WILL FUNDS BE FORCED TO COVER?

Overview

Great day across the grains, as wheat extends it's 5-day rally to nearly +70 cents while corn found strength following yesterdays poor performance.

Soybeans initially got hammered hard, down double digits but rallied back to close down just -1 to -3 cents.

Export sales for corn this morning where impressive and part of the reason corn was higher. Wheat export sales were decent. Soybean export sales were terrible and the main reason we sold off early in the day.

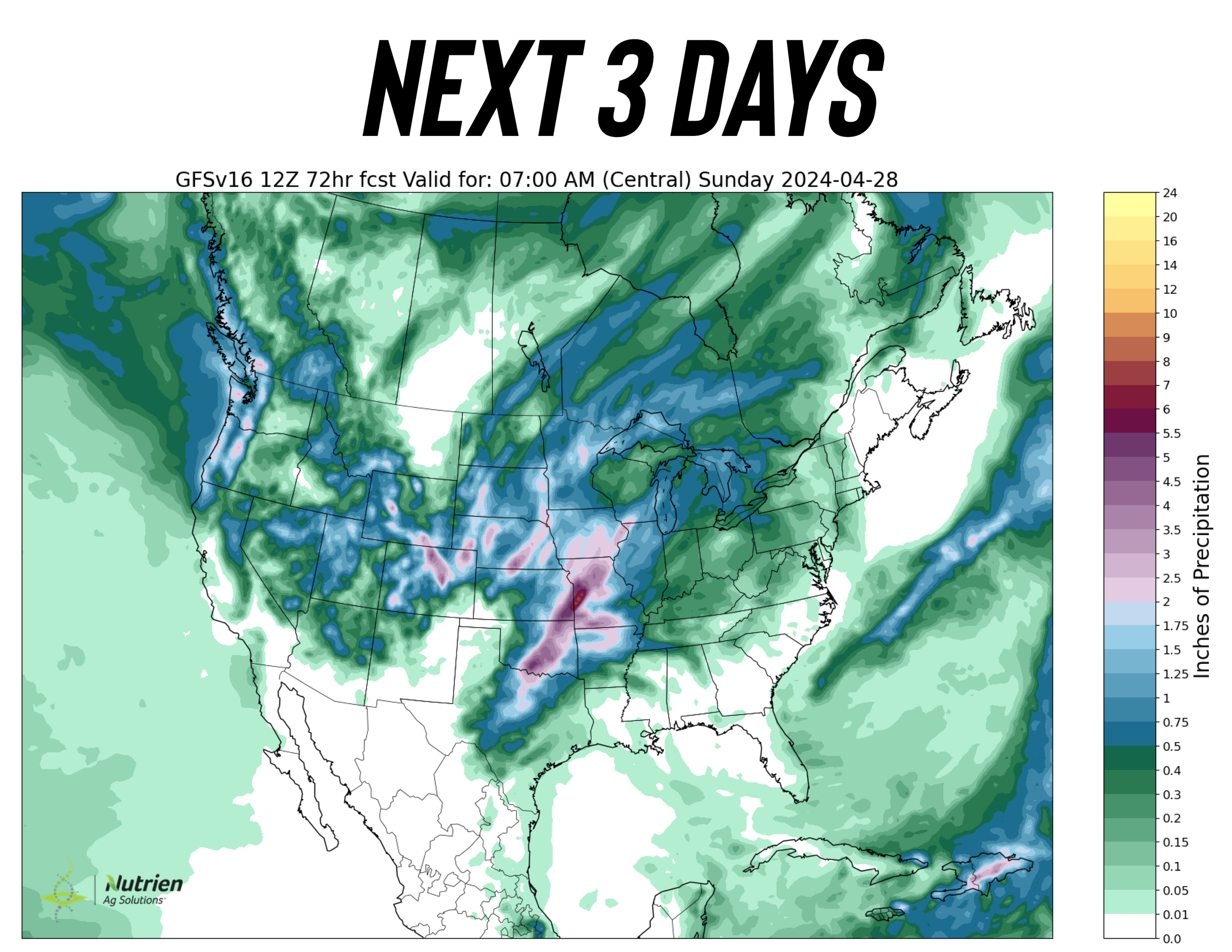

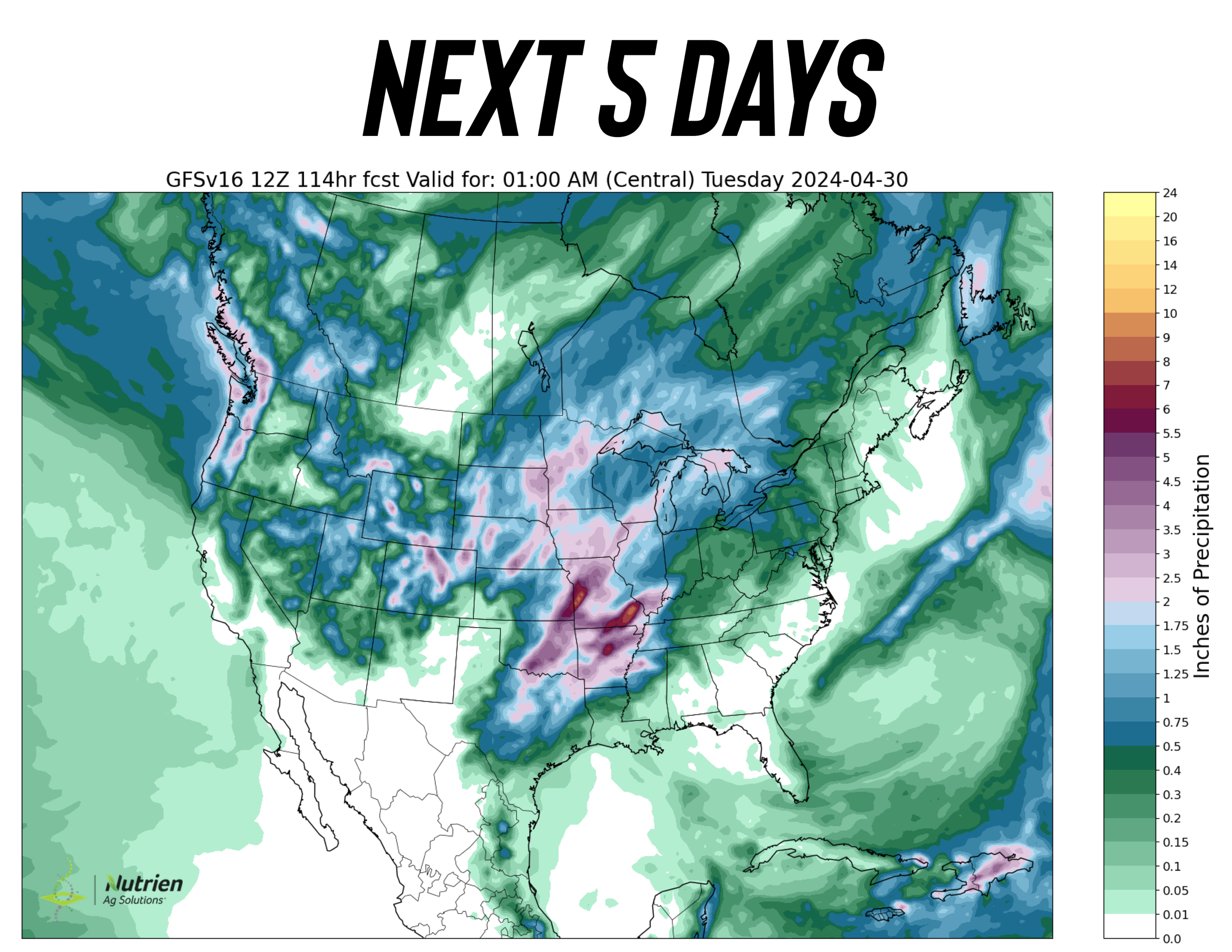

Planting has been going great so far for most, however it does look like we could see a step back the next 5-6 days. Rain in April isn’t unusual, but we are suppose to get decent rain until around May 4th. So about another week.

The rain is supposed to be the greatest in Iowa, Minnesota, Wisconsin, Missouri, eastern South Dakota, and Nebraska. Areas such as Indiana and Ohio are expected to be drier in comparison.

We are also going to be getting rain in the winter wheat country, the same one that has severely lacked moisture. However, some of these storms could bring high winds and possible tornados.

This is going to cause some delays to planting for the next week. Which means crop progress will likely fall behind normal pace next week, but should quickly rebound in early May.

Here are the forecasts:

Delayed Planting?

Let's say planting get's severely delayed. Remember 2019?

No I do NOT expect this to happen, but if it did the market would not even care about this for another 3 weeks if history is any indication.

In 2019 we had extremely delayed planting, the worst we have seen and the market did not find a bottom until May 13th before rallying.

Even with these slight delays I imagine planting will pick right back up after this week and go along at a normal to above normal pace.

IF it does not and IF we do NOT have 50% of this corn crop planted by May 10th (forecasts show wet until May 4th) the market will start to care.

Again, I don’t see this happening but it is possible.

The Funds

The funds are still heavily short:

Corn: -250k

Beans: -115k

Wheat: -35k

For the past 2 months, our markets have chopped sideways to slightly higher.

This means that the funds have been holding a position that is not making them money.

They are frustrated.

What do you do with a position when it isn’t making money?

You get rid of it.

We are also heading into a time frame associated with weather risk and a time where we typically price in weather premium and trade higher.

Options Exp & First Notice Day

Options experation is tomorrow. First notice day is next Tuesday.

What does this mean?

Typically this will……….

The rest of this is subscriber-only content. Subscribe to get every exclusive update via text & email. Along with 1 on 1 marketing planning. Become a price maker.

IN THE REST OF TODAYS UPDATE

What options exp & first notice day means

Something that could entirely change the corn situation

Technicals

How would carry out look if yield isn’t a record?

Why is wheat rallying? Where is the next stop?

Who should be making sales?

TRY 30 DAYS FREE

Try our daily updates & 1 on 1 market plans completely free. Make this the year you beat big at their own game. Become a price maker.

Scroll to check out past updates you would’ve received.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY