REASONING BEHIND MORNING SELL SIGNAL

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 1:25min

Beans: 5:00min

Wheat: 8:40min

Cattle: 9:40min

(I apologize for the audio quality today as I am still on the road)

Want to talk about your situation?

(605)250-3863

Lock in full access to our daily updates & signals before your free trial ends

Futures Prices Close

Overview

Grains on the weak side with cattle showing strength following their poor performance yesterday.

It was another wild day in the soybean market.

This morning soybeans were up over 25 cents. We then started to sell off around 11:00am CT and ended the day up just 3 cents.

Earlier this morning, we did have a sell signal for corn and soybeans. We will get into the reasoning behind the signal later in today's update.

Link to Signal

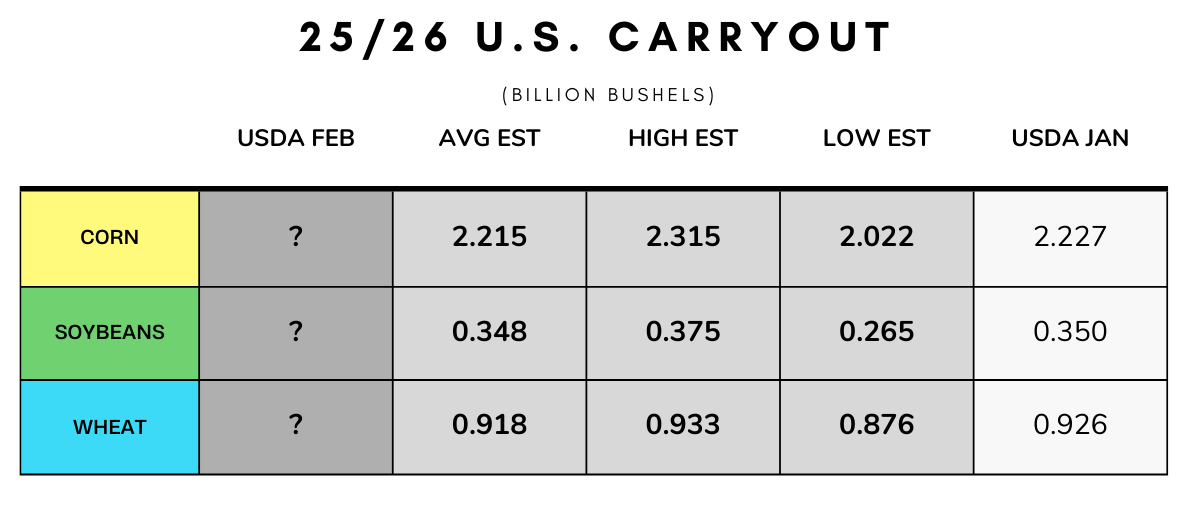

Tuesday, we do have a USDA report out.

This report is usually not a major market mover, as the only thing they play with is the demand side of the balance sheet.

The analysts are expecting slight decreases to carryout, but not expecting very big changes in this report at all.

The trade estimates have:

Corn down -12 million bu

Soybeans down -2 million bu

Wheat down -8 million bu

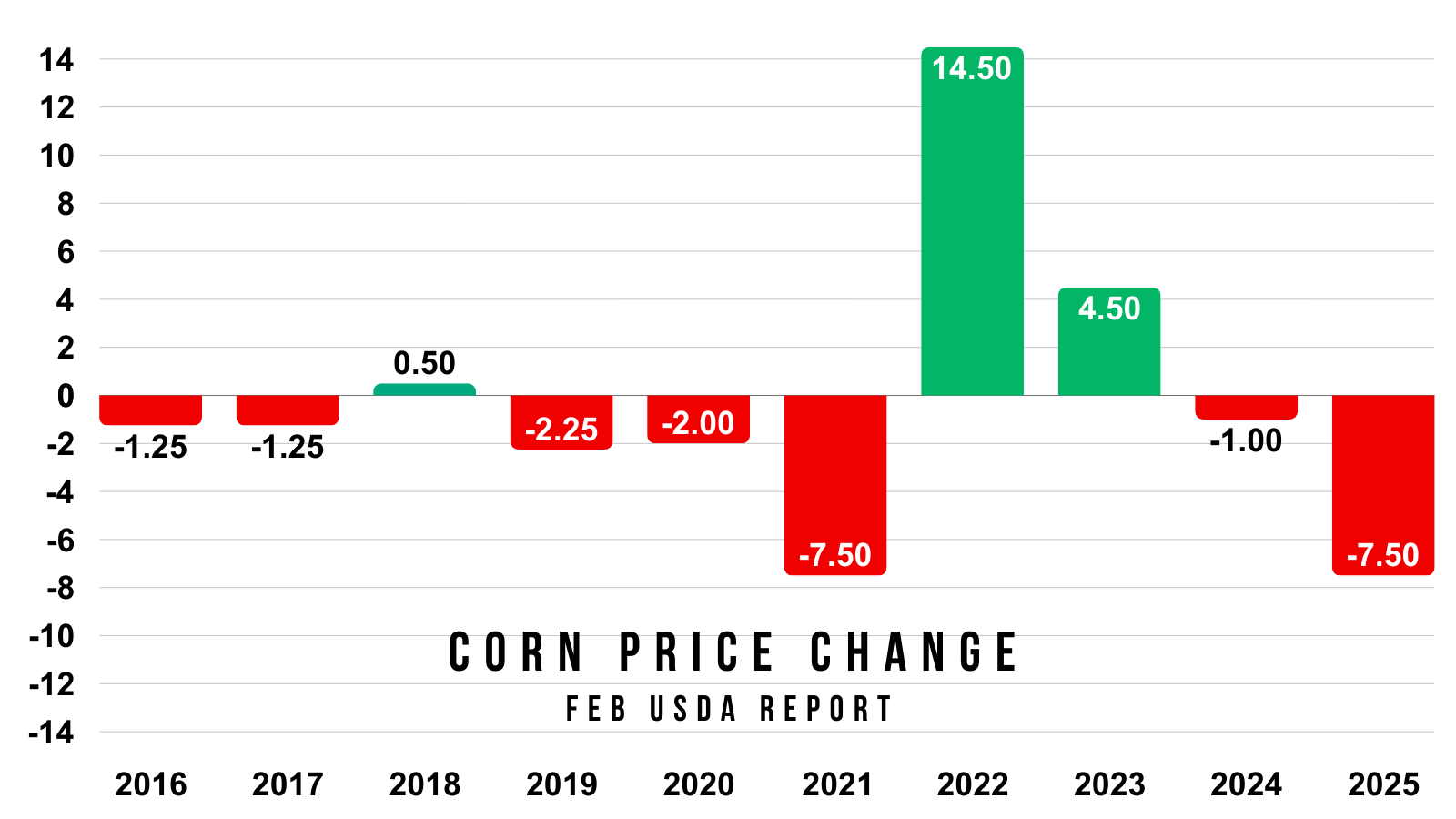

Here is the past performance from this report.

First for corn.

As you can it's typically not a big mover. The last decade has only featured one year with a double digit move.

Several years were only 1-2 cents.

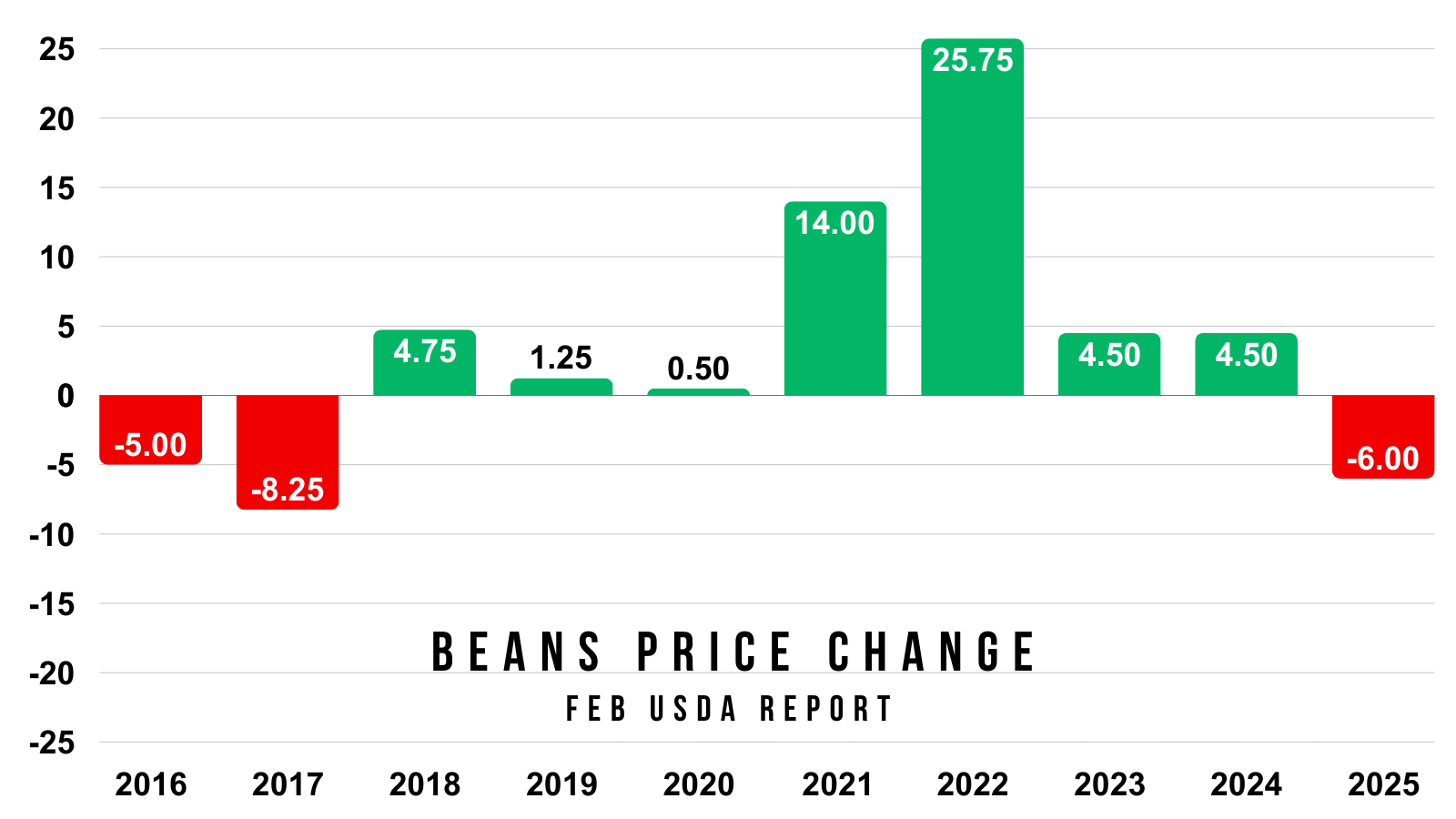

Same story with soybeans.

Only two years in the last decade featured a double digit move.

Over half had a move of 5 cents or less.

Today's Main Takeaways

Corn

Today's Sell Signal:

Let's jump right into this morning's sell signal and the reasoning behind it.

This was our first sell signal since $4.50

Why did we alert this?

The first reason was we have that USDA report on Tuesday.

Usually it's not a major market mover, but it offers risk following a decent rally.

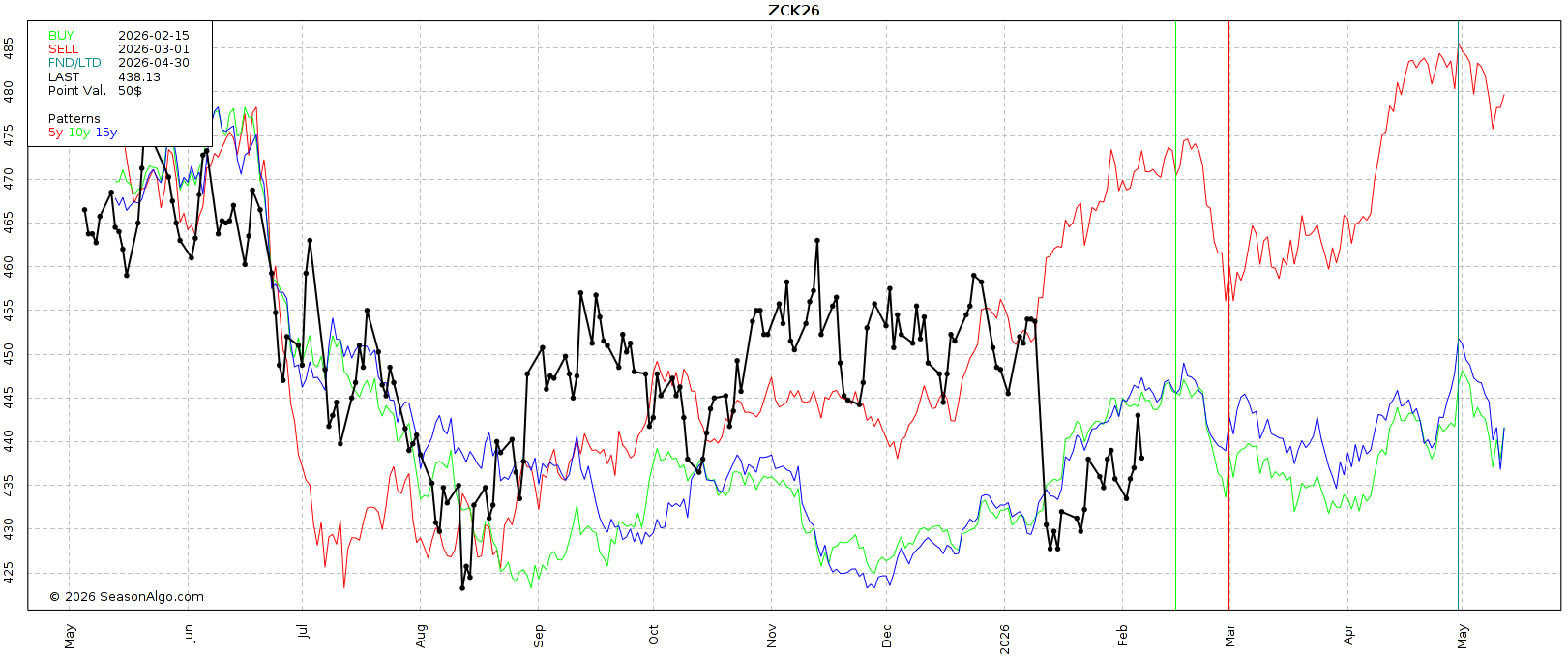

The 2nd reason was seasonality and first notice day.

Here is the seasonal pattern for corn.

In the 5 year seasonal, we sell off the last two weeks of February before finding a bottom right after first notice day (red).

In both the 10 and 15 year seasonals, we start to sell off in mid-February before finding at the end of March (blue and green).

All of them feature weakness starting in the middle of February.

Here is the data I've shown a handful of times the last week or so.

Corn has traded lower the last 8 of 11 years during the second half of February.

This especially adds risk for those who are going to have to price corn soon.

Why does this happen?

A lot of it is first notice day. Basis contracts have to be priced.

Big ag knows this, so we don’t want to let them front run us.

This year I am sure there are plenty of basis contracts out there. As many were probably waiting for a friendly January USDA report that we didn't get.

Then this is also the time of year where a lot of guys simply need cash flow.

Let's take a look at the last few years and some examples.

Last Year:

Our high was Feb 18th.

It was a straight sell off until the first few days of March.

After first notice day, this market found some footing.

2024:

In 2024 we were in a free fall all year long, but we found some life right before first notice day.

2023:

We topped out in the middle of February before finding our footing the first week in March after first notice day.

So this definitely adds some caution and played a role in this morning's signal.

The last reason was simply the technicals.

We were approaching key resistance in March corn.

We nearly clawed back 50% of the entire November highs.

That same level was our old key support before we fell apart.

The rally off harvest lows topped after clawing back 50% of the Feb highs and testing old key support from spring.

Like I've talked about for weeks.

It makes sense that corn would simply be stuck in a range bound range until we get fresh data and planting intentions etc.

We don’t have a reason to break out of the range, we have a record crop.

We don’t have a reason to completely fall apart, we have record demand.

So now what?

Corn needs to hold $4.24 to keep the bias remaining higher.

If we break below, it favors us going to test the lows.

That is the golden fib and most common level for a correction to end.

It's also our recent lows.

What about new crop?

Today's signal was geared more towards old crop.

Typically we like waiting for insurance pricing.

However, if you are someone who doesn’t have storage etc we said this is not the worst spot to start looking at some new crop protection or sales.

We clawed back 61.8% of the November highs.

The most common level for a bounce to fail.

Not only that, we are testing old support, which often turns into new resistance.

So seeing us struggle here would not come as a surprise at all.

Soybeans

Fundamentals:

Soybeans have been rallying off the back of Trump saying China is "considering" buying more soybeans.

Now IF that word "considering" turns into "confirmed," then it is going to be extremely bullish for soybeans.

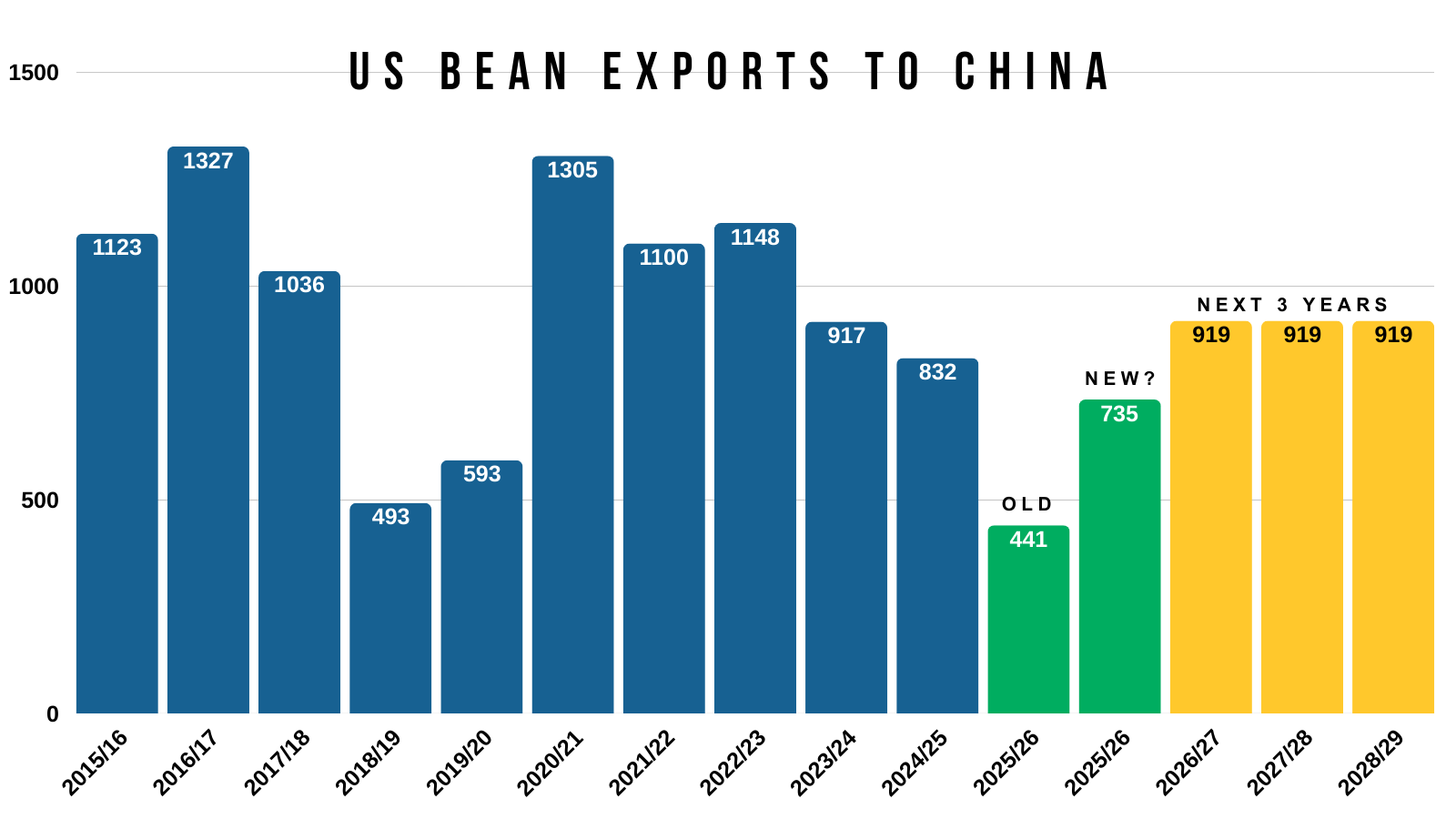

Orginally they agreed to buy 12 MMT = 441 million bu

Now they are considering 20 MMT = 735 million bu

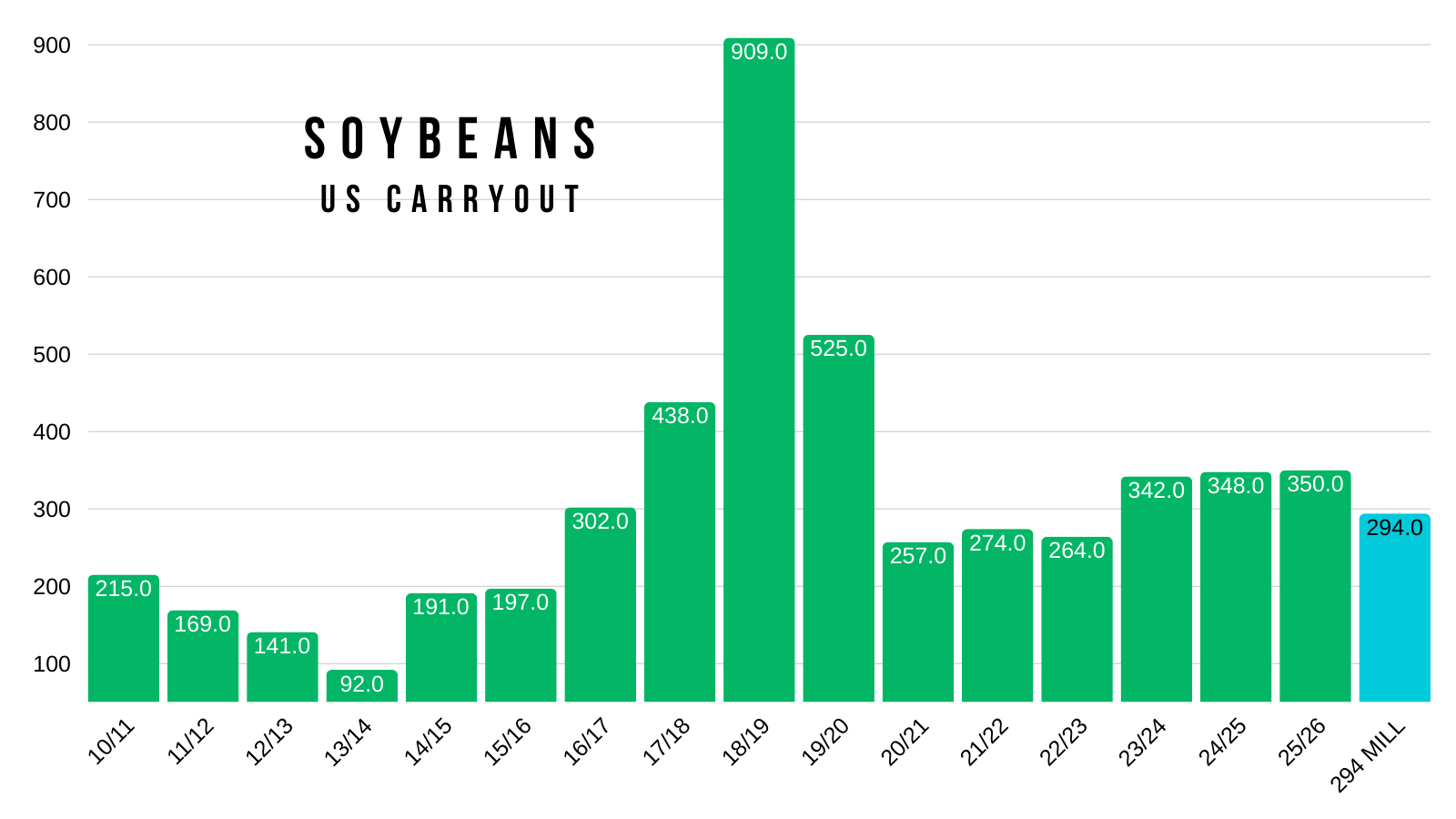

The difference = 294 million bu

IF that came to frution.. it would be massive.

Because that is pretty much the size of our entire US soybean carryout.

Which is 350 million bushels.

However, it's not quiet that simple.

Yes, the soybean balance sheet has the "potential" to get extremely tight, but it is not going to just vanish.

Demand is going to have to be rationed if China does buy this much.

Now, often times prices do need to go higher to incentivize lower demand. Which is why the market is now pricing in this extra potential demand.

But China buying our beans doesn’t change the global balance sheet. The soybeans aren’t disappearing, they are simply changing hands.

So we would need to lose out on non-China business and probably start importing soybeans from Brazil to prevent our carryout from getting too tight.

It's a hard situation to predict.

You could definitely argue that logistically, it doesn’t make any sense for it happen.

Brazil's beans are way cheaper. China probably doesn’t have room for these soybeans to begin with.

On the other hand, this is a political chess match.

What will China do to keep the US trade relations happy? Are soybeans just a small piece to a larger puzzle?

If it's a political move, you can't say that it can’t happen. Because it can. At the same time.. you can’t really count on it happening either.

Regardless, we felt like this rally needed to be rewarded.

Which is why we alerted a sell signal this morning when soybeans were up over +20 cents along with our corn signal.

Link to Signal

These Trump tweets do often tend to receive a buy the rumor sell the fact treatment. More times than not over the last year, they have been opportunities to reward.

Because for now, this entire rally was based on China "considering" buying more soybeans.

So it just feels like a risk following a phenomenal rally.

If it happens, yes it's going to be very very bullish moving forward. But China probably isn’t going to step in and buy right away either. They are still focused on Brazil's crop, and we have the Chinese New Year.

Take the November rally for instance.

We rallied hard on China agreeing to buy.

They did not have a single bushel of soybeans on the books.

The very first flash sale was announced on November 18th.

We posted our highs November 18th.

The same exact day as that first flash sale.

So when they finally started to buy, we went lower.

The technicals were the other reason for the signal this morning.

March, May, and July soybeans were all approaching our secondary targets. The 78.6% retracment levels up to the November highs.

Following the sell signal on Tuesday morning after hitting the first targets in the golden zone.

Today they all ultimately ended up failing to close above the 61.8% level.

Struggling in the golden zone we talked about earlier this week. Which is where many bounces often tend to fail.

So the charts do not look very hot following today's close.

All of them were up over +20 cents at one point, all of them ended the day only up +2-3 cents.

What about new crop?

Today's signal was not for new crop.

As front month beans have led this move higher while November beans have lagged behind.

As they continue to struggle in the golden zone and where we issued that sell signal on Tuesday.

Wheat

Technicals:

March KC

Just going over the charts today.

So far we're finding life right in the golden zone retracements of the recent bounce.

This area is also our old resistance.

This is the level we need to hold. Failure to hold opens the door back into the old range.

To the upside, if we can take out those November highs it opens the door higher.

If we can do so, we are eyeing the golden zone up to those June highs to take risk off the table.

March Chicago

The recent rally failed at the 61.8% retracement up to the Nov highs (blue box).

Break above that level and it should result in further upside.

To the downside, like KC, we are at a critical spot. The golden zone retracement levels (red box).

Need to bounce here to prevent us from going back to the old range.

Cattle

Fundamentals:

Today Trump did sign an executive order to quadruple beef imports from Argentina.

So this led to the cattle market giving back a good portion of the early gains today.

This is one of those moves that is aimed at increasing supply to help domestically lower beef prices.

I still view this market as having a ton of headline risk.

So we want to stay protected, as headlines are unpredictable.

One screwworm headline could change things fast.

Technicals:

April Live

Tuesday we left a gravestone doji which is often a reveral candle. We then followed it up with weakness yesterday.

We are still showing bearish RSI divergence.

So I'm still using caution in this market up here.

March Feeders

We are still in a clear uptrend.

However, we are still showing major bearish divergence on the RSI.

This doesn’t mean cattle has to top tomorrow. It doesn’t mean we can’t go post new highs.

But it tells us that momentum is getting weak.

So it does feel like this market might need an outside catalyst if it wants to go soar beyond those all-time highs.

Past Sell or Protection Signals

Feb 6th: 🌽 🌱

Corn & soybean sell signal & hedge alert.

Feb 4th: 🌱

Soybean sell signal & hedge alert.

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.