WHAT’S THE STORY FOR GRAINS?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 1:05min

Beans: 8:10min

Wheat: 13:35min

Cattle: 14:45min

Want to talk about your situation?

(605)250-3863

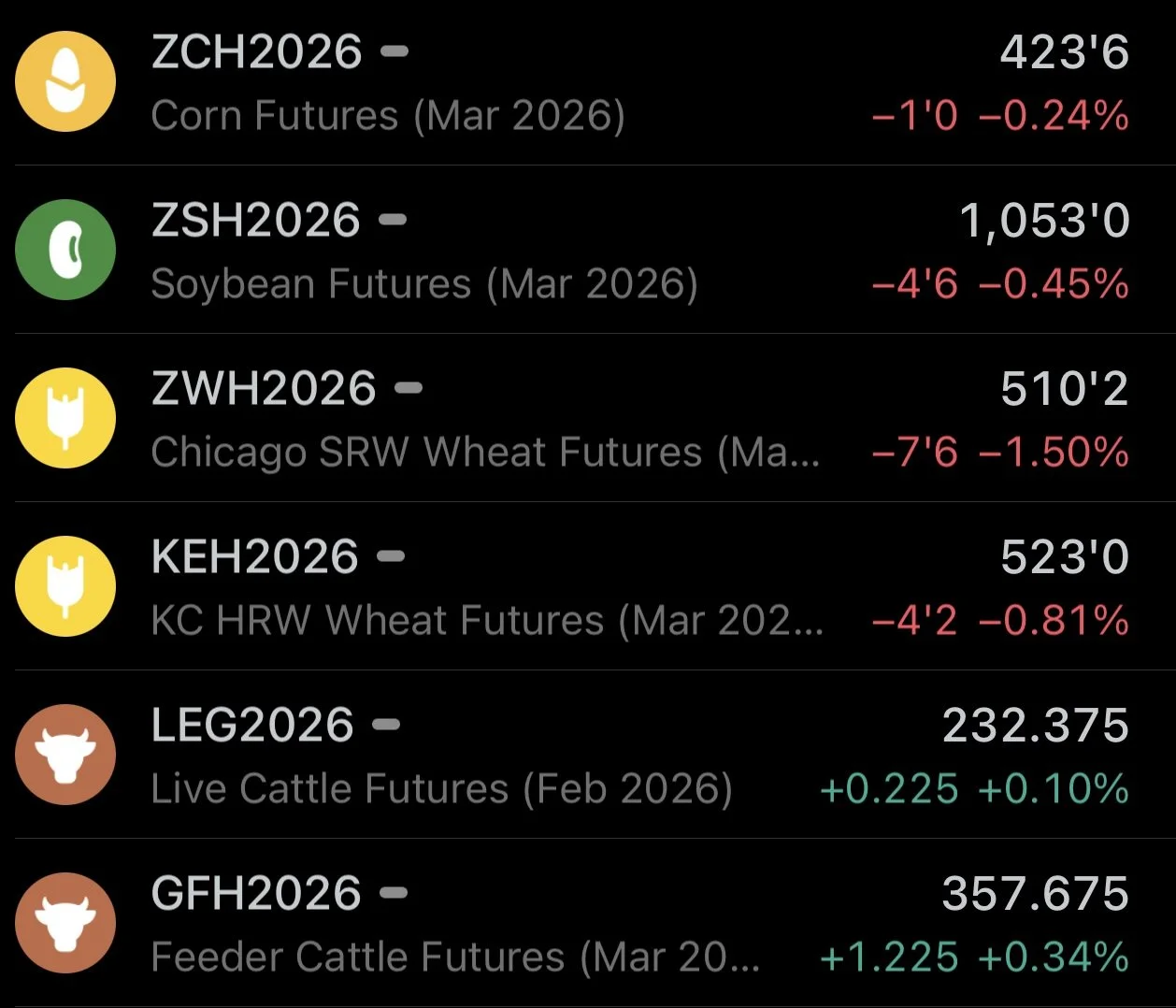

Futures Prices Close

Overview

Grains lower across the board with cattle finding a little life following Friday's sell off that was sparked off the back of screw worm news.

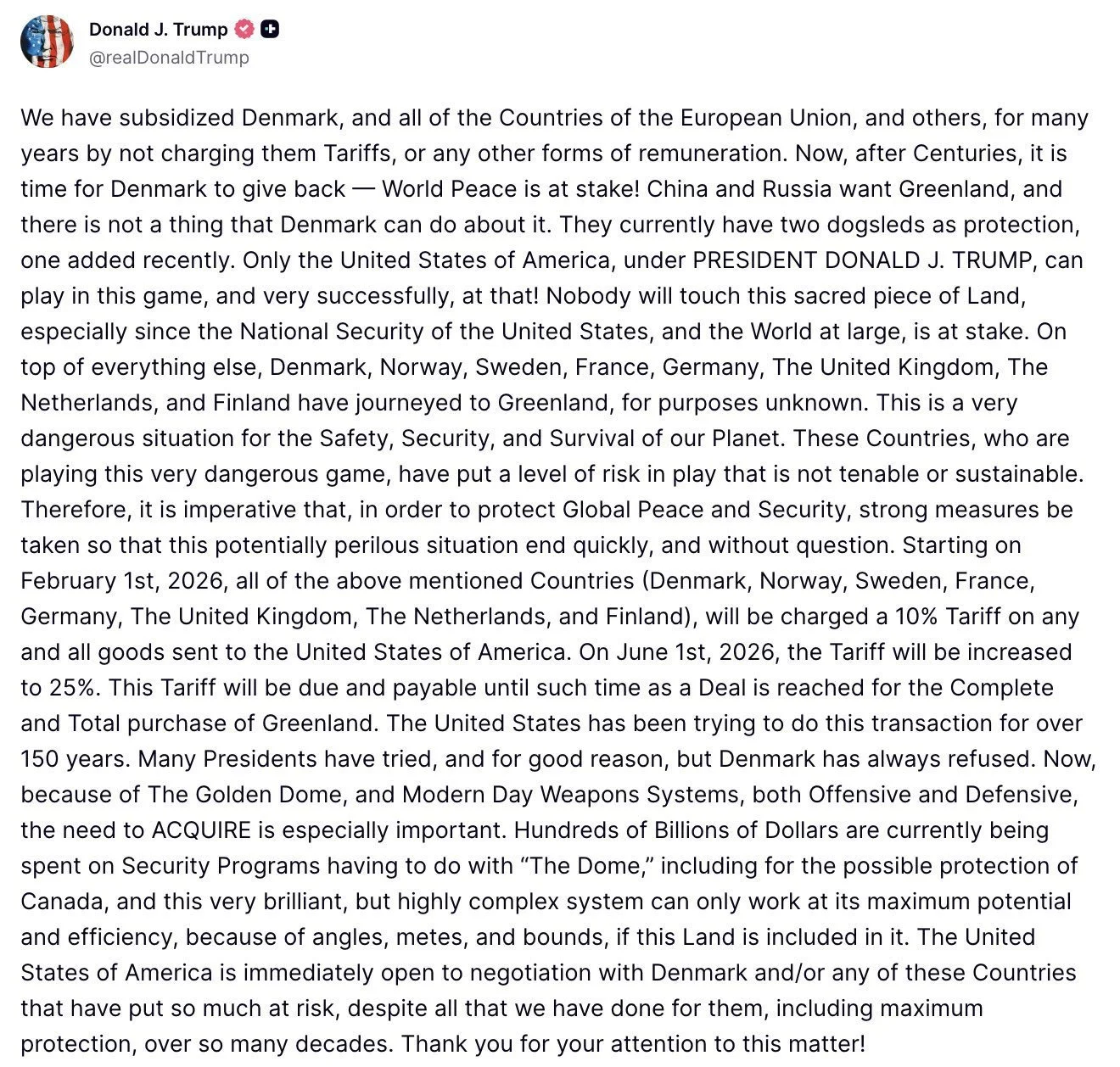

Tariff headlines had the outside markets spooked as the stock market and US dollar took a pretty sizeable hit. As Trump is trying to own Greenland and announced he would impose tariffs on the eight EU countries that are opposing the US owning Greenland.

In the meantime, money continues to pour into the metals. As gold hit another all-time high today.

This isn’t some wildly bearish factor for the grain markets, but does bring up a little bit of uncertainty surrounding export demand.

Overall I don’t think this Greenland news leads to any major impact on the grains.

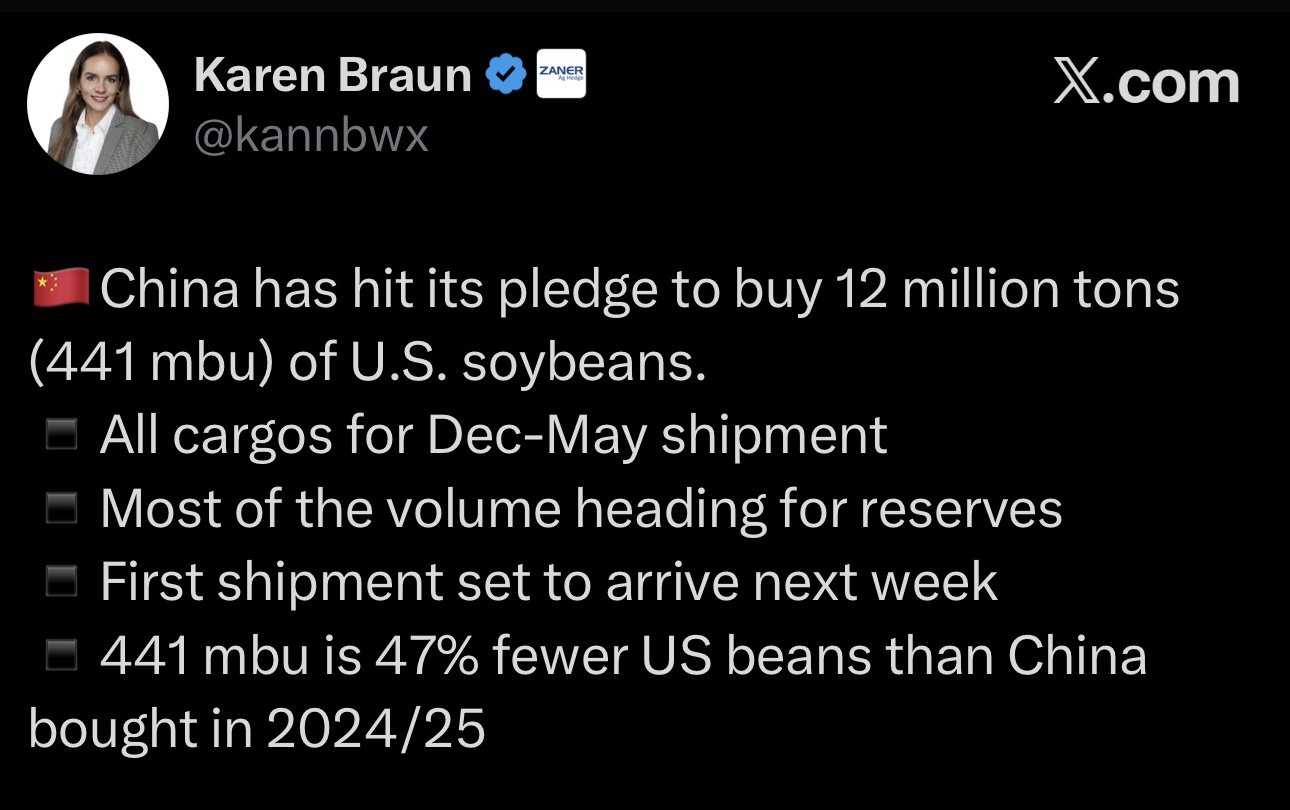

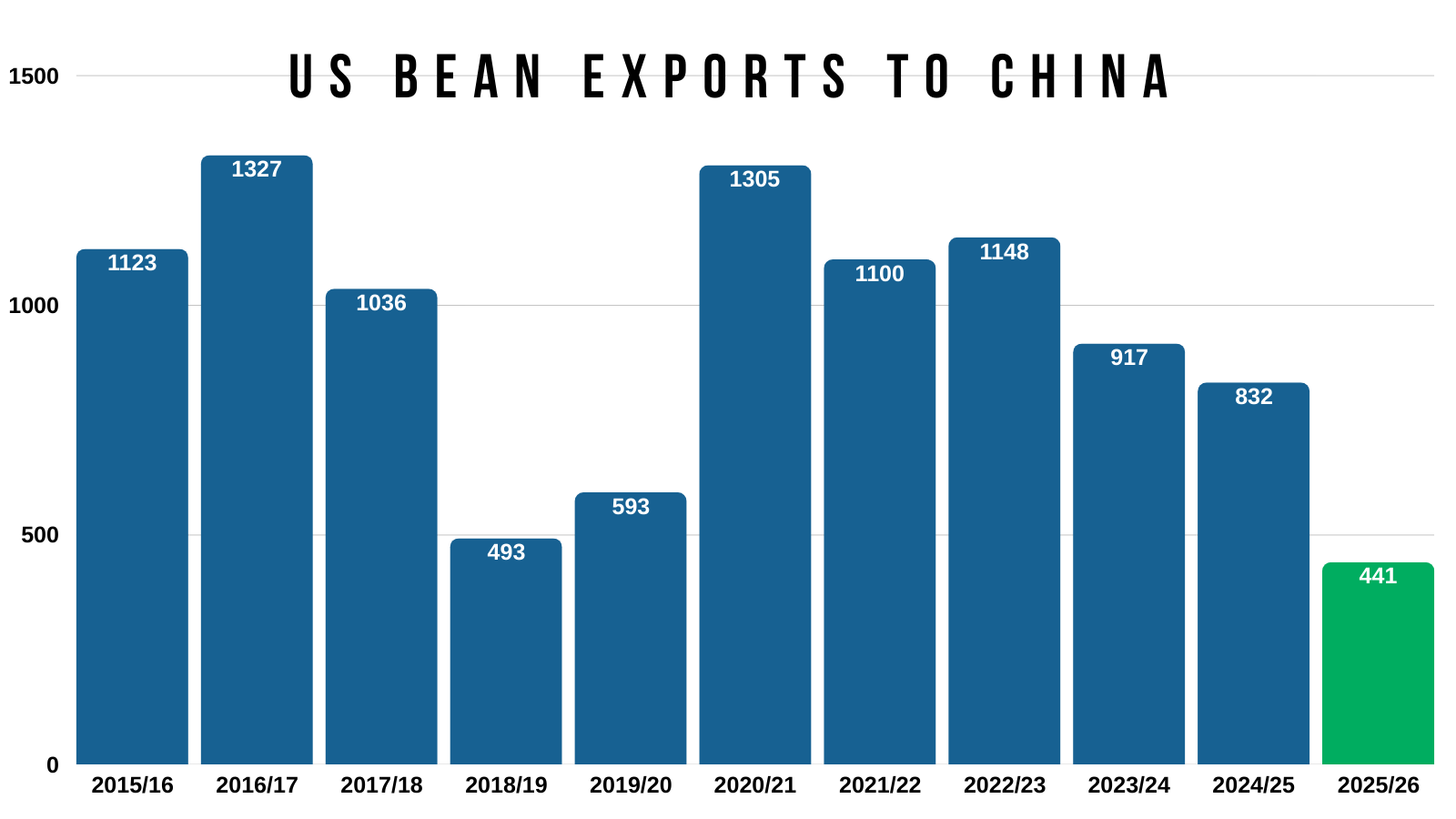

It was announced that China did officially meet their goal of buying 12 million metric tons of US soybeans.

This is great to see that they lived up to their word.

However, you do have to keep in mind that this 12 million is still only about half of what they bought last marketing year.

We'll touch more on this later.

Outside of that, it was a relatively quiet start to the week following the 3-day weekend.

Let's jump right into the good stuff.

Today's Main Takeaways

Corn

Fundamentals:

Corn is in a market where we have record supply, yet record demand.

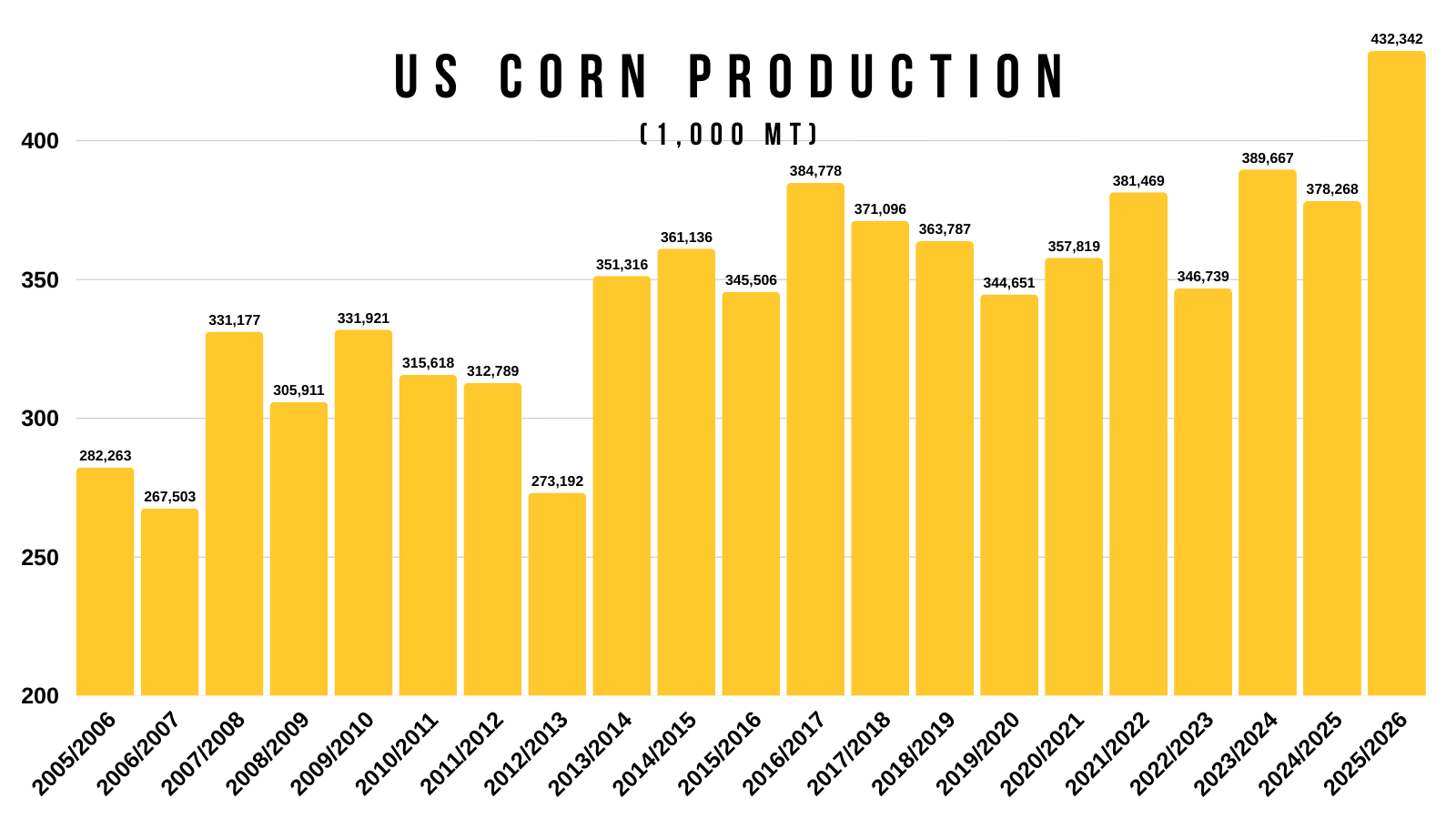

To give you a good visual, here is corn production over the years.

Clearly, we produced a ton of corn.

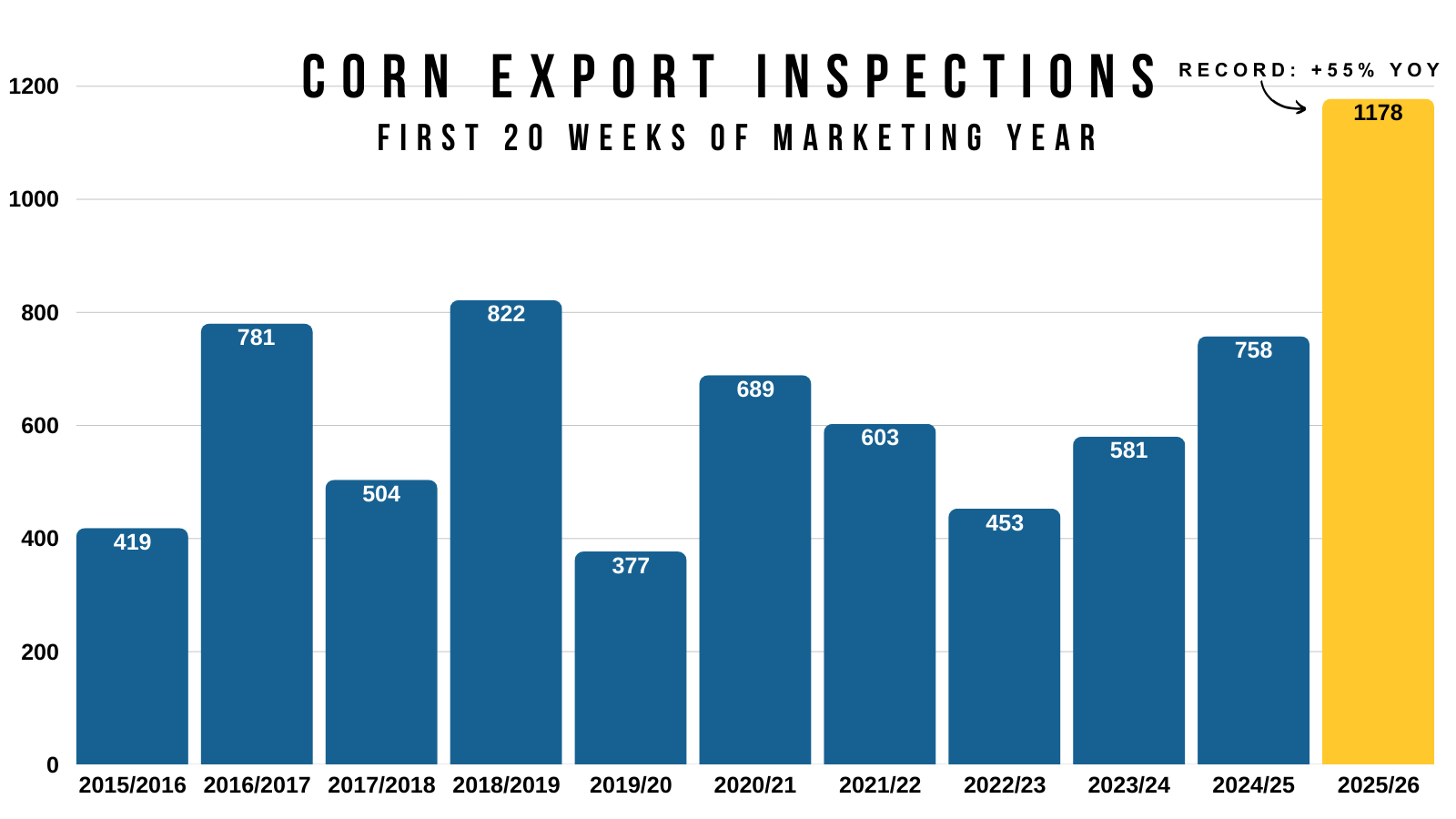

At the same time, here is our export inspections for the marketing year so far vs other years.

This year is in a world of it's own.

They are up +55% vs last year.

Keep in mind.. last year featured record export demand for the corn market.

Do I think corn has crazy upside from here short term?

No.

Do I think corn has to fall out of bed and go below $4.00 from here?

Also no.

Let me be clear, the US corn story is not bullish today.

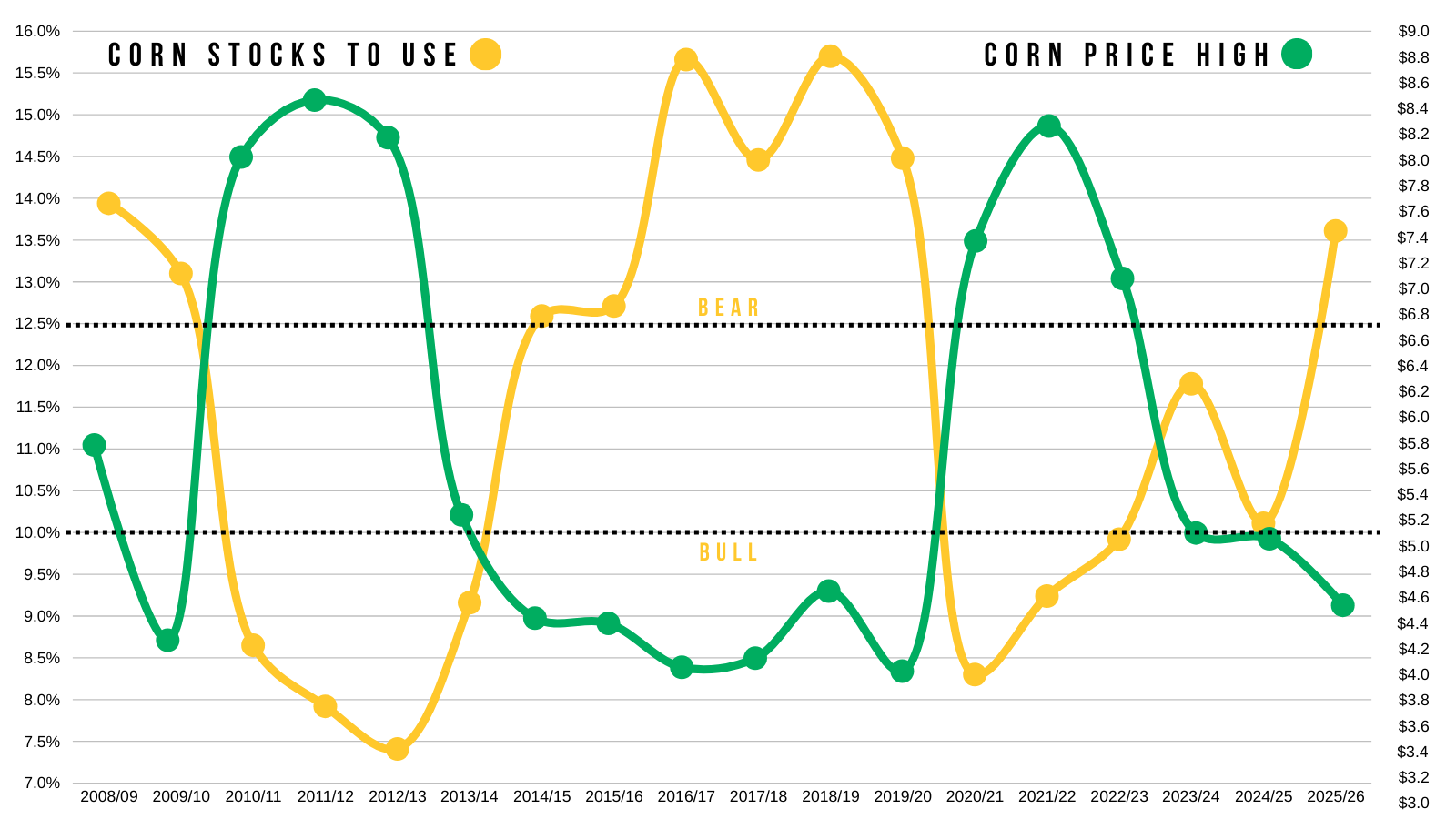

Our stocks to use is the highest since the last bear market.

I've shown this chart quiet a few times recently, but it shows our stocks to use vs corn's highest prices of the year.

The current stocks to use does not suggest corn has to go screaming higher from here.

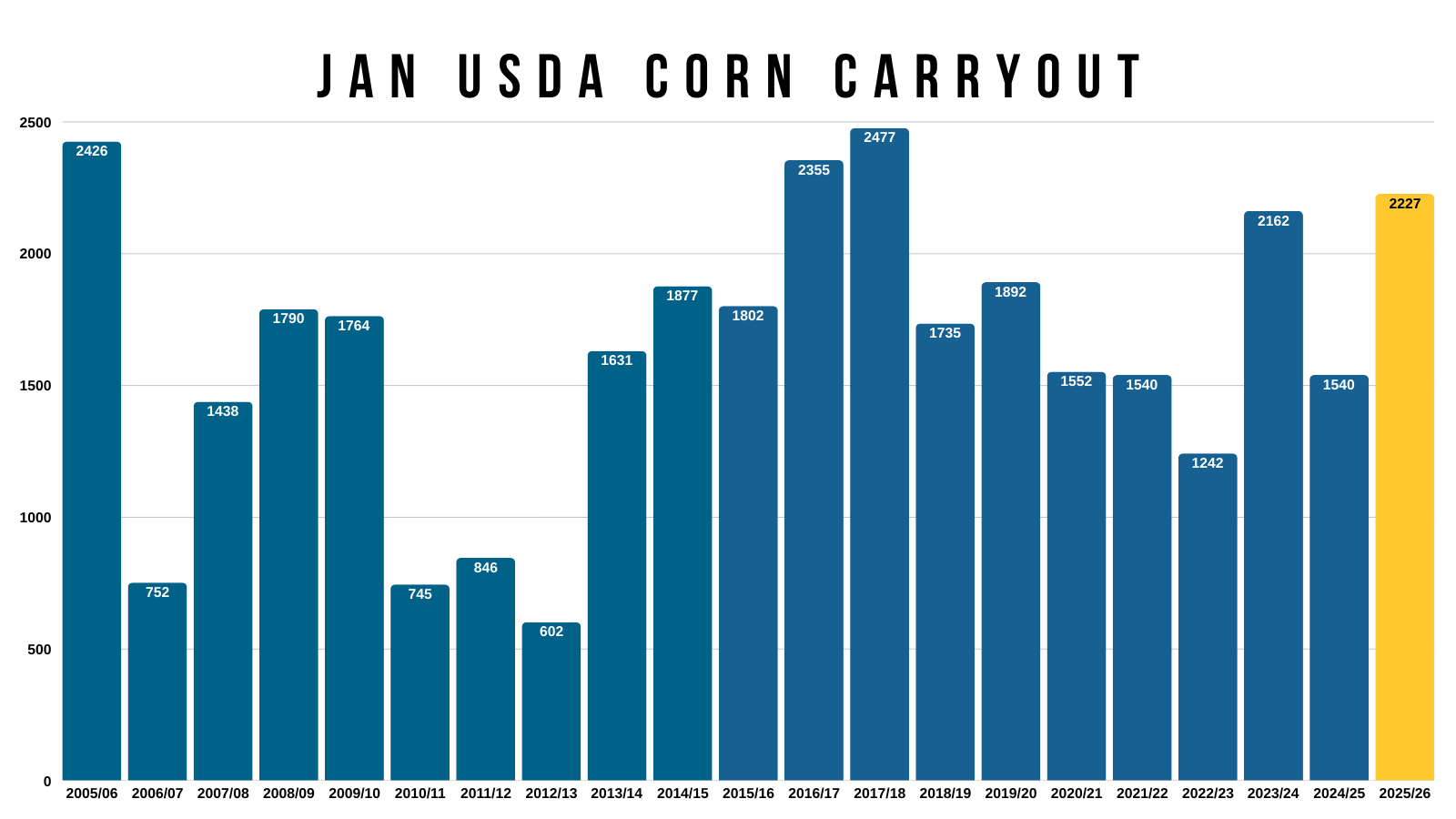

The 2.2 billion bushel carryout is one of the largest we've seen in the January report.

At the same time.. record demand should help keep a floor.

So you could easily argue that we don’t have to go a lot lower to create demand, because we already have it at these levels.

Last week's report is behind us now. Focus can now start shifting to the crop we are going to be growing this year. As the supply side of the balance sheet for last year's crop is set in stone.

The only thing that can change from here is demand.

Which means that it is hard to paint a more bearish situation than we already have. Last week's report will probably be the largest carryout we see for corn this year.

We have a LOT of supply to chew through. But the balance sheet doesn’t have a reason to get larger from here.

In August, this market bottomed the exact day the USDA printed a 188 yield.

The USDA just printed a 186.5 yield last week.

We sold off on the report, but have not received any follow through selling. This is a good sign, as it could mean the market has fully digested and priced in the numbers.

Now yes, it will be hard to get this corn market to take off and go on some crazy rally because the situation is not bullish.

At the same time, we don’t have a reason to continue to fall apart.

The next big set of data we will get is planting intentions.

So to me, it feels like this market is going to be pretty range bound until then. Then what that data says will set the stages and tell us where the market is headed from there.

The focus will soon shift to new crop. However, since the old crop supply situation is pretty large, it is likely going to take an outside factor to truly turn this market around. Because we simply have a large cushion now.

It could very well take a weather scare this summer. Which is something we haven’t seen in a few years.

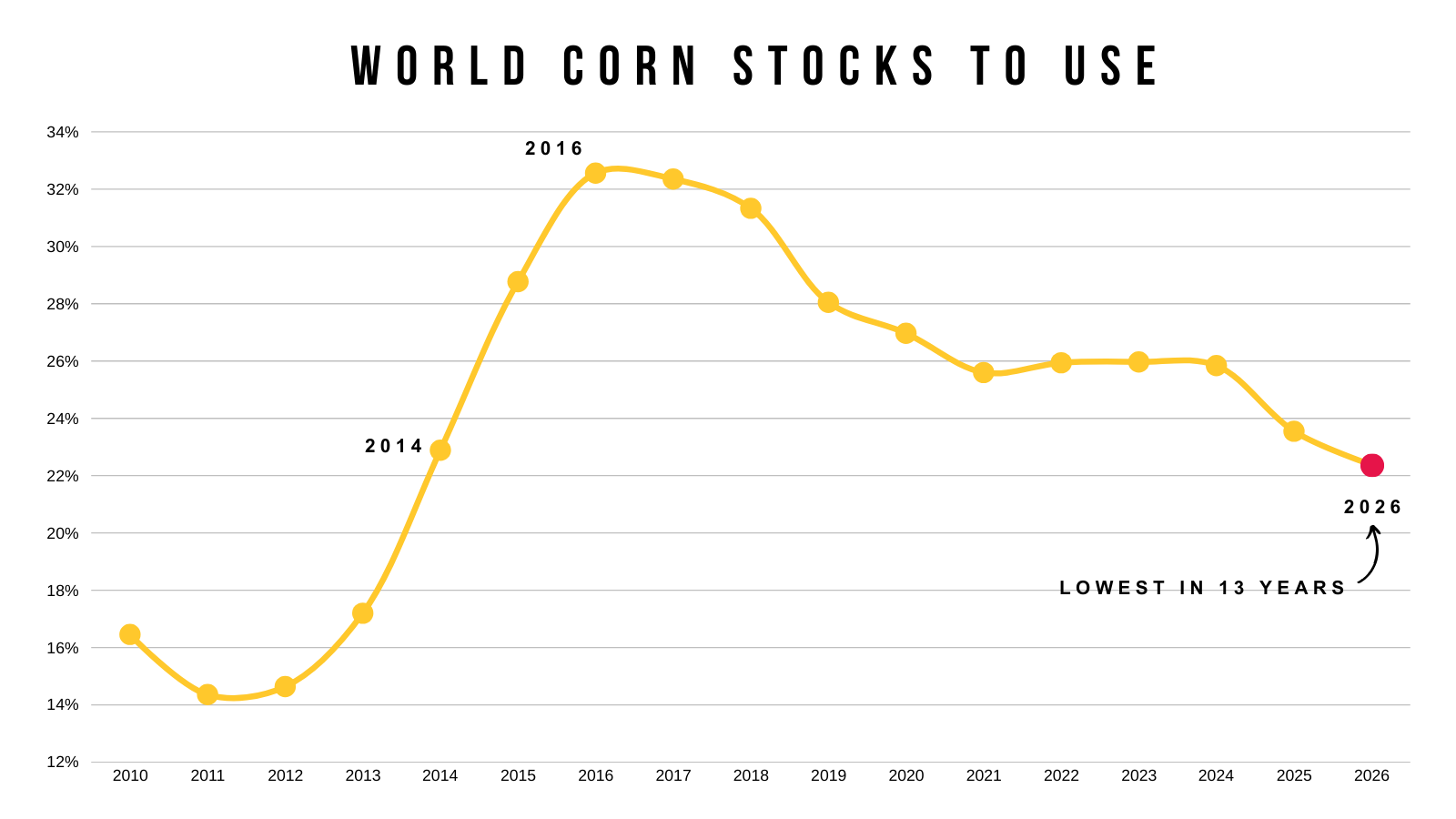

We've talked about this several times before, but the world story is the tightest it's been in over a decade.

This is with a record crop here in the US and a near record crop out of Brazil.

If the world story is tight.. why hasn’t it mattered?

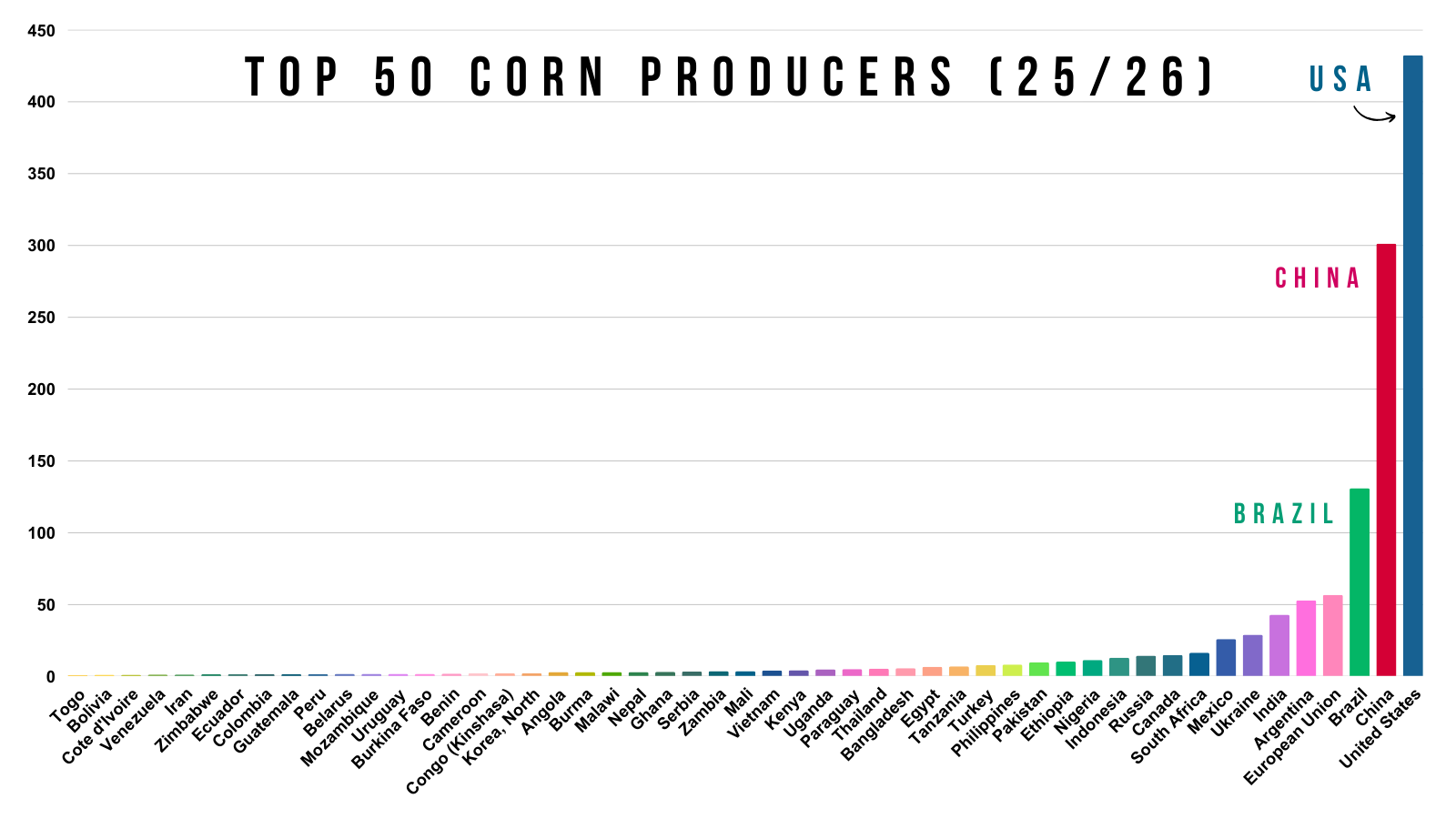

Here is the top 50 corn producers in the world.

Clearly, the US is the dominant player.

In 2nd we have China, we doesn’t export corn.

In 3rd we have Brazil. The only competitor that exports. Who produces way less than the US.

The US is the most important player. Currently, we have plenty of supply.

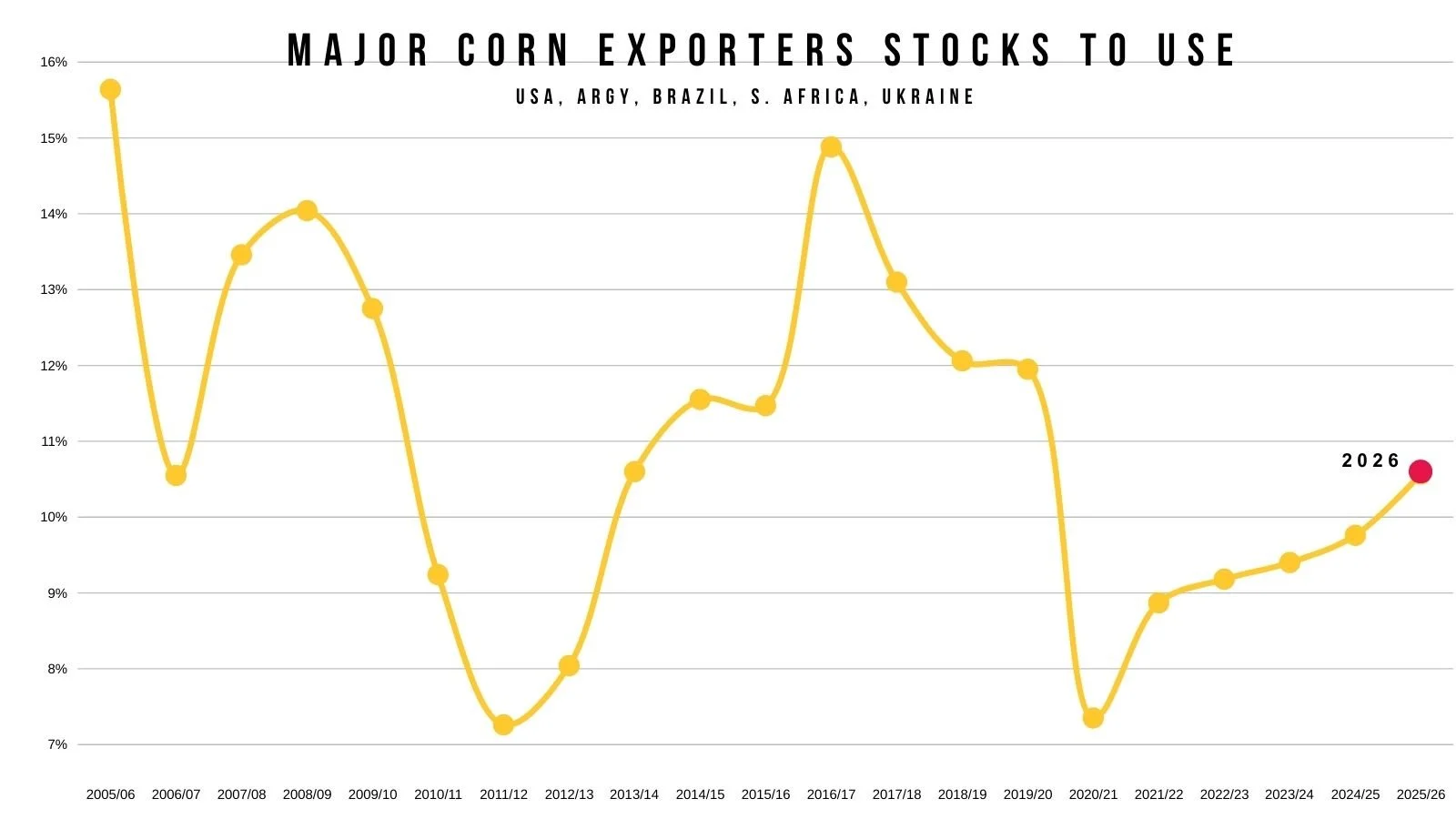

Here is the stocks to use when you combine only the top 5 major corn exporters.

This includes: the US, Argy, Brazil, South Africa, and Ukraine.

It's been on the rise since 2021.

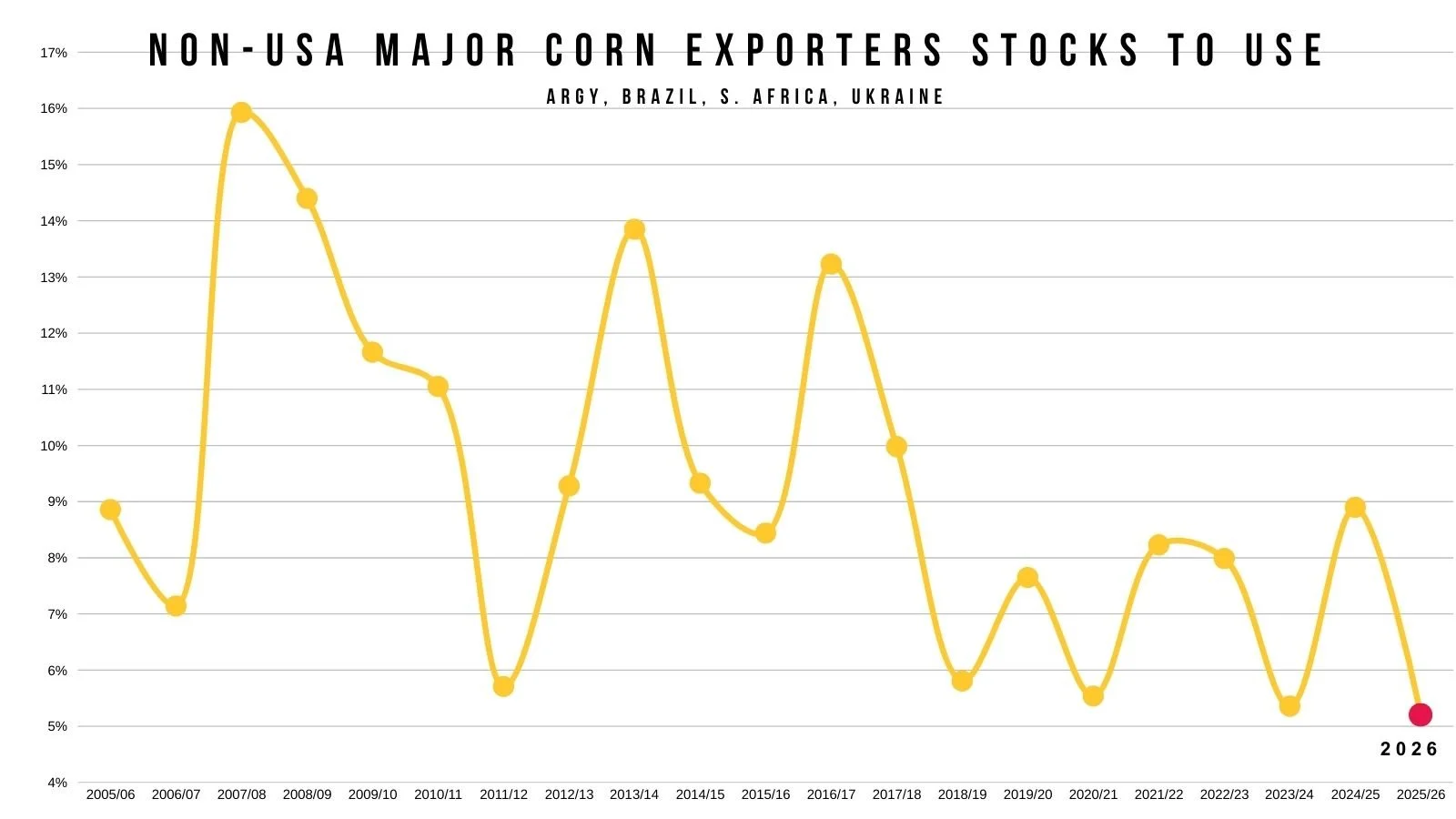

Now here is what that same chart looks like if you simply remove the US from the equation.

All of the sudden, the rest of the world's major exporters outside of the US are sitting in their tightest corn situation ever.

The world needs the US for corn. Period.

It doesn’t matter if the world is tight on corn, because the US is not.

HOWEVER, this is what makes things interesting moving forward.

Given that the rest of the world is so tight on corn, what happens if the US underperforms just for one crop?

That is how the entire story gets flipped upside down in the corn market and you run into a lot more friendly situation.

Given that the US is that important in the corn equation, all it would take is one below average crop or even just one weather scare to give this market real life.

Bottom Line:

The story in corn is not bullish. So we shouldn’t expect new highs unless we get some issues in either Brazil, the next month or so, or the US this spring or summer.

The market typically doesn’t pay a ton of attention to Brazil's 2nd corn until late February. So there is still time for that to move this market.

At the same time, I don’t think we have to completely fall apart.

Demand is amazing. The market is going to start to move on from that record supply before focusing on the upcoming crop and acres, and has likely already priced in a pretty bearish balance sheet for old crop.

What more could you possibly throw at this corn market that would make it more bearish from here? At least until we see what we are going to plant and what this growing season has in store.

I think trading sideways between $4.20 and $4.35 until planting intentions would make perfect sense. As there isn’t a catalyst to break this market higher or lower for now.

Technicals:

Range Bound?

Here is a visual of how I think this market could be range bound.

We traded in a tight range for several months last year.

We found resistance right at those support levels from spring.

It would make a lot of sense to find some resistance at our support from the last few months if we start to be range bound.

Monthly Corn

I showed this last week, but this is another reason I don’t think corn has to go drastically lower from here and stay sub $4.00

Corn's ceiling up until 2006 was $3.00.

After that, $3.00 became our new floor.

During the bear market from 2014 to 2020, our ceiling was $4.00.

So perhaps around that $4.00 range becomes our new floor.

A simple case of old resistance turning into new support. Which we've seen in the past.

The last few years we only ventured below $4.00 twice. Neither of them last very long.

March Corn

I can’t definitively say we are done going down.

That $4.20 level is the last level of support before contract lows.

I'm not against re-owning corn down here.

Despite not believing we have crazy upside, you have a clear level of invalidation if we take out last week's lows of $4.17

To the upside, I am looking to reward a move towards $4.33 to $4.36 if it were to come.

The golden retracement zone, 50-61.8% of the sell off.

We don’t have to get there, but if we do I think that's a good spot to de-risk.

That level also lines up with our old support from last year.

The rally off harvest lows topped out after clawing back 50-61.8% of the Feb highs and after running into the old support from last spring.

Soybeans

Fundamentals:

China finally met their goal that they agreed to last fall.

Export inspections this week were actually great. It was the 3rd highest of the marketing year following last week's record.

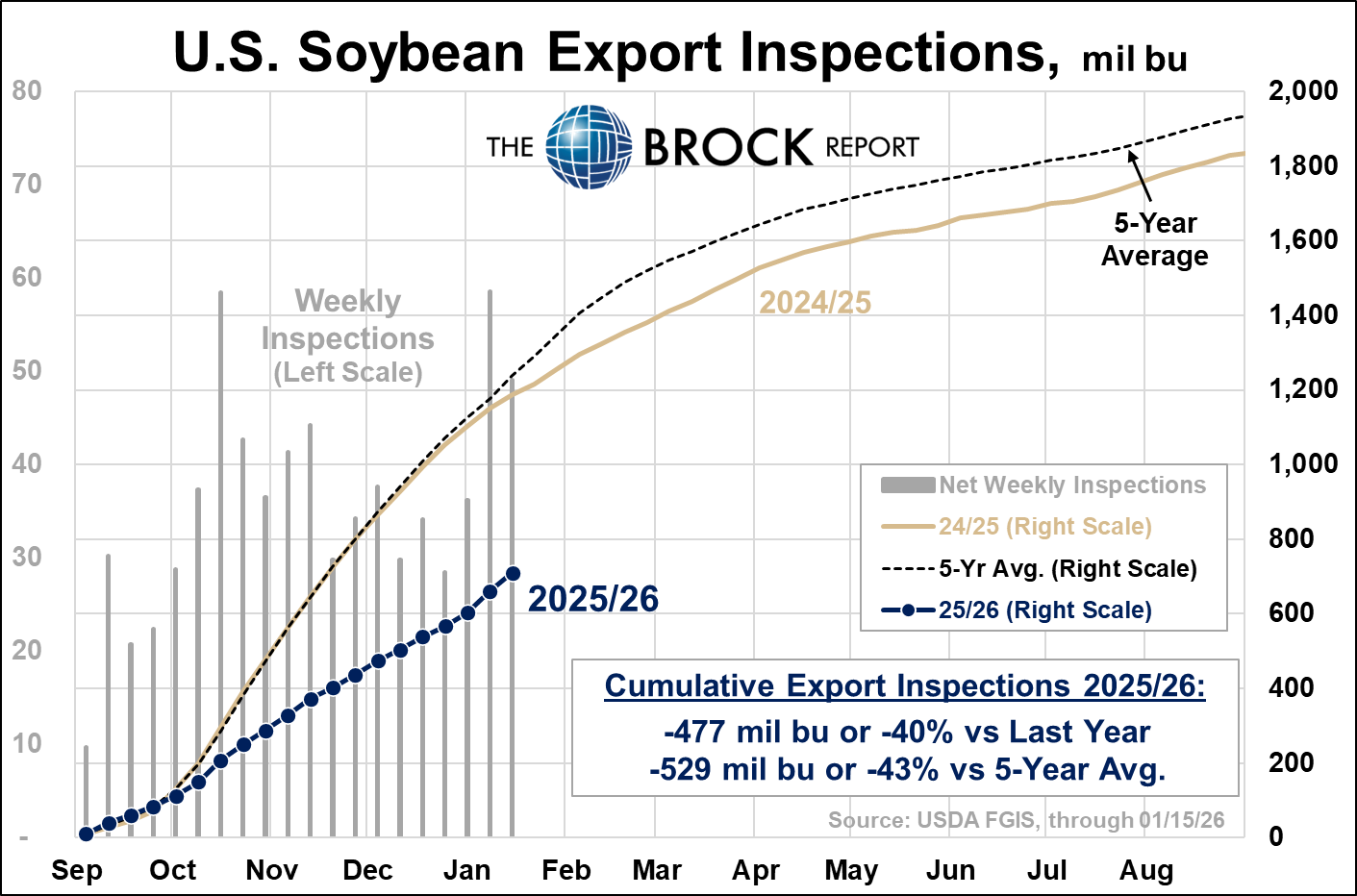

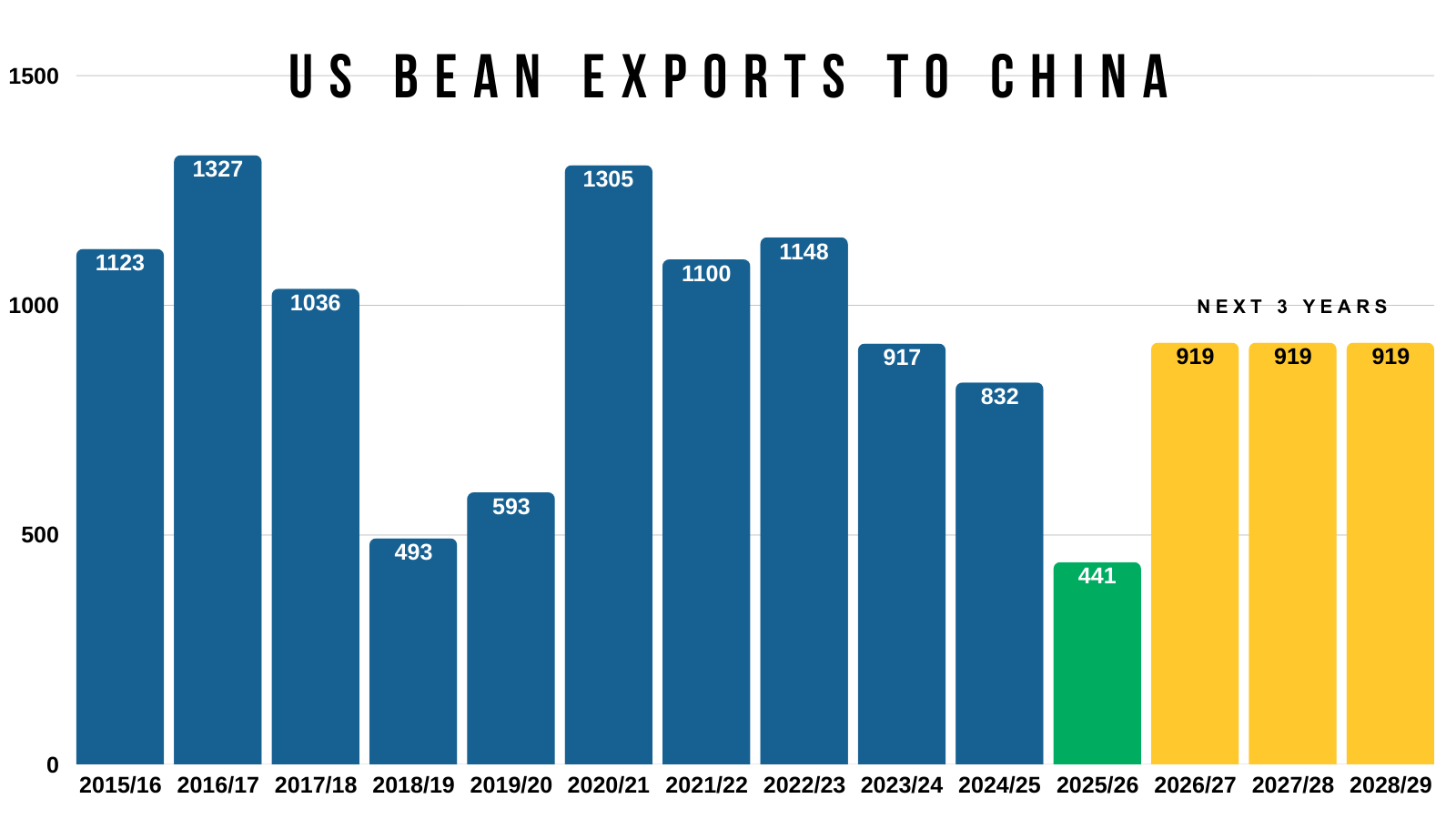

Here are 3 great charts from Dave Brock of the Brock Report show casing the export situation in soybeans.

Shout out to Dave for the charts (@drbrock37 on X).

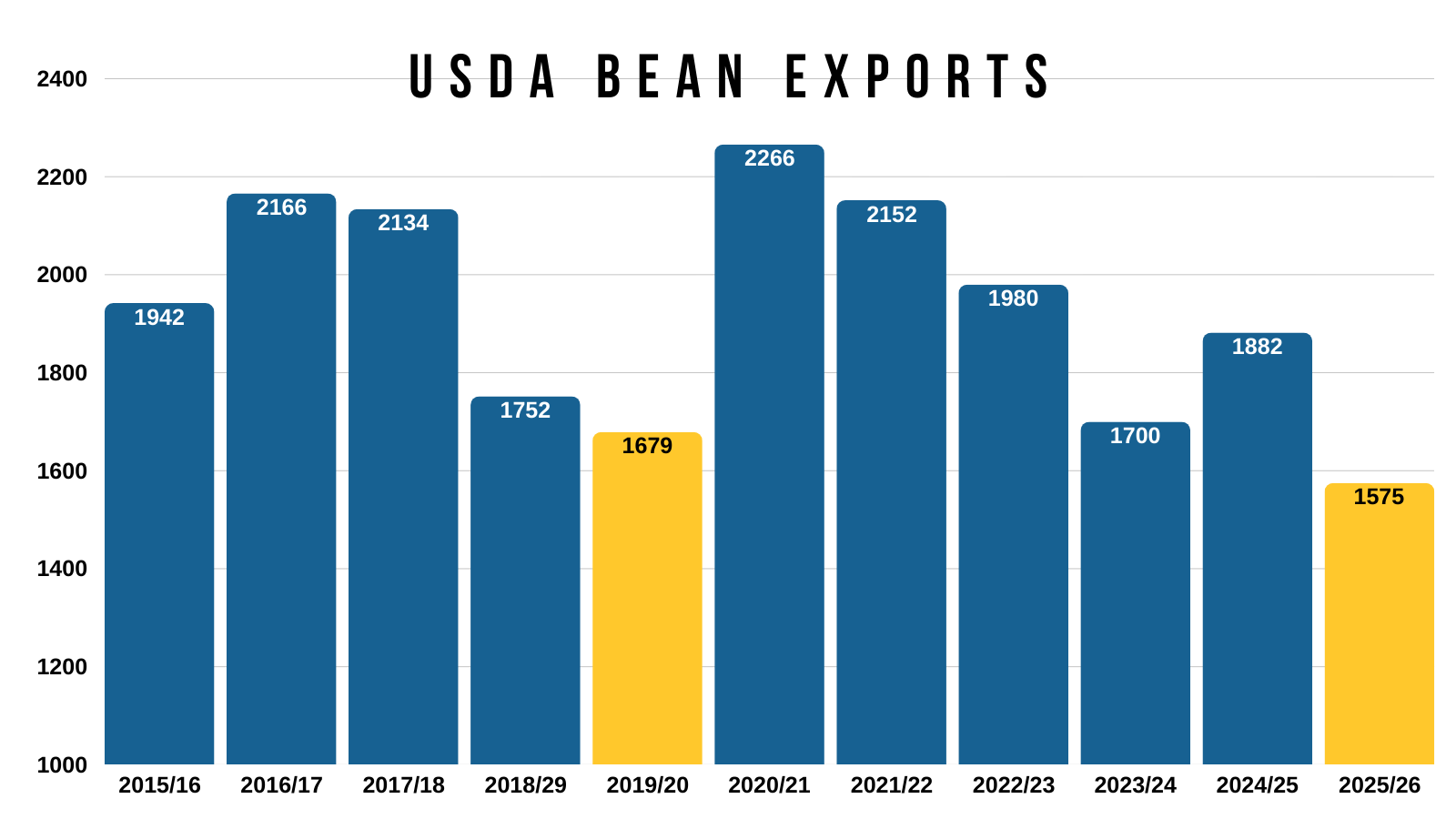

The first one is overall export inspections.

We've made some progress, but are still behind.

Currently we are -40% lower than last year.

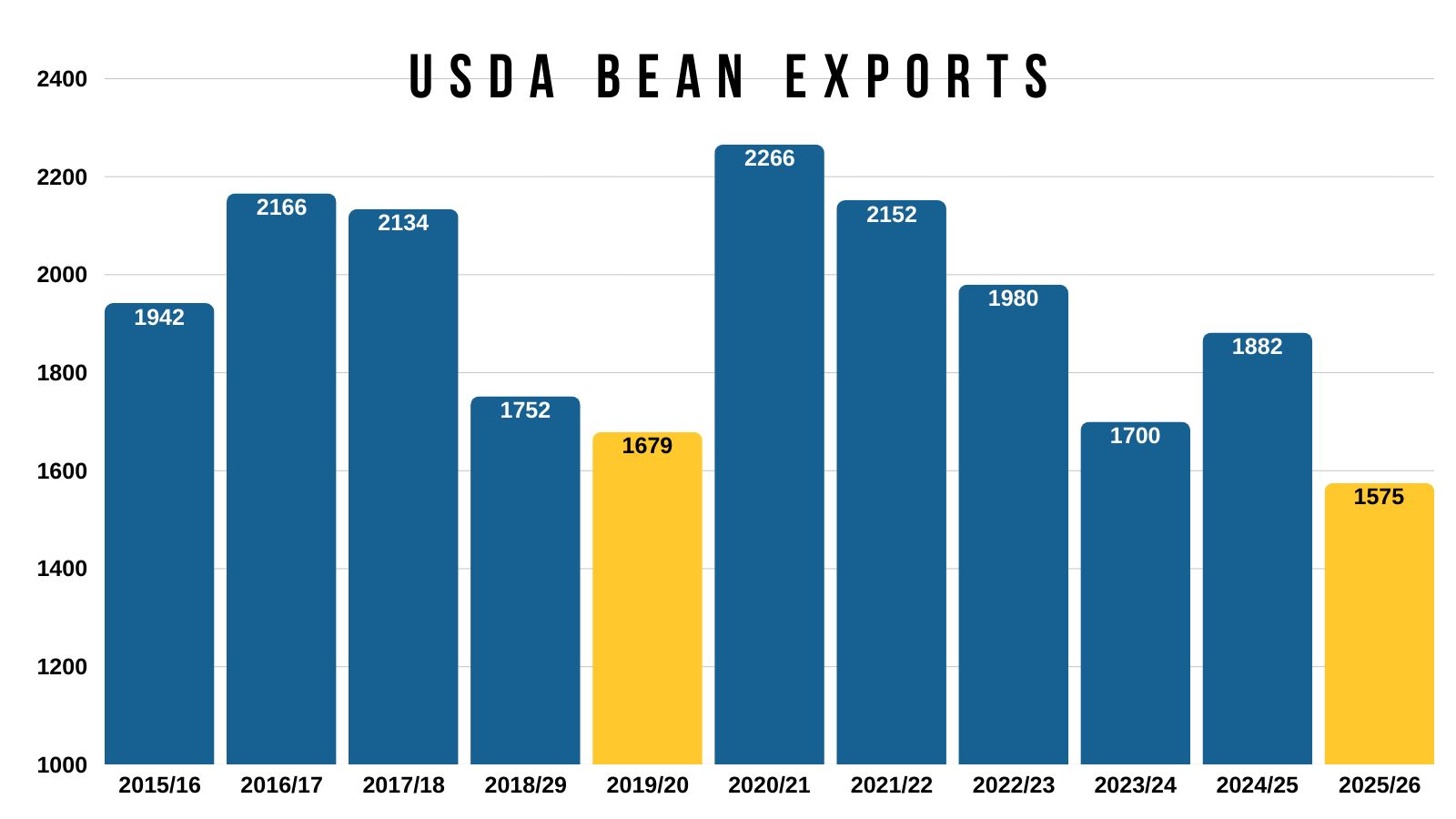

Just for reference, the USDA projects exports at some of the worst ever, but it's only expected to be down -16.5% compared to last year.

Last Year: 1,882

This Year: 1,575

Despite inspections being down -40% right now.

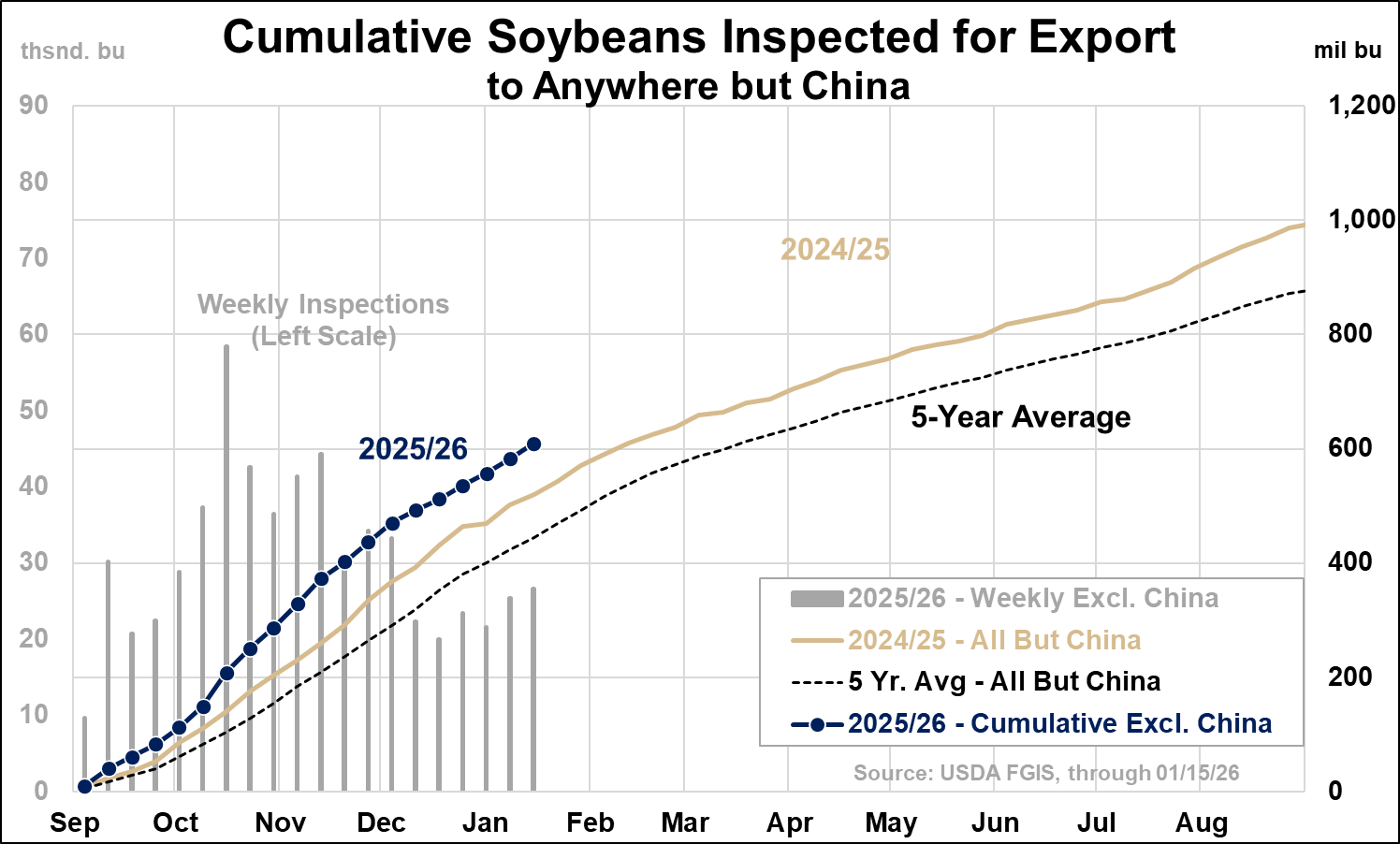

Here is the 2nd chart from Dave.

This one is export inspections to anywhere but China.

Actually pretty solid.

Above last year as well as the average.

So demand to everywhere but China has been above average.

Obviously the issue is China.

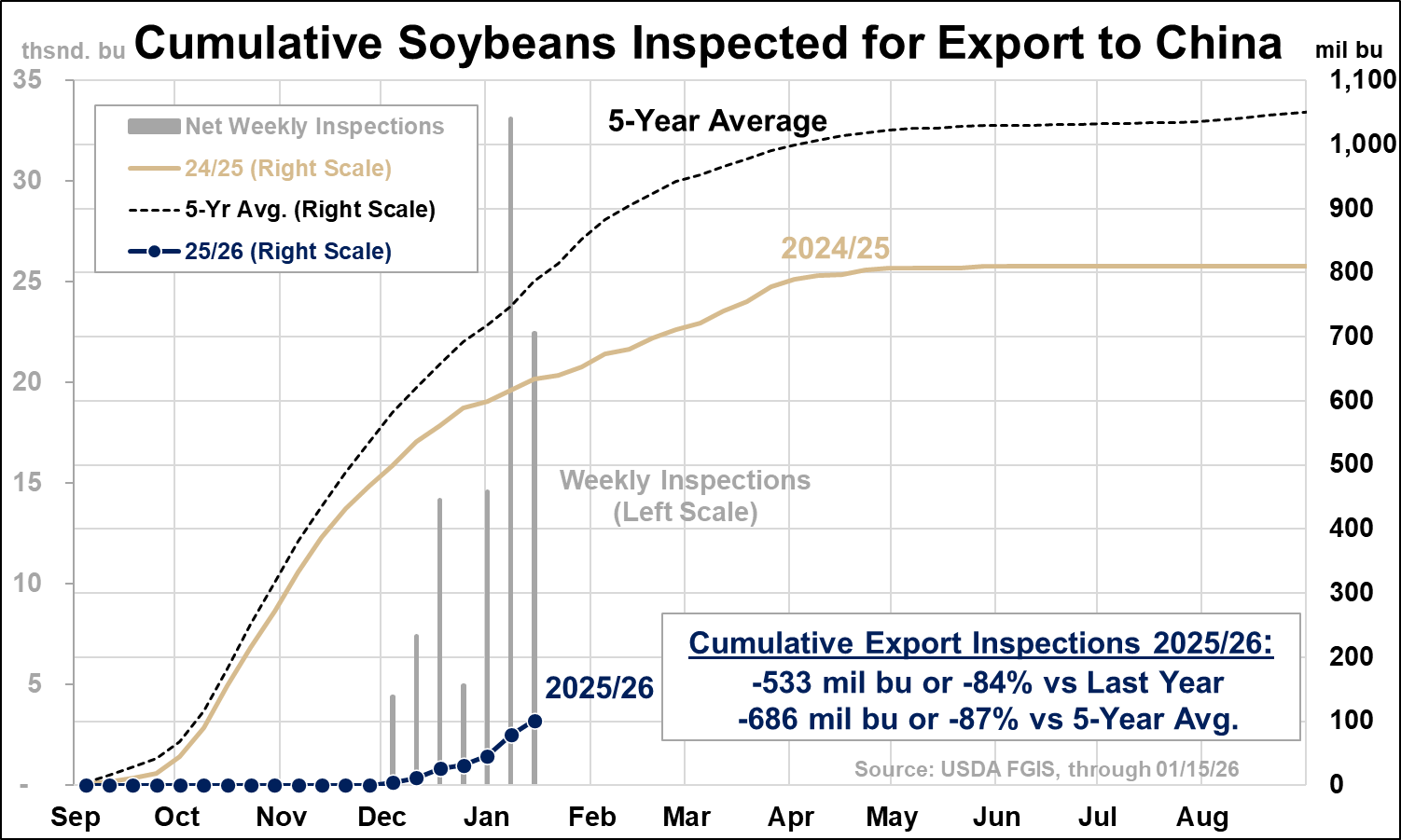

This 3rd and final chart from Dave gives a good visual on just how bad inspections to China have been.

Not even remotely close to average.

Unless China buys more than they agreed to buy, soybeans might not have a real bull story here.

Because you could definitely argue that if China does not, the USDA might be forced to lower exports once again, thus resulting in a looser carryout and balance sheet.

The risk is that China stops buying now that they've reached the target. Because it looks like that intial target won’t be enough to meet the USDA's needed pace.

Now looking to the next marketing year, China did agree to buy double what they just did.

Which realistically is only about on average with what they usually buy, but would be great to see.

Now the big question is.. will China continue to buy when Brazil's monster crop comes online soon?

Normally, you'd assume China wouldn’t buy much and opt for Brazil. Given their crop is cheaper to begin with. So they might not buy until after we get through the first few months of the Brazil supply.

On the other hand, you have to keep in mind, this is a political game. Will China simply continue to buy soybeans to please the US even though it might not logically make sense for them to do so?

A lot is riding on if China will buy more than they agreed to or not. If they continue to buy, the market will probably start to take notice. If they do not, that is the risk.

Soybeans had the potential to have a really bullish story last year.

We had the 2nd least acres in a decade.

We had an already relatively tight balance sheet.

But trade relations and poor exports ruined that potential.

The USDA is expecting exports to be worse than they were during the last trade by over 100 million bushels.

If exports would’ve been fine this year, soybeans had a real shot at going a lot higher.

Sadly, that didn’t happen. But that is a possible path higher here long term. If exports can get better from here and China lives up to the next marketing year's goal.

Bottom Line:

Overall, soybeans lack a catalyst to go a lot higher right now.

Bulls need China to step up.

We have Brazil's crop coming soon, which could lead to some hedge pressure as well.

Unlike corn, the story isn’t as close to being set in stone. There is more uncertainty.

We know corn has a record amount of supply, which is set in stone. We know corn demand is off the charts.

Soybeans on the other hand have the risk of export demand continuing to drag on the market.

It's just hard to create a massively bullish scenario without a big issue out of Brazil or additional demand out of China.

There definitely is risk in this market, but at the same time it is also hard to be overly bearish given the unknowns.

It's hard to have a definitive bias here for soybeans.

Given that the story isn’t considered "bullish", we are still looking to reward a sizable rally if it comes.

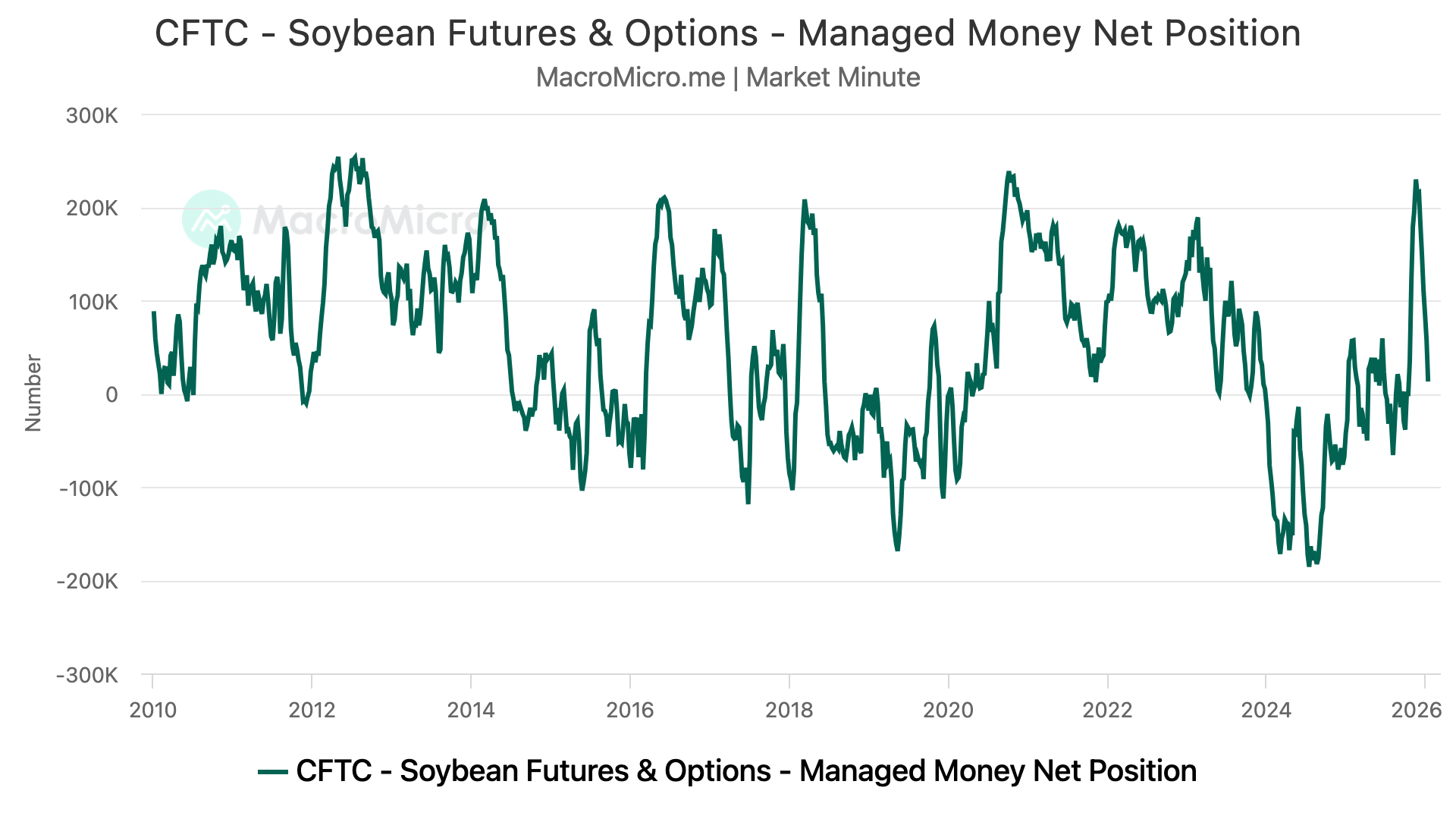

The funds have clearly given back most of their near record long position from November, but are still barely long soybeans. They aren’t short, so haven’t entirely flipped bearish yet.

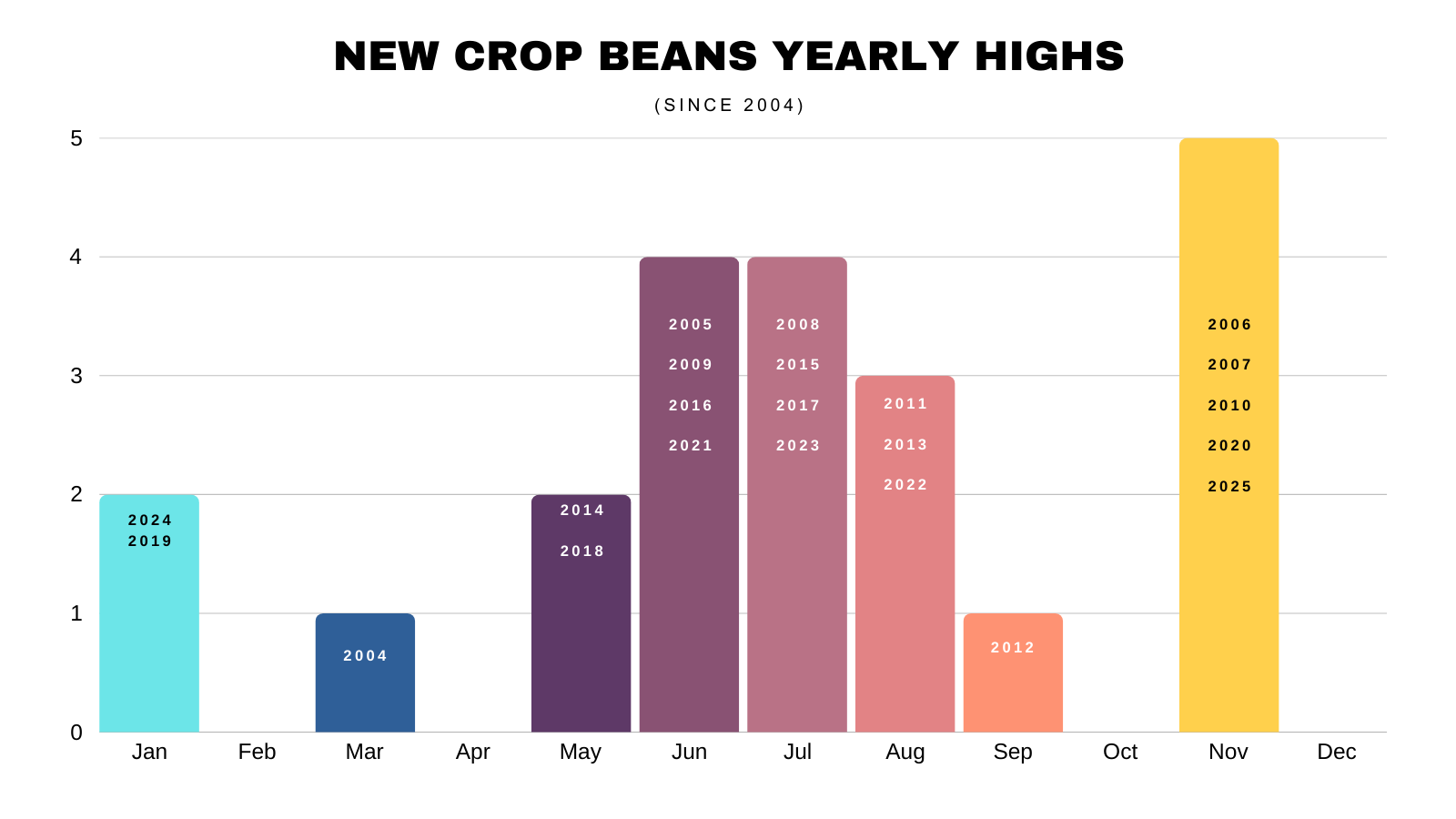

New Crop Yearly Highs

Here is the month where new crop soybeans have posted their highs for the year for every year since 2004.

The current high is $10.80 on Jan 12th.

Right now we are at $10.64 for Nov-26 beans.

This doesn’t mean we have to go take out the November highs from last year, but more often than not we don’t post our highest price for the year in January.

Since 2004, it's happened just twice. 2019 and 2024.

Technicals:

March Beans

Nice bounce the last few days.

However, we still aren’t out of the woods just yet.

We've got a series of lower highs and still remain in a clear downtrend.

We've had 3 separate mini bounces.

The 2nd one failed after reclaiming 61.8% of the 1st one.

This 3rd one has so far failed after reclaiming 61.8% of the 2nd one.

We need to break above this level to get some further upside. Until then, this is seen as just another relief bounce for now.

If we break the recent lows, the next point of interest is $10.18

IF we can break above those early January highs and post our very first higher high since October, it should result in a leg higher.

That is a big if, but if it happens, we want to reward a move towards $10.89 to $11.05

Which claws back 38.2% to 50% of the Nov highs.

Nov Beans

Here is Nov.

Still in a clear downward trend.

Want to look to reward a move towards $10.93 to $11.00 if it comes.

Which gives back 50-61.8% of the entire sell off.

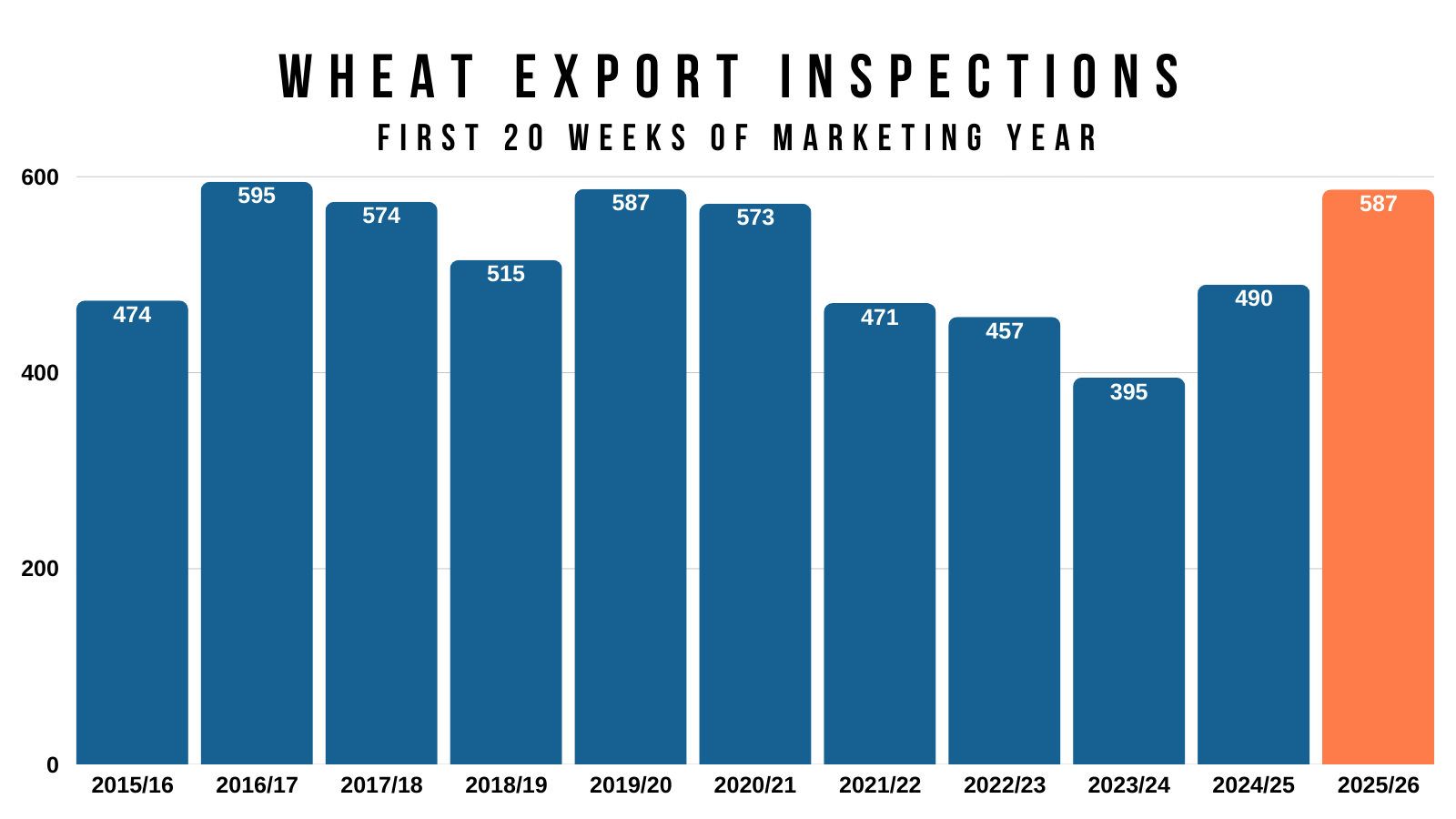

Wheat

The wheat market gave back a lot of Friday's rally.

Overall, I don’t have a ton of thoughts on wheat today.

Demand continues to be pretty strong.

It's some of the best over the last decade.

Well above what we've seen the last few years.

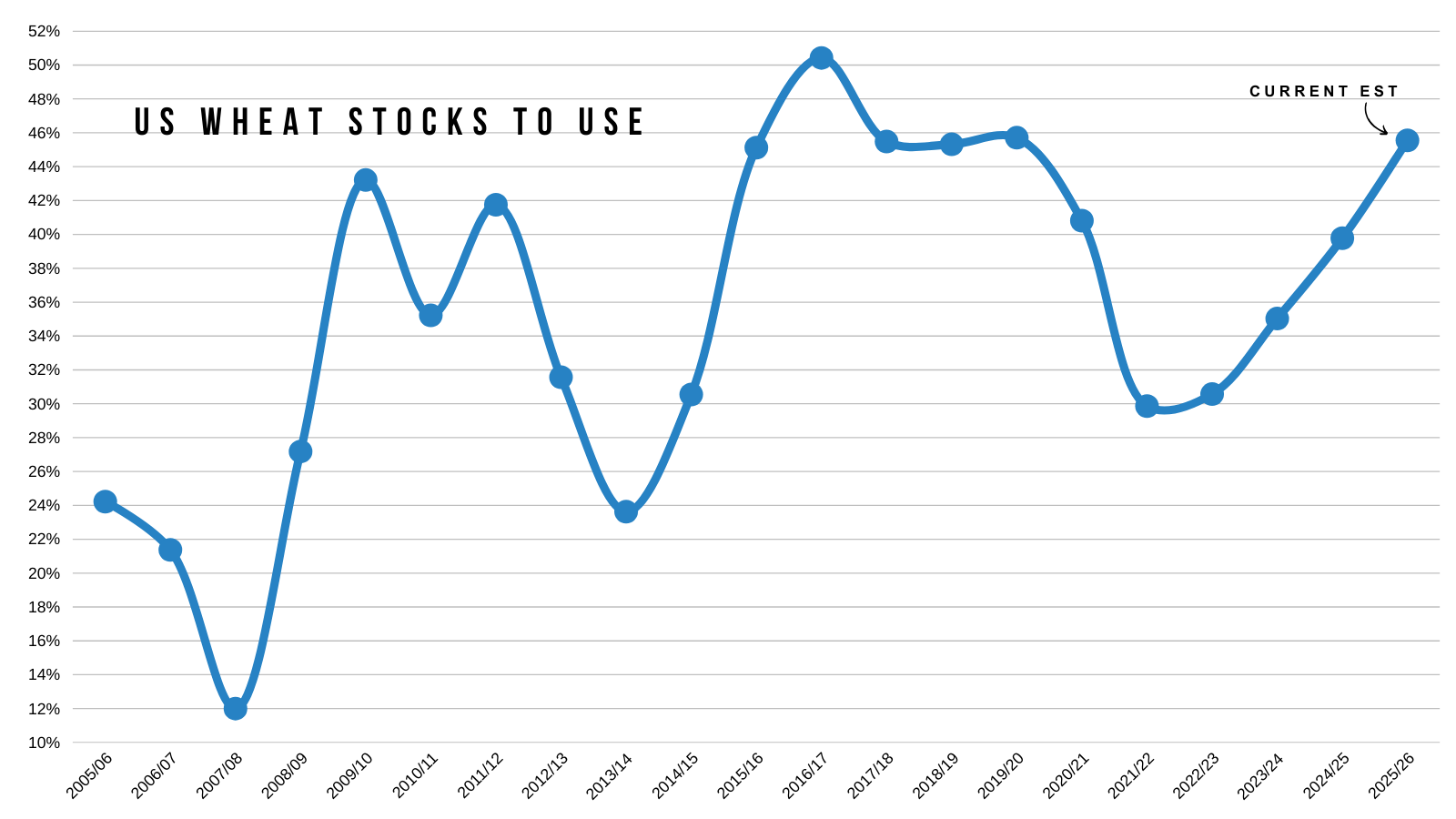

Demand isn’t the concern. Supply is.

Ample global supplies and no real weather issues anywhere is what has continued to keep a lid on this market.

There just isn’t a reason for money to get behind this market when the US situation is the most bearish in 5 years and no one globally is seeing any issues.

It'll likely take a supply scare somewhere to breathe some real life into this market.

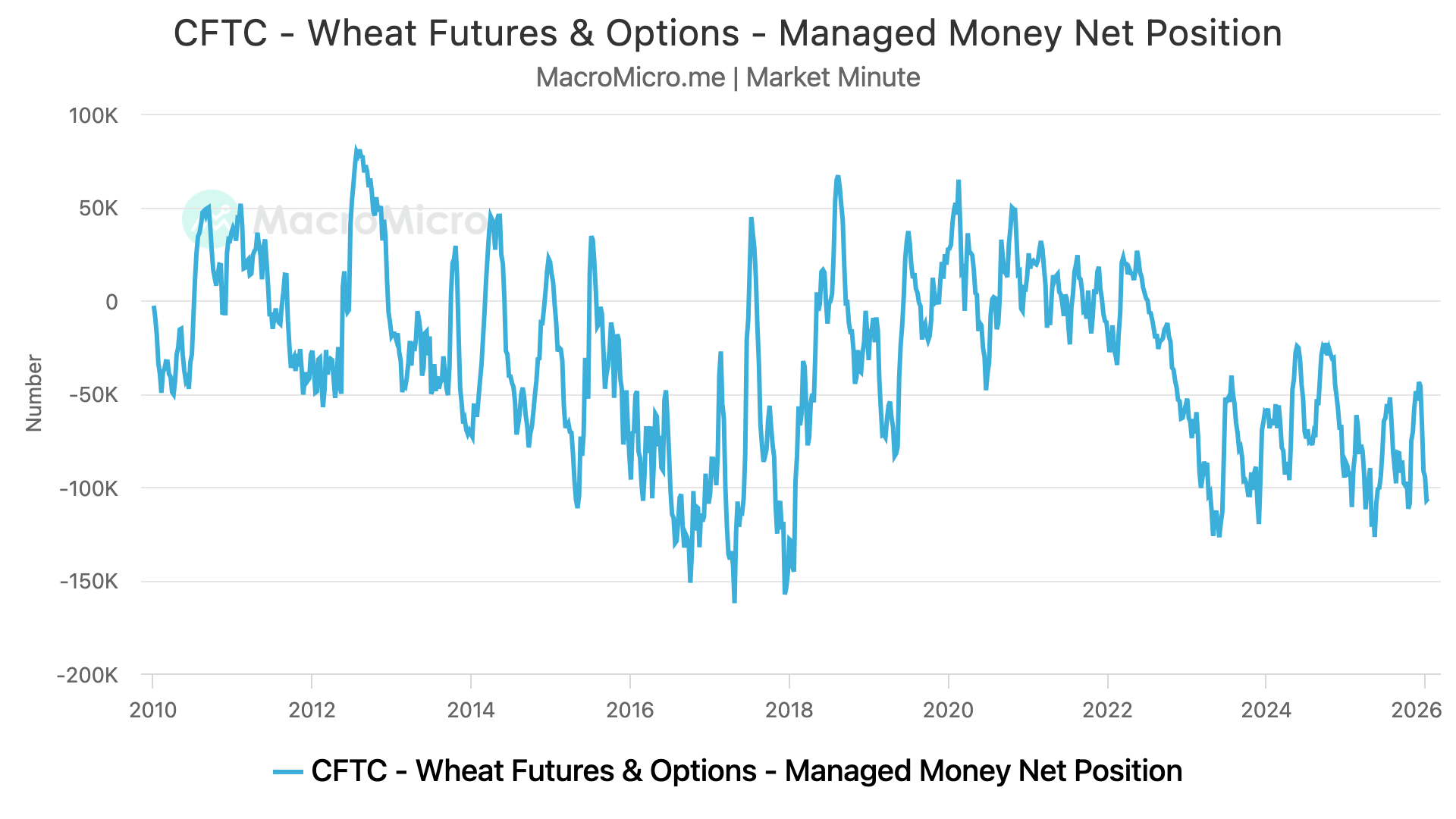

The funds are comfortable shorting wheat.

They haven’t been long wheat since 2022.

If we do ever run into a supply scare, somewhere, we should see a nice short covering rally.

Technicals:

March KC

Only going over KC today as Chicago has been sideways for weeks.

$5.35 is still the level we need to break.

If we can do that, it should spark a leg higher.

It's the 61.8% level up to those November highs.

We've now failed there several times.

We also have a wedge pattern in place, waiting for a decision to be made.

Cattle

Fundamentals:

Friday we got rumors surrounding screwworm in the US, and there have been a bunch of cases near the Texas border.

It was announced that there was not a confirmed case in the US.

However, Texas Agriculture Commissioner Sid Miller then went on national TV and said:

"Check livestock, check pets, it is going to be across the border. I hate to say it, but it's inevitable."

He pretty much said it's not "if" it happens it's "when" it happens.

It almost sounded like he is saying we might as well open the border because it will happen regardless.

Why wouldn’t this be bullish?

If this caused enough losses to the herd then it could maybe be bullish long term. No one really knows the impact it would cause physically. But markets price in the immediate factor first.

If screwworm is in the US, it could result in less exports and more supply stuck at home.

Essentially, it disrupts demand and causes chaos.

It would increase operational costs to treat it. What if we can’t transport across state lines? It makes it hard to want to buy cattle you can’t transport.

It also makes people concerned about what the impact would be on consumer demand for beef.

The funds are still long. If screwworm is found in the US, they might panic.

So it's a real concern for the cattle market.

Outside of that, yes the fundamentals are bullish. But like we've been talking about for a while, the wholesale side of things is showing signs of weakness.

Which is why we've been vocal about keeping downside protection.

I'm not saying this market can’t go higher, because it can.

But there are plenty of risks in this market sitting at these historically high levels.

It simply makes no sense to not defend these levels in some sort of manner, given all of the headlines and risks.

Cut Out Prices

Technicals:

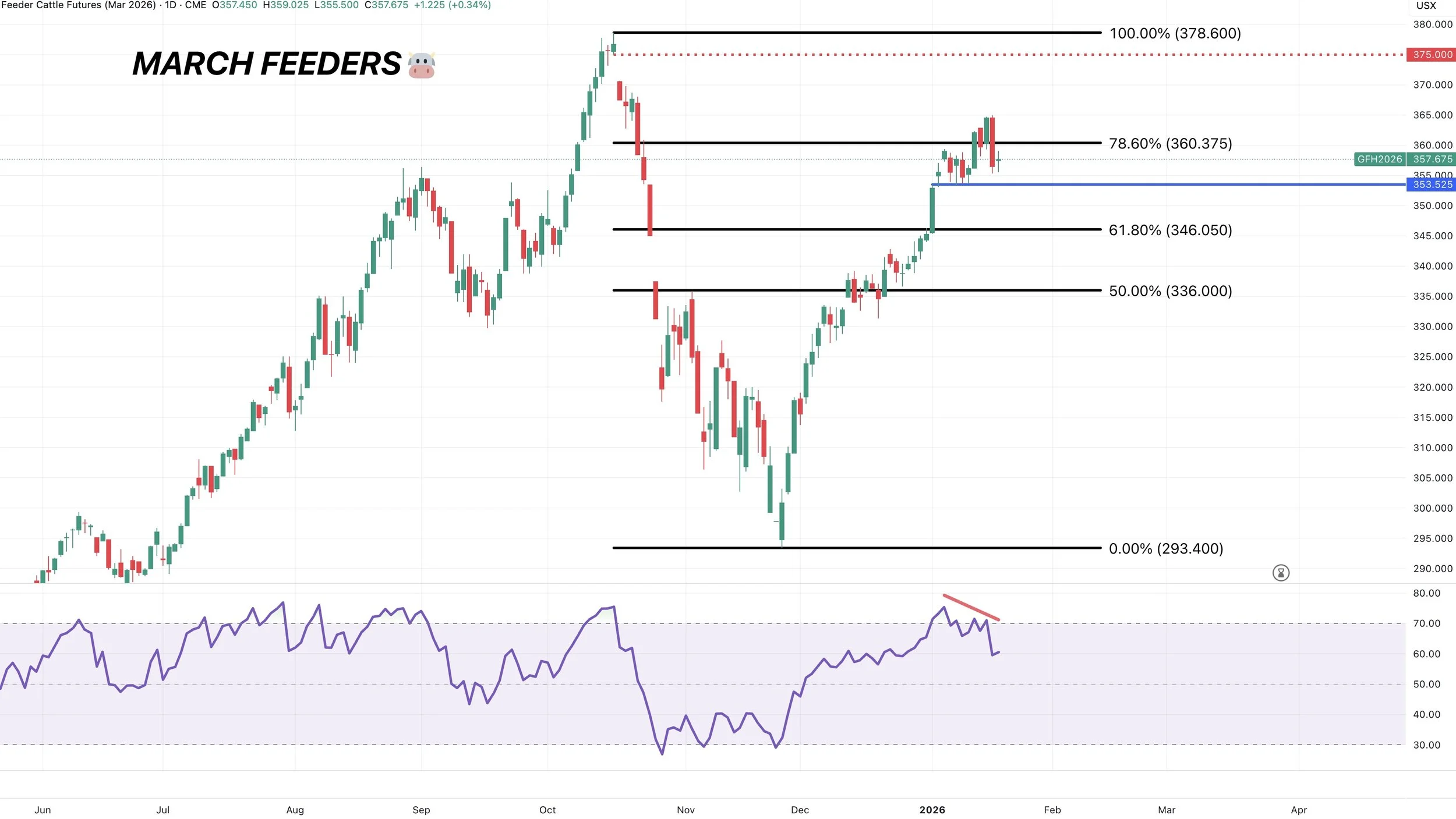

March Feeders

Last week we talked about how we were showing bearish divergence, a reason to be cautious here.

We took a hit Friday, but clearly this market is still in a bull trend.

If we take out this local support at 353.5 then it could spark a deeper leg lower.

Feb Live

Short term trend is still higher unless we close below 231. That would be the warning sign we are due for a deeper correction.

Past Sell or Protection Signals

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.