EXPECT BIG PRICE SWINGS & VOLATILITY

MARKET UPDATE

Prefer to Listen? Audio Version

Futures Prices Close

Overview

Grains higher across the board as wheat leads the rally taking back the losses from yesterday. Much like yesterday when there wasn’t any real fundamental news driving us down, we didn't have much driving us up today. We are in a time where volatility is only going to increase. Whether that move is up or down, and sometimes the funds are going to move this market for no rhyme or reason.

Big price swings should not be a surprise here as this volatility is just getting started. Do not be surprised if we go screaming higher one day only to come crashing back down the next for no particular reason. Just like how corn roared higher after the USDA report only to come back down to pre-report levels just two days later. Short term this market is going to be driven by big money and the algos.

Overall there is no real fresh news in the grains. They threw some rains in the forecasts for Brazil, but dryness is still a concern and the outlook for April and May leans dry. Brazil will be a wild card.

We also got that bird flu headline. Where bird flu hit cows, chickens, and now humans. The fear there is that when these birds migrate north they could bring this disease with them. This could be a problem for the chicken market and has some thinking it could lead to corn demand and bean meal demand seeing a downtick.

When we get headlines like that, sometimes the market can take it on the chin initially even if this doesn’t fundamentally change anything at all. The market will quickly go back to trading fundamentals and weather.

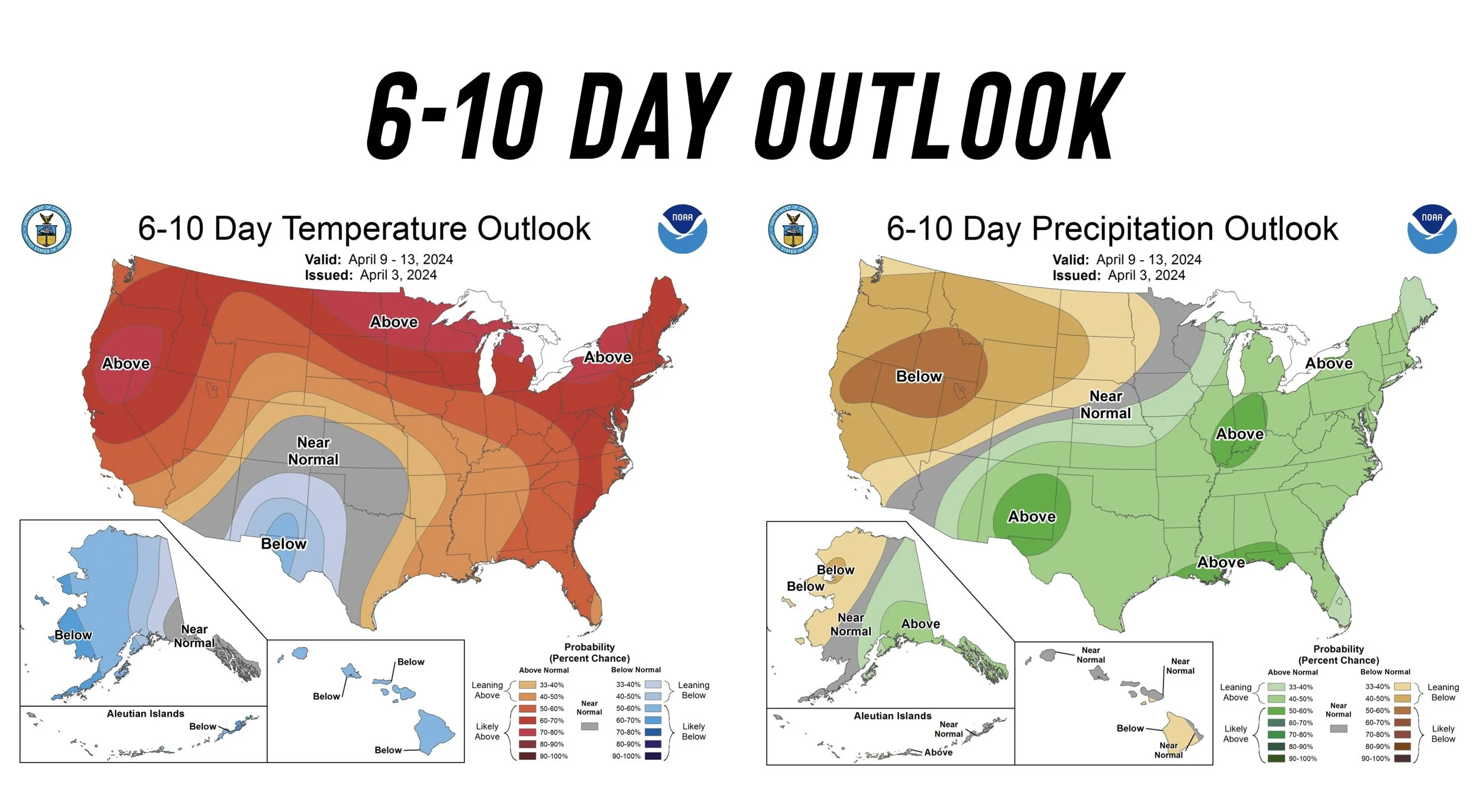

As for weather in the US, initially we heard all this talk about early planting. Now the talk is possible late planting. As the corn belt has got good rains this week and there is more in the forecasts for April. This has some thinking we could see slow field work, but this will be much needed for that soil moisture.

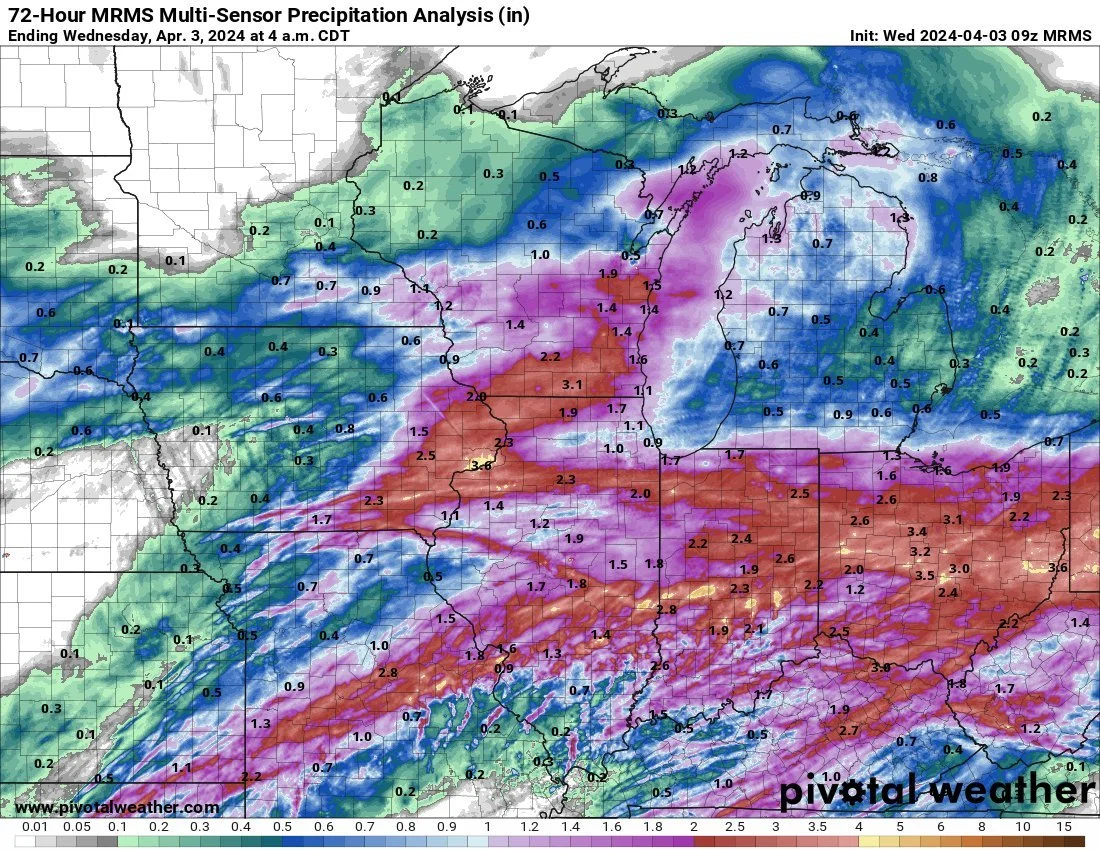

Here is the past 72 hours of rain.

It is cold right now so a lot of that rain is not being absorbed, however it is suppose to warm right back up next week.

So 10 days from now could offer a decent planting window.

Things might go quicker west of those rains.

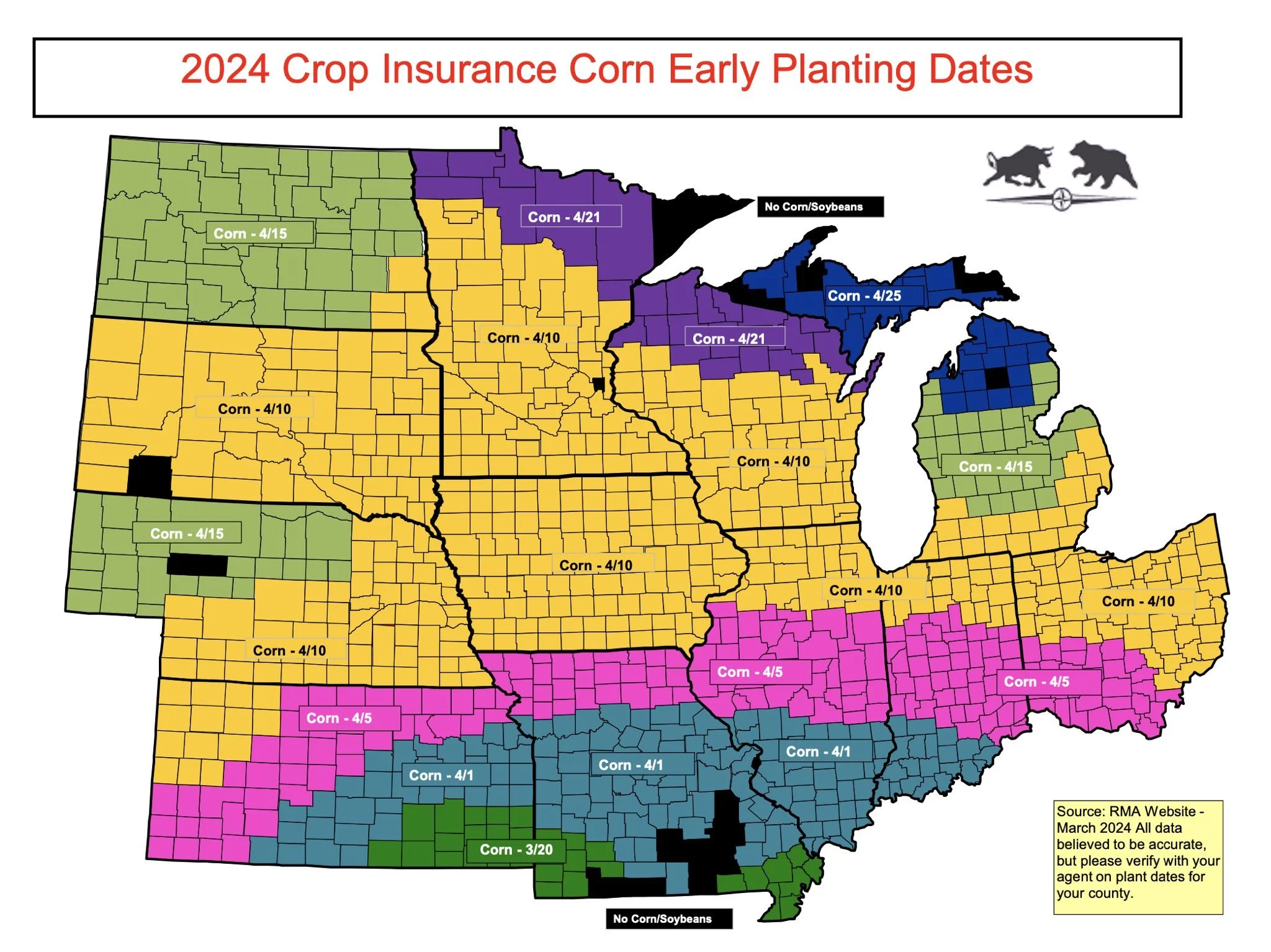

However many corn growers might wait for the insurance dates as well.

Today's Main Takeaways

Corn

Corn follows the rest of the market higher as we are exactly where we were last Tuesday after giving up the entire rally from Thursdays report.

Most of the recent sell off was due to farmer selling as well as fund selling.

Going into that report it felt horrible like all hope was lost. But then the report gave us a bullish surprise so some farmers took advantage, even though that rally only put us where we were just a week prior.

Taking a look at the acres, of those acres we lost in the report, a lot of them were from fringe areas which makes sense given the low prices and lower profitability lately.

Could we see acres higher come June?………..

The rest of this is subscriber-only. Subscribe to keep reading & get every exclusive update along with 1 on 1 marketing planning.

In today’s update we go over the acre situation and scenarios we could see, weather rally scenarios, our potential carryout situation, our thoughts on price action, the bean & wheat market, cotton & cattle and more.

Keep Reading - Try 30 Days Free

Try our daily updates completely free. Create a plan of attack for your operation along with 24/7 access to discuss your situation. Become a price maker.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24

ARE YOU READY FOR USDA CRAP SHOW?

3/26/24

WHAT TO DO AHEAD OF THIS POSSIBLE TREND CHANGING USDA REPORT

3/25/24

USDA ACRES & STOCKS REPORT IN 3 DAYS

3/22/24

PRE-USDA REPORT POSITIONING

3/21/24

GRAINS FAIL TO HOLD OVERNIGHT RALLY

3/20/24

MORE SHORT COVERING LEADS TO MORE SHORT COVERING

3/19/24

WHEAT LEADS WITH RUSSIA TARIFF RUMORS

3/18/24

ARE YOU PREPARED FOR 160 OR 190 BU CORN?

3/15/24