WEEKLY NEWSLETTER

By Jeremey Frost

Not so Fearless Comments for www.dailymarketminute.com

Is the railroad strike back on?

Check out the video link below in the Conspiracy Corner. According to the video, it may not have actually ever been agreed on. I guess time will tell but below in the Conspiracy Corner there is a video that gives you some info.

I know from being at CHS that dealing with the railroad is a joke. Always issues in getting railroad cars. But as one listens to the video below it tells how big of a grind it is. The bottom line is they need a ton more railroad workers.

In my opinion, the railroad companies need to be controlled by the government and maybe run in the red like other government agencies.

Farmers work hard and workers work long hours, but farmers treat their employees like humans and do their best to give them a good environment.

The railroad powers to be; well according to this video and from my experience with them I wouldn’t want my worst enemy to be a railroad worker.

Bottom line is the technology and work environment for that industry hasn’t kept up with what society demands. I don’t know how our railroads don’t fail as the next generations come to the workforce.

Railroads have zero efficiencies and we need to find a way for that to change. I for one don’t know the answer, but I am nervous as to how this will shake out.

Corn Basis implications from the Drought

This weekend I listened to a webinar from Dan O’Brien with K-State. After listening to this I went and looked at the latest USDA corn production. But with a fresh mind or a mind that hasn’t looked at this before followed with basis/grain flow mind; and implications for basis.

When I looked with a basis mind I noticed the production decrease in Kansas of over 120 million bushels less. Only producing about 83% of what they did a year ago.

Next on the list, I looked at was Oklahoma with about an 8 million bushel decrease in production. But once again only about 81% of last year's production.

Next, I looked at Nebraska, and from a raw standpoint nearly 220 million bushel decrease in production. Which is about 88% of last year’s production.

Next, off is Texas coming in about 45 million bushels less of production, but only 66% of 2021 production.

So then I put on my corn flow mindset.

I know grain flow has changed over the past several years. When I was with CHS I remember sending corn shuttles to Hereford Texas out of SD. According to my sources, that doesn’t happen very regularly anymore if at all.

South Dakota corn for example basically goes to ethanol plants or to the PNW.

My point in all of this; watch corn flow and watch where sales are getting made to and who with.

The basis implications of the NE-KS-OK-TX crops are going to be more competition for SD corn as well as the I states corn.

This goes without saying that I have a bias that basis in NE-KS-OK-TX will be stronger than a year ago.

A couple of key points on corn basis outlook. If you are an end user in a deficit area don’t let corn leave your area or you will really pay the price later.

As an example, if you are an ethanol plant in South Dakota I would be watching out for the elevators selling corn piles in different directions. If the corn is supposed to flow to you and it goes someplace else you will pay more later.

As a producer, if you are in a deficit area; watch for clues that the buyers are getting covered via corn from non-traditional sources. The buyers will be aggressive until they get comfortable. Once they get enough coverage on they will start playing games and drop basis; which will likely flush out the balance of the local corn.

TIPS

So if you are a producer in a deficit area; pick out two or three spots that are not in deficit and watch their basis as well.

If you are in a non-deficit area pick out a couple of areas in deficit and watch their basis.

Many times what happens in areas with a tight basis or deficits is that those areas have a super strong basis at the start of the year but then as buyers get covered it starts to weaken and not get as strong as it feels like it could.

Offsetting that are the areas with a weaker basis or better crops. We see grain leave the area and before you know it those areas with too much supply have let too much of it go and those areas become much stronger later in the year.

The bottom line is corn production is down over a billion bushels from a year ago. That means many areas are going to be deficit corn and that should lead to a stronger basis out of the gates; especially once harvest gets over and we get into the new year as export facilities and ports switch from beans to corn.

Nebraska has the biggest deficit year over year. So watch corn flow. How much corn will NE-KS-OK-TX pull from other areas?

MN producers should be watching to see where the increase in MN production goes to. You would assume that eastern SD and MN start off harvest with a weaker basis. I would think that those areas are slow at seeing basis firm.

Overall one has to be very bullish basis unless the board decides to take off and curb demand.

Here is the link for those that want to listen to the webinar. Watch here

After looking with a basis mind I decide to take another look.

Big Picture Mind

So the first thing that comes to mind is we really have a lot less corn than a year ago. Our carryout was pegged at a little over 1.2 billion bushels. Which is about how much less corn the USDA projected we will grow this year.

So with my simple mind that tells me we need to go higher to ration demand. Because if it is the same year over year we run out of corn. We all know that won’t happen.

That leads to my next thought of what if the USDA is still over-estimating supply (like I think). What if corn production is closer to Pro Farmer or what if it is less.

Technically the markets appear to be solid and I think the charts look like they could add a lot of strength on the next leg up.

What replaces corn in drought areas?

It’s not going to be milo with milo production only at 56% year over year. Down 195 million bushels.

Birdseed milo buyers might want to be a little more aggressive as this crop is small.

Wheat in the south; what wheat in the south?? Not much there to use. If we look at those same states NE-KS-OK-TX they are short about 170 million bushels of wheat production year over year.

Soybeans steal the show on the USDA report

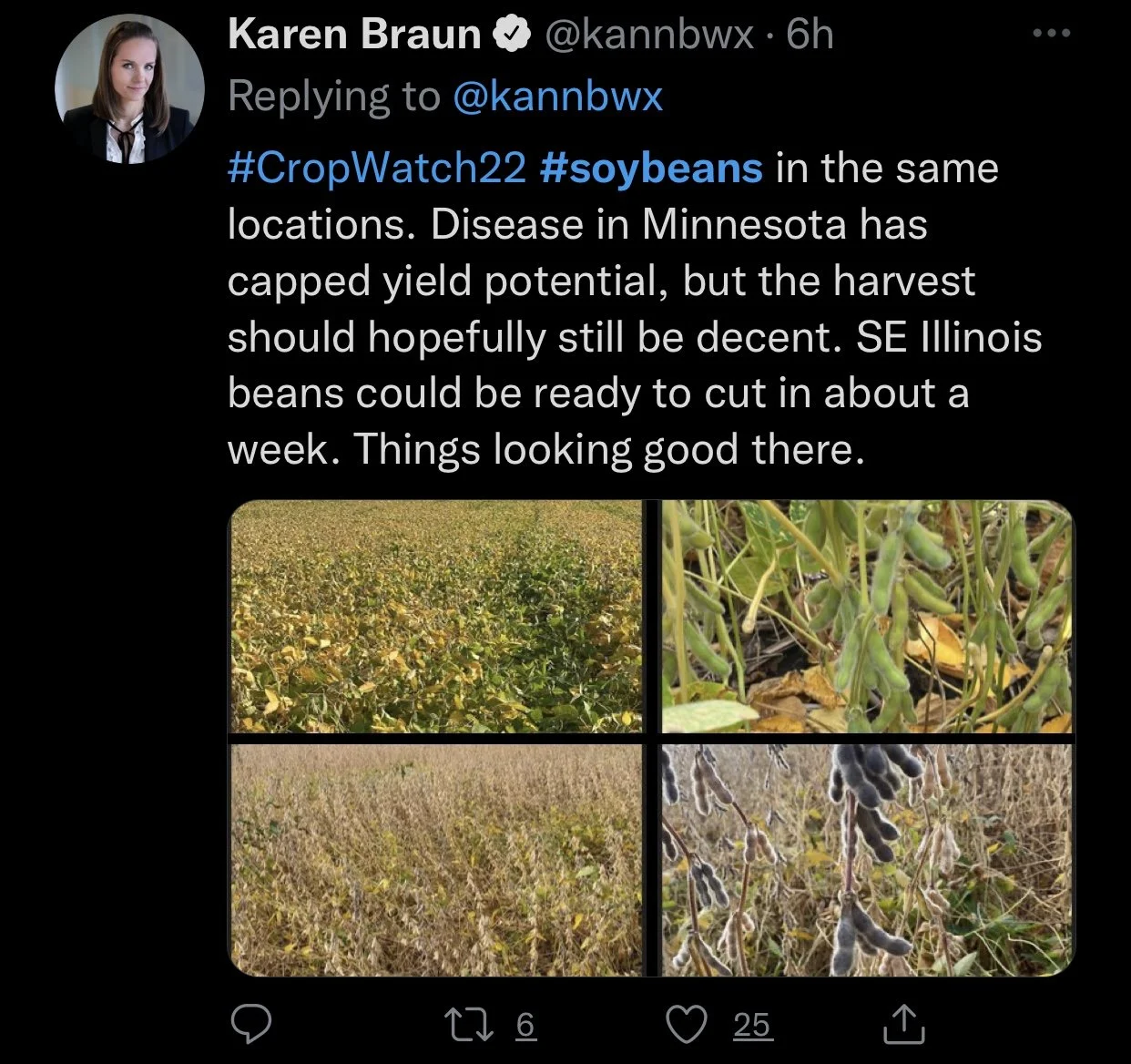

As everyone knows soybeans shocked the markets with the USDA report coming in at 1.4 bushels per acre less than a year ago. Longer term with all of the new soybean plants coming online one has to be super bullish soybeans. As we simply don’t have enough acres.

In the past couple of weeks, Argentina soybean price has increased with the currency change over 7 bucks a bushel in US dollars.

Trends/Tidbits

Corn production - Down over a billion bushels year over year.

DOW was smacked this week over 1300 points weaker - Is the market going to set back more?

My bias is that too many are too bearish the recession and that leaves the door open for something else happening.

Higher Highs and Higher lows for corn and beans several weeks in a row.

FedEx may suffer a $500 million revenue loss from Global Operations

Still on Fire Markets - White Proso Millet Market update

Last week I talked about how 21 years ago millet went 5x. This week we did a millet yield survey. Our results told us that 5x might be cheap.

With responses coming from farmers representing nearly 20% -25% of the US white proso millet crop. The yields reported were off the charts low.

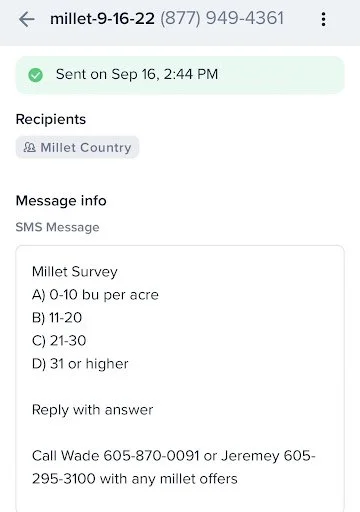

Here is a screenshot of the text we sent out.

We also posted questions on Facebook and www.newagtalk.com

Our results had over 90% that responded reporting A, with a couple comments mentioning max out of 30.

Millet yields in 2019-20-21 were 35.7 bu per acre, 18.8 bpa, and 23.2 bpa. Based on the survey my estimate is under 15 bpa. The actual results however indicate we could actually be closer to 10 bpa.

So we should be in a market that needs to ration demand. A market that could go straight up.

How high this market could and will go remains anyone’s guess. But I am going to go out on a limb and say that we see millet go over 5x. So that is at minimum $60.00 per cwt.

This market is going to attempt demand destruction. How quickly we get there is the question. Import cost or replacement is something we will need to watch and could be one reason my prediction doesn’t come true. But my experience is that it isn’t easy to import millet from overseas because of the various weed seeds.

Minor changes in our not so fearless predictions

We see new all-time highs in the following markets by 12-31-2023

Corn

Soybeans

CBOT Wheat

The US stock market rallies in September-December and starts 2023 off strong.

White Proso Millet trades to $30 by the end of the month and $40 by the end of the year. only to trade down to sub $20 pre-harvest 2023. White Proso Millet hits $60 before 2023 crop

Russia Ukraine war is still going on until January 1st, 2023 and escalates in the spring of 2023

Soybean demand in the US sets record domestic usage in 2024-2028 each year

Sunflower prices are bid as cheap as 24 per cwt at harvest in 2022, but prices increase to over $48 in 2023

The volatility leaves a sunflower plant on the wrong side of the market and we experience another Anderson Seed type of meltdown.

A millet buyer is also caught short; causing the company to either fire him or go bankrupt.

Farmers with bin room and holding power continue to gain ground against farmers without proper storage.

Conspiracy Corner

Chinese Drought

CNA - Water levels across China "so low", inland river shipping routes no longer safe.

Half of China hit by drought in worst heatwave on record.

Chinese Cloud Seeding

Drones and rockets bring rainfall to China

Economic Collapse - Supply Chain

Rail Strike Looms. AMTRACK Shuts Down 21,000 Miles of Routes

Railroad strike tentative deal no longer in place?

3 Rail Unions REJECT Tentative Deal | Rail Strike Back On?

Sign up for a monthly or yearly subscription for ’Market Minute’

Commodities Overview by Sebastian Frost

Overview

We saw a fairly quiet ending to week, as our early strength at the beginning of the week found some selling with harvest pressure and the ongoing battle with inflation putting pressure on the markets, as the stock and equity markets took a big hit through out the week, with the Feds interest rates coming in higher than expectations. The Feds will meet again on September 21st to decide how much they will raise interest rates again. Their decision will likely have a major impact on not only the stock and equity markets but will also make an impact on the grains as well.

Today's Main Takeaways

Corn

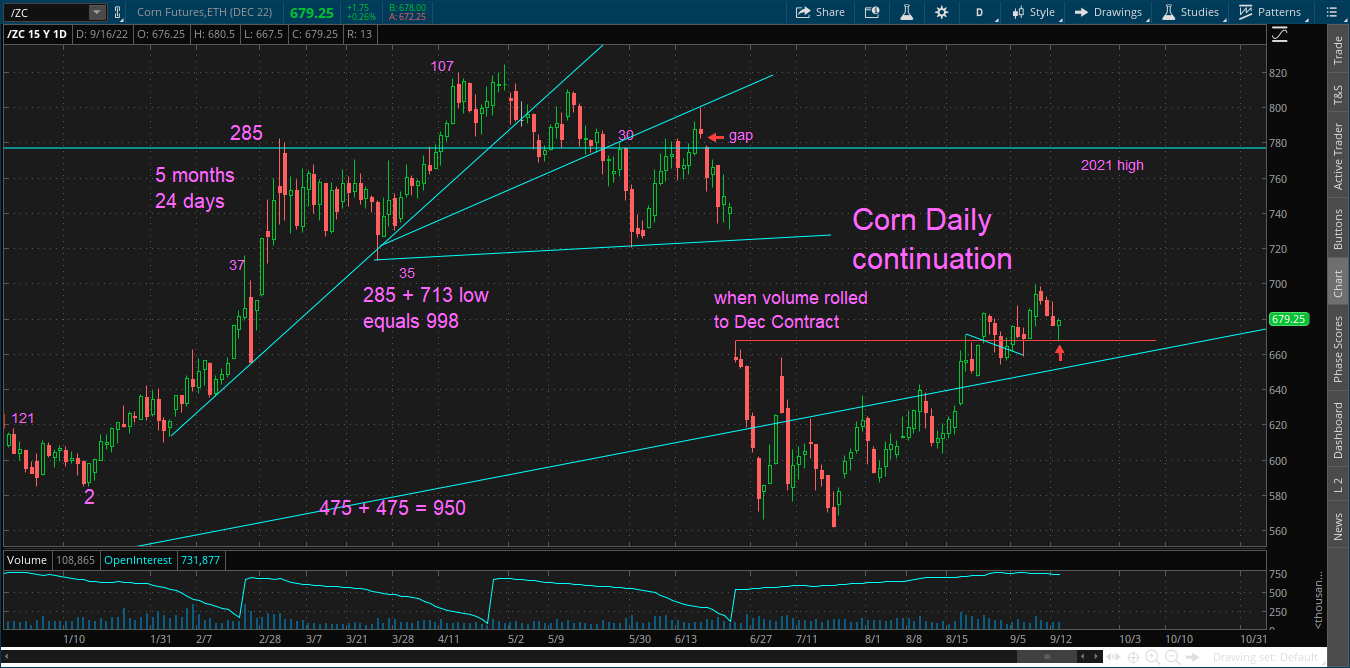

Friday we saw some back and forth trading with corn trading in a 13 cent range. Friday corn settled fractionally mixed with Dec-22 closing down -1/4 cents.

The weekly commitment of traders report showed net buying in corn from managed money funds during the week that ended in Sep. 13. This extended their net long contracts 14,164 contracts to 240,643 contracts.

On one hand, we did see weaker then expected exports. The U.S. weather is looking pretty good. Which should provide a pretty good window for harvest. As many of the major growing areas are expecting rain. So There isn't a ton of weather scare. Many appear to be lowering their export estimates and demand from China hasn't been great.

I still think corn definitely has the potential for more upside here. Now that doesn’t mean we will see some massive bull run. But, from a technical standpoint, corn is still in a solid uptrend. We also have the probability for lower U.S. yields. Not to mention the global weather concerns, as Argentina continues to face their worst drought in 30 years, with early corn planting progress getting sidelined due to the conditions and lack of precipitation. One could also argue that we could see Chinese demand turn around soon.

5-Day Change

Dec-22 Corn: -7 3/4 cents

Here is a snippet and technical analysis from 'Wright on the Market's Tech Guy'

"The Dec Corn low today was another horizontal line (red) found on the daily continuation chart starting from the high on the day the liquidity/volume moved from the July to the December contract."

He and Wright on the Market provide a ton of valuable information daily. I recommend reading a few of their articles.

Read his full write-up and analysis here

Tech Guy's Corn Chart Analysis

Dec-22 Corn (6 Month)

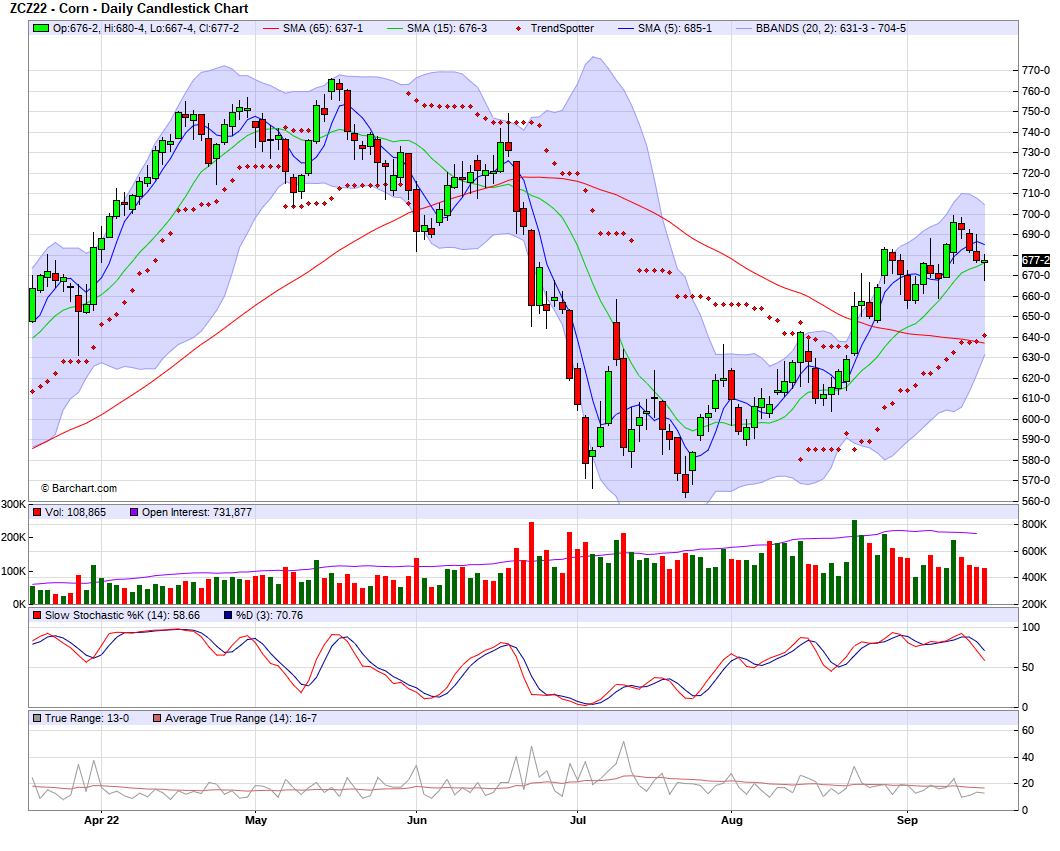

Soybeans

Soybeans finished just slightly lower Friday by 3 cents. After trading in a pretty wide range. After the massive rally to begin the week, we ran into some selling for the rest of the week. Nov-22 beans still managed to close up over 36 cents in the week on the week.

The commitment of traders report showed soybean spec traders were net buyers for the week ending in Sep. 13. Increasing their long positions by 12,498 contracts, to 112,127 contracts.

We had pretty solid weekly export sales with a little bit of Chinese buying as well. But I'm not completely sold on the thought that this is where we see that demand spark we've been searching for. As overall demand is still a pretty big concern despite the solid weekly exports.

We are also seeing pretty cooperative weather for harvest. To go along with the recent lower than expected NOPA crush numbers. As we saw Augusts crush come in at 165.5 million bushels. Which was lower than Julys 170.2 million.

Overall, I'd have to say demand is still the biggest concern for soybean futures. As the likelihood for any bullish weather headlines is looking pretty slim. So that makes us wonder whether demand itself will be enough to carry the weight of these markets and hold prices at these relatively high levels. We also have inflation and the ongoing rise of the strength in the U.S. dollar putting pressure on the markets. Along with the tensions with China, who just so happens to be the biggest soybean purchaser. Whom have recently went looking elsewhere for their soybeans, given the discount they've been able to receive from Argentina and other countries.

5-Day Change

Nov-22 Beans: +36 1/4 cents

Another snippet from 'Wright on the Market's Tech Guy'

" Friday was a better Doji (open/close the same) than Thursday's bar on Nov Beans daily chart- this usually means a change of direction day."

"I rarely know beforehand where exactly support and resistance are going to be on a chart but I can eventually find it. There is a red horizontal line across the July 10th swing high on the Nov Bean chart that caught the support of beans on this weeks correction. The note says, "This high supported prices this week".

Highly recommend you read his full breakdown of the markets here

Tech Guy's Bean Chart

Nov-22 Soybeans (6 Month)

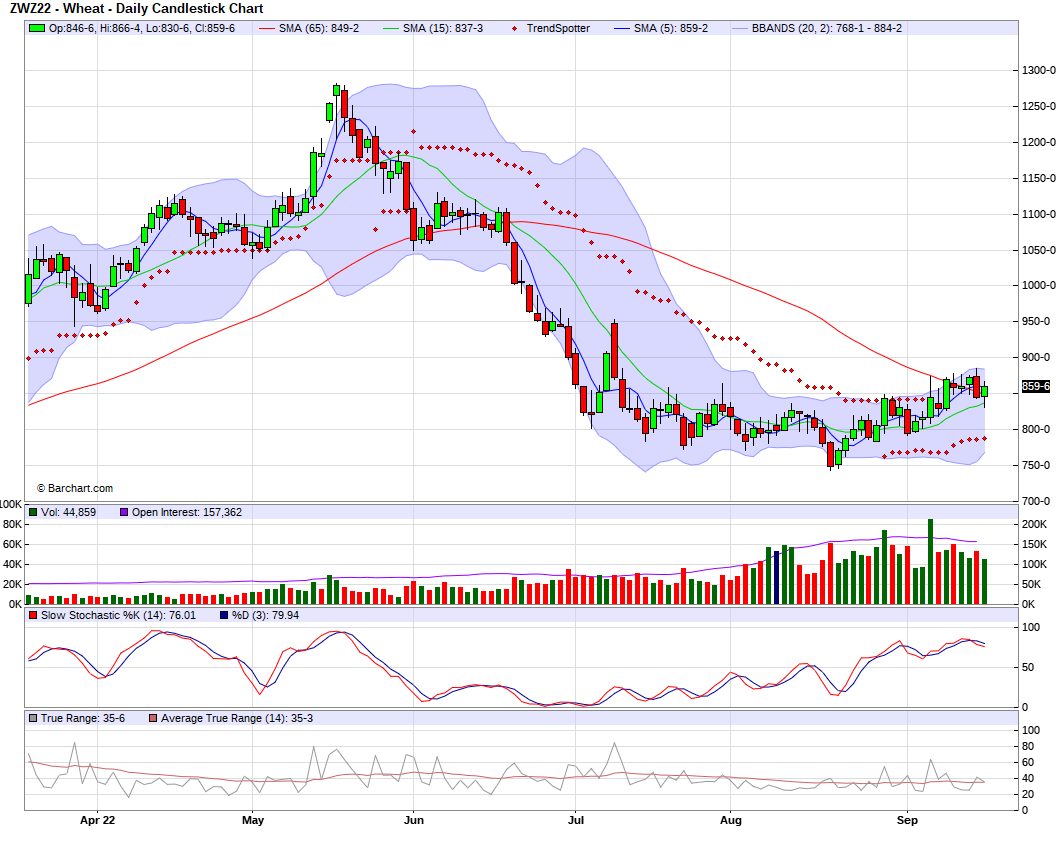

Wheat

Friday we saw wheat futures trade double digits higher. Which made up for some losses we occurred during the week. KC and MPLS both finishing higher on the week, while Chicago still finished the overall week lower.

U.S. exports were fairly disappointing last week. We also have forecasts showing widespread precipitation, which are both negative factors for the markets. Not to mention the record crops being reported. And of course the outside markets have continued to add pressure with the dollar still sitting near 20 year highs.

Wheat still in a pretty good uptrend. I wouldn’t be surprised if we saw prices continue to climb this week. With the global weather concerns and record droughts, as well as Ukraine/Black Sea headlines looking to add support. However, I also wouldn't be totally surprised to see things shift the other way, as everyone is keeping their eyes on Putin and what he decides to do. But nonetheless, I still remain fairly optimistic.

5-Day Changes

Dec-22 Chicago: -9 3/4 cents

Dec-22 KC: +6 cents

Dec-22 MPLS: +11 1/4 cents

Dec-22 Chicago Wheat (6 month)

Stock Market

Next week we will see the critical Federal reserve meeting. Many were surprised to see the higher-than-expected August consumer price index report, which showed inflation still standing at 8.3%. It appears that traders are running out of reasons to keep pushing stocks higher. As for the time being the economy isn't showing any major signs of cooling off.

Billionaire Ray Dalio, the founder of one of the world's biggest hedge funds is predicting a deep plunge in stock markets as the U.S. Federal Reserve raises interest rates aggressively in attempt to cool inflation. He isn't the only public figure prediction a major downfall in the both the U.S. and world economy.

He made the statement "I estimate that a rise in rates from where they are to about 4.5% will produce about a 20% negative impact on equity prices" he wrote in a LinkedIn post on Tuesday.

Last week the S&P 500 ETF $SPY dropped over -6% over the course of the week, following the higher than expected CPI numbers. The NASDAQ also dropped over -6% over the week. Dow Jones declined nearly -5%.

Last week U.S. investors lost about $1.5 trillion in the stock market. How much of an effect did this have on some of the world’s wealthiest? Here was net worth losses after Tuesday’s crash

Jeff Bezos net worth dropped $9.8 billion

Elon Musks net worth dropped $8.4 billion

Mark Zuckerbergs net worth dropped over $4 billion

Bill Gates net worth dropped $2.8 billion

We also saw weekly job claims decline for the 5th week in a row. To the lowest we've seen since the beginning of June.

News

The rail strike was temporarily averted. But the industry still remains far off track. After three years of negotiations, the unions tentatively agreed on new contracts.

According to The Insider, they surveyed a poll that showed the majority of Americans believe we should see age caps in Congress. They also had another poll that says most Americans believe the government is 'too old', and they want drastic changes.

Ukraine delivers another blow to Russia as it breaches front line on Oskil River.

Argentina farmers pause corn planting, and abandon some wheat amid the drought. As they face the worst drought they've seen in three decades.

Russias invasions destroyed or damaged roughly 14% of Ukraines grain storage.

Nov-22 Crude Oil WTI (6 Month)

Dec-22 Dollar Index (6 month)

Here is a few of our recent newsletters in case you missed them..

Morning Market Update Sep. 16

Stocks & Equities Plunge - What does this mean for the grains?

Last Week’s weekly newsletter - Sep. 11

Social Media

Precipitation Forecasts

2-Day

Weather

Source: National Weather Service