BIG SPOT FOR SOYBEAN BULLS

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 2:15min

Beans: 9:10min

Wheat: 11:45min

Cattle: 13:45min

Want to talk about your situation?

(605)250-3863

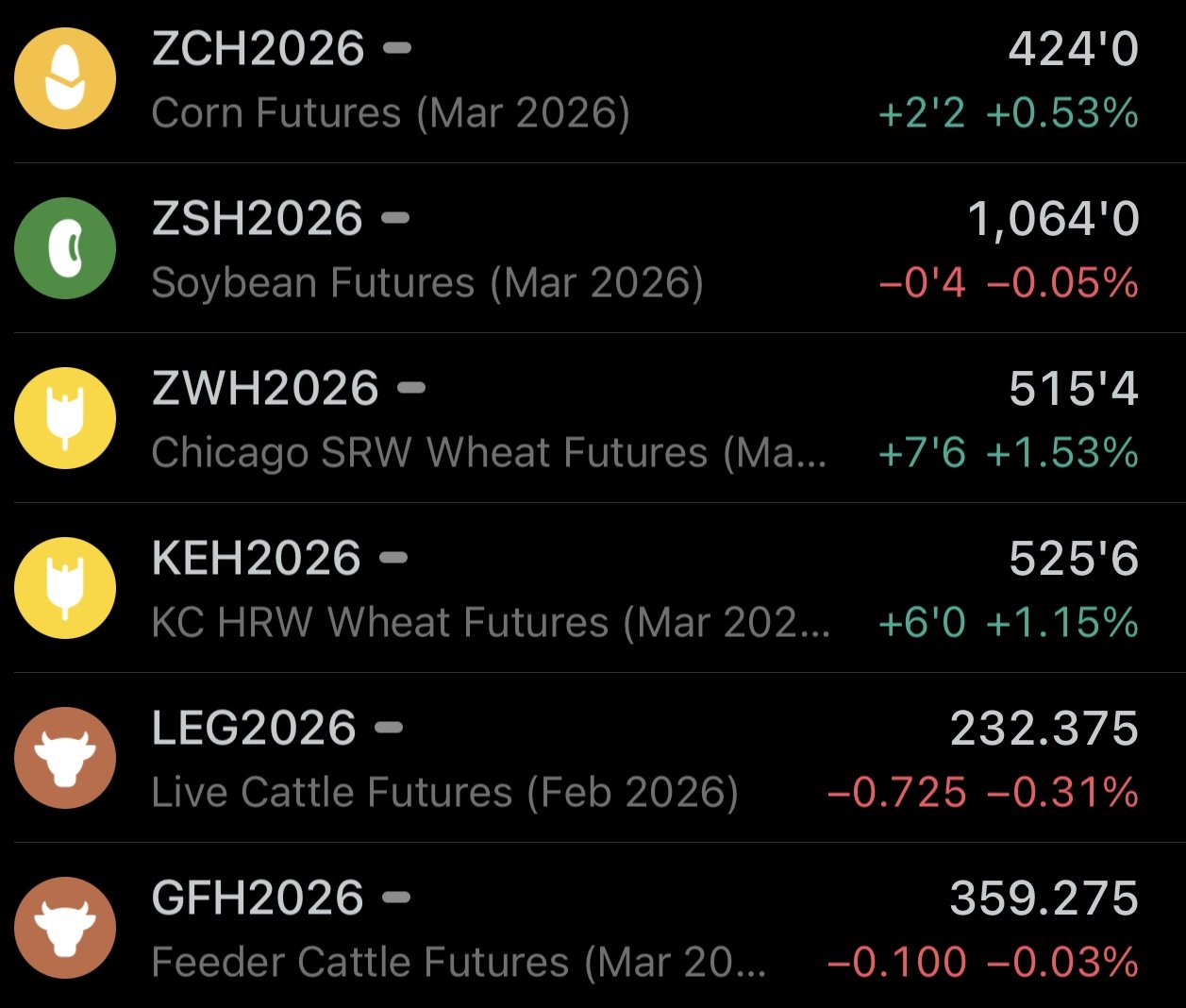

Futures Prices Close

Overview

Grains mostly higher while the cattle market was mostly flat.

Not a ton of fresh news for bulls or bears to chew on.

Yesterday, Trump eliminated the tariffs and threats on the EU as he's trying to acquire Greenland. The stock market rallied on the news. I still don’t think the whole Greenland situation will have much impact on grains, but calling off those tariffs is supportive.

The wheat market is seeing some weather premium off the back of potential winterkill, which we will touch on later.

Corn remains trapped in a tight sideways range. We've closed between $4.20 and $4.25 every day since the USDA report. So a tiny 5-cent range.

On the bright side, corn has continued to find demand down at these levels. As we continue to see flash sales with more this morning.

The soybean market has been finding relief the past few days. Closing higher for the last 4 of 6 days.

Part of this rally has been led by the rally we've been seeing in soybean oil.

We also have news confirming that China has officially met their goal to purchase 12 million metric tons of beans. Bessent then went out and said that they look forward to China meeting their 25 million goal next. He also mentioned that Trump is going to try to push for China to buy even more soybeans.

Argentina looks like they are also facing some dry weather, which is adding support to the soybean market.

Soybean harvest in Brazil is running a little behind. Which can lead to that 2nd corn crop planting getting delayed. That is going to be a story to watch the next month or so.

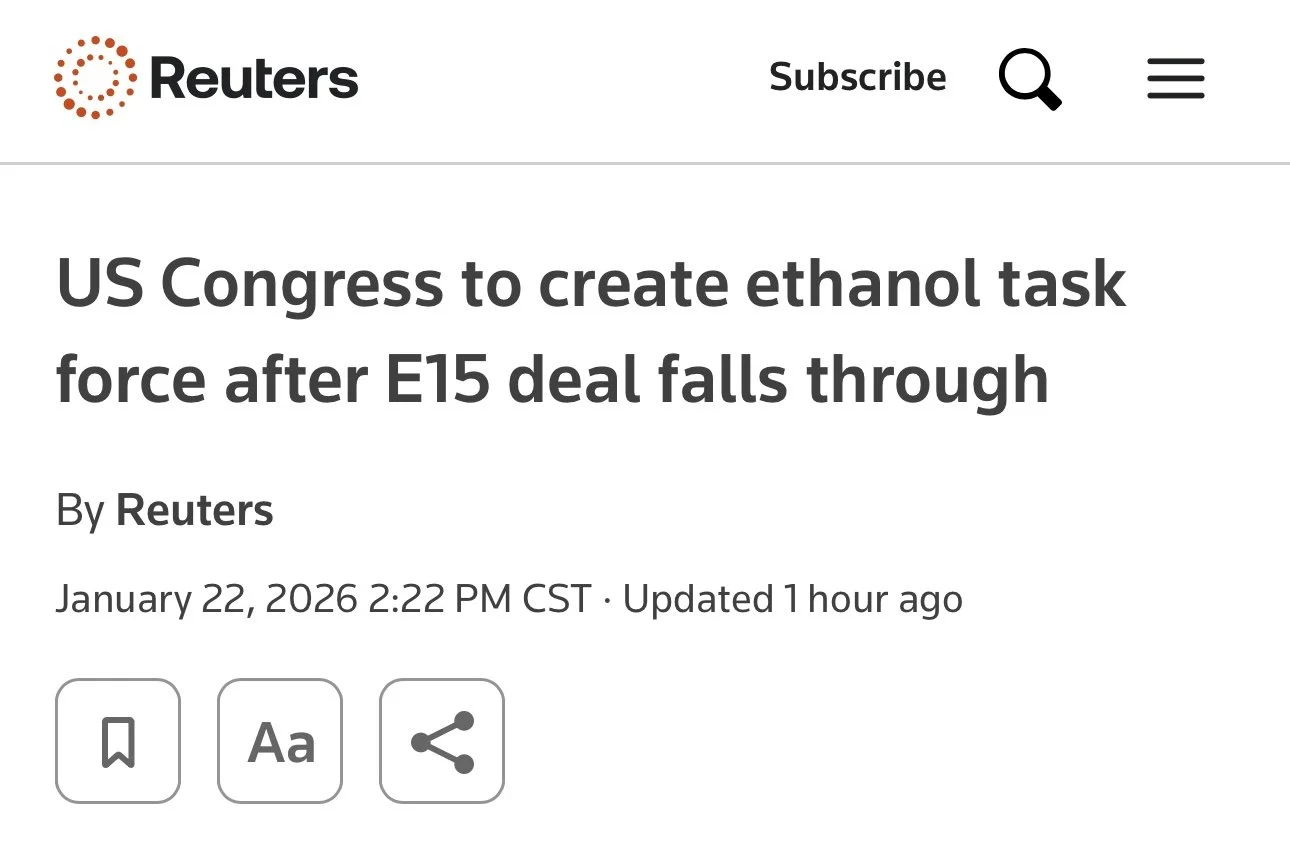

E15 News

The E15 story just hit a road block.

Congress offically excluded the year round use of E15 from their January 30th goverement funding bill.

Instread of passing the law, they created a council to study the issue further.

A deal was already in place between major oil groupd and farm advocates. However, a small group of independent refiners lobbied to have it removed at the last second.

The new council they created is supposed to report back by February 15th, and have a vote on February 25th.

So essentially they kicked the can down the road.

If this does end up getting passed, it would eventually lead to a lot of corn demand long term.

So something to keep your eye on.

That funding bill also did not include any more aid for farmers despite some lawmakers pushing for it.

Today's Main Takeaways

Corn

Fundamentals:

Corn really lacks a driving force higher or lower here.

Hence why we've only traded in a 5 cent range since the USDA.

However, the fact that corn has not yet seen any follow through selling whatsoever following one of the most bearish January reports of all-time is a great sign for this market.

To me, it feels like this market has mostly priced in that awful bearish report.

You could very easily argue, what else could the market possibly throw at us to make the situation in corn more bearish?

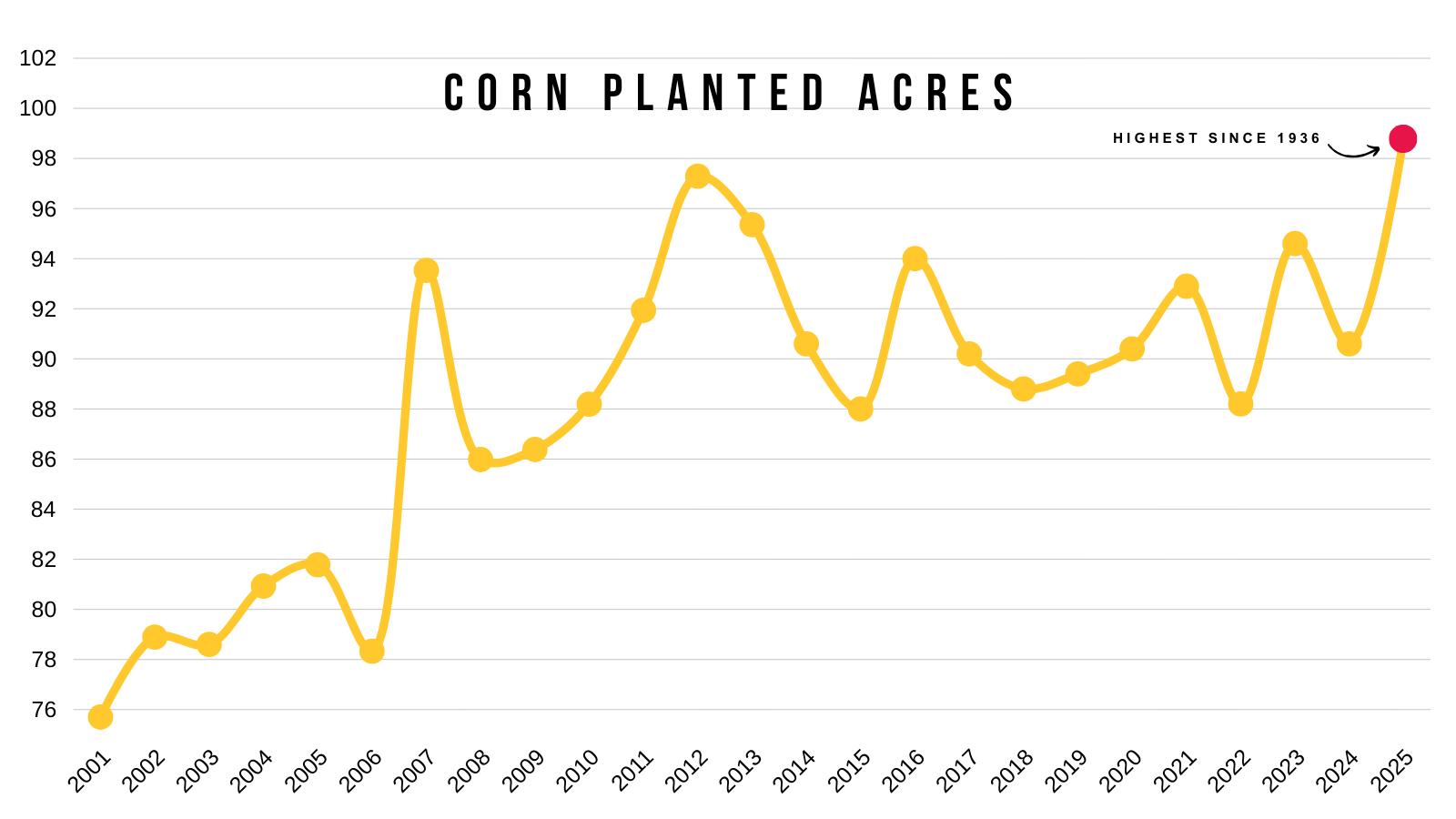

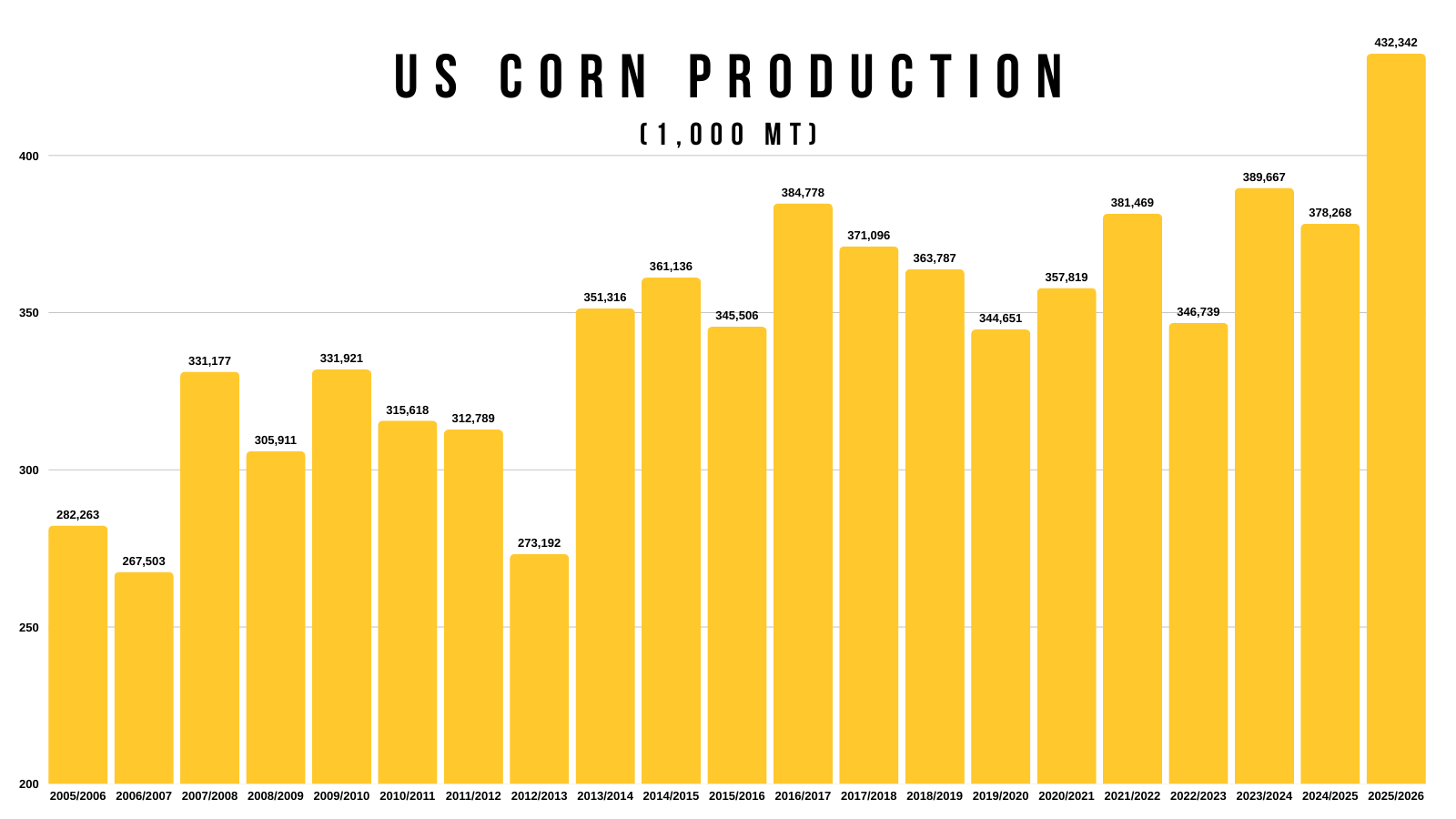

We already had record acres.

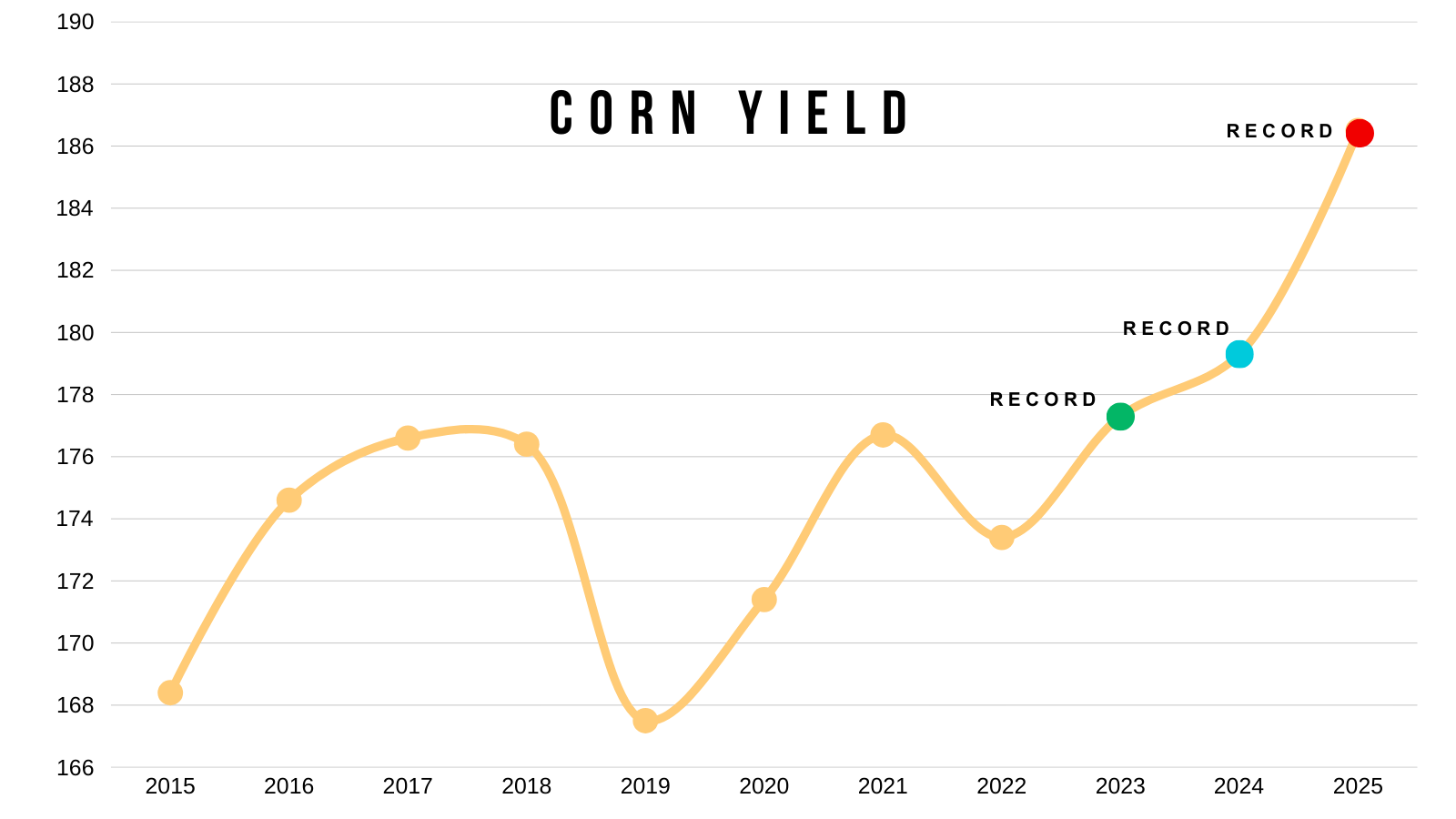

We had a record yield which is now set in stone.

Fun fact:

We've seen a record yield 3 years in a row now.

This is the very first time we've seen this since at least the 80's.

Production is the biggest it's ever been by a wide margin.

I am not overly bullish on corn.

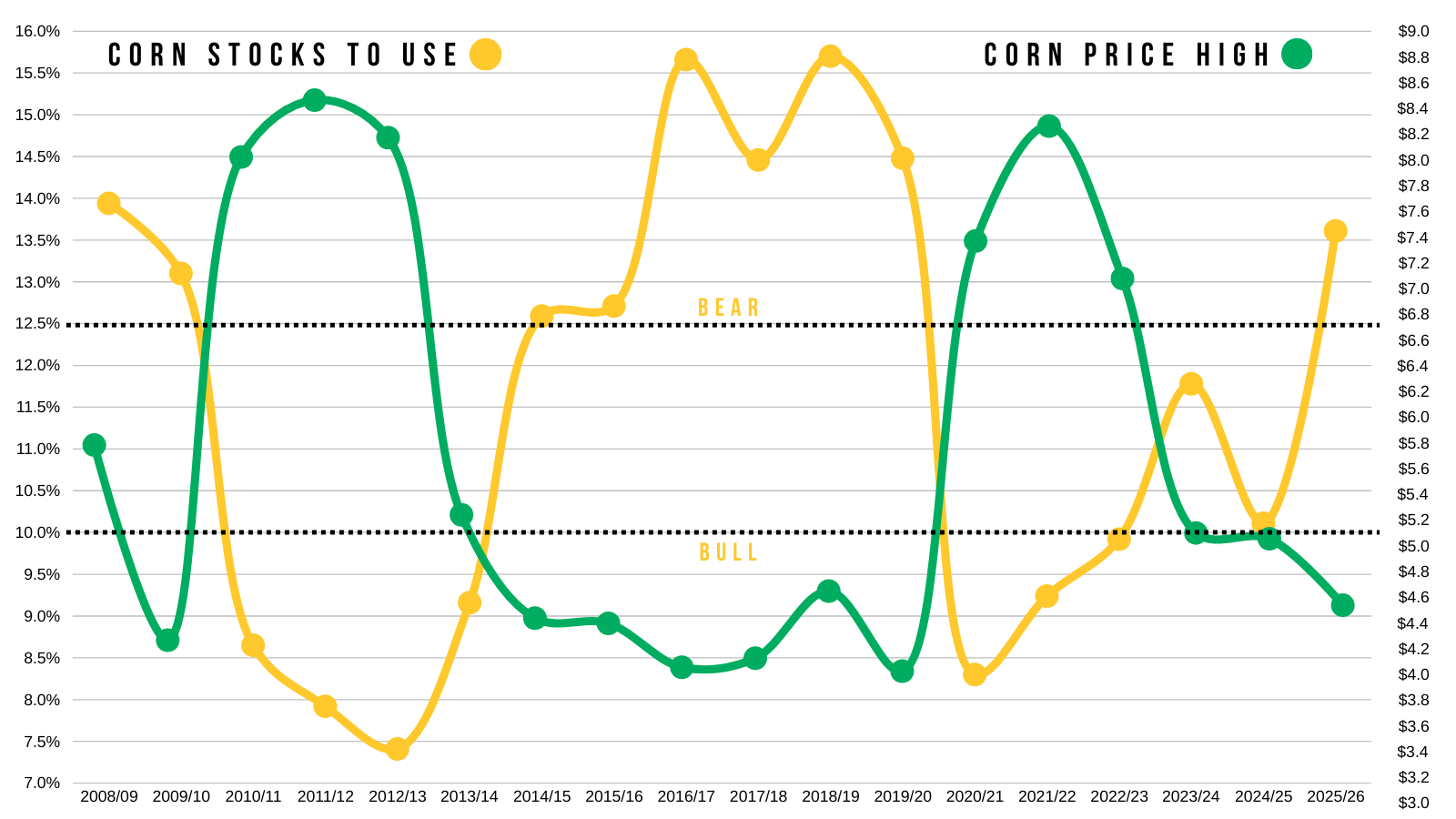

Just look at our stocks to use.

It's right on par with other bear market years.

Our upside is clearly going to be limited for now, barring a weather scare and or China buying corn.

But at the same time.. what else could you possibly throw at this corn market?

I showed this the other day.

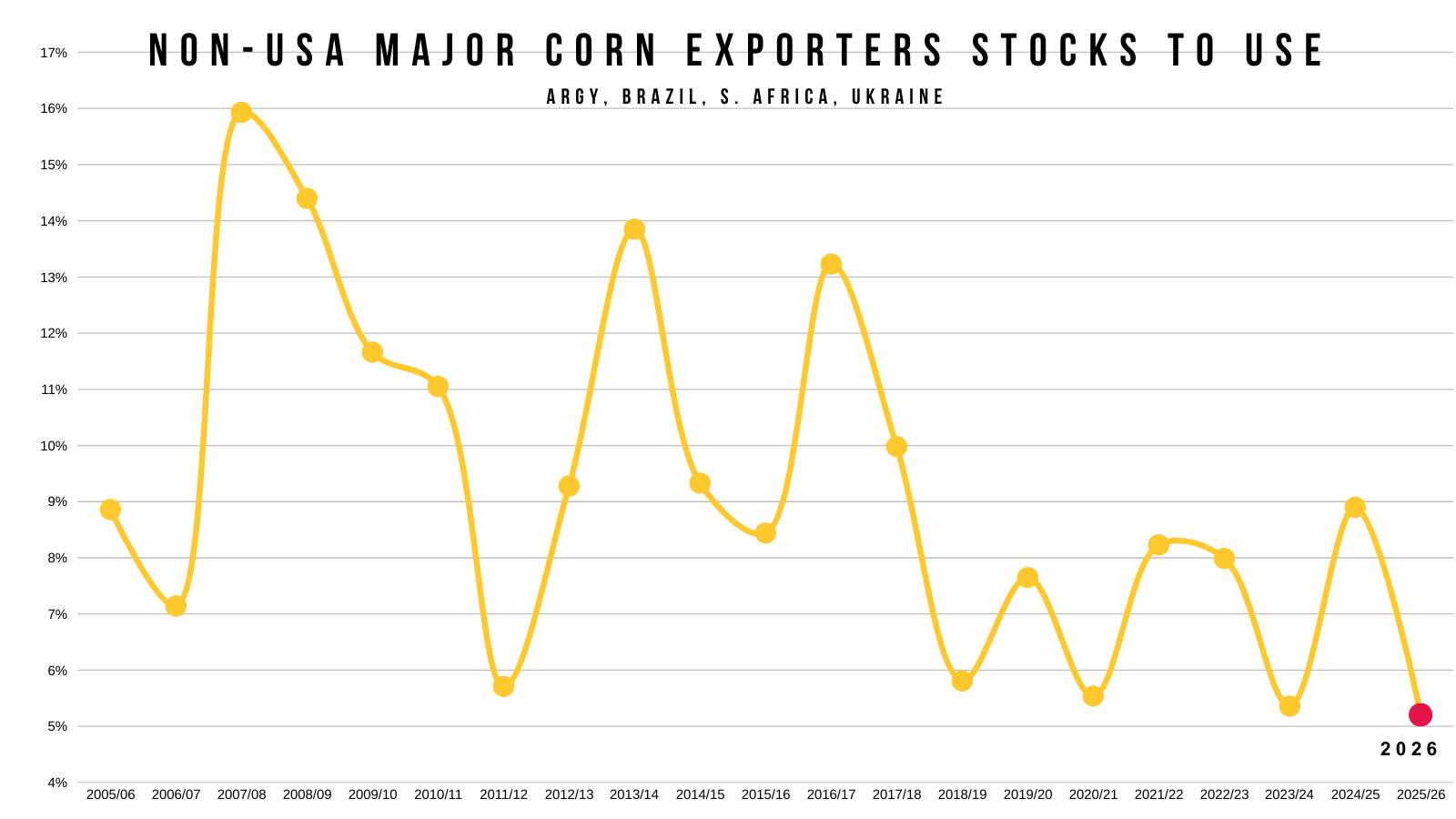

This is the stocks-to-use ratio of the world's leading corn exporters minus the US.

Amongst the tightest of all-time.

Meaning outside of the US, the rest of the world's big exporters are as tight as they've ever been on corn.

The world absolutely needs the US to perform.

It does not matter today, because the US just had a record crop.

But... if the US ever runs into even the slightest hiccup in production it could turn this bearish story in corn right around.

Despite me not thinking corn has major downside from here.

Without a weather scare or some other outside factor, it is going to be hard to get corn positioned for a very bullish scenario.

Acres should be coming down to a certain extent this year, given that we almost planted 100 million acres last year.

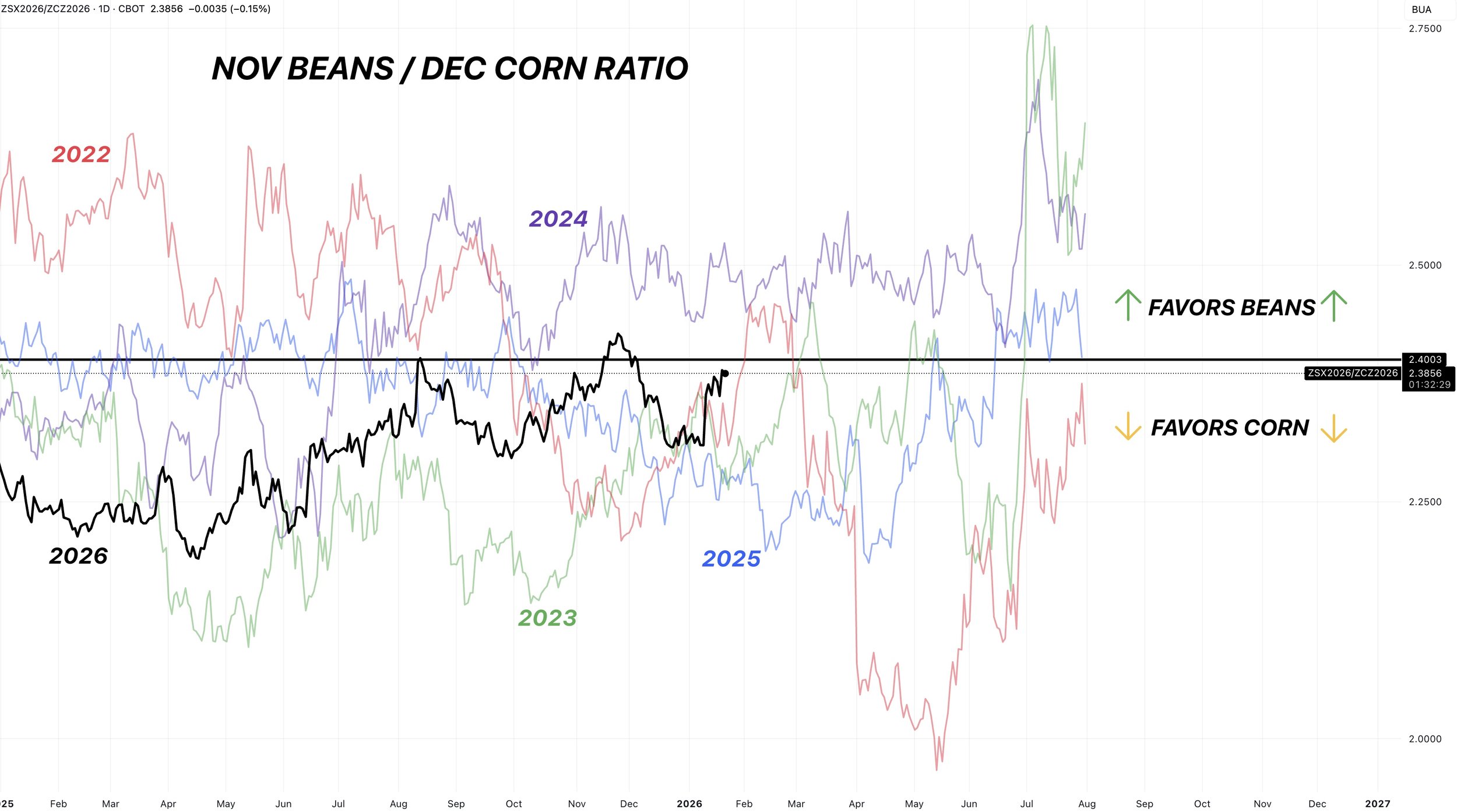

However, here is the Nov soybean to Dec corn ratio.

This chart divides soybean prices by corn prices.

The 10-year average and rule of tumb is a ratio of 2.4

So when the ratio is above 2.4, it favors farmers planting more soybeans.

When the ratio is under 2.4, it favors more corn planting.

It's still looking like corn is still going to be favored this year.

For soybeans to steal some acres, soybeans would have to go on a rally here while corn stays down at these levels. If we can push above 2.4 then corn could start to lose a little more acres.

Bottom line:

The story in corn isn’t bullish right now.

But, that doesn’t mean we have to completely fall out of bed either. We've already endured about as bearish of a scenario as we could’ve received.

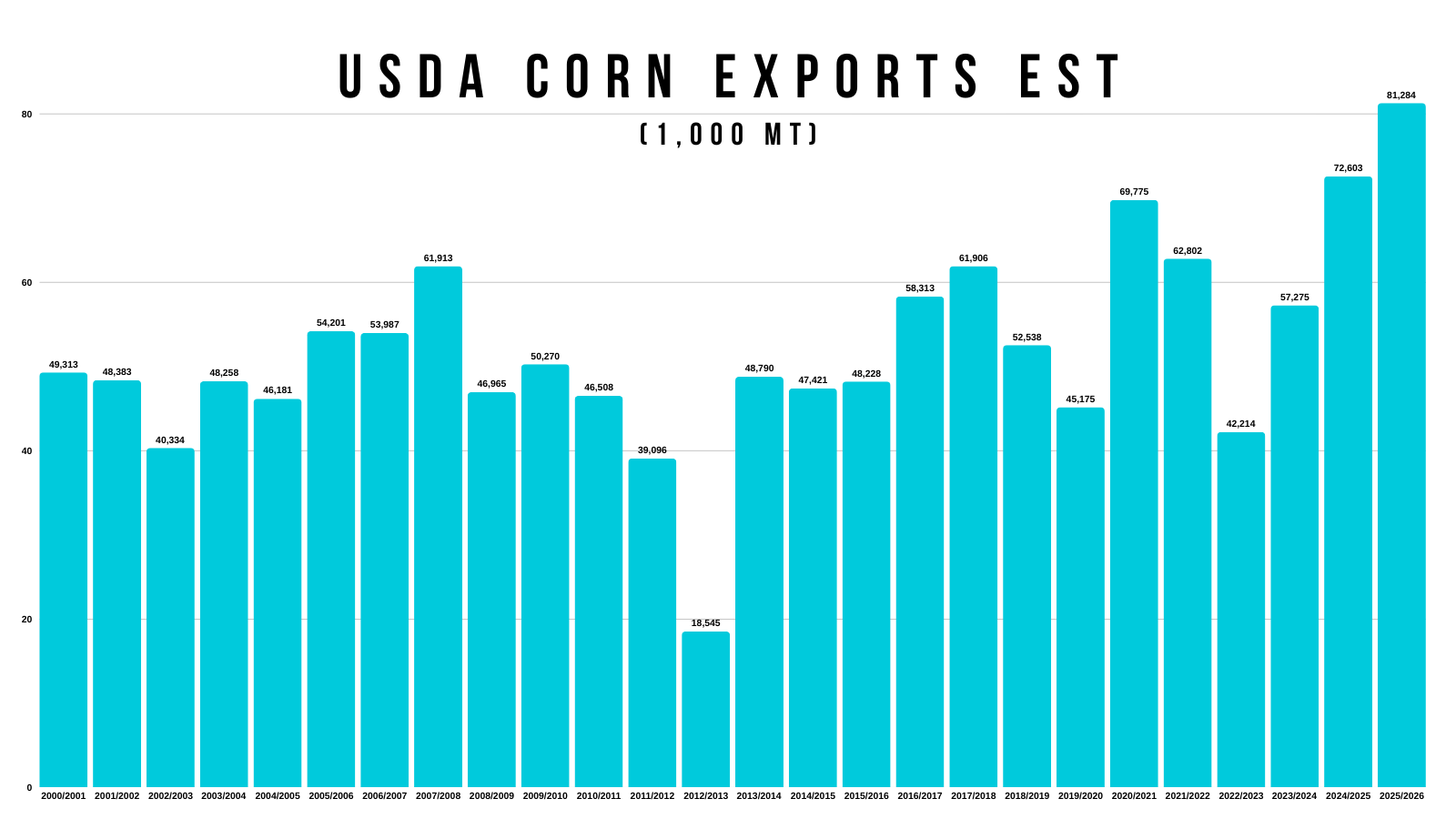

Demand is the best it's ever been.

We should continue to see demand support this market.

This market is going to lack fresh data until planting intentions.

So I think it's very reasonable to think that we will simply be range bound for the next month or so.

The market doesn’t have a reason to go screaming higher, but I don’t see a reason for it collapse either.

The outlook on planting intentions could very well decide the next move.

Monthly Corn:

I've shown this a few times recently, but it supports the thought process that I don’t think corn has this crazy amount of downside and I don’t think we are in for months of sub $4.00 corn if at all.

Until 2006, our ceiling was $3.00

From then until 2020 $3.00 became our new floor.

During the 2014-2020 bear market, our ceiling was $4.00

So far it has acted as a floor.

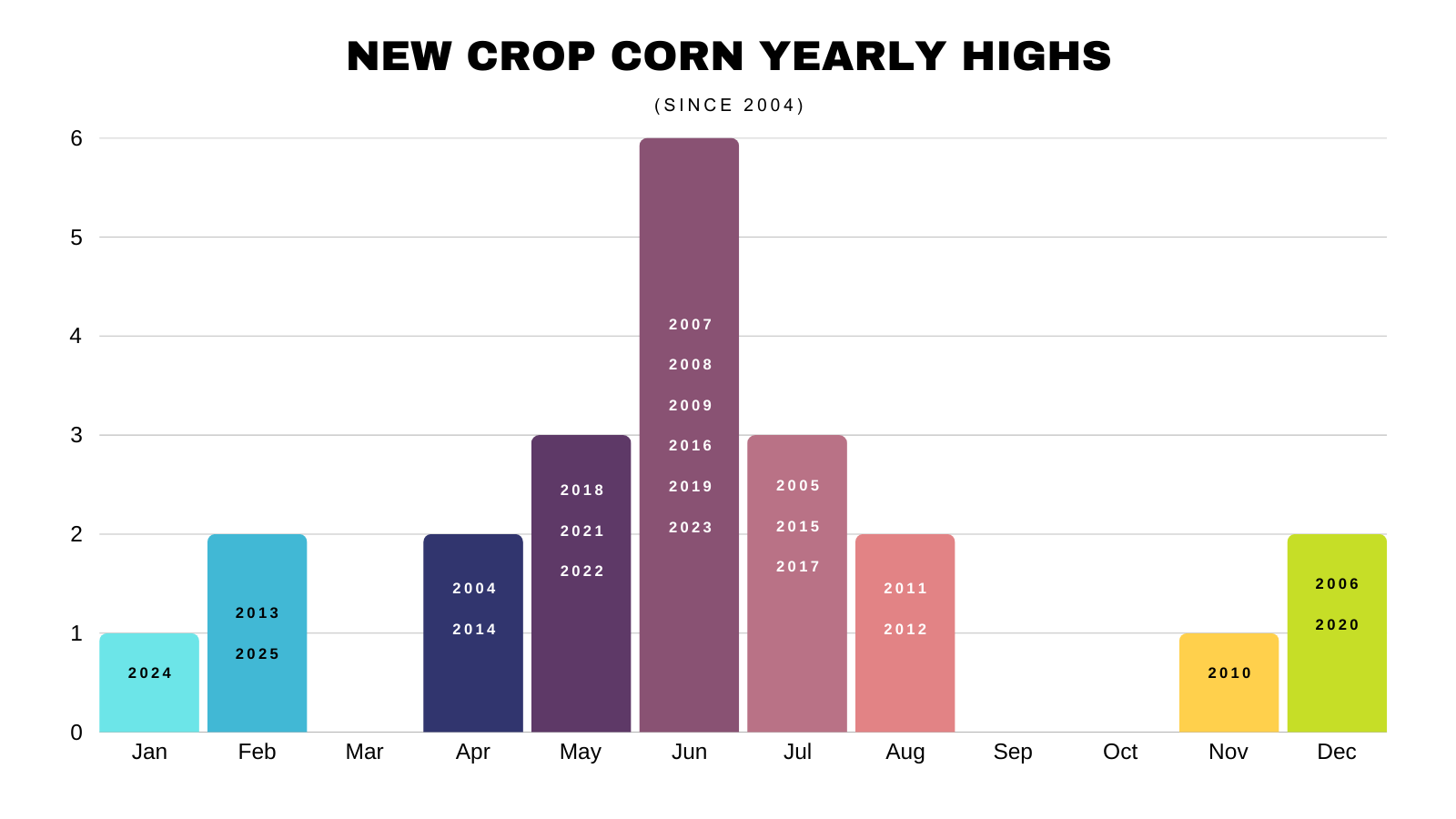

New Crop Yearly Highs:

Here is a chart that provides some optimism for new crop.

This shows when Dec corn has posted it's highest price of the year.

Currently Dec corn is about -15 cents off it's highs from the year.

More often that not, we won't see our highest price of the year in January.

However, the last few years have been a different story than the past. Because we simply haven’t seen any sort of weather scare at all since 2023.

Since 2004, new crop corn has only topped in Jan-Feb three times. But two of the three have came the last two years (2013, 2024, 2025).

The top typically comes around June, as we often do get a weather scare. That just hasn’t been the case the last few years.

Calls vs Storage:

Should you pay for storage or sell corn then re-own it with a call option?

For some of you, it very well could make sense to sell corn then re-own it with a call option instead.

For example, let's say you are paying 5 cents a month in storage.

You still have downside risk on that stored corn, plus the cost to store.

Let's say you sell your corn then re-own it with a call option for 5 cents instead. That would remove your downside risk, while at the same time keeping your upside open. Giving you a worst case of $4.19.

Floor: ($4.24 futures - $0.05 for call = $4.19)

If you have to move grain soon and it's in an elevator, then this might make sense for you.

An option you could use:

March corn $4.25 calls for around 5 cents. This keeps things simple and gives you coverage through February 20th, while being at the money.

Call or text us if you have questions.

Jeremey: (605)250-3864

Lauren and Jeremey at Texas Hedge put together some additional trade ideas for corn, soybeans, and cattle.

If you want to check those out visit their website:

Texas Hedge Trade Ideas Click Here

Technicals:

March Corn

Like we mentioned, we are trapped in a small range.

If we can break out of this small range, the point of interest where we want to take some risk off the table is going to be that $4.35 range.

Since our upside feels limited, that is the area we want to de-risk.

That is the golden zone retracement of the recent sell off, which happens to be our old support.

The rally off harvest lows failed in the golden zone up to the Feb highs, which happened to be support from last spring.

Soybeans

Fundamentals:

I don’t have much on soybeans today compared to usual.

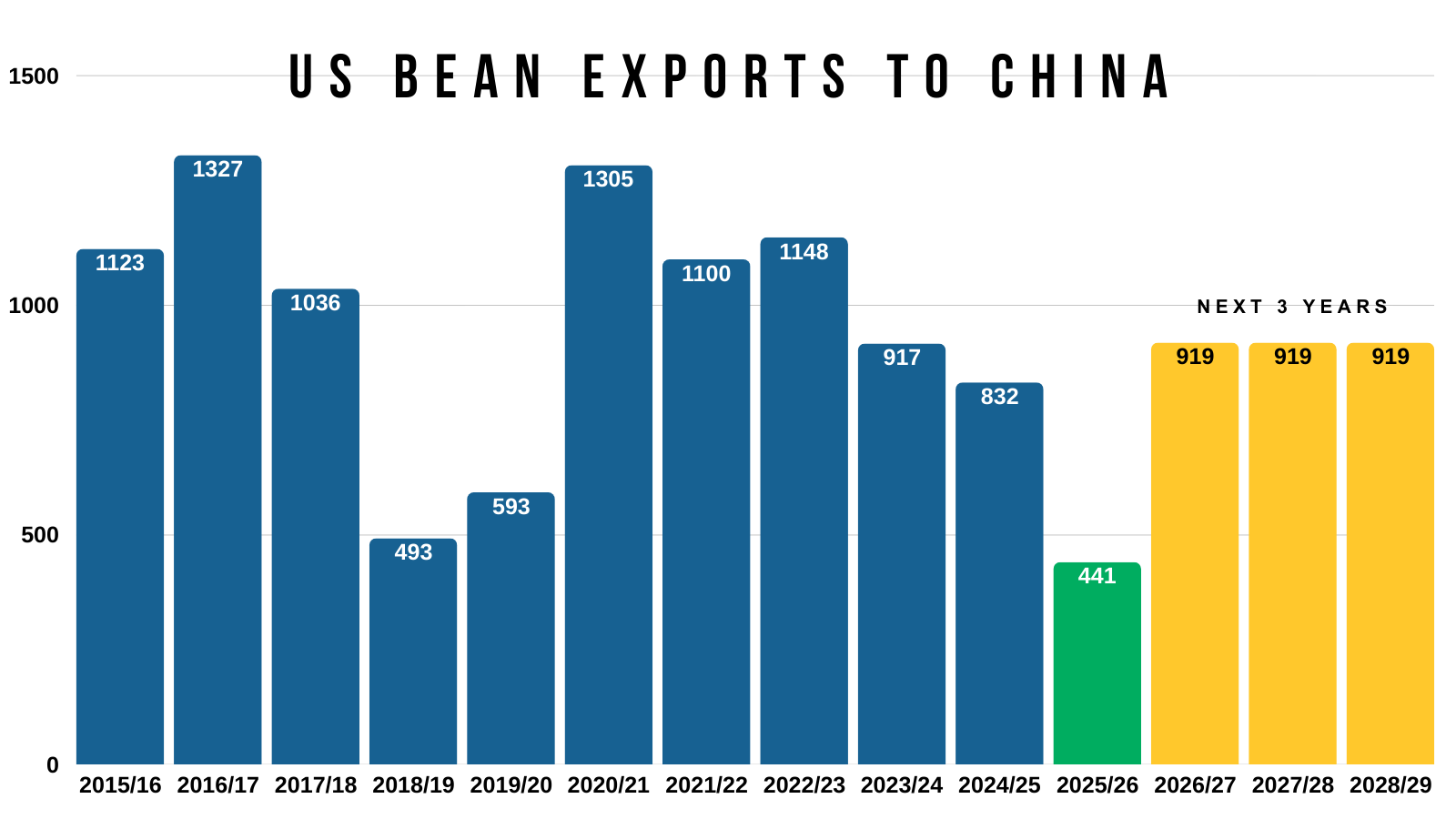

The biggest thing is going to be China.

They met their goal. Will they continue to buy or not?

Bears argue that Brazil has a monster crop. Brazil's crop is cheaper than ours. Typically China doesn’t buy from us right now. They met their goal, so why would they continue to buy?

All very valid arguments.

Bulls argue that China buying soybeans is simply a geopolitical trade. Them making some good faith purchases is really just a small drop in the bucket on the big scale of things.

We will just have to wait and see.

If they continue to buy and work towards that new goal of 25 million for this marketing year, then the market will notice.

If they opt for Brazil for a while, then it might be hard to muster a substantial rally.

Moving forward, that is going to be pretty important.

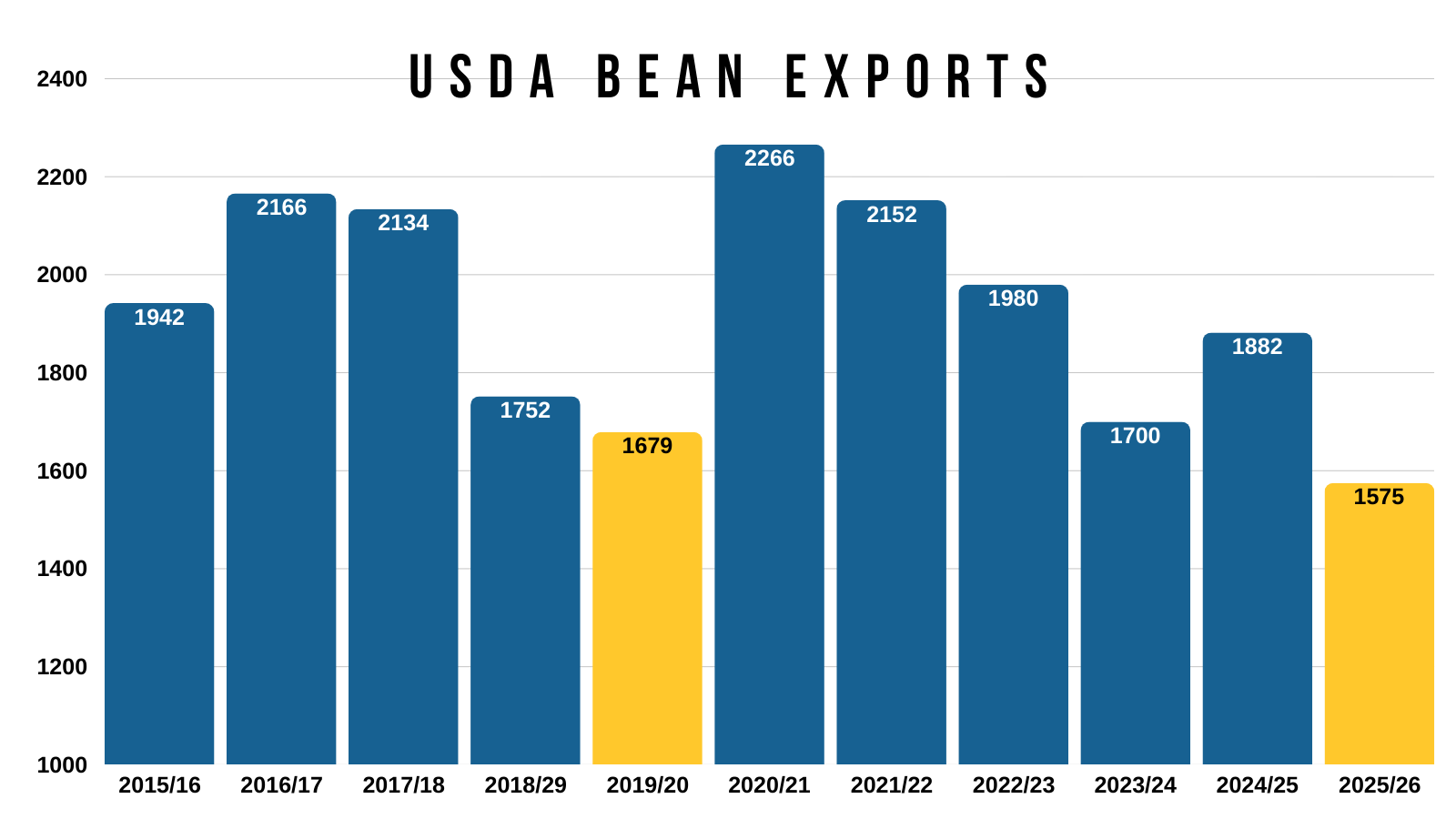

The US balance sheet isn’t that bearish for soybeans.

That is with our exports being over -100 million worse than the last trade war.

If exports can pick up, then soybeans might a story later on.

But for now, exports are still a clear concern.

Technicals:

March Beans

Soybeans are battling a pretty important spot here.

The very first retracement level up to those November highs.

The 23.6% level at $10.70 which we failed to break above today and yesterday.

It's a big spot for bulls.

Breaking above that level would also result in us posting our first higher high in months.

This market has had a series of constant lower lows the entire sell off.

If we can break above it, it should spark a move higher to the next set of fibs.

The point of interest is going to be the 38.2% and 50% levels of the entire sell off. Which comes in at $10.89 to $11.05

If we get a bounce up to there, we will be looking to reward it.

The market also failed there twice previously last year.

Here is another look at the importance of this fib level.

That fib level is the exact same spot the very first relief bounce failed at before we ultimately went lower.

Nov Beans

We want to be defending a move towards $10.93 to $11.00

That is the golden zone of the entire sell off.

It's called the golden zone for a reason. It's the most common level for a market to revert back to.

So if we get there, we want to reward it.

Wheat

This is one of the bigger stories going around.

The possibility for winter kill in the wheat market.

We are supposed to get a pretty serious cold snap this weekend.

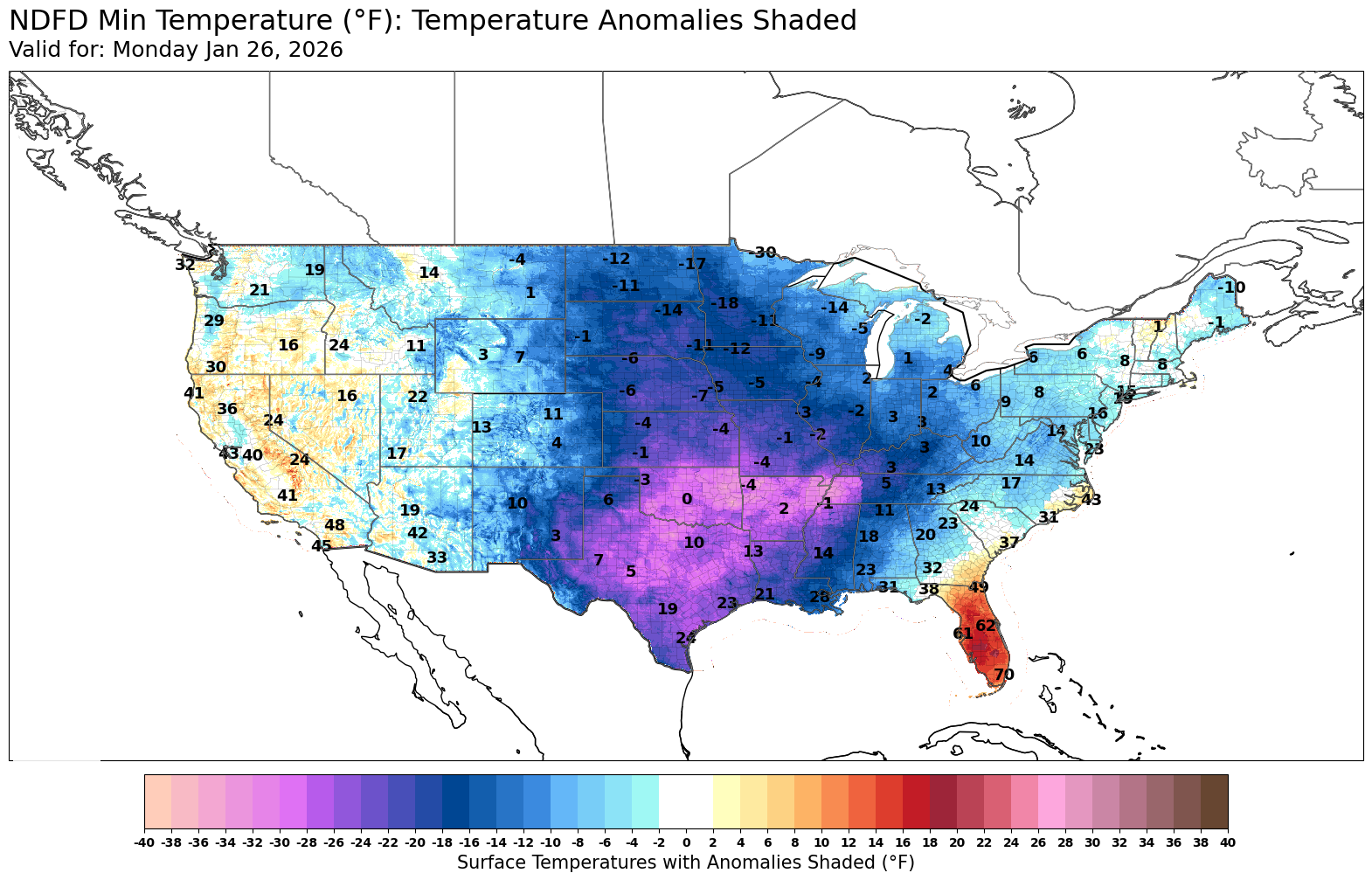

Here is the minimum temps for next Monday. Awfully cold in the southern plains.

Does this matter?

Well it seems like the wheat market is putting in a little bit of weather premium here.

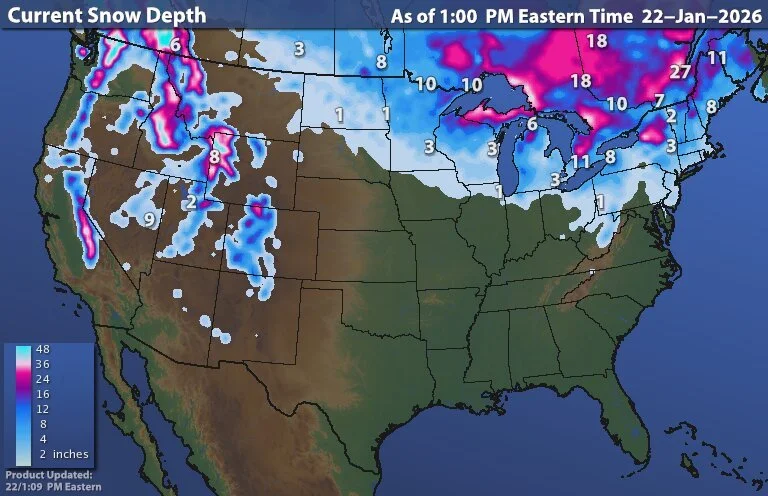

I mean there is currently zero snow cover in the plains right now.

However, it seems like the market always tends to shrug off winter kill until it actually results in material damage.

Will there be serious damage this time?

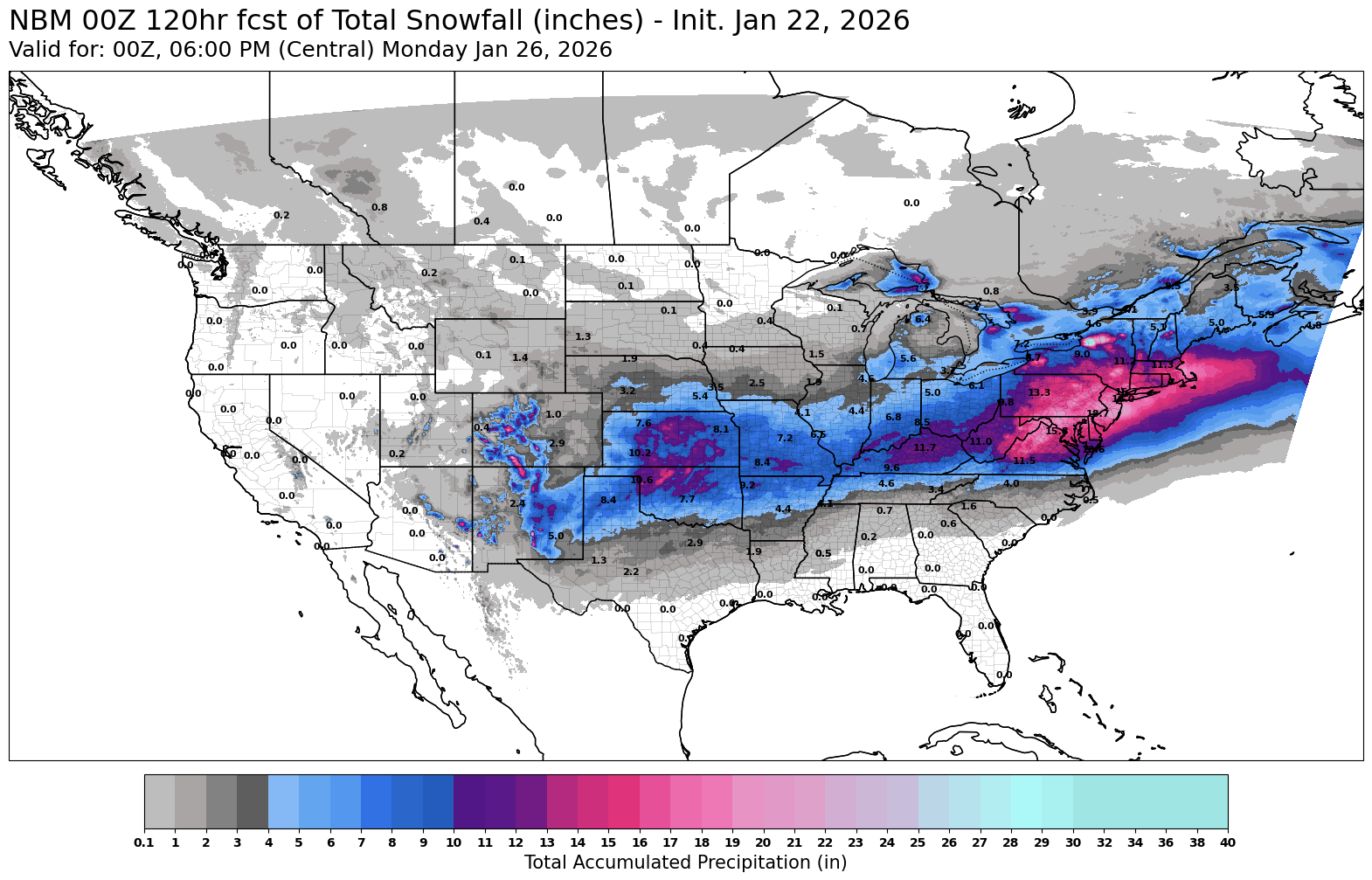

This cold snap is supposed to be accompanied by snowfall.

Which will minimize the effects.

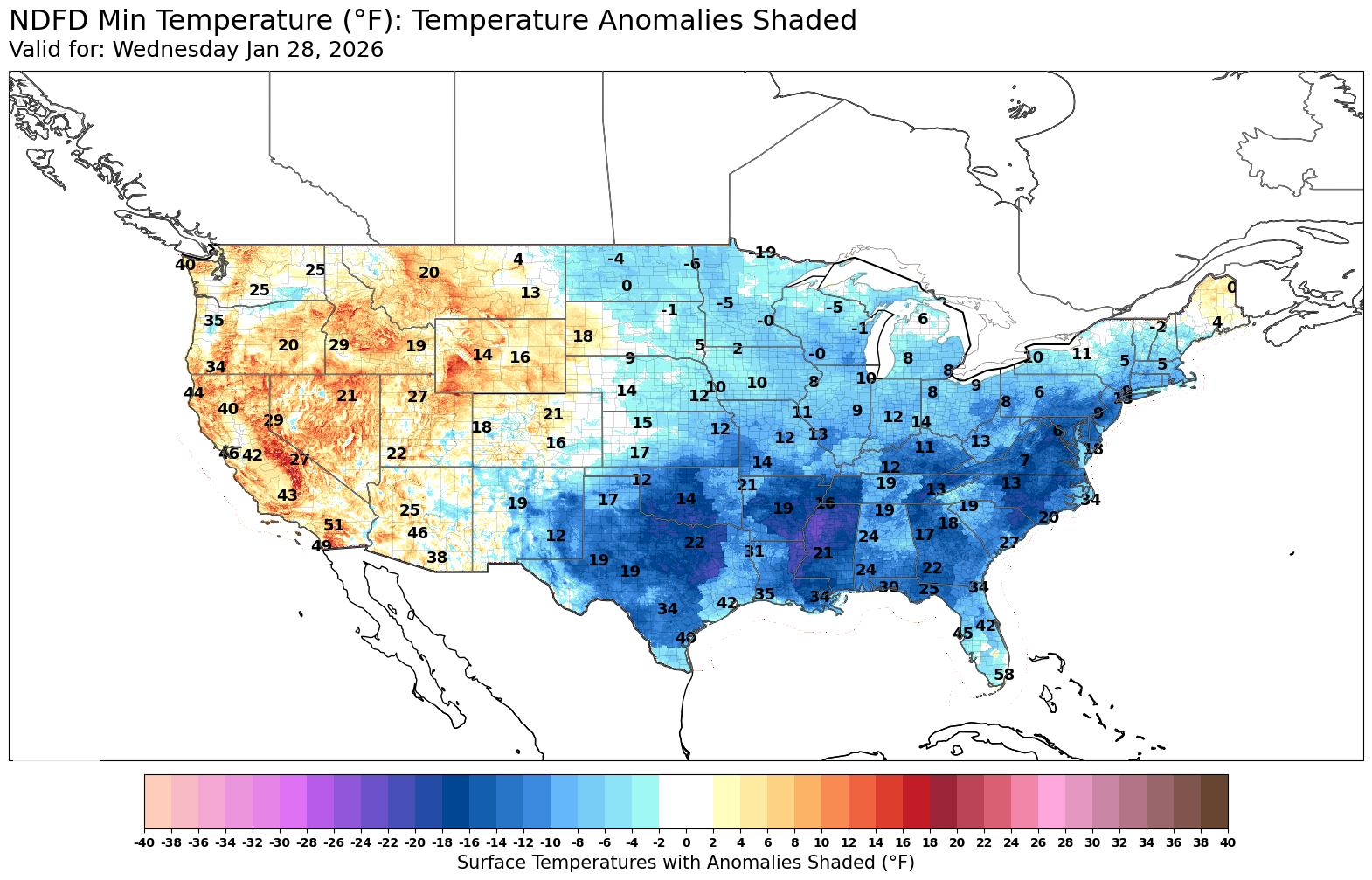

It's also suppose to start warming back up next week, or at least not be as brutally cold.

So given that the cold weather is going to feature snow and not last all that long, I'd say this could provide some weather premium, but I don’t view it as some major game changer.

Unless of course we see real damage, but often times with winter kill it just doesn’t happen.

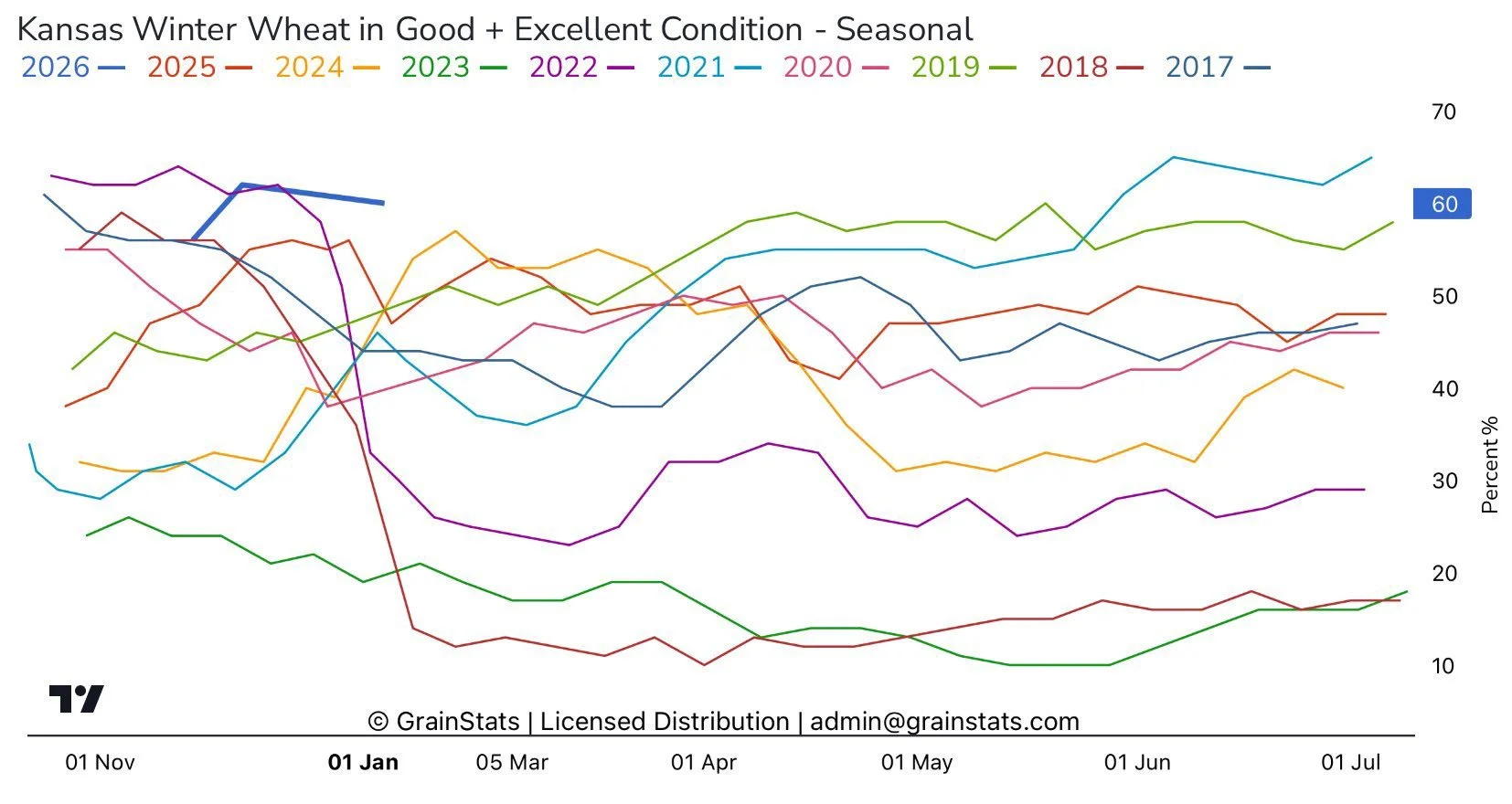

If you look at winter wheat ratings in Kansas, the crop really can’t get much better than it already is.

The crop is rated at it's best in years, but you could argue that it's only path from here might be progressing lower.

Chart from GrainStats

Outside of that, the wheat market still lacks a story.

Someone is always growing wheat somewhere in the world, and right now there just hasn’t been any issues.

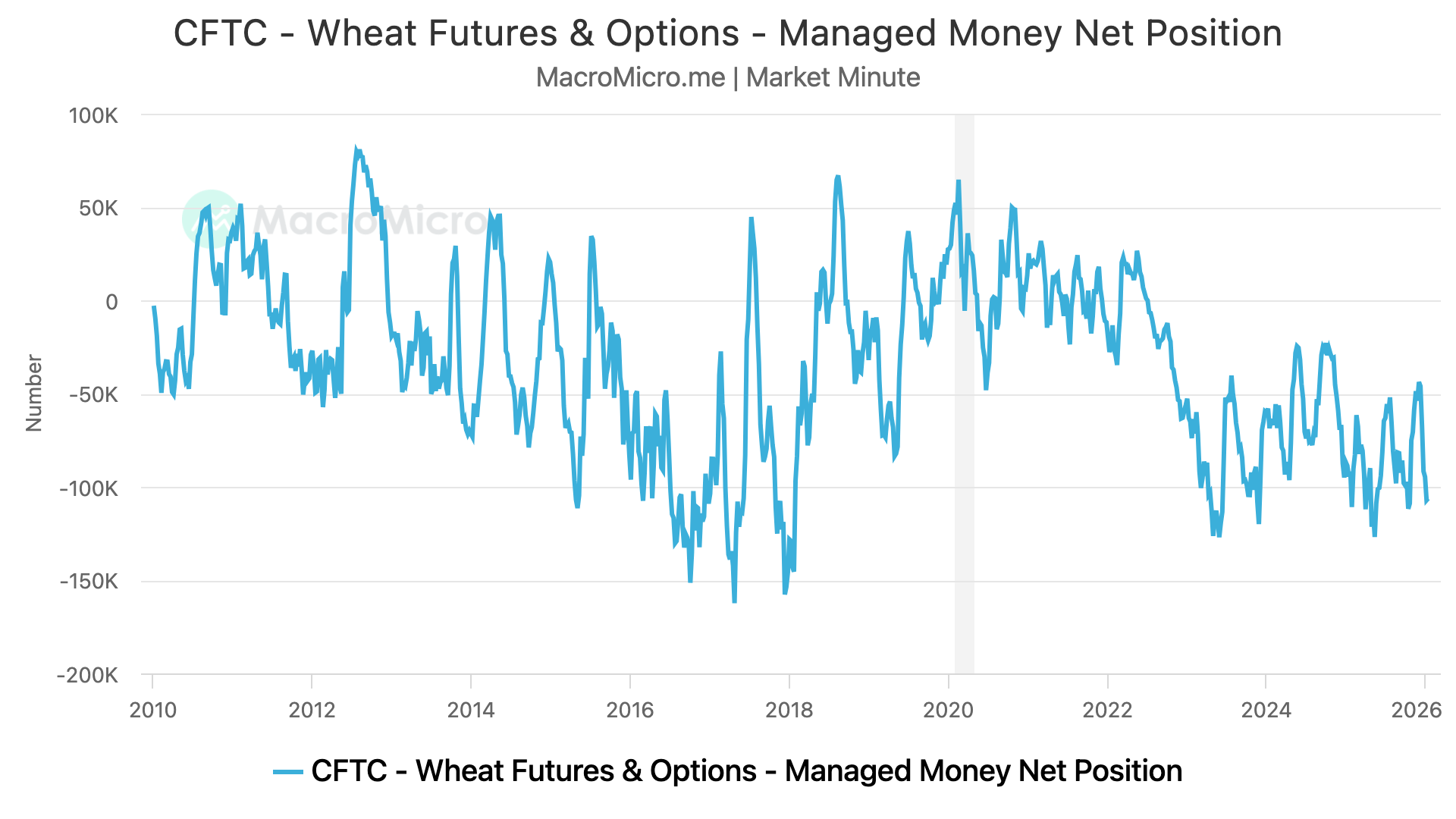

The funds are still heavily short as always.

It'll probably take a supply scare somewhere to get a real opportunity. If we run into a supply scare, we will get that typical short-covering rally eventually.

Staying as patient as I can in wheat.

Technicals:

March KC

KC actually looks optimistically solid here.

Sitting in a wedge pattern waiting for a breakout in either direction.

If we break above $5.35 it should result in the next leg higher.

Thats the 61.8% level up to the November highs. Have failed there multiple times now.

Cattle

Fundamentals:

It's a little odd that cattle aren’t rallying off the back of these winter storms.

Typically, a winter storm is friendly because cattle don’t gain when it's a blizzard and you see pounds come off the market.

So we have a winter storm that is supposed to be friendly. We also have the cattle on feed report tomorrow, which is expected to be bullish.

Yet, the market is flat.

This could suggest that the market is getting tired up here, as we aren’t able to rally on bullish weather or the anticipation of a bullish report.

So it might take a set of fresh news to push us higher from here.

Packer margins are deeply in the red. So they are slowing down their operations.

Like we've been talking about, the wholesale side of things is showing weakness.

Overall, we still like defending these levels. As there are plenty of factors at risk.

Screwworm is going to be the wild card. If it enters the US, it would be an immediately bearish factor.

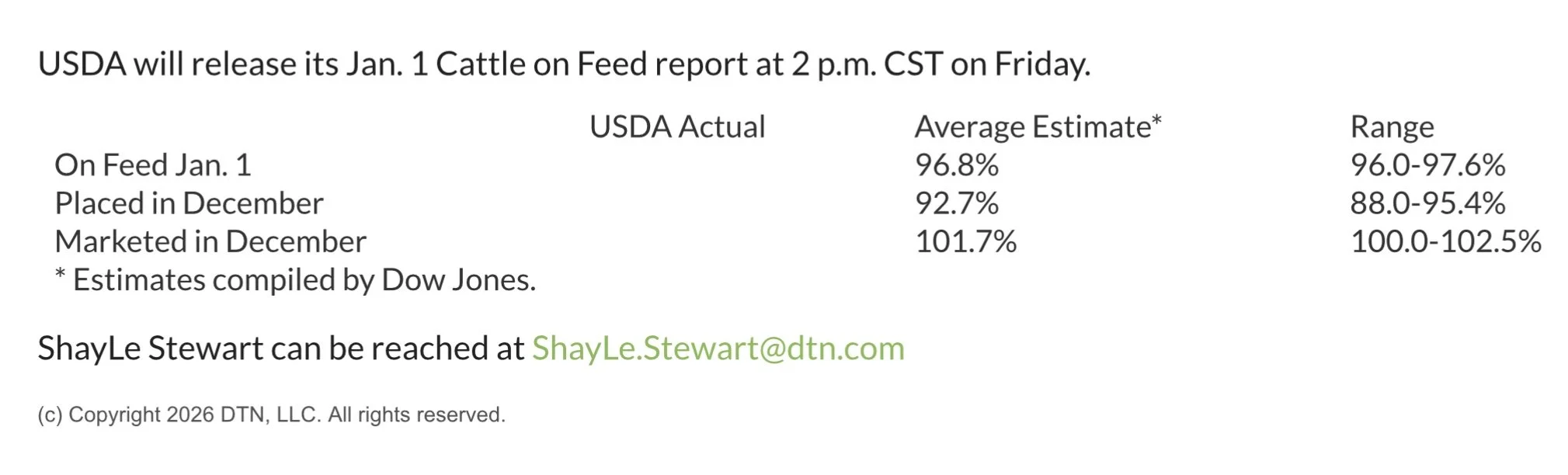

All eyes will be on tomorrow's cattle on feed.

If placements came in below 90% that would be the bullish shock that could push this market towards new highs.

If marketings are less than 100% it would be a bearish surpirse, as it would telll us packers are slowing down even more than expected due to their red margins.

Cattle on Feed Estimates

Technicals:

March Feeders

Trend is clearly higher for now.

We've got a level to hold here short term. Failure to hold could open the door lower. With trendline support along with horizontal support.

The MACD flipped bearish for the first time since those October highs.

(MACD is a momentum indicator)

Another reason to have some caution up here.

Feb Live

Live cattle needs to hold the 61.8% level of this recent mini rally (marked with blue lines).

Failure to hold could tell us we are in a deeper correction.

MACD also flipped bearish for the first time since the old highs.

Past Sell or Protection Signals

Dec 11th: 🐮

Cattle sell signal & hedge alert.

Dec 5th: 🐮

Cattle sell signal & hedge alert.

Nov 17th: 🌱

Soybean sell signal & hedge alert.

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.