Embracing Comfort in Grain Marketing Plans!

Introduction:

In the dynamic world of grain marketing, finding comfort and adopting a proactive approach are key to navigating the uncertainties of the market. This article draws upon insights from an www.dailymarketminute.com audio commentary focusing on strategies for grain marketing and how individuals can tailor their approach to align with their unique operational needs and market conditions.

You can listen to that audio HERE.

Understanding the Current Market Dynamics:

What is your farms situation in the short term when it comes to hauling grain, selling grain, pricing grain. Do you need to do something in the next 30-60 days? The less time you have to market your grian or the closer you are to having to do something with it the more proactive one should be. It is only natural the longer the time period the more the price possibilities become and hence the importance of being proactive drops with more time to make a decision. This shouldn’t always be considered a positive

Presently as I write this many farmers are in that camp where they need to move their grain in the next 30 to 60 days. The market is influenced by various factors, including the pressure on the US dollar, expected smaller Brazil crops for corn and soybeans, and China's buying patterns. These elements suggest potential upsides in the market, but they also require careful observation and timely action because on the bearish side of things you have a big corn carryout and potentially

The Concept of ‘Getting Comfortable’:

A central theme of this article is is the notion of "getting comfortable" with grain marketing decisions. This comfort doesn't imply a one-size-fits-all strategy but rather encourages individualized approaches. Whether it involves making sales, putting in floors, or purchasing courage calls in corn, soybeans, and wheat, the idea is to find what works best for each operation, mitigating stress and leading to more informed decisions. Less fear and greed decisions and more decisions that align with what your operation should be doing based on “have to’s, time frame of the “have to’s”, staying power, and risk reward profile.

Grain Market Trends, Macro Market Trends, and Future Possibilities and Probabilities of History Repeating itself:

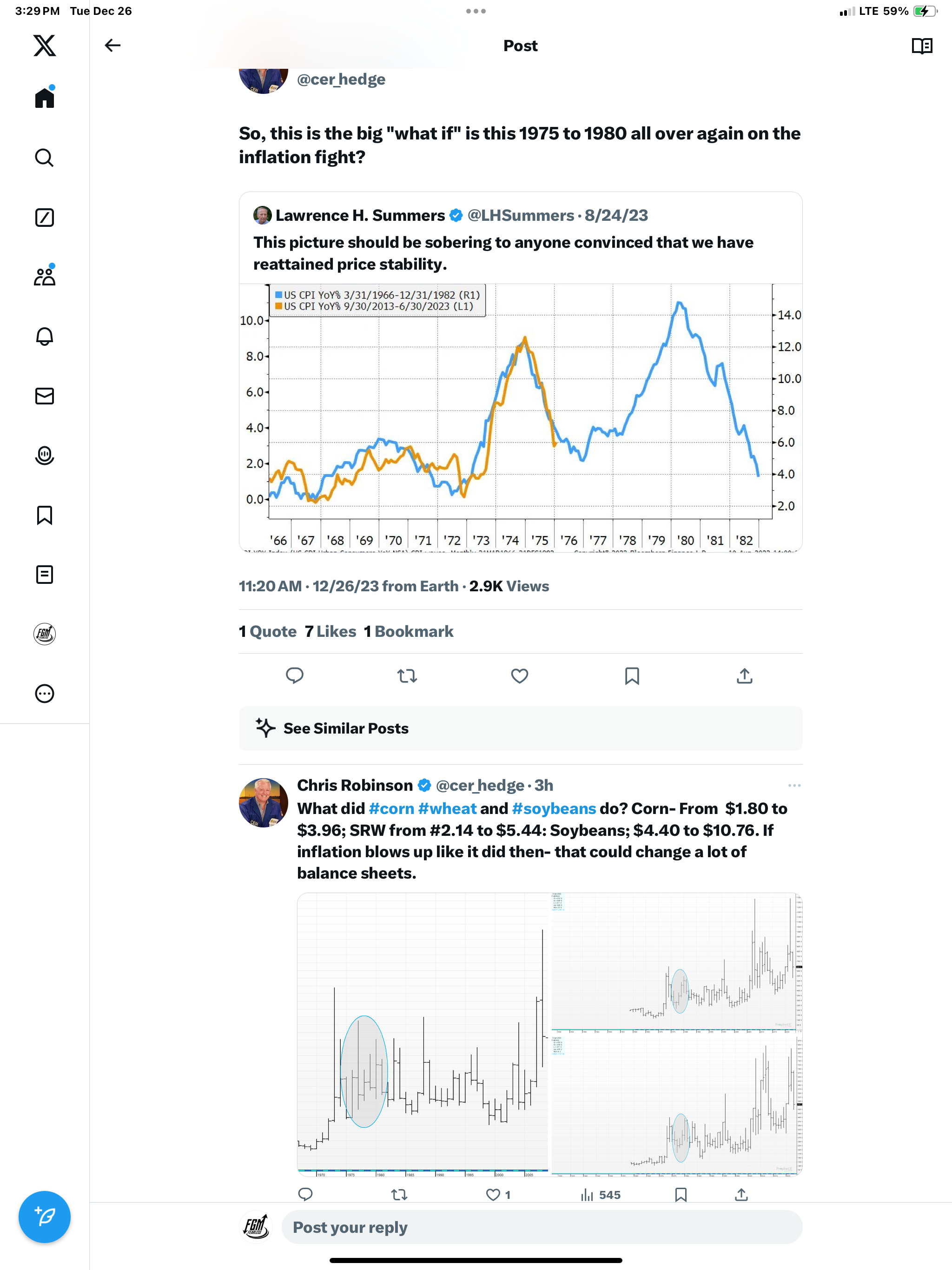

Recently there has been discussion of our historical trends and possible future scenarios, such as the inflation patterns of the 1970s, in particular 1975-1980, and their impact on grain prices. These reflections are not meant to predict the market but to prepare for various possibilities. Emphasis is placed on understanding the difference between what is possible and what is probable, thereby aiding in risk management. We are not hear to tell you what the prices will do, we are no smarter then you in that regard.

We are hear to help get you comfortable with all of the info we have at a given time. More then that we are hear to get you set up for when the market doesn’t do what we think it should or what you want it to do. How we handle grain marketing and or trading when we are wrong is one of the most important things one can ever learn in regards to grain marketing strategies The exit plan. We recently had two articles that sum up the exit plan or lack of exit plan mistake that many make. Check them out here:

Grain Marketing 101 Exit Strategies

Take a look at some of the talk on inflation in the screen shot below and what happened to corn, soybeans, and wheat price from 1975-1980. A percentage move like that on our present prices would be surprising. Not probable but possible.

If this happens, we will see a lot of broke elevators I am afriad. Check out this article from Wright on the Market as Roger gives insight on this risk:

https://www.wrightonthemarket.com/post/what-is-wrong-with-the-way-we-market-grain

Grain Marketing vs. Trading:

A clear distinction is made between grain marketing and trading. Grain marketing focuses on managing risk and making decisions that align with one's operational needs. In contrast, trading involves different dynamics, including exit plans and assessing risk-reward scenarios. Both require distinct strategies and mindsets. Bottom line is be clear what is a spec move and what is a hedge. Define exit plan on both.

Emphasizing the Importance of Exit Plans:

One of the key pieces of advice from the interview is the importance of having exit plans. This aspect is crucial, especially when the market does not move as anticipated. An effective marketing strategy includes not only plans for when predictions are correct but also contingency plans for when they are not. The risk isn’t what happen when you are right. The risk and challenge is what are you going to do when you are wrong? You will be wrong from time to time so it is very important to be in a situation to manage it in pre-defined manner. Don’t chase things or dig the whole deeper then one was originally comfortable with digging.

Call to Action and Resources:

The audio commentary concludes with a call to action, encouraging individuals to reach out for help in understanding and implementing strategies that suit their specific needs. Resources like www.Dailymarketminute.com are mentioned as useful tools for staying informed and making empowered decisions. Please give me a call at (605) 295-3100 or you can email me at jfrost@banghartproperties.com.

Conclusion:

In summary, getting comfortable in grain marketing is about finding a strategy that resonates with one's operational needs and market outlook. It involves being proactive, understanding market dynamics, differentiating between marketing and trading, and having solid exit plans. By embracing these principles, farmers and marketers can navigate the complexities of the grain market more effectively, turning challenges into opportunities for growth and success. Lastly really knowing your operation and what it is that would make you comfortable should corn go to 10 bucks or 2 bucks or anything in between.