MARKET UPDATE

Futures Prices Close

Overview

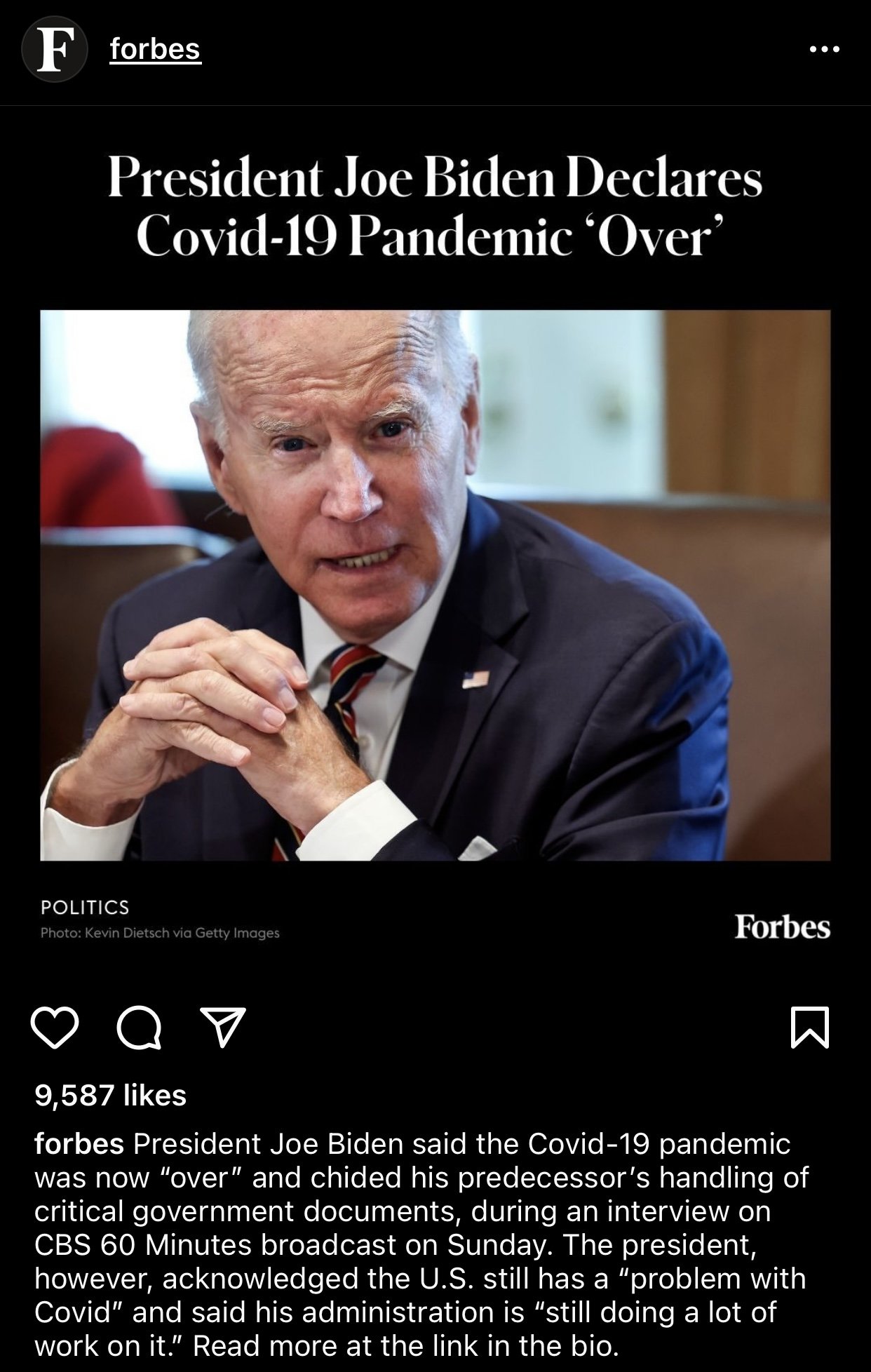

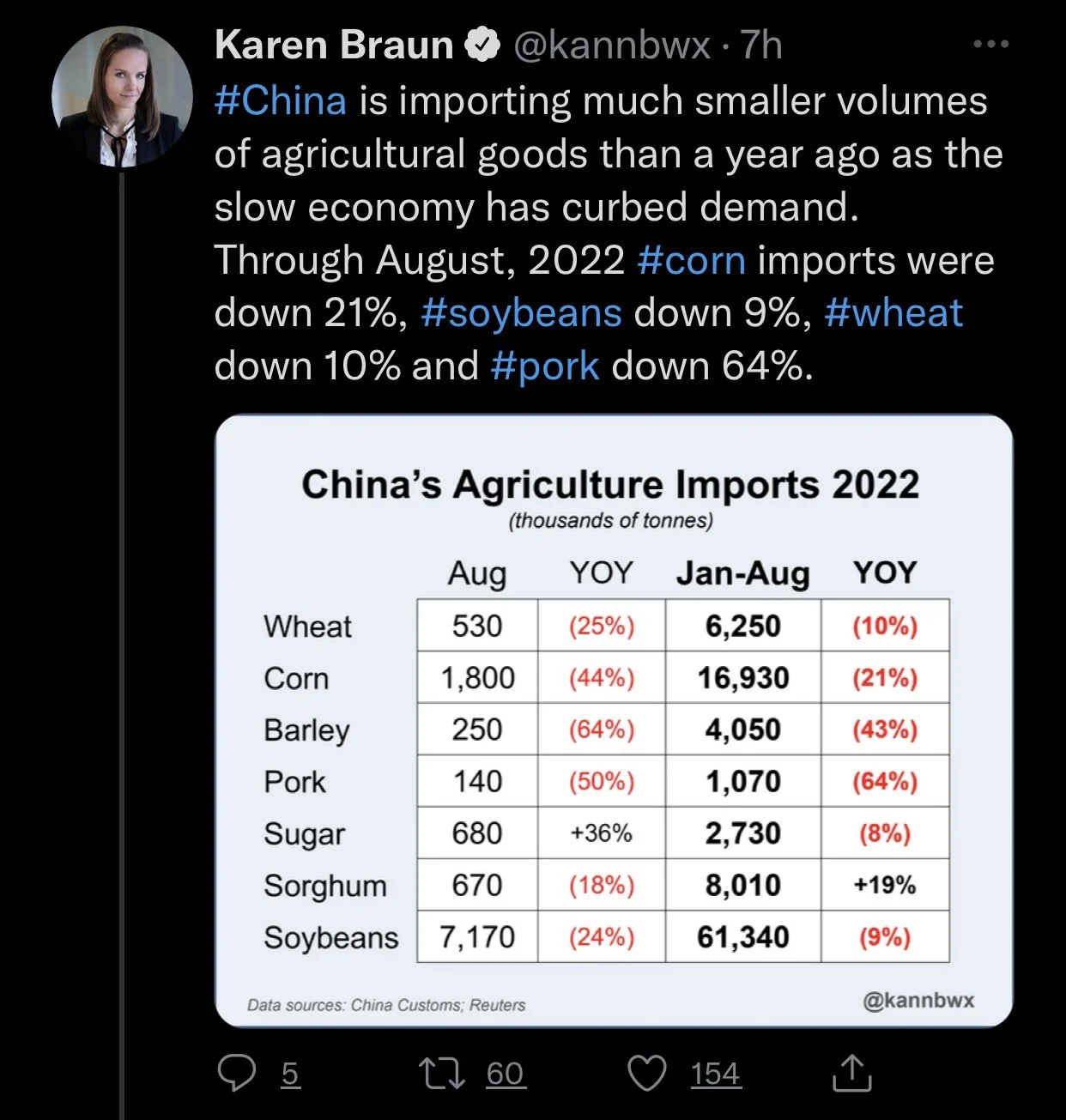

Markets were mixed, with wheat finishing sharply lower. Corn was slightly higher and soybeans closed firmly higher despite the strong dollar and worries about our economy. Biden's statements last night also sparked some more Chinese tension.

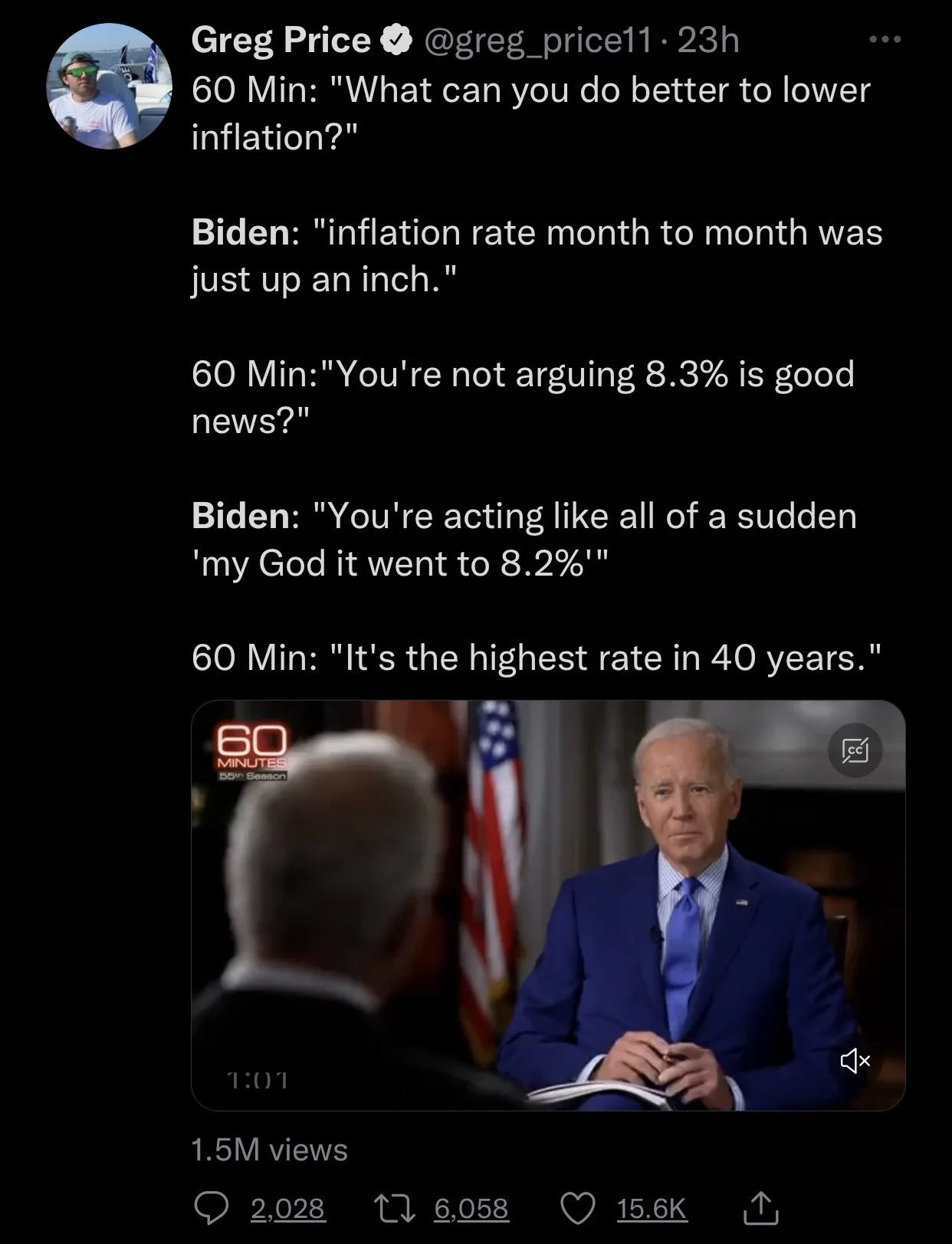

Tomorrow the Federal Reserve will begin their 2-day meeting, where they will are expected to raise rates once again, this time expected to raise rates by 75 points. It doesn't appear very likely, but some think we might actually see a full 1-point rate raise.

Today's Main Takeaways

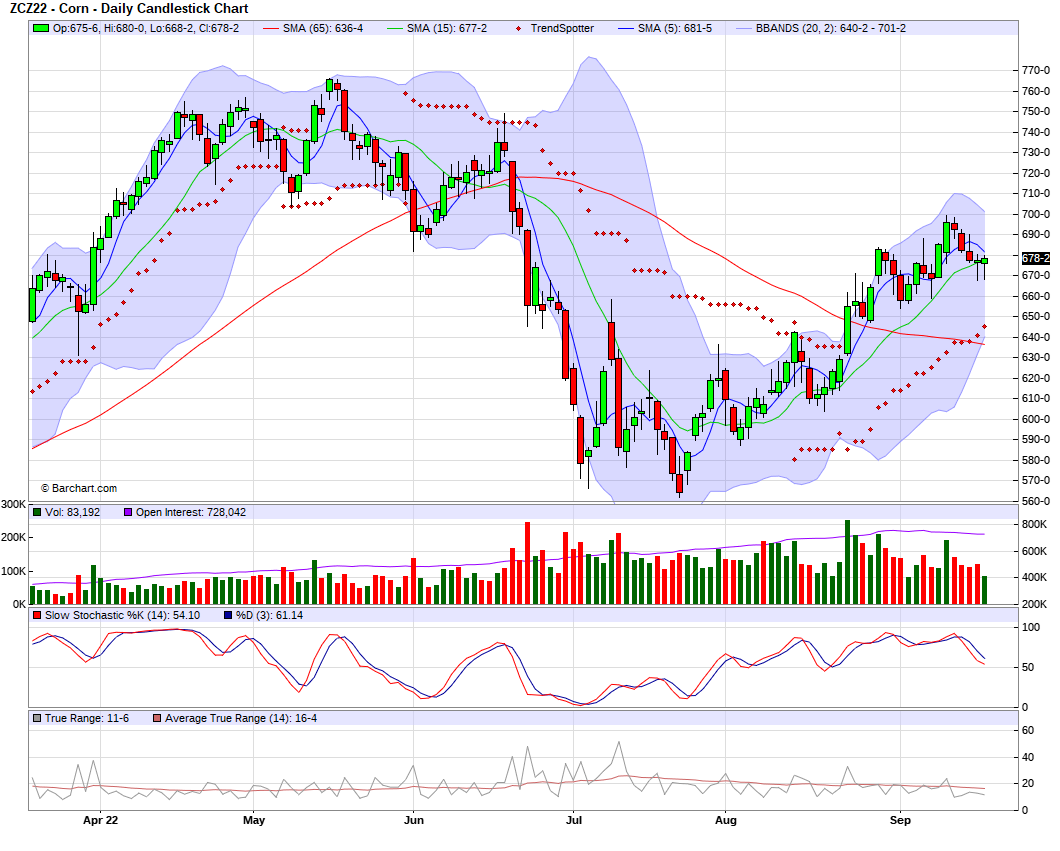

Corn

Corn traded both sides today. As corn futures were under some pressure with the sharply lower wheat prices. Corn did manage to close above its its support at the 100-day moving average.

We did see some yield reports in some states such as Illinois, Iowa, and Indiana, but its still a little early to tell how different the crop is compared to that of the Pro Farmer crop tours we saw a couple weeks ago.

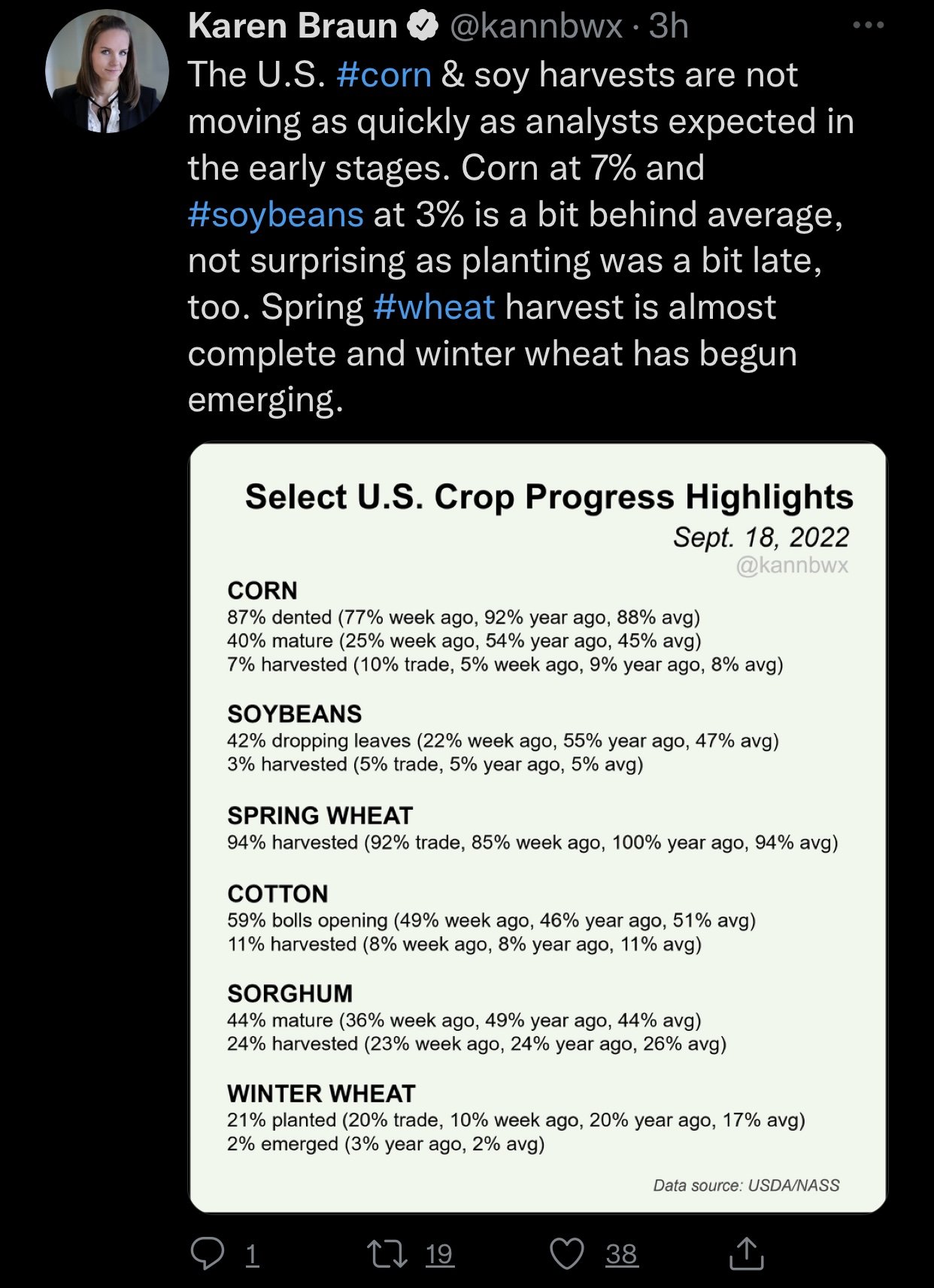

Crop conditions report had corn harvest at 7% vs 10% which was expected.

52% of corn was rated G/E which was 1% lower than last week (53%), last year was 59%.

Cron inspections were up 3 million bushels to 21.6 million

Weather headlines continue to shift towards South America, as Argentina remains in a record 30-year drought, but they did see some meaningful rainfall over the weekend, as did Brazil. Forecasts are expecting the corn belt to turn more seasonal in a few days, but no current threats of any frost until at least mid-October.

Most think it should be a pretty quick harvest with the friendly forecasts. Most think harvest is around 10-15% complete. And growers definitely have a pretty good window of opportunity here to get more out of the fields.

Demand still remains pretty lackluster. But we still have the potential to find more disappointing yields, and I could definitely seeing us go back and testing at least the $7 range. As last weeks high was $6.99 1/2. However, outside of the South Amercia weather headlines, we don't have much here in the U.S. to spark a weather driven bull run, nor do we have any crazy demand.

Dec-22 (6 Month)

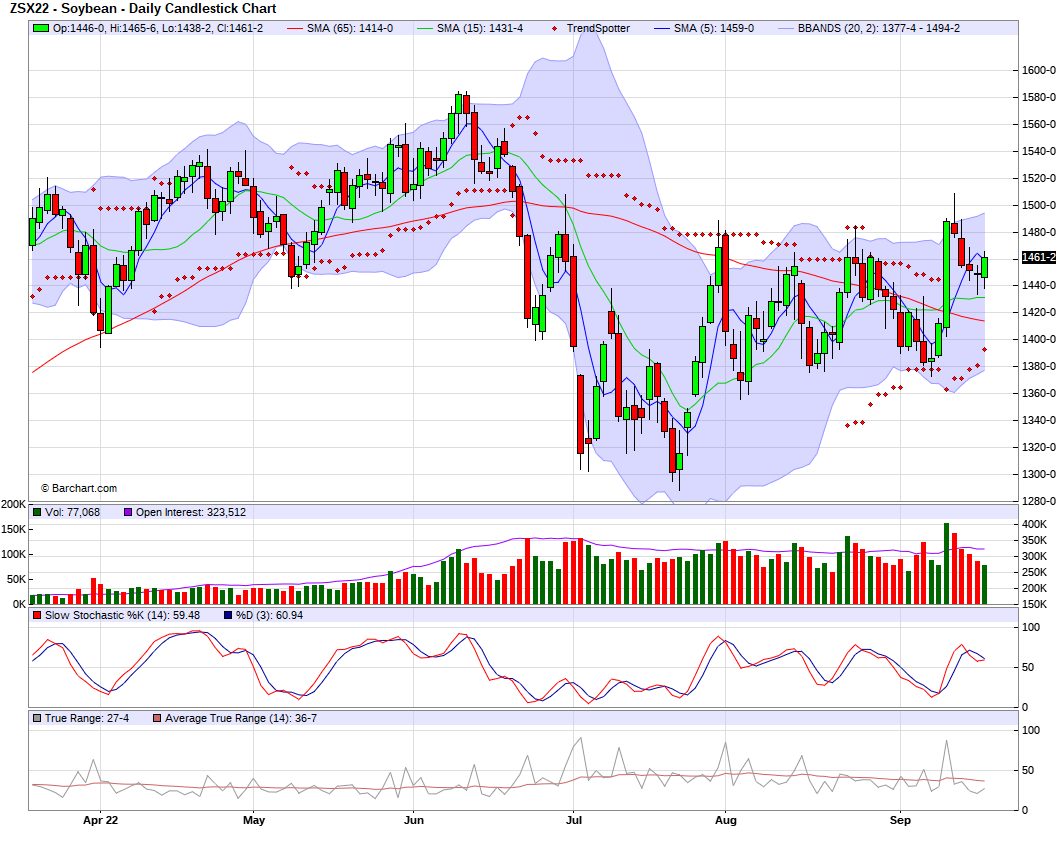

Soybeans

Soybeans initally started the morning lower but saw a turnarounds, closing firmly higher. Despite the weaker soyoil, beans found support in the strength in soymeal and the rally we saw in crude oil. Crude oil had nearly a $3.50 rally.

Soybeans found some technical support, as well as the Chinese purchase adding support. The nice push we saw in soymeal also added quiet a bit of support today. Soymeal was higher with recovering South American meal values as well as the potential for increased demand out of the European Union, as their domestic crushers are struggling with the high energy costs.

News this morning of an export sale for 136,000 tonnes of soybeans to China. Even with the purchase, we saw from China this morning, many are speculating that that might be the last one we see for a while. As President Biden said he would interfere militarily if China went into Taiwan. This likely is going to cause even more political tensions than we've already seen. As these comments will likely not sit well with the Chinese. Giving them all that much more reason to look anywhere but the U.S. for soybeans. Some think that this purchase was actually made before Biden's statement made last night.

Argentina farmers have now sold 6.8 million metric tons of soybeans.

Crop condition highlights had soybean harvest at 3% done vs 5% which was expected.

55% of soybeans were rated G/E, which was also down 1% from week (56%), last year was 58%.

Soybean inspections can in up 6 1/2 million bushels to 29 million.

With today's gains the soybean charts are looking a lot better. However, harvest pressure will likely eventually put a lid on prices. Similar to corn, we just don't have a ton of demand either, especially given the recent tensions between the China and the U.S., as well as the chances of a weather headline driving the markets continuing to look smaller.

Soymeal & Soyoil

Soymeal up +7.6 to 429.3

Soyoil down -0.80 to 65.16

Soybeans Nov-22 (6 Month)

Wheat

Wheat was sharply lower across the board. As traders are looking to position themselves ahead of the Federal Reserves meeting tomorrow. Wheat traded in a wide range today, and we did manage to close around 14 cents off the lows. Coming off a fairly mixed week, prices are still ranging at the upper range of the last three months or so.

Wheat exports were up over 1 million bushels to 29 million

Winter wheat is 21% planted, up from 10% last week, and 4% ahead of pace

Spring wheat is 94% harvested and on pace

165 ships left Ukraine, carrying 3.7 million metric tons of agricultural products.

We saw some pressure coming from the cheap Black Sea values. As well as estimates showing a record yield for Russian wheat crop. The forecast is set at 99 million metric tons. Which means Russian wheat will be cheap as they continue to sell across the globe. Which could add some pretty heavy global export pressure in the future.

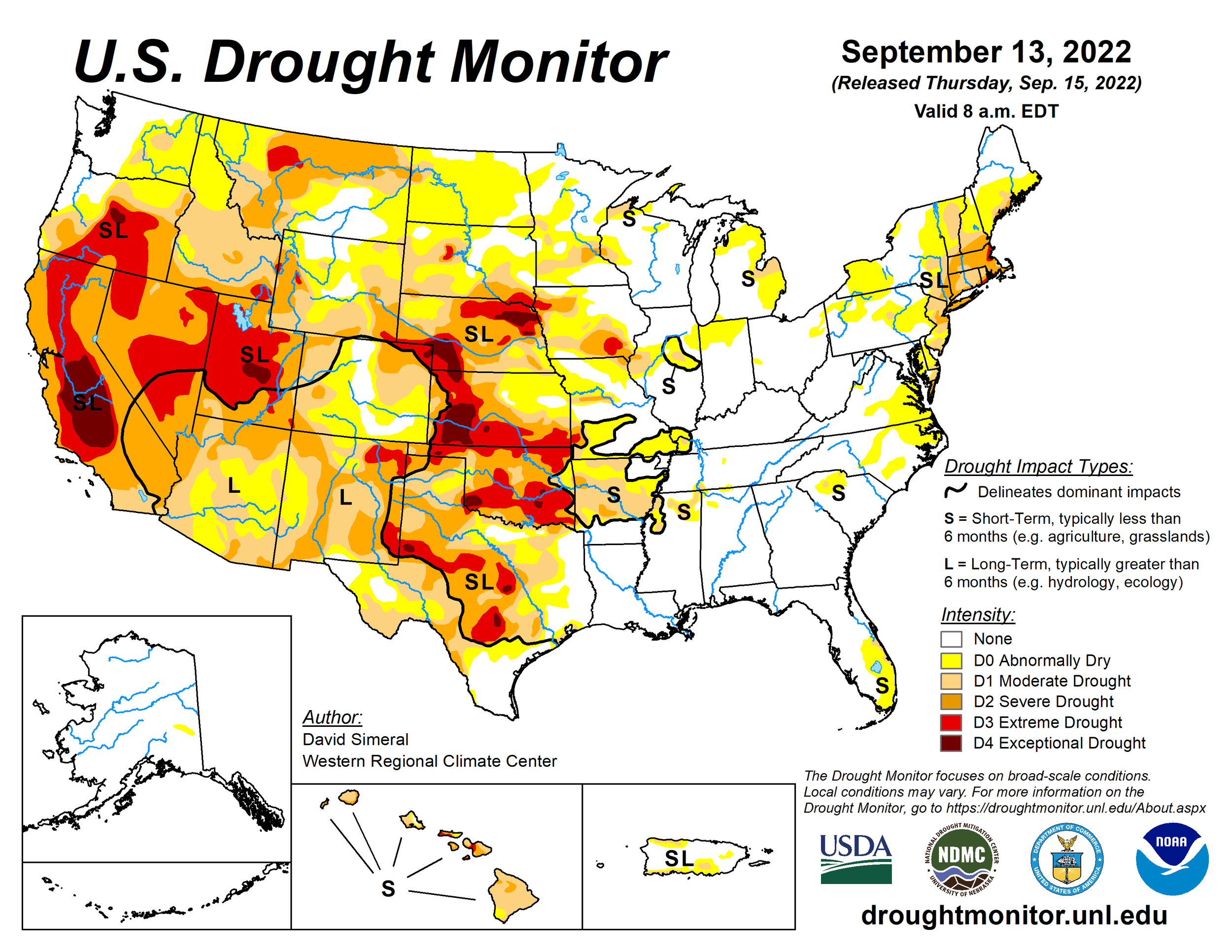

One would have thought that with the dry conditions out west we might have seen some support, but that wasn't that case today as that didn't appear to have much of an effect on the markets.

We saw some additional pressure come from the early strength in the U.S. dollar, as well as the markets expecting the Feds to remain aggressive raising interest rates as they head into their meeting tomorrow.

And of course, we have the uncertainty regarding Putin and his decisions with the Black Sea. Some think his comments about ending his export deal was all for monetary gain, and he’s not actually even considering ending the deal at all. As ships continue to flow out of Ukraine.

We could definitely possibly see a turnaround Tuesday tomorrow. But the charts aren’t looking all too amazing after today's losses, and if we see weakness in corn and beans its tough to think that wheat will be able to hold up on its own.

Chicago Dec-22 (6 month)

Other Markets

Crude oil rallied from 81.75 to 85.36, about a 3.5 rally

Dow Jones up +197

Dollar Index down -0.053 to 109.59. However earlier this afternoon before grains closed, the dollar was at 109.982

Stock market was strong. With both S&P 500 and NASDAQ closing higher

News

Putin said that Russia is ready to give free fertilizer to developing countries.

Conceral cuts EU wheat and corn production forecasts. Cutting EU wheat production by 2.5 MMT to 143 MMT. Lowering EU corn production by 14.1 MMT to 66 MMT.

Chinese pork prices surge

Strong dollar keeps a lid on import prices

SEC Chairman says emissions rule is not intended for farmers

Millet Market

The millet market still remains hot. As it continues to be a seller's market. If you have any offers don't hesitate to contact Jeremey or Wade at Banghart Properties. We believe the strength will continue as farmer's selling is very limited.

Contact Jeremey at (605)295-3100 or Wade at (605)870-0091 or visit their website here

Previous Newsletters

Check out yesterday's weekly newsletter in case you missed it. Would love any feedback or things you would like to see.

Yesterday’s Weekly Newsletter - Read Here

Social Media

Credit: All credit to users of posts

Precipitation Forecast

Weather

Source: National Weather Service