MORNING MARKET UPDATE

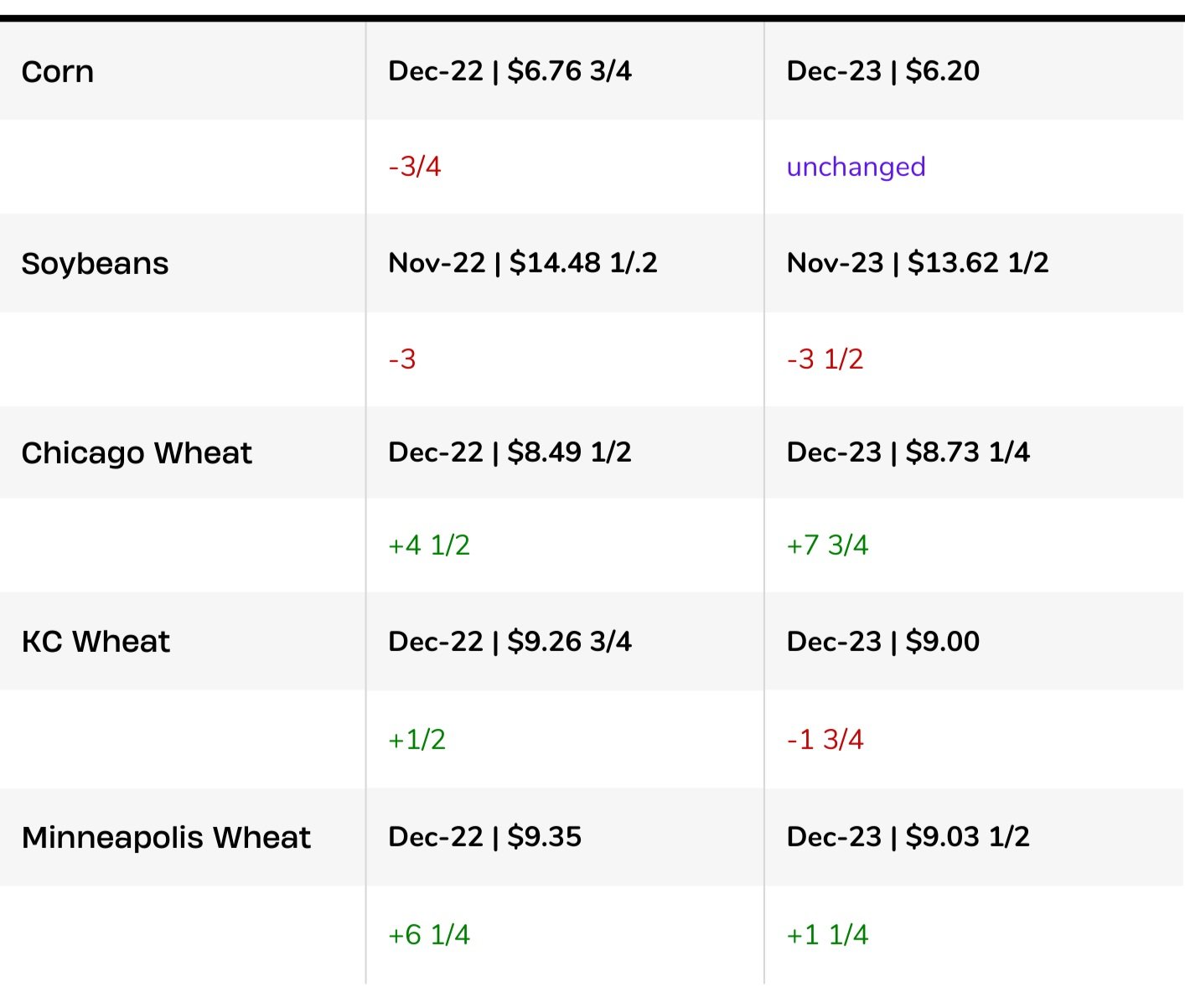

Futures Prices 11:30am CT

The millet market remains hot. Continues to be a sellers market. If you have any offers don't hesitate to contact Jeremey or Wade at Banghart Properties. We believe the strength will continue as farmers selling is very limited.

Contact Jeremey at (605) 295-3100 or Wade at (605) 870-0091 or visit their website here

Following the railroad developments and export sales data yesterday. The outside markets and weak economy have really taken over the grain markets here to end the week, which early this morning resulted in lower prices across the board with some follow-through selling from yesterday. However, it appears prices have turned around here a little bit. With corn just slightly lower, beans still slightly lower, and wheat higher. We also have U.S. row crop harvest adding some additional pressure to both corn and beans as we head into the weekend.

Recession and inflation have been beating up the stock and equity markets as of lately which hasn't been supportive of grain prices.

It appears the grain markets are looking to shift into a more demand-driven market, rather than that of a supply following the disappointing exports yesterday. The exports came in roughly around expectations but were still pretty disappointing overall. Corn by far had the biggest disappointment in the report yesterday. Which had them at 21% sold vs the 5-year average of 28%. Soybeans on the other hand weren't all that bad, at 45% compared to the 38% 5-year average. Wheat was on pace with the USDA at 46% sold compared to the 45% pace.

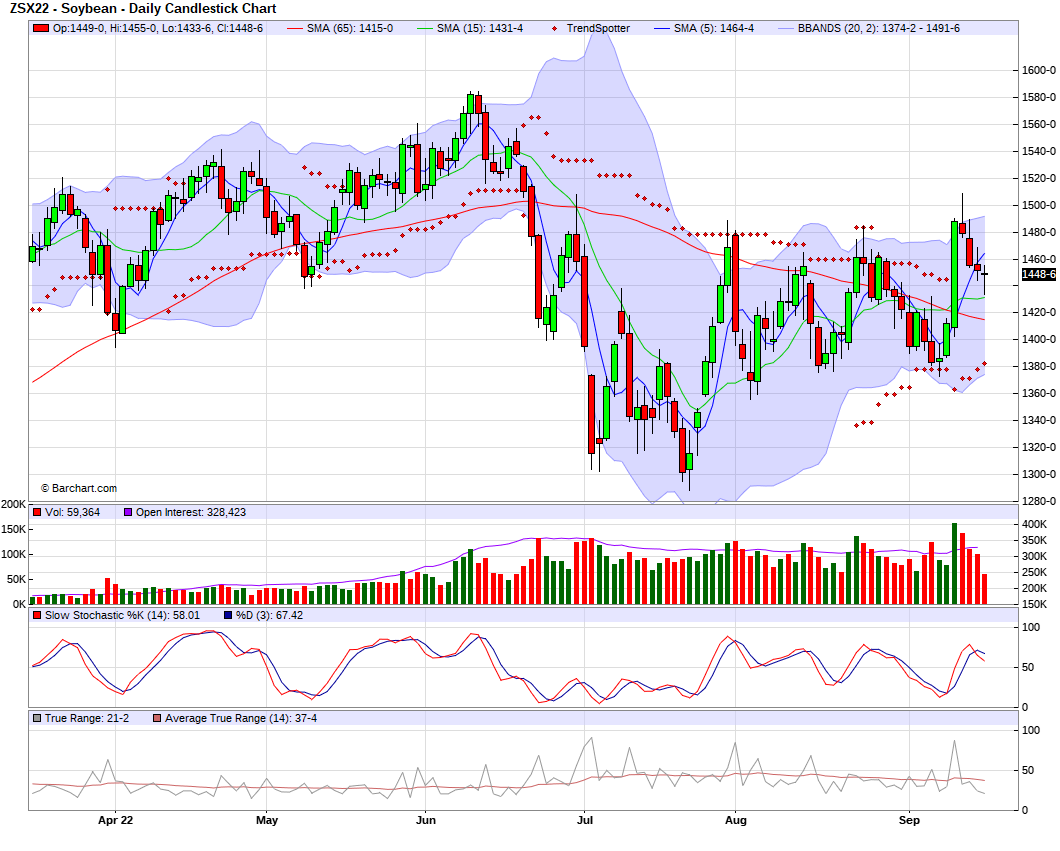

Despite a lackluster few days, soybeans are still firmly higher on the week. As I'm writing this morning they are up roughly +30 cents on the week. With corn currently down around -13 cents on the week. Wheat markets all down on the week as well. With Chicago down over -30 cents, KC down -14 cents, and MPLS barely down on the week -1 3/4 cents.

Corn fell below its 10-day moving average of 6.78 3/4. Being pressured by technicals and overall weak demand with the poor exports seen yesterday. On the other hand, it's a little early, but we do have the weather concerns in South America.

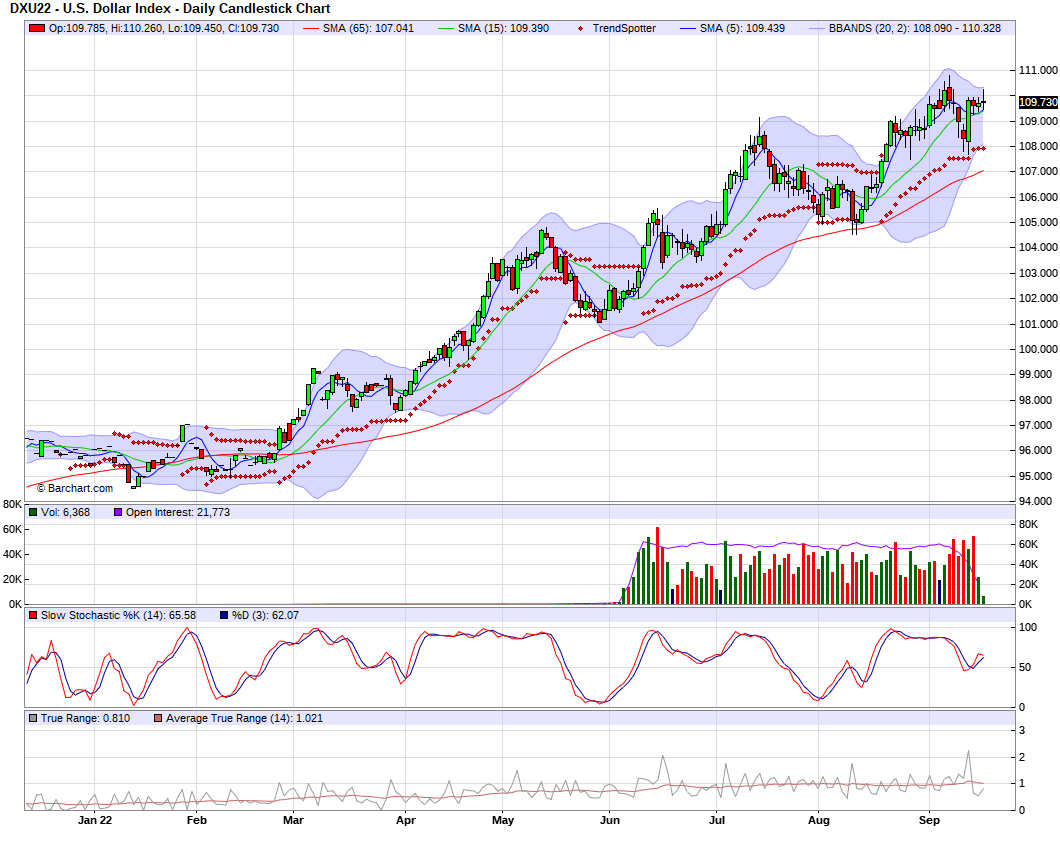

Soybeans are lower with harvest pressure, South America planting season, and a lot of concern regarding the future demand for U.S. soybeans as China and other countries continue to look elsewhere for soybeans. One one hand we did see fairly good exports yesterday as well as some Chinese buying. But will we continue to see demand. And if so, is demand enough to carry the bean markets by itself, and support prices at these relatively high levels. With the U.S. dollar trading at these 20-year highs its hard to make the argument that demand alone can carry this market.

Wheat is mixed this morning seeing pretty choppy trade. Weakness coming from technicals and a higher U.S. dollar. We also have bears looking at the widespread rain in the precipitation forecasts.

The railroads reached a tentative agreement with the unions. This doesn’t necessarily mean this whole fiasco is over. But, if it is approved by union members we won't see a strike. Which is a good thing for anyone involved in the grain markets.

The agreement provides railroad employees a 24% pay increase, while also dishing out an additional $11k per union member upon adoption.

We touched on this yesterday, but here is what we wrote yesterday regarding the railroad situation; "The railroad agreement was averted last minute, this could still potentially be a concern. We don’t know how this will shake out, as it was extended till the end of the month. Bottom line this doesn’t really affect the railroad performance. Farmers and elevators are hoping railroad performance improves because there are a lot of areas that are struggling to move product. As an example, locally in Sully County, there are a lot of farmers that looking to move wheat before fall harvest to clean out bins. It doesn't appear that they are going to get enough rail cars in to allow farmers to empty wheat bins before harvest. The less rail cars an elevator gets, the wider their basis and margin is. The more they get, the more competition is created."

Stocks and equities lower after the railroad shut down being temporarily averted. Investors will be looking at next week's critical Federal Reserve policy meeting. As it's been tough to find any optimism for stocks to be pushed higher with the ongoing inflation concerns. The retail sales data we saw yesterday didn't really show any signs of the economy cooling off. As August sales were up +0.3.

This morning we also saw the S&P 500 break below a very key support level of 3,900. As yesterday we closed above that level at 3,901. Currently down almost 2% this morning at 3,824.

The NASDAQ and Dow Jones also sharply lower this morning.

NASDAQ down -1.7%

Dow Jones down -1.27%

Crude oil is currently up +0.57 to 85.68

Dollar Index is up +0.035 to 109.78

Cotton limit down

FedEx stock down -22%

Dec-22 Corn (6-Month)

Nov-22 Beans (6-Month)

Dollar Index (1 Year)

Previous Newsletters

Here are our last few newsletters. Would love any feedback or things you would like to see.

Yesterday's Closing Market Update - Read Here

Stocks & Equities Plunge. What’s This Mean For Grains? - Read Here

Last Weeks' Weekly Newsletter - Read Here

Social Media

Credit: All credit to users of posts