WILD DAY. CHINA AGREES TO BUY SOYBEANS

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Corn: 2:25min

Beans: 5:25min

Wheat: 10:55min

Cattle: 12:30min

Want to talk about your situation?

(605)295-3100

Enjoying your free trial?

Our Halloween sale ends in 2 days

Subscribe before your trial ends so you don’t miss future updates or signals

Futures Prices Close

Overview

Soybeans higher with corn & wheat trade lower, meanwhile cattle was about unchanged.

Originally, grains were down drastically lower this morning.

Soybeans were down -23 cents at one point.

Corn was down -6 cents at one point.

Last night and into this morning it appeared that the Trump and China meeting was simply a "buy the rumor, sell the fact" event.

As after the meeting we did not get any specific commit numbers out of China.

All Trump said was:

"Purchases of soybeans will start immediately"

"On a scale of 1-10 the meeting with Xi was a 12"

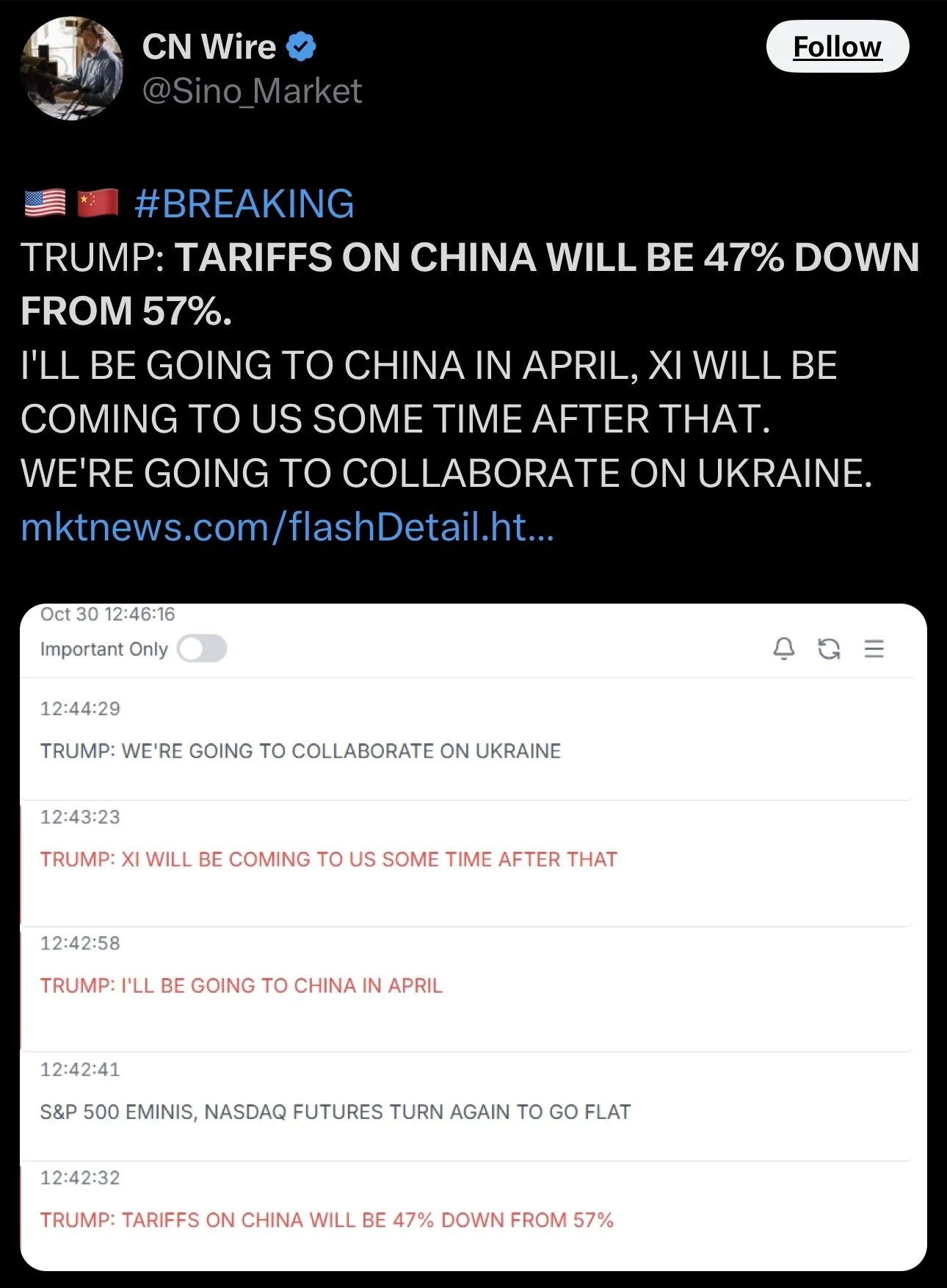

It was also announced that they came to a one-year agreement and that Trump would be dropping tariffs from 57% down to 47%.

He also said he would be visiting China in April.

Now since there wasn’t any specifics announced, soybeans tanked hard last night.

However.. this morning things got pretty interesting.

As we got volume specific news.

Bessent and Rollins announced that China agreed to buy 12 MMT (440 milllion bu) of soybeans this year.

While also buying 25 MMT (920 million bu) of soybeans for the next 3 years.

They also stated we had had come to an agreement with 6 other countries to increase soybean demand by 19 MMT (700 million bu). However, we did not get on details on this. So we have no clue what time period this is over or how it's different from what they already buy.

They also said they would buy US sorghum but no specific details were announced.

While removing tariffs on grains and ag products.

This news resulted in soybeans rallying a massive +40 cents off their lows in just 2 hours.

Here is a 15 minute chart to give you a good visual.

We started off the night slightly higher going into the meeting.

Right after the meeting ended, we dropped -35 cents because details weren’t announced.

Then when this announcement came out that we had specific purchase numbers from China, we ran +40 cents.

So it was a sell fact.. until it wasn’t.

Absolutely wild price action today. Soybeans traded in a +/-44 cent range. The largest trading range in the life of the Jan contract.

We will dive into these China numbers more in the soybean section.

Today's Main Takeaways

Corn

Fundamentals:

Not much to update on corn today.

We are fighting that $4.35 resistance we've been talking about following our sell signal on Tuesday. Which was the first one we've issued since the April rally.

I am going to keep today's corn section on the light side as there isn’t much new.

Here is why you can’t get "super" bullish on corn (not yet anyways).

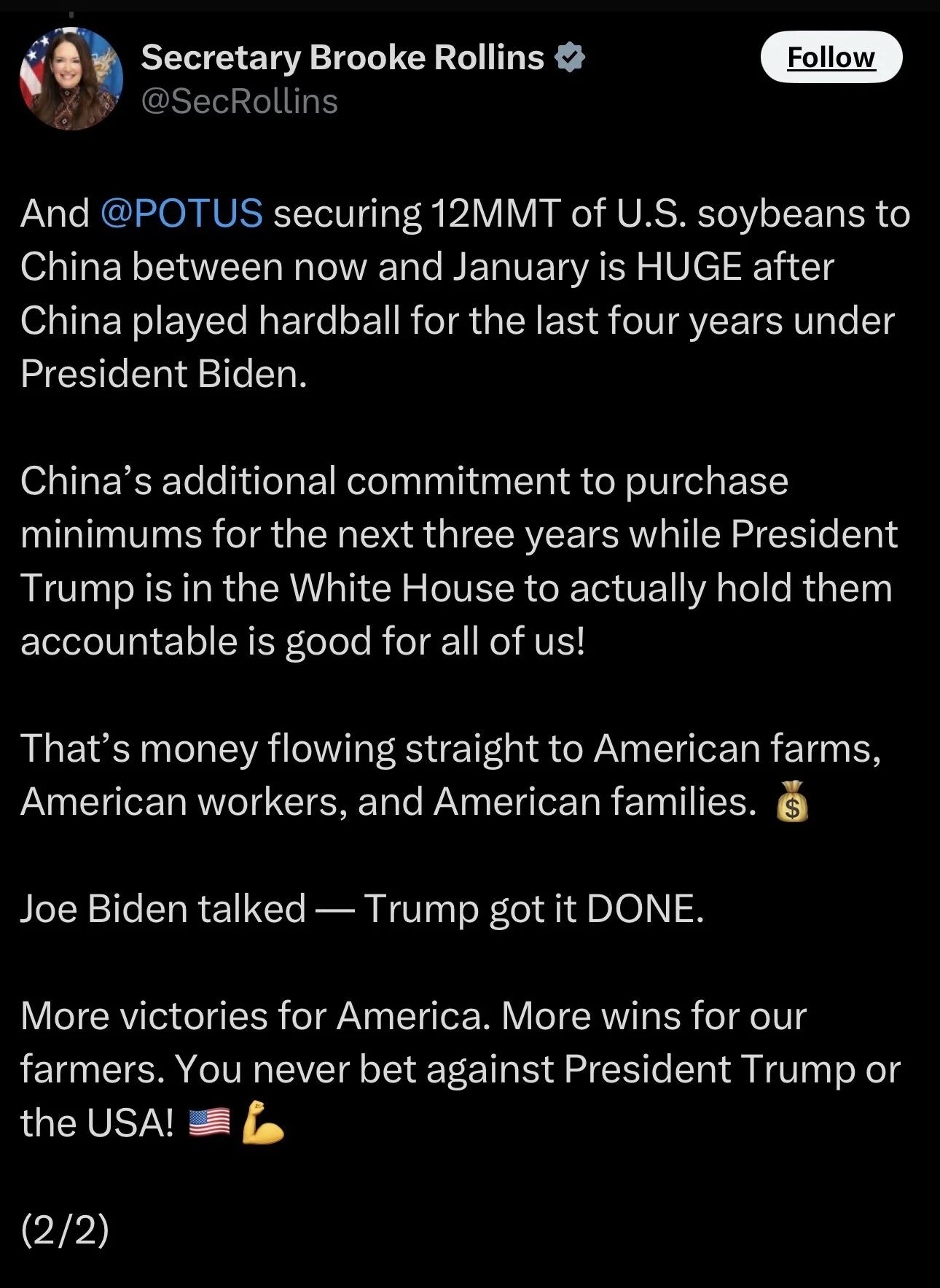

We do have a massive crop regardless of where yield comes in at.

Even if it drops to 175 bpa, we are still looking at a record.

This is almost entirely due to the utterly massive acres.

As acres this year were record high.

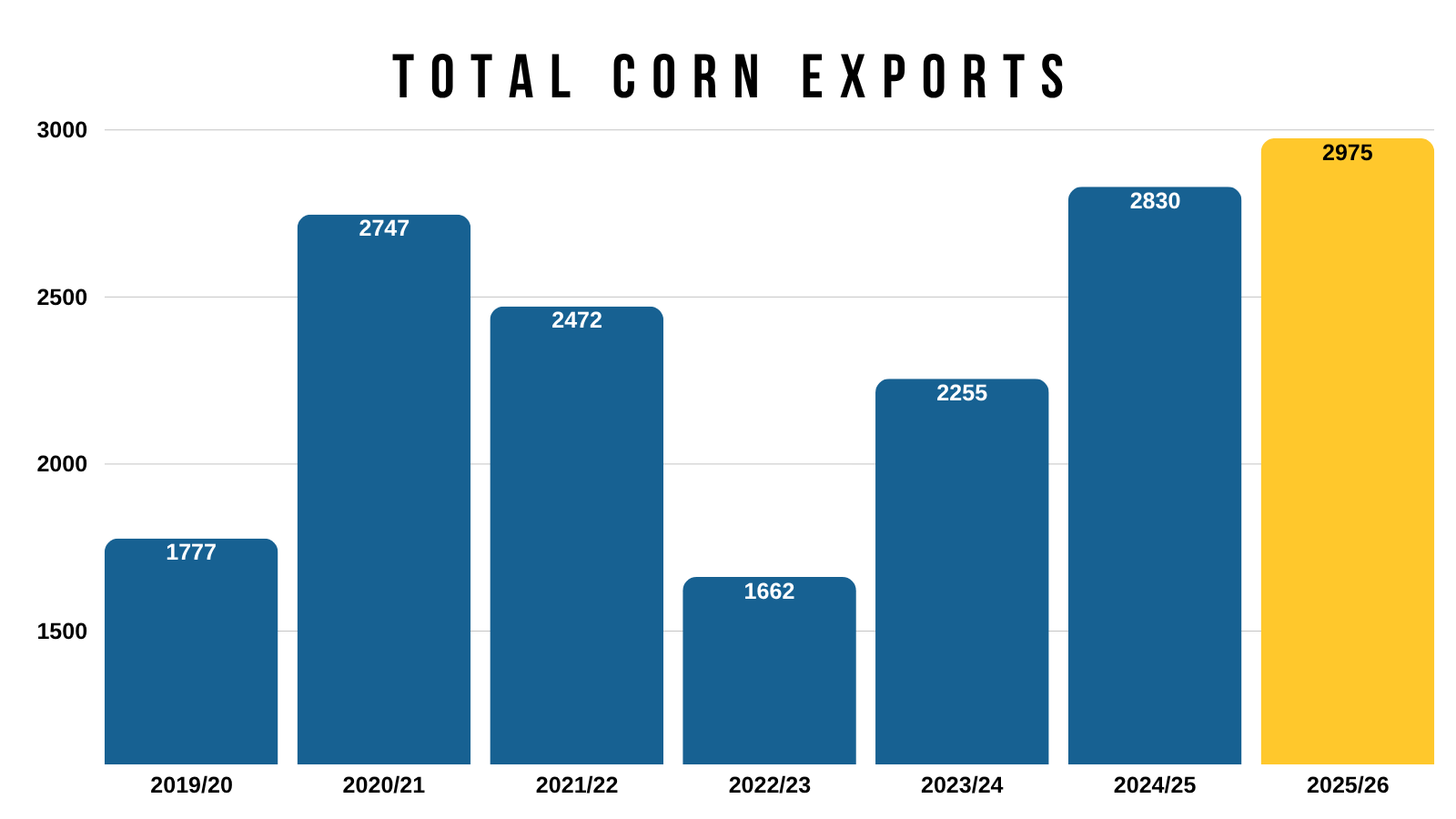

On the flip side, demand is the greatest it has ever been.

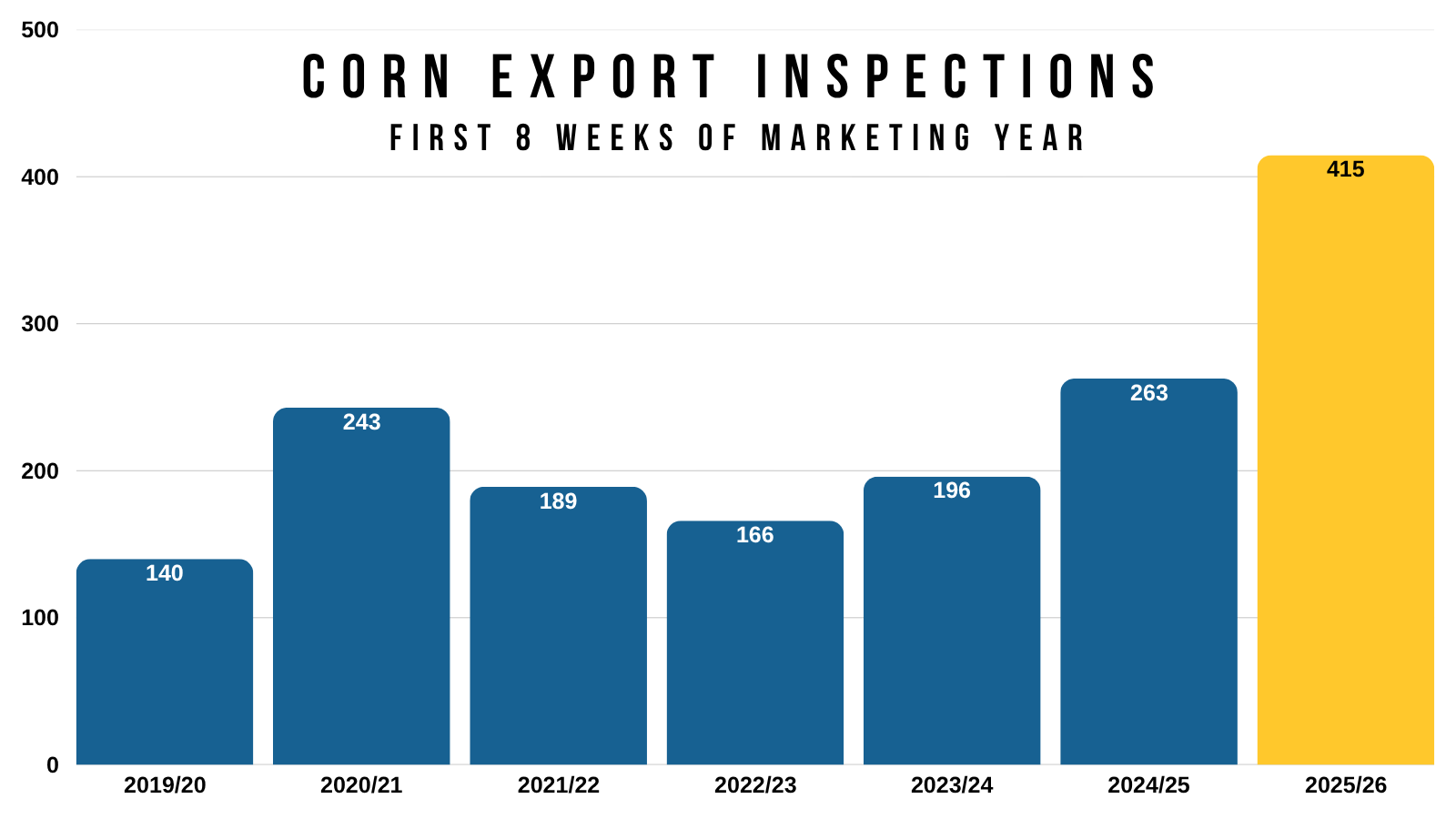

Export inspections up to this point in the marketing year are double what they normally are.

The best on record.

We haven’t had actual export data in a while, but based on the last USDA report they are expecting export demand to be the best it's ever been.

So that is why you can’t get too bearish on corn here either.

As I'd like to think record demand should help keep a floor under this market.

At the same time, yield is coming down.

That is a given.

By how much is the bigger question.

And will it take until January for it to be realized due to the government shutdown?

I've shown this chart a lot recently.

This is March-25 vs March-26 corn if you align the harvest lows.

It is still tracking pretty closely.

I can easily see a scenario where corn goes sideways before getting a greater opportunity towards the end of the year or into next.

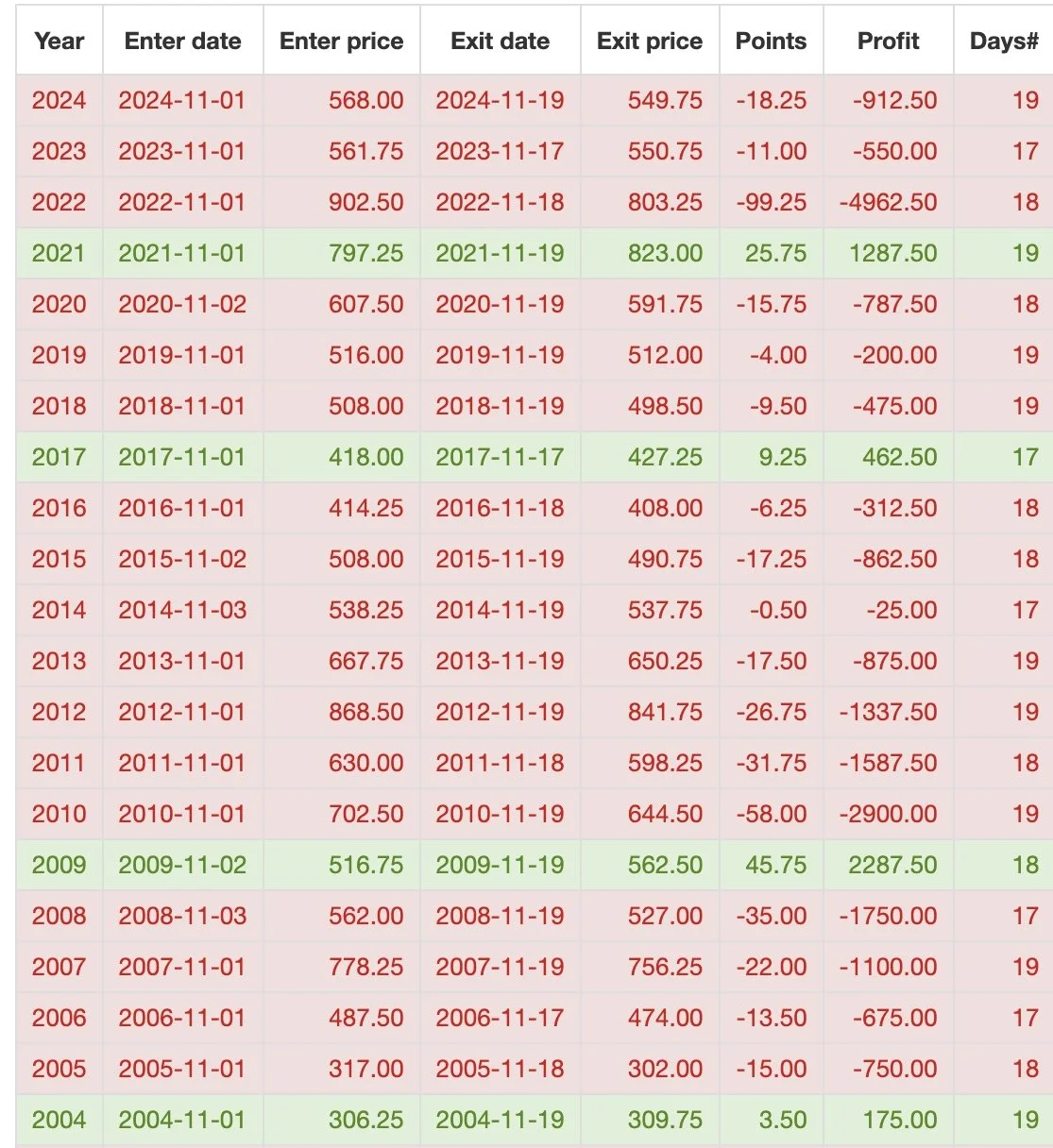

If we look at a quick seasonal.

Corn has traded lower from Nov 1st to Nov 19th the last 13 of 15 years.

The only years we traded higher was 2024 and 2020.

So seasonally, we are entering a weak time period, but doesn’t have to happen.

Technicals:

Dec Corn

Tuesday we hit that $4.35 target in Dec corn and alerted a sell signal & hedge alert.

Currently we are struggling here. As we've rejected there twice.

This reclaimed 50% of the Feb highs. It was also key support from spring. It is now viewed as resistance until proven otherwise.

If we can bust above this green box, then it could certainly open the door higher. But for now, it is resistance.

Maybe soybeans continue to drag corn higher. If that is the case, I will have my next target out if we break above this green box.

To the downside, if this truly was our local top, we want to hold $4.20. That would be a standard sized correction.

As it gives back 61.8% of the recent rally.

March Corn

If you have JFM delivery, we also hit our target March corn.

$4.50 clawed back exactly 50% of the February highs.

It was also old suppport from spring.

Soybeans

Fundamentals:

Let's dive right into the China news.

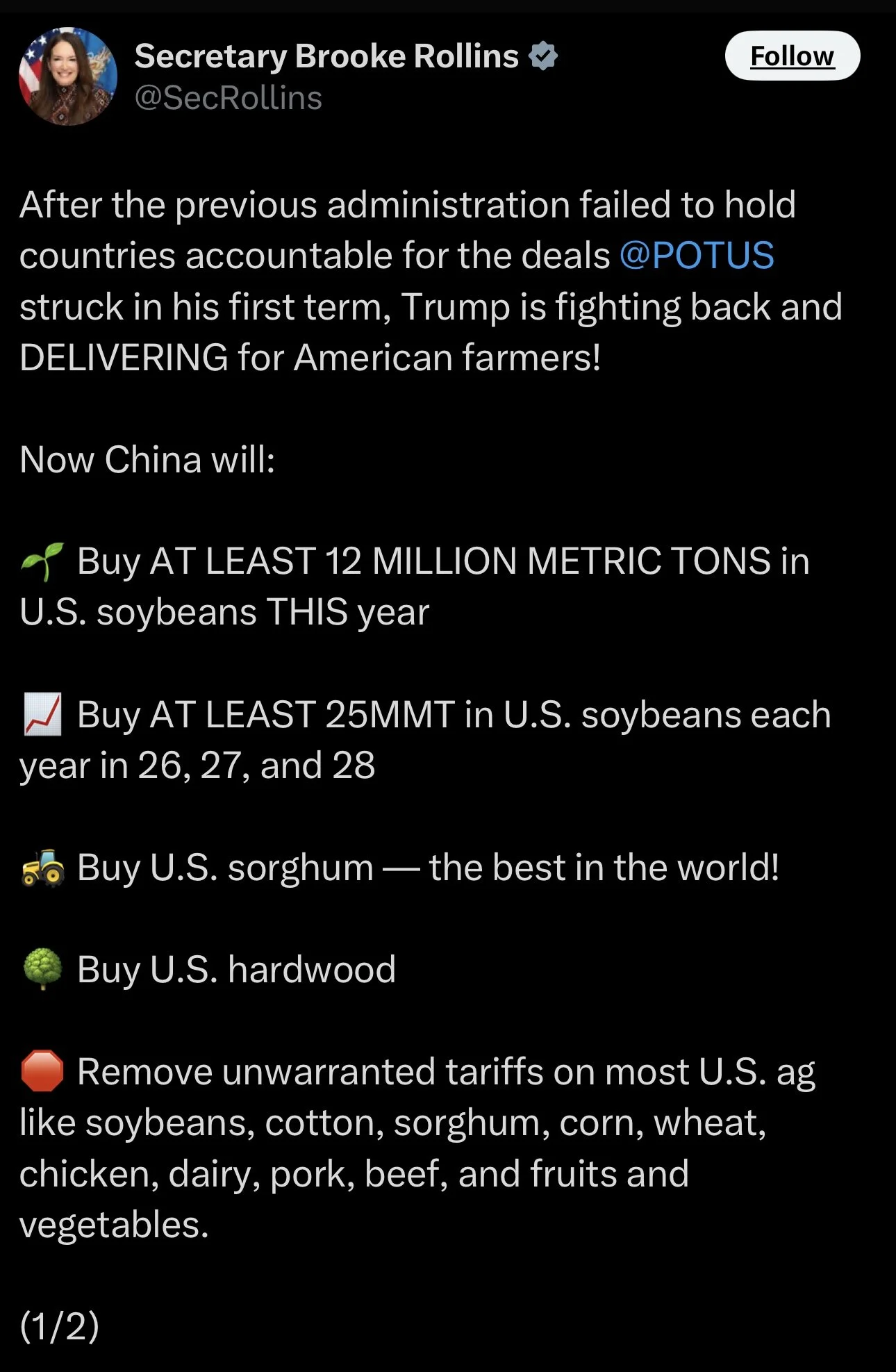

They said that China has agreed to buy 12 MMT (440 million bu) of soybeans this year.

Not only that, but they agreed to buy 25 MMT (920 million bu) of soybeans each year for the next 3 years.

Now are these massive numbers? No.

China essentially agreed to buy the same amount of soybeans they had previously been buying the last few years.

Here is a visual of that.

This is assuming they are talking about marketing years, not calendar years. That was not specified.

However, here is the difference.

Crush.

We are crushing more than ever. Our domestic demand is as strong as it's ever been.

So China is going to be roughly the same amount of soybeans they've been buying the last few years.

If you compare the years that resemble the same amount of soybeans China has agreed to buy, crush demand is +200-300 million bushels higher than those years.

So even though this commitment from China isn’t out of this world large, it is still friendly.

We also have far less acres than those years.

China does have a pretty shaky track record or living up to their promises. As they only fulfilled 58% of what they agreed to buy during the phase one trade deal.

However, that might be largely due to how the deal was structured back then.

In the phase one deal China agreed to buy a set dollar amount rather than pure volume. Soybeans were at low prices at the time, but ramped up. So it was harder for them to meet their requirement.

This agreement is far more reasonable and attainable because they are basically just buying what they normally do.

With the domestic demand we have, if Brazil has any weather issues at all, things could get pretty interesting.

Not to mention, we do have the 2nd lowest acres of the last decade.

Which makes the room for error on the balance sheet all that more smaller.

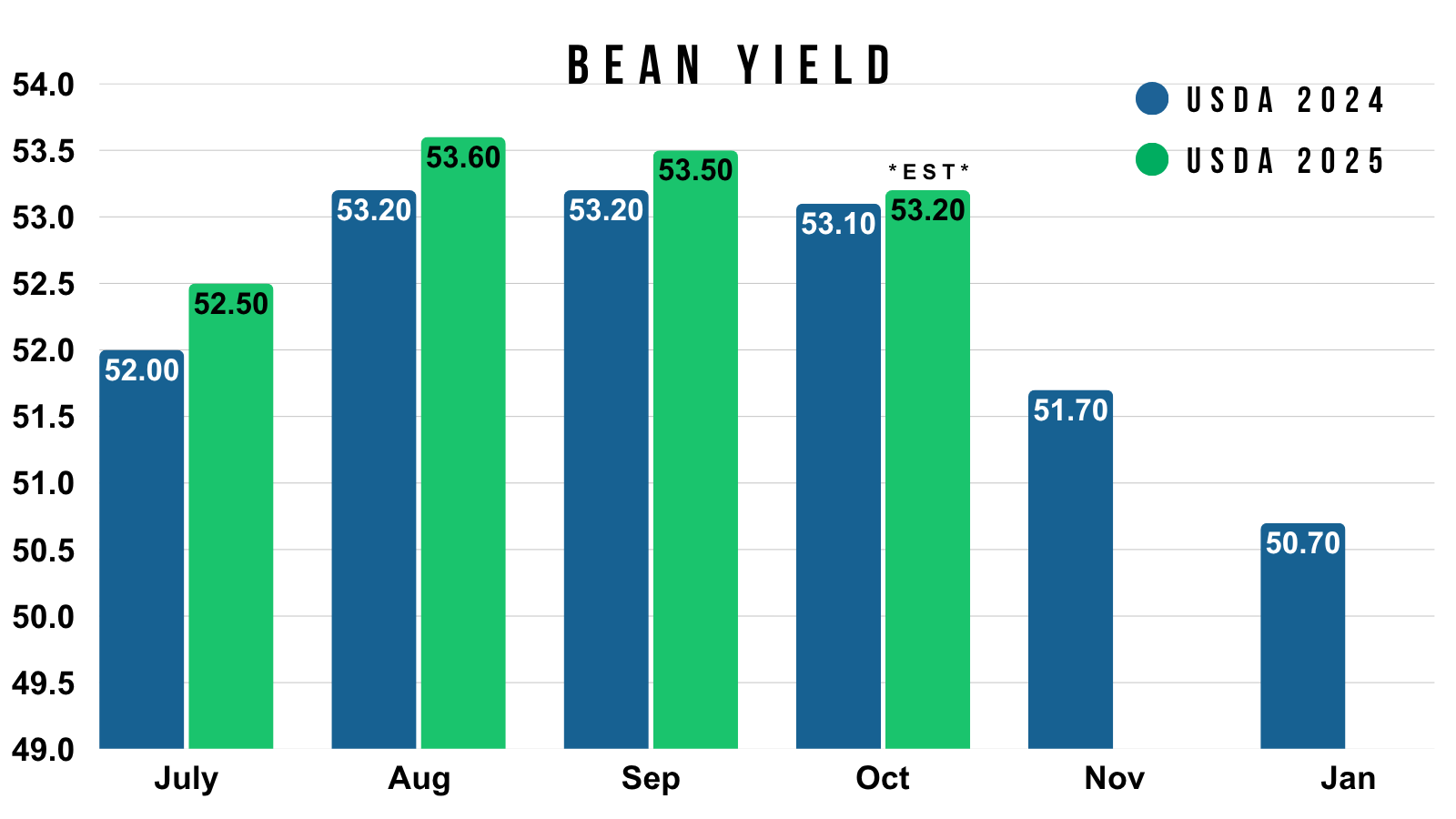

Here is a 2024 vs 2025 yield comparison.

Last year, Oct yield was the same as where the analysts pegged it at earlier this month.

Oct 2024: 53.10

Oct 2025: 53.20 (analyst est)

Last yield, yield fell substantially in Nov and Jan.

Nov 2024: 51.70

Jan 2025: 50.70

We had a similarly dry finish this year.

Odds favor us not getting a yield update until January with the government shutdown.

But what happens if we see a similar drop in yield like last year?

China has agreed to buy their usual amount of soybeans. We have small acres. Crush is at a record. There just isn’t a ton of room for error on the supply side.

I have been preaching this argument for months, but that is why this market has "potential".

Bottom line, this is great news that China is going to buy soybeans.

I mean Chinese demand was by far the biggest concern in this market.

China is only buying about half of what they did last year, but the concern was China wouldn’t be buying at all.

They aren’t buying a crazy amount of soybeans this year, but it should be enough to prevent the balance sheet from getting heavy. While at the same time locking in future sales for the next 3 years.

The next big factors are going to be Brazil's crop. Do they have any production issues? We are soon entering their weather season.

Then where does US yield ultimately come in at?

This market certainly has upside potential.

However, we do still like managing some risk up here if you have not done so yet on our sell signal & hedge alert on Monday.

We have been extremely patient on our soybean sell signals this year. So rewarding a $1.00 rally in some sort of manner makes sense.

Preferably something that keeps your upside open such as puts, or selling your grain then re-owning with a call.

If you don’t have a hedge account, like we said on Monday, we simply like making a few sales up here.

It depends on your situation, so give us a call or text if you want to talk specifics.

(605)295-3100

Regardless, I am definitely still keeping ammo in case this market continues higher. But don’t do nothing on a $1.00 rally and the highest prices we've seen in over a year.

Technicals:

Jan Beans

For starters, we did break out of a year range we'd been trapped in for over a year. Which is a pretty big deal.

My targets are subject to change as this is such a headline driven market right now.

For now, I am eyeing $11.20 then $11.55 if we hit them.

$11.20 gives back 50% of the contract highs from the contract lows.

$11.55 gives back 61.8% of the contract highs from the contract lows.

I think both of those are good spots to further de-risk.

Will we fill that gap we left Sunday?

Hard to say. Rule of thumb is typically that if the gap isn’t filled in 3-4 days then it doesn’t have to be filled.

Continuous Beans

I've been showing this chart for months and talking about how significant a break out of this range could be.

We've been trapped in a small range for nearly 500 days.

We've now broken out of that range.

There is a pretty clear gap of air higher. As on that 2024 sell off, it was hard and fast. Meaning we created zero support between here.

I showed this recently, as well as on social media.

Soybeans absolutely hate trading between $11.00 and $12.00

Does that mean soybeans "have" to go to $12.00? No of course not.

But historically, we very rarely ever trade between these two levels.

Most of the time we run up to $12 or higher, or crash below $11.00.

There have only been a handful of months ever where we've simply traded in the $11.00's.

I think $12.00+ soybeans is a possibility. But I will be managing my risk on the way up as nothing is ever a guarantee.

Wheat

Fundamentals:

Nothing new to update in wheat as has been the case recently.

We still don’t have a true catalyst in this market. But relatively speaking I still view the wheat market as being undervalued here long term.

We are entering a seasonally weak time frame similar to corn.

Wheat has traded lower from Nov 1st to Nov 19th the last 13 of 15 years.

We've only traded higher 4 times since 2004.

However, seasonally wheat was suppose to trade higher in September and cleary that didn’t happen either.

Just something to be aware of here.

Technicals:

Dec Wheat

Outside down today. As we took out yesterday’s highs then closed below yesterday’s lows.

We rejected right at those Sep highs.

That is going to be a big level to break above.

If we can break above, I think we could have room to run towards $5.55-70. Which is where I want to de-risk if we get there.

To the downside, a standard correction would take us as low as $5.09. That is the level we want to hold or it could create more downside.

Dec KC Wheat

Very similar chart to Chicago.

Outside down day today, which is bearish short term.

We rejected right at the Sep highs.

We did just break out of a multi-month downtrend, so that’s nothing to scoff at.

If we can take out the Sep highs, I think we have room to go to $5.45-60

Which gives back 50-61.8% of the June highs.

To the downside, we need to hold $4.95 to keep bias remaining higher.

Cattle

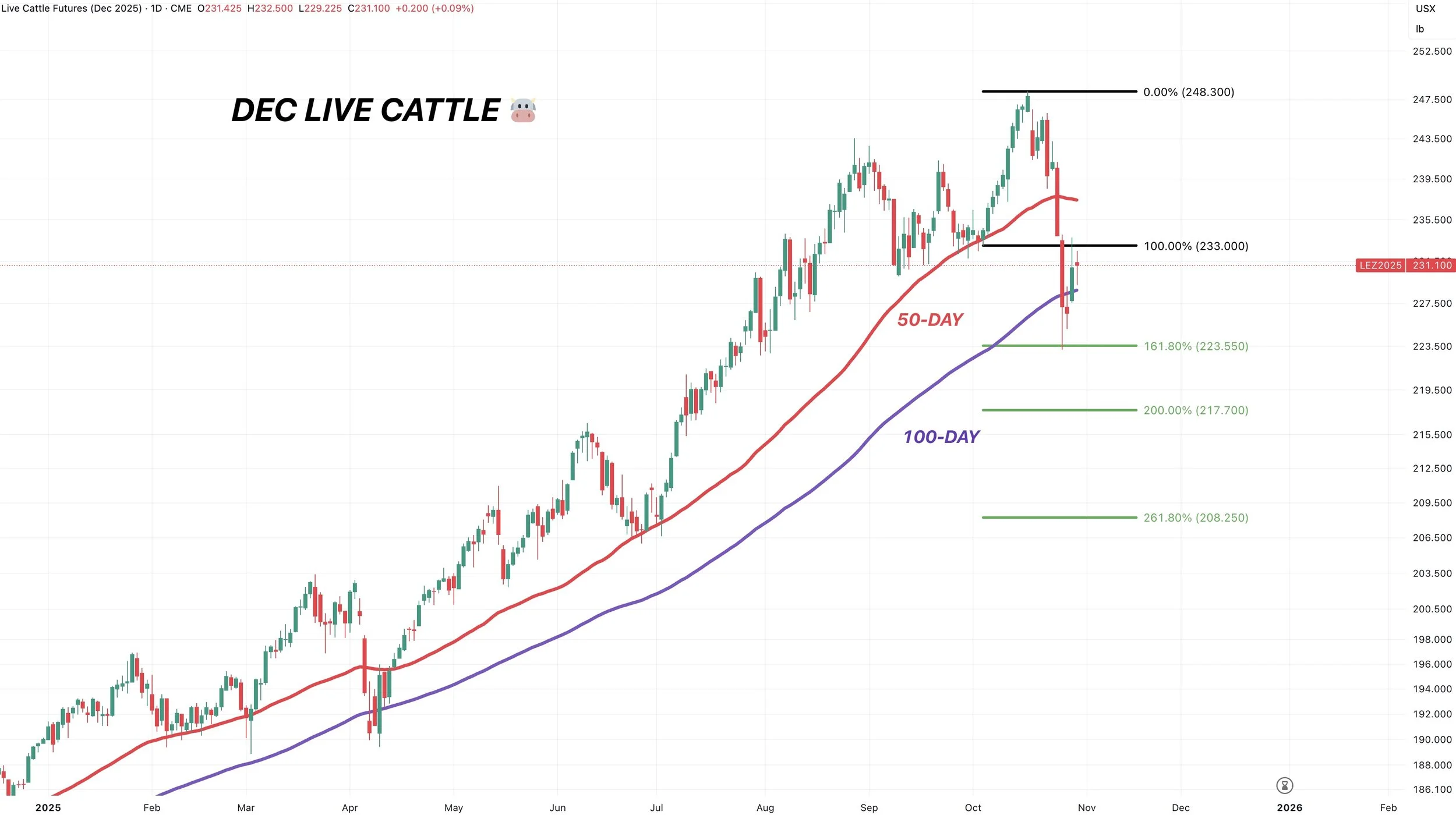

Dec Live Cattle

Inside day for both live and feeders, as the market is pausing searching for a direction.

Remember how massive of support the 50-day had been all year long?

That is now going to be our upside point of interest if we get a bounce.

Since it was incredible support, it could offer pretty stiff resistance.

So that is where we are going to wanting to be looking to reward if we get a rally.

To the downside, I added some retracement levels.

All these are is I measured the top down to where we previously bounced off the 50-day MA at before that big rally.

Earlier this week we touched the 161.8% level before bouncing. If that level fails the next levels of support are on the chart.

For reference, here is a zoomed out look of the 50-day.

Was a floor all year long.

Jan Feeder

We left a massive gap on Monday.

If we are able to crawl up and fill that gap, we should be rewarding the bounce. That is going to be out point of interest if it fills. Gaps do not have to fill, but that is an area to reward if we do.

It is possible that that gap does not get filled, as open interest yesterday indicates that yesterday’s rally was not met with fresh buying.

Similar to live cattle, we bounced at the 161.8% retracement. Failure to hold could drop us to the next levels.

Continuous Feeder

Fundamentally, nothing has actually changed in this market.

We did get reassurance that the border would remain closed for the time being.

But with the government clearly trying to get prices lower, there is still risk in this market.

If the top is truly in, where could we expect to find a bottom?

This is my big picture thinking; it could be months or even years. It won’t happen right away, and doesn’t have to happen at all.

But historically, cattle has found a bottom where it previously found resistance.

The highs from the 90's turned into the floor during the 2000's.

The highs from the 2000's turned into the floor during the 2010's.

So perhaps we find a floor at those highs from last year. Or maybe those highs from 2014.

Testing that level would make sense.

Past Sell or Protection Signals

Oct 28th: 🌽

Corn sell signal & hedge alert.

Oct 27th: 🌱

Soybean sell signal & hedge alert.

Oct 13th: 🐮

Cattle sell signal & hedge alert.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.