USDA TOMORROW

AUDIO COMMENTARY

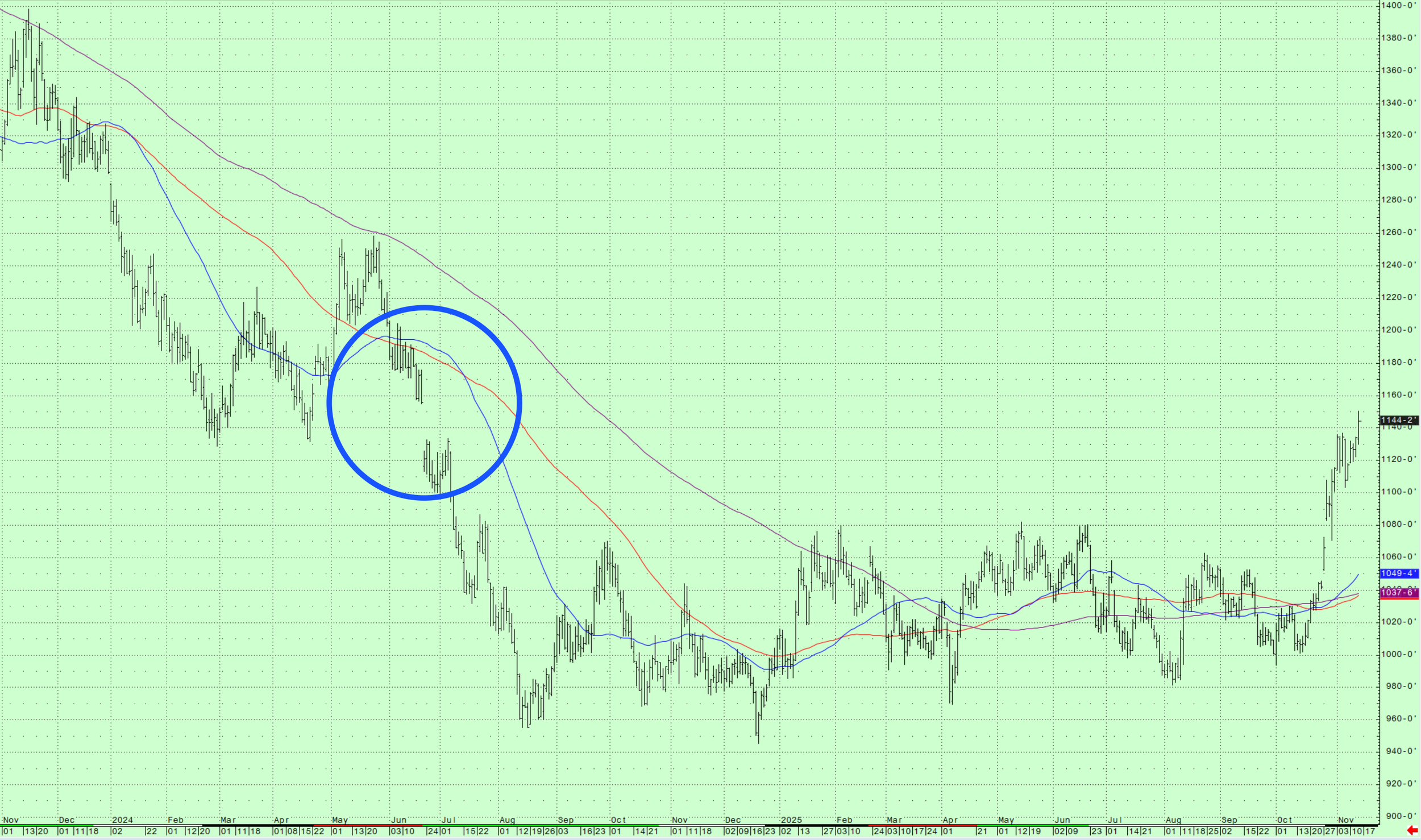

Corn breaking out (chart below)*

Very solid price action in corn & beans

Corn highest since July 4th

Beans post 16-month highs

Risk for USDA bull trap

A lot riding on tomorrows report

Will take until Jan until export sales up to date

Not sure if report will be done properly

Massive trade ranges for this report

All announcements coming at same time as USDA

Bears argue beans fundamentally overvalued

Details on our pre-USDA alert

How to manage your risk here

Using calls to establish minimum prices

When to use a call vs a put?

Soybean nearing next target (chart below)*

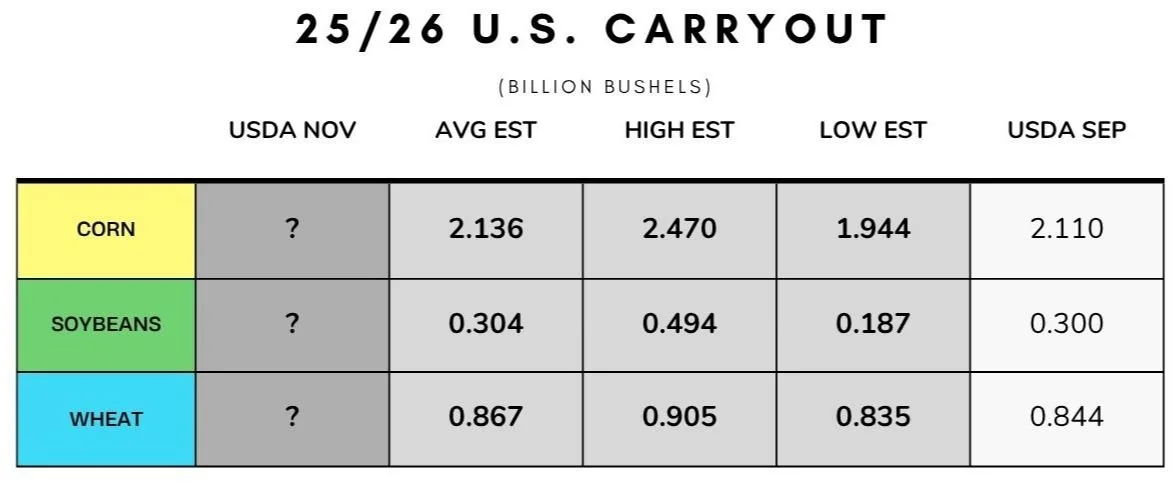

USDA estimates below audio*

Listen to today’s audio below

CHARTS & USDA ESTIMATES

Dec Corn 🌽

We have offically broken above this key resistance we’ve been talking about for months.

As long as the USDA doesn’t spoil the party.. the chart looks poised for more upside.

The level we just broke above was key support from spring. Which was now viewed as resistance. As we rejected there for 2 weeks in a row.

This was also 50% of the Feb highs.

Not only that.. but we closed above the 200-day MA for the first time since June (really for the first time since May).

I will share my next target tomorrow if the USDA doesn’t ruin the break out.

We also have that inverse head and shoulders I’ve been showing since September.

The implied move for this does bring you to $4.70

Jan Beans 🌱

We are approaching our next target of $11.55

That gives back 61.8% of the contract highs

There is also a gap at $11.55 on the active daily continuation chart (scroll for this chart).

Our 2nd target is going to be right about at $12.00

That is the 78.6% level to contract highs and a big psychological level.

I personally think there is a solid chance we will see $12.00 (scroll for my reasoning as to why).

Here is the active daily continuation chart.

When we rolled off the July contract, we left a gap at $11.55

That level perfectly lines up with 61.8% of the contract highs.

So it is our next target which we are quickly approaching.

Here is the weekly chart.

This is why I think soybeans have a great shot at $12.00

When we broke out of that yearly range.. it opened the door to an incredible amount of upside.

Where we rejected all year long was the same spot we rejected in 2015, 2017, and 2018.

The two times we broke above that resistance.. we ran a lot higher.

2016 we ran right to $12.00 before failing there.

2020 we went much higher.

There just simply isn’t any real resistance between $10.80 and $12.00 like we’ve been talking about all year long.

USDA ESTIMATES

We have a massive trade range.

Over 4 bpa in corn yield.

A 500 million range in corn carryout.

A 300 million range in soybean carryout.

A 187 bean carryout would be the tightest in a decade. A 494 bean carryout would be one of the largest of all-time only behind the trade war.

Past Sell or Protection Signals

Nov 13th: 🌽 🌱

Managing risk in corn & beans ahead of USDA report.

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.