DROUGHT & INFLATION PLAY?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

China & Trump: 0:00min

Drought: 0:55min

Inflation Play?: 2:15min

Corn: 4:00min

Beans: 6:00min

Wheat: 8:30min

Cattle: 10:05min

Want to talk about your situation?

(605)295-3100

Futures Prices Close

Overview

Grains lower across the board for the 2nd day in a row.

Today was a very quiet news day and there isn’t much fresh fundamental changes, so today's update isn’t going to be as deep of a dive as usually do on some things.

The only real piece of news we saw was a statement Trump made.

He said:

"May do an extension with China, close to a deal."

Trump and China's President are scheduled to have a meeting tomorrow morning.

Nobody knows what this so called deal will include. It could simply be the TikTok deal or another tariff extension.

If I had to guess, this meeting isn’t going to include anything about soybeans.

It is most likely a non-event. If it is not, then soybeans will catch a bid. But I am not holding my breath.

Regardless, any progress made with China is a good step in the right direction.

Drought Picking Up

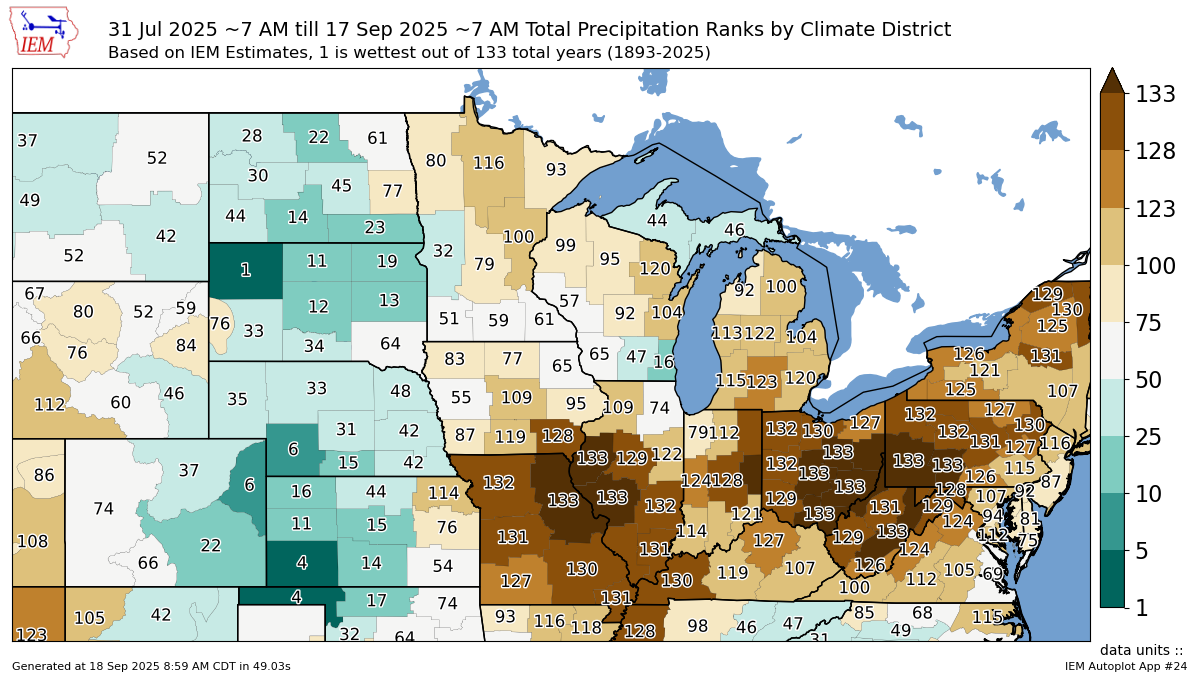

We already know this past August was one of the driest on record.

September has continued that dryness.

Again, here is the precip rankings from August 1st until today.

I wouldn’t call that an ideal finish.

Several areas out east are actually THE driest of all-time for this time frame.

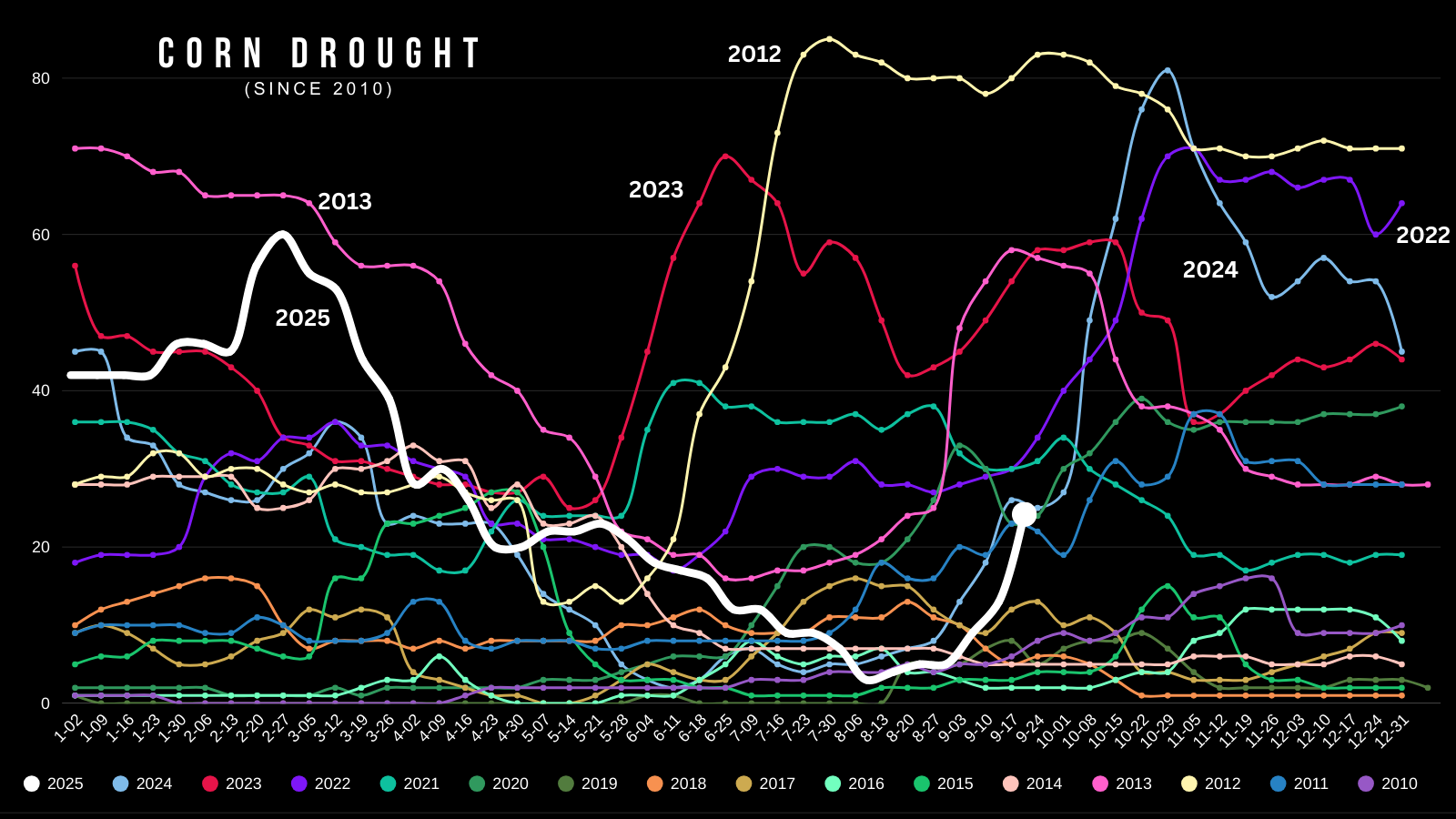

This past week we saw areas in drought jump pretty dramatically.

Neither of these are crazy high numbers by any means, but we've seen a sizeable jump the past few weeks in corn and soybeans.

Here is a visual of the entirety of corn areas in drought.

We were at just 3% drought at the beginning of August. Drought was non-existent. It has picked up pretty fast.

*(2025 is white line)*

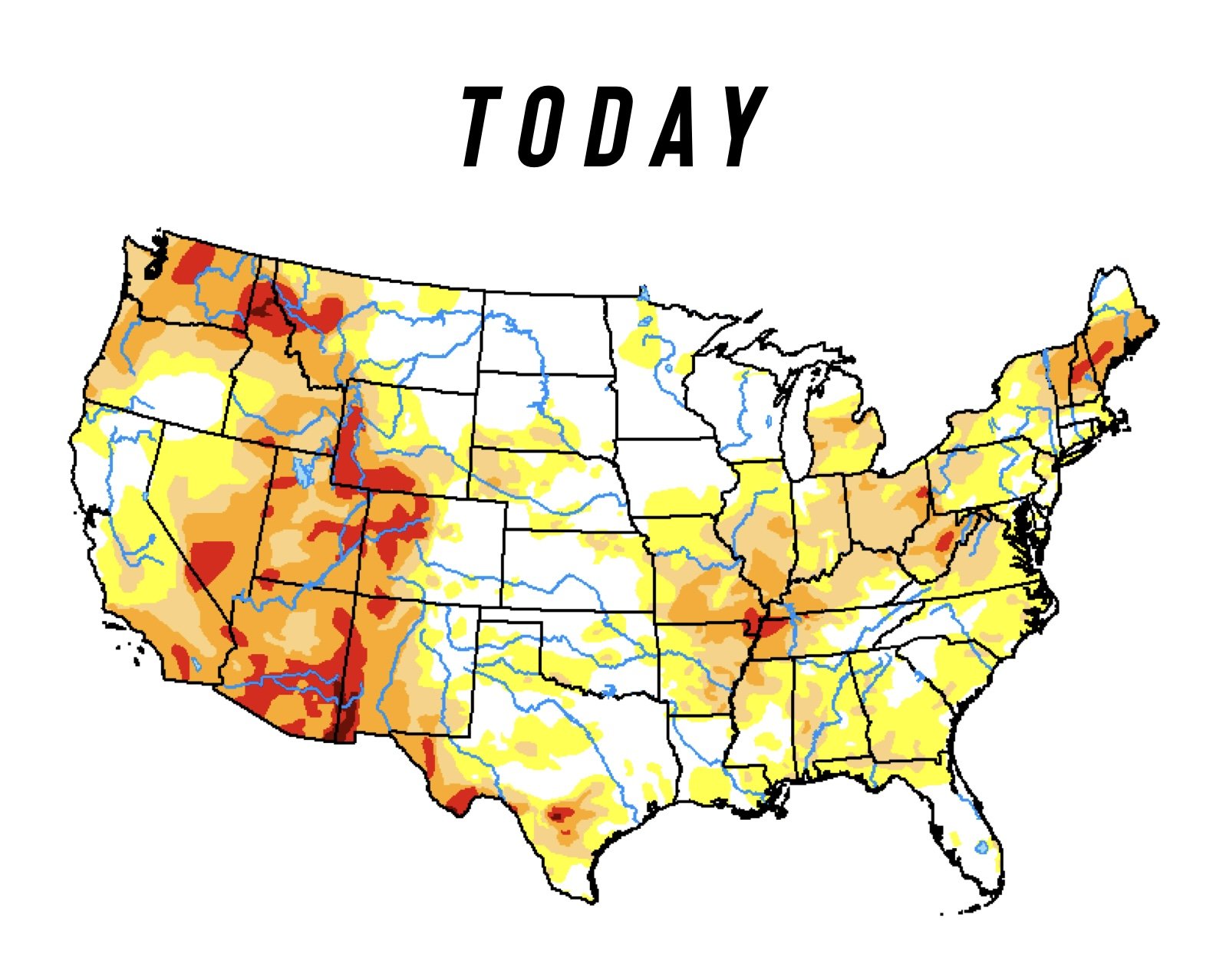

Here is the drought monitor change from today vs August 1st.

Things have drastically changed in just a few short weeks.

Inflation Play?

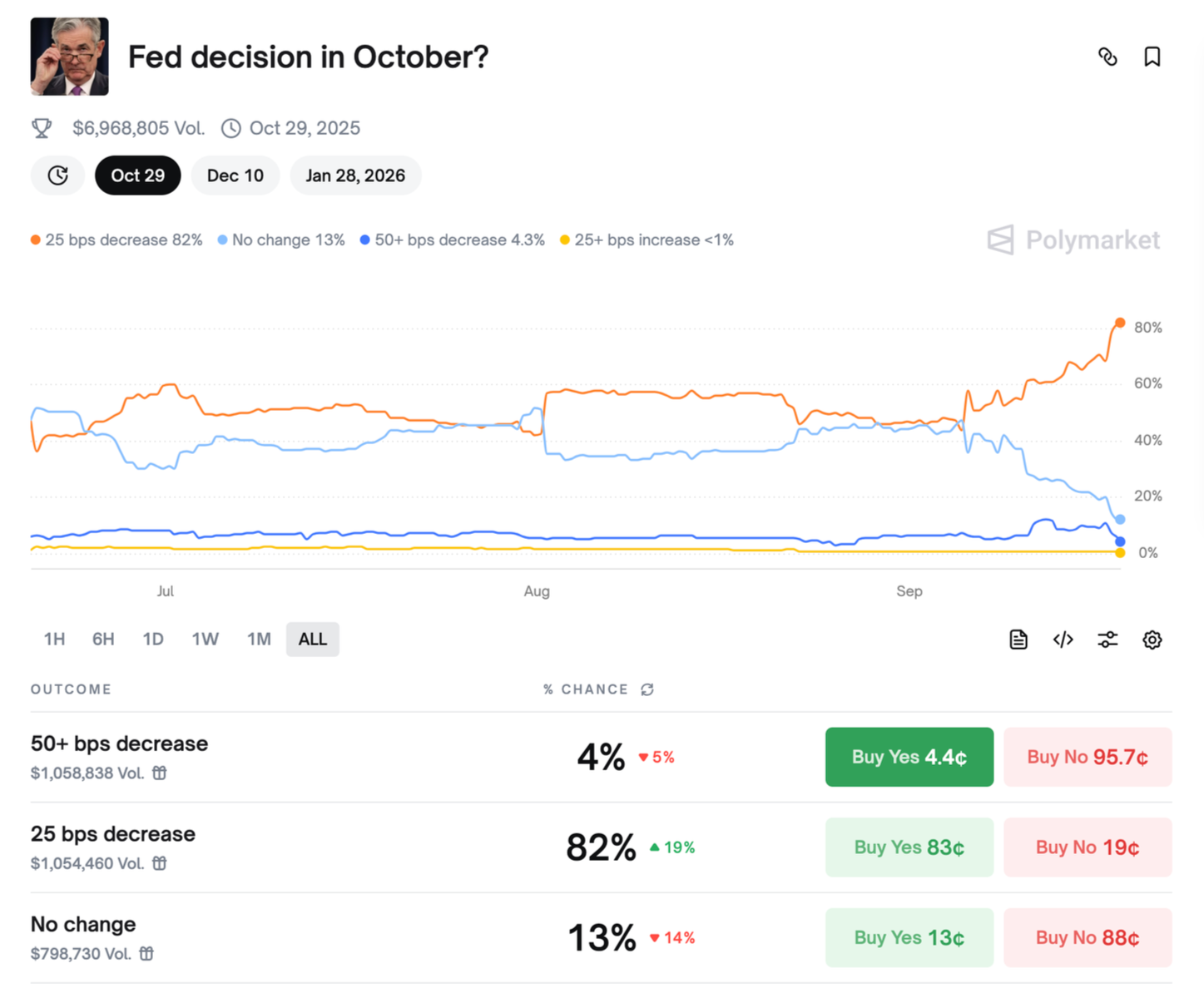

Yesterday the feds cut interest rates by 25 bps.

This was our first rate cut since last year.

Odds makers say that there is now an 86% chance we get another rate cut in October.

I've shown this chart countless times. So I apologize if you've seen this but it needed to be mentioned.

This outlines our past rate cuts, rate hikes, inflation, along with corn and soybean prices.

Rate Cuts = Higher Inflation

Which can intice higher priced commodities.

Rate Hikes = Lower Inflation

Which can lead to cheaper commodities.

It could simply be a coincidence. But rate hikes marked the top of the bull market back in 2022.

In fall of 2024, we saw rate cuts for the first time since 2020.

Where they cut rates 3 times for a total of 100 bps.

Coincidentally.. corn then went on to have it's most sustained rally of the entire bear market.

If you notice, corn and soybean prices tend to follow inflation.

This is a long-term factor. Not an immediate one.

This doesn’t mean grains have to go higher at all.

However, if rates continue to get cut, you have to wonder if this could be a reason for the funds to get behind this market.

Perhaps similar to what we saw last year in the corn market.

Because on the surface, if the funds were truly trading balance sheets, our old crop stocks to use ratio was one of the tightest of all-time.

It suggested corn could’ve easily been +$6 purely based on this.

As it was on par with the bull market years.

That didn’t happen.

Today's Main Takeaways

Corn

Not a ton to update on corn today. As earlier this week we did a deep dive on the balance sheets.

So check that out if you haven’t:

CLICK HERE

Demand remains great.

The crops are getting smaller not larger.

The funds have been consistent buyers since July.

Now although I think we've seen the lows for the year, we can’t ignore the fact that we have a large crop even if yield comes down.

Given that the USDA raised acres once again, it does make it that much harder to paint a super bullish corn situation right now.

Because in the last two reports, the USDA has +1.10 billion bushels of supply, but they also added +600 million bushels of demand.

So if supply takes a step back (which it should), the USDA now has some wiggle room to adjust demand lower as well. Offsetting some of the supply loss.

Regardless, the balance sheet is probably getting smaller not larger from here.

The USDA probably does not come clean about where yield is actually at until January. So maybe we don’t get a major opportunity until post-harvest. As there is going to be a lot of supply hitting the markets here with harvest.

The 5-year seasonal does provide some optimism, as on average for the past 5 years we've grinded higher the rest of the year after posting our harvest lows.

This seasonal has been incredibly accurate thus far.

We got the July sell off. We got the August low. We got the start of the rally now.

Daily Dec Chart:

I am still eyeing $4.35 to alert a sell signal in Dec corn.

That gives back 50% of the Feb highs and is key support from spring.

We are above the simple trend line that marked our highs a dozen times since April, so the trend has definitely shifted higher.

For now, I would like to see us hold $4.21

That gives back 61.8% of this mini rally and would be seen as a standard correction. If that fails, it could trigger more downside.

Soybeans

It is the same old story in soybeans.

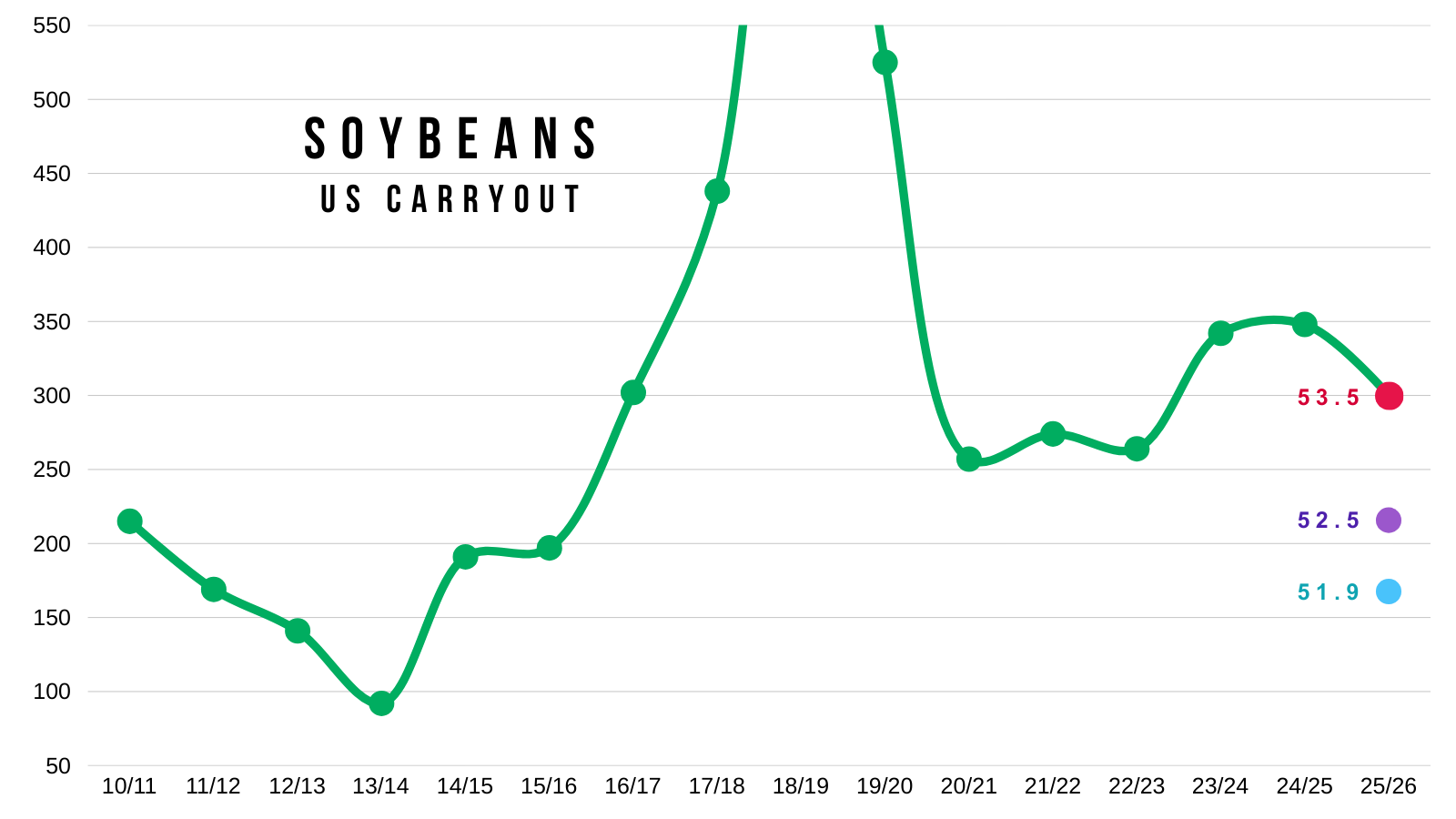

We are going to see supply get smaller. I don’t see a world where yield is 53.5 given the incredibly dry finish.

But how much of that supply loss is going to be offset by the losses in demand?

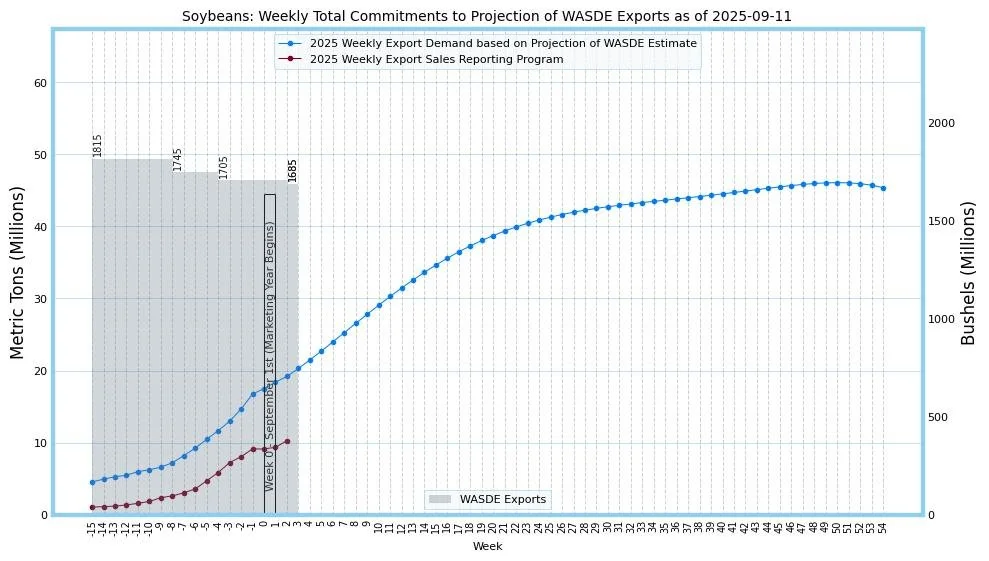

Here is an export chart from Robert McClure that compares this year vs the USDA estimates.

We are lagging behind by a decent amount. The USDA is more than likely going to cut export demand.

The bigger question is by how much, and does China come to the table or not?

If it wasn’t for the demand concerns, you could argue soybeans would be quiet a bit higher than they are right now.

If demand isn’t an issue, there is simply zero room for error on the supply side of the balance sheet.

I've made this argument a thousand times, but even if yield slips to 52 (which would be a record) it would print our lowest carry out in a decade if you left demand unchanged.

Of course demand losses are going to partially off set this, so it won’t be this drastic. The USDA is already too high on exports demand, if supply gets cut they'll ration demand even lower.

But you get the point. The upside potential in this market is certainly there, especially if China starts to buy our beans.

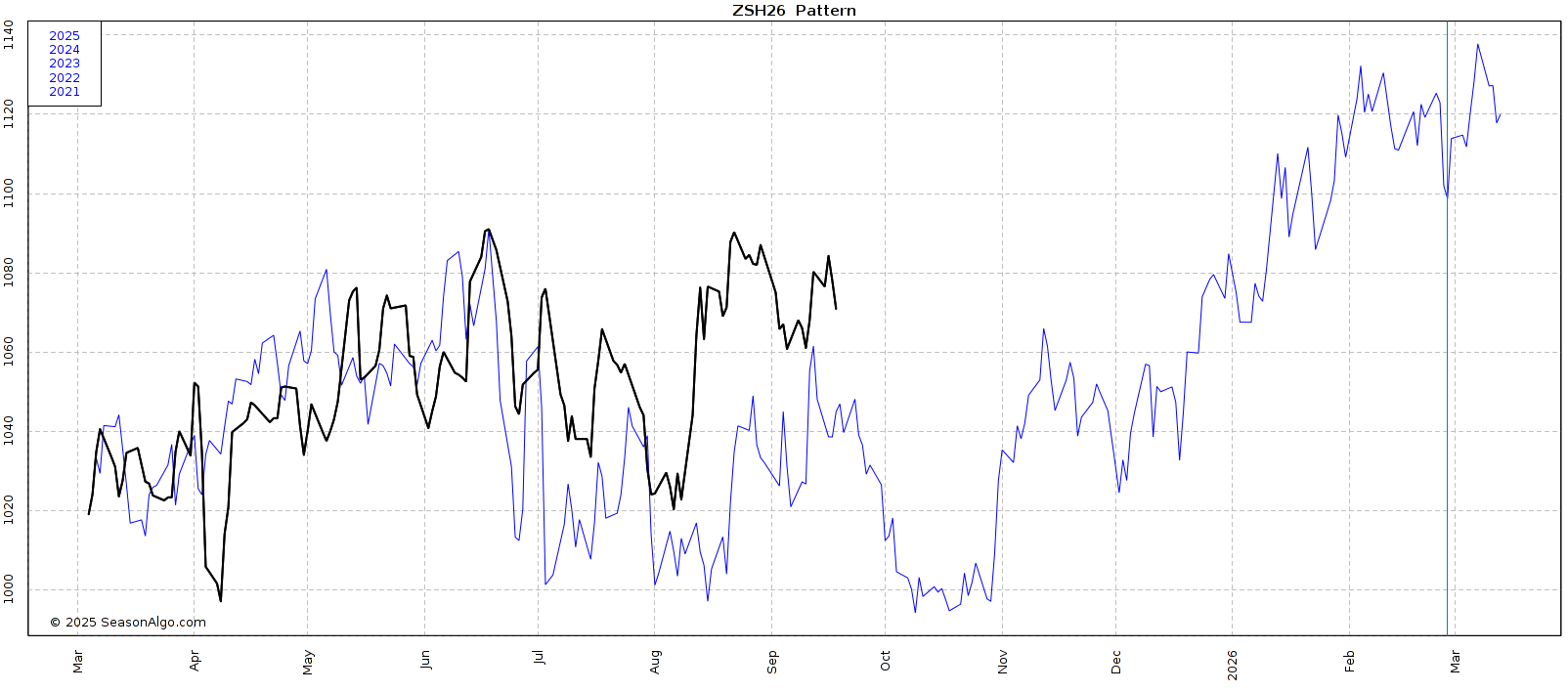

One reason to have some caution here short term is the 5-year seasonal.

Seasonals aren’t as great of a tool in soybeans as they are corn, because soybeans revolve around two crops. Brazil and the US. So there is a lot of factors at play.

Meanwhile, the US is the dominant player in the corn market.

However, this is about the time of year where we can tend to struggle before finding a bottom in October.

We then tend to head higher into the end of the year if we get production worries down in South America.

Daily Nov Chart:

Earlier this week Nov beans closed above the 61.8% retracement up to the recent highs, which was a good sign, but it appears to have been a fake out.

We now need to hold $10.33

That gives back 61.8% of this recent mini rally.

If that level fails, we could go down and test the blue box again. That is a big spot to hold short term.

$10.12 remains the line in the sand for our bias to lean higher. If that level gives out it opens up even further downside and the sell off would be viewed as more than just a correctional sell off before heading higher.

Wheat

One of the friendliest factors in the wheat market has been demand.

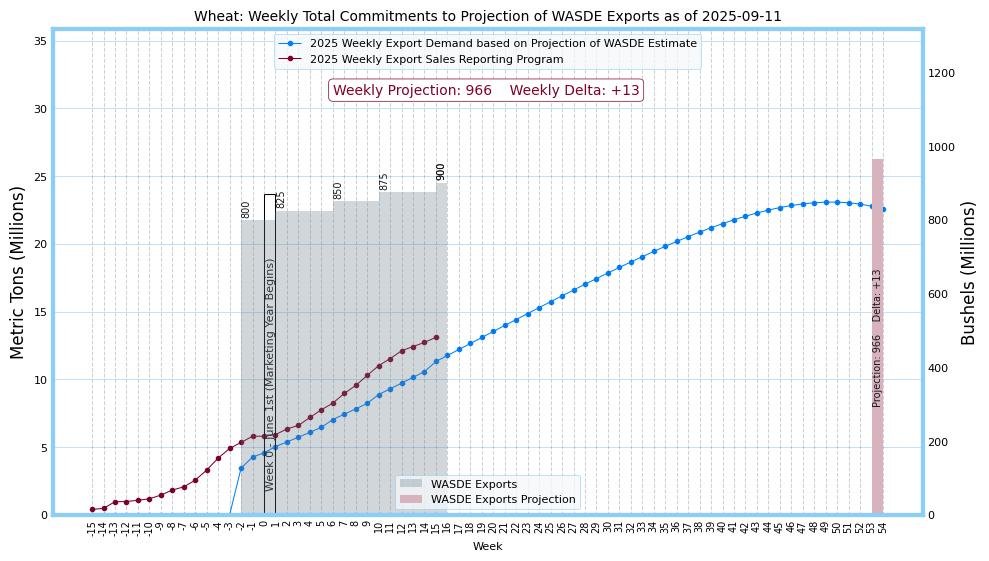

Here is a chart from Robert McClure.

This is wheat exports vs the USDA's expectations.

We are currently soaring well above the estimates.

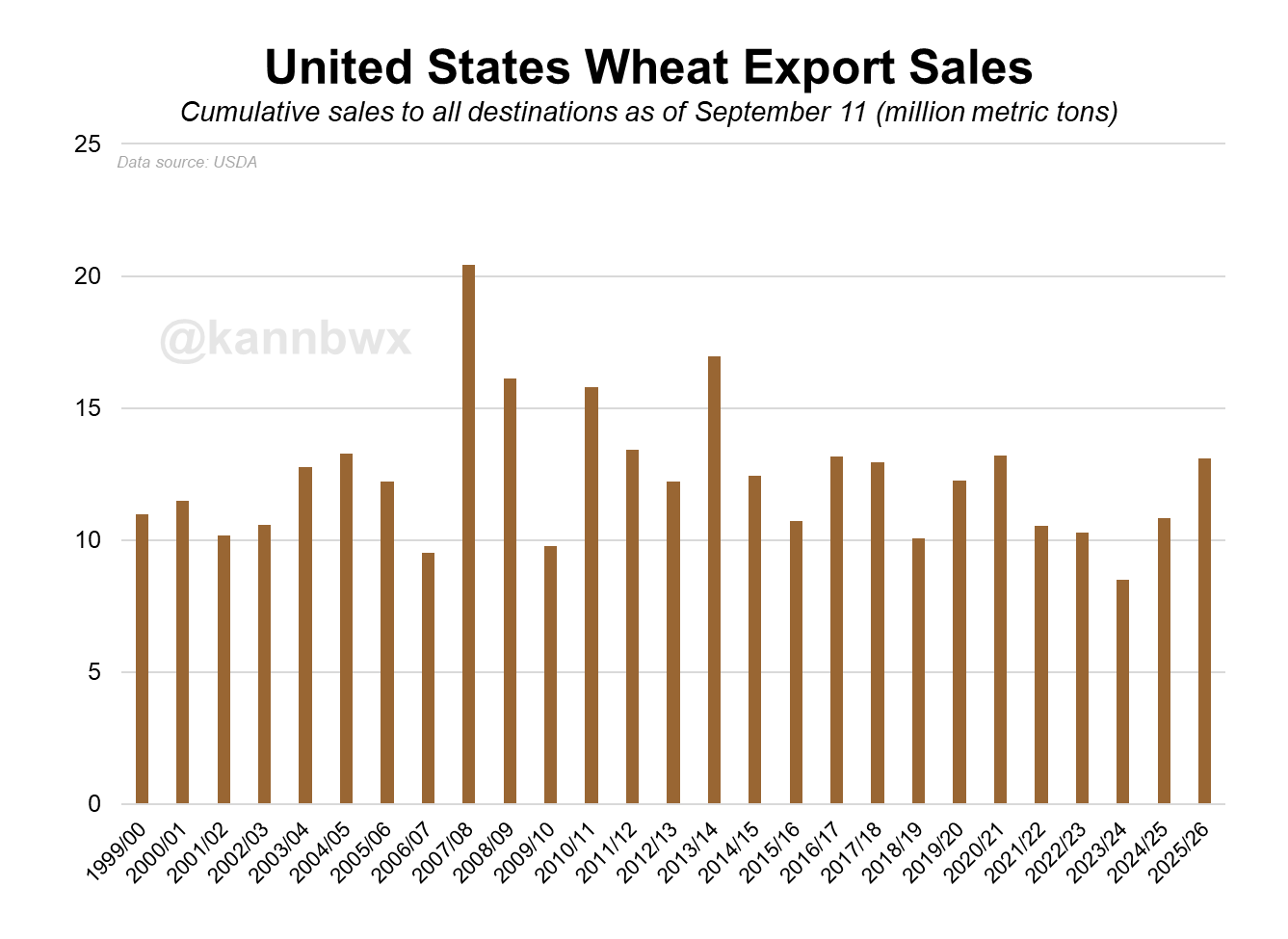

Here is a chart from Karen Braun.

Export sales through today are at a 5-year high.

Here is a 10-year seasonal for Dec wheat.

Typically, we find a bottom right about now.

I'd like to think we carve out some meaningful lows here soon.

Daily Chicago:

My bias still leans higher here even though the wheat market has brutual.

We rejected right off that $5.35 resistance level.

That is still the level we need to clear to get the green light saying this market is ready to finally move higher.

After that, I think we have a path to $5.52, which is 38.2% of the June highs.

To the downside, we need to hold $5.21, which is the 61.8% retracement of this rally. If it fails we could go post new lows again.

Daily KC Wheat:

We got the breakout of this downward channel.

Today it looks like we back tested it perfectly.

So bouncing here would make sense.

First big point of interest is still around $5.44, which is 38.2% of the June highs and previous support.

Cattle

Inside day and week for the cattle markets as we continue to consolidate and chop sideways.

Beef is starting to show some signs of weakness and demand slowing down, which is seasonal here after Labor Day.

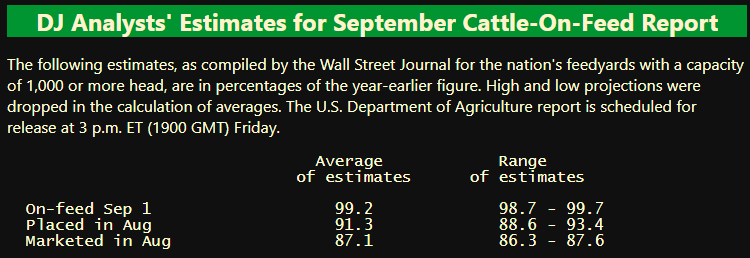

We have the cattle on feed report tomorrow, so it looks like the market is waiting on that.

Here is the estimates.

We still like keeping downside protection in this market, using puts not futures for most.

Two of the biggest reasons to be cautious in the cattle market still remains the funds and the seasonals.

The funds have been selling at a large pace since July. That record long position is now the smallest it has been all year long, meaning they are taking profit after a historic rally.

Seasonally we tend to struggle here as well. As it post grilling season.

That bottom then typically comes in late October.

We don’t have to see the size of sell off this seasonal suggests. We are in a bull market.

But some weakness at a seasonal time frame where we are weak shouldn’t come as a surprise.

Oct Feeder:

Both live and feeder cattle are sitting at some key support.

We've been essentially sideways for the past week.

However we are still managing to hold the golden zone support.

Which is the 61.8% retracement of the August rally (red lines).

That is a big spot to hold. If it fails, it opens the door lower.

On the other hand, if we break above the green box odds favor us heading higher.

Oct Live:

Live cattle also finding support right in the golden zone.

We've bounced off that 61.8% level 5 times now.

Still a major spot to hold. If it breaks it opens the door lower.

Bulls want to break above the green box to trigger more upside.

Past Sell or Protection Signals

Aug 22nd: 🌱

Soybean sell signal & hedge alert.

July 31st: 🐮

Cattle sell signal & hedge alert.

July 10th: 🐮

Cattle sell signal & hedge alert.

CLICK HERE TO VIEW

June 5th: 🐮

Cattle sell signal & hedge alert.

June 2nd: 🌾

MPLS wheat sell signal.

April 10th: 🌽

Old crop corn sell signal.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.