BEARISH USDA, BULLISH REACTION

AUDIO COMMENTARY

USDA report wasn’t friendly

Market didn’t believe USDA

Corn acre surprise again

Do funds have a reason to stay short

Renewable fuel news

Negative report positive price action

Highest corn acres since 1936

World wheat bearish surprise

Production went higher yet prices traded higher

Could see a corn sell signal next week

Don’t get hosed on basis

Corn pennant breakout (chart below)*

Beans at golden zone (chart below)*

Wheat breaking out? (chart below)*

Cattle fails golden zone (chart below)*

USDA numbers below*

Listen to todays audio below

Want to talk? (605)295-3100

CHART BREAKDOWNS

Dec Corn 🌽

We broke out of this bullish pennant pattern I showed you yesterday. This is a bullish pattern.

Not only that, but we finally busted above this downward trend that has marked our highs several times since April. Also a friendly sign.

Our target is still $4.35

That gives back 50% of the Feb highs. It is also some key support from spring.

Nov Beans 🌱

We are at a very key spot here.

As I showed earlier this week, $10.47 is the spot to watch.

It reclaims 61.8% of this recent sell off.

If we break above or fail, we will know if this bounce is simply a correctional bounce or something bigger.

If we break above, odds favor us going higher and will tell us this is not a correctional bounce.

If we fail here, it could still be a correctional bounce meaning this lows might not be in.

Big spot for beans. As $10.47 tells us if the lows are in or not.

Dec Wheat 🌾

We are breaking out of this falling wedge pattern after posting a nice reversal candle yesterday.

My bias leans higher here.

A falling wedge pattern is bullish more often than not. We are trying to break through right now.

If we break above $5.35 I think we have a lot of room to run.

The first resistance is at $5.52

Oct Feeder 🐮

We failed to the hold golden zone retracement of the recent rally.

This is not a good sign.

As it opens the door lower.

We could very easily test the blue box, which is the golden zone of the entire rally since June.

USDA NUMBERS

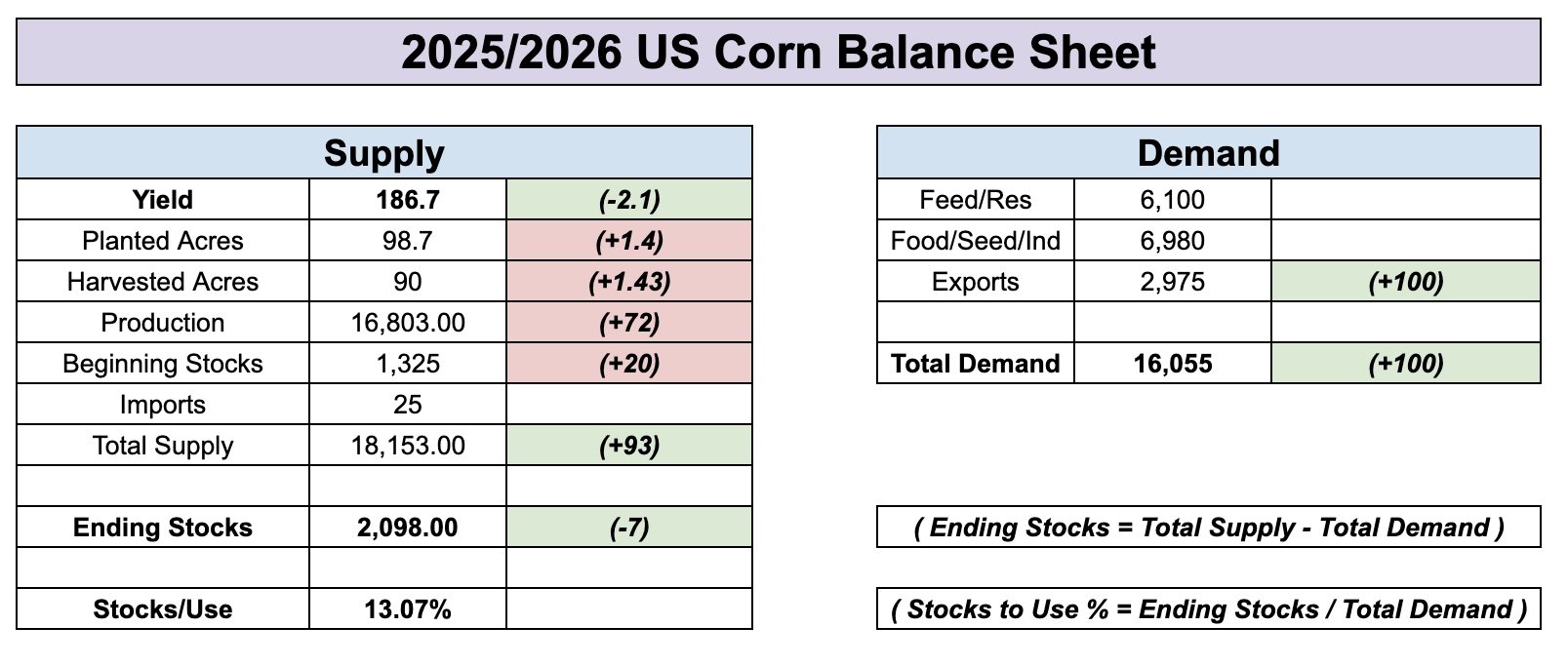

Corn Balance Sheet Change

Red = Bearish

Green = Bullish

The acre increase offset the loss in yield.

The bump in exports resulted in a very very small decrease on the carryout.

Bean Balance Sheet Change

The slight increase in acres offset the slight decrease to yield.

The bump in crush & seed demand offset the loss in export demand.

Resulting in a small net increase to carryout.

NUMBERS VS ESTIMATES

Past Sell & Protection Signals

We recently incorporated these. Here are our past signals.

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

KC wheat & corn signal.

Jan 23rd: 🌽 🌱

Corn & beans sell signal.

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

CLICK HERE TO VIEW

Dec 11: 🌽

Corn sell signal at $4.51 200-day MA

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys. If you need help with anything at all, don’t hesitate to shoot us a call, text, or email.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100