TRUMP SAYS CHINA WILL BUY MORE BEANS

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Trump, China & Beans: 0:00min

Corn: 8:00min

Beans: 11:20min

Wheat: 12:00min

Cattle: 13:50min

Want to talk about your situation?

(605)250-3863

Futures Prices Close

Overview

Wild day for the soybean market.

The market was slightly lower, than out of nowhere we rallied a massive +50 cents in just 20 minutes.

Why?

All because of one tweet from Trump.

He had a call with China. He essentially said that they discussed China bumping their soybean purchase agreement from 12 million metric tons to 20 million metric tons.

While at the same time reiterating that they are committed to fulfilling that 25 million goal for next season.

Soybean Sell Signal

This morning, we did issue our first soybean sell signal and hedge alert since November 17th, following the news.

Link to Signal

What was our reasoning behind this signal?

The main reason was simply based on the charts, as 90% of our signals are.

If we look at March soybeans, we alerted the signal because we hit the golden zone.

They ran right into that golden zone before ultimately falling well off their highs.

(The golden zone is when we reclaim 50-61.8% of a sell off. It is the most common spot for a bounce to fail).

What about November soybeans?

They too hit the golden zone retracement and 61.8% level up to those November highs.

Why the Golden Zone?

You hear me talk about this all the time.

Why does this zone tend to be so important?

It is the most common spot for a bounce to fail.

Not all the time.. but it is very common.

There are several instances of this over the years.

Let's go over a few of them.

March-26 Corn: Last November

Here is the most recent example of this zone and where it marked a significant high in a market.

In this case, that same level also happened to be old support. Which we've talked about several times since harvest.

We clawed back 50-61.8% of the highs from February before failing.

July-25 Corn: Last April

We had that brutal sell off after posting those February highs.

We then received a dead cat bounce.

It failed at the golden zone.

July-25 Corn: Last February

From the contract lows, that rally going into February reclaimed 50% of the contract highs.

This level lined up with prior support and resistance.

When the golden zone lines up with old points of support and or resistance, it helps narrow down the target even further.

Sep-23 Corn: Summer of 2023

Remeber that weather scare in 2023 that rallied corn +$1.30 in just a month.

That rally failed after clawing back 61.8% of the contract highs.

Jan-25 Beans: Last November

This was the reason for that sell signal back in November.

We went on that China driven rally before topping out after taking back 61.8% of the contract highs.

This doesn’t mean soybeans definitely topped today.

The point is that it just simply makes sense to take risk off the table in the area where it historically makes the most sense to do so.

Does Trump & China News Change Anything?

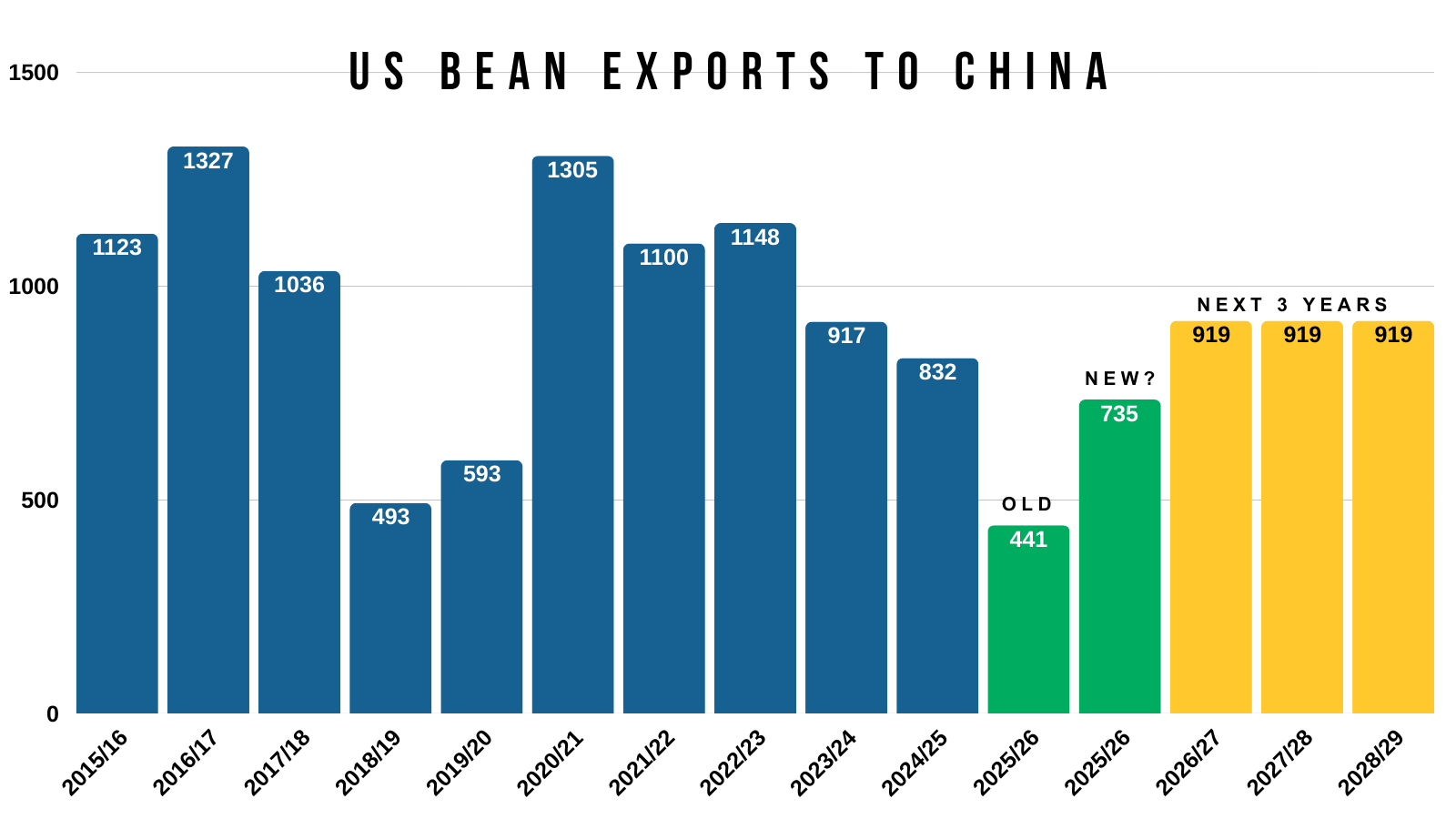

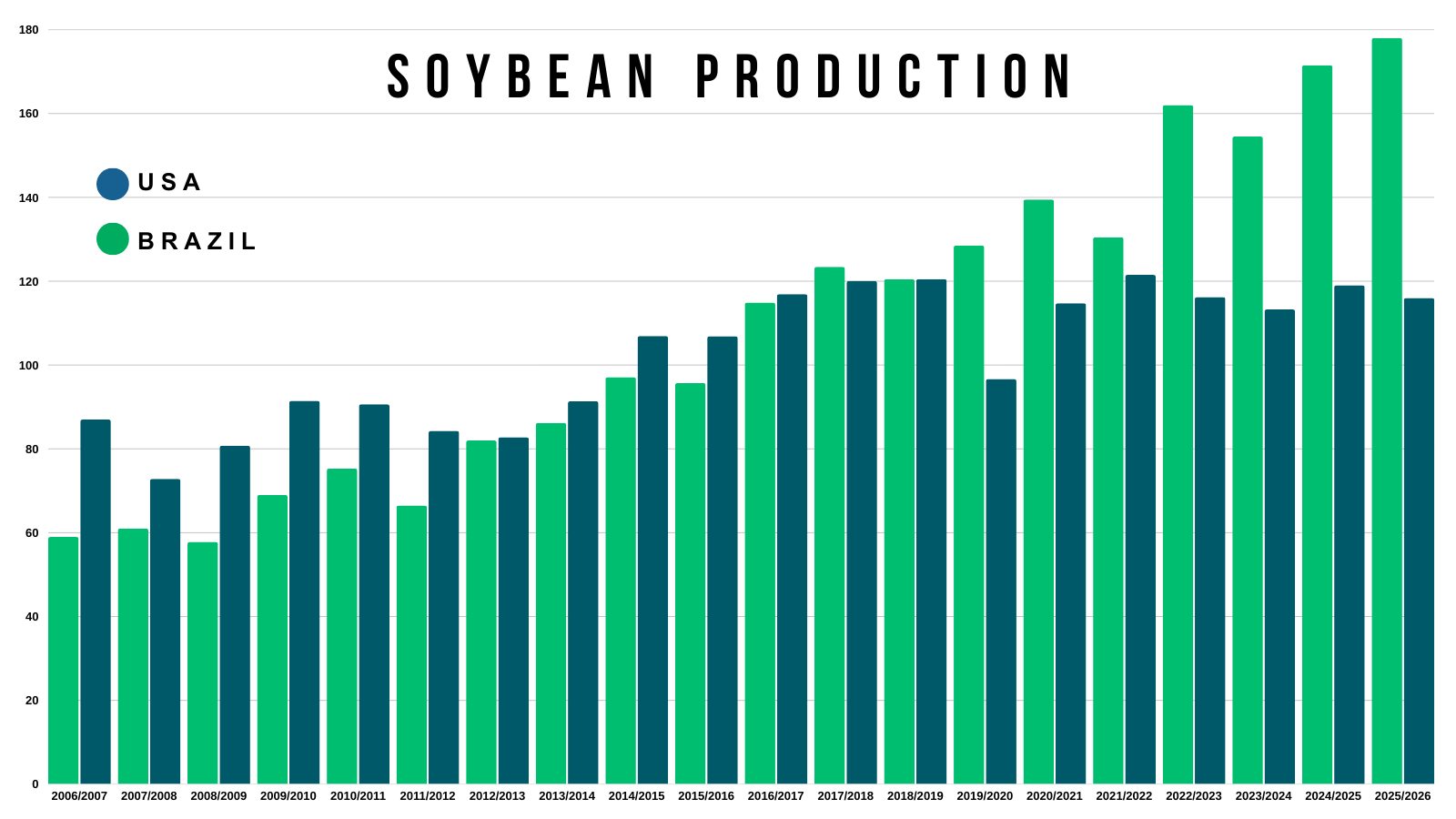

Here is a visual of China's purchases of US soybeans.

This chart includes their past purchases over the years.

It also includes their old agreement, along with the "rumored" new agreement.

12 million metric tons = 441 million bu

20 million metric tons = 735 million bu

Difference = 294 million bu

That is a pretty massive increase.

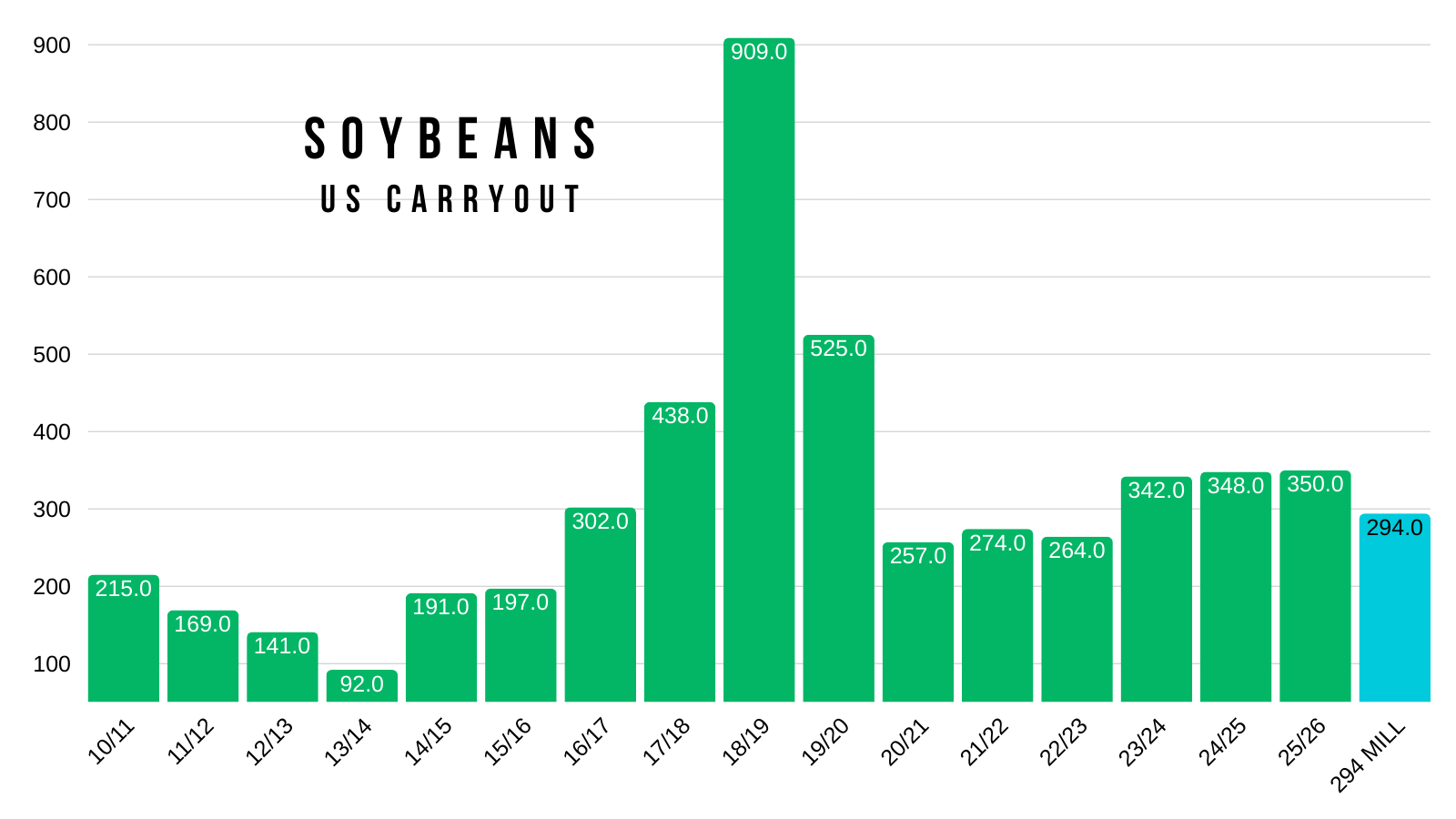

For reference, the entire US soybean carryout is 350 million bushels.

Seems pretty bullish when you think about it that way.

As the US doesn’t have an extra 300 million bushels to export.

We'd literally run out of beans.

But it's not quiet that black and white as there are a lot of moving parts.

However, we still felt that it made sense to reward that size of a move.

As the action could've very well been algo buying on the headline, and we weren’t sure if this market would see any follow through or not.

After all, Trump did only say they are "considering" bumping their purchases.

If that word changes from "considering" to "confirmed" it would be very bullish.

If it is true and China follows through, this is exactly what soybean bulls might’ve needed.

We had been talking about the impact China buying would have for a while. If they continue to buy US soybeans, the market will take notice.

If they back off their purchases like they historically do here, given that Brazil has a monster crop coming around the corner and their soybeans are cheaper than ours, then soybeans will struggle to find a reason to go higher.

Who knows how the political chess match will turn out.

If China wants to continue buying, there is no reason we can’t go higher.

The US balance sheet does NOT have room for an extra 294 million bushels of demand. That is almost the entire carryout.

If China were to buy that amount, prices would probably have to go higher to ration demand.

Because we would need to push away our business from non-China destinations and hand it off to Brazil.

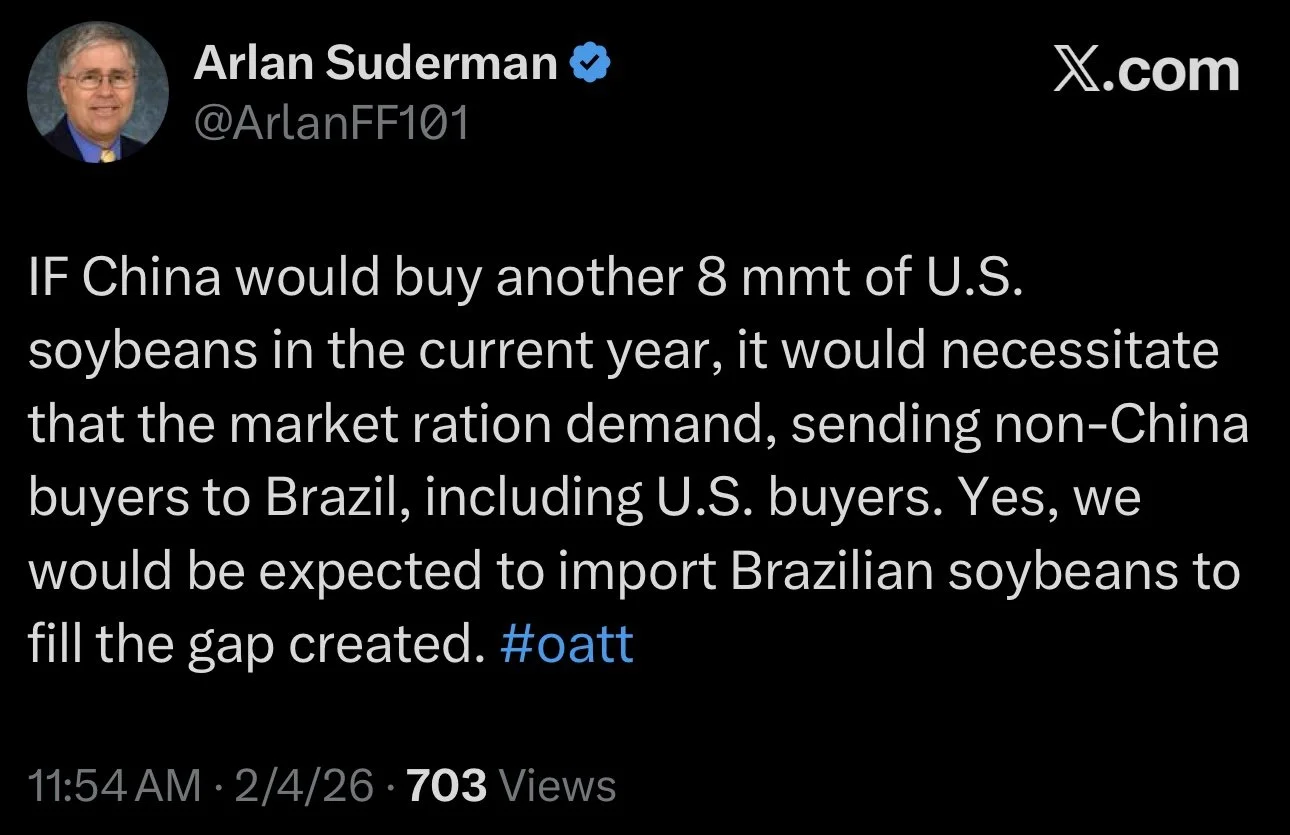

There is even talk that the US could end up having to import Brazil soybeans.

Brazil's beans are more way cheaper than ours.

So China's commercial crushers don’t have an incentive to buy at all. It just doesn’t make any sense for them to buy.

Which means the buying might have to come from their government reserve, not normal commerical demand.

If it is the government buying instead of the commercials, we could see basis and spreads do a lot of the work.

If their government is buying, it could result in the US balance sheet getting tighter, but the world balance sheet remaining the same.

Because those soybeans aren’t going to vanish into thin air. They have to go somewhere.

There is also simply some logistical question marks.

Does China even have room for an extra 300 million bushels of soybeans?

They probably don’t, and that original 12 million already has deliveries scheduled from February to August.

So for China to actually buy this amount of soybeans they might have to do something awkward. Such as buy the soybeans, then auction them into crush to help make room.

There are so many different ways it could go.

It sounds hard, but not impossible.

Like we've talked about before, soybeans could very well just be a small peace offering in the grand scheme of things for the trade war.

Something to keep in mind is that China probably won’t come in and buy these soybeans right now. They are going to be busy with Brazi's crop. We also have the Chinese new year coming up soon.

Regardless, it made sense to defend the rally in some sort of manner at a key spot on the charts.

This market sold off what felt like every day for the last 3 months.

We clawed back nearly 2/3rd's of that sell-off in 20 minutes. Not a move we want to completely ignore.

This could definitely change the tide moving forward this year.

Who knows if today's rally will simply be a one day thing or not, or the start of a bigger rally like in October.

But we still have to keep in mind that Brazil's harvest could start to add some pressure to this market.

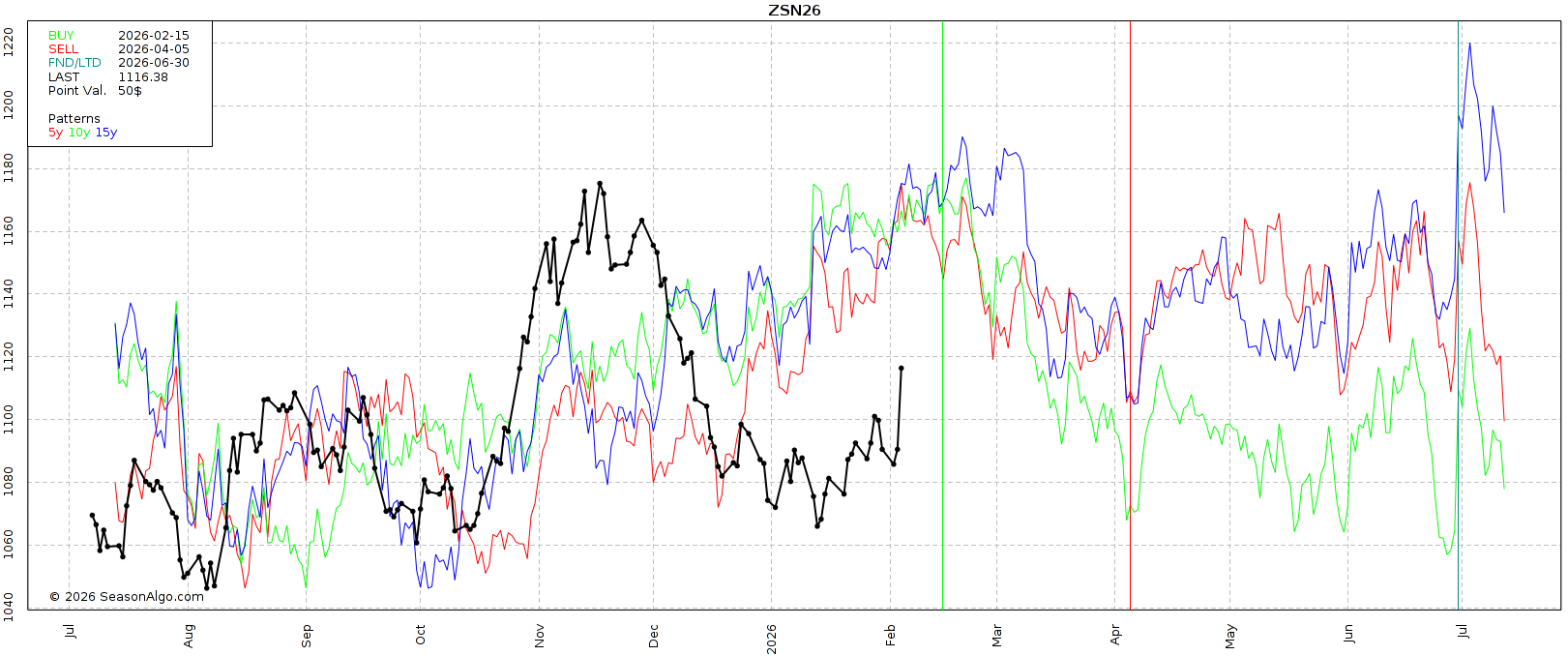

Seasonally, soybeans do tend to struggle from the middle of February until April due to their harvest.

Similar to how the corn market finds life after getting through the harvest pressure here in the US.

Soybeans tend to do the same when it comes to the Brazil crop.

Given that Brazil is by far the dominant player now.

But if China does step up now rather than later, it could very well change things. However, there is some reasons to doubt it happens right away.

Today's Main Takeaways

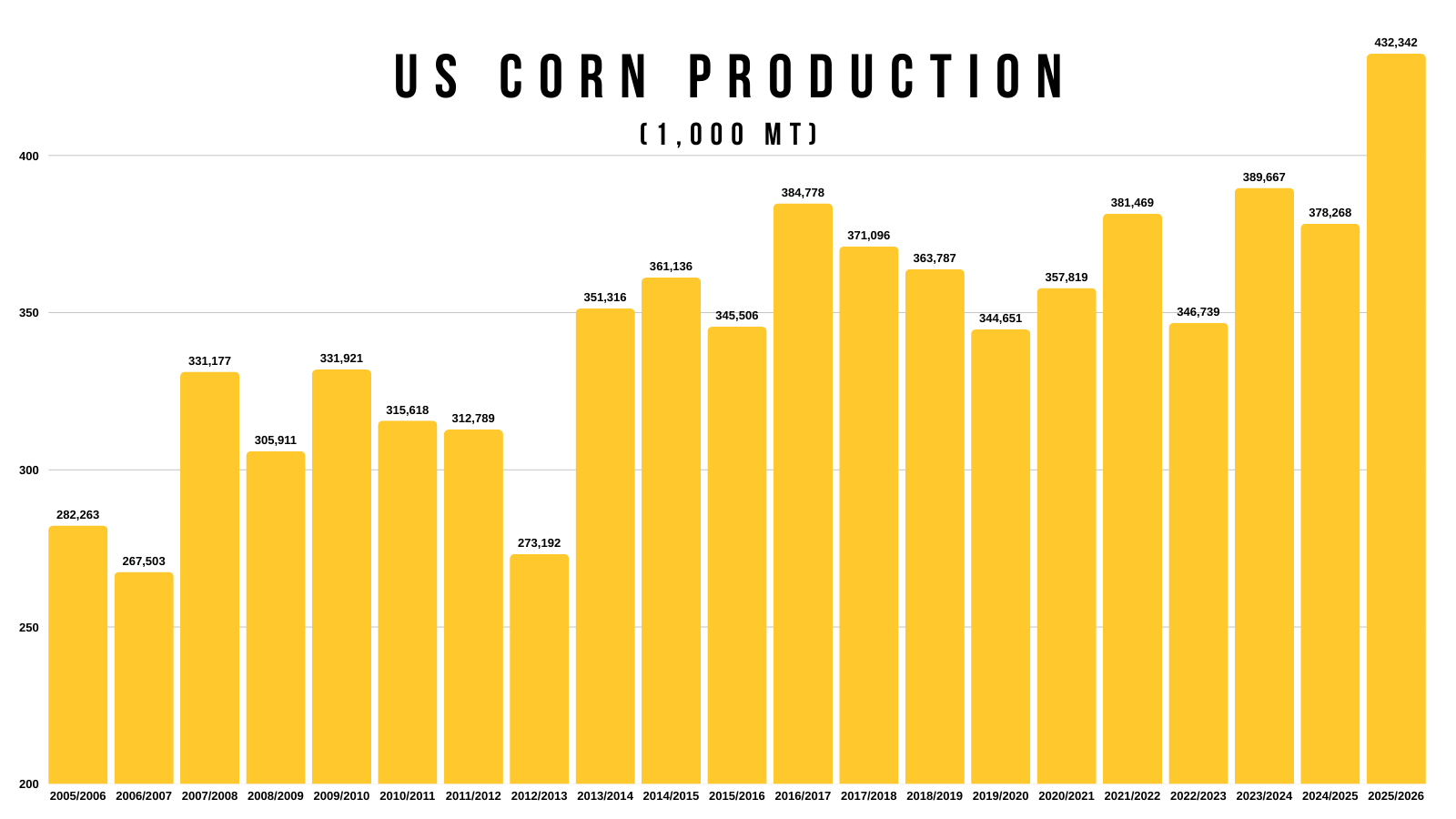

Corn

Fundamentals:

Not much fresh news on corn today.

We are still essentially range bound.

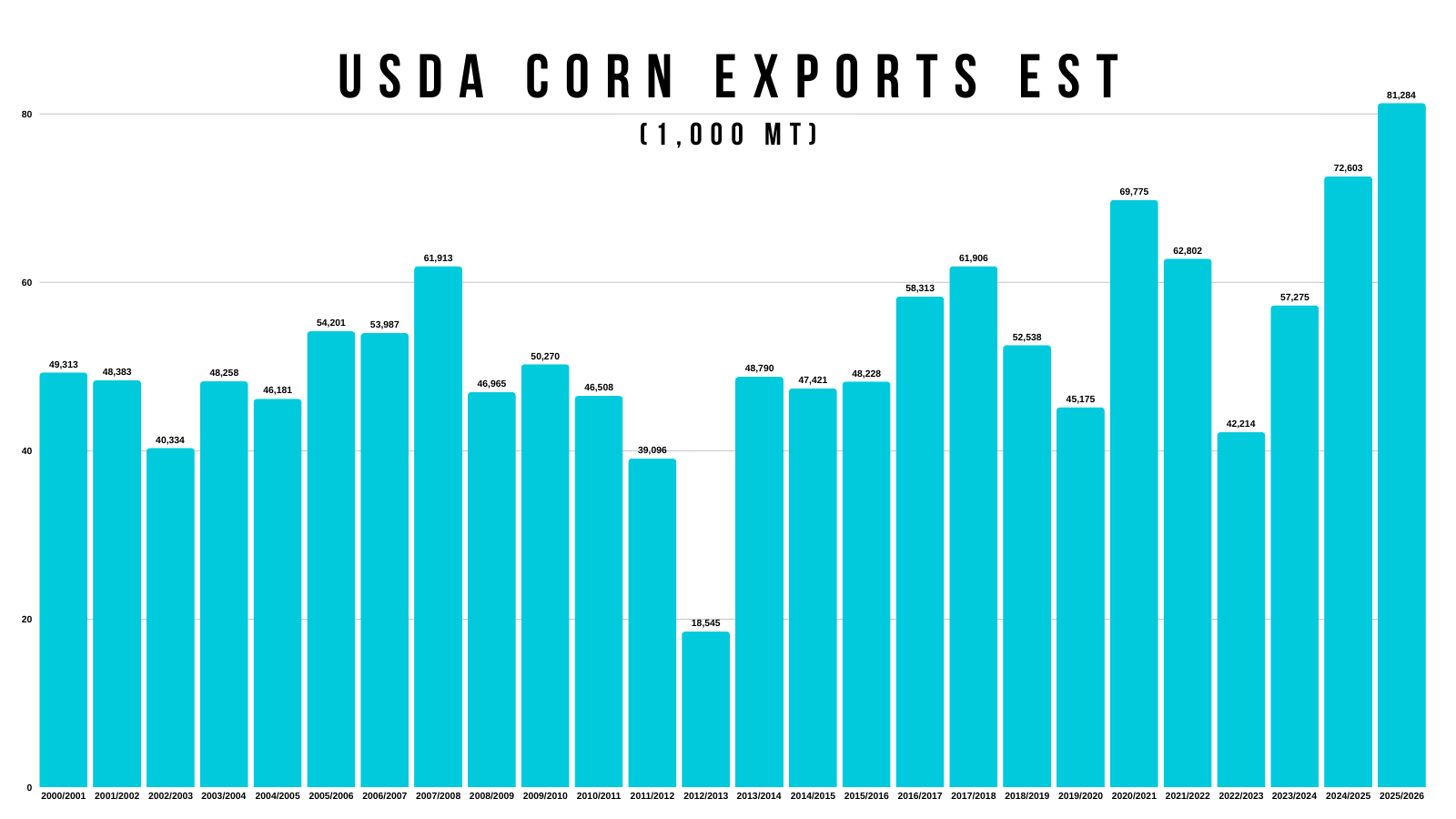

We have record demand keeping a floor under us.

We have record supply keeping a lid on us.

Demand is as great as it's ever been, but we definitely aren’t short on corn here.

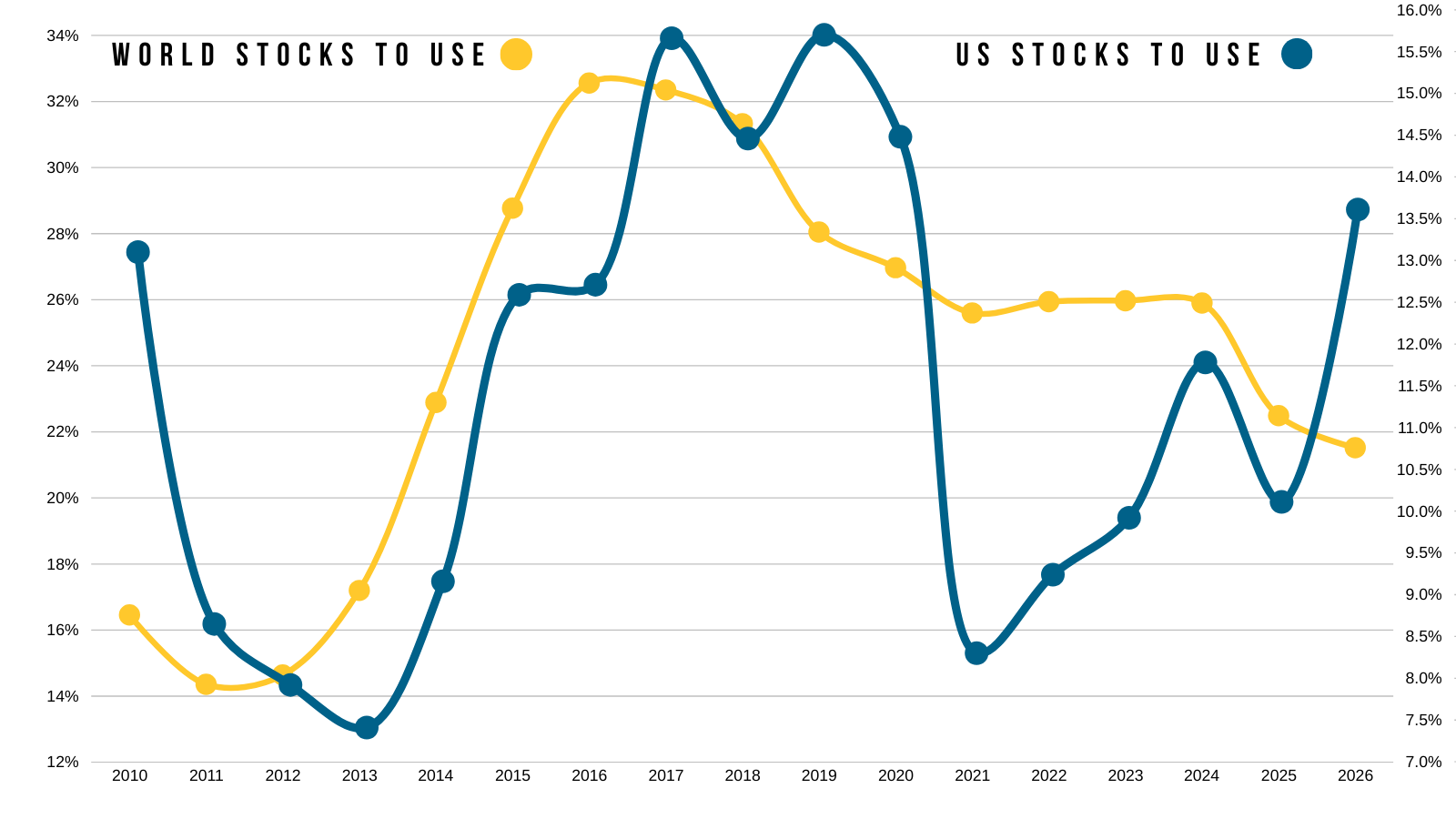

We have two completely different stories when it comes to the US vs the world for.

Here is the world stocks to use overlayed on top of the US stocks to use.

The world is the tightest in over a decade.

The US is far from being bullish.

We've talked about this several times before, but essentially, this just means the US has to perform. As the rest of the world couldn’t afford it.

One sub-par US crop would flip the corn story right around in a heart beat.

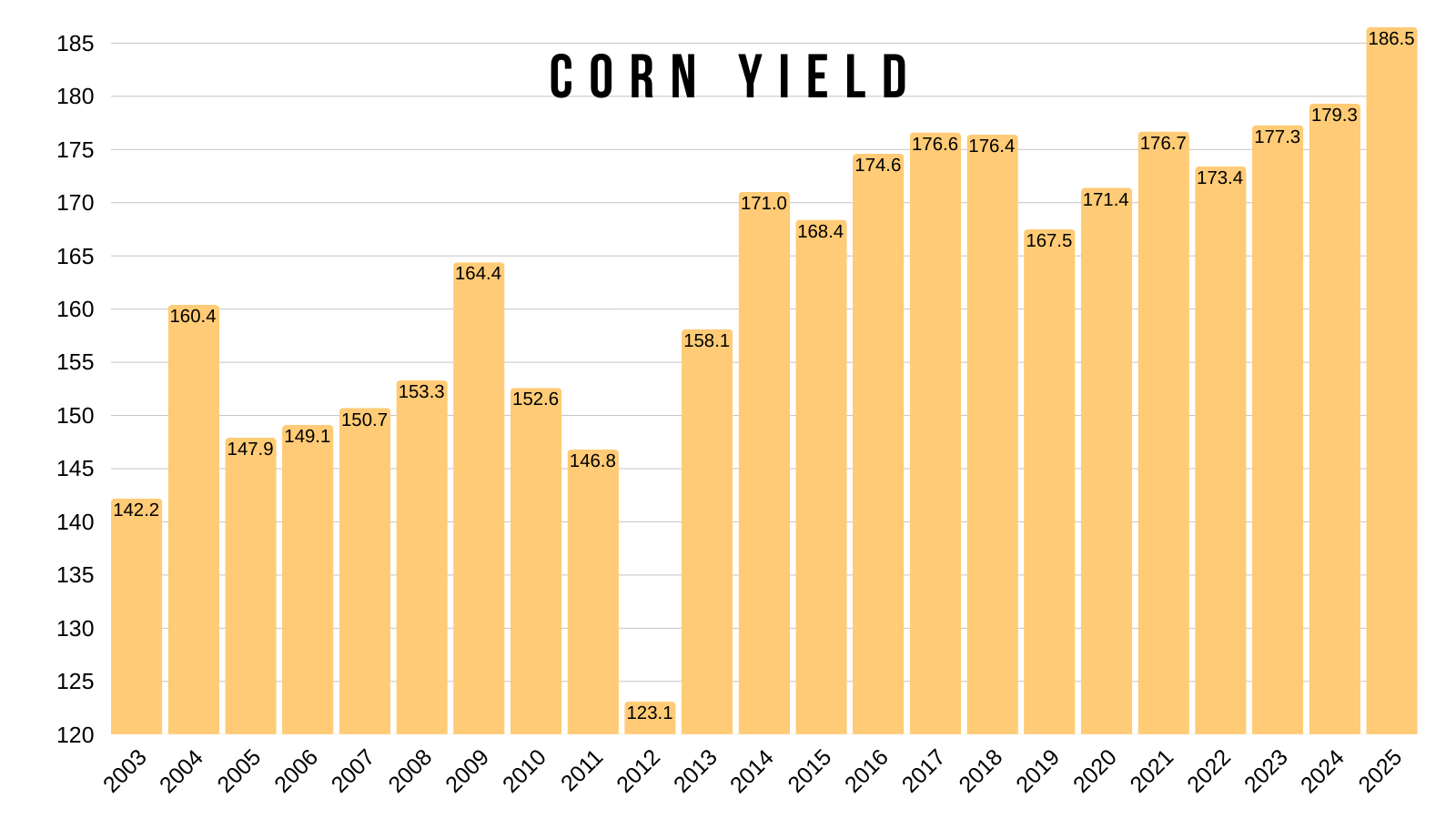

Yield has been a record for 3 straight years.

The first time we've seen a record yield 3 years in a row in around 50 years.

Can we go for 4 in a row or not?

The current situation is not overly friendly corn at all. But I don’t see a reason for us to collapse either.

It very well could take a weather scare to get a major opportunity.

Something we haven’t seen since 2023.

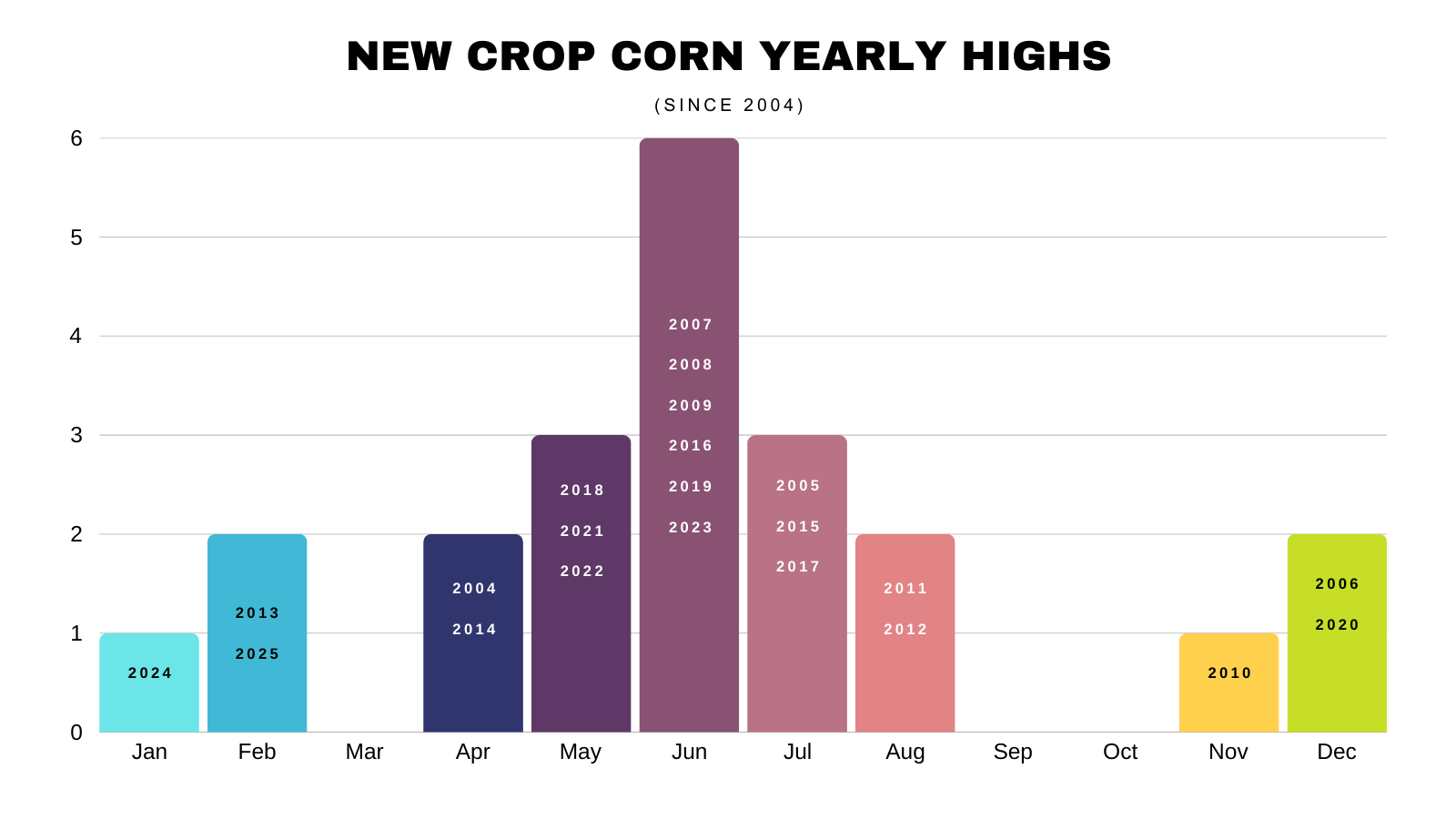

I've shown this chart in my last few updates. This is when corn has posted it's highs for the year since 2004.

We "almost" always get an opportunity in the spring or summer.

Which is typically off the back of a weather scare.

The last 2 years were in a realm of their own.

Sure, it could happen 3 years in a row. But up until 2024 we had only posted our highs for the year before April one single time.

That was in 2013 when we were already on a downfall coming off the record 2012 levels.

So history does favor an opportunity.

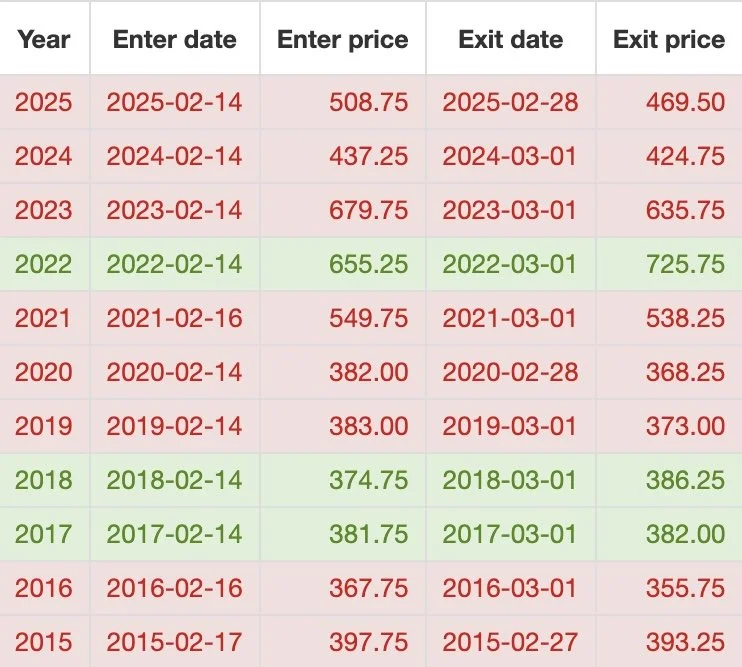

Short term, we still need to be cautious of first notice day.

We've traded lower the last two weeks of February 8 of the last 11 years heading into first notice day.

Overall it's hard to get super bullish on corn here unless we see a weather scare that threatens supply. For now our upside does feel limited.

The market is going to lack fresh data until we get into the acre talk and planting intentions.

We have that USDA report next week, but the only thing the USDA will play with is the demand side.

You could very well argue that they are too light on their export projections.

We've created a demand monster in corn.

What happens if the US underperforms?

If the USDA is right, the US will absolutely need another big crop to keep up with demand.

Something to keep in mind this growing season.

Technicals:

March Corn

I still want to reward a move towards $4.36 to $4.37

It's 50% of the November highs and old key support.

The fall rally failed at 50% of the February highs and key support from last spring.

Same set up. Smaller scale.

We are finding life right at the golden zone retracement of this entire bounce.

This is where the market decides if the bounce is over, or if it's time to continue higher.

Holding this level is key to keeping our bias remaining higher.

It's the most common spot for a correction to end, so bouncing here would make perfect sense.

Soybeans

Fundamentals:

We covered soybeans earlier, so let's just take a quick look at the March chart.

Technicals:

March Beans

Monday we bounced right after giving back 61.8% of this entire rally.

The exact level we needed to hold.

Today we then rallied and clawed back into the golden zone retracement of the entire sell off from November.

A very common level for a bounce to fail. Hence why we issued the sell alert this morning.

We closed -22 cents off the highs today. So not the best looking candle here short term.

Tomorrow's price action will be interesting and give us some further confirmation if the rally is over for now or not.

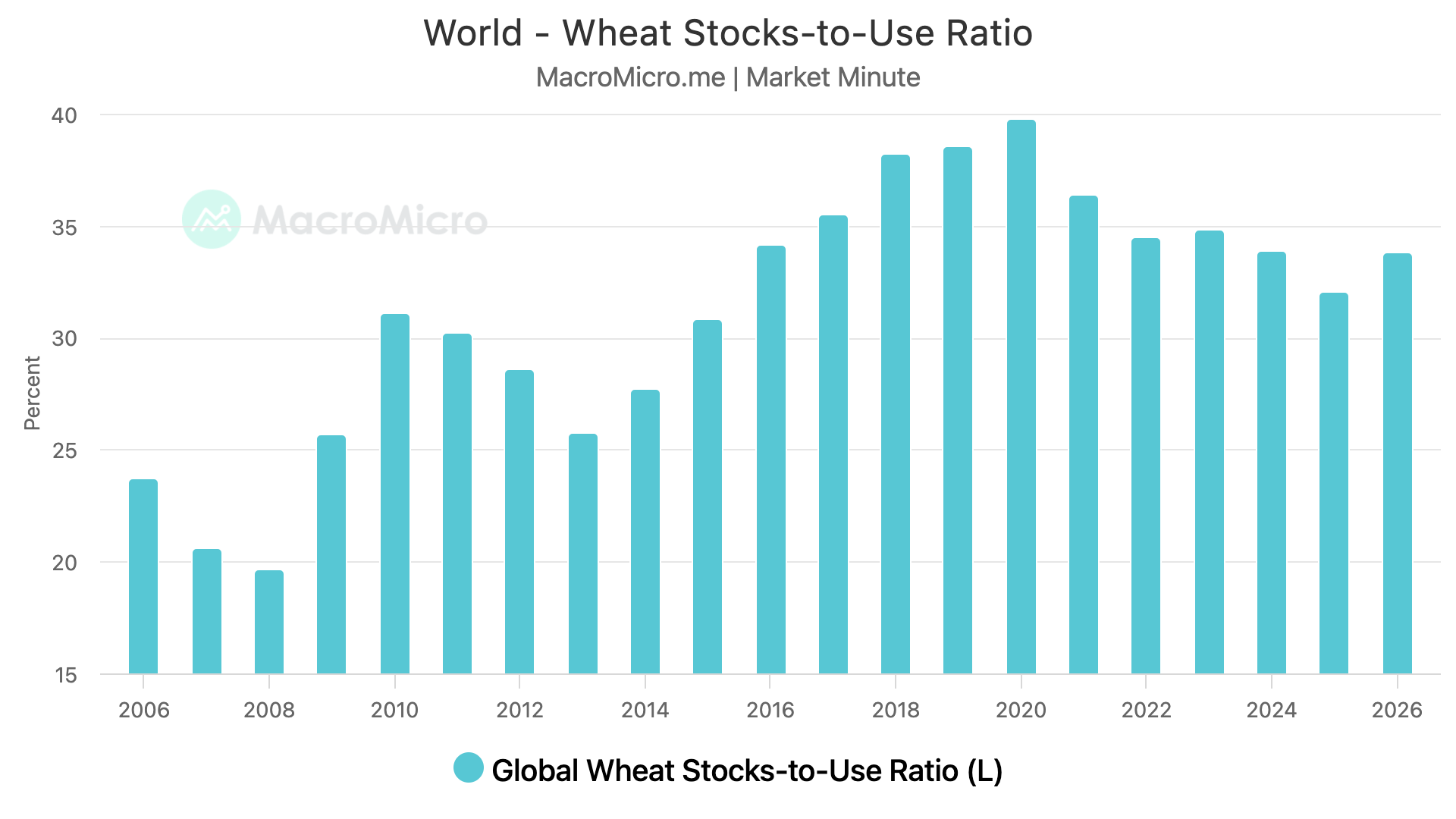

Wheat

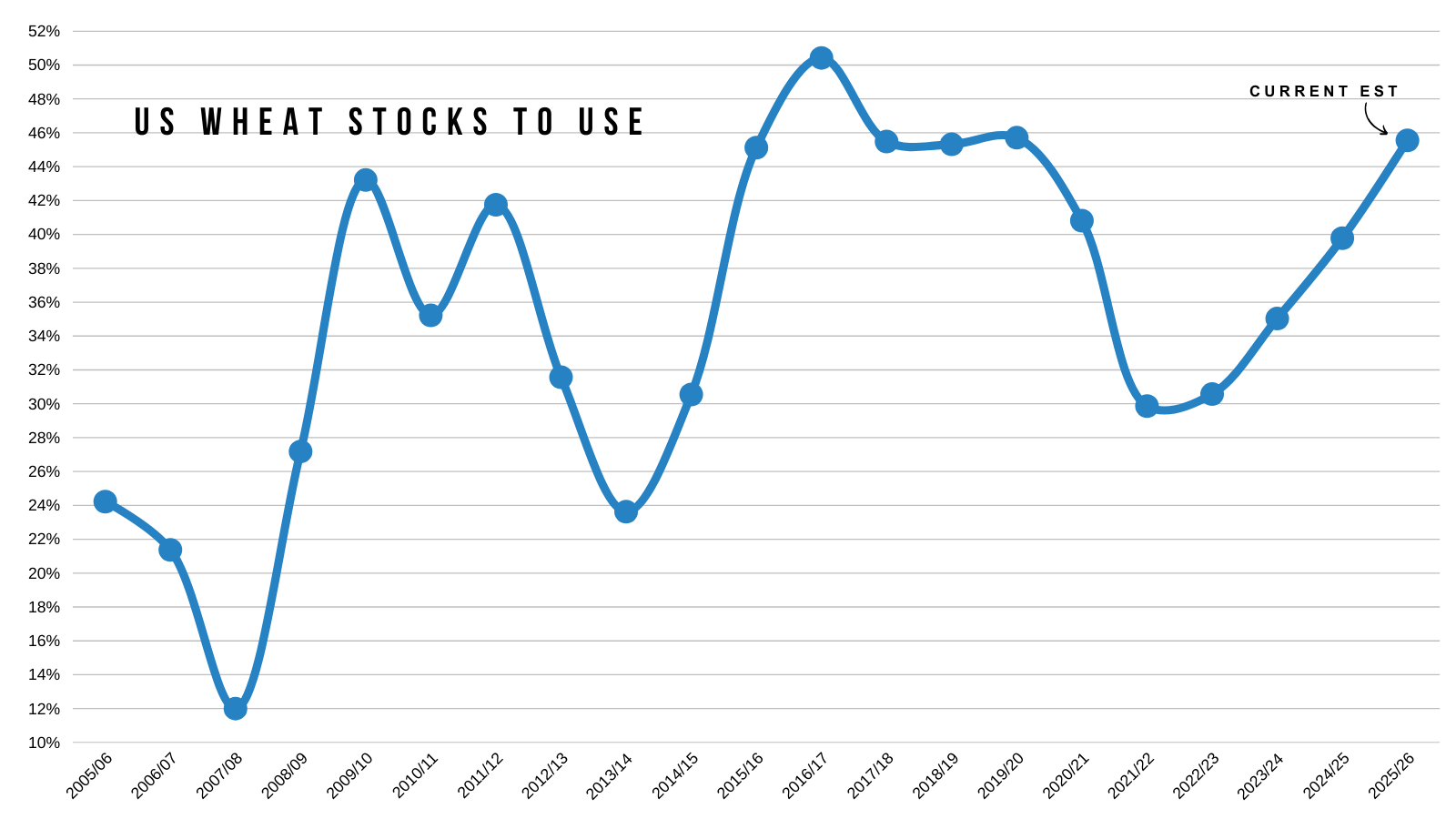

Fundamentals:

The US wheat situation is far from bullish.

The world situation is on the rise for the first time in a few years as well.

But that does not mean the wheat market cannot provide an opportunity.

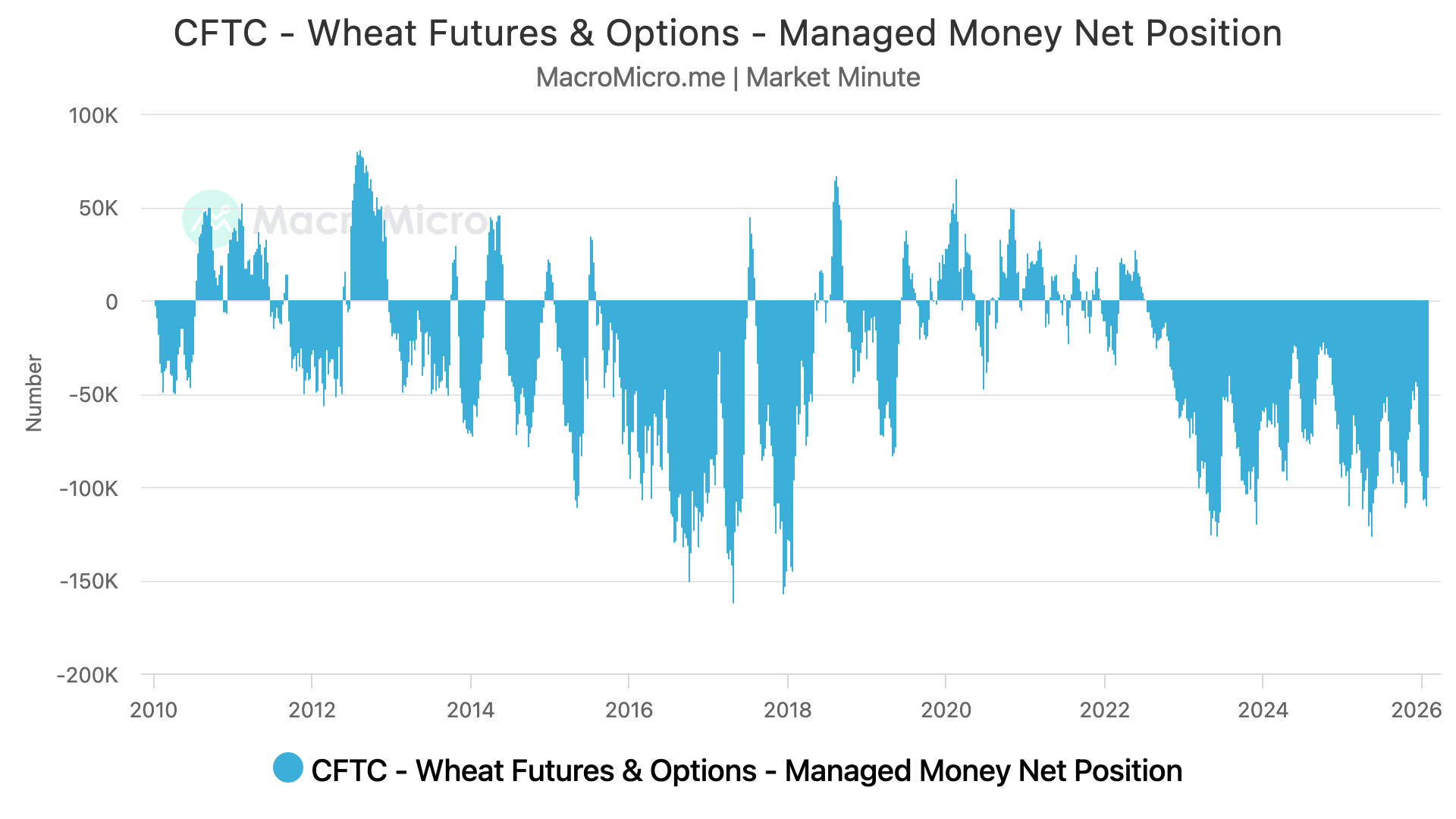

The funds are still incredibly short like usual. They haven’t been long since 2022.

Since the US and world stories are not super friendly, the wheat market will need to see some sort of supply scare somewhere in the world.

Which we have been seeing a little bit of with the US and Ukraine both experiencing brutal cold snaps recently.

We now have Russia getting awfully cold as well.

But it doesn’t appear like we've seen anything material that is going to result in a massive rally just yet.

For the wheat market to continue higher, it will likely take a supply scare.

The thing about supply scare rallies is that they don’t typically last very long. However, they can run far in a short amount of time.

Technicals:

March KC

Sitting right at the 61.8% retracement of the last bounce.

Must hold spot here short term to keep the immeditate bias remaining higher.

If we are going to bounce, it needs to be here.

Otherwise, we likely fall back into the old range.

March Chicago

The recent rally failed at the 61.8% retracement up to the Nov highs.

Break above that level and it should result in further upside.

To the downside, like KC, we are at a critical spot. The golden zone retracement levels.

Need to bounce here to prevent us from going back to the old range.

Cattle

Fundamentals:

Not a lot on cattle today.

The market clearly found Friday's report to be bullish and reaffirmed the fundamental situation is as tight as ever. The tight situation isn’t something that can be fixed overnight.

This market could easily challenge the highs, but it might take some additional news for this market to go and post some crazy new highs.

There is still definitely headline risk in this market, which can happen at any time.

If you're the funds, you took a pretty big hit back in October because of one Trump tweet. What would make you want to again get overly long in this market?

The biggest headline risk has to be screwworm.

If screwworm enters the US, I am sure the algos will take the headline and run.

Despite cattle still having potential given the tight fundamentals, it still just makes sense to defend these levels given all of the headline risk.

Technicals:

April Live

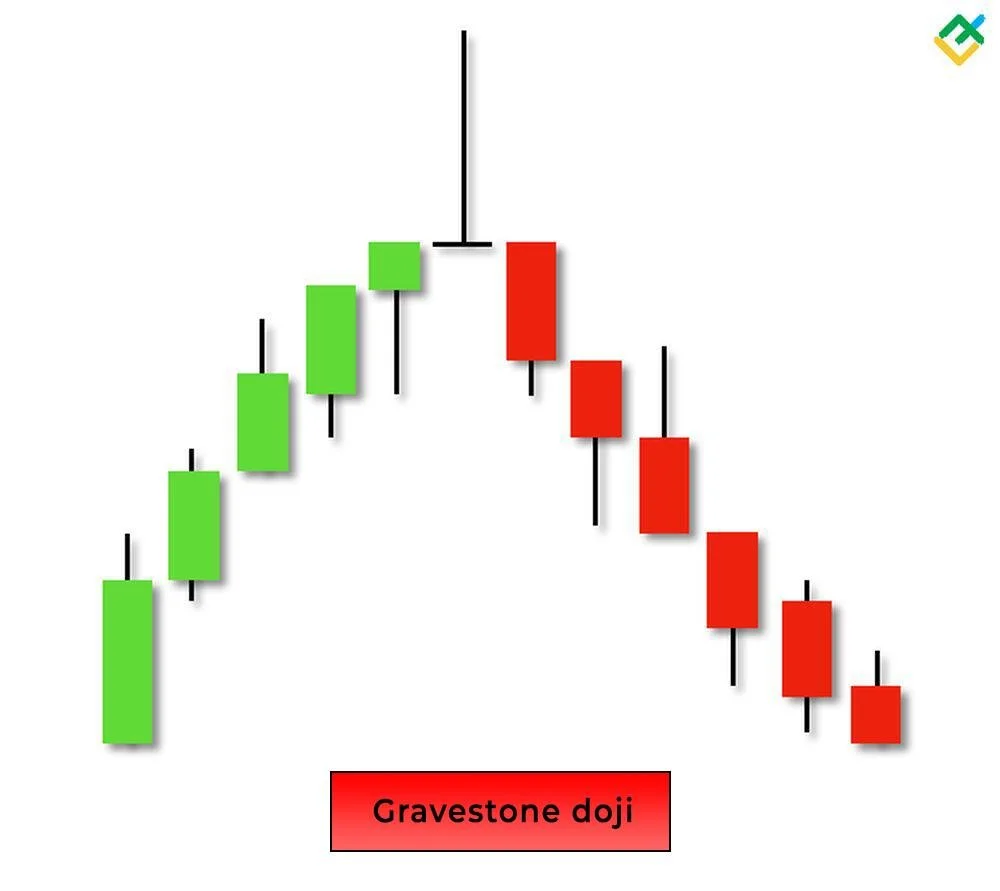

We left a gravestone doji candle today.

That can often can be considered a potential reversal candle.

Still showing some bearish RSI divergence.

March Feeders

Nearly filled the gap.

Also still showing very clear bearish divergence on the RSI.

Which is typically a sign upside momentum is starting to get weaker.

Past Sell or Protection Signals

Feb 4th: 🌱

Soybean sell signal & hedge alert.

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.