GRAINS WAITING FOR WEATHER MARKET

Overview

Grains mixed as corn continues it's brutal chop while soybeans continue their 4-week sell off.

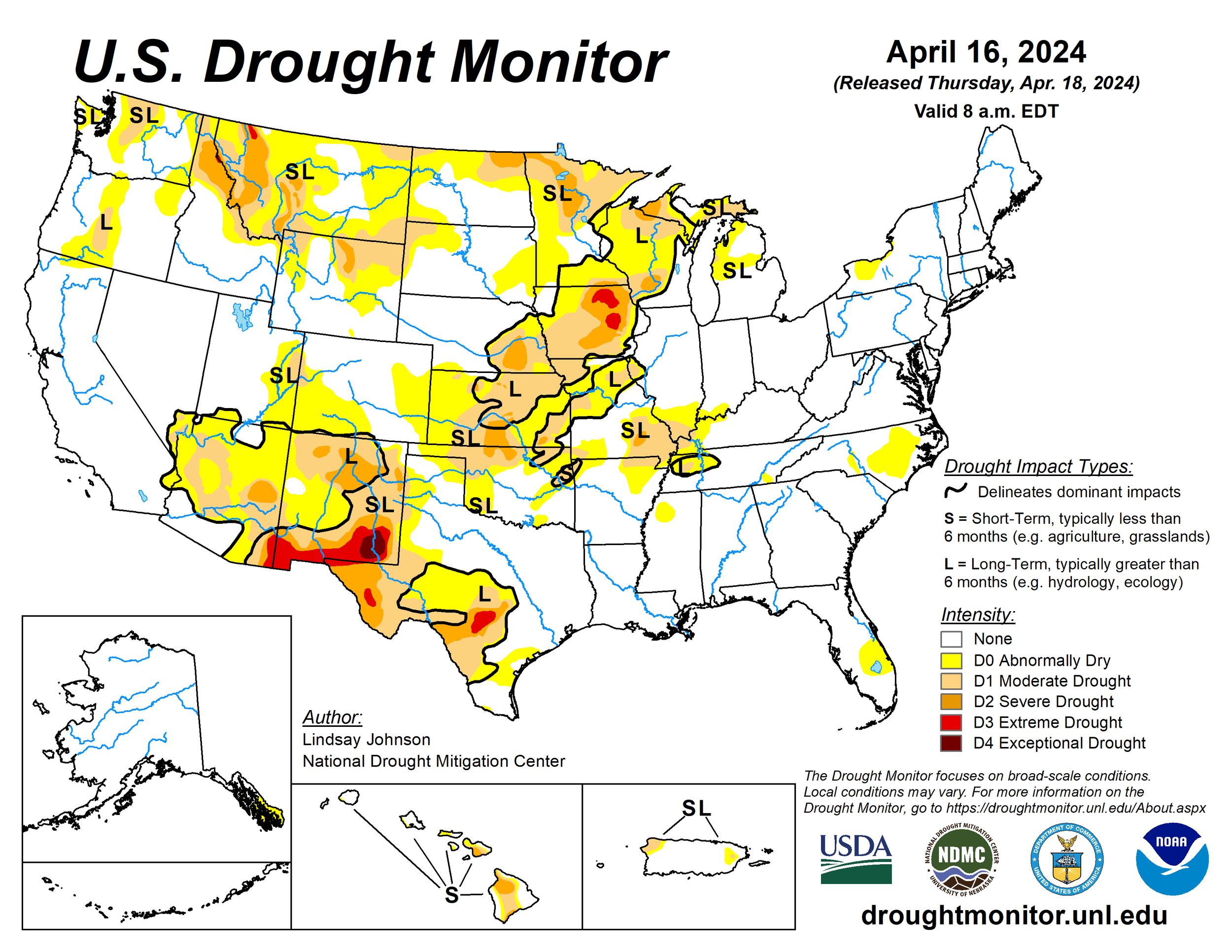

Corn and soybeans are seeing some pressure due to rains falling in the western corn belt where the soil moisture lacks. As virtually all of the drought sits west of the Mississippi river.

However, weather does not really matter right now. It will in a few weeks, but right now weather doesn’t have the ability to push us sizably higher nor lower.

The biggest thing in corn that could be adding pressure the next week or two is first notice day and all of these May basis contracts that are going to have to be priced. This often leads to more farmer selling.

An example of this would be in February, we made our lows the day after the March basis contracts expired.

Then soybeans.. Why do we continue to fall off the recent highs?

For starters planting is going good early. We came in at 3% planted which is not a huge number and it is still far too early, but that is decently fast compared to normal.

The biggest concern is soybeans is the recent rally in the US Dollar to Brazilian Real. This has been due to the recent rally in the US dollar. When the dollar goes up, it makes everything else we export that more expensive to foreign buyers. However, farmers in Brazil get paid more of their currency when the US dollar rises due to the exchange rate.

For example, if the US dollar goes up +5%, the Brazil farmer would get paid 5% more in their currency.

Why does this matter? Because this has created a lot more Brazil farmer selling.

As you can see by this chart of US Dollar vs Brazil's Real, yesterday this fell and soybeans bounced. Today it rallied and soybeans fell.

Why is the rally in the dollar happening?

The fear is that we might not see rate cuts this year, or as soon as most were originally expecting we were going to.

We also have the war in Iran and Israel. This spooked the stock market and helped rally the dollar.

War in the middle east does not rally the grains like the war in Russia and Ukraine as the middle east are not producers of grain like they are.

US Dollar vs Brazilian Real

Now taking a look at US weather and planting.

Right now this does not really matter. In 2 or 3 weeks it will, but not today.

We have gotten off to a decent start to planting, and most are expecting Monday's crop progress report to show pretty good pace as well.

Early and fast planting in most cases pressures the grain markets lower through out early to mid spring. This is something we have been mentioning the past few months.

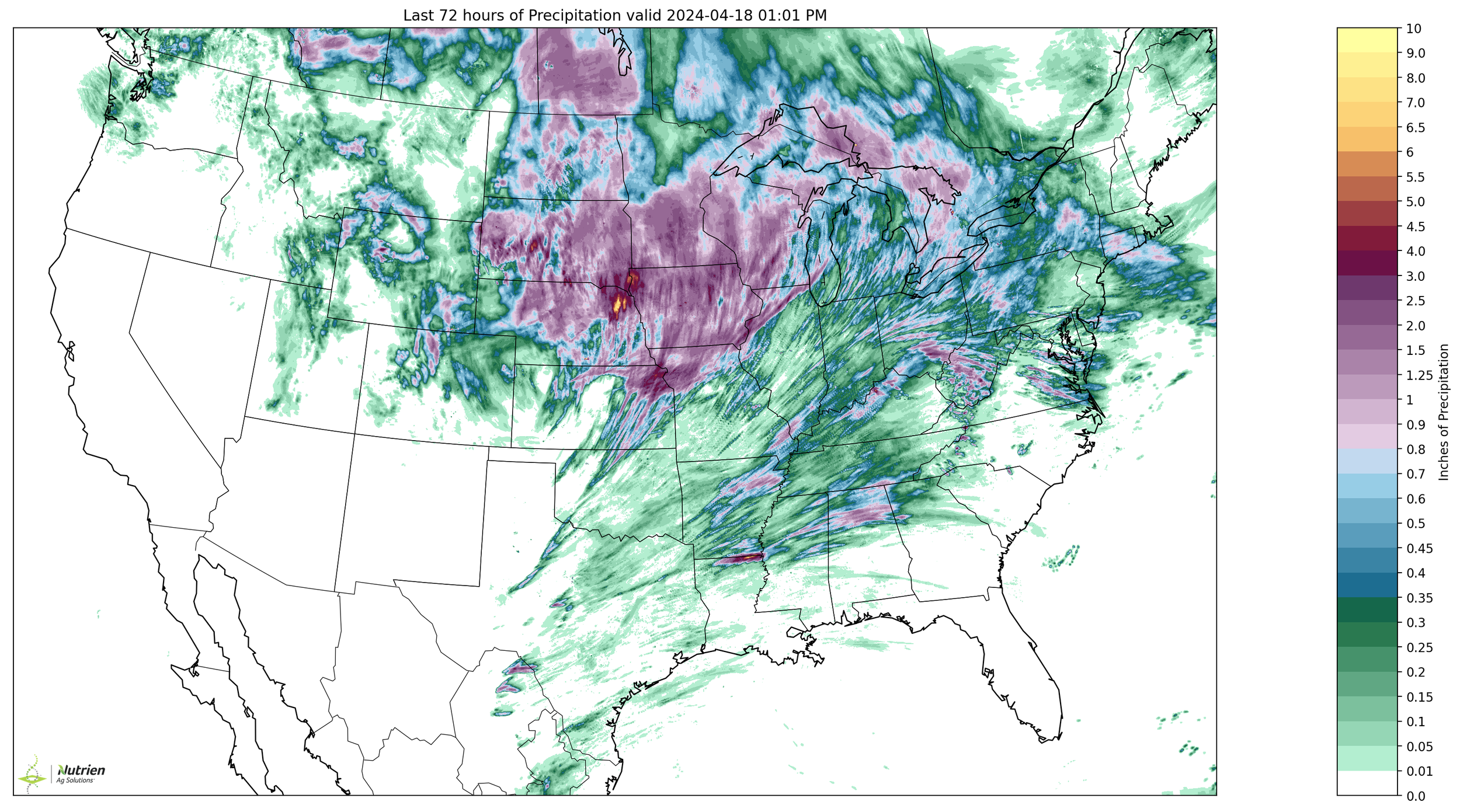

The western corn belt is getting some rain. These are the areas that needed a recharge the most. Despite the rains, a lot of areas that had problems still have problems. As we move forward this will start to gain more attention, but not today.

Orginally it looked like we were going to get extremely fast planting to the west, but with the rain it doesn't look like it will go as fast as it could have.

Past 3 Days Rain

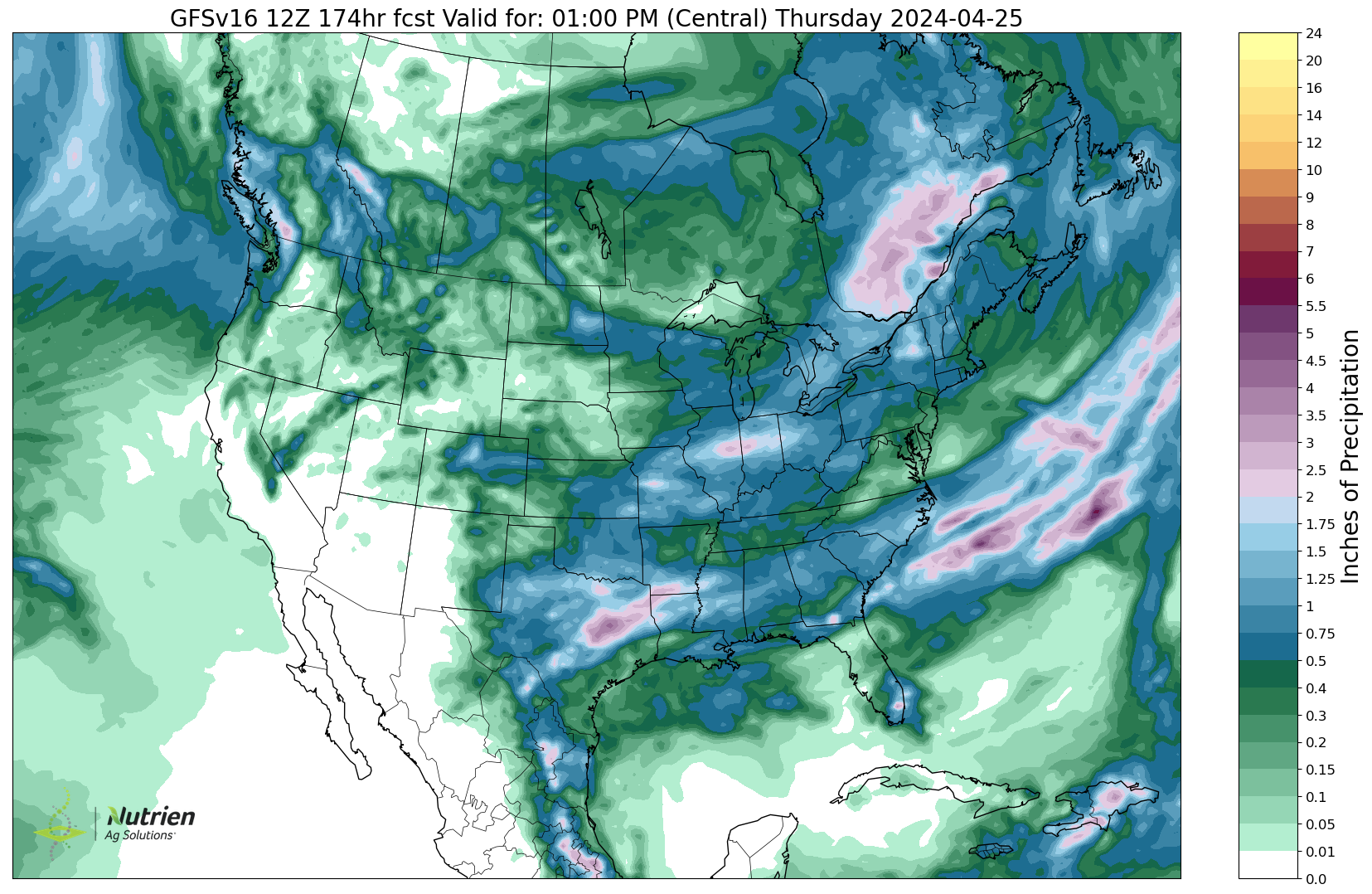

Next 7 Days Rain

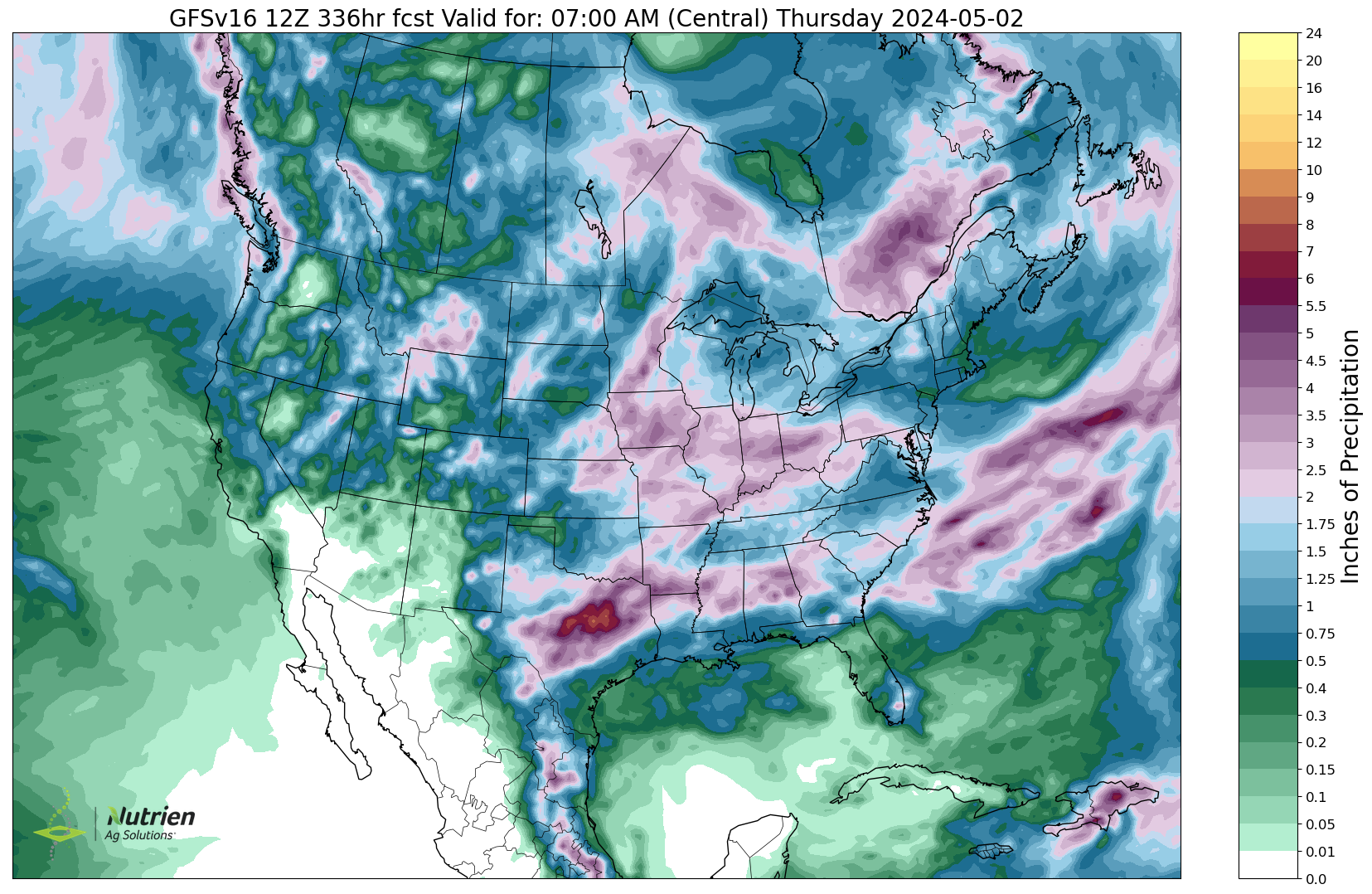

Next 14 Days Rain

We are at least 3 weeks away from any real weather discussions.

Let's say it does just keep raining out of nowhere and planting gets delayed. When would the market care?

Take 2019 for example. This is an extreme example. But this was the worst delayed planting we have ever seen. The market did not bottom and realize this until May 13th.

So even if we do get delayed planting, the market is not going to care until the middle of May more than likley.

2019 Corn Chart

However 2019 isn't happening.

Overall the outlook still favors decent planting.

So what should you expect moving forward? Short term we will……..

The rest of this is subscriber-only. Please subscribe to keep reading and get every update.

IN REST OF TODAYS UPDATE

What to expect short term

When will the funds have a reason to cover?

What first notice day and May basis contracts exp means for grains

When will weather start to matter?

Why I see a weather scare this summer..

Summer outlooks

Concerns in Iowa still

Why the inflation should cool

Are we in for lower prices?

TRY OUR DAILY UPDATES FREE

Learn all of the tools to be prepared for this upcoming growing season. Become a price maker.

Comes with 1 on 1 grain market plans.

Try completely free.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24