HARVEST STORAGE DECISIONS

DECIDING WHAT TO SELL, WHAT TO STORE, & WHY

Prefer to Listen? Audio Version

Here is the situation I went over with a customer last week.

He has a dilemma because he doesn’t have enough storage to hold both his corn and soybean crop. Nor are the buyers offering much for selling alternatives.

He is short 100,000 bushels of space. Here is what we discussed and then what he decided to do.

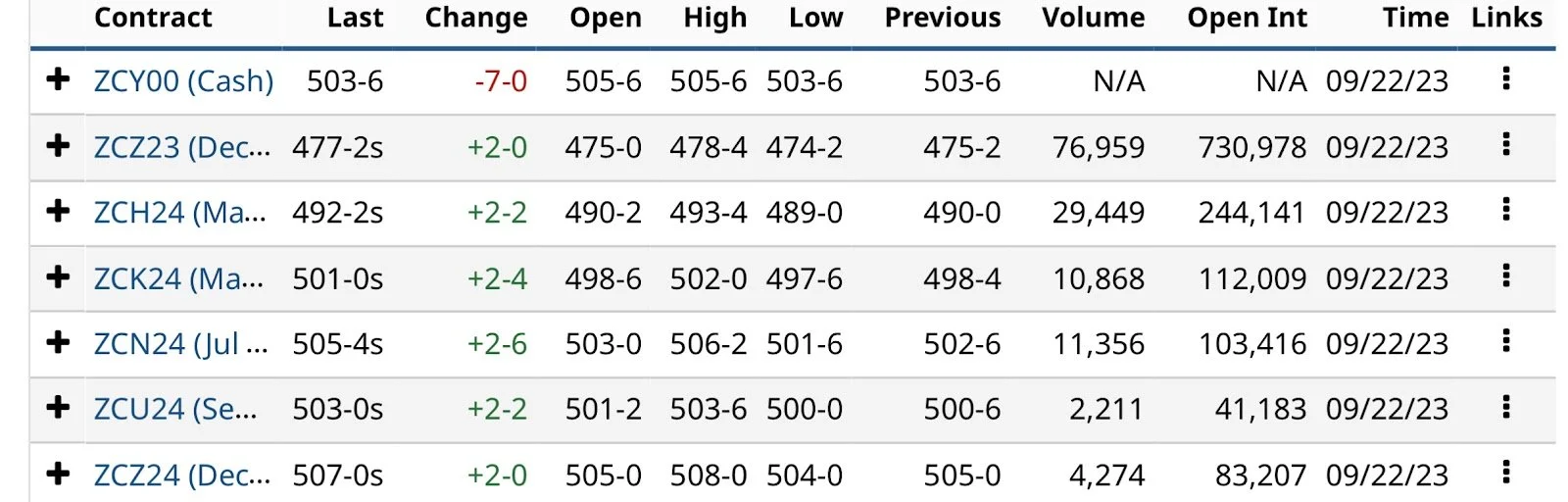

First thing I asked him was if he was borrowing any money. Then we looked at the local cash bids of 4.00 and 12.00.

Which equates to $400,000 or $1,200,000 in cash flow depending which. I asked him how long he would like to hold whichever crop he didn’t move off of the combine. As a true Hank Holder he said until a couple weeks before next year's harvest.

So I calculated his interest difference in a year at $48,000 or $0.48 cents for a year. He has a drier and operationally he believes in phantom yield loss when corn dries naturally in the field.

Next we talked about what we thought the possible upside was for futures and basis. We determined because of the local ethanol plant that typically corn basis see’s more appreciation then soybean basis in our area.

We both thought soybeans had more upside potential on the board, but also more risk to the downside.

Next I asked him if he had interest in locking in the carry on either. Being a Perma Bull, that was a no.

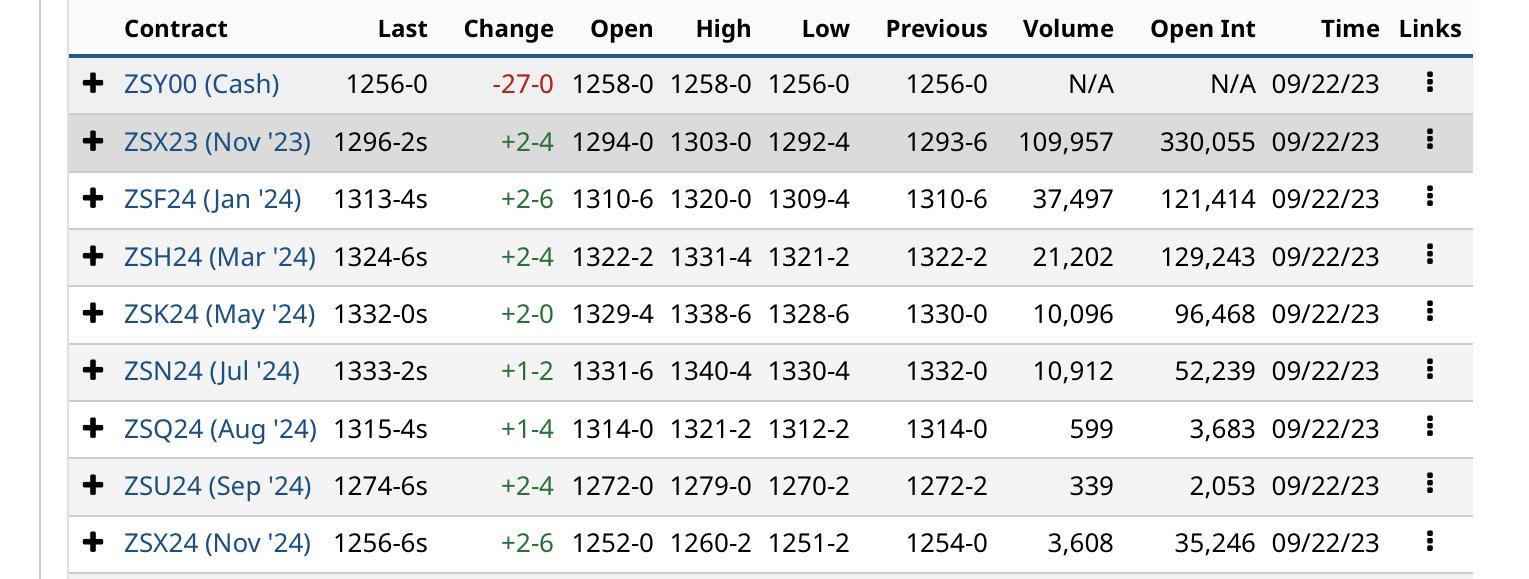

But we looked at market structure between the futures months and noted both had sizeable carries out to spring. While New Crop 2024 beans had about a $0.70 cent inverse to the July 24 contract.

The market structure of the inverse tells me that soybeans have more potential to the upside then corn does or at least that is what the commercials believe.

After all of this I said, what I like to sell is what is overvalued in historical comparison. Then it was a non discussion, corn is too cheap versus beans in our opinion.

It didn’t take long and we had decided to sell the beans off the combine and hold the corn. But now was the real hard part.

How does he stay in the game for when soybeans rally. After all grains have to go up after harvest right?

From there I asked him his risk appetite and staying power. I went over several what if scenarios to gauge. Then I asked him again, now really, tell me what you are going to think if you get a $200,000 margin call because SAM raises an unreal crop and something happens with SAF and we have a Chinese trade war again. Then I asked him what if it is $400,000 margin call.

After that I went over the following possible re-ownership strategies.

Buying futures. What month would we use? Would we use 2024 Nov? What is the benefit or risk of where we put our long hedge.

I asked him if he liked the idea of selling Nov beans around 13, while buying July beans $0.30 some cents higher. I said, is the point not to buy low and sell high?

Next we talked about buying calls, how long would we want them for? How much are we willing to pay? If we went out a ways it didn’t seem like we payed a lot more then we would have in interest and a small storage charge. But then I asked what would be our exit plan? Buy and hold? Would certain call option strategies make his exit plan more proactive than others?

Then we got more creative and I asked about considering using bull future spreads as a way to re-own. I mentioned the cheaper margin and he liked that. But then I told him how deadly the widow maker can be. (July-Nov soybean future spreads are often referred to as the widow maker due their historical high volatility).

Then we talked about selling a put as a way to re-own. Lastly, we talked about a combination of futures & option strategies such as selling puts, buying calls, ratio spreads etc.

This talk was a good hour long and very in detail.

What did he decide to do?

It doesn’t really matter because his operation, risk, reward, and staying power isn’t the same as you. So what was a100% correct decision for him may not be what is correct for you. Yet I have no doubt after the conversation we had, his move was 1,000% right for him and his operation.

If you are in a similar situation and want to discuss what you should consider, give me a call at 605-295-3100. Send me a text, shoot me an email.

You can give Sebastian a call at 605-280-1186 or you can call Wade at 605-870-0091. We are here to help turn you into price makers.

Disclaimer: Trading futures, options on futures, and retail off-exchange foreign currency transactions are complex and involve substantial risk of loss and are not suitable for all investors. There are no guarantees of profit. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Options, market data, and recommendations are subject to change without notice. Market Minute shall not be held responsible for any actions taken based on this communication. Parties acting on this communication are responsible for their own actions. Past performance is not necessarily indicative of future results