USDA & SOYBEAN EXPORTS DISAPPOINTS

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 1:35min

Beans: 8:20min

Wheat: 12:40min

Cattle: 13:45min

Want to talk about your situation?

(605)250-3863

Futures Prices Close

Overview

Grains hammered across the board following the first USDA report in 2 months.

Overall there wasn’t any major changes on the USDA report.

Bulls were disappointed we didn’t see bigger changes.

I'd say the report was bearish for corn, neutral to slightly friendly for beans, and bearish for wheat.

For soybeans, the market was more disappointed by the lack of China purchases in the export sales data which we will touch on later in today's update.

We did not receive the updated commitment of traders data like many thought we would.

Let's dive into the USDA numbers.

First for yield, they opted to only lower corn yield by -0.7 bpa to 186.

The trade was looking for 184.

They dropped soybeans by -0.5 to 53. The trade was looking for 53.1 so the numbers came in just below the estimates.

Next for carryout.

Corn came in slightly higher than the estimates. Coming in at 2.154 billion bushels. Due to the not as large of drop in yield.

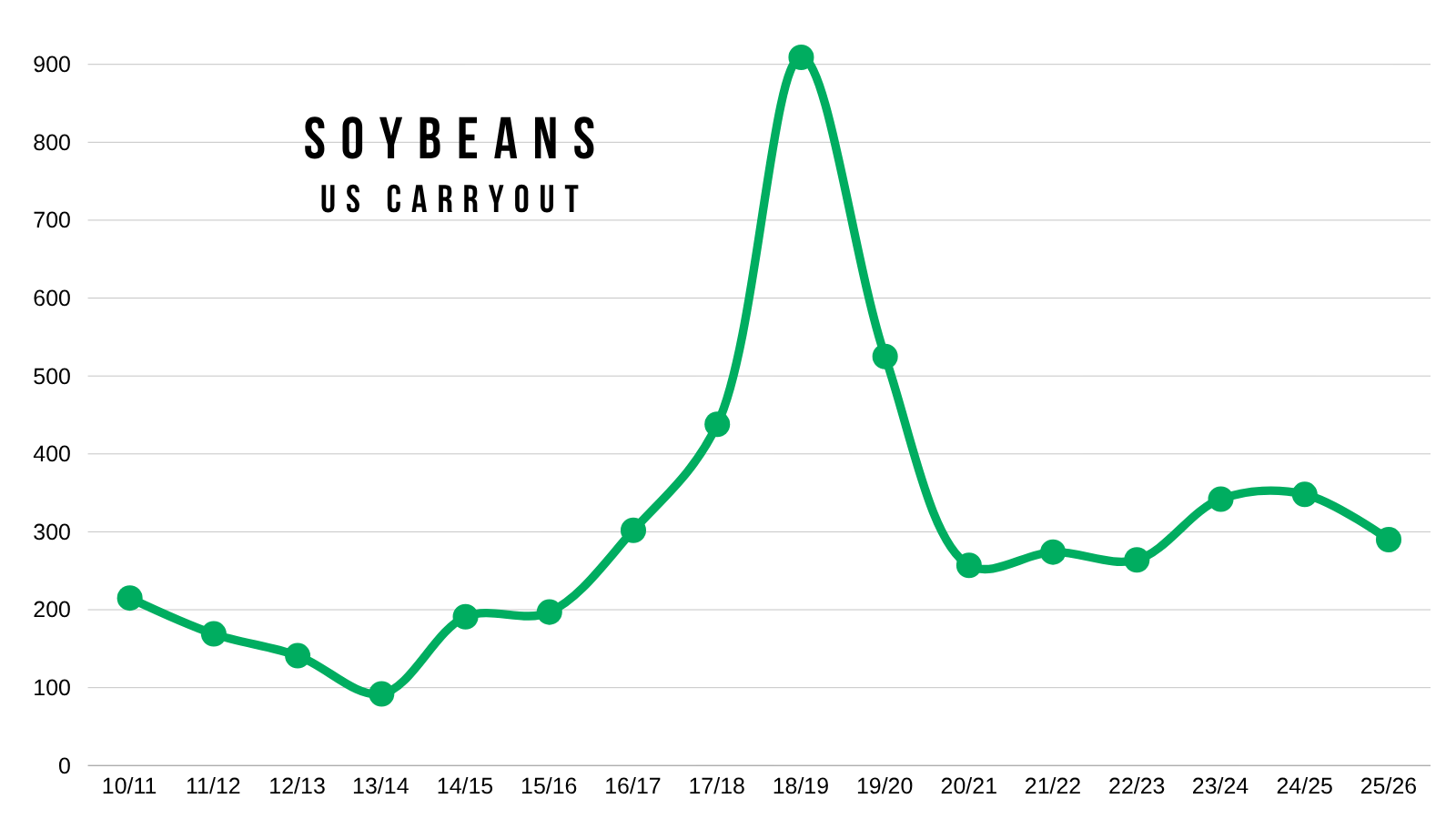

Soybeans came in at 290 million bushels. Which was less than last month's 300 million and the 304 million trade estimates.

Wheat surprised high. Coming in at 901 million bushels. Which was well above September's 844 and the estimates of 867 million.

World corn and soybeans both actually surprised low.

Wheat on the other hand surprised high. Adding even more bearish tone for wheat on this report.

Today's Main Takeaways

Corn

Fundamentals:

So what was all changed for corn?

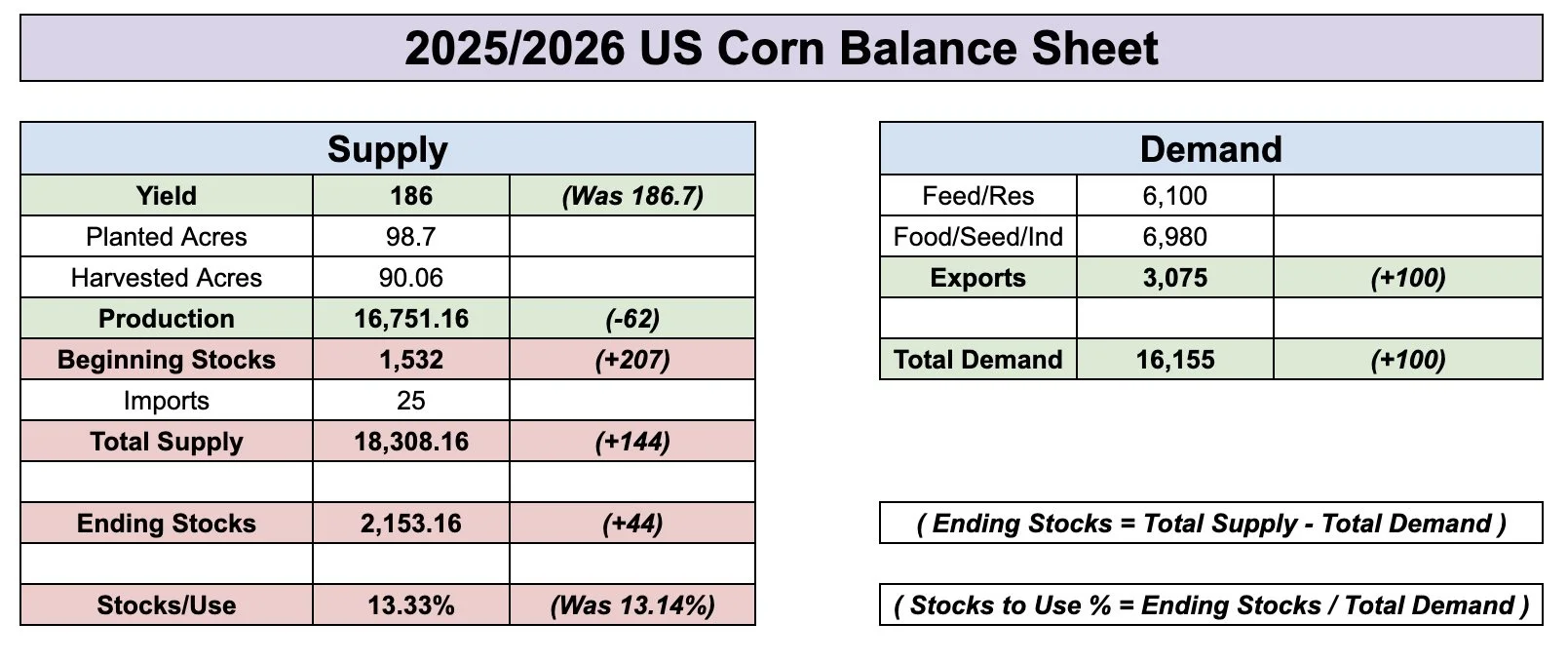

Here is the balance sheet along with the changes the USDA made from Sep.

Green highlights a bullish change. Red highlights a bearish change.

They dropped yield by -0.7 bpa which resulted in production falling by a little over -60 million bushels.

However, you have to remember that in the quarterly stocks report at the end of Sep the USDA dropped old crop feed demand by nearly -200 million bushels.

So we automatically had +207 million bushels of supply added to the new crop balance sheet in the form of beginning stocks.

For a total supply increase of +144 million bushels.

(+207 beginning stocks - 61 production = +144)

However, the USDA also raised our exports by +100 million bushels.

Which led to our carryout only increasing by a total of +44 million.

(+144 supply - 100 demand = +44 total)

In case you forgot, here is the changes that were made to the old crop balance sheet in that quarterly stocks report.

This is the reason for that extra +207 million bushels of supply on the new crop beginning stocks.

They slightly raised acres which bumped production by +25 million.

They dropped feed and residual demand by -182 million.

For a net change of +207 on the old crop carryout.

Bulls were disappointed we didn’t see a larger drop in yield.

But on the bright side, this report was not as bearish as it could've been.

How so?

The USDA did not drop feed and residual demand like most thought they could and should.

If the USDA would’ve dropped yield more, I am sure they would’ve offset some of that supply loss by dropping feed demand.

So essentially, by them leaving yield this high and not lowering feed demand, it gives them more wiggle room later on to balance the balance sheet.

Because there is still a real arguement to be made that feed demand is too high.

I don’t think yield is close to 186. But the January report just became extremely important.

Here is a visual of the Nov and Jan yield changes.

Since 2014, we have seen a Nov yield cut 5 times.

In 4 of those 5 years, the USDA went on to lower yield in the January report by more than they did in the Nov report.

Average Nov Cut: -1.46

Average Jan Cut: -3.12

However, the issue here is that -3.80 is the largest yield cut we've seen in the Jan report in the last decade.

Which would only put us at 182.2 bpa. Not sub 180.

The chance for low 180's or even sub 180 is still there. But it just became a lot less likely given that we haven’t seen a cut that large in at least a decade.

If carryout stays where the USDA just pegged it at.

A 2.15 billion bushel carryout is bearish.

It would be the highest since 2019/20.

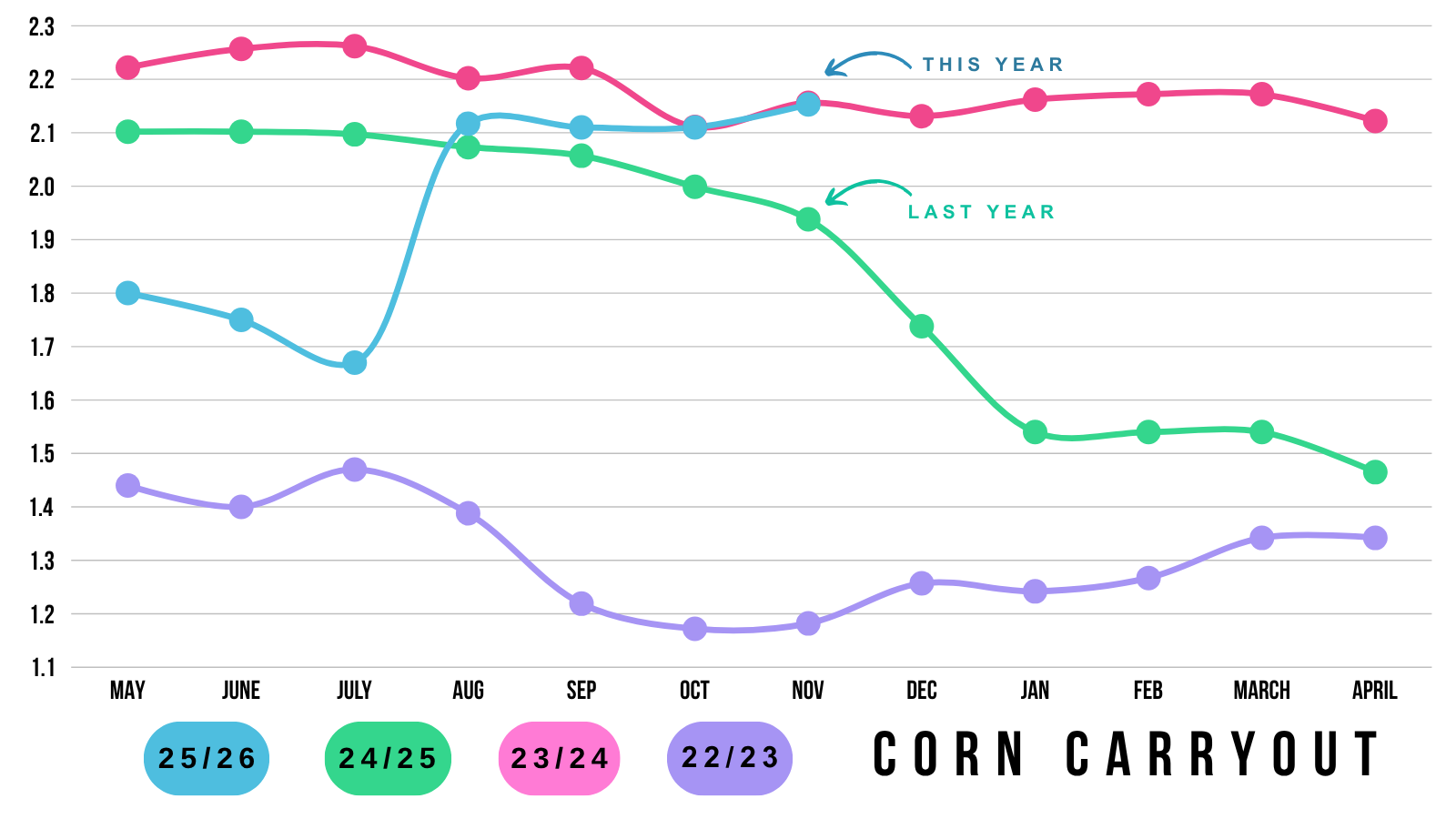

Here is a month by month change of carryout the last few years.

The current carryout is about exactly where it was during 2023 at this same time.

I am not bearish on corn.

But given the massive supply and record acres, it is hard to get extremely bullish on corn unless yield actually winds up closer to 180 or perhaps lower.

Because even if yield fell down to 175 we are still looking at record production simply due to the record acres.

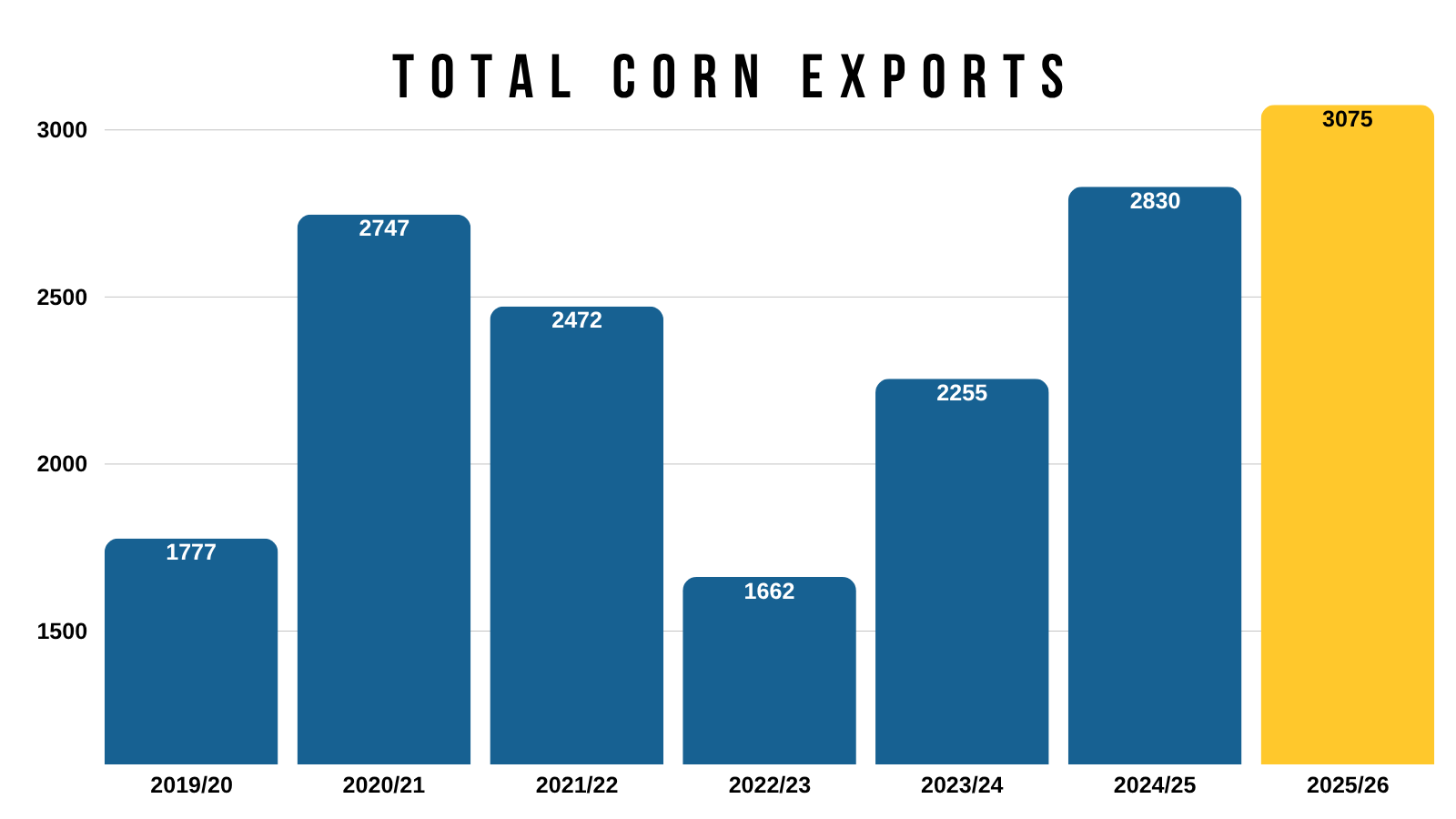

On the other hand, export demand is the greatest it has ever been.

Export demand doesn’t appear to be slowing down.

So that should help keep a floor under this market and prevents me from being too bearish on corn especially at these levels.

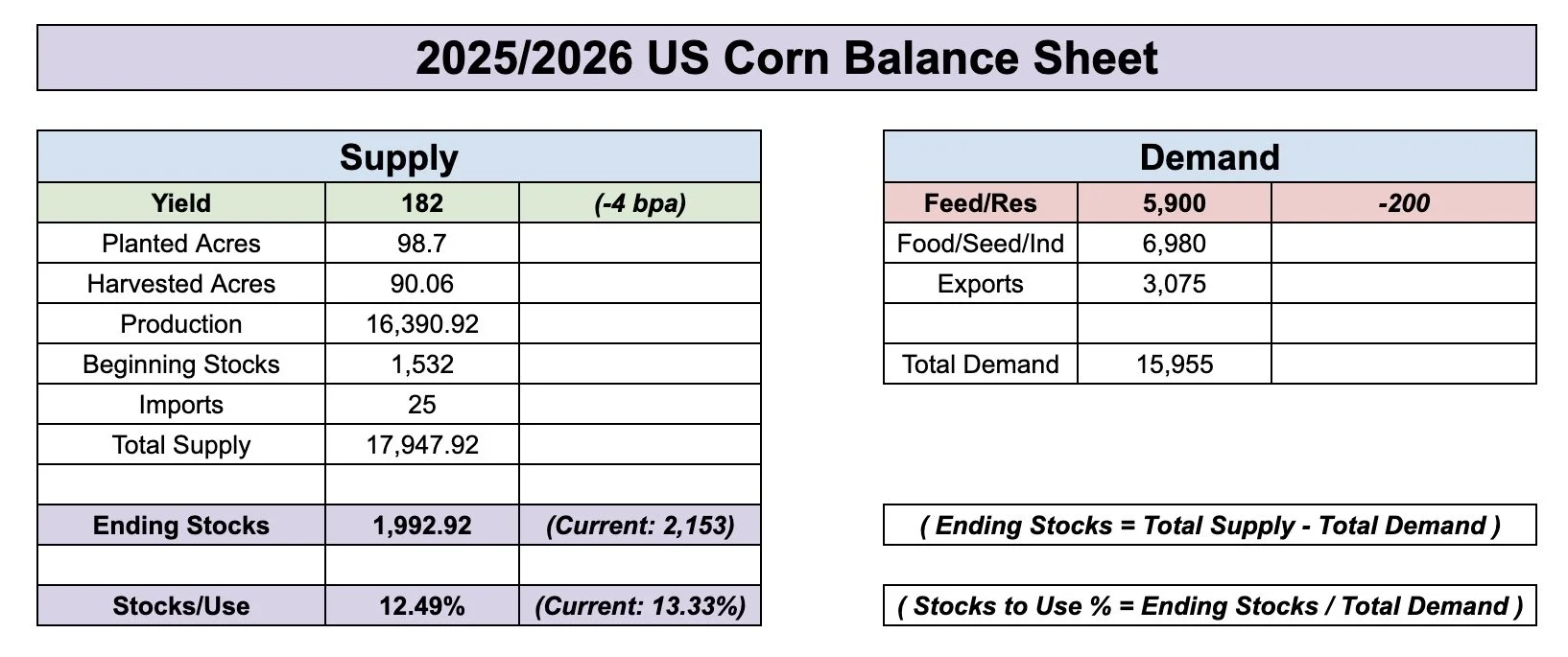

Now let's run through some scenarios.

Let's say yield is actually 182.

But at the same time, the USDA drops feed demand by -200 million bushels.

It would still result in a near 2 billion bushel carryout.

Unless exports are going to be raised again, China starts buying corn, or if yield is dramatically smaller it is hard to be "overly" bullish on corn. For now anyways.

Here is another scenario.

Perhaps yield falls to 179.

Feed demand is lowered by -200 million.

That paints a little more friendly of a situation with a sub 11% stocks to use ratio, but isn’t anything crazy like $6-7 corn bullish.

Some argue feed demand needs to be dropped by even more.

At the same time, some argue exports need to be further.

There are a lot of factors, but ultimately yield will be the deciding one.

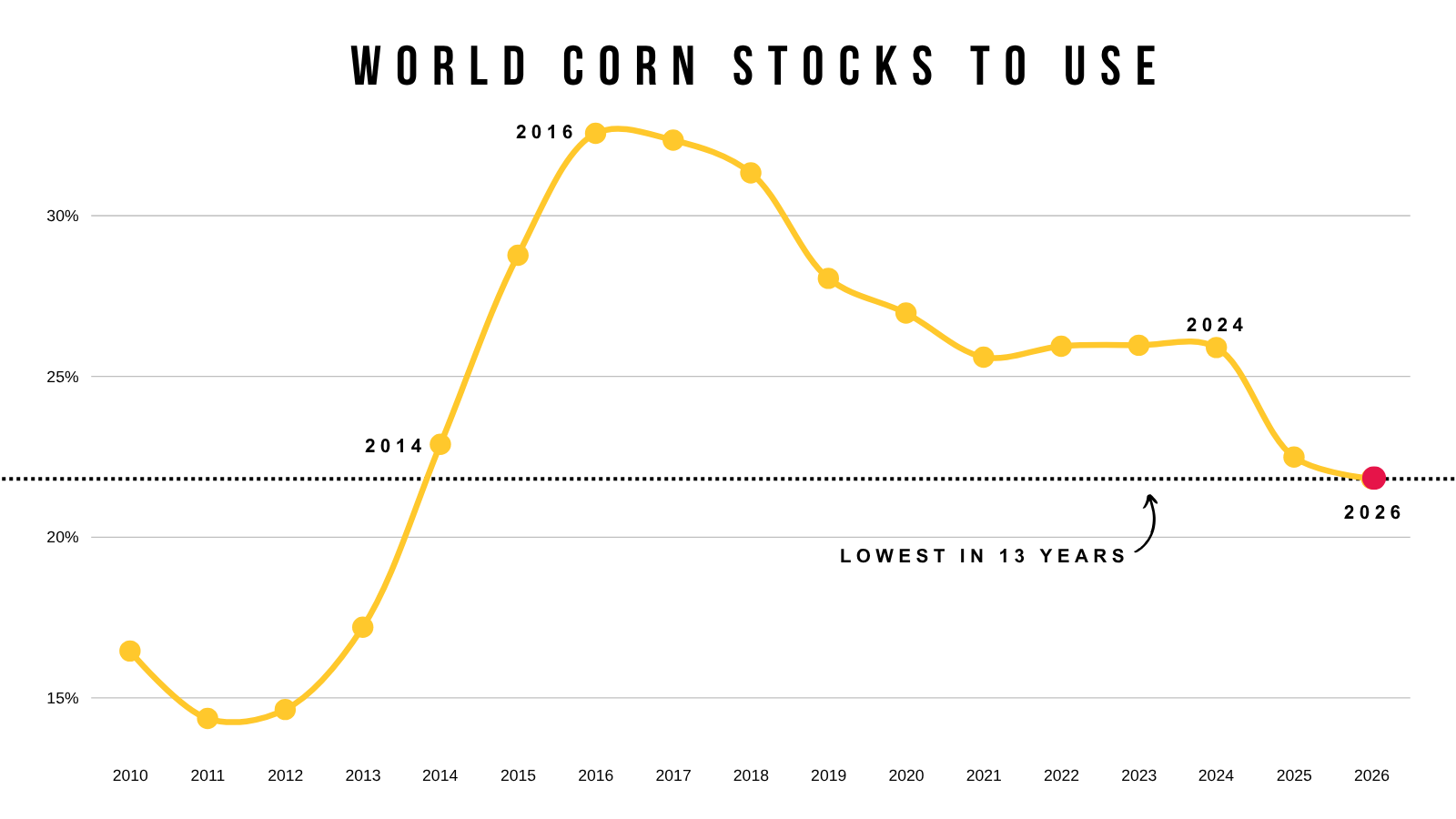

The last thing to mention in corn is the world situation.

Even with a record US crop. A record crop out of Brazil.

The world situation continues to get tighter and tigher.

The world is using more corn than ever and will continue to need our corn.

If production disappoints anywhere globally, we could see this number continue to drop drastically.

Final Thoughts:

The USDA kicked the can down the road on yield.

Hopefully they come clean in January.

However, it is hard to imagine we see that drastic of a yield cut in January to where sub falls sub 180. As we rarely see that size of cut.

Who knows, maybe the USDA hardly touches yield in January. Then they cut it in the Sep stocks report once everyone is already focused on the next year's crop.

We have too much supply to get super bulled up.

We have too great of demand to get too bearish.

We did just see a +50 cent rally. Seeing some sideways or even slightly lower action shouldn’t come as a surprise while the market digests everything.

I could still very well see a scenario like last year where we don’t really get an opportunity until the end of the year or into next year.

(Updated March-26 vs March-25 Corn Pattern)

Technicals:

Dec Corn

Potential bull trap in corn.

Yesterday it looked like we had a clear breakout above that key resistance level as well as the 200-day MA.

However, the USDA spoiled the party and we broke back down below that level and the 200-day MA.

If we continue to fall, bulls want to hold that red box to prevent further downside.

That gives back 50-61.8% of the recent rally. The most common spot for a correction to end.

The Sep sell off ended at the 50-61.8% level off contract lows (orange box).

Soybeans

Fundamentals:

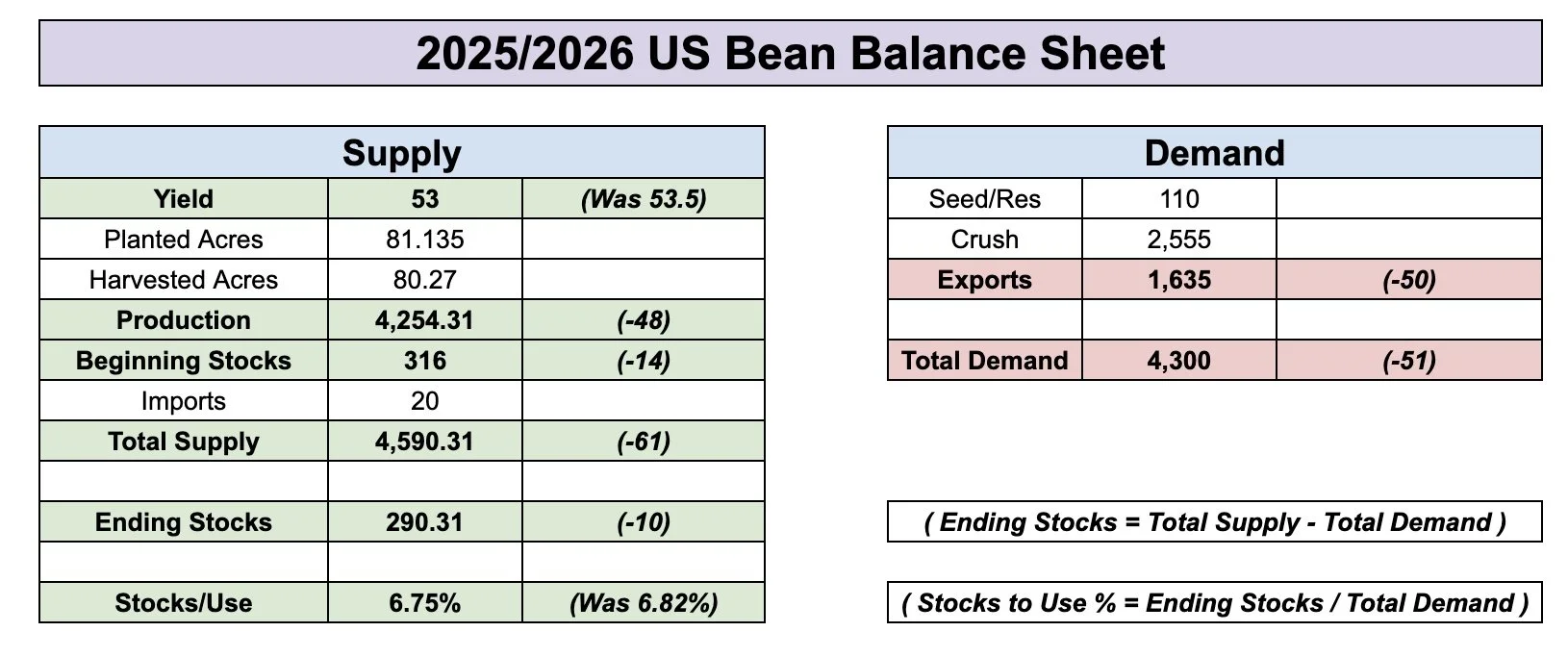

The USDA really didn’t make that big of changes to soybeans either.

They dropped yield which led to production falling by around -50 million. We also had beginning stocks drop for a net loss of -60 million on the supply side.

Aat the same time they dropped exports by -50 million.

As exports have continued to disappoint.

This led to just a minor drop of -10 million bushels on the carryout.

The market wasn’t disappointed by the USDA report.

As a matter of fact I would view the report itself as neutral to maybe even slightly friendly for soybeans. As a 290 million bushel carryout isn’t considered bearish.

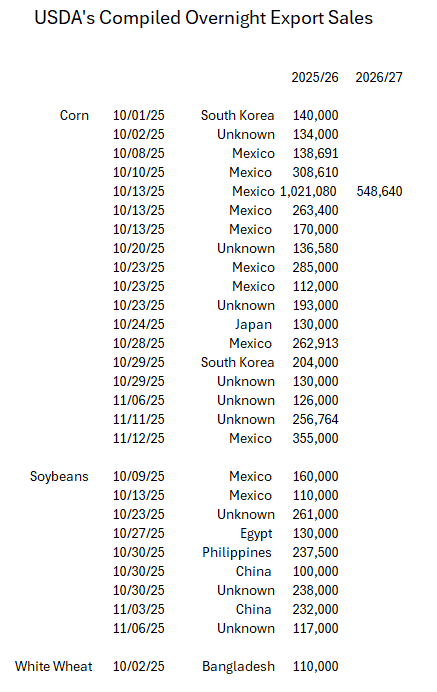

The market was more disappointed by the export sales data that came out with the report.

The USDA released their compiled overnight export sales for the entire time the government was shutdown.

There was no sign of big Chinese buying like many had speculated.

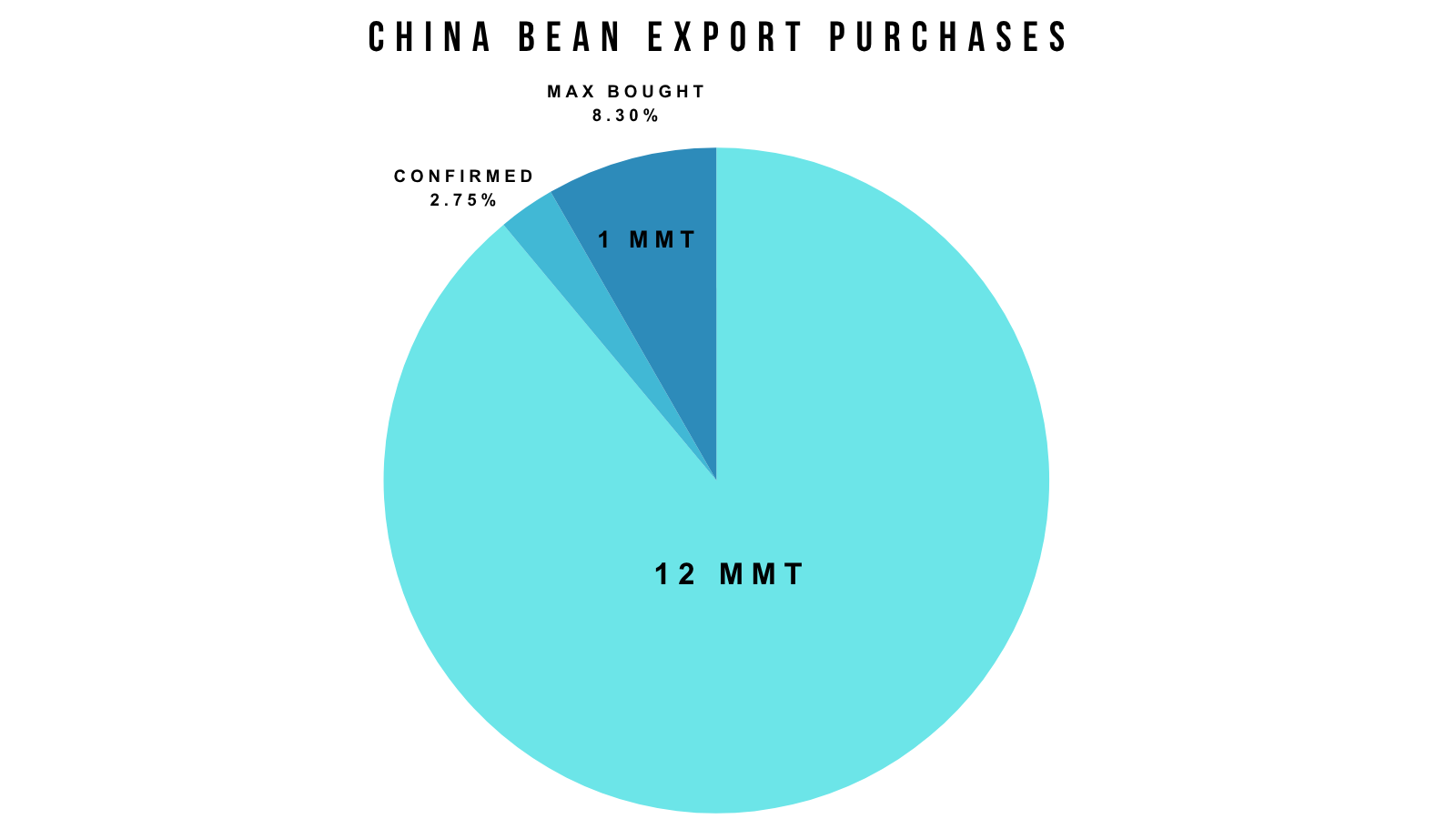

We saw 332k MT to China along with 616k MT to unknown.

For a max total of a little less than 1 MMT.. if all of that unknown business is even China. Which we don’t know.

So the total "confirmed" amount to China was 332k.

With the potential for it to be as much as 1 million.

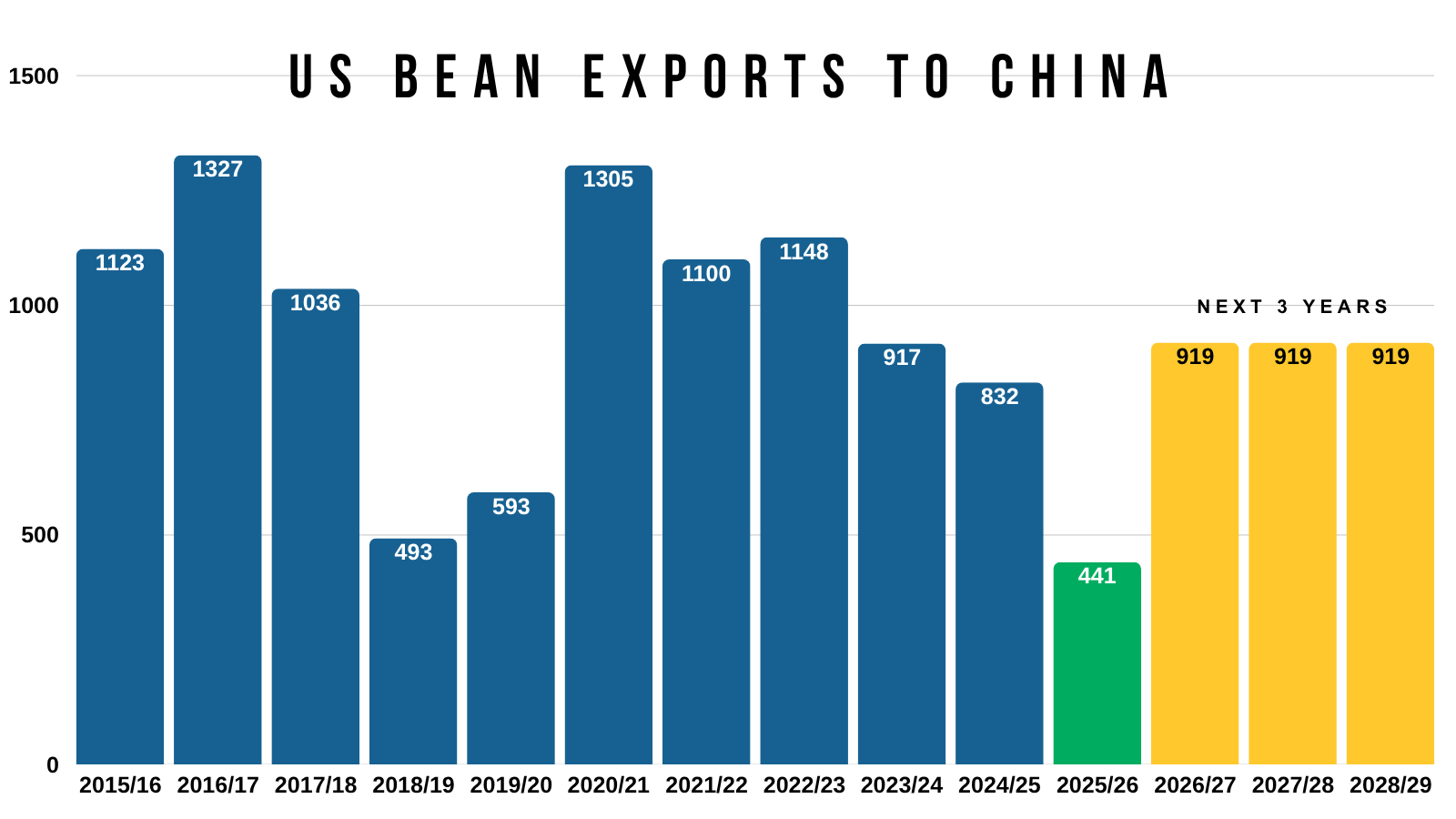

If you remember, China agreed to buy 12 million MT.

That 332k "confirmed" sales = 2.75% of what they agree to.

The max total they could've bought = 8.3% of what they agreed to.

So either China needs to start buying a ton of soybeans.. or it might not happen.

Either way, the market was expecting a lot more out of China and thinks they are running out of time.

The USDA report itself was not bearish.

Demand to China is going to be the biggest wild card.

Will they actually buy what they said? That is impossible to know.

However, the supply side of the balance sheet still doesn’t have room for error in beans.

Which is why there is "potential" in this market if demand doesn’t flop.

Carryout is already at 3 year lows.

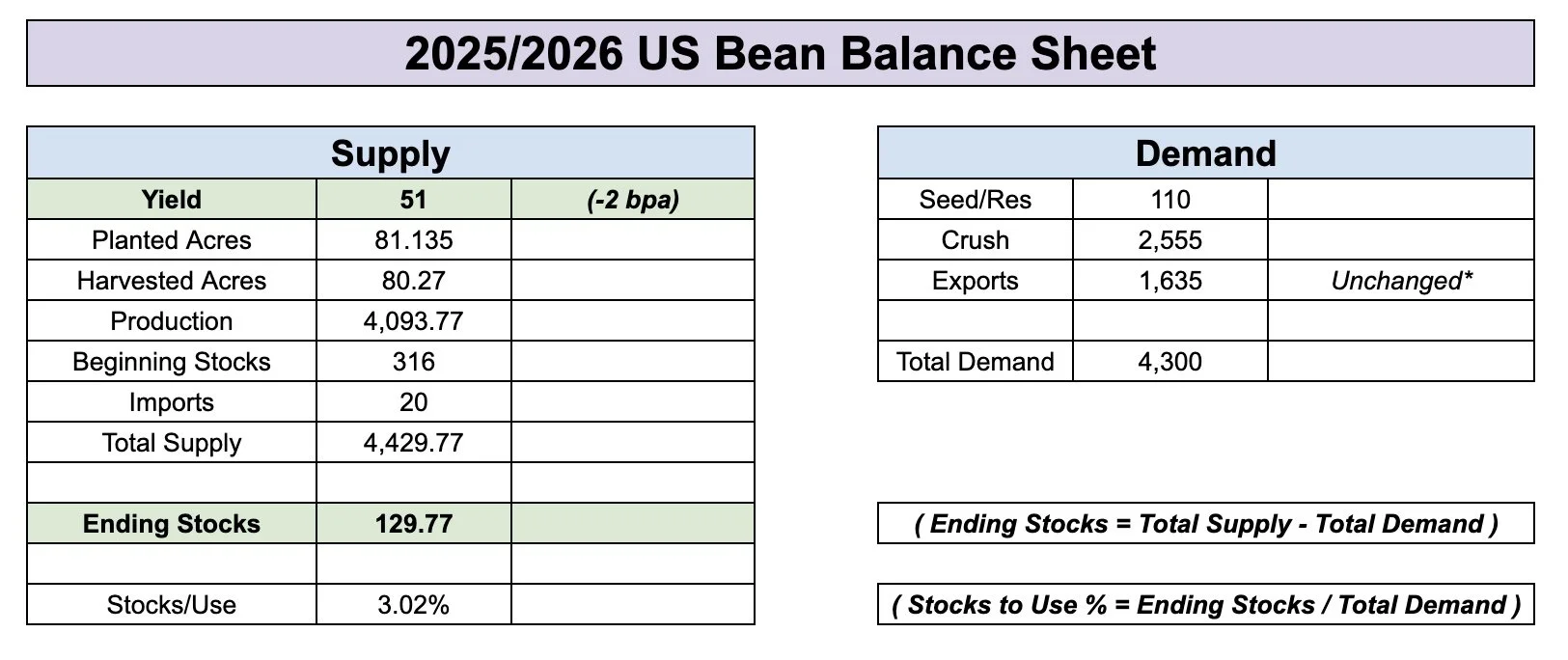

If yield were to fall to 51 bpa for example AND demand remained unchanged.

It would drop our carryout from 290 to 130 million.

Which would be the lowest levels in over a decade.

Here is the balance sheet of that scenario.

Final Thoughts:

I still think soybeans have the potential for $12.00

That is if China shows up and or if we get any sort of weather issues out of Brazil.

If China does not show up, then we probably need to give part of this rally back. Because this rally was entirely driven by the thought process that China was buying.

Yesterday we issued that pre-report hedge alert & sell signal that was specifically for those that had DP, basis contracts, or needed to move any grain by the end of the year.

If you missed it: CLICK HERE

Technicals:

Jan Beans

Not a great candle today. We traded above yesterday’s highs then closed below yesterday's lows. So that would be considered a reversal candle.

Bulls need to hold this $11.20 level to prevent further downside.

$11.22 gives back 61.8% of this recent little rally (marked with green lines). $11.20 claws back 50% of the contract highs.

So Monday's price action will be pretty important.

We got up almost to that $11.55 target which was the reason for the signal yesterday.

As that reclaimed 61.8% of the contract highs.

If the rally continues, our next target is right around $12.00

Here is why I still think $12.00 is very possible.

We never trade in the $11.00's.

We were trapped under this blue box for over a year.

Once we broke through, we had some air to the upside.

That same level we struggled to break above this year, was resistance in 2015, 2017, and 2018.

Until now, we had only broken above this resistance twice. In 2016 and 2020.

In 2016 we ran to $12.00 before failing.

In 2020 we went a lot higher.

Wheat

Fundamentals:

The report was bearish for wheat no doubt.

As it was confirmed we simply have an ample amount of wheat across the world.

Wheat just doesn’t have much going for it here outside of being at cheap price levels and 5 year lows. But that isn’t a catalyst for higher prices.

The market got all excited about China buying wheat only for it to be really a nothing burger and not make a fundamental impact.

With the world wheat situation being as bearish as it is, it might be hard for the wheat market to catch an extreme bid higher.

Just have to be patient on wheat and wait for an opportunity.

That opportunity could take a while. It might be far longer than you'd like.

Technicals:

Dec Wheat

The orange box is the golden zone of the entire rally.

Bulls need to hold there to prevent further downside.

That is the most common spot for a correction to end.

Dec KC Wheat

Same story here.

We need to hold the orange box or it could spark more downside.

That gives back 50-61.8% of the entire rally off contract lows.

Cattle

After the market closed today, it was announced that Trump would be signing an order today to reduce tariffs on beef, tomatoes, coffee, and bananas.

Cattle recovered nicely today, but we got a bearish headline when the market closed.

Dec Live Cattle

We posted new lows today but closed higher.

The green box does not have to hit, but if it does that is where we want to be taking risk off the table.

As it reclaims 50-61.8% of the entire sell off.

The 50-day MA also sits there.

The 50-day was once an absolute floor in this market. So it is viewed as resistance if we get there.

Really it feels like a falling knife kind of a market here though. With the government actively trying to get prices lower.

The risk remains lower.

Continous Live

We bounced right off the 200-day MA on the continuous chart.

That is a pretty big spot to hold.

If we break below that, it could open the door even lower and trigger more downside.

(I am only showing live cattle as feeders switched contracts, so this 200-day MA is not a great technical indication on there)

Past Sell or Protection Signals

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.