AFTERNOON MARKET UPDATE

Futures Prices Close

Overview

Overall quiet day for the markets, as wheat extends into its third day of the rally and markets close mixed. The export sales this morning confirmed the lack in demand we have been talking about for a few weeks now. The poor exports, the Dow Jones continuing to struggle, and all the recession talks/interest rates, and harvest progress have all combined and added pressure to grains making it tough to see a rally here. Wouldn’t be too totally surprised to see grains lower tomorrow to end the week, as we also have October options expiring for the grains which can often tend to see lower prices on the day of.

Bullish or Bearish Survey

We are conducting a survey on whether people are bullish or bearish on the grains. You can submit your answers here

Data will be provided in this week's weekly newsletter

Export Sales

Export sales were pretty miserable across the board this morning.

Corn

0.182 million tonnes

Corn sales are about half the year ago levels

Soybeans

0.446 million tonnes

Soybeans were about half of what they were looking for

Wheat

0.184 million tonnes

Today's Main Takeaways

Corn

Corn managed to close 2 3/4 cents higher despite the uncertainty in demand and poor export numbers.

Yesterday we saw Ethanol production drop (6.4%) 62,000 barrels per day to 901,000 barrels per day. Stocks were down 300,000 barrels (1.5%) to 22.5 million barrels. U.S. gasoline demand is down -8% compared to last year.

We've been talking about demand for a few weeks now, and the story still remains the same, and the big question is still surrounding overall demand. Its tough to think that we are just going to see a major spark in overall demand sooner rather than later. Especially with the dollar hitting new highs yesterday. As the price of the dollar makes it harder to sell grain.

With the poor exort sales this morning, it was somewhat surprising to see corn manage to close higher on the day. But from a technical standpoint, corn continues to chip away higher and remains in a pretty solid uptrend. Hopefully we can see demand flip and contribute to higher prices, I'm just not fully convinced that will happen for the time being.

We also have to keep in mind that even though demand on the surface is sloppy, the reality is we have to have less demand than a year ago otherwise, we will run out of corn because production is going to be over 1 billion bushels less.

We did see a few sales, with 105 to Mexico and another 105 to unknown. But these were nothing crazy and likely didn’t have much of an impact on the markets.

We still see some pretty heavy resistance at the $6.90 to $7.20 area as we have struggled to push past $7.00. Looking to the downside, we have the $6.40 range or so for support.

Dec-22 (6 Month)

Soybeans

Soybeans closed lower again today following sharply lower prices yesterday, closing down 4 1/4 cents this afternoon. Similar to corn, the soybean export sales were extremely disappointing. With soybeans coming in at half of what they were expecting. This certainly added pressure to soybeans.

We don't really have anything driving demand in the soybean market right now. Until the Argentina peso deal runs out in a little over a week. Argentina is going to continue to sell an awful lot of soybeans, and China is going to be looking to stockpile as much as they can. That really hurts our demand as demand is really the main concern here with both corn and soybeans.

The Chinese have been buyers, but mostly small stuff here and there. We haven’t seen anything note worthily large. People keep debating the yield back and forth, whether we will see something lower or higher than the USDA's current 50.5 bushels per acre forecast.

We just don't have very much potential bullish news to push prices higher here looking short term. As there isn't a ton of weather concerns here in the U.S., and demand here is also very lackluster. Looking long term however, we do have the potential to see some problems in South America which could ultimately support prices. However, South American weather remains neutral currently as it becomes more important as we get closer to the end of year.

We could definitely see some choppy trade until we do get a better understanding of Chinese demand and other market factors. Currently, we are seeing some resistance around the $14.80 range, and major support at the $14 mark. Hopefully, we can hold the nearby support of $14.50 which is only 7 cents away, otherwise, that could open the door to potentially lower prices.

Soymeal was also very weak today which further put the markets under pressure.

Soymeal & Soyoil

Soymeal down -9.9 to 428.9

Soyoil up +1.46 to 66.46

Soybeans Nov-22 (6 Month)

Wheat

Wheat entended their gains again today. With the Russia and Ukraine conflicts supporting prices. We haven’t really seen much of an update since yesterday’s news. As Putin threatens nuclear war and brings up 300,000 troops to prepare for war. People are now fleeing Russia to get away from all the chaos. Markets seem to think he's going to do something to stop the exports out of Ukraine and the black sea region. Anytime Putin mentions nuclear war it will almost always cause a shift in the wheat markets.

We actually initially opened trade lower, but then we rallied more than 30 cents off our lows. But, we also closed roughly 12 off our highs. Yesterday we saw a Chicago close above $9 for the first time since June 29. Today we saw a new 11-week high close from wheat.

Looks like we are seeing some more rain in regions such as Kansas which is good for the wheat crop, and added additional pressure to overnight prices. As we broke roughly 20 or so cents off our highs last night. But nonetheless, the headlines were enough to push wheat prices higher again here today.

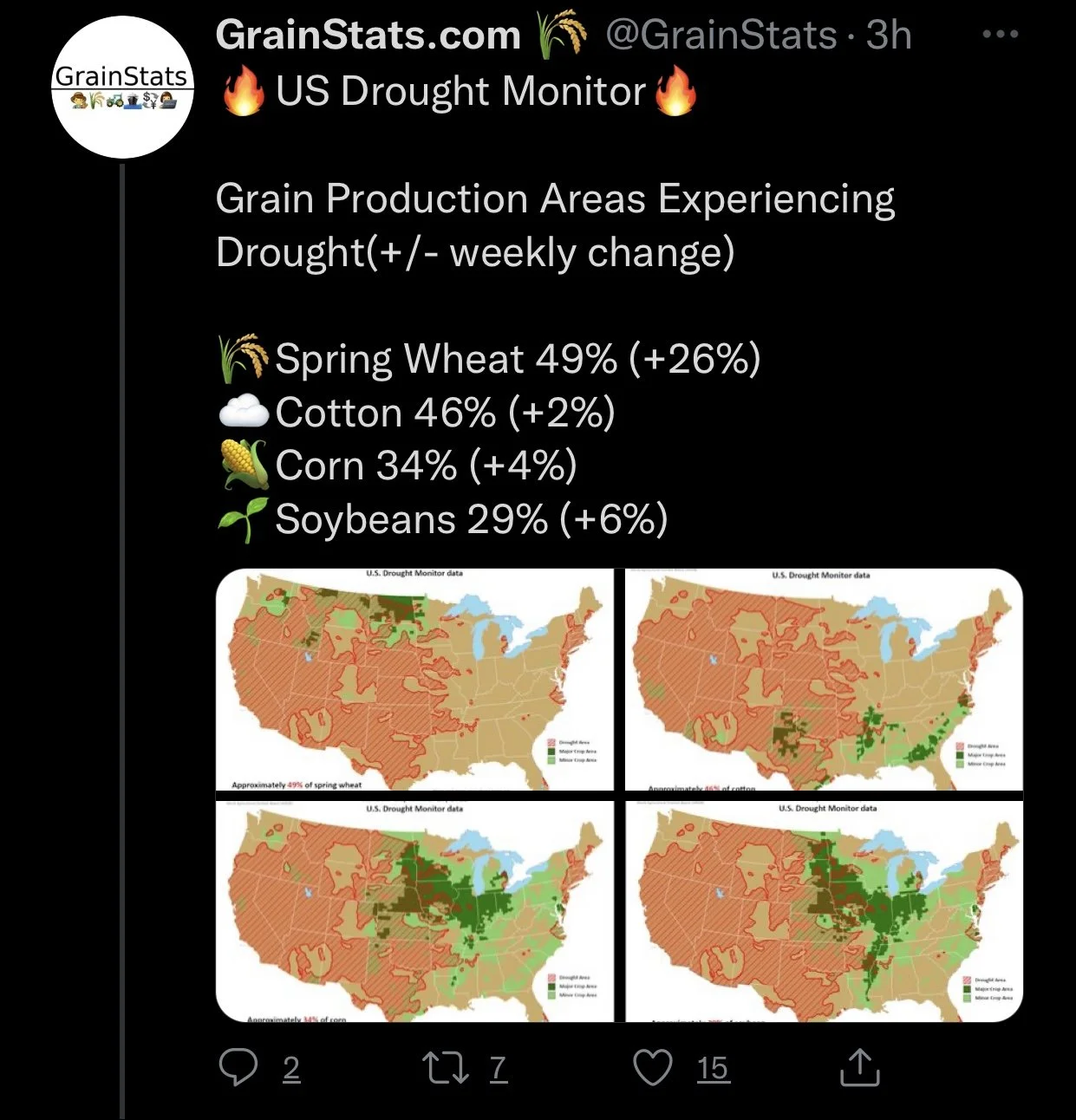

We also have the continued dry weather here in the U.S. and globally that is adding support and causing some global supply concerns.

The Russia and Ukraine headlines will likely dominate the wheat markets going forward here short term. Even with the dollar hitting new 20-year highs, the wheat market ignored inflation and recession concerns and the primary focus remains on Putin what his next move will be.

We also have to keep in mind that on the surface, a high U.S. dollar is negative for the markets. But, in reality, people may be buying more grain short term if they believe the dollar is only going to keep going higher for the next year and not come back down. In attempts to combat even higher prices in the future. Nonetheless, one could argue either side. An interesting fact from “Wright On The Markets” is that in 1979 when inflation was at 13.9%, the U.S. set a record for exports. That record stood until 2007, and has only been surpassed by the following years 2007, 2017, 2020, and 2021.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +0.54 to 83.48

Dow Jones down -100

Dollar Index up +0.709 to 111.055

Cotton up down -0.38 to 96.54

News

The railroad unions started voting yesterday. The approval of the tentative agreement is not going to be a an easy once. According to the union members there is still a small possibility that the agreement is not approved.

Ukraine exports down -43% year to year

Brazils wheat crop projections are +41% higher than last year

Indias palm imports could jump +9% from a year ago

U.S. dollar hit new fresh 20-year highs again

Interest Rates

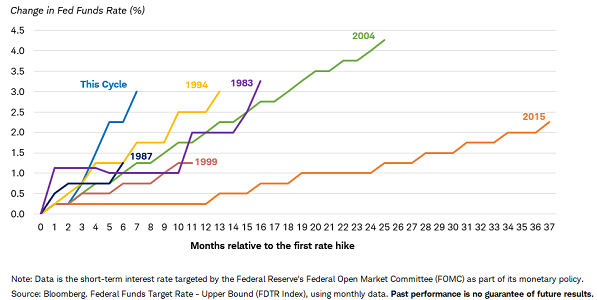

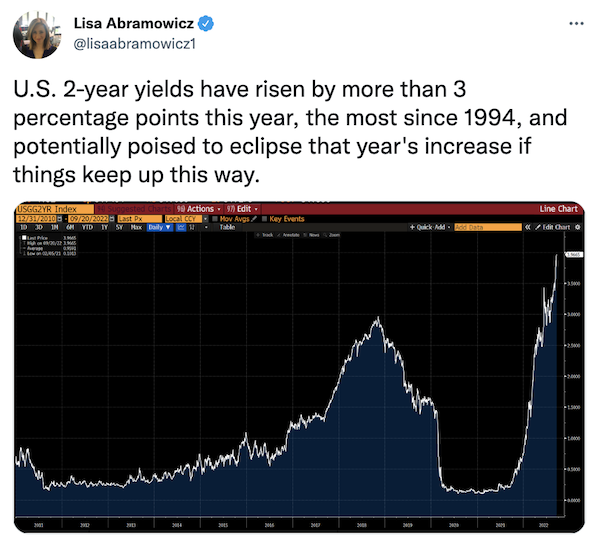

As most of you probably already know, the Federal Reserve raised interest rates by 75 basis points after a third consecutive rate hike. Bringing rates to 3.25%, the highest we've seen since 2008.

The Feds now see inflation reaching 5.4% by the end of 2022, and 2.8% in 2023. As they expect more rate hikes through 2023.

Below is a chart showing the pace of rate hikes

Below is a 20-year chart showing the growth of the dollar and where we stand today.

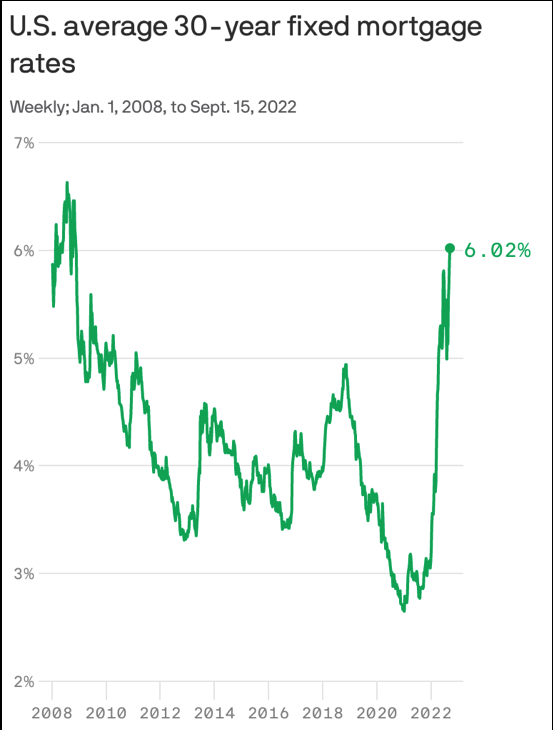

I saw this today and it’s a pretty wild fact. If you secured a 30-year mortgage on a $600,000 home at a 2.6% interest rate in 2021, you would have the same monthly mortgage payment as someone who just bought a $392,000 at today's 6.2% mortgage interest rate. As mortgage rates surge to a 14-year high.

Below is a graph showing mortgage rates

This Week's Weekly Newsletter - Read Here

Monday's Audio - How much money is Putin making on the wheat markets - Listen Here

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service