GRAIN MARKETING STRATEGIES EXPLAINED: CORN BASIS CONTRACTS

PRICE MAKER TIPS

This past couple of weeks I have had a lot of farmers asking me if they should do basis contracts for old crop corn. I was asked if basis contracts where a good grain marketing strategy for farmers? To answer that question, I will ask them why they want to do a basis contract.

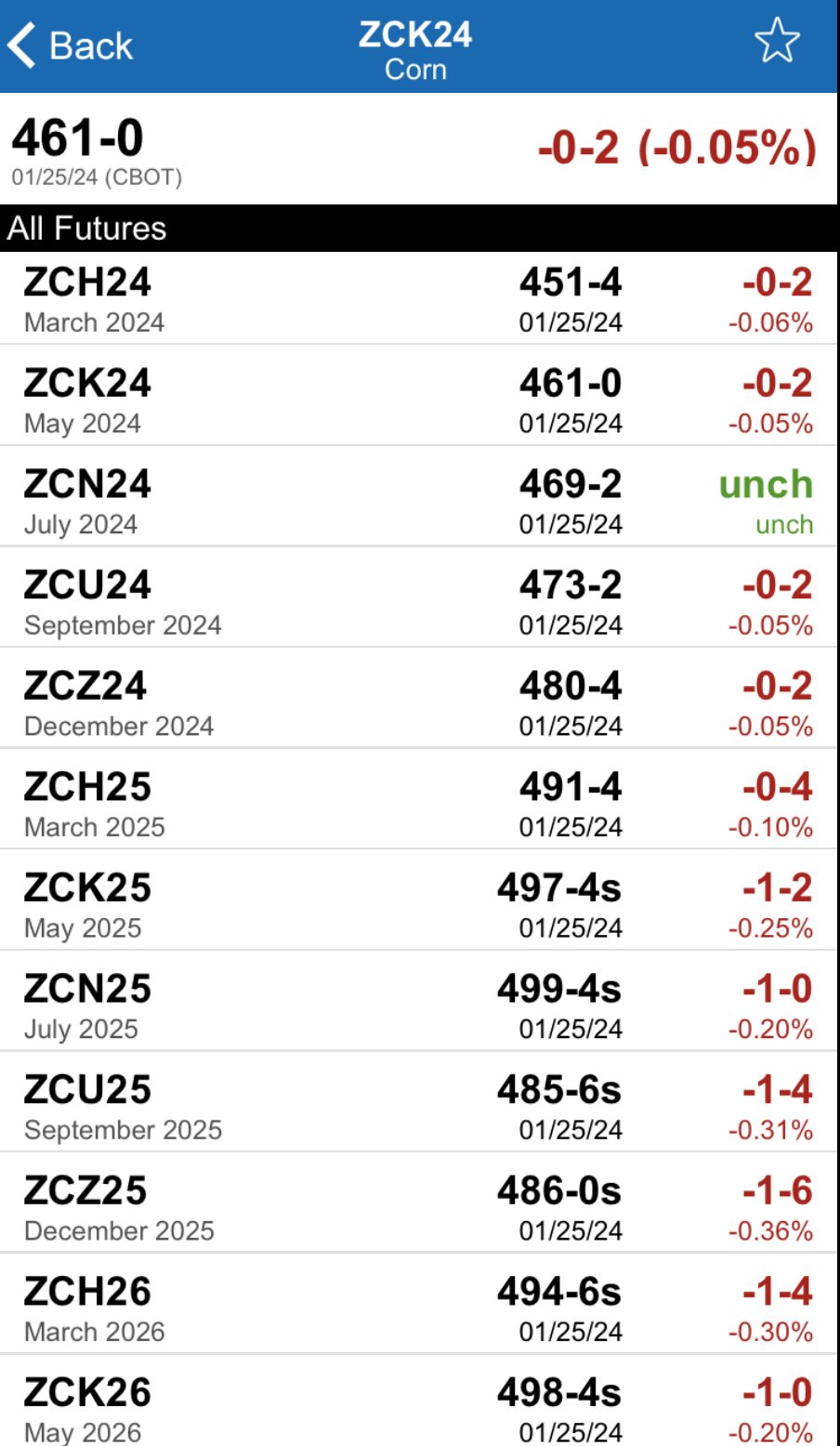

If the answer is that they have an inverted local market. I typically respond with it makes sense to sell basis in inverted markets, but you do realize that we have a carry on the board. Which means your basis will get wider if you roll it. Plus as I show below we have a carry between the futures contracts all the way out well into 2025.

Another typical response as to why the farmer wants to do a basis contract will be he needs to move grain this time of the year plus his buyer will give him an advance on basis contracts once they are delivered. So I ask him several questions such as:

What is your exit plan? Both objective and worst case? Do you have something that will act as a pricing trigger such as a moving average or another technical indicator?

Have you done basis contracts before?

When you did basis contracts did you roll them? Was the board futures spreads between month to month a carry or an inverse?

What price are you trying to achieve via doing the basis contract? Is your pricing goal realistic via doing this basis contract?

If the board gets lower do you think your basis will contract will be better then the basis later or worse? Don’t futures and basis tend to offset each other a little bit. So if the futures go down won’t basis have to do some of the work to procure the corn?

What is your local supply outlook? Is there a unique situation that forces you to supply the market at this time?

Who is recommended to you to do a basis contract? Is it a buyer that might have some different motivation than your best interest?

Are you utilizing a basis contract simply to avoid selling corn in hopes of a higher price? Are you doing it to get an advance on the grain’s value?

You realize that once you do a basis contract you have sold the grain. That you are long in the buyers hedge account someplace, he is using your money instead of paying. you for the corn.

Do you wear the pants in the house? Just wondering why you wouldnt use your own hedge account instead of using the buyers. I am sure the buyer has no motivation to have you utilize his?

What is your exit plan if you don’t get your price goal?

You do realize we have a decent carry on the board?

What type of interest is your corn costing you per bushel per month?

What are you going to do if corn futures don’t go up? What is your exit plan?

After I get done asking the questions I say I have no issues doing basis contracts, but keep in mind if you are delivering grain in March we will no longer be trading March futures, we will be off of the May, and if you delivery in May we will be off of the July.

Plus in carry markets like we are presently in the correct grain marketing move is to sell the carry, roll the short hedges to pick up the additional carry. Basis contracts are to be utilized in inverted markets .

If you don’t have an exit plan should we not get to your target price, your basis contract will either get rolled or priced. Depending on the buyers policy. Presently that I will hurt your basis.

So if you want to do a basis contract my recommendation is that you do it for the right reasons and if your reason isnt because we have a huge inverse in the board you must have an exit strategy if we don’t get to your goal or target price.

And if you delivery the corn and you haven't got the futures priced yet, put your big boy panties on and get all of your cash via pricing the corn and go long futures simultaneously. Write a margin check and then find a proactive plan that has an exit strategy that doesn’t involve buy and hold for years.

Don’t back yourself into the corner where you are rolling the contract every time futures contracts change.

Figure out a plan that is proactive. If you need help coming up with a plan give me a call (605)295-3100

If you want more advice and ways to improve your grain marketing knowledge please give our daily updates a try completely free.

For more information on basis contracts & other strategies in the grain markets check out a few of our other articles:

PRICE MAKER TIPS: CLICK HERE

EDUCATIONAL ARTICLES: CLICK HERE