FIRST NOTICE DAY SELL OFF

Overview

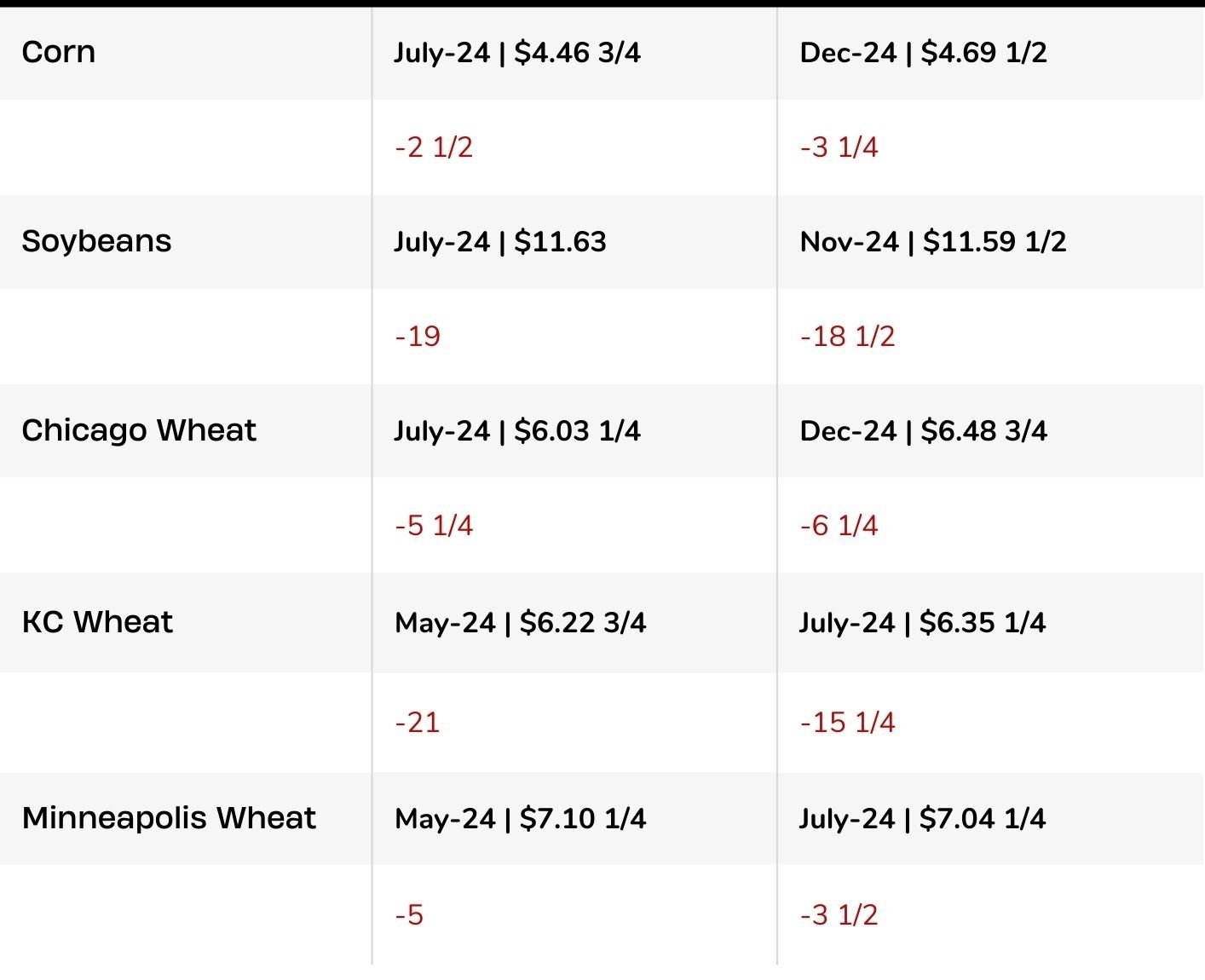

Grains lower across the board for first notice day.

Soybeans lead the way lower, hammered -19 cents as they were pressured with a few negative demand headlines, as well as a negative first notice day to go along with lower action in soymeal and soy oil. Planting also came in faster than normal which added some slight additional pressure.

Wheat was lower due to rains in southern Russia leading to profit taking, as well as a slight negative first notice day.

Corn simply followed the rest of the markets lower.

First Notice Day

First notice day was friendly for corn and winter wheat wheat, negative for beans, and slightly negative for Chicago wheat.

As for beans there were 533 contracts delivered against May futures. This had a pretty negative effect on beans.

Bean oil had 2,101 contracts delivered, this helped push bean oil to it's lowest levels since January 2021.

Chicago wheat saw a big 1,151 contracts delivered compared to the trade expecting just 250 to 500. Again a slight negative for that market.

For May corn there were 0 deliveries. There was also 0 for winter wheat. Friendly for both.

The is the first first notice day since September where the grain markets didn’t make new lows.

More deliveries = Negative for markets

Light deliveries = Friendly for markets

If there is a large number of deliveries that means that supplies nearby is abundant and is a bearish sign. If they are light, it means the physical owner of the commodity wants to hold on to the real product, which is a friendly sign.

Argentina Labor Strikes

The other big headline was the Argentina strikes on a bill that introduced a reduction to minimum salary.

This initially sent soybean meal higher, and along with first notice day helped push bean oil to the lowest prices since January of 2021 as mentioned.

The more they crush to get meal, the more oil they are going to get and they just don’t have a place to sell the oil. So this could help push meal higher and oil lower until it gets resolved.

The strikes are a slightly friendly factor for soybeans, but overall I do not think this is a major factor. We see these strikes from Argentina nearly every single year.

US Planting Progress & Weather

Now taking a look at US weather and planting progress.

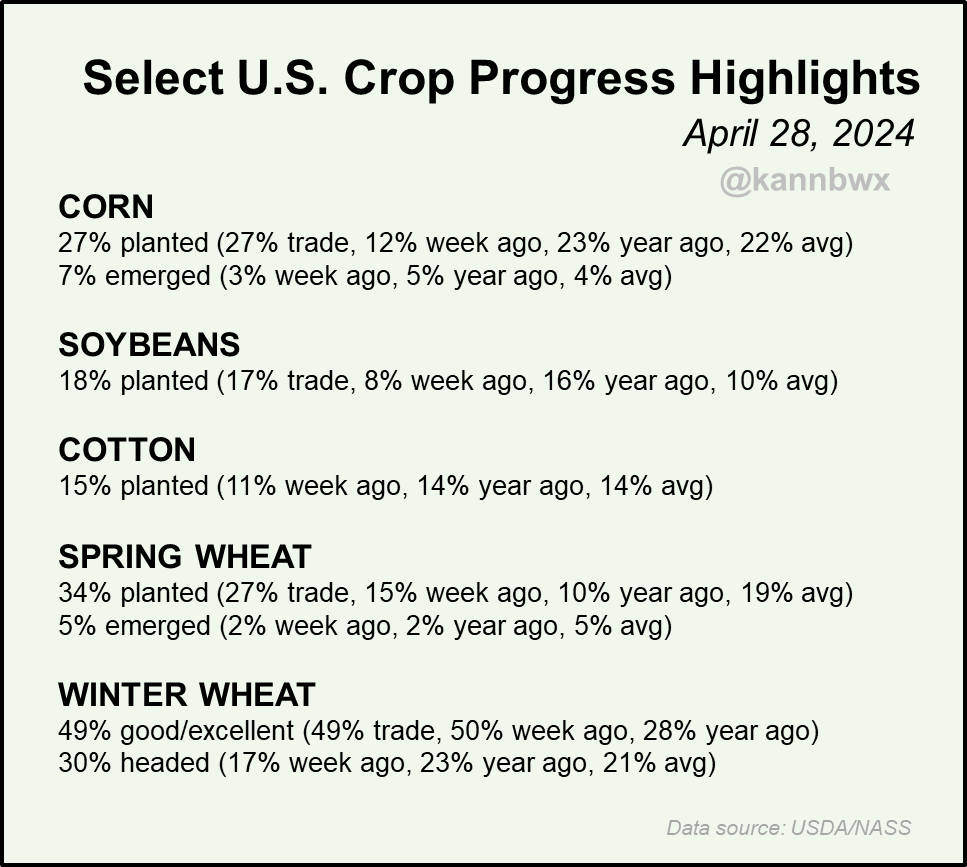

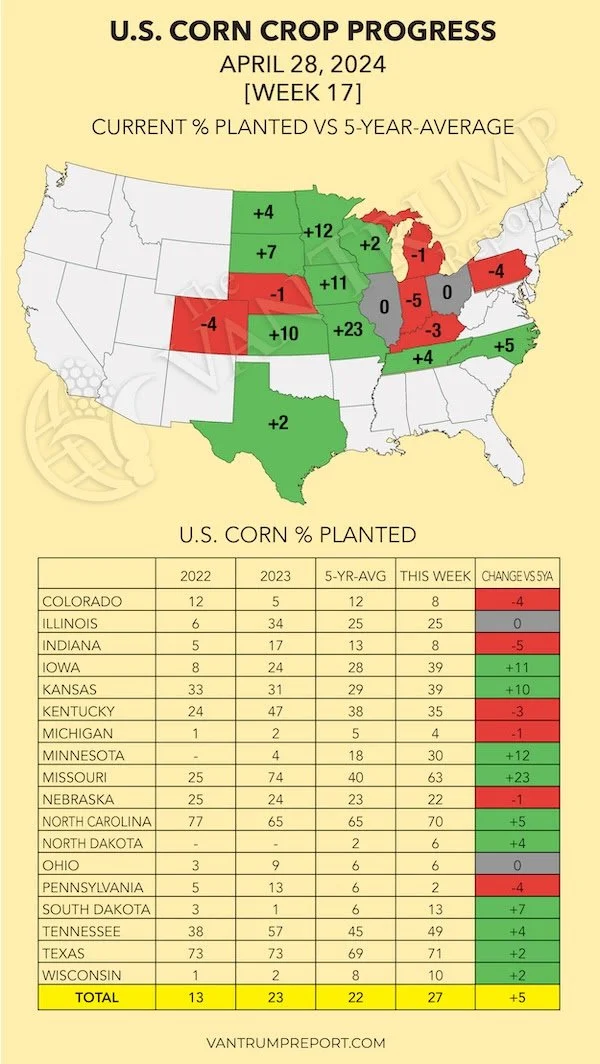

Corn and bean planting came in as expected, but ahead of average. Spring wheat planting pace is the fastest since 2021 and was faster than expected and the average pace.

The faster than usual planting has added some pressure to both soybeans as well as spring wheat.

Here was the planting progress numbers from Karen Braun & Kevin Van Trump:

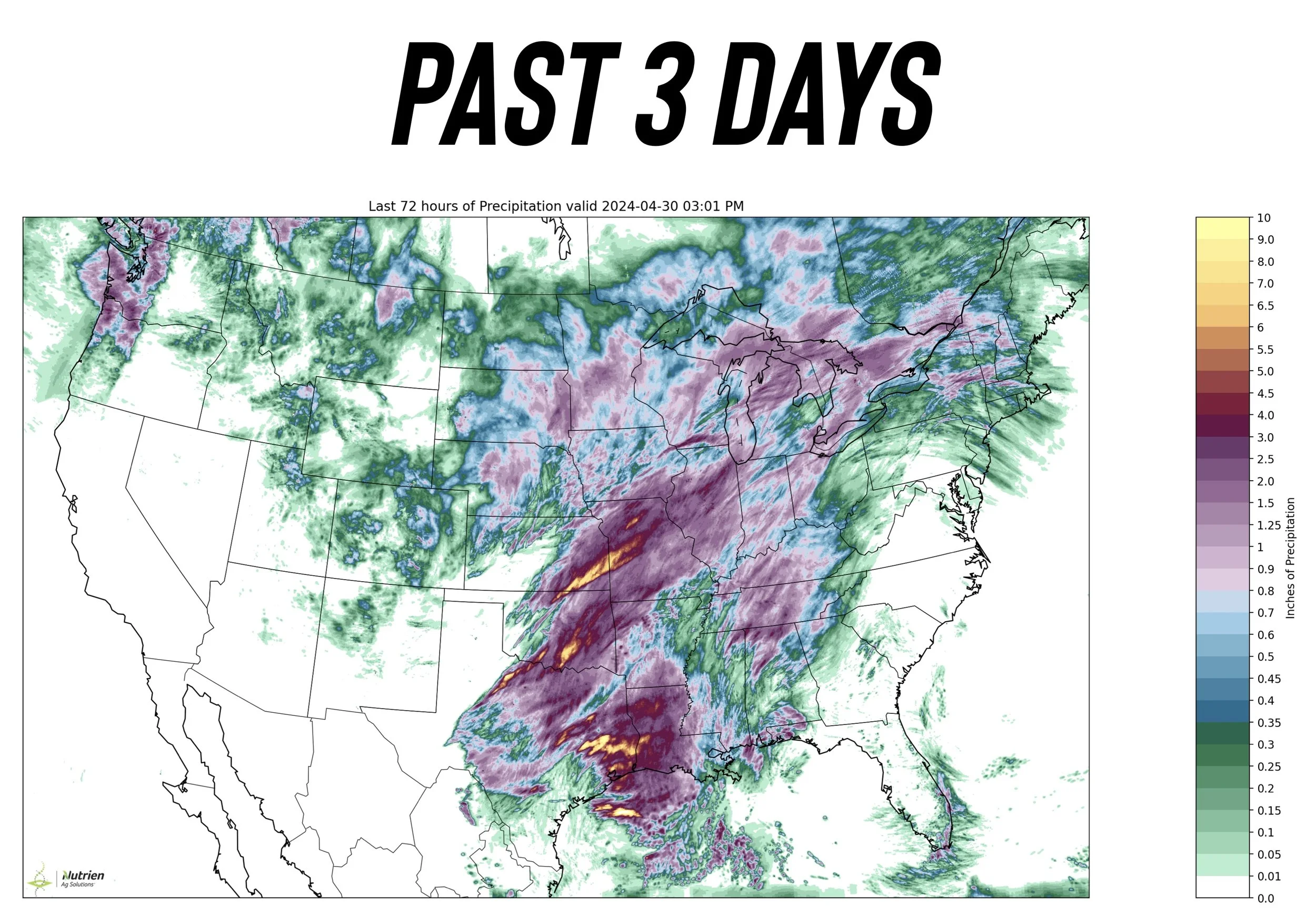

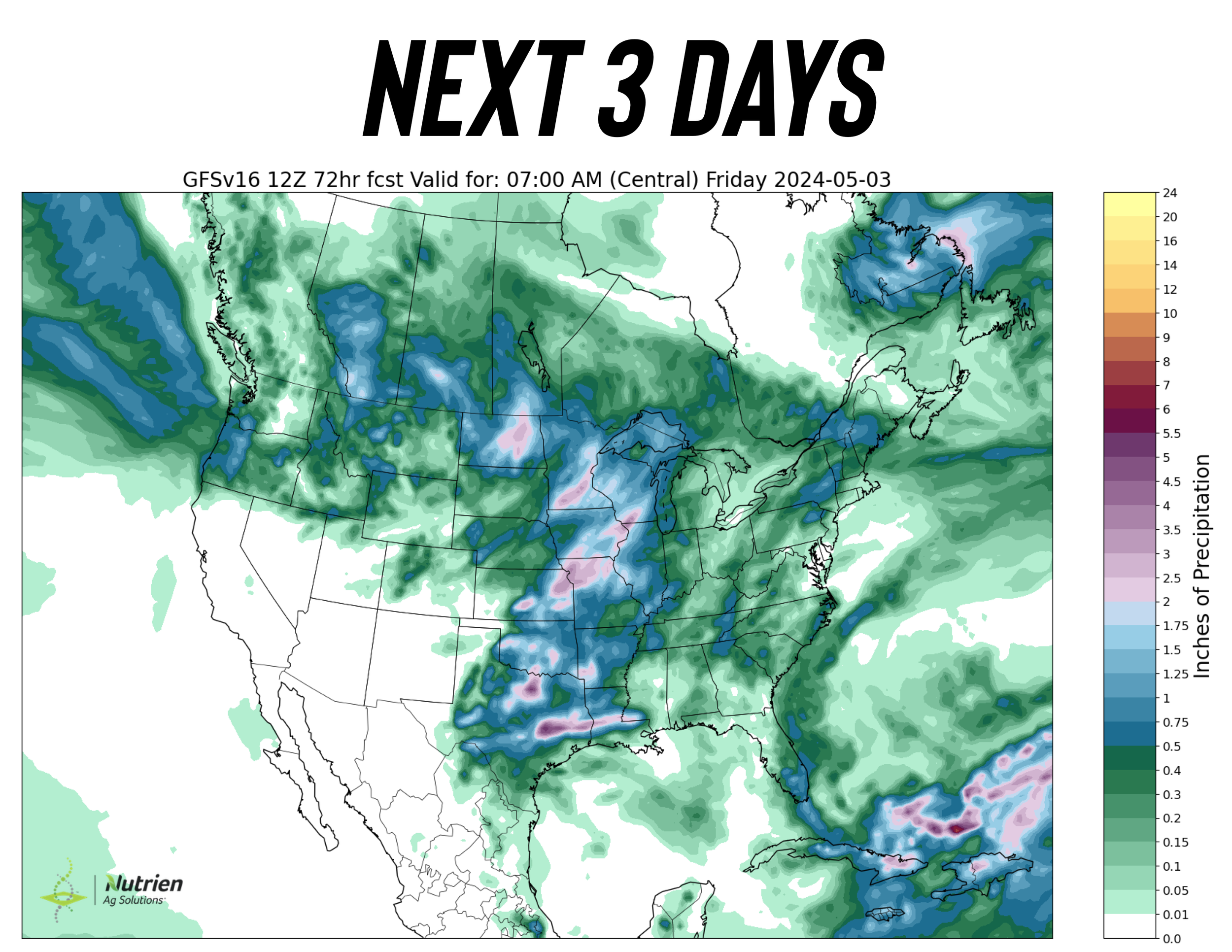

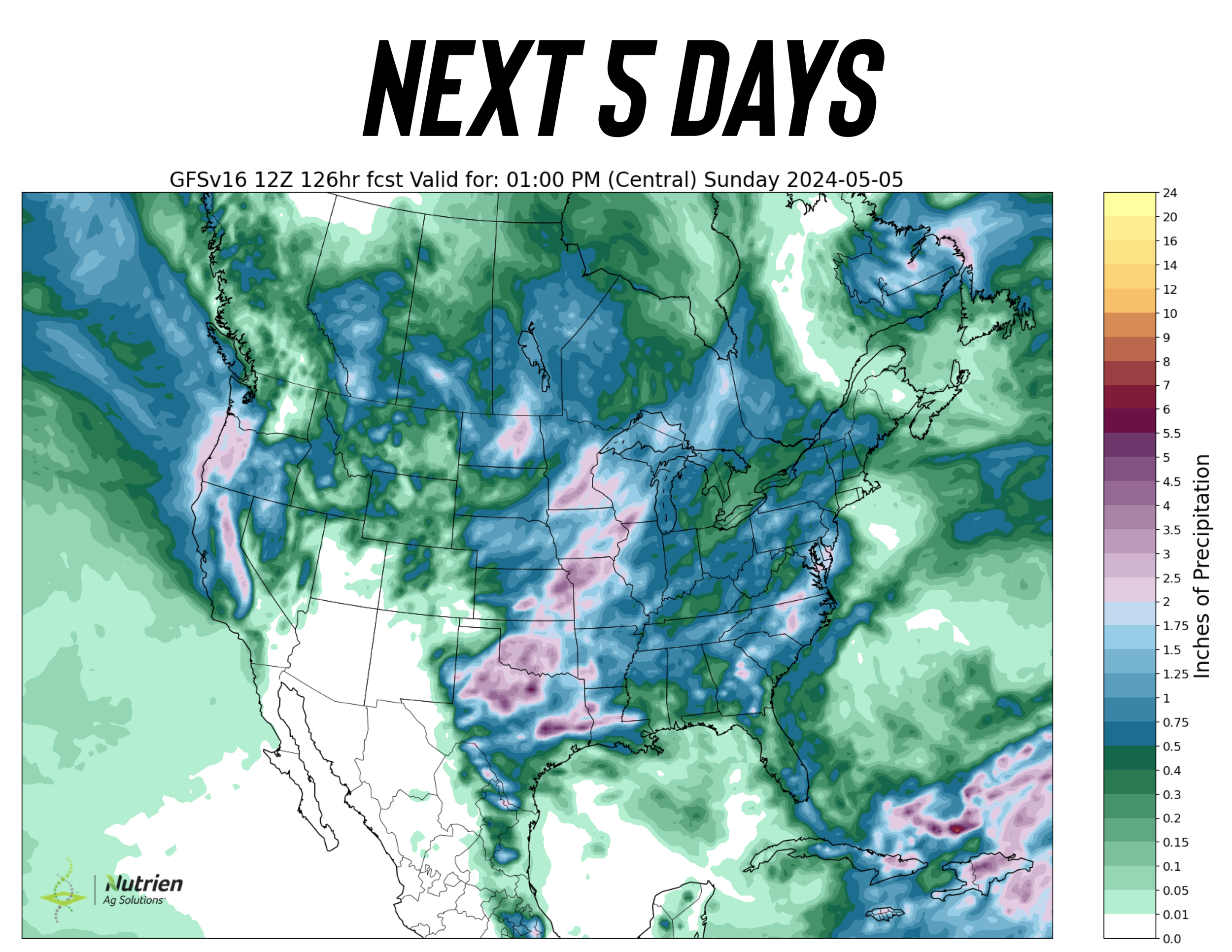

It appears that rains could slow things until around May 11th or so.

Right now we are ahead of pace in planting, so perhaps we fall slightly behind the next few weeks.

These recent numbers did not take into effect the recent rains. So next Monday we could see numbers slow up.

However, after that I believe we will start to ramp things up and shouldn’t be too far behind and will probably still be right around average pace.

So I personally do not see delayed planting as an issue. A lot of times delayed planting talk can be somewhat blown out of proportion. If the forecasts hold true, we will see slight delays and producers planting later than they might like, but overall no real concerns.

If planting were to somehow fall drastically behind, the market would likely not take notice for a few more weeks. Again I do not think that is in the cards, but if it happened that is what you could expect. These markets did not find life until May 13th back in 2019.

We got some good rains in the corn belt, and rain is expected to return over the western to central corn belt while being drier to the eastern corn belt.

Let's dive into the rest of today's update....

Today's Main Takeaways

Corn

Corn slightly lower, following the rest of the markets lower.

Every year for the past 20 years, corn futures have traded higher than where they closed April at.

The largest increase was $3.00 which isn't in the cards this year, but the average increase is +70 cents. Which is a possibility. +70 cents onto December corn today ($4.70) would bring us to $5.40.

However, 75% of the time corn futures do end up lower than where they were at the end of April at harvest. With an average of -25 cents lower.

I am not saying either of these will happen, I am pointing out that historically we go higher from here and make our highs typically in June, and then we trade lower into harvest usually.

The funds are still short over -250k contracts of corn.

So far they have covered around +40k contracts, yet futures have only rallied a dime or so. Why is this?

A lot of this recent short covering was met with farmer selling due to all of those May basis contracts that needed to be priced last week.

Now that we got basis contracts, first notice day, and options expiration out of the way, I think it will give this corn market a chance to start to grind higher.

We all know weather time is go time for corn. If we get a weather scare (which we do nearly every year) I expect better pricing opportunities ahead.

As we have said for a while, we want to be making sales when you don't know what you are going to raise. When you hear all of this drought talk and everyone thinks corn is just going to go higher and higher, that is when we make the sale and or lock in a floor with puts.

Courage calls here are still a good way to re-own for most of you (not all). As we get into this weather market, options will get more expensive. As they will price in bigger potential moves. Give us a call if you have questions or want to create a game plan (605)295-3100.

We aren’t quiet in the weather market yet, but are getting close.

If you look at the chart, we have traded in a 20 cent range since February 28th. Now over 2 months of brutal sideways trading.

For starters, this means the funds are holding a position that has not made them money in 2 months. Which gives them even more reason to cover ahead of the time of year where we are going to have uncertainty and seasonally trend higher.

If we can take out $4.60 (+15 cents away) I think the funds are going to have to cover more.

If you look at December corn, that $5.00 area where we initially broke lower on New Years is a big area.

We chopped in that range for months, if we get to that area on a crop scare, that would be a decent target to do some marketing. However, I do prefer to wait for a trigger to say the top is in rather than waiting for a target price. As you can leave money on the table with targets. But if we get there, there would be nothing wrong with having that as a spot to do something.

Dec Corn

July Corn

Soybeans

Soybeans hammered, giving back all of last weeks gains in one day.

Why did soybeans get hit so hard today?

1. ) Slightly faster than normal planting

2. ) A negative first notice day

3. ) US losing Chinese market share to Brazil

4. ) Crush expansion not going as well as planned

5. ) Concerns about Trump reelection

First the slightly faster planting. It is only the 3rd week, but we are well ahead of pace already. As we mentioned for months leading up to this, fast planting can be negative for prices. Although it does look like things will slow down a bit.

I already mentioned first notice day, but essentially this was a negative indicator that supplies nearby isn’t a major issue.

One of the bigger stories is US's share of the Chinese bean market is expected to decline this year. We have Argentina with a crop twice the size as last year, and Brazil is going to hold a significant share due to it's competitive prices.

Last year the US's share of the Chinese market dropped to 24%, down from 33% in 2021. At the same time Brazil grew from 60% to 70% of the market share.

Chinese traders are expecting this trend to continue due to the election. As the concern is Chinese soybean crushers are nervous that if Trump is elected, it could lead to resistrctions on US bean imports.

So yes we have had some negative demand news. Which you can’t ignore.

But keep this in mind.. US growing season is by far the single most impactful event.

If we get any sort of weather scare that makes the market believe that even for a second that yield could be 48 rather than 51 or 52, the market will rally. If that happens, none of this demand stuff will matter for a moment of time.

If yield drops a few bushels, our carryout situation here in the US is tight enough to where we could run out of beans fast.

We are not yet in that weather market, but we are getting closer and closer.

Still remaining patient, we typically want to be making bean sales in that June to even a little later time frame.

Looking at the chart, it doesn’t look very good. I wouldn’t be surprised to see us make a new low. I do not think we go much lower than that, but it is possible.

We need to take out that first resistance to bring more upside. After that the next stop could be the 100-day moving average which is around $12.25 today.

After that I don’t see why we couldn’t fill that gap above $13 that we left on New Years. That gap will be a good point of interest for those we want a target.

Opportunities will come.

July Beans

Wheat

Wheat gets hit hard with rains in southern Russia, profit taking, technical selling, and a slightly negative first notice day.

Spring wheat planting is far ahead of pace, sitting at 34% complete vs the 27% estimates and the 15% average. So that added some slight pressure to that market as well.

Concerns about the winter wheat conditions remain.

Winter wheat ratings dropped -1% to 49% rated G/E as expected.

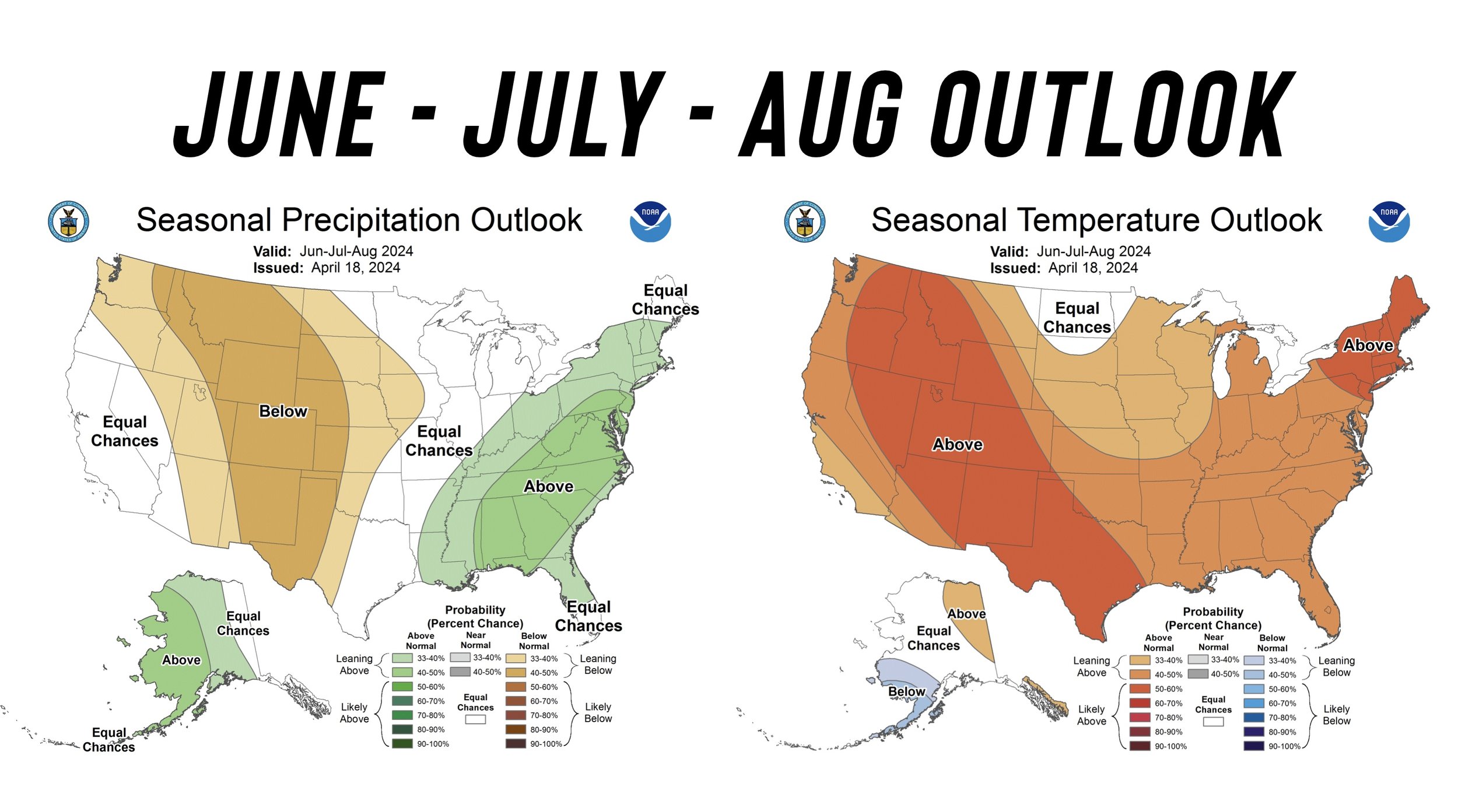

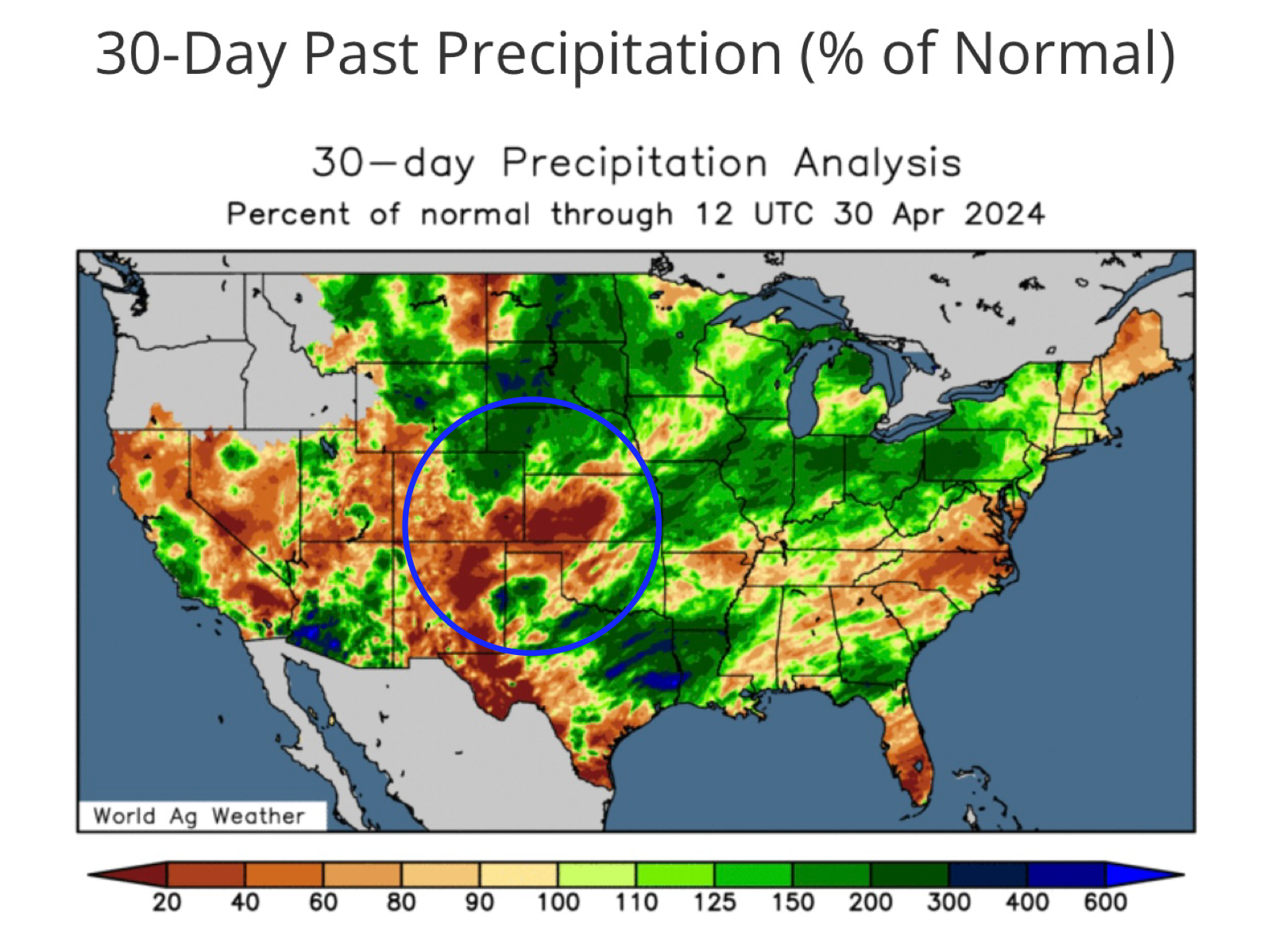

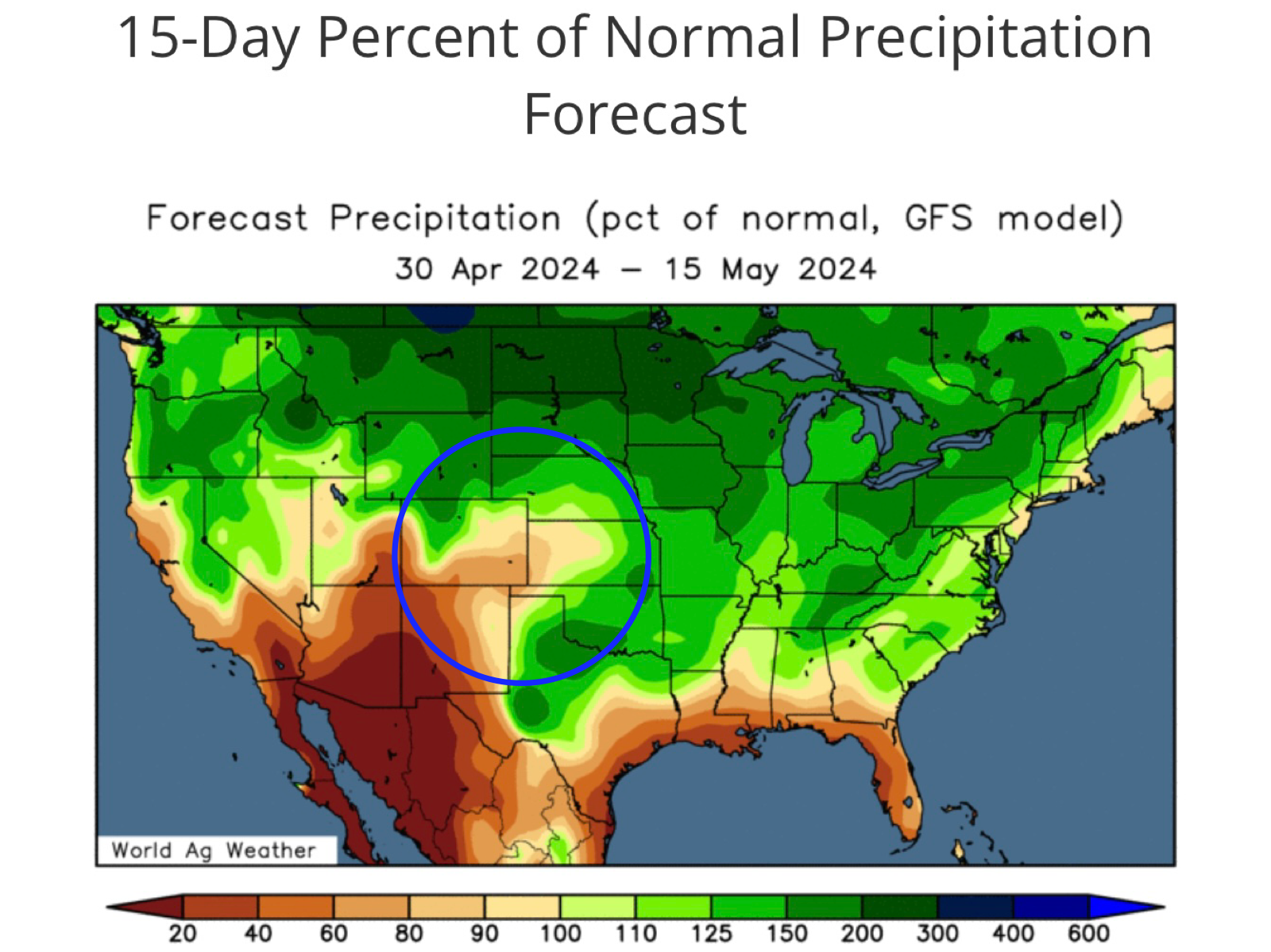

Many parts of southwestern Kansas and into eastern Colorado are still facing extreme dry conditions. As some have received less than 1/2 an inch of rain in the past 60 days. They are expected to get a little rain, but it won’t be a soak.

Most of winter wheat country has continued to miss these rains that the midwest got, and the forecasts are also looking spotty.

Majority seem to think we continue to see these ratings drop.

Southern Russia is now expected to get rains, which will be a negative for the wheat market.

Take a look at how dry the past month has been compared to the next 14 day forecast

As for marketing, nothing has changed since last week.

If you are someone who does not have storage or knows you are going to have to move something soon, then reward this rally or lock in a floor with puts. We are still near the recent highs.

If you aren’t comfortable and are going to have to sell wheat off the combine, it might make sense to reward the rally or lock in a worst case scenario with puts.

If you are someone who can wait and sit on wheat for a year or longer at a time, I like continuing to wait. You waited this long. There isn’t a reason to sell down here if you do not have to.

If you need help or want to walk through your situation please give us a call. That is why we are here. (605)295-3100.

My bias is still higher from here especially a little more long term, but like I mentioned last week I said I wouldn’t be surprised to see a pullback.

I actually liked the price action in Chicago wheat, we found support right at the 100-day moving average and bounced +8 cents off the lows.

Unless KC wheat bounces, we might not have much support until $6.21

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24