PLANTING PROGRESS & BRUTAL CHOP

Overview

Grains lower across the board as soybeans lead the way lower giving back all of Fridays gains despite seeing a record NOPA crush number today.

The choppy sideways trade continues. It looks like the grains are going to be unable to sustain a trend higher or lower short term. It appears that rallies will find sellers and sell offs will find buyers. For example, we rallied Friday only to sell off today.

The big news over the weekend was the war going on in the middle east. As Iran attacked Israel but was unsuccessful, as over 99% of the missiles were shot down by Israel and US defenses. Israel responded this afternoon saying that they will forcefully retaliate.

What does this mean for the grains?

Unlike the war between Ukraine and Russia, a war in the middle east is not directly supportive for grains. It could be supportive for crude oil, and if crude oil goes sky rocketing higher perhaps some of that strength leaks over into the grains. But no, overall this is not directly friendly for the grains.

US weather is going be the biggest market factor going forward heading into planting and growing season.

We got a lot of planting done over the weekend. Corn planting is a tad slower than was expected but still faster than usual.

Soybeans on the other hand are off to a very fast start. It is only 3% but this is a pretty fast starting pace for beans.

Here was the crop progress report released today:

Corn

6% planted

7% estimates

3% last week

7% last year

5% avg

Beans

3% planted

2% estimates

3% last year

1% avg

Spring Wheat

7% planted

7% estimates

3% last week

2% last year

6% avg

Winter Wheat

55% good to excellent

55% estimates

56% last week

27% last year

So the warm weekend got many states off to a quick start but we are expected to see some rains the next week which could slow things down slightly for a few days. However, after these rains it does look to dry out so that should offer a decent planting window. So there doesn’t look to be any real problems with getting the crop in the ground.

Many are expecting planting progress to soar the next 2 weeks.

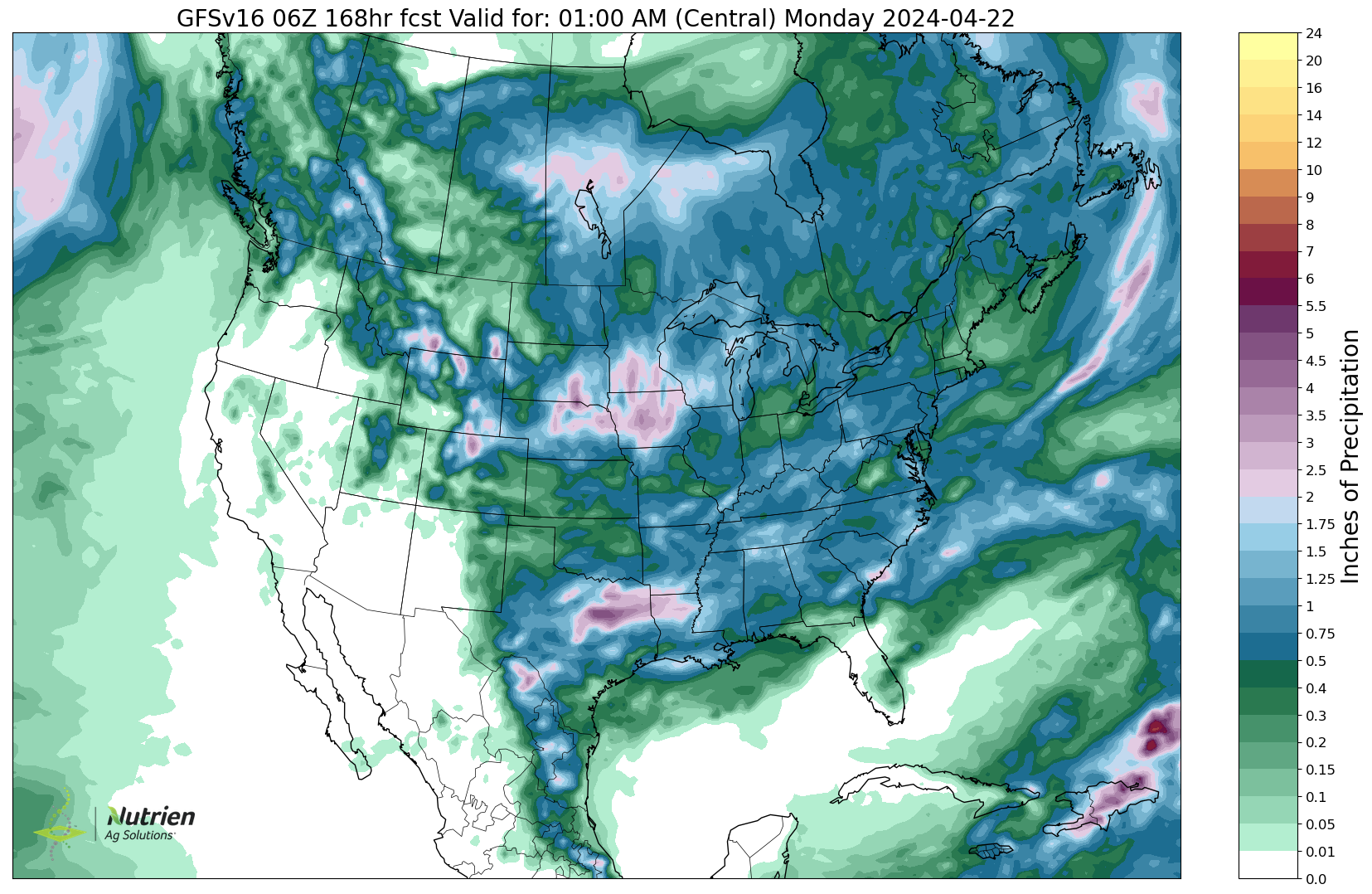

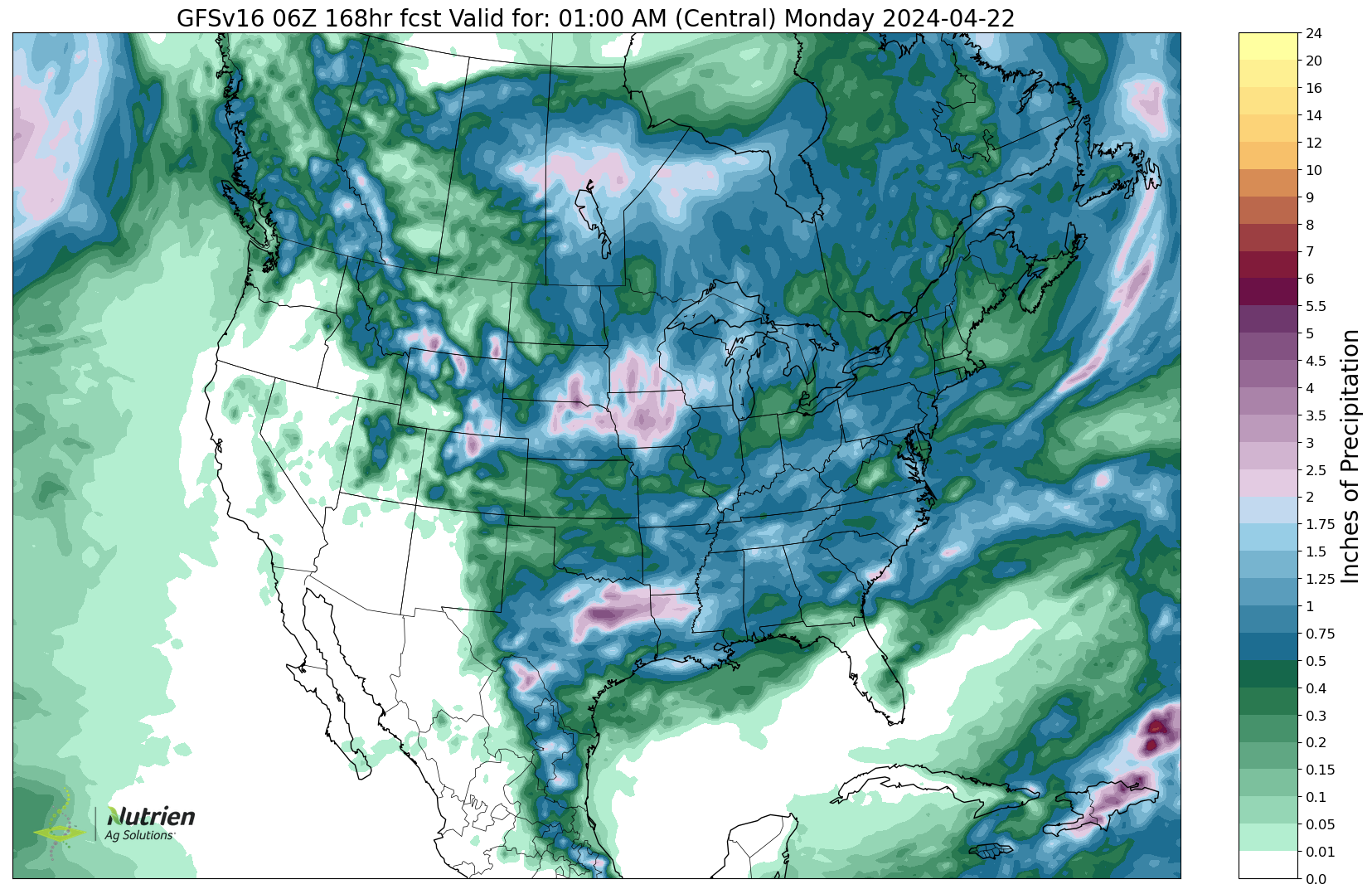

Here are the forecasts.

7-Day Rain

14-Day Rain

Overall weather is mixed for the time being. First the western corn belt was dry, now they are expected to get some raini n states such as Iowa. While the eastern corn belt just got a lot of rain, but are now expected to dry out. Nothing too noteworthy yet. I expect planting to go along fairly smoothly and fast still.

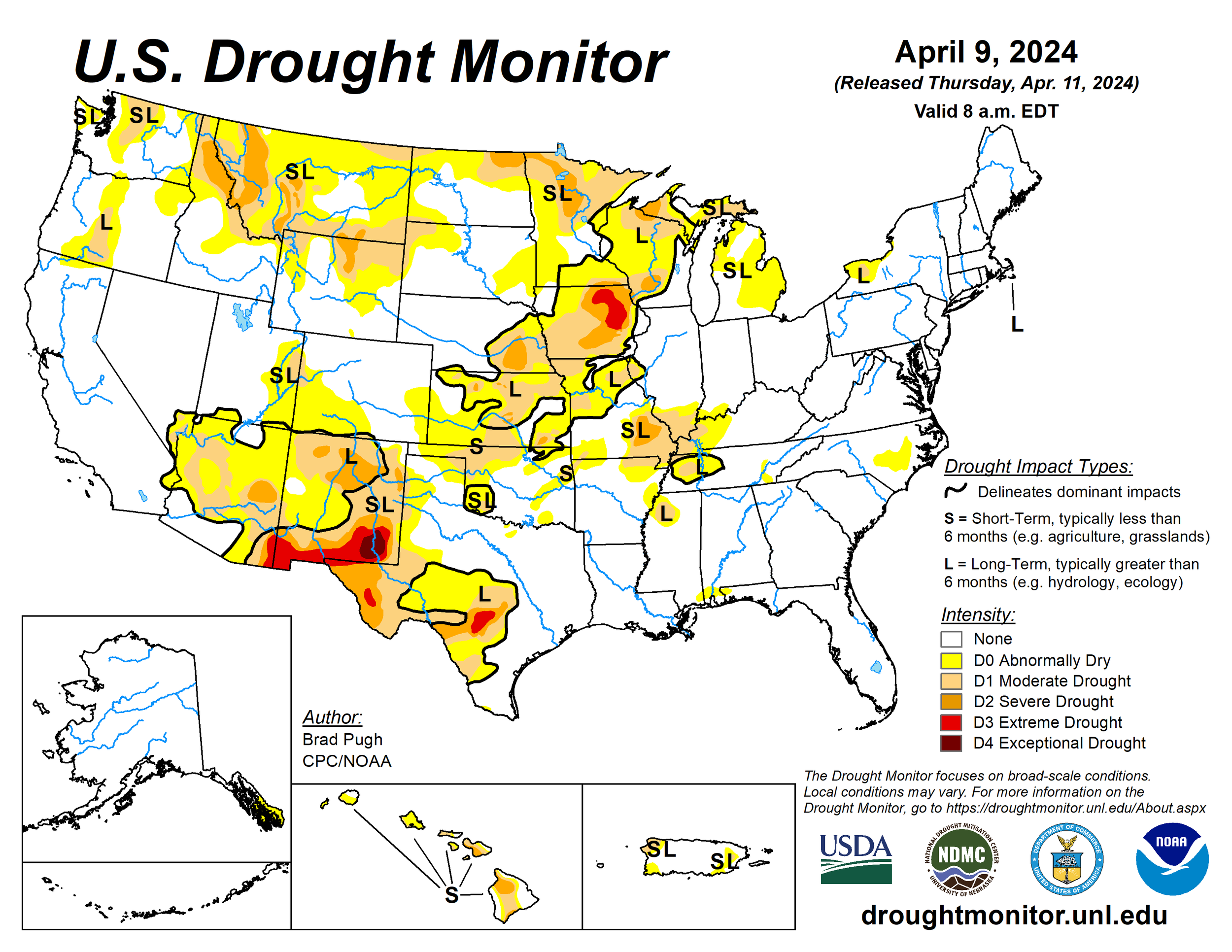

The western corn belt is still dry, Iowa for example is extremely dry. While drought is virtually nonexistent east of the Mississippi river with the recent rains.

If planting progress starts to move fast, the market would take it as a negative sign at least short term.

I do not see planting getting slowed too far, but if it were to happen it would be a friendly factor for prices short term but negative long term.

Looking short term, this market could still face some pressure. The funds are still incredibly short. They are short -250k corn, -140k beans, and -85k wheat. Short term they are not in a real rush to cover these until we get past the end of the month.

There is no compelling reason yet as long as planting is smooth. We will be having all of these May basis contracts expiring at the end of the month as well, which could lead to some additional farmer selling. Similar to what we saw to end February with the March contracts.

Let's dive into the rest of today's update....

Today's Main Takeaways

Corn

Corn continues its brutal sideways chop. Since April 4th, we have not had back to back green days or red days. Meaning since then we have been higher one day, lower the next, and vice versa.

Also to show you just how brutal this chop has been, corn has not closed above the highs nor below the lows from the day of USDA report back on March 28th.

A break past those highs could bring more technical buying, a break below could cause technical selling. Until then expect sideways action like we have seen all April.

BASIS CONTRACTS:

In regards to basis contracts for those of you that have a basis contracts against the futures and you have it delivered. You are essentially long in someone else's hedge account.

So it is a recommendation to use your own hedge account vs someday else's because you get more cash low and you become much more proactive vs being complacent when you have a basis contract that you simply roll, and roll, and roll.

For some of you, it might make more sense to simply buy a call and cash out of a basis contract or cash out of grain on delayed price vs paying interest and/or storage charges.

It is going to be tough for basis to rally, until farmers have sold enough grain on delayed price that makes the buyers have to pay up right now.

The buyers have those with grain on delayed price held hostage.

They have no reason to pay up because they already have the grain.

We have had a lot of guys asking us lately about 2025 grain sales, we don't like doing that unless you could make sure that you are locking in profit.

So if I am going to make 2025 grain sales, you better be sure that you have at least a portion of your inputs locked in.

Otherwise, I am just speculating and I might take it in the shorts should we get an unforeseen rally.

Please give us a text or call if you have questions or want to go through your situation. (605)295-3100.

***

Overall corn remains in no mans land. The market is simply waiting to get a better grasp on what this weather market will look like.

If planting gets going fast, we could see prices struggle to maintain a rally.

Short term prices could very well continue to chop around. Go and test the recent highs, then go and test the recent lows.

Currently the funds are short -250k contracts of corn. The funds have never not once got long during a year. The smallest amount they have ever been long during a year was in 2017 where they only got long 107k contracts. So far the funds have only covered somewhere around 30k contracts of corn and prices have rallied 20 cents from the bottom.

We almost always get some sort of weather scare or premium added to this market. I do not expect this year to be any different. When we get that scare and with the funds being as short as they are, it does give us the potential to see a pretty fast bounce.

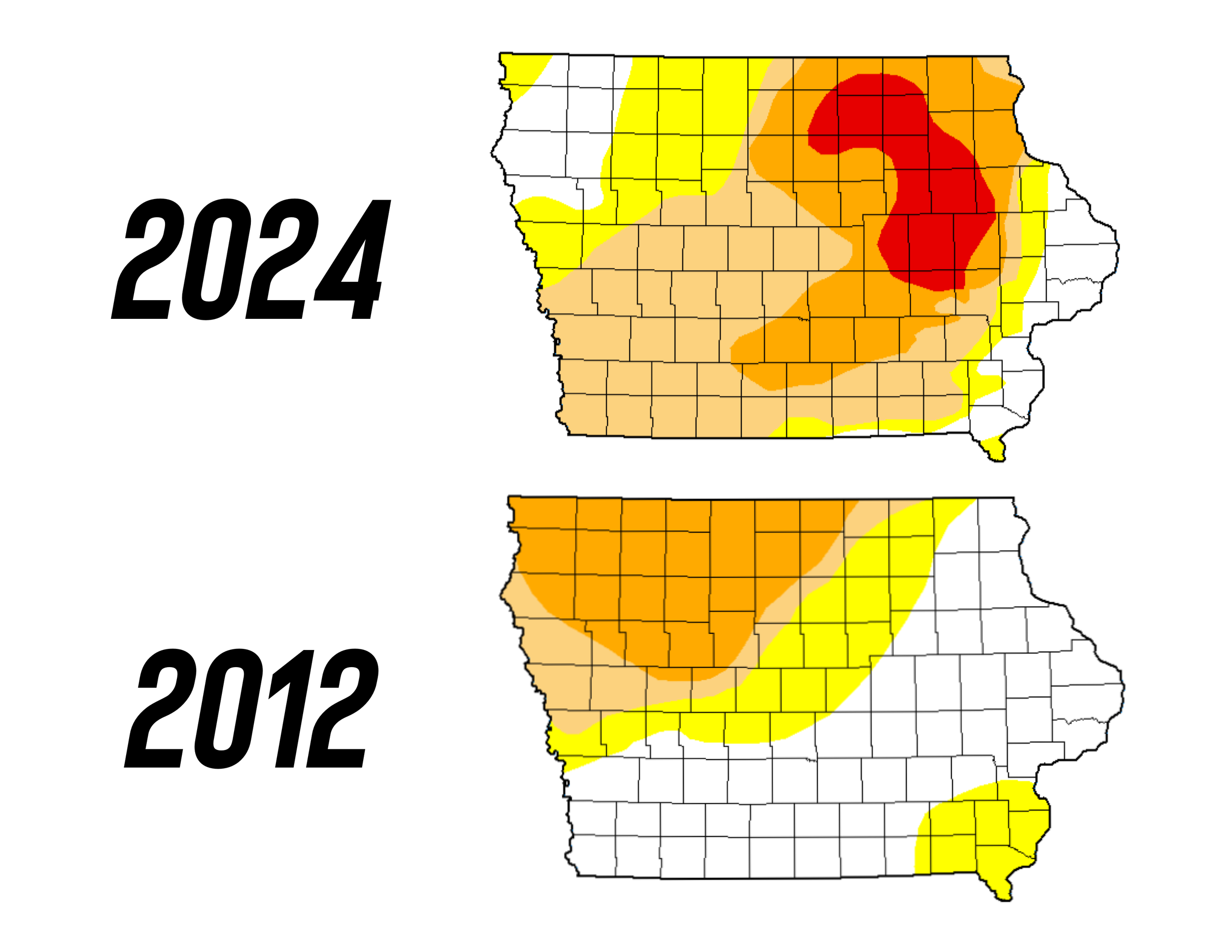

We have been getting rain, but just take a look at Iowa for example. They are the #1 grower of corn and #2 grower of soybeans.

There is some obvious concerns here heading into summer.

32.14% of Iowa is in a class 2 to 4 drought. In 2012 this was only 21.72%.

They are currently 64% short to very short moisture compared to 42% last year.

Something to note is that Iowa is expected to get rain the next few weeks which will be much needed, but the longer forecasts show and dry in late summer. The point is that many states such as Iowa haven’t fully recovered from the last 4 years of dryness, which makes drought issues all that more possible.

A weather scare will come. Nobody knows just how big it will be or if we go lower before hand, but we will get one. We always do.

We want to be making sales in late spring to early summer, when you the producer and the market is unsure what we are going to raise. Right when you start hearing the talk about a 2012 repeat and all of these drought headlines. Right when the market thinks that a drought is possible.

Short term, expect some brutal choppy sideways trade. Don’t be surprised if we even go lower until the end of the month with potential producer selling and basis contracts expiring.

If we can get above $4.45 it would make this chart look a lot better and could bring more upside. On the other hand we need to hold $4.25.

Corn May-24

Soybeans

Soybeans give back the entire rally from Friday.

While we got a record NOPA crush number, soybean export inspections came in weak which added pressure. Coming in at 433k MT down from 492k last week.

As for NOPA, it was an all-time record high for any month.

196.5 vs 185.1 last year, however despite the record it was smaller than the trade estimates were expecting, as they expected 197.79 million.

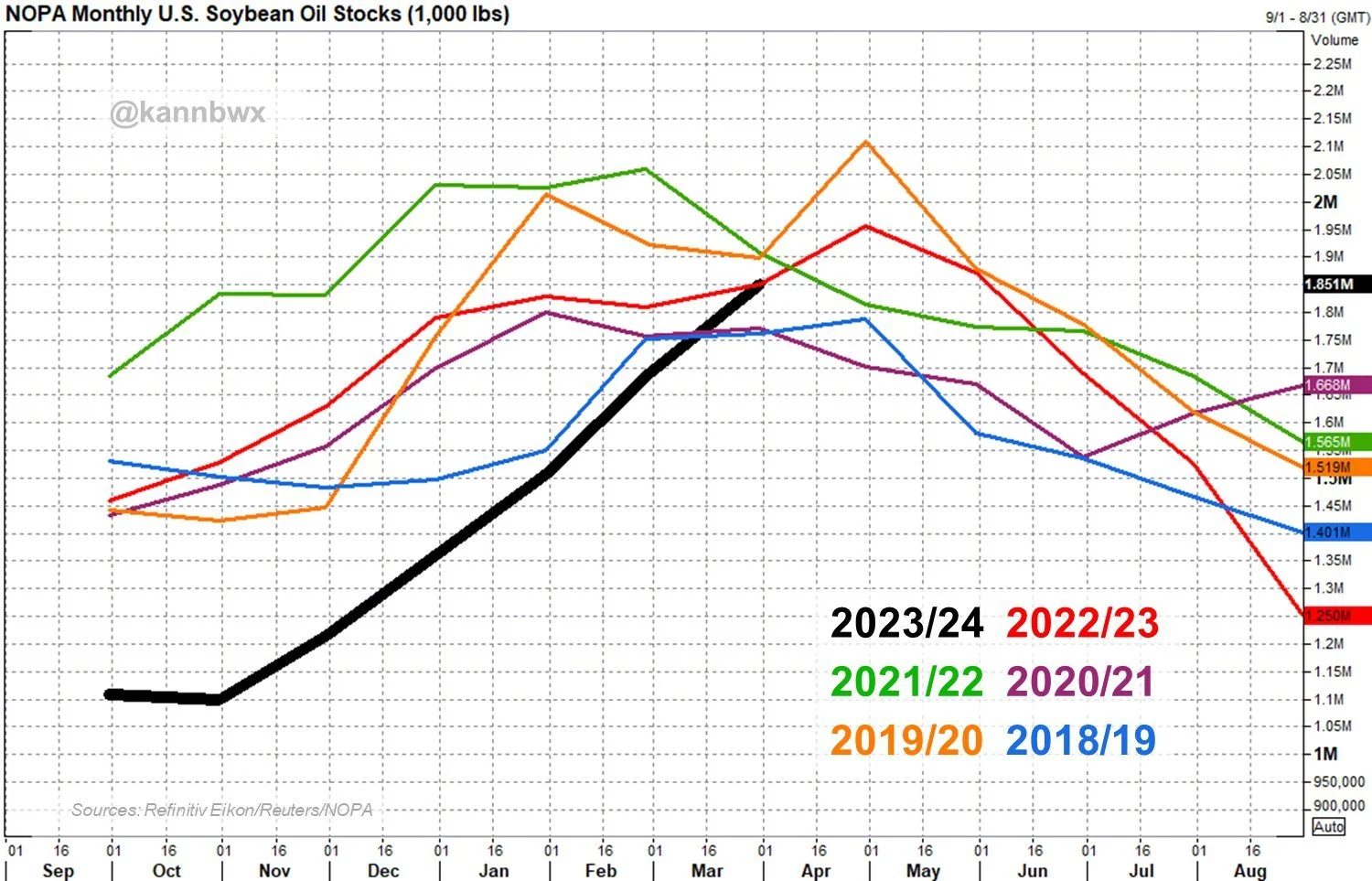

Soyoil stocks came in at 1.85 billion lbs. Identical with a year ago and the largest since last May.

Last October we saw soyoil stocks the lowest for any month since December of 2014, since then soyoil stocks have surged 68%, the strongest 5-month gain in 18 years.

This suggests that soy processing levels are keeping up with the current demand.

Bottom line, no the market does not have a reason to go screaming higher just yet.

Looking more long term there are plenty of reasons beans could go higher.

We have a tighter situation here in the US, crush demand doesn’t look like it is going away, potentially smaller Brazil crop, and we have an entire growing season here in the US. Not only that but we are heading into growing season with the funds holding near record shorts. Seasonally we go higher into growing season due to the uncertainties Mother Nature tends to bring and due to this being the time of year where supplies are the tightest.

We want to be making sales when we don't know what we will raise. Since soybean growing season is later than corn, sometimes we will be making sales in soybeans a little later than corn.

Similar to what I mentioned in corn, do not be shocked if prices go sideways or even struggle for another few weeks especially if planting continues at a fast pace.

On today's lower action we did not make any damage to charts.

Soybeans May-24

Wheat

Intially it looked like the wheat market was going to get hammered, but we bounced double digits off those lows just suffering losses of -3 to -6 cents across the wheat market.

Export inspections for wheat were solid yet again. Coming in at 551k tons, above the 350-525k trade estimates. This was the 3rd straight week in a row of solid inspections for wheat. This is especially strong considering that the 2023/24 export forecasts 50 year lows.

Like I mentioned, the war in the middle east has little impact on the grain markets. So do not hold your breathe waiting for this to be the spark that causes a major rally. The war in Russia and Ukraine is a different story. This is still very alive and does have a direct impact on the wheat market, so that one does still have the potential to be a wild card.

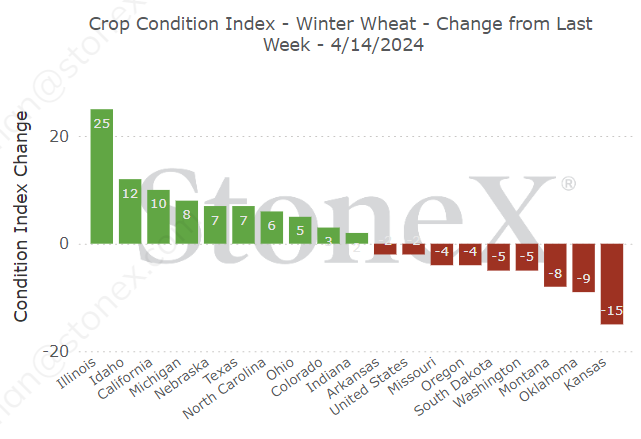

Winter wheat conditions came in down -1% from last week as expected. That crop is still far better than last year, but if the dryness in the plains such as Kansas continues, this could start to begin to be a bigger problem which could make KC lead wheat higher for some time.

Illinois winter wheat ratings surged +25% from last week, but Kansas ratings dropped -15%.

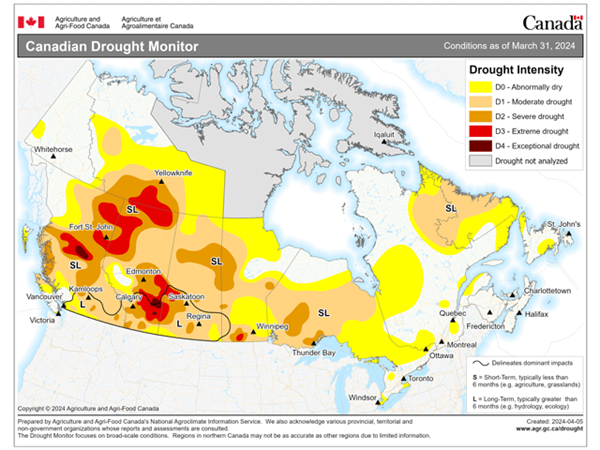

Another thing to watch is Canada. 82% of ag land in western Canada is in a drought. There are many areas such as SW Manitoba, N Saskatchewan, and N Alberta that have had less than 85% or normal precip the past 6 months. Something to keep an eye on.

Overall I am still remaining patient in the wheat market.

Taking a look at the chart, if KC wheat can take out $6 that chart would look like a breakout.

May-24 Chicago

May-24 KC

Cattle

Cattle market continues to chop near the recent bottom it put in.

It looks like we might be finding support, but I am skeptical that we have found a bottom. The charts still do not look very friendly. I would not be surprised to see more downside.

Give us a call if you want to go through any strategies. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24