USDA & CONAB TOMORROW

Overview

Grains mixed with soybeans taking it on the chin for the 3rd day in a row while KC wheat rallies ahead of tomorrow’s USDA report.

Soybeans are seeing some pressure from the continued weakness in meal as well as pre-report positioning for the report tomorrow, as the expectations are that we see a larger bean carryout tomorrow.

Corn followed wheat higher seeing some strength due to the expectations that we see the USDA cut it's corn carryout tomorrow.

The wheat market especially KC wheat is seeing strength due to the dry conditions and heat coming across the plains such as Texas, Colorado, Kansas, and Oklahoma. Winter wheat conditions were left at 56% G/E on Monday, but most seem to think we see these numbers take a hit next week.

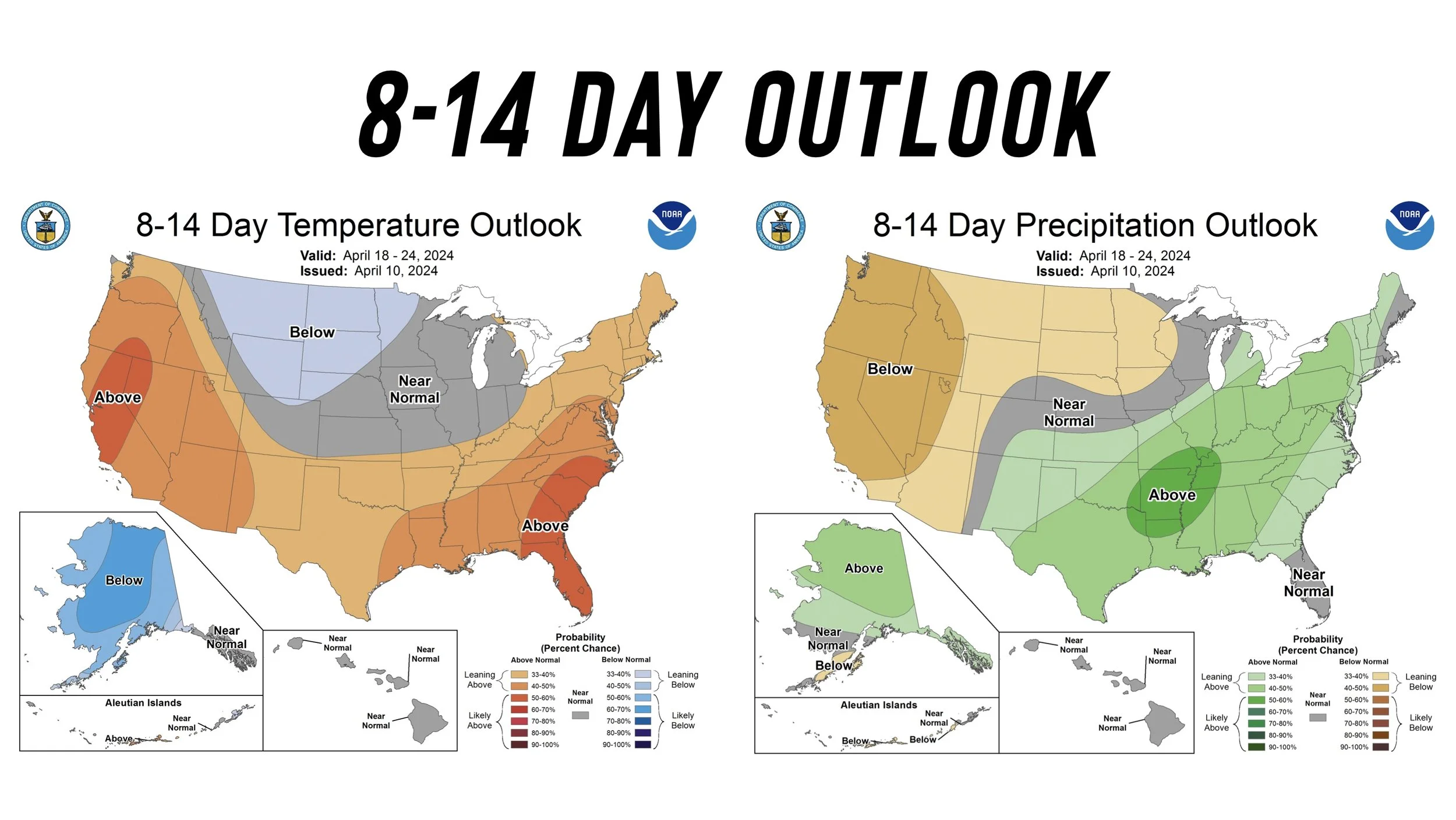

Overall weather in the US is neutral to bearish as the western corn belt should be getting a very good planting window here soon which will probably start to pick up more aggressively towards the 3rd week of April. The eastern corn belt however is supposed to get rain which could slow things down.

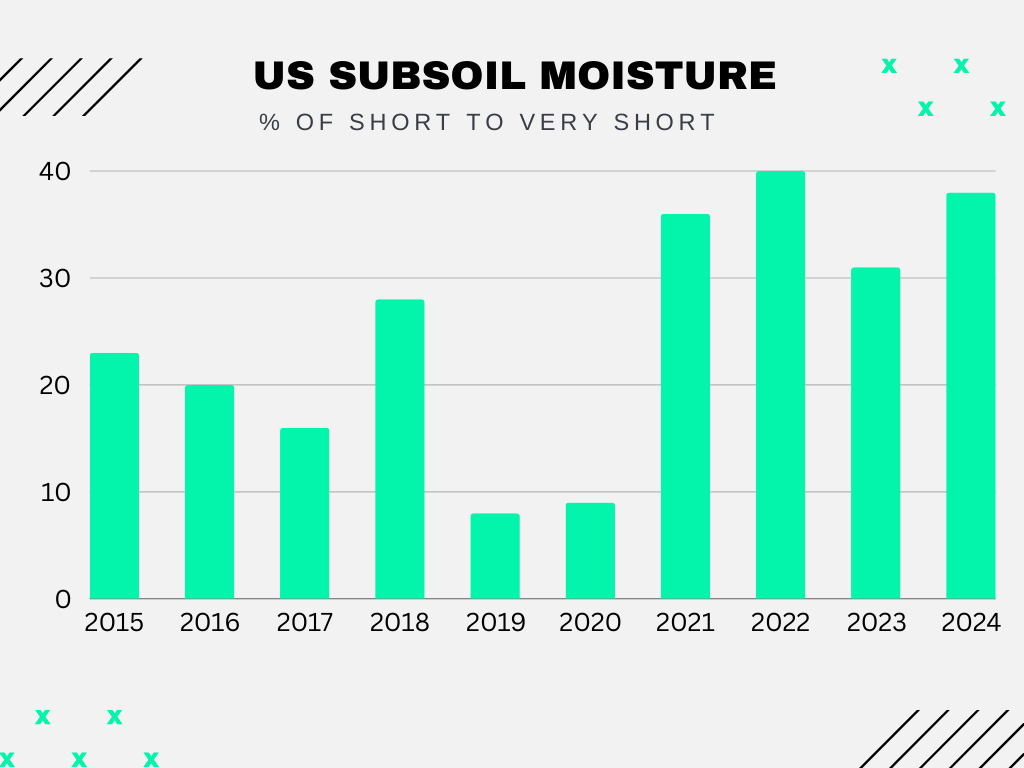

Going into growing season, the concern is still in the western corn belt as they still lack soil moisture. There are many states who haven’t fully recovered from the past 4 years lack of moisture.

The CPI data came in this morning. It came in at +0.3% higher, +0.1% higher than the estimates. This lowers the chance of us seeing rate cuts this summer. The feds said that they now think we will see rate cuts in July instead of June.

USDA Estimates

There are no major changes expected from this report. This report is typically not as big of a market mover as for example the one in May or June after we really get into planting and growing.

In this report they are expecting US corn carryout to be -60 million less than last month, with bean carryout to be slightly higher and wheat carryout to be higher as well.

For world carryout they are expecting both corn and bean carryout to be down from last month while wheat is expected to be slightly higher.

Now if we get a surprise, the Brazil numbers could be one that provides a surprise. All eyes are on the South America numbers.

There is some wide ranges for that crop. For their corn they are expecting 121.75 down from 124 last month with a range of 118 to 124.

They have beans at 151.68 down from last months 155 with a range of 148 to 155.

USDA reports are impossible to predict, but with bean basis improving +90 cents the past few weeks, it has me thinking that maybe we see this bean crop slightly smaller. But then again they are already expecting a pretty large -3 million cut.

Argentina has produced a great crop thus far, however I have heard some chatter that their corn crop could be suffering a little from too much disease and pest infection. For example Rosario grain exchange cut their corn crop estimate from 57 million to 50.5 million due to this. However I am not expecting that to show in this report.

CONAB comes out before the USDA tomorrow. Last month the CONAB had 112.7 for corn and 146.9 for beans. Both still far smaller than what the USDA estimates are expecting.

Overall this report could be friendly or negative, nobody knows. However if we do get a negative report I don't think this report has the potential be to "extremely" negative.

Strategies for Report

Here is a few strategies you could consider heading into the report. As always please give us a call if you want to discuss which strategy would best fit your operation. Marketing isn't one size fits all. (605)295-3100.

Bullish - Simple - New Crop

Buy new crop short dated July $4.90 call for 10 cents

Based off Dec 24 contract, expires 6/21

Bearish - Simple - New Crop

Buy new crop short dated June $4.60 put

Sell June short dated $5.00 call

Both expire 5/24/24

Net cost: 5.5 cents

Bullish - July

Sell 1 July $4.50 call

Buy 2 July $4.70 calls

Net cost: 3 cents

We highly recommend hedge accounts for everyone. They are an essential tool heading into growing season. They are one of the only tools that give you the ability to outperform the market. When do not have one, you have to solely rely on selling at the top. Which is a much harder task than getting comfortable by putting in floors and buying on opportunities.

Click here if you want to open one with us or simply give us a call or text at (605)295-3100.

*Disclaimer: Futures and options are risky and may not be suitable for everyone. This is not investment advice.

Today's Main Takeaways

Corn

As mentioned, most expect the USDA report to be "friendly" corn with a decrease in carryout.

Some think that the USDA Brazil corn number will be higher due to the recent rain in Brazil.

While others think that the CONAB numbers might surprise low.

Here is what Wright on the Market said:

"There is rumors that CONAB's corn numbers may be reduced much more than the market expects. Analysts say that the USDA on the other hand is showing "a more optimistic scenario than reality" as Brazil has a very significant reduction of corn acres."

Nobody knows how this report will shake out. If we get a surprise, I think it will be the Brazil numbers. But I am also aware that the USDA will likely slow play this.

I wouldn’t be surprised for CONAB to put out some decent numbers, but again their numbers are already far smaller than the USDA.

By late April to early May, it will start to be too late for weather to have a major impact on that second corn crop.

This report is not expected to be a ground breaking one. The more important ones will be later into planting and growing season.

Overall weather in the US is neutral to bearish as the western corn belt should be getting a very good planting window here soon. The eastern corn belt however is suppose to get rain which could slow things down.

The concern is still in the western corn belt as they still lack soil moisture. There are many states that have not fully recovered that moisture they have lacked the past 4 years.

Until we get some major moisture, drought is going to continue to be a concern in areas such as Iowa.

Just take a look at how short our subsoil moisture has gotten the past few years. If we get a hot and dry summer, this makes the possibility for drought all that more possible.

Bottom line, the forecasts suggest a hot and dry summer. Even though many I-states are indeed getting rain, there are plenty that are still in need of a lot of moisture.

Even if we do not get a full blown drought, all it takes is the thought of one to spark a rally and create a pricing opportunity. The market just has to think that a 170 yield is possible.

If planting goes well we will probably see acres a tad higher, maybe 91 million. But for example, if acres stay at 90 and yield comes in at 172 and if demand were to stay the same, it would bring our carryout down to 1.5 billion. A massive difference from where are today.

I am not saying that will happen, I am saying that if the market thinks there is a chance for it to happen it will create an opportunity.

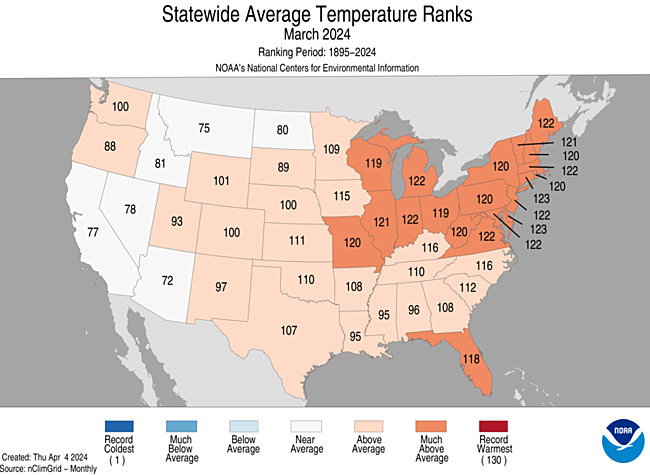

Even though we have got some recent rains, this March was amongst the warmest on record following a record warm winter. If this summer is hot, heat is what can kill a crop.

That is why we typically want to be making sales in May or June depending on a few factors.

Some of you may want to wait until after the report, but right around now is still a good time to utilize courage calls for many of you as options are cheap. We are not yet in a weather market. When we get into a weather market, the price of options will increase due to implied volatility.

Implied volatility increases the price of options because the price of an option acts as insurance. The higher the risk for something to happen, the more expensive the insurance. A weather market will create larger price swings in the market, thus increasing implied volatility because the options price in those expected big moves.

I see higher prices towards late spring and early summer, but expect some brutal chop short term and do not be surprised if short term prices struggle if we get going in the fields nice and early.

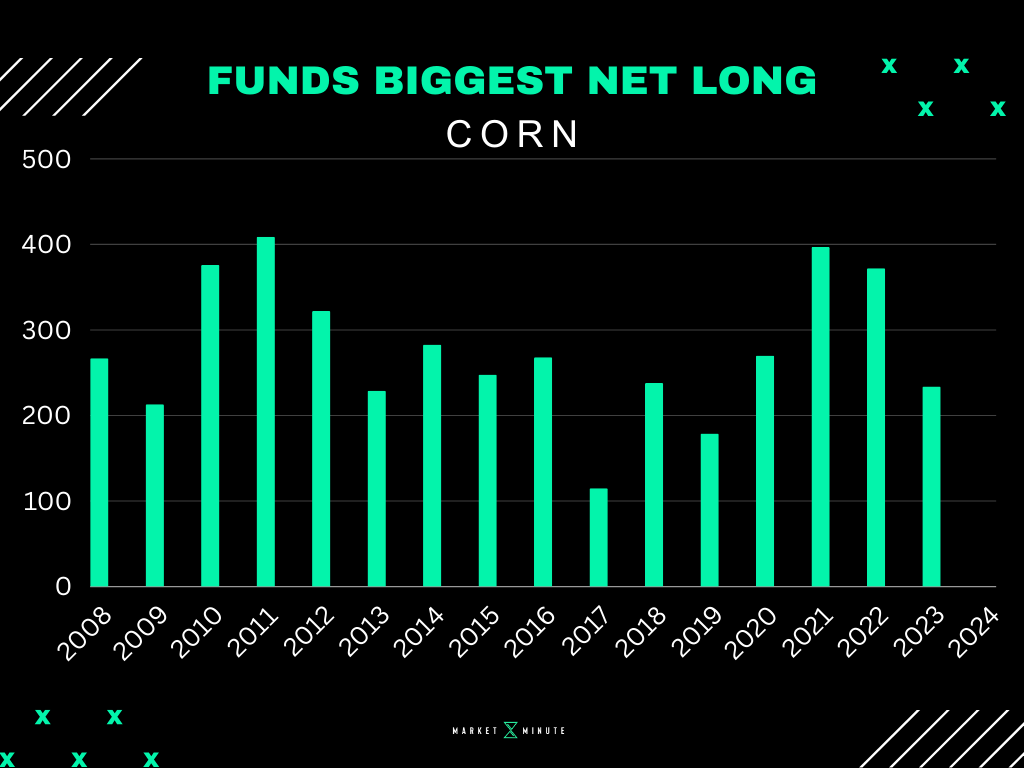

Lastly I wanted to show this chart. The funds have never not at one point got long during a year. Could it happen? Sure, but history is on our side. Once they cover, they are still short short a whopping -246k corn.

$4.24 is some pretty solid support. I need a break above $4.46 to open the door to higher prices.

Corn May-24

Soybeans

Soybeans lower for the 3rd day in a row, now -47 cents off our highest close back in late March.

As I mentioned some of the pressure is simply pre-report positioning. The trade is expecting higher bean carry out numbers. So the trade is just preparing for that possibility.

The other thing is meal. Argentina is the worlds largest meal exporter and they are going to start pushing their meal into the market in around a month. This could put a damper on meal demand. Last year we saw a lot more meal demand because they ran out of meal.

Brazil is going to be by far the biggest thing to watch in this report.

The estimates are over -3 million smaller than last month (151.7 vs 155 last month).

Brazil basis has firmed +90 cents the past few weeks. Why would this happen if they have supposedly this large crop?

I am not saying it will happen, but I could definitely see CONAB and or the USDA giving friendly numbers on the Brazil beans. If the USDA comes in at 150 or lower it would be a very friendly surprise.

Looking past the report, I still see upside in this market. We have a fairly tight situation here in the US. Crush demand isn't going away. We have an entire growing season ahead filled with uncertainties.

The summer outlook is hot and dry, but the farther you get towards August and September the drier they look. Beans are made in August.

Bottom line I am remaining patient. Give us a call if you want to discuss your specific marketing or put together a game plan for tomorrow’s report. (605)295-3100.

Soybeans May-24

Wheat

Wheat strong today, mainly in KC wheat as Chicago and MPLS barely close higher while KC rallied +13 cents.

As I mentioned, KC wheat rallied due to the hot and dry conditions in the plains. Many think this crop could take a toll.

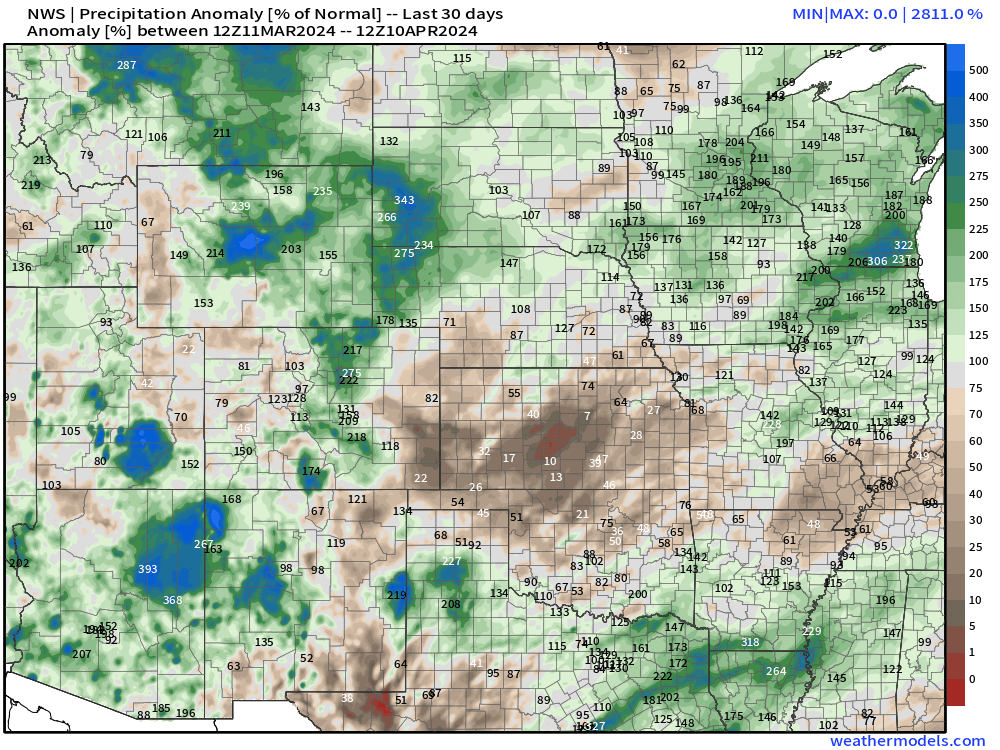

Here is the last 30 days compared to normal. Most areas got good moisture, but Kansas completely missed out.

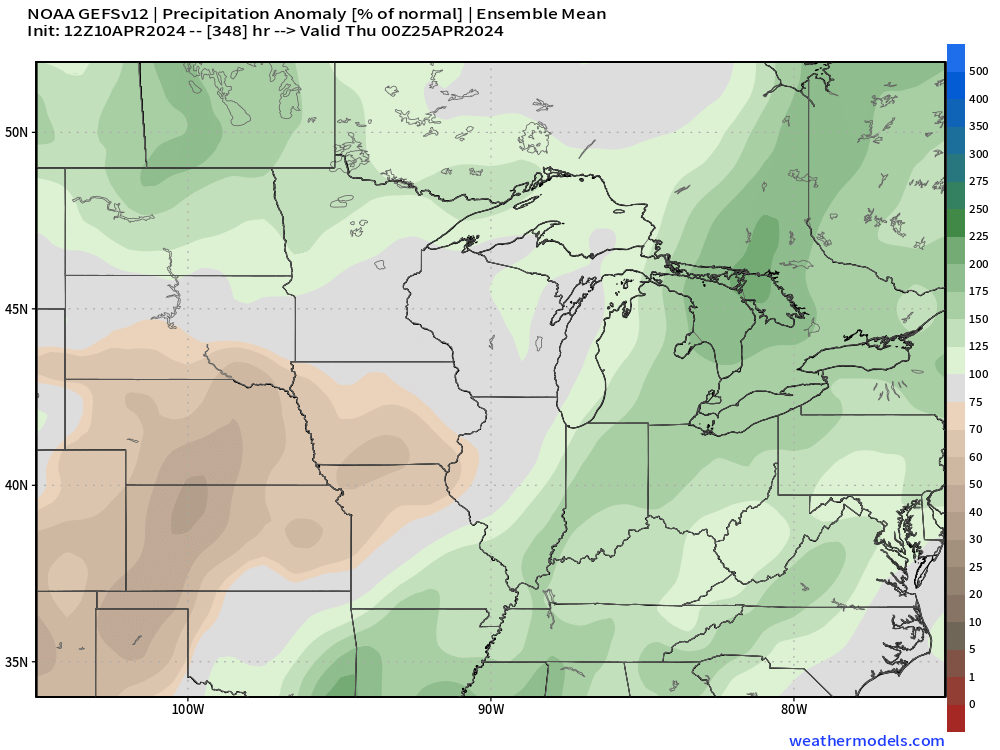

Here is the next 14 days.

Russia has also had a much warmer winter and spring than normal. So there is many saying that their wheat crop could be getting smaller which would certainly help the markets. Because Russias ample supply is one of the biggest bearish factors this market faces.

Then we also have a war still going on, as we got more headlines of missle strikes. Even with the headlines, Ukraine grain exports continue to flow through the Black Sea. War always has the chance to be a wild card, but I'm not holding my breathe waiting for a war headline to spark a rally.

The weather is driving KC and the rest of the wheat market, but the technical situation is starting to turn around and look more friendly.

July KC wheat closed above the 50-day moving average for the first time since July 31st.. that is a very long time.

A close above $6.00 on KC could really open that chart up.

Chicago has formed an uptrend and is looking to break out of that downward trendline from December.

Overall the wheat market is starting to look a lot better. Remaining patient.

May-24 Chicago

May-24 KC

Sunflowers, Millet, & Milo

Our partners at Banghart Properties professional grain marketing have new crop act of god contracts available.

Sunflowers, millet, and milo.

On farm pickup.

Call Wade (605)870-0091 or Jeremey (605)295-3100 for more details.

Cattle

Cattle market was lower on a number of things.

Exports on beef leaving the country are low while imports entering the country have been high.

We have went 14 straight months of importing more beef than we are exporting.

Along with the CPI data and the recent rally in the dollar, it isn’t helping us get any more export business.

There is still concerns surrounding the cattle market. One would be that we are feeding cattle to record weights. We are 30lb above last year. That extra weight is equivalent to 3% more beef on a weekly basis. So even if we butcher 5% less, production is only down 2%.

Personally I still think this market could suffer more pain.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24

ARE YOU READY FOR USDA CRAP SHOW?

3/26/24