MONDAY’S PRICE ACTION WILL BE IMPORTANT

AUDIO COMMENTARY

Soybeans & wheat rally off the lows

Corn stuck in a sideways range

Cattle posts new highs for the move

Potential reversal in soybeans? (chart below)*

Monday’s price action will be key in beans

How you could play soybeans from the long side with a defined downside risk

Funds positions up to date. Still long soybeans but neutral in the corn market

Bridge payments were announced (numbers below)*

Demand should help keep a floor under corn, but supply could limit our upside potential

Soybeans need to bounce here to prevent more downside risk

The wheat story isn’t bullish, but staying patient

Listen to today’s audio below

Want to talk? (605)250-3863

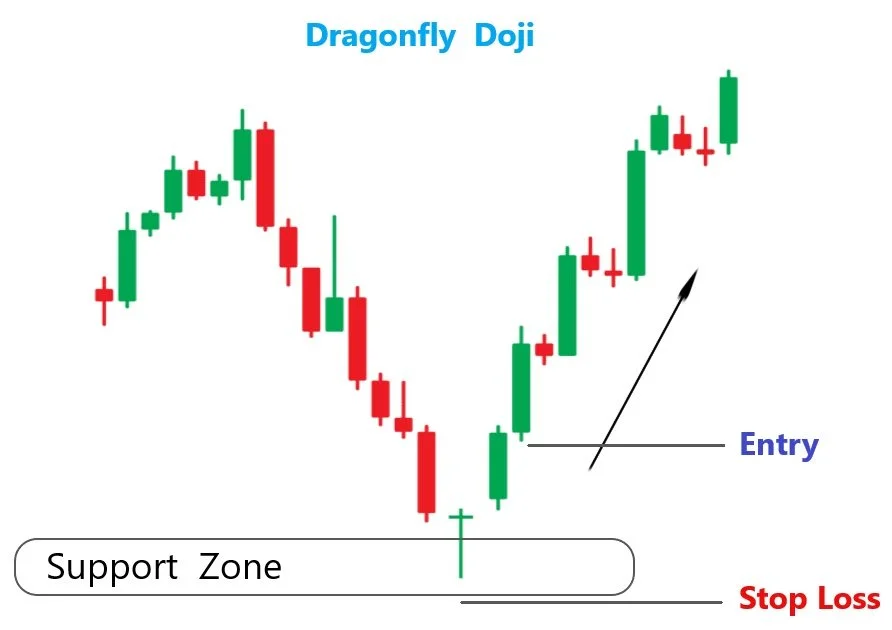

SOYBEAN CHART

We are just below the 61.8% retracement down to contract lows.

We are also right at that trendline support from contract lows.

Both of those are seen as key support levels, which we broke.

We need to bounce pretty much right now.

If we do so, this could be viewed as a bear trap. Which happens when prices break a key level, but snap back above it fast.

Traps are more common when volume is low.

If we fail to bounce here and take out todays lows, it could open the door towards $10.20.

Monday’s action will be very important.

(Scroll to view the potential reversal pattern)*

We closed well off the lows today, leaving a possible reversal candle.

However, this needs follow through.

If we close with a green candle on Monday, this would look like a dragon fly reversal.

How you typically play this reversal pattern:

Go long on confirmation of a green candle after the reversal candle.

Use the reversal candles lows as a stop loss.

So if we close green on Monday, it would look pretty optimistic.

We are still showing some possible bullish divergence on the RSI.

Prices made new lows.

The RSI did not.

BRIDGE PAYMENT RATES

Past Sell or Protection Signals

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.