SOYBEAN BUY ZONE ALERT

Who this this alert for?

This is for those who followed our sell signal at $11.55 on November 17th.

For those that have short futures, short calls, or long puts from that sell signal. We are entering a zone where we would be looking to lock in some profit.

For those that are looking to re-own in a manner that makes sense for your operation, we are entering an area where we like doing so.

There is nothing wrong with simply walking away from a good sale +$1.00 higher than we are today. But for those that want to re-own, we like these levels.

If you have specific questions or want to talk about what makes the most sense for your operation, please reach out to us via text or call. As not everyone should be looking to re-own.

Jeremey: (605)250-3863

Why the alert?

Jan beans are approaching our downside target.

On the Nov rally, we reclaimed 61.8% of the contract highs before topping out.

We have now almost given back 61.8% of the entire rally off contract lows up to those Nov highs.

We topped out at the 61.8% level up to contract highs.

Getting a bounce and local bottom at the 61.8% level down to contract lows would make sense.

That level sits at $10.48

We broke the 61.8% level of the entire China fueled rally.

The next level is the 78.6% level. Which sits at $10.46

This closely lines up with the other $10.48 target.

We are also sitting right at the 200-day MA.

We are also showing hidden bullish divergence.

As the RSI is extremely oversold, while prices are much higher the last time the RSI was this low.

Bearish divergence marked the highs.

As prices were posting new highs, but the RSI was not.

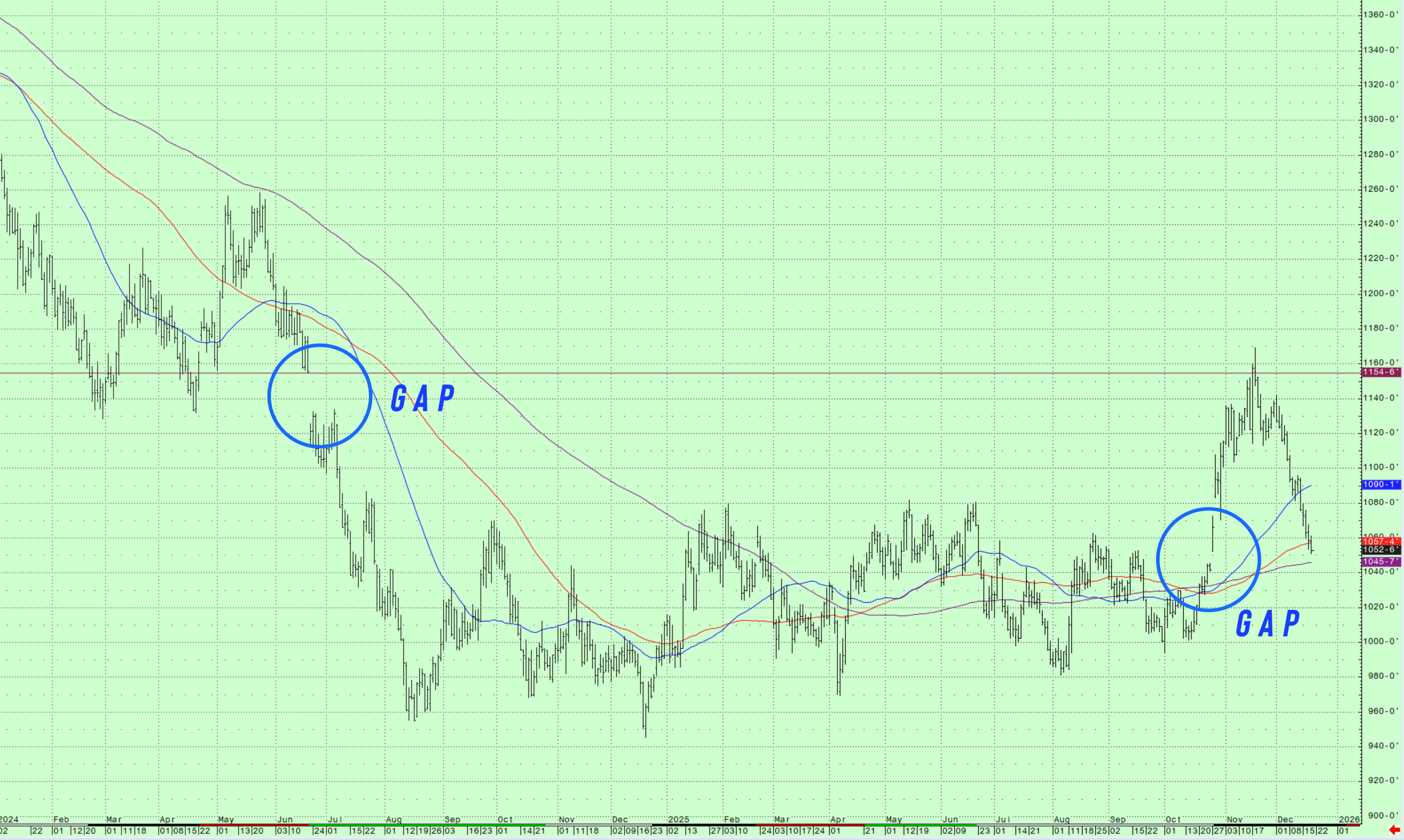

On the active daily contination chart, we have a gap sitting at $10.45 1/2.

This chart currently follows Jan beans.

We had a gap to the upside at $11.55 back on that sell signal.

This downside gap lines up with the other downside targets.

March soybeans are also approaching the 78.6% level of the entire China fueled rally.

Which sits at $10.59

Also sitting right at the 200-day MA.

Past Sell or Protection Signals

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.