USDA OUT TOMORROW

AUDIO COMMENTARY

Cattle held golden zone (chart below)*

USDA out tomorrow

Knowing the rigged game

Last year balance sheet got smaller every month

Trying to get a good average

Don’t put all your eggs in one basket

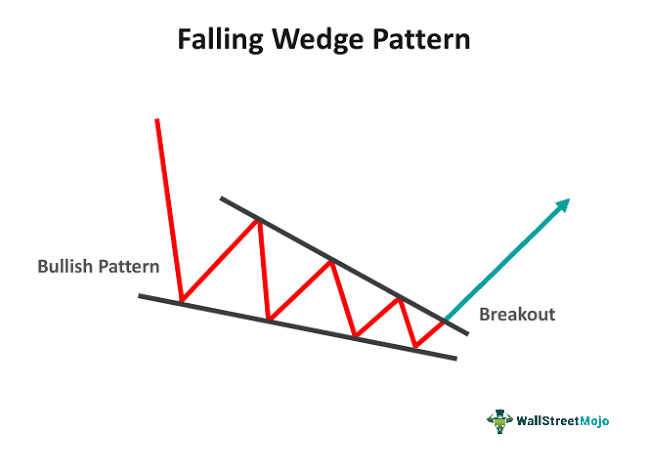

Friendly pattern in wheat (chart below)*

USDA make or break on wheat chart

Chatter of bean sales to China, but it was late reporting for old crop

This trade war is better than the last one

Odds favor cut to demand and supply in soybeans tomorrow

Risk is if supply cut doesn’t offset demand cut

Feels like USDA will be slow at cutting demand

Lot of reports of less bean yield than last year

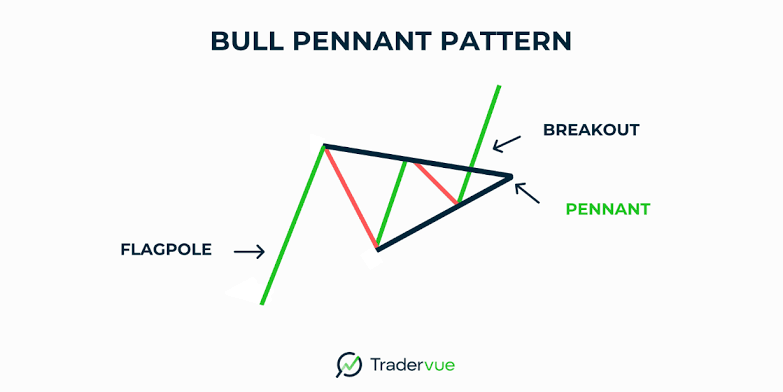

Bullish pendant in corn? (Chart below)*

All charts below audio*

Listen to todays audio below

Want to talk? (605)295-3100

CHARTS

Dec Corn 🌽

Interesting set up going into tomorrow.

We are battling this major downward trend.

We are also sitting in a potential bullish pennant.

So the chart says we “could” be setting up for a move higher. But the USDA will have the final say.

Target still remains $4.35 if we get a breakout. Which is 50% of the Feb highs.

Need to hold $4.11 to keep short term bias remaining higher. Which is 61.8% of the recent rally.

Nov Beans 🌱

This chart has been completely sideways for a week now.

We need to hold $10.12 to keep our bias remaining higher (61.8% of the entire rally), otherwise we could fall right back down to that black trendline. $10.12 is a must hold level.

To the upside, we need to break above $10.47 to be confident we are heading higher. Which reclaims 61.8% of the recent sell off.

Anything between the red and blue box is simply noise.

Dec Wheat 🌾

We continue to trickle lower but this chart continues to show bullish signs.

Yet again we are on the verge of breaking out of a falling wedge pattern. Coiling up pretty tight here.

We need to clear $5.35 to give us the green light that we are headed higher.

If we do that, we should have a clear shot at $5.52 before any major resistance.

Targets are still 50-61.8% of the June highs.

We are still showing major bullish divergence on the RSI.

Oct Feeder 🐮

We held the first golden zone, which bulls like to see.

If we break below this red box, our next stpo might be the blue box.

This red box is a major spot to hold short term. The red box gives back 50-61.8% of the recent rally.

The blue box gives back 50-61.8% of the entire rally since June.

Past Sell & Protection Signals

We recently incorporated these. Here are our past signals.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

KC wheat & corn signal.

Jan 23rd: 🌽 🌱

Corn & beans sell signal.

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

CLICK HERE TO VIEW

Dec 11: 🌽

Corn sell signal at $4.51 200-day MA

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys. If you need help with anything at all, don’t hesitate to shoot us a call, text, or email.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100