USDA NEXT WEEK

AUDIO COMMENTARY

Cattle higher last 4 of 5 days

Cattle targets to de-risk (charts below)*

Trend is still lower in cattle. Ready to reward

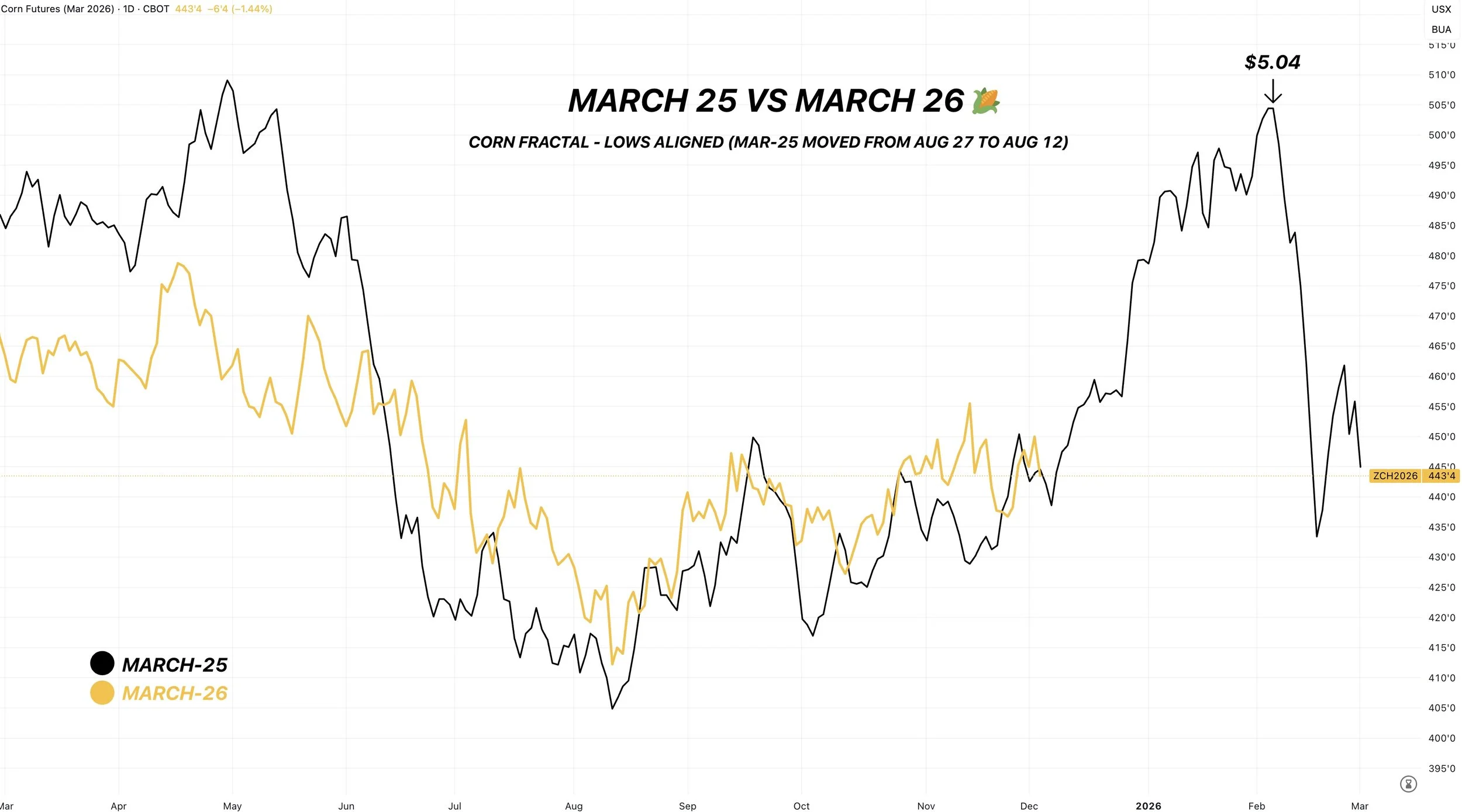

Could corn continue to follow last year’s path? (chart below)*

Wheat sideways at big support (chart below)*

Who should remain patient

Should you look at 26 crops?

For those that don’t need to sell

China still betting on Brazil weather

Don’t look for production changes in next week’s USDA report. Eyes on the January report

The bullish possibilities for Jan report

Don’t give up control of your grain

Some charts below audio*

Listen to today’s audio below

Want to talk? (605)250-3863

CHARTS

March Wheat 🌾

We’ve traded sideways for the last several days.

We are still holding this key spot.

$5.31 gives back 61.8% of the entire rally. It is seen as a pretty important spot to hold.

If we are going to bounce, it should be here.

Failure to hold opens the door lower.

Looking to de-risk in the green box.

That is also where the 200-day MA sits. We’ve only been above it a handful of times the last year. Each time was very short lived.

Jan Feeders 🐮

We are looking to de-risk in the green box.

It claws back 50-61.8% of the entire sell off.

That is the most common spot for prices to revert back to before making a decision.

Not only that, but the 50-day MA sits there as well. This acted as a massive floor on several occasions. So it is now viewed as resistance.

Lastly we do also have the large gap we left back in October as well.

Feb Live 🐮

Same set up as feeders.

Looking to de-risk in the green box.

The golden zone retracement of the entire sell off.

If we get up there, that is a good spot to de-risk in my opinion.

The 50-day MA sits there as well.

March Corn 25 vs 26 🌽

So far we are still following a very very similar path to last year.

Past Sell or Protection Signals

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.