MARKET CLOSING UPDATE

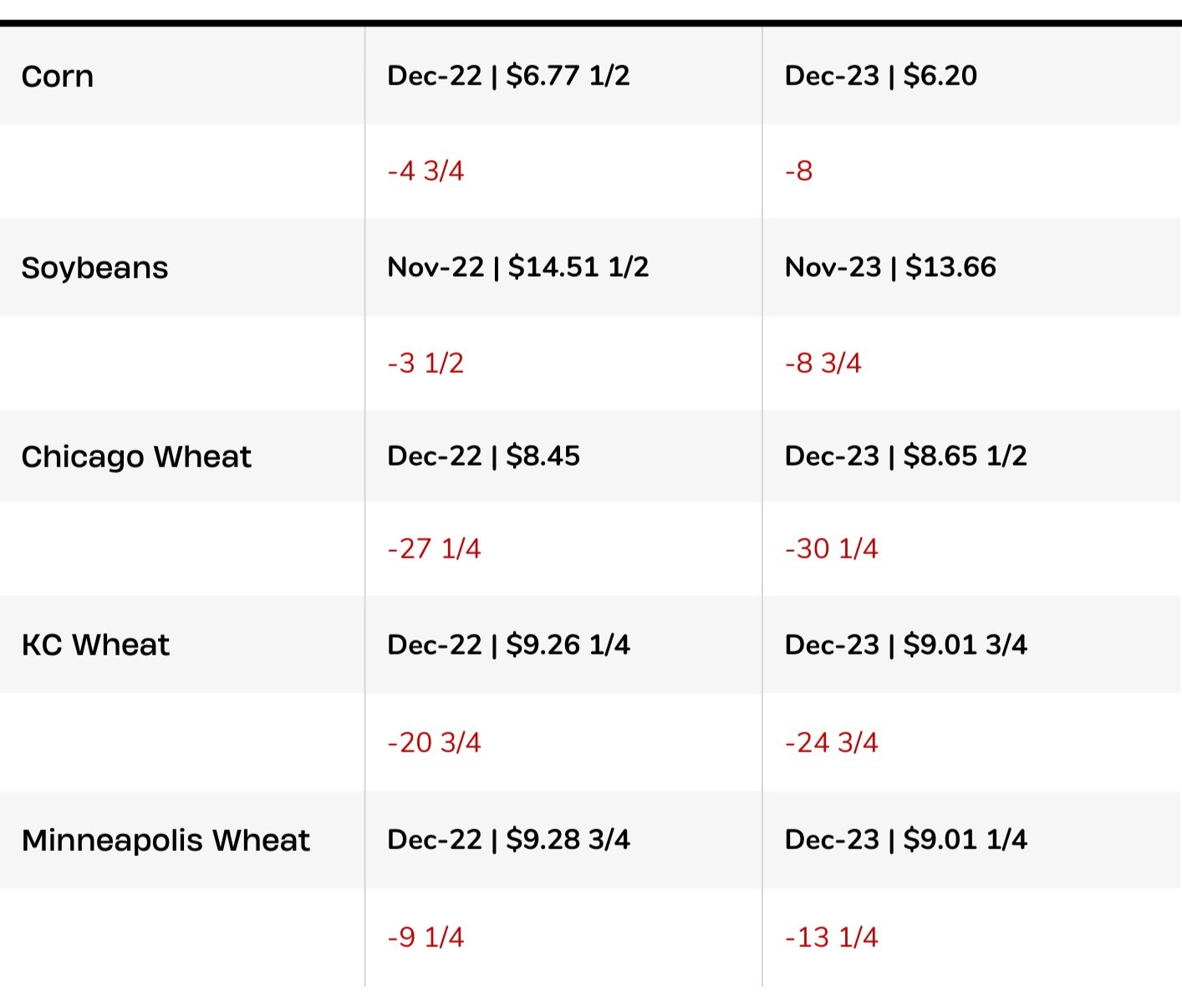

Futures Prices Close

Overview

Grains mostly lower here to end the day. We did see some nice highs over night but saw selling come in as the day went on. We saw outside markets putting pressure on the grains, crude oil down around $3.50 to $85, roughly $4 off its highs. Today was a risk off day. With corn and soybeans closing slightly lower as wheat finished sharply lower. All grains well off their early highs. With wheat and crude sharply lower, the rest of the markets followed suite ending in a red day across the board.

We finally saw the much delayed export sales data from the USDA. Which were mostly in line with the low expectations, not providing much support, with U.S. prices still higher than the world's other competitors and harvest starting.

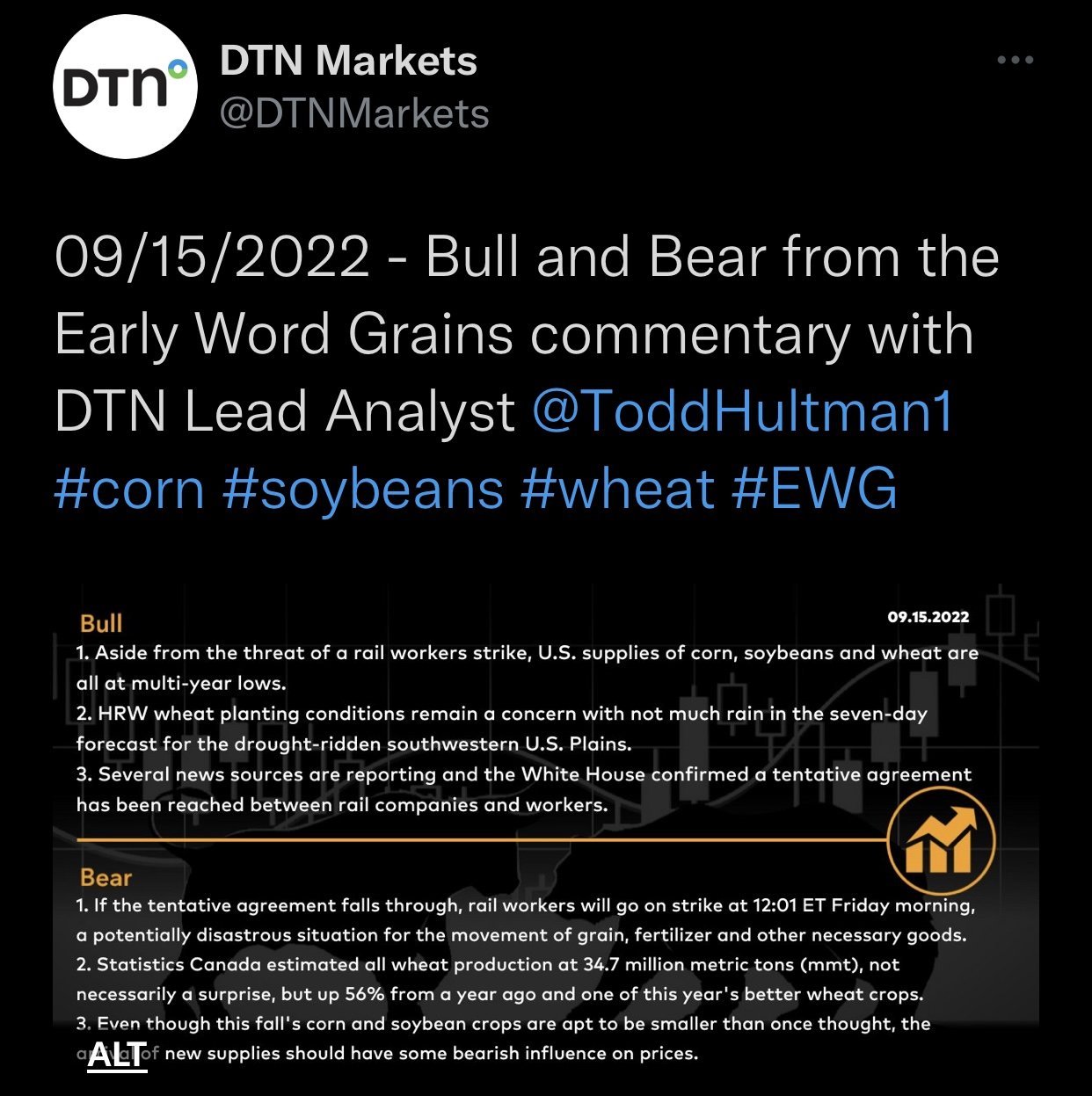

The railroad agreement was averted last minute, this could still potentially be a concern. We don’t know how this will shake out, as it was extended till the end of the month. Bottom line this doesn’t really affect the railroad performance. Farmers and elevators are hoping railroad performance improves because there are a lot of areas that are struggling to move product. As an example, locally in Sully County, there are a lot of farmers that looking to move wheat before fall harvest to clean out bins. It doesn't appear that they are going to get enough rail cars in to allow farmers to empty wheat bins before harvest. The less rail cars an elevator gets, the wider their basis and margin is. The more they get, the more competition is created.

Today's Main Takeaways

Corn

Corn finished slightly lower. Corn closed around -12 1/2 cents off its highs of 6.90. We've been struggling to break through resistance past $7 but still hold above technical support levels. We saw the much-delayed exports, some were thinking we'd see a curve ball, but they came in at the middle of the expected range. They were pretty disappointing coming in at 2.3 MMT. Which didn't really add any support to prices.

Currently, the U.S. weather appears to be cooperative for the time being and harvest is expected to see fairly good progress. There are some regions of the country that are well behind the traditional pace, and some are worried about some frost causing complications. Which could lower yield even further.

Reuters said that Argentines growing areas are facing the driest conditions in 30 years. Which will likely lead to planting delays.

France is looking at its smallest corn crop in 30 years.

Ukraine’s corn crop is expected to fall to 30.24 million metric tons. This estimate is -12 million metric tons lower than the record harvest in 2021. However, this number is just slightly below the 5-year average.

There is some demand concerns, as Brazil's president recently sharply lowered fuel taxes. Which could result in lower demand for ethanol, thus resulting in less need for corn. There are also concerns about harvest pressure.

We could definitely see us making another run-up. But that doesn’t mean prices won't go lower before we see that rally happen. We will need to see strong demand and possibly a weather story to spice up production worry if we want to see corn make another run. Many are also debating whether the USDA will continue to lower its yield, as many think that their recent estimate wasn't quite low enough. From a technical standpoint, corn has faired relatively well as we are still in an uptrend and holding above our 10-day moving average.

Dec-22 (6 Month)

Soybeans

Soybeans also closed just lower, sitting right above its 100-day moving average. Hopefully we can see some support from there, if we see a break below that could result in us seeing prices make another move lower. Nov beans closed 17 cents off their highs of 14.68 1/2.

We saw the delayed sales come in at 5.644 MMT which was actually pretty strong. Better than this point at where we were last year. Expectations were between 2.5 and 5.3 MMT. Argentina has been selling a lot of their beans due to their new currency deal, which has put some pressure on the U.S. exports.

Argentina farmers sold over 15% of the country’s soybeans 44 million tons of 2021/22 soybean crop in the last week alone. Of course this is due to the country offering a favorable exchange rate. There was rumors that China purchased over 40 cargeos of beans from Argentina over the past couple of weeks. Is China putting us on the sidelines due to our support for Taiwan? Perhaps, but the largest part is the currency rate, giving them the ability to offer beans at a cheaper value.

NOPA crush came in and was weaker than expected. Coming in at 165.54 million bushels vs the 166.11 expectations.

Soyoil stocks came in at 1.565 billion pounds. Which is the lowest we've seen since June of 2021.

Similar to corn, my biggest concern for the soybean market has to demand. Im just not sure whether we can see demand strong enough to pull up prices by itself. As we see the markets beginning to transition away from the U.S. weather headlines and continue to hear a large amount of record acres being planted.

Soymeal & Soyoil

Soymeal up +4.9 438.0

Soyoil down -0.57 to 64.30

Soybeans Nov-22 (6 Month)

Wheat

The entire wheat market was sharply lower here this afternoon, getting beat up the most. With Chicago closing nearly -40 cents off its highs, KC roughly -32 cents off its highs, and MPLS about 19 cents off its highs. The wheat market actually made new 2-month highs overnight before giving back all of its gains its found through out a pretty strong start to the week.

Delayed exports for wheat came in around expectations as well, coming in at 1.410 MMT.

The dollar was slightly higher today but has been sitting around this range for a few weeks now. So it wasn't likely a huge factor but did add some pressure to the lower prices. There just wasn't even fresh bullish news to support the wheat market here. We saw a solid correction, however, we still remain in a firm uptrend.

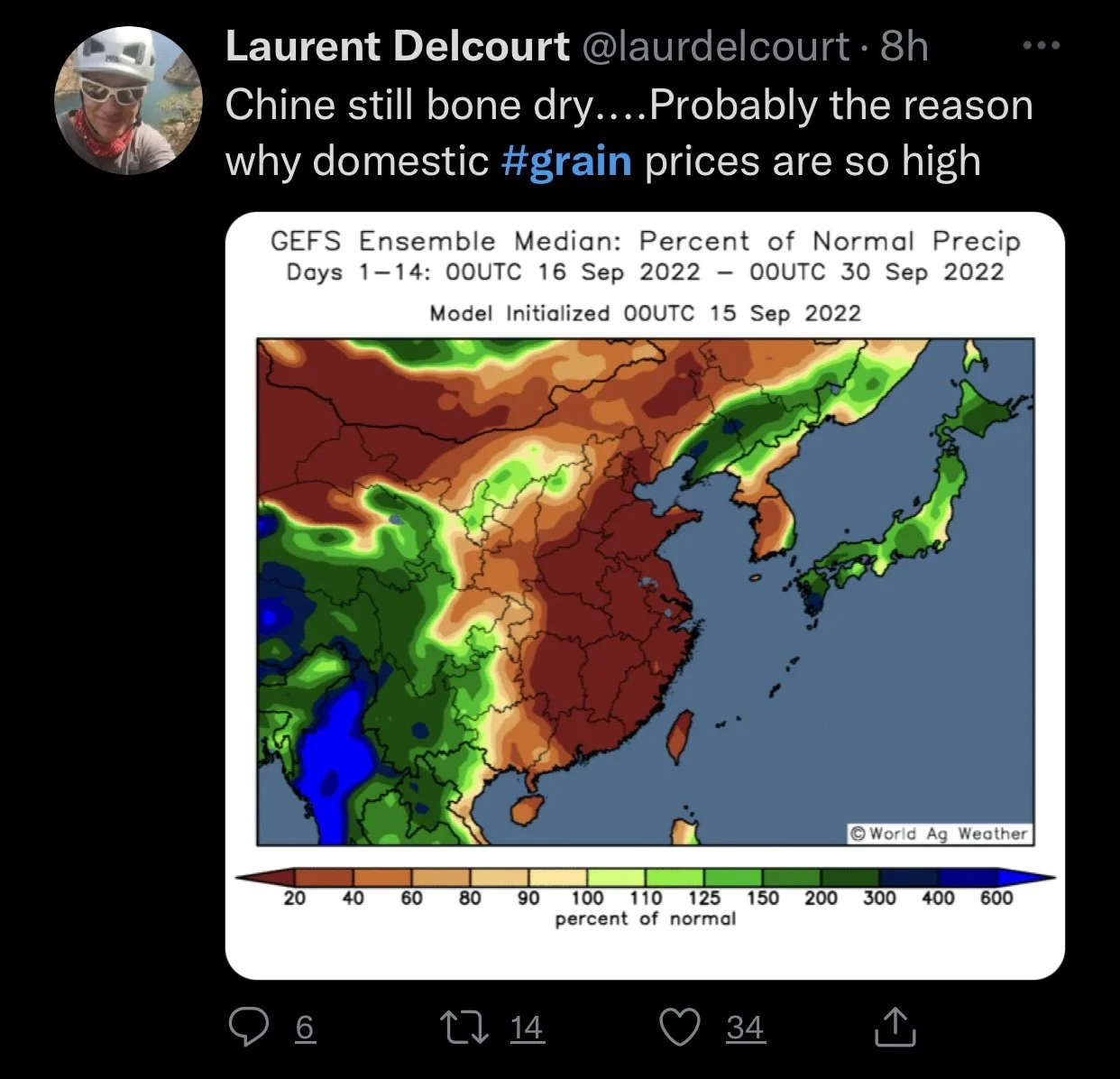

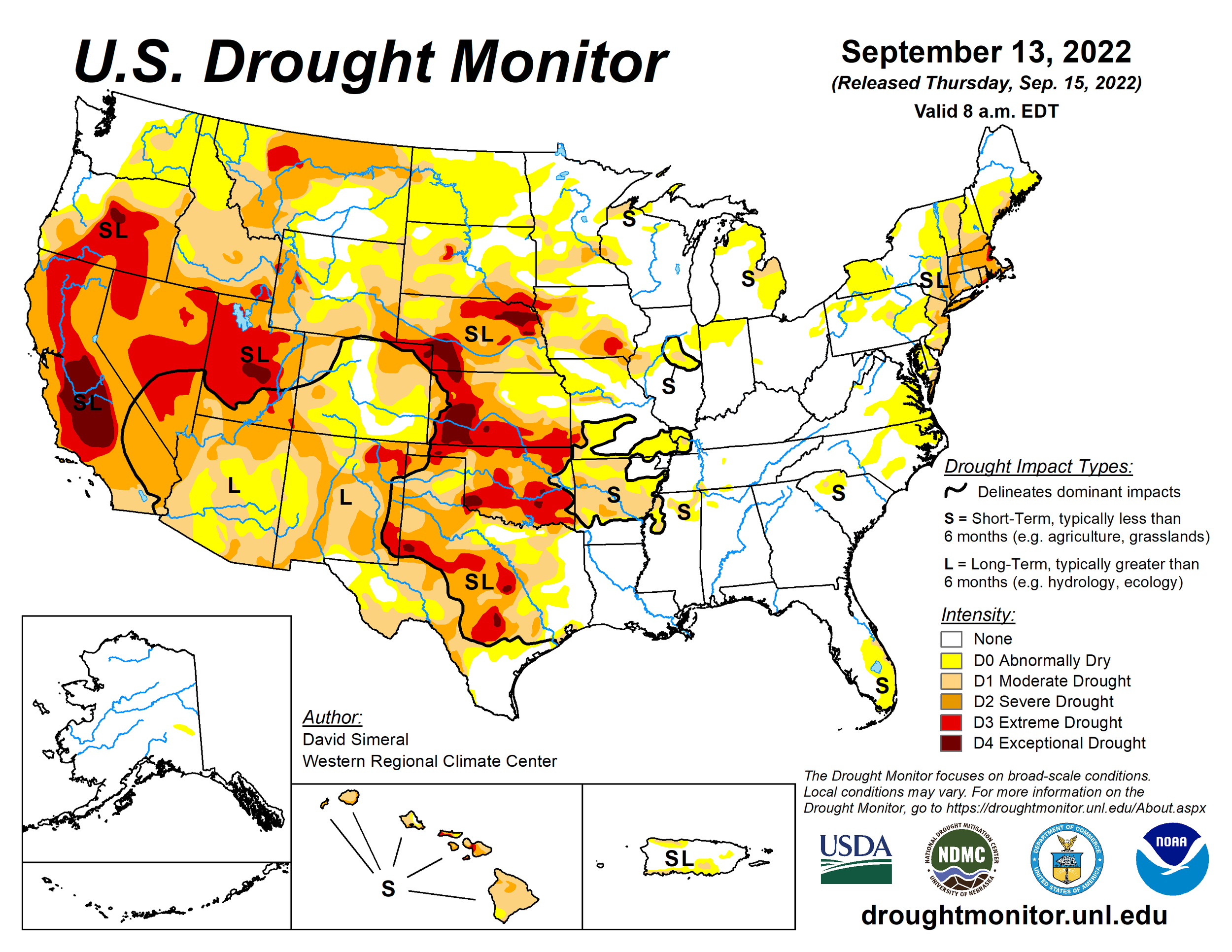

Other than today’s losses, wheat has put together a pretty solid run here. The outside markets will likely play a big part in which direction we see wheat heading as the dollar remains extremely strong. We have a lot of technical support, however, there isn't a ton of fundamental support outside of the dry weather in the southern plains. We also will have to keep an eye on both U.S. and global weather as they could potentially benefit prices. As well as the war and Ukraine headlines still have the possibility to spark some buying.

Other Markets

Crude oil was down -$3.21 to $85.27

DOW down -204 to 30,945

Cotton up +0.58 to 103.29

Dollar Index up +0.109 to 109.763

Energy markets hit hard

Diesel fell to its lowest levels in 5 weeks.

Inflation and recession concerns hit all the markets today with the S&P trading under 3900

News

The U.S. railroads and railworker unions reached an agreement.

China announces that they will increase cooperation with Russia trade.

U.S. mortgage rates topped 6% for the first time since 2008

The PPI (Producer Price Index) came in at 8.7% for August, down from 9.8% the month prior. Decline was mainly due to lowered gasoline prices.\

Ukraine exported 1.5 MMT of grain in the first 13 days this month. However this pace is still 34% behind the same time period last year.

Millet Market

The millet market remains hot. Continues to be a sellers market. If you have any offers don't hesitate to contact Jeremey or Wade at Banghart Properties. We believe the strength will continue as farmers selling is very limited.

Contact Jeremey at (605)295-3100 or Wade at (605)870-0091 or visit their website here

Previous Newsletters

Here are our last 2 newsletters. Would love any feedback or things you would like to see.

Stocks & Equities Plunge. What Does This Mean For Grains? - Read Here

Post USDA Market Update & Audio - Read/Listen Here

Social Media

Credit: All credit to users of posts

Precipitation Forecast 4-5 Day

Weather

Source: National Weather Service