POST USDA MARKET UPDATE

HAVE GRAINS MADE THEIR HIGHS?

Listen to today's audio below

Overview

Overall it was a friendly report around. We saw corn yield left unchanged, with a rather large cut in soybean yield. We saw U.S. acres and production reduced around. As for South America the USDA left projections unchanged across the board. Soybeans closed up sharply higher, with corn following behind. Wheat closed slightly down. We have to keep in mind that the day after the report is typically more important than the day of.

Today's Main Takeaways

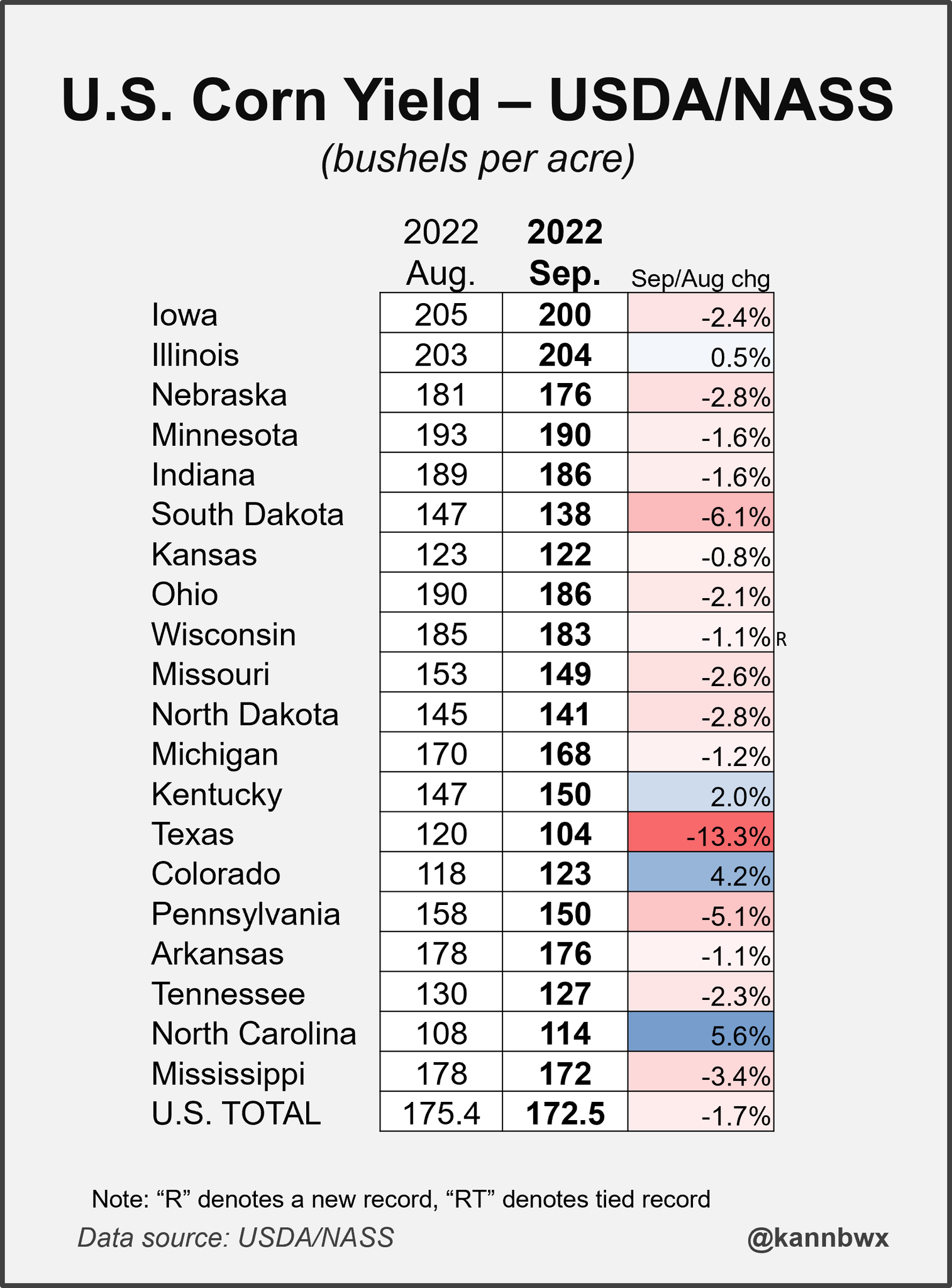

Corn

Today's USDA report pegged yield at exactly the pre report estimates, coming in at 172.5 bpa. Despite no real shocker there to pull the markets higher off a first reaction, the more interesting number was the harvested acres. With harvested acres coming in at 80.6 million bushels, which was well below the trade estimates. This pulled down corn production, which we saw lowered down to 13,944 million bushels. Far below last month and nearly 150 million bushels below the average estimate.

Dec-22 corn closed up +11 cents on the day, just shy of $7.00 at $6.96. We haven’t seen the Dec-22 contract close above $7 since mid-late June.

Despite the numbers not coming in too crazy bullish, it's reasonable to think that corn will continue to be the leader for the markets. As many think we will see yield lowered even further, as well as a smaller U.S. crop and problems in Russia and Ukraine all adding support to the markets.

USDA Numbers Corn

2022/23 U.S. production

September USDA 13,944 million bushels

Average estimate 14,088 million bushels

August USDA 14,359 million bushels

Corn yield

September USDA 172.5 bpa

Average estimate 172.5 bpa

August USDA 175.4 bpa

Corn harvest acres

September USDA 80.8 million bushels

Average estimate 81.686 million bushels

August USDA 81.840 million bushels

2021/22 U.S. ending stocks

September USDA 1,525 million bushels

Average estimate 1,547 million bushels

August USDA 1,530 million bushels

2022/23 U.S. ending stocks

September USDA 1,219 million bushels

Average estimate 1,217 million bushels

August USDA 1,388 million bushels

2022/23 World ending stocks

September USDA 304.53 MMT

Average estimate 302.29 MMT

August USDA 306.68 MMT

State By State Yields

Chart Source: @Karen Braun on Twitter

Dec-22 Corn (6 Month)

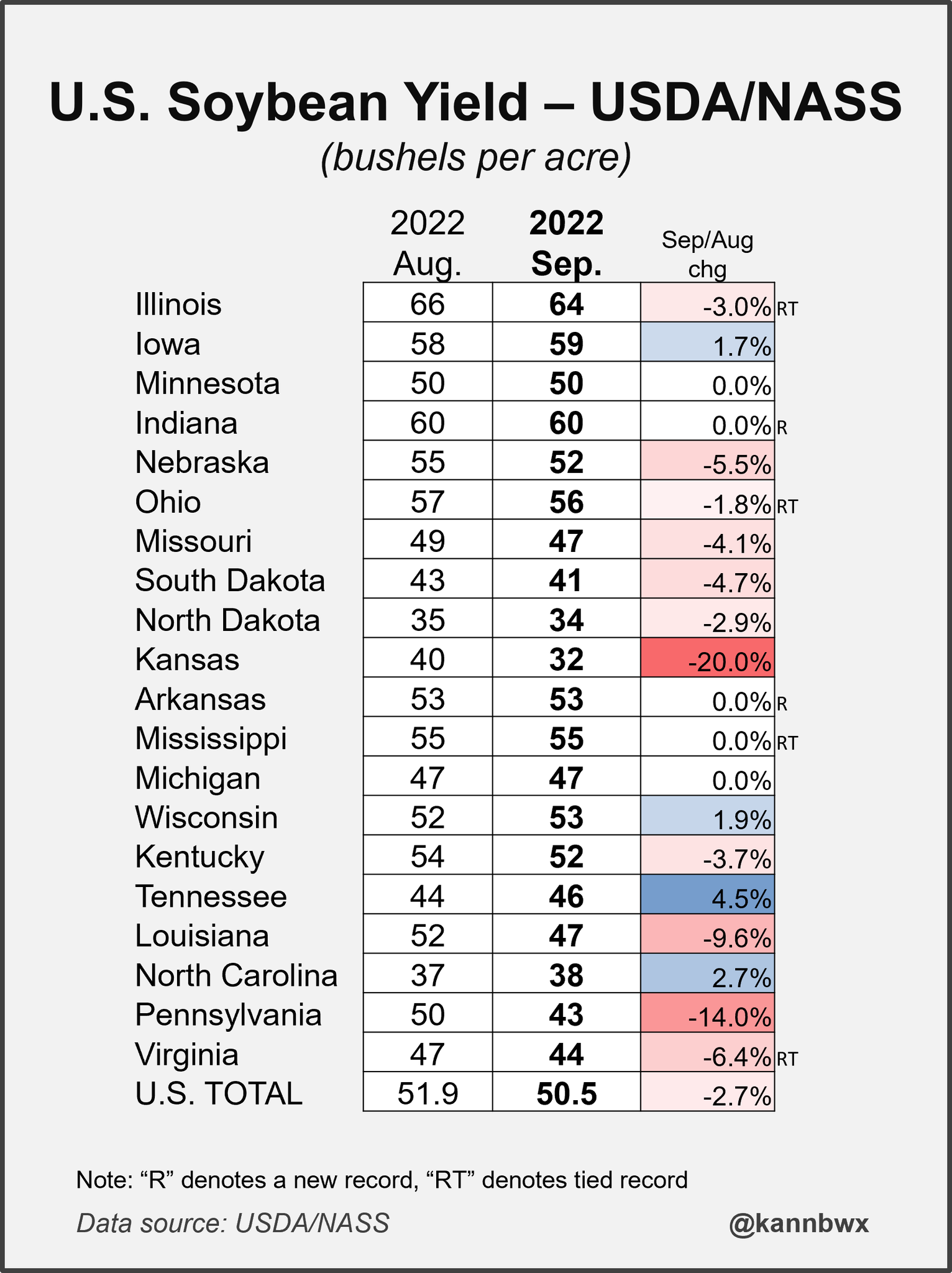

Soybeans

We had a nice bullish surprise from the USDA soybean numbers released this morning. With yield, acreage, and stocks all well below estimates. Not very many people were expecting such a large cut in U.S. soybean yield. With yield coming in an entire 1 bushel per acre lower than the average trade estimate. As well as average and stocks well under expectations as well. This sent soybeans surging throughout the entire day. With Nov-22 contract closing up an astonishing +76 cents at close, just two cents off their highs (14.88 1/4).

Aside from the USDA bullish numbers this morning, we still have a few factors that could put pressure on the markets. With China and their lockdowns, as well as some favorable later U.S. rains could all be negative factors. We also have the U.S. and Brazil looking at potential record harvests. Despite the lower estimates, we are still looking at a top 5 record crop for the U.S., behind last year's all-time record. I'm not sure what’s all left in the bag here to push soybeans even higher, Argentia and Brazil will be more than willing to sell at these prices. However, the 200 million bushel carry out is pretty tight. But for soybeans to keep extending this rally we will need to see great demand and export numbers which we haven’t seen a whole lot of lately.

USDA Estimates Soybeans

2022/23 U.S. production

September USDA 4,378 million bushels

Average estimate 4,496 million bushels

August USDA 4,531 million bushels

Soybean yield

September USDA 50.5 bpa

Average estimate 51.5 bpa

August USDA 51.9 bpa

Soybean harvest acres

September USDA 86.6 million bushels

Average estimate 87.288 million bushels

August USDA 87.211 million bushels

2021/22 U.S. ending stocks

September USDA 240 million bushels

Average estimate 236 million bushels

August USDA 225 million bushels

2022/23 U.S. ending stocks

September USDA 200 million bushels

Average estimate 247 million bushels

August USDA 245 million bushels

2022/23 World ending stocks

September USDA 98.92 MMT

Average estimate 101.19 MMT

August USDA 101.41 MMT

Soymeal & Soyoil

Soymeal up +23.9 to 434.6

Soyoil up +1.67 to 66.49

State By State Yield

Chart Source: @Karen Braun on Twitter

Nov-22 Soybeans (6 Month)

Wheat

Numbers from the report this morning weren’t anything of a surprise. With numbers fairly in line with the estimates. Overall it was a pretty neutral report for wheat, as you could see from the price action today. With Chicago closing down -10 3/4 cents, and both KC and MPLS closing down a little over -2 cents. Corn did help pull wheat roughly 15 cents higher off their early morning lows.

We saw France and Romania maybe putting together some sort of deal here to get some of those Ukraine exports to the developing countries. That may have added some pressure here as well. The weaker dollar added some support.

Even with the neutral report, there is still plenty of optimism surrounding the wheat market. The Russia/Ukraine and export situation will be the largest factor in deciding whether we keep pushing higher following our recent uptrend.

Overnight we saw prices hit two-month highs.

USDA Estimates

Wheat 2022/23 U.S. ending stocks

September USDA 610 million bushels

Average estimate 618 million bushels

August USDA 610 million bushels

Wheat 2022/23 World ending stocks

September USDA 268.57 MMT

Average estimate 268.10 MMT

August USDA 267.34 MMT

Other Markets

Crude oil back up to nearly $88, helping support corn

Dow up +203

Cotton had higher ending stocks, wound up +0.87 to 105.71

Dollar index down -0.66 to 108.335

Stock market closes higher ahead of CPI report

News

Tomorrow we will see key U.S. inflation data

Wall street posts 4th straight day of gains ahead of CPI report

France and Romania agree to deal to boost Ukraine exports, transport minister says

Third vessel set to carry Ukrainaian grain to Africa arrives

Consumer spending was up +10% in August

Ukraine to ask the U.S. for long-range weapons according to WSJ

Here is a few of our recent newsletters/audio in case you missed them..

Yesterday’s Weekly Newsletter

Audio Sep. 9 - What to expect after the USDA report

Last Week's Weekly Newsletter - Sep. 5

Social Media

All credit to users of posts

Precipitation Forecasts

Sep. 13

Sep. 14

Weather

Source: National Weather Service