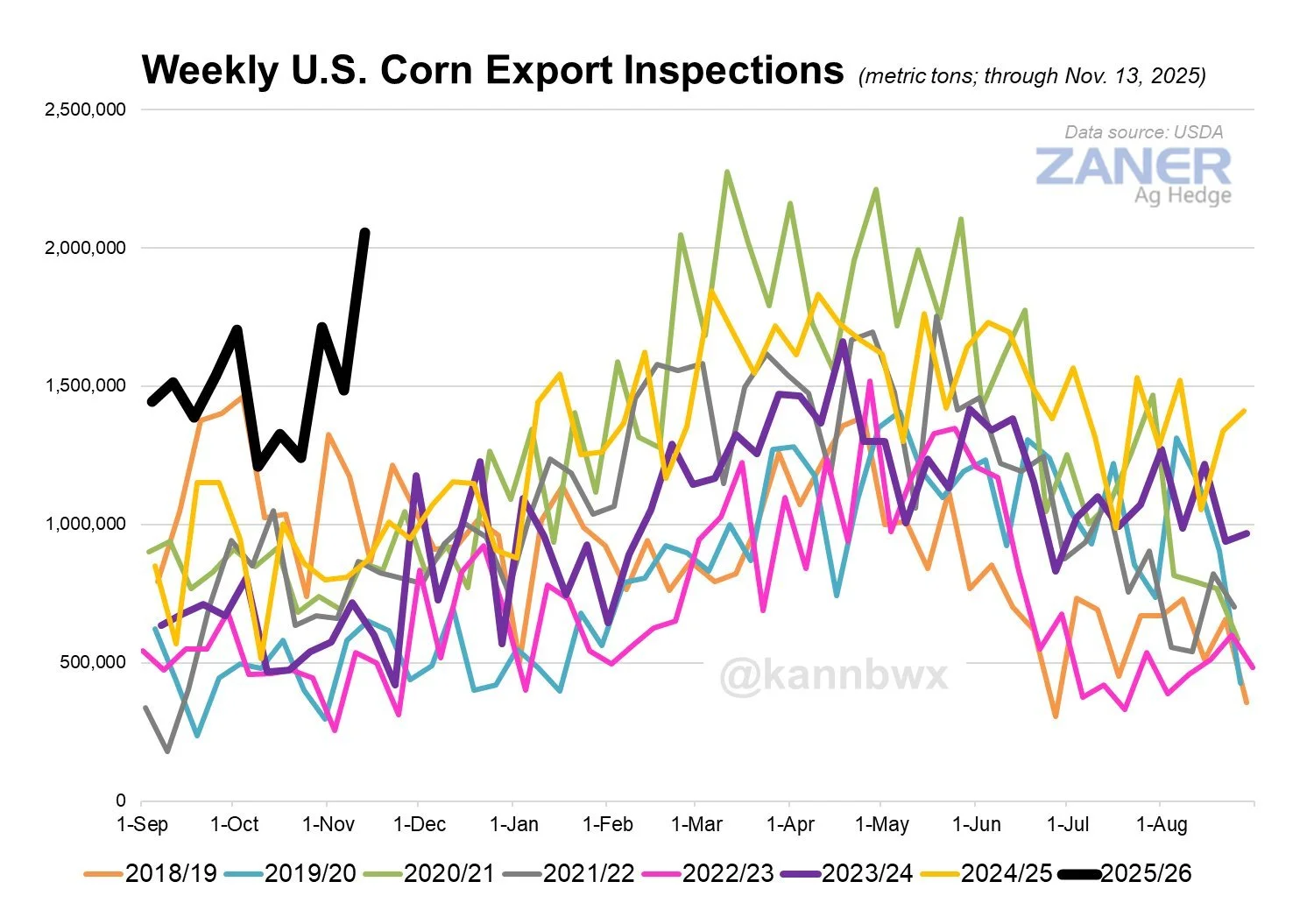

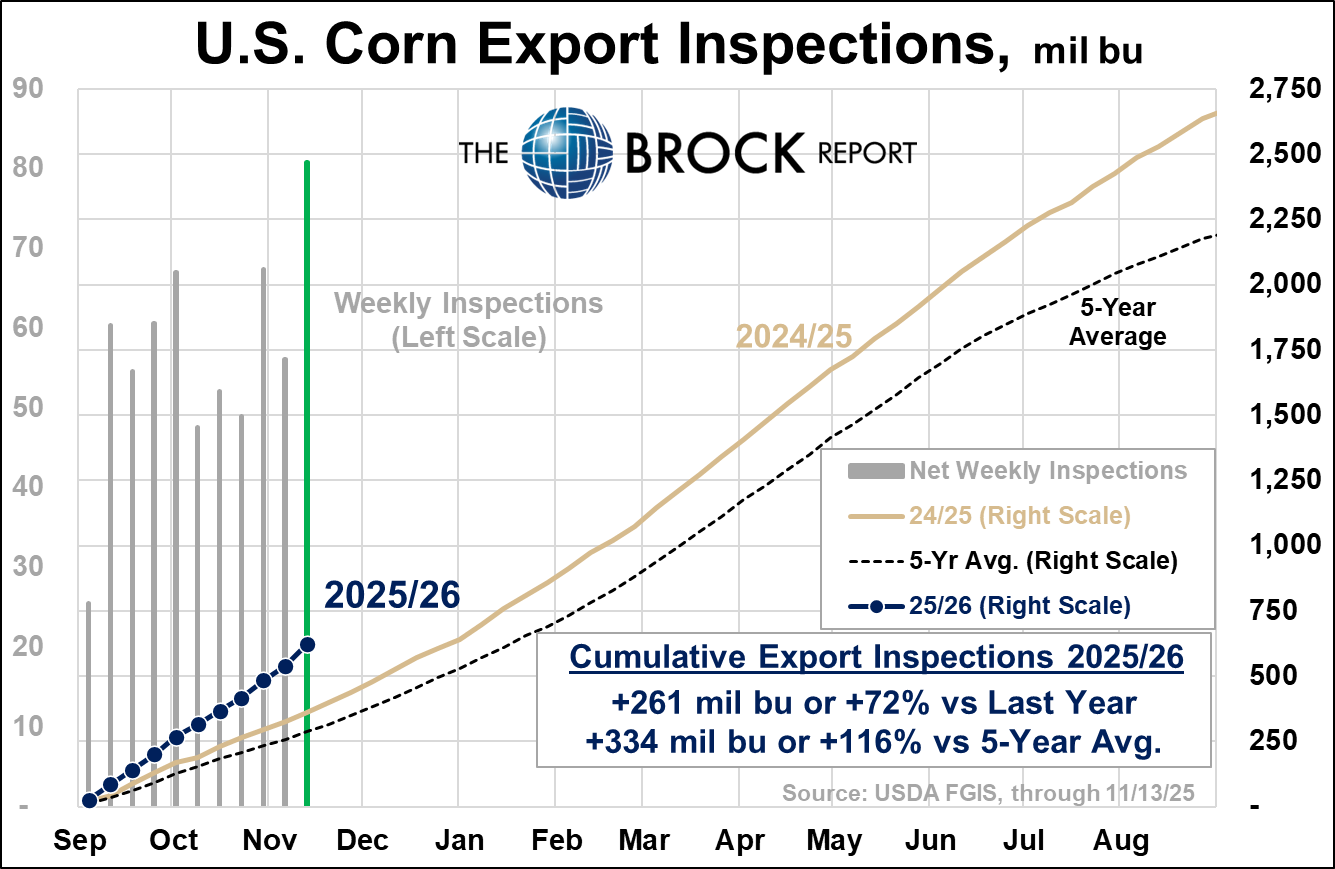

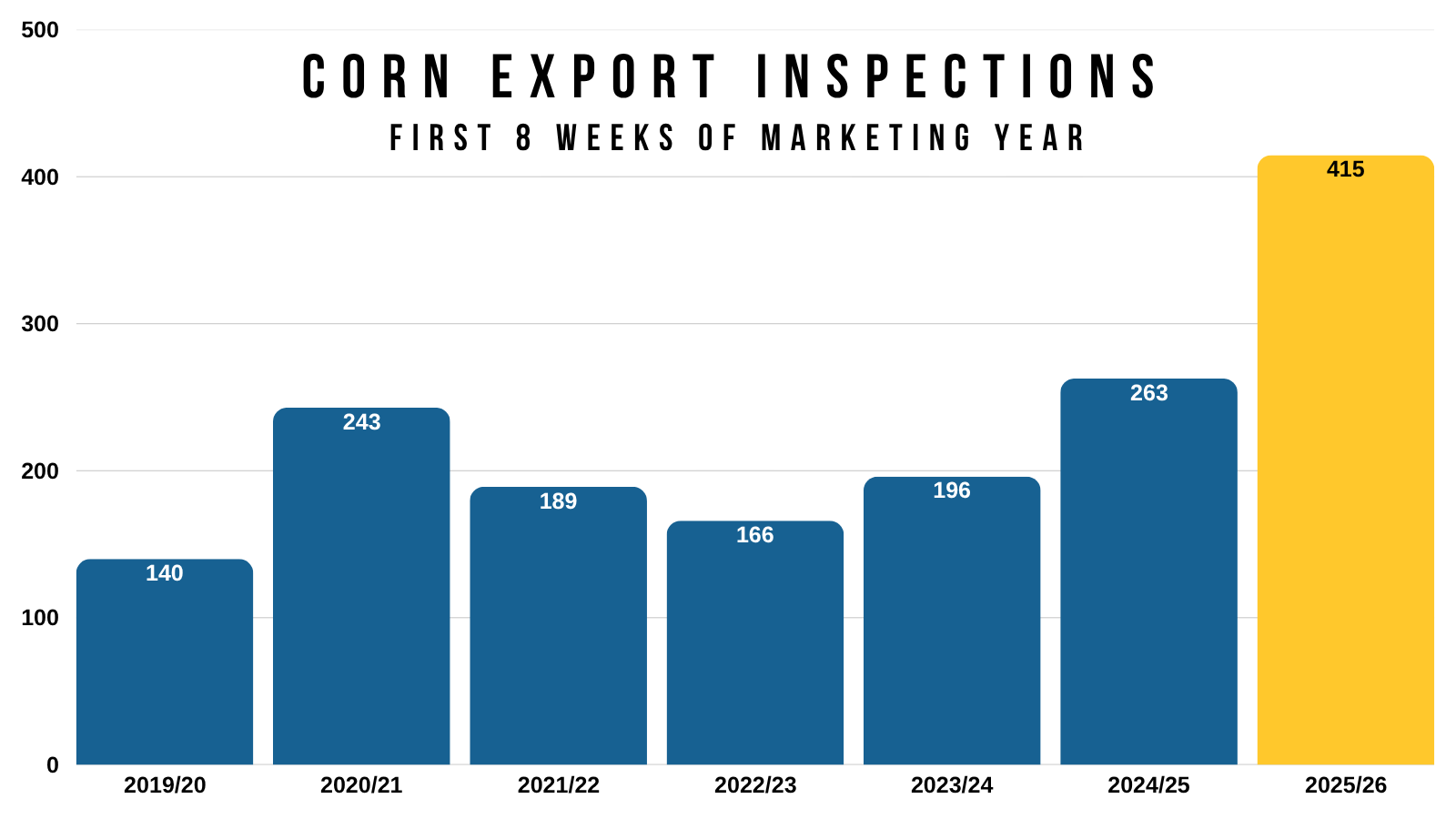

Meanwhile export inspections are up +61% vs last year.

Yet the USDA projections exports only up +13% vs last year.

We are currently on pace to beat the USDA's estimate by over 300 million bushels.

So a bump in exports would’ve made sense. Rather than a bump in feed.

I'm sure exports will eventually be raised higher.

The numbers yesterday don’t make sense, but they are the numbers we got.

This report does change things it a big way.

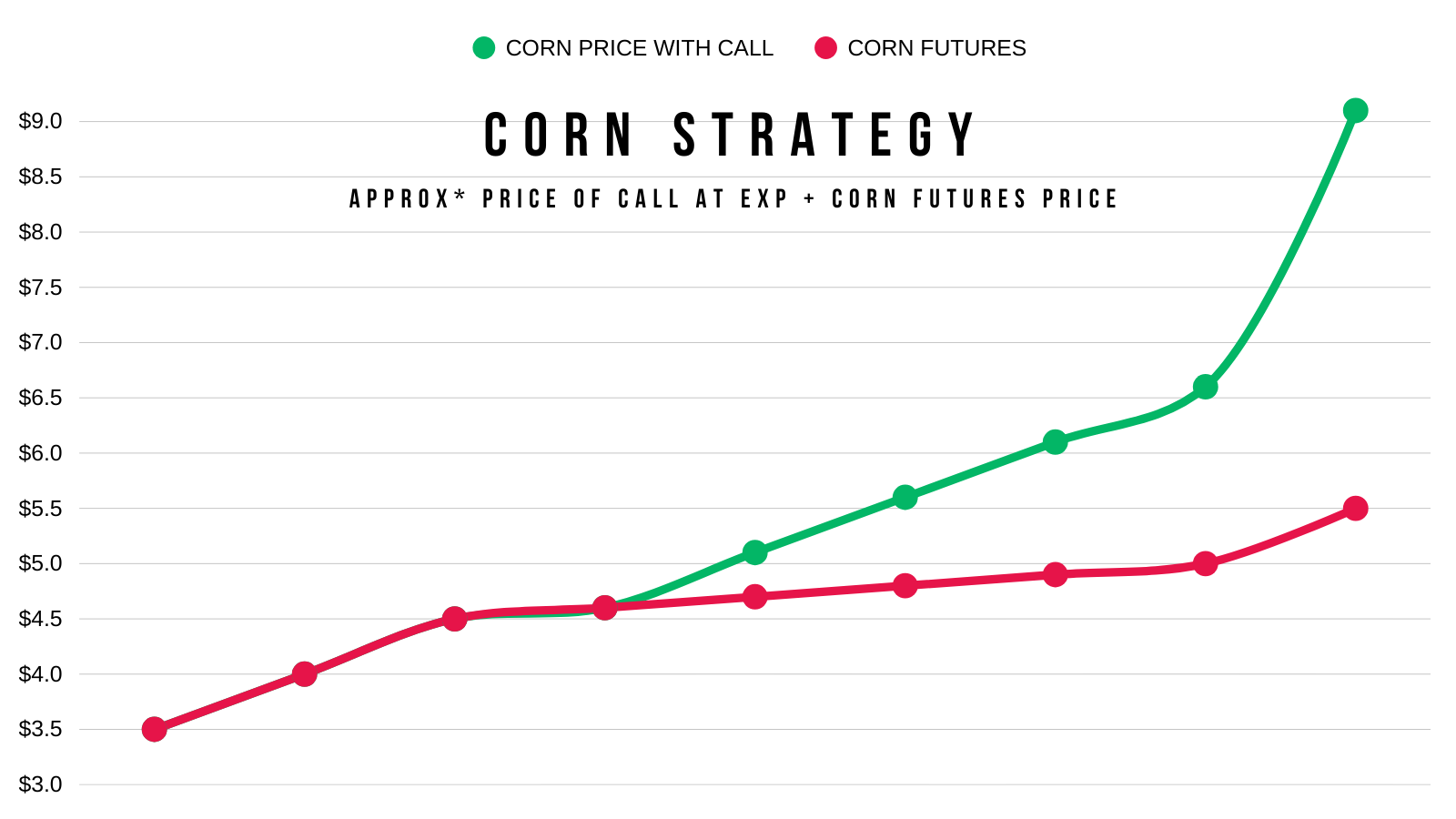

For a long time I’ve been talking about how corn had limited upside, and it would be an uphill battle to see $5.00 this year.

Given that we had record production no matter how you sliced the pie.

That battle just a whole lot harder, some would say almost impossible without some sort of outside influence such as a weather scare.

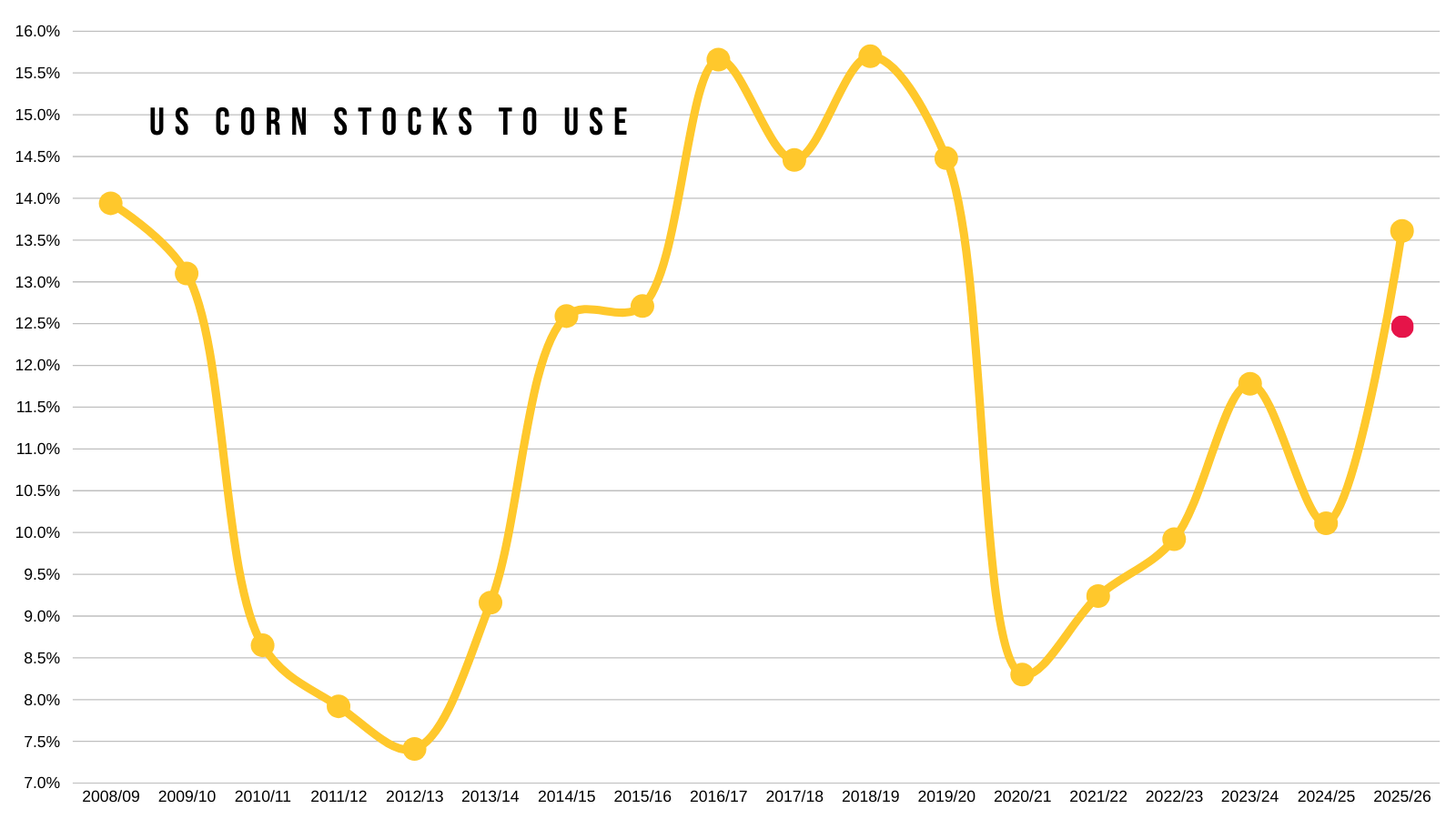

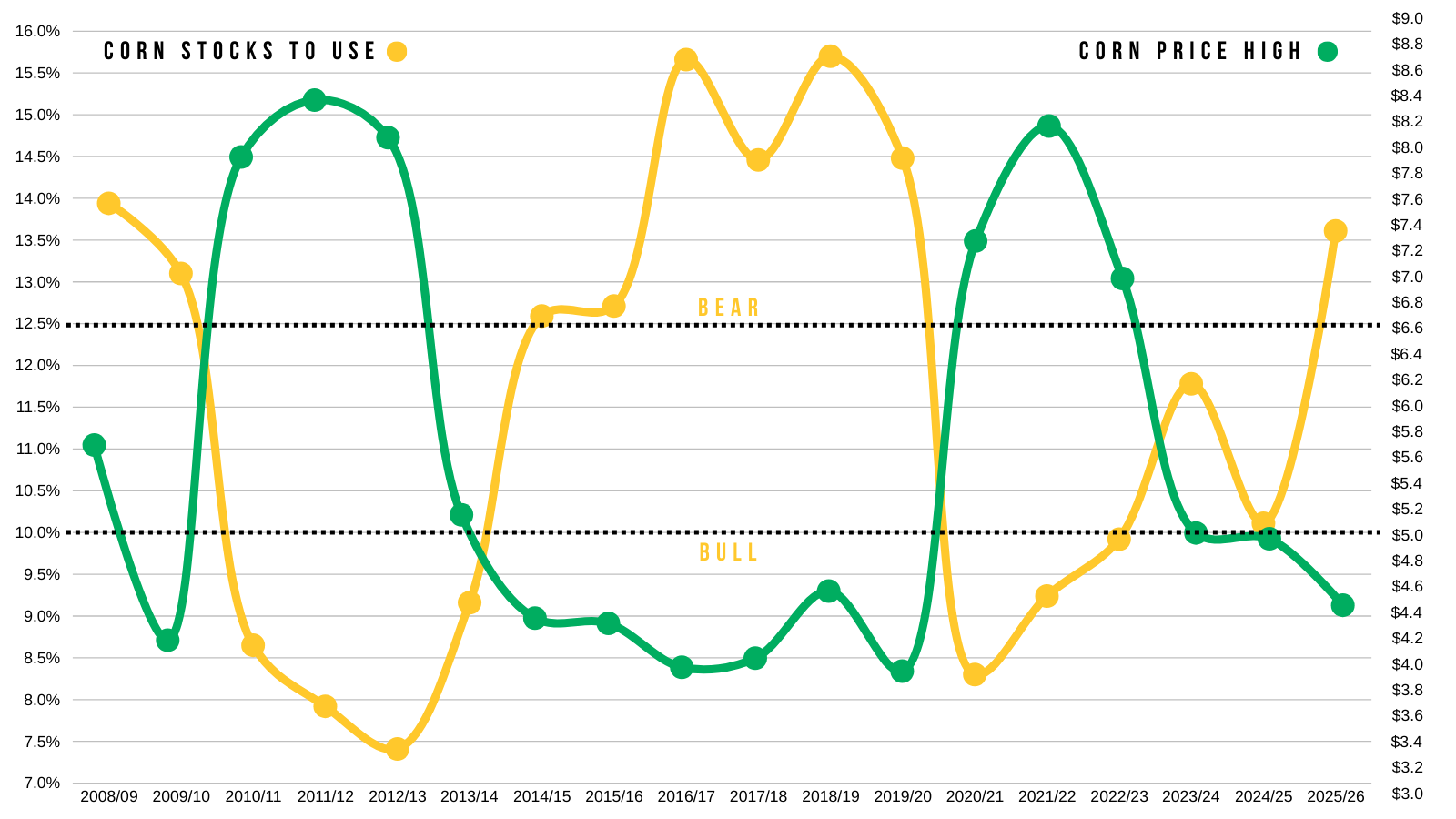

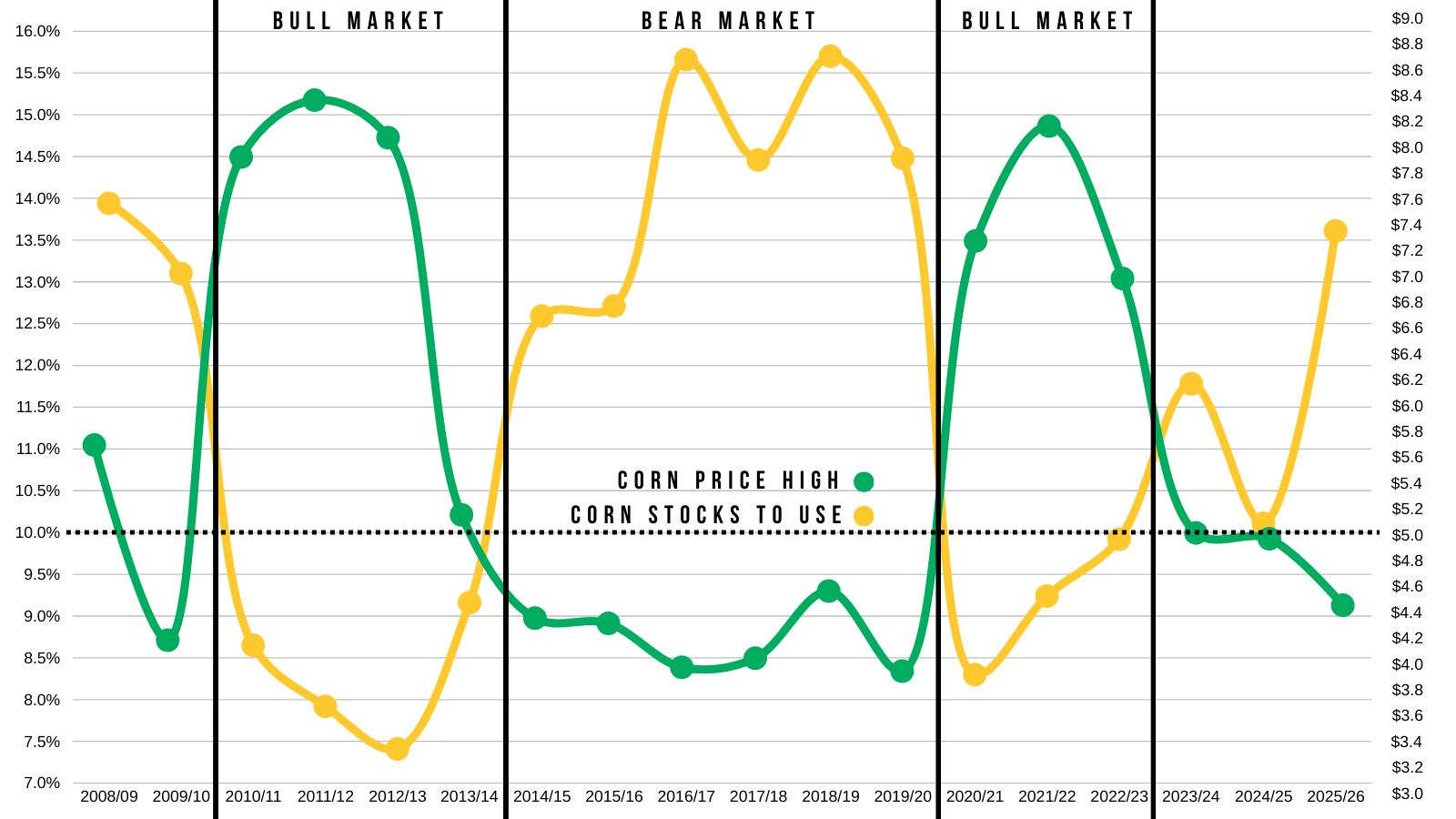

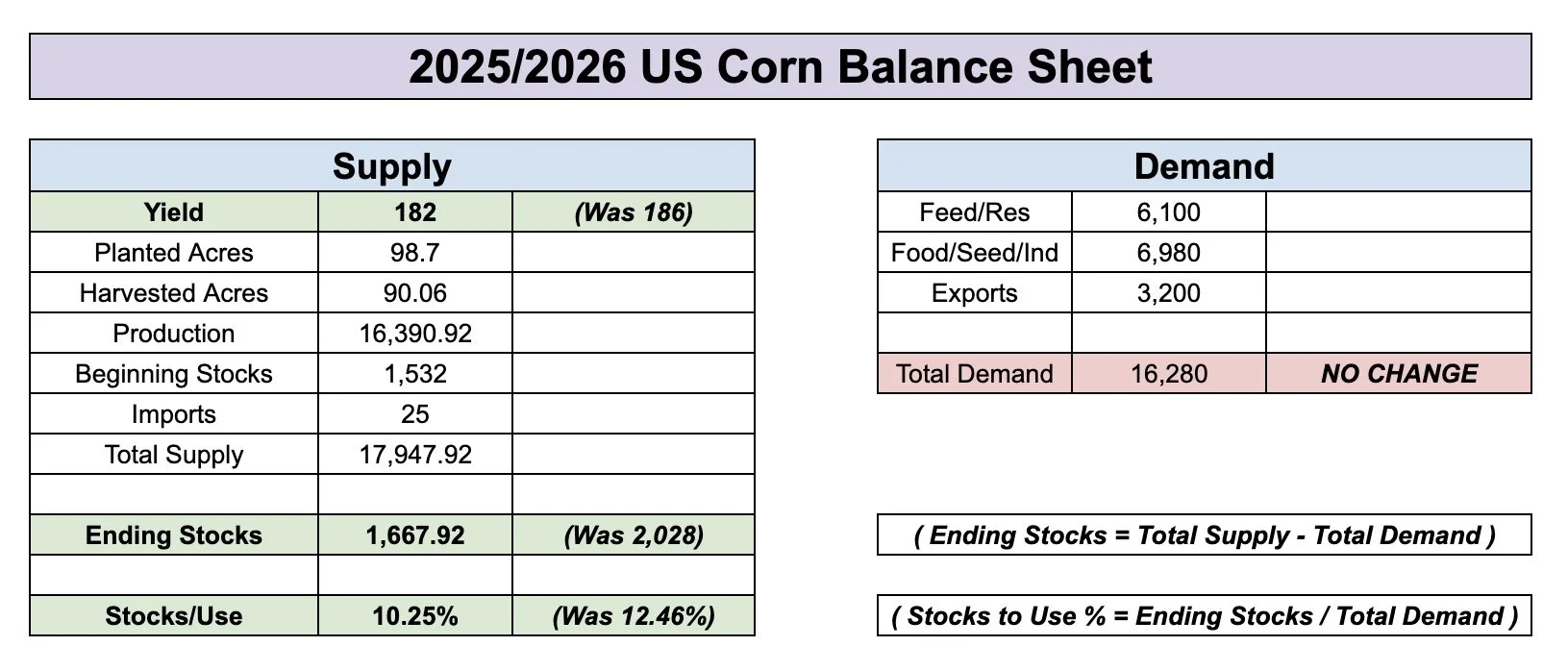

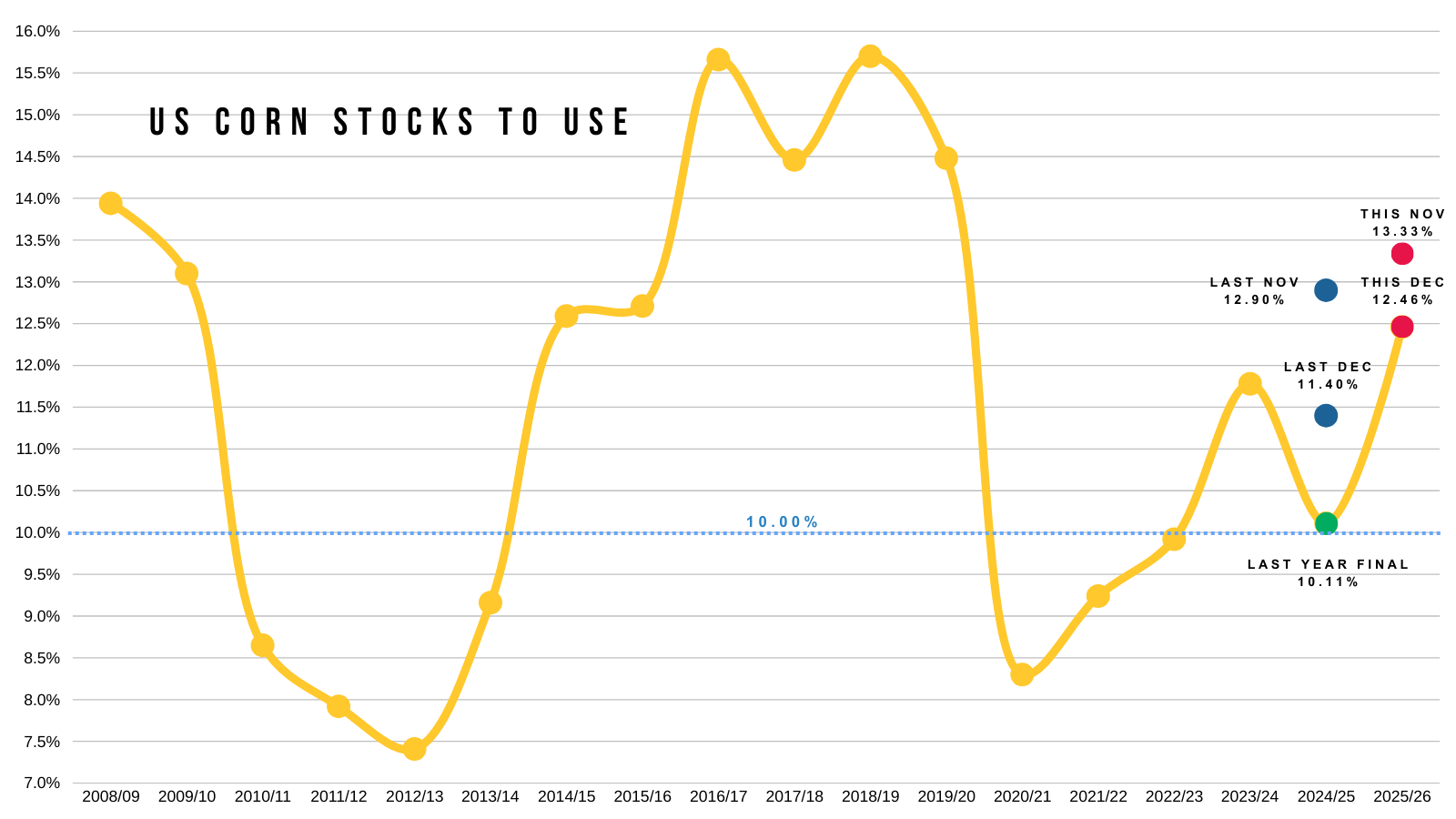

First for the stocks to use ratio.

It jumped from 12.46% to 13.61%.

That is a bearish number. The most bearish since 2019/20.

(Red dot is previous estimate)

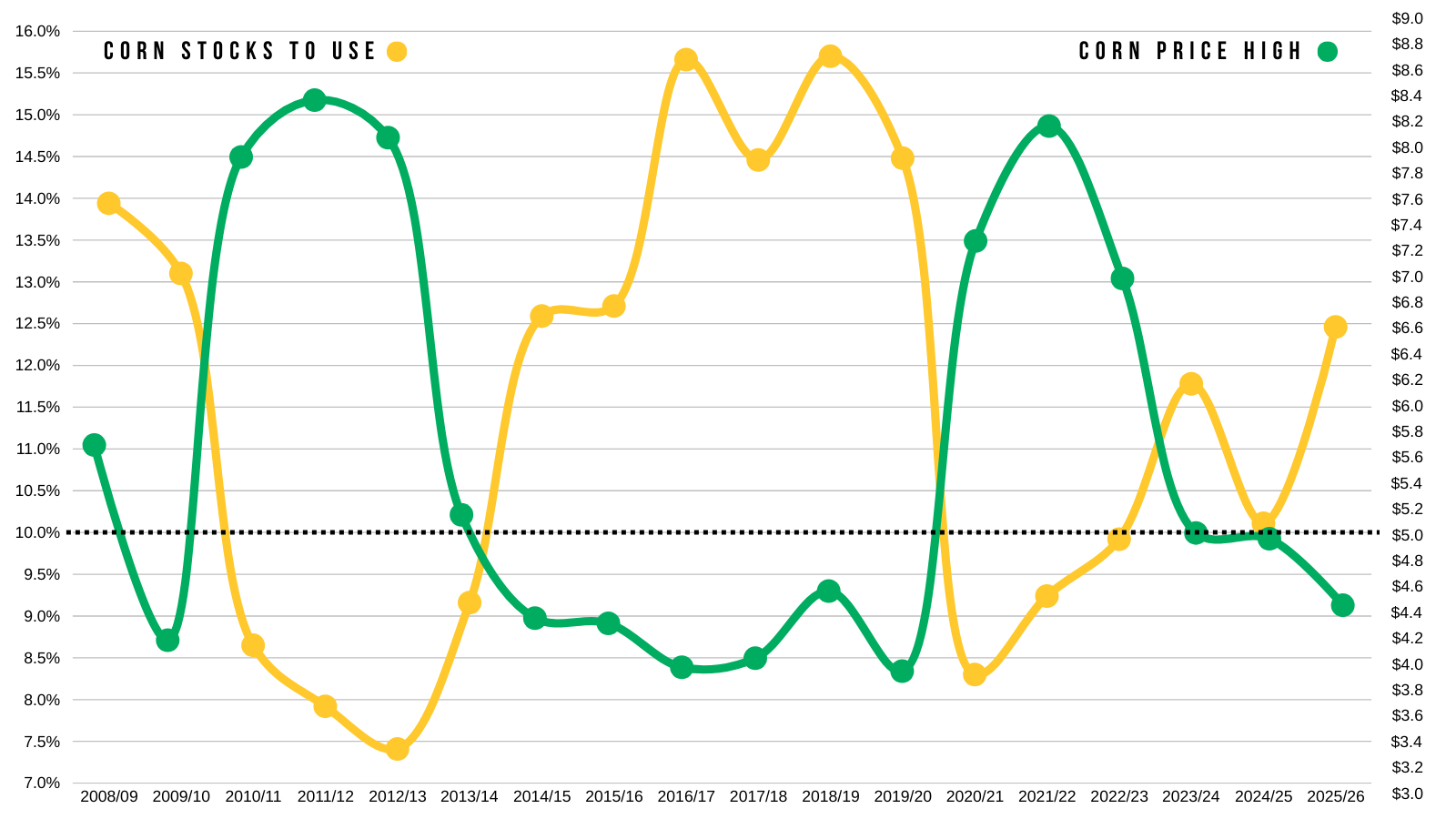

Here is a good way to visualize the stocks to use and it's impact on prices.

This chart shows our stocks to use in yellow.

Along with corn's highest price for the year in green.

I drew two lines on this chart.

One at 10% and one at 12.5%.

To get prices beyond $5.00, it almost always takes a stocks to use 10% or lower.

If you focus on that bottom line, anytime the stocks dips below 10% (yellow), the prices jump above $5.00 (green).

Now let's focus on the top line.

Anytime our stocks to use (yellow) is above 12.5%, our prices (green) tend to top out under $5.00 and result in a bear market.

Here is another way to look at it.

By splitting up the bull markets and the bear markets.

If our stocks to use stays this high, it is about on par with the last bear market.

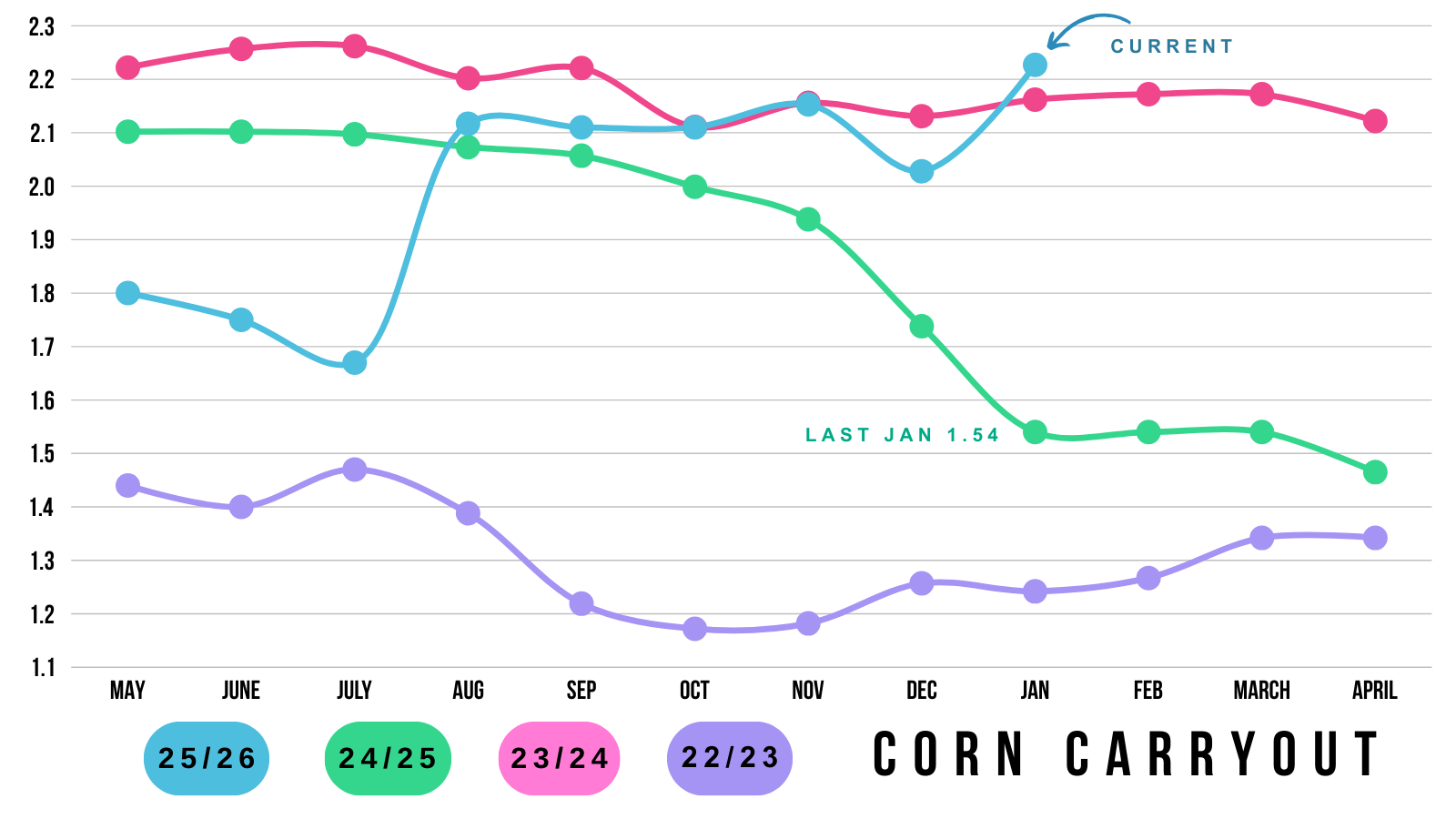

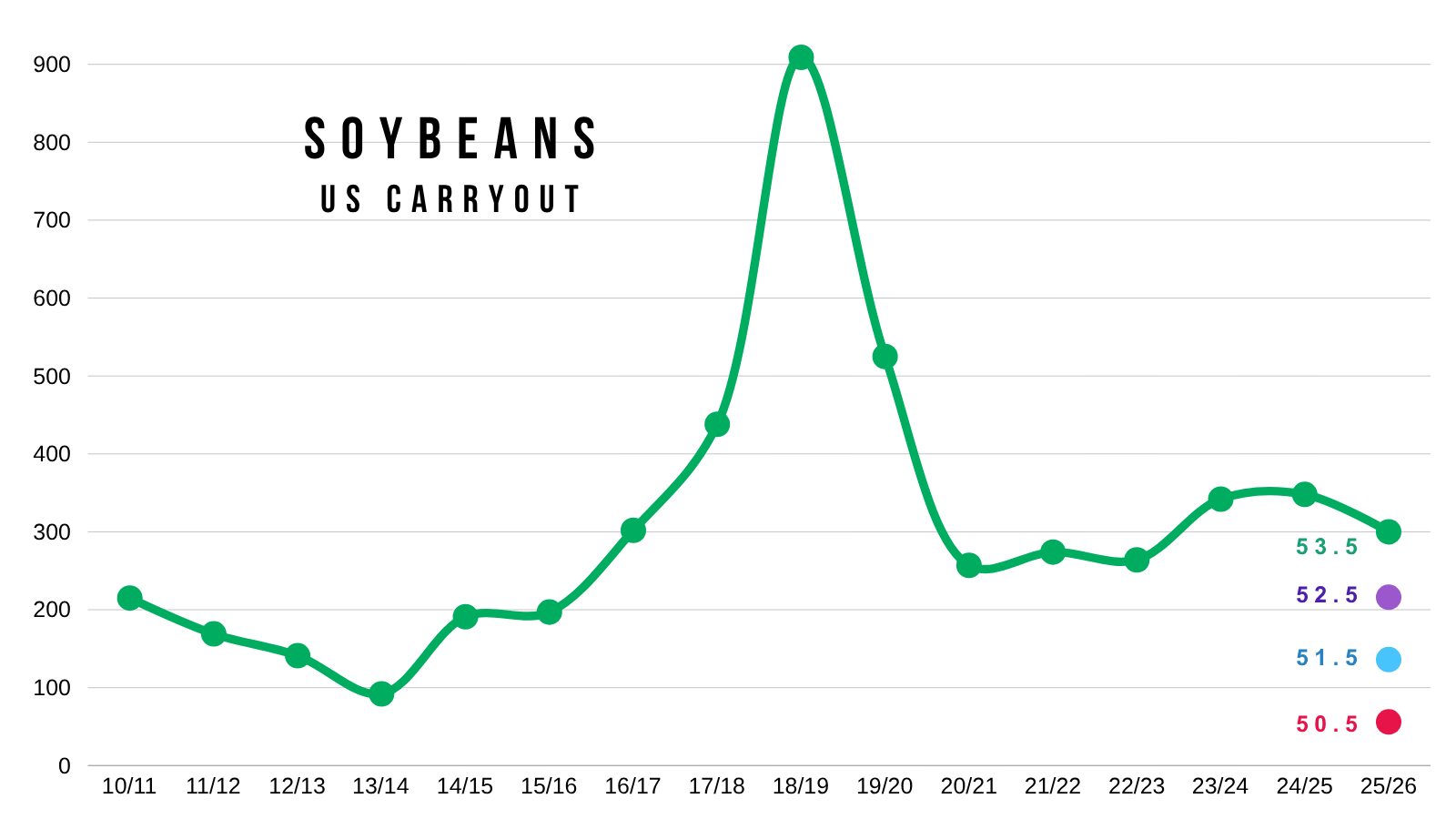

Here is a visual of our carryout.

It's now sitting at a pretty massive 2.23 billion bushels.

Which is the largest in the last few years.

We went from a not "overly bearish" situation if yield would’ve fallen down to 182 for example, to a clearly bearish situation.

To eat into that carryout, we'd have to see one of two things happen.

Demand continues to eat into it, or we get a weather scare.

The problem is that since the USDA once again upped feed usage, they more than have the ability to lower it in the future. So it seems like it'll be pretty difficult to get a carryout below 2 billion for now.

If we want corn to have a real story, we will need less acres this spring, a weather scare, or some other outside factor.

Until then, we will want to be rewarding any opportunity or rally that comes. As the fundamentals suggest sizeable rallies should be sold.

The report was indeed a game changer and answered questions about what corn's potential truly is from here.

I am not saying corn can’t go higher and we won't get an opportunity. Even bear markets provide opportunities. But it could very well be a struggle for corn here the next few months maybe even until planting.

We want to be prepared for when they do this year.

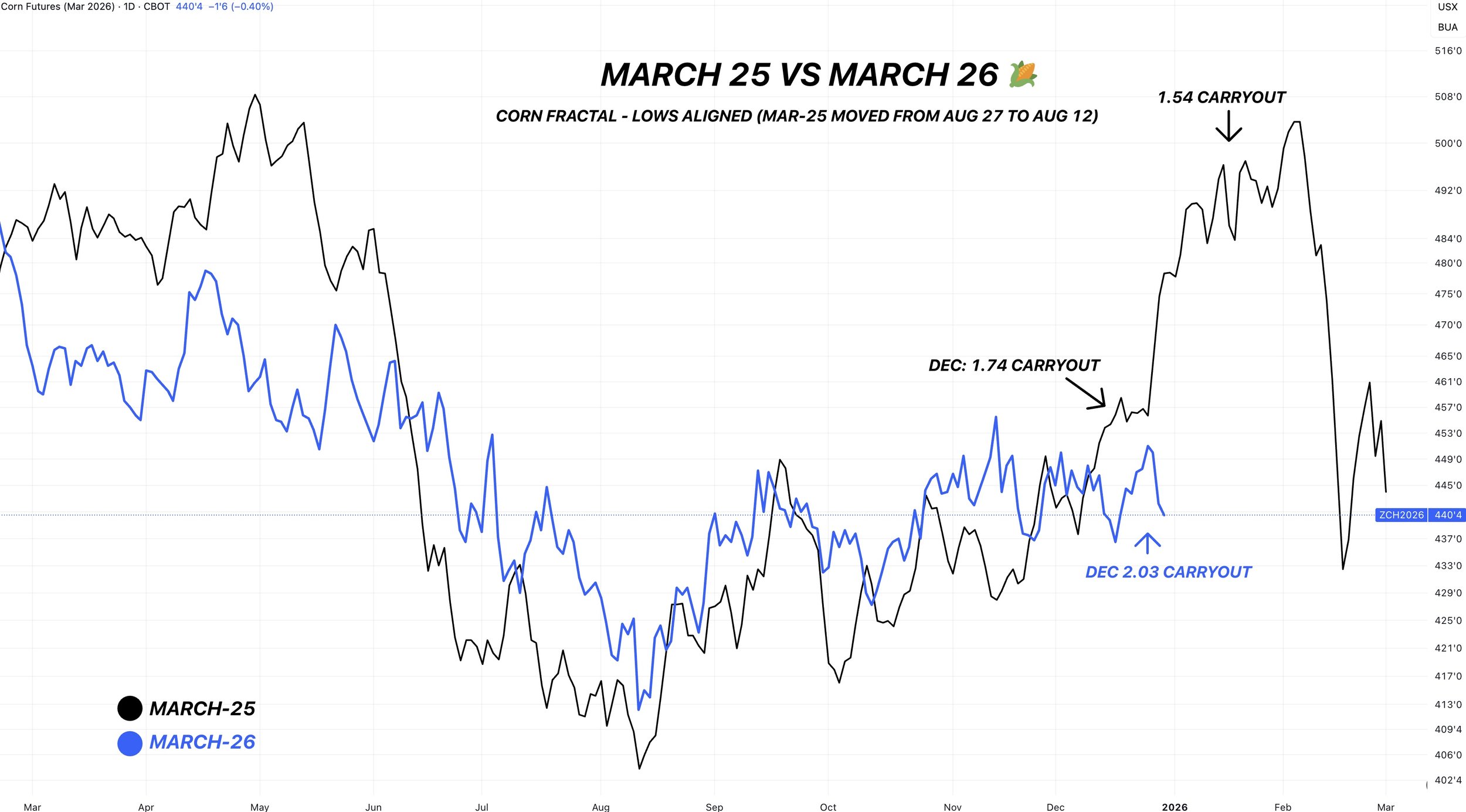

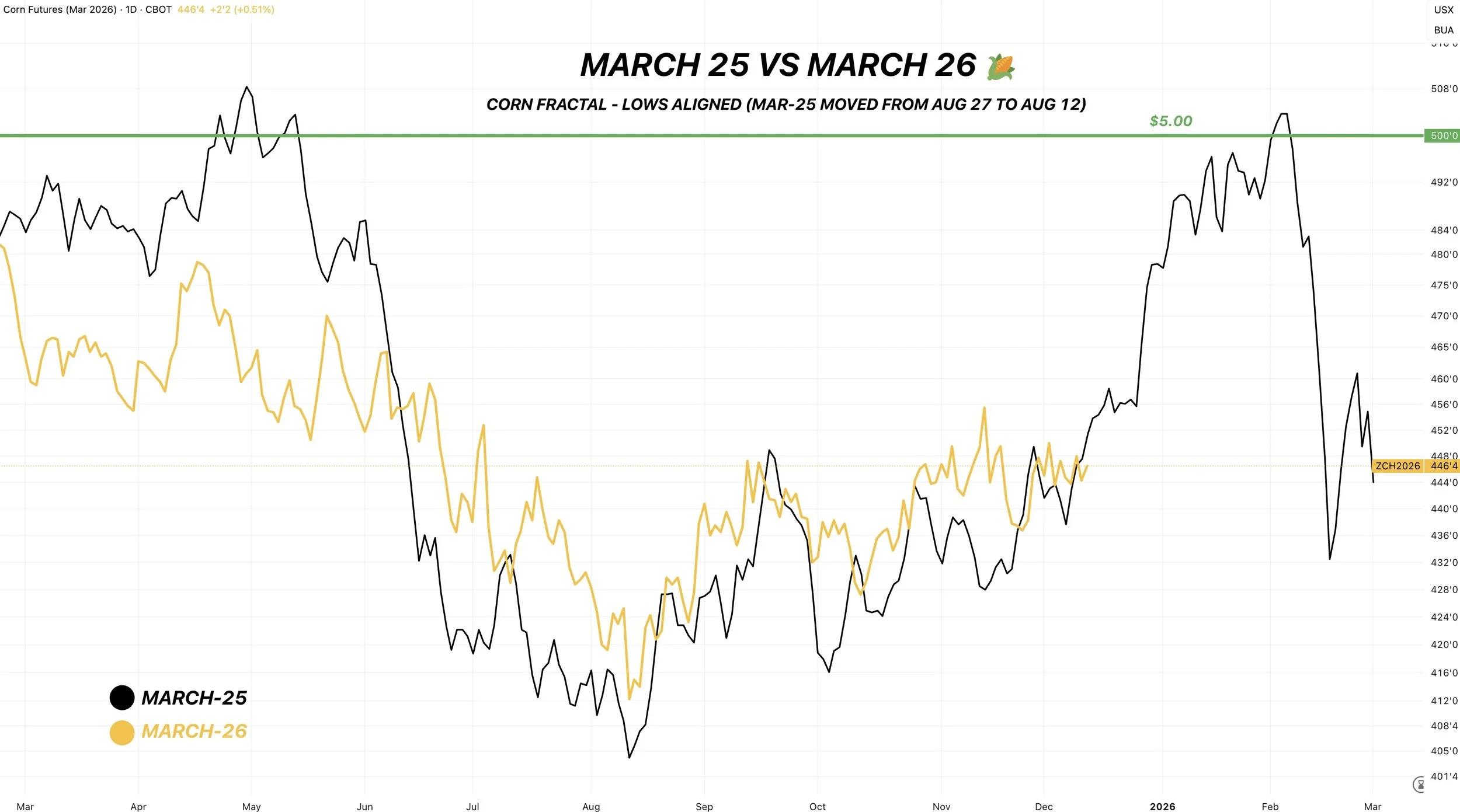

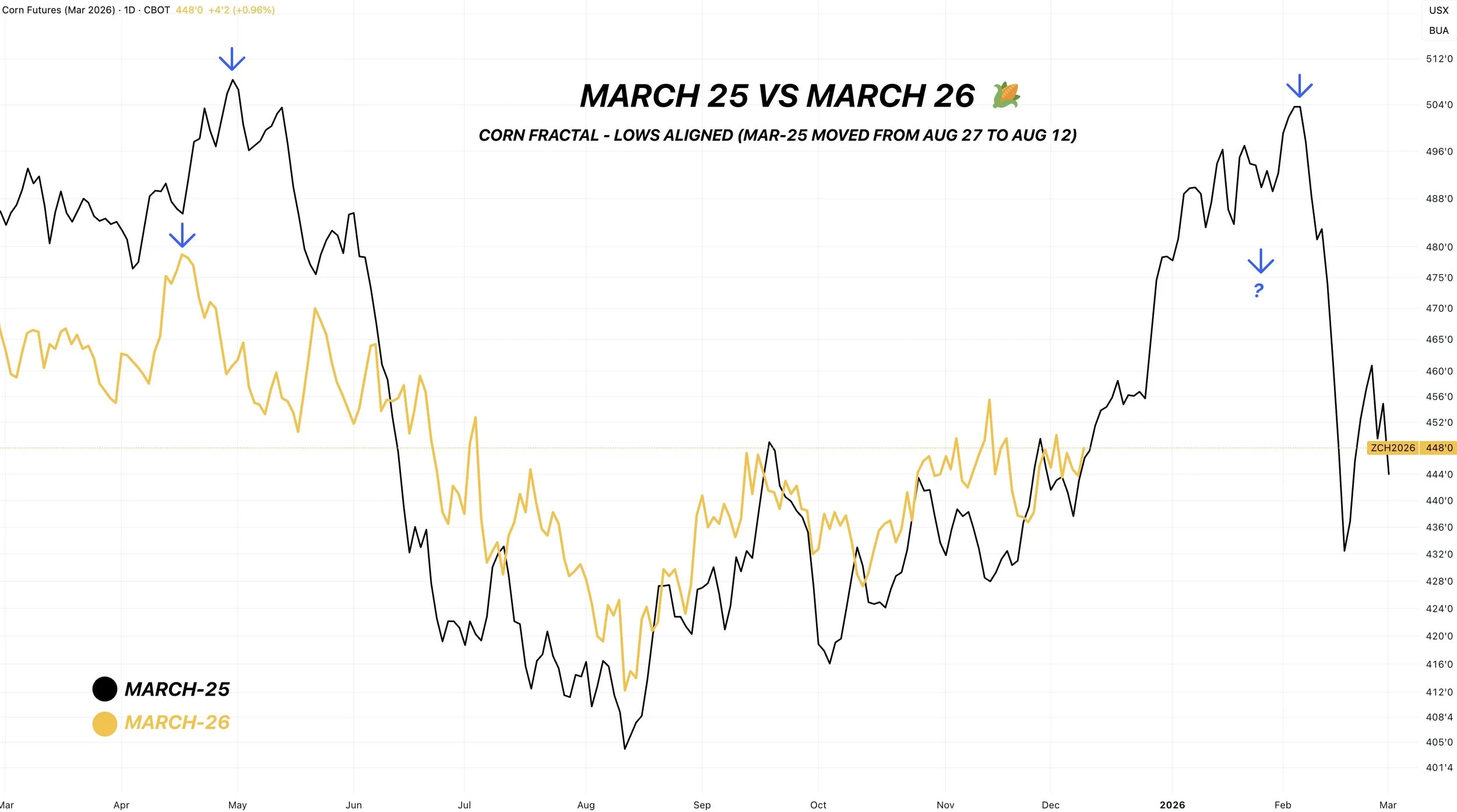

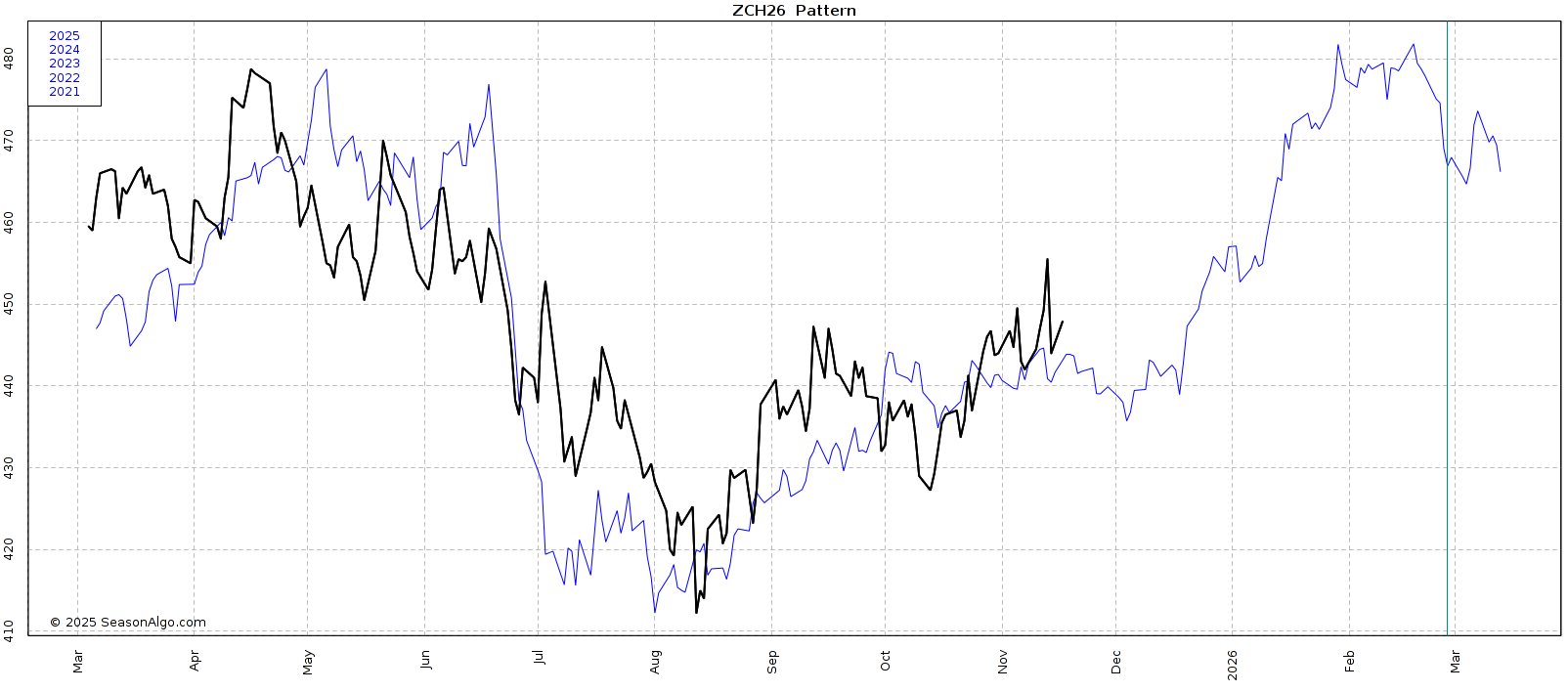

We had been tracking this pattern between March-25 and March-26 corn for the last several months.

Up until yesterday, were still tracking almost identically.

Those similarities ended yesterday.

Last year, the USDA dropped carryout by -198 million.

Yesterday, the USDA raised carryout by +198 million.

They did the exact opposite as last year, and the market got the exact opposite reaction.

Technicals:

March Corn

We originally had that sell signal at $4.50.

As it was key resistance and our first target.

In hindsight, yes, I wish we had been more aggressive.

That $4.50 was the level we needed to break through to get the next leg higher and we just didn’t get that.

Those numbers were about the only thing the USDA could’ve printed to get THAT bearish of a reaction.

I am not going to personally try to catch a falling knife here.

Today's candle did provide some optimism.

But we are essentially at our last line of defense before those contract lows.

Which is the 78.6% retracement down to contract lows.

If we take out this level, contract lows is the next point of interest.

Where to de-risk:

We will get a dead cat bounce at some point whether we go lower from here first or not.

We will want to be looking to reward any relief bounce that claws back 50-61.8% of this sell off.

If we move lower, then this target box changes.

Currently, that golden zone aligns with our old support.

Targets do not have to hit. They are just there to let you know to de-risk if they do.

Soybeans

Fundamentals:

Corn's overly bearish report stole the show.

But the report for soybeans was also pretty bearish.

Not only are soybeans dealing with a bearish USDA, but we are once again dealing with trade conflicts. Which is probably part of the reason why we struggled today.

Trump announced he would be imposing 25% tariffs on any country that trades with Iran.

China is Iran's #1 trading partner.

The Supreme Court rules on Trump's tariffs tomorrow.

Odd makers say there is a 73% chance they rule them illegal.

We will have to see if the soybean market reacts to the ruling.

The soybean situation does suck, given that there was so much potential for soybeans to have a really bullish situation.

The potential was definitely there.

But trade conflicts ruined that.

Our exports are estimated to be 104 million bushels below what they were in 2019/20.

The US situation would be very tight if exports would’ve been fine.

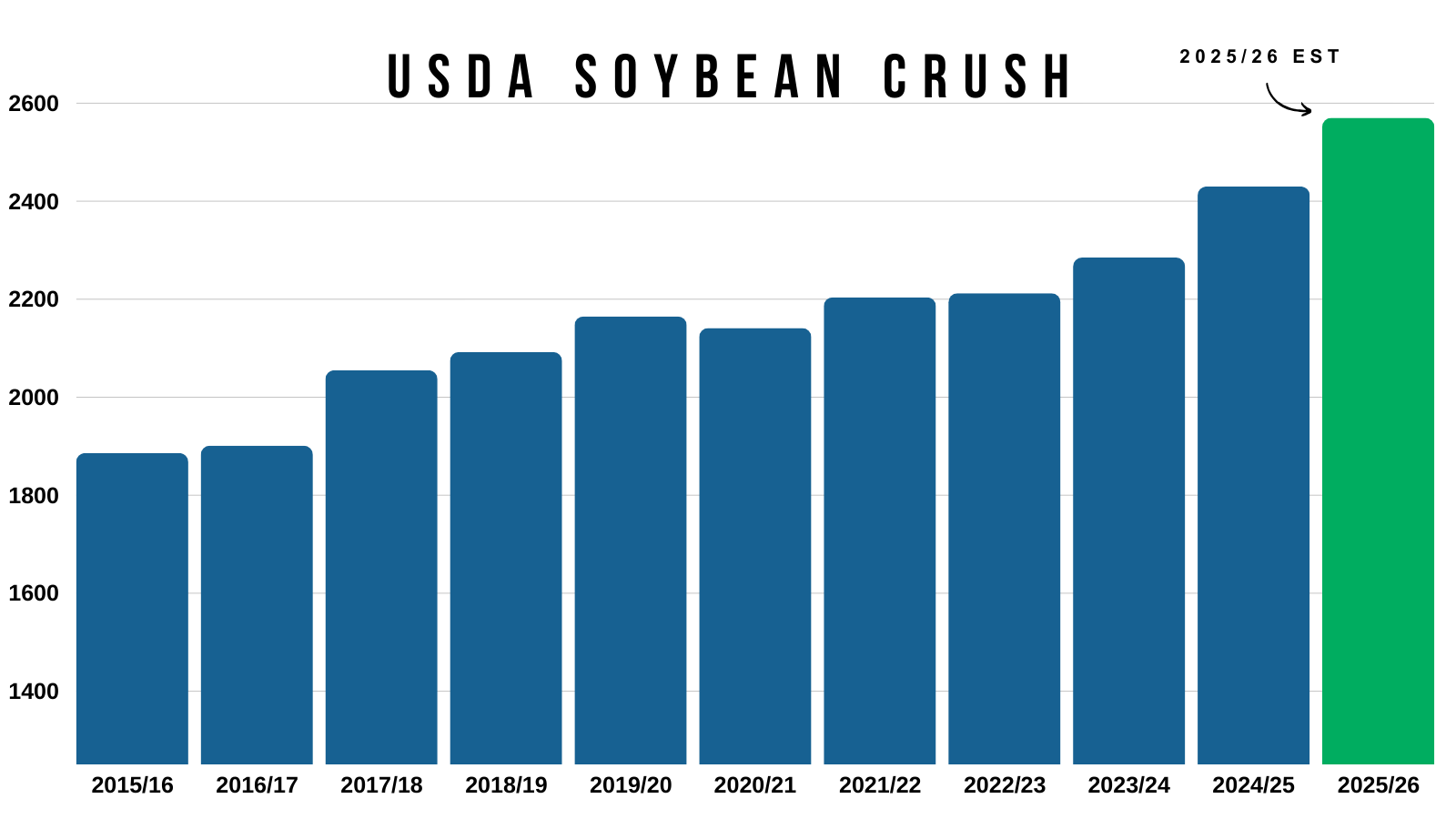

We are crushing more than ever.

Crush demand is as strong as it's ever been.

So imagine if exports weren’t awful.

Even if we had the same exports as the last trade war, you'd be taking off an extra 100 million bushels of supply on the balance sheet.

With a carryout of 350 million, that is a big swing.

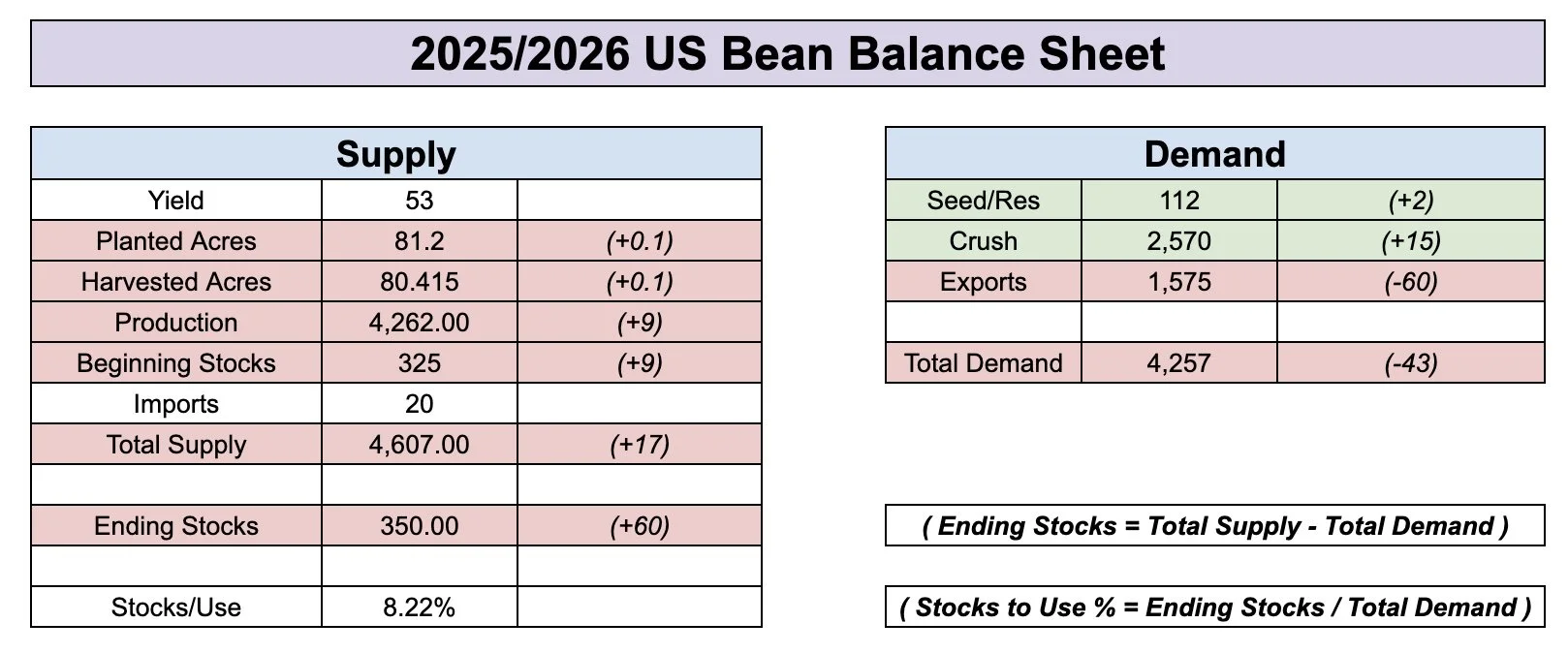

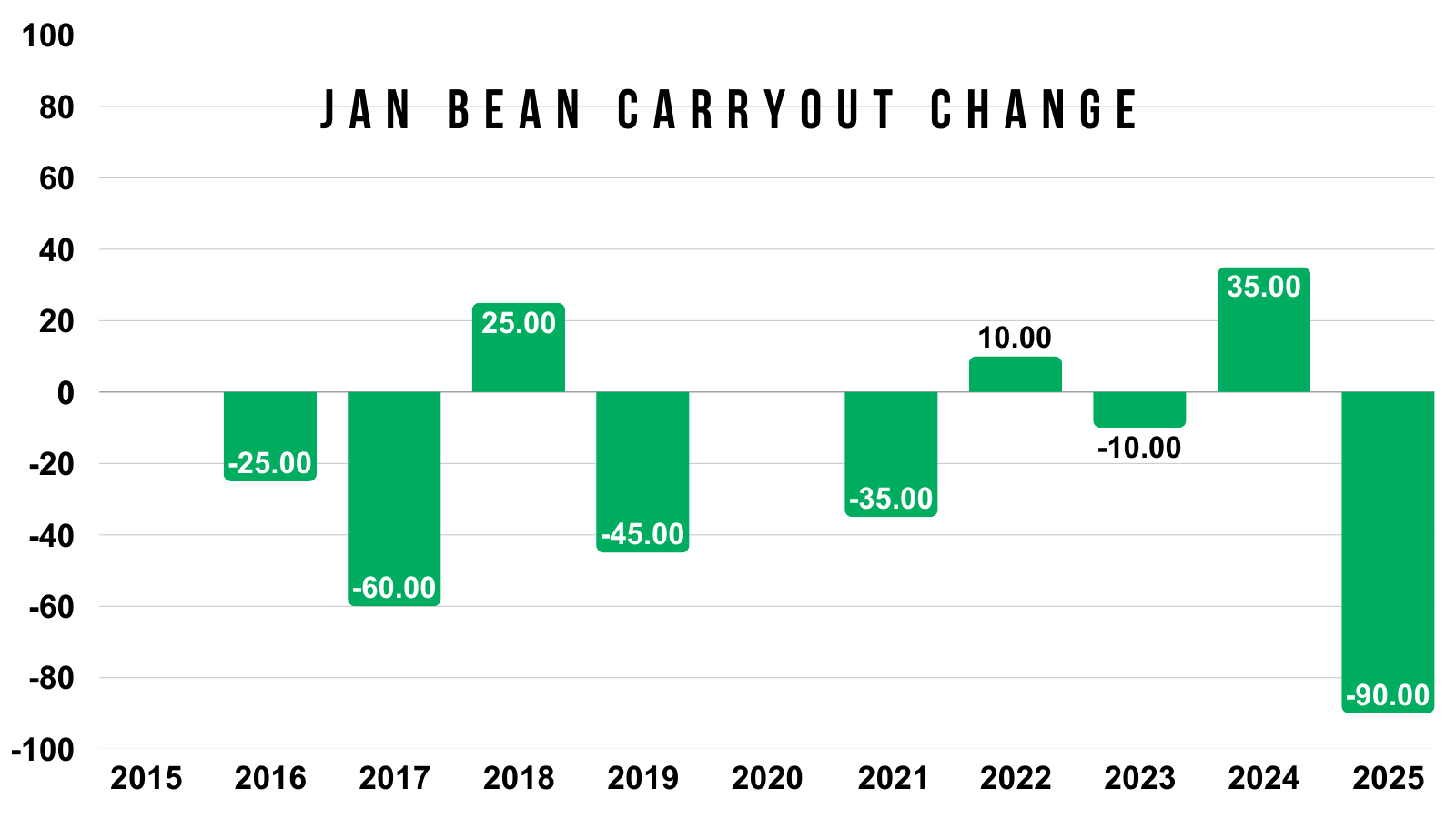

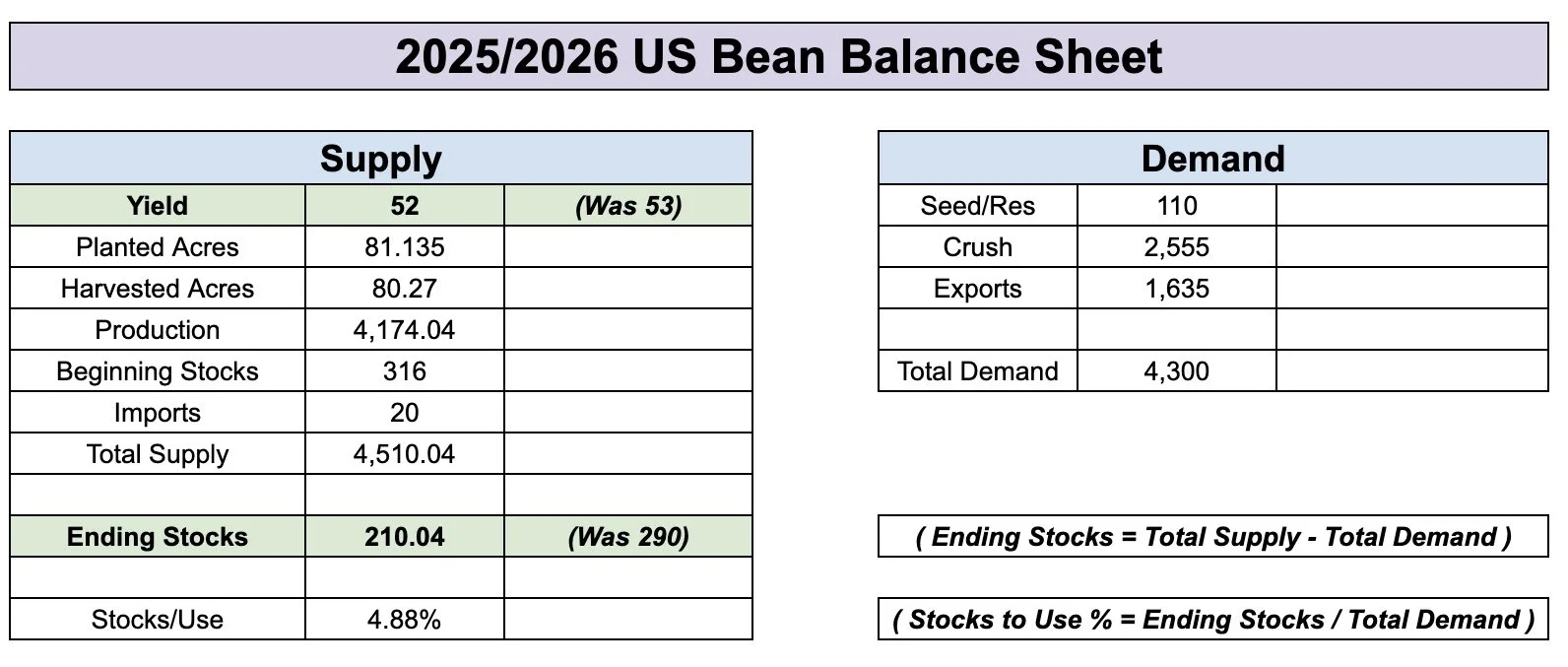

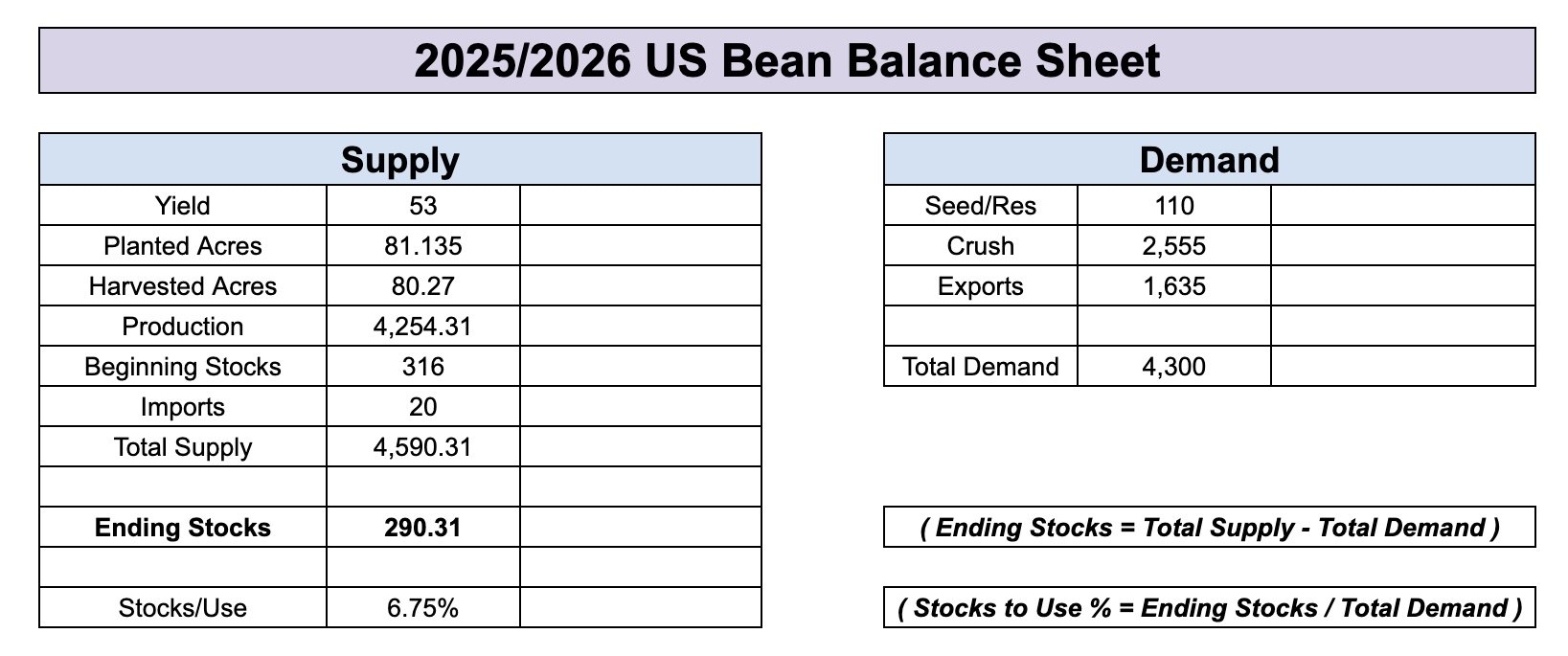

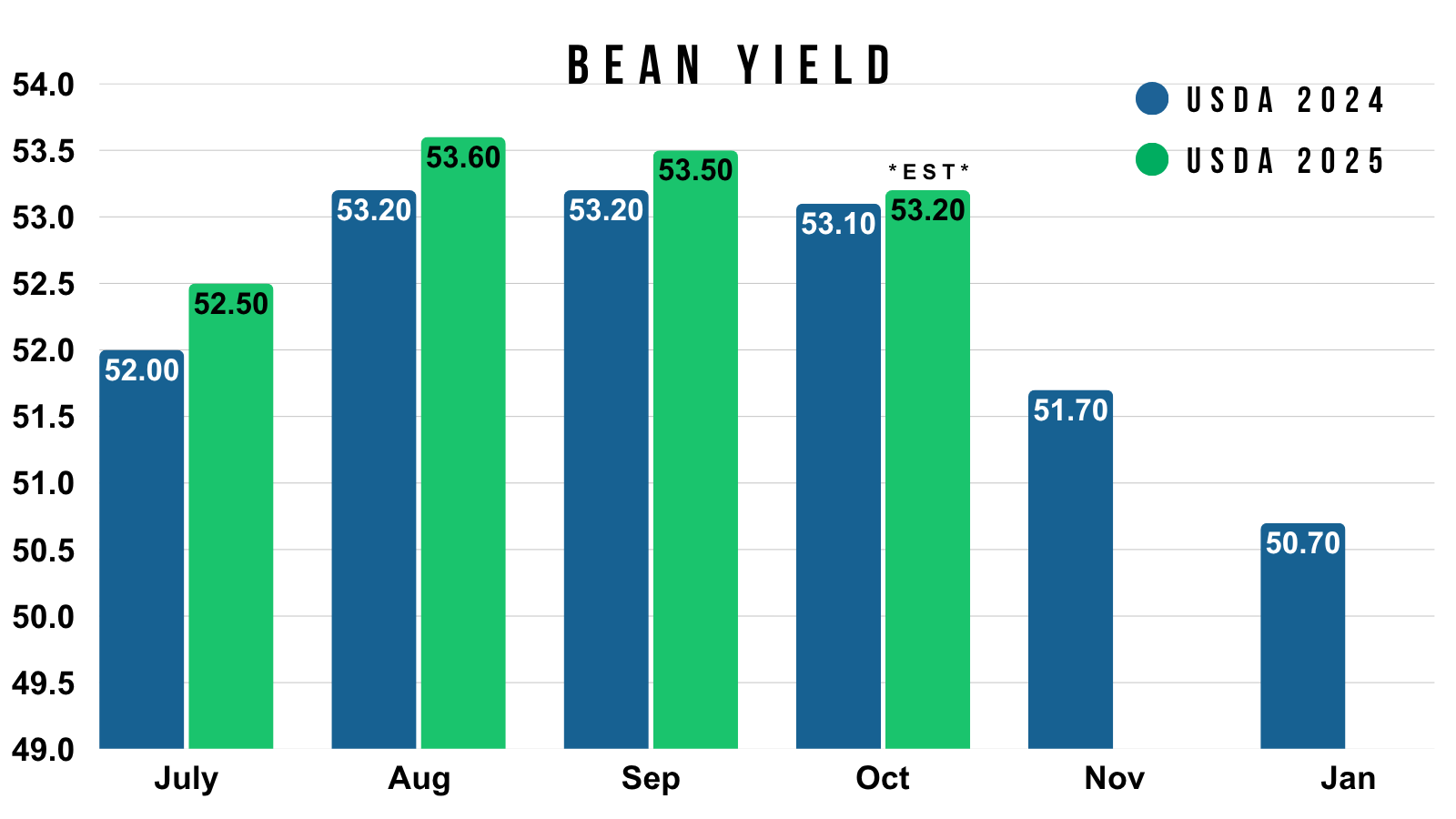

Here is the balance sheet changes from the report.

Yield unchanged.

Exports dropped -60 million.

Crush increased by +15 million.

They found an extra 100k acres.

The increase in crush was offset by the increase in acres.

Resulting in carryout jumping by +60 million from 290 to 350 million.

You can’t really argue against their decision to cut exports.

I think that is totally justifiable.

Export demand is so far behind pace and we are well past our prime shipping window.

We're down -43% vs last year.

To add on to that, Brazil has a record crop that's about to come online.

They haven’t seen any weather issues.

Which makes it that much harder for soybean exports.

This was the 5th time in the last 12 years where yield didn’t come down in this report.

Like corn, this report was one of the most bearish in the last decade.

It featured our largest increase to carryout in over a decade.

Almost double the next largest one.

Technicals:

March Beans

The chart doesn’t too great here.

We failed to bust above that 61.8% retracement up to those Christmas highs. Which was the level we need to break to spark further upside.

We now broke that trendline support from contract lows.

We are now sitting right at those lows from new years.

If we fail to hold that level, it could easily open the door another -20 cents lower.

As the next point of interest is going to be the 78.6% level down to contract lows.

Still looking to reward a sizeable relief bounce if it comes.

Wheat

Wheat was trying to breakout before the report but ultimately failed. The data certainly didn’t help, but I'd imagine the collapse in corn spilled over to the wheat market.

There wasn’t a ton of adjustments for wheat in the report.

Wheat had the least bearish report, but like corn and soybeans couldn’t escape the bearish surprises.

Carryout surprised a little high.

Winter wheat plantings were down about -1% vs last year.

But came in higher than the trade was anticipating.

Most feel like this number could work itself lower given that prices are far from appealing.

You could argue that we see some downward revisions come March.

Outside of that, the wheat story still lacks a catalyst and the situation is still far from being bullish.

We have plenty of supply in the US.

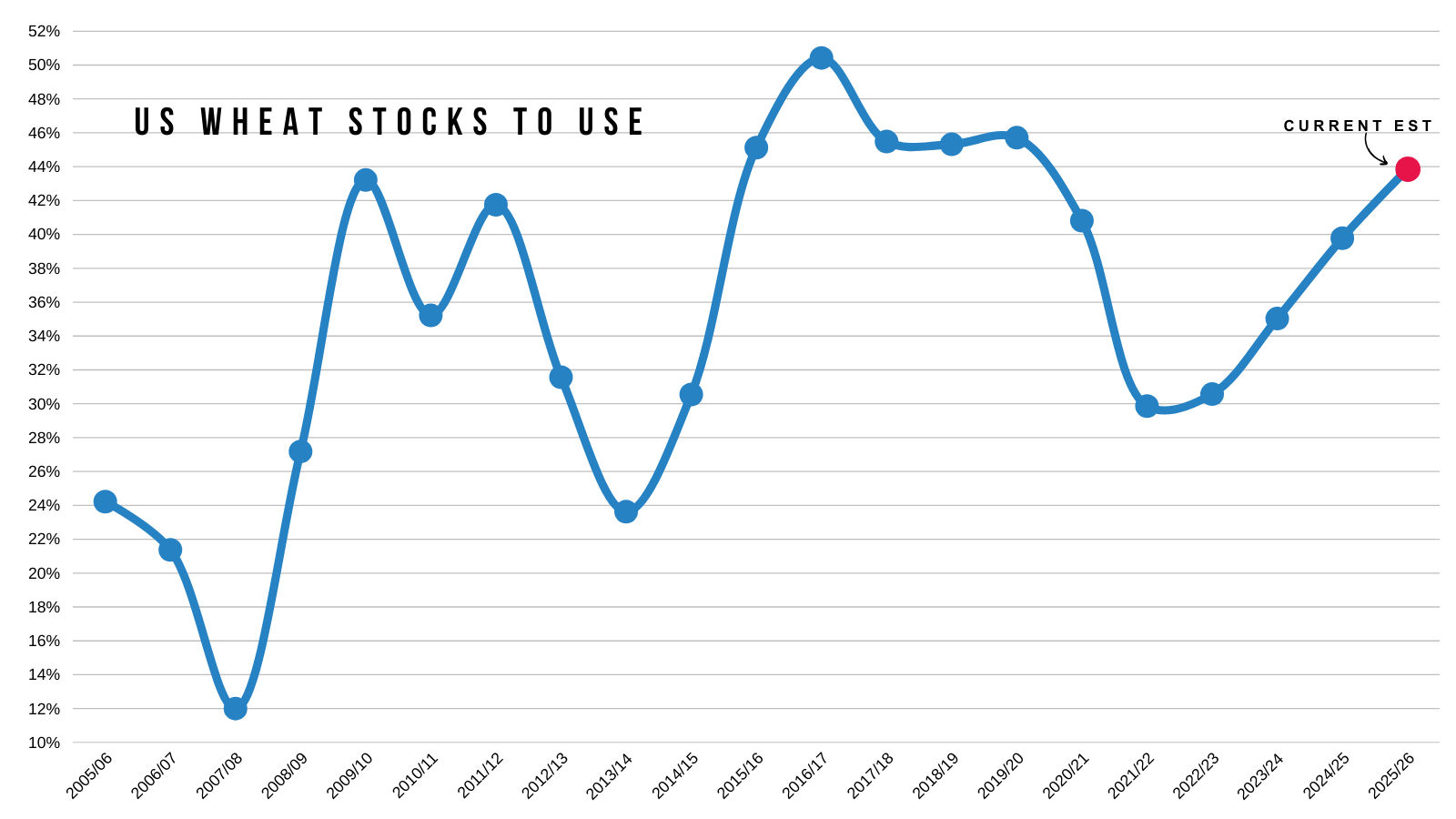

The stocks to use increased once again.

(Red dot is previous month)

We also still have plenty of supply globally.

Without a major global player having any supply or weather issues, it just makes it hard for the wheat market to catch a real bid.

There will be a concern somewhere eventually, but for now there just isn’t.

Still remaining as patient as I can in wheat.

We don’t have a reason to get overly bullish. But at the same time, it's hard to justify being bearish at $5.00 wheat.

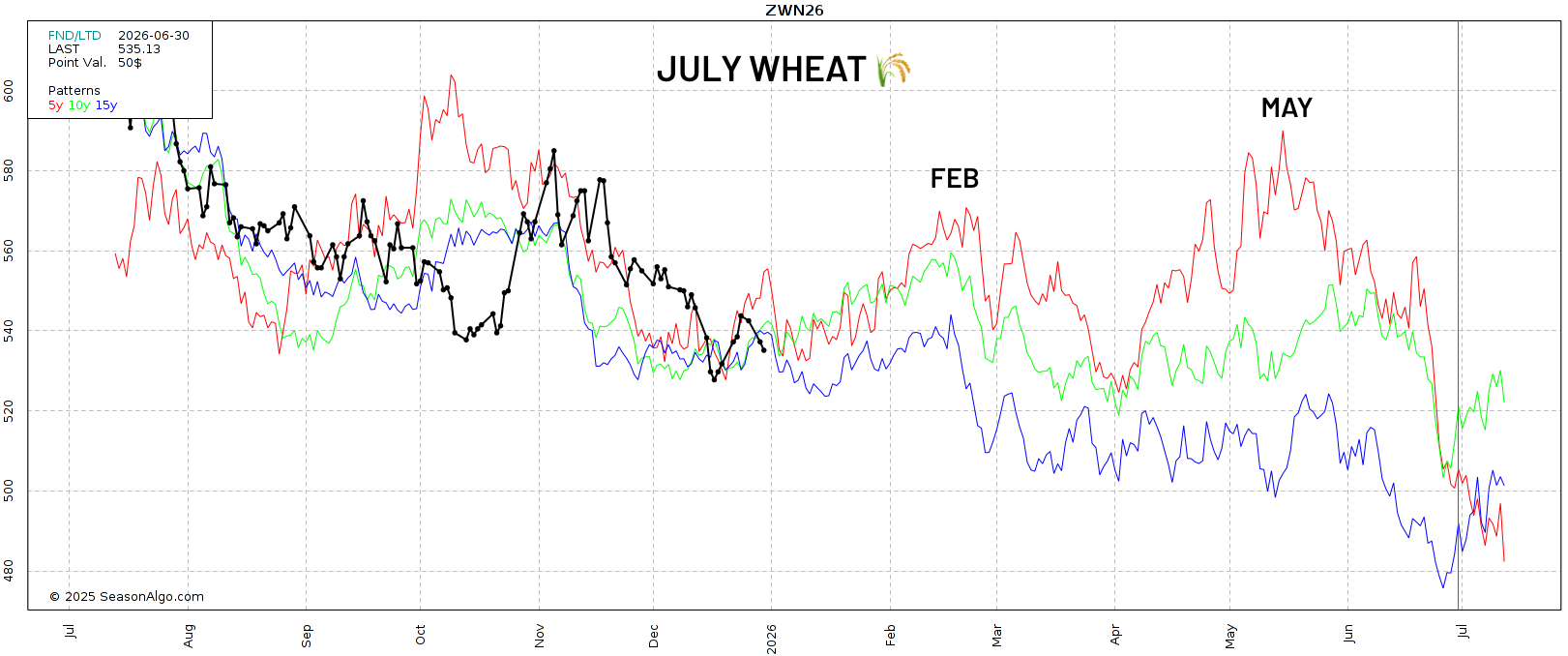

Seasonally, the wheat market tends to get it's biggest opportunity of the year during the spring.

Chicago Seasonal

KC Seasonal

Technicals:

March KC

We failed right at that 61.8% retracement up to those Nov highs once again.

We also failed to break trendline resistance.

That $5.35 level is still the clear level bulls need to break to get a leg higher.

In the meantime, we've now given back 61.8% of yesterday's highs down to those Dec lows. Important spot to hold here.

If we fail to hold here, we could go test those lows.

March Chicago

Nothing to update here.

Simply consolidating near the lows.

Cattle

Fundamentals:

Not a ton on cattle today as today's focus in the update was the USDA report and the grains.

Cattle continues to push higher with the lower corn.

It makes the cost of gain cheaper so you can theoretically pay for more cattle.

Which often supports feeders the most because feedlots can pencil better margins and theoretically bid more aggressively for feeder cattle.

The cattle situation is still tight.

However, I am skeptical that we have much more upside for beef demand here.

Here is an interesting tweet I saw from Swift Trading.

They make a good argument.

They argue that yes cattle supply is tight, but that doesn’t automatically mean beef gets tighter from here.

They are basically saying that cattle can be tight while beef production still holds up because carcass weights can increase, and slaughter pace can stay strong. You can end up with more beef showing up, even without more cattle showing up.

Cheap corn and a high cattle market will also incentivize heavier carcass weights. That is a metric we need to continue to monitor here.

So if beef production stays steady and demand isn’t growing, then you could argue cattle prices might need to soften because the beef pipeline isn’t getting tighter.

Overall, the cattle market clearly remains bullish with the big picture tight supply story.

But I am still using caution up here as some areas of demand aren’t showing a lot of room for further upside. Such as weak cut out.

The wholesale side of things are also showing some signs of weakness. For example, rib primal value is -26% lower than a month ago. Which feels important because when the wholesale side gets weak, it can often be a sign that demand is getting tapped out at these levels.

There is talk about a dairy buy out program in attempts to get ground beef prices lower. But from what I've heard, it doesn’t sound like it will be happening. The trade hasn’t seemed to care about it either.

Technicals:

March Feeders

We are now above the 78.6% level of the entire sell off.

So from a technical standpoint, the next point of interest is that last gap and those highs.

We are showing some bearish divergence on the RSI. Just a reason to have some caution as well. Prices made new highs, the RSI did not.

Overall, we still like defending these levels in some sort of matter if you have not yet done so. It's hard to call a top in a bull market.

Feb Live

Next point of interest is the 78.6% level just over 240.

Past Sell or Protection Signals

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

HISTORY OF JAN USDA

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Jan USDA: 2:20min

Corn: 4:40min

Beans: 10:00min

Wheat: 12:45min

Cattle: 13:50min

Want to talk about your situation?

(605)250-3863

Your free trial has ended

Here is extended access to our holiday sale

Don’t miss future updates or signals

Futures Prices Close

Overview

Grains mixed while cattle led the way higher.

The markets are back out of holiday mode but overall we still lack a ton of fresh news. With all eyes set on next week's USDA report.

We did see China buy more US soybeans. With a 336k MT flash sale this morning.

They've officially bought around 7.2 MMT, which is 60% of the 12 MMT goal.

Chart from GrainStats

However, rumors speculate that they've actually bought closer to 10 MMT. Which would be 80% of the goal.

So it doesn’t look like it should be too hard to reach that goal by the end of February, which was Scott Bessents deadline.

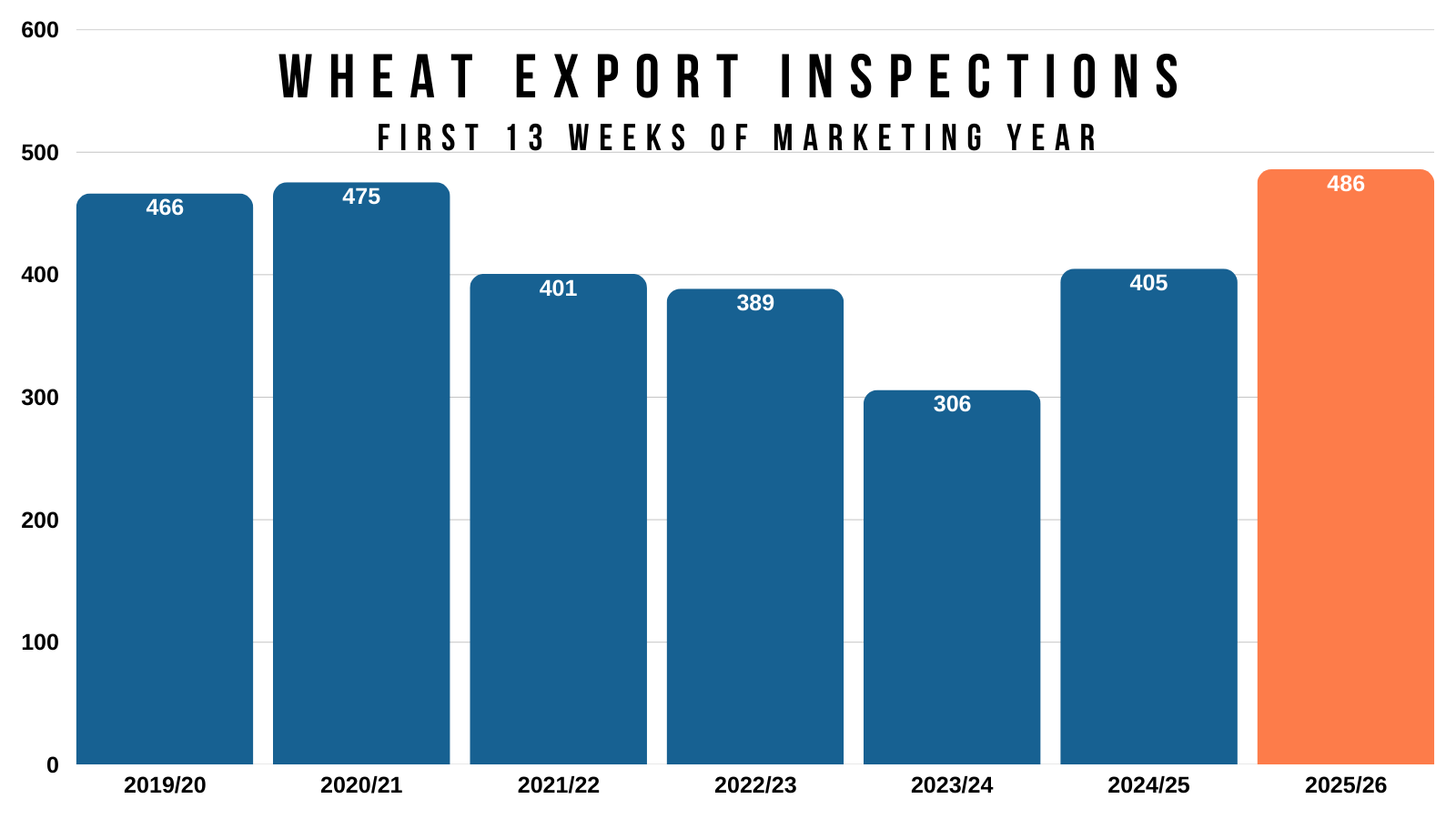

Export Inspections vs Last Year

This Year vs Last Year

Corn: +65%

Beans: -45%

Wheat: +20%

Corn demand remains phenomenonal.

Soybean demand continues to be some of the weakest on record.

Wheat demand continues to impress.

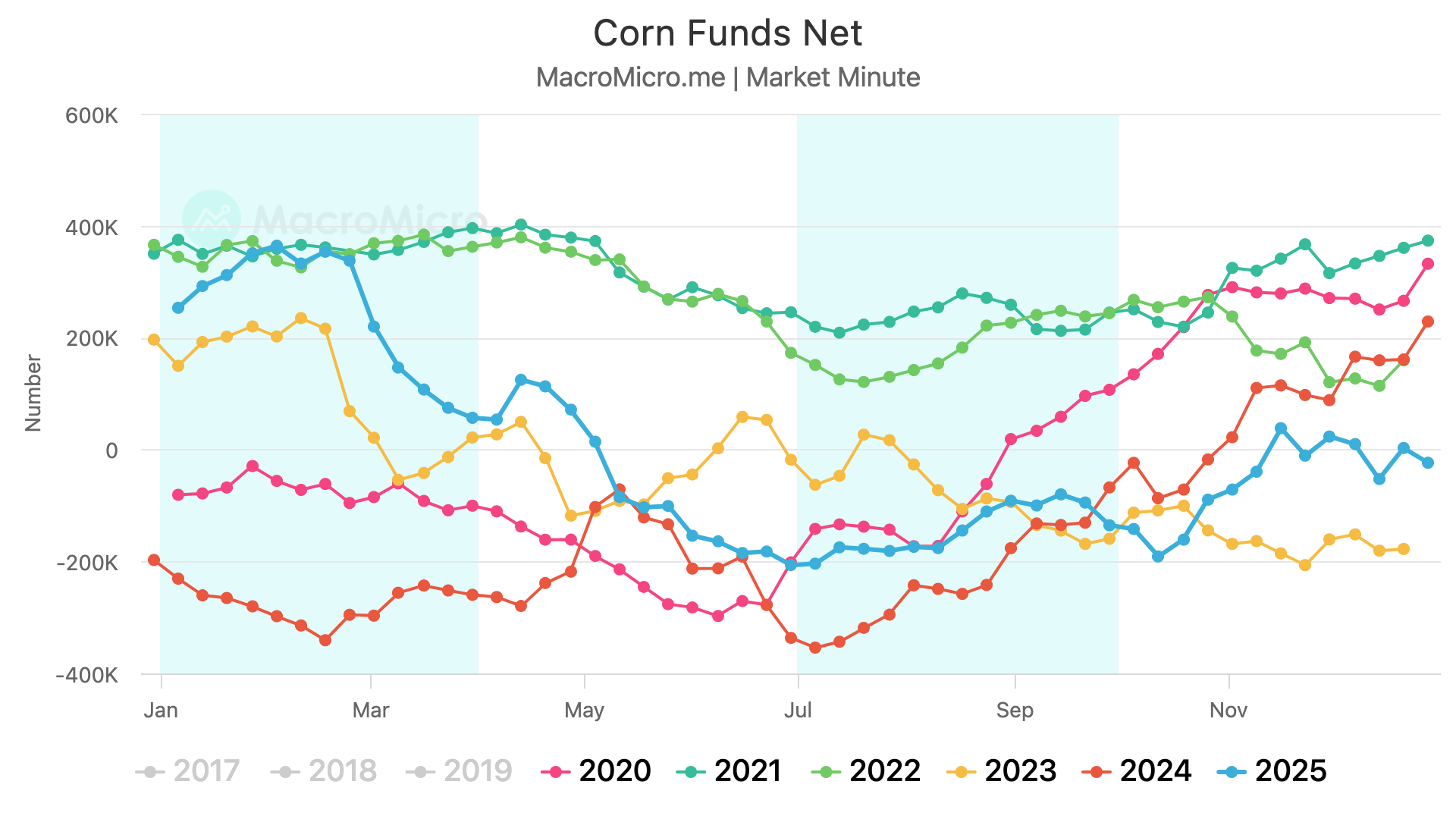

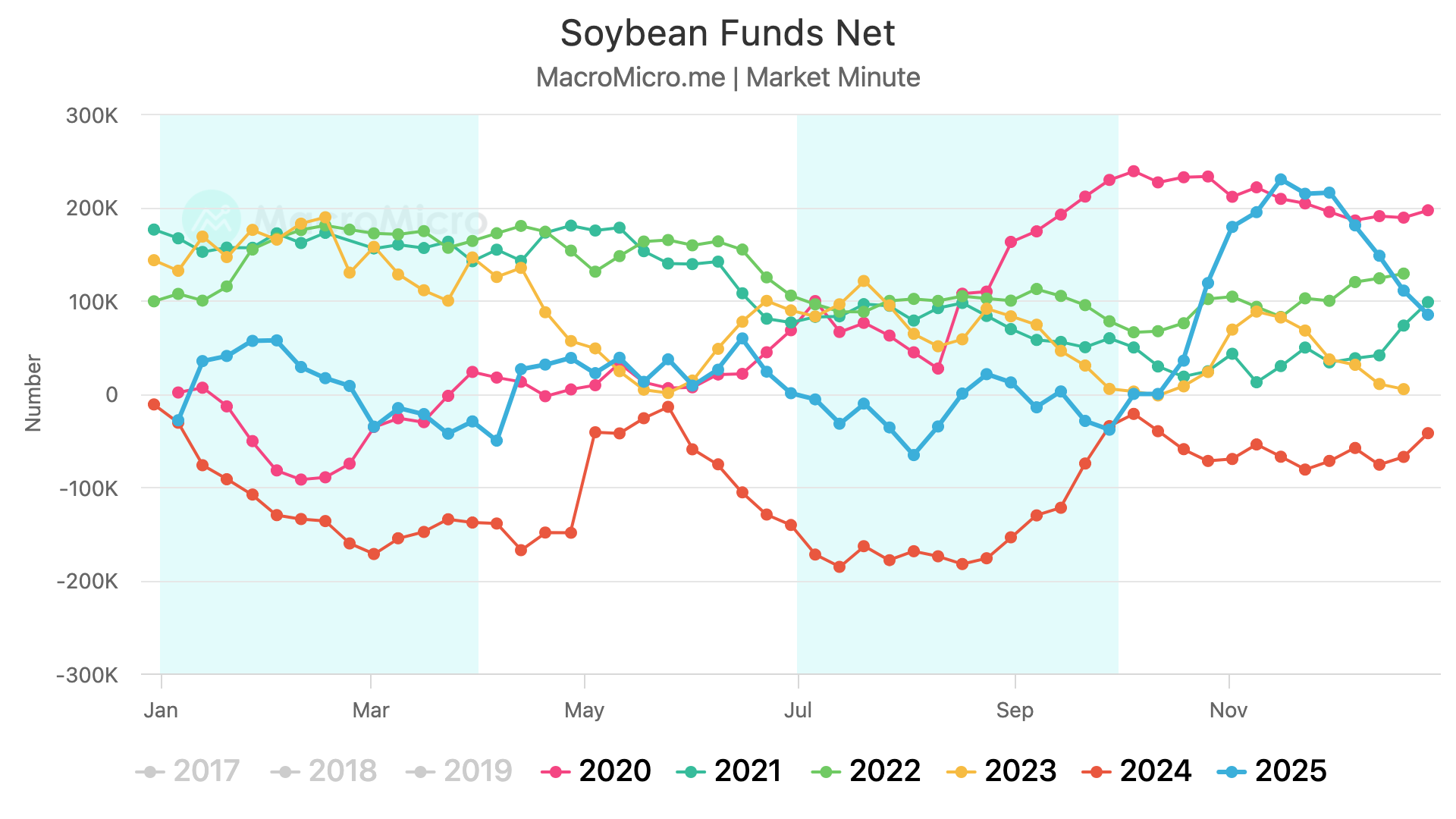

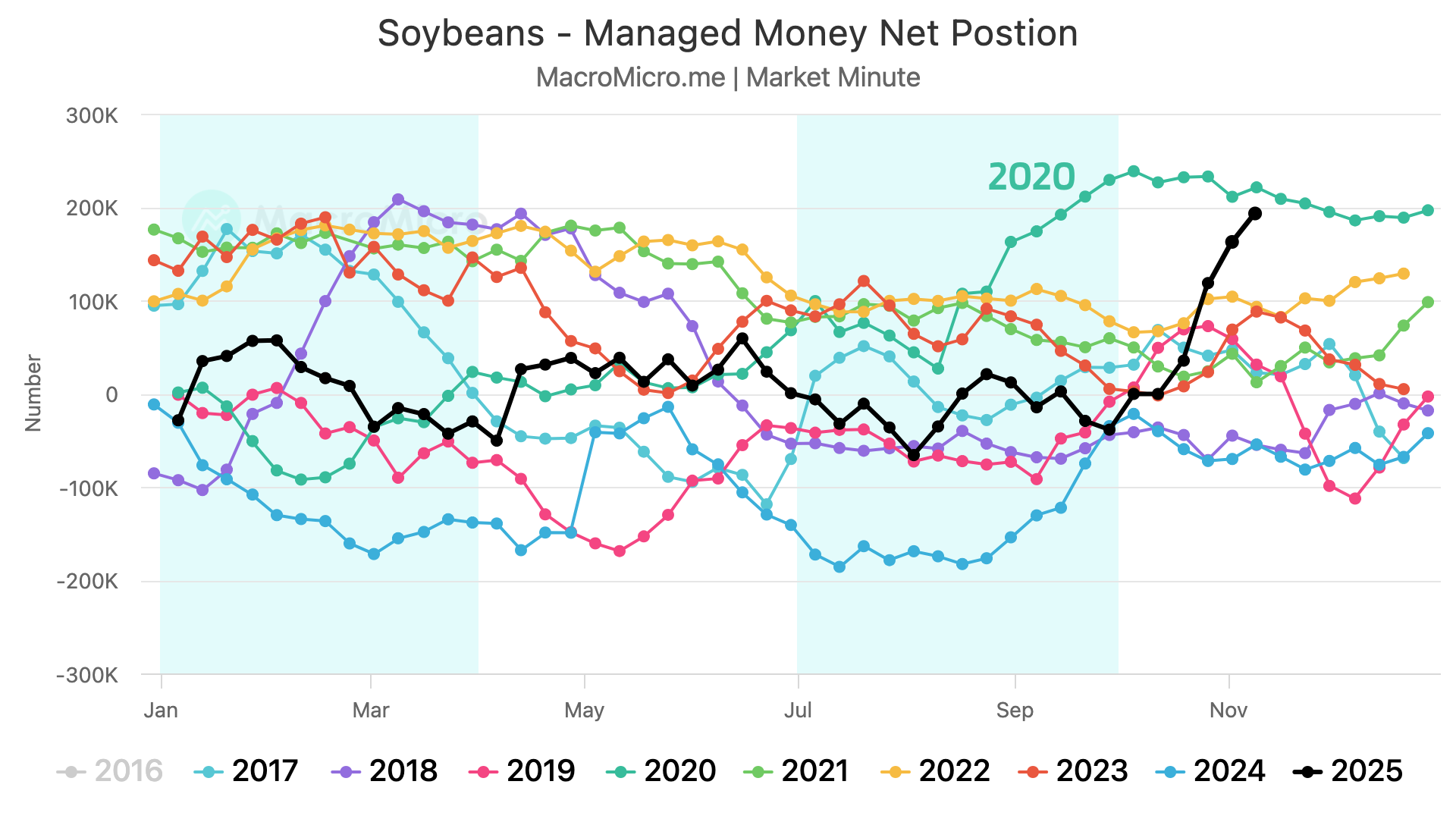

The Funds

We are finally getting caught up on all of the delayed data from the government shut down.

The funds positioning is fully up to date now.

Their positions:

Corn: -23k

Soybeans: 85k

SRW Wheat: -95k

Live Cattle: 93k

Here are the visuals.

Corn funds are essentially neutral as they haven’t done much for the last two months. Hence why prices have also traded sideways for the last two months.

For soybeans, the funds were near record long back in November.

Long 230k contracts.

They've clearly given back a big chunk of that length, but are still long 85k contracts. So they haven’t entirely given up that position.

In live cattle, the funds still hold a large position historically speaking.

But isn’t close to the length we saw earlier this year.

The funds are actually holding a smaller position at the end of 2025 than they were at the end of 2024.

History of Jan USDA

This report is always one of the biggest of the year.

It can set the tone for a few months and ultimately has the potential to be a game-changer in either direction.

Let's dive into what this report has provided in the past.

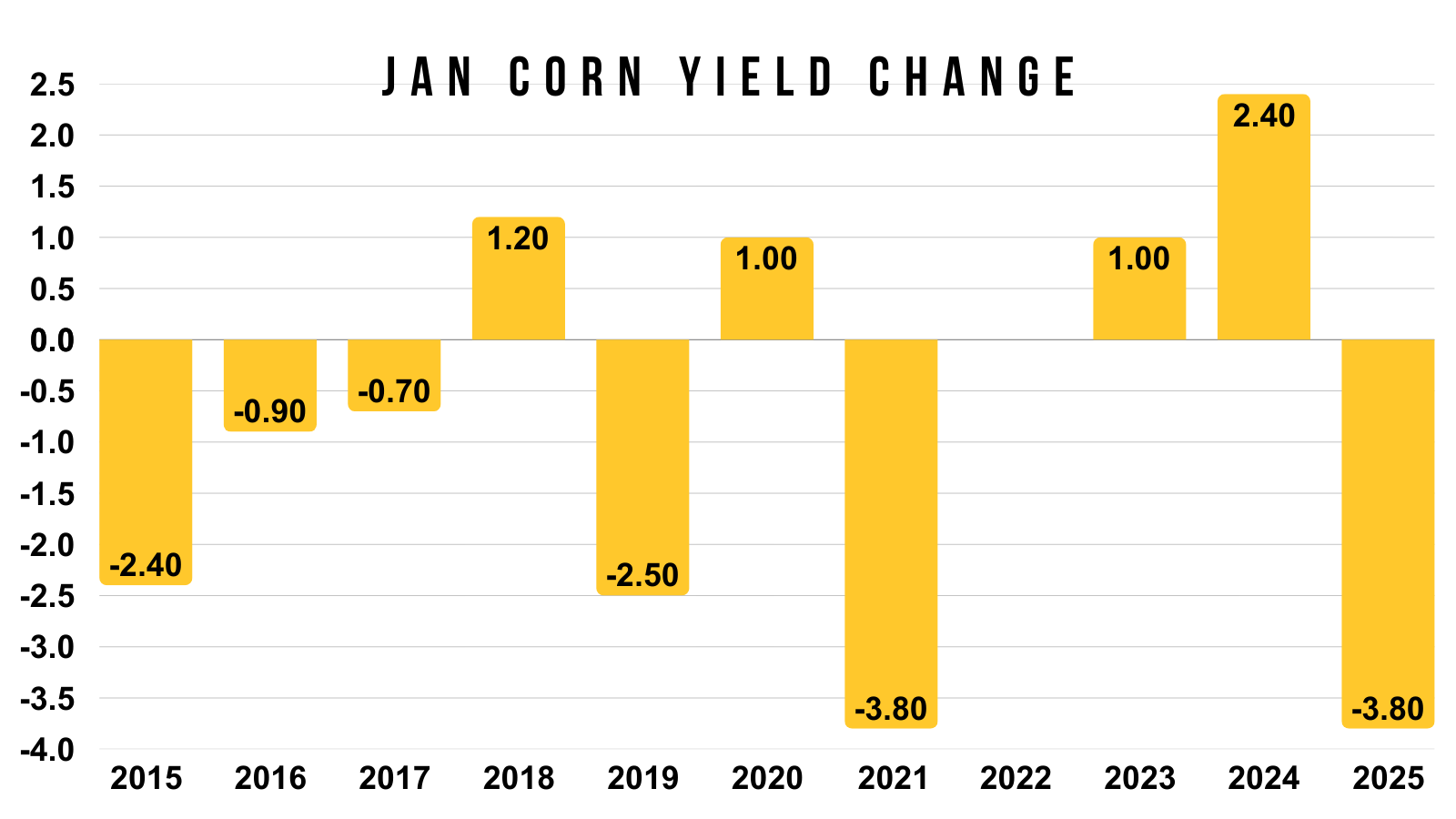

First for corn.

Corn has traded higher on this report the last 8 of 12 years.

Interestingly enough, in 3 of those 4 losses we only traded lower by around 2 cents.

There is only one time in recent memory where we truly had a negative reaction. Which was 2024.

More often than not, this report doesn’t tend to be overly bearish.

It doesn’t mean it has to be "bullish" like last year, but we rarely sell off the day of the report.

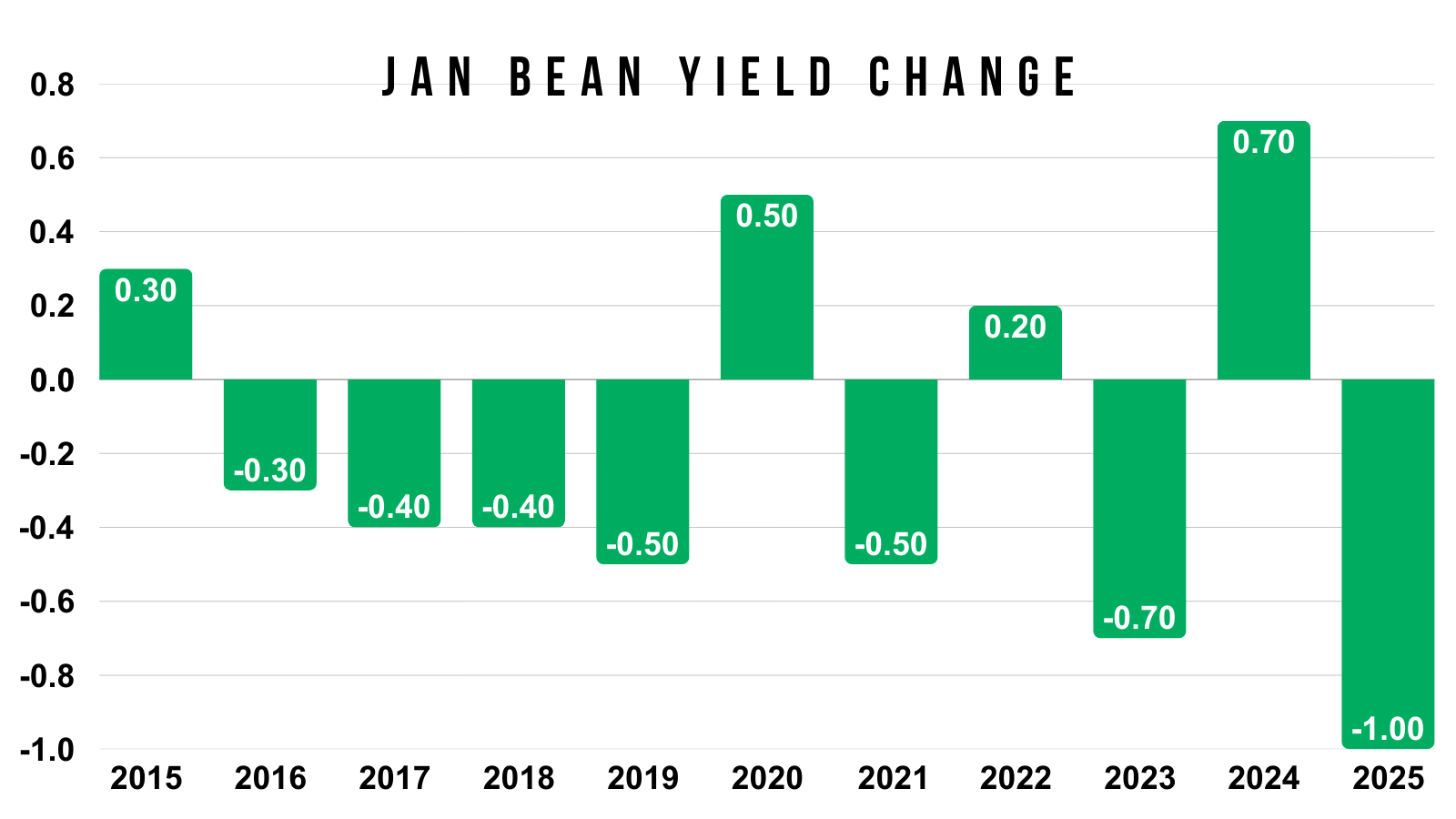

Yield tends to come down in this report.

I think everyone agrees yield should be dropping in this report.

The biggest drops we've seen in recent memory came last year along with Jan 2021.

Where yield dropped -3.80 bushels an acre.

The current yield estimate is 186. So if we saw the same cut as last year, it would peg us at 182.2 bpa.

Meaning it would take the biggest drop we've ever seen to get yield below 182 in this report.

Lastly for carryout.

In at least the last decade, we've never seen carryout bumped by more than 50 million bushels.

However, we've only seen it drop by more than 100 million three times.

Last year was the largest we've seen.

Again, this report doesn’t tend to be overly bearish, even if it doesn’t wind up being mega bullish like in 2021 or last year.

Next for soybeans.

The price action provides some interesting data.

Soybeans have only traded lower on the day of this report twice in the last 12 years.

So the data says this report does tend to be friendly.

Yield also tends to come down in soybeans.

But last year was the only year in the last decade where yield fell by a full 1 bushel an acre.

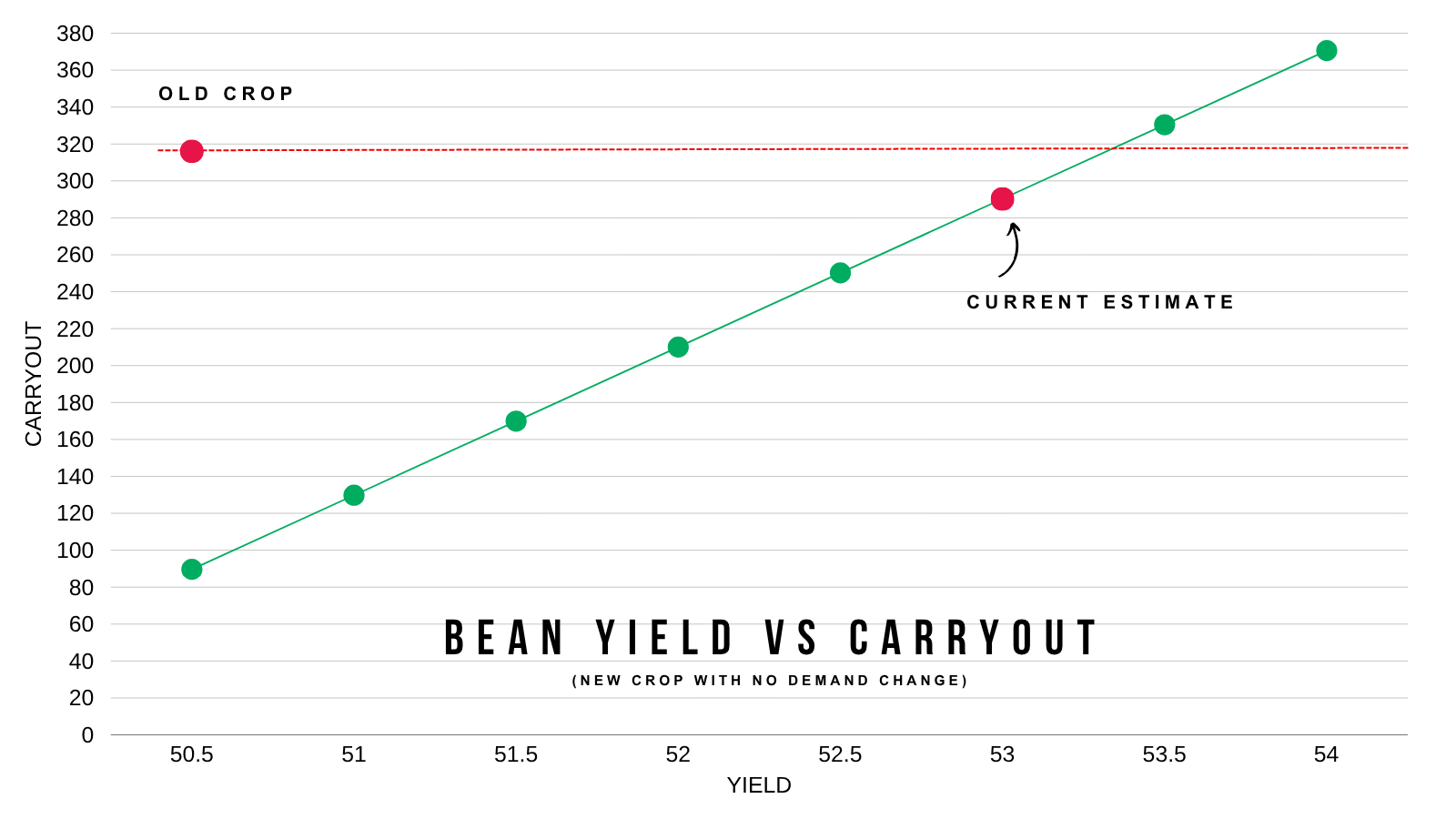

With the current estimate of 53 bpa.

That means to get a yield below 52, it would take one of the largest cuts we've seen.

Lastly here is the carryout changes.

Last year provided one of the largest drops ever. As it dropped -90 million.

Today's Main Takeaways

Corn

Fundamentals:

Demand is still amazing. The sole reason you can’t get overly bearish on corn.

However, we still have an ample amount of supply and a carryout of 2 billion bushels.

Both of these have led to corn trading virtually sideways for a few months. Every break has been bought. Every rally has stalled.

I think corn has upside potential from here.

That record supply and large carryout has already been priced in, meanwhile we have record demand continuing to prevent this market from falling apart.

Just a reminder, corn has traded higher 8 of the last 10 years during the month of January.

Higher the last 4 of 5 years.

Higher the last 11 of 15 years.

Seasonally it's a friendly time period.

But what would it take to get corn beyond $5.00?

We have record supply, but clearly the corn story isn’t the most bearish it's ever been. Because we also have record demand.

Stocks to use ratio is the best way to determine the supply and demand story.

It tells us how much supply is left over after demand.

This chart shows our stocks to use (in yellow).

Along with the highest corn prices each marketing year (in green).

I drew line at a 10% stocks to use ratio as well as $5.00

Based on this chart, you can see that normally, to get corn much above that line of $5.00, the stocks to use ratio typically has to also drop below that line of 10%.

For example:

2010 to 2013 the stocks to use was below 10%. Prices were above $5.00

2014 to 2020 the stocks to use was above 10%. Prices were below $5.00

2021 to 2023 the stocks to use was below 10%. Prices were above $5.00

So if you want greater than $5.00 corn, you usually need a stocks to use ratio below 10%.

We currently have a stocks to use ratio of 12.5%.

Last year we ended at a 10.10% stocks to use with a high price of $5.04.

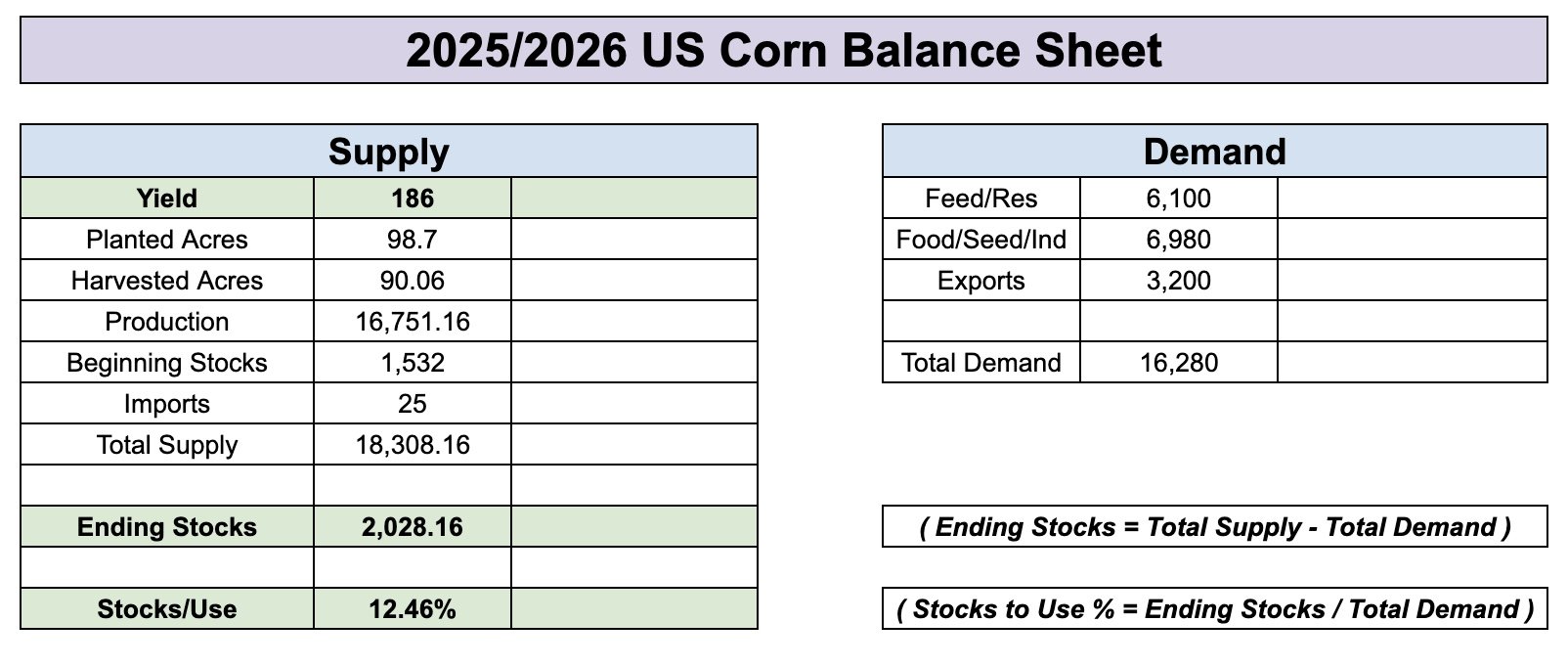

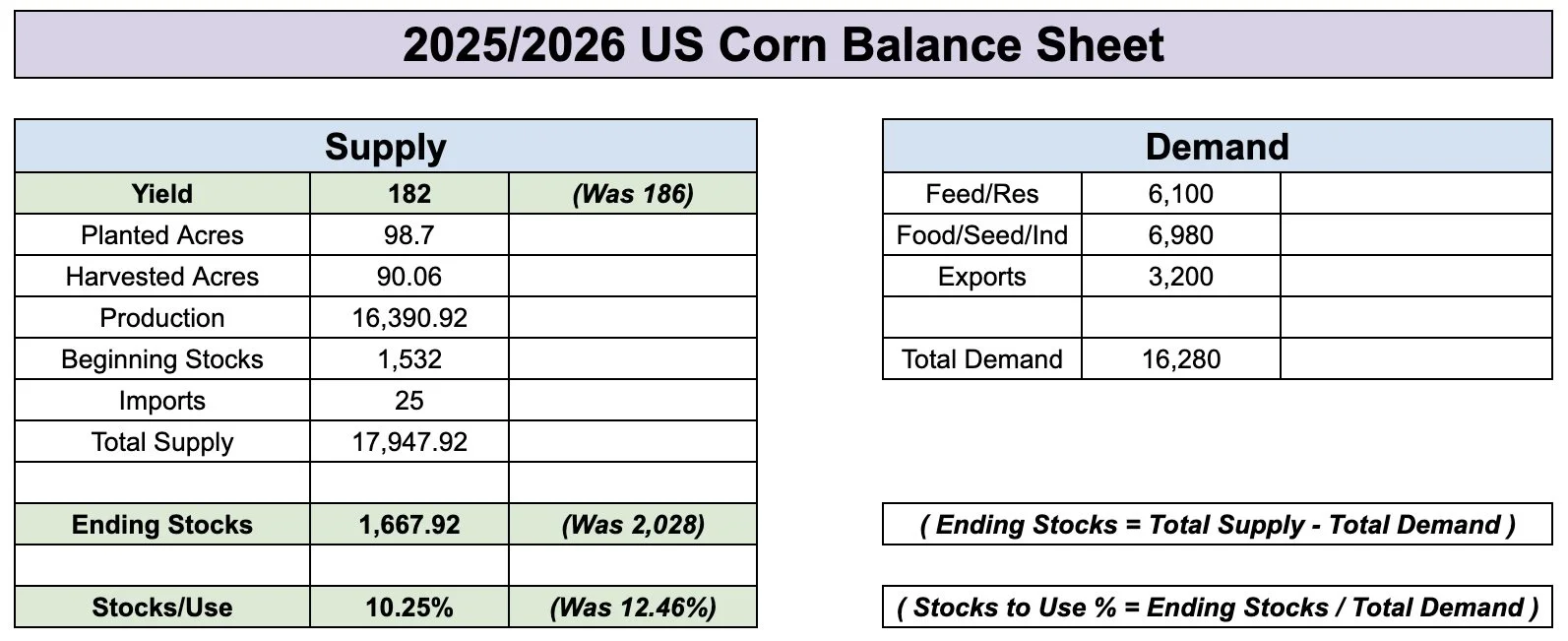

Here is the current balance sheet ahead of the USDA report.

We have:

186 yield

2.03 billion carryout

12.46% stocks to use

I've shown this example before.

But for this example, let's just say yield comes in at 182.

If you did NOT change any demand numbers at all.

This would drop our stocks to use ratio down to 10.25%.

HOWEVER, if the USDA drops yield, they will inevitably drop demand. To balance the balance sheet.

Most argue feed and residual demand is too high to begin with. While others argue our export demand is being understated.

Regardless, you can see that it is hard to paint a scenario where the corn balance sheet drops to near 10%.

As it would take a 182 yield with demand being left unchanged to do so.

Which is why I personally think corn's upside is limited beyond $5.00 for now.

Later in the year, a completely new story could emerge.

China could buy corn. We could run into a supply scare this summer, and ultimately go a lot higher.

I am not bearish corn, but unless one of those happens, it is an uphill battle to get a stock to use near 10%.

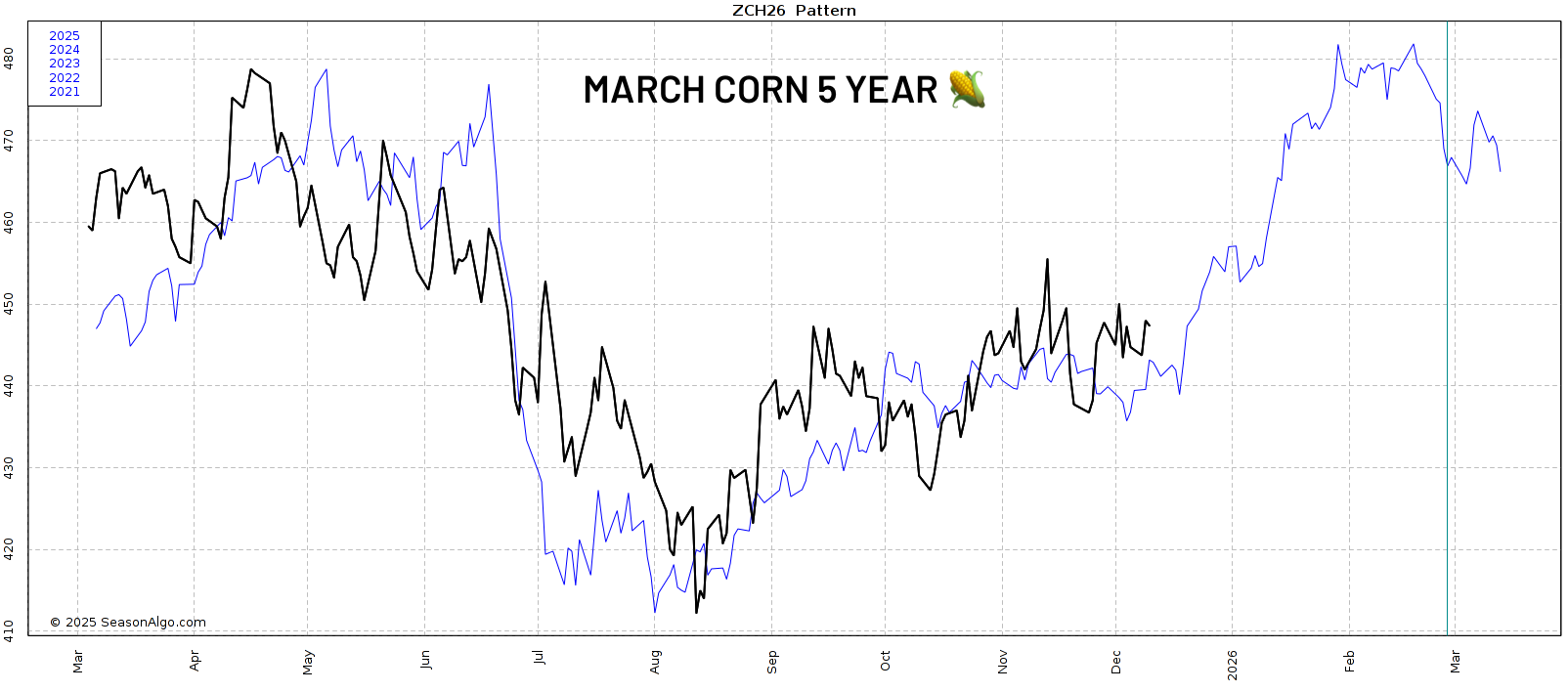

Now we are showing some very interesting similarities to corn last year when it comes to price action.

Here is March-25 corn overlayed on top of March-26 corn.

We are sitting in the exact same ascending triangle pattern.

We have seen identical action off the harvest lows.

I do not think we have quite the upside as last year, based on the fundamentals not being as friendly this year, but I do think we could follow a similar pattern with a breakout in January.

Technicals:

March Corn

We've traded sideways since October.

We now have a triple bottom pattern in place. Which is typically considered a bullish set up.

We've tested the local lows 3 times now.

Which is showing that sellers continue to fail while we build a floor.

The clear level to break is $4.50

If we break above, it should result in a leg higher.

In the meantime, we want to hold those local lows to prevent a leg lower.

Here is the weekly chart.

We have still yet to get a close above $4.50

Again, that is key resistance.

We've failed there for months now.

It was support from spring.

It claws back 50% of the Feb highs.

Break above key resistance and we should go higher.

Soybeans

Fundamentals:

The biggest questions going into the report are going to be yield and if the USDA drops soybean exports.

I mean exports are down -45% vs last year. Yet the USDA's estimates are only -13% lower than last year.

So there is definitely an argument to be made.

The biggest thing preventing bulls from getting excited is South America.

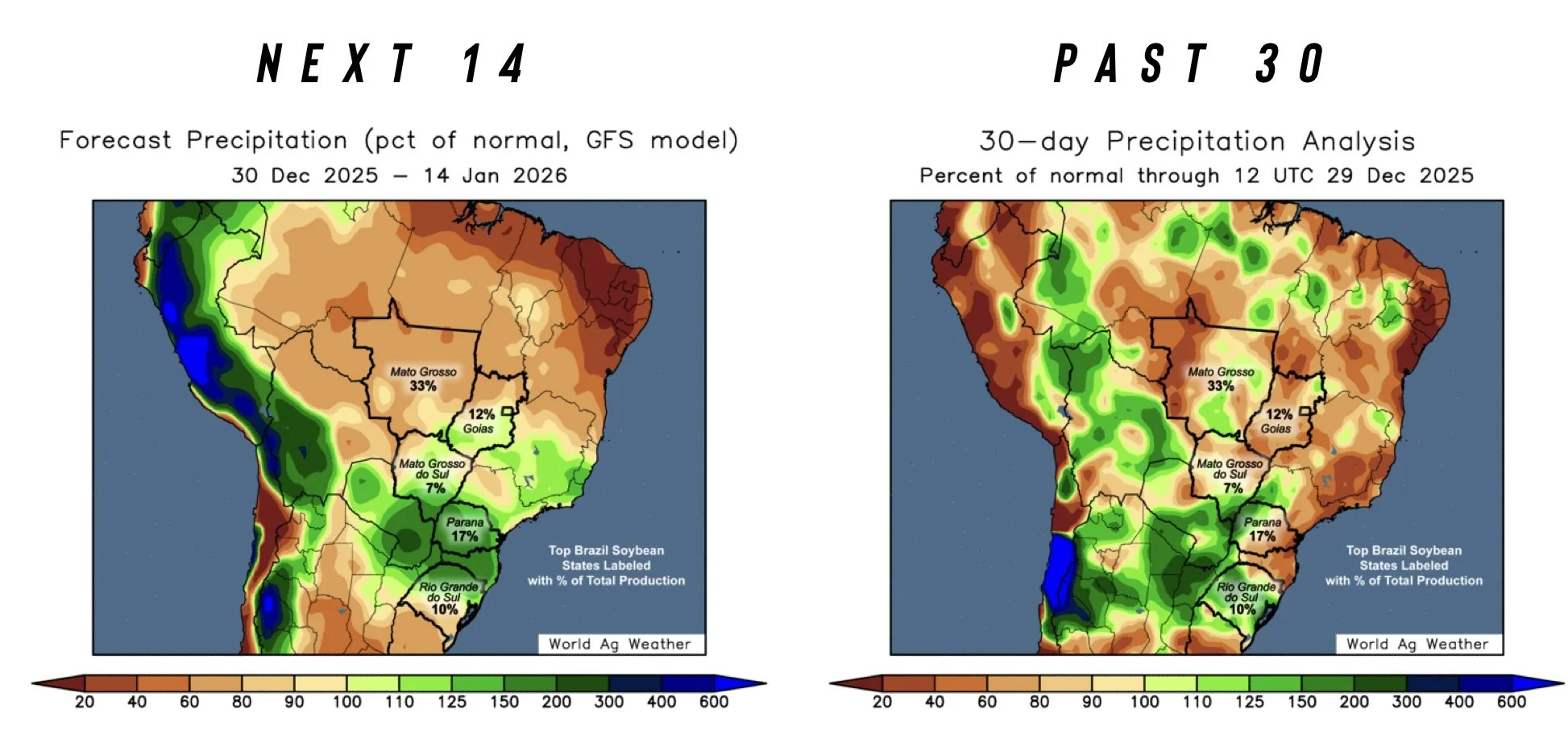

Weather has been mostly favorable.

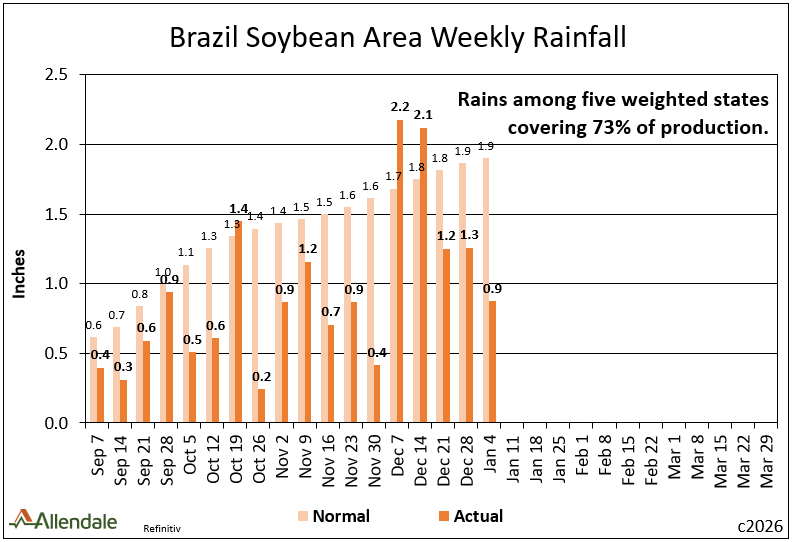

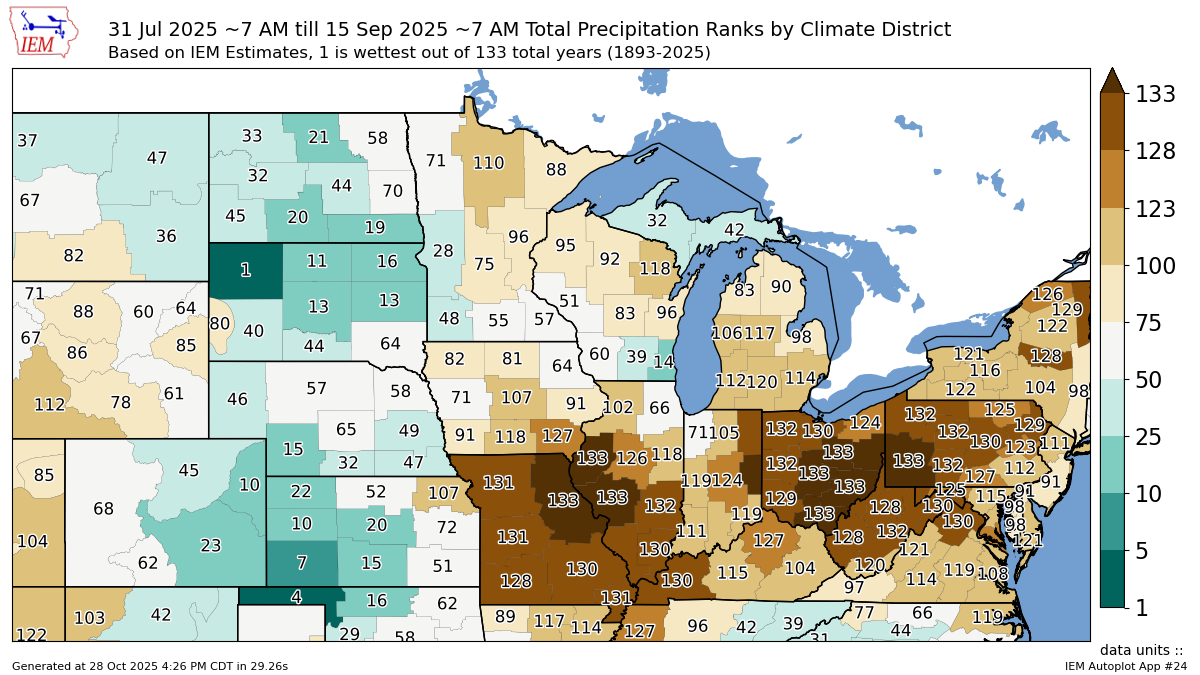

Here is Brazil's weekly rainfall amounts vs normal.

They've seen some dry weeks here and there, but overall nothing to be concerned about. Clearly the market hasn’t seemed worried about it.

Charts from Rich Nelson of Allendale

China has continued to buy soybeans and live up to their word. Which is great to see.

But the market seems to think it's not enough.

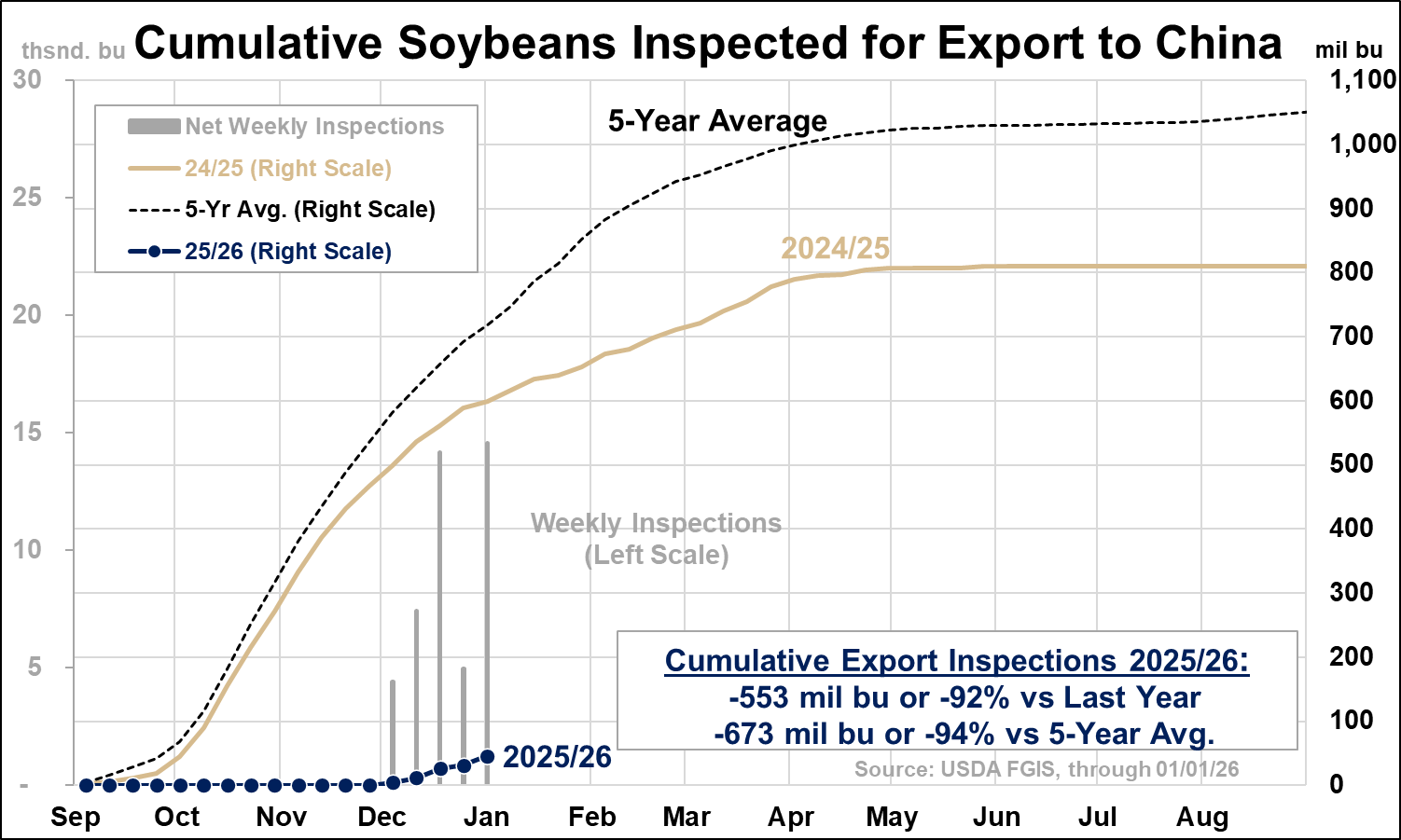

For reference, export inspections for soybeans to China do look pretty worrisome.

They are down over -90% vs last year.

Chart from Dave Brock of Brock Report

Taking a bigger picture perspective, China did agree to buy double for the next few years as to what they agreed to buy this year.

Which could be viewed as a silver lining moving forward if the agreement stays.

Overall there isn’t much for bulls to get overly excited about for now.

Brazil isn’t having any issues.

China continues to buy but overall export demand is still a big question mark.

We will have to see if the USDA provides bulls anything to chew on next week.

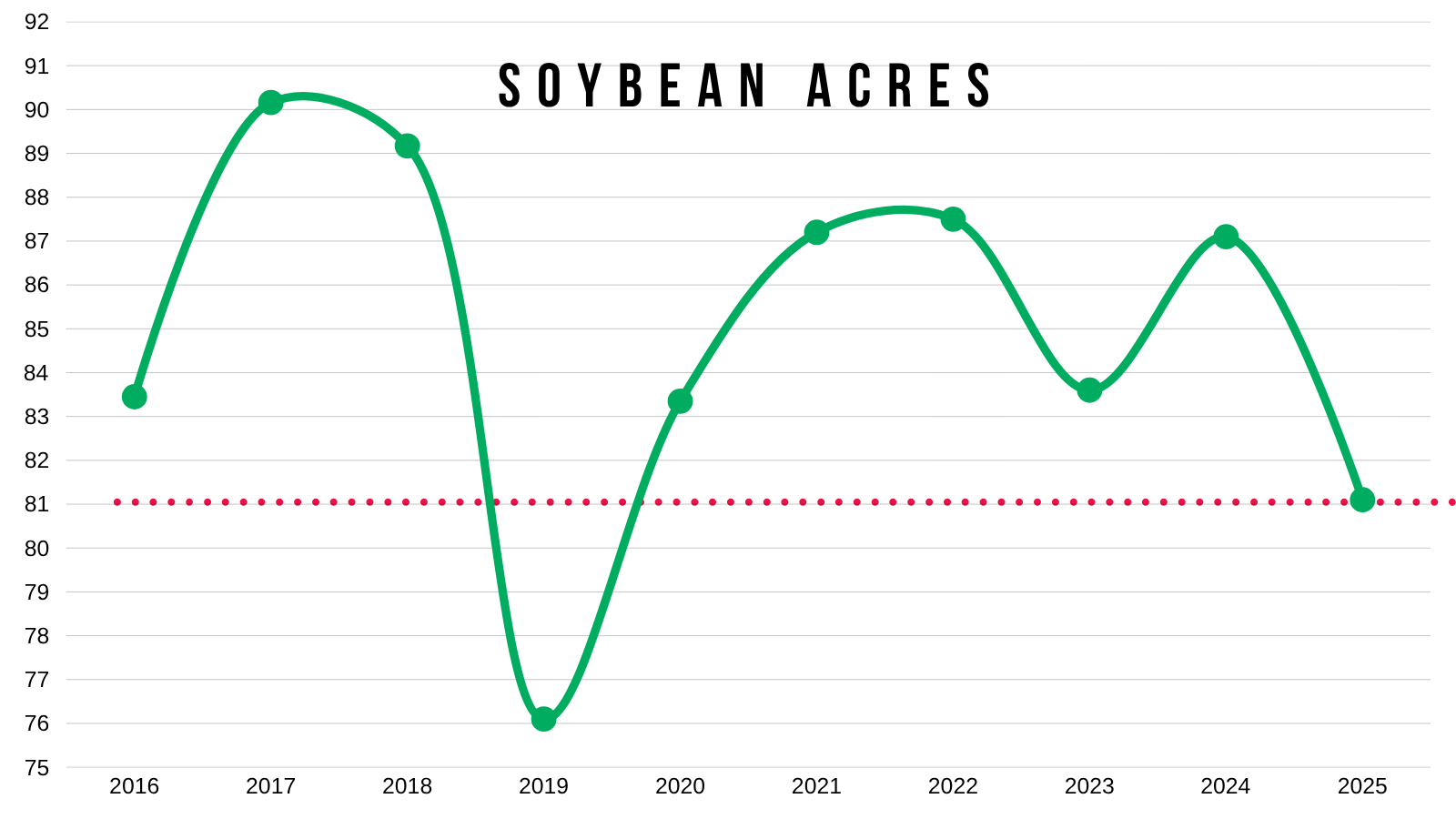

As the supply side of the US balance sheet is still fairly tight, given the 2nd-tightest acres of the last decade. That is if exports aren’t totally overestimated.

Technicals:

March Beans

Today was somewhat of a disappointing candle following yesterday's solid price action.

As on Friday, we left a dragonfly doji, and we then followed it up with a very solid day yesterday.

This is a textbook reversal pattern.

We also had a potential classic bear trap on Friday.

False breakdowns (aka bear traps) occur when you break below key support but quickly snap back above it.

In this case, we broke below the golden fib down to contract lows. Along with trendline support from contract lows.

Yesterday we then rallied back above them

We also posted confirmed bullish divergence.

As prices made new lows, yet the RSI did not.

Yesterday's rally looks optimistic for some further upside.

However, the line in the sand is going to be Friday's lows of $10.38.

If we break below that level, we could open the door another 20 cents lower.

As $10.18 would be the next level of support.

I'll have upside targets and areas to de-risk when I'm confident we've printed our lows.

If we close above $10.65 I'd be confident we are ready for a leg higher. As that is the 61.8% level up to those recent Christmas highs.

Wheat

Not going to go over much in wheat today as I don’t want to make today's update too long. There isn’t much new in the wheat market to begin with.

We still lack have a bullish catalyst.

As the US wheat situation is bearish, and globally, there are zero concerns with supply.

Patiently waiting for an opportunity.

Technicals:

March KC

So far we are finding some support where we need.

The 61.8% level of this entire mini bounce we had to end the year.

Need to hold that otherwise we go and test the contract low area.

To the upside we need to take out those Christmas highs at $5.34.

That claws back 61.8% of the Nov highs.

Do that and we can be confident we are ready for the next leg higher.

Weekly Continuous KC

Here is the weekly chart.

We do have a massive wedge pattern we've been forming since 2024.

I'd like to think that eventually we get a break out.

Just might not happen as soon as we'd like.

March Chicago

Hovering near contract lows.

We have some work to do for me to be confident we've found a bottom.

Cattle

Fundamentals:

Live cattle are stalling while feeders continue to rally.

The price action does feel a little backwards.

Cattle is ripping higher even though packers are in the red, we had a packing plant close down, and the beef cutout isn’t strong. Yet they continue to push this market higher. So this rally is hard to justify fundamentally.

Feeders have been leading the charge on this move. It feels like a dash for cash, a race to buy feeders as fast as they can.

It feels like we are getting a little disconnected as far as margins go.

With feedlot margins and packer margins not lining up, the market is getting a little stretched out. For the rally to stay "fundamentally clean". Cash needs to keep going higher or cut out needs to improve significantly.

If you look at the charts, clearly they aren’t bearish. I've been surprised at the strength of this rally. We've blown past some key levels, and the trend remains higher unless we take out last Friday's lows.

With the market doing the opposite of what it feels like it should be doing, we want to be cautious.

We don’t want to stand in front of a moving train here. But this is absolutely a rally where we should be taking chips off the table and upgrading protection.

If you have LRP coverage with a much lower floor, consider rolling that floor up with some strategies.

Give us a call if you have questions:

Jeremey: (605)250-3863

Lauren: (806)391-7178

Technicals:

March Feeders

We've now blown past that orginal target box. Which was the golden zone retracement of the entire sell off.

We are now really close to hitting my last target before those highs.

Which is the 78.6% level up to those highs.

If we take out this level, then the next point of interest is that last gap and those highs.

Regardless we still like taking some chips off here.

Feb Live

Live cattle also above that original target box.

The next point of interest is the 78.6% level right above 240.

Past Sell or Protection Signals

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

WHEN DO PRICES SEASONALLY RALLY & FALL APART?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Seasonals: 0:55min

Corn: 5:50min

Beans: 9:30min

Wheat: 13:00min

Cattle: 14:00min

Want to talk about your situation?

(605)250-3863

Holiday sale ends tomorrow

Your free trial has ended.

If you’d like to keep full access to our updates & signals make sure you lock in our biggest offer of the year.

Futures Prices Close

Overview

Grains mostly lower while cattle trades higher today, following yesterday's brutal price action in the grains.

Overall, it's been pretty quiet with the holidays. We haven’t seen much if any major news.

Traders are on holiday mode which means small volume.

Yesterday’s blood bath could’ve easily been a spill-over trade from the weak outside markets, some last minute farmer selling, and or fund re-positioning heading into the new year. When volume is light, it can make moves over exaggerated.

All eyes are set on the USDA report scheduled for January 12th to give us some fresh fundamental news for bulls and bears to chew on.

The markets will be closed on Thursday with the new year. Outside of that, the trading schedule remains completely the same. With normal open and closes tomorrow as well as Friday.

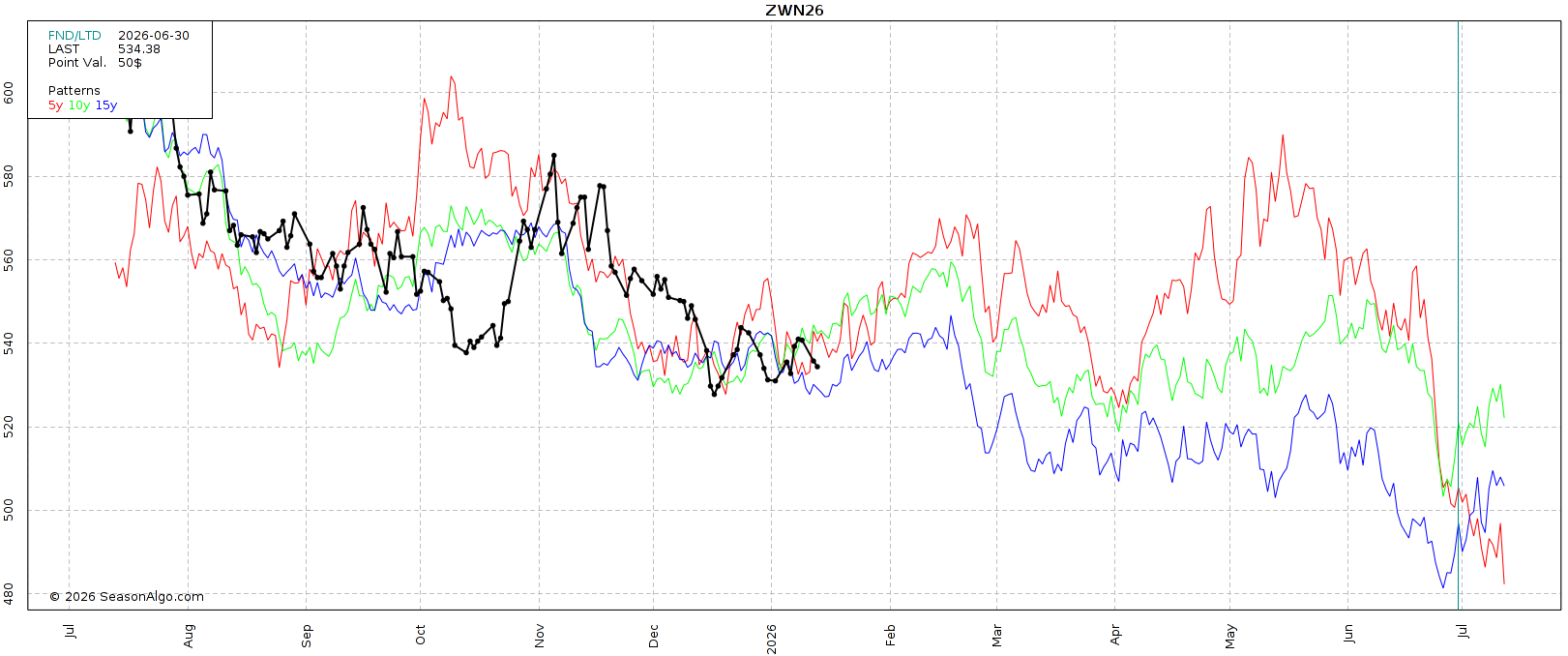

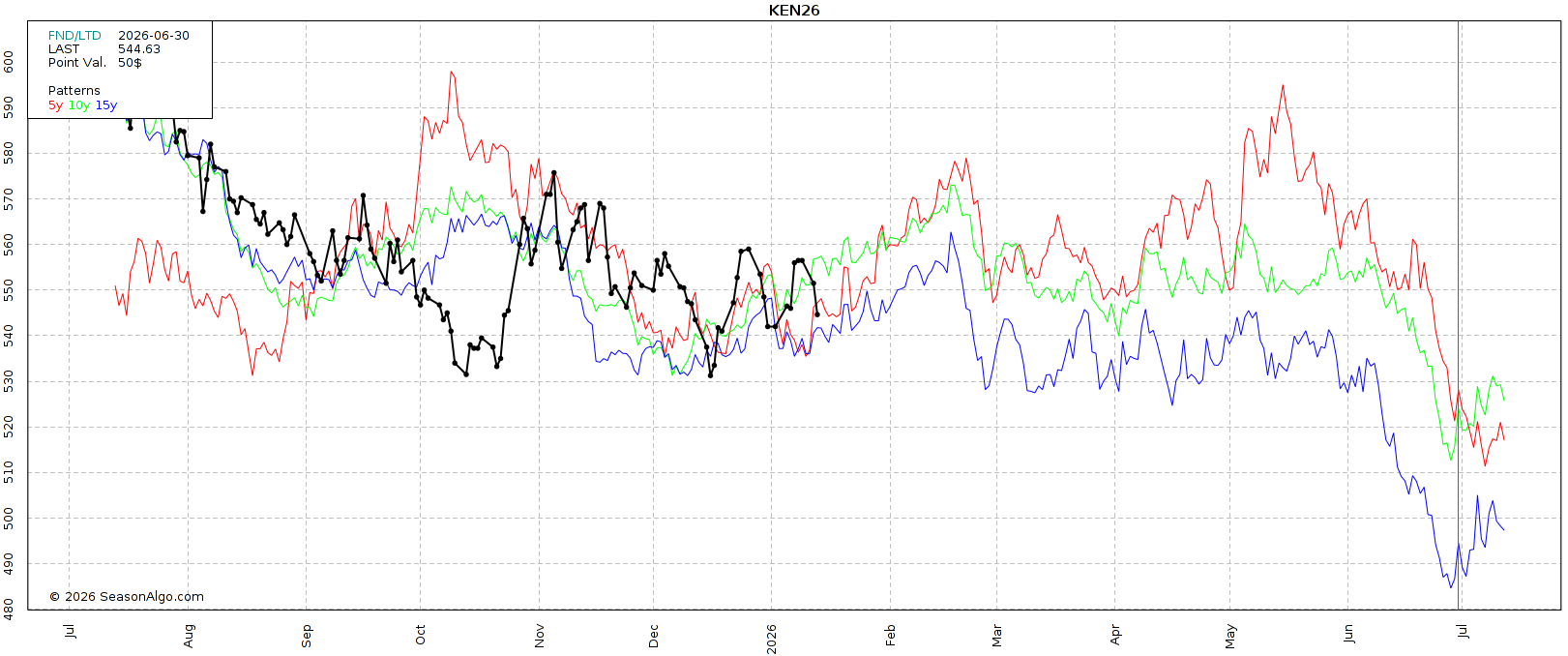

Full Seasonal Pattern Breakdowns

Since there isn’t much news to digest we are going to go over the seasonal patterns for corn, soybeans, wheat, as well as cattle.

When do each of these markets typically catch a bid or sell off based on prior years?

Corn

First for corn.

We are going to go into the most detail for corn, as corn tends to follow seasonal patterns more closely than the rest of the grains.

As it largely follows the US growing season. Whereas soybeans and wheat rely more heavily on growing seasons from other large players, such as Brazil for soybeans.

Let's look at March corn.

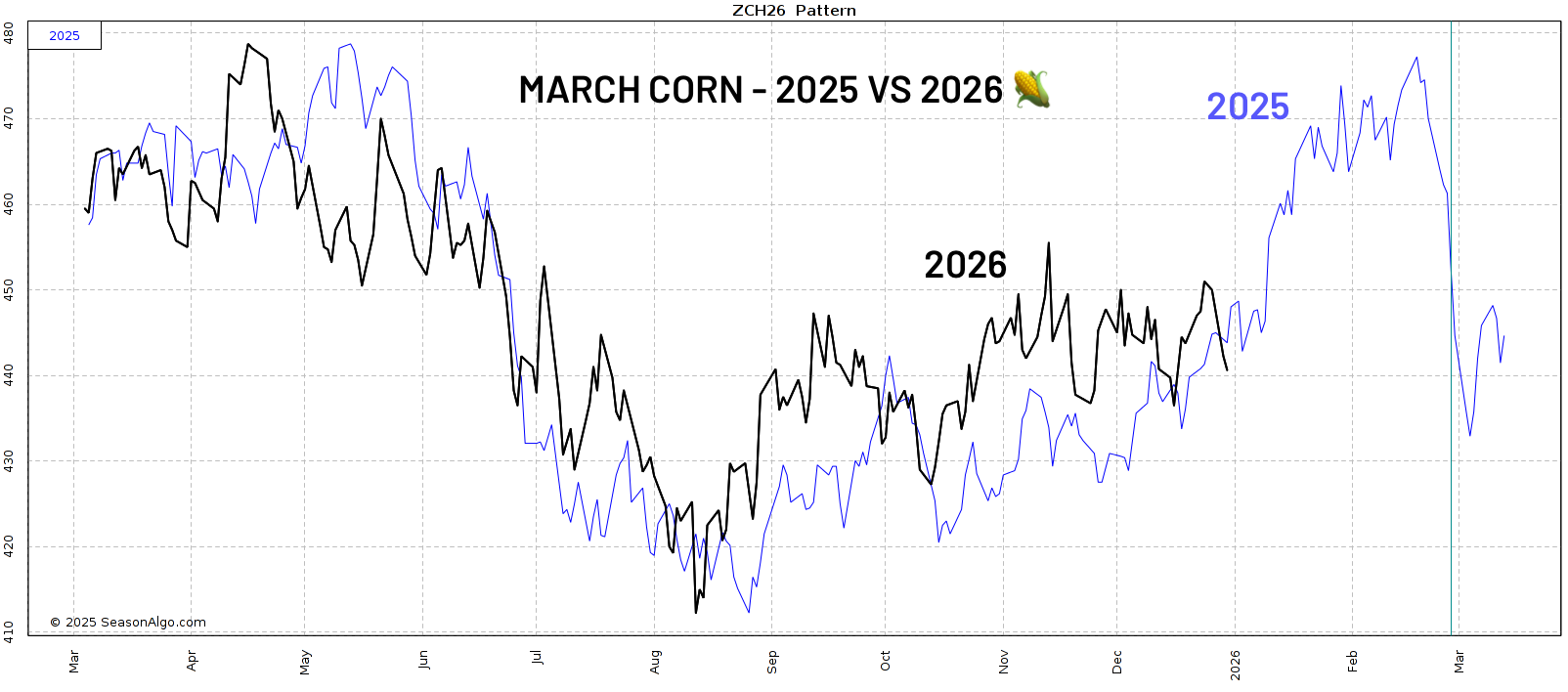

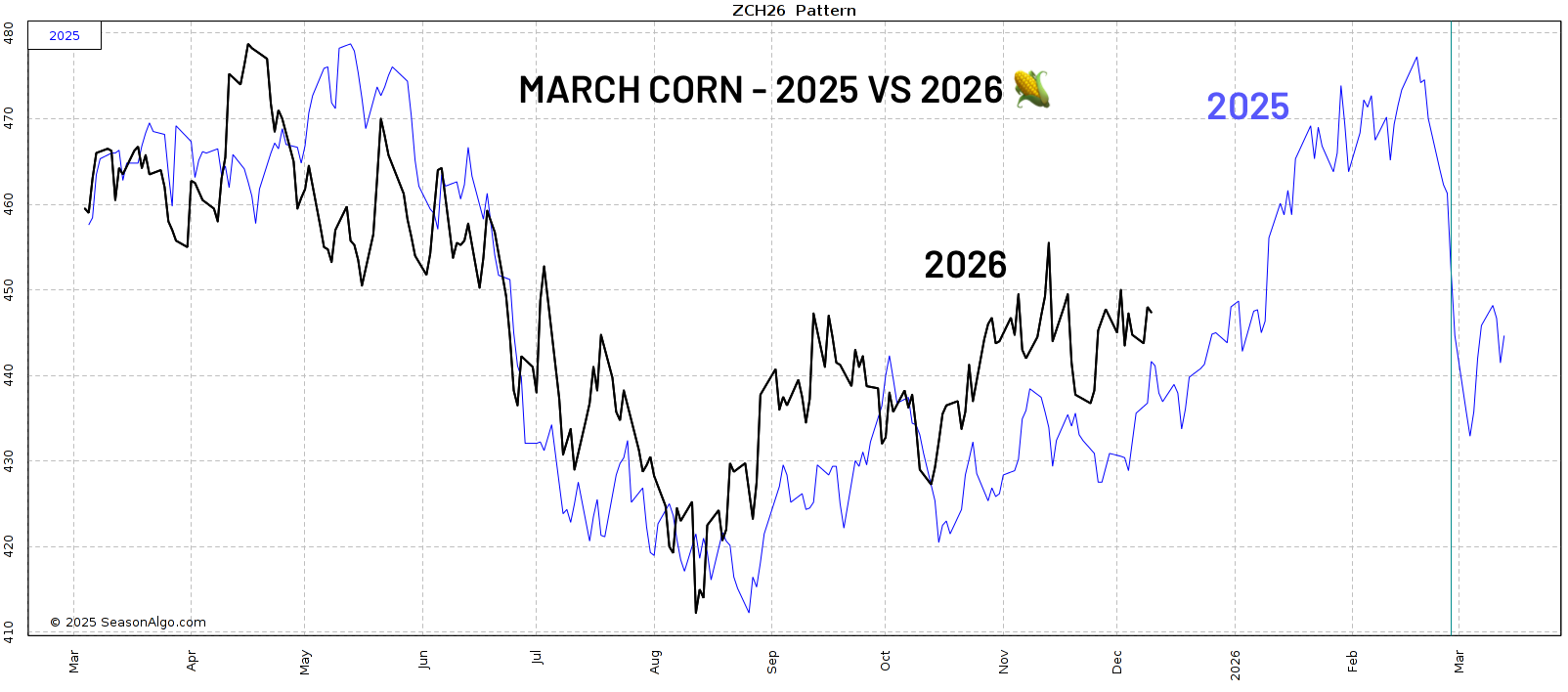

This first pattern is 2025 (last year) vs 2026 (this year).

We've been tracking very, very close to last year's price action.

Last year we continued higher before topping in February.

If we dive into the analytics, last year actually does have the highest pattern correlation to this year.

It sits at a near 80% correlation to one another.

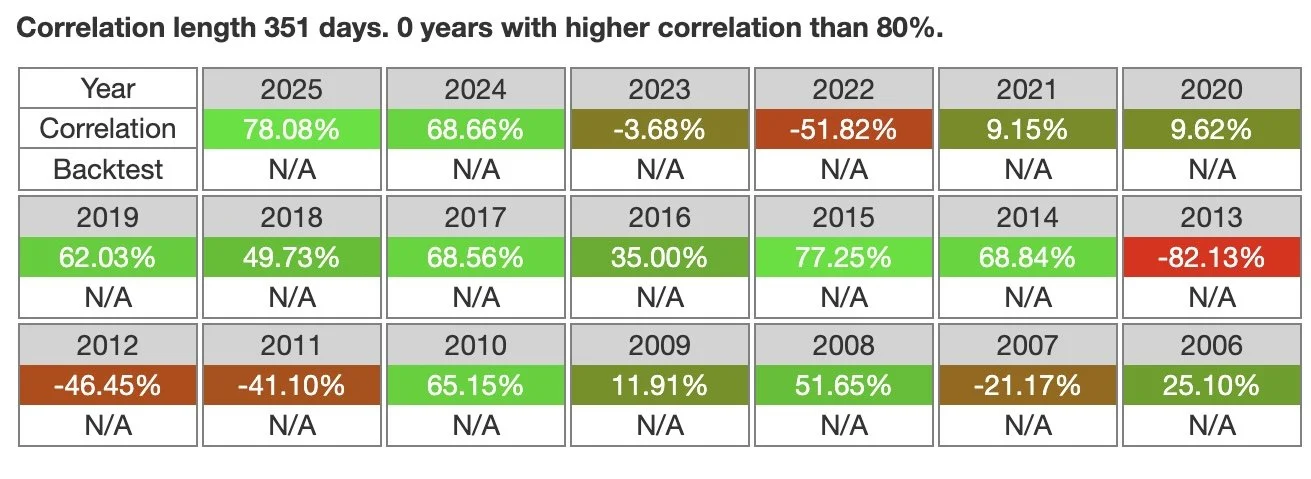

These are all the correlations to this year.

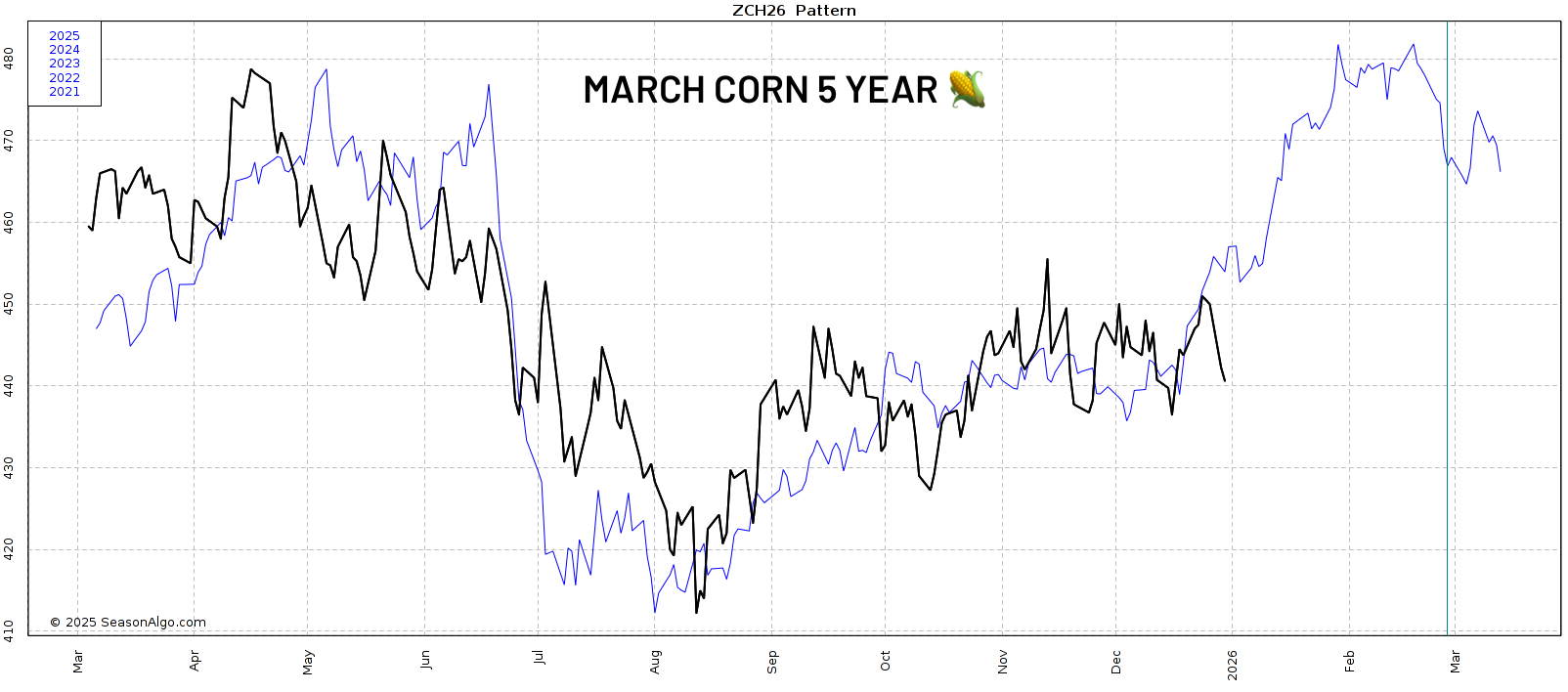

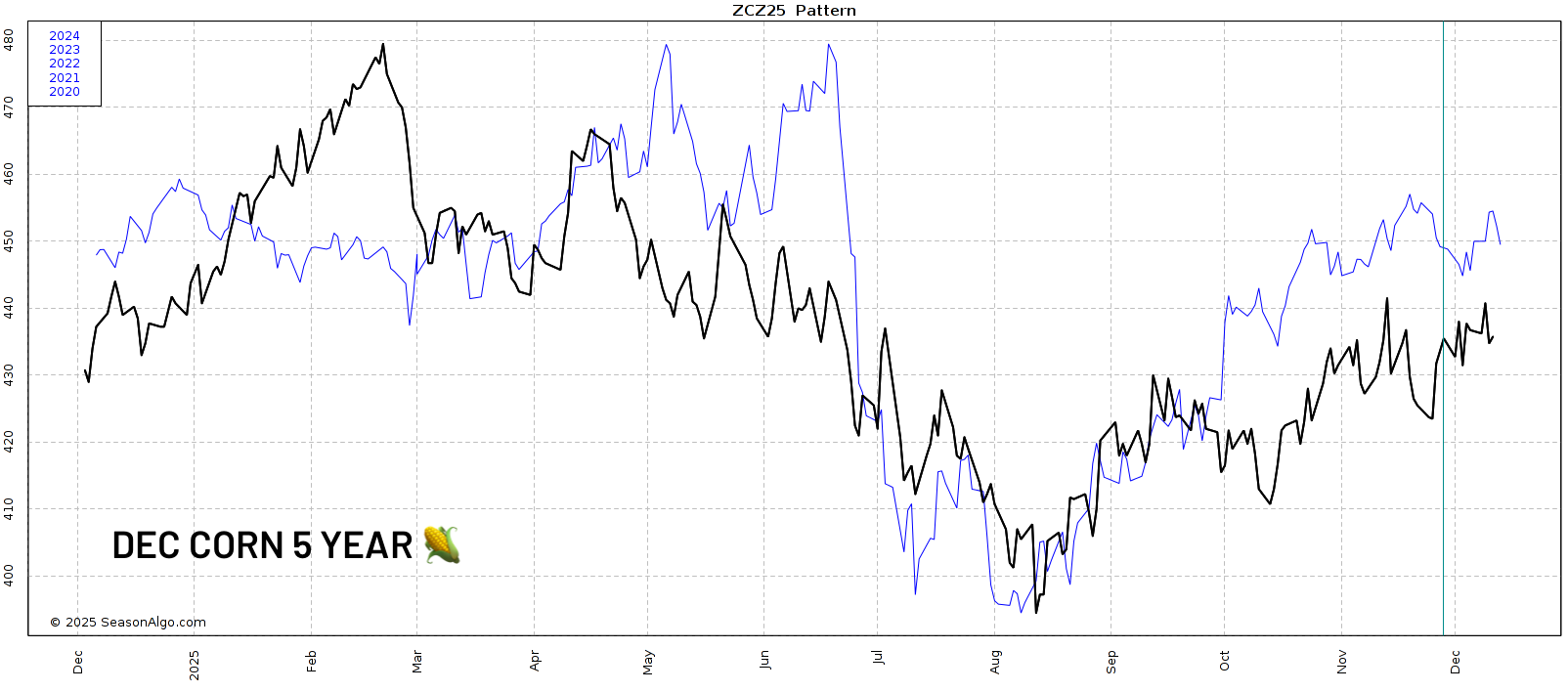

Now here is the March corn 5-year pattern.

This one has tracked very closely as well.

The summer sell off, the August bottom, the rally going into October before trending sideways. All similar.

It too has us climbing higher into February.

Here is the 10-year seasonal.

We clearly haven’t followed this pattern at all.

But it also has us continuing higher into February.

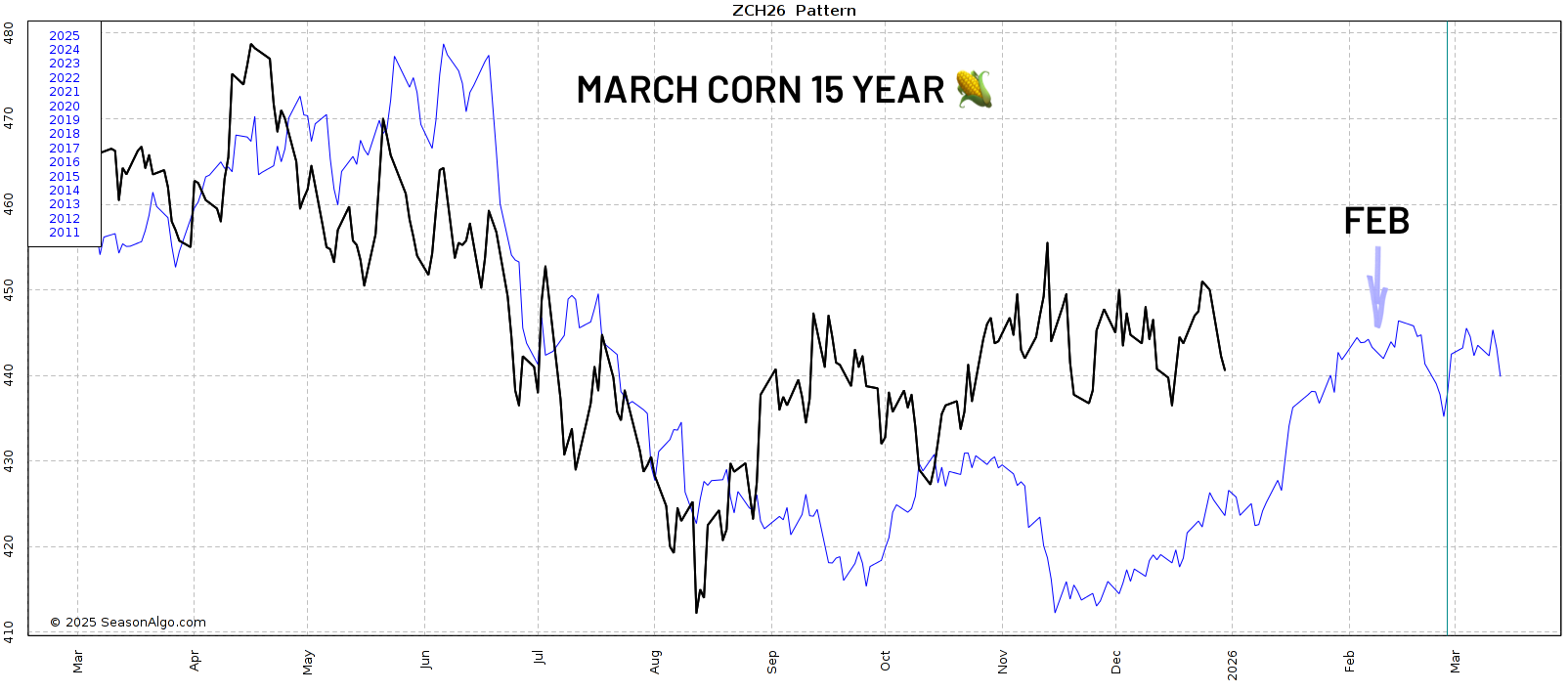

Same story with the 15-year.

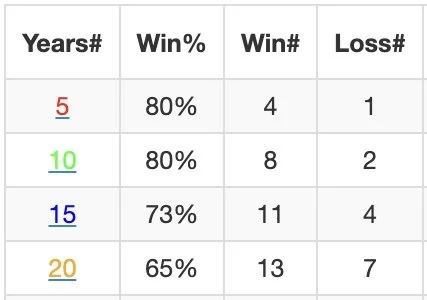

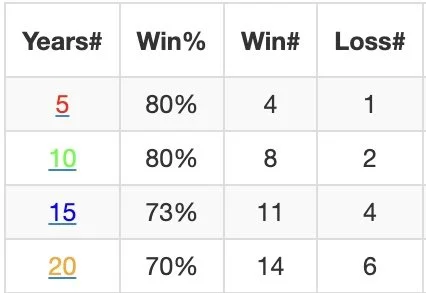

Here is the actual data for March corn's price action from today until February 1st.

We've traded higher the last:

4 of 5 years (80%)

8 of 10 years (80%)

11 of 15 years (73%)

So January is often a friendly month for the corn market.

We don’t "have" to go higher. But history favors us doing so.

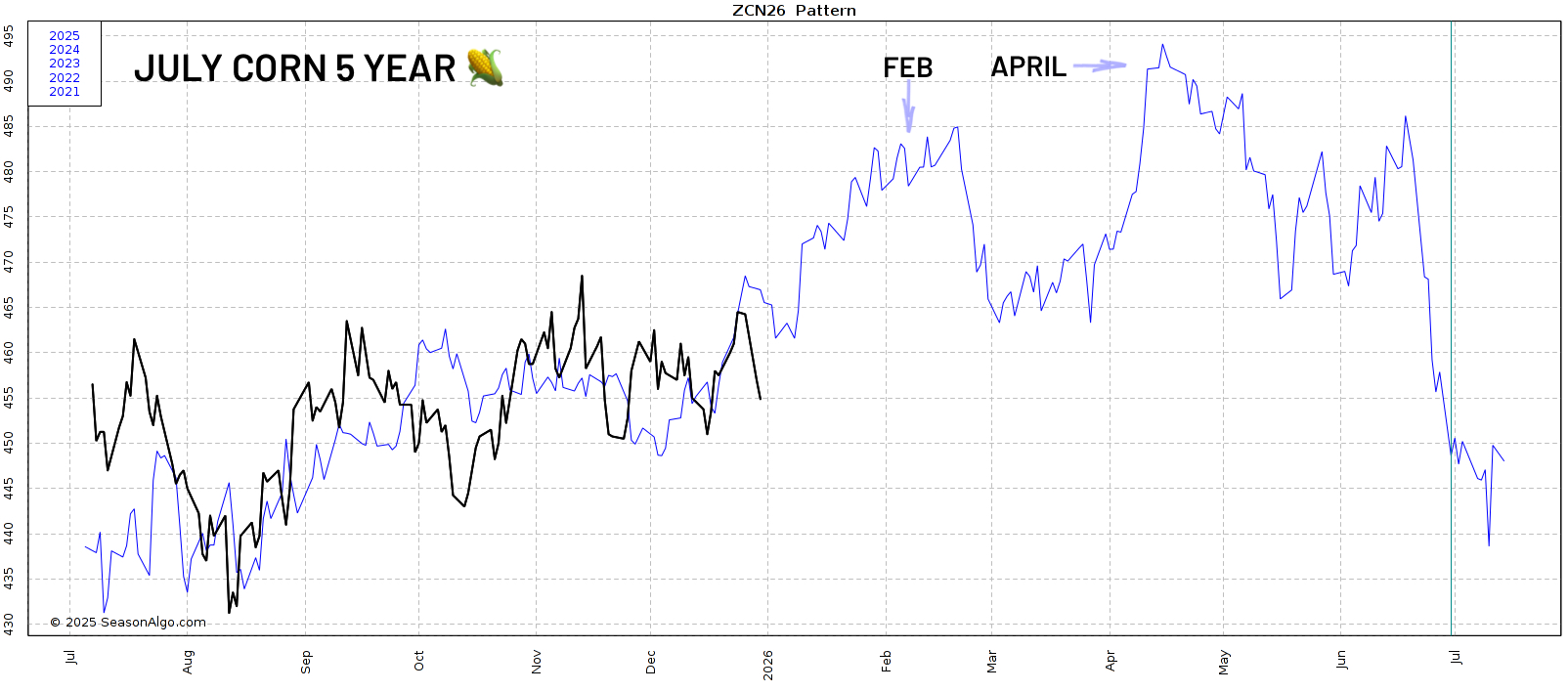

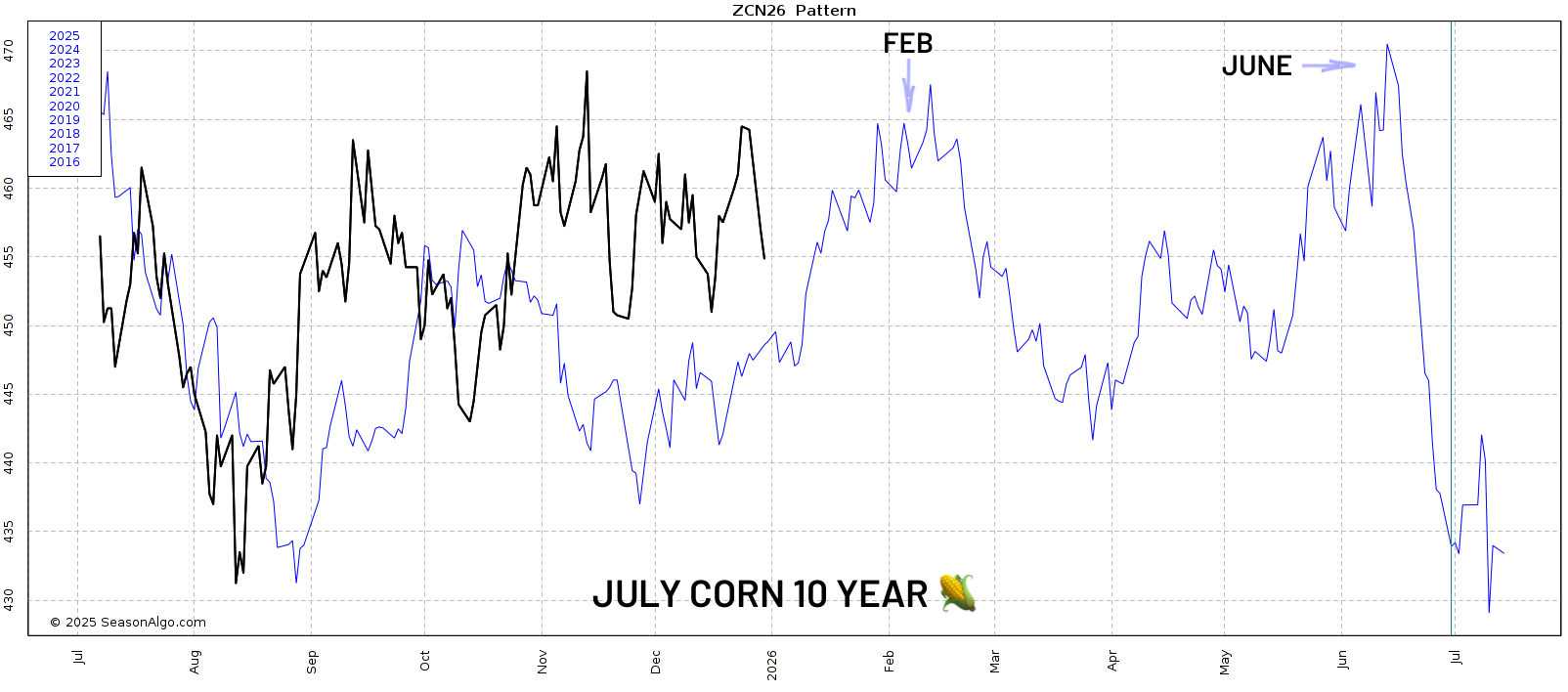

Next let's look at July corn.

First the 5-year pattern.

We typically post two major tops in this market.

Ths 1st is in February.

The 2nd is in April.

Here is the 10-year.

Again we have two tops that typically form.

February and June.

Seasonal patterns are far from perfect.

But it would be reasonable to think we get that opportunity around February followed by a second opportunity in spring or early summer.

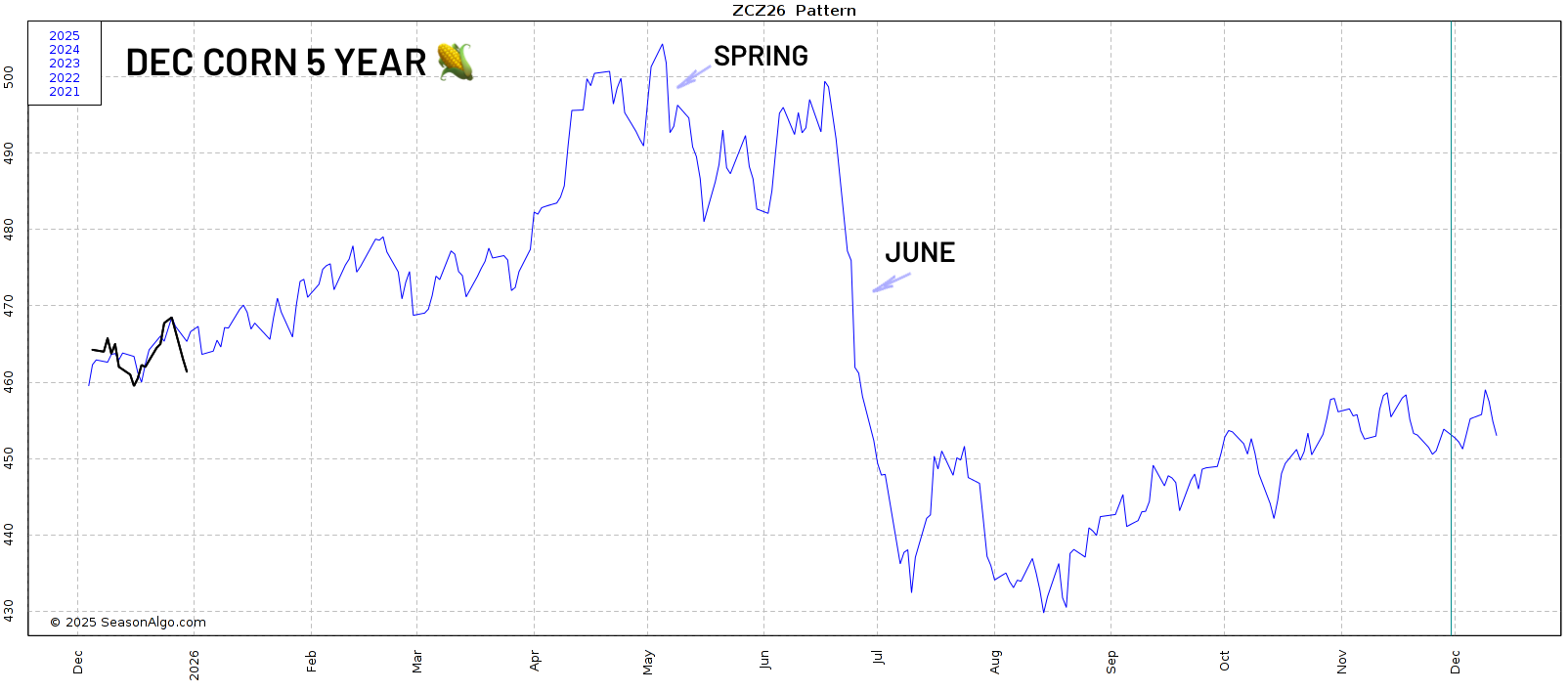

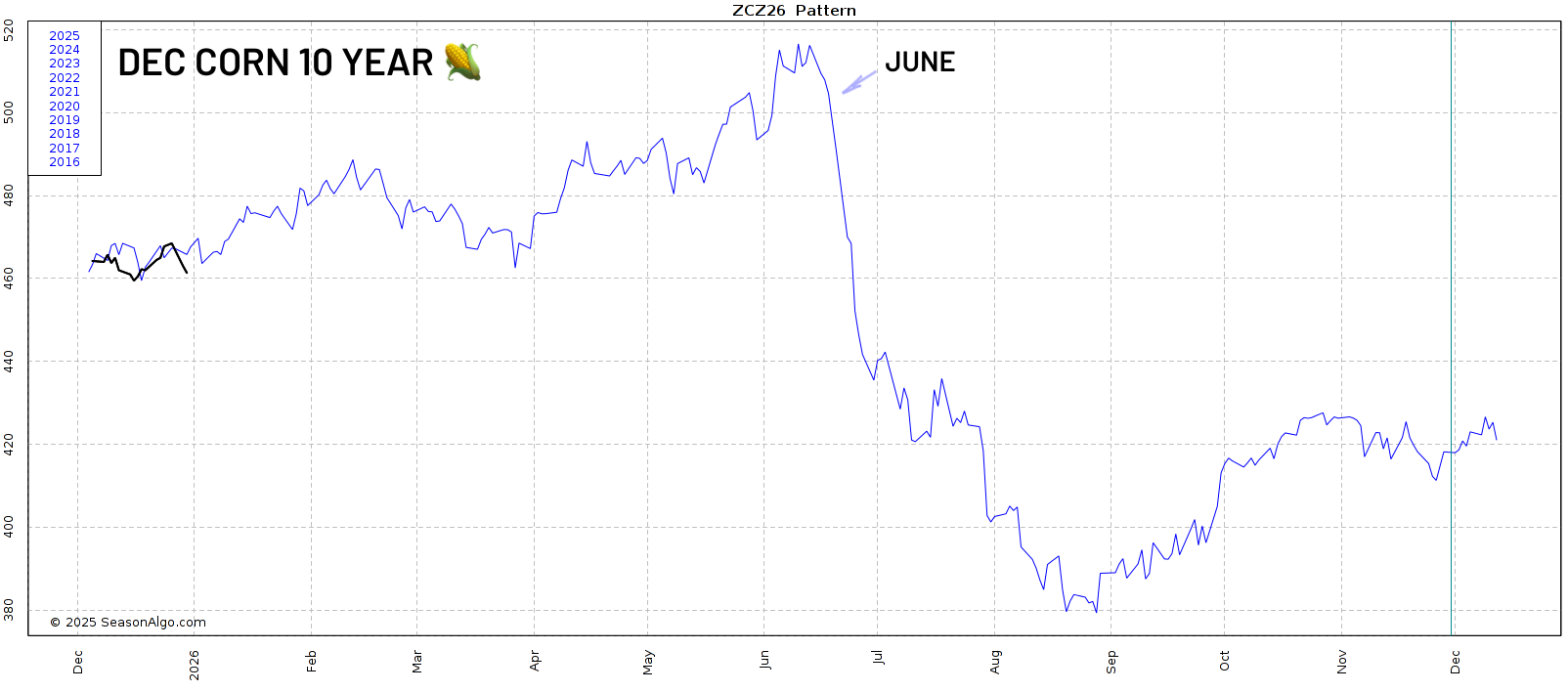

Lastly here is Dec corn.

This is the 5, 10, and 15-year patterns.

Regardless of where the high is.

Every single one of them has us collapsing in June and July.

It happens almost every year without fail. Something to keep in mind for later.

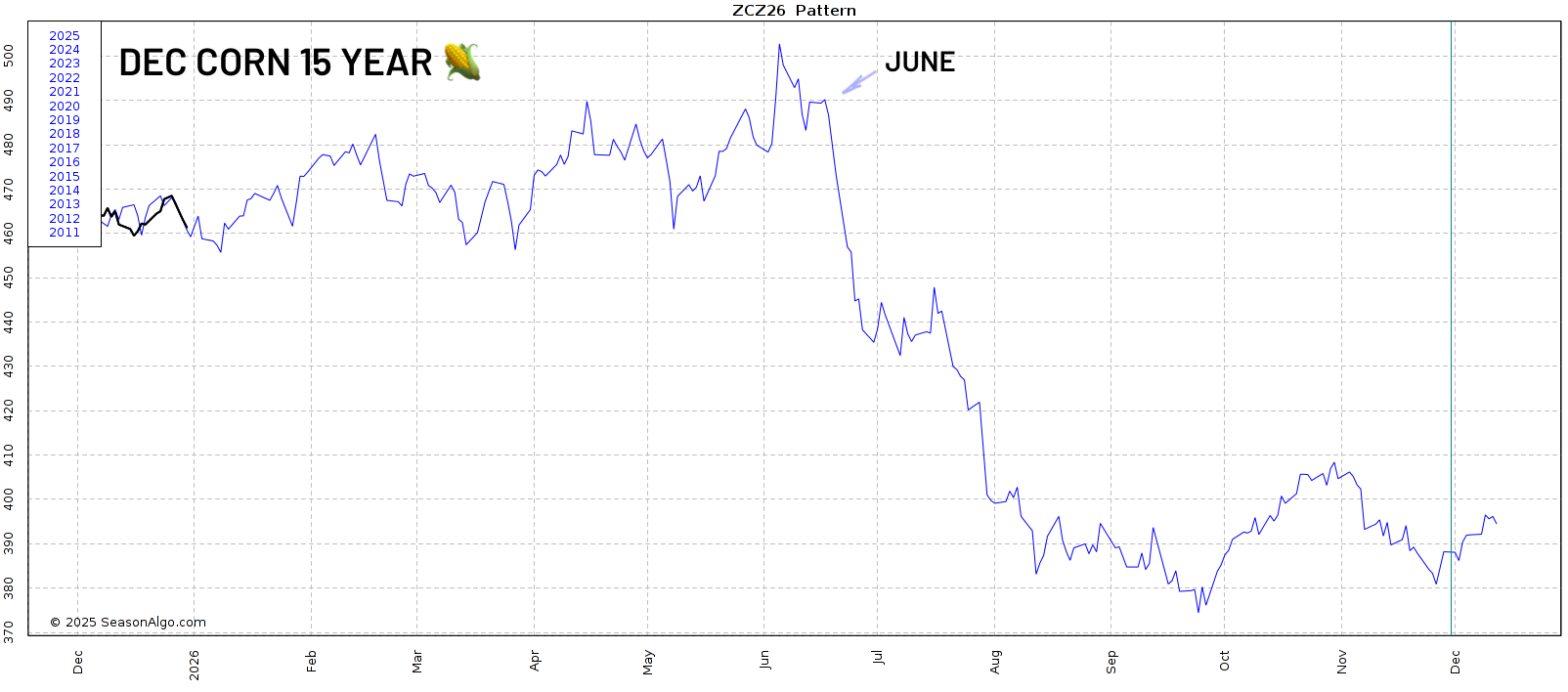

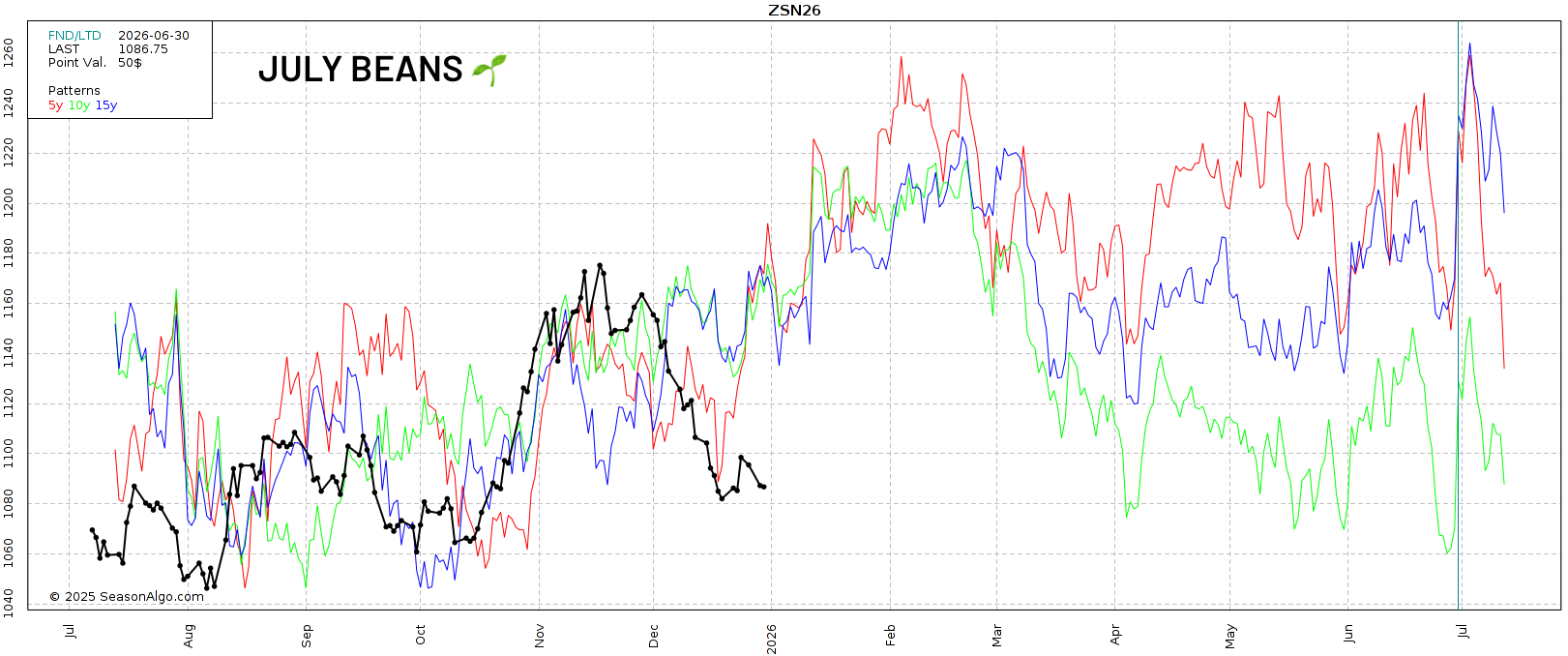

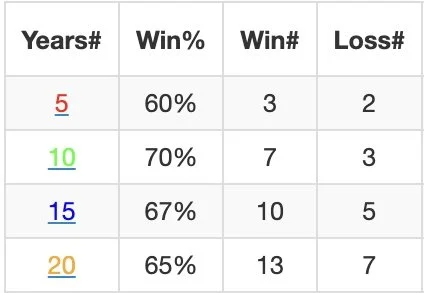

Soybeans

I am not a huge fan of seasonal tendencies in soybeans. As I mentioned, they revolve around more than one growing season so they can be skewed and differ.

However, seasonally soybeans do push higher into February in the 5 (red), 10 (green), and 15 (blue) patterns. Followed by a sell off going into April.

This is July soybeans.

Here is the data for March soybeans from today until February 1st.

The data leans friendly, but not as overly convincing like the corn data.

We've traded higher the last:

3 of 5 years (60%)

7 of 10 years (70%)

10 of 15 years (67%)

Here is Nov soybeans to give you a bigger picture.

We typically get 3 different rallies.

One going into February, June, and November.

Wheat

July wheat usually sees two opportunities.

We typically head higher in February, get a pullback, then get the final opportunity around May.

After that May opportunity, the market usually completely falls apart.

Here is Sep wheat to give you a good visual of that collapse we seasonally get.

Feeder Cattle

Here is March feeders.

We got that seasonal low about a month later than usual.

We now do tend to trend higher into February as well like the rest of the grains.

Feeders typically see two tops.

One around February to March. Then a pullback into spring.

Followed by the real top that usually comes in July and August.

Today's Main Takeaways

Corn

Fundamentals:

Yesterday corn posted it's largest daily loss in over a month.

Fundamentally, nothing has changed.

Demand is great. So every break ends up being bought.

We have a ton of supply. So every rally runs out of steam.

Export inspections are up over +65% vs last year.

Yet, the USDA is only projecting exports to be up around +13% compared to last year.

So you could easily argue exports are going to need to be bumped further.

Yield should be coming down in January. I think that is pretty clear.

The issue is that most think the USDA is going to offset some of that supply loss by cutting feed demand.

To get a corn balance sheet as tight as last year, it would take yield falling down to 182 while at the same time not touching demand at all.

That would give you a 10.25% stocks to use ratio, about on par with last year.

Altough I think we could follow a similar pattern price action wise.

It is hard to think that corn has more upside than last year based on what we know today.

Simply given that it's harder to create some mega bullish story that is friendlier than last year, unless yield is drastically lower.

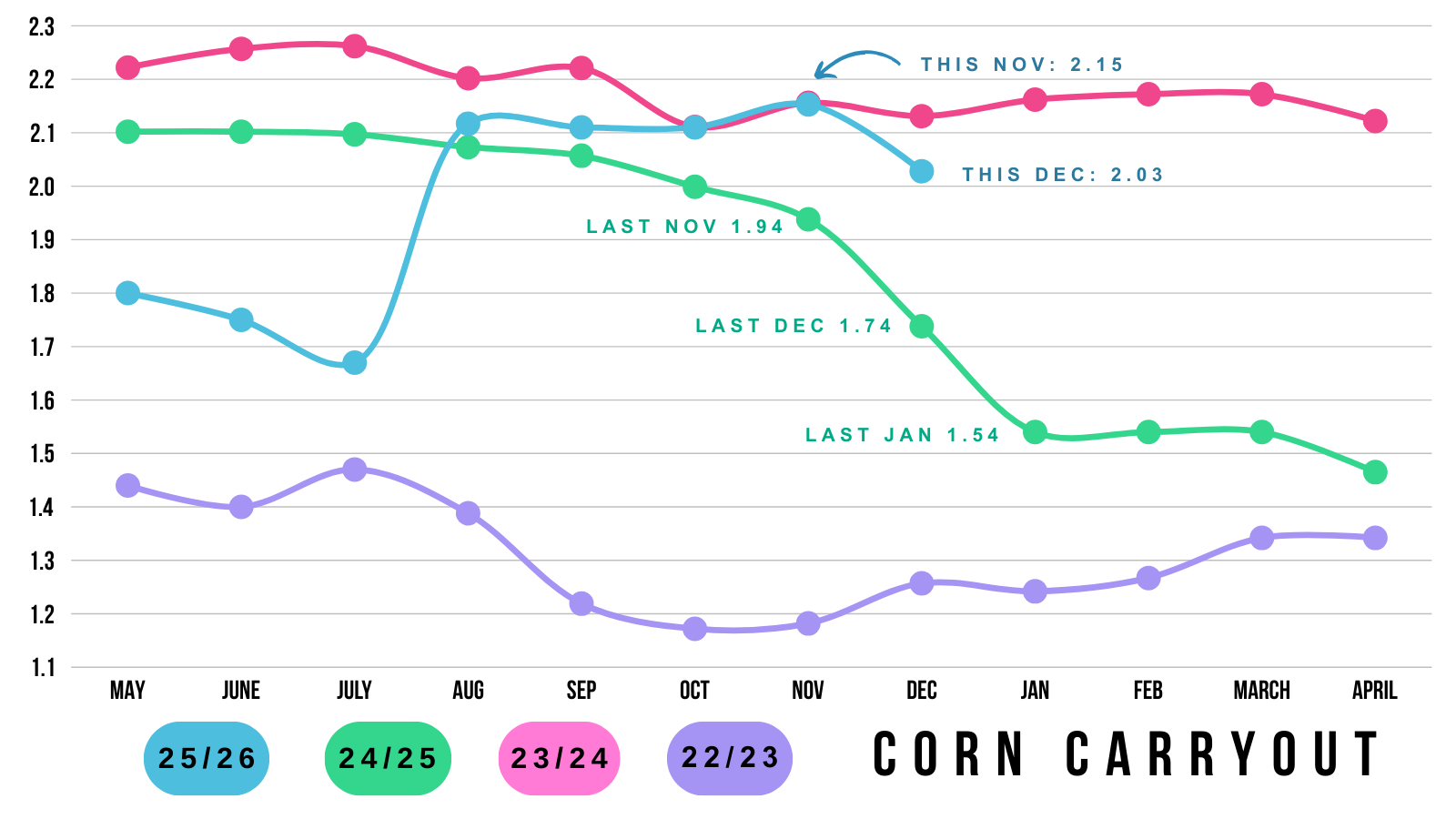

Last year, the corn market topped out at just over $5.00 with a 1.54 billion bu carryout in February. Last year, we had a 1.74 billion carryout in December.

We still have a 2 billion bu carryout today.

Record demand should prevent this market from completely falling apart.

Seasonally we trend higher from here.

We should see some sort of yield reduction come January.

The bigger question is how much, and how the USDA responds on the demand side.

Do they bump exports? Do they cut feed demand?

We have to keep in mind that we're coming off a record crop fueled by record acres. This makes it harder for the balance sheet to tighten in a big way. Which makes me think our upside is capped in that $4.70 to $5.00 range for now.

Of course, we could run into a weather scare this summer. The USDA could throw a majorly bullish surprise. China could buy corn. We could go beyond $5.00

But for now, those are all just wild cards.

My bias leans higher from here, but upside feels somewhat limited unless one of those cards is drawn to shake things up.

Technicals:

March Corn

Back to the range we go.

We've essentially traded between $4.40 and $4.50 since October.

A very brutal sideways range of just 10 cents for the last 70 days.

Here is the weekly chart.

$4.50 is the clear level we need to break through to get bulls excited and be confident this market is ready for the next leg higher.

It was key support from spring.

We've failed there the last 7 of 10 weeks.

It claws back 50% of the Feb highs.

Break above and it should spark further upside.

Right now we are simply range bound.

If we take out $4.50, we should go higher.

But if we were to take out those $4.35 lows the next point of interest would be the blue box.

I'd be looking to re-own around that level if it came.

As that is the 50-61.8% level down to contract lows.

Ascending Triangle: March 2025 & 2026

We have a possible ascending triangle pattern developing on the charts.

Which is where you have horizontal resistance, but an uptrend of support.

This is a very similar pattern to what we saw in March corn last year before we ultimately broke out in January.

Soybeans

Fundamentals:

The biggest thing soybeans have going for them is that we are oversold.

We dropped over -$1.00 over the course of just 30 days.

Outside of being at an area of interest on the charts and being oversold, fundamentally soybeans don’t have many bullish factors going their way.

Yes, the US situation does have a "path" to become tight.

Arguably an easier path than corn does.

For reference, a 52 yield while leaving demand unchanged results in a near 200 million bushel carryout.

The issue is that you could definitely argue the USDA is going to have to lower export demand.

Which would offset some supply loss if it came.

Currently export inspections are down -45% vs last year.

The USDA only expects export demand to be down -13%.

We are already past our prime shipping window.

Who knows if the USDA will lower it, but it’s a concern that the trade is aware of.

At the same time, we've seen virtually zero issues out of Brazil.

We still have not received any sort of trade agreement Rollins claimed we'd be getting several weeks ago.

Bottom line, I do still think we are at an area where soybeans could find some life. But we will want to be looking to reward the relief bounce if it comes. As a major rally might be hard to come by with no issues out of Brazil.

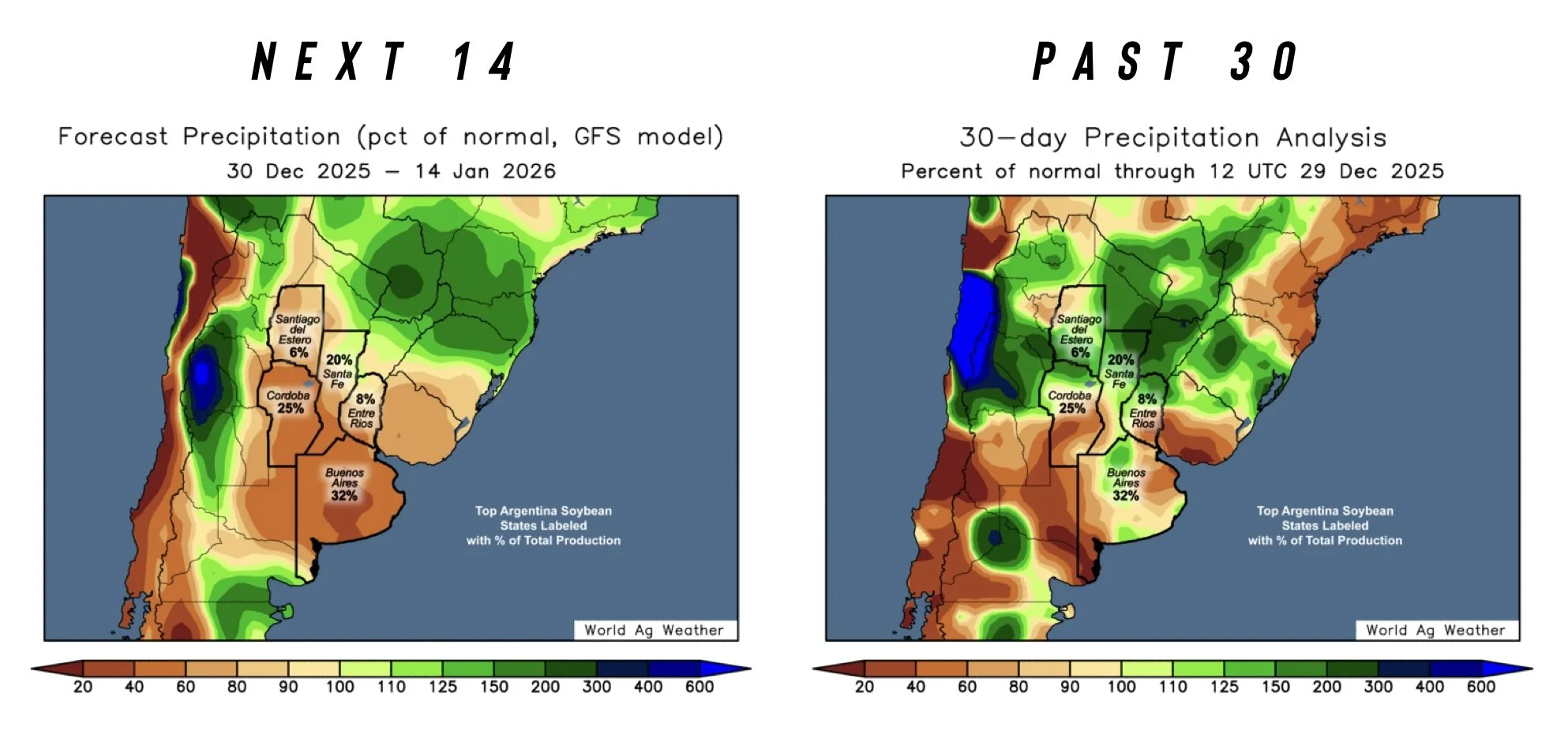

Argentina is supposed to be hot and dry for the next 2 weeks. Only receiving 50% of their normal rainfall. So perhaps that could add some support, but overall not a game changer.

Below is the 2-week forecast vs the last 30 days of precip vs normal.

Argy is dry, but Brazil looks fine for the next 2 weeks.

Neither has had any big concerns the last 30 days.

Technicals:

March Beans

We are still right at the 78.6% retracement level down to the pre-China fueled lows.

So finding some life here still makes sense.

If we fail to hold this level, we have some trendline support around that $10.50 area.

To the upside, we want to be looking to reward a move towards $11.00 to $11.15 if it comes. That claws back 38.2% to 50% of the entire sell off.

If we look at the indicators.

We had hidden bullish divergence. The RSI was making new lows, yet prices were a lot higher compared to the last time the RSI was this oversold.

If prices make a new low, but the RSI does not. That is called normal bullish divergence. So that could definitely we something we see here if we make new lows over the next few days but the RSI does not.

The MACD indicator is a momentum indicator (on the bottom).

It has not yet flipped bullish, but is close to doing so. The last few times it flipped bullish it did lead to higher prices.

A few other reasons why we could find life down here.

Continuous Chart

Here is the continuous chart.

At the highs, we had a gap left unfilled from 2024.

We almost perfectly filled the gap before going lower.

Now to the downside, we had a gap left open. Which we filled last week.

At the same time, this level gives back 61.8% of the entire rally.

It's also our yearly resistance.

This adds even more reasons to believe this area is a point of interest.

Wheat

Like the rest of the markets, there isn’t much for news.

Wheat demand has been great. Inspections are up over 20% vs last year.

But this market really needs a supply story to get any momentum behind it.

We just don’t have one for now.

Simply remaining patient in wheat for now. Waiting for that rally that only comes a few times a year that typically doesn’t last long.

Technicals:

March Wheat

Nothing to update here.

Trying to call a bottom would be like trying to catch a falling knife. As I haven’t seen anything definitive that's made me believe we've put in a bottom yet.

Ultimately we need above the blue box to be confident this market is ready for a real move higher.

March KC Wheat

KC looks a lot better than Chicago.

We perfectly rejected that golden fib, as we clawed back 61.8% of this sell off.

That is the level we need to break above to be confident this market is going to catch a bid higher.

Like we always talk about, that level is where the market typically decides if this is simply a relief bounce or something bigger.

Cattle

Nothing new in cattle.

Fundamentally, the cattle situation is clearly still tight.

The biggest risk in cattle has to be the government.

I think the government probably keeps big money and the funds from wanting to get too long in this market, because they know a headline could pop out at any moment.

Then we have the Mexican border which could re-open early next year.

Feeder cattle did post a new high today, but live cattle has been trapped in a brutal sideways range.

We still like keeping some downside protection up at these levels.

Technicals:

March Feeders

March feeders did offically fill that gap we left back in October.

This level almost perfectly lines up with reclaiming 61.8% of the entire sell off.

Both of these are big points of interest.

So if you haven’t yet, we still like defending this level.

As this is still where most relief bounces can tend to fail.

Feb Live

Completely sideways.

Consolidating right in the golden zone.

Same story as feeders. This is where relief bounces can often fail.

We still like defending here.

Past Sell or Protection Signals

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

CORN AT BIG SPOT. BEANS BOUNCING. NEXT TARGETS & MORE

VIDEO CHART UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video. The video may be easier to follow along with the charts.

Timestamps for video:

Beans: 0:40min

Corn: 5:20min

Cattle: 7:45min

Wheat: 8:30min

Want to talk about your situation?

(605)250-3863

Your trial has ended

Don’t miss our future updates or signals

Our holiday sale ends next week

Overview

Today, we are only going to be going over the charts and some things we're watching as there is very little fresh fundamental news with the holidays.

Soybeans are seeing a nice bounce right at those downside targets. Corn is up against some pretty key resistance bulls would like to break. The wheat market is starting to look a little more optimistic. Cattle is still consolidating at our upside targets.

The usual full video updates will resume next week. Where we'll look at seasonals and do some fundamental digging.

Here are the chart breakdowns:

Soybeans

Jan Beans

We are going to start off with soybeans, as we alerted that buy zone alert late last week.

If you missed it, check out last week's video where we went over the methodology behind it.

Click Here to View

So far, we have perfectly bounced off those downside targets we sent out in both Jan and March beans.

We will be switching over to March as the main focus, but I wanted to include Jan beans because they were a large reason for that buy alert.

On Nov 17th we issued that sell signal. Which was because we simply reclaimed 61.8% of the contract highs and were showing bearish divergence.

Late last week, we gave back 61.8% of the contract lows off those Nov highs, and were showing hidden bullish divergence. So we alerted the buy signal at $10.48

It's still too early to say that we found a bottom, but so far we've seen a great reaction off that level.

March Beans

Jumping over to March.

That buy signal came at $10.59

We broke the 61.8% level of the entire China fueld falled. The next level was the 78.6% level at $10.59

When you pair it with Jan beans approaching the 61.8% level down to contract lows, it was enough to trigger a buy signal and take profits off the shorts.

We were also the most oversold we've been in over a year.

At the same time, we were showing hidden bullish divergence here as well.

The RSI was very oversold, yet prices were much higher than the last time it was this oversold.

This doesn’t mean prices "have" to rally. It simply told us downside momentum might be getting weak.

Continuous Weekly Chart

This is the continuous chart and shows the contract with the most volume.

We had a clear area of resistance all year long.

We got the break out in October.

We've now came down and tested that point of break out. Often times, old resistance becomes new support and vice versa.

A perfect example of this would be the highs we just posted. We happened to fail right at those old support levels from 2024.

At the same time, this chart had a gap left open.

Last week we filled that gap, which perfectly lined up with the old resistance. Along with the 61.8% retracement level down to the Sep lows.

So finding life here makes sense.

March Beans Target:

Well, now how high can we go?

Since this correction was so deep, it appears unlikely that this market is going to go and post new highs. If it did, I think it would take a larger outside factor. Such as an issue in Brazil or China buying more beans than the market has currently priced in. But for now, neither of those seem all that likely.

So if we found our local bottom here, we are going to want to be looking to reward this relief bounce.

The golden zone is the 50-61.8% levels. However, I have my doubts that this market has enough steam to get that high given the size of the sell off.

So I am looking to de-risk in the $11.00 to $11.15 area as of now, but is of course subject to change as the chart develops.

That level claws back 38.2% to 50% of the entire sell off.

Past Relief Bounces

Like we talked about last week.

When a market posts a major high, often times it will give some sort of relief bounce. Not every time, but a lot times.

It's typically not just a straight sell off that goes to zero.

This is because the most common correction pattern is markets is called an ABC correction.

You get the intial A wave down. The B wave relief bounce. Then the last C wave down.

We showed this last week. But an example of this is July corn from earlier this year.

We got the initial sell. We then got a relief bounce up to the golden zone. We then went a lot lower.

Interestingly enough, the top was marked with bearish divergence. The bottom of the relief bounce was marked with bullish divergence.

So some similarities there to what we are currently seeing in soybeans.

Here is another great example of a relief bounce.

This one is Dec-23 corn.

We had that weather scare rally that took corn from $4.90 to $6.30 in a few weeks.

Corn then gave it all back in just a matter of days.

But the market did offer a relief bounce before ultimately falling apart.

The relief bounce failed once again right in that golden zone.

The point is, relief bounces are common. But we want to reward it if it comes. Just like we rewarded the April bounce in corn this year.

As they are often opportunities when they present themselves.

Corn

March Corn

March corn is currently battling some big resistance we've continue to struggle at for months now.

This is a big spot for corn, as we are flirting with a breakout if we can clear this level.

It was support from spring, we've rejected this level a dozen times since October.

If we get a break above, it should result in further upside.

We are also above the 200-day for the 3rd day in a row. Which is something we haven’t seen since summer.

Being above the 200-day after being below it for so long, can often be a sign that a market's long term momentum is shifting higher. So it's nice to see that.

March Weekly Chart

Here is the weekly chart.

We had our highest weekly close since June today.

This chart shows you just how big of resistance that $4.50 level is.

We bounced there on 8 separate weeks this spring.

We've now failed that level 5 weeks the last two months.

Big spot to clear.

Upside Targets

We alerted our first sell signal and take risk off the table for the first time since April we hit that intial $4.50 target.

If you haven’t taken any risk off the table at all, taking a small amount off while we are sitting at our highest levels since July and some key resistance isn’t the worst idea in the world.