WEEKLY NEWSLETTER

By Jeremey Frost

Some not so Fearless comments for www.dailymarketminute.com

At what price should I sell?

A few days ago I was asked a question on New Ag Talk

The question was “at what price corn and beans would you tell any and everybody to sweep the bins, sell of all grain from this crop and the next”

My answer was (apologies for the format but this is exactly what I responded with)

“For guys in my area; central and western SD…..there is no price where I would tell them to sell all of next year's crop; because the production is too variable…..and it's not like they can lock in a decent basis

Also, your question is legitimate but at same token, it’s not…..as it’s too generic…….

So I wouldn’t have a certain price……at least not the same price for everyone

I would say that in some areas a huge inverse in basis …..that is something that would cause me to sell out……….but it might and most likely would mean selling the higher price cash grain and re-owning the lower priced futures

I wouldn’t oppose guys putting a floor in on all of the bushels at a certain price…….but that is too generic of a question and the reality is that every farmer and every operation should have a different answer to that question

I know a guy that had 500,000 in a hedge account a few years ago….long futures…...this guy has staying power…..his goal was to get to a million bucks…….when he got there; he asked me what I thought……I said no way I would sell it……you have been holding it for this long…..and now you have a chance to really hit a home run…..this market has got tons of upside……I said don’t sell just because we got to your target……let the market give you a reason to sell

Before long it was at 2 million bucks…..he asked the same question…….and I just told him let the market tell you what to do……the trend is your friend

This guy sold the long futures and replaced with some long dated calls when the market gave him that reason but it was at a heck of a lot better of a price then what his goal was at……it was nearly 5 times his original goal……….he no longer has any downside risk other then his option premium

So there is NO level where i would say everyone should be sold out…….but for some we may already be at a level where they should be sold out…..for others it might be 8.00 corn……for others they might want to be 100% protected at 7.00 corn……

Grain Marketing is not a one size fits all……….never has been and never will be”

The complete thread can be found here or button below

What is hard work?

As I think of that generic question that was asked of me earlier in the week even deeper I am reminded of a YouTube NBA motivational video. What is hard work? This is a motivational video that I had my kids listen to numerous times as they grew up; to help teach them that it’s not about just giving your all. It’s about giving your all while doing it consistently and using your head that God gave you.

In this, they say you have to work hard, work smart, and work consistently.

Before you ask why is he writing about this; I am going to take some of these points and place a grain marketing spin on them.

Here are a couple of other concepts mentioned in the video. Learn to be comfortable being uncomfortable, working hard a habit, hard work beats talent when talent doesn’t work hard. The biggest point is all of these are relative terms.

As I mention the biggest point is these are all relative terms. So is grain marketing; a relative term meaning that it’s not a one size fits all. As they mention in the video what one guy views as hard work, might make another guy laugh, and what he views as working hard might make Kobe Bryant or Kevin Durant laugh.

Do you or someone in your operation work hard at grain marketing?

If not as the video says don’t expect to be successful at grain marketing. Now, this seems harsh to say; but keep in mind it is relative. If you are comfortable with where you are at and it aligns with your risk-reward profile and farm operation goals. It is ok if you are using a KISS method as it might be what’s right for you.

With working hard really being a relative term as to how important grain marketing is for your operation let’s look at the next thing. Do you do it consistently?

Is your grain marketing style consistent?

Do you always pre-harvest market grain, or always wait until you grow it? One of the biggest mistakes I have seen year after year is the guy that is always chasing what worked previously; never sticking to a plan. One year he sells too early; the next year it’s too late. Sometimes he has his bins empty but typically it’s when the markets are at it's lows and then other times he has his bins full but then it is usually at the market highs.

If Ed Usset had a character he would probably name him something like Will the Whipsaw Whooping Boy. If one has a consistent marketing style you won’t hit the home runs, but you won't strike out all the time either. If it's consistent then it’s going to add some value to your operation. If it’s not you have the chance of getting whipsawed year after year with our markets.

So being consistent in it will help your operation, make one more comfortable and take out some of the highs and lows that go with grain marketing. Eliminating or redefining the choice of your grain marketing style will help everyone in your operation.

Is your grain marketing style smart?

Do you or does someone in your operation work smart in grain marketing? Are you more educated about basis, futures spreads and what they are signally one do to or not do than generations before you? Do you subscribe to any grain advisor newsletters like www.dailymarketminute.com? Do you know what an inverse in the board or basis does to your operation? Does your operation utilize storage? How do they utilize storage? Is your operation growing and learning or simply doing what has always been done?

For me, working smart in grain marketing means that I am thinking about various possible outcomes balancing them with my risk reward and I have found the point where I am not comfortable, but I also don’t want to do or not do anything else because I have also found the point of being comfortable being uncomfortable.

As I mentioned in my post on AgTalk for some operations one might want to be all sold out. For others, you might not want to have anything sold. Grain marketing is not one size fits all.

Whatever you do for grain marketing, work hard at it, do it smart, and do it consistently. Not in just the ways I mentioned above. You know your operation so if you go to someone like me and ask a generic question like above and you get a response from someone that doesn’t know your operation make sure if you follow the advice that it keeps your grain marketing plan working hard, smart, and consistently. Do not make grain market fear sales because someone tells you or convinces you that it’s going down.

Millet Market and Millet Crop Remain on Fire!!

The millet market remains on fire with very few good yield reports. There seems to be a large amount of carry over from last year but it is hard to think that those that held it over for a year won’t continue to hold until we get substantially higher. The big question remains is what will demand do?? Will we be able to import any usable millet? What will the import replacement cost and quality be?

We have buyers looking for white proso millet offers and German Hay Millet offers so please give Wade or Jeremey a call at 605-870-0091 or 605-295-3100.

2023 New Crop Act of God Contracts

Both millet and sunflowers are starting to see some new crop 2023 Act of God contracts pop up. Millet market is inverted to the present prices but depending on area is between 15-20 dollars a cwt. Sunflower prices depending on area are between 25-30 per cwt.

Price Outlook

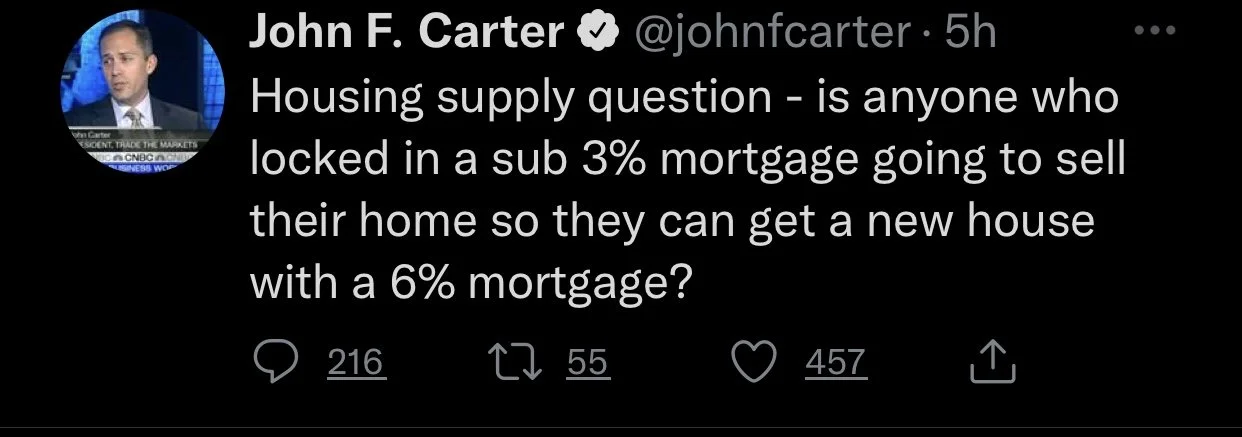

This week is the USDA small grains summary and September 1 stocks report. I look for choppy to firmer trade ahead of the report. The risk is the outside markets but ever been on a teatertodder with too many people on one side? Eventually someone jumps the fence so to speak. I wonder if some of the outside markets such as the DOW and Crude are near those levels. Do you know anyone who is bullish on the stock market?

Do you know anyone not thinking we are going into a recession or depression?

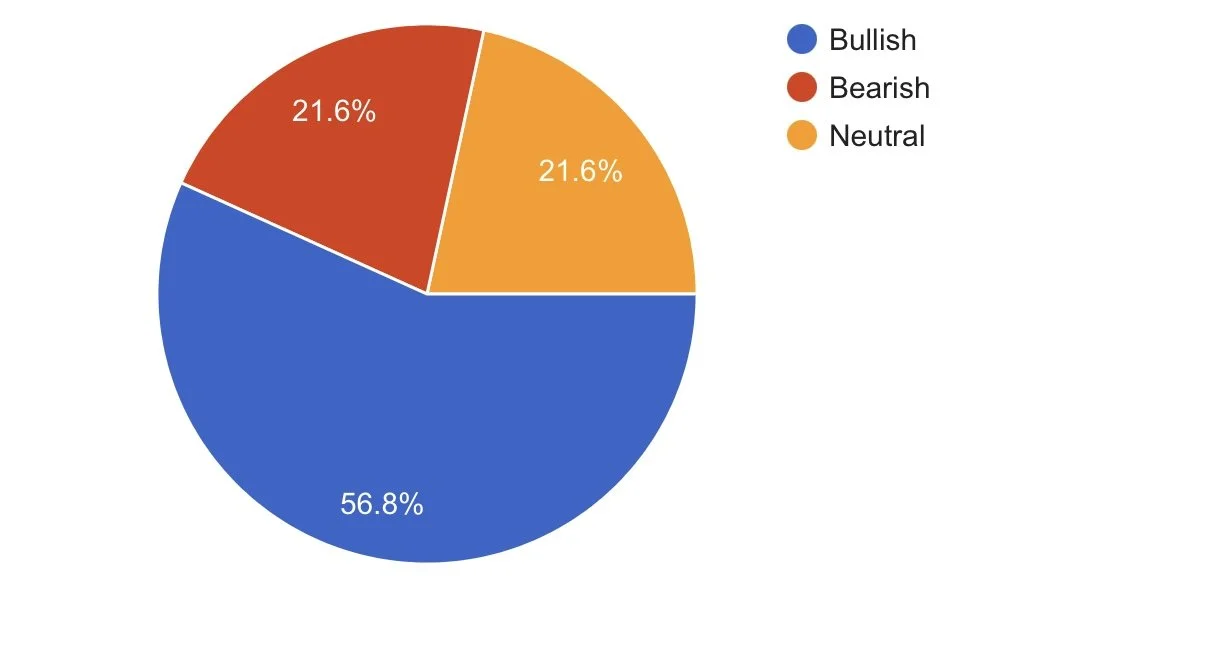

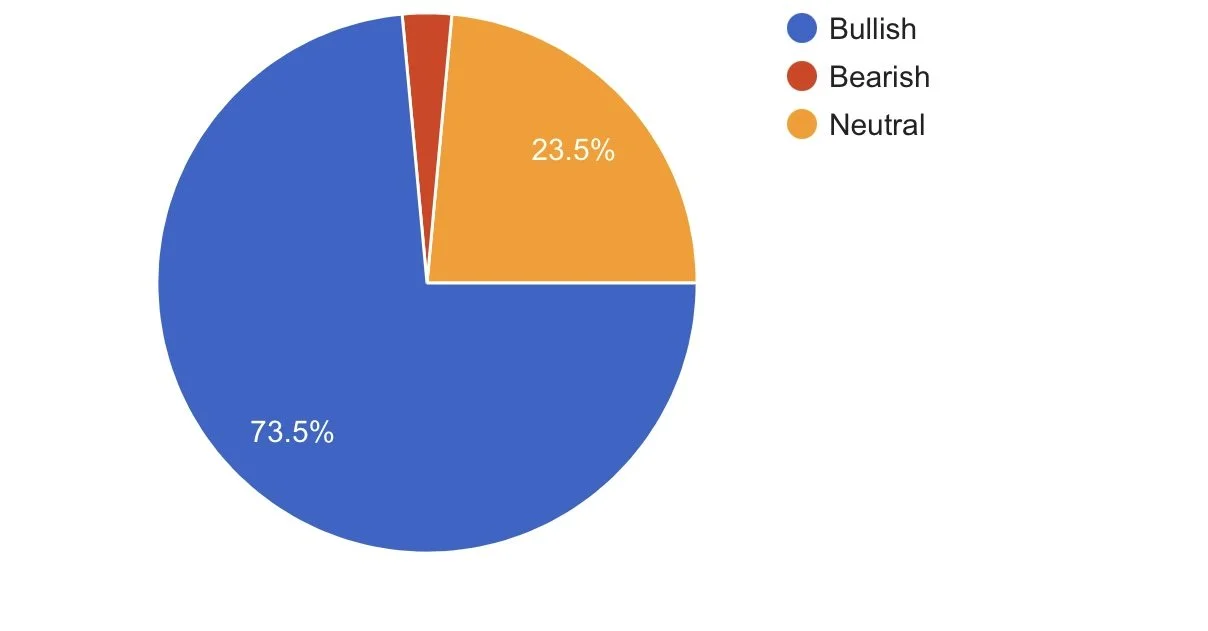

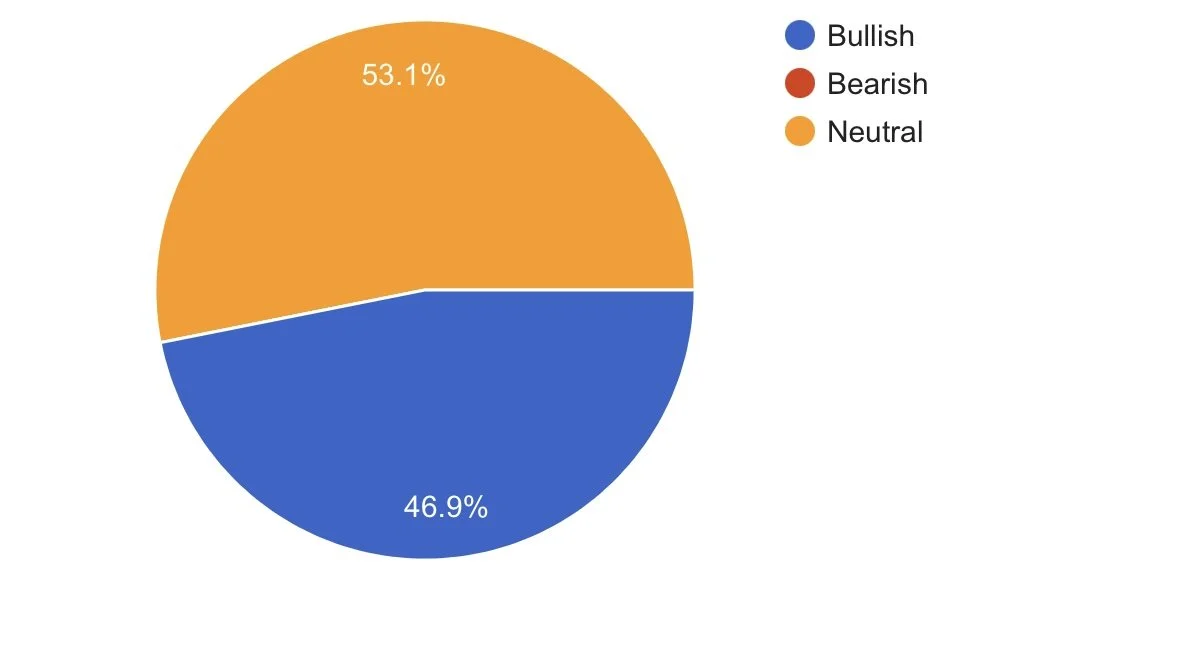

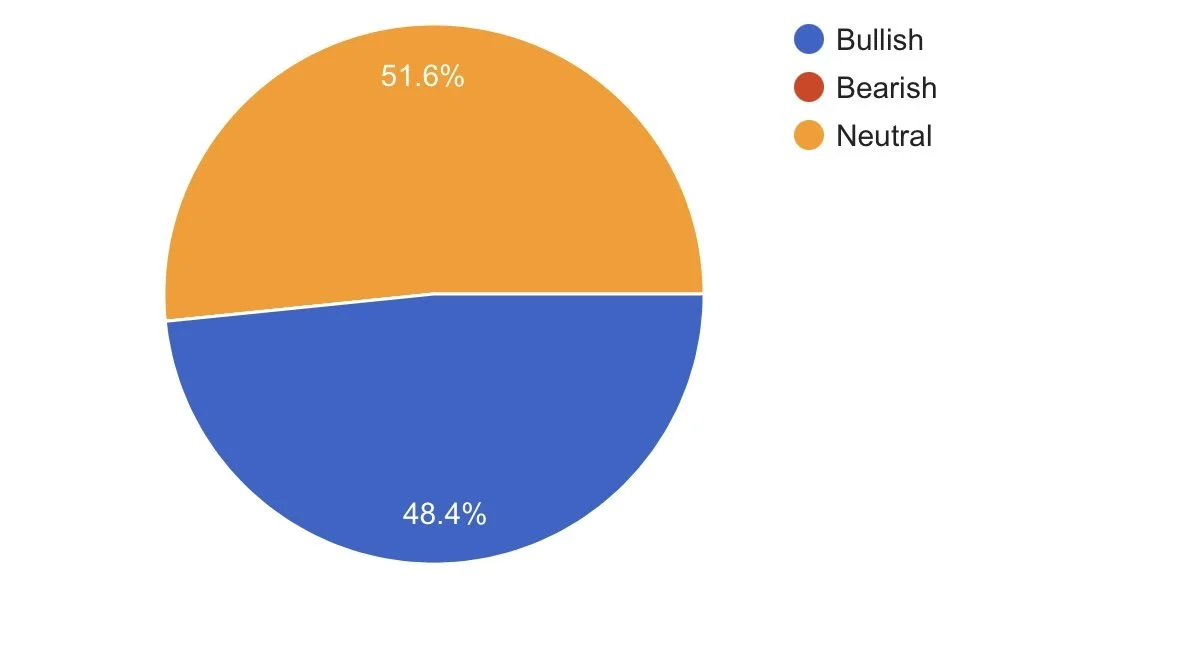

Results from Bullish or Bearish Survey

This survey was posted on social media and in our newsletters through out the week. Here are the results

Corn

Soybeans

Wheat

Sunflowers

Millet

Conspiracy Corner

Yesterday wasn’t the end of the world. So far this one looks to be busted. As I don’t remember much of anything about yesterday.

Here is a top 10 list of conspiracy theories

3 Suns in the Sky in China?

Fires in China

QAnon - Trump Conspiracy

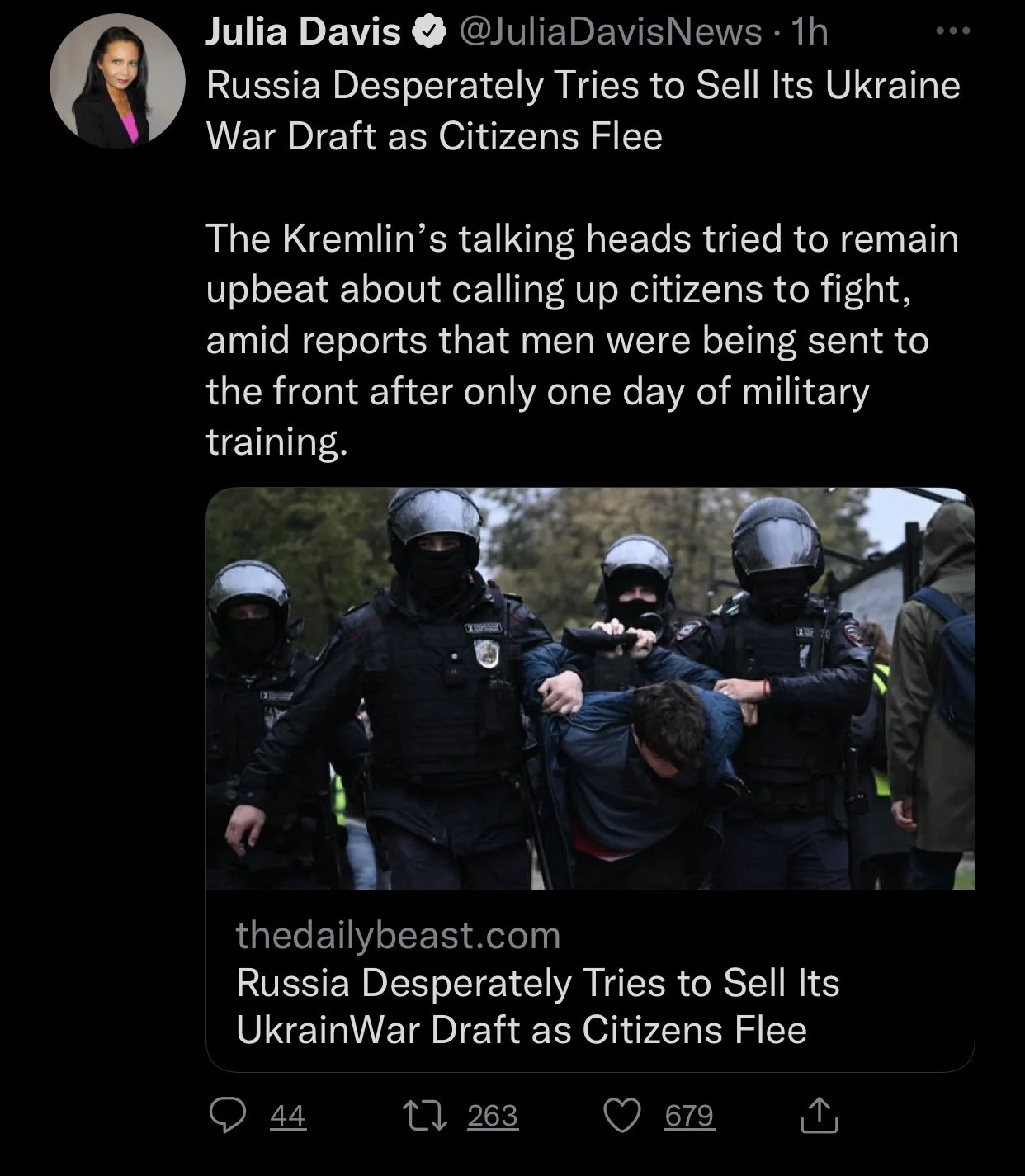

Nuclear - Russian Threat

AI

Commodities Overview by Sebastian Frost

Overview

Friday we saw a risk off day. As the tough end of the week wiped out early week gains in both corn and soybeans. With not only the grains sharply lower, but both the stock and equity markets sharply lower as well. The dollar hit news highs, and crude oil was the lowest we've seen since February.

Given the very poor end of the week, it wouldn’t be too surprising to see a relief bounce to start off this week.

Today's Main Takeaways

Corn

Friday we saw corn slip over a dime, but still managed to hold up the best out of the grains, as soybeans and wheat saw major sell offs.

The grains have been supported from the recent headlines surrounding Russia and the Black Sea, as there is still a lot of uncertainty regarding the entire situation. We also have planting in Argentina going slower than was originally expected, which will look to be a beneficial factor in supporting prices. We also can't forget about the potential changes we could see in yield, as many believe we still need to see the USDA lower its number.

The U.S. harvest weather looks relatively dry for the majority of the next few weeks which should aid in helping harvest move along faster. However, many are watching to see if the recent hurricane down south will move and make any impacts on growing regions.

We will also be watching out for next Friday as the USDA will be releasing its quarterly small grains stocks report. The report is expected to show tight stocks which could be beneficial to helping push prices higher if that's the case.

On the other side of things, we have the obvious recession and inflation concerns that haven’t made things any easier for grains to rally. Demand also remains a pretty large concern.

Last Thursday we saw corn futures close at their highest levels comparatively to the date. Following only 2012. So we also have to keep in mind that prices still remain near histrionically high levels.

For the week, corn closed just in the red by half a cent.

5-Day Change

Dec-22 Corn: -1/2 cent

Dec-22 Corn (6 Month)

Soybeans

We ended the week in a hard sell off for soybeans, as they closed down -31 cents, following wheat and crude oil sharply lower Friday. Which gave up all of our gains made earlier in the week.

Soybeans were lower with no fresh bullish news to piggyback on, as well as the weekly exports coming in far below expectations confirming the lack in demand, as demand is still a very large concern especially with the Chinese tensions. And of course the outside markets added a ton of pressure, with crude hitting lows we haven’t seen in months, and the dollar hitting new highs once again.

As mentioned Friday, its a little early, but one could argue we have the potential to see the recent drought in South America lead to problems later in the year. Which would ultimately be supportive of prices.

Looking at the charts. We broke below a key support level at the $14.50 level we had mentioned early in the week, and as expected prices took another leg down. We bounced at the $14.20 level which is the current nearby support, as soybeans ended the week at $14.24 3/4.We will have to see if we can make up for Fridays and how this week pans out, but either way we can expect the quarterly report to make the markets very volitle.

We also saw major losses in soymeal Friday, which took away a majority of the gains from the week. Soymeal managed to close +1.6 higher on the week at 423.3 following Friday’s -5.6 loss. Soyoil closed the week -2.28 lower to 63.68

Friday’s major sell off took away all of the early gains in the week, and soybeans finished the week quiet a bit lower.

5-Day Change

Nov-22 Beans: -22 1/4 cents

Nov-22 Soybeans (6 Month)

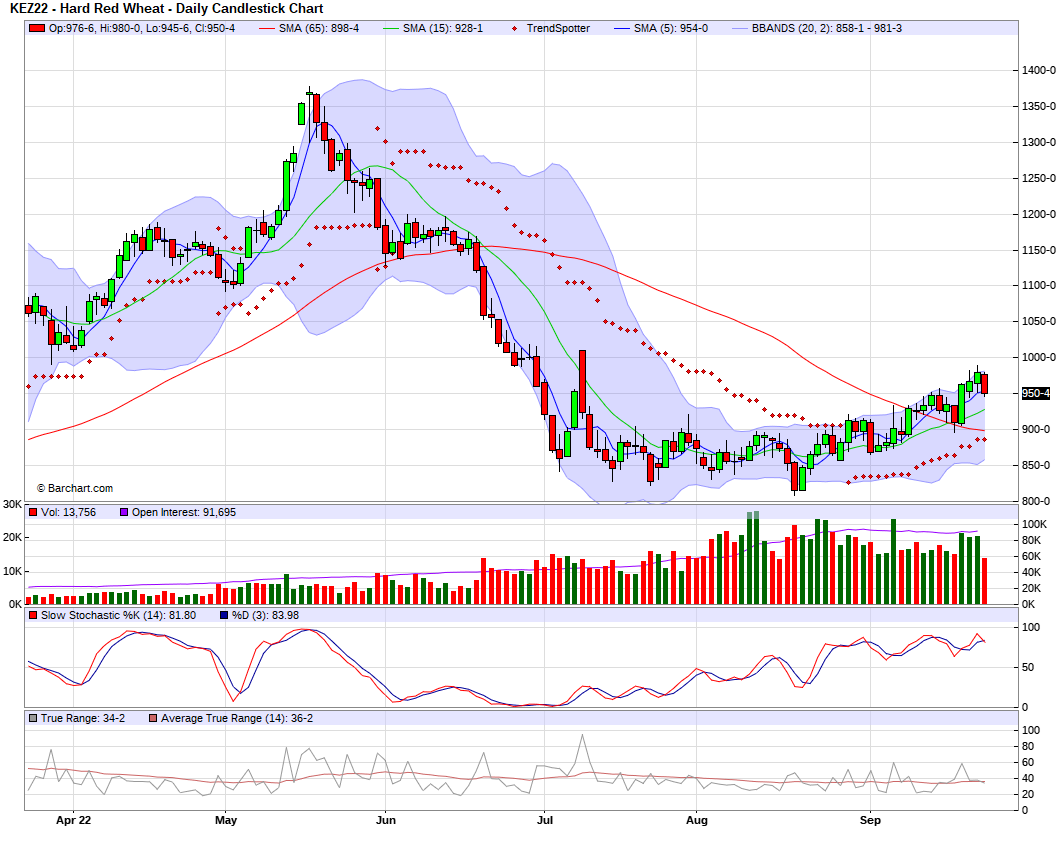

Wheat

Following the impressive rally through out the majority of the week, wheat found sharp losses to end the week. With all three classes closing nearly -30 cents lower.

A correction and profit taking after the recent rally was expected. To go along with the absolute break down in all the markets which pressured more selling. The very poor export numbers didn't help either.

Wheat was driven by Russia/Ukraine headlines for the majority of the week. Nobody ever knows what trick Putin will pull next, but we will have to wait and see what moves he makes next. As any news will likely cause a shift in the wheat market either way.

Even with the sharp losses occurred on Friday, wheat managed to close firmly higher on the week with the early week rallies.

5-Day Changes

Dec-22 Chicago: +20 3/4 cents

Dec-22 KC: +15 1/4 cents

Dec-22 MPLS: +10 1/2 cents

Dec-22 Chicago Wheat (6 month)

Dec-22 KC Wheat (6 month)

Dec-22 MPLS Wheat (6 month)

Stock Market

Last week, the Feds decision to raise rates for the third consecutive time, this time by 75 basis, caused a massive sell off in the markets. And is looking very likely that we will continue to see interest rates rise.

Fed Chair Jerome Powell said in a speech "No one knows whether this process will lead to a recession or, if so, how significant that recession would be."

Dow Jones fell to 22-month lows and was down -3.71% on the week

The dollar hit news highs of over 113, and was up +3% on the week

The S&P 500 was down -4.43% on the week

Tesla was down nearly -10% on the week

Crude oil fell below $80, after its -5% drop Friday

Year to Date

S&P 500 -23%

NASDAQ -31.45%

Dow Jones -19.12%

U.S. Dollar +17.46%

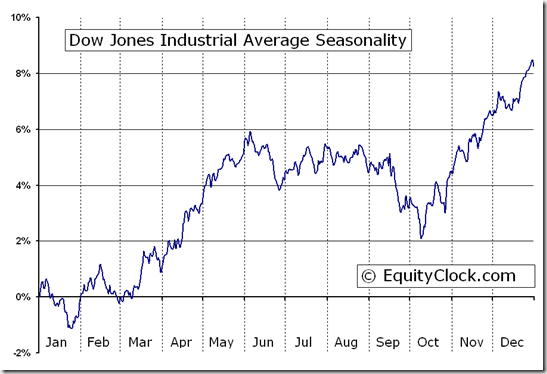

With all the reccession talks, we also have to keep in mind that this time of year is seasonally the worst performing time of year for the stock markets. Below is a graph showing the seasonality of Dow Jones performance.

News

U.S. warns of catastrophic consequences if Russia uses nuclear weapons in Ukraine.

Ukraine has shipped around 4.7 million tonnes of food under grain deal

Seven more ships left Ukraine ports today

Argentina farmers are switching to soybeans rather than corn due to the recent drought

Russias historic 100 million-ton wheat crop piles up at home

No railroad update

Here is a few of our recent newsletters in case you missed them..

Friday's Afternoon Market Update

Audio Comments - Does it matter how high the dollar gets?

Social Media

Precipitation Forecasts

2-Day

Weather

Source: National Weather Service