GRAINS WAITING FOR WEATHER MARKET

Overview

Grains mixed as corn continues it's brutal chop while soybeans continue their 4-week sell off.

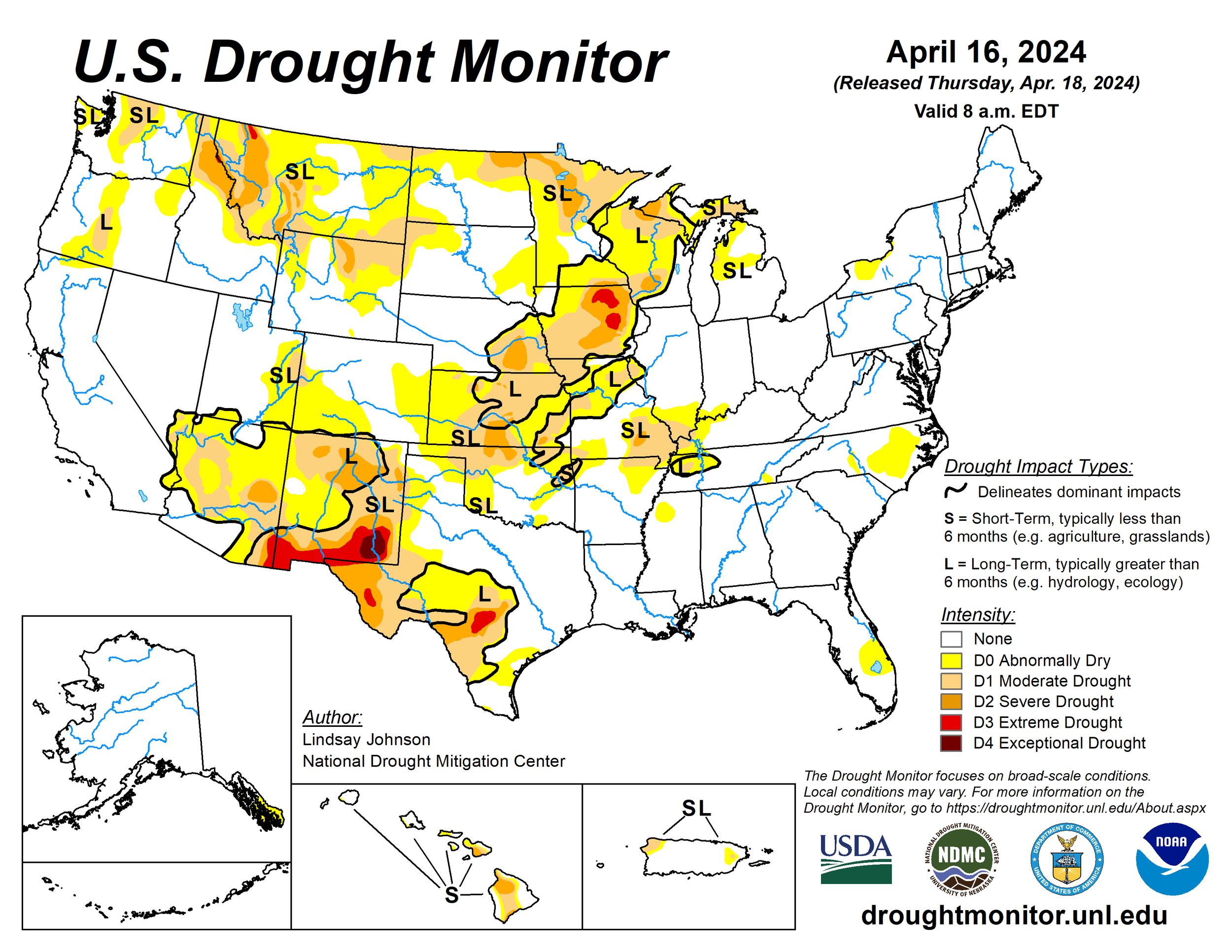

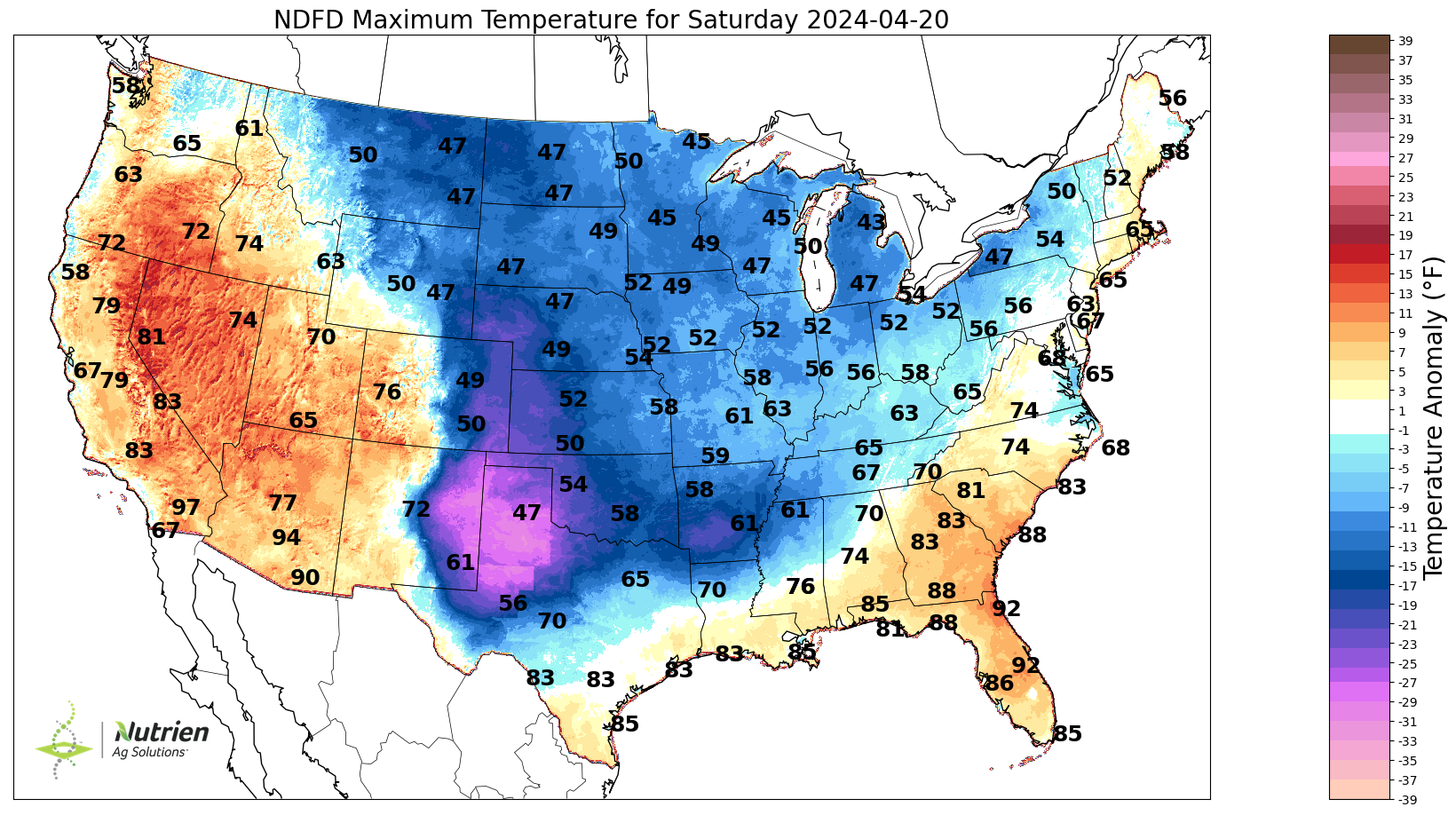

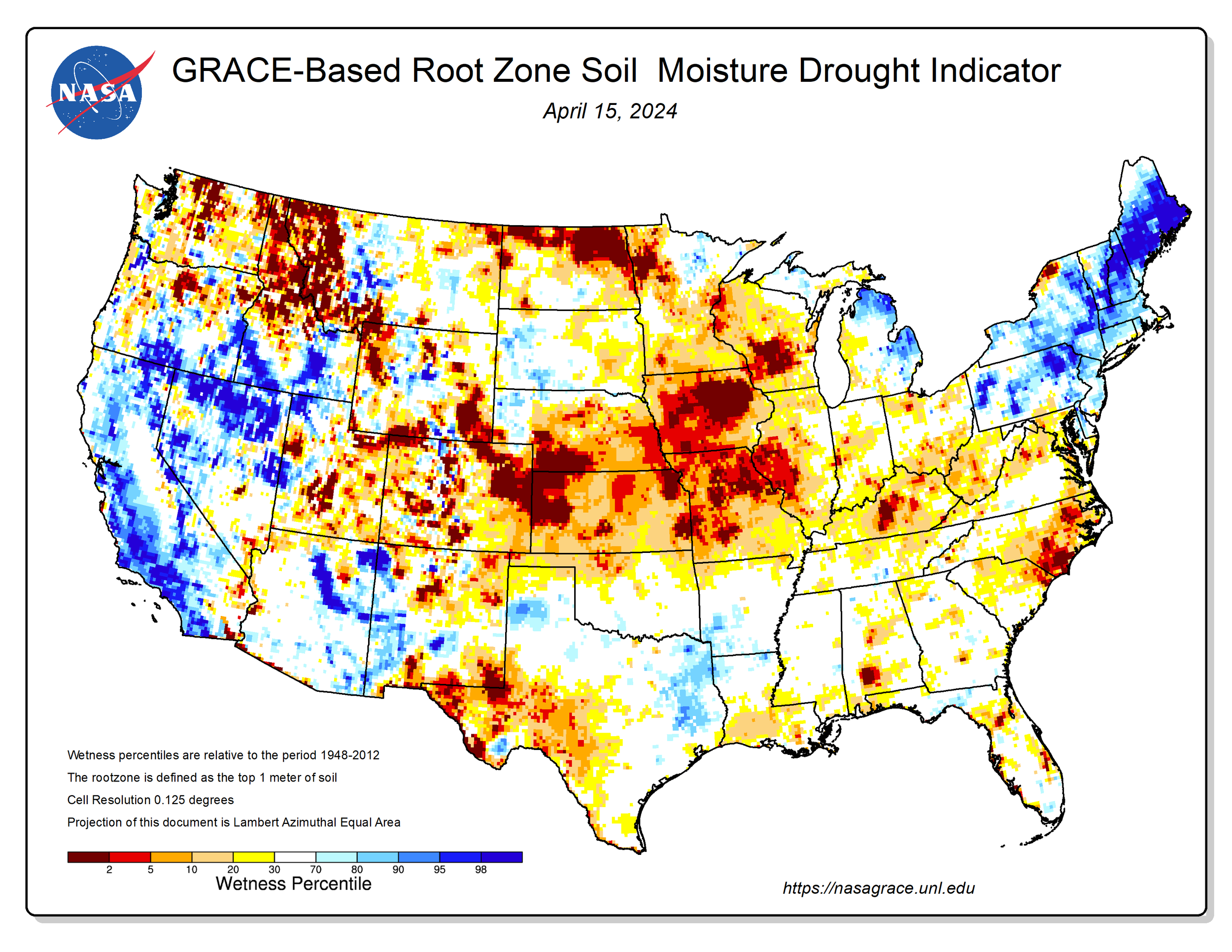

Corn and soybeans are seeing some pressure due to rains falling in the western corn belt where the soil moisture lacks. As virtually all of the drought sits west of the Mississippi river.

However, weather does not really matter right now. It will in a few weeks, but right now weather doesn’t have the ability to push us sizably higher nor lower.

The biggest thing in corn that could be adding pressure the next week or two is first notice day and all of these May basis contracts that are going to have to be priced. This often leads to more farmer selling.

An example of this would be in February, we made our lows the day after the March basis contracts expired.

Then soybeans.. Why do we continue to fall off the recent highs?

For starters planting is going good early. We came in at 3% planted which is not a huge number and it is still far too early, but that is decently fast compared to normal.

The biggest concern is soybeans is the recent rally in the US Dollar to Brazilian Real. This has been due to the recent rally in the US dollar. When the dollar goes up, it makes everything else we export that more expensive to foreign buyers. However, farmers in Brazil get paid more of their currency when the US dollar rises due to the exchange rate.

For example, if the US dollar goes up +5%, the Brazil farmer would get paid 5% more in their currency.

Why does this matter? Because this has created a lot more Brazil farmer selling.

As you can see by this chart of US Dollar vs Brazil's Real, yesterday this fell and soybeans bounced. Today it rallied and soybeans fell.

Why is the rally in the dollar happening?

The fear is that we might not see rate cuts this year, or as soon as most were originally expecting we were going to.

We also have the war in Iran and Israel. This spooked the stock market and helped rally the dollar.

War in the middle east does not rally the grains like the war in Russia and Ukraine as the middle east are not producers of grain like they are.

US Dollar vs Brazilian Real

Now taking a look at US weather and planting.

Right now this does not really matter. In 2 or 3 weeks it will, but not today.

We have gotten off to a decent start to planting, and most are expecting Monday's crop progress report to show pretty good pace as well.

Early and fast planting in most cases pressures the grain markets lower through out early to mid spring. This is something we have been mentioning the past few months.

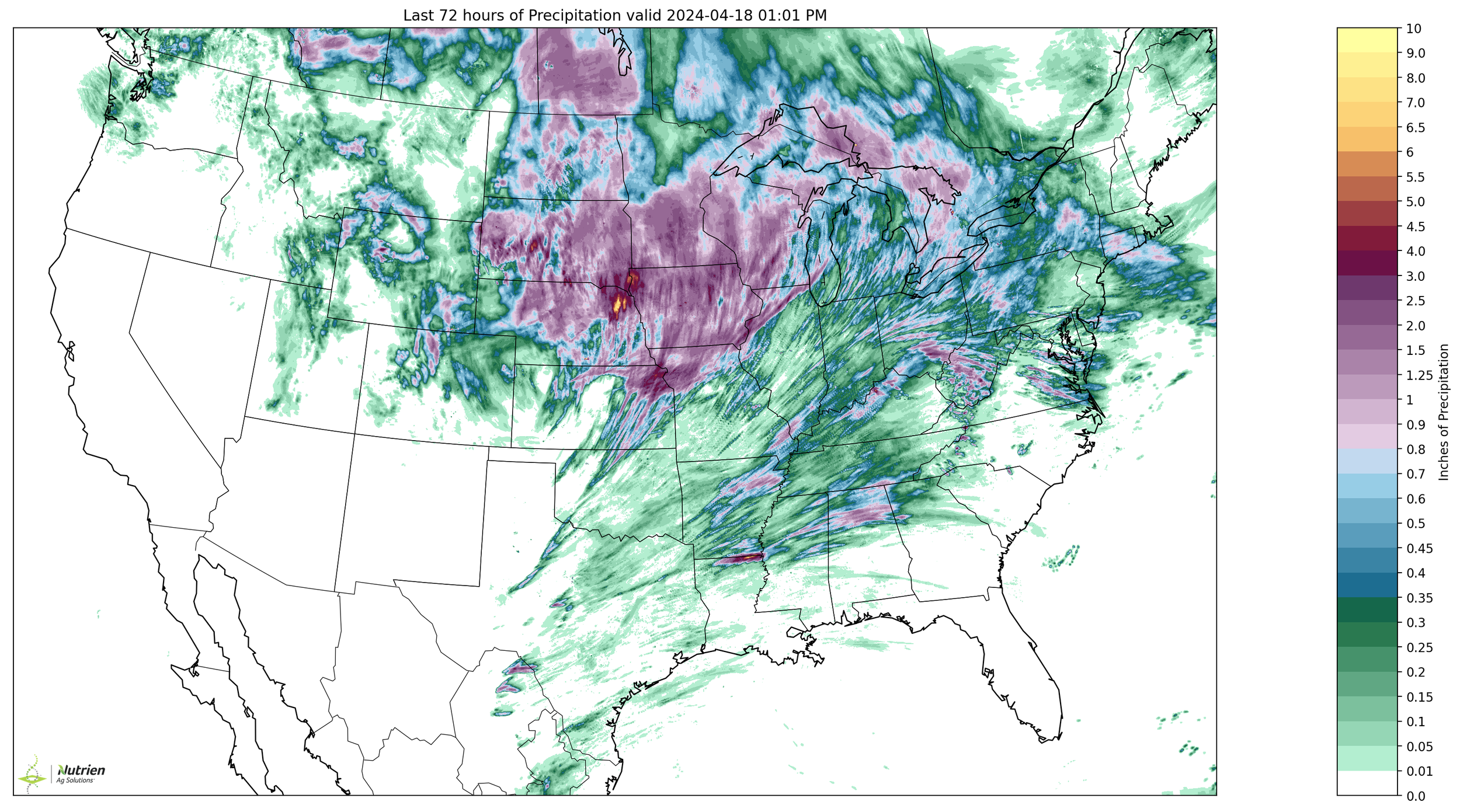

The western corn belt is getting some rain. These are the areas that needed a recharge the most. Despite the rains, a lot of areas that had problems still have problems. As we move forward this will start to gain more attention, but not today.

Orginally it looked like we were going to get extremely fast planting to the west, but with the rain it doesn't look like it will go as fast as it could have.

Past 3 Days Rain

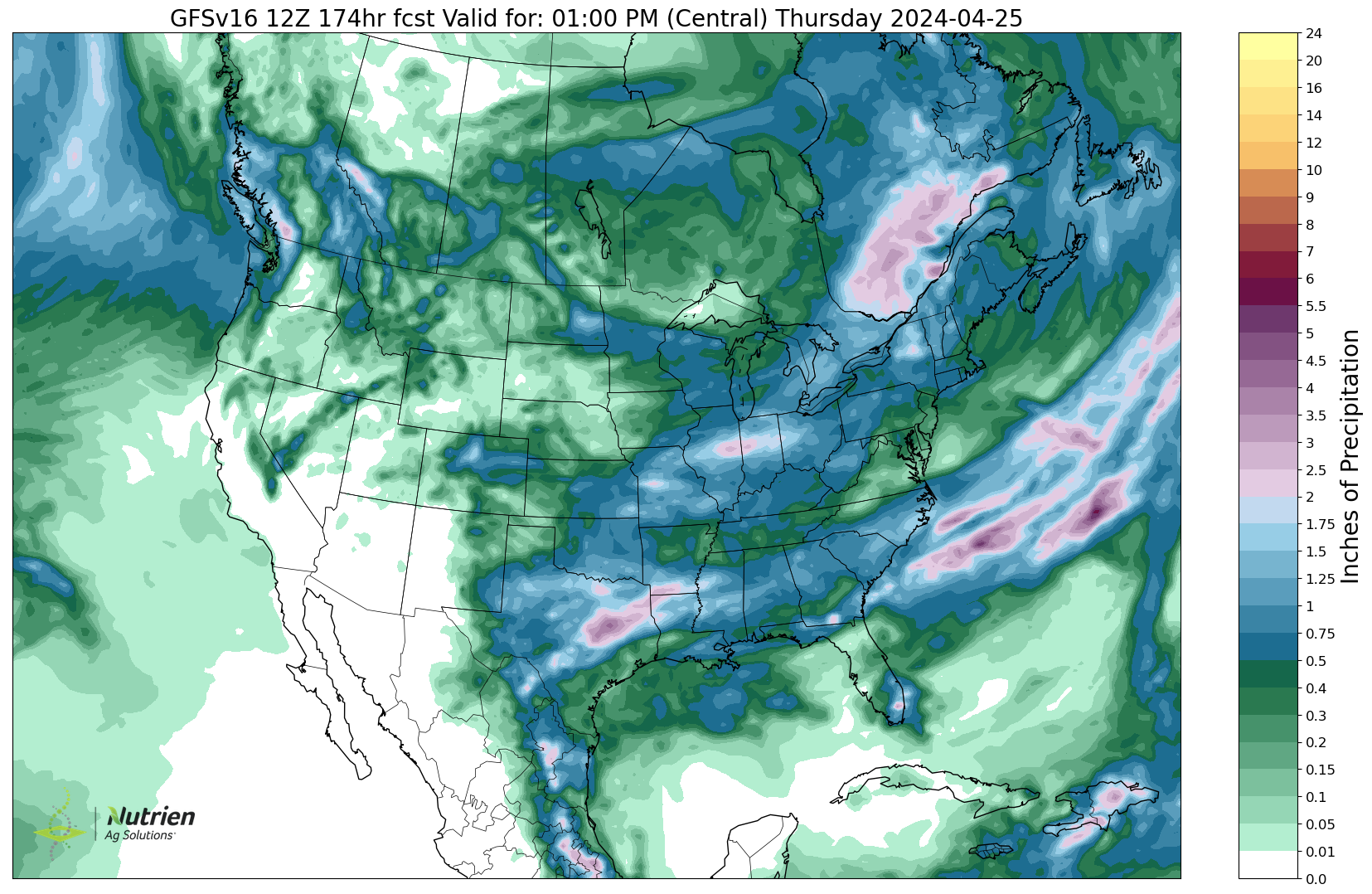

Next 7 Days Rain

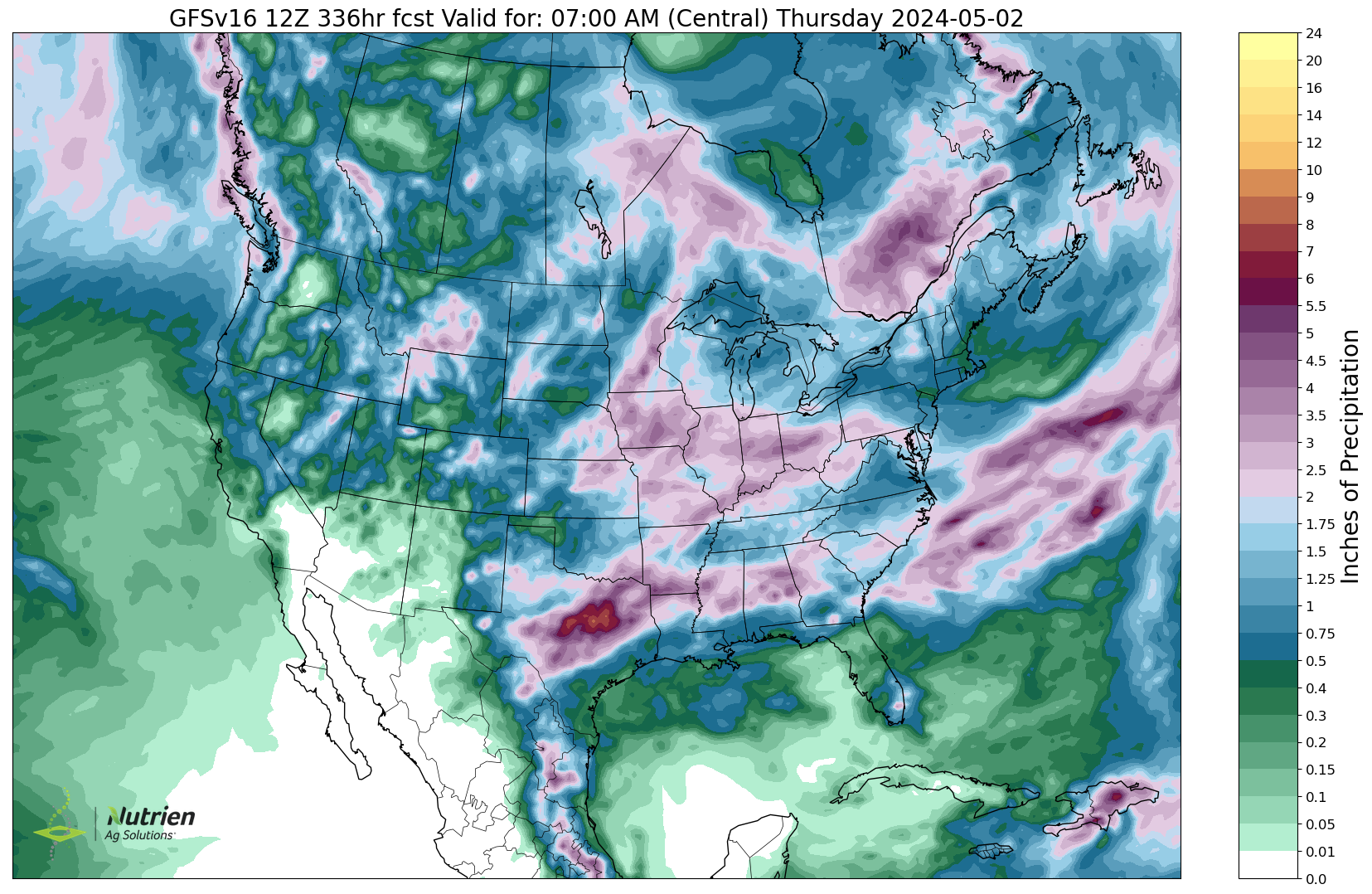

Next 14 Days Rain

Over the weekend it is suppose to be colder along with those rains, so we might not see a ton of time in the fields over the weekend.

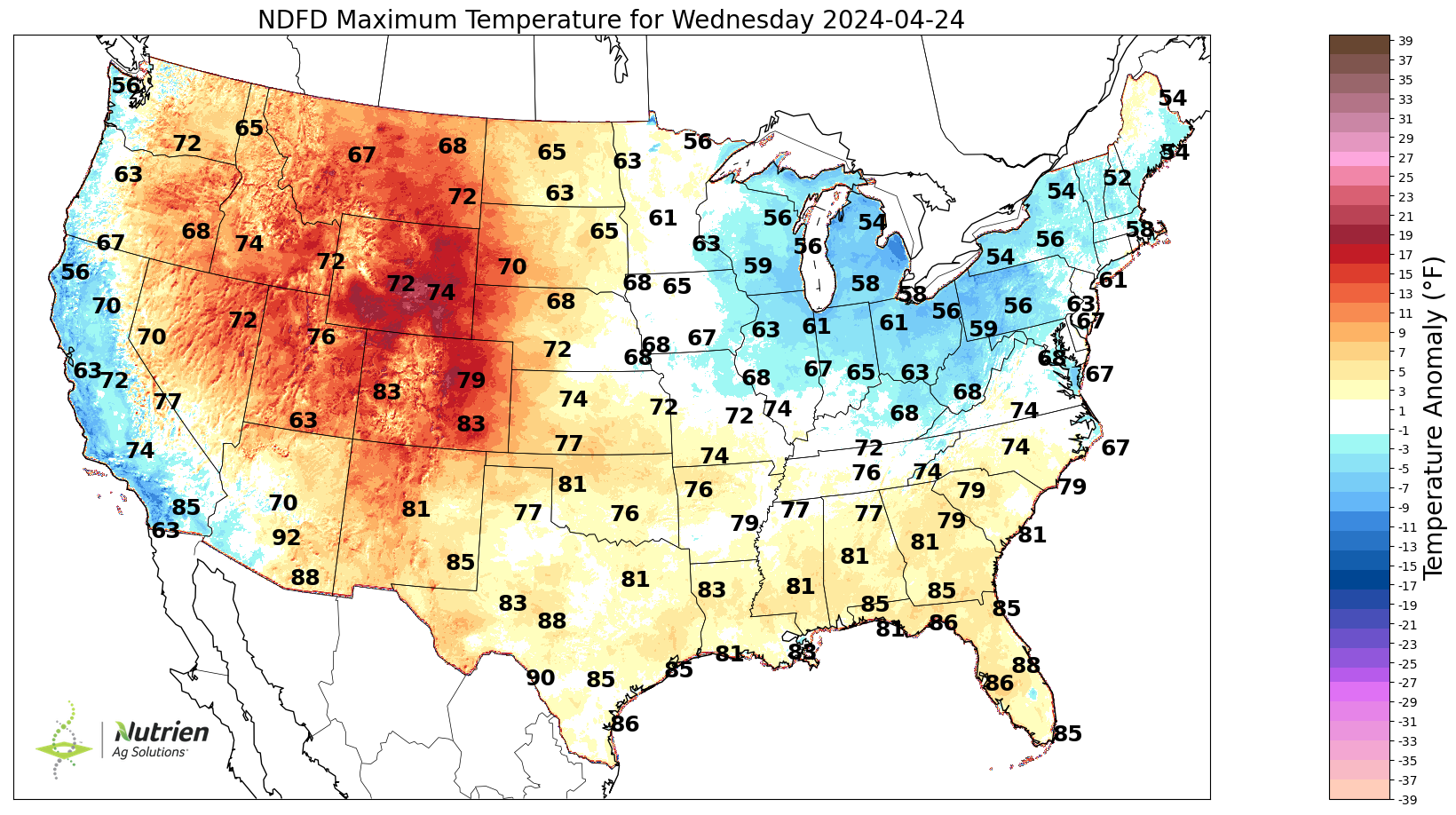

However, it is suppose to warm right back up next week. So I do not see any real threats or delayed planting. Most still expect planting to move fast the next few weeks.

Saturday Max Temp

Next Wednesday Max Temp

We are at least 3 weeks away from any real weather discussions.

Let's say it does just keep raining out of nowhere and planting gets delayed. When would the market care?

Take 2019 for example. This is an extreme example. But this was the worst delayed planting we have ever seen. The market did not bottom and realize this until May 13th.

So even if we do get delayed planting, the market is not going to care until the middle of May more than likley.

2019 Corn Chart

However 2019 isn't happening. Overall the outlook still does look like a pretty favorable planting.

So short term expect choppy sideways to even lower price action the next few weeks as there is nothing to get the markets excited.

With first notice day and the expiring basis contracts, to go along with the possibility for fast planting the next few weeks, this market could continue to struggle until the end of the month when we get those out of the way. Because until we get into a real weather market, the funds do not have any reason to cover.. but eventually they will. Just not today or tomorrow.

Let's dive into the rest of today's update....

Today's Main Takeaways

Corn

Corn continues slightly lower, still remaining in a very tight choppy trade range. As we have been stuck in a 20 cent range since February.

The commercial side of things is actually providing some support in corn. As we continue to see basis firm. A lot of that is because we are going into a busy planting season, which means there will be less farmer selling.

Rosario Grain Exhange said that further cuts to the Argentina corn harvest could be coming. They said that the northern corn growing states could lose 40-50% of their crop due to disease. They said the disease being spread by leaf hoppers have reached areas never seen before. This is a potential bullish wild card to watch out for if true.

The funds are short -260k contracts of corn. Right now there is no weather story or anything fundamental that will make the funds cover. So the path of least resistance is sideways to lower.

Weather will start to matter soon but not today. Weather will be the reason the funds cover. We always get some sort of scare that causes them to cover their shorts and push this market higher. Typically it is a drought scare. We get drought talk nearly every year and I expect this year to be the same.

Last year we raised a great crop, but even for that few week period where it looked like drought was a possibility was enough to rally this market.

Short term do not be surprised if we continue sideways or even lower. As I mentioned we have first notice day and May basis contracts expiring which typically brings farmer selling.

Long term we are waiting for that opportunity. Seasonally that usually comes around June. Right now the outlook for summer is very hot and very dry. So I do think we will see a weather scare when those July forecasts start being talked about. Remember, the corn crop is made in July.

Even with the recent rains, areas like Iowa who are the number #1 corn growing state still have obvious concerns heading into the growing season.

We have yet to take out that candle from the day of the March 28th USDA report, neither the highs nor the lows.

We sit right at the lows from that day. If we take that out, we could look to test those lows from February. Bulls need to hold $4.25 and get above $4.45.

Corn May-24

Soybeans

Soybeans post a new low close. Sitting just +5 cents off our February 29th lows now.

As I mentioned there is a few things pressuring the bean market.

I do not believe the recent rally in the dollar and Brazil farmer selling is going to continue to have this negative of effect of soybeans.

The dollar is rallying due to inflation concerns and middle east war concerns. Often times the dollar is viewed as a safe heaven when things get scary.

In my opinion the Feds will be forced to cut interest rates otherwise we will go into a recession. Nobody wants that. So even if it takes longer, I think inflation will cool this year.

Nobody knows how this Iran war will shake out, but just like Russia and Ukraine, you have to realize that eventually the market stops paying attention to war headlines. Most of the time they are just an initial shock factor.

Fast planting could very keep pressure on soybeans if they continue at this pace. However it is still too early to tell what kind of planting or growing season we are going to have.

There are plenty of reasons this market could go higher looking long term. We have the crush demand that isn't going away. A potentially smaller crop in Brazil. A pretty tight situation here in the US. The funds are incredibly short heading into an entire growing season filled with uncertainties.

If you look at the forecasts above, these forecasts look very friendly for soybean prices. It is called for very hot and very dry in the key growing time frame for soybeans.

So overall I am remaining patient for this market to provide an opportunity. Short term don’t be surprised if we make new lows and continue to struggle for another few weeks.

From a technical standpoint the bean chart does not look good at all. If we can’t hold the February lows we could get another leg lower. Need a bounce fast.

Soybeans May-24

Wheat

The wheat market sees a little bit of strength on potential freeze scares with the cold temps forecasted for this weekend.

I do not think this will have much of an impact, but it is a possibility.

We are still in a time period where there is a lack of news driving the wheat market.

Dryness in the plains and Kansas is a slight concern, but they are getting rain for now.

We had those old crop cancellations which were a negative,

The recent rally in the dollar isn't helping wheat prices either, as Russias cheap ample supply is still one of the biggest negatives in wheat.

No there is not a reason for wheat to go screaming higher today. But if those winter wheat acres continue to suffer from a lack of rain it could develop into a much bigger story.

Overall still remaining patient knowing wheat has a lot of potential but may take a while to develop.

May-24 Chicago

May-24 KC

Cattle

Cattle market actually looks like it might be starting to turn around.

This looks like it could be potentially forming a rounding bottom. I was skeptical that the bottom was in as I didn't want to catch a falling knife, but this chart is starting to show signs of renewed strength.

Give us a call if you want to go through any strategies. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24