MARKET DOESN’T BELIEVE THE USDA

Overview

Grains higher across the board.

Seems like the market is calling BS on the USDA's Brazil numbers.

Keep in mind, these April reports generally are considered useless. The ones that actually matter will be in the following months.

Soybeans for example had a somewhat bearish report, yet we bounced a dime off the lows yesterday and rallied today. We are now +20 cents higher than where we were trading right before the USDA report was released.

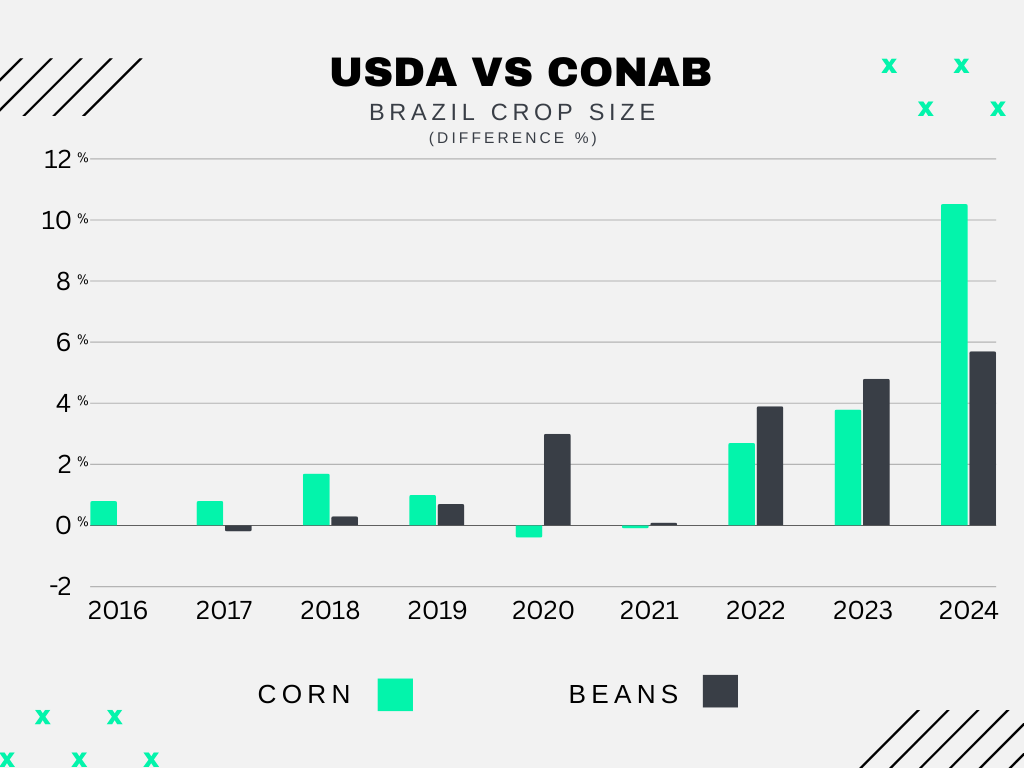

In yesterday's report the USDA opted to leave both the Brazil corn and bean numbers unchanged.. while CONAB continued to drop theirs. The difference between the USDA and CONAB's numbers is the largest discrepancy ever and it is not even close. The USDA's bean crop is +5.5% larger and the corn crop is a massive +10.5% larger.

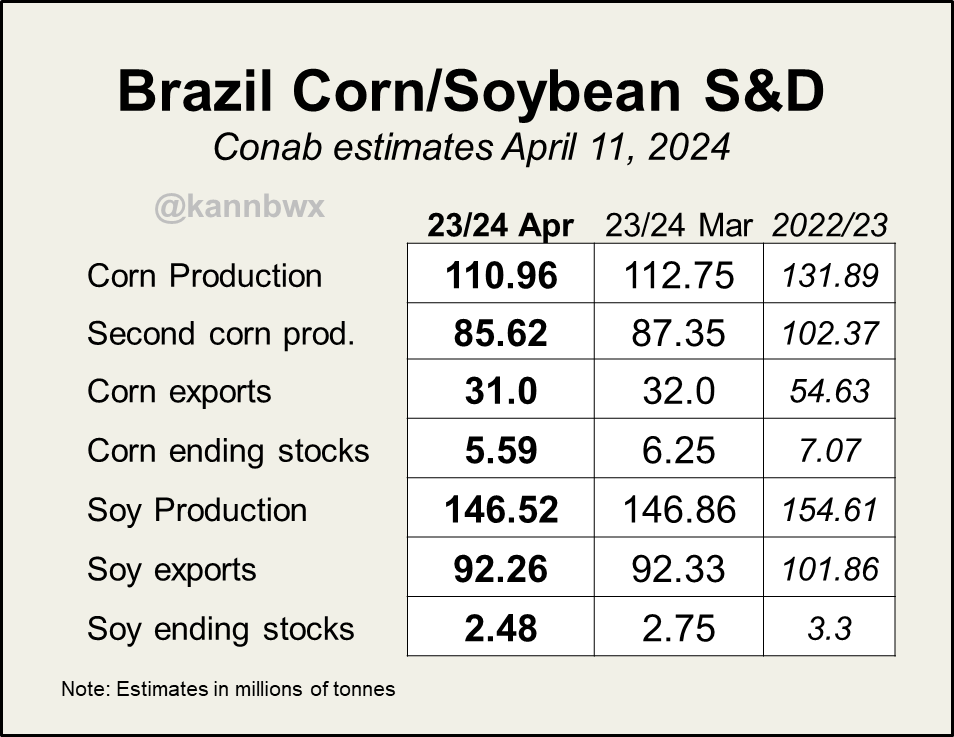

Here are the numbers.

Although US carryout came in higher across the board than the estimates, we did see corn carryout shrink from last month which was supportive.

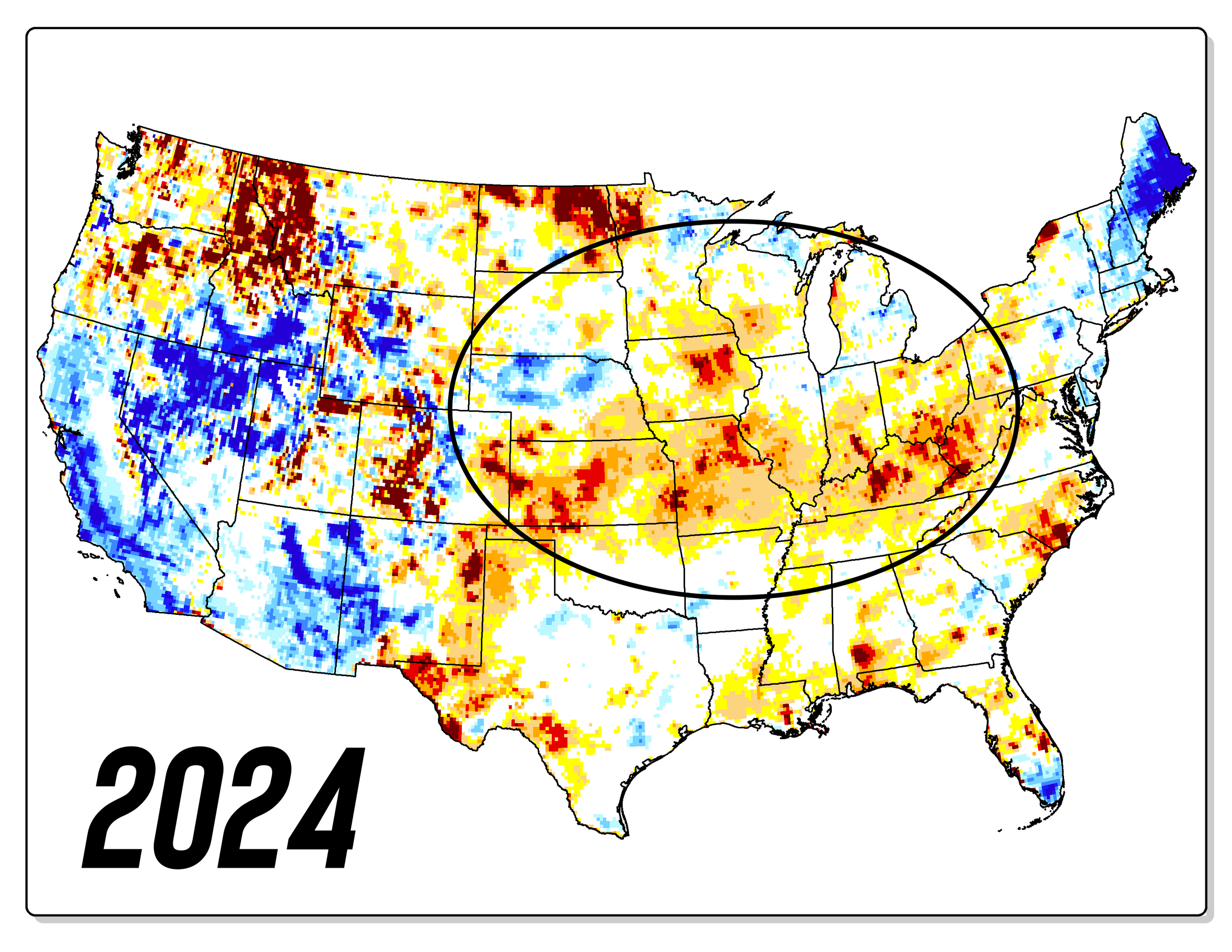

The markets will very soon start to enter a weather market as we get deeper into planting and growing season.

The eastern corn belt has been getting some rain which could slow things, but overall short term the market faces risks from early planting due to mostly favorable weather, which could add pressure.

Long term looking towards late spring and early summer, the trade will realize planting is going good because it is dry.

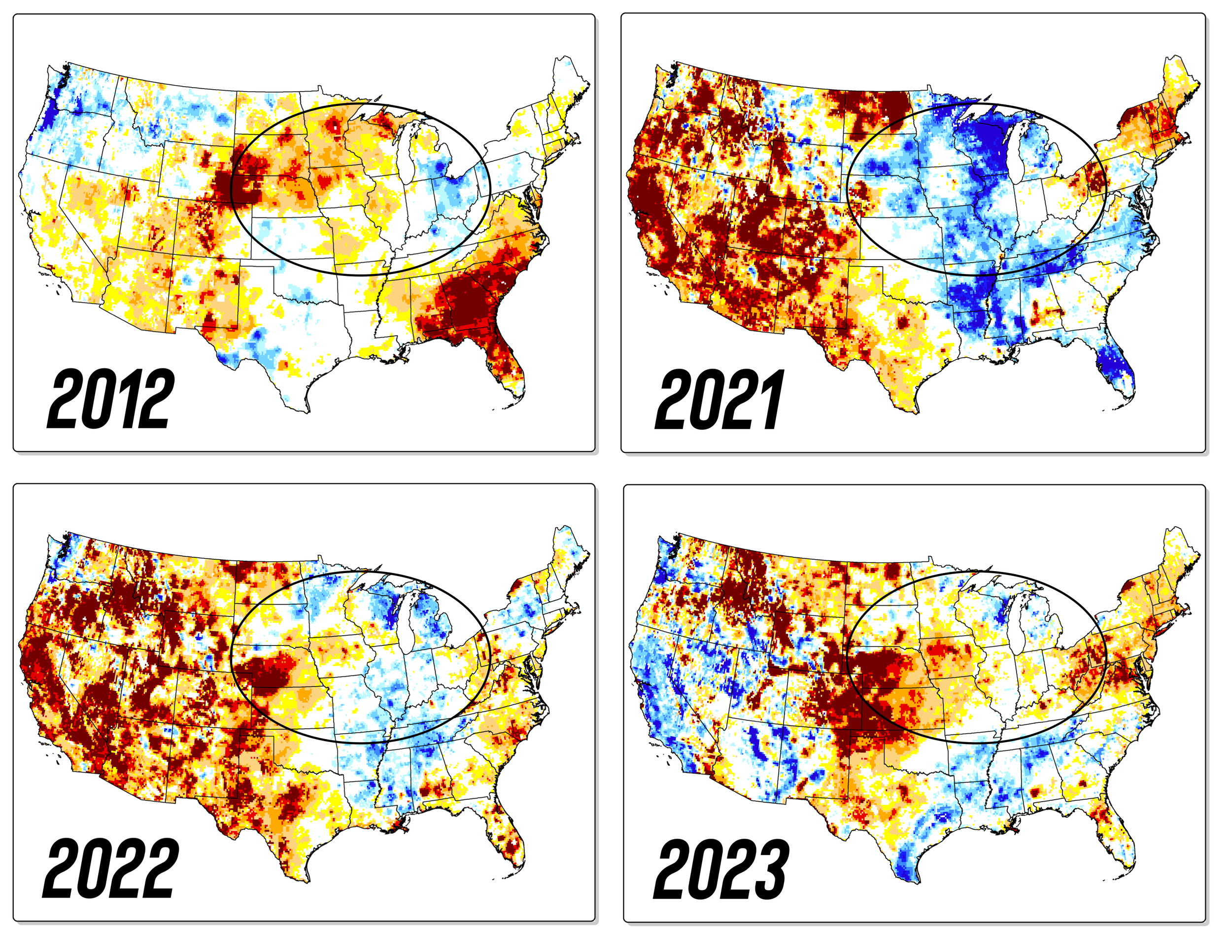

Just look at our sub soil moisture situation.

Many areas have received needed rain, but there is still some obvious concerns heading into growing season.

At this point in the year, this is the first time where we have really lacked soil moisture in the I-states.

Overall US subsoil is only 65% adequate, down from 69% last year.

However the top corn grower Iowa’s subsoil is 36% adequate vs 66% a year ago.

Top soybean grower Illinois’ subsoil is 73% adequate vs 93% a year ago.

Top wheat grower Kansas subsoil is 43% vs 17% a year ago.

Now these numbers are even more important given the fact that…….

The rest of this is subscriber-only. Please subscribe to keep reading and get every daily update.

In today’s update we go over why we believe there will be some type of weather scare and how to prepare, La Nina, concerns in Brazil, courage calls & implied volatility, if corn acres will be higher come June, the Kansas drought, exactly why we see higher prices in the grains looking towards summer & more.

TRY OUR DAILY UPDATES FREE

Make this the year you beat big ag at their own game. Try our daily updates completely free for 30 days.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24