USDA & CONAB TOMORROW

MARKET UPDATE

Prefer to Listen? Audio Version

Futures Prices Close

Overview

Grains mixed with soybeans taking it on the chin for the 3rd day in a row while KC wheat rallies ahead of tomorrow’s USDA report.

Soybeans are seeing some pressure from the continued weakness in meal as well as pre-report positioning for the report tomorrow, as the expectations are that we see a larger bean carryout tomorrow.

Corn followed wheat higher seeing some strength due to the expectations that we see the USDA cut it's corn carryout tomorrow.

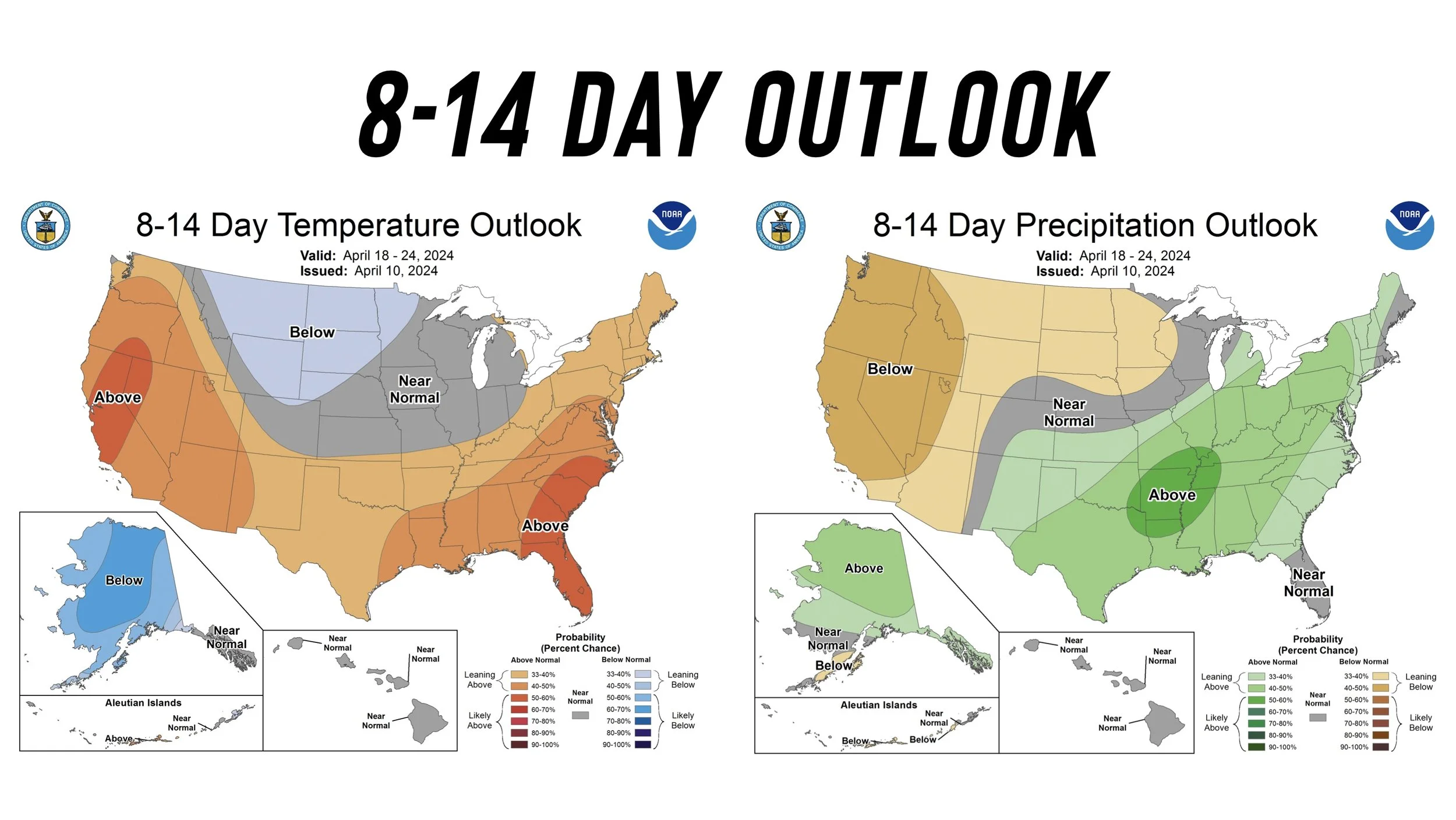

The wheat market especially KC wheat is seeing strength due to the dry conditions and heat coming across the plains such as Texas, Colorado, Kansas, and Oklahoma. Winter wheat conditions were left at 56% G/E on Monday, but most seem to think we see these numbers take a hit next week.

Overall weather in the US is neutral to bearish as the western corn belt should be getting a very good planting window here soon which will probably start to pick up more aggressively towards the 3rd week of April. The eastern corn belt however is supposed to get rain which could slow things down.

Going into growing season, the concern is still in the western corn belt as they still lack soil moisture. There are many states who haven’t fully recovered from the past 4 years lack of moisture.

The CPI data came in this morning. It came in at +0.3% higher, +0.1% higher than the estimates. This lowers the chance of us seeing rate cuts this summer. The feds said that they now think we will see rate cuts in July instead of June.

USDA Estimates

There are no major changes expected from this report. This report is typically not as big of a market mover as for example the one in May or June after we really get into planting and growing.

In this report they are expecting US corn carryout to be -60 million less than last month, with bean carryout to be slightly higher and wheat carryout to be higher as well.

For world carryout they are expecting both corn and bean carryout to be down from last month while wheat is expected to be slightly higher.

Now if we get a surprise, the Brazil numbers could be one that provides a surprise. All eyes are on the South America numbers.

There is some wide ranges for that crop. For their corn they are expecting 121.75 down from 124 last month with a range of 118 to 124.

They have beans at 151.68 down from last months 155 with a range of 148 to 155.

USDA reports are impossible to predict, but with bean basis improving +90 cents the past few weeks, it has me thinking that maybe we see this bean crop slightly smaller. But then again they are already expecting a pretty large -3 million cut.

Argentina has produced a great crop thus far, however I have heard some chatter that their corn crop could be suffering a little from too much disease and pest infection. For example Rosario grain exchange cut their corn crop estimate from 57 million to 50.5 million due to this. However I am not expecting that to show in this report.

CONAB comes out before the USDA tomorrow. Last month the CONAB had 112.7 for corn and 146.9 for beans. Both still far smaller than what the USDA estimates are expecting.

Overall this report could be friendly or negative, nobody knows. However if we do get a negative report I don't think this report has the potential be to "extremely" negative.

Strategies for Report

Here is a few strategies you could consider heading into the report. As always please give us a call if you want to discuss which strategy would best fit your operation. Marketing isn't one size fits all. (605)295-3100.

The first strategy is……..

The rest of this is subscriber-only content. Please subscribe to keep reading & get every update along with 1 on 1 planning to ensure more success for your operation.

We go over the USDA report. Strategies you could use. Why we will probably see some sort of weather scare in the corn market & more.

TRY OUR DAILY UPDATES FREE

Take back that edge from Big Ag. Comes with 1 on 1 marketing planning. Try completely free for 30 days.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24

ARE YOU READY FOR USDA CRAP SHOW?

3/26/24