TRUMP & CHINA FIASCO CONTINUES

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 4:35min

Bean: 8:00min

Wheat: 11:20min

Cattle: 13:05min

Want to talk about your situation?

(605)295-3100

Before your trial ends

Here is extended access to our harvest sale that ended this weekend. Don’t miss future updates or signals

Futures Prices Close

Overview

Grains mostly higher across the board as wheat leads the charge. Meanwhile the cattle market continues to run higher, closing higher for the 8th day in a row.

Early in the session, all the grains were weaker but bounce nicely off the lows.

Chicago wheat traded below $5.00 for the first time years and posted new contract lows this morning before rallying nearly a dime off the lows and closing back above $5.00.

Soybeans tested that $10.00 level before bouncing over a nickle off their early lows.

Why did we bounce off the early lows?

The China and Trump saga continues.

Today it was confirmed that a meeting has been scheduled between China and Trump.

If you remember, last Friday we sold off very hard across the board because Trump made it sound like he no longer wanted to meet with China.

On Friday he also said he was considering new tariffs on China.

Post from Friday

He then ultimately said on Sunday that he would be imposing a 100% tariff on China starting Nov 1st unless an agreement is reached.

Post from Sunday

The grains lack government news and direction and continue to trade every headline that comes out.

It's not just the grains though.

On Friday, the stock market posted it's worst day since April (the last trade war headline fiasco), and has now reclaimed a good portion of those losses due to the situation de-escalating.

The most recent piece of news in the Trump and China situation came after the markets closed today.

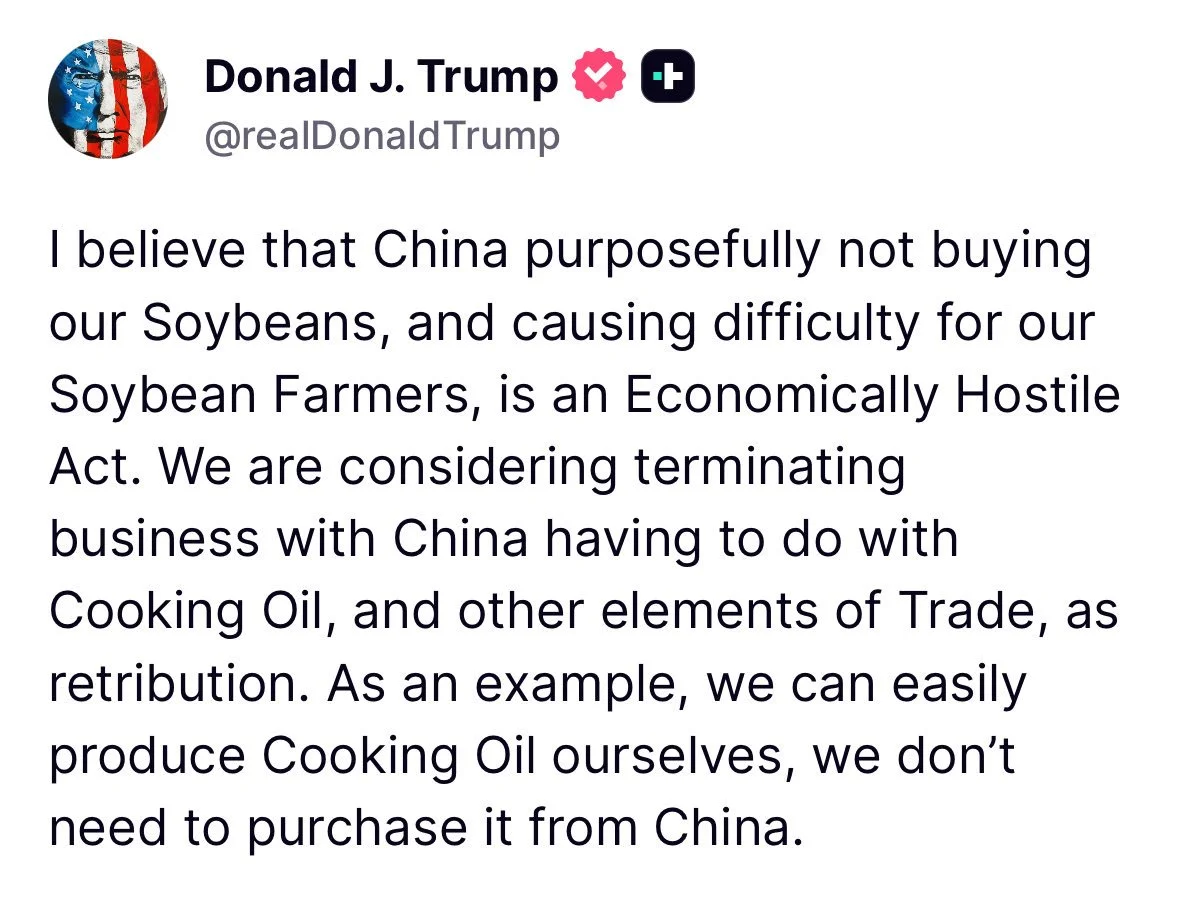

Around 2:45pm CT Trump posted this.

He accused China of an "economically hostile act" for purposefully not buying US soybeans.

He said he is considering terminating business with China, having to do with cooking oil, and other elements of trade, as retribution.

He says we can produce cooking oil ourselves instead of buying it from China.

Stocks took it on the chin on this news, as this adds trade tension. So we'll have to see if it has a negative impact on the grains tomorrow.

If we don’t import cooking oil from China it would be friendly for the crush, but at the same time it means we wouldn’t be getting a deal done with China. So I'd say it's a negative factor.

Post from Today

I don’t think us not buying used cooking oil from China as the bargaining chip is the best move.

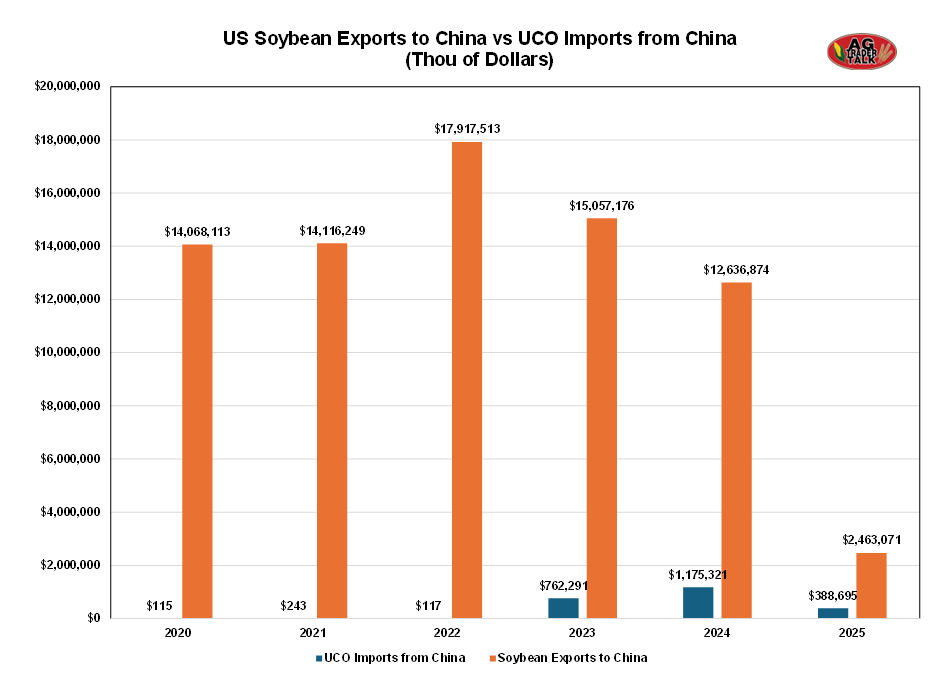

In 2024, we imported $1.5 billion worth of cooking oil from China.

In 2024, we exported $12.5 billion worth of soybeans to China.

Here is a visual from AgTrader Talk that shows our UCO imports from China vs our soybean exports to China in terms of dollars.

It's not even close.

The post about soybeans and cooking oil today came after saying our relationship with China is completely fine.. just 2 days.

So the Trump and China is situation is all over the place.

From this Weekend

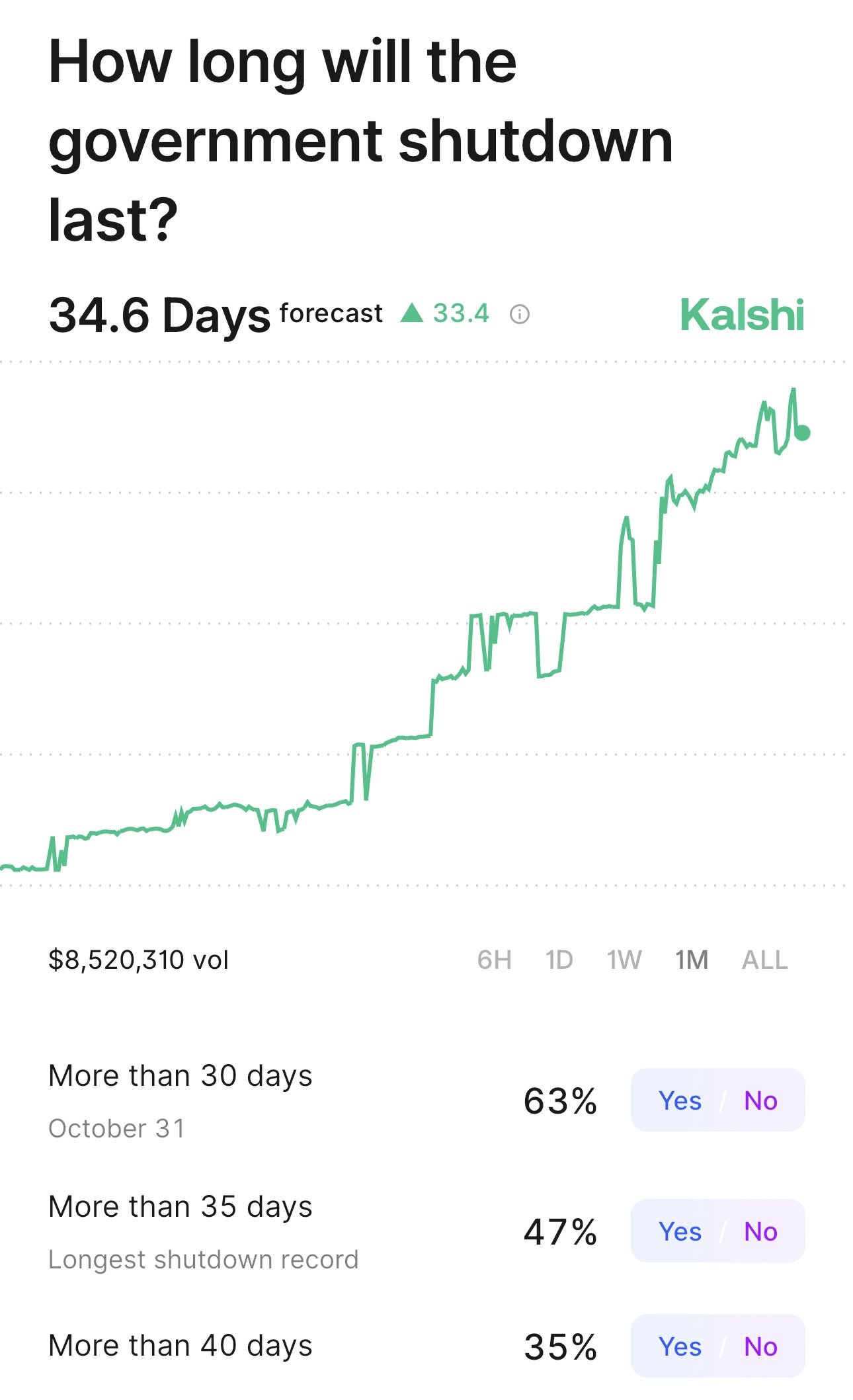

The US government is still shut down. Which means we will not be getting the October USDA report.

Who knows how long the shutdown will last, there is always the chance we don’t even get the November USDA.

We'd like to see a USDA report, because then we'd get confirmation that yield is coming down.

The betting markets currently suggest the shutdown will last 35 days.

With a 63% chance it lasts over a month.

The shutdown started Oct 1st. So we are only 2 weeks in so far.

The betting markets are also suggesting there is about a 20% chance the shutdown lasts until Nov 16th or longer.

If this happened, we would also miss that Nov USDA report.

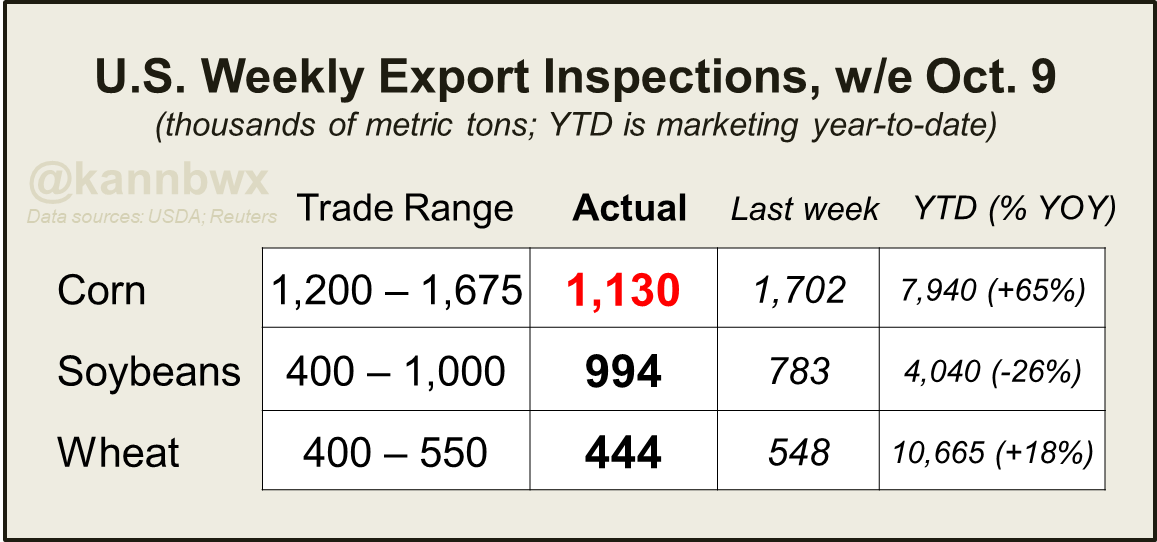

Despite the shutdown, we did get export inspections data again.

Corn actually disappointed. Coming in at their lowest in the first 6 weeks of the marketing year. However, still well ahead of last year which I'll show in the next image.

Soybeans were strong compared to the expectations, but export demand for soybeans still remains awful if you compare the numbers to last year. Sitting down -48% vs the same week last year.

Wheat was about where expected.

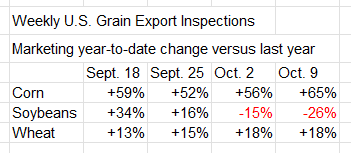

Chart from Karen Braun

Here is a nice chart from Karen Braun that shows export inspections vs last year for the last few weeks up to this point.

Corn is +65% better than last year despite the disappoint this week.

Soybeans are -26% worst than last year despite the strong week.

Wheat remains nicely ahead of last year at +18%.

Today's Main Takeaways

Corn

Fundamentals:

According to the estimates, corn harvest is believed to be 44% complete.

It is still hard to get overly bullish just simply given the utterly massive production we are going to see due to the record acres.

On the other hand, I think getting too bearish on the corn market is risky.

We have record demand supporting this market with a yield that is certainly getting smaller.

This market could simply just be range bound for a while until we see some real fundamental changes.

We don’t have enough bullish catalysts to send this market to $4.50 tomorrow, but $4.00 and lower just wouldn’t be justified given the stellar demand and fact that the crop has gotten smaller since we printed those harvest lows.

There isn’t much to update fundamentally, and we've went over plenty of fundamentals over the last few weeks so I am going to keep the corn section short today.

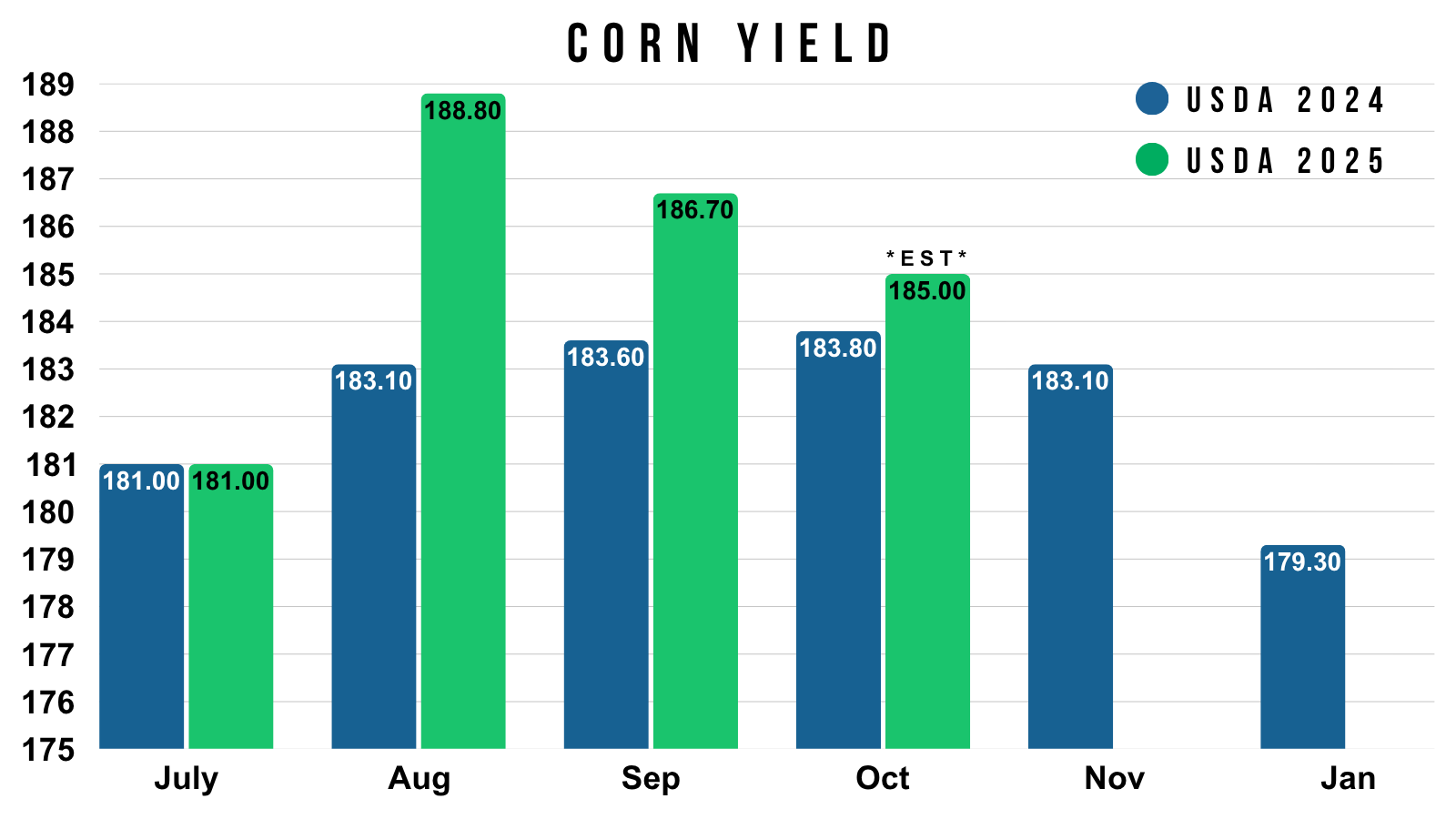

I included this chart last week, but once again wanted to mention it.

This shows the USDA's yield estimates for this year and last year.

In August:

2024: 183.10

2025: 188.80

The USDA was expecting this crop to be far larger than last year back in August.

In October:

2024: 183.80

2025: 185.00 (analyst est)

Compared to last October, analysts don’t see this crop that much larger. As that year over year gap shrank from 5.7 bpa in August, to now just 1.2 bpa in October.

Last year yield dropped in both the Nov and Jan reports before ultimately ending at 179.30.

Yield is getting smaller this year as well.

Export demand is fantastic. Feed demand is where the bears start to chip in.

It is hard to imagine that when yield gets walked back, that the USDA isn’t going to also be walking back their feed demand estimates.

We don’t have any animals and we have a lot of wheat and sorghum.

To add on to the fact that the USDA did just also lower our old crop feed demand by nearly -200 million in the quarterly stocks report.

Technicals:

Dec corn is right back down in this golden zone.

$4.07 gives back 61.8% of the entire rally off of contract lows.

That is the most common spot for a correction to end.

If the harvest lows are in, between here and $4.07 would be the most logical spot for us to find another bottom here.

I am personally looking for a bounce in this red box.

However, this is a very important spot to hold. If we break $4.07 we could potentially go test those contract lows.

Here is another reason why I think the $4.07 level will hold.

If you take corn's entire range for the most of August, the $4.06 area had the most volume.

The area of most volume is called the "point of control".

Meaning this is the price where the most buying and selling took place in August.

A point of control is basically the market's "center of gravity".

Since $4.06 is the point of control and area of most volume, often time buyers will step into that area and offer a good amount of support.

Despite the recent correction, we do still have a potential inverse head and shoulders pattern in place, which is viewed as a possible bullish pattern.

Soybeans

Fundamentals:

Soybeans continue to drug around by Trump and China headlines.

Here is a timeline of Trumps tweets.

August 11th he said China needs soybeans. We went on to rally +80 cents, altough this rally also had to due with the USDA lowering acres.

October 1st he said that soybeans were going to be a major topic of discussion with China. We went on to rally +37 cents.

Last Friday he then said he's going to tariff China and that China was being hostile. Soybeans are now down -25 cents off their recent highs.

The biggest most obvious concern is demand.

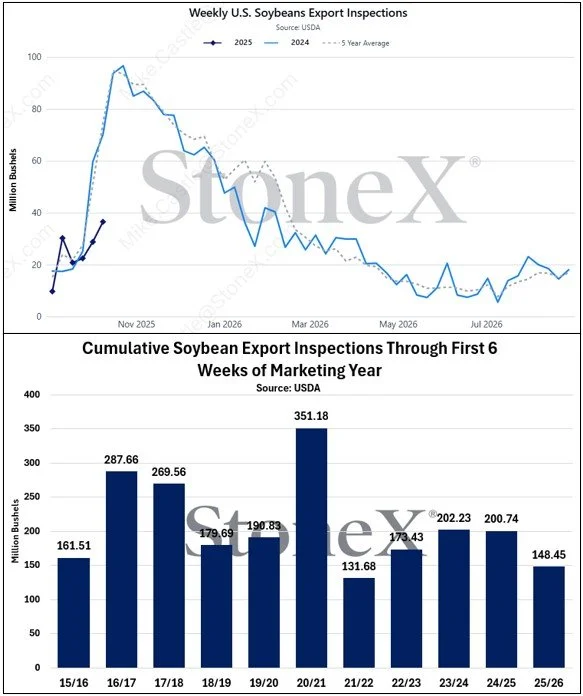

If we look at export inspections through the first 6 weeks of the marketing year, this year is one of the worst ever up to this point.

Chart from StoneX

Despite demand remaining awful, I do think this trade far is different than the last one.

Last time, african swine fever resulted in China soybean imports plummeting. They didn’t need as much soybeans to begin with.

China soybean imports this year are record high. So they need soybeans.

Compared to last trade war, we are domestically crushing more soybeans as well. Which can help offset the losses in exports on the balance sheet.

Clearly, a trade war isn’t friendly, but it doesn’t have to be as detrimental as last time.

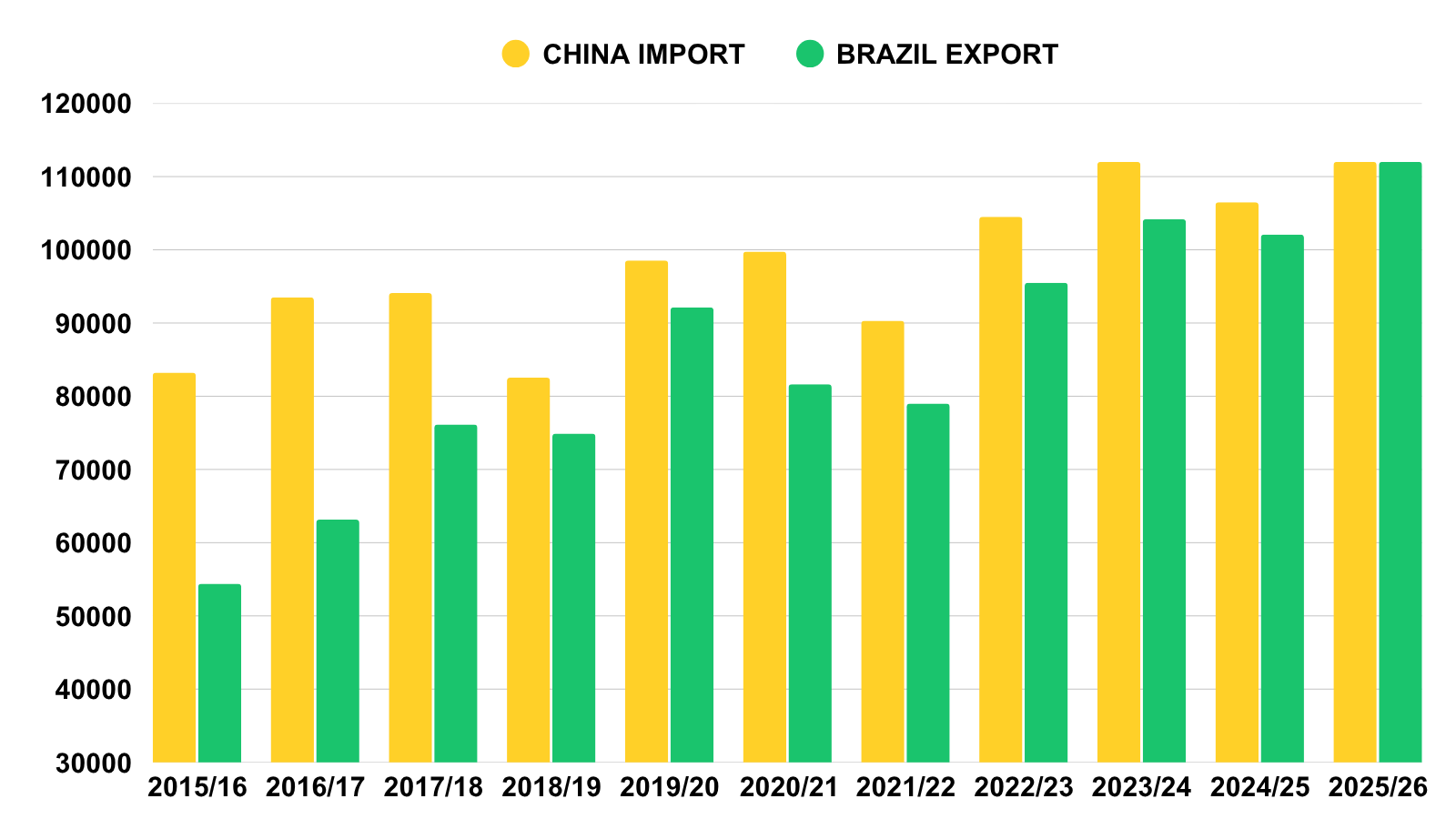

The problem is that Brazil is covering pretty much all of their needs despite China's record need for beans.

Interestingly enough, Brazil's export projections are almost identical to China's import projections.

So in theory, if these projections remain unchanged, Brazil could almost cover all of China's needs.

The biggest wild cards in this market will be:

1. Trump and China

Will we reach an agreement? If we reach an agreement, will soybeans even be included?

If they cannot come to agreement, November 1st is when the 100% tariffs on China are scheduled to take place.

If we get a trade deal, will it be a similar one to what we saw in the Phase 1 Trade Deal? Where China agrees to buy X amount of our corn and soybeans?

Is it too late to force China to buy soybeans this year? Given that we've already missed a good chunk of our prime export window.

2. Brazil Weather

This has to be the other big wild card.

Currently, China is making a bold bet that Brazil is going to be able to cover most of their soybean needs.

However, if Brazil has any hiccup in production at all, they would not be able to meet China's needs. Thus would be forced to cave in and come to the US.

A production scare or hiccup would be very bullish for soybeans, but is impossible to guess.

Technicals:

The soybean chart doesn’t look too hot.

We rejected exactly off of that 61.8% retracement of the sell off at $10.30 that we'd been talking about.

Until you break above that level, the risk remains lower.

It does not have to happen, but I could still see a scenario where we come down and post one last low and test that trendline support. A lot hinges on what Trump and China say.

I just don’t see enough to give me a ton of confidence to get long soybeans here yet.

On the bright side, we have been able to hold that $10.00 psychological level.

Wheat

Fundamentals:

For the first time in a while, wheat led the grains higher today so that was nice to see.

Wheat is the one that isn’t really impacted by the trade war headlines, but tends to follow the sentiment higher or lower.

With the shutdown there isn’t much fresh news to chew on.

The wheat market still lacks a catalyst to catch a bid despite sitting at 5-year lows and demand being pretty solid.

Seasonally, the wheat market catches a bid heading into October. But that cleary hasn’t been the case

This was just the 3rd time in the last decade that wheat failed to trade higher for the month of September.

Just the 2nd time in the last 7 years.

The wheat market sucks. We don’t have a fundamental factor saying "wheat has to go higher".

But can you really get overly bearish at 5-year lows?

The wheat market likes to grind lower for months, then out of nowhere can offer an opportunity.

We are simply waiting for that opportunity.

Dec Wheat Technicals:

I really liked the price action today.

We posted new contract lows, but then proceeded to rally well off the lows and nearly post a key reversal.

We broke the bottom of the original wedge, but this could "possibly" be a bear trap. We need to crawl back above for confirmation.

Now sitting in another potential falling wedge.

I think we have 40-50 cents of upside whenever this market decides to go higher, even if that doesn’t happen as soon as any of us would like.

Dec KC Wheat Technicals:

KC did post a key reversal today.

As we made new contract lows then proceeded to close above yesterday’s highs.

We want to see some upside follow through.

Cattle

Oct Feeder Chart:

Yesterday we alerted a hedge signal as we tapped our first target at 377.

That target was 161.8% of the rally from the middle up Sep to those late Sep highs.

That is a very common spot for a 2nd rally to pause.

However, we have now rallied past that target.

So our next target is going to be the 200% level at 385.

I like layering into more protection at that level in a manner that makes sense for your operation.

This 200% level also lines up nicely with our target in live cattle that has yet to hit.

Dec Live Cattle:

Since feeders led this move, live cattle have yet to hit their golden fib target.

That target is 248.

Which is 161.8% of the size of the rally from to middle to end of September.

Past Sell or Protection Signals

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.