GRAINS HIGHEST IN 4 MONTHS

Overview

New highs in the grains as the rally continues.

Corn and soybeans trade to their highest levels in 4 months, as beans rally +35 cents.

Wheat makes a new high for 2024, as it rallies +40 cents off todays lows.

So that means anyone who sold corn or beans since January, could have sold higher today than anytime in the past several months. The same goes for anyone who sold wheat this year.

And any of the funds who were selling short since, are now underwater.

While most were preaching for lower levels, we have been saying the opportunities were going to come in spring to early summer for months.

Soybeans are up +90 cents to start the month of May. Now over $1.00 of their April lows.

Corn is up +23 cents to start May, up +46 cents off the February lows.

Wheat is up +50 cents the past 3 days, nearly +$1.00 off their recent April lows.

All grains are now ABOVE the 100-day moving average.

Why are the grains rallying?

Corn

The majority of this corn rally has been short covering from the funds. We said this would happen, given that they have been holding a historically large short position for months, and that position hasn't been making money since February. They are still short over -200k contracts.

The funds are now nervous due to the thought of potentially late planting.

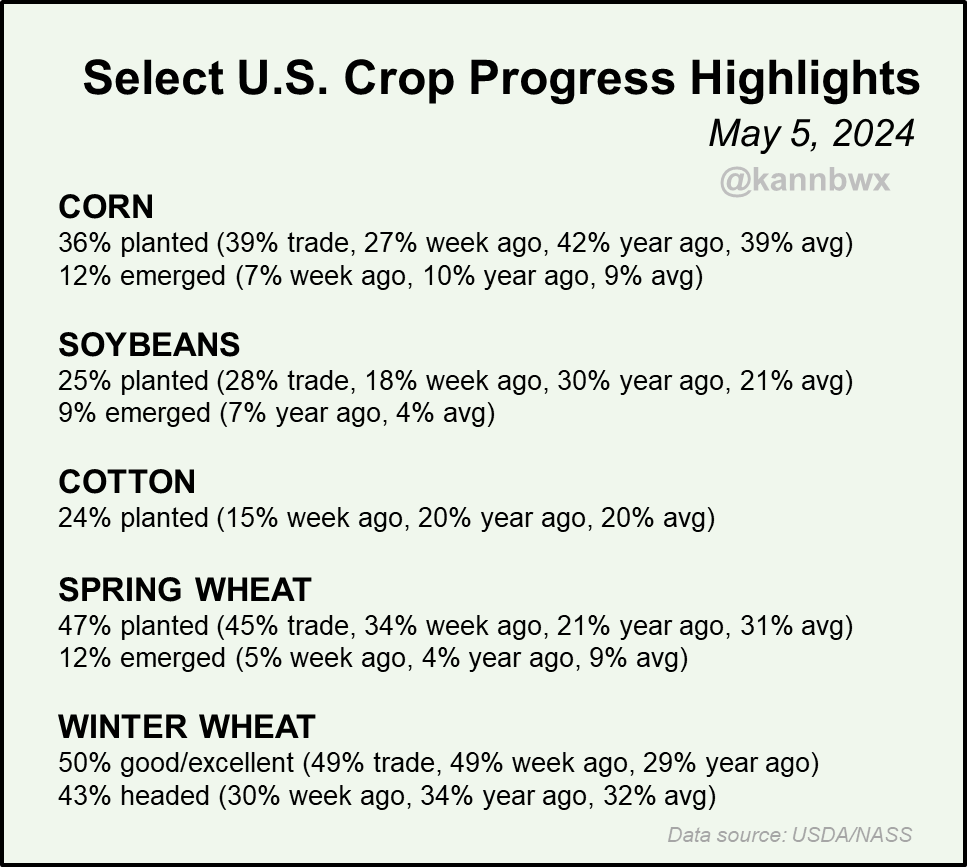

Planting progress today came in at 36%, which is now actually behind the average pace of 39% and slower than what the analysts were expecting.

I expect planting progress to come in even slower next week.

Chart Credit: Karen Braun

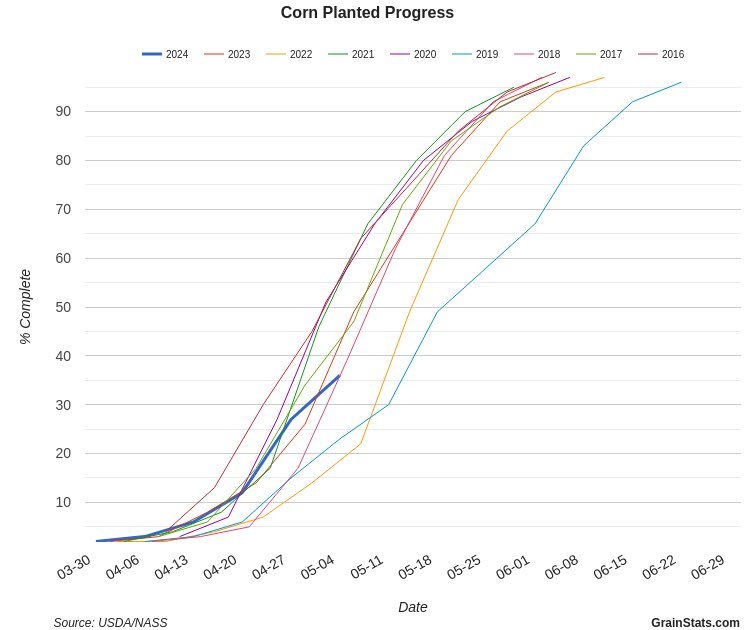

There is not a huge concern for delayed planting yet, as we are nothing close to 2019.

But the market is starting to take notice and price in the possibility.

Chart Credit: Grain Stats

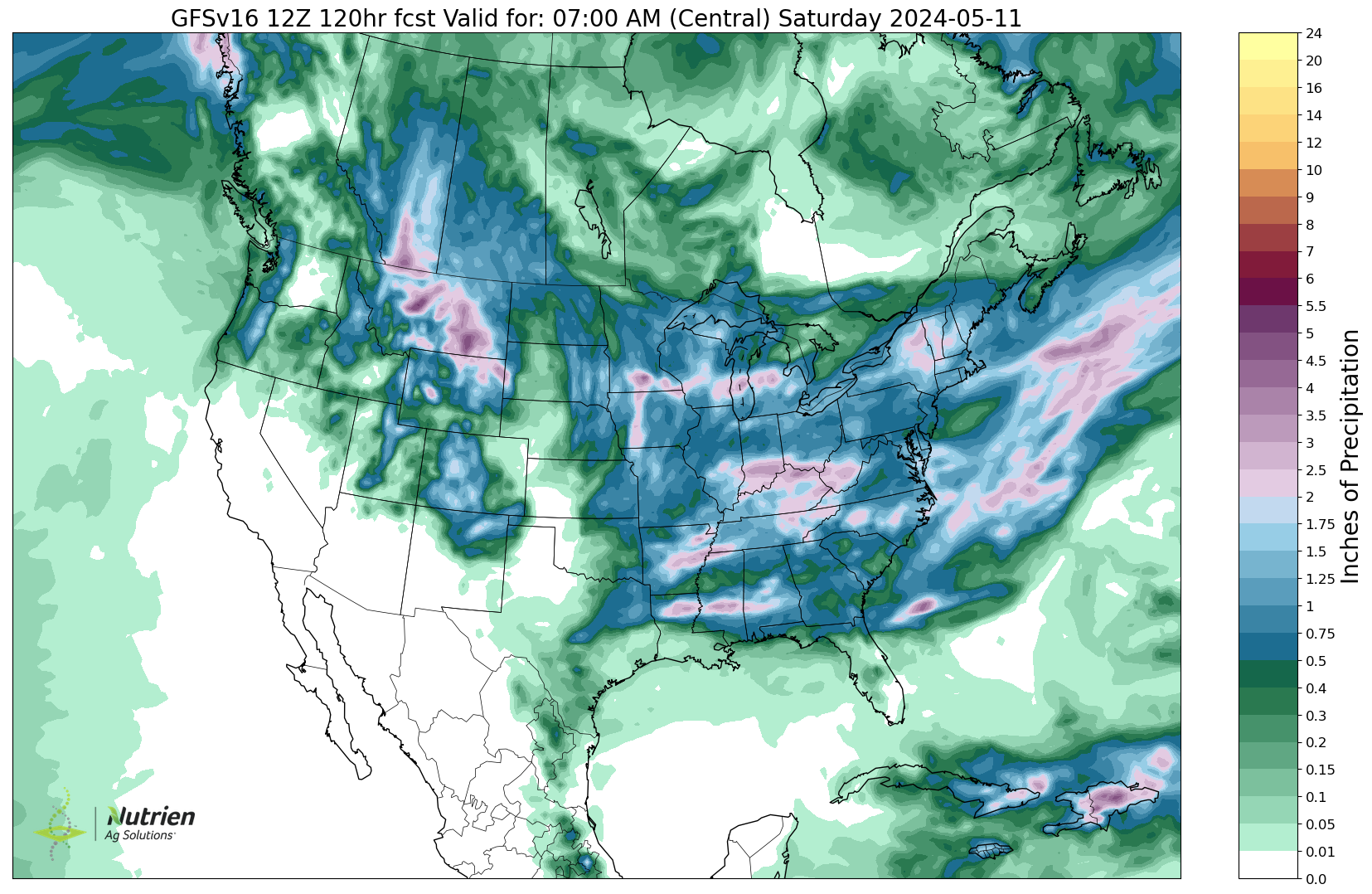

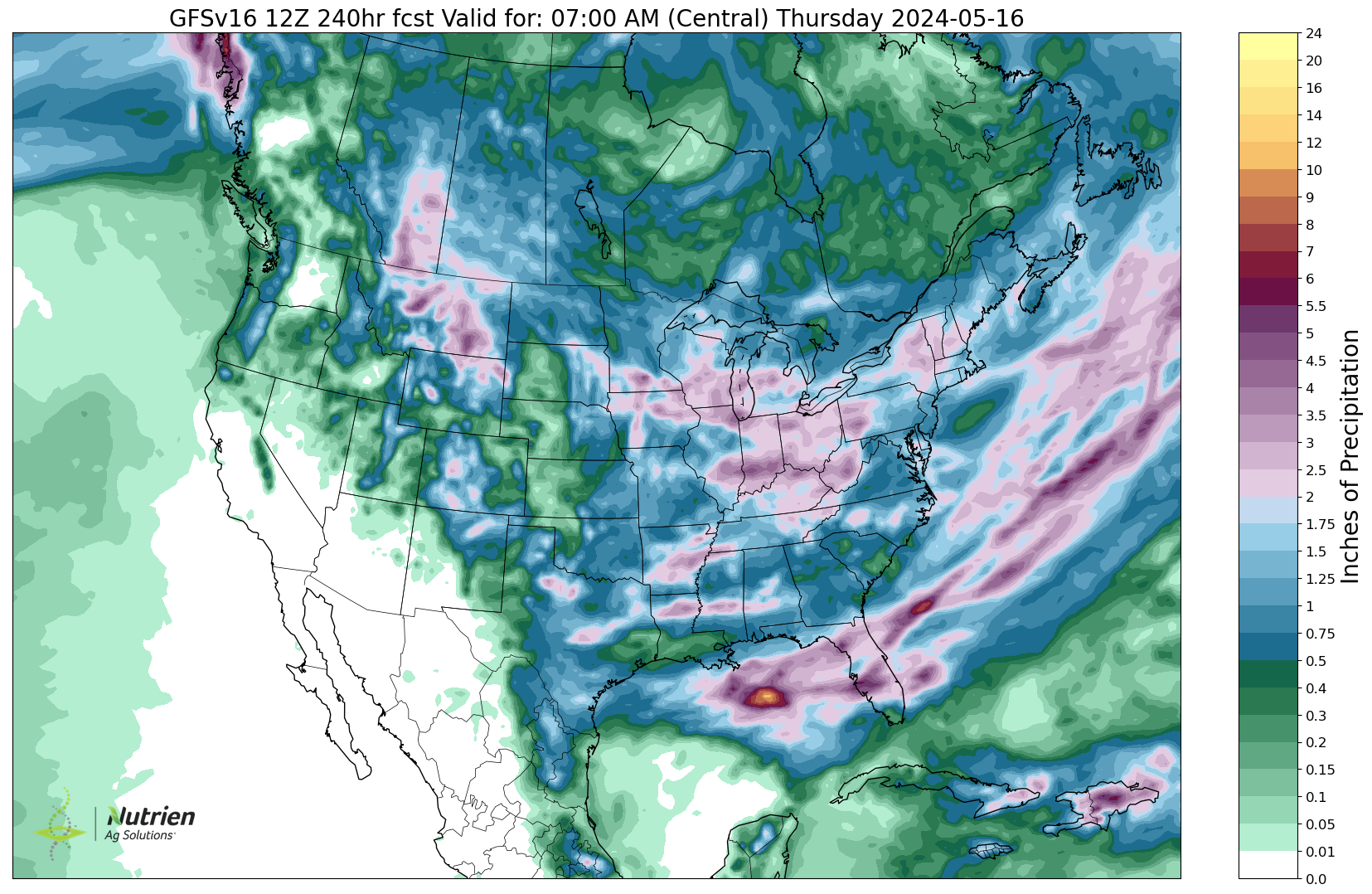

Planting is going to be slightly delayed and we are going to be getting rain in many areas the next 10 days. So field work will be slowed until around May 11th and the market is taking notice.

The funds are covering some of those shorts due to the "possibility" for this to continue. This is a "futures" market after all. It prices in what the future could look like.

Late planting can push these crops into a less favorable growing window. Especially given the fact that we are expected to get a La Nina to drive very hot and very dry conditions in the US this summer.

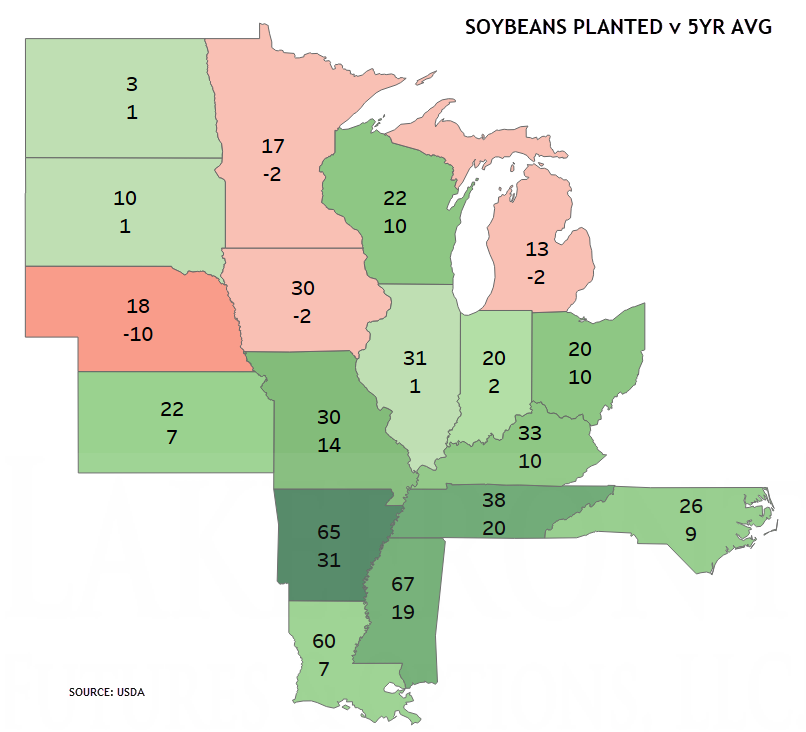

Overall, national planting isn’t that far behind. The concern is the eastern corn belt and the top producing states. The tops states of Iowa, Illinois, and Indiana are all seeing some struggle getting the crop in.

Chart Credit: Darin Fessler

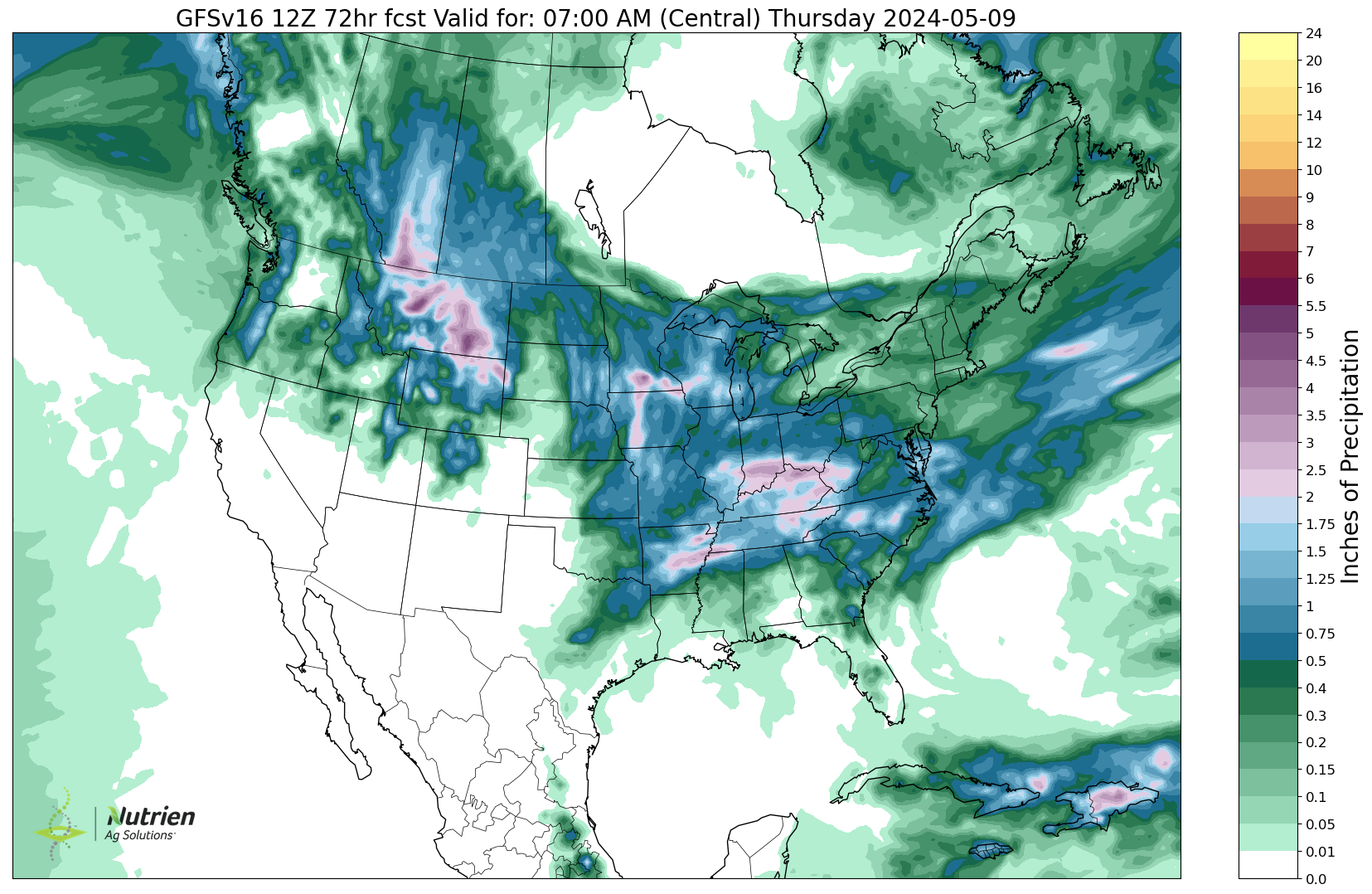

Here is the forecasts. Still pretty wet for the next week or two especially in those top growing state areas.

Next 3 Days

Next 5 Days

Next 10 Days

Last year we got spoiled with an ideal spring. When we go from that to this, it can cause issues. If this crop is still seeing delays 2-weeks from now, then we could continue to rally. If we find great planting window, then this market could pull back short term.

Not only does this push the crop to a less favorable window, but the bigger concern might be the compaction issues a wet spring brings.

Those issues don't go away, the only way to have an outstanding yield after this is if it rains all year long. If we go through a dry spell, there won’t be root structure and it's not going to yield as well.

Did I mention summer is supposed to bring potential record heat and dryness?

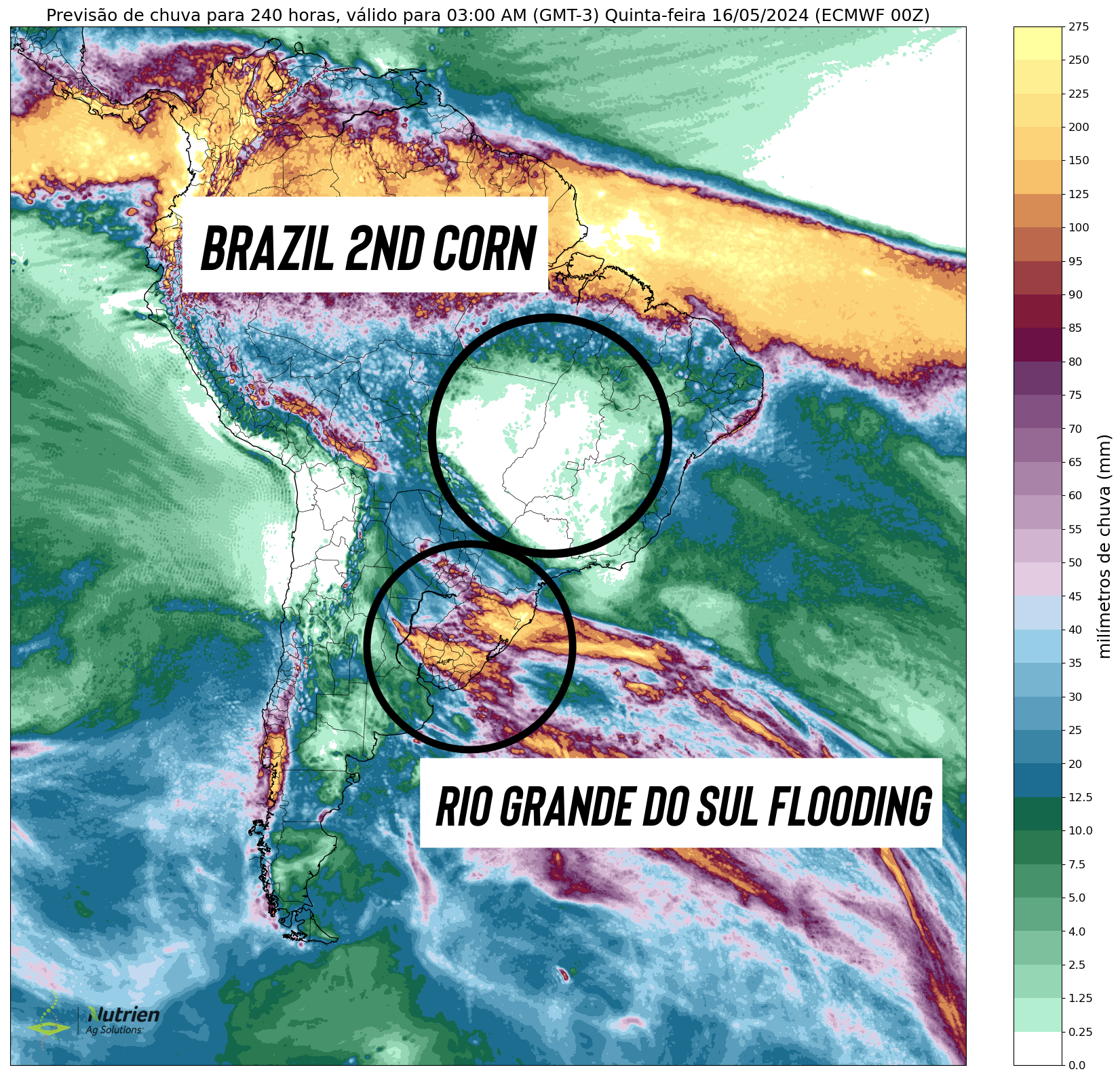

To go along with this potential delayed planting, something that we have been mentioning for months is the 2nd corn crop in Brazil.

The wet season for this crop is on the way out. In a normal year that would fine. As April is typically the prime growing season and May is where the crop matures and early harvest starts.

However, that isn't the case this year. I have been saying since last year that this entire crop is behind. The soybean planting was behind which pushed this crop behind. So the dry forecasts could be a real problem as the 2nd corn crop makes up 75% of total corn production.

Take a look at this map. Virtually no rain in the corn growing area. However, it is severely wet to the south, which brings us to soybeans..

Soybeans

Fund short covering is leading the way as now we have some problems in Brazil that are making the funds rethink their historical large short position. They are still short over -110k contracts.

The 2nd largest soybean producing state in Brazil is having it's worst flooding in over +80 years. About half of their soybeans are still in the fields as they try to finish up harvest……….

The rest of this is subscriber-only content. Subscribe to keep reading & get every update along with 1 on 1 market plans. Be prepared this growing season and don’t miss the opportunities.

IN REST OF TODAYS UPDATE

Why the grains are rallying

Is this the start or end of the rally?

Who should and shouldn’t reward the rally?

Technicals

Thoughts & future outlook

TRY 30 DAYS FREE

Try our daily updates & 1 on 1 market plans completely free.

READY TO COMMIT?

Take advantage of our planting sale and get our daily updates & 1 on 1 tailored market plans. Be prepared for this growing season and the upcoming opportunities.

Offer: $399 vs $1,250 a year

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24