COULD THE BOTTOM BE IN?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

2024 vs 2025 Weather: 0:45min

Corn: 3:00min

Beans: 6:00min

Wheat: 9:20min

Cattle: 11:50min

Want to talk about your situation?

(605)295-3100

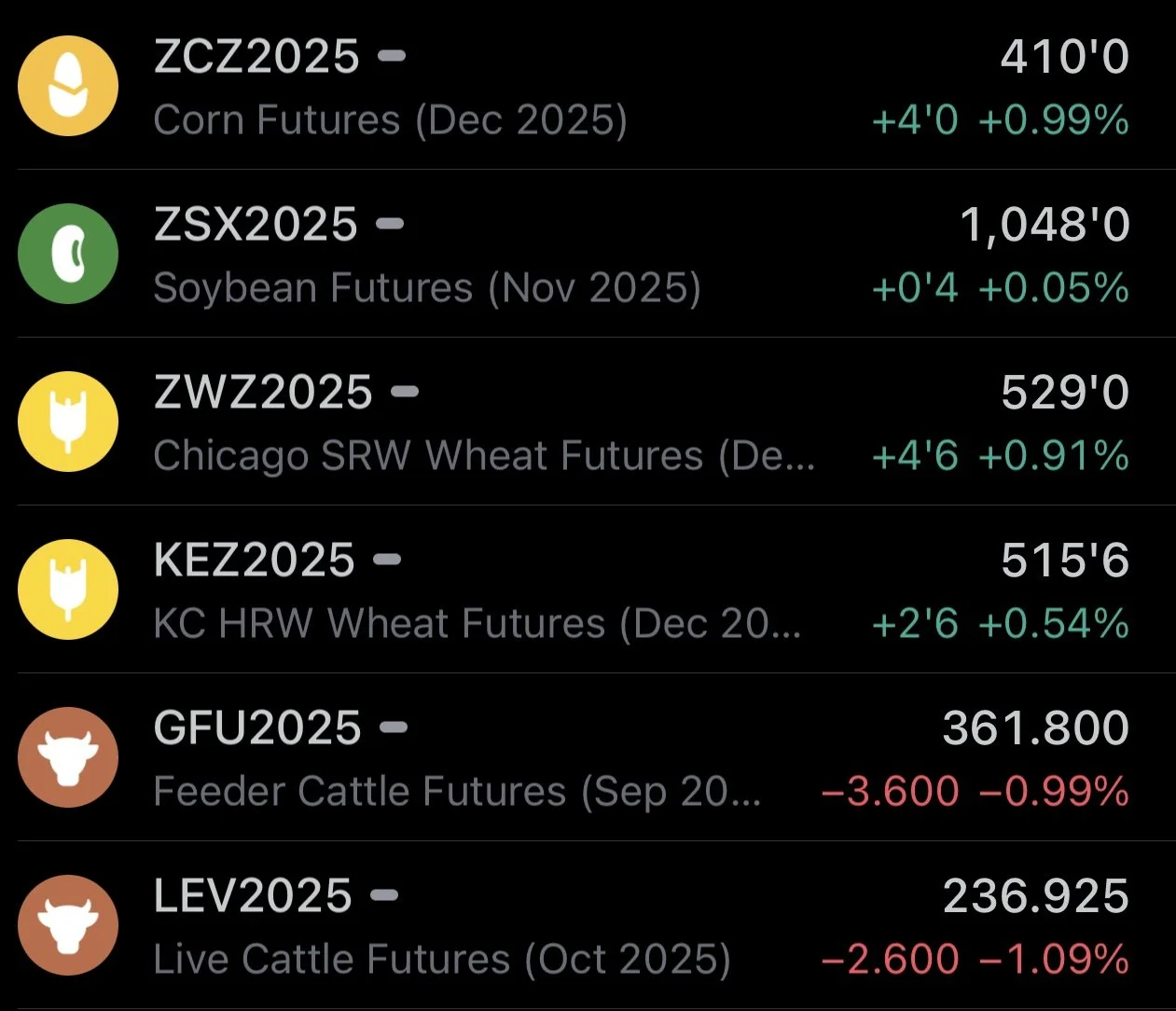

Futures Prices Close

Overview

Decent action across the grains, as all opened lower and rallied off the early lows.

Meanwhile, the cattle market sees some follow through weakness following yesterday's ugly candles.

First notice day is tomorrow.

This has been a big reason for the weakness this week, especially in the corn market. This happens nearly every single contract month for the corn market if you go back and look.

Now that the natural sell pressure from first notice day is out of the way, maybe we can start to find some footing.

Bulls are arguing this dry finish could take the top end off of these crops, while corn & wheat demand continue to impress.

Bears are arguing that soybean demand is in jeopardy and we have a monster amount of corn supply.

Let's dive into the good stuff.

2024 vs 2025

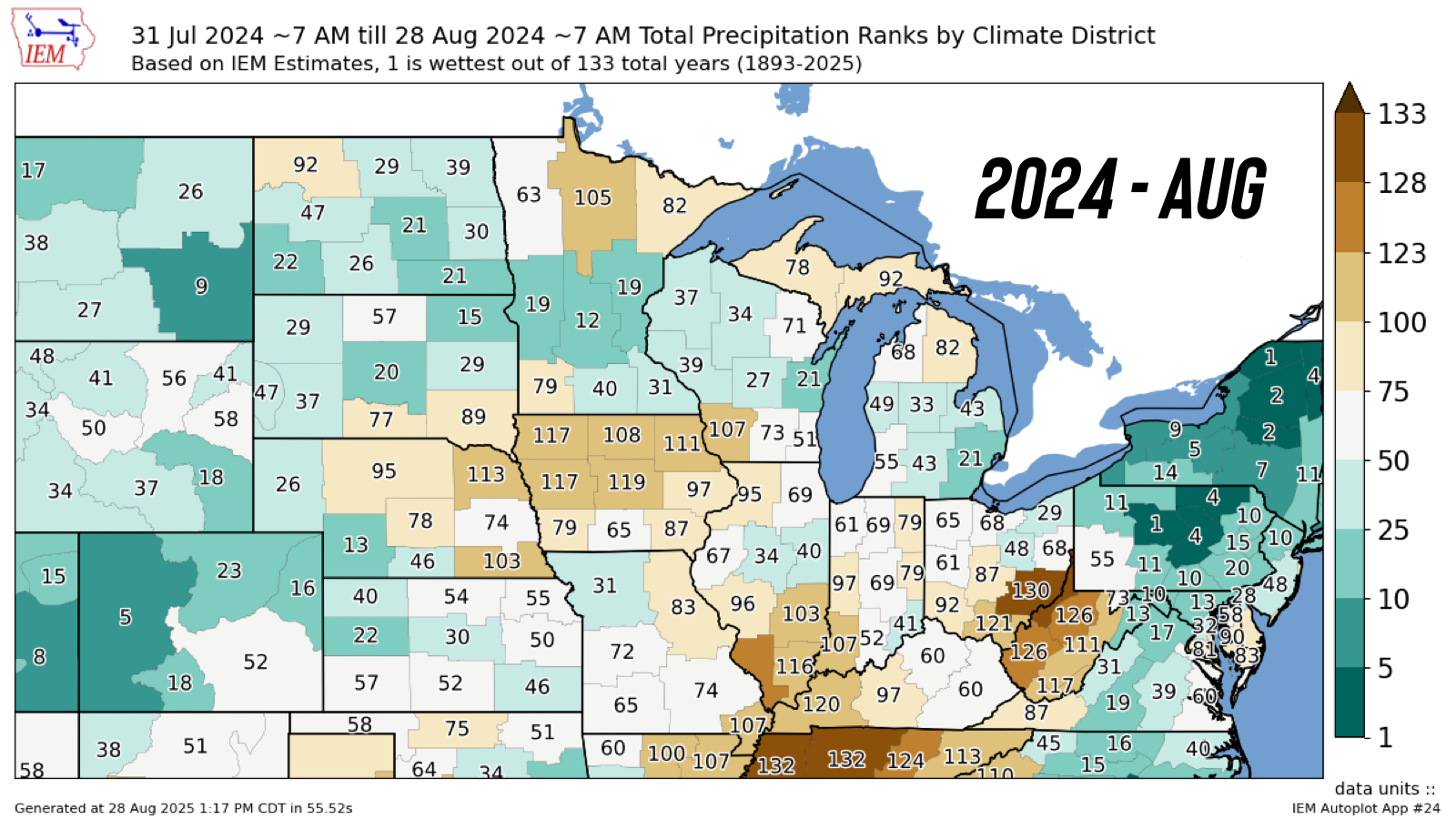

On Tuesday, I showed how much drier August was for this year compared to last year.

But I wanted to take this one step further.

Last year, yield clearly took a hit with the dry finish.

Again, here is the August precip rankings for this year vs last year.

This year had a much drier August.

Especially out east. The eastern corn belt definitely has some concerns.

2025 - August Precip

2024 - August Precip

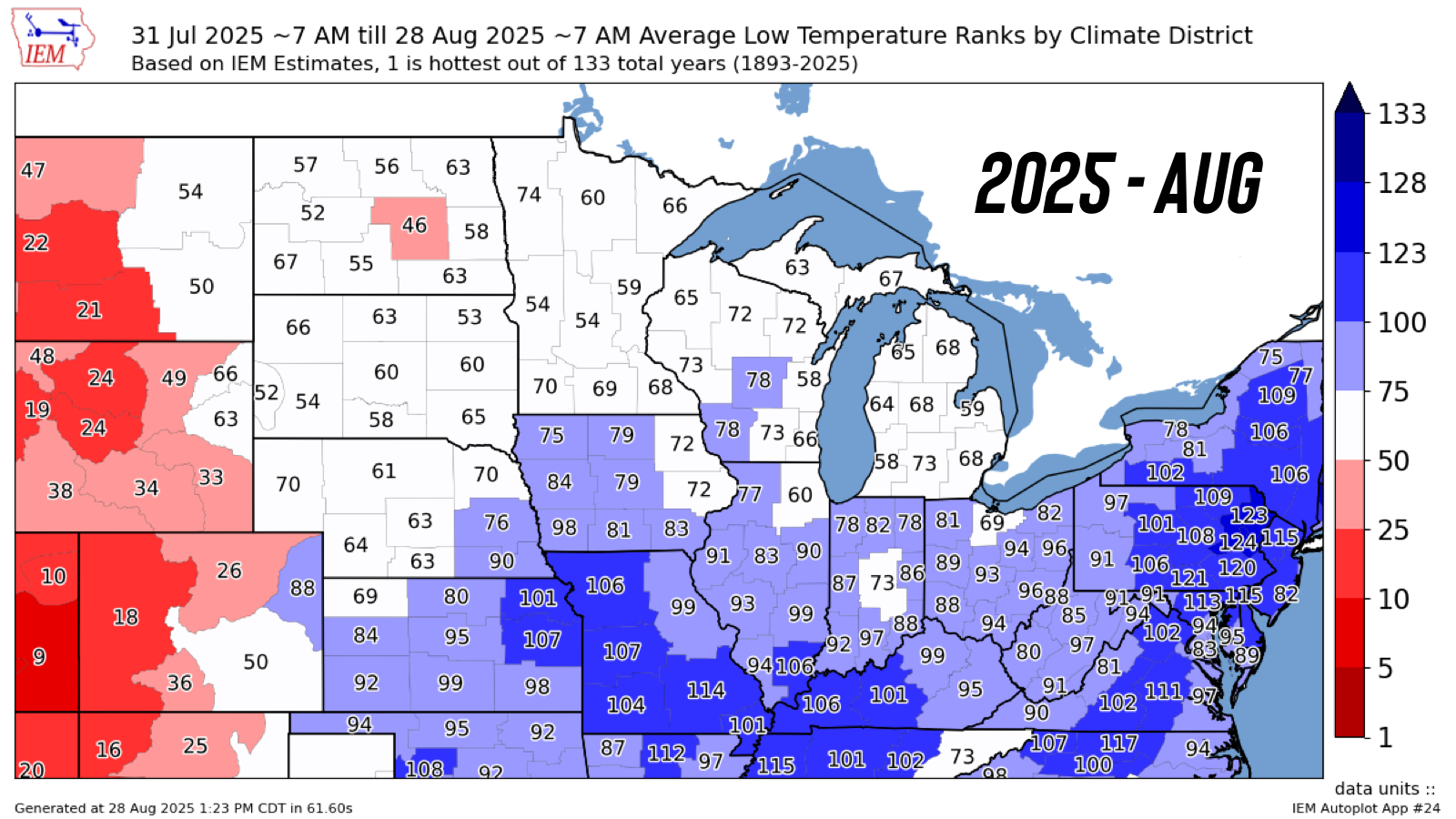

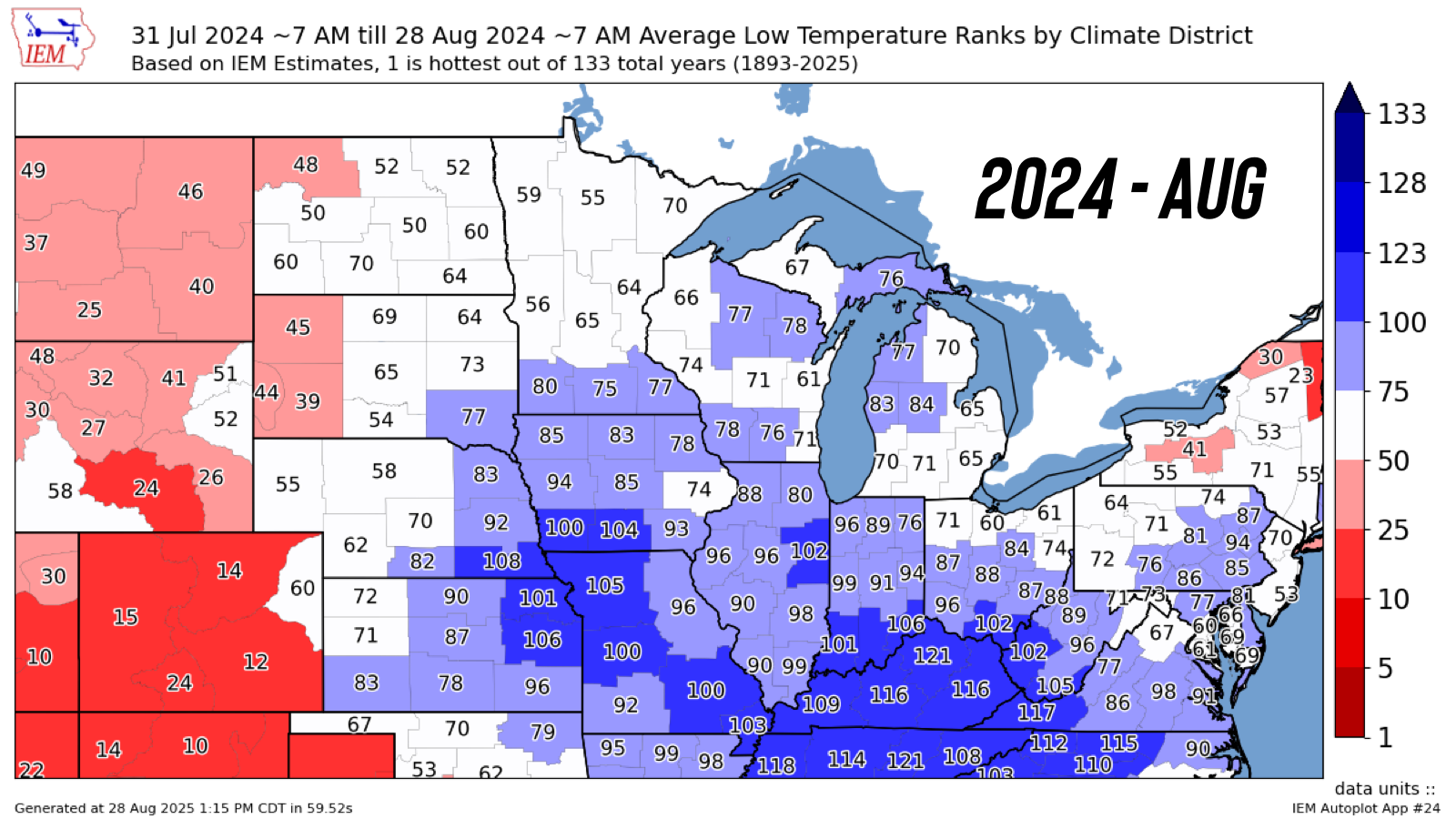

Neither this August or last year's August featured much heat at all.

2025 - Aug Low Temps

2024 - Aug Low Temps

If last August wasn’t as dry as this year, and didn’t feature any heat, where did the yield loss come from?

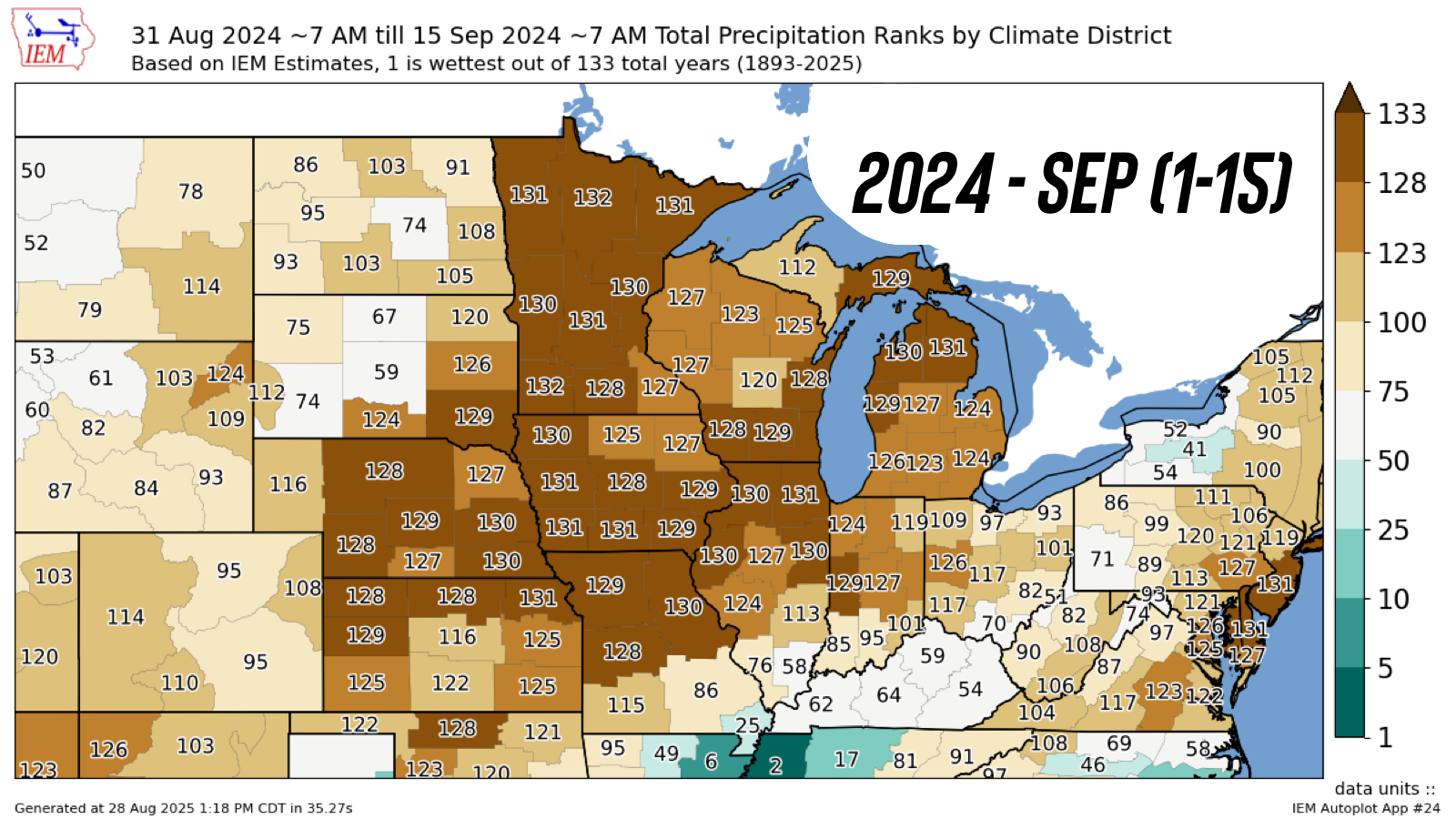

Here is precip and temp rankings for the first half of September last year.

It was one of the driest first halves of September on record for the central corn belt.

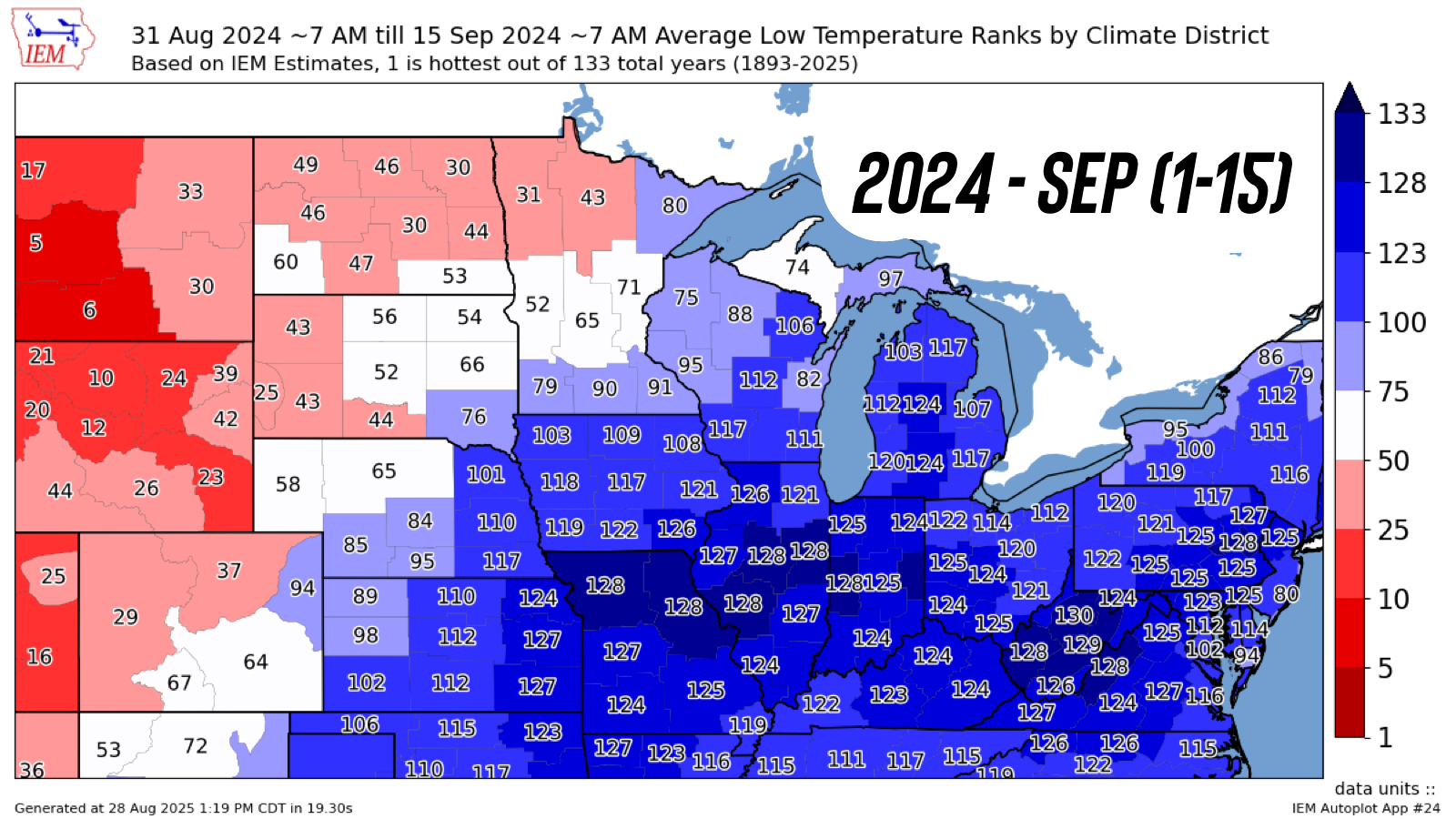

Meanwhile, it did also have some of the coolest nights.

2024 - Sep 1-15th Precip

2024 - Sep 1-15th Low Temps

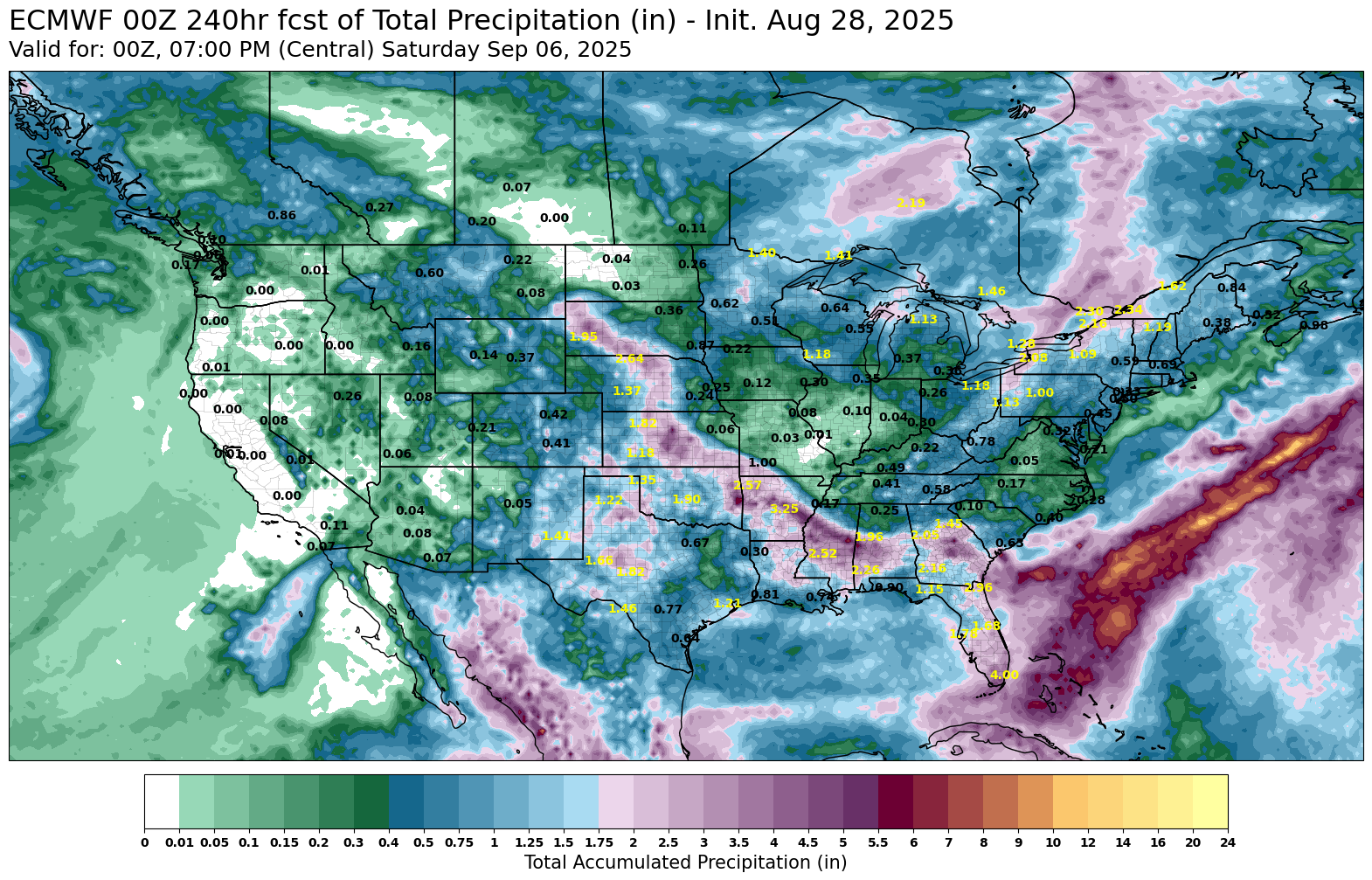

Here is the next 10 days of precip.

It is suppose to remain dry in those same areas that have been dry all of August.

This growing season has seen some great things and some not so great things.

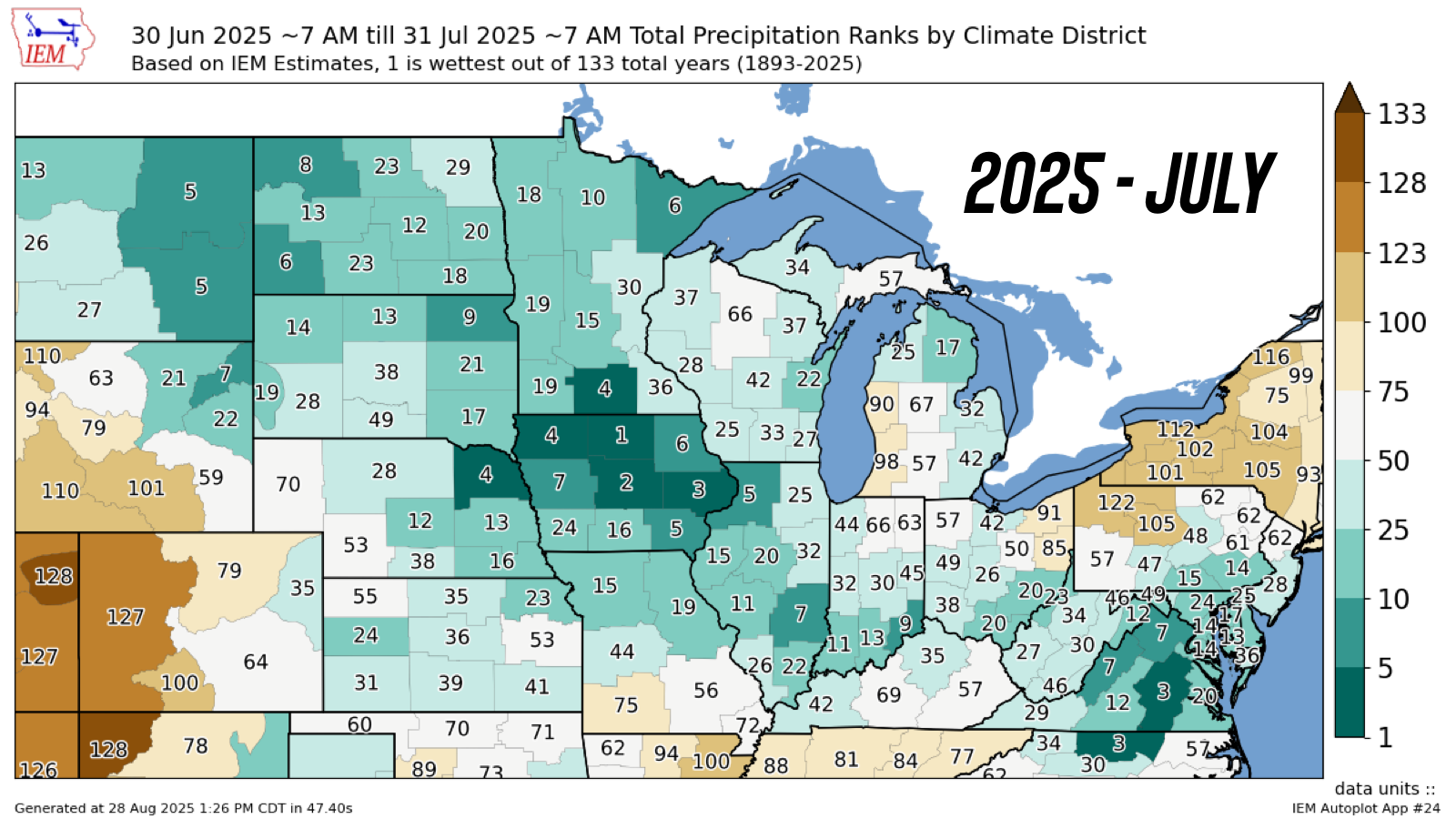

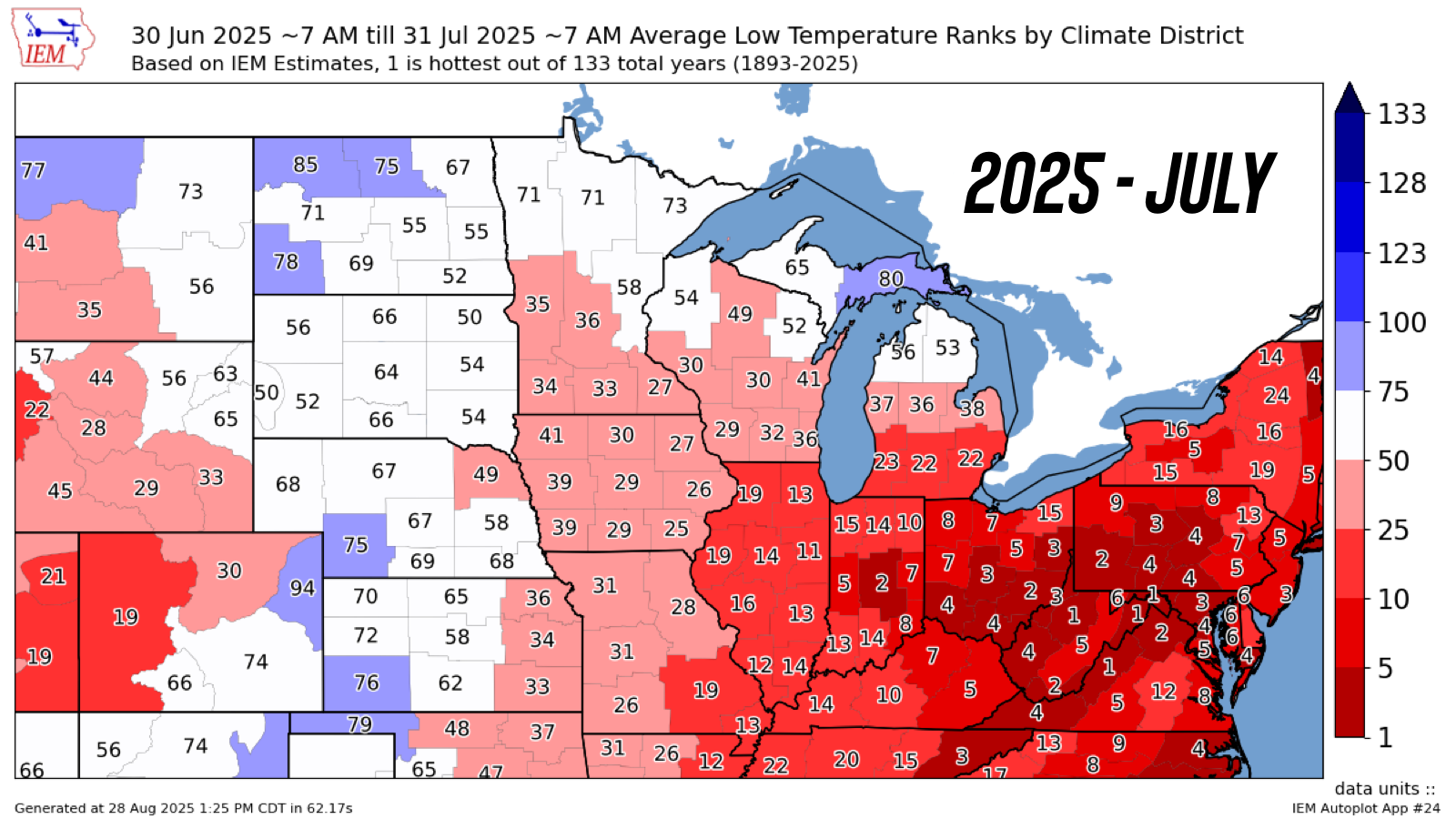

Let's look at the July precip & temp rankings for this year.

This July was one of the wettest on record. Especially for Iowa.

However, overnight temps were some of their hottest ever. Especially in the eastern corn belt, which is the area currently suffering from a dry August.

Overnight heat in July and August can be a silent killer. It's one of the things that can have the biggest impact on yield but doesn’t show up from the side of the road.

Do we have a record crop? Yes probably.

Do we have a 189 corn yield? I'd say probably not.

2025 - July Precip

2025 - July Low Temps

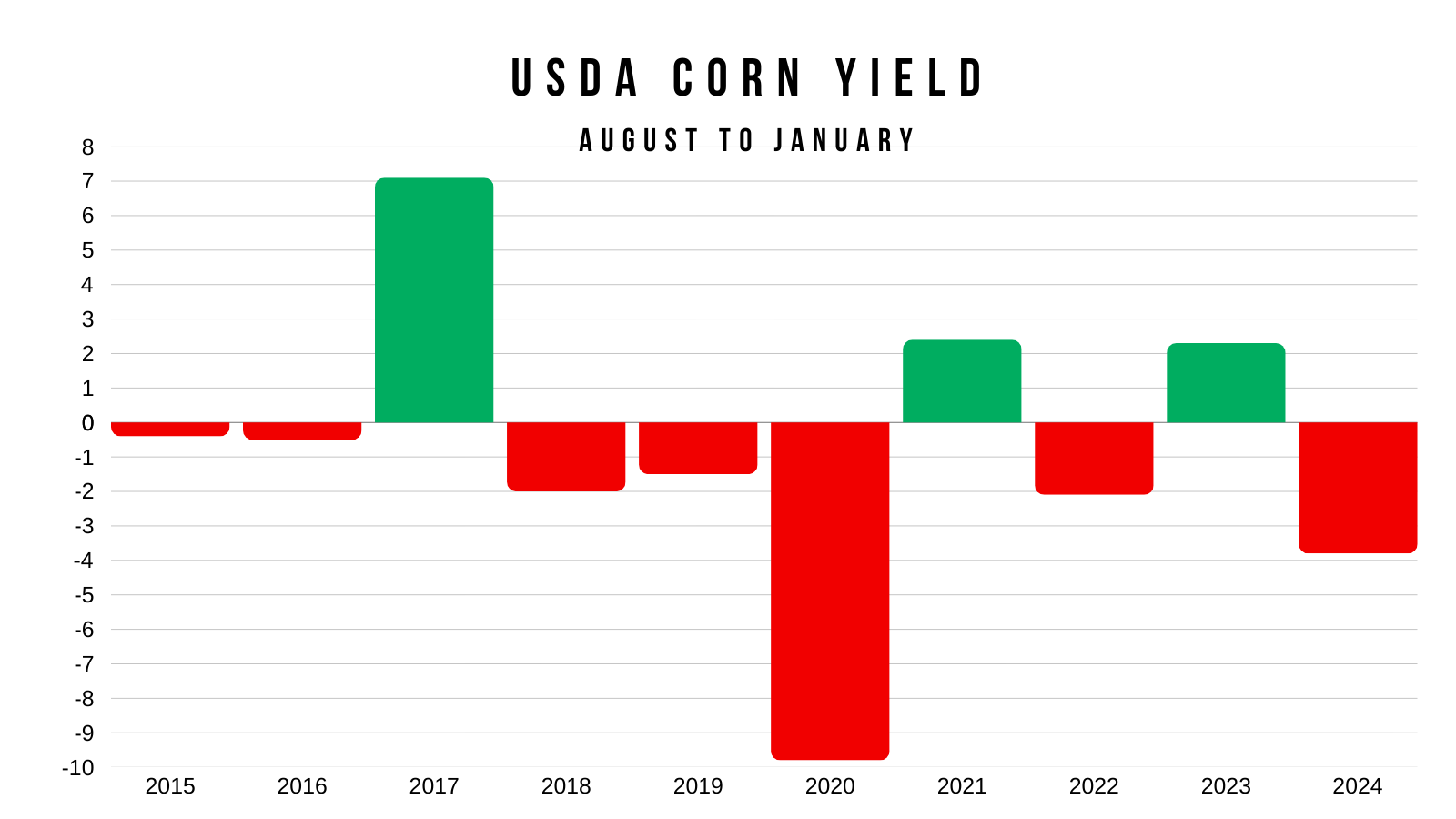

Last year August yield was 183.1 bpa.

Last year's final was 179.3 bpa.

Which is a -2.1% decrease.

Just for reference, if we saw that same decrease, it would put us at 184.8 bpa.

Today's Main Takeaways

Corn

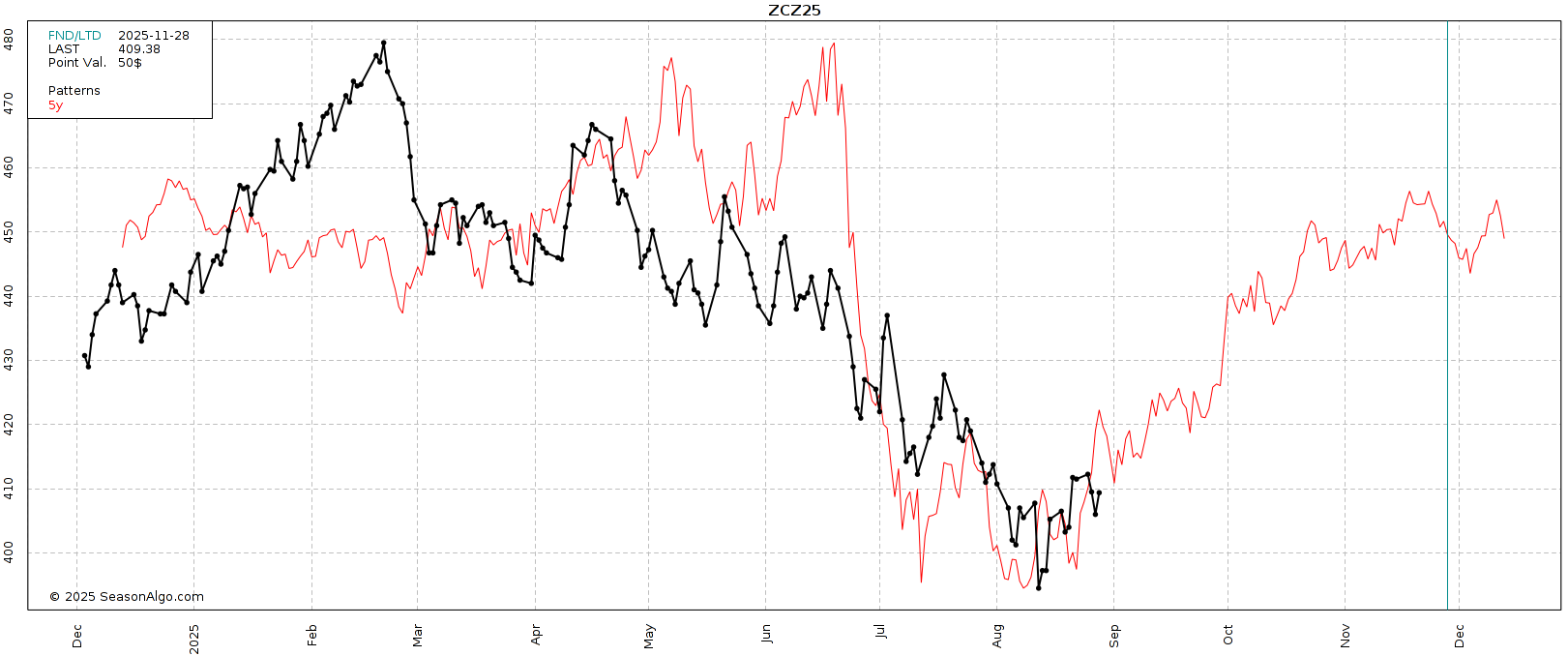

Corn bounced right off the golden zone (which we will touch on).

The recent weakness was mostly first notice day.

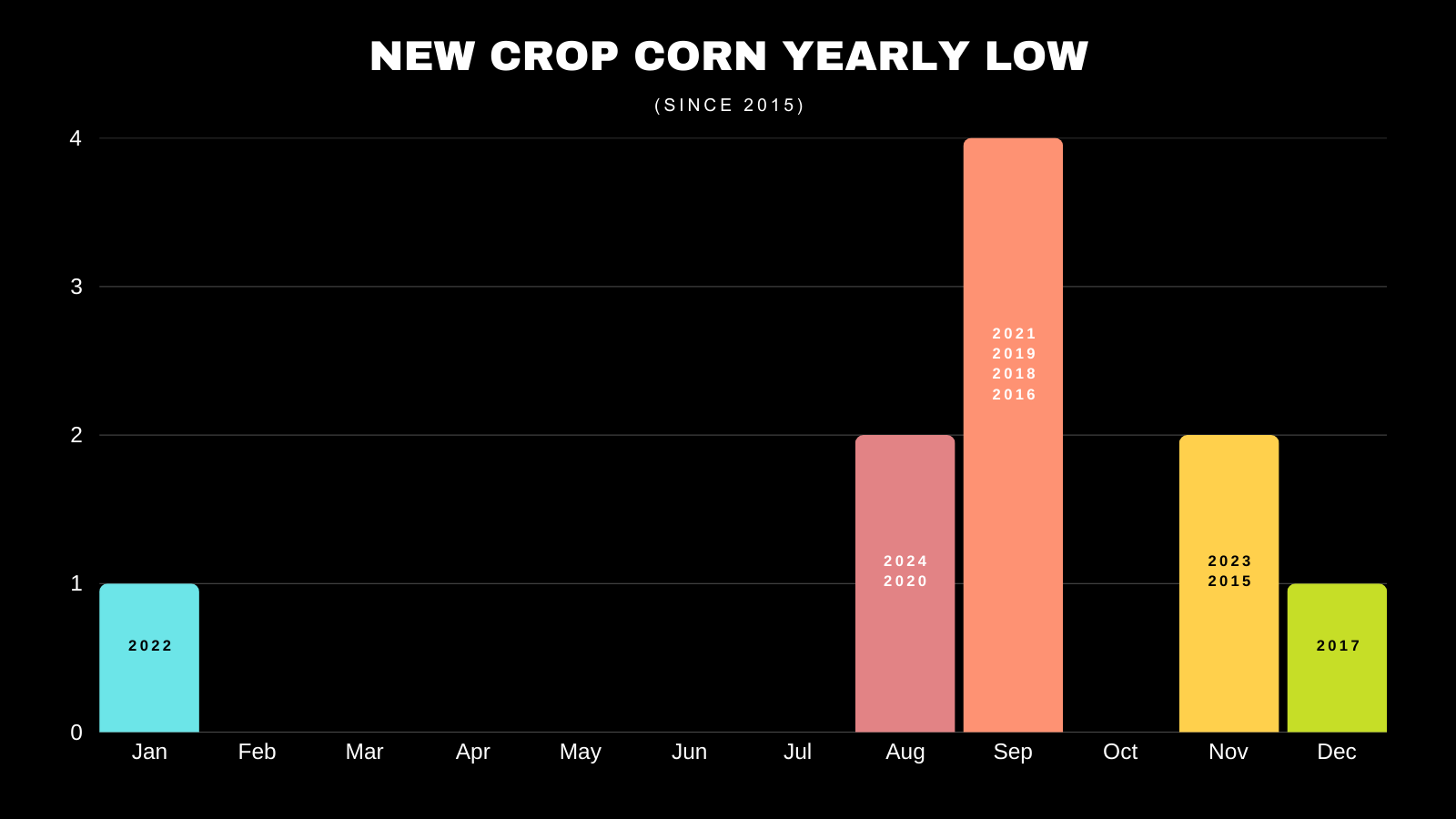

Are the harvest lows in?

Last year, corn bottomed yesterday on August 27th.

The 5 year seasonal says the bottom is in.

As this one bottomed right about where we did back in mid-August.

The 10 year seasonal also says the bottom is in.

As this one bottoms right about now.

If we look at the month where Dec corn has posted it's lows the past 10 years.

50% of them occured in August or September.

This is seasonally when we bottom.

Is corn going to rally +50 cents in the next month? Doubtful.

At these levels, my bias leans higher long term towards next year and as we get into the acre battle.

But short term, it is still going to a battle to mustard a real major rally. I am talking anything north of $4.30 to $4.40.

The massive acres are going to be hard to overcome.

We have a record yield and record acres.

Higher corn prices is going to be a long process, because we do now have an extra +1 billion bushels of supply to chew through.

At the same time, I don’t think we spend much time below $4.00 if at all.

I think the blood shed is mostly over. But it isn’t time for a face melting rally either. If the lows are in, it's probably going to be more of a slow grind up.

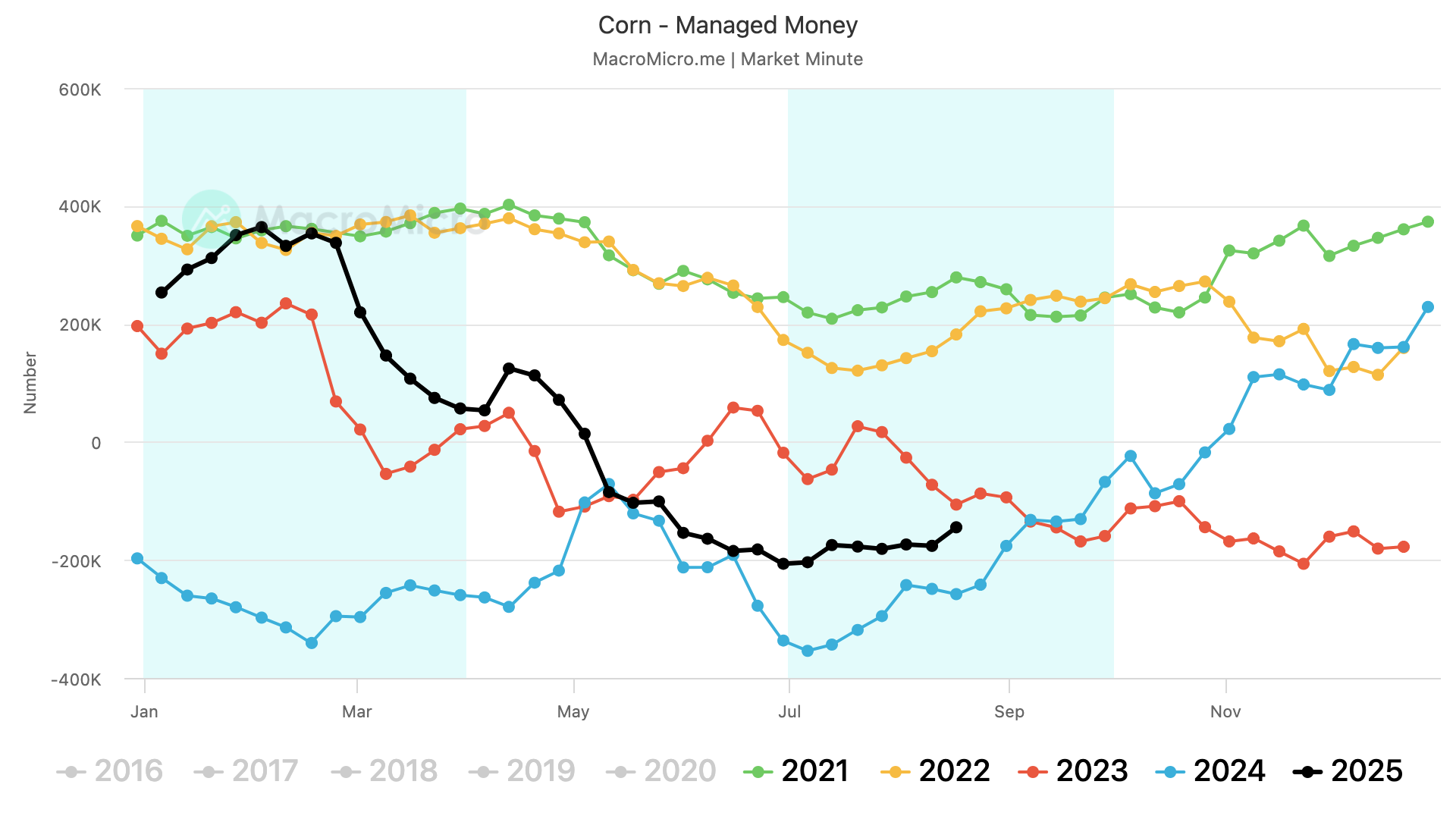

It looks like the funds might finally be ready to stop selling this market. As they've been buying consistently for the first time since January.

Daily Dec Chart:

Corn perfectly bounced in that golden zone today.

The 50-61.8% retracements of this entire recent rally.

Good sign here. As that was the level we were looking for. That level was deep enough for a standard correction.

We also took out yesterday’s lows and closed right at yesterday's highs. Another good sign.

We still need to hold $4.01 to $4.04 or the next support is contract lows.

To the upside, if we take out $4.16 we could have a little room to run.

$4.16 is the 61.8% retracement up to the mid-July highs.

Which is exactly where we topped this recent rally at.

If we take out $4.16, I'd be confident the harvest low is in and odds would favor us heading higher.

I am not looking to de-risk unless we crawl into the $4.30 to $4.35 range. Which is where we have a ton of old support and resistance.

Here is a zoomed out chart of that support and resistance box.

Soybeans

The US and China are meeting in DC today or tomorrow but no one is expecting much to come of it.

Bears argue the problem is demand.

Which is valid. China still hasn’t bought any soybeans

However, US beans are cheaper than Brazil soybeans.

So you'd think that China would eventually come to the table. Why pay a premium?

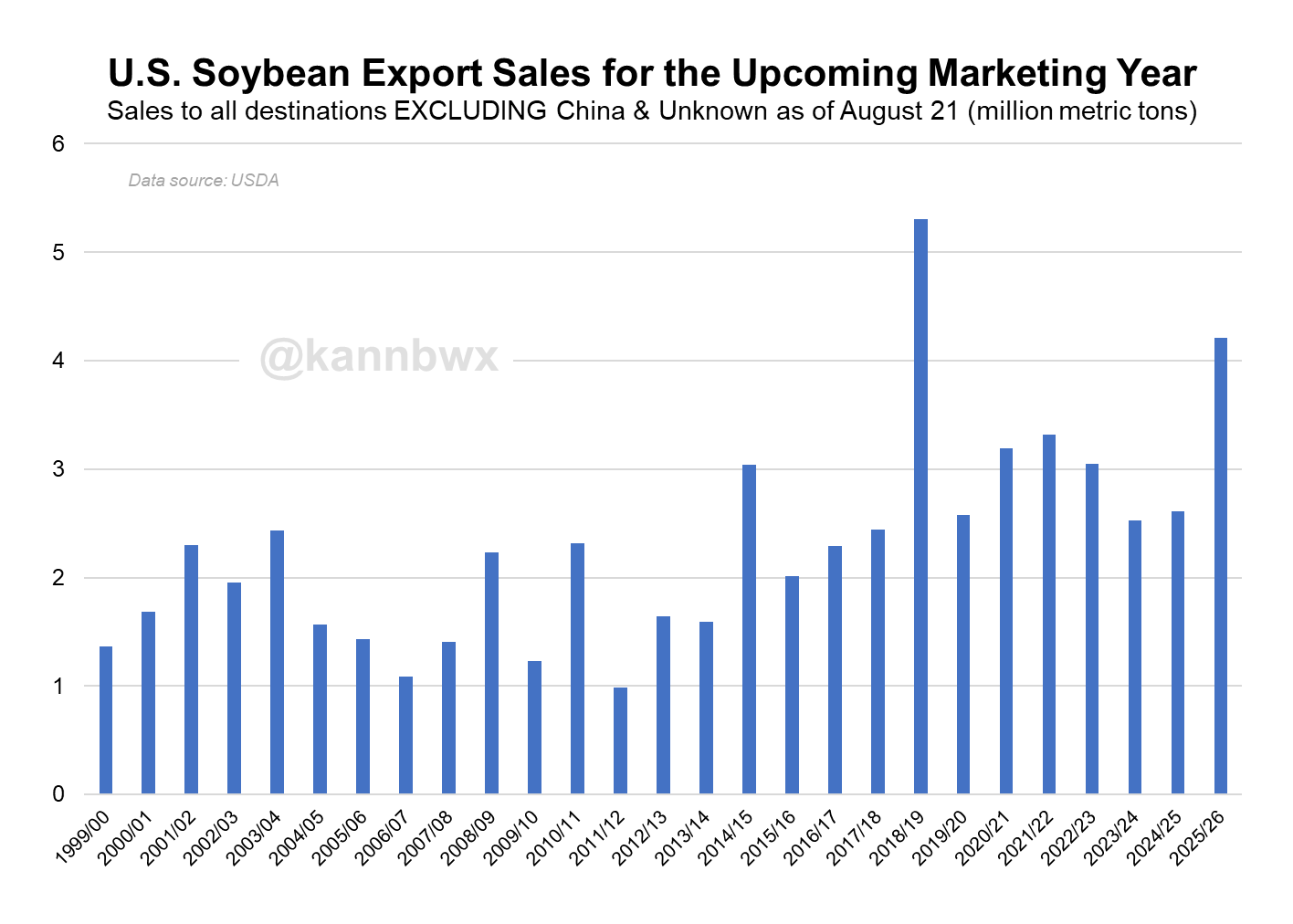

Despite China having not bought any beans, one could argue soybean demand has actually been kind of good.

New crop soybean sales to everywhere except China and unknown destinations are the 2nd highest of all-time.

Only behind the actual 2018 trade war.

Demand to China is the only bad thing about soybean demand. The demand to everywhere else has been above average.

Here is a great chart from Karen Braun showing that.

Unlike corn, the loss of 2.5 million acres in the last USDA report completely shifted the balance sheet trajectory for beans.

If you just look at the balance sheet, you can’t help but have a friendly bias.

Disregarding demand concerns, this alone has the chance to spark an opportunity soybeans down the line.

Who knows if yield is 52 or 54.

Even if yield is 54, based on the current demand numbers, our carryout would still be lower than last year. This is soley due to less acres. That isn’t bearish.

A 52 yield would evaporate the carryout. Which would still be a record yield.

Based on the weather we saw in August, you have to question how big this crop really is at the end of the day.

Until China starts buying, our upside is probably limited.

However, we are one trade deal away from explosive potential in soybeans.

Daily Nov Chart:

Good action in soybeans today.

We bounced right at the 61.8% retracement level of the recent mini rally.

Bulls need to there. If we fail to hold $10.40, it could easily spark a leg lower.

If $10.40 fails, the downside target would be the $10.12 to $10.22 area. Which gives back 50-61.8% of the entire rally off of $9.80

Even if we fell to $10.12, the bullish structure of this chart would still be in place. That level is seen as the line in the sand for bullish bias to remain.

We had a sell signal last Friday.

The plan for our next sell signal is if we crawl up to the $10.80 to $10.82 range.

This is our target for a multitude of different reasons.

First reason is that $10.82 is gives us back exactly 50% of the highs from May 2024.

If we look at the contiuous chart, every single major rally over the last year has topped out at $10.80 on the front month contract.

Break above and there is incredible upside potential.

But until then.. it is seen as resistance and our next target.

Wheat

Good price action in the wheat market today.

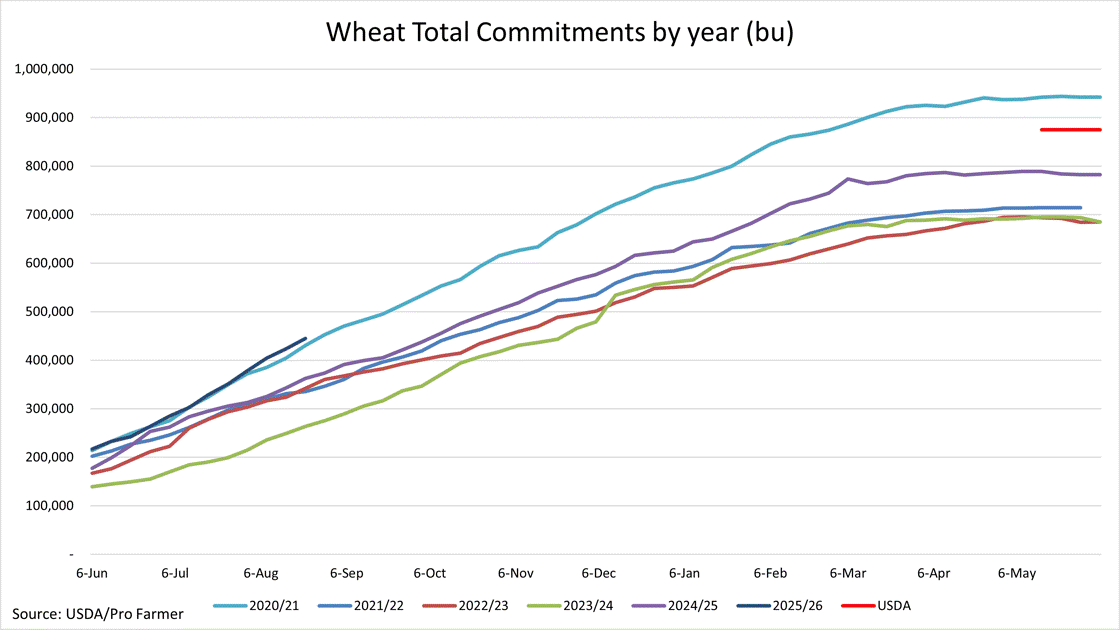

Overall we continue to struggle despite phenomenal demand.

Wheat export sales are at historically strong levels.

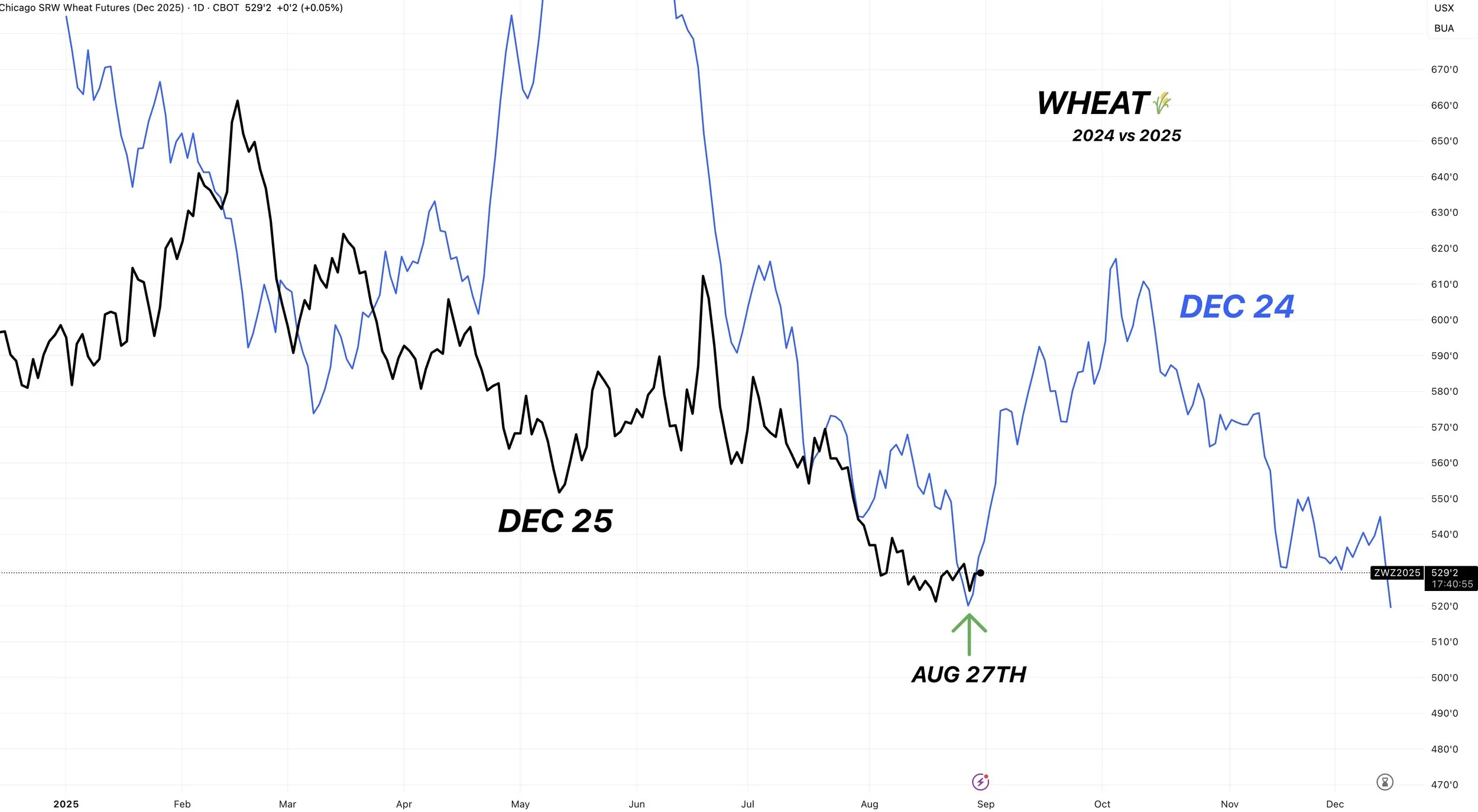

The 10 year seasonal says we bottom here pretty soon within the next week or two.

Last year the wheat market bottomed on August 27th.

Other than strong demand, there isn’t anything new to update fundamentally.

Seasonally we bottom soon.

The charts are showing a little bit of reasons to be optimistic.

Overall I still think the wheat market has more upside than downside potential here.

Last Wednesday we had a buy signal for wheat. That signal still stands and I still see wheat at an area of value here.

Daily Chicago:

On the recent mini bounce, we rejected the 61.8% retracement of the recent sell off.

So the level to watch is $5.33

If we break above, it should spark a leg higher. If you notice, we rejected that level for 5 straight days. So it is big resistance.

Break above there and I'd be more confident saying the lows are in.

Here is the chart zoomed out.

We were sitting in a falling wedge pattern that we are potentially breaking out of.

This is seen as a bullish pattern.

Eyeing the blue box as a target.

Daily KC Wheat:

Despite posting new contract lows, KC wheat is also sitting in a falling wedge pattern.

Which is a bullish pattern.

Continous KC Wheat:

When the continuous chart rolled from Sep to Dec, it left a roll gap.

As Dec was trading at a premium to Sep wheat.

Today we almost perfectly filled that gap before bouncing and reversing higher.

This is something to be optimistic about.

If you look at last year, we saw a very similar thing happen.

When contracts rolled, we left a gap.

A few days later we filled the gap, before finding a bottom on August 26th.

Cattle

Jim Cramer talked about cattle yesterday on Mad Money.

If you know anything about Jim Cramer, he is notoriously known for being wrong.

There are several examples of where he says he likes something and it marks a top, or he says he hates something and it marks a bottom.

This doesn’t have anything to do with cattle fundamentally, but a lot of times when a market makes headlines like this it can mark a local top.

Basically, a boat is fullest before it tips.

Thoughts from Lauren Urbanczyk:

Lauren is our partner who specializes in cattle. This is what she had to say about the market:

Yesterday both live & feeder cattle made new contracts highs but closed well off their highs.

Open interest was significantly lower yesterday in live cattle. That is what we would describe as a blow off top. However, we've seen that a few times before.

We haven’t had two down days in a row since May. I can’t remember the last time we've seen three down days in a row. However, you can only get so high.

Beef has been up the past 2 weeks in preparation for Labor Day buying and demand. So we have to question if that demand will follow through after the holiday.

We also have August live & feeder cattle expiring. If we do get a trend change, it wouldn't be surprising to see that happen at contract expiration or option expiration. It is too early to confirm we've seen the highs, but we have all of the signs of it showing.

We also have month end approaching tomorrow. The funds have a very large long position. We could see some profit taking at the end of the month. Last month at month end, the board was down hard but then of course resumed higher a couple days later. We would potentially expect weakness tomorrow with the month end. Will that be enough to trigger two or three down days in a row? That is to be determined.

We recommend using caution up here. These prices are high enough that we would look at any and all risk management strategies, custom tailored to fit your operation.

We have been rolling up calls and rolling up puts this week to capture the equity in the market. If you have LRP on that is out of the money, we can add put spreads to protect those.

Give us a call if you want to talk or have questions.

Lauren: (979)-587-9252

Jeremey: (605)295-3100

Sep Feeder:

Yesterday we left a nasty looking candle.

We posted new highs, but then reversed hard and nearly gave back the entire days rally.

Then today we followed that up with weakness.

This price action is definitely a reason to be concerned in this market.

The real warning sign is going to be this upward channel. If we break the uptrend, it could spark a real leg lower. As this market has gone straight up for months.

If this truly was the local top, we could fall as far as that blue box. That is the downside target.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.